Stock Picks Bob's Advice

Friday, 9 September 2005

September 9, 2005 Global Payments (GPN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before I talk about stocks, I want to continue to celebrate New Orleans. Some have you may arrived to this blog looking for Katrina hurricane-related stock picks. But more importantly, we need to remember the things that made New Orleans special, and to work to support the people, the place, and the culture of the City.

I spent three years of my life in New Orleans. I met my wife there and my first son was born at Ochsner Clinic, the only Hospital/Clinic functioning through the hurricane.

One of the sites seen throughout New Orleans, especially in the Uptown area, was the Roman Candy Truck. For 50 cents you could get a long stick of this taffy candy. Just something Special I guess.

The story of the Roman Chewing Candy truck follows:

The Roman Candy Company began as a family treat with a recipe that dates back at least four generations. My great grandmother, Angelina Napoli Cortese, made the candy for family and friends at social and special events like Christmas and St. Joseph's Day. Her son, Sam Cortese, who was a street vendor by trade since the age of 12, would on occasion bring the left over candy on his fruit and vegetable wagon to sell the next day.

Roman Candy always sold very well and people began to ask for it, so Sam decided to try to sell candy on a regular basis. The problem however was that his mother didn't have time to make candy everyday and still tend to her other children and do all the things that mothers do.

Sam realized he would have to find a way to make his Roman Candy as he rolled along and sold it. In 1915, he went to a wheelwright named Tom Brinker and together they designed the wagon that is still used today.

The Roman Candy gourmet taffy initially sold for 5 cents a stick and stayed at that price until 1970. After his death in 1969, Sam's grandson took over the business and it continues to this day. The wagon and mule can be seen rolling through the streets of New Orleans, uptown, downtown and occasionally even in the suburbs on an almost daily basis.

Let us celebrate the small special things about New Orleans!

Now back to stocks!

The stock market is continuing to rally today, after the small profit-taking session yesterday. Looking through the

list of top % gainers on the NYSE today, I came across Global Payments (GPN) which is trading at $68.89, up $3.89 or 5.98% on the day. I do not own any shares nor do I have any options in this company.

According to the

Yahoo "Profile" on Global Payments, the company "...provides electronic transaction processing services to consumers, merchants, independent sales organizations, restaurants, universities, financial institutions, government agencies, and multinational corporations in the United States, Canada, Latin America, and Europe."

On July 20, 2005, GPN

announced 4th quarter 2005 results. Revenue climbed 14% to $207.7 million, up from $181.8 million for the same quarter last year. Net income grew 44% to $25.9 million, up from $18.0 million last year. Diluted eps climbed 39% to $.64/share, up from $.46/share in the same period last year.

Looking longer-term at the

"5-Yr Restated" financials on Morningstar.com for GPN, we can see a pretty picture of steady revenue growth from $340 million in 2000 to $759 million in the trailing twelve months (TTM).

Earnings are reported since 2002 at $.63/share, climbing steadily to $2.13/share in the TTM.

In addition, the company pays a small dividend of $.16/share.

Free cash flow has been positive but has fluctuated with $138 million reported in 2002, dropping to $11 million in 2003 and coming in at $174 million in the TTM.

The balance sheet is fair with $58.2 million in cash and $107.4 million in other current assets. This is outweighed slightly by the current liabilities of $179.2 million and the $96.5 million in long-term liabilities. With the $174 million in free cash flow, this shortfall should not (imho) be a problem.

Looking at

Yahoo "Key Statistics" on GPN for some valuation parameters, we can see that the company is a large cap stock with a market cap of $2.7 billion. The trailing p/e is a tad rich at 29.63 with a better forward p/e (fye 31-May-07) of 21.91. The PEG ratio is a bit high at 1.45.

Using

Fidelity brokerage for information, I found that this company is in the "Business Services" industrial group. Within this group, the price/sales ratio of GPN puts it near the top. Leading the group is Equifax (EFX) at 3.3 price/sales, followed by Global Payments (GPN) at 3.2, Cintas (CTAS) at 2.2, Certegy (CEY) at 1.9 and IPAYMENT (IPMT) at 1.2.

Other statistics from Yahoo reveal that there are only 39.12 million shares outstanding with 6.97 million shares out short (as of 7/12/05) representing 18.10% of the float or 25.6 trading days. This is a

LOT of shares out short (I use 3 trading days of volume as my own cut-off for this statistic), and may explain the upward pressure of the stock as short-sellers scramble to cover.

As noted earlier, the company pays an annual dividend of $.16/share yielding 0.20%. No stock splits are reported on Yahoo.

What about the chart? Taking a look at the

"Point & Figure" chart on GPN:

We can see that the stock traded sideways between 2001 and 2002 between a trading range of $20 and $39. In November, 2002, the stock broke through resistance at the $30 level, and has traded higher since to the current $69 level. The stock looks quite strong to me.

So what do I think? Well, I am not in the market for any stocks sitting on my full complement of 25 positions. However, this stock looks nice with a strong recent quarter, a good five year record of earnings and revenue growth, and a strong chart. Valuation is a tad rich and the balance sheet could show a little more in the current assets department. Otherwise, things look nice for this stock!

Thanks again for stopping by! If you have any comments, or questions, please feel free to email me at bobsadviceforstocks@lycos.com, or leave your thoughts right here on the blog!

Bob

Wednesday, 7 September 2005

"Trading Transparency" Mentor (MNT)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Stocks have rallied the last couple of days and this has put another of my stocks in the sale range on a gain. Mentor (MNT), as I write, is trading at $55.19, up $1.49 or 2.77% on the day. Earlier today, I sold 37 shares of Mentor at $55.24. This represented 1/4 of my 150 share position.

These Mentor shares were acquired on 2/3/05 at $34.37/share. Thus, these shares were sold with a gain of $20.87/share or a 60.7% gain over the initial purchase. This was my second sale of shares of Mentor, having sold 50 shares of my 200 share initial position on 7/28/05, a little over a month ago, at a price of $44.98, which represented a gain of $10.20 or 29.7%.

If you follow my blog, you know that I like to sell stocks quickly at a loss, using 8% as my limit, and also sell shares slowly at targeted gains, with 1/4 positions (of remaining shares) sold at 30%, 60%, 90%, 120%; (then by 60% intervals): 180%, 240%, 300%, 360%; (then by 90% intervals etc.). Thus, with Mentor, I shall try to sell another 1/4 position at 90% gain level, or unload

all of my remaining shares if the stock retraces to a 45% gain point. (After selling more than once, I use a 50% retracement of the highest gain % as my sale point.)

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 6 September 2005

September 6, 2005 Nordstrom (JWN)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Some of you have come to this blog in search of the best hurricane stock picks. Looking to profit from the Katrina disaster. I do think some stocks will prosper with the tremendous need for reconstruction that the City of New Orleans will face. However, as we think of the profit we are earning, let us all remember to

contribute to the Red Cross and other worthy organizations helping to put the City and the lives of the families so terribly disrupted back together.

One thing I have been enjoying here on the blog is taking a moment to highlight some of my own personal favorite spots in New Orleans with all of my readers.

If you have other favorites, well post them here and I will try to expand on them as well.

Being a bit of a shopper, I will often visit the

Jackson "Jax" Brewery:

This is a great shopping mall on the Mississippi, in the French Quarter. Housing stores and restaurants in a converted brewery building, it is a "must-see" for the first-time New Orleans visitor!

But back to stocks!

My selection today is a favorite shopping place for my family whenever we are on vacation. Unfortunately, we don't have a Nordstrom in our own town, but that doesn't stop any of us from racking up our charges for shoes and clothing in this upscale retail outfit. I don't have any shares or options in this stock although I did own a few shares at least five years ago for a short while.

My selection today is a favorite shopping place for my family whenever we are on vacation. Unfortunately, we don't have a Nordstrom in our own town, but that doesn't stop any of us from racking up our charges for shoes and clothing in this upscale retail outfit. I don't have any shares or options in this stock although I did own a few shares at least five years ago for a short while.

The Nordstrom story is one of the great histories in retail in America. As noted on their homepage:

The Nordstrom story is one of the great histories in retail in America. As noted on their homepage:

In 1887, a 16-year-old boy left his home country of Sweden for the promise of New York City. He arrived with only five dollars in his pocket, unable to speak a word of English. His name? John W. Nordstrom.

The first years in the land of opportunity were hard. To make ends meet, young John labored in mines and logging camps as he crossed the United States to California and Washington. Then one morning in 1897, he picked up a newspaper and read the front-page headline "Gold Found in the Klondike in Alaska." The very next day, he made plans to head north.

Things were no easier in the Klondike. The labor was hard, the terrain difficult, and there was an over-supply of eager workers. But within two years, John had earned $13,000 in a gold mine stake and returned to Seattle.

Back in the Northwest, John was eager to invest his money. He had befriended a man while in Alaska, Carl Wallin, who owned a shoe repair shop in downtown Seattle. It wasn't long before the two decided to go into partnership and open a shoe store together.

In 1901, the two opened their first shoe store, Wallin & Nordstrom, in downtown Seattle. This was the start of what would become the retail legend of Nordstrom, Inc.

Today, Nordstrom is a high-end retail firm, with stores located coast-to-coast.

Looking through the

list of top % gainers on the NYSE today, I came across Nordstrom (JWN), which closed at $35.01, up $1.91 or 5.77% on the day.

On August 16, 2005, Nordstrom

reported 2nd quarter 2005 results. Total sales for the quarter ended July 30, 2005, increased 7.8% to $2.1 billion, compared to the sales of $2.0 billion in the prior year same quarter. Perhaps more importantly, during the quarter same-store sales increased 6.2%.

Earnings increased 39% to $148.9 million or $.53/diluted share, up from $106.9 million, or $.37/share for the same quarter last year. In another positive note, the company

raised guidance for earnings per share to $1.80 to $1.90 for the year, up from prior estimates of $1.70 to $1.75. I always enjoy seeing strong earnings reports

along with raised guidance!

Looking longer-term at the

"5-Yr Restated" finances on Morningstar.com, we can see revenue growing steadily from $5.5 billion in 2001 to $7.3 billion in the trailing twelve months (TTM).

Earnings per share have been a little

less consistent with earnings dropping from $.78/share in 2001 to a low of $.33/share in 2003. However, since then the earnings have been growing steadily again with $1.52/share reported in the TTM.

In addition, the company has a dividend and has been

growing the amount. Nordstrom paid $.18/share in 2001, and has increased it to $.25/share in the TTM.

Free cash flow which was a negative $(45) million in 2003, has improved, with $404 million in free cash flow reported in the TTM.

The balance sheet, as reported by Morningstar, also looks good with $796.7 million in cash and $1,814.5 million in other current assets. This is balanced against $1,236.4 million in current liabilities and $1,490.2 million in long-term liabilities.

What about some "

Key Statistics on JWN"?

Here we can see that this is certainly a large cap stock with a market capitalization of $9.56 billion. The trailing p/e isn't too bad at 20.88 (imho) with a forward p/e of 16.59 (fye 29-Jan-07). The PEG is a bit rich but not bad at 1.26. (Fair valuation is usually at a PEG of 1.0).

What about the price/sales ratio? Using my Fidelity Brokerage for research, I found that Nordstrom is in the "Apparel Stores" industrial group. Within this group, JWN is fairly reasonably priced. Abercrombie & Fitch (ANF) tops the list with a price/sales ratio of 2.2, American Eagle (AEOS) next at 2.0, PacSun (PSUN) follows at 1.3, then Nordstrom (JWN) at 1.2, Gap (GPS) at 1.0 and the Limited (LTD) at 0.9.

Other statistics from Yahoo show that JWN has 273.12 million shares outstanding. 8.39 million are out "short" as of 7/12/05, representing 6.00% of the float or 3.9 trading days of volume.

The company pays a dividend of $.34/share yielding 1.00%. The last time the stock split was just a couple of months ago (7/1/05) when a 2:1 split was carried out.

How about a chart?

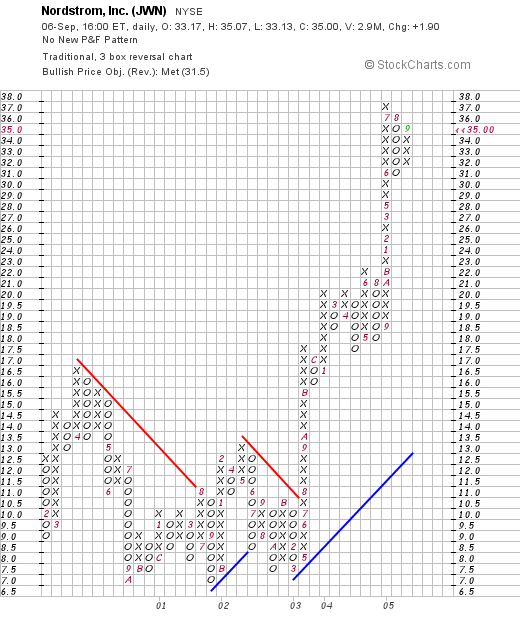

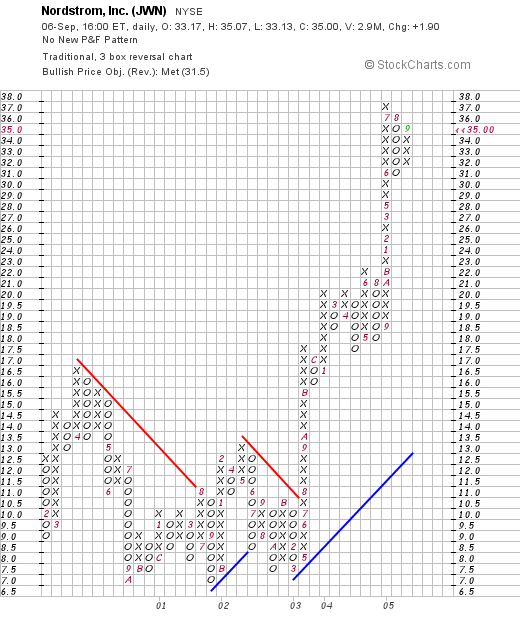

Looking at a

"Point & Figure" chart from Stockcharts.com:

We can see that the stock was trading sideways between February, 2000, and July, 2003, when it was trading in a range between $7.50/share and $16.50. The stock broke through resistance in July, 2003 at $10.50 and has traded strongly higher since!

So what do I think? Well lets review: the stock made a nice move higher today, the same store sales figures are solid, the last quarter was very nice and the past five years, especially the past three years have been very strong in terms of earnings and revenue growth. In addition the company pays a growing dividend!

Free cash flow has been positive and growing, and the balance sheet looks nice if not spectacular. Value is reasonable with a p/e just over 20, a PEG just over 1.0, and a price/sales in the middle of its industrial group. In addition, the chart looks nice too. Most everything is nice, except for one fact, I don't own any shares :(. And with 25 positions in my portfolio, I don't have any 'room' even if I were interested!

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 5 September 2005

"Looking Back One Year" A review of stock picks from the week of July 5, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before going into my weekly review of past picks, I wanted again to take this time to share with you some of my own memories of places and things that have made New Orleans special to me and special to all of America! I lived three years in New Orleans and now have family that has homes under water, lives disrupted, and finances in disarray. This story is repeated over and over. Everyone in my family is safe. That cannot be said for other families; some are still trapped in the City.

But this entry is not about mourning New Orleans but of celebrating the City that shall rise again on the banks of the Missippi sandwiched (or should I say Muffaletta'ed) between the "Big Muddy" and Lake Pontchartrain.

In fact, as I write, my wife is preparing to have some friends over for Muffaletta sandwiches. The best place to have one of these, and to be sure to visit once it is open again, is

Central Grocery, right in the heart of the French Quarter.

With a wonderful array of delicacies, this is a place not to be missed! An Italian delicatessen with an array of foods, sausages, and desserts, but especially the famous Muffaletta Sandwich!

O.K., before I get everyone hungry, let's get back to stocks for a bit!

As you probably know, if you are a new reader, I like to pick stocks on this blog :). But in order to know if what I write is actually successful, there needs to be some sort of analysis of what was discussed and how they actually turned out. The stocks discussed are mostly investments that I do not own. However, my own Trading Portfolio, that I do discuss, and have links to on the side of the blog, comes from the list of stocks that I have written up on the blog. I try very hard to let you know when I actually purchase or sell anything in the trading portfolio, and I do this with the entries titled "Trading Transparency". I am trying to keep my own personal trading account and activity as "transparent" as possible to you, the reader!

As you probably know, if you are a new reader, I like to pick stocks on this blog :). But in order to know if what I write is actually successful, there needs to be some sort of analysis of what was discussed and how they actually turned out. The stocks discussed are mostly investments that I do not own. However, my own Trading Portfolio, that I do discuss, and have links to on the side of the blog, comes from the list of stocks that I have written up on the blog. I try very hard to let you know when I actually purchase or sell anything in the trading portfolio, and I do this with the entries titled "Trading Transparency". I am trying to keep my own personal trading account and activity as "transparent" as possible to you, the reader!

In my actual trading account I employ a variety of trading "rules" that I have discussed over and over on this blog. Basically, I sell my losers quickly if they hit an 8% loss (or exceed it), and sell my winning investments slowly at different % gain targets. For this review, however, I am assuming a "buy and hold" strategy, which will yield results that might be better or worse than what actually happens when I personally purchase stocks.

On July 6, 2004, I posted Cal-Maine Foods (CALM) on Stock Picks at a price of $15.09. CALM closed at $6.79 on 9/2/05 for a loss of $(8.30) or (55)%. This stock is possibly (?) a victim of the collapse of the low-carb dieting craze when everyone was eating loads of eggs (?).

On July 6, 2004, I posted Cal-Maine Foods (CALM) on Stock Picks at a price of $15.09. CALM closed at $6.79 on 9/2/05 for a loss of $(8.30) or (55)%. This stock is possibly (?) a victim of the collapse of the low-carb dieting craze when everyone was eating loads of eggs (?).

On August 1, 2005, Cal-Maine (CALM) reported 4th quarter 2005 results. Revenue dropped from $142.4 million last year to $81.5 million this year fourth quarter. Net loss was $(6.6) million or $(.28)/diluted share as compared to $17.2 million or $.70/diluted share in the same quarter last year. As pointed out by the company:

On August 1, 2005, Cal-Maine (CALM) reported 4th quarter 2005 results. Revenue dropped from $142.4 million last year to $81.5 million this year fourth quarter. Net loss was $(6.6) million or $(.28)/diluted share as compared to $17.2 million or $.70/diluted share in the same quarter last year. As pointed out by the company:

"Beginning in the summer of 2003, the egg industry experienced very strong demand. This demand was related to the high-protein, low-carb diets that were very popular at the time. This strong demand, combined with moderate supply, resulted in record high egg prices for approximately 15 months. However, In the early fall of 2004, this demand trend related to the popular diets faded dramatically. In the meantime, the egg industry had geared up to produce more eggs to meet the strong demand. As a result, during the past nine to 12 months, our industry has experienced an oversupply of eggs resulting in lower prices and losses for the egg industry.

On July 8, 2004, I

posted Anika Therapeutics (ANIK) on Stock Picks at a price of $16.01. ANIK closed on 9/2/05 at $13.40 for a loss of $(2.61) or (16.3)%.

On July 27, 2005, Anika

announced 2nd quarter 2005 earnings. Total revenue for the quarter ended June 30, 2005, came in at $7.02 million, a 12.1% increase over $6.26 million in the same quarter the prior year. Net income worked out to $1.3 million or $.12/diluted share, up from $765,000 or $.07/diluted share in the same quarter last year.

Finally, on July 9, 2004, I

picked Johnson Controld (JCI) for Stock Picks at a price of $53.24. JCI closed at $59.70 on 9/2/05 for a gain of $6.46 or 12.1%.

On July 21, 2005, JCI

reported 3rd quarter 2005 results. For the quarter ended June 30, 2005, sales increased 9% to $7.1 billion from $6.5 billion in the same quarter in 2004. Net income came in at $254.7 million up from $222.2 million, or $1.31/diluted share, up from $1.08/diluted share last year.

So how did we do? Well not very well! In fact, of the three stock picks, two declined and one had a gain for a performance amounting to an average loss of (19.7)% for the period.

Muffalettas at Central Grocery.

By the way, my friends all came over this afternoon, we made some Hurricanes from an old Pat O'Brien's Hurricane mix, ate some bread pudding, listened to some Cajun music, and reminisced.

Sometimes having a bad week in the stock market isn't the worst thing in the world. May all of your prayers and your contributions be directed towards the victims of Katrina! Have a great week trading everyone.

Bob

Posted by bobsadviceforstocks at 1:13 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 5 September 2005 8:29 PM CDT

Saturday, 3 September 2005

"Weekend Trading Portfolio Analysis" Affymetrix (AFFX)

I cannot write anything without urging you to donate to the Katrina Relief fund. You can donate

here, which is the Amazon.com donation site. Please dig deep into those pockets. If I have helped you make any money on this website, do it for me.

Again thinking of New Orleans, I would like to use this entry to think of the many cultural things that make this devastated city a jewel that shall need to be restored. One of the things I enjoy when visiting New Orleans are the wonderful pralines! If you haven't visited a New Orleans praline shop, well you haven't had that treat!

The Evans Creole Candy Factory on 848 Decatur is worth a visit as soon as they get things back up and going in New Orleans. There is nothing better than a freshly prepared New Orleans praline to hit the sweet spot!

Anyhow, back to the stocks! Last weekend I decided to start a systematic review of the stocks I hold in my actual Trading Account. I discuss many stocks on the blog; I try to let you know when I own some shares and when I sell them. The stocks I actually own are actually a very small percentage of stocks examined on Stock Picks.

Anyhow, back to the stocks! Last weekend I decided to start a systematic review of the stocks I hold in my actual Trading Account. I discuss many stocks on the blog; I try to let you know when I own some shares and when I sell them. The stocks I actually own are actually a very small percentage of stocks examined on Stock Picks.

I first posted Affymetrix (AFFX) on Stock Picks on January 27, 2005, when it was trading at $40.62. I purchased 160 shares of Affymetrix that same day with a cost basis of $40.98/share. I hit my first sale point (with about a 30% gain) on 5/26/05, and sold 1/4 of my holdings (40 shares) at a net of $53.18, for a gain of $12.20 or 29.8%. Currently, I own 120 remaining shares which closed at $49.07 on 9/3/05, for a gain of 19.75%. I shall be selling my second portion at a gain if the stock is up 60% or about $65.57, or at $40.98 on the way down, in which case I would be selling all remaining shares.

Looking for the latest quarter, AFFX reported 2nd quarter 2005 results on July 21, 2005. Revenue came in at $84.1 million for the second quarter, up from $79.8 million in the same quarter the prior year. Net income came in at $7.8 million or $.12/diluted share, up from $7.0 million, or $.11/diluted share last year. However, as reported, analysts had been looking for $.17/share on sales of $88.1 million. Thus, results disappointed on both the revenue and earnings front. In addition, the company guided lower for the upcoming quarter, forecasting a loss of $(.06)/share, on revenue of $95 million. The "street" had been looking for a profit of $.29/share, on revenue of $101.7 million. Needless to say the stock sold off on this double disappointment. The stock price, however, has been fairly resilient, probably on anticipation of more longer-term positive results.

Looking for the latest quarter, AFFX reported 2nd quarter 2005 results on July 21, 2005. Revenue came in at $84.1 million for the second quarter, up from $79.8 million in the same quarter the prior year. Net income came in at $7.8 million or $.12/diluted share, up from $7.0 million, or $.11/diluted share last year. However, as reported, analysts had been looking for $.17/share on sales of $88.1 million. Thus, results disappointed on both the revenue and earnings front. In addition, the company guided lower for the upcoming quarter, forecasting a loss of $(.06)/share, on revenue of $95 million. The "street" had been looking for a profit of $.29/share, on revenue of $101.7 million. Needless to say the stock sold off on this double disappointment. The stock price, however, has been fairly resilient, probably on anticipation of more longer-term positive results.

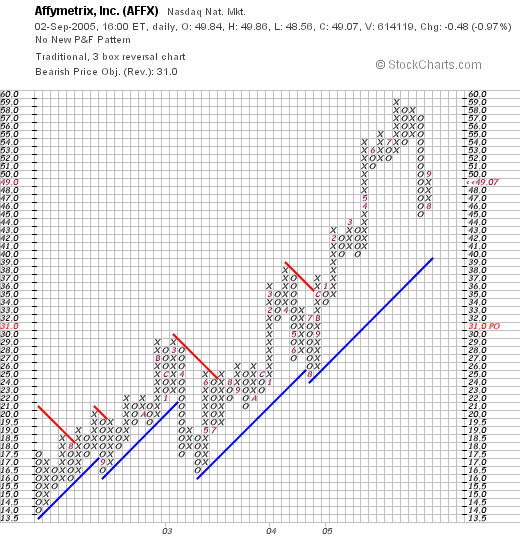

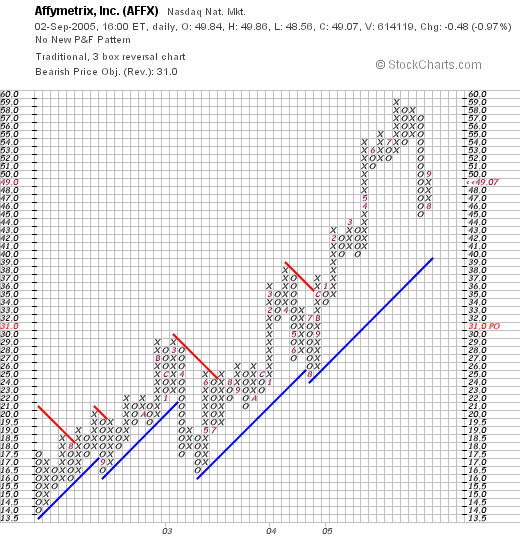

If we take a look at the "Point & Figure" chart on AFFX from Stockcharts.com:

We can see that the stock has been trading quite strongly higher since breaking through "resistance" at around the $25 level in July, 2004. The stock did appear to be a bit "ahead of itself" as it distanced itself from the support line, but the price action has not apparently broken down and recently has been moving higher through the month of August, 2005.

So what do I think? Well, the future of gene identification laboratory tests is really quite unlimited. That is at least the story part of the equation. The last quarter was a disappointment, and the next quarter too will be a drag on performance. However, long-term, the story part of the equation is likely still intact. And meanwhile, I shall be watching the stock price and allow the market to "tell" me what I need to do to manage this position!

Thanks again for dropping by. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or leave them right here on the blog!

Remember to think of all of the people displaced, and remember the good times of New Orleans, a city that will rise again between the waters of Lake Pontchartrain and the Mississippi.

Remember to think of all of the people displaced, and remember the good times of New Orleans, a city that will rise again between the waters of Lake Pontchartrain and the Mississippi.

Bob

Posted by bobsadviceforstocks at 3:46 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 3 September 2005 8:33 PM CDT

Friday, 2 September 2005

A Thank You to "Deep Market" Blog!

Eric Cahoon writes a blog,

Deep Market and has included an entry dated September 1st 2005 that is very kind and complimentary to this blog,

Stock Picks Bob's Advice. I would simply like to say "Thank You!" for your kind plug. I haven't met you, but as an amateur investor, I appreciate your kind words. I work hard at explaining my thinking and if I have added some understanding to the world of investing, well that is about all I am about. And yes, you caught me getting behind at updating my other pages including my trading portfolio. I have a three day weekend, so maybe I can squeeze a few moments into updating the blog!

Eric writes:

There are a lot of stock market related blogs out there. I have looked at many of them and have been impressed with the effort that some people put into providing (potentially) valuable analysis for free. Of course, there are a lot of splogs - spam blogs - also. However, in looking through the universe of stock blogs, I found Stock Picks Bob’s Advice website. From what I can tell, it looks like Stock Picks Bob has been doing a great job documenting his ideas, background information, and charts since 2003. Golly, and what a history of postings to read through. Did I mention the pretty pictures? Not just the charts, but also nice photos.

I am guessing that Bob has an interest in Point and Figure charting - most of the charts I saw use P&F.

He also tracks his trades, but I don’t see an update since June 2005. If you have a question, Bob seems to be more than happy to provide answers - he has “A Reader Writes…” sections sprinkled liberally through his other postings. He begins his answers to questions with the following caveat:

As always, please remember that I am an amateur investor so please consult with your professional investment advisor prior to making any decisions based on information on this website.

Truer words have not been spoken, but I doubt most “professional investment advisors” would be willing to have their trading records in an open forum like Bob has his. In the world of brooding and negative blogs, Bob provides a useful and positive source of information.

Thanks again.

I shall try to work hard to work up to your kind words of recommendation!

Bob

Thursday, 1 September 2005

A Reader Writes: "What would be some stocks that I could fall into?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am

truly an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I always enjoy getting mail and questions from readers. For me, it makes the whole writing about stocks more interesting. Unfortunately, I am not qualified to give individual advice to anyone. So when I received this letter, I knew I couldn't and shouldn't answer specifics, but let me try to answer the question with some general thoughts about investing.

The email:

Hello Bob,

My name is Long P---, I am currently living and working in Baton Rouge for E-911 service restoration for all wireless carriers. Honest to say, I would like to take a chance to find a nitch in stock investment during this period of time.

What would be some stocks that I should fall into? BMHC?

You are alway said on your blog that "I am an amateur with stocks" but I believe that you could lead me a good way. I want to take an opportunity to be sucess in life and helping other during their down time.

Best regards

Long J. P---

Well Long, that you so much for writing. I really

am an amateur investor. I am not a certified financial advisor or any such thing. I just like to pick stocks and talk about them. There are literally hundreds of stocks on the blog that I review, and if you go through some of them, I am sure you may find stocks that fit your particular interests.

Thank you for working in Baton Rouge helping get New Orleans back on E-911 service. Needless to say,

that is very important work and much needed for all of the hurricane victims.

I really cannot tell you which stock to invest in, basically because I really don't know. I suspect that stocks that are involved in construction, whether it be a cement manufacturer, a lumber stock, a building supply firm, or the like, will find their products and services in great demand.

My own strategy of picking stocks is to let the stocks come to me rather than chasing after stocks which I figure

ought to do well! I can only suggest that you consider doing the same.

As you may know, if you read my blog, I start with the top % gainers of the day. I use CNN Money website to find this, but this is available on USA Today and elsewhere. After that I go to Yahoo and research the latest quarter. I don't do anything complicated, I just see if their revenue and their earnings are positive and growing. Next to Morningstar where I look at revenue and earnings, as well as free cash flow (I insist it be positive and growing if possible), the balance sheet, and some key statistics. If everything looks good, well then I take the plunge.

I like to sell my losing stocks quickly and then slowly sell my gaining stocks, selling 1/4 of my remaining positions at specified gain points. Internally in the portfolio, I use a sale at a gain as a "good news signal" that enables me to add a position (up to my maximum # of positions which is now 25), and use a sale at a loss or on bad news as a "bad news signal" which directs me to "sit on my hands", that is, avoid reinvesting proceeds of stocks that were recently sold under less than ideal circumstances.

That's about it.

I don't have any magic about what I do. Lots of old-fashioned 'elbow grease' as my mother would like to say. Just do my homework, remain skeptical, and be quick to act.

Good luck and thank you from all of us for your work in getting New Orleans, the "Big Easy" back on its feet!

Bob

September 1, 2005 Cavco Industries (CVCO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before I post, I wanted again to express my concern and prayers for all of those who have been impacted by the catastrophe called Katrina.

One of the fun things to do in New Orleans is to ride the steamboat. Here is an

image of the Steamboat Natchez.

Anyhow, back to stocks! Scanning through the list of top % gainers on the NASDAQ, you can see what I would call "Katrina-related" stocks. These are companies that investors, or speculators, believe may benefit from the eventual massive investment in rebuilding and repair of the hurricane disaster region.

One company that made the list today is Cavco Industries Inc. (CVCO) which, as I write, is trading at $36.00 (in an otherwise weak market), up $2.46 on the day for a 7.33% gain. I do not own any shares nor have any options on this stock.

One company that made the list today is Cavco Industries Inc. (CVCO) which, as I write, is trading at $36.00 (in an otherwise weak market), up $2.46 on the day for a 7.33% gain. I do not own any shares nor have any options on this stock.

According to the Yahoo "Profile" on Cavco, the company "...engages in the design and production of manufactured homes primarily in the southwestern United States." I would expect that this type of business may well be in great demand with the damage to housing from the hurricane!

According to the Yahoo "Profile" on Cavco, the company "...engages in the design and production of manufactured homes primarily in the southwestern United States." I would expect that this type of business may well be in great demand with the damage to housing from the hurricane!

On July 20, 2005, Cavco reported 1st quarter 2006 results. For the quarter ended June 30, 2005, net sales grew 28% to $45.9 million from $35.9 million the prior year. Net income was up 107% to $3.5 million, compared with $1.7 million the prior year, and on a per share basis this worked out to $.56/diluted share, up from $.27/diluted share last year same period.

What about longer-term results? Looking at the Morningstar.com "5-Yr Restated" financials on CVCO, we can see that revenue has been steadily growing from $95.5 million in 2001 to $167.4 million in the trailing twelve months.

Earnings reports actually start in 2005 with $1.54 reported and $1.81 in the trailing twelve months (TTM).

Free cash flow is positive and appears to be growing with $2 million reported in 2003, expanding to $16 million in the TTM.

The balance sheet is very strong with $50.4 million in cash and $26.2 million in other current assets, enough to cover both the $29.9 million in current liabilities and the $9.6 million in long-term liabilities more than 2x over.

Reviewing Yahoo "Key Statistics" on CVCO, we can see that this is a very small company with a market cap of only $226.37 million. The trailing p/e is 19.82 and the forward p/e (fye 31-Mar-07) is even nicer at 15.0. With this excellent valuation (imho), it is no surprise that the PEG is 0.71. Anything under 1.0 is a good value in general.

Reviewing Yahoo "Key Statistics" on CVCO, we can see that this is a very small company with a market cap of only $226.37 million. The trailing p/e is 19.82 and the forward p/e (fye 31-Mar-07) is even nicer at 15.0. With this excellent valuation (imho), it is no surprise that the PEG is 0.71. Anything under 1.0 is a good value in general.

Insofar as the price/sales ratio is concerned, CVCO appears moderately priced. That is, within its industrial group of "Manufactured Housing" it is not a screaming steal! Topping this list is Nobility Homes (NOBH) with a price/sales ratio of 2.1. This is followed by CAVCO (CVCO) at 1.3, Champion Enterprises (CHB) at 0.9, Palm Harbor Homes (PHHM) at 0.7, MODTECH Holdings (MODT) at 0.6, and Cavalier Homes (CAV) at the bottom of the pack with a price/sales ratio of 0.4.

Other statistics from Yahoo show that the company has 6.29 million shares outstanding. As of 8/10/05 there were 31,610 shares out short representing 0.50% of the float or 2.9 trading days of volume. This doesn't look significant to me.

No cash dividend is reported. The stock did split 2:1 this year, on 2/1/05. (an appropriate date for the split don't you think!)

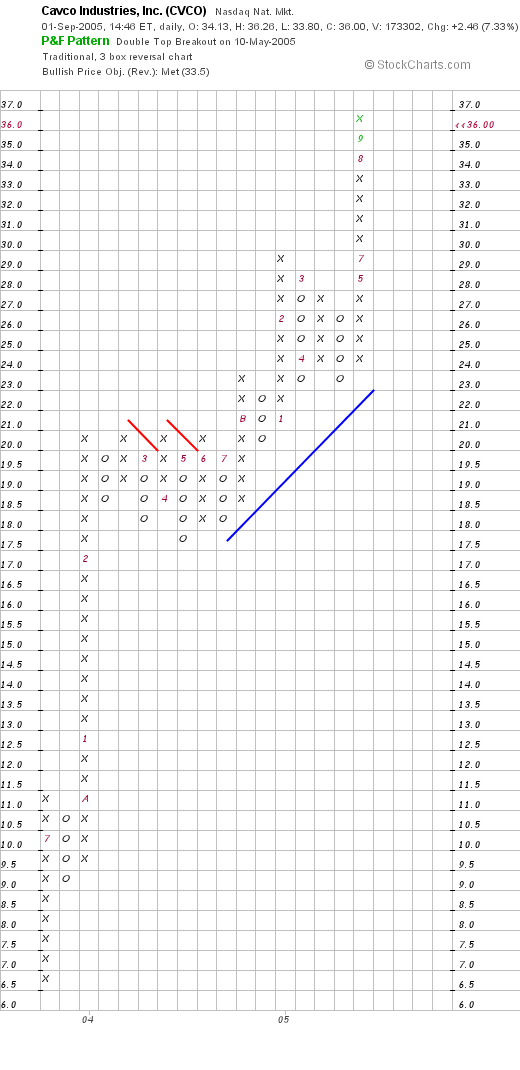

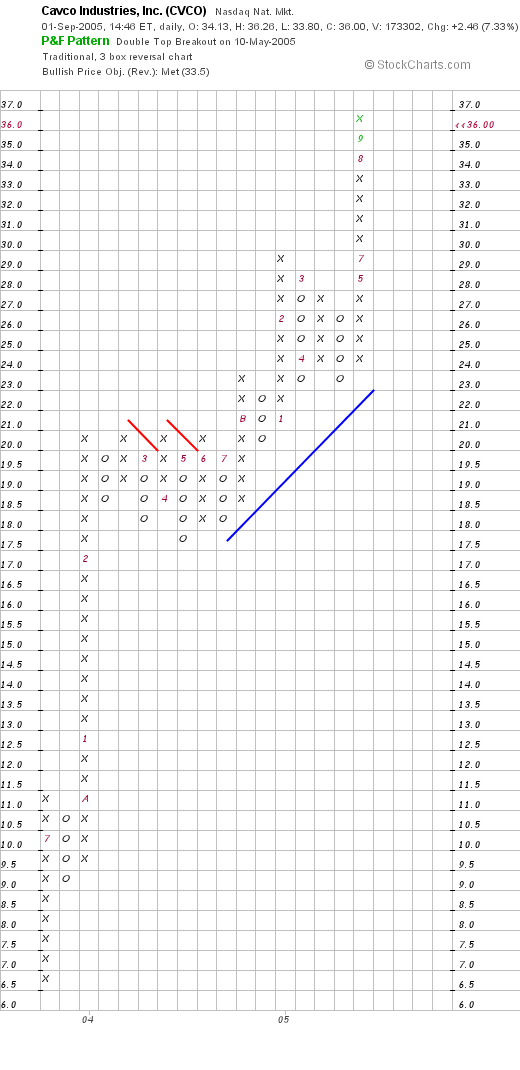

What about a chart? Taking a look at a "Point & Figure" chart on CVCO from Stockcharts.com:

We can see what looks like an explosive chart with a shart rise from $6.50 in June, 2003, to its current level at around $36. The stock is trading above its support line and does not appear to have found much resistance at this time.

So what do I think? Well, I just bought some GI so I am not in the market for a stock at this time. However, I like what I see on this stock. Let's review some of the things I have written: the stock is making a nice move higher today and has a bit of a "story" associated with the hurricane. Underlying this move, was a strong quarter just reported, a five year record of steady growth, free cash flow is positive and growing, the balance sheet is excellent, and valuation is reasonable with a p/e under 20 and a PEG under 1.0. The stock is not the cheapest in its group by the price/sales analysis, but still not really that overpriced either. Finally, the chart looks nice!

On the downside, the threat of continued increases in the interest rates may put a damper on housing sales and all of the companies associated with construction or manufacture of housing. However, with the Katrina disaster, I don't believe the FED is going to aggressively push rates higher for the time being. Just a hunch!

Anyhow, I hope you enjoyed that stock. It is fun to find stocks that have all their "ducks in a row"! If you have any comments or questions, please leave them on the blog or feel free to email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Giant Industries (GI)

Hello friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As you may note from the previous post, I sold a portion of my Meridian Bioscience (VIVO) at a 60% gain level. This "entitled" me to add a position, considering I am at 24, under my 25 goal, and I set to work scanning the lists of top % gainers.

Noticing that Giant Industries (GI) was doing quite well today, in fact trading at $53.02, up $3.77 or 7.65% on the day, and that I had just discussed the stock on stock picks, knowing it met my criteria, I jumped in and purchased 160 shares at $53.15 a few moments ago.

So much for that nickel in my pocket :). I always seem to find something to do with it!

Thanks again for stopping by. If you have any comments or questions please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" VIVO

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, my shares of Meridian Bioscience (VIVO) hit a sale point on the upside and I sold 75 shares, 1/4 of my position of 300 shares I currently held, at the 60% gain point. The exact sale was 75 shares at $27.70. These shares were purchased 4/21/05 with a cost basis of $16.67, so this was a gain of $11.03 or 66.2% on the upside.

As you probably know, I like to sell my losers quickly if they hit an 8% loss. I sell my gainers slowly, and partially, trying to sell 1/4 of my holdings at 30%, 60%, 90%, 120%, 180%, 240%...etc. gain points.

Also, if I am under 25 positions (my goal), this "entitles" me to add a position. Thus, the nickel is burning a hole in my pocket already. I shall be scanning the top % gainers to see if there are any candidates there today that I find interesting.

I shall keep you posted! Please leave a message on the blog or email me at bobsadviceforstocks@lycos.com if you have any comments, or questions.

Bob

Newer | Latest | Older

The stock market is continuing to rally today, after the small profit-taking session yesterday. Looking through the list of top % gainers on the NYSE today, I came across Global Payments (GPN) which is trading at $68.89, up $3.89 or 5.98% on the day. I do not own any shares nor do I have any options in this company.

The stock market is continuing to rally today, after the small profit-taking session yesterday. Looking through the list of top % gainers on the NYSE today, I came across Global Payments (GPN) which is trading at $68.89, up $3.89 or 5.98% on the day. I do not own any shares nor do I have any options in this company.

My selection today is a favorite shopping place for my family whenever we are on vacation. Unfortunately, we don't have a Nordstrom in our own town, but that doesn't stop any of us from racking up our charges for shoes and clothing in this upscale retail outfit. I don't have any shares or options in this stock although I did own a few shares at least five years ago for a short while.

My selection today is a favorite shopping place for my family whenever we are on vacation. Unfortunately, we don't have a Nordstrom in our own town, but that doesn't stop any of us from racking up our charges for shoes and clothing in this upscale retail outfit. I don't have any shares or options in this stock although I did own a few shares at least five years ago for a short while. The

The  Looking through the

Looking through the  Looking longer-term at the

Looking longer-term at the  Here we can see that this is certainly a large cap stock with a market capitalization of $9.56 billion. The trailing p/e isn't too bad at 20.88 (imho) with a forward p/e of 16.59 (fye 29-Jan-07). The PEG is a bit rich but not bad at 1.26. (Fair valuation is usually at a PEG of 1.0).

Here we can see that this is certainly a large cap stock with a market capitalization of $9.56 billion. The trailing p/e isn't too bad at 20.88 (imho) with a forward p/e of 16.59 (fye 29-Jan-07). The PEG is a bit rich but not bad at 1.26. (Fair valuation is usually at a PEG of 1.0).

As you probably know, if you are a new reader, I like to pick stocks on this blog :). But in order to know if what I write is actually successful, there needs to be some sort of analysis of what was discussed and how they actually turned out. The stocks discussed are mostly investments that I do not own. However, my own Trading Portfolio, that I do discuss, and have links to on the side of the blog, comes from the list of stocks that I have written up on the blog. I try very hard to let you know when I actually purchase or sell anything in the trading portfolio, and I do this with the entries titled "Trading Transparency". I am trying to keep my own personal trading account and activity as "transparent" as possible to you, the reader!

As you probably know, if you are a new reader, I like to pick stocks on this blog :). But in order to know if what I write is actually successful, there needs to be some sort of analysis of what was discussed and how they actually turned out. The stocks discussed are mostly investments that I do not own. However, my own Trading Portfolio, that I do discuss, and have links to on the side of the blog, comes from the list of stocks that I have written up on the blog. I try very hard to let you know when I actually purchase or sell anything in the trading portfolio, and I do this with the entries titled "Trading Transparency". I am trying to keep my own personal trading account and activity as "transparent" as possible to you, the reader! On July 6, 2004, I

On July 6, 2004, I  On August 1, 2005, Cal-Maine (CALM)

On August 1, 2005, Cal-Maine (CALM)  On July 8, 2004, I

On July 8, 2004, I  On July 27, 2005, Anika

On July 27, 2005, Anika  Finally, on July 9, 2004, I

Finally, on July 9, 2004, I

Anyhow, back to the stocks! Last weekend I decided to start a systematic review of the stocks I hold in my actual

Anyhow, back to the stocks! Last weekend I decided to start a systematic review of the stocks I hold in my actual  Looking for the latest quarter, AFFX

Looking for the latest quarter, AFFX

Remember to think of all of the people displaced, and remember the good times of New Orleans, a city that will rise again between the waters of Lake Pontchartrain and the Mississippi.

Remember to think of all of the people displaced, and remember the good times of New Orleans, a city that will rise again between the waters of Lake Pontchartrain and the Mississippi. I always enjoy getting mail and questions from readers. For me, it makes the whole writing about stocks more interesting. Unfortunately, I am not qualified to give individual advice to anyone. So when I received this letter, I knew I couldn't and shouldn't answer specifics, but let me try to answer the question with some general thoughts about investing.

I always enjoy getting mail and questions from readers. For me, it makes the whole writing about stocks more interesting. Unfortunately, I am not qualified to give individual advice to anyone. So when I received this letter, I knew I couldn't and shouldn't answer specifics, but let me try to answer the question with some general thoughts about investing.

One company that made the list today is Cavco Industries Inc. (CVCO) which, as I write, is trading at $36.00 (in an otherwise weak market), up $2.46 on the day for a 7.33% gain. I do not own any shares nor have any options on this stock.

One company that made the list today is Cavco Industries Inc. (CVCO) which, as I write, is trading at $36.00 (in an otherwise weak market), up $2.46 on the day for a 7.33% gain. I do not own any shares nor have any options on this stock. According to the

According to the  Reviewing

Reviewing