Stock Picks Bob's Advice

Sunday, 30 November 2008

A Reader Writes: "Maybe stock selection is worthless." and a closer look at my Trading Portfolio!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

Doug wrote:

"You have been very quiet both publicly and privately recently. Any thoughts where the general market may be heading short term? Individual stock selection has been a waste of time(and money) for the last few months."

Doug, you are right on the mark with this letter. I have indeed been a bit 'quiet' and share your own sense of discouragement at the relentless correction and bear market we have been experiencing. So many 'right' stocks have been acting simply 'wrong'!

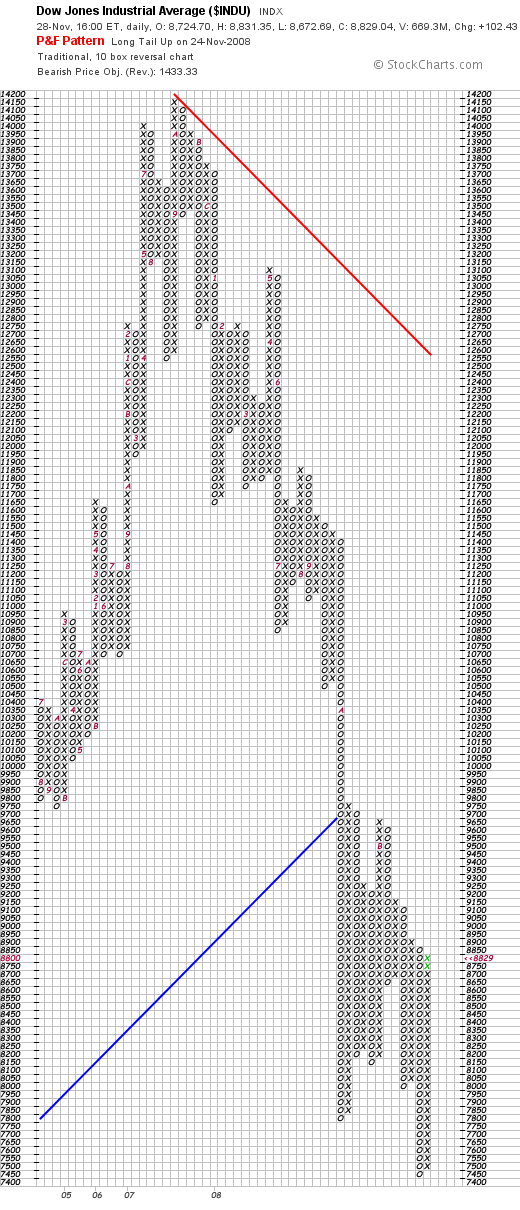

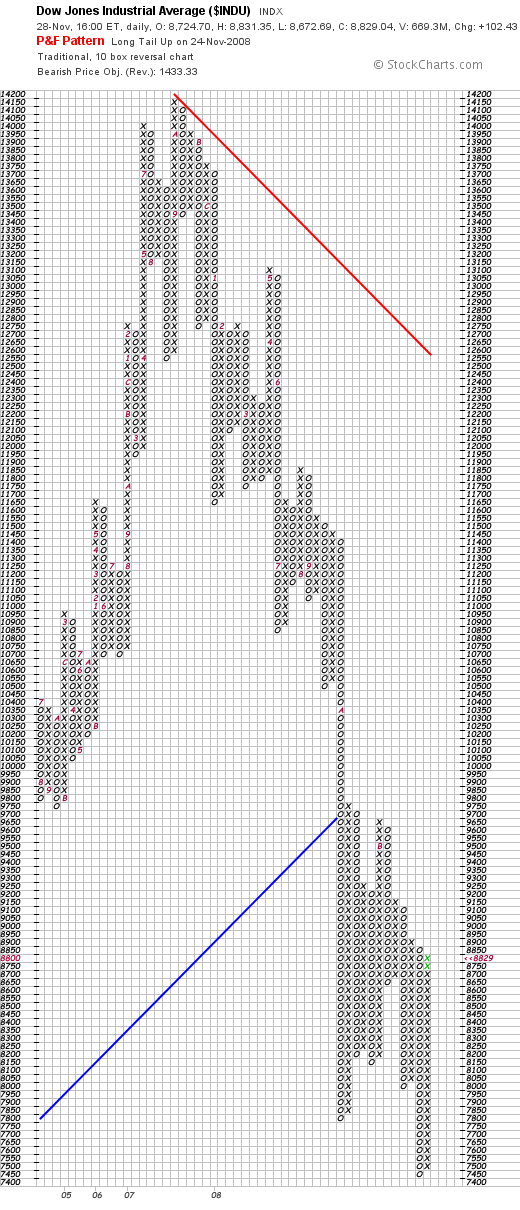

Using my 'point & figure' approach to charts, let's take a look at a point & figure graph from StockCharts.com on the Dow:

We can see that the Dow peaked at about 14,150 in October, 2007, and hit a recent low this month (November, 2008) at about 7,450. The stock market is currently rebounding and closed at 8829 on November 28, 2008. The chart is, however, far from encouraging. The trend appears to continue to be lower--with lower lows and lower highs. At least technically, I don't see anything that appears to be very promising.

Sorry to be so gloomy. But I can see what everyone else is looking at as well.

So what is an investor to do?

I feel like hibernating like this bear. Oh that is a very mixed metaphor so excuse me :)

But I do not believe that picking stocks is now obsolete. It is just that the over-riding influence on all of our investments has been the "M" in CAN SLIM.

My approach to investing has always been that I would try to maximize my own investments by picking what I thought were the 'best' stocks to own and yet being quite aware of the possible effects of both a climbing 'bull' market as well as the ravaging effects of a 'bear' market!

In fact, my own approach which reduces my holdings down to a minimum of 5 (out of a maximum of 20) positions was not even adequate to deal with the tremendous correction we are facing. Thus, I recently reduced my 'replacement' positions in the bottom 5 to 1/2 of the average of the remaining holdings. In addition, in light of the record volatility of the market with hundreds of points in both directions in the same day becoming the norm, I have expanded my exposure to loss in any individual holding to 16% from 8% in my bottom 5 holdings only.

So I share your frustration. But I believe that we are closer to the bottom than the top and that the market will actually start moving higher before the recession is over, moving in anticipation of the actual economic recovery.

I have always pointed out that I am not able to call a bottom, a top, or anything in between. However, as an observer of the market, I can respond to the actions of my own portfolio that I hope will continue to generate 'signals' to let me know whether I need to continue to pull back from equities or whether it is time to shift some of my cash position into new holdings.

As part of my own effort to respond to the market when it does turn positive, I have changed my own arbitrary sizing rule for positions to the 125% of the average of my holdings on purchases above my minimum of five holdings, and have, as I have indicated, reduced the position sizes to 50% of the average holding on replacement purchases to maintain my five position exposure minimum.

I hope that these strategies will help me respond to market opportunities yet continue to allow me to protect my account value in the face of a savage bear market.

Speaking of my holdings, let me use this opportunity to briefly review my five holdings. This list will show the names of the stocks, their symbols (in alphabetical order of their trading symbols), the number of shares held, date of purchase, the cost basis, latest price (11/28/08), and the % gain or (loss).

Current holdings:

Haemonetics (HAE), 50 shares, 10/27/08, $51.70, $57.19, 10.62%

Johnson Controls (JCI), 95 shares, 11/20/08, $14.80, $17.66, 19.05%

PetSmart (PETM), 104 shares, 11/20/08, $15.58, $17.55, 12.67%

Rollins (ROL), 350 shares, 10/16/08, $14.69, $17.32, 17.91%

WMS Industries (WMS), 83 shares, 10/28/08, $20.12, $24.65, 22.49%

In terms of my overall portfolio, I currently have $21,903.32 in a Money Market account, and $14,470.35 in equities as described above. As of 11/28/08, I have $2,044.86 in unrealized gains in my trading account and this year, I have a net gain of $609.10, resulting from net short-term losses of $(8,679.66) and net long-term gains of $9,288.76. The total account value is $36,374.27. I am currently adding $200.00/month in new cash into the account each month.

My entire strategy is a very tedious business. When the market turns around, I am likely be slow in re-entering, but I shall commit new funds in a methodical fashion as my own stocks indicate. In the same fashion, if the bear market continues, I shall strive to protect my account with the same conservative stock management that has served me well thus far.

I am not sure if I adequately answered your question and comments Doug, but I came out of my slumber for a short while to write. Now, back to that cave and some more sleep. Will someone please wake me when it is all over :).

If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 20 November 2008

Esco Technologies (ESE), PetSmart (PETM), and Johnson Controls (JCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is acting in what is for me an unprecedented fashion.

The market is acting in what is for me an unprecedented fashion.

How do you explain a stock market that drops another 444.99 points today to 7,552 on the Dow, or another 70.30 points on the Nasdaq to 1,316? I guess you don't.

Needless to say that "M" in CAN SLIM, as William O'Neil would say is determining the performance of all of my holdings. And I was disappointed today that I needed to sell my 47 shares of Esco (ESE) at $27.27. These shares were purchased literally just days ago at $32.73, so in this short period of time I incurred a loss of $(5.46) or (16.7)% since purchase.

Since this position is one of my final five positions, as I have pointed out elsewhere, I have tried to tolerate the greater volatility in the market with (16)% loss limits (instead of my usual 8% loss limit). Even so, within days this stock managed to dip that 16% and I sold my shares this morning. The market deteriorated into the final hour (as it has been tending to do on a regular basis), and ESE closed at $25.97, down $(2.18) or (7.74)% on the day.

This is in no way a reflection on the underlying fundamentals of this stock, as far as I can tell, but rather on the underlying fundamentals of the entire market. Esco had great quarterly results reported just days ago, and as I wrote in my earlier post, a very nice Morningstar.com '5-Yr Restated' financials page.

But the powerful downward plunge of this market is 'lowering all ships' and Esco (ESE) is no exception.

I sold my shares and paradoxically, since I was then down to 3 positions, this generated a buy signal giving me the opportunity to purchase two positions, albeit reduced in size, to bring me back to my minimum of 5.

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced good earnings, at $15.50/share, and thinking that the entire automotive industry might yet be 'saved', I thought it might be a good time to venture back into my 'old favorite' Johnson

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced good earnings, at $15.50/share, and thinking that the entire automotive industry might yet be 'saved', I thought it might be a good time to venture back into my 'old favorite' Johnson  Controls (JCI) and purchased 95 shares at $14.75.

Controls (JCI) and purchased 95 shares at $14.75.

PETM gave up much of its earlier gain before the close, itself being caught in the downdraft, and closed at $14.84, up $1.52 or 11.41% on the day. JCI closed down a little less from my own purchase at $14.14, up only $.07/share on the day or 0.50%.

I am back to my minimum of 5 positions. But with each of these purchases, I continue to shrink the size of my holdings, and shift a little more each time over to cash.

Currently my 5 positions add up to about $11,000 in value, and my cash position in my ever-shrinking portfolio is at $22,000. And to think that just months ago I was listening to my son tell me I needed to get out of margin. My portfolio management strategy is working, albeit in fits and starts, to shift me into cash while allowing me to continue to have equity holdings to direct my own future sales and purchases!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 19 November 2008

Why Portfolio Management is Essential to Preserving Capital

What is an individual investor to do?

Is the market closer to the bottom or the top? Is it too late to sell or should one move to cash? Is it time to 'bottom-fish'? Are we on the verge of a Great Depression 2 or is 2009 to find us with indices pushing towards new highs?

I will be the first to tell you I don't know the answers to the above questions.

I am not sure anyone really knows.

But I do believe that each of us has the power to implement disciplined approaches to our own portfolios that may assist us to avoid excessive exposure to equities when times are bad and help us to know when to be adding to equities when the market firms up and improves profit possibilities for investors.

What I have been doing isn't very complex.

I have been using the actions of my own holdings to direct me to either be adding to stocks or moving from stocks into cash. It is that simple.

I am not sure this is a profitable approach; certainly there must be better ways to go about all of this. I just know that I find it helpful.

Without discussing the which stocks I buy which I have written about elsewhere and shall certainly write up again, let me simply suggest that from my approach I am trying to own only the highest 'quality' stocks on the market. We each may define quality differently, but there may be reasons why managing our holdings in response to market actions may be wise.

My approach is based on the belief that market actions may be interpreted through the price changes within our own portfolios of holdings.

Like a barometer responding to atmospheric pressure, my own portfolio is built to drift between 5 and 20 positions depending on the market's effects on my own holdings.

Assuming that a maximum of 20 positions is utilized, I believe that 10 positions would be a neutral posture, 5 is most conservative, and 20 is most aggressive. Once I have my holdings I either add positions (assuming I am under 20 positions), or sit on my hands with the proceeds---moving to cash (assuming I have at least 5 positions)---based on targeted moves higher or lower of my individual stock holdings.

These permission slips or directives to avoid reinvesting proceeds are the indicators I use to posture my own holdings. It is that simple.

I have set appreciation targets for partial sales at 30, 60, 90, 120, 180, 240, 300, 360, 450%...etc., at which point I sell 1/7th of my remaining shares of that holding. These sales are considered sales on 'good news' and they generate the signal to add a new position (unless at 20 in which case I do the opposite---sit on my hands).

On the other hand, sales on declines are used as indicators of sickness of the overall market environment as evaluated through the eyes of my own holdings. Targeted sale points are either at an (8)% loss (if I own 6-20 positions) or (16)% losses (if I own 5 or less positions). I have increased my loss limit for my last 5 positions to reduce my own trading velocity in a declining and highly volatile market. In addition, after a first sale of 1/7th of a holding at a 30% gain, I sell all of my shares if the stock should decline to break-even, or sell my entire position if a stock has reached two or more appreciation targets (60% or higher), I move my sale point up to 1/2 of the highest % sale. In other words, if I happened to sell a stock 3 times (1/7th of holdings each time) at 30, 60, and 90% holdings, I would move my sasle point up to 1/2 of 90% or at a 45% appreciation target for ALL remaining shares.

These 'bad news' sales generate a directive to NOT reinvest funds and instead to 'sit on my hands' unless I am at 5 or less positions. In those particular cases, which I currently find myself in, these sales paradoxically do generate a buy signal to get me back up to my minimum of 5 holdings. However, in my continued recognition of the need to shift from equities to cash in these situations, I have recently modified the purchase to a smaller holding--representing 1/2 of the average size of the remaining positions.

In fact, I have recently also been doing some more thinking on position size. As above, when buying to replace one of the last 5 holdings, I buy enough shares for 1/2 of the average size of the remaining positions. However, as the market presumably improves its tone and I wish to start once again increasing my exposure to equities, for positions 6 through 20, I plan on adding 125% of the size of the remaining positions.

These sales and movement into cash and back again, and these position sizing allows me the opportunity to automatically respond to market actions in some sort of rational fashion.

I hope that the current currection is short-lived, although I have my doubts about that. In any case, I am positioning my portfolio to continue to have exposure to equities but to work hard at listening to my own portfolio as my own holdings let me know how to deal with the overall market.

Thanks so much for bearing with me. I wanted once again to lay out my strategy in some detail. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 2:14 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 20 November 2008 12:08 AM CST

Rock-Tenn Co. (RKT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am not pleased to report that one of my five holdings, Rock-Tenn (RKT) has hit a sale point on a drop in price. But exactly that happened this morning and I sold my 93 shares of Rock-Tenn at $27.75. These 93 shares were acquired earlier this month on 11/4/08 at a cost basis of $33.15. Thus, these shares had incurred a loss of $(5.40) or (16.3)% since purchase.

I am not pleased to report that one of my five holdings, Rock-Tenn (RKT) has hit a sale point on a drop in price. But exactly that happened this morning and I sold my 93 shares of Rock-Tenn at $27.75. These 93 shares were acquired earlier this month on 11/4/08 at a cost basis of $33.15. Thus, these shares had incurred a loss of $(5.40) or (16.3)% since purchase.

Reflecting my current portfolio management strategy which requires me to have at least five positions and a maximum of 20 positions, and yet recognizes the special purchases that are involved at the bottom end of my equity exposure spectrum, I now tolerate a (16)% loss before selling one of my minimum of 5 positions. Thus with this sale, I now have a 'buy signal' to be looking for a new holding that fits into my own requirements for stocks. I am unlikely to find anything today, at least with the Dow down currently (211) points at 8213.

In addition, my strategy requires me to replace this position with an even smaller holding amounting to 1/2 of the average size of the remaining four positions. Thus, even while I maintain exposure to equities with these minimum of 5 holdings, I continue to shift my funds, albeit slowly, into cash in the face of the continued evidence of the continued bearish market environment.

My own sale is not based on any fundamental problem that I have observed with Rock-Tenn (RKT). Indeed with the decline in price it may well represent an increasing good value for that investor so inclined to evaluate stocks on that basis. Indeed as you may recall from my previous write-up on RKT, they reported outstanding earnings on November 3, 2008, which led me to my own purchase of shares. In addition, the 5-Yr Restated financials on Morningstar.com are also attractive.

But my own purchases, which are based on these fundamental findings, are separate from my sales which are price-dependent both on the upside as well as the downside. I respond to price movement with sales and adjust my own investment posture towards my entire portfolio as well.

Thank you for bearing with me as we all suffer from the ongoing market correction that is dragging down values of portfolios, retirement accounts, and is making this amateur investor feel much less than brilliant, totally humbled, and aware of limitations facing each of us as we try to respond to challenges not previously imagined.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 17 November 2008

Is it Time to Bring Back Savings Stamps?

In 1961 I was in the second grade at Fort Ord III Elementary in Monterey, California. I don't remember much about school. I worked hard and was always proud of my report card that I brought back for my mom.

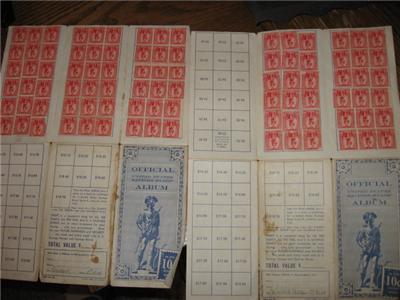

One thing I do remember was that I found Savings Stamps to be something that was sold at school and I put together a savings book to get enough stamps to buy a Savings Bond. 1961 was the last year Savings Stamps were issued.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

I know I would.

I know my children would.

I have been meaning to write up this blog post so many times, but decided to do so this evening for whatever reason. With our nation building up our debt with stimulus packages for our banks, for our auto industry, for out insurance companies, for our money market funds, and for whatever is next, isn't it time we asked our citizens to reach into their pockets and purchase Savings Bonds?

And what a great way to do so with Savings Stamps that can be purchased with the change we have in our pockets. We can dispense them at gas stations and grocery stores, post offices and malls. Wherever people congregate. Wherever they go to school. We can teach our children once more about investing in their nation. And make it real easy. What a great habit.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

What could be wrong about that?

If you like this idea, forward this to your Congressman or Congresswoman and ask them 'Why not?'. And tell them Bob sent you :).

Yours in investing,

Bob

Posted by bobsadviceforstocks at 11:01 PM CST

|

Post Comment |

Permalink

Updated: Monday, 17 November 2008 11:06 PM CST

Sunday, 16 November 2008

NEW PODCAST on Haemonetics (HAE) and "Investment Philosophy" and "Position Sizing"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Click HERE for my podcast on "Investment Strategy, and Haemonetics (HAE)".

Thanks for visiting!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing!

Bob

Thursday, 13 November 2008

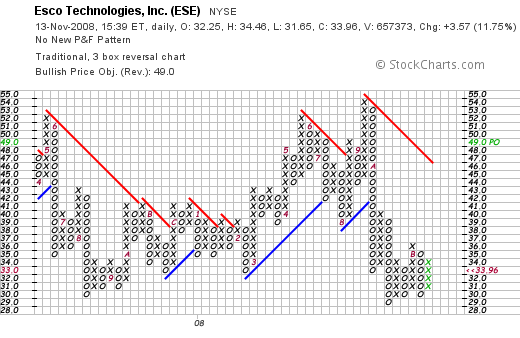

Esco Technologies (ESE) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please rememeber that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier this morning, with the market appearing to move moderately higher (before a dip and then another rally!), I looked to find that 5th position to complete my 5 position minimum in my portfolio. Applying my reduced size strategy, the average size of the other 4 positions was $3000, so looking to invest 1/2 of that amount to complete my five postion minimum, I saw that Esco (ESE), one of my old favorites on the blog was on the list of top % gainers on the NYSE, and I purchased 47 shares at $32.56/share.

Earlier this morning, with the market appearing to move moderately higher (before a dip and then another rally!), I looked to find that 5th position to complete my 5 position minimum in my portfolio. Applying my reduced size strategy, the average size of the other 4 positions was $3000, so looking to invest 1/2 of that amount to complete my five postion minimum, I saw that Esco (ESE), one of my old favorites on the blog was on the list of top % gainers on the NYSE, and I purchased 47 shares at $32.56/share.

As I write, shortly before the close of trading today, Esco (ESE) is continuing to move higher (along with the rest of the market) and is quoted at $34.36, up $3.97 or 13.06% on the day. Relative to my own purchase price, the stock is higher by $1.80 or 5.5% since my acquisition of shares.

Let me try to briefly review some of the things that led me to select Esco today to fill out my minimum portfolio holdings. First of all, after the close of trading yesterday, Esco announced 4th quarter 2008 and full year results. For the quarter ended September 30, 2008, the company reported net sales of $196.0 million, a 40.1% increase over the same quarter last year's result of $139.9 million in sales. Net earnings came in at $20.1 million, up 34.9% from last year's $14.9 million result or on a per share basis, this worked out to$.17/share, up over 100% from $.07/share last year.

Longer-term, if we review the Morningstar.com "5-Yr Restated" financials on ESE, we can see the steady rise in revenue from $397 million in 2003 to $528 million in 2007 and $651 million in the trailing twelve months (TTM). Earnings have been a bit less consistent increasing from $1.00 in 2003 to a peack of $1.70 in 2005, before dipping back to $1.20 in 2006 then increasing steadily once again to $1.70/share in the TTM. No dividend is paid. The outstanding shares have been very stable at 26 million in 2003 and 26 million in the TTM.

Free cash flow is positive but decreasing (not a positive sign imho), with $60 million in 2005, dipping to $50 million in 2006 and $26 million in 2007. The balance sheet appears adequate with $23 million in cash and $223 million in other current assets, resulting in a total of $246 million in current assets which when compared to the $135.1 million in current liabilities, yields a current ratio of 1.82. The company has an additional $308.9 million in long-term liabilities per Morningstar.

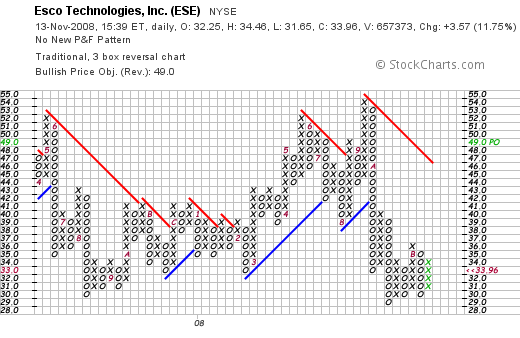

Looking at the "point & figure" chart on Esco from StockCharts.com, we can see that after peaking at $54 in September, 2008, the company continues to be under pressure, bottoming at $29 in October, 2008, and appearing to be trying to work its way slowly higher. This appears fairly typical for the severe bear market that we find ourselves in today.

In terms of valuation, looking at Yahoo "Key Statistics" on Esco (ESE), we can see that the company is a mid-cap stock with a market capitalization of $883.89 million. The trailing p/e is 22.94, but with the rapid growth expected, the forward p/e (fye 30-Sep-09) is only 15.57. Thus, the PEG ratio comes in at a very reasonable 0.61.

In terms of valuation, utilizing the Fidelity.com eresearch website, we can see that the Price/Sales (TTM) ratio of 1.33, is higher than the industry average of 0.66. Even by profitability, the Retorn on Equity (TTM) comes in at 10.25%, compared ot the industry average of 20.87%. Neither of these indices come out particularly flattering to ESE relative to its peers.

Finishing up with Yahoo, there are 26.04 million shares outstanding with 25.34 million that float. Currently, there are 2.42 million shares out short (as of 10/10/08), representing 8.1 trading days. This is significant relative to my own arbitrary '3 day rule' for short interest.

As noted, no dividend is paid, and the last stock split was a 2:1 split back on September 26, 2005.

To summarize, being under my 5 position minimum (my own trading rule), I had a 'permission slip' to be adding another position to bring be back to my minimum in equities exposure. Esco made the list today, was a fairly good fit for my blog and my strategy and I purchased a 'reduced' position for my trading account. The latest quarterly report was strong, the last 5 years have been strong, valuation is reasonable with a PEG well under 1.0, but the chart looks rather dismal.

It is good that I have a little price appreciation today as so many of the time I have purchased shares recently on a positive earnings announcement, many have declined on profit-taking even the same day. The follow-through today is encouraging.

Thanks again for stopping by and visiting! If you have any comments or questions, please leave them on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 12 November 2008

Anticipating a Bull Market: Reconsideration of Position Size

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your investment advisers prior to making any investment decisions based on information on this website.

I have been tinkering with my investment strategy recently. As I have discussed previously, my portfolio management system requires me to be invested with at least some exposure to the market, regardless of the health or tone of the underlying business climate.

I have been tinkering with my investment strategy recently. As I have discussed previously, my portfolio management system requires me to be invested with at least some exposure to the market, regardless of the health or tone of the underlying business climate.

For me that means owning at least 5 positions at most times (I am presently at 4 waiting to find something to buy to bring it back to 5 after selling my BEAV shares this morning). I do this because my own strategy depends on the actions of my own holdings to let me know whether I should be moving further into equities or moving instead towards cash.

Sales on good news generate 'buy signals' to add positions (assuming I am under 20 holdings), and sales on bad news--or declines--generate the opposite signal---that is they instruct me to 'sit on my hands'--unless I am at my minimum of 5--in which case these sales also give me a buy signal (as I received with my sale of my BE Aerospace shares this morning).

However, instead of buying a 'full' position, I am purchasing a reduced position equal to 1/2 of the average size of the remaining four positions. Thus, instead of just continuing to compound my losses over and over on the way down, I do a bit of compounding but continue to pull back from stocks each transaction with continuing reduced exposure to equities.

I hope you follow.

I have assumed that on the way up, I would instead add an 'average' of the remaining positions as the size of the new holding.

But that isn't enough.

Otherwise I would be adding a tiny position resulting from past sales. I need to be a bit more aggressive than that.

With that in mind, I am proposing on the way up that I shall be adding positions that are 125% of the average. Thus in that way, I shall be putting my foot on the accelerator just like I put my foot on the brake pedal when times are bad. I need to commit greater amounts of funds to the market as the eventual bull market unfolds.

Is 125% the right amount? I don't know. It took me awhile to get to the 1/7th position sales on the upside. If you all have a better idea, please feel to leave your comments on the blog or email me at bobsadviceforstocks@lycos.com.

This is all new to me. But it makes intrinsic sense in the midst of the chaos that is Wall Street.

Wish me luck. I wish all of you luck as well!

Yours in investing,

Bob

BE Aerospace (BEAV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There are many things to like about BE Aerospace (BEAV). That is why I recently added it to my portfolio. Things like the great recent quarterly result, and the "5-Yr Restated" financials from Morningstar.com.

There are many things to like about BE Aerospace (BEAV). That is why I recently added it to my portfolio. Things like the great recent quarterly result, and the "5-Yr Restated" financials from Morningstar.com.

But this blog is not about a love-fest of stocks. It is about building a portfolio of terrific stocks of terrific companies and then managing that portfolio of stocks in response to the vagaries of the market--the bullish and bearish influences that bear down upon each of us.

Recently I have modified my trading strategy to acknowledge that there are times that are so terribly negative that naively replacing stocks on 8% losses and continuing to maintain the same size of positions only allows a certain compounding of losses.

To deal with the negative environment that drives me down to under 5 positions (my minimum), I have chosen to do two things: to reduce my replacement size of a position being replaced to maintain that minimum to 1/2 of the average size of the remaining positions, and to allow each stock to dip to a 16% loss (instead of an 8% loss) to hopefully avoid unnecessarily replacing stocks that are victim of the increased volatility we are all observing.

Directly to the point, my BE Aerospace (BEAV) stock hit a 16% loss this morning, and I sold my 215 shares at $9.4154. I had just purchased these shares 10/27/08 at $11.23, thus I had a loss of $(1.81) or (16.15)% since purchase.

With my holdings now down to 4, I have another "permission slip" in my pocket to purchase a new position to make 5, however, I am not in a big hurry to do anything. After having burnt my fingers over and over in this treacherous market, the nickel feels rather cool in my pocket.

Doesn't appear to be burning a hole at all this time!

Thanks again for visiting. I shall continue to update my own actions and thoughts on this market.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 5 November 2008

Expeditors International of Washington (EXPD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I do not like to get whipsawed and do so publicly. And yet, I am committed to implementing my own idiosyncratic system of limiting losses and responding to market influences in some sort of rational fashion.

I do not like to get whipsawed and do so publicly. And yet, I am committed to implementing my own idiosyncratic system of limiting losses and responding to market influences in some sort of rational fashion.

Earlier this morning the market handed me my quick 8% loss on Expetitors (EXPD) and I sold my 45 shares at $36.8506. These shares were just purchased yesterday, yes yesterday, at a price of $40.1894. Thus, my loss was $(3.34) or (8.3)% since purchase. With this being the sixth position in my portfolio, I am implementing my (8)% loss limit, and now back to five positions, my loss tolerance is increased to (16)% with the 'final five' of my 20 position maximum.

I hope this all makes sense.

My sale of EXPD is not representative of any dislike of this stock. I find the numbers on this company intriguing, the consistency of growth, etc.. My sale is just a reflection of my own amateur attempt of limiting losses and responding to market influences. The volatility is just killing me though.

I know there are lots of readers over at Seeking Alpha who are pointing out the VIX levels and I am learning this the hard way.

Since my sale is at a loss, and I still am now at 5 positions (my minimum), I shall not be replacing this holding.

Thank you for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

The market is acting in what is for me an unprecedented fashion.

The market is acting in what is for me an unprecedented fashion.  With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced  Controls (JCI) and purchased 95 shares at $14.75.

Controls (JCI) and purchased 95 shares at $14.75. To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead. How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond? Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

There are many things to like about BE Aerospace (BEAV). That is why I recently added it to my portfolio. Things like the great recent

There are many things to like about BE Aerospace (BEAV). That is why I recently added it to my portfolio. Things like the great recent