Stock Picks Bob's Advice

Wednesday, 9 January 2008

Universal Electronics (UEIC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In order to demonstrate what a total amateur investor I really am, and I am NOT kidding, I probably should explain to you the series of really amateur mistakes I made today with my Universal Electronics Stock (UEIC). I am really getting ready to stick to my rules and stop all the short-term trades. While the rest of the market moved higher today, my own account dipped.

Earlier today, I saw that my UEIC stock was taking a nosedive for no particular reason.

Rule #1. Don't try to figure out the reason. Just respond to market action.

I didn't.

I tried.

And I lost.

I figured since the drop was outrageous and the stock was gorgeous, I was smarter than the market and ought to buy some shares. And buy I did. I purchased an additional 800 shares of UEIC at approximately $26.95/share early on. In the face (!) of a declining stock. After all, I had the one position to 'trade' didn't I?

But the stock kept dropping. Just like trying to catch that falling knife, I started to feel the pain. And now with a really large position! So I sold 455 of my shares at around $45.50 and then sold the rest of my shares with the stock still in the $25.50 range closing out my entire position.

I haven't calculated my loss, but it was well over $1,000.

Stupid, stupid, stupid.

But at least the rest of my account was moving higher dampening out the effect of my folly.

Have I learned my lesson?

I don't know. I know I really burnt my fingers on this one. There are totally different skills between trading the short moves and investing for the long run. I am pretty darn good at the latter and a total hack at the former.

I apologize to myself and to all of you for acting so foolishly in public.

But learning to invest is a lifelong process. I have been doing this a long time and have learned a thing or two, but trading is something totally different.

If you would like to read about and learn more about 'trading' instead of investing, visit Timothy Sykes, a fellow Covestor fan and terrific trader. Stick around here to learn more about investing. Let me make a few of these dumb mistakes and maybe you won't do the same.

Meanwhile,

UNIVERSAL ELECTRONICS (UEIC) IS RATED A HOLD

down from a "buy".

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 7 January 2008

Dolby (DLB)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I have written many times, there are probably two broad processes that are required to invest successfully. The first is identifying the stocks that belong in a successful investment account and the second is managing those stocks. I spend most of the entries discussing my ideas about the first and also share with you my success at implementing the second. I hope that you all find this helpful.

While some investment letters seem to pull names out of the air, I try very hard to explain my own philosophy and how I arrived at these stocks. Time will tell if this approach will be successful. If any of you use similar strategies, or if any of you have utilized my perspective in developing your own portfolios, I would greatly appreciate hearing how it has been working out for you and any changes that you have implemented. There isn't anything magical or mysterious about the names that I write about on the blog, they simply represent stocks of companies that I view as the highest of quality. For me quality is about consistency of good results reported with a background of underlying financial strength.

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

DOLBY (DLB) IS RATED A BUY

First of all, I do not own any shares nor do I have any options on Dolby. But it is a stock that I would hope to have the opportunity of adding to my portfolio in the future, and if I did have a 'buy signal', it would be the kind of stock I would be buying today.

Dolby caught my eye when it made the list of top % gainers on the NYSE today, closing at $49.21, up $3.68 or 8.08% on the day. Scanning manually through the lists of top % gainers is the place that virtually all of my stock 'picks' originate.

What exactly does Dolby (DLB) do?

According to the Yahoo "Profile" on Dolby, the company

According to the Yahoo "Profile" on Dolby, the company

"...engages in the development and delivery of products and technologies for the entertainment industry worldwide. The company offers products comprising traditional cinema processors, digital cinema products, digital 3D products, digital media adapters, broadcast products, and live sound products, which are used in content creation, distribution, and playback. It also licenses a range of technologies, which are used in DVD players and personal computer DVD playback software; digital televisions and portable electronic devices; and consumer electronic products, such as gaming systems and audio/video receivers."

Is there any news to explain today's move?

The Consumer Electronics Show is being held this week in Las Vegas. Dolby has announced audio and image technologies that are being favorably received.

How did they do in the latest quarter?

On November 8, 2007, Dolby reported fiscal 4th quarter results. For the quarter ended September 28, 2007, revenue climbed 26% to $129 million from $102.1 million in the same period last year. Earnings climbed 75% to $44.2 million or $.39/share from $25.2 million or $.22/share last year.

These results beat expectations of $120.6 million in revenue and $.25/share in earnings. The company also raised guidance on fiscal 2008 to earnings of $1.27 to $1.37/share on revenue of $560 to $600 million. Analysts polled by Thomson Financial had been expecting profits of $1.23/share on revenue of $536.6 million.

In other words, this was a gorgeous earnings report imho.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Dolby (DLB), we can see that revenue has been steadily increasing from $217 million in 2003 to $482 million in 2007. Earnings have also steadily increased from $.36/share in 2003 to $1.26/share in 2007. No dividends have been paid. Shares outstanding have increased somewhat from 86 million in 2003 to 114 million in 2007. This represents an approximately 30% increase in shares during which time the revenue grew by over 100% and the earnings increased by over 200%. This is an 'acceptable' level of dilution imho.

Free cash flow has been positive and growing with $66 million reported in 2005 increasing to $124 million in 2006 and $152 million in 2007.

The balance sheet as reported by Morningstar.com appears quite solid with $368.0 million in cash which by itself is adequate to cover both the $143.2 million in current liabilities and the $51.3 million in long-term liabilities combined. Calculating the current ratio, there are a total of $733 million in total current assets which when compared to the current liabilities of $143.2 million yields an extremely strong ratio of 5.12. (Generally ratios of 1.25 or higher are 'healthy').

In other words the Morningstar.com report is fabulous.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" we can see that this is a large cap stock with a market capitalization of $5.43 billion. The trailing p/e is rich at 39.12 with a forward p/e (fye 28-Sep-09) estimated at 29.82. The PEG ratio is also a bit rich at 1.83.

Examining the Fidelity.com eresearch website, we find that in terms of Price/Sales (TTM), Dolby is reasonably priced with a Price/Sales (TTM) ratio of 10.33 compared to the industry average of 36.84. Also on Fidelity, DLB compares favorably when profitability is examined, at least as measured by Return on Equity (TTM), Dolby comes in at 19.81% compared to the industry average of 6.10%.

Finishing up with Yahoo, there are 110.39 million shares outstanding while only 49.22 million of them float. As of 12/11/07, there were only 652,790 shares out short representing a short ratio of 1, and only 0.6% of the float. There aren't a lot of investors willing to 'bet' against this stock!

No dividends are reported on Yahoo and no stock splits are recorded either.

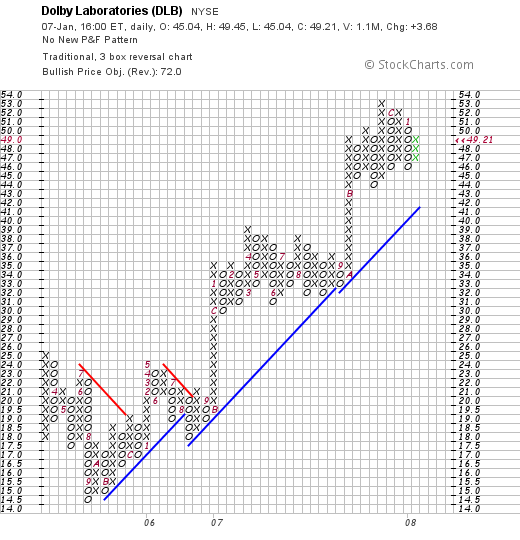

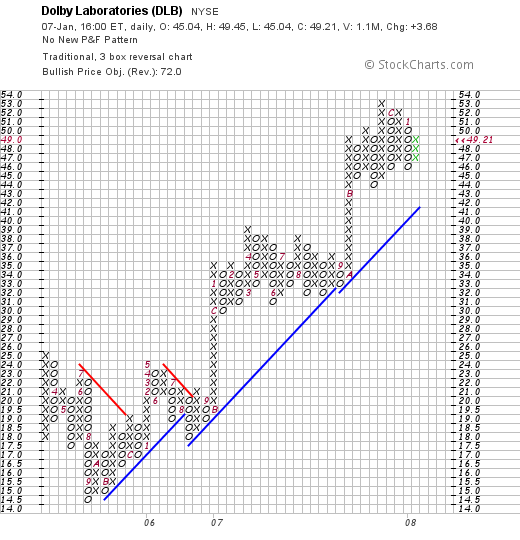

What about the chart?

If we review the "point & figure" chart on Dolby from StockCharts.com, we can see that the company last experienced technical weakness between March, 2005 when the stock traded at $25 until the end of September, 2005, when the stock bottomed at around $14.50. Since that bottom, the stock has stayed fairly true to the support line moving the stock nicely higher to the current level of $49.21, under the November, 2007 high of $53. The stock chart looks strong and not overextended to me.

Summary: What do I think?

As you know, I wouldn't be writing up this stock unless I liked it :), and I really like Dolby a lot. If only the market environment was a bit better and my portfolio generated a 'buy signal', this is a stock I would love to own.

To review, the stock moved sharply higher with some publicity surrounding a consumer electronics show in Las Vegas this week. Their latest quarter had everything I look for in a stock: strong revenue and earnings growth, beating expectations on both, and raising guidance! What I would call a 'trifecta plus'!

Longer-term, the picture is just as nice with steadily increasing revenues and earnings, relatively slower growth in outstanding shares, and nice positive and growing free cash flow. Finally the balance sheet is quite strong with enough cash on hand to pay off all of its liabilities--both short-term and long-term combined!

Valuation-wise, the p/e is certainly rich as is the PEG ratio. However, the Price/Sales per Yahoo is reasonable relative to similar companies and the Return on Equity is also stronger than the industry averages. There aren't a lot of short-sellers out there. Finally the chart looks strong.

On a 'Peter Lynch style of investing', I can recall my fascination with Dolby noise reduction in cassette players years ago. This is a picture of a 1982 cassette boom box by Hitachi with Dolby noise reduction:

But of course that was a long time ago :).

Finally, the chart is quite strong but not over-extended from my amateur perspective. There really isn't much I don't like about this stock except that I don't own any shares :(.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com. I read all of my email but cannot answer every letter I receive.

If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is analyzed and compared to both other investors as well as the many trading indices. On SocialPicks you can also find out about the many other stock picks I have made during 2007 and 2008 and how they have all turned out. And if you still have time, please feel free to visit my Podcast Page where my mp3's are waiting to be downloaded to your iPod or mp3 player so that you can listen to me discuss many of the same stocks I write about here on the blog.

If you are interested in an intriguing website started by the e-Loan founder, and wish to find out more about person-to-person lending, visit Prosper.com and if you sign up through this link, both you and I will earn $25. (Full disclosure, I have earned a total of $25 through referrals up to this time which went towards loans on Prosper.) Please be aware of the great risk involved in these unsecured loans, but hopefully I shall be successful by limiting my exposure to the highest risk or lowest credit-rated borrowers. Even that may or may not be successful....so be sure and do your homework but I am sure if you visit, you will get hooked as I was when my nephew Ryan showed me the website!

Have a great week trading!

Bob

FMC Technologies (FTI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my remaining 100 shares in FMC Technologies (FTI) at $62.90/share. These shares were purchased 1/3/08 at $63.52/share. They were part of a larger lot which was purchased and sold the same day. I left 100 shares as I was happy with the stock and it met my criteria. I do believe that I shall be implementing this strategy of selling most of a "trade" in my one position arbitrary 'trade' strategy, and leaving behind enough for a regular position if it is successful. I haven't blogged much about this as this whole process is evolving. Anyhow, since I had sold the stock 'once' for a gain, with the stock now moving past break-even into a slight loss, it is time to unload the remaining shares.

I am not convinced of the depth of the current rally which for me suggests a bounce in an 'oversold' market.

Anyhow, with my own sale of FTI, I am reducing my rating on the stock:

FMC TECHNOLOGIES (FTI) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 6 January 2008

"Looking Back One Year" A review of stock picks from the week of July 3, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I don't need to repeat myself and complain about how awful a trading week we just had. At least for those of us who are going long on investments.

The weeks do seem to fly by as once again I am back at my keyboard typing away about a weekend review. These reviews are my own attempt at some sort of 'quality control' or review to assess the success and failures of my investment selection process and to encourage some of you to dig into the blog where there are literally hundreds of stocks that I have reviewed over the past four, almost five years.

Anyhow, last week I reviewed the selection(s) from the week of June 26, 2006, so let's move ahead a week and see how things worked out for the stock(s) selected the following week, the week of July 3, 2006. My reviews assume a 'buy and hold' strategy for investment. In practice, I advocate and follow a very disciplined (?) investment strategy which demands of me to sell my losing stocks quickly and completely and sell my gaining stocks slowly and partially at targeted appreciation levels. This difference in strategy would certainly affect performance, but for the ease of analysis, I have always been assuming a 'buy and hold' strategy for these weekend reviews.

On July 3, 2006, I posted Sirenza Microdevices (SMDI) on Stock Picks Bob's Advice when the stock was trading at $13.52.

On July 3, 2006, I posted Sirenza Microdevices (SMDI) on Stock Picks Bob's Advice when the stock was trading at $13.52.

Sirenza was acquired by RF Micro Devices (RFMD); the acquisition was completed on November 21, 2007. As reported:

"

Thus, the stock pick has an appreciation of $3.28 or 24.3% since it was "picked".

As the stock is no longer traded, I do not have a rating on this company.

Thus, for the only stock picked that week in July, 2006, the stock appreciated 24.3% until being acquired. A very acceptable performance in light of the current difficulty the market is facing.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is monitored, analyzed and compared to other investors and indices. Also, my SocialPicks page may interest you as they have been monitoring my blog for all of my stock picks since the first of 2007. And if you have any time left, drop by and visit my Podcast Page where I have been storing some radio shows about various stocks I write about here on the website.

Wishing you a better week starting Monday! Be well!

Bob

Saturday, 5 January 2008

A Reader Writes "Can you help end dispute?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I enjoy receiving emails from readers.

I enjoy receiving emails from readers.

However, I just received a note and I am not sure whether I mis-spoke or not in the blog, so let me share this email with all of you and if any of you can add to this discussion, please just leave a comment or email with your thoughts at bobsadviceforstocks@lycos.com.

As an amateur, I am capable of mis-speaking or mis-stating my own observations of the fact. If you do ever catch me doing that (some time back I posted the wrong chart with a stock!), just let me know and I shall try to make amends as soon as possible.

Anyhow, Shannon wrote:

"hey,

I may have misinterpreted newmentioning china perchase of naztac last year...tried to find out and ended up on your site..did i tell a friend wrong about hearin' cpurchase of stockco? every time i search it comes up china instead of dead end..can you help end dispute/thanku"

Shannon, thank you for writing. I hope that I didn't make any mistakes in what I wrote. My concern about foreign ownership is something that every nation must address when it has an imbalance of trade. That is, if we purchase more imports than sell exports to other nations around the world, the effects will include the drop in the value of our currency, the dollar.

For those of you who haven't noticed the news on the balnce of trade, this tidbit was

released December 17, 2007 by the United States Bureau of Economic Analysis:

"The U.S. Current-account deficit--the combined balances on trade in goods and services, income, and net unilateral current transfers--decreased to $178.5 billion (preliminary) in the third quarter of 2007 from $188.9 billion (revised) in the second quarter. Increases in the surpluses on income and on services and a decrease in the deficit on goods more than accounted for the decreases. An increase in net unilateral current transfers to foreigners was partly offsetting."

Thus, we have a growing and significant balance of trade deficit in America. And this trade imbalance is one of the prime movers in the decline of the dollar. As

reported in the Wall Street Journal:

"Messrs. McKinnon and Hanke are right that there is a common interest in maintaining the stability of the dollar but jawboning to convince foreign governments and their central banks to support the dollar will not solve the problem.

The best way to support the dollar is to balance our trade. The economic literature is full of the gains from trade that accrue to all trading partners, but every example to prove such gains shows trade to be in balance. Our goal should be free and balanced trade with emphasis on balance."

Another impact of our poorly managed trade situation is the 'recycline' of these exported $'s into ownership of our own manufacturing base. Warren Buffett, along with Carol J. Loomis commented on this as far back as November 10, 2003, in a Fortune Magazine article available online:

"In effect, our country has been behaving like an extraordinarily rich family that possesses an immense farm. In order to consume 4% more than we produce--that's the trade deficit--we have, day by day, been both selling pieces of the farm and increasing the mortgage on what we still own.

To put the $2.5 trillion of net foreign ownership in perspective, contrast it with the $12 trillion value of publicly owned U.S. stocks or the equal amount of U.S. residential real estate or what I would estimate as a grand total of $50 trillion in national wealth. Those comparisons show that what's already been transferred abroad is meaningful--in the area, for example, of 5% of our national wealth.

More important, however, is that foreign ownership of our assets will grow at about $500 billion per year at the present trade-deficit level, which means that the deficit will be adding about one percentage point annually to foreigners' net ownership of our national wealth. As that ownership grows, so will the annual net investment income flowing out of this country. That will leave us paying ever-increasing dividends and interest to the world rather than being a net receiver of them, as in the past. We have entered the world of negative compounding--goodbye pleasure, hello pain."

In fact, that is exactly what has been happening in America as we have been finding ourselves selling, and yes even seeking to sell our own asset base as our 'farm' is under distress.

Dubai is moving ahead with its investment in 19.9% of the NASDAQ.

As reported the other day:

"January 2, 2008 (FinancialWire) Nasdaq Stock Market Inc. (NASDAQ: NDAQ)

has received approval from the Committee on Foreign Investment in the

United States to give Dubai's state-owned bourse a stake in the U.S.

electronic exchange.

The New York Stock Exchange completed its acquisition of Paris-based

Euronext this year to form NYSE Euronext (NYSE: NYX).

The approval is the first step in allowing the Nasdaq to continue with

its plan to acquire Stockholm-based exchange operator OMX. The new

exchange will be known as Nasdaq OMX Group Inc.

Borse Dubai Ltd. will own a 19.9 percent stake in Nasdaq, though its

voting stake will be capped at five percent. It will also receive

Nasdaq's stake in the London Stock Exchange.

Nasdaq will make an investment in Dubai International Financial

Exchange, which is owned by Borse Dubai.

CFIUS is a committee with representatives from 12 federal agencies

established to review how acquisitions of American assets by foreign

companies might affect national security."

Other notable 'recycling' of dollars includes the $7.5 billion investment in Citigroup by Abu Dhabi:

"ADIA is the world's largest sovereign wealth fund with assets of $875 billion, derived from the country's oil surpluses. The fund, which will take no role in Citi's management, will buy securities that convert into 235.6 million shares starting in 2010 and yield 11% in the meantime -- almost double the bank's normal bond yield, and 4% higher than its shares' current dividend yield. Between March 15, 2010 and Sept. 15, 2011, the securities will convert to Citigroup shares within a $31.83-37.24 price range. "The structure of the deal suggests that Abu Dhabi is very bullish, effectively participating in the upside beyond $37.24, and sharing in the downside below $31.83," said George Nikas of Deutsche Bank. The purchase will make Abu Dhabi Citigroup's largest shareholder, followed by LA-based Capital Group Co. and Saudi billionaire Prince Alwaleed bin Talal."

Foreign investment in America is occurring at a torrid pace.

As reported:

"Merrill Lynch & Co., Morgan Stanley, Citigroup Inc. and Bear Stearns Cos., based in New York, sold $20 billion in stakes to bolster capital eroded by credit-market losses. International purchases of U.S. financial assets totaled $114 billion in October, the Treasury Department said Dec. 17, the fastest pace in five months."

In the year 2000: $(83.8) billion

2001: $(83.1) billion

2002: $(103.1) billion

2003: $(124.1) billion

2004: $(161.9) billion

2005: $(201.5) billion

2006: $(232.6) billion

2007: $(213.5) billion

These dollars also need to be recycled.

In 2006 it was

reported that China owned $339 billion in U.S. Treasury Bills. Not Chinese investors, and not investors from Dubai, and not investors from Abu Dhabi, but the actual

governments of these countries are buying America.

In May, 2007, it was

reported that China would invest $3 billion in Blackstone Group, amounting to approximately 10% of this asset management and hedge fund company.

My concerns about this series of rather rapid changes in our domestic corporate ownership involves questions about actual sovereignty of our nation. We are well aware of the role that corporations play in our government .

Recent Supreme Court decisions have

extended Constitutional Rights to Corporations. What will this mean when more and more United States corporations are partially owned not just by non U.S. Citizens, but by arms of foreign

governments?

Bob

Posted by bobsadviceforstocks at 9:37 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 5 January 2008 10:51 AM CST

Friday, 4 January 2008

On Today's Decline

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am really at a loss for words to explain away today's miserable action in the market. For the record, the Dow closed today at 12,800.18, down 256.54 points, and the Nasdaq closed at 2,504.65, down 98.03, with the S&P off 35.53 at 1,411.63.

In my own trading account, I had a loss of $(2,016.31) putting my current account value at $59,136.68. Every one of my 13 stocks declined except for Covance (CVD) which managed to post a gain of 2.18% on the day. In other words it was an awful day in the market.

And yet what is the individual investor, especially the amateur investor to do? Seriously. What is the proper action to take. Is it time to sell everything and move to cash? Perhaps. Is it time to ratchet up the buying as things are about to rebound? Maybe. Or is it wisest to stay invested and 'ride out the storm?' It is possible that's the right action.

In other words, I don't have any magic answers for this question. I am sure some of you arrived at this website expecting answers, after all some of you Googled me with the term "stock advice".

So let me tell you my strategy if you don't know it already.

Except for an occasional trade that doesn't particularly stick to the rules, my planned portfolio management strategy is to stick to my own rules. That is, I am currently at 13 positions (12 plus the 100 shares of FMC from my recent trade.) I shall drift down further towards a minimum of 5 positions depending on the price action of my holdings---or move towards the maximum of 20 positions again dependent on the price action of my own stocks.

How does that work?

I have set up sale points (at least in my head) for every stock I own. Both on the upside and the downside. As my stocks appreciate, hitting targeted appreciation points at 30, 60, 90, 120, 180, 240, 300, 360, 450, 540% etc. appreciation points, I implement sales of 1/7th of my holdings. These sales are what I call good news sales and give me a "permission slip" to add a new position.

On the other hand, after an initial purchase, I execute sales on the entire position should a position decline to an (8)% loss for me--regardless of my duration of ownership. If I have sold 1/7th of a holding at the first sale point, which is at a 30% gain, then I sell all remaining shares at the break-even point, instead of waiting for a stock to decline to an (8)% loss.

These sales on the downside are considered 'bad news' sales and require me to 'sit on my hands' with the proceeds---essentially moving me away from equities and into cash.

If I have sold a portion of a stock more than once at appreciation points, that is at 30, and 60% or higher points, then the entire position comes up for a sale if the stock should decline to 1/2 of its highest appreciation percentage sale point. That is, for instance, if I have sold a stock three times: at 30, 60, and 90% appreciation points, and the same stock now declines to only a 45% appreciation level, the entire position is sold. And the stock, regardless of the fact that it carries a profit, is still considered a 'bad news' sale.

And I once again sit on my hands unless that sale brings me under 5 positions, which would instead give me a signal to add a new position to the account.

It is this method that allows my own portfolio to respond to the long-term moves of the market. I haven't really had a bad bear market to deal with in the past few years as I implemented this approach. But I hear some growls that might just be a bear in the vicinity.

Will this work?

I don't know. I hope so. But I don't know of anything better than more 'shooting from the hip' guessing or just trading from the gut, or arbitrary decisions that don't make much sense to me.

In general bear markets are shorter than bull markets and the overall direction of the market is up. Those things I am pretty confident about. But what the market will do this coming Monday or a week from Monday is anyone's guess.

I don't know if that answered your questions. But I shared with you what my plan is. I planned this when times were good. I have been around plenty long in the stock market to remember times other than good that I have lived through.

Good luck with your investments. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 3 January 2008

FMC Technologies (FTI)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the market rather anemic this afternoon and with a couple of point gain on my 'trading position', I decided to pull the plug on 300 of the 400 shares, selling them a few moments ago at $65.42. (These shares were purchased this morning at $63.52, so it almost mad a $2 gain.) I kept 100 shares for the account as I really do like this stock. But with this trade 'outside of my rules', and my margin balance still quite significant, it seemed wise to undo the bulk of the position.

FMC TECHNOLOGIES (FTI) IS RATED A BUY

Thanks so much for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

FMC Technologies (FTI) "Trading Transparency'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

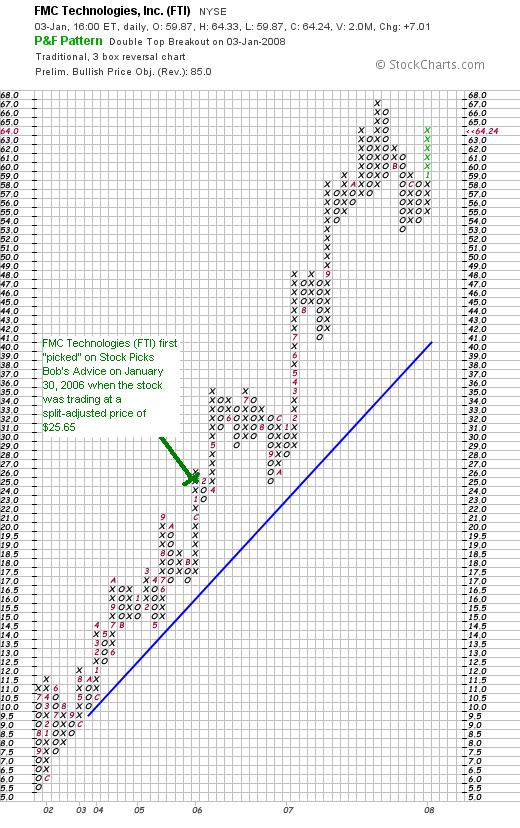

A few moments ago, I exercised my prerogative that I have established to 'break the rules' with one position in my portfolio. With that in mind, I noticed that an old favorite of mine, FMC Technologies (FTI) had made the list of top % gainers on news. I say 'old friend' because I have owned FTI in the past and first wrote it up on Stock Picks Bob's Advice back on January 30, 2006, almost two years ago! With that in mind, and sensing that the market was going to turn positive, I purchased 400 shares of FMC Technologies (FTI) at $63.52 earlier this morning.

A few moments ago, I exercised my prerogative that I have established to 'break the rules' with one position in my portfolio. With that in mind, I noticed that an old favorite of mine, FMC Technologies (FTI) had made the list of top % gainers on news. I say 'old friend' because I have owned FTI in the past and first wrote it up on Stock Picks Bob's Advice back on January 30, 2006, almost two years ago! With that in mind, and sensing that the market was going to turn positive, I purchased 400 shares of FMC Technologies (FTI) at $63.52 earlier this morning.

FMC TECHNOLOGIES (FTI) IS RATED A BUY

Let me briefly review the usual factors that went into my decision.

This morning, FMC announced that it had been awarded a $980 million contract to "supply deepwater processing and production systems to Total Exploration & Production Angola."

Probably in light of this contract, Wachovia upgraded the stock from "underperform" to "market perform".

Regarding the latest quarter, FMC reported 3rd quarter 2007 results on October 29, 2007. Revenue came in at $1.1 billion, up 22% over 3rd quarter 2006. Diluted earnings per share came in at $.60/share up 46% from $.41/share the same quarter last year.In the same report, the company raised guidance for full year 2007 to $2.16 to $2.21.

With this report, the company beat expectations of $.55/share and met expectations of revenue of 1.14 billion.

Longer-term, the Morningstar.com "5-Yr Restated" financials page is solid with strong revenue growth, a resumption of earnings growth (after a slight dip from $.84/share to $.75/share between 2004 and 2005, then $1.97/share in 2006 and $2.32/share in the TTM), and stable outstanding shares. Free cash flow has improved from $16 million in 2006 to $174 million in the trailing twelve months (TTM). The balance sheet appears reasonably solid.

Finally, the chart looks strong. Checking the StockCharts.com "point & figure" chart on FTI:

Anyway, I am 'back in the game!' I don't think I should be 'day-trading' a quality stock like this for a point or two. I don't know if that's a mistake or not. I shall stick with my disciplined portfolio management for my other holdings, but this holding shall continue to be an ongoing experiment for me as I try to think 'out of the box' and purchase and sell stocks in a more unrestrained fashion. Wish me luck!

Thanks again for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Covestor Page where my Trading Portfolio is analyzed and compared to the indices and other investors, my SocialPicks page where my stock picks are reviewed since the first of last year, and my Podcast Page where you can listen to me discuss a few of the many stocks I have reviewed here on the blog.

Have a great 2008!

Bob

Tuesday, 1 January 2008

New Year's Resolutions

Hello Friends! It is the first of January of 2008. And I am still trying to figure out what is going to happen when Y2K hits. Doesn't that seem like just yesterday? I remember all of the panic and planning that went on as all of our computers were supposed to crash and struggle as the year 2000 rolled over. And I am still waiting.

I thought I would spend a few moments today and share with you some resolutions that I am making for the New Year. As always, please remember that these are 'amateur' resolutions :). So always seek advice with professionals before copying any of mine :):).

1. To stay with my approach in a disciplined fashion. But occasionally, when the 'writing is on the wall', go ahead and do something that isn't completely on the straight and narrow. I recall in 2007 when I saw that Starbucks (SBUX) wasn't acting well. I love the store. The stock had been great for me. The stock hadn't hit any sale points, yet I unloaded shares because they came in with some week same store sales numbers, and as I recall they missed slightly on earnings. It paid to think a little.

2. To give credit to others more often. This year I would like to expand my reading of other blogs and comment more on what some very bright and innovative minds are writing. There are so many great thinkers out there and we can all learn more from others if we spend the time. This will also increase the possibilities of integrating what I write more into the 'blogosphere'. I do enjoy reaching more readers and having them stick around more than the 0:00 seconds that my Sitemeter reads on their visits. This also includes encouraging all of you to comment and write letters more often so that we can increase the amount of two-way discussions here on this website. Please be aware that if you email me at bobsadviceforstocks@lycos.com I shall try to answer your comments either directly or on the blog. But I cannot guarantee that I shall be able to respond to every letter even though I read all of them.

3. To blog less and to blog better. I cannot be blogging every single day. It just isn't physically possible. Although I come close. But to continue to work on improving the content with as much educational links as possible.

4. To learn more about charting, day-trading, and short-selling.

5. To integrate political commentary into the blog. Occasionally I digress and offer some political observations here on this website. While we can all agree that profitable investing is useful, there will likely be large ranges of opinions on these controversial topics. I have been reluctant to enter into these discussions except on rare exception, and while I am not sure it is the wisest thing for this blogger to do, blogging is a personal affair that is shared with the public. I have many different hats, and one of them is as a very political person. How I do this, I haven't decided.

6. To work hard at staying humble. It is easy for my head to 'get bigger' as I blog and write as if I really have all the answers. I don't. I am capable of failure, my approach may or may not work long-term, and there are many brighter investors out there. I have been very lucky to have so many 'followers' over at the Covestor site. But I trust that these followers are interested in my thoughts on stocks and not necessarily my performance which lags many great fellow investors. I shall try hard to stay ahead of the S&P (which I accomplished in 2007), but remember that we all must work to refine out techniques, enhance our understanding, and recognize that our accomplishments may all be just one step ahead of failure.

7. To stay upbeat about investing, blogging, and my family. Without being so pessimistic at such an early time in the year, I have a wonderful group of readers on this blog. I love to sit down and write about things and share with all of you my thoughts, and I have a wonderful family that I can be proud of. Without sounding Pollyannish, there is much for me to be 'glad' about :).

8. To continue to look at ways to improve the functionality of my blog and maybe, perhaps, develop some index :).

This may be just Part I of my resolutions so stay tuned. Meanwhile, I would like to wish all of you the best of years in 2008. May you find happiness and success as well as an occasional profit. May all of you experience the best of health and find the strength to deal with all of the challenges that may lie ahead for all of us this year. And maybe we can find 2008 a year that has more Peace and Well-Being for each inhabitant across the globe who may find reason to have more hope than discouragement about their own lives and families.

Bob

Sunday, 30 December 2007

"Trading Portfolio Update" December 30, 2007

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As we approach the end of 2007 and begin a new year in a couple of days, I thought that this was about as good a time as any to take a look at my Trading Account. I haven't been doing these updates quite as frequently as previously because you can all venture over to my Covestor Page where my holdings and performance are summarized and analyzed and compared to indices as well as other investors on the site.

In fact, I last reviewed my holdings on October 7, 2007, and my overall performance has been pretty neutral since that post.

This is the status of my account as of December 30, 2007. These holdings are listed in the alphabetical order of their trading symbols followed by number of shares, date of purchase, price of purchase, latest price (12/28/07), and percentage unrealized gain or (unrealized loss).

Abaxis (ABAX), 180 shares, 10/25/07, $28.29, $36.90, 30.42%

Cerner (CERN), 103 shares, 2/2/07, $49.76, $57.58, 15.71%

Copart (CPRT), 210 shares, 9/27/07, $33.73, $42.62, 26.36%

Covance (CVD), 102 shares, 4/9/07, $62.61, $87.28, 39.40%

Harris (HRS), 103 shares, 1/31/07, $50.05, $62.69, 25.25%

IHS (IHS), 140 shares, 10/1/07, $58.53, $61.21, 4.58%

Morningstar (MORN), 103 shares, 11/22/05, $32.57, $77.60, 138.22%

Precision Castparts (PCP), 64 shares, 10/24/06, $69.05, $138.54, 100.63%

ResMed (RMD), 150 shares, 2/04/05, $29.87, $52.55, 75.94%

Universal Electronics (UEIC), 155 shares, 2/23/07, $25.24, $33.33, 32.05%

Meridian Bioscience (VIVO), 199 shares, 4/21/05, $7.42, $30.57, 312.05%

VCA Antech (WOOF), 210 shares, 7/27/07, $41.04, $44.60, 8.68%

Currently I am at 12 positions with 20 being the maximum and 5 the minimum. My equity value is $90,809.41 with $28,702.47 in margin outstanding with a net account value of $62,105.02. My margin equity percentage is 68.30%, up from 57.11% at the last report in October.

As of December 28, 2007, I had a net of $27,511.45 in unrealized gains in the account. Since the first of the year I have taken a net of $282.20 in short-term gains and $30,851.56 in long-term gains giving me a total of $31,133.76 in realized gains.

I have had total income of $422.74 and have paid $(4,888.66) in margin interest as of this date.

This has been a very good year for me in the market. I hope that the market has treated you just as kindly. Wishing all of my friends the happiest and healthiest of New Years in 2008.

Bob

Newer | Latest | Older

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why

Let's take a look at a stock Dolby (DLB) that caught my attention. I will share with you what it is about this stock that I find provocative and why According to the

According to the

On July 3, 2006, I

On July 3, 2006, I  I enjoy receiving emails from readers.

I enjoy receiving emails from readers. A few moments ago, I exercised my prerogative that I have established to 'break the rules' with one position in my portfolio. With that in mind, I noticed that an old favorite of mine, FMC Technologies (FTI) had made the

A few moments ago, I exercised my prerogative that I have established to 'break the rules' with one position in my portfolio. With that in mind, I noticed that an old favorite of mine, FMC Technologies (FTI) had made the