Stock Picks Bob's Advice

Wednesday, 5 November 2008

Expeditors International of Washington (EXPD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I do not like to get whipsawed and do so publicly. And yet, I am committed to implementing my own idiosyncratic system of limiting losses and responding to market influences in some sort of rational fashion.

I do not like to get whipsawed and do so publicly. And yet, I am committed to implementing my own idiosyncratic system of limiting losses and responding to market influences in some sort of rational fashion.

Earlier this morning the market handed me my quick 8% loss on Expetitors (EXPD) and I sold my 45 shares at $36.8506. These shares were just purchased yesterday, yes yesterday, at a price of $40.1894. Thus, my loss was $(3.34) or (8.3)% since purchase. With this being the sixth position in my portfolio, I am implementing my (8)% loss limit, and now back to five positions, my loss tolerance is increased to (16)% with the 'final five' of my 20 position maximum.

I hope this all makes sense.

My sale of EXPD is not representative of any dislike of this stock. I find the numbers on this company intriguing, the consistency of growth, etc.. My sale is just a reflection of my own amateur attempt of limiting losses and responding to market influences. The volatility is just killing me though.

I know there are lots of readers over at Seeking Alpha who are pointing out the VIX levels and I am learning this the hard way.

Since my sale is at a loss, and I still am now at 5 positions (my minimum), I shall not be replacing this holding.

Thank you for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Rock-Tenn Co. (RKT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers before making any investment decisions based on information on this website.

That "nickel" was burning a hole in my pocket! I always talk about having a nickel in my pocket when I have sold a portion of one of my holdings at a gain. Indeed yesterday my recently purchased holding, WMS Industries hit a first appreciation target and I sold 1/7th of my small holding. These sales are the barometers I use to determine my own equity exposure in the market. With that sale, I started to look for a new position that met my own criteria for a holding, and a purchase that would be at the 'average' of my remaining holdings in size.

That "nickel" was burning a hole in my pocket! I always talk about having a nickel in my pocket when I have sold a portion of one of my holdings at a gain. Indeed yesterday my recently purchased holding, WMS Industries hit a first appreciation target and I sold 1/7th of my small holding. These sales are the barometers I use to determine my own equity exposure in the market. With that sale, I started to look for a new position that met my own criteria for a holding, and a purchase that would be at the 'average' of my remaining holdings in size.

Looking first to the list of top % gainers, I came across Rock-Tenn (RKT) which closed at $32.94, up $3.79 or 13% on the day. I purchased 93 shares at $33.06.

Rock-Tenn climbed yesterday after releasing 4th quarter 2008 results. The company reported that it earned $28.4 million or $.74/share, up from $19.7 million or $.50/share last year. "Excluding one-time items, Rock-Tenn earned $34.5 million or $.90/share."

I place great significance on expectations of earnings in trying to determine how 'good' an earnings report really is. In this case, the company easily outperformed expectations as analysts polled by Thomson Reuters had been expecting earnings of $.84/share.

But of course, a single quarterly result isn't enough to get my own 'seal of approval' on a stock!

Reviewing the Morningstar.com '5-Yr Restated' financials on RKT, we can see the steady growth in revenue from $1.4 billion in 2003 to $2.3 billion in 2007 and $2.7 billion in the trailing twelve months (TTM).

Earnings, however, have been far more erratic, dipping from $.85/share in 2003 to a low of $.49/share in 2005. Since 2005, earnings have grown to $.77/share in 2006, $2.07/share in 2007, and per Morningstar a dip to $2.07/share in the TTM. However, with the latest quarterly result, we can see that the increase is 'back on track'.

The company has a record of paying dividends and has been increasing that dividend from $.32/share in 2003 to $.39/share in 2007 and $.40/share in the TTM.

Outstanding shares have been fairly stable with 35 million outstanding in 2003 increasing to 38 million in the TTM.

Free cash flow is positive and growing with $99 million in 2005, $160 million in 2007 and $175 million in the TTM. The balance sheet appears adequate with $57 million in cash and $618 million in other current assets, compared to $636.5 million in current liabilities---a current ratio just over 1.0, and $1.7 billion in long-term liabilities on the balance sheet.

This isn't a perfect fit to my own strategy of steady earnings growth and solid balance sheets. But the overall fit works for me.

Let's take a quick look at the 'point & figure' chart from StockCharts.com:

We can see that the price moved higher between April, 2005, when it dipped to a low of $9.50, to a peak of $46 in September, 2008. The stock broke down after that dipping to a low of $24 in October, 2008, just last month. The stock appears to be attempting to break through resistance at $40, but actually has a ways to go.

Like so many stocks in today's bear market, the charts are under pressure.

With my own 'leash' on every investment, and my own signal to be adding a position, this one works for me. This company that "manufactures packaging products, paperboard, and merchandising displays in North America" according to the Yahoo "Profile". This is a mid-cap stock with a market cap of $1.26 billion, a p/e of 17.33, and a PEG of 1.18 per the Yahoo "Key Statistics".

Wish me luck.

I shall try to keep you posted with all of my holdings, my own trades, my own thoughts and fears and hopes and aspirations in the market.

By the way, congratulations are in order to all of my friends who supported Obama for President! For those of you who supported McCain or others, I feel your pain as well and offer you my understanding.

But isn't it great that all of the campaigning is over?

If you have any comments or questions, please feel free to leave them on the blog, or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Tuesday, 4 November 2008

Expeditors International of Washington (EXPD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I sold my shares of Graham (GHM) on a plunge in the stock price below my purchase price on what appeared to be a reasonably good earnings report. I suppose with the rise in the price of oil and this earnings report, the stock reacted to the news. It doesn't matter to me. My sale is based on the price performance of my holding and not my own expectations of the future prospects.

Earlier today I sold my shares of Graham (GHM) on a plunge in the stock price below my purchase price on what appeared to be a reasonably good earnings report. I suppose with the rise in the price of oil and this earnings report, the stock reacted to the news. It doesn't matter to me. My sale is based on the price performance of my holding and not my own expectations of the future prospects.

Dipping below my minimum of 5 positions generated a 'buy signal' for me to replace it with a position of reduced size (1/2 of the average size of the remaining positions.) I have initiated purchases based on sales on good news to be sized at the average of the remaining holdings.

Looking through the lists of top % gainers on the NASDAQ today, I came across Expeditors (EXPD) and felt it would fit well into my own portfolio.

Let me share with you briefly why I made this decision and decided to purchase 45 shares of EXPD at $40.19. As I write, EXPD is trading at $38.68, a bit below my own purchase, trading up $6.68 or 20.88% on the day.

First of all, what drove the stock higher today was the announcement of 3rd quarter 2008 results. Earnings came in at $85.6 million during the 3rd quarter, up from $74.3 million during the same period last year. Diluted earnings per share worked out to $.39/share this year, up from $.34/share last year. The company reported "same-store" results, with same store net revenue climbing 11%, and same store operating income climbing 13% year-over-year. Revenue for the quarter came in at $1.56 billion, up from $1.41 billion last year.

The company exceeded expectations on earnings and apparently met expectations on revenue results. Analysts had been looking for $.37/share (the company beat this by $.02).

Longer-term, if we check the Morningstar.com "5-Yr Restated" financials on EXPD, we can see that revenue has been steadily increasing with $2.6 billion in sales in 2003, climbing to $5.2 billion in 2007 and $5.6 billion in the trailing twelve months (TTM).

Earnings have also steadily increased from $.46/share in 2003 to $1.21/share in 2007 and $1.28/share in the TTM.

The company pays a dividend and has been increasing the dividend annually from $.08/share in 2003 to $.30 share in the TTM.

Outstanding shares have been very stable with 216 million shares in 2003, increasing only to 221 million in the TTM.

Free cash flow has been positive and growing from $176 million in 2005 to $243 million in the TTM.

The balance sheet appears solid with $703 million in cash and $1.04 billion in other current assets. This yields a current ratio of 2.0. The company reports only $95 million of long-term liabilities.

Looking at some valuation numbers, we can see that this is a large cap stock with a market cap of $8.22 billion according to Yahoo "Key Statistics".

The trailing p/e is 30.27 with a forward p/e (fye 31-Dec-09) of 25.43. The PEG (5 yr expected) works out to an acceptable 1.51.

Yahoo reports 213 million shares outstanding with 209 million that float. 9.18 million shares are out short representing a short ratio of 2.2 days. The company, as noted, pays a dividend with a forward yield of 1.0%. The last stock split was a 2:1 split back on June 26, 2006.

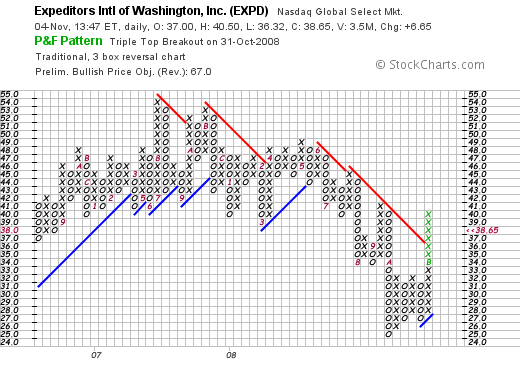

And the chart?

If we examine a

'point & figure' chart on EXPD from StockCharts.com, we can see that the stock has been relatively weak since peaking at $54 in August, 2007, and has traded as low as $25 in October, 2008. The stock has recently broken through resistance at the $36 level, and short-term appears to be a bullish chart.

To summarize, with my sale of Graham (GHM) putting me under 5 positions, my own strategy requires a minimum of 5 holdings in my portfolio (with my own maximum of 20 positions). I set out to find a new holding starting with the top % gainers lists. Expeditors was performing well today, and a closer look reveals a terrific earnings report, a longer-term record and financial fundamentals quite impressive, and a less than impressive chart.

But it was enough to get me to bite and nibble away I went.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Graham Corp (GHM) and WMS Industries (WMS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There is no doubt that Graham (GHM) a relatively thinly-traded AMEX stock has been one of the most volatile of my holdings. It has performed for me on the upside, and I have burned my fingers on this stock more than once. Add today to that list of burnt fingers!

There is no doubt that Graham (GHM) a relatively thinly-traded AMEX stock has been one of the most volatile of my holdings. It has performed for me on the upside, and I have burned my fingers on this stock more than once. Add today to that list of burnt fingers!

Graham (GHM) was purchased in my Trading Account last month, purchased 10/8/08 at a cost basis per share of $16.34. I sold my first portion of Graham at a 30% gain only 5 days later on 10/13/08 at $22.37. Today, after the 2nd quarter 2009 earnings report was released, the stock slumped, even though the rest of the market was enjoying an Election Day rally. As I write, GHM is trading at $15.43, down $(5.52) or (26.35)% on the day.

I sold my 360 remaining shares of Graham (GHM) earlier this morning at $15.441. This represented a loss of $(.90) or (5.50)% from my purchase.

This sale was not at a 16% loss limit as I have discussed in my previous posts that I have been implementing for my remaining 5 positions. But this represents my still employed strategy of selling stocks if they break through my purchase cost if I have sold once at a gain. And this is exacly what has happened.

Going down to 4 positions, this entitled me to add a new position, and I did purchase 45 shares of Expeditors Intl (EXPD) at $40.19/share. I shall try to discuss this later today.

But what I wanted to discuss further was my partial sale of WMS Industries, sold almost immediately after my Graham sale, but this time on 'good news' due to an appreciation in that stock's price!

WMS Industries (WMS) is a recent purchase of mine, having acquired 96 shares at a cost basis of $20.12 on 10/28/08. This morning I sold 1/7th of my WMS holding or 13 shares at $26.67. This represented a gain of $6.55 or 32.6% since purchase. My next targeted appreciation point for a sale of 1/7th of my remaining shares would be at a 60% gain or 1.6 x $20.12 = $32.19. On the downside, just like my sale today of my Graham (GHM) shares, after a single partial sale at a 30% appreciation level, I sell my shares should they decline or pass through break-even. Thus remaining shares would be sold if WMS should decline to $20.12.

WMS Industries (WMS) is a recent purchase of mine, having acquired 96 shares at a cost basis of $20.12 on 10/28/08. This morning I sold 1/7th of my WMS holding or 13 shares at $26.67. This represented a gain of $6.55 or 32.6% since purchase. My next targeted appreciation point for a sale of 1/7th of my remaining shares would be at a 60% gain or 1.6 x $20.12 = $32.19. On the downside, just like my sale today of my Graham (GHM) shares, after a single partial sale at a 30% appreciation level, I sell my shares should they decline or pass through break-even. Thus remaining shares would be sold if WMS should decline to $20.12.

These two sales demonstrate my philosophy of selling both on bad and good news. Both of these sales have triggered buys in different fashions. My Graham (GHM) sale brought me under my minimum of 5 positions and I did go ahead and purchase a small position of EXPD (1/2 of the average size of my remaining positions), and now have a 'permission slip' to be adding a 6th position which would be slightly larger, actually at the average size of my remaining holdings.

Thanks so much for stopping by and visting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 2 November 2008

A Reader Writes "Do I understand correctly...?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite activities on this blog is to receive and respond to emails. I am always interested in discussing stocks and my methods with fellow investors who are also interested in understanding investment methods.

One of my favorite activities on this blog is to receive and respond to emails. I am always interested in discussing stocks and my methods with fellow investors who are also interested in understanding investment methods.

I received a great letter from Don who is a fellow Covestor participant over on the Covestor website who also has a great website, Crossing the Threshold. Please visit Don's website and tell him 'Bob sent you!'

I received a great letter from Don who is a fellow Covestor participant over on the Covestor website who also has a great website, Crossing the Threshold. Please visit Don's website and tell him 'Bob sent you!'

But let me get right to Don's letter as he has some questions for me about my own idiosyncratic approach to buying and selling stocks and managing my portfolio in the face of a volatile market that swings from bear into bull and leaves many an investor scrambling to figure the appropriate strategy.

Don wrote:

"Hi Bob,

I started a fairly ambitious project in response to your note about the changes to your system, but just plain ran out of time this weekend. I'll keep at it. I think you'll find the results interesting.

And on a semi related note, I attended a seminar on Fidelity's Wealth Lab Pro system testing software, and, as a minimum it looks interesting. Once you have the rules for a system set up, you can run it on any portfolio of stocks going back 30 years. It's virtually instantaneous.

Do I understand correctly that if you're at 6+ trades, that you'll liquidate any trade at +30%, and then liquidate another 1/7th at each of these levels, "30, 60, 90, and 120% appreciation, then 180, 240, 300, 360 and 450% appreciation targets, then 540, 630, 720 and 810% appreciation levels, etc."

My question is this, if you buy 700 shares, do you sell 100 at each of those levels, or, does it mean 100 (leaving 600), then 85 (1/7th of 600), then 74 (1/7 of 515), etc?

Thanks, and good luck in this market!

Don"

First of all I would like to thank you Don for taking the time to write! I have enjoyed reading many of your own entries and watching you gather many 'fans' of your own on your Covestor page. There is nobody on Covestor with as much enthusiasm as you have in teaching and sharing ideas with fellow investors!

But let me get back to your letter.

I will not spend much time talking about stock selection as you understand some of the basic premises with recent price momentum, solid recent quarterly and longer-term results, positive free cash flow, stable outstanding shares, and reasonable balance sheets as ideas that many of us share.

Currently I am trying to keep my portfolio at between five and twenty positions. As you know, as my stocks appreciate to set appreciation levels (the 30%, 60%, 90%, 120%, 180, 240, 300, and 360%, and then 450, 540, 630%....etc.), I have chosen to sell a portion of my holding.

Initially selling 1/4 of my remaining shares, I have gradually reduced this amount and have now chosen to sell 1/7th of remaining shares. Thus if I had 700 shares, I would first sell 1/7th of 700 or 100 shares, then 1/7th of 600 shares or 85 shares, then 1/7th of 515 shares or 73 shares, etc.

With these sales at individual positions reaching targeted levels, I use these sales as 'signals' that give me 'permission slips' to be adding a new position (assuming I am below my maximum of 20 holdings. If at the maximum, I simply move the sale of the shares into my cash holding.)

However, I have not previously detailed my amount of a new position to purchase. Mathematically, I have recently chosen to purchase a new position equal to the average size in dollars of the remaining positions. I do this as long as I have at least 5 positions in my portfolio.

As you know, I have sales of positions on declines as well. Simply put, after an initial purchase, I sell my entire position at an 8% decline if I have not sold these shares previously, and I am at 6 or greater number of holdings. At 5 or less holdings, I am assuming that the bear market is severe and my tolerance has now been increased to a 16% decline.

After a holding has reached the first partial sale point at a gain, I move my sale point up from an 8% loss to break-even. After more than a single sale at a gain, I have moved my sale point up to 1/2 of the highest appreciation point for a sale of the entire position. Again I emphasize that sales on the downside are entire positions rather than partial sales as I implement on the upside.

As I get down to 5 positions, my sale target changes to a uniform 16% loss from the purchase price.

But I believe in maintaining 5 positions as a minimum. Even if I am in a bear market and am handed losss after loss. It is my reliance on my own exposure to equities that determines my own actions and response in the market. Much like a parrot in a coal mine, these positions offer me a rational (?) approach to determining the market environment and guiding me in my own investment decisions.

I hope you are following me.

In addition, I have changed something else. Previously, I have been pretty 'seat of the pants' in determining the size of the positions I shall be buying. If I am buying shares in a position just to get me back to my 5 position minimum, obviously, the market environment is pretty awful (as it has been recently) and I should be working to reduce my exposure. Since I am determined to have those five positions, I should at lease reduce the size of those holdings---and this is one of the changes I have implemented--these replacement holdings are now set as 1/2 of the average size of the remaining positions.

If I get up to 5 positions and I get a permission slip to be buying a new position as one of my 5 has hit a sale point on a gain----then I increase the size of the new position back to the 'average' of the remaining positions I hold. Thus, as I move back up to 20 positions, the holdings should increase, I continue to be in a relatively bullish posture until I get down to 5 positions---as I should---because between 5 and 20, I only get 'buy signals' because one of my holdings has been performing properly and has hit a sale point on an upward gain.

However, at 5 or less positions, as I sell them, I am buying new positions only to get my portfolio back to 5 and thus I am paradoxically getting a buy signal after selling something at a loss. Thus, with these sales, I still replace to get back to 5, but buy a smaller position---1/2 of the average size of the remaining holdings.

Don, I hope this answers your basic question. I know that my entire process seems far more complicated than necessary. However, I believe it is a logical process and look forward to hearing more of your thoughts on this and whether you think it might in fact work!

If you have any other questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 30 October 2008

A Few Comments on Stock Picks and Trading Philosophy and This Blog

Hello Friends!

I start out each entry or almost every entry with that comment because I mean it. I also mean it when I say I am an amateur. So always keep that in mind.

You may have reached this website because you searched "stock pick" on Google. Or maybe you were looking for "stock advice" or maybe you have been here before and understand what I am doing as I write my stock selections and share with you my actual trades and results.

That doesn't really matter.

For picking stocks may well be the easiest part of the entire equation. There are many ways to evaluate stocks, for the most part I am a momentum investor. I select stocks with daily momentum of price, recent momentum of earnings, longer-term momentum of improving fundamentals, with reasonable financials, desirable valuation, and an acceptable chart.

I don't always get all of those criteria met, but those are the bulk of the things I consider. I am not much different from many other investors who similarly look to select stocks with similar criteria.

But a larger question remains. When do you buy a stock? When do you sell a stock? And how do you respond to the market environment in making your decision--in other words--is there any way to avoid bear markets by minimizing equity exposure during these difficult times, and is there similarly any way to maximize equity exposure during bull markets and positive market environments? And can we do this automatically?

It is tough enough to select a stock, but managing your portfolio and responding automatically to market action is even a larger demand put upon my own strategy.

And to top it off, I am trying to do this publicly. To share my successes and failures with all of you and try to stick to a strategy in a disciplined fashion. And my strategy isn't refined, I am learning that I need to make changes as I implement my own decisions. I still lose money when stocks decline and make money when stocks advance.

But if I can develop an approach that adjusts automatically to the market, that guides me to select certain stocks, that lets me know when to be selling those same positions--whether in part or in entirety--I shall achieved something far greater than any particular 'great call'.

Thank you for coming along with me in this journey.

Yours in investing,

Bob

Tuesday, 28 October 2008

National Oilwell Varco (NOV) and WMS Industries (WMS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions

I continue to work my strategy even in the face of this volatile market that was screaming higher at the close. The Dow closed at 9,065.12, up 889.35, and the Nasdaq moved up 143.57 to close at 1,649.47. The S&P also participated, moving up 91.59 to close at 940.51. I cannot guess when the market shall be moving higher or correcting sharply.

All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares.

All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares.

Earlier today, before the last hour climb in the Dow, I sold my 210 shares of National Oilwell Varco (NOV) at $23.55/share. This stock has been travelling lower in synch with the price of oil. And no matter how pretty the numbers on this company, the price has been relentlessly declining since my purchase. These shares were purchased literally just days ago on 10/17/08, at a cost of $28.83/share. Thus I had a loss of $(5.28) or (18.3)% since purchase.

No way around this, it had passed my 16% limit for a loss and was sold. Ironically, this stock rebounded later in the day to close at $25.49, up $1.99 or 8.47% today----but I hate that analysis. It is far more important to make decisions in the market than to kick yourself about decisions that might have worked out some other way.

Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

I went to the list of top % gainers and identified WMS Industries (WMS) which seemed to fit my own requirements and purchased 96 shares at $20.04. Even though I missed the rise in NOV, I now paricipated in WMS which closed today at $22.44, up $4.34 or 23.98% on the day. My own gain on WMS (a paper profit that can disappear as fast as it appeared), amounted to $2.40/share, or 12% since purchase. (Most of this gain could disappear as WMS is trading at $20.56, down $(1.88) or (8.38)% in after-hours trading!)

Let's take a little closer look at WMS.

First of all, what does this company do?

According to the Yahoo "Profile" on WMS, the company

"...engages in the design, manufacture, and distribution of gaming machines and video lottery terminals (VLTs) for customers in gaming jurisdictions worldwide. The company�s products consist of video gaming machines, mechanical reel gaming machines, and video poker gaming machines. It also sells spare parts, conversion kits, amusement-with-prize gaming machines, and used gaming machines, as well as equipment manufactured under original equipment manufacturing agreements to casinos and other licensed gaming machine operators."

And the latest quarter?

Yesterday after the close of trading, WMS reported 1st quarter 2009 results. Earnings camne in at $15.7 million or $.27/share, up from $11.1 million or $.19/share the prior year. This result exceeded expectations from analysts polled by Thomson Reuters who were looking for earnings of $.25/share. Revenue came in at $151.4 million, up 14% from last year's $132.5 million result. Again, this revenue figure exceeded expectations by analysts.

The company reaffirmed fiscal 2009 guidance.

Longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see the steady revenue growth, the steady earnings growth, and the relatively stable outstanding shares. Free cash is solidly positive and the balance sheet is strong.

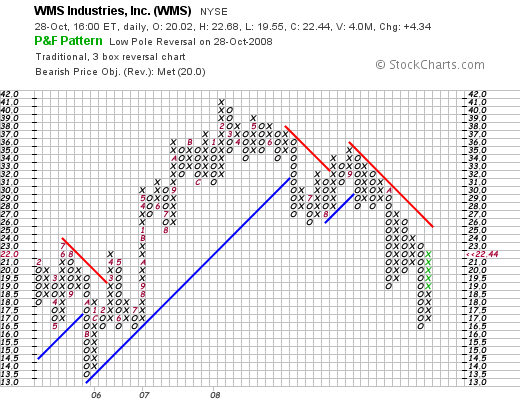

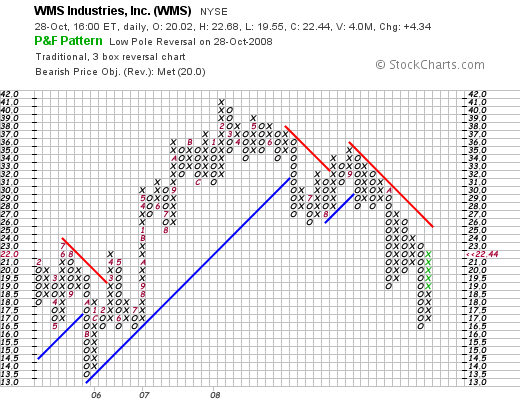

And what about the chart?

Looking at the "point & figure" chart on WMS from StockCharts.com, we can see what looks like a rather dismal chart to me! The stock failed to move higher in September, 2008, at the $36 level and has been trading under the 'resistance line' since. I would like to see this stock break through the $27 level to reaffirm the change in price momentum.

Summary:

The market has been tossing me wildly like a ship in the midst of a storm. I am learning to adapt---giving my last 5 holdings a larger leash before selling, and I am reducing the size of my replacement positions without changing my underlying strategy. I hope this works.

I sold my National Oilwell Varco stock (NOV) and replaced that fifth position with WMS Industries (WMS), a gambling machine stock. I did so because of a strong quarter which exceeded expectations on revenue and earnings, a solid Morningstar.com report, and reasonable valuation. The chart however looks awful. I hope this approach works out!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadvicefortocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 4:31 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 28 October 2008 4:41 PM CDT

Monday, 27 October 2008

Haemonetics (HAE) and BE Aerospace (BEAV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website.

I must be a glutton for punishment. After having sold two of my positions earlier today, I started looking at the lists of top % gainers to see if I could find any new candidates for the portfolio, utilizing my new reduced investment size strategy I discussed in the previous entry.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

Briefly, Haemonetics today reported 2nd quarter results for the quarter ended September 27, 2008. Revenue climbed 20% to $145.9 million, and earnings came in at $14.8 million or $.57/share up from $11.2 million or $.42/share last year. This exceeded expectations of profit of $.52/share on revenue of $136.3 million according to analysts polled by Thomson Reuters.

The company also went ahead and raised guidance for fiscal 2009 to $2.38 to $2.44/share, up from prior guidance of $2.33 to $2.43/share. They also expect revenue growth of 12 to 14% from prior range of 10 to 13% expected revenue increases.

The "5-Yr Restated" financials from Morningstar.com appear solid.

The stock looked good to me and I added Haemonetics to my portfolio.

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

With BEAV at $9.74, this would represent a loss of $(1.45) or (13)% since purchase. This is still above my (16)% loss limit with these last five holdings but just barely above a sale.

What drove the stock to the top % gainers list (at least when I was looking at it) was the announcement of 3rd quarter results today with revenue climbing 37% to $587.8 million. Net income came in at $51.8 million or $.54/share up from $44.5 million or $.48/share last year. Analysts had been expecting earnings of $.53/share, so they exceeded analysts expectations.

The Morningstar.com "5-Yr Restated" financials on BEAV appear relatively solid.

It was my hunch that purchasing shares of an airplane interiors manufacturer might well be the benefit from the declining oil price. I hope that wasn't a stretch!

Anyhow, that brings you up to date. I shall continue to do the impossible, swim upstream against this bear market like the most dedicated of Salmon.

Thanks so much for stopping by and sharing with me my own investing adventure. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Refining My Investment Strategy in the Face of a Bear Market

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on infrmation on this website.

One of my biggest goals from blogging about investing and sharing with all of you my decisions and trades is to develop a coherent approach to selecting stocks and managing my holdings in a fashion that preserves my gains, limits my losses, and adjusts my exposure to equities depending on the market environment.

If you have read some of my latest posts, you will notice that my approach has struggled in this awful market environment. My investment strategy is to vary my holdings between 5 and 20 positions and to use sales on gains as signal to buy new positions (except if I am at my maximum of 20), and to use sales on losses as a signal of a poor market environment and simply to 'sit on my hands' with the proceeds of these sales unless I am at the minimum of 5 positions in which case, a 'buy' signal would be generated to keep me at my minimum equities exposure.

It is in this 'under 5 positions' environment that my system has apparently broken down. To take serial (8)% losses only to replace these positions with new holdings that quickly accrue another loss is to compound my poor performance. And I have been busy compounding :(.

So as of today I have implemented two changes that I would like to present and look forward to some of your comments.

As I have alluded to recently, when I am at 6-20 positions, no changes will be made. However, at 5 or less, I shall first of all be more tolerant of losses. That is, while normally I sell holdings after an initial purchase at an (8)% loss, in this minimal position mode, I shall increase my tolerance to losses to (16)%. This is necessary due to the increased volatility of the entire market where the Dow routinely swings hundreds of points each trading day.

The other refinement is regarding the size of positions. Up to this point, I really haven't had a consistent approach. Position sizing will affect all of my purchases whether below 5 or approaching 20.

Again, I mentioned earlier that I would buy a '1/2 position' in the under 5 environment. To make this more exact, I will drop my fascination with buying shares divisible by 7 (to prepare me for my 1/7th sale at a gain), but rather if buying a holding to get my portfolio back to the 5 position minimum, I will determine the actual average size of my remaining holdings, and then purchase enough shares of the new position to equal 1/2 of that average.

After getting back to 5 positions, assuming an appreciation of one of my holdings to my partial sale at a gain (30% appreciation over the initial purchase price) I shall continue to sell 1/7th of my holding, and then add a position equal to the average size of my existing holdings.

This will deal with two situations. First in a poor environment as holdings are sold sequentially at less than 5 positions, I shall continue to add new positions that are smaller in size each time---equalling in size to 1/2 of the average of the current holdings.

As the market improves in tone, I shall add new positions equal to the average holding size, which assuming market improvements, will also increase in size over time.

Will this work? I am not sure. However, it has to be better than my current approach. Rules are no guarantees to success, but thinking about trading rules ahead of time is more likely to provide me guidance better than 'from the hip' trading decisions.

I will keep you posted. Meanwhile, if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Covance (CVD) and Imperial Oil (IMO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Clearly my investment approach shows the greatest weakness on severe contractions and large degrees of volatility in the market. While trying to step aside and then re-enter equities, I feel like I have been getting my face slammed in a revolving door over and over again.

I may have gotten smacked once more :(.

As I discussed previously, I have adjusted my own trading system to reduce the number of trades in a very down market by increasing my loss tolerance to (16)% losses on my last five positions.

Even this apparently is not enough.

Earlier today I sold two of my five remaining positions. I sold my 102 shares of Covance (CVD), which has been behaving particularly weak this past week, at $48.23/share. These shares had been acquired 4/9/07 at a cost basis per share of $62.61. Thus, I had managed to incur a loss of $(14.38)/share or (23)% since purchase. Out they went.

I also unloaded my recently acquired shares of Imperial Oil (IMO) at $29.31. These shares were just acquired 10/20/08 at a cost basis per share of $35.17. Thus, I had quickly incurred a loss of $(5.86)/share or (16.7)% since purchase.

Yikes.

So I am now down to three positions: Graham (GHM), National Oilwell Varco (NOV), and Rollins (ROL). I shall try to hang onto those unless they too incur a (16)% loss.

At least for the time being.

And on any new positions, I shall try to limit their size to 1/2 of the average size of the remaining positions. In this way, my committments to the market should diminish if I tend to be 'whip-sawed' frequently into buying and then selling positions as the market gyrates.

Will this work?

I frankly don't know. My brilliance is rapidly losing its shine. My performance is moving right to the mean and I am ready for this bear market to be over. (Even though that may take months or years!)

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

I do not like to get whipsawed and do so publicly. And yet, I am committed to implementing my own idiosyncratic system of limiting losses and responding to market influences in some sort of rational fashion.

One of my favorite activities on this blog is to receive and respond to emails. I am always interested in discussing stocks and my methods with fellow investors who are also interested in understanding investment methods.

One of my favorite activities on this blog is to receive and respond to emails. I am always interested in discussing stocks and my methods with fellow investors who are also interested in understanding investment methods.  All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares.

All of the stocks I own I consider "great companies". But they do not always perform as I would like (move higher). I have changed my strategy when down to the minimum of 5 positions, as I have written about previously. I continue to try to have a minimum of 5 holdings, but I can tolerate a 16% loss, and after they hit that loss and are sold, I replace them with a smaller position. I actually now determine the average size of my remaining holdings and buy a new position at 1/2 that size as measured by the cost of the purchase---not the number of shares. Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

Back to four positions in my trading portfolio, I had a new 'permission slip' to be buying a stock. However, this purchase would necessarily be smaller, representing 1/2 of the average size of my remaining four holdings.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day. Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)