Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

In case someone hasn't noticed, this blog is NOT about "getting rich quick". It isn't about any kind of gimmicks or short-cuts. What I am trying to do is simply to help you think about investments. To learn to 'look under the hood' so to speak. To ask questions. To check earnings reports, same-store sales, free cash flow, PEG ratios and Price/Sales ratios. In other words, to do your homework. It is my strong belief that if I can find a group of stocks with what I call quality characteristics that I will stand half a chance to have a portfolio that will perform respectfully relative to the market and other standards. We shall all have losing stocks and gaining stocks. But I want to know why any particular stock is in my portfolio at all. I hope that my evaluations help you address this same question!

This afternoon, after a great day in the market, I was convinced that I would be able to find another stock to discuss on this blog. As I do when I am looking for new stocks, I scan through the lists of top % gainers. In this particular case I was reviewing the list of top % gainers on the NYSE when I came across Regal-Beloit (RBC) which closed at $47.18, up $2.33 or 5.20% on the day. Why did I pick this stock when there are so many other stocks I could have chosen? In fact, I did look at a number of other stocks but nothing seemed to work as well for me as this company. Let me explain.

This afternoon, after a great day in the market, I was convinced that I would be able to find another stock to discuss on this blog. As I do when I am looking for new stocks, I scan through the lists of top % gainers. In this particular case I was reviewing the list of top % gainers on the NYSE when I came across Regal-Beloit (RBC) which closed at $47.18, up $2.33 or 5.20% on the day. Why did I pick this stock when there are so many other stocks I could have chosen? In fact, I did look at a number of other stocks but nothing seemed to work as well for me as this company. Let me explain.

In the first place, I do not own any shares of this company nor do I have any options. I am proud of the fact that this is another great Wisconsin company. O.K., so I am loyal to my state. But there are several of these midwestern firms that I like, including Manitowoc Co., Oshkosh Truck, and Johnson Controls. Let's add Regal-Beloit to this list as well.

In the first place, I do not own any shares of this company nor do I have any options. I am proud of the fact that this is another great Wisconsin company. O.K., so I am loyal to my state. But there are several of these midwestern firms that I like, including Manitowoc Co., Oshkosh Truck, and Johnson Controls. Let's add Regal-Beloit to this list as well.

What exactly does this firm do?

According to the Yahoo "Profile" on RBC, the company

"...engages in the manufacture and supply of electrical and mechanical motion control products principally in North America, Europe, and Asia. It operates in two segments, Electrical and Mechanical. The Electrical segment offers various products, including a line of alternate and direct current commercial and industrial electric motors; heating, ventilation, and air conditioning motors; and electric generators and controls, capacitors, and electrical connecting devices."

Is there anything in the news to explain today's move?

No. I don't see anything particularly pertinent to move this stock today. I think that this stock probably moved together with all of the other stocks in the market. In addition, the company is a part of the S&P 600 SmallCap Index and the S&P 1500 Super Comp Indices, so perhaps in any institutions were buying the index, well this stock got bought up as well. That is about my best guess.

How did they do in the latest reported quarter?

On July 27, 2006, Regal-Beloit reported 2nd quarter 2006 results. For the quarter ended July 1, 2006, net sales increased 18% to $435.3 million from $368.8 million in the second quarter of 2005. Net income grew an impressive 80.6% to $33.3 million, up from 418.4 million in the same period in 2005. Diluted earnings per share climbed 59.7% to $.99/share, up from $.62/share in the same quarter in 2005. Clearly, this was a fantastic report.

If you are a regular reader of this blog, you will know that one of the key determinants of an earnings report, in regards to its effect on the 'market' is what the company did relative to the expectations of analysts who follow this stock. As reported, analysts polled by Thomson Financial had been expecting earnings of $.95/share on revenue of $436 million. So the company beat the expectations on earnings and came in a hair shy of the revenue figures expected.

The second part of an earnings report is the question of guidance. This again is an expectations game. In other words, the company is helping analysts out with how the future is going to turn out. When a company raises guidance it acts to raise expectations for earnings which acts to increase the price that investors or institutions are willing to pay for a stocks. This is probably related to a 'recalculation' of what is called the net present value of an investment. While not an exact analogy, the rethinking of future earnings streams to investors and stockholders results in a recalculation of the current price that a company is worth.

In this particular case, RBC did raise guidance in this report, forecasting third-quarter earnings in the range of $.78 to $.84/share. Analysts apparently had been expecting Regal-Beloit to earn $.67/share in the next quarter.

What about longer-term financial results?

Part of my evaluation of a stock is the review of results over the past several years. I am not seeking a quick turn-around or value investment. I am searching for what I call 'high-quality' companies. I define quality as a consistency in results, allowing a possible extrapolation of trends into the future with some reliability.

Reviewing the Morningstar.com "5-Yr Restated" financials on RBC, we find that revenue actually dropped from $664 million in 2001 to $605 million in 2002. However, since 2002, the company has grown steadily and has even seemingly accelerated that growth. Regal-Beloit reported $757 million in revenue in 2004, $1.43 billion in 2005 and $1.56 billion in the trailing twelve months (TTM).

Earnings have also been a bit erratic, increasing from $.93/share in 2001 to $1.01 in 2002, flat at $1.00 in 2003, then increasing strongly to $1.22 in 2004, $2.25 in 2005 and $2.93 in the TTM.

The company does pay a dividend: $.48/share in 2001 to 2004, then increased to $.51/share in 2005 and $.53/share in the TTM.

On a negative note, the company has been increasing its float with 21 million shares reported in 2001, increasing to 30 million by 2005 and 31 million in the trailing twelve months. Basically the company's shares are up 50% while earnings have been able to more than double and revenue has also climbed more than 100%. So while I prefer to see minimal increase in shares, as long as earnings and revenue grow quicker, then it doesn't appear to be very significant to me.

Free cash flow has also been positive and strong with $41 million in 2003, $22 million in 2004, increasing to $84 million in 2005 and the TTM.

Looking at the balance sheet from Morningstar.com, we find what appears to be a solid report with $24.6 million in cash and $532.8 million in other current assets. This total of $557.4 million, when compared with the $274 million in current liabilities yields a current ratio of 2.03. In general, current ratios over 2.0 are considered 'healthy'. In addition, RBC has $441.6 million in long-term liabilities.

How about some valuation numbers for this stock?

Examining the numbers on Yahoo "Key Statistics" for Regal-Beloit, we find that this is a mid-cap stock with a market capitalization of only $1.46 billion. The trailing p/e is a reasonable 16, with a forward p/e (fye 31-Dec-07) estimated at 13.37. The PEG is reported at 1.17 (5 yr expected).

Checking the Fidelity.com eresearch website for some additional comparative figures, we find that RBC is in the "Industrial Electrical Equipment" industrial group. The company is a good value insofar as the Price/Sales ratio is concerned. The most expensive in the group is Rockwell Automation (ROK) with a ratio of 2, followed by GE at 1.1, Eaton (ETN) at 0.5 and the most reasonable in the group are Regal-Beloit (RBC)O at 0.4 and Energizer Holdings (ENR) at 0.4.

Checking on profitability, as measured by ROE (Return on Equity), we find that unfortunately RBC is at the bottom by this measurement. Leading this group is Energizer at 74.5%, Rockwell at 34.9%, Eaton at 22.1%, GE at 17.6% and RBC at 14.5%.

Going back to Yahoo, the company has 30.87 million shares outstanding, with 28.35 million that float. As of 9/12/06, there were 1.97 million shares out short representing a significant 9.2 trading days of volume (or 6.60% of the float). Any time the short ratio climbs over 3 days, I believe this is a significant factor that can lend support to a stock price in light of good news. We may well have been seeing a bit of a squeeze of the shorts as the entire market moved higher.

As noted, the company pays an anticipated dividend of $.56/share yielding 1.3%. The company last split its stock, per Yaho, on August 15, 1994 when the stock split 2:1.

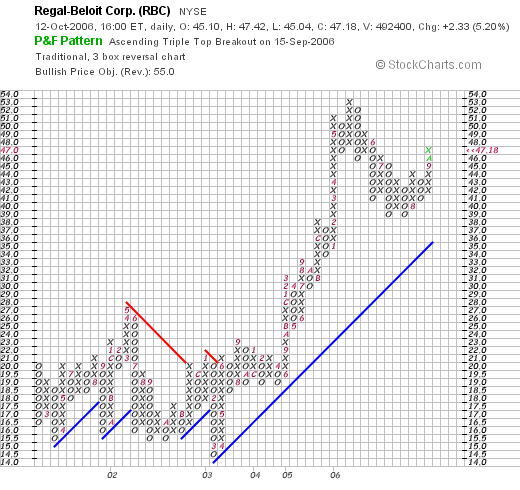

What does the chart look like?

If we review the "Point & Figure" chart on Regal-Beloit from StockCharts.com, we can see that the stock really went nowhere between 2001 and into June, 2003. Sometime in June, 2005, the stock broke out above $21 and has been moving higher since. The chart looks strong to me and not over-extended.

Summary: What do I think about this stock?

Let's review a few points on this stock. No particular news that I can see resulted in a nice move higher today. Perhaps the relatively large number of short-sellers got squeezed. I don't know for sure. The latest quarter was phenomenal with the company essentially beating expectations for earnings and raising guidance.

The last several years have been excellent for RBC, with revenue growing extremely strongly, earnings increasing solidly, and the company even pays a dividend which has been increased the past couple of years. The company has been increasing its float a tad quicker than I would prefer to observe. Free cash flow is positive and growing and the balance sheet appears solid with a current ratio over 2.

Valuation-wise, the p/e appears reasonable in the mid-teens, the forward p/e is even lower and the PEG is just a tad over 1.1. The Price/Sales is cheap, but the ROE is the weakest in its group. One thing that may be supporting this stock is the strong short interest with over 9 days of short interest outstanding. Finally, the chart looks solid. There really isn't much I don't like about this stock come to think. But then again, I don't have a buy signal, so I am still sitting on my hands even if the overall market is starting to move higher. But if I were buying....well this is the kind of stock I might be adding to my portfolio!

Thanks once again for taking the time to visit! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob