Stock Picks Bob's Advice

Wednesday, 26 September 2007

A Reader Writes "(ICOC) Why did you sell?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite activities as a writer of this blog is to receive and respond to emails from interested readers. Please remember that I am also an amateur investor, so I offer my responses as my opinion only, and not that I am more correct than anyone writing.

If you have any comments or questions, you are always welcome to leave them on the blog or email me directly at bobsadviceforstocks@lycos.com.

Earlier today, as I wrote, I sold my shares in ICO Corporation (ICOC). I sell shares for one of three reasons. Either there is some fundamental announcement whether bad financial results or some undefined announcement including an acquisition, the stock declines to a specified sale point, or the stock appreciates to a targeted level at which time I sell a portion of my holdings.

In this case, after an initial purchase, ICOC hit my 8% sale point and I sold my shares without regard to any fundamental change in the 'story' behind this company. Not all of my readers appreciated this move.

Alan T. wrote to me this afternoon:

"Why did you sell? Have you not seen the past volatility in this stock? I understand the thought of limiting losses, but maybe you should consider buying on a pullback, when a stock like this provides numerous pullback opportunities." |

|

| | |

|

| | |

This was a terrific question! Why wouldn't it be a great idea to buy some more shares on a pullback rather than selling my shares? Especially in a stock as volatile as this company, which 'provides numerous pullback opportunities.'

This isn't necessarily a bad approach. But it isn't my approach. Before I buy any stock, I have a plan about what my reaction will be when the stock either appreciates or declines in price. I like every stock that I own. But I am prepared to sell any or all of my holdings if those stocks decline to 'sale points'. It doesn't matter to me whether I have held a stock for one week or one year, these sale points are what matter to me.

In the past I have been ready to make exceptions to my trading rules. And my portfolio suffered subsequently. The purpose of this blog has been to involve all of my readers into increasing my own trading discipline and not to make exceptions or variations in my approach. Those who are value oriented might well find a stock that has declined to be of even greater attractiveness than a stock that has appreciated. The opposite is my assessment of those situations.

There will be times when these decisions won't be the best approach to every single trading situation. It may well be the time to be buying ICOC and not selling shares. I don't know. I don't have any insider information nor do I seek that information. And it doesn't matter if ICOC climbs back tomorrow, as I do suspect it shall do. What matters is my own trading discipline in the long-term.

But I cannot apologize for maintaining my own strategy that requires me to sell stocks with small losses. For my trading philosophy requires me to sell stocks quickly at small losses and completely, and partially and slowly at targeted gains. Let's find out how this strategy works. We will only know if we implement and follow our own rules for trading and investing.

Bob

ICO Inc. (ICOC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my 420 shares of ICOC at $13.5505. These shares were purchased just last week (!) at a price of $14.979. Thus, this represented a loss of $(1.43) or (9.5)% since purchase. Virtually all of this loss occurred today (for no discernible reason that I could identify) with the stock trading at $13.56 as I write, down $(1.66) or (10.91)% today alone.

Since I am personally selling my shares I am thus reducing my rating:

ICO (ICOC) IS RATED A HOLD

I don't like to buy shares and only see them hit my tight 8% loss limits so quickly. That is one of the reasons I have not had a lot of success with relatively thinly traded shares of stocks priced not much over $10. But hopefully, my continued discipline in limiting losses by selling losing stocks quickly will continue to improve my overall portfolio quality long-term.

Since this was a sale on "bad news", I shall once again be 'sitting on my hands' waiting for a partial sale on appreciation to find a new position. In fact, my Bolt (BTJ) is bouncing very close to a sale as well, again on no apparent news that I can find either.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website. Also, my Covestor Page is an interesting addition to my blogging, as it has been tracking my trading portfolio and evaluating its performance since June, 2007, against the S&P as well as other managed accounts. Finally, if you have any time left, check out my SocialPicks page where SocialPicks evaluates my stock picks and has been doing so since some time in January, 2007.

Have a great week trading.

Bob

Sunday, 23 September 2007

"Looking Back One Year" A review of stock picks from the week of April 3, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend, and that means that it is time to write up a review of my past stock picks. Last weekend I reviewed the stocks from the week of March 27, 2006. Moving one week ahead, let's take a look at all of the stock picks from the week of April 3, 2006. These reviews assume a buy and hold strategy. In reality, I advocate a disciplined portfolio management strategy that directs me to sell losing stocks quickly and completely and sell gaining stocks slowly and partially at targeted appreciation levels. I have discussed and shall continue to discuss these techniques throughout my blog.

But for the ease of measurement, let's find out what would have happened if we had indeed purchased equal dollar amount of each stock discussed that week about a year-and-a-half ago.

On April 4, 2006, I posted CheckFree (CKFR) on Stock Picks Bob's Advice when the stock was trading at $54.14. CKFR closed at $46.82 on September 21, 2007, for a loss of $(7.32) or (13.5)% since posting.

On April 4, 2006, I posted CheckFree (CKFR) on Stock Picks Bob's Advice when the stock was trading at $54.14. CKFR closed at $46.82 on September 21, 2007, for a loss of $(7.32) or (13.5)% since posting.

Since CheckFree is to be acquired at $48 in cash on December 31, 2007, subject to regulatory approval,

CHECKFREE (CKFR) IS RATED A HOLD

Looking at the 'point and figure' chart on CheckFree (CKFR) from StockCharts.com, we can see the relatively weak performance of the stock prior to the announcement of the acquisition.

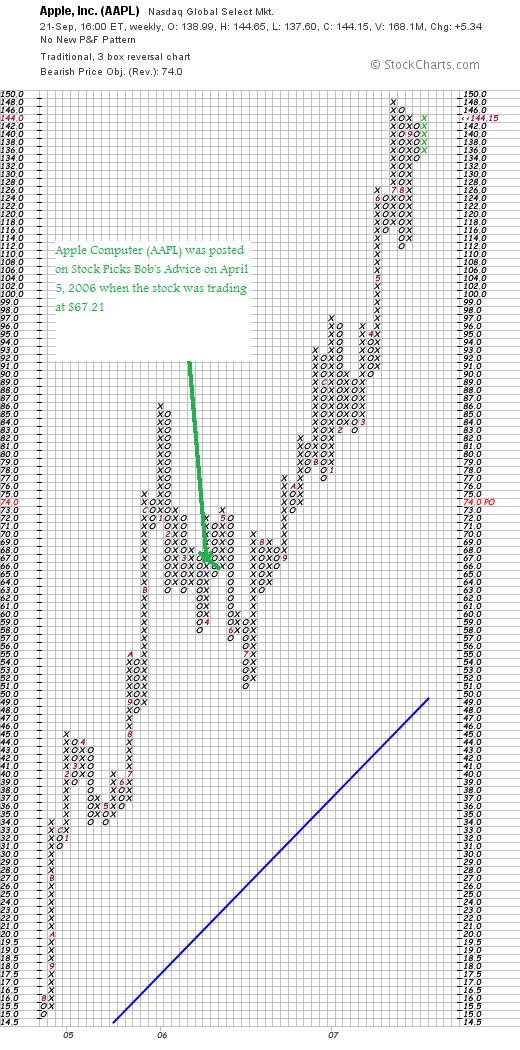

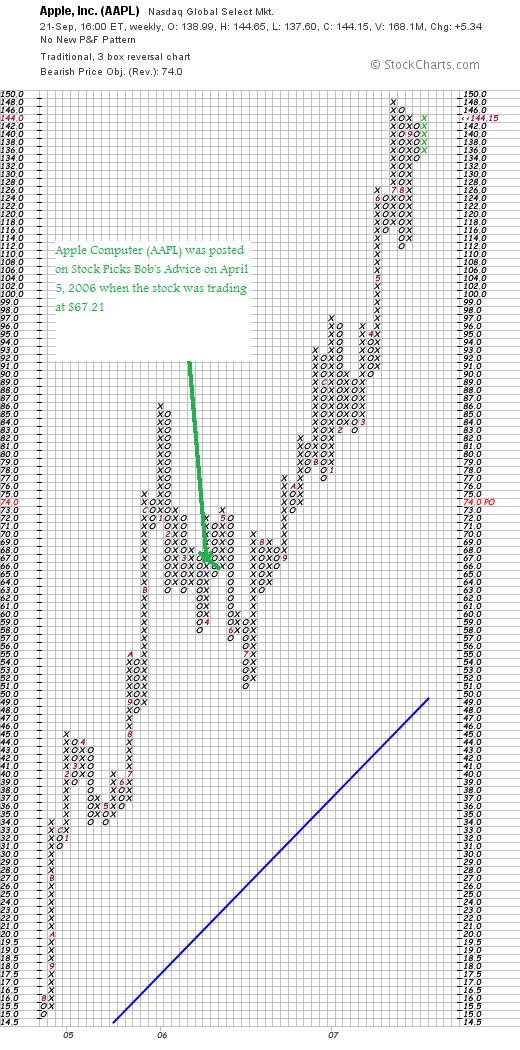

On April 5, 2006, I posted Apple Computer (AAPL) on Stock Picks Bob's Advice when the stock was trading at $67.21. AAPL closed at $144.15 on September 21, 2007, for a gain of $76.94 or 114.5% since posting.

On April 5, 2006, I posted Apple Computer (AAPL) on Stock Picks Bob's Advice when the stock was trading at $67.21. AAPL closed at $144.15 on September 21, 2007, for a gain of $76.94 or 114.5% since posting.

On July 25, 2007, Apple announced 3rd quarter 2007 results. Revenue came in at $5.41 billion up from $4.37 billion the prior year same period. Quarterly profit was $818 million, up sharply from last year's $472 million profit. On a per share basis this came in at $.92/diluted share up from $.54/share last year.

On July 25, 2007, Apple announced 3rd quarter 2007 results. Revenue came in at $5.41 billion up from $4.37 billion the prior year same period. Quarterly profit was $818 million, up sharply from last year's $472 million profit. On a per share basis this came in at $.92/diluted share up from $.54/share last year.

The company beat expectations of analysts who were expecting earnings of $.72/share on revenue of $5.29 billion.

The "5-Yr Restated" financials on AAPL from Morningstar.com are intact.

APPLE COMPUTER (AAPL) IS RATED A BUY

Looking at the "point & figure" chart on AAPL from StockCharts.com, we can see a chart that appears phenomenally strong!

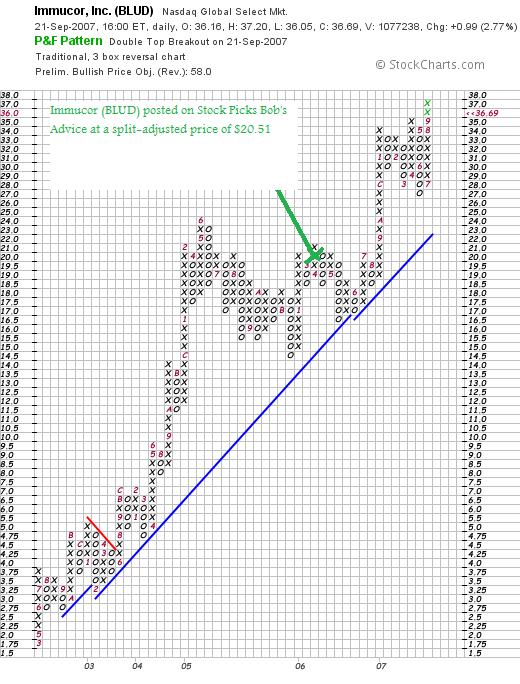

On April 6, 2006, I

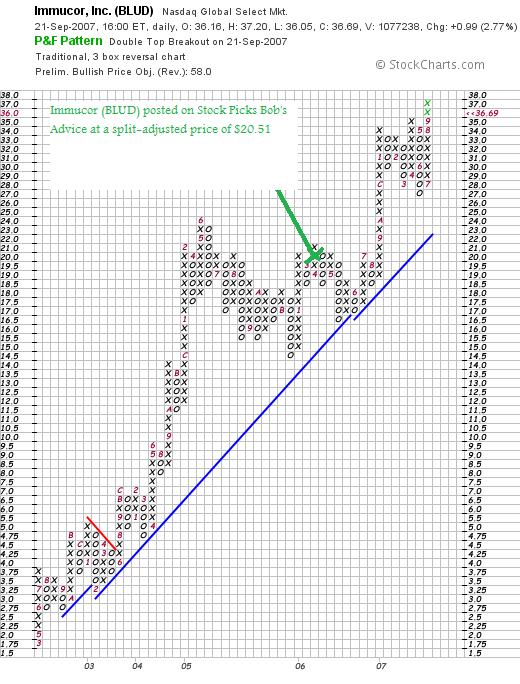

posted Immucor (BLUD) on Stock Picks Bob's Advice when the stock was trading at $30.76. BLUD split 3:2 on May 16, 2006, making my effective stock pick price actually $20.51. BLUD closed at $36.69 on September 21, 2007, giving this stock pick a gain of $16.10 or 78.5% since posting.

On July 25, 2007, Immucor announced 4th quarter 2007 results. Revenue for the quarter ending May 31, 2007, came in at $61.1 million, up 22% from $50.0 million. Net income for the quarter was $18.2 million, up 51% from $12.1 million last year. Diluted earnings came in at $.26/share, up 53% from the $.17/share the prior year.

On July 25, 2007, Immucor announced 4th quarter 2007 results. Revenue for the quarter ending May 31, 2007, came in at $61.1 million, up 22% from $50.0 million. Net income for the quarter was $18.2 million, up 51% from $12.1 million last year. Diluted earnings came in at $.26/share, up 53% from the $.17/share the prior year.

The Morningstar.com "5-Yr Restated" financials on BLUD are intact.

IMMUCOR (BLUD) IS RATED A BUY

Looking at the "point & figure" chart on BLUD from StockCharts.com, we can see the very strong price movement from as far back as March, 2002. The stock exhibited some weakness in late 2005, but never 'broke down' below the support lines.

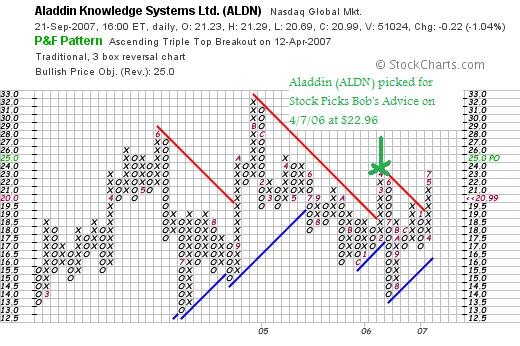

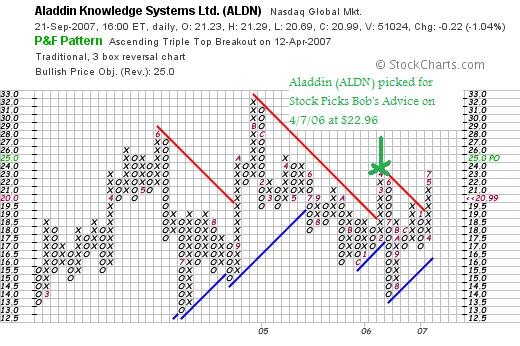

Finally, on April 7, 2006, I posted Aladdin Knowledge Systems (ALDN) on Stock Picks Bob's Advice when the stock was trading at $22.96. ALDN closed at $20.99 on September 21, 2007, for a loss of $(1.97) or (8.6)% since posting.

Finally, on April 7, 2006, I posted Aladdin Knowledge Systems (ALDN) on Stock Picks Bob's Advice when the stock was trading at $22.96. ALDN closed at $20.99 on September 21, 2007, for a loss of $(1.97) or (8.6)% since posting.

On July 19, 2007, Aladdin reported 2nd quarter 2007 results. For the quarter ended June 30, 2007, revenue came in at $25.5 million, up 22% from $20.9 million the prior year. Net income came in at $3.9 million or $.26/diluted share, up from $3.3 million or $.22/diluted share the prior year.

On July 19, 2007, Aladdin reported 2nd quarter 2007 results. For the quarter ended June 30, 2007, revenue came in at $25.5 million, up 22% from $20.9 million the prior year. Net income came in at $3.9 million or $.26/diluted share, up from $3.3 million or $.22/diluted share the prior year.

The company beat expectations of revenue of $24.1 million and profit of $24.1 million according to analysts polled by Thomson Financial. In addition, the company raised guidance for 2007 full year results for a profit of $1.00 to $1.12/share, up from prior guidance of $.90 to $1.09/share. In addition, they raised expectations on revenue to between $100 million and $106 million, from the prior guidance of $95 million to $102 million.

The Morningstar.com "5-Yr Restated" financials on ALDN are intact.

ALADDIN KNOWLEDGE SYSTEMS (ALDN) IS RATED A BUY

Reviewing the "point & figure" chart on Aladdin from StockCharts.com, we can see that this is a very unimpressive price chart. The stock has been volatile since June, 2004, when the stock peaked at $27. The stock dipped as low as $13 in July, 2004, only to see the stock price climb right back to a peak at $32 in November, 2004. The stock then dipped back to a low of $14 in July, 2006. The stock appears to be moving higher once again. This stock chart is certainly not over-extended, however, the volatility is of concern and is the big negative factor for this stock.

So how did we do with these stock picks? In a word phenomenal! Two stocks showed small losses and two stocks had large gains. The average performance for these four stocks was a gain of 42.7%! Certainly past performance is not a reliable indicator for future performance but wasn't that a great week for picking stocks?

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast Website, or my Covestor Page where my trading portfolio is continually being monitored, or my SocialPicks Page where my blog is reviewed by the people over at SocialPicks!

Regards and wishing you a great week trading!

Bob

Posted by bobsadviceforstocks at 3:20 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 23 September 2007 4:21 PM CDT

A Reader Writes "Are there techniques that help lessen the effect of currency fluctuation...?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I always enjoy receiving letters from readers. Especially new investors that somehow have found my blog helpful as they are looking for new ideas for stock selection. They too must remember that I am an amateur investor as well and of course do their own homework including consulting with professional advisors prior to making any decisions. But I am glad that I can be a source of ideas.

I always enjoy receiving letters from readers. Especially new investors that somehow have found my blog helpful as they are looking for new ideas for stock selection. They too must remember that I am an amateur investor as well and of course do their own homework including consulting with professional advisors prior to making any decisions. But I am glad that I can be a source of ideas.

If you are interested in contacting me, please remember that the comments section after each entry is open to all. (I do occasionally try to remove blatent spam attacks that all websites must deal with.) Or if you prefer, you can write me directly at bobsadviceforstocks@lycos.com. I read all of my email, and try to respond to as many as possible.

Anyhow, back to the letter. Erik C. from Canada wrote:

"Hello Bob,

I recently turned 21 and I've just started investing in stocks almost a 13 months ago. Your blog was one of the websites that helped me decide what I should be looking for. I've been reading your blog a couple times a week ever since and I think you've been doing a great job. I especially appreciated your frequent  updates during the recently excitement in the subprime madness.

updates during the recently excitement in the subprime madness.

One question I haven't been able to easily wrap my head around is how the value of the US dollar affects me. I'm from Canada and roughly half my positions are on the TSX so those aren't the problem, but I have about $28,000 invested in US stocks. I bought $23,000 of it when our exchange rate was roughly 90 cents to the US dollar and now a year later, with Benanke cutting rates by half a percentage point, the exchange rate was last seen at 99 cents to the dollar.

It seems to me that due to the enormous change in value of the CAD relative to the USD, all my US stocks are naturally took a hit with nothing I can do about it. What is your take on it? Am I looking at it the wrong way? Are there techniques that help lessen the effect of currency fluctuations in these situations?

One good thing that has come from this is that I've been looking for an oil company to add to diversify my portfolio the last couple months, but I've been off on my own buy signal due to the instability of the market. With the rate cut, it gave me a signal to buy because stocks are rallying again and it affected the exchange rate effectively making whatever stock I choose to buy cheaper. In the end, I bought 40 shares of NOV, a company you actually blogged about in the past. As of now, I am already up a couple percentage points. I always feel better post purchase when the stock is floating in the green early on.

Thank you for taking the time to read my email, your insights are always taken in high regard."

Erik, than you so much for writing and for all of your kind words. I hope that you find my blog useful in your continued education in the investment world.

I would like to try to comment on your astute observation that while the Bernanke rate cut may well have rallied the market it didn't really do much positive for the value of the dollar which as reported on Bloomberg.com:

"Sept. 20 (Bloomberg) -- Canada's dollar traded equal to the U.S. currency for the first time in three decades, capping a five-year run on the back of booming demand for the nation's commodities.

The Canadian dollar rose as high as $1.0008, before retreating to 99.87 U.S. cents at 4:16 p.m. in New York. It has soared 62 percent from a record low of 61.76 U.S. cents in 2002. The U.S. dollar fell as low as 99.93 Canadian cents today. The Canadian currency last closed above $1 on Nov. 25, 1976, when Pierre Trudeau was Canada's prime minister."

A 62% increase in 5+ years is not a small change in currency. In fact, this is a challenge for Canadians investing in the market as the value of their own holdings (in Canadian dollars) has thus dropped by the same amount during this period.

A good explanation of this was written up on msn.money:

"What are the risks of buying foreign investments?

While most of your assets will probably be in dollar-denominated investments, you may be faced with substantial currency risk if you own stocks or bonds denominated in other currencies -- or if you plan to travel abroad.

Currency movements, which fluctuate daily based on each country’s economic and political conditions, can hand you significant gains or losses. When you buy an individual stock or bond in another country or own a mutual fund that invests in foreign securities, the value of your investment will fluctuate in part based on how many dollars it takes to buy a unit of the foreign currency. If you own a German stock, for instance, the money you paid to buy the stock has been converted into Euros, the currency of such countries as France, Germany, Italy and the Netherlands. If the value of the Euro falls against the U.S. dollar, your German shares will be worth less if you were to sell the stock and convert the Euros back into dollars. On the other hand, if the Euro gains against the dollar, your German stock would be worth more if you were to sell it."

So you are very correct. As the American dollar has dropped vis a vis the Canadian dollar, then the value of your U.S. holdings has dropped just based on the Canadian/American exchange rate.

Certainly this is a difficult problem. I haven't actually addressed this myself in my own holdings except in my own retirement account I hold foreign as well as domestic assets in the form of mutual funds but most of my own holdings are based in the United States and are priced in American dollars. Thus, without realizing it, I as have all American citizens, been losing buying power while my accounts appear to have appreciated. I kind of wish you hadn't reminded me about this :).

Seriously, what to do? I suppose the first thing is to do nothing. To concentrate on the underlying business fundamentals---things like earnings and revenue growth. You also could concentrate on companies based in Canada, I know I have written up a few of those like Gildan (GIL) a great firm (I don't own any shares currently). Or other Canadian firms that you can identify using my own strategy. But that probably isn't going to be a satisfactory response.

The solution of this problem is called "Currency Hedging", and I needed to do a Google Search to get more information. Here is a page from that search that discusses complex solutions like "Spot Contracts", "Forward Contracts", "Foreign Currency Options", "Interest Rate Options", "Foreign Currency Swaps", and "Interest Rate Swaps", among other trading devices. I don't do any of these and doubt they would be appropriate for the individual amateur investor like you or me.

There are also some investors who believe that gold is a good hedge against currency fluctuations. Indeed there is some support to this thesis, but it isn't very consistent as this report by Caple, Mills, and Wood shows:

"Abstract

The extent to which gold has acted as an exchange rate hedge is assessed using weekly data for the last thirty years on the gold price and sterling–dollar and yen–dollar exchange rates. A negative, typically inelastic, relationship is indeed found between gold and these exchange rates, but the strength of this relationship has shifted over time. Thus, although gold has served as a hedge against fluctuations in the foreign exchange value of the dollar, it has only done so to a degree that seems highly dependent on unpredictable political attitudes and events."

Personally, I believe that much of the blame for this drop in the dollar has been the inability of Congress and the President to restore fiscal responsibility in the United States to the Federal budget process. There has been an aversion to any new taxes while tax cuts are instead adopted as being "stimulative" and expenditures, including unbelievable costs associated with the Iraq conflict, have been added to the budget.

As this New York Times article reported:

"Not all the moves can be explained by the dollar’s strength or weakness, of course. The relative attractiveness of other currencies has varied. Under President Bush, the dollar has almost held its own against the yen, as the Japanese government has feared a strong yen could damage the country’s exports.

Still, during the Bush administration, the dollar has fallen against each of the five currencies shown — the euro, the yen, the British pound, the Australian dollar and the Canadian dollar. It also is down against the two currencies in the index — the Swiss franc and the Swedish krona — that are not shown.

Over all, the dollar index has fallen at a rate of 4.8 percent a year in this administration, considerably more than the previous record of 2.7 percent a year, during the Carter administration. Mr. Bush is the first president not to show a gain against any of the currencies in this index."

So with Democrats now in nominal control of Congress (it now requires 60 votes to pass anything to avoid a filibuster), and with the 2008 elections close by, I suspect that economic and foreign policy changes are likely to ensue. So what has happened to the Canadian/American dollar may revert back to a normal relationship or at least see the deterioration of the American dollar slow. At least that is my hope.

Meanwhile, good luck with your investments and consider a visit to the United States where travel and merchandise is a better deal than may have been previously. As reported:

"BLAINE, Wash. -- In the spirit of '76 - 1976, that is - Canadians are swarming into Washington state to take advantage of the newly regained parity of the Canadian and U.S. dollars.

With the rising value of the loonie, a nickname based on the bird on the Canadian $1 coin, 50 percent more cars were recorded at the Peace Arch crossing at this border town last month than in August 2006, according to figures from the U.S. Bureau of Customs and Border Protection. The crossing at the northern end of Interstate 5 is the third-busiest on the U.S.-Canadian border.

U.S. businesses from retailers to real estate firms are benefiting.

"Being equal gives them the last reason they needed to spend more time and more loonies here in the U.S.," said Mike Kent, who sells houses in nearby Birch Bay and Semiahmoo for Windermere Real Estate. "It's not just because you can get good spending power, it's the lure of being in a different country. You feel as if you've truly gotten away.""

Thanks Erik for stopping by! I don't know if I have answered any of your answers. I do expect the exchange rate to stabilize in the future assuming America can adopt more responsible policies, and that this shouldn't be as much of an issue for you.

If you or anybody else have any questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, my Covestor Page where my actual trades are posted, and my SocialPicks Page where SocialPicks has been evaluating my performance on this blog.

Have a great Sunday everyone!

Bob

Saturday, 22 September 2007

About the New Prosper.com Ad

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information ont his website.

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

I shall try to limit my digressions like this, and I do indeed receive a referral fee (full disclosure) if you do sign up through the above link. But it is indeed a fascinating, albeit potentially risky, venture.

In a nutshell, the website, started by one of the E-Loan founders and other web pioneers, involves individuals looking for short-term loans (36 month duration) of limited amount (up to $25,000) in an unsecured fashion. They apply to Prosper.com and submit a credit application. Much like any loan company, Prosper obtains a credit report but instead of loaning the money, the request is listed, eBay-style, and multiple investors are given the opportunity of bidding for a portion of the loan. Generally bids are in the $50 to $100 range.

If the borrower is successful, then the entire 'consortium' of lenders, (both lender and borrower remain anonymous to each other) become the lender and the borrower pays back a portion of that loan to each lender monthly (Prosper handles the distribution of funds). If the borrower fails to pay on time, then the usual collection process is initiated.

Prospers allows prospective lenders the right to sort through the loans (again with anonymous borrowers) based on credit ratings and other criteria. Many highly rated loans are placed with ratings of 8% and higher and rates climb into the 20% range as the riskiness increases. Of course, defaults on loans, which are then sold to collection agencies, will diminish one's overall performance and certainly could even result in a loss.

Anyhow, it's a fascinating site and if you use this link and do get involved, I do get some credit for referring people over. But I am intrigued with the entire process. It is a win-win for the little guy who now have an opportunty to obtain funds at a rate lower than otherwise would be possible. For the lender, this represents an opportunity to receive a return on one's funds far greater than available in a CD or Money Market!

Bob

Thursday, 20 September 2007

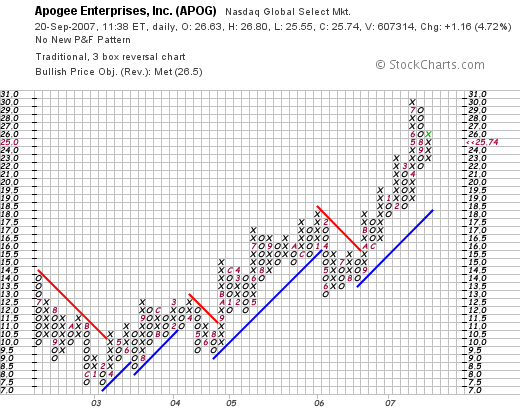

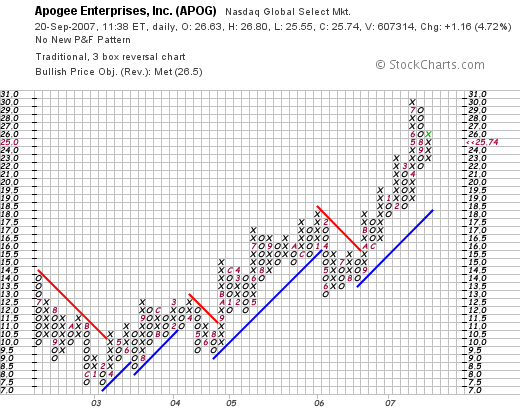

Apogee Enterprises Inc. (APOG)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please rmeember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

APOGEE ENTERPRISES (APOG) IS RATED A BUY

I was looking through the lists of top % gainers this morning and came across this small glass-products company, Apogee Enterprises (APOG) that deserves a spot on this blog. I do not own any shares or options on this company. (I should point out that by the time I got around to writing up this stock, the company was no longer on the top % gainers list, but having been there earlier, and being the author of this blog :), I would like to share this stock with you in any case! APOG as I write is trading at $25.76, up $1.18 or 4.8% on the day.

What exactly does this company do?

What exactly does this company do?

According to the Yahoo "Profile" on Apogee, the company

"... through its subsidiaries, engages in the design and development of glass products, services, and systems. The company operates in two segments, Architectural Products and Services, and Large-Scale Optical Technologies."

How did they do in the latest quarter?

As is so often the case on this blog, it was the announcement of 2nd quarter 2008 earnings after the close of trading yesterday that caused the stock to move higher this morning. Revenue for the quarter came in at $217.7 million, up 20% over the prior year period. Earnings came in at $.39/share, up from $.26/share last year. In addition, the company raised guidance for fiscal 2008 to $1.43 to $1.53/share, up from prior guidance of $1.37 to $1.47/share.

Analysts, according to Thomson Financial surveys, had been expecting second quarter profit of $.36/share. Thus the company beat expectations with this report.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that the company, after a dip in revenue from $538 million in 2003 to $490.8 million in 2004, has been steadily growing revenue to $779 million in 2007 and $802 million in the trailing twelve months (TTM). Earnings also dipped from $1.10 in 2003 to a loss of $(.20)/share in 2004. However, since 2004 earnings have been positive and growing to $1.10/share in 2007 and $1.40 in the TTM. Meanwhile, outstanding shares have been stable with 27 million reported in 2006 and increasing only to 28 million in the TTM.

Free cash flow has been positive but not growing, with $11 million reported in 2005, $8 million in 2007 and $6 million in the TTM. Overall operating cash flow has been growing solidly, but capital spending has also been keeping pase increasing from $20 million in 2005 to $47 million in the TTM. This has kept a lid on the free cash flow growth.

The balance sheet appears solid to me with $4 million in cash reported on the Morningstar.com page, with $225 million in other current assets. When compared to the $133.8 million in current liabilities, the current ratio works out to an acceptable 1.71. In addition, the company has a moderate amount of long-term liabilities reported at $83.1 million.

How about some valuation numbers?

According to the Yahoo "Key Statistics", this company is a small cap stock with a market capitalization of only $749.43 million. The trailing p/e is a very reasonable (imho) 19.10, with a forward p/e (fye 03-Mar-09) of only 14.89. With the strong growth expected, the PEG (5-Yr expected) is estimated at only 0.87.

The Fidelity.com eresearch website reports that the Price/Sales (TTM) is at 0.87, with an industry average of 0.75. According to Fidelity, the company has a Return on Equity (TTM) of 15.82%, compared to the industry average of 107.56%. (this isn't a typo!)

Finishing up with Yahoo, there are 28.90 million shares outstanding with 28.06 million that float. As of 8/10/07, there were 2.70 million shares out short representing 7.3 trading days of average volume (the short ratio), or 9.6% of the float. This is a significant number imho, using my own '3-day rule'. With the strong earnings report, this relatively thinly traded stock may well find short-sellers scrambling to cover their 'negative bets'.

The company even pays a small dividend with $.27/yr paid yielding 1.105. The last stock split was a 2:1 stock split in February, 2007.

What does the chart look like?

Looking at the "point & figure" chart from StockCharts.com on Apogee (APOG), we can see the stock dipping from $14 in July, 2002, to a low of $7.50 in February, 2003. This was the same time the numbers 'turned around' as you recall on the Morningstar.com page. After this low, the stock has esssentially steadily been moving higher with a recent peak of $30 in July, 2007. The stock pulled back to the $22 level in September, 2007, and is now pushing higher at the $25.74 level. The chart looks strong to me.

Summary: What do I think?

Well, needless to say I like this stock. I especially get a 'kick' out of stocks from the humble midwest :). Seriously, they reported solid earnings that beat expectations and raised guidance simultaneously. They have a 3-4 year record of positive financial results, a stable # of shares, and positive free cash flow with a solid balance sheet. They have a reasonable p/e with a PEG under 1.0. Price/Sales and ROE are a bit under the industry average. Finally, there are a significant number of short-sellers out there.

The company even pays a small dividend and has a habit of frequently splitting its stock! I don't have any 'permission slip' to be buying any stocks, but this is my kind of small company! I shall keep it in my vocabulary and if the time is right, you never know when I may be able to make this one a holding!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Stock Picks Podcast Website where I talk about a few of the many stocks I write about here on the blog. Also, if you are interested, stop by my Covestor Page which has been reviewing my own trading portfolio performance for the past three months, or my SocialPicks Page which has been looking at all of my stock picks this past year.

Regards and have a great day trading and investing!

Bob

Posted by bobsadviceforstocks at 9:56 AM CDT

|

Post Comment |

Permalink

Updated: Thursday, 20 September 2007 11:05 AM CDT

Wednesday, 19 September 2007

ICO Inc. (ICOC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the early partial sale of VIVO (Please note,

MERIDIAN BIOSCIENCE (VIVO) IS RATED A BUY)

I had a 'permission slip' to add a new position. And that nickel was burning a hole in my pocket right away.

Checking the list of top % gainers on the NASDAQ, I saw that ICO (ICOC) made the list. As I am writing now, ICOC is trading at $14.82, up $.58 or 4.07% on the day. I purchased 420 shares of ICOC at $14.979 earlier this afternoon. This gave me 16 positions out of my maximum of 20.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of my effort at transparency, I try to report on any trades that I have personally done in my own trading account. You can see more about my own holdings and activity on my Covestor Page where Covestor review my trading activity. To make a long story short, a few moments ago I sold 33 shares of my Meridian Bioscience (VIVO) stock at $29.94, representing 1/7th of my 232 shares, when VIVO hit a sale point on the upside.

I purchased Meridian (VIVO) on 4/21/05, at a cost basis of $7.42/share. Thus, these shares were sold with a gain of $22.52 or 303.5% appreciation since purchase. The 300% level is a targeted appreciation point for me. Currently, after a purchase, I sell shares if a stock hits 30, 60, 90, and 120% appreciation, then 180, 240, 300, and 360% appreciation levels. This was indeed the 7th partial sale of VIVO since my original purchase, having sold shares all along the way as the stock has been rising in price.

When shall I sell shares next? On the upside, I plan on selling 1/7th of my remaining shares if the stock should rise to a 360% appreciation level or 4.6 x $7.42 = $34.14/share. On the downside, my strategy is to sell if the stock should decline to 1/2 of the highest point at which a partial sale has been made. Having now sold a portion at a 300% gain, this would mean that if the stock should decline to a 150% appreciation level (working out to $7.42 x 2.50 = $18.55), then I would plan on selling ALL remaining shares. I also reserve the right to sell all shares if any fundamentally bad news is announced about the company.

In addition, sales on appreciation, like the current VIVO sale is a 'signal' for me. I use 'good news' like sales on appreciation as a signal that the market is o.k. to put another toe into equities, that is, to buy a new position, since I am at 15 positions, well under my maximum of 20. (Sales on 'bad news' like declines are indications to 'get out of the water' and I don't reinvest those proceeds.)

Like I so often say, "that nickel is burning a hole in my pocket already!" With that permission slip, so to speak, I shall now be on the prowl for a new stock, perhaps one of my old favorites, on the top % gainers list to add to my own holdings. Wish me luck!

Bob

Monday, 17 September 2007

Another Podcast and another Carnival for You to Visit!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This should be a short entry. At last! I just wanted to let you all know that you could download my latest podcast on LKQ Corporation (LKQX) by clicking HERE.

I also submitted this entry to the 54th Festival of Stocks, a blog carnival! You can see that post described as well as some other great posts from other bloggers on that page.

O.K., that's enough of a post! There, it was a short post, wasn't it? Have a great week trading. Good luck to all of us as Bernanke and the Fed meet tomorrow. I hope they make the right decision, whatever that may be!

Bob

Sunday, 16 September 2007

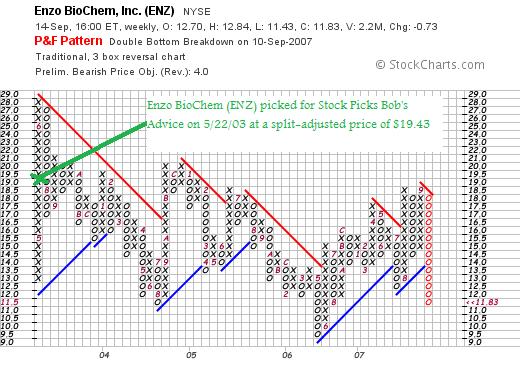

Enzo Biochem (ENZ) "Long-Term Review #12"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor so please remember to consult with your professsional investment advisers prior to making any investment decisions based on information on this website.

I was looking at the 'control panel' for this blog. It is hard to believe that I am now up to 1,605 entries (this is #1,606!). My first post was back on May 12, 2003, when I made a short entry on St Jude Medical (STJ). Needless to say, each entry got a little longer, a little more detailed. I added hyperlinks to source material, and learned how to add pictures. I continue to truly be an amateur blogger!

For some time, I have been doing weekend reviews like I did earlier today. A few months ago, I decided it would be a good idea to look deep into the blog and examine the early entries and find out how they turned out. And whether they still deserve a spot on this website!

Two weeks ago reviewed my entry on Dick's Sporting Goods (DKS). The next entry on the blog was Enzo Biochem (ENZ) which was also posted on May 22, 2003. I wrote:

Two weeks ago reviewed my entry on Dick's Sporting Goods (DKS). The next entry on the blog was Enzo Biochem (ENZ) which was also posted on May 22, 2003. I wrote:

"May 22, 2003

Enzo Biochem (ENZ)

Here is a new one for you. Near the top of the list for the NYSE best advancers is Enzo Biochem (ENZ). They are trading currently (1:42 pm Central time) at

$20.40 up $2.36 on the day or a gain of 13.08%.

News for the day is about a new Phase I Clinical Trial result for Crohn's disease....Phas II study to be initiated (this was on  5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

Last quarter, revenues increased 11% and net income was up 76%. In actual amounts, revenue for the 3 months ending 1/31/03 amounted to $13.1 million vs $11.8 million a year ago...and operating income was about $2.0 million vs $1.0 million last year. According to the same news story cash flow, an important criterion to consider, was strongly positive at $9.3 million with cash and cash equivalents at $75.9 million vs $61.9 million a year ago.

Looking at the 5 year growth in revenues on Morningstar, we find 1998 at $40.4 million, 1999 at $44.3 million, 2000 at $42.8 million, a slight drop, 2001 at $52.3 million, 2002 at $54.0 million, and $59.3 million for the trailing twelve months.

Cash flow has indeed improved with a $4 million positive in 2000, $7 million in 2001, $9 million in 2002 and $14 million in the trailing twelve months.

Looking a Yahoo, we find the stock with a market cap of $578.4 million, and a p/e of 58.19. An interesting if not compelling issue to be considered for investment. I do not own any shares of this stock nor plan to be buying any in the immediate future. Good luck! Bob"

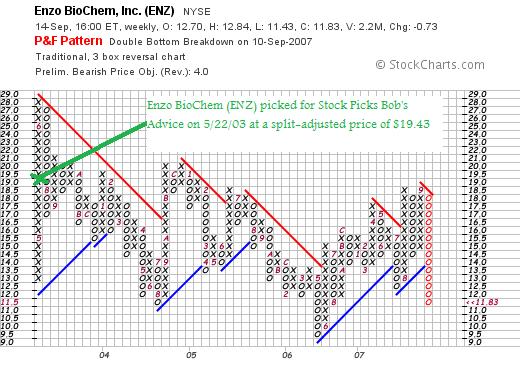

First of all, I selected ENZ on May 22, 2003, at a price of $20.40. ENZO had a 5% stock dividend on October 21, 2004, making my effective pick price actually $20.40 x 100/105 = $19.43. ENZ closed at $11.83 on September 14, 2007, for a loss of $(7.60) or (39.4)% since posting.

How about their latest quarterly report?

On June 11, 2007, ENZ reported 3rd quarter 2007 results. Revenues climbed 45% to $14.0 million vs. $9.6 million in the year-earlier same period. The net loss for the period was $(3.8) million or $(.10)/share, improved from a lossof $(3.4) million or $(.11)/share the year-earlier.

On June 11, 2007, ENZ reported 3rd quarter 2007 results. Revenues climbed 45% to $14.0 million vs. $9.6 million in the year-earlier same period. The net loss for the period was $(3.8) million or $(.10)/share, improved from a lossof $(3.4) million or $(.11)/share the year-earlier.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials page, we can see that revenue actually declined from a peak of $54 million in 2002 to as low as $39.8 million in 2006 and has improved to $44.9 million in the trailing twelve months (TTM). Earnings dipped from $.20/share in 2002 to a loss of $(.20)/share in 2004, profitable at $.10/share in 2005, then a loss of $(.50)/share in 2006, improving slightly (as noted above) to a loss of $(.40)/share in the TTM. Shares have been stable with 31 million in 2002 and 33 million in the TTM.

Free cash flow which was positive at $12 million in 2005, dipped to a negative $(14) million in 2006 and $(13) million in the TTM. The company has a solid balance sheet with $120 million in cash and $18 million in other currnt assets, vs. only $8.9 million in current liabilities and $1.1 million in long-term liabilities. Certainly, they can handle both the losses and the negative cash flow for quite awhile.

What about a chart?

Reviewing the 'point & figure' chart on ENZ from StockCharts.com, we can see a rather dismal price chart with the price basically staying below resistance levels for the past 4 1/2 years and a general drift lower with a recent sharp dip in the stock price. This is a poor chart from my amateur perspective.

What do I think?

With the poor quarterly report, the unimpressive Morningstar.com report, and the very weak stock chart,

ENZO BIOCHEM (ENZ) IS RATED A SELL

I rate these stocks with a 'rear-view' mirror. I do this based on my own fundamental screens that I have detailed above. I should note that Lazard Capital Markets just initiated coverage of ENZ with a "buy" rating. Clearly, they look at different things than I do. But I am limiting my own "buy" ratings to stocks with steady revenue and earnings growth, profits, and positive charts. This one just doesn't cut it for me.

Thanks again for stopping by and visiting my blog! If you have any comments or questions, be sure and leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Page where I discuss a few of the many stocks I write about on the blog. Also, if you want to know how my own Trading Portfolio is performing, visit my Stock Picks Covestor Page where Covestor, a third-party website, evaluates my actual holdings. Also, since January, 2007, or thereabouts, SocialPicks has been reviewing and analyzing all of my stock picks, and you can visit my Stock Picks SocialPicks Page to read about that! Now THAT should keep you busy :).

Stay well and keep on visiting!

Bob

Newer | Latest | Older

On April 4, 2006, I

On April 4, 2006, I  On April 5, 2006, I

On April 5, 2006, I  On July 25, 2007, Apple announced

On July 25, 2007, Apple announced

On April 6, 2006, I

On April 6, 2006, I

Finally, on April 7, 2006, I

Finally, on April 7, 2006, I

updates during the recently excitement in the subprime madness.

updates during the recently excitement in the subprime madness.  I wanted to stop for a second and share with you a fascinating

I wanted to stop for a second and share with you a fascinating

What exactly does this company do?

What exactly does this company do?

Two weeks ago

Two weeks ago  5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site. On June 11, 2007, ENZ reported

On June 11, 2007, ENZ reported