Stock Picks Bob's Advice

Wednesday, 29 August 2007

MICROS Systems Inc. (MCRS) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

What a difference a day makes! I suppose in retrospect when I noted that ALL 15 of my stocks had declined, I should have figured that at least for the short-term that was some sort of climactic sell-off. At least for now, the market is over-sold and appears to be rebounding with the Dow up 118 points at 13,160.29 and the Nasdaq up 26.91 points at 2,527.55 with several hours left in the trading day.

I was looking through the list of top % gainers on the NASDAQ this morning and came across an 'old favorite' of mine, MICROS Systems (MCRS) which as I write is trading at $59.50, up $3.99 or 7.19% on the day. I say 'old favorite' because I first wrote up MICROS on Stock Picks Bob's Advice on October 28, 2005, when the stock was trading at $45.82. Thus the stock has appreciated $13.68 or 29.9% since posting. I do not own any shares or have any options on this company.

I was looking through the list of top % gainers on the NASDAQ this morning and came across an 'old favorite' of mine, MICROS Systems (MCRS) which as I write is trading at $59.50, up $3.99 or 7.19% on the day. I say 'old favorite' because I first wrote up MICROS on Stock Picks Bob's Advice on October 28, 2005, when the stock was trading at $45.82. Thus the stock has appreciated $13.68 or 29.9% since posting. I do not own any shares or have any options on this company.

MICROS SYSTEMS (MCRS) IS RATED A BUY

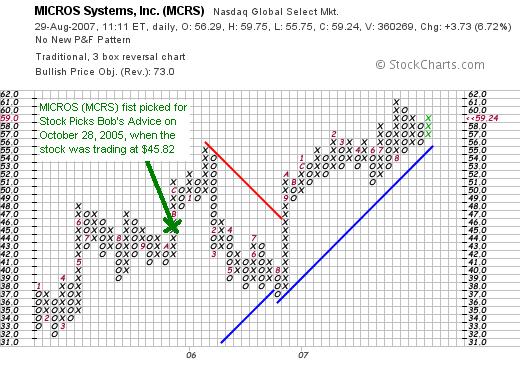

Since we are discussing prices of this stock and my last write-up, let's take a look at a "point & figure" chart on MICROS from StockCharts.com:

On the chart we can see that the stock reached an intermediate peak of $55 in January, 2006, only to sell-off to $36 in August, 2006. In that same month the stock turned around and broke through resistance on the upside and has resumed its upward trek since. The stock appears to be solidly in an upward move trading above support lines.

What exactly does the company do?

According to the Yahoo "Profile" on MICROS (MCRS), the company

"...engages in the design, manufacture, marketing, and servicing of  enterprise information solutions for the hospitality and specialty retail industries."

enterprise information solutions for the hospitality and specialty retail industries."

What about the latest quarter?

As is so often the case, and was the case when I first wrote up MICROS in 2005, what moved the stock higher today was the report of earnings results, in this case 4th quarter 2007 results, which were announced after the close of trading.

For the quarter ended June 30, 2007, revenue came in at $221.6 million, up 15.5% over the prior year same period. GAAP net income came in at $785.7 million, up 15.7% over the prior year. GAAP diluted eps came in at $.66, up 24.5% over the same period last year.

The company beat expectations for the quarter. Analysts had been expecting earnings of $.49/share on revenue of $202.7 million. In addition, the company raised guidance for fiscal 2008 to earnings of $2.59 to $2.62/share, on revenue of $910-$915 million. Analysts on average had been expecting earnings of $2.56/share on revenue of $905.5 million.

For an earnings report, I like to call this a "trifecta-plus" which for me means a company reports strong revenue growth, strong earnings growth, beats expectations and raises guidance. And the street liked what it read as well and the stock came out of the gate charging higher this morning!

What about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials on MICROS, we can see what I consider to be a very 'pretty' picture! Revenue has been steadily increasing from $372 million in 2002 to $679 million in 2006 and $756 million in the trailing twelve months (TTM).

Earnings during this period increased by six-fold from $.30/share in 2002 to $1.60/share in 2006 and $1.80 in the TTM. During the same period, the outstanding shares increased from 35 million in 2002 to 39 million in the TTM, a dilution of a little over 10%, quite acceptable to me.

Free cash flow has been positive and growing with $63 million reported in 2004, increasing to $111 million in 2006 and pulling back slightly to $109 million in the TTM. The balance sheet appears quite solid with $301 million in cash, which by itself could cover both the $246.5 million in current liabilities and the $29.6 million in long-term liabilities combined.

Calculating the current ratio, the total of current assets works out to $573 million, which when compared to the current liabilities of $246.5 million, yields a current ratio of 2.32.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" on MCRS, we can see that this stock is a mid cap stock with a market capitalization of $2.42 billion. The trailing p/e is a moderat 33.12, but the forward p/e is estimated at 18.65 (fye 30-Jun-08). Thus the PEG ratio, which takes into consideration the future growth in earnings in determining the richness in the price, comes out to a very reasonable 1.16 (I generally find PEG's between 1.0 and 1.5 to be reasonably priced).

In other measurements of valuation, according to the Fidelity.com eresearch website, the company has a Price/Sales ratio (TTM) of 2.84, well below the industry average of 6.02. There is a nice article by Paul Sturm at Smart Money on the importance of relative Price/Sales ratios, and MCRS does well in this regard.

In terms of profitability, Fidelity suggests MCRS is not quite as good as its peers, with the Return on Equity (TTM) coming in at 15.78%, under the industry average of 25.05%.

Finishing up with Yahoo, we find there are 40.52 million shares outstanding with 38.39 million that float.

As of July 10, 2007, there were 3.11 million shares out short. This works out to a short ratio (as of 7/10/07) of 7.4 trading days of average volume or 7.7% of the float. I personally use a '3 day rule' for significance, and at 7+ days, this is well above that, setting this stock up for a short squeeze, which may well be developing today as the company announces strong results attracting interest in the stock and buyers coming into the market driving the stock price higher.

No cash dividend is paid and the last stock split was a 2:1 stock split on February 2, 2005.

Summary: What do I think?

Well, as you probably can tell I like this stock a lot. I practically LOVE this stock :). But I don't own any shares :(. However, if I were in the market to be buying a stock today, this is the kind of stock I would be adding to my portfolio. Meanwhile, I shall keep it in my 'vocabulary' of stocks, ready to buy at the appropriate time.

Let me summarize a few of the findings. First of all the stock reported strong earnings with both earnings and revenue growth as well as beating expectations for both and then raising guidance for both! Longer-term the company has been steadily increasing revenue, earnings, and free cash flow, while keeping the outstanding shares relatively stable. The balance sheet is solid with the company with enough cash to pay off all liabilities--both short-term and long-term!

Valuation-wise, the p/e is a tad rich in the 30's, but the PEG is just over 1.0. The Price/Sales is good compared to other companies in the same industry, but the Return on Equity is a bit weak. In addition there are lots of short-sellers who appear to be betting the wrong way on this stock.

Finally, the chart looks great, moving higher without appearing over-extended. This stock belonged in the blog in 2005 and deserves a spot in 2007!

Thanks again for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Page where I discuss some of the stocks I write about here on the blog. In addition, check out my Covestor Page which analyzes my actual trading portfolio performance relative to other registered invesotrs, and visit my SocialPicks Page which has an ongoing analysis of my blog since about January, 2007. Now you also have a lot of homework!

Regards and isn't it nice to have a market moving higher for a change?

Bob

Tuesday, 28 August 2007

A Reader Writes "Is there something I am missing?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I always enjoy receiving, and responding to email. By the way, if you have any comments or questions, you are always welcome to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. I read every email I receive and I try to answer as many as I can....so bear with me. Remember that as much as you may enjoy this blog, I am still an amateur investor answering all of your questions. I guess you could say we are all in this together :).

I always enjoy receiving, and responding to email. By the way, if you have any comments or questions, you are always welcome to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. I read every email I receive and I try to answer as many as I can....so bear with me. Remember that as much as you may enjoy this blog, I am still an amateur investor answering all of your questions. I guess you could say we are all in this together :).

Anyhow, instead of concentrating on how bad everything was today and the past month for that matter, I wanted to share with you a nice email I received from Asad R. who writes from Racine, Wisconsin, about "buy and hold" investing.

Asad wrote:

"Hello!

I read your website, I have a question:

I have looking at stocks like Yahoo, Walmart, Coca Cola etc.

And it seems to good to be true.

For example: if one had bough one thousand dollars worth of shares of Yahoo back in 1996 when the price per share was one dollar,

today with splits you would have 24,000 shares and since the price per share is 23.59, you would have: $566,000.

Wal-Mart for example, back in 1974 was 4 cents per share. If you had bought $1000 worth of shares that would have been 25,000 shares.

It split 9 times since then. So you would have 12,800,000 shares. At the current price of $43 per share you would have $550,400,000. (Half a billion).

Now some may say: 'yeah but you have to chose a winning stock many stocks will lose money or even go bankrupt.

But I say: Let's say you spend $50,000 on stocks, spening $1000 each in 50 companies. Even if 40 of those 50 companies went bankrupt, as long as you chose one winning stock (like Wal-Mart or Yahoo) you would be a millionaire!

Just seems to good to be true. This 'buy and hold' strategy.

Is there something I am missing? Some catch?

Any comments would most appreciated, thank you

Asad R."

First of all, thank you for writing Asad! You are indeed correct. If you can possibly find these companies when their shares are in the pennies and they go on to become gigantic firms, you may well be on your way to wealth! I cannot argue with you. But the challenge is in identifying those companies and staying with them long-term.

I am not opposed to 'buy and hold' approaches.

In fact, nothing would delight me more than to have perhaps found one of these companies on the way to immense levels of appreciation.

The only difference in what I do is to think about some of the 'what if's'. In other words, what if your stock declines after your purchase? What if they announce poor earnings and problems with management? What if they are being investigated for fraud? What if they turn to losses instead of gains and their revenues shrink away? What if?

On the other hand, I do not believe that you should sell a stock completely just because it appreciated in value. Nowhere will you find that recommendation on this blog. I have suggested that it is wise to aggressively sell your losers. To balance these sales, I like to sell my gainers very slowly and only partially. As I have sold some of these stocks multiple times, I continue to give them greater rein to travel. That is, I let them decline more before pulling the plug, increasing the likelihood that they shall become long-term gainers.

Furthermore, I believe it is important to identify the characteristics of these companies like Wal-Mart or Coca Cola before they become the fabulous success investments they look like today. It is my belief that it is relatively foolish to buy a random basket of 50 stocks with $1,000 in each. I would much rather see you do some work and identify those characteristics of the stongest stocks and instead buy 10 stocks with $5,000 apiece.

But don't just randomly select stocks.

Identify those characteristics that made the Wal-Mart's or the Coca Cola's of the world so fabulous. This is what I have referred to previously as the Fastenal stock. The stock that keeps on appreciating year in and year out making millionaires out of relatively small investors. From my perspective, this is a product of the steady growth in revenue, earnings, possibly dividends, stable shares, positive free cash flow and a solid balance sheet.

I believe that if I build a portfolio based on these criteria, I shall be successful. That at least is my dream.

Good luck with whatever you do. You are not incorrect to note that you might be able to buy 50 stocks and if one hits the jackpot you win. But the chance to find that one stock might well be under 1/50. I don't know the chance of your success. This isn't my approach, but maybe it is something you would like to do. Let me know what you decide.

In any case, thanks again for visiting and taking the time to write. You have added some provocative ideas to this blog and I appreciate that very much. There really isn't one approach that makes sense in investing. There are many approaches and some shall be more successful than others in differing trading environments.

Paraphrasing the Byrds, "There is a Time and a Season for every Purpose."

Bob

How I am Dealing with the Market Correction

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It was another lousy day in the market. The Dow closed at 13,041.85, down (280.28) and the Nasdaq did just as poorly, closing at 2,500.64 down (60.61) points on the day. My own portfolio wasn't spared, EVERY SINGLE POSITION closed lower, for a loss of $(2,355.29) on the day in my trading account.

So WHAT is a trader supposed to do?

And how am I dealing with this rout?

Part of this blog is to see whether the trading strategy that I have been using will be successful over the long haul. And that includes bear as well as bull markets! So NO, I have not changed my strategy.

My approach to the markets is to let my own portfolio tell me what to do. That is I manage each of my holdings independently and the combined effect of all of these decisions is my way of responding to the market.

I am already down from 20 to 15 positions. Currently, only my VCA Antech (WOOF) is flirting with a sale, down to a $(541.41) loss or (6.28)%. If the stock makes it to an (8)% loss, the entire position shall be sold.

I am monitoring my other positions as well. I know where I need to sell each and every one of my holdings. As you may recall, after an initial purchase, I allow a stock to move to an (8)% loss before selling. I also sell stocks as they appreciate at different intervals. After a single partial sale at a 30% gain level, I move my 'stop' up to a break-even level before selling all remaining shares. After two or more partial sales at 60% or higher, I move my stop up further to 1/2 of the highest appreciation level sale. For instance, if I have sold a portion of a holding, with the last sale at a 90% gain, then I would move my sale point up to a 45% appreciation level before unloading all shares.

A couple of points in addition. If I sell a stock on 'bad news' I 'sit on my hands' with the proceeds. That is, I either apply it to my unfortunately significant margin level, or if that is paid down, I simply save it as cash. I continue to pull back my investment exposure until I am at a 25% invested posture. With 20 stocks being my maximum, the minimum portfolio size is planned to be 5 positions. At 5 positions, if any of these stocks are sold, then for the time being, I shall be replacing those positions with new stock investments that meet my criteria.

So when stocks decline, I do not look to find 'value' in the depressed issues. Perhaps I should, but that is not my strategy. I do not depend on diversification into bonds and other forms of investments to protect my stocks. Instead I manage my holdings aggressively and in a very disciplined fashion. I do not try to anticipate the market. I don't know where it shall be a week from now. I do not try to outsmart the market. I simply try to listen to what the market is telling me and to respond to the price actions of my stocks in my own portfolio.

I hope this will be successful for me.

I wanted all of you to know that I too am feeling the pain of the stocks dropping in price. I shall keep you all posted as I write about and struggle with managing stocks in good times and bad.

Bob

Monday, 27 August 2007

Stock Picks Bob's Advice in Carnival of Personal Finance

If you are a frequent blog reader you may well be aware of the phenomenon of "carnivals". These are events in which the hosting website invites contributions of blog entries on a given topic from across the blogosphere.

I contributed and had my post on "Averaging Down" included in the Free Money Finance: Carnival of Personal Finance. Please visit this and you will appreciate many of the other financial blogs that are commenting and thinking about personal finance and investing. I look forward to participating in future carnivals as I share my writing with others across the 'net.

Bob

ICF International (ICFI)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your financial advisers prior to making any investment decisions based on information on this website.

Earlier today, scanning through the list of top % gainers on the NASDAQ, I came across ICF International (ICFI) which as I write, is trading at $22.70, up $1.05 or 4.85%. The stock is no longer on the list of top gainers, but after reviewing the stock this morning, I feel it deserves a place on the blog. I do not own any shares nor do I have any options on this stock.

Earlier today, scanning through the list of top % gainers on the NASDAQ, I came across ICF International (ICFI) which as I write, is trading at $22.70, up $1.05 or 4.85%. The stock is no longer on the list of top gainers, but after reviewing the stock this morning, I feel it deserves a place on the blog. I do not own any shares nor do I have any options on this stock.

ICF INTERNATIONAL (ICFI) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on ICFI, the company

"...and its subsidiaries provide management, technology, and policy consulting and implementation services primarily to government, commercial, and international clients. Its services primarily address energy; environment and infrastructure; health, human services, and social programs; and homeland security and defense markets."

Is there any recent news to explain the move today?

This morning, before the open of trading, the company announced two new contracts worth up to 4.5 million Euros under the 'European Commission's Technical Aid to the Commonwealth of Independent States (TACIS)" program.

How did they do in the latest quarter?

On August 9, 2007, the company reported 2nd quarter 2007 results. Revenue came in at $190.2 million for the quarter ended June 30, 2007, a 25.3% increase from the $151.7 million reported last year. Net income was $11.2 million, or $.75/diluted share, up about 25% from the $8.7 million or $.60/diluted share in the preceding quarter, and up sharply from last year's revenue of $56.1 million and a net loss of $(1.4) million or $(.15)/diluted share.

A large portion of the revenue was the $128.6 million received from the New Orleans "The Road Home" contract which was recorded in the second quarter of 2007. The earnings report does note that even minus The Road Home revenue, there would have been a 12.1% increase sequentially and a 10.6% increase year-over-year in the revenue.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ICFI, we can see the steady increase in revenue from $143 million in 2002 to $146 million in 2003, then a dip to $139 million in 2004, increasing sharply thereafter to $331 million in 2006 and $564 million in the trailing twelve months (TTM).

Earnings have also been erratic during the earlier years with $.10/share in 2002, increasing to $.30/share in 2004, dropping to $.20/share in 2005 then ramping up to $1.10 in 2006 and $2.50/share in the TTM.

The company has increased its float slightly from 8 million shares in 2002 to 10 million in 2006 and 11 million in the TTM. This 40% increase in shares has been accompanied by a 200% increase in revenue and about a 700% increase in earnings. This is an acceptable dilution in shares outstanding.

Free cash flow which was $2 million in 2004 and only $1 million in 2005, increased to $16 million in 2006 and $47 million in the TTM.

The balance sheet is adequate with $2 million in cash and $151 million in other current assets, which when compared to the $133.4 million in current liabilities, yields a current ratio of 1.15.

What about some valuation numbers?

Looking at the Yahoo "Key Statistics" on ICFI, we can see that this is a small cap stock with a market capitalization of $323.69 million. The trailing p/e is quite cheap at 9.50, with a forward p/e estimated (fye 31-Dec-08) at 13.98. Looking at earnings going forward, the PEG ratio is estimated at 0.49.

Checking the Fidelity.com eresearch website, we can see that ICFI has a Price/Sales (TTM) of 0.63, well below the industry average of 2.70. The company is also more profitable than its peers, with a Return on Equity (TTM) of 20.04%, according to Fidelity, compared to an industry average of only 12.66%.

Finishing up with Yahoo, it is reported that there are only 14.39 million shares outstanding with 13.05 million that float. There are only 204,560 shares out short as of 7/10/07, representing 2.4 trading days of volume (the short ratio) or only 1.5% of the float. According to Yahoo, there are not dividends paid and no stock splits are reported.

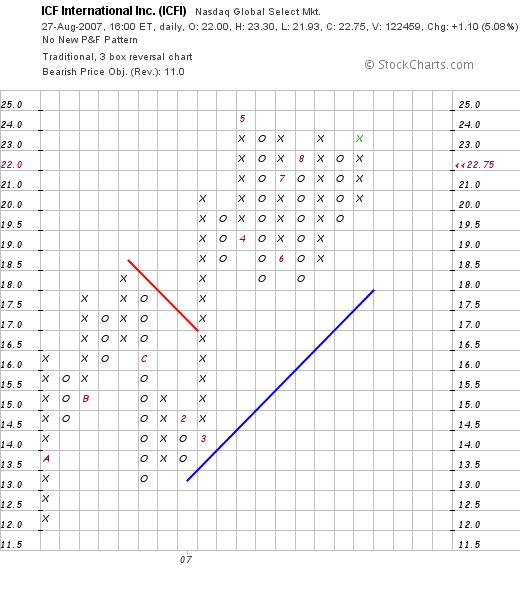

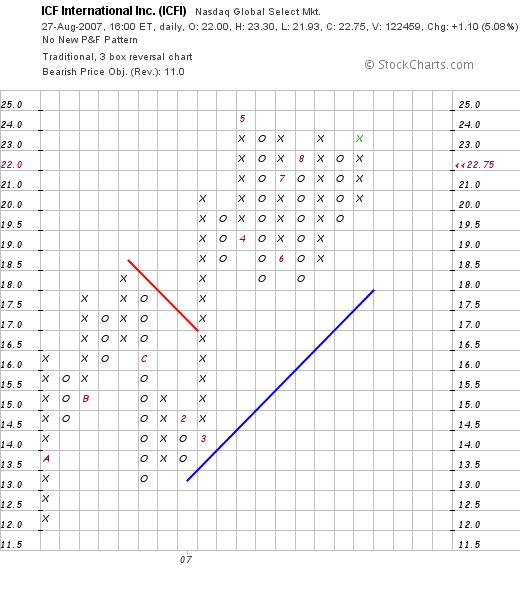

What does the chart look like?

Reviewing a "point & figure" chart on ICF International (ICFI) from StockCharts.com, we can see that the stock, which traded as low as $12 in September, 2006, has moved fairly steadily higher to as high as $24/share in May, 2007. The stock has been trading between $18 and $25 since then and overall appears to be moving higher above its support line.

Summary: What do I think about ICFI?Well needless to say, I like the stock. The recent announcement of European contract is encouraging. There is indeed a large dependence on The Road Home contract which makes up a big part of its business. But the company is still growing it business nicely even without that particular contract.

The latest quarter was strong, the last several years were quite strong, the balance sheet looks nice and valuation is dirt cheap with a p/e in the teens, a PEG well under 1.0, a Price/Sales ratio under its peers and a Return on Equity exceeding other similar enterprises. Finally the chart looks encouraging without appearing overextended.

If I were buying any stock today, this is the kind of stock I would be purchasing and it thus belongs in the blog.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Stock Picks Podcast Page as well as my Covestor page which tracks my actual trading portfolio, and my Social Picks Page which reviews my past stock picks for this year.

Regards!

Bob

Sunday, 26 August 2007

"Looking Back One Year" A review of stock picks from the week of March 6, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is Sunday, and I shall try to get through the rather busy week of March 6, 2006, when I posted review of three stocks. This review assumes a buy and hold strategy when calculating performance assuming that equal $'s of each security were purchased and held without regards to subsequent price performance. For the average performance, a simple mathematical average of the individual percentages is used to derive this figure.

In practice, I suggest and employ a very disciplined portfolio management strategy that involves selling losing stocks quickly and completely and gaining stocks slowly and partially. This difference between my actual strategy and the performance estimated on this review is significant and should be taken into consideration when reviewing these results. However, for the ease of calculating the "What if...?", this buy and hold approach is useful if not completely consistent with my own idiosyncratic approach to portfolio management.

On March 8, 2006, I posted Alliance Data Systems on Stock Picks Bob's Advice when the stock was trading at $45.22. Alliance Data Systems (ADS) closed at $77.15 on August 24, 2007, for a gain of $31.93 or 70.6% since posting.

On March 8, 2006, I posted Alliance Data Systems on Stock Picks Bob's Advice when the stock was trading at $45.22. Alliance Data Systems (ADS) closed at $77.15 on August 24, 2007, for a gain of $31.93 or 70.6% since posting.

On August 8, 200, ADS announced that shareholders had approved a $6.76 billion takeover of the company by the Blackstone Group. Since this company is to be acquired, I shall no longer be following this stock, and

ALLIANCE DATA SYSTEMS (ADS) IS RATED A HOLD

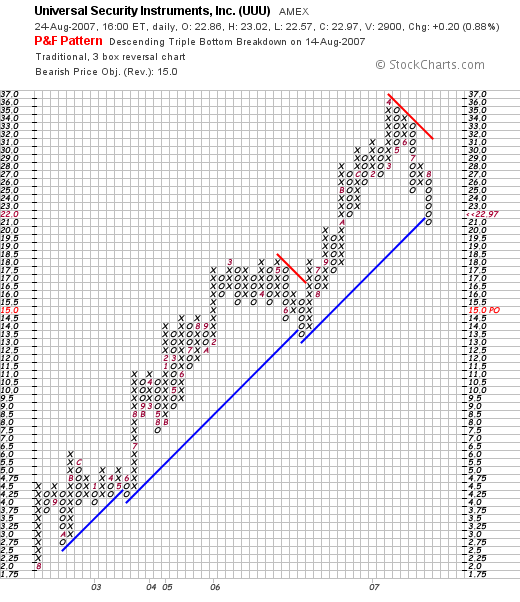

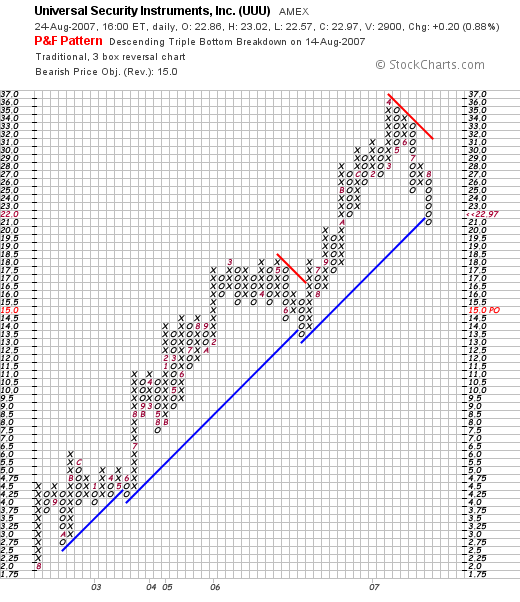

On March 10, 2006, I posted Universal Security Instruments (UUU) On Stock Picks Bob's Advice when the stock was trading at $21.65. UUU had a 4:3 stock split on April 4, 2006, and then another 4:3 stock split on October 17, 2006. Thus, our effective pick price was actually $21.65 x 3/4 x 3/4 = $12.18. UUU closed at $22.97 on August 24, 2007, for a gain of $10.79 or 88.6% since posting.

On March 10, 2006, I posted Universal Security Instruments (UUU) On Stock Picks Bob's Advice when the stock was trading at $21.65. UUU had a 4:3 stock split on April 4, 2006, and then another 4:3 stock split on October 17, 2006. Thus, our effective pick price was actually $21.65 x 3/4 x 3/4 = $12.18. UUU closed at $22.97 on August 24, 2007, for a gain of $10.79 or 88.6% since posting.

On August 14, 2007, UUU announced  . For the quarter ended June 30, 2007, sales increased strongly to $13.0 million from $8.0 million last year. However, earnings dropped to $791,002 or $.31/diluted share, from $1.6 million or $.62/diluted share last year.

. For the quarter ended June 30, 2007, sales increased strongly to $13.0 million from $8.0 million last year. However, earnings dropped to $791,002 or $.31/diluted share, from $1.6 million or $.62/diluted share last year.

If we look at the "point & figure" chart on UUU from StockCharts.com, we can see that although there has been some short-term weakness on UUU, the uptrend appears to be essentially intact.

With the phenomenal performance of this stock I am reluctant to put this at a 'sale' with only the earnings down with revenues strongly higher. Thus,

UNIVERSAL SECURITY INSTRUMENTS (UUU) IS RATED A HOLD

Finally, On March 9, 2006, I picked Claire's Stores (CLE) for Stock Picks Bob's Advice when the stock was trading at $33.03.

Finally, On March 9, 2006, I picked Claire's Stores (CLE) for Stock Picks Bob's Advice when the stock was trading at $33.03.

Claire's was also the subject of an acquisition and was acquired by Apollo Management for $33/share. This was completed by May 29, 2007.

Thus, I had a loss of $(.03)/share on this pick or (.1)% since posting.

So how did I do this week in March, 2006. In a word, fantastic! I had two companies acquired, one with a large gain and the other break-even, and the other stock showed a large gain as well. The average gain for the three stocks worked out to 53%!

Last week the review wasn't quite as nice! However, sometimes I get lucky :). Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 1:42 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 26 August 2007 1:44 PM CDT

Thursday, 23 August 2007

Is it Time to Sell or Time to Buy or Just Time to Ignore it All?

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This is a tidepool picture from La Jolla, California. Years ago I spent a summer in La Jolla at the Bishop's School where I had the opportunity of studying Marine Biology and Oceanography for high school students at the Scripps Institution of Oceanography. Year's later, I had the opportunity of spending more time in San Diego doing a year of advanced medical studies at the Scripps Clinic. San Diego has a special place in my life. But I can recall the many times I would drift down and climb on the rocks and peer into the tide pools.

Each small pool was like a microcosm of the ocean. Small fish. Small molluscs. Sea weed and other plants. And small waves splashing over each pool.

When I think about building my portfolio, I understand that I am building a small microcosm of the market itself. I can observe the stocks that I hope I shall be able to hold as they mature but am aware of the tremendous forces that wash over the portfolio as each of the stocks get tossed and turned in the turbulence. What is going on within my portfolio is a reflection of the entire market.

When stocks were climbing and I would blog about my small sales on appreciation, many of my readers would write asking me why I would sell any shares in such strong stocks. Why not simply buy more? Average up! Why not?

Certainly if stocks were set to climb indefinitely, and the strongest stocks likely to climb a lot, then such activity would definitely make sense and likely be quite profitable. On the other hand, if we are to accept that the market exerts tremendous influences over all of us, like the waves battering a tide pool on a stormy day, we will understand the need to harvest our gains when times are good and put them away for those days of challenge, the days when subprime concerns challenge our faith in the long-term viability of our investments.

There probably are basically three basic approaches to dealing with market corrections. There are others, but these three exemplify what I believe are the techniques that the smartest minds out there are utilizing. (And I am not including myself into that group. Not at this time!) I would like to comment on each of these and perhaps help you think about how your philosophy fits into these strategies.

The first strategy I would label the 'diversify and forget about it'. In other words, the proponent of this advice would suggest that the markets are too complex or too contradictory to predict and respond to successfully. And that anyone who does will likely buy too late, sell too late and be out of step as they try to shift into yesterday's hottest investment.

I found this article from the Providence Journal Newspaper which fairly clearly expressed this sentiment:

"If you have a diversified portfolio, you don’t have to be fearful of current events, says Jeff Seely, chief executive of ShareBuilder, an online brokerage that caters to small investors and is designed for long-term investing. “Recently, there has been a lot of volatility, with 200 to 300 point up days followed by equal-magnitude down days,” Seely points out. “Small investors absolutely get stressed when the market is unstable, particularly after a sustained period of good performance.”

But if you select good fundamental stocks, or broad exchange-traded funds, those investments should produce gains longer term, and a downturn is a time to buy, he said.

“Market normalcy is in fact a sequence of ups and downs, but with a general up-trend over time,” Seely said. “Taking the dips along with the upticks is unfortunately an inescapable part of the process.”

Davidson said that if you want to avoid reaching for antacid during times like this, divide your investment contributions so that a certain percentage is invested in a variety of assets, such as large-cap or large, blue-chip stocks. You should have some money in mid-cap and small-cap stocks (medium- and small-sized companies). Put a percentage in real estate and international securities, and in fixed income securities, such as bonds.

“I think it’s safe to say every investor no matter [his or her] risk tolerance should have some exposure to all the major asset classes,” Davidson said."

I know that I personally subscribe to this philosophy in my own job-associated 403B retirement plan where I too have a variety of mutual funds in varying classes that I hope will somehow work to even out the ups and downs of the market. But that isn't what I do with my trading portfolio! I concentrate on the strongest stocks I can find and sell them quickly when they are weak and slowly and partially when they are strong.

The next approach is what I would call the 'value' approach. Or perhaps it would be better to label it the Warren Buffett approach of looking at stocks that are just plain cheap and buying them at a discount. In fact, as you or I might be avoiding a stock like Countrywide Financial (CFC) like the plague, Buffett is poking around at that carcass of a mortgage company thinking about whether it might be a time to buy a bit of it at a discount.

James B. Stewart expresses this value-driven approach well. And recently wrote an article for the Wall Street Journal about how this correction presents for the value investor. Stewart wrote:

"Early Thursday, I heard on the radio that foreign markets were selling off. By the time I got to the office, trading had begun in New York and the Nasdaq was down 50, well below my buying target of 2450.

I suppose there are circumstances in which I'd ignore my own system. But I'm hard-pressed to imagine such a scenario. A major goal of my system is to take emotion out of the decision to buy and sell. Fear of the unknown is an emotion, not a reason to stop investing. And so I launched my buying campaign.

I bought commodity producers Companhia Vale do Rio Doce and Rio Tinto, both of which had the added advantage of being foreign, boosting my allocation toward non-U.S. assets. In energy I added to my position in Valero. Among cyclicals I bought Deere, Caterpillar and Cummins. In the financial sector, I was tempted by Goldman Sachs and Morgan Stanley, but settled for more diversified, main-line banks: Wells Fargo and Bank of America.

Later at lunch, I noticed stocks had fallen further. If only I'd waited! There were even more bargains to be had. But then I got a grip, reminding myself that no one has perfect timing. The important thing is that I was able to buy at a big discount to where the market was just days ago. When the market averages again hit new highs -- which they will someday -- my gains will be all the more impressive."

For Stewart, each decline in the market is an opportunity. For an investor who likes to invest like Warren Buffett, or who follow the Benjamin Graham approach to investing, these drops in the market only make a value investor salivate. So many things to eat and only so much money to buy them with!

I cannot argue with value investors any more than I can argue with those whose main approach is to diversify assets. But I respect the tremendous strength of the market and do not wish to move against that tidal strength that can wash away any investment that doesn't respect the strength and force of a market move.

Perhaps my favorite investor of all time was the wise and wily Jesse Livermore. This picture is from an Italian website review.

Perhaps my favorite investor of all time was the wise and wily Jesse Livermore. This picture is from an Italian website review.

Livermore made his millions not by diversification, not by being a value investor, but rather by observing the motions of the market itself. Much like Martin Zweig who famously observed "Don't fight the tape and don't fight the Fed.", Livermore watched the tape and tried to move with the market.

As this review explains:

"Livermore was a trend follower. He only took positions in the direction of the trend, and he added new postions whenever his system told him to do so."We know that prices move up and down. They always have and they always will. My theory is that behind these major movements is an irresistible force. That is all one needs to know...Just recognize that the movement is there and take advantage of it by steering your speculative ship along with the tide."

The basic rule to the Livermore System, therefore, is to take positions only in the direction of the trend. In or out. Long or short."

Livermore also believed in limiting losses. As this blogger wrote:

"As long as the stock is acting right, and the market is right, do not be hurry to take a profit. You know you are right, because if you were not, you would have no profit at all. Let it ride and ride along with it. It may grow into a very large profit, and as long as the “action of the market does not give you any cause to worry, “have to courage of your convictions and stay with it.”

On the other hand, suppose you buy a stock at $30.00 and the next day it goes to $28.00, showing a two-point loss, you would not be fearful that the next day would possibly see a three-point loss or more. No, you would regard it merely as a temporary reaction, feeling certain that the next day it would recover its loss. But that is the time that you should be worried. That two-point loss could be followed by two points the next day, or possibly five or ten within the next week or two. That is when you should be fearful, because if you did not get out, you might be forced to make a much greater loss or later on. That is the time you should protect yourself by selling your stock before the loss assumes larger propotions."

Livermore was patient. He would also sell quickly when stocks moved against him.

More recently, Martin Zweig has expressed this similar philosophy:

More recently, Martin Zweig has expressed this similar philosophy:

"The basis of Martin Zweig's investment philosophy is to take a measure of whether the broader market is bearish or bullish and then stay in tune with it. If the market is bullish, buy attractive stocks and let your profits run. Lock in profits or cut your losses by selling according to pre-established criteria. If the market is bearish, stand on the sidelines with cash, waiting to enter the market when it turns bullish."

Finally, William O'Neil took the Livermore thinking, the Zweig analysis, and other observations and rolled it together in the CANSLIM approach. He realized that earnings were important, that understanding the direction of the Market was critical, and that limiting losses was part of the equation.

I do not reject those that seek value in their investments. I also look for value and like to see low p/e's, low price/sales ratios, reasonable PEG's and similar valuation numbers. But valuation is for me useless out of the context of the entire market itself.

I also do not deny the role of diversification, especially in building long-term mutual fund portfolios, in protecting the individual investor. But diversification is like spreading one's bets on a roulette table. It will increase your frequency of winning yet reduce the amount of each successful wager. Nothing wrong with it, but can we remove our blinders and instead focus on the strongest stocks in he market, the highest quality companies with the steadiest record and the strongest balance sheets?

Like Livermore, like O'Neil, and like Zweig, I am interested in listening to the market, to reading the tape and avoiding moving against the tidal movement of markets. I have chosen to listen to my own portfolio, and have been letting the stocks I own let me know when it is time to buy and when it is time to sell. I avoid the problem of pulling completely out of the market by never allowing my portfolio to go below the minimum equity position of 1/4th the maximum (5 positions).

And when things are good, I hedge my bet. I am willing to sell a little when things are good. And sell a lot in a hurry when things are bad. It seems to work for me. I just wanted to share with you a few thoughts this Thursday evening on what other people are doing. And why I am comfortable, and believe I am in good company, in doing what I do.

Bob

Monday, 20 August 2007

VSE Corporation (VSEC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

CLICK HERE FOR THE PODCAST ON VSE CORP

I did a podcast on this stock tonight and thought I ought to do a brief posting on this company. I do not own any shares nor do I have any options on this stock.

I did a podcast on this stock tonight and thought I ought to do a brief posting on this company. I do not own any shares nor do I have any options on this stock.

VSEC made the list of top % gainers on the NASDAQ today, closing at $38.93, up $3.68 or 10.44% on the day. According to the Yahoo "Profile" on VSE Corporation, the company is among other things, a military contractor which provides logistical support to the government.

The 2nd quarter 2007 results were solid. The Morningstar.com "5-Yr Restated" financials are solid. The Morningstar.com "5-Yr Restated" financials are excellent showing steady revenue and earnings growth, positive free cash flow, stable # of shares, a small dividend and a reasonably good balance sheet.

Yahoo "Key Statistics" shows this is a small cap stock with a p/e of just over 18. According to the Fidelity.com eresearch website, the price/sales (TTM) is reasonable relative to other companies in the industry, and also on Fidelity, the return on equity (TTM) exceeds other companies in the same industrial group. Yahoo shows only a few shares out short. The company recently split its stock 2:1 on 6/29/07.

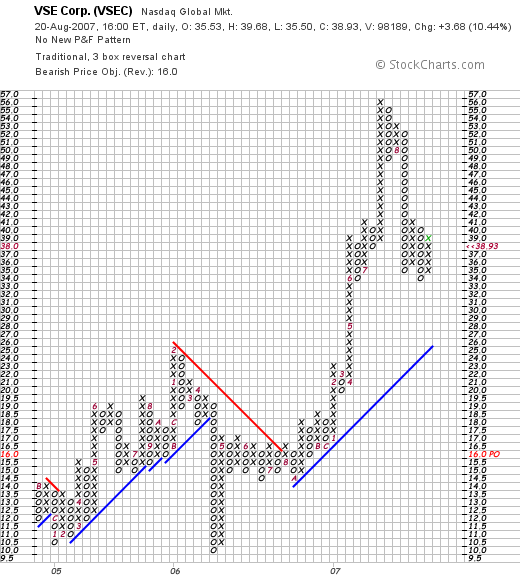

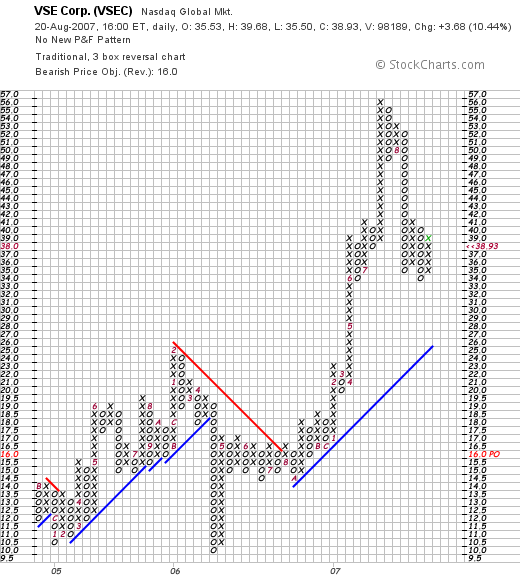

Looking at the VSEC "Point & Figure" chart on StockCharts.com, we can see a relatively strong chart above support levels.

With the strong move higher today, the solid earnings report, the nice Morningstar.com '5-Yr Restated' financials page, reasonable valuation, and a solid chart,

VSE CORP (VSEC) IS RATED A BUY

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Satyam Computer Services (SAY) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The stock market is making a less than convincing continuation of the rally from Friday, at least thus far today. Most trading seems to occur in the last hour of the day, so I shall reserve judgment.

However, earlier today my Satyam stock (SAY) hit a sale point at an (8)% loss since purchase and I sold my entire position of 210 shares at $23.468. With this technical weakness,

SATYAM COMPUTER SVCS (SAY) IS REDUCED TO A HOLD

These shares were just purchased 4/20/07 at a cost basis of $25.55/share. Thus, I had a loss of $(2.082)/share or (8.15)% since purchase. This is my sale point after an initial purchase of stock regardless of the duration of my holding. It is indeed rather arbitrary but it allows me to limit my losses to some 'acceptable' level before unloading shares.

I am now down to 15 positions. I shall be waiting for a 'buy signal' from one of my existing holdings before moving to 16. Meanwhile, I shall be 'sitting on my hands' as patiently as possible.

Thanks again for visiting! Please leave a comment on the blog or feel free to email me at bobsadviceforstocks@lycos.com if you have any comments or questions.

Bob

Sunday, 19 August 2007

Research in Motion (RIMM) "Revisiting a Stock Pick"

CLICK HERE FOR MY PODCAST ON RESEARCH IN MOTION (RIMM)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier tonight I did a podcast on RIMM before I had written it up. (I think it shows since I usually have the entry written first which gives me more structure as I am 'casting!)

Earlier tonight I did a podcast on RIMM before I had written it up. (I think it shows since I usually have the entry written first which gives me more structure as I am 'casting!)

Let me try to briefly (if at all possible) go over a few of the things I discussed on the podcast and why I thought Research in Motion deserved a spot on this website.

RESEARCH IN MOTION (RIMM) IS RATED A BUY

First of all, RIMM made the list of the top % gainers Friday, closing at $220.52, up $22.50 or 11.36% on the day.

I say "revisit" RIMM, because I first posted RIMM early in the history of this website, writing up Research in Motion (RIMM) on September 26, 2003, when the stock was trading at $38.24/share. The stock split 2:1 on June 7, 2004, making my effective stock pick price even lower at $19.12. Thus, this stock has appreciated a WHOPPING $201.40 or 1,053.3% since posting! (Too bad I didn't buy any shares back then and I don't have any shares now!)

On June 28, 2007, RIMM reported 1st quarter 2008 results for the quarter ended June 2, 2007. Revenue for the quarter was $1.082 billion, up 16.3%  from $930.4 million in the same quarter the prior year. GAAP net income was $223.2 million or $1.17/diluted share, up from $187.4 million or $.98/diluted shre last year.

from $930.4 million in the same quarter the prior year. GAAP net income was $223.2 million or $1.17/diluted share, up from $187.4 million or $.98/diluted shre last year.

These results exceeded expectations as analysts had been expecting earnings of $1.06 on revenue of $1.05 billion. In another expression of confidence in the company, the board announced a 3 for 1 stock split which will be payable August 20th (tomorrow!).

Longer-term, examining the "5-Yr Restated" financials n RIMM from Morningstar.com, we can see the steady revenue growth from $307 million in 2003 to $3.03 billion in 2007. Earnings have also steadily improved from a loss of $(1.00)/share in 2003 to $.30/share in 2004, and all the way to $3.30/share in 2007. During this period, outstanding shares have been stable with 155 million shares outstanding in 2003, increasing to 185 million in 2007. This approximately 30% increase in shares was accompanied by a 700% increase in revenue and a 1000% increase in earnings!

Free cash flow has been a bit erratic, but was $42 million in 2004, increasing to $169 million in 2005, dropping to a negative $(29) million in 2006 and back positive at $482 million in 2007.

The balance sheet is solid with $677 million in cash, enough to cover both the $546.6 million in current liabilities and the $58.9 million in long-term liabilities combined. The company has an additional $1.2 billion in other current assets making its current ratio somewhere north of 3.0.

Checking Yahoo "Key Statistics" on RIMM, we can see that this is a large cap stock with a market capitalization of $123 billion. The trailing p/e is a rich 173.36, with a forward p/e (fye 03-Mar-09) estimated at a more reasonable 27.74. Thus, the PEG ratio, a good valuation of the relative richness of the p/e is a more reasonable 1.38. (1.0 to 1.5 is satisfactory imho).

In terms of valuation, RIMM has a Price/Sales ratio (TTM) of 11.66, well ahead of the industry average of 4.00 according the Fidelity.com eresearch website. The company does better in the 'profitability department' with a Return on Equity (TTM) reported at 30.23%, ahead of the industry average of 24.57%.

There are 558.00 million shares outstanding with 485.4 million that float. Of these, as of 7/10/07, there were 9.31 million shares out short representing 1.1 trading days of volume (the short ratio). This does not appear to be a significant short interest at least relative to my own '3 day rule' for short interest.

No dividend is paid and the last stock split was a 2:1 stock split June 7, 2004.

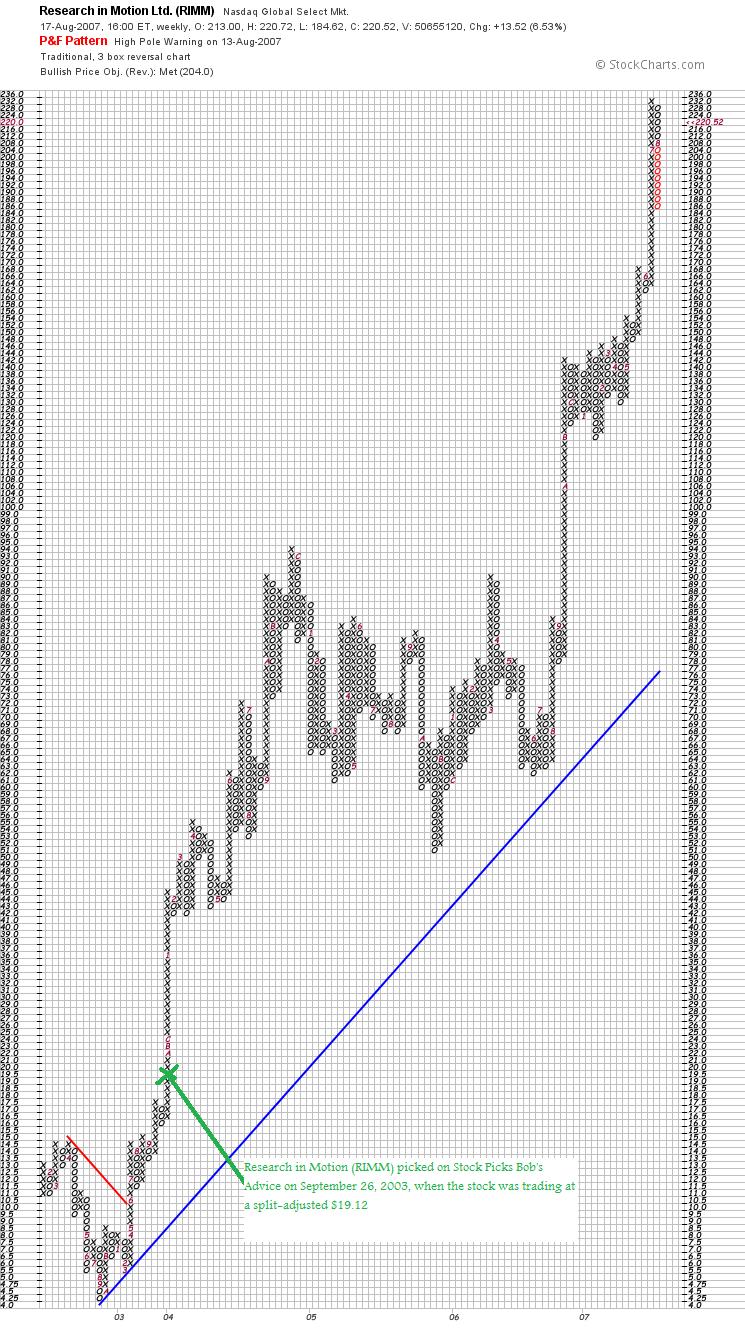

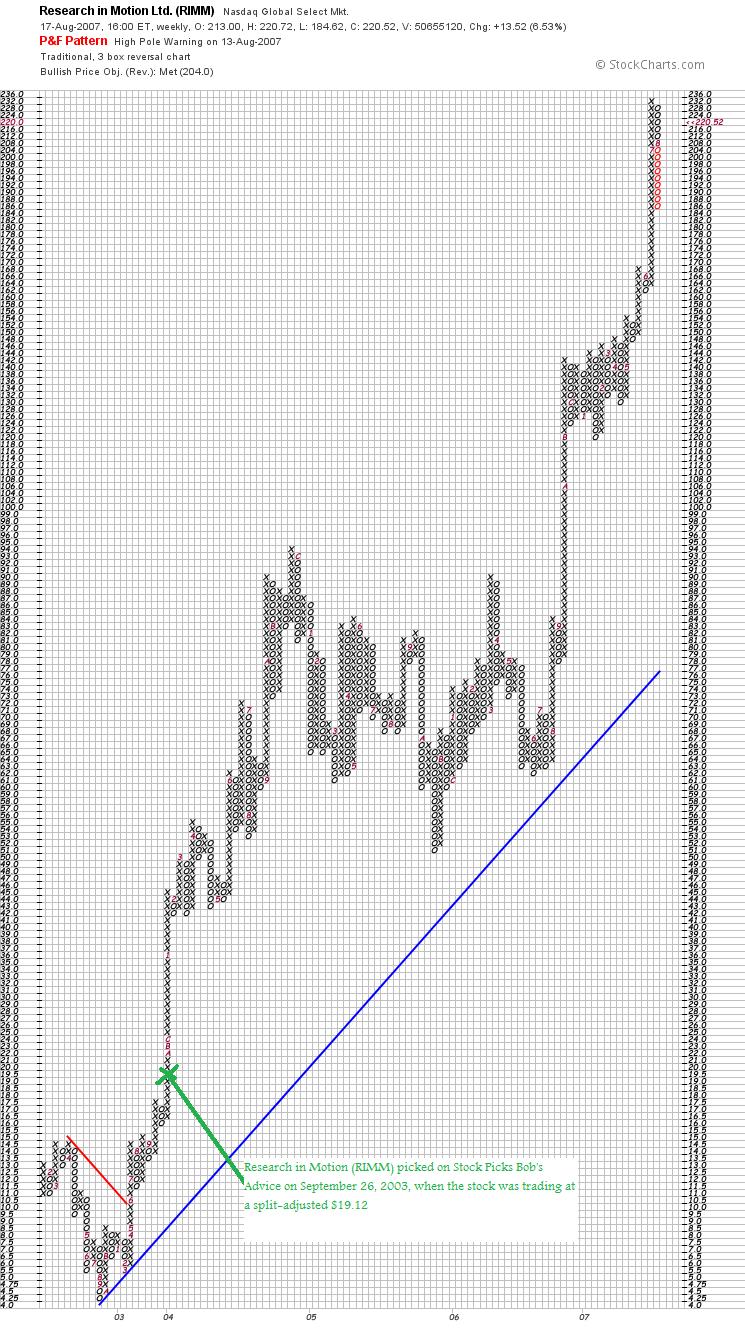

Let's take a look at the incredible 'point & figure' chart on RIMM from StockCharts.com:

The chart shows such a meteoric increase since 2003 that it is difficult to display on the blog! The chart still looks strong but certainly the continued strength of this stock is dependent (from my perspective) on the continued performance on a fundamental basis of this company.

Thus, RIMM stock had a great day Friday. Shows an unbelievable increase from the posting back in 2003. Earnings are still strong and beating expectations and the Morningstar.com report looks solid.

Thanks again for visiting my blog! If you have any comments or questions, please fee free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Page where you can review an download all of my podcasts (including this one on RIMM), visit my Covestor Page where my actual trading portfolio is reviewed and evaluated, and take a look at my Social Picks Page where that website works to evaluate the success and usefulness of my writing.

Regards to all of my friends and readers. Hopefully, we shall see more of the same from Friday tomorrow and the rest of the week!

Bob

Newer | Latest | Older

![]() I was looking through the list of top % gainers on the NASDAQ this morning and came across an 'old favorite' of mine, MICROS Systems (MCRS) which as I write is trading at $59.50, up $3.99 or 7.19% on the day. I say 'old favorite' because I first wrote up MICROS on Stock Picks Bob's Advice on October 28, 2005, when the stock was trading at $45.82. Thus the stock has appreciated $13.68 or 29.9% since posting. I do not own any shares or have any options on this company.

I was looking through the list of top % gainers on the NASDAQ this morning and came across an 'old favorite' of mine, MICROS Systems (MCRS) which as I write is trading at $59.50, up $3.99 or 7.19% on the day. I say 'old favorite' because I first wrote up MICROS on Stock Picks Bob's Advice on October 28, 2005, when the stock was trading at $45.82. Thus the stock has appreciated $13.68 or 29.9% since posting. I do not own any shares or have any options on this company.enterprise information solutions for the hospitality and specialty retail industries."

I always enjoy receiving, and responding to email. By the way, if you have any comments or questions, you are always welcome to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. I read every email I receive and I try to answer as many as I can....so bear with me. Remember that as much as you may enjoy this blog, I am still an amateur investor answering all of your questions. I guess you could say we are all in this together :).

I always enjoy receiving, and responding to email. By the way, if you have any comments or questions, you are always welcome to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. I read every email I receive and I try to answer as many as I can....so bear with me. Remember that as much as you may enjoy this blog, I am still an amateur investor answering all of your questions. I guess you could say we are all in this together :). Earlier today, scanning through the

Earlier today, scanning through the

On March 8, 2006, I

On March 8, 2006, I  On March 10, 2006, I

On March 10, 2006, I

Finally, On March 9, 2006, I

Finally, On March 9, 2006, I

Perhaps my favorite investor of all time was the wise and wily Jesse Livermore. This picture is from an

Perhaps my favorite investor of all time was the wise and wily Jesse Livermore. This picture is from an  More recently, Martin Zweig has

More recently, Martin Zweig has  I did a

I did a

Earlier tonight I did a

Earlier tonight I did a  from $930.4 million in the same quarter the prior year. GAAP net income was $223.2 million or $1.17/diluted share, up from $187.4 million or $.98/diluted shre last year.

from $930.4 million in the same quarter the prior year. GAAP net income was $223.2 million or $1.17/diluted share, up from $187.4 million or $.98/diluted shre last year.