Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. Use of this website implies your understanding that I cannot be responsible for any losses generated by your own trading activity and I shall not ask for any part of any profits that you might accrue.

Yesterday, I purchased some shares of Greif (GEF), and I wanted to go over the numbers and the information that I found on review of this company and why I thought it made a nice addition to my portfolio. Yesterday, GEF made the list of top % gainers on the NYSE, and thus was in my list of stocks to consider purchasing in light of my recent sale of a portion of Cantel (CMN) and Ventana (VMSI) at gain targets.

Yesterday, I purchased some shares of Greif (GEF), and I wanted to go over the numbers and the information that I found on review of this company and why I thought it made a nice addition to my portfolio. Yesterday, GEF made the list of top % gainers on the NYSE, and thus was in my list of stocks to consider purchasing in light of my recent sale of a portion of Cantel (CMN) and Ventana (VMSI) at gain targets. Currently, as I am writing, GEF is trading at $74.06/share, up $.41 or .56% on the day today.

Currently, as I am writing, GEF is trading at $74.06/share, up $.41 or .56% on the day today. According to the Yahoo "Profile" on GEF, Greif "...is a global producer of industrial packaging products with manufacturing facilities located in over 40 countries. The Company offers a line of industrial packaging products, such as steel, fiber and plastic drums; intermediate bulk containers, closure systems for industrial packaging products and polycarbonate water bottles, which are complemented by a variety of value-added services."

On March 2, 2005, Greif reported 1st quarter 2005 results. Net sales for the quarter rose 24% to $582.6 million for the first quarter of 2005, up from $468.9 million for the same quarter last year. Net income was $15.1 million this year compared with a loss of $(3.4) million last year. Diluted earnings per share came in at $.52/share compared to a loss of $(.12)/share last year.

On March 2, 2005, Greif reported 1st quarter 2005 results. Net sales for the quarter rose 24% to $582.6 million for the first quarter of 2005, up from $468.9 million for the same quarter last year. Net income was $15.1 million this year compared with a loss of $(3.4) million last year. Diluted earnings per share came in at $.52/share compared to a loss of $(.12)/share last year.How about longer-term? Looking at the Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown from $1.0 billion in 2000 to $2.3 billion in the trailing twelve months (TTM). Earnings have been more erratic, increasing to

$3.14/share in 2001, then dropping to $.34/share in 2003, but increasing since then to $2.30/share in the TTM.

Free cash flow has been solid, increasing from $90 million in 2002 to $175 million in the TTM.

The balance sheet is adequate if not overpowering. That is, cash of $56.1 million, combined with the $550.2 million in other current assets, is plenty to cover the $384 million in current liabilities and make a bit of a dent in the $761.2 million in long-term debt. I always prefer a bit more in the assets than liabilities.

What about "valuation"? Looking at Yahoo "Key Statistics" on GEF, we can see that this is larger mid-cap stock with a market capitalization of $1.69 billion. The trailing p/e is moderate at 25.62, with a forward p/e (fye 31-Oct-06) of 16.89. Thus the PEG is at 1.19, demonstrating rather reasonable valuation. The Price/sales is nice at 0.72.

What about "valuation"? Looking at Yahoo "Key Statistics" on GEF, we can see that this is larger mid-cap stock with a market capitalization of $1.69 billion. The trailing p/e is moderate at 25.62, with a forward p/e (fye 31-Oct-06) of 16.89. Thus the PEG is at 1.19, demonstrating rather reasonable valuation. The Price/sales is nice at 0.72.Yahoo reports 22.81 million shares outstanding with 16.20 million that float. Of these, as of 3/8/05, there were 418,000 shares out short representing a bit of a significant 5.359 trading days of volume, but only 2.58% of the float is actually out short.

This NYSE company does pay a small dividend of $.64/share yielding 0.87%. No stock dividends are reported on Yahoo.

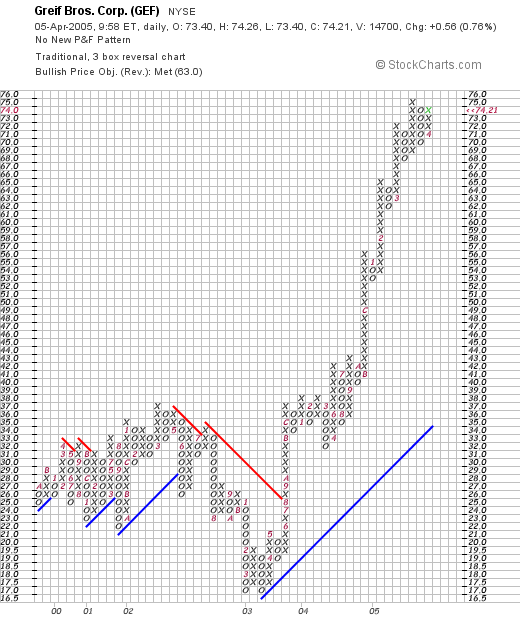

And how does the chart look like? Taking a look at a "Point & Figure" chart on GEF from Stockcharts.com, we can see that this stock demonstrated what I would call a rather lackluster performance between late 2000 when in was trading in a range between $25 and $31, when it actually broke down in price to a low at $16.50. Starting in March, 2003, the stock has rallied strongly to its current $74 level. If anything the graph looks a bit overextened with the stock price significantly above its support level (the 45 degree blue line on this chart)

Well what do I think? Well, looking closer at the stock, I can see attractive things that got me to make a purchase decision. Usually, I take a quick look before making a purchase and think later (lol). The latest quarter is great. The revenue growth is strong. Earnings have been a bit erratic. Free cash flow is solid. The balance sheet is fine. Valuation is reasonable. And the graph is strong if a bit overextended.

The stock, in the packaging industry, is something different from my usualy holdings in my portfolio, and thus, I felt it would be a helpful addition. Time will tell. I shall be keeping a close watch on this as I do all of my stocks!

Thanks again for stopping by. Please feel free to email me at bobsadviceforstocks@lycos.com if you have any questions, comments, or words of encouragement!

Bob