Stock Picks Bob's Advice

Friday, 23 February 2007

Bolt Technology Corp (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am a bit old-fashioned about my sales of stock at targeted appreciation levels. That is, I don't do this automatically. I just check my portfolio and when I see a stock hitting a sale point, I execute the trade. Apparently, Bolt (BTJ), had a big trading day and moved higher, especially later in the day yesterday, hitting my first sale point without me realizing it!

This morning, Bolt was still above my first sale target (which is a 30% appreciation level) and I sold 1/6th of my holding, or 50 shares out of 300 shares, at a price of $23.18. These shares were actually acquired just last month on 1/12/07, at a cost basis of $17.44. So this represented a gain of $5.74/share or 32.9% since my purchase.

When will my next sale be? On the upside, if Bolt hits a 60% appreciation target, or 1.6 x $17.44 = $27.91, then I plan on selling another 1/6th of my remaining shares or 250/6 = 41 shares, at that level. On the downside, after a single sale at the first appreciation target, I plan on allowing Bolt to drift back down to its purchase price, or $17.44/share, prior to unloading all of my remaining shares.

How does this affect my overall portfolio strategy? Since I am at 16 positions, under my maximum of 25 holdings, this sale at a gain gives me a "permission slip" to add a new position. As I like to say, that nickel is already burning a hole in my pocket! So I shall have to examine the list of top % gainers today, and see if anything fits the bill!

Thanks so much for stopping by and visiting! I hope that my commentary is helpful to you! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, where you can hear me talk about many of the same stocks and issues I write about on this website!

Bob

Thursday, 22 February 2007

VCA Antech (WOOF) "Revisiting a Stock Pick"

CLICK HERE FOR MY PODCAST ON WOOF!Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I posted how I had purchased shares of VCA Antech after getting the 'permission slip' to add a new position after selling some of my Morningstar stock at a targeted gain. As promised, let's take another look at WOOF and I will share with you why I believe it deserves a spot on this blog and why I bought shares!

Earlier today I posted how I had purchased shares of VCA Antech after getting the 'permission slip' to add a new position after selling some of my Morningstar stock at a targeted gain. As promised, let's take another look at WOOF and I will share with you why I believe it deserves a spot on this blog and why I bought shares!

As I noted in my previous post, I first wrote up VCA Antech (WOOF) on Stock Picks Bob's Advice on March 17, 2004, at a price of $34.69. Adjusted for a 2:1 stock split, this pick price is actually $17.35. WOOF is currently trading at $38.89 up $2.67 or 7.37% on the day. This represents an appreciation of $21.54 or 124.1% since my original post!

What exactly does this company do?

According to the Yahoo "Profile" on VCA Antech (WOOF), the company

According to the Yahoo "Profile" on VCA Antech (WOOF), the company

"...operates as an animal healthcare services company in the United States. It provides veterinary services and diagnostic testing to support veterinary care; and sells diagnostic imaging equipment, and other medical technology products and related services. The company operates in three segments: Laboratory, Animal Hospital, and Medical Technology."

How did they do in the latest quarter?

It was the announcement of their 4th quarter 2006 results after the close of trading yesterday that drove the stock higher today. For the quarter ended December 31, 2006, revenue climbed 11.7% to $242.4 million. Net earnings increased 13.4% to $19.3 million and diluted earnings per share were up 15% to $.23/share.

The company beat expectations of $.21/share in earnings on revenue of $232.4 million. In another positive part of the report, the company raised guidance for 2007 to earnings of $1.29 to $1.33 per share, up from earlier views of $1.27 to $1.31/share. In addition, they raised guidance on revenue to $1.07 to $1.09 billion, up from $1.05 to $1.08 billion previously estimated.

What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on VCA Antech, we can see the perfect picture of revenue growth climbing from $435.2 million to $839.7 million in 2005 and $957.9 million in the trailing twelve months (TTM).

Earnings have also increased steadily from $.28/share in 2002 to $.81/share in 2005 and $1.22 in the TTM. The company has been increasing its shares outstanding modestly from 73 million in 2002 to 84 milllion in the TTM. However, during this period, revenue basically doubled and earnings quadrupled. This is an acceptable dilution imho.

Free cash flow has been positive and increasing overall with $61 million in 2003 increasing to $86 million in 2005 and $84 million in the TTM.

The balance sheet is adequate although the company does have a bit of long-term debt. WOOF is reported to have $32.8 million in cash and $104 million in other current assets. This total of $136.8 million, when compared to the $81.9 million in current liabilities yields a current ratio of 1.67. As I just noted, they also show $447.8 million in long-term liabilities that doesn't appear to be a problem for them with their growing free cash flow and nice current ratio.

How about some valuation numbers on this stock?

Checking the Yahoo "Key Statistics" on WOOF, we find that the company is a mid-cap stock with a market capitalization of $3.25 billion. The trailing p/e is a bit rich at 31.90 with a forward p/e of 29.22 (fye 31-Dec-07) estimated. The PEG (5 yr expected) works out to a slightly rich 1.74. (I like PEG's between 1.0 and 1.5 if possible).

According to the Fidelity.com eresearch website, VCA Antech carries a Price/Sales (TTM) ratio of 3.07, compared to an industry average of 1.08. The company, however, is more profitable than average with a return on equity (ROE) (TTM) of 27.07%, compared with an industry average of 20.64%.

Finishing up with Yahoo, WOOF has 83.5 million shares outstanding with 80.78 million that float. As of 1/9/07, there were 1.92 million shares out short representing 2.4% of the float or 5.3 trading days of average volume. We could well be observing a 'short squeeze' today as the stock climbs sharply on the back of good news.

No cash dividend is reported and as I noted above, the company last split is stock as a 2:1 split in August, 2004.

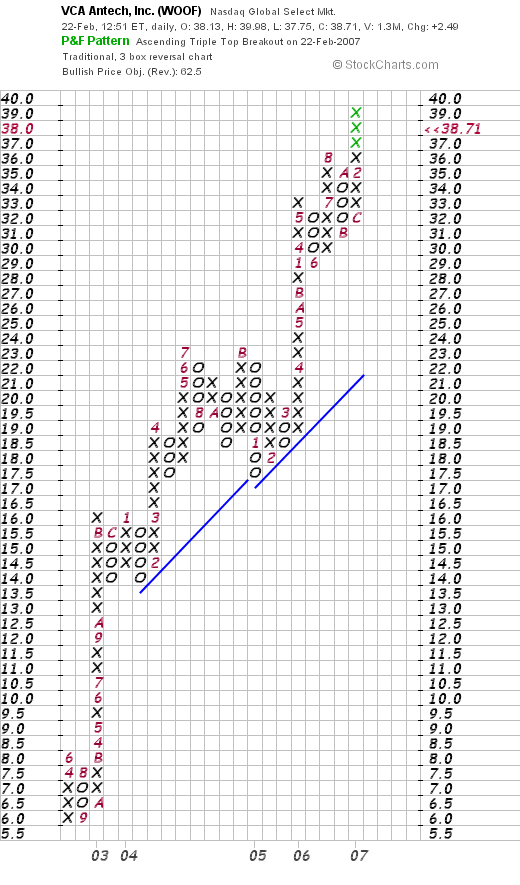

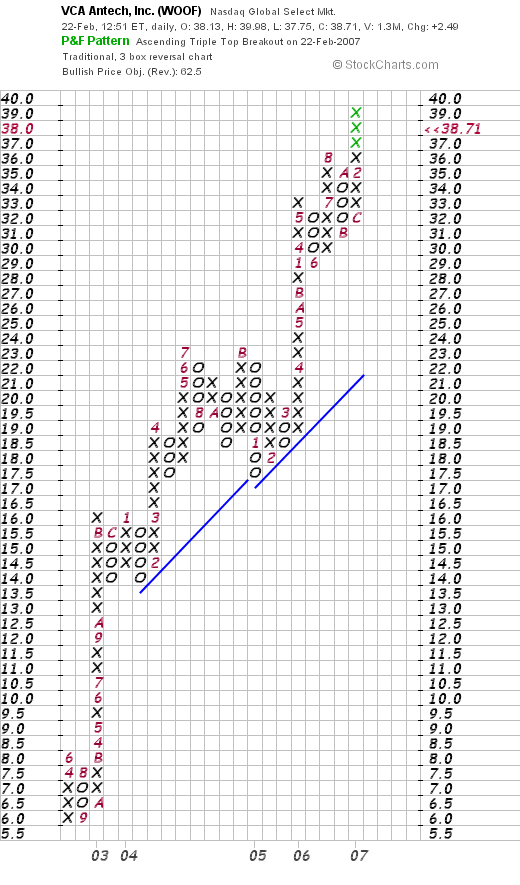

What does the chart look like?

Examining the "Point & Figure" chart on WOOF from StockCharts.com, we can see a very strong price appreciation from $6.00 in March, 2002, to its current high of $38.71. This is a very strong chart with little weakness seen in its price for the last several years.

Summary: What do I think?

Well, as you can tell I liked this stock well enough to buy some shares today! Seriously, the stock is moving strongly higher in a relatively weak trading days likely on the back of good earnings and lots of short-sellers scrambling to cover. The company reported solid earnings and revenue growth, beat expectations, and raised guidance for both! That is about as perfect an earnings report as you could expect!

The Morningstar.com report looks nice with steady and strong revenue and earnings growth, a small increase in the shares outstanding, positive and growing free cash flow, and a solid balance sheet (although long-term debt is a bit significant).

Valuation is indeed a bit rich with a p/e in the 30's and a PEG over 1.5. The Price/Sales figure is also a bit higher than the industry average, but the return on equity suggests the company is also a bit more profitable. Finally, there are lots of short-sellers (more than my '3 day rule'), and the chart looks quite strong. It was enough to get me to buy some shares and that is exactly what I did!

Thanks so much for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast Website.

Bob

Posted by bobsadviceforstocks at 12:18 PM CST

|

Post Comment |

Permalink

Updated: Monday, 26 February 2007 9:56 PM CST

VCA Antech (WOOF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Well that nickel didn't last long in my pocket did it? (some surprise?) Having a 'permission slip' to buy another position, I went right to the top % gainers list today and came across an old favorite of mine, VCA Antech (WOOF) which was on the list of top % gainers on the NASDAQ and is trading at $39.05, up $2.98 or 8.23% on the day as I write.

I say "old favorite" as I first wrote up this stock on March 17, 2004, on Stock Picks Bob's Advice when it was trading at $34.69. WOOF had a 2:1 stock split in August, 2004, making my effective pick price actually $17.35.

Anyhow, seeing an old favorite of mine, a stock that I would say is part of my vocabulary of stocks, I went ahead and purchased 180 shares at a price of $39.15.

I shall try and do an updated write-up on this stock later today :).

Thanks so much for visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your notes on the blog!

Bob

Morningstar (MORN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, checking my holdings in my Trading Account, I noticed that Morningstar had hit a 'sale point' and I sold 27 shares, 1/6th of my 167 share holding, at $52.32. These shares had been purchased 11/22/05 at a cost basis of $32.57. Thus, this represented a gain of $19.75 or 60.6% on the original purchase. This was my second sale of Morningstar shares, having sold 33 shares of Morningstar 2/16/06 at a net of $42.94, which was at a gain of $10.37 or 31.8%.

As you may know, my strategy in this account is to sell portions (currently 1/6th of remaining shares) at targeted appreciation points, which I have set at 30, 60, 90, 120, then 180, 240, 300, 360, then 450, etc. This sale also creates a 'buy signal' entitling me, since I am well under my maximum 25 positions (currently holding 15 positions) to add a new position to my holdings. As I like to say, "that nickel is burning a hold in my pocket already!"

When do I plan to sell Morningstar shares next? As I noted above, on the upside, if the stock should appreciate to a 90% appreciation point, then I shall be selling 1/6th of my 140 shares (23 shares), or on the downside, if the stock should retrace 50% of the highest sale point, or back to a 30% appreciation point (1.3 x $32.57 = $42.34) then I plan on selling all remaining shares.

I believe that this pattern of selling gaining stocks slowly and partially and declining stocks quickly and completely will prove to be an effective strategy at creating a winning portfolio. Of course, this is a work in progress, and time will tell if this will be successful!

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:06 AM CST

|

Post Comment |

Permalink

Updated: Thursday, 22 February 2007 10:09 AM CST

Wednesday, 21 February 2007

Vulcan Materials Company (VMC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on this website.

As I like to do, I was looking through the list of top % gainers on the NYSE to see if I could get either a new name to discuss, or an old name that had not been discussed for at least a year. (I generally don't like to 'revisit' stocks unless a good 12 months has passed.)

As I like to do, I was looking through the list of top % gainers on the NYSE to see if I could get either a new name to discuss, or an old name that had not been discussed for at least a year. (I generally don't like to 'revisit' stocks unless a good 12 months has passed.)

Near the top of the list (following an old favorite of mine, Jack in the Box), I found Vulcan Materials (VMC), which as I write is trading at $121.65, up $10.97 or 9.91% on the day. I do not own any shares of Vulcan nor do I have any options on this stock.

This is actually an interesting stock pick, because Vulcan is in the process of acquiring Florida Rock (FRK), another old favorite of mine here on Stock Picks! In fact, I posted FRK on Stock Picks Bob's Advice on July 20, 2004, when Florida Rock was trading at $42.21/share. FRK split 3:2 on July 5, 2005, making my effective stock pick price actually $28.14. Unfortunately, I don't own any shares of FRK either :(, because with this buy-out from Vulcan, FRK is trading at $68.43 as I write, showing an appreciation of $40.29/share or 143.2% since posting. Oh well, that is water under the bridge, or in this case, concrete under the overpass you could say.

What is interesting, is that usually the acquiring company declines in price with the assumption of debt and the dilution of shares. In this case, the street liked the merger and the stock price of Vulcan and Florida Rock have been climbing.

Let's take a closer look at Vulcan and I will show you why I believe it deserves a place on the blog!

What exactly does this company do?

Reviewing the Yahoo "Profile" on Vulcan Materials, we find that the company

Reviewing the Yahoo "Profile" on Vulcan Materials, we find that the company

"...and its subsidiaries engage in the production, distribution, and sale of construction aggregates and other construction materials and related services in the United States and Mexico. Its construction aggregates include crushed stone, sand and gravel, rock asphalt, and recrushed concrete, which are used in highway construction and maintenance, as well as in the production of asphaltic and portland cement concrete mixes, and as railroad track ballast. It also offers other products and services, including asphalt mix and related products, concrete, trucking services, and water transportation services."

How did they do in the latest quarter?

On January 31, 2006, Vulcan announced 4th quarter 2006 results. Net sales climbed 9% to $816.3 million from $754.6 million in the same period last year. Net earnings per share increased 33% to $1.20/share from $.90/share in the 4th quarter of 2005.

The company also raised guidance on 1st quarter 2007, indicating earnings of $.75 to $.95/share for the quarter. Analysts had apparently been expecting $.69/share. The company also raised guidance on earnings for the full year to $5.51 to $5.91/share. Analysts had been expecting $5.40/share in 2007.

Another indicator on the confidence of management regarding company prospects, the company raised its dividend 24.3% to $.46/share from $.37/share.

How about longer-term financial results?

Examining the Morningstar.com "5-Yr Restated" financials on VMC, we see that the company, after a dip in revenue from $2.3 billion in 2001 to $2.2 billion in 2002, turned around and grew revenue strongly and steadily to $2.9 billion in 2005 and $3.3 billion in the trailing twelve months (TTM).

Earnings also dipped from $2.17 to $1.66 between 2001 and 2002, then increased steadily to $3.73/share in 2005 and $4.38/share in the TTM. The company also pays a nice dividend and has been increasing that dividend steadily from $.90/share in 2001 to $1.16/share in 2005 and $1.40/share in the TTM. After maintaining the shares outstanding stable with 101 million in 2001 increasing less than 1% to 102 million in 2005, the company retired shares recently with only 94 million reported in the TTM.

Free cash flow has been positive, although not increasing recently, with $325 million in 2003, dipping to $258 million in 2005 and $199 million in the TTM.

The balance sheet appears solid with $68.7 million in cash and $762.7 million in other current assets. This total of $831.4 million can easily cover the $574.9 million in current liabilities and the current ratio works out to a reasonable 1.45. The company, in addition, has $922.3 million in long-term liabilities per Morningstar.

What about some valuation numbers?

Checking Yahoo "Key Statistics" on Vulcan, we find that this is a large cap stock with a market capitalization of $11.55 Billion. The trailing p/e isn't bad at 26.03 (imho), with a forward p/e estimated (fye 31-Dec-08) of 19.36. The PEG is a bit rich at 2.16.

According to the Fidelity.com eresearch website, the Price/Sales (TTM) is a bit rich at 3.21 with an industry average of 2.18. The company has a Return on Equity (TTM) of 23.67% much higher than the industry average of 14.47%.

Finishing up with Yahoo, we find that there are 94.70 million shares outstanding with 93.94 million that float. Of these, 3.9% of the float is out short representing a short ratio of 8.3 trading days of volume. This exceeds my own particular '3 day rule' for short interest and we may well be seeing a bit of a 'squeeze' of the shorts as the stock price climbs.

The forward dividend is $1.84 yielding a not inconsequential 1.6%. The last stock split was a 3:1 split in March, 1999.

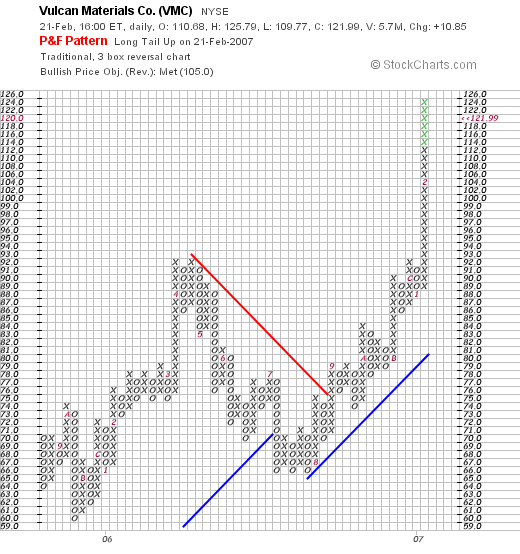

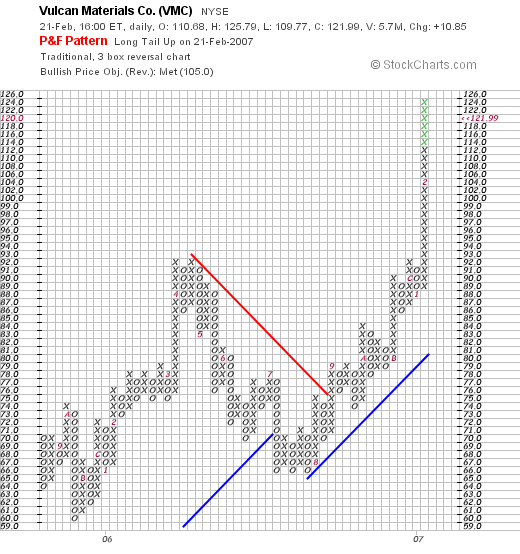

What does the chart look like?

If we look at a "Point & Figure" chart on Vulcan from StockCharts.com, we can see how the stock surged between August, 2005, and April, 2006, from a price of $64 to a high of $91. The stock then sold off to a 'triple bottome' at the $66 level, only to turn higher moving almost vertically between $92 and $123. The stock does appear to be a bit overextended technically.

Summary: What do I think?

Well, in general I like this company. They had a great quarter, beating estimates and raising guidance, their Morningstar.com report looks solid with steady revenue and earnings growth the past several years and they even pay an increasing dividend. They have maintained their outstanding shares and even bought back some recently.

Free cash flow is positive, but decreasing, and the balance sheet appears reasonable.

Valuation-wise the p/e is ok with a PEG over 1.5 suggesting a bit of a rich valuation. The Price/Sales is also a bit higher than average for its industry, although profitability, as measured by the Return on Equity is also higher than average. In addition, there are a bunch of shares out short that may well be scrambling to be 'undone', with the price moving sharply higher today. The chart does look a bit over-extended on an unmaintainable verticle rise, but overall, it appears that this company has been doing things right for quite awhile.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast site!

Bob

Tuesday, 20 February 2007

VASCO Data Security International (VDSI) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website.

If you read the latest two entries, you might think that I don't like any stocks that readers write to me about. That really isn't true. I first became aware of one of my current holdings when a good friend of mine, George K. emailed me about Precision Castparts. The rest, as they say, is history. Last year, on January 31, 2006, Sean G., another reader of this blog, wrote in to ask me about Vasco Data Security (VDSI). I wrote up both of these stocks and I generally did like what I read about. And it was because of my work a year ago, that when the stock came up again today, it made sense to write about it once more.

Looking through the list of the top % gainers on the NASDAQ today, I saw that VASCO (VDSI) had made the list, closing at $18.45, up $3.32 or 21.94% on the day. A year ago, when I wrote up Vasco on January 31, 2006, the stock was trading at $10.75. Thus, the stock has appreciated 71.6% since the original post a little over a year ago. I do not own any shares, nor do I have any options on this stock.

Looking through the list of the top % gainers on the NASDAQ today, I saw that VASCO (VDSI) had made the list, closing at $18.45, up $3.32 or 21.94% on the day. A year ago, when I wrote up Vasco on January 31, 2006, the stock was trading at $10.75. Thus, the stock has appreciated 71.6% since the original post a little over a year ago. I do not own any shares, nor do I have any options on this stock.

What exactly does this company do?

According to the Yahoo "Profile" on VASCO, the company

"...through its subsidiaries, engages in the design, development, marketing, and support of open standards-based hardware and software security systems that manage and secure access to information assets worldwide. It offers patented �Strong User Authentication� products for e-business and e-commerce, which enable secure financial transactions to be made over private enterprise networks and public networks, such as the Internet. Its product line includes, Digipass and VACMAN."

How did they do in the latest quarter?

This morning, prior to the opening of trading, VASCO announced 4th quarter 2006 results. For the quarter ended December 31, 2006, revenues increased 44% to $25.2 million from $17.5 million in the same quarter in 2005. Net income for the quarter came in at $5.1 million or $.13/diluted share, up sharply from $3.0 million or $.08/diluted share in the same period last year.

The company beat expectations for earnings; analysts had been expecting $.11/share, and the company came in at $.13. The company did come in a little light on revenue; analysts expected $25.7 million and the company came in at $25.2 million. At the same time, the company forecast an optimistic picture of revenue growth of 35-45%. This was enough to push the stock price sharply higher today.

What about longer-term financial results?

Looking at the Morningstar.com "5-Yr Restated" financials on VDSI, we find that revenue growth, which dipped from $23 million in 2001 to $17 million in 2002, subsequently steadily and strongly increased to $55 million in 2005 and $68 million in the trailing twelve months (TTM). The company reported a loss of $(.06)/share in 2003, turned profitable at $.09/share in 2004, and came in at $.21/share in 2005 and $.28/share in theTTM.

There were 29 million shares in 2003. By the TTM, the number of shares had increased by almost a third to 37 million, however, during this same period of time, revenue was up almost 200% from $23 million in 2003 to $68 million in the TTM. This does not appear to be a significant dilution in company stock.

Free cash flow is positive and growing the past few years. $2 million in 2003 increased to $7 million in 2005 and $11 million in the TTM.

As reported by Morningstar.com, the balance sheet appears solid with $23.5 million in cash, which by itself could easily cover the combined $16.5 million in current liabilities and the $.7 million in long-term liabilities combined. Calculating the current ratio, the company has a total of $40.6 million in current assets, which when compared to the $16.5 million in current liabilities, works out to a 'healthy' 2.46 ratio.

What about some valuation numbers?

Checking the Yahoo "Key Statistics" on VDSI, we find that the market cap is a mid cap $673.59 million. The trailing p/e is a rich 66.61 with a forward p/e (fye 31-Dec-07) estimated at 41.93. The PEG ratio is a bit rich at 1.53. (Generally 1.0 to 1.5 are reasonable PEG's imho).

Reviewing the Fidelity.com eresearch website, we find that VDSI has a Price/Sales ratio (TTM) of 8.04, well ahead of the industry average of 5.55. It should be noted that the company is more profitable than average with a 'return on equity'(TTM) of 35.08%. This is significantly higher than the industry average of 21.12%.

Finishing up on Yahoo, we find that there are 36.51 million shares outstanding with 26.40 million that float. As of 1/9/07, there were 2.62 million shares out short representing 9.8% of the float or 5.5 trading days of volume. With the solid earnings report today, the 'naysayers' might have gotten "squeezed" with the stock price rising as the short-sellers scrambled to pick up shares to cover their already 'pre-sold' stock!

No cash dividend and no stock splits are reported on Yahoo.

What does the chart look like?

Looking at a "Point & Figure" chart on VDSI from StockCharts.com, we can see that while the stock price was actually declining back through nearly all of 2002 and the first few months of 2003, the stock actually hit a low at $.25/share in 2003, only to climb sharply higher to the current $18.50 level. The chart looks strong to me!

Summary: What do I think about this stock?

Reviewing a few of the points I made above, the company came in today with a strong financial report. They have been growing nicely the past several years with steady revenue, earnings, and free cash flow with a very solid balance sheet. However, the stock price is fairly rich with a p/e in the 60's, a Price/Sales higher than the average company in its industrial group, and a chart that looks strong but perhaps a little overextended short term. This is an interesting stock that is the kind of stock that I would be buying, if I had a 'permission slip' to be out purchasing a new position!

Thanks again for visiting! If you have any comments or questions, please feel free to leave your comments right on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please feel free to visit my Stock Picks Podcast Site, where I discuss many of the same stocks I write about here on the blog.

Bob

A Reader Writes "IRIS...I was wondering...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I always enjoy receiving email from readers and commenting on stocks. I cannot predict whether stocks will rise or fall in the future. I also do not have any inside information as to what a company will be reporting in the future. Stock prices usually rise when a company exceeds expectations and prices often drop when companies fail to meet those same financial expectations.

Also, when you do email me at bobsadviceforstocks@lycos.com, and I look forward to your emails, please be aware that I am likely to write up your question/comment so that I may respond in a transparent fashion and also so that other readers who may have a similar question, may take advantage of our discussion.

With all of that in mind, I was glad to receive an email today from Mike P. who wrote:

With all of that in mind, I was glad to receive an email today from Mike P. who wrote:

"Hello Bob

I purchased myself a bunch of Iris stock right around

the 11.70 level. I was wondering what your outlook is

for the company prior to the March 7th financial

report.

Thanks

-Mike"

So first of all, thanks for writing Mike. From what Mike writes, I assume he is long Iris at the $11.70 level. Coincidentally, IRIS is trading at $11.70, down $(.03) on the day as I write.

As you probably know, I first covered IRIS back on October 4, 2005, on Stock Picks Bob's Advice when it was trading at $20.97. So this particular stock is considerably below the price where I wrote it up.

In general, my assessment of a stock includes whether a company has had a good recent quarter, whether longer-term results is consistent, and if the chart looks nice. If a company has had a 'down quarter' as the latest report, I don't look further. This doesn't mean that the stock isn't likely to move higher. Furthermore, as even my own post on Iris back in 2005 demonstrates, the fact that a company meets my own criteria doesn't mean that the stock price will necessarily rise. This is just something that I have found useful.

As you note, Iris has announced that they will be releasing 4th quarter results on March 7, 2007. If the company is able to meet or exceed expectations, the stock price may well appreciate. But that would be anyone's guess I suppose. I am not prepared to guess.

So I am stuck looking at the 3rd quarter 2006 results, which while a bit hard to locate, are found right on the company website.

The company reported:

"CHATSWORTH, Calif., Nov. 14, 2006 — IRIS International, Inc. (NASDAQ: IRIS) today announced revenue of $18.0 million for the third quarter ended September 30, 2006, a 13% increase over revenue of $16.0 million in the third quarter of 2005.

Net income for the third quarter of 2006 was $0.8 million or $0.04 per diluted share after the effect of reserves, increased professional fees and inventory adjustments totaling $1.1 million or $0.04 per share. Third quarter 2006 earnings reflect additional reserves taken for sales return allowances, increased warranty reserves for iQ®200, physical inventory losses of service parts, increased inventory reserves and additional accrual for increased professional fees associated with compliance with Sarbanes Oxley Section 404."

Well that is all well and good. But the earnings of $.8 million or $.04/diluted share, regardless of whatever accounting requirements are explained, is below the net income of $1.5 million or $.09/diluted share reported in the same period the prior year. So I am unable to say that this stock meets my requirements. But I am also unable to tell you which direction the stock price is likely to move in the future. Since you are a holder of the stock, I hope the stock price appreciates and you make a ton of money.

I hope that this is helpful for you. I do not mean to be discouraging, but as I said in the prior entry, I try very hard to be honest and consistent as well as transparent in everything I write about here on this website. I do not own any shares in IRIS nor do I have any options.

If you have any comments or questions you would like me to address, please feel free to leave your comments on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, where you can get a chance to listen to me talk about some of the many stocks I write about here!

Bob

Posted by bobsadviceforstocks at 1:43 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 20 February 2007 1:45 PM CST

Monday, 19 February 2007

A Reader Writes: "SGMS. Care to revisit?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the favorite things about writing a blog is to receive comments and emails from all of you readers. I cannot promise to always provide you with the answer you are looking for, but I shall try to provide you with as honest a response as I am able.

One of the favorite things about writing a blog is to receive comments and emails from all of you readers. I cannot promise to always provide you with the answer you are looking for, but I shall try to provide you with as honest a response as I am able.

I had a nice email yesterday from Anthony G. who wrote:

"Bob

I have been reading your articles on this for a couple years now...

Care to revisit? I'm bullish on it going higher and wanted to know what your views were.

Thanks and I appreciate your feedback you've shared on the web!

Anthony"

First of all, thank you so much for writing! There really are two parts to your question, 'do I agree with you that we should be bullish on this stock', and 'would I care to revisit Scientific Games' on the blog'?

For the first question, I do not have any opinion on whether Scientific Games goes higher or not. Apparently you own some shares, so I shall be rooting for you and your stock purchase that you make a lot of money. There are indeed a lot of nice things about SGMS that could lead to the price moving higher.

Next, would I revisit this stock. In general I like to wait a full year after discussing any stock that I have reviewed previously.

I first posted Scientific Games on Stock Picks on September 12, 2003 when the stock was trading at $11.55. I then "revisited" the stock on January 14, 2005, when the stock was trading at $25.87. The stock closed at $34.14 on February 16, 2007, so the initial pick and the second pick were both good calls and the stock has appreciated significantly since being mentioned here on the blog. I do not own any shares or options on this stock.

But this begs the question. The real issue is whether the stock still meets my criteria for inclusion; not whether there is a possibility that the stock appreciates strongly from here.

One of my requirements for a company to be posted is whether the latest quarter shows increasing earnings as well as revenue compared to the year earlier period. It is rather an arbitrary and rigid approach to picking stocks but it is what I do.

On November 2, 2006, SGMS reported 3rd quarter results. As reported:

"NEW YORK, Nov. 2 /PRNewswire-FirstCall/ -- Scientific Games Corporation (Nasdaq: SGMS) today reported third quarter 2006 revenues of $217.4 million, up 10 percent from $196.8 million in the third quarter of 2005. Net income was $11.5 million or $0.12 per diluted share, net of $4.6 million of stock compensation expense and $10.2 million of pari-mutuel asset impairment charges, down from $19.2 million or $0.21 per diluted share in the third quarter of 2005. Non-GAAP adjusted net income before stock compensation expense and asset impairment charges for the third quarter of 2006 was $22.8 million or $0.24 per diluted share, compared to non-GAAP adjusted net income of $24.9 million or $0.27 per diluted share for the third quarter of 2005."

You can see from the above report, that while revenue did climb 10% to $217.4 million from $196.8 million, net income declined to $.12/share vs. $.21/share in the year earlier period. Even by using non-GAAP adjusted results we have $.24/diluted share vs. $.27/diluted share the prior year. Either way we cut it, earnings declined year-over-year. For now, this precludes an 'endorsement' of the stock from me. However, if the company returns to growth, and the next quarter should be reported soon, that would certainly change my outlook.

I hope this answers your question. Thanks so much for writing and reading my blog. If you or anyone else have any questions or comments, please feel free to reach me on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure you stop by and visit my Stock Picks Podcast website.

Bob

Saturday, 17 February 2007

Precision Castparts (PCP) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decision based on information on this website.

I try to accomplish a lot of different objectives on this blog simultaneously. Since 2003, I have been writing up stocks that I believe meet my criteria for investment, I have been discussing different ways of managing your portfolio, and have also shared with all of you readers my actual trading portfolio; letting you know what I own, when I buy shares, and when I sell them. As part of this "transparency" I have been trying to review my actual trading portfolio going through a different position every two or three weeks going alphabetically through the list. Currently, I am up to 15 positions (below my maximum of 25 and above my minimum of 6). Three weeks ago I reviewed my Morningstar position and going alphabetically, I am up to my Precision Castparts (PCP) holding.

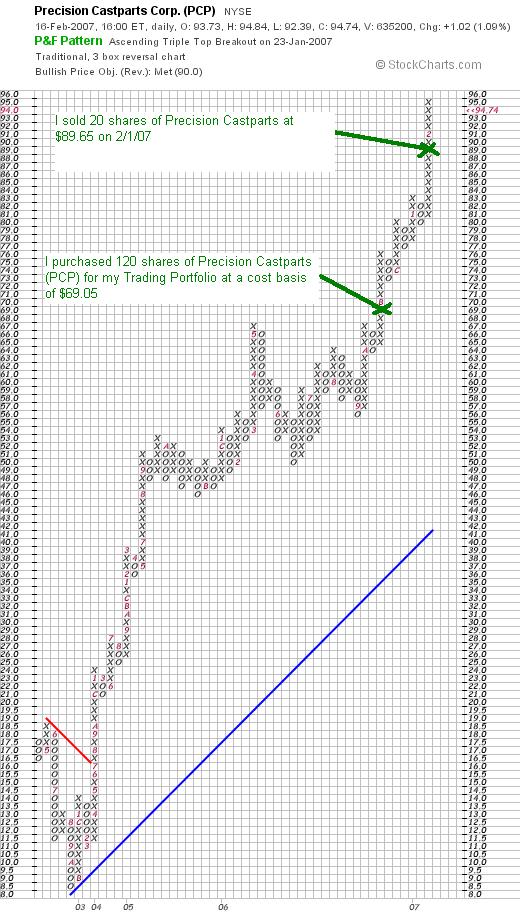

I currently own 100 shares of Precision Castparts (PCP) in my Trading Portfolio which were acquired on October 24, 2006, at a cost basis of $69.05/share. PCP closed on February 16, 2007, at a price of $94.74, representing an unrealized gain of $25.69/share or 37.2%.

I currently own 100 shares of Precision Castparts (PCP) in my Trading Portfolio which were acquired on October 24, 2006, at a cost basis of $69.05/share. PCP closed on February 16, 2007, at a price of $94.74, representing an unrealized gain of $25.69/share or 37.2%.

As is my practice, I sold a portion of my holding of PCP, 1/6th to be exact, or 20 shares of my original 120 shares at $89.65 (net) for a realized gain on these shares of $20.60 or 29.8%. It is my strategy to sell 1/6th of holdings if they should appreciate to 30, 60, 90, 120, 180, 240, 300, 360, 450, etc. appreciation points. I plan on selling another 1/6th of my holding or 16 shares if PCP should appreciate to a 60% gain level or 1.6 x $69.05 = $110.48. On the downside, after a single sale at a gain, I plan on selling all remaining shares if the stock should decline back to break-even or $69.05.

Let's take another look at this company and see if it still deserves a spot on this blog!

What exactly does this company do?

According to the Yahoo "Profile" on Precision Castparts, the company

"...engages in the manufacture of metal components and products; and the provision of investment castings, forgings, and fasteners/fastener systems for critical aerospace and industrial gas turbine applications. It operates through four segments: Investment Cast Products, Forged Products, Fastener Products, and Industrial Products."

"...engages in the manufacture of metal components and products; and the provision of investment castings, forgings, and fasteners/fastener systems for critical aerospace and industrial gas turbine applications. It operates through four segments: Investment Cast Products, Forged Products, Fastener Products, and Industrial Products."

How did they do in the latest quarter?

On January 23rd quarter 2007 results.3, 2007, Precision Castparts reported 3rd quarter 2007 results. Total sales for the quarter came in at $1.4 billion, growing 61.5% over the $857.3 million in sales the prior year. Net income for the quarter came in at $158.3 million or $1.15/diluted share vs. net income of $93.7 million or $.69/diluted share the prior year.

The company beat expectations of earnings of $.98/share and also beat revenue expectations of $1.3 billion.

What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that after a dip in revenue from $2.19 billion in 2002 to $1.81 billion in 2003, the company resumed a sharp increase in revenue to $3.5 billion in 2006 and $4.3 billion in the trailing twelve months (TTM).

Earnings have indeed been erratic, climbing from $.41/share in 2002 to $1.17/share, only to drop the next two years to $(.01)/share in 2005. Since then, the stock has turned sharply around reporting $2.58/share in earnings in 2006 and $3.39/share in the TTM.

The company has been paying a dividend of $.06/share from 2002 through 2005. In 2006 the company raised the dividend to $.11/share and has paid $.12/share in the TTM.

The company has also increased the number of shares outstanding modestly from 103 million in 2002 to 133 million in 2006 and 136 million in the TTM. This 30% increase in shares has been accompanied by a nearly 100% increase in revenue and a 500% increase in earnings. This is a dilution that seems quite reasonable to me!

Free cash flow, while not completely steady, has been positive and growing with $87 million reported in 2004, $132 million in 2006 and $286 million in the TTM. The balance sheet, as presented by Morningstar.com, appears solid with $108.7 million in cash and $1,781.9 million in other current assets. This total of $1.89 billion of current assets, when compared to the $1.10 billion in current liabilities yields a current ratio of 1.72 which appears healthy to me. In addition, the company has another $1.16 billion in long-term liabilities reported on Morningstar.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" on PCP, we can see that this is a large cap stock with a market capitalization of $12.99 billion. The trailing p/e is a moderate 24.58, with a forward p/e (fye 02-Apr-08) more reasonable at 17.98. Thus the PEG (5 yr expected) works out to an estimated 1.01. Generally PEG ratios between 1.0 and 1.5 are reasonable to me from a GARP perspective.

Checking the Fidelity.com eresearch website, we see that PCP comes in with a Price/Sales ratio (TTM) of 2.70, well ahead of the industry average of 1.37. Fidelity also shows that the Return on Equity (ROE) (TTM) works out to 21.59%, ahead of its two main competitors per Fidelity: Alcoa (AA) with a ROE of 15.03% and Ladish (LDSH) which has an almost as good ROE of 20.36%.

Finishing up with Yahoo, we find that there are 137.12 million shares outstanding with 136.50 million that float. As of 1/9/07, there were 2.75 million shares out short representing 2% of the float or 3.2 trading days of volume. This short intererst is just a bit over my '3 day rule' for significance.

As noted above, the company pays a forward dividend of $.12/share yielding 0.1%. The company last split its stock 9/9/05, when it had a 2:1 stock split.

What does the chart look like?

If we review the "Point & Figure" chart on Precision Castparts from StockCharts.com, we can see one of the strongest charts I have on the blog. However, with the stock climbing almost vertically it does appear to be a bit overextended at least short-term.

Summary: What do I think about this stock?

Well, first of all, I do own shares of PCP, so I am quite prejudiced :). However, let's review a few of the things I wrote up above. First of all the stock is continuing to move higher since I purchased shares. The latest quarter was incredible! They reported a HUGE increase in revenue and earnings, and beat expectations on both. Longer-term, they have been growing revenue strongly the past few years. Earnings have been a bit more erratic, but have increased very strongly the past couple of years.

The company pays a small dividend and has been recently increasing the payment. The number of shares is relatively stable compared to the sharp revenue and earnings increase.

Free cash flow is strongly positive and the balance sheet appears solid. Valuation appears reasonable with a moderate p/e and a PEG just over 1.0. The Price/Sales ratio does appear steep, but the ROE is better than at least a couple of its largest competitors. Finally the chart looks quite strong if not overextended. The stock may well be due to a correction short-term, but I see nothing holding it back from future appreciation. Much will of course depend on the next quarter's results. Anyhow, this is a great stock that has done well for me!

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please feel free to visit my Stock Picks Podcast Website. Have a great weekend everyone!

Bob

"Looking Back One Year" A review of stock picks from the week of October 3, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is once again the weekend, and last weekend I never did get around to reviewing prior stock picks. So now I am another week behind that 'year' :(. So let's get this review going before I crash for the night!

I try to do a lot of different things on this website. First of all, I like to present stocks that I find worthy of consideration for investment and I like to share with you the reasons I have concluded this. In addition, I actually share with you my trading portfolio, letting you know how and when I have made decisions. In order to determine if my strategy is working, and if it needs adjustment I also like to review past stock picks and find out how they would have turned out if I had indeed purchased shares. I review lots of different stocks, but only have the resources to purchase a few!

This review assumes a buy and hold strategy. In practice, I recommend and I also employ a disciplined trading strategy that requires me to sell losing stocks quickly and completely on small losses and sell gaining stocks slowly and partially at targeted appreciation levels. Certainly, this difference in strategy will greatly affect outcomes. For the purpose of this review, and for the ease of calculation, I assume equal dollar purchases of each stock 'picked' during that particular week, and a 'buy and hold' strategy employed to determine the 'performance'. Please take these differences into consideration as you go over my review.

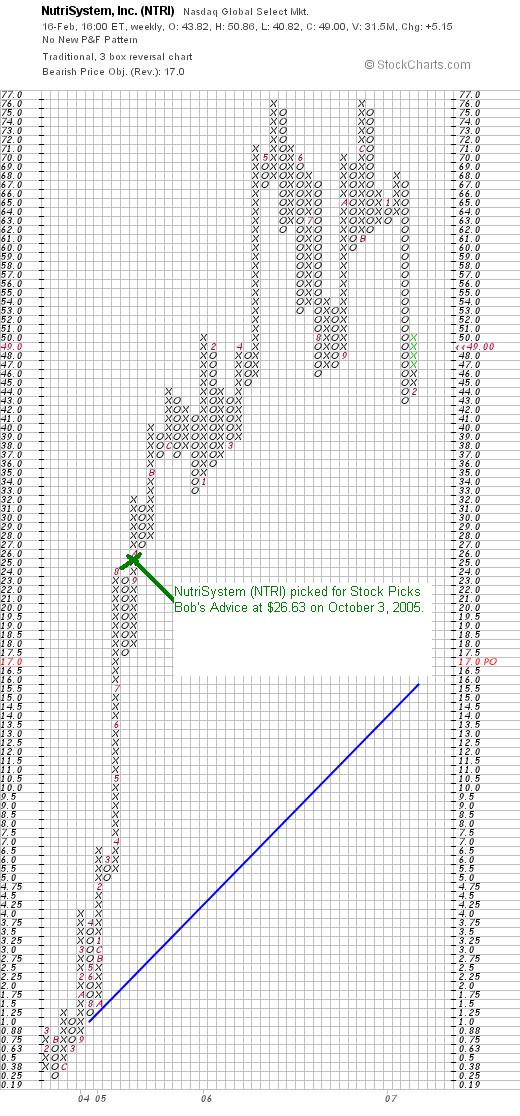

On October 3, 2005, I "picked" NutriSystem (NUTRI) for Stock Picks Bob's Advice when it was trading at $26.63. NTRI closed at $49.00 on February 16, 2007, for a gain of $22.37 or 84% since posting.

On October 3, 2005, I "picked" NutriSystem (NUTRI) for Stock Picks Bob's Advice when it was trading at $26.63. NTRI closed at $49.00 on February 16, 2007, for a gain of $22.37 or 84% since posting.

On February 14, 2007, NutriSystem reported 4th quarter 2006 results. For the quarter ended December 31, 2006, revenue increased 92% to $133.6 million, from $69.6 million in the same quarter in 2005. Net income jumped 213% to $19.6 million or $.53/diluted share, compared with net income of $6.3 million or $.17/diluted share in the fourth quarter of 2005.

On February 14, 2007, NutriSystem reported 4th quarter 2006 results. For the quarter ended December 31, 2006, revenue increased 92% to $133.6 million, from $69.6 million in the same quarter in 2005. Net income jumped 213% to $19.6 million or $.53/diluted share, compared with net income of $6.3 million or $.17/diluted share in the fourth quarter of 2005.

The company beat expectations handily. Analysts expected fourth-quarter earnings of $.51/share (the company came in at $.53) on revenue of $130.9 million (the company reported revenue of $133.6 million).

In the same report, the company also raised guidance both for the upcoming quarter as well as all of fiscal 2007. They forecast first quarter earnings of $.88 to $.92/share on revenue of $205 million. (Analysts are currently expecting first quarter earnings of $.85/share on sales of $208.3 million). For the full year, the company guided to earnings of $3.00 to $3.10/share on revenue of $720 million. (Analysts had been expecting earnings of $2.89/share on $739.9 million in revenue.) Thus the guidance was mixed: raised for earnings and actually guiding lower for revenue.

Looking at the "Point & Figure" chart on NutriSystem from StockCharts.com, we can see that the stock has recently pulled back from its short-term highs:

On October 4, 2005, I posted IRIS International (IRIS) on Stock Picks Bob's Advice when it was trading at $20.97. IRIS closed at $11.73 on February 16, 2007, for a loss of $(9.24) or (44.1)% since posting.

On October 4, 2005, I posted IRIS International (IRIS) on Stock Picks Bob's Advice when it was trading at $20.97. IRIS closed at $11.73 on February 16, 2007, for a loss of $(9.24) or (44.1)% since posting.

On November 14, 2006, Iris reported 3rd quarter 2006 results, for the quarter ended September 30, 2006. Revenue for the quarter came in at $18 million, up 13% from the $16 million reported in the same quarter in 2005. Net income for the quarter came in at $800,000 or $.04/diluted share, down from $1.5 million or $.09/diluted share in the 2005 same quarter.

On November 14, 2006, Iris reported 3rd quarter 2006 results, for the quarter ended September 30, 2006. Revenue for the quarter came in at $18 million, up 13% from the $16 million reported in the same quarter in 2005. Net income for the quarter came in at $800,000 or $.04/diluted share, down from $1.5 million or $.09/diluted share in the 2005 same quarter.

Looking at the "Point & Figure" chart on Iris from StockCharts.com, we can see how the stock climbed to $28/share in August, 2005, only to break through support at $16 and trade lower. In fact the stock is coming off its recent low of $8.00/share at $11.73, still well below its resistance level.

Summary: How did I do with these picks from the week of October 3, 2005?

Well, my NTRI stock pick moved sharply higher, while my IRIS pick moved in the opposite direction :(. Thus, the average of the two stocks was a gain of 20.0%. Not too shabby after all :).

Thanks so much for stopping by and visiting my blog! Please remember that past performance is no guarantee of future price moves. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Site where I discuss some of the many stocks I write about on the blog.

Bob

Newer | Latest | Older

Earlier today I posted how I had purchased shares of VCA Antech after getting the 'permission slip' to add a new position after selling some of my Morningstar stock at a targeted gain. As promised, let's take another look at WOOF and I will share with you why I believe it deserves a spot on this blog and why I bought shares!

Earlier today I posted how I had purchased shares of VCA Antech after getting the 'permission slip' to add a new position after selling some of my Morningstar stock at a targeted gain. As promised, let's take another look at WOOF and I will share with you why I believe it deserves a spot on this blog and why I bought shares! According to the

According to the

As I like to do, I was looking through the l

As I like to do, I was looking through the l Reviewing the

Reviewing the

Looking through the

Looking through the

With all of that in mind, I was glad to receive an email today from Mike P. who wrote:

With all of that in mind, I was glad to receive an email today from Mike P. who wrote:

I currently own 100 shares of Precision Castparts (PCP) in my Trading Portfolio which were acquired on October 24, 2006, at a cost basis of $69.05/share. PCP closed on February 16, 2007, at a price of $94.74, representing an unrealized gain of $25.69/share or 37.2%.

I currently own 100 shares of Precision Castparts (PCP) in my Trading Portfolio which were acquired on October 24, 2006, at a cost basis of $69.05/share. PCP closed on February 16, 2007, at a price of $94.74, representing an unrealized gain of $25.69/share or 37.2%.

On October 3, 2005, I

On October 3, 2005, I  On February 14, 2007, NutriSystem reported

On February 14, 2007, NutriSystem reported  On October 4, 2005, I

On October 4, 2005, I  On November 14, 2006, Iris reported

On November 14, 2006, Iris reported