Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website as I am an amateur investor. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

One of the things I like to do on the blog, is to share with you my actual trading portfolio. I do this by posting trades as I make them and also by reviewing my holdings, one at a time, on the weekend. Going alphabetically, I am at Barnes Group (B), but since I just wrote about this stock that I just purchased this past week, we shall skip this review for now, and take a closer look at Dynamic Materials (BOOM). With 22 positions in my Trading Portfolio, and my occasional weekend that I skip, it should take me about 6 months to get through the list, allowing me to update my holdings about twice a year at this rate.

I first discussed Dynamic Materials (BOOM) on Stock Picks Bob's Advice on May 23, 2005, when it was trading at $37.64/share. BOOM had a 2:1 stock split on October 13, 2005, giving me an effective pick price of $18.82. Dynamic Materials closed 2/17/06 at $29.55, giving my 'stock pick' an effective gain of $10.73 or 57% since posting.

I first discussed Dynamic Materials (BOOM) on Stock Picks Bob's Advice on May 23, 2005, when it was trading at $37.64/share. BOOM had a 2:1 stock split on October 13, 2005, giving me an effective pick price of $18.82. Dynamic Materials closed 2/17/06 at $29.55, giving my 'stock pick' an effective gain of $10.73 or 57% since posting.I puchased 240 shares of Dynamic Materials (BOOM) on 12/5/05 at a price of $28.27. On January 27, 2006, I sold 40 shares (1/6th of my 240 share position) at a price of $37.50 for a gain of $9.23 or 32.6% over the purchase price. As you may know, the 30% appreciation point is a target for me in managing my portfolio and my strategy dictates that I sell a sixth of a holding at that level. Since I have now sold 1/6th of my position for one sale, my sale point on the downsite is supposed to be my purchase price. As an earlier entry has pointed out, I missed that sale, and the stock rebounded to a level above my purchase price. Thus, on the downside, my sale point for my remaining shares would be at $28.27, or on the upside, another 1/6th position (or 200/6 = 33 shares) would be at 1.60 x $28.27 = $45.23.

Let's take another look at Dynamic Materials (BOOM) and see if it still fits into my strategy on this blog!

First, the profile. According to the Yahoo "Profile" on Dynamic Materials, the company

"...engages in metalworking business in North America, western Europe, Australia, and the Far East. The company operates in two segments, Explosive Metalworking and Aerospace. The Explosive Metalworking segment utilizes explosives to perform metal cladding and shock synthesis. Its principal product is a explosion welded clad metal plate, which is used in the construction of heavy, corrosion resistant pressure vessels, and heat exchangers for petrochemical, refining, and hydrometallurgy industries. The Aerospace segment provides welding services principally to the commercial and military aircraft engine markets, and to the power generation industry."And how about the latest quarterly report?

On November 8, 2005, BOOM announced 3rd quarter 2005 results. For the quarter ended September 30, 2005, sales advanced 68% to $20.2 million vs. $12.1 million the prior year. Net income grew 278% to $3.2 million or $.52/diluted share, up from net income of $.8 million or $.16/diluted share in the same quarter last year. Even sequentially, from the immediately prior quarter, net income increased 49% from $2.1 million or $.35/diluted share in this year's second quarter. This was a solid performance for this company!

How about longer-term? Looking at the Morningstar.com "5-Yr Restated" financials on BOOM, we can see the strong, if somewhat inconsistent, revenue growth from $24.3 million in 2000 to $54.2 million in 2004 and $76.1 million in the trailing twelve months (TTM).

Earnings have also been quite erratic, bouncing from $(.27)/share in 2000 to $.27 in 2001, down to a loss of $(.06)/share in 2003, and then improving to $.27/share in 2004 and $.79/share in the TTM.

The company has paid $.10/share in the TTM, the first dividends noted by Morningstar. Total shares have increased from 8 million in 2000 up to 10 million in 2004 and 12 million in the TTM.

Free cash flow has been positive, if small, with $4 million in 2002, dropping to $2 million in 2003, then increasing to $3 million in 2004 and $4 million in the TTM.

The balance sheet is solid with $1.4 million in cash and $29.2 million in other current assets, which, when balanced against the $12 million in current liabilities, gives us a current ratio of 2.5. A ratio of 1.5 or better usually is an indication of a healthy balance sheet. In addition, the company has another $6.8 million in long-term liabilities.

What about the chart?

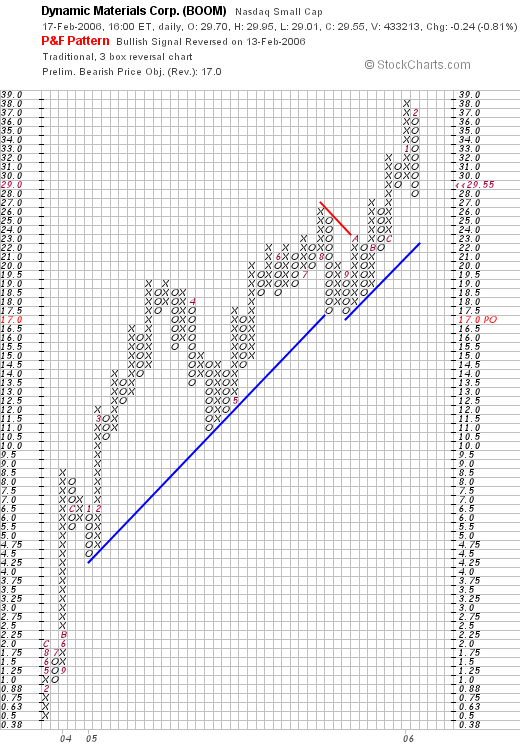

If we look at a "Point & Figure" chart on BOOM from Stockcharts.com:

We can see the very strong upward movement of this stock from the $.50/share range in January, 2003, to the $38 range in January, 2006. The stock has recently pulled back to the $29.55 level, but still is staying well above the support (blue) line. On my limited understanding of technicals, the stock price appears steady and doesn't appear to have broken down.

What do I think?

Well, I should really have sold BOOM when it hit my cost, but the stock rebounded and by the time I realized what had happened it was once again above a selling point. In any case, the company reported a superb earnings report, and is due to report the fourth quarter results soon. Revenue growth has been solid, but earnings reports have indeed been erratic. The company is generating free cash and the balance sheet is reasonable.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob