Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decision based on information on this website.

(Click HERE for the PODCAST on this entry)

I had another interesting email for the website that I would like to share with you. Vooch writes:

Hi Bob,Thanks Vooch for writing! I appreciate your interest in my blog and my podcast. I am glad you picked up a few ideas from my blog, and hope they are useful for you.

I love your Podcast! I've been listening to it a few days, and I

went back to listen to all the shows. I look forward to listening to

what you say every day. Your thought process is similar to mine, and

I've learned a few things (eg. morningstar and fidelity web features).

I've heard about your buy points (the sell 1/6th at

30,60,90,120,...), but could you elaborate on your sell points? How

do those work? Hypothetically, let's say a stock is taking a steady

decline to -95%, but you don't know it of course. What do you do as

the price keeps falling? Do you average down to improve your cost

basis? Or, do you sell portions off to eat the loss and reduce your

risk exposure?

Finally, I'd like to get your opinion of AEOS. I bought it a week

ago, and the stock dropped 6 out of 7 days or so, leaving me with a

current -13.55% loss (not including today).

Thanks,

Vooch

Let me get right to your questions. You write:

I've heard about your buy points (the sell 1/6th at 30, 60, 90, 120,...), but could you elaborate on your sell points?First of all, unless you wrote something you didn't intend, I believe you have misunderstood my strategy. These appreciation points: 30, 60, 90, 120, 180, 240, 300, 360, 450, 540...., are sell points and not buy points! That is these are points where I sell portions of my holdings on what I call "good" news, that is on an appreciation of the underlying holdings. For instance, if I purchase a stock at $10, I will sell ALL of my shares if the stock drops 8%, that is down to $9.20.

On the other hand, I will also start selling a stock as it appreciates. Currently, I am planning on selling 1/6 positions on gains of 30%, 60%, etc. In the case of this particular example, I would be selling 1/6 of my holdings if the stock hit the first 'appreciation point' representing a 30% gain or $13/share. This is not in any way a point at which I am buying shares. I am selling some of my holdings!

You write further:

Hypothetically, let's say a stock is taking a steadyI must of course point out with this discussion, that my approach is not necessarily the best way, the only way, or even always a profitable approach to investing. It is just the way that I am doing things currently!

decline to -95%, but you don't know it of course. What do you do as

the price keeps falling? Do you average down to improve your cost

basis? Or, do you sell portions off to eat the loss and reduce your

risk exposure?

Back to the question. If a stock is heading down hypotheticall -95% as you say, I shall not be owning it for long! Here are my trading rules for selling a stock on a decline:

1) If I have not sold any shares of this holding at a gain, then I shall sell ALL of the holding at an 8% decline from the purchase price.

2) If I have sold a portion of my holdings ONCE at a gain, that is I sold either 1/4 or 1/6 of my holding generally at the 30% appreciation point, then I will only allow a stock to fall back to the "break-even" stock price. Any lower and I plan on selling all of my remaining shares in that company.

3) If I have sold a portion of a stock more than once, then I will allow the stock to fall back to 50% of the highest appreciation sale point. That is if I sold 1/6 of my shares for the third time at the 90% gain level, I would plan on selling ALL of my remaining shares if the stock retraced back to a 45% appreciation level.

Other parts of your question: I do not average down. I do not sell portions of a stock as it

declines, I sell the whole thing.

Finally about American Eagle (AEOS). You commented on how you just purchased the stock and it has declined 6/7 days. Leaving you with a (13.55)% loss. In my portfolio, I would probably consider buying a stock like AEOS. I will review it in a second. But I wouldn't stay sitting on a (13.55)% loss. As soon as a stock hits an 8% loss, I sell the holding. I don't care if I have held the stock for one week or one year. The stock goes down, then out it goes.

Let's take a look at American Eagle Outfitters (AEOS). I do not own any shares nor do I have any options on this company.

Let's take a look at American Eagle Outfitters (AEOS). I do not own any shares nor do I have any options on this company. American Eagle Outfitters (AEOS) closed at $21.00 on December 2, 2005, up $.18 or 0.86% on the day.

American Eagle Outfitters (AEOS) closed at $21.00 on December 2, 2005, up $.18 or 0.86% on the day.First place to check things out on an investment is the news. Is there something there that you should know about the stock before committing money. Looking through the Yahoo Finance page on AEOS, I came across the November Same-Store Sales report. On November 30, 2005, AEOS reported that sales at stores open at least a year, gained 1.7% which was "far below analyst estimates." Even though total sales climbed 6.9%, much of this was due to new store openings.

In the news story:

The company said the results were below management's expectations, and cut its fourth-quarter outlook to earnings between 70 cents and 72 cents per share, from 73 cents to 75 cents per share, including a 2-cent tax charge. Analysts, on average, are expecting the company to earn 74 cents per share.Thus we have a real "double-whammy" to report---same store sales coming under expectations and the company lowering guidance to analysts. No wonder the stock has been retreating!

Let's look at the latest quarterly report. On November 15, 2005, AEOS reported 3rd quarter results. Total sales climbed 20.5% to $577.7 million from $479.6 million for the same quarter last year. Comparable store sales were up 13.6% in the quarter. (You can see how dramatic the slow down was for November). Net income was also up nicely at $73.3 million or $.47/diluted share, up nicely from the $57.9 million or $.38/diluted share the prior year.

Taking a look at the Morningstar.com "5-Yr Restated" financials on AEOS, the page looks perfect, with steady revenue growth, nice increase in earnings, which did dip from $.60 to $.41/share in 2004, but has increased to $1.77/share in the TTM. The company also pays a small dividend and recently increased it. Free cash flow is positive and growing, and the Balance Sheet is perfect with $950 million in combined cash and other current assets, easily exceeding aht $240.1 million in current liabilities and the smallish $87.6 million in long-term liabilites combined.

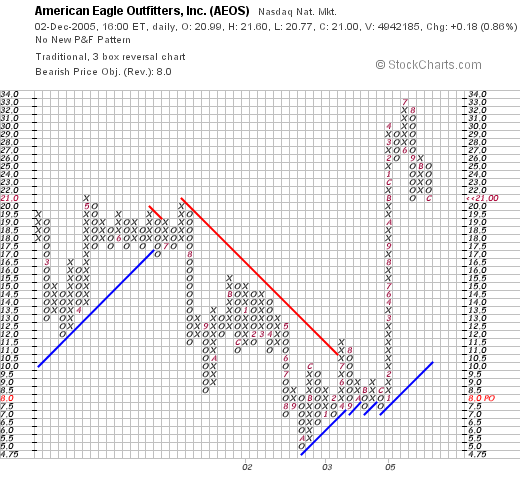

Taking a look at the Morningstar.com "5-Yr Restated" financials on AEOS, the page looks perfect, with steady revenue growth, nice increase in earnings, which did dip from $.60 to $.41/share in 2004, but has increased to $1.77/share in the TTM. The company also pays a small dividend and recently increased it. Free cash flow is positive and growing, and the Balance Sheet is perfect with $950 million in combined cash and other current assets, easily exceeding aht $240.1 million in current liabilities and the smallish $87.6 million in long-term liabilites combined.What about a chart? Taking a look at a AEOS "Point & Figure" chart from Stockcharts.com, we can see that the stock has been trading very erratically, increasing from $11.50 in 2001 to $21/share in July, 2001. The stock subsequently sold off, down to $4.75/share in Septeber, 2002, again moved higher, breaking through resistance at $11 in August, 2003. the stock is currently trading at the $20 level, and I don't see support on the chart until way down to around $11. Anyhow, that's an amateur take on this chart :).

So what do I think? The latest quarter was solid, the Morningstar.com report was great, and the balance sheet is o.k. What concerns me is the very latest bit of information on same store sales that are anemic, and the company reducing guidance on earnings. This isn't the combination that is likely to lead to a stock price appreciation in the short-term. That, at least, is my take on the matter.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 5:31 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 4 December 2005 8:19 PM CST

Updated: Sunday, 4 December 2005 8:19 PM CST