Stock Picks Bob's Advice

Monday, 25 July 2005

"Trading Transparency" VIVO

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so PLEASE consult with your professional investment advisors to make sure that all of your investment decisions are appropriate, timely, and likely to be profitable for you!

I have been away from my computer for a few days...and thus, have a few things I need to catch up on. First of all, checking my trading portfolio today, I noticed that my Meridian Bioscience (VIVO) had hit a first sale point (it is currently trading at $22.95, up $.885 or 4.00% on the day). Earlier today, I sold 100 shares of my 400 share position (a 1/4 of my shares) at $22.77. These shares were acquired on 4/21/05 (a little over three months ago!), at a cost basis of $16.67/share. Thus, I had a gain of $6.10/share or 36.6% on my original purchase price.

As you may recall, I like to sell my gaining shares slowly at targeted gains of 30%, 60%, 90%, 120%, 180%...etc. I try to sell about a 1/4 position each time of the remaining shares to allow my original investment amount to remain fairly intact. Sort of selling my "winnings" I guess you could say!

Anyhow, since I am at my goal of 25 positions, I shall be applying this sale to my margin which still remains hefty. If I had been under 25 positions, I would otherwise be using this sale as a signal to add a new position to my portfolio!

Thanks so much for stopping by. I know I have a couple of emails that I shall be answering here in a bit...but I am back at it here on the blog. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 20 July 2005

"Trading Transparency" St. Jude Medical (STJ)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One thing I try very hard around here to accomplish is to share with you actual trades in my very real

"Trading Portfolio". I choose from the stocks that I have discussed and use the same rules to pick these holdings as I do when I review stocks on this blog.

As I have pointed out elsewhere, I have some very disciplined trading rules that I have established for my holdings. First of all I have selling rules on the downside. Let me review if you are not familiar: all stocks subject to sale at an 8% loss after first purchase. If I have sold a portion of a stock once at a 30% gain target, then I sell the remaining shares if the stock retraces back to "break-even". Otherwise, I sell all of the other stocks at 50% of their highest targeted gain-sale point. That is if I sold a portion at 60% gain, then I would allow it to retrace to a 30% gain level before unloading the issue.

On the upside, I sell 1/4 of my position at 30, 60, 90, 120% points, then increase by 60%: 180, 240, 300, and 360% target, then increase by 90%: 450%,....etc.

Going back to the subject at hand, I acquired my shares of St. Jude Medical (STJ) on 10/15/03 at a cost basis of $28.90/share. I made my first sale on 1/28/04, selling 30 shares at $69.84 (out of an original holding of 150 shares). The stock subsequently split, and with 240 shares, I have now hit a 60% gain level (my second targeted sale point), and have just a few moments ago sold 60 shares at $46.72, with a gain of $17.82/share or a 61.7% gain. Thus, my next sale will be at a target of either 90% on the upside or 30% gain on the downside.

What drove the stock higher today was an announcement just prior to the opening of

2nd quarter 2005 results which beat the street by $.02. In addition, guidance was raised for the 3rd quarter of 2005. Sales for the quarter ended June 30, 2005 came in at $724 million, a 30% increase over the prior year's same quarter. Net earnings for the quarter excluding non-recurring items (including them the result was flat at $.27), came in at $.38/diluted share, a 41% increase over the $.27/share reported the prior year.

Anyhow, things look solid for STJ and the stock as I write this note is trading at $46.70, up $2.95 or 6.74% on the day!

Regarding my own portfolio management, since I am up to 25 positions, I will not be adding a new position as a sale at a gain allows, and instead shall continue to work on paying down my sizeable margin level. Otherwise, if I sell one of my 25 on bad news, then that would open up a slot and a future sale at a gain would once again allow me to add positions up to my goal of 25.

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com. Please be aware that I shall probably use your question in the blog itself! Regards to all.

Bob

Tuesday, 19 July 2005

July 19, 2005 CDW Corp (CDWC)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor. That doesn't mean that what I write isn't informative! It just means that when you read what I write, if you like what you read, you STILL should check with a professional investment advisor to make sure that all information discussed is appropriate, timely, and likely to be profitable for you!

The market had a nice day today with the Dow closing at 10,646.56, up 71.57, and the NASDAQ closing at 2,173.18, up 28.31 on the day. I thought I might stop with just one post today, but curiosity got the better of me and I went back to those lists of top % gainers and found another candidate to discuss.

CDW Corp (CDWC) closed at $61.98, up $5.39 or 9.52% on the day. I do not own any shares of this stock, nor do I own any options.

According to the

Yahoo "Profile" on CDWC, the company "...and its subsidiaries engage in the direct marketing of multibrand computers, and related technology products and services in the United States." I know about CDW from receiving their catalogs in the mail!

What drove the stock higher today was the

announcement of 2nd quarter 2005 results. For the quarter ended June 30, 2005, sales climbed 11.3% to $1.54 billion from $1.38 billion in the same period last year. Net income was $67.1 million, up 15.1% from $58.3 million last year. Diluted earnings per share jumped 19.4% to $.80/share from $.67 in the second quarter last year.

Taking a look at the

Morningstar.com "5-Yr Restated" financials on CDWC, we can see a very steady growth in revenue from $3.8 billion in 2000 to $5.9 billion in the trailing twelve months (TTM).

Earnings have been steadily growing, except for a small dip after 2002 when they dropped to $2.03 from $2.10, but otherwise resumed their upward trend with $2.88 reported in the TTM.

As an added plus, the company started paying dividends with $.30 reported in 2003, and $.36 in the TTM.

Free cash flow has been solid with $221 million in 2002, and $187 million in the TTM.

Morningstar.com shows that the balance sheet is also quite attractive with $590.2 million in cash, more than enough to cover the $401.7 million in current liabilities. Interestingly, long-term liabilities are reported at -0-. In addition, the company has almost $1 billion other current assets, actually $823.1 million as reported on the page.

Looking at

Yahoo "Key Statistics" on CDWC, we can see that this is a large cap stock with a market capitalization of $5.05 billion. The trailing P/E appears reasonable at 21.55 (although the growth rate isn't that high it is still in the teens), the forward (fye 31-Dec-06) P/E is 17.76, and the PEG (5 yr expected) is a reasonable 1.03.

According to Fidelity, CDWC is priced reasonably on a Price/Sales ratio relative to other constituents of the "Computers Wholesale" industrial group. This group is topped off by Electronics for Imaging (EFII) with a Price/Sales of 3.2, Palm (PALM) at 1.1, CDWC at 0.8, Ingram Micro (IM) at 0.1, and Tech Data (TECD) also at 0.1.

Other facts from Yahoo include the shares outstanding at 81.54 million with 63.42 million that float. Currently there are 3.97 million shares out short, equivalent to 6.30% of the float, or 4.8 trading days of volume. This is above my 3 day significance level and may be a bit of a squeeze on the shorts with this release of good news.

Yahoo does show that the $.43/share dividend is yielding 0.76%, and the last stock split was a 2:1 in June, 2000.

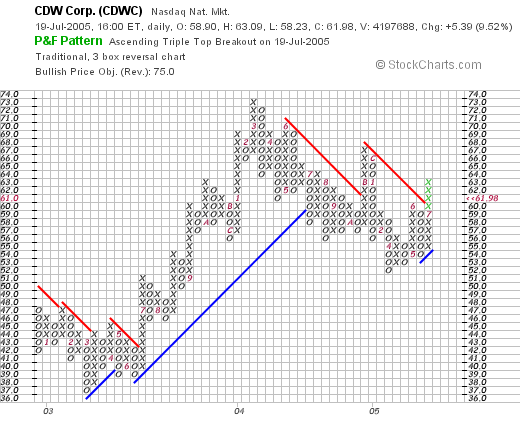

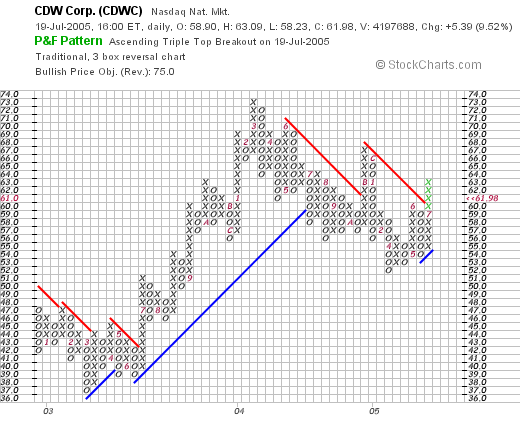

Looking at a

"Point & Figure" chart from Stockcharts.com on CDWC:

the chart appears to show a strong move between March, 2003, when the stock bottomed at around $37, to a peak at $73 in March, 2004. Since then the stock has pulled back to $52 in April, 2005, but is now breaking through resistance at the $63 level, and looks to be heading higher, at least over the short time. The chart, imho, looks mildly bullish but certainly not overextended. I would like to see the stock stay above the $55 level on its next pullback and move to higher short-term highs.

So what do I think? The stock did make a nice move higher today on what appears to be a solid earnings report. The rate of growth is probably sustainable imho, the record the past five years looks nice with a steady picture of revenue growth and an almost uninterrupted picture of earnings growth. For the "icing on the cake" the company has initiated and is increasing its dividend!

Free cash flow is strong, and the balance sheet looks nice with the cash on hand able to pay off all of the current liabilities; the company does not have any long-term liabilities per Morningstar. Valuation also looks nice with a moderate P/E in the low 20's and a PEG just barely over 1.0. The Price/Sales ratio is moderate and reasonable in the industrial group that CDWC finds itself. Finally, the chart looks at least short-term bullish imho. Certainly not over-extended, but maybe not yet convincingly on an upturn. In addition, there are a lot of shorts out there that will need to cover by buying back shares. All in all, the picture looks promising to me. Of course, I am now at 25 positions, and am not in the market to buy anything.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:23 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 19 July 2005 10:29 PM CDT

July 19, 2005 FileNet (FILE)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market is moving higher today which always makes me optimistic about finding the kind of stocks that I like to write about on this website! For any newbies around here, my first step in identifying a prospect for this website is to scan the top % gainers list. These are often stocks with some news that exceeds expectations.

This morning, while looking through the list of

top % gainers on the NASDAQ, I came across FileNet (FILE) which as I write is trading at $29.97, up $2.71 or 9.94% on the day. I do not own any shares nor do I have any options in this stock.

According to the

Yahoo "Profile" on FileNet, the company "...engages in the development, marketing, sale, and support of a software platform and application develoopment framework for enterprise content management (ECM) and business process management (BPM) worldwide."

Anyhow, what drove the stock higher today was the

2nd quarter 2005 earnings report released before the open of trading today. For the quarter ended June 30, 2005, revenue came in at $104.6 million, compared with revenue of $94.1 million, an 11.1% increase. Net income was $8.7 million in the quarter, up 295% from $2.2 million the prior year and up sequentially from $8.3 million in the prior quarter. Per diluted share this came in at $.21, up 320% from $.05/diluted share in the prior year and up 5% from the $.20 in the prior quarter. Overall, the street liked what it saw, and bid up the stock price rapidly!

Longer-term, looking at the

"5-Yr Restated" financials from Morningstar.com, we can see that the company did have a difficult year in 2001, when revenue dropped from $400.4 million to $334.6 million, and earnings dropped from $1.05/share to a loss of $(.47)/share. However, since that time, both revenue and earnings have steadily been growing to the $398.1 million in revenue in the trailing twelve months (TTM) and $.82/share in earnings in the TTM.

Free cash flow has also been growing the last several years from $11 million in 2002 to $55 million in the TTM.

The balance sheet reflects this solid free cash flow performance with $365.8 million in cash reported by Morningstar, enough to cover both the $142.8 million in current liabilities AND the $4.8 million in long-term liabilities more than two times over. In addition, Morningstar reports that FILE has $56.6 million in other current assets. This is a very pretty balance sheet!

Looking at

Yahoo "Key Statistics" on FILE, we can see that this is a mid cap stock with a market capitalization of $1.19 billion. The trailing P/E is a bit rich at 35.46, and the forward P/E (fye 31-Dec-06) is a bit better at 29.87. However, the PEG isn't cheap at 1.67.

Looking at the Price/Sales ratio in terms of its relative valuation within its industrial group of "Business Software & Svcs", we see that FILE is placed midway with BEA Systems (BEAS) topping out at 3.2 Price/Sales, First Data (FDC) at 3.0, FILE at 2.8, Business Objects (BOBJ) at 2.7, Automatic Data Processsing (ADP at 2.6 and Fiserv (FISV) at 2.3. Thus, the stock appears to be reasonable valued by this particular parameter.

Other statistics on Yahoo show that there are 40.94 million shares outstanding with 40.75 million that float. Currently there are 2.54 million shares out short, representing 6.20% of the float or 5.8 trading days. Using my own 3 day rule on short interest, this

is significant, and with the good earnings report, we might be witnessing a bit of a squeeze on the shorts.

Yahoo does not report any cash dividends and the last stock split was a 2:1 split in June, 1998.

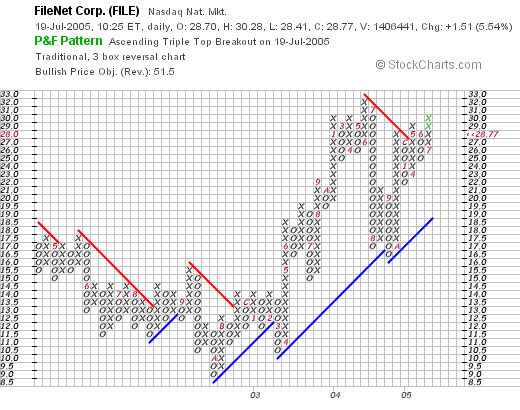

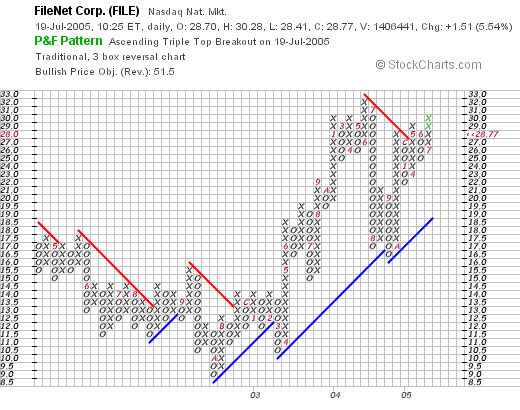

Looking at a

"Point & Figure" chart from Stockcharts.com on FILE:

We can see that this stock was trading lower beween May, 2002, when it was in the $18.00 range, to a low of $9.00 in October, 2002. Since then, the stock has been trading fairly steadily higher to its current level of $28.67 (as I write.)

So what do I think? Let me review, the stock has moved higher today on a strong earnings report. FILE has been growing steadily the last 3-4 years, is generating lots of free cash and has a great balance sheet. Valuation is a bit steep in terms of P/E and PEG, but the Price/Sales is moderate within its "group". Finally, the chart looks strong but not over-extended. I do suspect as I look at the intra-day chart on FILE, that the initial euphoria on the earnings report might have gotten a bit overdone, but the picture remains strong, and this does not appear to be a "one day event".

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 18 July 2005

July 18, 2005 Charles & Colvard (CTHR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the

list of top % gainers on the NASDAQ this morning and came across Charles & Colvard Ltd (CTHR). I do not own any shares nor do I have any options in this company.

CTHR is having a great day in the face of an otherwise negative market; trading at $27.87, up $1.93 or 7.44% on the day as I write.

What is moving the stock higher today is a company

report that earnings will be released tomorrow (7/19/05) and an earlier

press release that upped guidance for sales.

According to the

Yahoo "Profile" on CTHR, the company "...engages in the manufacture, marketing, distribution, and sale of moissanite jewels. It sells moissanite (also known by its chemical name, silicon carbide) jewels principally in the United States and Canada."

CTHR reported

1st quarter 2005 results on April 18, 2005. For the first quarter ended March 31, 2005, CTHR reported a 100% increase in sales to $11.2 million from $5.6 million the prior year same quarter. Net income came in at $2.01 million or $.14/diluted share, a 262% increase over the last year's $555,000 or net income or $.04/diluted share.

Examining the

"5-Yr Restated" financials on Morningstar.com for CTHR, we can see that revenue did drop slightly from $12.8 million in 2000 to $11.5 million in 2001, but has rather rapidly expanded to the $29.5 million reported in the trailing twelve months (TTM).

Earnings per share have also been a bit erratic, increasing from $(.94)/share in 2000 to $.66/share in 2002. However, this was followed by a drop to $.08/share in 2003, and subsequent increases from that level.

Free cash flow has been flat with $3 million reported in 2002, dropping to $0 in the TTM.

According to Morningstar.com, the balance sheet is impeccable, with $13.5 million in cash alone, enough to cover the $3.0 million in liabilities more than four times over! There are NO long-term liabilities reported. In addition, CTHR has $34.9 million in other current assets.

Taking a look at

Yahoo "Key Statistics" on CTHR, we can see that this is a small cap stock with a market capitalization of only $403.44 million. No P/E is reported and thus no PEG ratio either.

Reviewing the Price/Sales ratio with data from

Fidelity, in the "Recreational Goods, Other" industrial group, we have CTHR at the top with a Price/Sales of 12.7. This is followed far back by RC2 Corp (RCRC) at 1.9, Fossil (FOSL) at 1.7, Orange 21 (ORNG) at 1.3, Movado (MOV) at 1.1, and LJ International (JADE) at 0.4. Thus, the stock is a bit pricey on this particular parameter.

Looking at other statistics on CTHR, we find that there are 14.39 million shares outstanding with 10.69 million shares that float. Of these, there are 604,430 shares out short representing 5.10% of the float or 4.5 trading days of volume, which will just be adding some buying pressure on this already strong stock.

The company

does pay a small dividend of $.05/share yielding 0.19%. No stock dividends are reported on Yahoo.

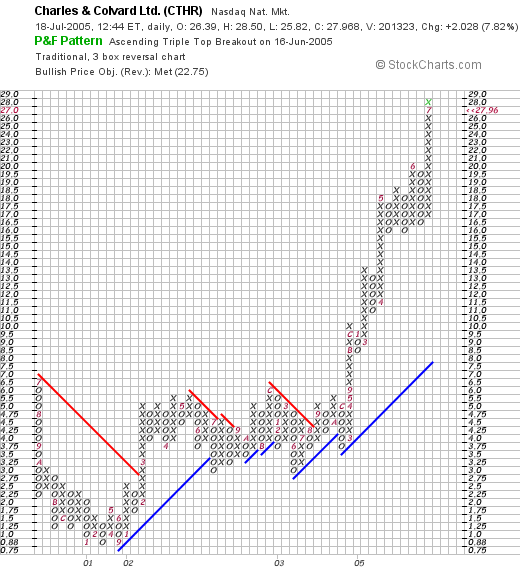

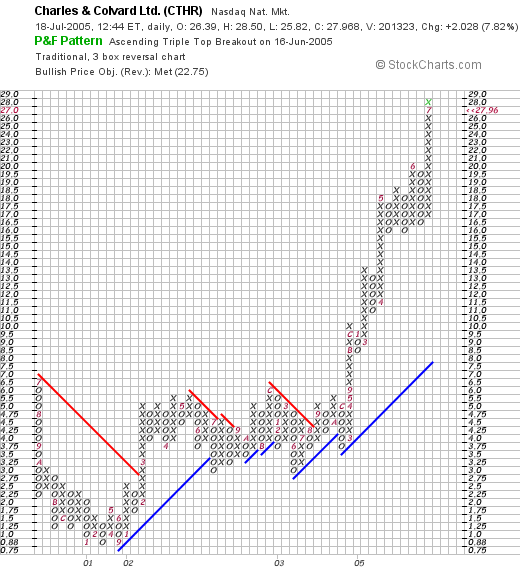

Taking a look at the

"Point & Figure" chart on CTHR from Stockcharts.com:

we can see that this stock was trading sideways between 2001 through August, 2003, when it broke through "resistance" at $4.50 and has moved strongly higher since then. This is a strong chart, albeit a bit overextended imho.

So what do I think? Well this is a very small company and I cannot tell what the potential is for synthetic jewels. However, the last quarter was strong, the company is raising guidance, the balance sheet is impeccable, revenue has been growing steadily, and the chart looks strong.

Valuation is a bit questionable, but this is often the case in stocks that move strongly!

Thanks so much for stopping by and visiting my blog! Be sure to email me or leave your comments right here if you have any!

Bob

Sunday, 17 July 2005

"Looking Back One Year" A review of stock picks from the week of May 24, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am truly an amateur investor so PLEASE consult with your professional investment advisors prior to acting on any information on this website!

If you are new to this blog, well "Welcome!" and please make yourself at home. I have lots of stocks that I have taken a look at you are welcome to my thoughts. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to get back to you.

One of the things I like to do on this blog is to review my past "picks" and see how they have done over the year since posting. These analyses assume a buy and hold approach that I do not in fact employ in practice. I believe in selling losing stocks quickly and gaining stocks slowly. I use an approximately 56 week trailing period for review and each week review the next week of selections.

On May 24, 2004, I

posted PetMed Express (PETS) on Stock Picks at a price of $7.36. PETS closed at $8.07 on 7/15/05, for a gain of $.71 or 9.6% since posting.

On May 16, 2005, PETS

announced 4th quarter 2005 results. For the quarter ended March 31, 2005, net sales increased 10% to $23.5 million, from $21.5 million in the prior year same quarter. Net income came in at $2.4 million or $.10/diluted share, up 67% from $1.3 million or $.06/diluted share.

On May 25, 2004, I

posted Coldwater Creek (CWTR) on Stock Picks at a price of $25.40. CWTR has been a VERY strong stock since posting and has had TWO 3:2 stock splits: the first on 7/26/04, and the second on 3/21/05, since posting. This makes our effective stock pick price actually $11.29/share. CWTR closed at $23.70 on 7/15/05, giving me a gain of $12.41 or 110% since posting!

On May 25, 2005, CWTR

reported 1st quarter 2005 results. Net sales increased 25% for the quarter ended April 30, 2005, from $124.5 million in the same quarter last year. Net income increased 60% to $3.2 million or $.14/diluted share up from $5.3 million or $.09/diluted share the prior year same quarter.

On May 26, 2004, I

posted Copart (CPRT) on Stock Picks at $23.02. CPRT closed at $24.83, for a gain of $1.81 or 7.9%.

On June 1, 2005, CPRT

announced 3rd quarter 2005 results. For the quarter ended April 30, 2005, revenues increased 12% to $130.4 million from $116.6 million the prior year. Earnings grew 24% to $30.9 million or $.33/diluted share, up from $25.0 million or $.27/diluted share last year.

The last stock pick that week was Wendy's (WEN) which I

posted on Stock Picks on May 28, 2004 at a price of $37.43. WEN closed at $45.88 on 7/15/05 for a gain of $8.45 or 22.6% since posting.

Because of the

"finger in the chili" case scandal, sales at Wendy's restaurants were adversely affected, and sales grew during the

1st quarter 2005, results of which were posted on 4/28/05. Revenue grew 7.1% to $894 million. Earnings, however, were flat at $.45, compared with $.45/share a year ago.

So overall, this was another great week for Stock Picks! All four stocks discussed that week had nice gains ranging from a 7.9% gain for Copart to a 110% gain for Coldwater Creek. The average performance of all four stocks "picked" that week works out to a gain of 37.5%.

Thanks so much for visiting here! Please remember that past performance is NO guarantee of future performance, that I am truly an amateur and that you should check with your professional investment advisors, and always do homework on all stock market ideas yourself prior to investing!

Have a great week trading everyone!

Bob

Posted by bobsadviceforstocks at 5:04 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 22 November 2005 6:17 AM CST

Friday, 15 July 2005

July 15, 2005 Cintas (CTAS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As ALWAYS, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The first place I go to find a new stock pick is the top % gainers list. I use the Cnn.money site, but the USA Today site, or other internet sources are certainly workable. This afternoon, looking through the

list of top % gainers on the NASDAQ, I came across Cintas (CTAS) which closed at $44.00, up $4.20 or 10.55% on the day. I do not own any shares or options in this company.

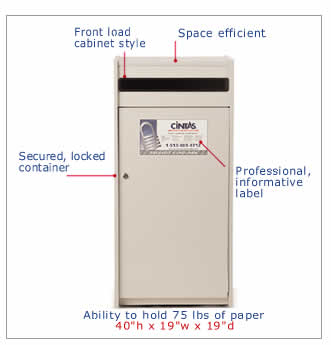

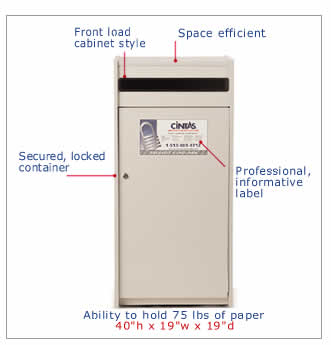

According to the

Yahoo "Profile" on CTAS, this company "...engages in the manufacture and provision of corporate identity uniform programs, entrance mats, restroom supplies, promotional products, first aid and safety products and services, and document management services."

What drove the stock higher today, was the

4th quarter 2005 earnings report which was released after the close of trading yesterday. For the quarter ended May 31, 2005, revenue climbed 9.6% to $809.2 million, and earnings jumped 14% to $83 million or $.48/share from $72.7 million, or $.42/share in the 4th quarter of 2004. The company also guided revenue estimates for the upcoming year slightly higher.

Looking a bit longer-term, reviewing the

"5-Yr Restated" financials for CTAS on Morningstar.com, we can see a very steady improvement in revenue, with growth from $1.9 billion in 2000 to $3.0 billion in the trailing twelve months (TTM).

Earnings have also progressed in a remarkably steady fashion from $1.14 in 2000 to $1.68 in the TTM.

As a BONUS, the company also has been steadily increasing its DIVIDEND...raising it each year from $.19/share in 2000 to $.32 in the TTM.

Free cash flow has also been solid with $270 million in 2002 reported, increasing to $309 million in the TTM.

Looking at the balance sheet, we can see that CTAS has $367.8 million in cash according to Morningstar.com, and $824.5 million in other current assets. This is plenty to cover both the $385.4 million in current liabilities and the $385.4 million in long-term liabilities combined.

Reviewing

"Key Statistics" from Yahoo on CTAS, we can see that this is a large cap stock with a market capitalization of $7.57 billion. The trailing p/e isn't bad at 26.17, with a forwar p/e (fye 31-May-06) at 19.47. thus, the PEG is just a bit over 1.0 at 1.25.

Looking at the Price/Sales ratio in the context of a

Paul Sturm perspective, that is in the context of other companies in the same "industry group", we can see that Cintas is fairly reasonably valued as well. Cintas is in the "Business Services" group per Fidelity, and the steepest Price/Sales ratio in that group is Equifax (EFX) at 3.7 Price/Sales, Global Payment (GPN) at 3.3, Cintas (CTAS) at 2.3, Certegy (CEY) at 2.2, and IPAYMENT (IPMT) at 1.4. Thus, CTAS is in the middle of this group in regards to this particular valuation parameter.

Other "numbers" from Yahoo, show that there are 172.09 million shares outstanding with 140.68 million that float. As of 6/10/05, there were 5.29 million shares out short, up slightly from the prior month. This represents 3.70% of the float, or a significant (imho) 6.7 trading days of volume.

The company, as noted, does pay a small dividend of $.32/share yielding 0.80%. The last stock split was a 3:2 split in March, 2000, per Yahoo.

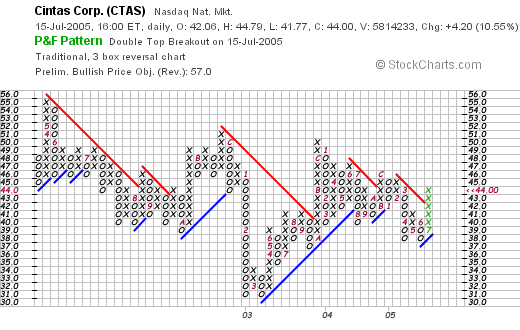

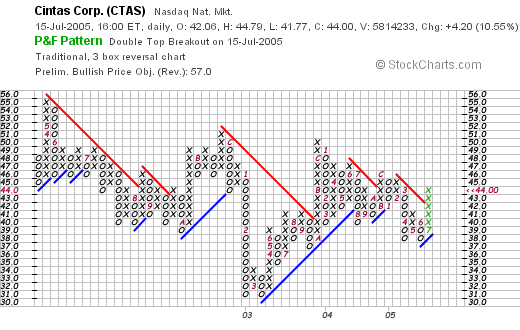

What about a chart? Taking a look at the

"Point & Figure" CTAS chart from Stockcharts.com:

I see what looks like a long-term declining trend in stock price from $56, all the way back in May, 2002, to the $44 level where it closed today. What concerns me is what appears to be a series of declining highs, but the recent move breaking through a resistance level is moderately encouraging. Certainly the stock chart is not ahead of itself, and I wouldn't call this one over-extended. Yet the question remains whether this shows any significant upward momentum at all!

So in summary, the stock moved higher today on a positive earnings report and guidance yesterday. Other positives include the steady growth in revenue the past five years, the steady growth in earnings, and even the growth in dividends each and every year! Free cash flow is solidly positive and the balance sheet looks healthy. Valuation numbers are reasonable and there are even a lot of shares out short that need to be covered. In fact, my only particular concern is the less-than-convincing point and figure graph. But over the short-term, the chart does show the stock breaking past resistance levels....but can is sustain this advance?

In any case, I don't have any cash or a market signal to be investing! Thanks again for stopping by. I hope you all have a wonderful weekend. As always, please feel free to leave comments right here on the blog or feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 13 July 2005

A Reader Writes "Can you give me an opinion on the chances of this stock to rise?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Checking my mail earlier this week, I came across a letter from Jean B. who wrote:

Dear Bob,

My brother had recommended dogpile.com as a search engine a while

ago. He works at aa hospital, and the interns recommended it to him.

While the name leaves a smelly taste, I checked it again today, and

figured they could challenge Google. It's a branch of InfoSpace

(INSP), and I checked their earnings and point and figure chart. It

has a mouth-watering P/E of 9.x. Can you give me an opinion on the

chances of this stock to rise? I couldn't wait for the earnings

announcement on July 26th, and already bought some.

Sincerely,

Jean B

First of all, thank you Jean for writing. As you know, I cannot tell you the chances any particular stock will rise. I simply don't know and would be just guessing. However, I would be happy to look at this stock through my perspective and let you know what I think.

Some basics: InfoSpace (INSP) closed today (7/13/05) at $33.70, down $.48 or 1.40% on the day.

According to the

Yahoo "Profile" on INSP, the company is "...a technology and services company, engages in the development and marketing of internet and wireless solutions for a range of customers, including consumers, merchants, wireless operators, content brands and financial institutions. The company has two units, Search and Directory, and Mobile."

About the first place I go to research a stock is the latest quarterly result. Apparently INSP will be reporting their latest quarter in the next couple of weeks. However, as far as reported results, INSP

reported 1st quarter 2005 results on April 26, 2005. Revenue for the quarter ended March 31, 2005, came in at $87.0 million, an 81% increase over the $48.1 million in the first quarter of 2004. Net income for the first quarter came in at $93.9 million or $2.52/diluted share, compared to net income of $36.7 million or $1.03/diluted share the prior year. However, much of this was from settlement of litigation, and excluding the gain from litigation, net income came in at $16.6 million or $.45/diluted share vs. $5.4 million, or $.15/diluted share in the first quarter of 2004.

However the company guided lower for the second quarter than what analysts had been expecting. As

reported on Thestreet.com:

However, the company's near-term guidance disappointed. For the second quarter, InfoSpace said it expects to earn 36 cents to 39 cents a share on revenue of $83 million to $85 million. This was below analysts' expectations of earnings of 42 cents a share and revenue of $91.7 million.

This was enough to drive the stock lower in the short-term.

Looking at the

"5-Yr Restated" financials from Morningstar.com for INSP, we can actually see that revenue fell from $201.2 million in 20002, to a low of $115 million in 2002, before resuming its progression with $288.3 million reported in the trailing twelve months. The last few years are solid, but I prefer to see longer periods of growing revenue prior to a purchase of stock.

The company was losing money betweek 2000 and through 2003, improving from a loss of $(9.28)/share in 2000, decreasing to a small loss of $(.20)/share in 2003. Since then, the company reported $2.26 in earnings in 2004 and $3.75 in the trailing twelve months (TTM).

Free cash flow is also attractive with $(23) million in 2002, improving to $126 million in the TTm.

The company is loaded with cash and has a beautiful balance sheet, at least as presented by Morningstar with $366 million in cash and $93.4 million in other current assets, with a relatively paltry $58.8 million in current liabilities and $12.2 million in long-term liabilities. Thus this looks good too!

Taking a look at

"Key Statistics" on INSP from Yahoo, we can see that this is a mid cap stock with a market capitalization of $1.12 billion. The trailing p/e, as you noted, is only 8.92. However, I am sure that is due to the inclusion of litigation earnings....so it is a bit higher than that. Thus, the forward p/e is 14.72 (fye 31-Dec-06), and the PEG (5 yr expected) is still low at 0.67. The stock indeed looks to be a good "value".

According to the Fidelity Brokerage information I use, INSP is in the "Online Financial News Industry" and sports a Price/Sales ratio of 3.9, midway between the top stock CNET (CNET) at 5.7, above the Street.com (TSCM) at 2.5, and ahead of Dow Jones (DJ) at 1.8.

Going back to Yahoo, we can see that there are 33.20 million shares outstanding with 33.17 million that float. Of these, 2.83 million are out short, representing 2.3 trading days or only 8.70% of the float. The short interest does not look significant imho.

No cash dividends are paid and the last stock dividend was a

reverse stock split, a 1:10 on 9/13/02.

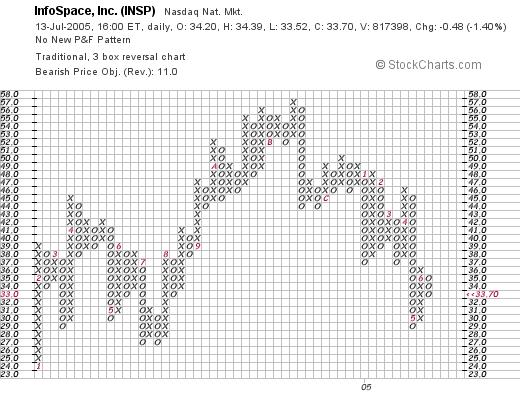

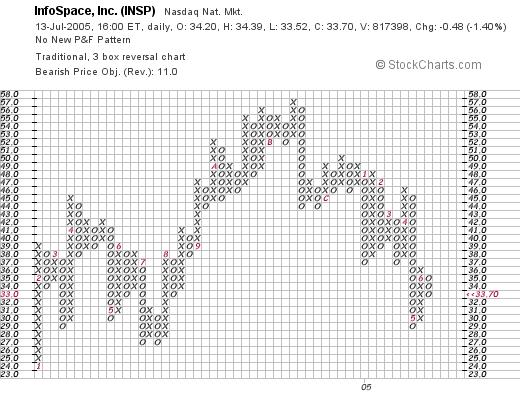

What about a chart? Taking a look at a

"Point & Figure" chart on INSP from Stockcharts.com:

we can see what appears to be a relatively weak graph that hit a peak of around $57 in November, 2004, seemingly 'rolled over' and has been trading lower to its current level. I am not encouraged by what I see. I cannot tell if the stock will be trading higher from the graph in the near future, but it appears that trading higher would require the company to reverse the current trading trend.

So what do I think? Well, let's review: the latest quarter was very strong, but then the company revised lower for the next quarter (a negative imho). The past five years are a bit of a roller-coaster of revenue growth, with a sharp decrease, followed by an equally strong increase in revenue. Earnings appear to be increasing, and free cash is positive while the balance sheet looks excellent. Valuation-wise, the low p/e is a bit misleading due to the one-time settlement of litigation. However, the forward p/e is still low, and the PEG is under 1.0. The price/sales is also moderate within its group.

Finally, the graph looks weak.

Thus, I am not ready to endorse this stock. This does not mean it may not appreciate in the near future. In fact, if they come through with a solid quarter in the next two weeks, I would not be surprised to see this stock rally higher. It certainly is a good value. But that is not really my style of investing. Doesn't mean you are wrong to buy this stock. Just not my style.

I hope that what I wrote was helpful. I do not mean to be negative. I am frankly unable to predict price moves :). Good luck and I hope that your "value" purchase works out for you! I bet it will if that next quarter surprises on the upside!

Bob

"Revisiting a Stock Pick" Resources Connection (RECN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor. I like to share with you some of my own ideas about investing and encourage you to participate in this discussion. As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I first

posted Resources Connection (RECN) on Stock Picks Bob's Advice(RECN), which does business under the Resources Global Professionals name, On January 8, 2004, when it was trading at $34.50. RECN had a 2:1 stock split on 3/2/05, making my effective stock pick price actually $17.25. Today, RECN made the

list of top % gainers on the NASDAQ , closing at $29.42, for a gain of $5.57 or 23.35% on the day. The stock is trading at $12.17 higher than my pick price, for a gain of 70.6% since posting here. I do not own any shares nor any options on this company.

What drove the stock higher today, was the

4th quarter 2005 earnings report which was released after the close of trading yesterday. For the quarter ended May 31, 2005, revenue grew 40.2% to $150.0 million, from $107 million for the same quarter in fiscal 2004. Net income came in at $15.7 million, up from $10.7 million last year, or $.31/diluted share, a 41% increase over the $.22/diluted share reported last year. This was an impressive quarter and the "street" voted with its pocketbook, driving the stock price higher!

Looking at the

"5-Yr Restated" financials from Morningstar.com, we can see a steady growth in revenue, except for a small dip between 2001 when revenue dropped from $191 million to $182 million in 2002, climbing to $495 million in the trailing twelve months (TTM).

Earnings have increased from $.29/share in 2002 to $1.01 in the trailing twelve months.

Free cash flow has also been increasing from $13 million in 2002 to $51 million in the TTM.

The balance sheet is "gorgeous" with $66.8 million in cash and $86.1 million in other current assets reported on Morningstar, balanced against $52.5 million in current liabilities and $4.7 million in long-term liabilites.

Looking at

Yahoo "Key Statistics" on RECN, we can see that this is a large mid-cap stock with a market capitalization of $1.40 Billion. The trailing p/e is 29.17, and the forward p/e (fye 31-May-06) is better at 23.86. In fact the company is anticipated to be growing so quickly that this p/e results in a PEG under 1.0 at 0.92.

While the Price/Sales ratio looks nice at 2.3, looking at other stocks in this industrial group of "Management Services", we find RECN at the top of the pack. Following RECN is Ceridian (CEN) at 2.2, Heidrick & Struggle (HSII) at 1.4, Accenture (ACN) at 1.4, Hewitt Associates (HEW) at 1.1, and BearingPoint (BE) at 0.5. Thus, in this measurement, RECN isn't that cheap a stock at all!

Other statistics from Yahoo show that this company has 47.59 million shares outstanding with 44.56 million that float. Currently there are 7.56 million shares out short as of 6/10/05, representing 16.90% of the float, or 11.7 trading days of volume. This short interest, using my own "3 day rule" looks significant and may be adding to the buying frenzy as shorts get "squeezed".

No cash dividend is reported, and as I noted earlier, the last stock split was just a few months ago when the stock split 2:1 on 3/2/05.

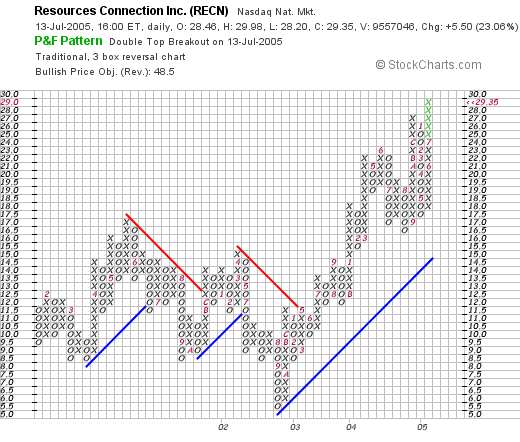

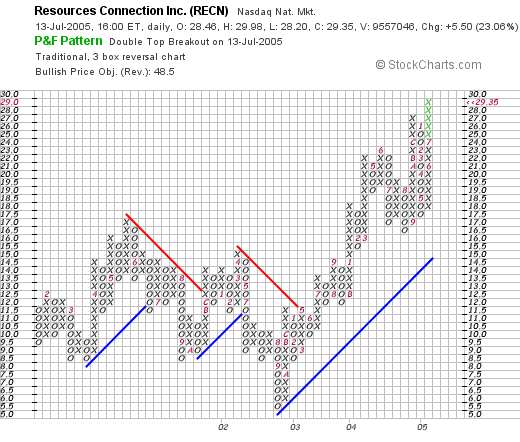

Taking a look at the

Stockcharts.com "Point & Figure" chart on RECN:

we can see that this stock was trading sideways between much of 2001 and 2002, and actually more or less "rolled over" hitting a low of $5.50 in September, 2002. The stock has traded strongly higher since that time, and appears to be poised for further appreciation without being very over-valued. Of course, that is just my take on the chart :).

So what do I think? Well, reviewing: the latest stock report that came out yesterday was phenomenal. The company has shown almost perfect growth in revenue and earnings (except the dip in 2002 as noted) the last five years. Free cash flow is positive and growing and the balance sheet is gorgeous. Valuation looks nice in terms of the p/e and PEG ratio (under 1.0), but the Fidelity review shows that the Price/Sales ratio is a bit rich within its particular group. Finally, the short interest is high, adding buying pressure, and the graph looks nice.

Now of course, I cannot buy any new stocks as I am up to 25, my current maximum # of holdings, but if I were in the market, well this is the kind of stock I would be buying! Thanks so much for stopping by. If you have any questions, comments, or words of encouragement, please feel free to comment right here on the blog, or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 11 July 2005

July 11, 2005 Arrhythmia Research Technology (HRT)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the AMEX today, I came across Arrhythmia Research Technology, which as I write, is trading at $14.55, up $.64 or 4.60% on the day. I do not own any shares of this stock nor do I own any options.

According to the

Yahoo "Profile" on HRT, the company "...engages in the licensing of medical software which acquires data and analyzes electrical impulses of the heart to detect and aid in the treatment of lethal arrhythmias."

On May 11, 2005, HRT

announced 1st quarter 2005 results. Revenue for the quarter ended March 31, 2005, grew 44% to $3.1 million, compared to revenue of $2.1 million the prior year. Net income increase 35% to $429,000 compared to $318,000 for the same quarter in 2004. On a per share basis, this was a 33% increase to $.16/share, up from $.12/share the prior year.

Looking at the

Morningstar.com "5-Yr Restated" financials on HRT, we can see that revenue did dip from $9.5 million in 2000 to $7.2 million in 2001. However, since that reporting period, HRT has showed steady growth in revenue to $12.1 million in the trailing twelve months (TTM).

Earnings/share also dropped from $.18/share in 2000 to $.07/share in 2001, but increased steadily since to $.64/share in the TTM.

Free cash flow has stayed above water with $1 million reported in 2002-2004, with $0 in free cash flow in the trailing twelve months.

The balance sheet also emphasizes the small nature of this company with $1.5 million in cash and $3.7 million in other current assets, balanced against only $900,000 in current liabilities and no long-term liabilities at all.

Looking at

"Key Statistics" from Yahoo on HRT, we can see that this is a TINY "micro-cap" stock with a market capitalization of only $38.79 million. This would make this company one of the smallest I have ever reviewed on this website!

The trailing p/e is 22.73, which isn't bad, but there are no forward p/e's nor any PEG ratios to consider, most likely due to the probability that there are few analysts who follow this tiny company.

The Price/Sales ratio is 3.07. This also makes the company appear reasonably priced in the "Medical Appliances/Equipment" industrial group. At the top of this group is St. Jude (STJ) at 6.7 Price/Sales, Medtronic (MDT) at 6.3, Zimmer (ZMH) at 6.3, Biomet (BMET) at 4.8, followed by Arrhythmia Research (HRT) at 3.1, and Edwards Lifesciences (EW) at 2.7.

Other key statistics confirm the tiny nature of this company with only 2.67 million shares outstanding and 2.03 million that float. Currently there are 590,750 shares out short as of 6/10/05, representing 30.70% of the float (!) or 7.7 trading days of volume. You can see how a little bit of good news could cause these shorts to scramble to cover! The company does pay a small dividend of $.12/share yielding 0.86%. No stock dividend is reported on Yahoo.

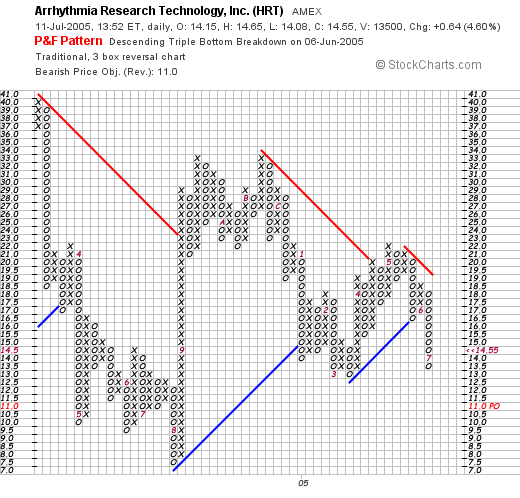

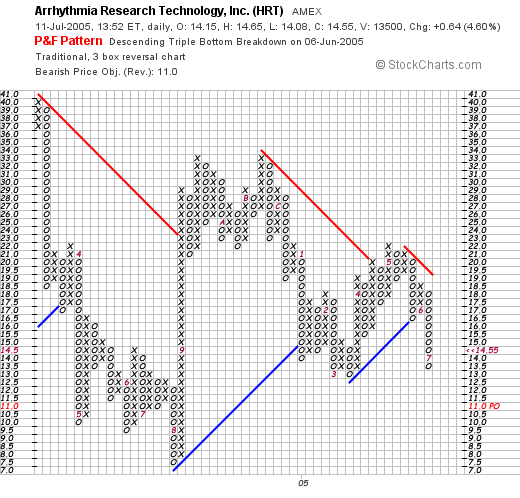

Taking a look at a

"Point & Figure" chart on HRT, we can see that the stock has been trading fairly sideways, until last month when it broke down under support levels at $16, and traded as low as $13.50. The stock is trading slightly higher now, but is still below support levels. The chart does not look encouraging to me!

So what do I think? Well this is certainly what I would call a "mixed bag" of results! Some of the positive things about this stock include the nice move today, the great quarterly report, the past 4-5 years of solid growth in both revenue and earnings, the nice balance sheet and the reasonable valuation both in terms of p/e and Price/Sales ratios. The significan short interest may be included in the "plus column".

On the downside, the company does not generate any free cash flow, the chart looks weak, and the fact that there are so few shares outstanding makes it vulnerable to volatility and price manipulation. This would certainly be a more speculative investment, but it may be worth putting on your horizon to watch and see how future earnings return.

Thanks so much for stopping by. If you have any questions or comments, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 1:32 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 11 July 2005 1:37 PM CDT

Newer | Latest | Older

I have been away from my computer for a few days...and thus, have a few things I need to catch up on. First of all, checking my trading portfolio today, I noticed that my Meridian Bioscience (VIVO) had hit a first sale point (it is currently trading at $22.95, up $.885 or 4.00% on the day). Earlier today, I sold 100 shares of my 400 share position (a 1/4 of my shares) at $22.77. These shares were acquired on 4/21/05 (a little over three months ago!), at a cost basis of $16.67/share. Thus, I had a gain of $6.10/share or 36.6% on my original purchase price.

I have been away from my computer for a few days...and thus, have a few things I need to catch up on. First of all, checking my trading portfolio today, I noticed that my Meridian Bioscience (VIVO) had hit a first sale point (it is currently trading at $22.95, up $.885 or 4.00% on the day). Earlier today, I sold 100 shares of my 400 share position (a 1/4 of my shares) at $22.77. These shares were acquired on 4/21/05 (a little over three months ago!), at a cost basis of $16.67/share. Thus, I had a gain of $6.10/share or 36.6% on my original purchase price.

One thing I try very hard around here to accomplish is to share with you actual trades in my very real

One thing I try very hard around here to accomplish is to share with you actual trades in my very real  The market had a nice day today with the Dow closing at 10,646.56, up 71.57, and the NASDAQ closing at 2,173.18, up 28.31 on the day. I thought I might stop with just one post today, but curiosity got the better of me and I went back to those lists of top % gainers and found another candidate to discuss.

The market had a nice day today with the Dow closing at 10,646.56, up 71.57, and the NASDAQ closing at 2,173.18, up 28.31 on the day. I thought I might stop with just one post today, but curiosity got the better of me and I went back to those lists of top % gainers and found another candidate to discuss.

The market is moving higher today which always makes me optimistic about finding the kind of stocks that I like to write about on this website! For any newbies around here, my first step in identifying a prospect for this website is to scan the top % gainers list. These are often stocks with some news that exceeds expectations.

The market is moving higher today which always makes me optimistic about finding the kind of stocks that I like to write about on this website! For any newbies around here, my first step in identifying a prospect for this website is to scan the top % gainers list. These are often stocks with some news that exceeds expectations.

I was looking through the

I was looking through the  According to the

According to the  Looking at other statistics on CTHR, we find that there are 14.39 million shares outstanding with 10.69 million shares that float. Of these, there are 604,430 shares out short representing 5.10% of the float or 4.5 trading days of volume, which will just be adding some buying pressure on this already strong stock.

Looking at other statistics on CTHR, we find that there are 14.39 million shares outstanding with 10.69 million shares that float. Of these, there are 604,430 shares out short representing 5.10% of the float or 4.5 trading days of volume, which will just be adding some buying pressure on this already strong stock.

On May 24, 2004, I

On May 24, 2004, I  On May 16, 2005, PETS

On May 16, 2005, PETS  On May 25, 2004, I

On May 25, 2004, I  On May 26, 2004, I

On May 26, 2004, I  The last stock pick that week was Wendy's (WEN) which I

The last stock pick that week was Wendy's (WEN) which I  Because of the

Because of the  The first place I go to find a new stock pick is the top % gainers list. I use the Cnn.money site, but the USA Today site, or other internet sources are certainly workable. This afternoon, looking through the

The first place I go to find a new stock pick is the top % gainers list. I use the Cnn.money site, but the USA Today site, or other internet sources are certainly workable. This afternoon, looking through the  According to the

According to the  Looking at the balance sheet, we can see that CTAS has $367.8 million in cash according to Morningstar.com, and $824.5 million in other current assets. This is plenty to cover both the $385.4 million in current liabilities and the $385.4 million in long-term liabilities combined.

Looking at the balance sheet, we can see that CTAS has $367.8 million in cash according to Morningstar.com, and $824.5 million in other current assets. This is plenty to cover both the $385.4 million in current liabilities and the $385.4 million in long-term liabilities combined.

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Some basics: InfoSpace (INSP) closed today (7/13/05) at $33.70, down $.48 or 1.40% on the day.

Some basics: InfoSpace (INSP) closed today (7/13/05) at $33.70, down $.48 or 1.40% on the day.

I first

I first

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  According to the

According to the  Looking at

Looking at