Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The stock market sure has been volatile the past few days. I cannot tell you how many times I felt like selling a position just because it didn't 'feel right'. Fortunately I have a very well-defined strategy of buying and selling stocks and can depend on it to keep me from making a quick move that I might regret later.

I found an interesting article about Martin Zweig that caught my eye today.

(Here is a picture of Mr. Zweig from the Wharton Alumni Magazine)

The article discusses Mr. Zweig's approach to picking stocks. I share many of the same beliefs about investing. Let me share with you what the article had to say:

The article discusses Mr. Zweig's approach to picking stocks. I share many of the same beliefs about investing. Let me share with you what the article had to say:

"Focus on earnings

In his analysis of individual stocks, Zweig is first and foremost concerned with the company's earnings. "I don't get that much involved in the product being produced," he wrote in Winning on Wall Street. "If a company can show nice consistent earnings for four or five years, I don't care if it makes broomsticks or computer parts."

Unlike many investors, however, Zweig doesn't simply look at earnings growth over one fixed period; instead, he dissects a company's earnings from a variety of different angles, trying to find firms that have shown steady and "reasonable" long-term growth that has been accelerating in recent quarters. I've broken his earnings analysis down into two main categories below.

- Long-term earnings: These criteria include long-term earnings per share growth and "earnings persistence". To show sufficient long-term growth, a company must have increased its EPS by an average of 15 percent per year, with long-term growth of 30 percent or more the best case. To show "earnings persistence", meanwhile, it must have increased its EPS in every year for a five-year period.

A good example of a stock that meets these standards is American clothier Aeropostale (NYSE:ARO), a New York-based mid-cap ($1.52 billion market cap) whose 700-plus stores sell a variety of casual clothing targeted at 14- to 17-year-olds. Aeropostale has a long-term growth rate of 32.37 percent (based on the average of its three-, four-, and five-year EPS figures). What's more, its per-share earnings for the past five years have been $0.36, $0.62, $0.98, $1.00, and, most recently, $1.32, showing the kind of continuous increases that pass this test. •

- Recent earnings: Zweig wants the current quarter's earnings to be positive, and wants the current quarter growth (over the same quarter last year) to be positive. But he doesn't just want to see growth; he also wants the rate of growth to be accelerating. He doesn't want to jump on the train too late, after earnings growth has peaked."

I believe that Mr. Zweig is right on the money about investing. At least that is my own philosophy as well. I don't think there is anything magical about picking stocks for a portfolio. It is important to narrow down your universe of acceptable stocks (what I call my "vocabulary of stocks") and have some sort of system that assists you in determining when you should be buying and when you should be selling.

The article continues with some suggestion about examining the underlying fundamentals behind each stock investment:

"The P/E ratio: A different take

Like many investors, Zweig also focuses on the P/E ratio. But unlike most others, he doesn't just target stocks with low P/E figures. In fact, to Zweig there is such a thing as a P/E that is too low. His reasoning: a very low P/E may be very low for a reason -- that the company is weak and doesn't have the ability or potential to command higher share prices from investors. The model I base on his approach thus requires stocks to have P/Es greater than 5, to protect against such weak companies.

Because he targets companies with steady and reasonable growth -- the type of companies that aren't likely to go unnoticed on Wall Street -- Zweig is willing to buy stocks with above-average P/E ratios. Still, there is a point at which price can get too high relative to earnings for him, and the model I base on his writings sets that upper limit at three times the market average. As a way to make sure that the market itself isn't too overpriced, this model also sets an absolute limit of 43 for a company's P/E ratio.

Currently, the market P/E is 19.0. Aeropostale, meanwhile, has a P/E of 13.2, based on trailing 12-month earnings, passing this test.

Don’t forget sales, debt, and insiders

It's important to note that, while Zweig focuses a good deal on earnings, he acknowledges that earnings sometimes don't tell the whole story. In order to keep growing over the long-term, Zweig believes that earnings must be accompanied by a comparable or better increase in sales; cost-cutting measures are fine, but by themselves they can't sustain good growth over the long haul."

In addition, Zweig examines debt as well as insider transactions. (I haven't been using insider trades as an indicator but it is worth considering!)

"Another factor that can make good earnings misleading, Zweig says, is debt. A lot of debt means a company has significant fixed interest payments, and if business slows, those payments can whittle away profits. Zweig makes a very smart point here: that debt levels vary by industry. The model I base on his approach thus makes sure that a company's debt/equity ratio is less than its industry average. In this regard Aeropostale excels: While other retail apparel firms average 48.95 percent debt/equity ratios, Aeropostale has no debt.

One final Zweig-based category: insider transactions. Zweig believes that those who work for a company know the business best. If a lot of them are selling their shares, and no one buying shares, it could mean trouble; conversely, if a lot of them are buying, but no one selling, it could bode well."

Finally Zweig also knew when it was important to sell a stock. He set limits on his purchases.

"One final key part of Zweig's approach is his belief in stop-losses, which I don't include in my model. Essentially, Zweig set downside limits on his investments, and if the stock ever fell to these levels, it was automatically sold, as a means to limit losses."

Does all of this sound familiar? I do not claim to be in the same league as a Martin Zweig. But we can all learn from the best investors out there. I hope you enjoyed the comments.

Since I have been a bit verbose this evening, I shall try to stay brief and share with you why I believe Mettler Toledo International (MTD) deserves a spot on this blog. (I suspect that Marty Zweig might even like this one as well!)

METTLER TOLEDO INTERNATIONAL (MTD) IS RATED A BUY

I was looking through the list of top % gainers on the NYSE today and came across Mettler Toledo (MTD). Mettler Toledo closed today at $112.52, up $7.41 or 7.05% on the day. I do not own any shares of this stock nor do I have any options.

I was looking through the list of top % gainers on the NYSE today and came across Mettler Toledo (MTD). Mettler Toledo closed today at $112.52, up $7.41 or 7.05% on the day. I do not own any shares of this stock nor do I have any options.

What exactly does this company do?

What exactly does this company do?

According to the Yahoo "Profile" on MTD, the company

"...supplies precision instruments and services worldwide. It offers various laboratory and industrial instruments, and retail weighing instruments for use in laboratory, industrial, and food retailing applications."

How did they do in the latest quarter?

Much like a 'broken-record', I shall explain that the company made a big move higher today after a strong earnings report after the close of trading yesterday! On November 1st, the company announced 3rd quarter 2007 results. For the quarter ended September 30, 2007, sales growth was 7% in 'local currency' with sales coming in at $442.6 million, up from 4397.3 million. GAAP earnings were flat at $1.16/share in both 2007 and 2006, but adjusting for 'one-time items', adjusted EPS in 2007 was $1.15, up 24% over the prior year amount of $.93/share.

The company beat expectations of $1.06/share for the quarter.

What about longer-term financial results?

If we review the "5-Yr Restated" financials on MTD from Morningstar.com, we can see that first of all the company has been consistently growing its revenue from $1.2 billion in 2002 to $1.6 billion in 2006 and $1.7 billion in the trailing twelve months (TTM).

Earnings during this period did dip from $2.20/share to $2.10/share between 2002 and 2003, then since then have steadily increased to $3.90/share in 2006 and $4.30/share in the TTM.

No dividend is reported, but the outstanding shares were even better than stable, they actually were decreased from 44 million in 2002 to 42 million in 2005 and 40 million in 2006 and 2007.

Free cash flow has been solidly positive and growing the past several years with $138 million in 2004, $145 million in 2005, $157 million in 2006 and $173 million in the TTM.

Meanwhile, the balance sheet appears solid with $100 million in cash and $533 million in other current assets. This total of $633 million in current assets, when compared to the $378.7 million in current liabilities yields a current ratio of 1.67. The company also has a moderate amount of long-term liabilities listed at $588 million.

What about some valuation numbers?

Yahoo "Key Statistics" on Mettler Toledo are helpful in providing us with some valution numbers. With a market capitalization of $4.18 billion, MTD should be considered a large mid-cap stock!

The trailing p/e is a moderate 25.98 with a forward p/e of 22.73 (fye 31-Dec-08). The PEG works out to a bit rich at 1.85.

Valuation-wise, from the Fidelity.com eresearch website, we can see that the Price/Sales (TTM) ratio is a very reasonable 2.39, compared to the industry average of 4.10. The company is also quite profitable compared to its peers with a Return on Equity (TTM) of 27.91% compared to the industry average of 8.01%.

Finishing up with Yahoo, there are 37.18 million shares outstanding with 32.2 million that float. As of 9/25/07, there were 84,560 shares out short, not representing much of a short interest, with 0.5 trading days of volume (the short ratio). No dividend is paid and no stock split is reported on Yahoo.

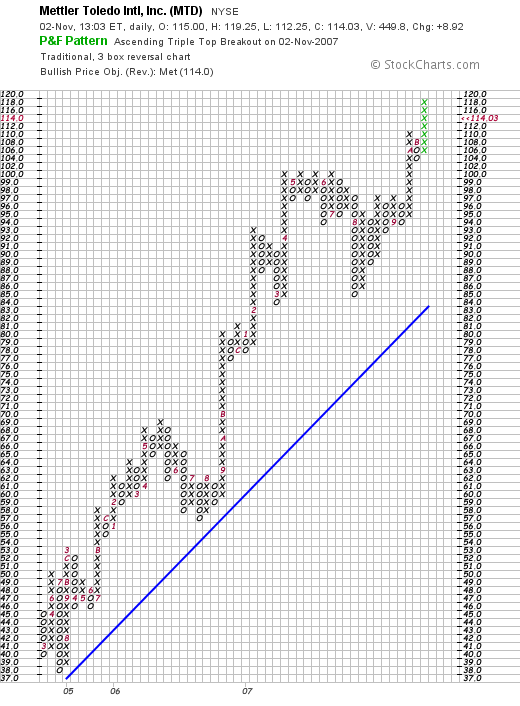

What does the chart look like?

Examining the "point & figure" chart on Mettler Toledo (MTD) from StockCharts.com, we can see what I would have to call a gorgeous picture of stock price appreciation with a rather steady rise in price from a low of $38 in July, 2004, to a recent high near $116.

Summary: What do I think?

Needless to say I like this stock a lot! This is my kind of company with persistence of earnings, persistence of revenue growth, increasing free cash flow, a slightly decreasing outstanding shares, and a solid balance sheet. With the great technical chart, what is there not to like?

I am not in a position to be buying any shares of anything, so I shall be keeping this stock in my 'vocabulary' of investable stocks.

Thanks again for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my Trading Portfolio is analyzed, my SocialPicks page where my stock picks are evaluated, and my Stock Picks Podcast website, where I discuss many of these same stocks I write about on the blog!

Have a great weekend everyone!

Bob