Stock Picks Bob's Advice

Thursday, 15 December 2005

"Happy Holidays" An Editorial

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice.

I generally spend my time on this blog writing about stocks and investments. And I plan to continue to do so in the future. But from time to time, just as you may see a comment in the Wall Street Journal or the Investors Business Daily, I would like to share a word with you about a perhaps unrelated subject. And you are welcome to respond and add your comments to this discussion.

There has been a movement started in this country to defeat the "War Against Christmas" as Bill O'Reilly, John Gibson, Rush Limbaugh, Pat Robertson and others have been explaining. And what is this "War" been doing? Have there been shots fired? Churches burned? Pogroms against true believers?

No. The war is simply that some people and some businesses are using and encouraging their employees to say "Happy Holidays". Perhaps sometimes in preference to the more Christian "Merry Christmas".

The war includes broadsides against Christianity in the form of inserts in the newspapers advertising sales and toys and maybe even a "holiday tree" instead of a Christmas tree. Of course, the attack on Christmas also includes denial of Christmas in public schools, removal of Creches from the Town Square and making things in general more "politically correct."

Is Christmas in trouble? Do we need to rise to the front to defend this assault?

What most of these pundits try to gloss over to their readers and listeners is the most important fact that America is a multicultural nation. We have a majority of Christians, a large majority in fact, but we have a variety of religious denominations and many who choose not to believe anything in the religion department at all.

When businesses say "Happy Holidays", they are recognizing and indeed respecting the diversity of all of their customers. And that is the American tradition and the freedom that we cherish in America.

To respect diversity is to respect tolerance, inclusivity, and yes indeed to respect our love for our fellow man.

Insofar as the public space is concerned, keeping religion out of this arena protects both the public that may or may not share this particular message, preventing the "Establishment of Religion" prohibited in the First Amendment, but also protects that religion itself.

The development of "Happy Holidays" is indeed a watered-down version of "Merry Christmas" for most people. This is the risk of mixing government and religion as well. We get a secularized version of a religious message. A new religious message that may not make anyone happy. And then we will have each religious denomination lobbying to have its version included or made the exclusive view. So let us continue to work on separating church and state to protect both institutions.

So let us encourage the good will and love of this holiday season. Let us respect diversity and not create conflicts that are imaginary to fire up our political base.

Wishing all of my friends a very Merry Christmas, a Happy Hannukah, Happy Kwanzaa, Happy Holidays and Season's Greetings!

May you all have a wonderful 2006 and may it find us more at peace with each other, with other nations, spending money to find cures for disease, hunger, ignorance, and improving the quality of life for all of the inhabitants on this planet. And may we all seek ways to understand and respect each other, and not feel threatened when some may choose to be inclusive in their holiday greetings!

Bob

Wednesday, 14 December 2005

New ***PODCAST*** for Matrix Initiatives (MTXX)

Hello Friends! I just wanted to let you know that I have made a

***PODCAST*** on MTXX .

Bob

"Revisiting a Stock Pick" Matrixx Initiatives (MTXX)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NASDAQ, I came across Matrixx Initiatives (MTXX) an old stock pick of mine, that is trading at $20.63, up $1.52 or 7.95% on the day as I write. I first

posted Matrixx on Stock Picks Bob's Advice on December 29, 2003, almost two years ago (!), when it was trading at $18.28. The stock actually declined significantly

after my post, dropping to as low as $8 in July, 2004, before climbing back to its current level.

Matrixx has recently been plugged by Jim Cramer on

Mad Money. While I do not always see 'eye to eye' with Jim in his approach, I respect his stock-picking talents, and if we can find a stock that is also on his list, all the more power to us I guess. However, this type of media attention on a stock will only add to its volatility. By the way, I do

not own any shares of this stock nor do I have any options or other leveraged positions involving this company.

To get a description of this company, I like to refer to the

Yahoo "Profile" on Matrixx Initiatives:

"Matrixx Initiatives, Inc. engages in the development, production, marketing, and sale of over-the-counter pharmaceutical products. The company, through its subsidiary, Zicam LLC, produces and markets various products, including Zicam Cold Remedy nasal gel, a homeopathic remedy that reduces the duration and severity of the common cold; two related nasal swab cold remedy products, Zicam Cold Remedy Swabs and Zicam Cold Remedy Swabs Kids Size; three homeopathic oral delivery cold remedy products...."

Going through my usual regimen of checking out a company, I first inspected the

news on Matrixx, which revealed that the company was

raising guidance for 2005! The company now expects revenue for 2005 to grow 45-50%, and fully diluted eps to improve 35-45%. This was an increase in the prior guidance which suggested revenue growth of 25-35% and a 10-20% increase in earnings. I always love to see guidance being raised; the stock price usually follows in the same direction!

And how about the latest quarter results? On October 25, 2005, MTXX

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenue climbed 49% to $25.2 million, compared to $16.9 million in the year ago same period. Net income came in at $5.6 million, or $.58/diluted share, up from $3.7 million or $.39/diluted share in the third quarter of 2004. These were solid results imho!

And what about longer-term? For that I like to turn to the

Morningstar.com "5-Yr Restated" financials on MTXX where we can see that revenue has steadily grown from $10.8 million in 2000 to $73.4 million in the trailing twelve months (TTM).

During this period, earnings have been a bit erratic, climbing to $1.36/share from $(.91) between 2000 and 2001, then dropping to a loww of $.35/share in 2003, before climbing once again to the current result of $.80/share in the TTM.

Free cash flow, while small, has been positive recently with $0 reported in 2002, improving to $4 million in 2003, $7 million in 2004, and $5 million in the TTM.

And the balance sheet? As reported by Morningstar, this appears solid with $7.3 million in cash and $35.2 million in other current assets; this is plenty to cover both the $12.9 million in current liabilities and the $.9 million in long-term liabilities.

And how about some valuation numbers? Looking at the

Yahoo "Key Statistics" on Matrixx, we can see that this is a very small company, actually a small cap stock with a market capitalization of $195.12 million. The trailing p/e is a moderate 25.57, with a forward p/e of 21.88. The PEG is a very nice 0.73. Any time we can get a stock with a PEG under 1.0, that means that the company is growing at a faster rate than the indicated price/earnings ratio.

Looking at the

Fidelity eResearch website, we find that MTXX has been assigned to the "Drug Delivery" industrial group. Within this group of stocks, with Alkermes (ALKS) at the top with a Price/Sales ratio of 14.4, followed by Nektar (NKTR) at 11.6, Elan (ELN) following next with a Price/Sales ratio of 11.1, Biovail (BVF) at 4.3, Matrixx (MTXX) at 2.5, and Andrx (ADRX) at 1.2. Thus, the stock is reasonably priced by this statistic as well.

Back to Yahoo! This is a small company with only 9.59 million shares outstanding. Currently (11/10/05) there are 601,820 shares out short representing 6.805 of the float or 7.3 trading days of volume. Thus, this is significant using my 3 day short ratio cut-off of significance.

No dividend is paid and no stock splits are reported on Yahoo.

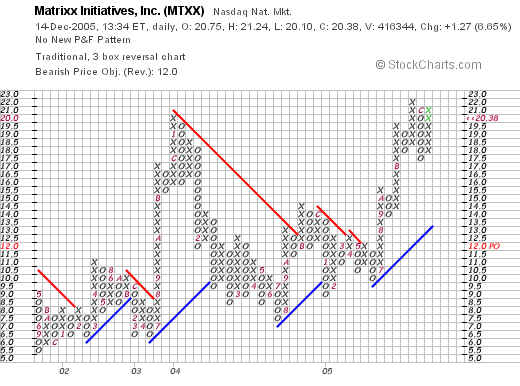

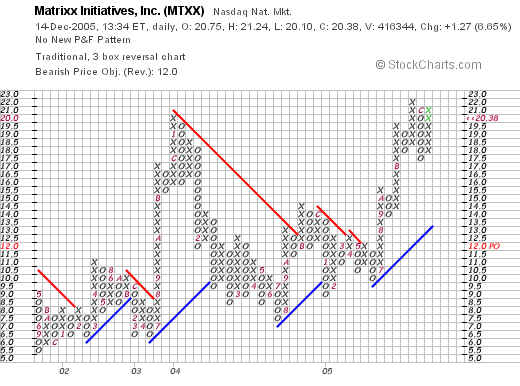

What about a chart? Taking a look at a

"Point & Figure" chart on MTXX:

We can see that this stock has been slowly moving higher since mid-2001 when this chart starts. I say this due to the subtle pattern of higher lows and hnigher highs. Since July, 2005, this stock has broken out into higher priced territory at the $21 level. We should note that a similar pattern in early 2004 resulted in the stock price breaking back down to a low of $7 in July, 2004. Overall, the chart appears to be mildly optimistic.

So what do I think? Well I like this stock. I liked it back in 2003 (although the price declined after my pick; the situation continues to look solid. Let's review: first of all, this is a Cramer pick so that adds interest from all of his viewers, the company raised guidance, reported a solid latest quarter, has a five year history of fairly strong revenue and earnings growth, free cash flow is positive and steady, the balance sheet looks nice, and valuation, both with a PEG under 1.0, and a Price/Sales near the lowest in its group, appears reasonable. What is there not to like?

Thanks again for stopping by! Please be sure to check with your professional investment advisors! If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 11 December 2005

New ***PODCAST for the Weekend Review: PARL, WIT, and WWW

Hello Friends! I have posted another podcast for the latest blog post. Click

CLICK HERE FOR MY PODCAST.

Bob

Posted by bobsadviceforstocks at 10:19 AM CST

|

Post Comment |

Permalink

Updated: Sunday, 11 December 2005 3:43 PM CST

"Looking Back A Year" A review of stock picks from the week of October 4, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I like to do is to think about investments and in particular to pick stocks that seem to have the qualities that might lead to future price appreciation. In order to find out whether the selections are successful, I have taken to reviewing past stock selections on a rolling 52 (now about 60) week trailing basis. That is, I look at stocks from a bit more than a year ago, moving ahead another week each review, and see how they have turned out. Of course, this review depends on what is called a "buy and hold" strategy. In actuality, I sell losing stocks completely and quickly on price break-downs, and I sell my gaining stocks slowly and partially at targeted appreciation levels. However, for the sake of this review, this analysis suffices.

On October 4, 2004, I

Posted WIPRO (WIT) on Stock Picks Bob's Advice when it was trading at $20.86. WIT split 2:1 on 9/2/05, making my effective pick price actually $10.43. WIT closed at $11.18 on 12/9/05, giving me a $.75/share gain or 7.2% appreciation since posting.

On October 18, 2005, Wipro

reported 2nd quarter 2006 results. For the quarter ended September 30, 2005, revenue climbed 26% over the prior year and net income was up 23%.

On October 6, 2004, I

posted Wolverine World Wide (WWW) on Stock Picks Bob's Advice when it was trading at $28.90. WWW split 3:2 on 2/2/05, so my effective pick price was actually $28.90 x 2/3 = $19.27. WWW closed at $22.52 on 12/9/05, for a gain of $3.25 or 16.9%.

On October 5, 2005, WWW

reported 3rd quarter 2005 results. For the quarter ended September 10, 2005, revenue came in at $279.1 million, up 7% from the prior year's $260.9 million. Earnings per share came in at $.42, up from $.37/share the prior year, a 13.5% increase. The company also raised guidance. As reported in the same news story, from Timothy J. O'Donovan, the company's Chairman and CEO:

"With strong third quarter results and an order backlog increase of approximately 19 percent, we are increasing the Company's 2005 earnings per share estimate. We now expect earnings per share to range from $1.26 to $1.28. We have also focused our 2005 revenue range from $1.050 to $1.060 billion. The earnings per share estimate does not include any impact from the potential repatriation of foreign earnings under the American Jobs Creation Act of 2004 which the Company is currently evaluating."

A strong earnings report with an increase in guidance from the CEO is usually very bullish for a stock price!

Finally, on October 7, 2004, I

posted Parlux Fragrances (PARL) on Stock Picks Bob's Advice when it was trading at $14.95. PARL has had a very nice "aroma" for this website, closing at $30.84 on 12/9/05, for a gain of $15.89 or 106.3% since posting.

This stock gets a

BIG "thumbs-up" on the latest earnings report! On November 14, 2005, PARL

announced 2nd quarter 2006 results. For the quarter ended September 30, 2005, net sales came in at $39.3 million, up 73% from $22.7 million last year. Net income was $4.4 million, up from $2.4 million, an 87% increase (!). Earnings per share grew 83% on a diluted basis from $.23/share last year to $.42/share in this year's quarter. These were very strong results!

So how did we do a year later in this week's group of stock picks? Fabulous! I picked three stocks that week and they have since moved higher in price ranging from 7.2% to 106.3% for an average price appreciation of 43.47%. Most of that is of course from the PARLUX stock. Unfortunately, I don't own any shares of any of these stocks but my stock club does, at my last meeting at least, own a few shares of WIPRO.

Please remember that past performance is

never a guarantee of future performance, that I am an amateur investor, and that you should check with your professional investment advisors prior to making any investment decisions based on information on this website!

Thanks again for visiting! If you have any questions or comments, please feel free to write me a note at bobsadviceforstocks@lycos.com or leave your comments on the blog.

Bob

Saturday, 10 December 2005

New ***PODCAST*** for Weekend Trading Portfolio Review: ResMed (RMD)

Hello Friend! I just wanted to update my newest

***PODCAST on Weekend Trading Portfolio Review: ResMed (RMD)***.

If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 9 December 2005

"Weekend Trading Portfolio Analysis" ResMed (RMD)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my goals on this blog is to allow you to understand investing from my perspective. That includes updates regarding my positions, my trading and my current thoughts on the investments that make up my portfolio. Several months ago, I started adding a weekly look at a single holding in my portfolio, working through the holdings alphabetically. Last week I

discussed Quality Systems (QSII) on Stock Picks Bob's Advice; next alphabetically is ResMed (RMD).

On February 9, 2005, I purchased 120 shares of ResMed (RMD) in my trading account at $59.67/share. On September 27, 2005, I sold 30 shares of ResMed netting $77.64/share for a gain of $17.97 or 30.1%. This was 1/4 of my shares (as I like to point out, I have reduced my sales of shares to 1/6th positions) at my first "targeted sale price". RMD subsequently, on October 3, 2005, had a 2:1 split, making my effective purchase price actually $59.67/2 = $29.84. RMD closed 12/9/05 at $40.21, giving me an unrealized gain of $10.37 or 34.8% over my purchase price.

When will I be selling next? On the downside, since I sold a portion at the 30% gain level, I have moved my "mental stop" up to break even or $29.84/share. On the upside, the next point to sell 1/6th of my shares is at a 60% gain or 1.6 x $29.84 = $47.74.

Let's take an updated look at this company and see if it still looks like an attractive investment!

First of all, let's review the company's business. According to the

Yahoo "Profile" on ResMed:

ResMed, Inc., through its subsidiaries, engages in the design, manufacture, and marketing of equipment for the diagnosis and treatment of sleep-disordered breathing and other respiratory disorders, including obstructive sleep apnea. Its products include airflow generators; diagnostic products; mask systems; headgear; and other accessories, including humidifiers, cold passover humidifiers, carry bags, breathing circuits, Twister remote, the Aero-Click connection system, and the AeroFix headgear.

And what of the latest quarter? On November 2, 2005, ResMed

announced earnings results for the quarter ended September 30, 2005. Revenue came in at $127.1 million, a 45% increase over the same quarter last year. Even without acquisition related revenue, growth in revenue still amounted to a strong 30% growth. Net income came in at $16.4 million, up from $13.9 million last year. Diluted earnings per share amounted to $.23/share, up from $.20/share last year. The reported earnings included restructuring and amortization of "acquired intangibles" without which, earnings worked out to $.28/share. Still, even with this, earnings were up 15% for the quarter.

And what about Morningstar? Looking at the

Morningstar.com "5-Yr Restated" financials on RMD, we can see the steady revenue growth from $155.2 million in 2001 to $464.9 million in the trailing twelve months (TTM). Earnings also show an uninterrupted pattern of steady growth from $.18/share in 2001 to $.94/share in the TTM.

A negative is the $(1) million in free cash flow due to a large increase in caital spending in the last twelve months. I shall need to continue monitoring this, although I do not think this is significant in the long run.

The balance sheet is solid with $134.2 million in cash and $236.4 million in other current assets, balanced against $230.3 million in current liabilities and $80.8 million in long-term liabilities.

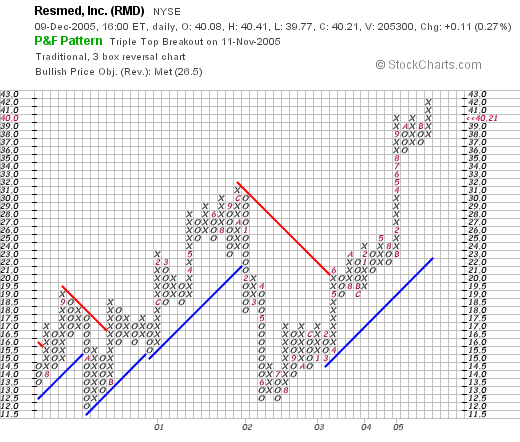

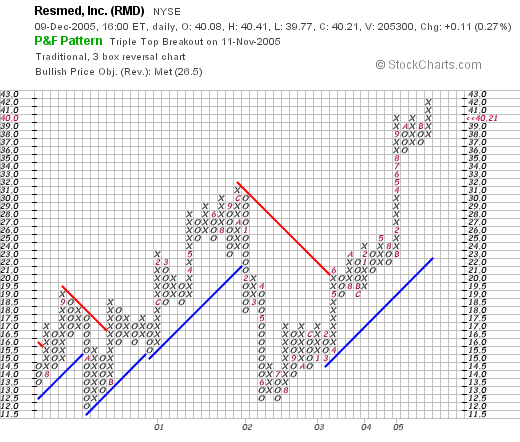

And the chart? Looking at a

"Point & Figure" chart on RMD from Stockcharts.com, we can see that since breaking through resistance in June, 2003, at the $21 level, the stock has been moving strongly higher. I don't think the chart looks at all negative, in fact, the stock is moving into new high territory.

Thus, the stock still looks like a great investment to me! The recent quarter was solid, the Morningstar.com report is essentially intact (except for the negative free cash flow which deserves attention), the balance sheet looks nice, and the chart looks strong.

Thanks so much for stopping by and visiting! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:54 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 10 December 2005 6:21 PM CST

Thursday, 8 December 2005

December 8, 2005 ***PODCAST*** for Veritas DGC (VTS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice.

Please click

***HERE FOR MY PODCAST ON VERITAS DGC (VTS)***.

Have a great weekend!

Bob

December 8, 2005 Veritas DGC Inc. (VTS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do when looking for a potential stock pick, I started out tonight looking through the

list of top % gainers on the NYSE today. Near the top of the list was Veritas DGC Inc. (VTS), which I of course initially confused with Veritas Software (VRTS), which of course you wouldn't do would you? Anyhow, VTS closed at $37.28, up $3.00 or 8.75% on the day. I do not own any shares of this stock nor do I have any options on this equity.

"Image courtesy of Veritas DGC Inc. All rights reserved."

So

what does Veritas DGC do anyway? Well, according to the

Yahoo "Profile" on VTS:

Veritas DGC, Inc. provides geophysical information and services for the national and independent oil and gas companies worldwide. It acquires, processes, interprets, and markets geophysical information that provides 2D and 3D images of the subsurface. The company also produces 4D surveys, which record fluid movement in the reservoir, by repeating specific 3D surveys over time. In addition, it uses geophysical data for reservoir characterization to enable its customers to recover oil and natural gas.

Veritas DGC is in the Seismic Information business for the Oil Industry!

As is often the case, what drove the stock higher today was an earnings report. In fact, yesterday, after the close of trading VTS announced

1st quarter 2006 earnings. The results, on first glance, were nothing short of fabulous. Revenue for the quarter climbed 30% to $168.7 million from $129.6 million. For the quarter earnings were $11.8 million or $.32/share, up about 1,000% (honestly) from $978,000 or $.03/share the year earlier. The latest quarter

does include a $2 million one time insurance payment, but even without that payment, the earnings growth was phenomenal! Expectations by Thomson Financial were reported to be $.20/share on $155.4 million of revenue. Clearly, the company blew away analysts expectations. That, of course, is always bullish for a stock price.

And what does Morningstar report on this company? Taking a look at the

"5-Yr Restated" financials from Morningstar.com on VTS, we can see that except for a small dip in revenue from $476.6 million in 2001 to $452.2 million in 2002, revenue has grown steadily to $634 million in the trailing twelve months (TTM). Earnings have been erratic; dropping from $.68 to a loss of $(1.77) between 2001 and 2003, then turning positive in 2004 and increasing to $2.37/share in the TTM.

And free cash flow? This is solidly positive, increasing from $170 million in 2003 to $269 million in the TTM.

The balance sheet as reported by Morningstar shows $249.4 million in cash and $203 million in other current assets. This is quite adequate to cover both the $192.4 million in current liabilities and the $191.6 million in long-term liabilities combined.

And how about some valuation 'numbers' on this stock? Looking at

Yahoo "Key Statistics" on Veritas DGC, we find that the stock is a mid-cap stock with a market capitalization of $1.29 billion. The trailing p/e is nice at 15.74, and the forward p/e is actually higher (?) (fye 31-Jul-07) at 18.36. No PEG is reported.

Using the

Fidelity.com eResearch site on VTS, we can see that Veritas DGC is in the "Oil & Gas Equipment/Svcs" Industrial Group. Within this group, VTS sports a very reasonable Price/Sales ratio of 1.9. Topping this group is Schlumberger (SLB) at 4.5, BJ Services (BJS) at 4.1, Baker Hughes (BHI) at 3, Cooper Cameron (CAM) at 2, then Veritas DGC (VTS) at 1.9 and Halliburton (HAL) at 1.7.

Looking for some additional numbers on VTS, Yahoo shows 34.59 million shares outstanding. As of 11/10/05, there were 2.42 million shares out short, representing 7% of the float or 4 trading days (the short ratio) of volume. This is a bit heavy imho, and may be some of the buying pressure in this stock.

No cash dividend is paid and the last stock split reported by Yahoo was a reverse 1:3 split in January, 1995.

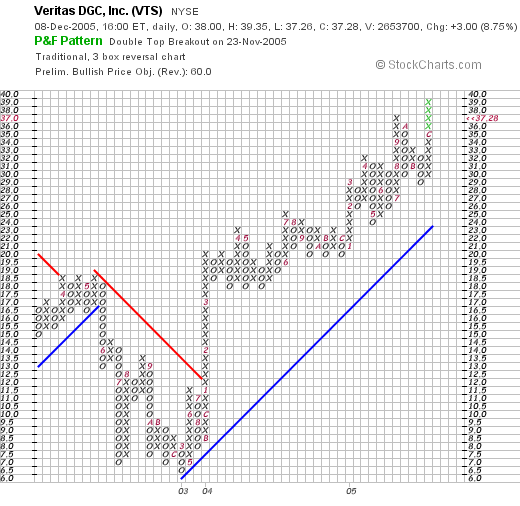

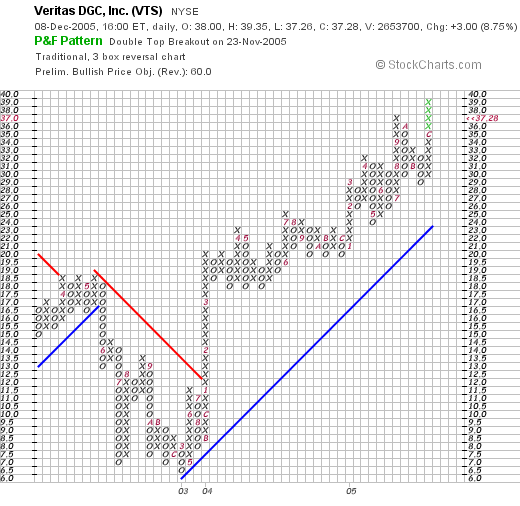

What about a chart? Looking at a

"Point & Figure" Chart on VTS from Stockcharts.com, we can see that the stock traded lower from $18.50 in April, 2002, to $6.50 in March, 2003, and then started trading higher. The stock is trading nicely higher since that period, above its support line on the graph. It is interesting that this period of weakness in the chart corresponds nicely with the underlying performance of the company during this time.

So what do I think? Well, the company is certainly in a very hot energy-related field. The latest quarterly report was superb, the Morningstar report for the last few years has been strong and valuation is downright cheap in both the p/e and the price/sales reviews. The chart looks nice and I don't think it is done with its climb imho. Unfortunately, I don't have a buy signal to allow me to buy this stock. But the overall picture is certainly interesting.

Thanks so much for stopping by! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com. Or you can just leave your comments right on the blog.

Bob

Posted by bobsadviceforstocks at 10:18 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 8 December 2005 11:19 PM CST

Wednesday, 7 December 2005

PODCAST for HURCO (HURC)

Click

***HERE for my PODCAST on HURCO***.

If you have questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Looking through the

Looking through the  Matrixx has recently been plugged by Jim Cramer on

Matrixx has recently been plugged by Jim Cramer on  And how about the latest quarter results? On October 25, 2005, MTXX

And how about the latest quarter results? On October 25, 2005, MTXX  And the balance sheet? As reported by Morningstar, this appears solid with $7.3 million in cash and $35.2 million in other current assets; this is plenty to cover both the $12.9 million in current liabilities and the $.9 million in long-term liabilities.

And the balance sheet? As reported by Morningstar, this appears solid with $7.3 million in cash and $35.2 million in other current assets; this is plenty to cover both the $12.9 million in current liabilities and the $.9 million in long-term liabilities.

On October 4, 2004, I

On October 4, 2004, I  On October 18, 2005, Wipro

On October 18, 2005, Wipro  On October 6, 2004, I

On October 6, 2004, I  Finally, on October 7, 2004, I

Finally, on October 7, 2004, I  One of my goals on this blog is to allow you to understand investing from my perspective. That includes updates regarding my positions, my trading and my current thoughts on the investments that make up my portfolio. Several months ago, I started adding a weekly look at a single holding in my portfolio, working through the holdings alphabetically. Last week I

One of my goals on this blog is to allow you to understand investing from my perspective. That includes updates regarding my positions, my trading and my current thoughts on the investments that make up my portfolio. Several months ago, I started adding a weekly look at a single holding in my portfolio, working through the holdings alphabetically. Last week I  On February 9, 2005, I purchased 120 shares of ResMed (RMD) in my trading account at $59.67/share. On September 27, 2005, I sold 30 shares of ResMed netting $77.64/share for a gain of $17.97 or 30.1%. This was 1/4 of my shares (as I like to point out, I have reduced my sales of shares to 1/6th positions) at my first "targeted sale price". RMD subsequently, on October 3, 2005, had a 2:1 split, making my effective purchase price actually $59.67/2 = $29.84. RMD closed 12/9/05 at $40.21, giving me an unrealized gain of $10.37 or 34.8% over my purchase price.

On February 9, 2005, I purchased 120 shares of ResMed (RMD) in my trading account at $59.67/share. On September 27, 2005, I sold 30 shares of ResMed netting $77.64/share for a gain of $17.97 or 30.1%. This was 1/4 of my shares (as I like to point out, I have reduced my sales of shares to 1/6th positions) at my first "targeted sale price". RMD subsequently, on October 3, 2005, had a 2:1 split, making my effective purchase price actually $59.67/2 = $29.84. RMD closed 12/9/05 at $40.21, giving me an unrealized gain of $10.37 or 34.8% over my purchase price. Let's take an updated look at this company and see if it still looks like an attractive investment!

Let's take an updated look at this company and see if it still looks like an attractive investment! And what about Morningstar? Looking at the

And what about Morningstar? Looking at the

As I like to do when looking for a potential stock pick, I started out tonight looking through the

As I like to do when looking for a potential stock pick, I started out tonight looking through the  So what does Veritas DGC do anyway? Well, according to the

So what does Veritas DGC do anyway? Well, according to the  And what does Morningstar report on this company? Taking a look at the

And what does Morningstar report on this company? Taking a look at the  And how about some valuation 'numbers' on this stock? Looking at

And how about some valuation 'numbers' on this stock? Looking at