Stock Picks Bob's Advice

Wednesday, 24 November 2004

Happy Thanksgiving!

Give thanks that you are not a turkey! Happy Thanksgiving everyone! Thanks for visiting my blog,

Stock Picks Bob's Advice!

Bob

A Reader Writes "What About Sun Microsystems?"

Hello Friends! Thanks for stopping by my blog,

Stock Picks Bob's Advice. Please remember that I am an amateur investor so please do your own investigation of all stocks discussed on this website, and consult with your professional investment advisors before making any investment decisions based on information here. If you have questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

I received a letter today from a reader who wrote:

Hi! I found your blog through blogarama.com and was wondering what

your take on Sun Microsystems is. I am having a lot of trouble finding

opinions and advice on the stock and hope that you will give me your

thoughts.

Thanks,

JeffWell Jeff, thanks so much for writing. I am sure you have read the disclaimer all over this blog, and I have to tell you it is true. I AM an amateur investor, and thus cannot tell you whether Sun Microsystems (SUNW) would be a good investment for you to make or not. In fact, I cannot tell you whether the stock will be appreciating in price in the near future or not....all I can tell you is whether it fits into my strategy of investing.

In other words, there are many ways to invest successfully in the market. My particular strategy involves momentum, both earnings and price, with a look at underlying fundamental issues. The investment in SUNW is more of a "turn-around" or contrarian "value" investment style, looking for stocks that are deeply undervalued which might have rapid appreciation in the future. That is a great strategy, but that is not what I do around here. I look for stocks that are already doing well, with nice same day percentage gains, great recent quarterly results, a nice Morningstar report, and a reasonable stock chart. Hopefully, my approach will be successful, but it is in no means to imply that there might not be better strategies that might be more successful in selecting stocks.

Well, that being said, let's take a look at SUNW and see what we come up with!

SUNW closed today, 11/24/04, at $5.21, up $.03 or 0.58% on the day. Taking a look for the most recent earnings report, I found that on Yahoo,

Sun reported 1st quarter 2005 results on October 14, 2004. For the 1st quarter ended September 26, 2005, revenue came in at $2.628 billion, a 3.6% increase over the first quarter in 2004 fiscal year. Net LOSS for the first quarter came in at $(174) million or $(.05)/share compared with a net loss of $(286) million or $(.09)/share the prior year same quarter. So the revenue is growing sequentially and the loss is shrinking, so things are improving somewhat.

How about longer-term? For that I like to turn to the

Morningstar.com "5-Yr Restated" financials which show that first, revenue hit a peak of $18.2 billion in 2001, and has been decreasing each year until 2004 when it came in at $11.185 billion. Apparently the last two quarters are showing signs of a turn-around which is positive. However, when I pick stocks for this blog, I avoid stocks that haven't been steadily increasing revenue the last five years.

Also on Morningstar, we can see that earnings were greatest in 2000 at $.55/share, and have been decreasing into losses with a bottom in 2003 at $(1.07)/share. 2004 was a little less bad with a loss of $(.12)/share and apparently the turn-around continues at SUNW.

How about free cash flow? Well this looks superb with $321 million in 2002, $664 million in 2003, and $2.0 billion in 2004. This means that the financials are likely improving and that the growing cash will provide some flexibility for the SUNW management. However, remember that they are still losing money at least in the earnings department.

Balance sheet? Appears adequate with $3.6 billion in cash and $3.7 billion in other current assets, compared with a significant $5.1 billion in current liabilities, and a $3.0 billion in long-term liabilities. Financially the company appears to be on solid footing.

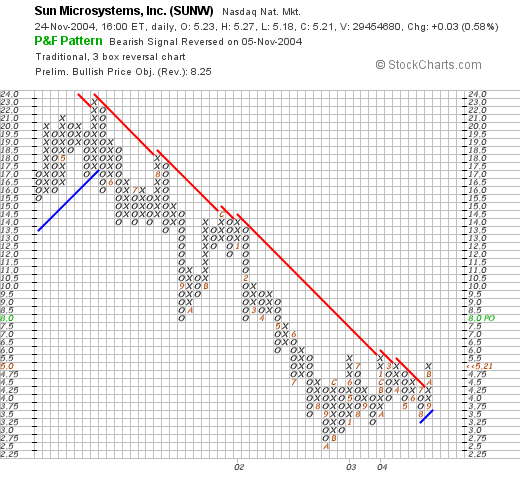

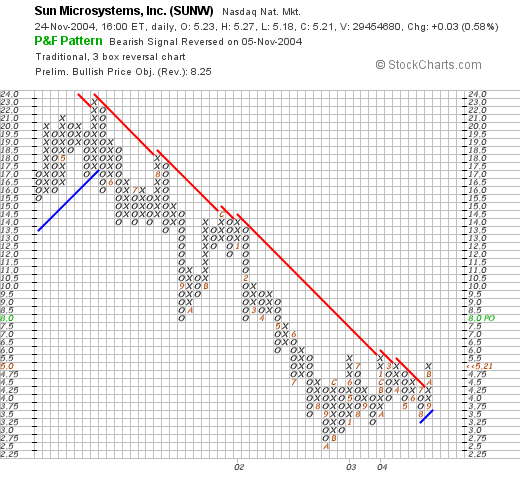

Technicals? Let's look at a Point & Figure Chart from

Stockcharts.com:

Here we can see that this stock peaked in May, 2001, at $23.00/share and has headed steadily lower. Recently, in what appears to be mid-September, 2004, the stock broke through a resistance level and has headed higher to its current level of $5.21. Quite frankly, in the short fun, this stock does look like it has been bottoming from its $2.50 low in October, 2002, and now may well be heading higher.

What do I think? Well this does not fit into the stock profile that I have been looking for here on Stock Picks. However, the recent earnings report shows improvement with slowly increasing revenue, and decreasing losses, and the balance sheet/free cash flow looks fine. I don't like the multi-year history of decreasing revenue, the persistent losses, and the "turn-around" nature of this investment. That is just not my style. However, if you like that kind of thing, this might be your cup of tea. No telling really!

Good luck and keep me posted! Thanks again for stopping by! I hope that review of SUNW was helpful for you! Regards and have a Happy Thanksgiving!

Bob

Monday, 22 November 2004

November 22, 2004 Manitowoc Co. (MTW)

Hello Friends! Thanks as always for stopping by my blog,

Stock Picks Bob's Advice. As I always like to remind you, I am an amateur investor, so please consult with your investment advisors before making any investment decisions based on information on this website. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com .

I came across Manitowoc Co. (MTW) this morning when it was on the list of top % gainers, but as I write it has pulled back a little and is trading at $38.29, up $.91 or 2.43% on the day. It doesn't make the cut as I write, but I like what I saw earlier and would like to share it with you! I do not own any shares or options on this company.

According to the

Yahoo "profile", MTW "...is a diversified industrial manufacturer with three operating segments: Cranes and Related Products, Foodservice Equipment and Marine." Personally, I have seen the name mostly on ice machines (!) but they are active in industrial ship-building and cranes as well!

On October 27, 2004, Manitowoc

announced 3rd quarter 2004 results. For the quarter, sales rose 21% to $491.1 million from $407.2 million last year. They earned $12.7 million, or $.47/share, a 77% increase from the $7.2 million or $.27/share last year. As strong as this was, this was still a penny below expectations!

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar.com, we can see that revenue has grown steadily, and impressively, from $680 million in 1999 to $1.8 billion in the trailing twelve months (TTM).

Earnings, however, have been erratic, dropping from $2.55/share in 1999 to a loss of $(.80)/share in 2002, but have been improving since then to $1.23/share in the trailing twelve months.

Dividends have also been erratic, increasing from $.30/share in 1999 to $.63/share in 2002, but dropping the next year down to $.28/share where it stands now.

Free cash flow has been strong at $78 million in 2001, hitting $119 million in 2003, and still at $79 million in the TTM.

The balance sheet looks adequate if not spectacultar with $49.2 million in cash, and $700.7 million in other current assets, plenty to cover the current liabilities of $603.5 million, and to start to make a small dent in the $790.7 million in long-term liabilities.

How about valuation questions? Looking at

Yahoo "Key Statistics", we find that the market cap is a mid-cap sized $1.03 Billion. The trailing p/e is a moderate 27.52, but the forward p/e is a very reasonable 14.62 (fye 31-Dec-05), giving us a PEG of 0.83, which is very reasonable imho, and a Price/Sales of 0.55...also under 1.0.

Yahoo reports 26.86 million shares outstanding with 21.90 million of them that float. Of these 957,000 shares are out short, representing 4.37% of the float, as of 10/8/04. This is lower than last months 1.27 million shares out short so about 20% of the short-sellers have thrown in the proverbial "towel" on the downward movement of this stock. The shares out short are significant representing 7.362 trading days which is also bullish for the stock (imho) if we use the 3 day rule I have started to apply.

Yahoo shows that the company still pays the small dividend of $.28 yielding .75%. The last stock split reported was a 3:2 in April, 1999.

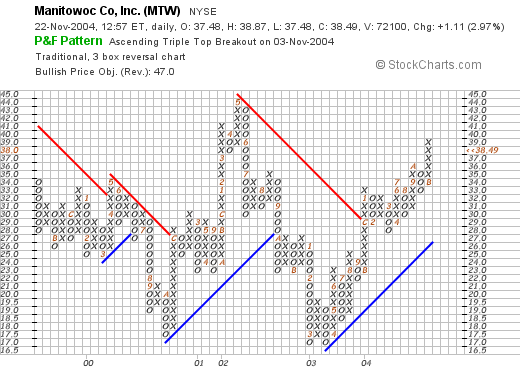

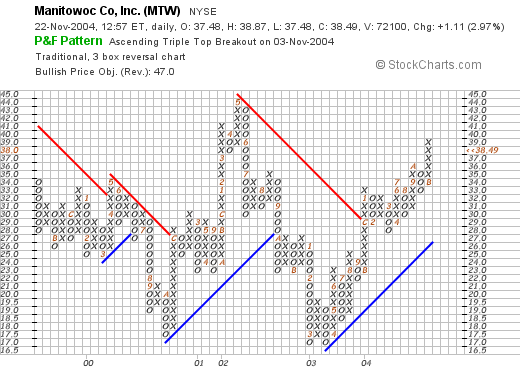

And what about "technicals"? If we take a look at a Point & Figure chart from

Stockcharts.com:

We can see that the stock has really been trading sideways since 1999 when it initially declined to a low of around $17/share in October, 2000, climbed to a high of $45/share in May, 2002, then declined once again to a low of around $17 where it bottomed twice in March, 2003. Since that time the stock broke through a resistance level at around $30 in August, 2003, and has been trading higher since. The graph, in my humble opinion, looks strong, but not overpriced!

So what do I think? Well let's review, first the latest quarterly report looks strong, the five year revenue growth is excellent but the earnings and dividend record are erratic, although they look strong the last few years. Valuation is terrific with a PEG under 1.0 as is the Price/Sales. There are even a significant number of short sellers out there who need to cover their negative "bets". The graph looks nice as well. Frankly, this is my kind of stock....now if I just had a sale that would allow me to pick up some shares...but I shall be waiting to sell a portion of one of my holdings at a gain before adding a new position. I AM close with VMSI and a second sale of AMMD is not out of the question!

Thanks so much for stopping by! I hope that this discussion helps you frame some of your own investment decisions in a manner that is relatively easily understood. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Sunday, 21 November 2004

Wishing you all a wonderful week!

Hello Friends! As we start another week, I want to wish all of you the best. I also wanted to share another

painting by one of my all-time favorite painters, Wayne Thiebaud. He is a California artist who I much admire and you can see all of the fun and whimsy in his creations. Doesn't it just want to make you smile?

With all of my warmest wishes for a Happy Thanksgiving!

Sincerely,

Bob

Saturday, 20 November 2004

"Looking Back One Year" A review of stock picks from the week of October 6, 2003

Hello Friends! Thanks so much for stopping by. I appreciate your visits, your messages and emails, for all of you who come by and participate here make it all worthwhile for me! So make yourself at home here at

Stock Picks Bob's Advice. Always remember that I am an amateur investor, so please consult with your professional investment advisors and do your own investigation of all stocks discussed here to make sure they are appropriate, timely, and likely to be profitable for you! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Another week has come and gone. It appears that a lot of our post-election investment "euphoria" has now evaporated and we are faced with the more serious prospects of a weak dollar, high oil prices, and government debt that threatens the financial solvency of this government as we find out elected officials raising the debt limit by $800 billion. As I read one internet poster write, "I wish I could do THAT with my credit cards!" In addition, the American course in Iraq appears as difficult as ever as the evidence for a quick suppression of the violent insurgency is appearing more distant.

Well enough for the doom and gloom! Let's take a look at what I was writing here a little over a year ago. The weekend is the time I like to review the past stock picks from a year or so ago. Our discussion infers a "buy and hold" investment strategy. In reality, I employ a buy and "sell quickly on an 8% loss" and "sell slowly as the stock appreciates" so actual performance would differ from our analysis. But it helps to check those stocks in any case!

On October 6, 2003, I

posted Fargo (FRGO) on Stock Picks at a price of $14.82. FRGO closed at $14.42 on 11/19/04 for a loss of $(.40) or (2.7)%.

On October 19, 2004,

FRGO reported 3rd quarter 2004 results. Net sales came in at $19.6 million, up from $17.1 million the prior year. Net income was $2.3 million or $.18/share, compared with $2.5 million or $.19/share the prior year. The revenue growth was nice, but I prefer to see earnings growth as well!

I

posted InterParfums (IPAR) on Stock Picks on 10/6/03 at a price of $10.98. IPAR closed at $15.10 on 11/19/04 for a gain of $4.12 or 37.5%.

IPAR reported 3rd quarter 2004 results on 11/10/04. During the quarter, sales rose 17% to $67.1 million from $57.4 million a year ago. (Adjusting for currency fluctuations, the growth was only 11% but still strong!) Net income declined 14% to $4 million from $4.7 million, diluted eps was $.20/share compared with $.23/share last year. Again, we have a report with growing revenue but declining earnings. The overall stock performance has been solid from a year ago, but the latest report gives me some concern, imho.

On October 7, 2003, I

posted CVS Corp. (CVS) on Stock Picks at a price of $33.57. CVS closed at $45.80 on 11/19/04 for a gain of $12.23 or 36.4%.

On November 4, 2004, CVS

reported 3rd quarter 2004 results. Net sales for the quarter ended 10/2/04 increased 24% to $7.91 billion from $6.38 billion. Same store sales for the quarter grew 5.2%. This was led by "front-end" same store sales increased 1.8% with pharmacy same store sales increasing 6.8%. However, net earnings for the quarter decreased 1.7% to $184.6 million or $.44/diluted share compared with net earnings of $187.8 million or $.46/diluted share last year. However, $.07 of this decline was due to the Eckerd qcquisition. The company is bullish about the rest of the year and

raised guidance for 2004. A solid earnings report and an increased guidance are two elements for solid stock price appreciation in my humble opinion!

On October 7, 2003, I

picked Regis Corp. (RGS) for Stock Picks at a price of $35.17. RGS closed at $45.30 on 11/19/04 for a gain of $10.13 or 28.8%.

RGS

reported 1st quarter 2005 results on October 27, 2004. Consolidated revenues increased 10% to $506 million from $461 million last year. Same store sales increased 0.9%. First quarter net income edged up 2% to $25.5 million or $.55/diluted share. Regis pointed out that hurricane disruptions dropped revenue in the quarter by $4 million. These results were positive, the stock is holding its price well, but I like to see stronger revenue and earnings growth in the companies we hold!

On October 8, 2003, I

posted Ceradyne (CRDN) on Stock Picks at a price of $30.50. CRDN split 3:2 on 4/8/04 and oour resultant selection price was actually $20.34. CRDN closed at $47.63 for a gain of $27.29 or 134.2%.

On 10/28/04,

CRDN reported 3rd quarter 2004 results. Sales for the third quarter 2004 jumped 108.3% to $56.3 million from $27 million the prior year. Net income increased to a record $7.3 million or $.44/diluted share compared with net income of $3.3 million or $.21/share, a greater than 100% increase, in the third quarter in 2003. On a more somber note, the

company announced that the CEO would be reducing some of his responsibilities due to illness, however, the company raised guidance for earnings and sales for the rest of 2004. Very strong earnings and revenue reports along with raised guidance is everything an investor could ask for! (However, even great earnings and revenue growth aren't much for a CEO or anyone, if you have problems with your help, and I certainly wish the CEO the best of health for the future!)

On October 9, 2003, I

posted NetGear (NTGR) on Stock Picks at $17.88/share. NTGR closed on 11/19/04 at $15.62/share for a loss of $(2.26) or (12.6)%.

On October 28, 2004, NTGR

reported 3rd quarter 2004 results. Net revenue for the quarter increased 34% to $101.2 million compared with $75.8 million for the same quarter ended September 28, 2003. GAAP net income was $5.9 million or $.18/diluted share compared to a net loss of $(4.0) million or $(.15)/diluted share last year. This was a strong quarter overall, but the stock price is a bit behind where I selected this stock for this blog!

Finally, on October 10, 2003, I

posted Infosys Technologies Ltd (ADR) (INFY) on Stock Picks at $77.40. INFY split 2:1 on 7/7/04, so our effective pick price was actually $38.70. INFY closed on 11/19/04 at $65.51 for a gain of $26.81/share or 69.3%.

On October 12, 2004,

Infosys announced quarterly results. For the quarter ended September 30, 2004, revenues came in at $379 million, up 51% from the corresponding quarter last year. Earnings were up almost 50% from $.25/share to $.36/share this year. These were great results! More recently, Microsoft

announced a partnership with Infosys as well as with WIPRO, another Stock Picks selection.

So how did we do the week of October 6, 2003 in picking stocks? Well, of our seven selections, there were two losses: (2.7)% loss with Fargo, and a (12.6)% loss with NetGear, and five gains ranging from a 28.8% gain with Regis, and a fabulous 134.2% gain with Ceradyne. The average gain for the seven stocks was an average gain of 41.6%.

THAT was a FABULOUS performance. I only wished I OWNED those stocks! PLEASE remember that past performance is NO guarantee of future stock price performance, and that I am an amateur investor so PLEASE consult with your professional investment advisors prior to making any investment decisions based on information from this website. Again, I thank you for stopping by and wish you the best for the rest of the weekend and the upcoming Thanksgiving holiday!

If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 6:47 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 20 November 2004 7:23 PM CST

Thursday, 18 November 2004

November 18, 2004 Genesco (GCO)

Hello Friends! Well it is another Thursday and another set of stocks to review. I hope you are all well and preparing yourself for Thanksgiving. As for me, I shall try to go a little easier on the stuffing this year. I have all the stuffing I need :).

Thanks so much for stopping by my blog,

Stock Picks Bob's Advice. Please remember I am an amateur investor, so please do your own investigation on all stocks discussed and consult with your professional investment advisors to make sure that all stocks you select are appropriate, timely, and likely to be profitable for you! If you have any comments, questions, or would like to share with our readers your own thoughts on investing, please email me at bobsadviceforstocks@lycos.com or you can always click on the links below each post to leave your message.

I came across Genesco (GCO) this morning while scanning the

list of top % gainers on the NYSE. I do not own any shares or options on this stock. According to the

Yahoo "Profile", GCO "...is a retailer and wholesaler of branded footwear. The company operates four business segments: Journeys, consisting of Journeys and Journeys Kidz retail footwear chains; Underground Station?Jarman Group, consisting of the Underground Station and Jarman retail footwear chains; Johnston and Murphy, composed of Johnston and Murphy retail operations and whole sale distribution, and Dockers Footwear."

I recall Genesco from years ago when my father, who was the one instrumental in getting me interested in stocks, told me about this shoe company. I don't remember much about what he said, except he was impressed by the management. Anyhow, GCO is having a nice day today, trading at $28.35, up $1.60 on the day or 5.98% in an otherwise lackluster trading session this morning.

Like so many stocks on this blog, what pushed this stock higher was the

announcement of 3rd quarter earnings. Net income rose to $12.1 million or $.54/share up from $9.4 million or $.42/share a year ago. Genesco also raised guidance for future sales and earnings. This was a bullish report! In a slightly

more recent report, GCO detailed their revenue and reported that sales jumped 36% during the quarter.

How about longer-term? Is this earnings and revenue growth a fluke? I believe it is the consistency in earnings and revenue growth that is the best prognosticator of an outstanding price appreciation in an investment. For this information, I like to turn to the

"5-Yr Restated" Financials on Morningstar.com. Here we can see clearly illustrated the consistent growth in revenue from $553.0 million in 2000 to $837.4 million in 2004 and $936.6 million in revenue in the trailing twelve months (TTM).

Earnings have been less consistent, but have improved from $1.05 in 2000 to $1.66/share in the trailing twelve months.

Free cash flow which was a negative $(12) million in 2002, improved to $49 million in 2004, and has stayed positive at $20 million in the TTM.

The balance sheet is solid, with $15.3 million in cash and $305.2 million in other current assets compared with $169.5 million in current liabilities and $239.7 million in long-term liabilities.

What about valuation issues? First, using the

Ameritrade definition of market capitalization, which places mid cap stocks between $500 million and $3 billion in market cap, this stock just makes the cut for a mid cap stock with a market cap of $640.16 million. The trailing p/e is nice at 17.24 (imho), and the forward p/e is nicer at 14.03.

Yahoo reports only 22.04 million shares outstanding with 19.40 million of them that float. There are 2.0 million shares out short as of 10/8/04, representing 10.31% of the float or 9.804 trading days. This seems to be quite a few shares out short, which are now facing the current good news....with a stock price appreciation, these shares may need to be covered which is a bullish statistic on this stock.

This stock does not pay any dividend and no stock splits are reported on Yahoo.

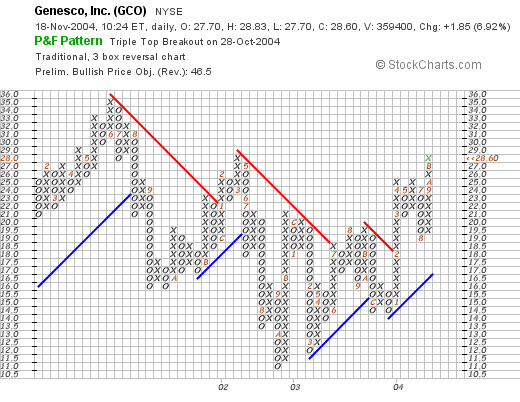

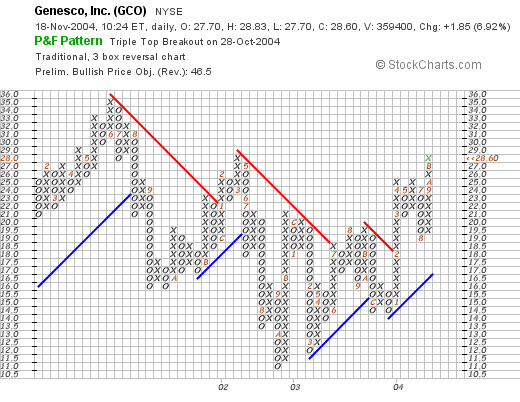

How about technicals? If we take a look at a point and figure graph from Stockcharts.com:

This stock appears to have been trading lower since June, 2001, when it peaked at $35.00/share, this trend appears to have been broken in mid-July, 2003, when it broke through a resistance level at $18/share, and then again more strongly in February, 2004, when it broke through a resistance level, again at $18/share. The stock appears to be heading higher and does not appear over-extended in my humble opinion.

So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain!

So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain!

Thanks so much for stopping by. Please remember that I AM an AMATEUR, so do your own investigation of stocks, and consult liberally with your professional investment advisors. If you have any questions, please feel free to email me at bobsadviceforstocks@lycos.com .

Regards,

Bob

Wednesday, 17 November 2004

November 17, 2004 Watts Industries (WTS)

Hello Friends! Thanks again for stopping by and visiting my blog,

Stock Picks Bob's Advice. I enjoy your visits and I love to look at and share ideas about stock market investing. By all means, please remember that I am an AMATEUR investor, I cannot in any way be responsible for any of your trades, and you should absolutely do your own investigation and discuss your ideas with PROFESSIONAL investment advisors before making any decisions. If you have any questions, please feel free to email me at bobsadviceforstocks@lycos.com . I recently got into some discussions about investing on MSN. Let me make clear my belief that there are many different ways of investing in stocks, that this method may not in the long run turn out to be profitable is a possibility, and that other methods may be more profitable is also a real and likely possibility! I hope I have cleared the air on THAT.

The market has been behaving well. Today, after a small correction yesterday, the Dow and the NASDAQ have been moving higher. Scanning the lists of top percentage gainers, I came across Watts Water Technologies Inc (WTS) which is, as I write, trading at $29.90, up $1.50 or 5.28% on the day. I do NOT own any shares of this stock. According to the

Yahoo "Profile" on Watts, WTS "...is a global manufacturer of safety and flow control products for residential and commercial plumbing, heating and water quality markets."

On November 2, 2004 WTS

announced 3rd quarter 2004 results. Sales came in at $214.8 million, a $39.3 million or 22% increase over sales in the same quarter in 2003. Net income was $13.7 million, a 54% or $4.8 million in crease compared to the comparable 2003 3rd quarter. This company has been busy making acquisitions, but clearly they appear to be handling these purchases satisfactorily, in my humble opinion.

How about longer-term? Taking a look at the

"5-Yr Restated Financials" from Morningstar.com, we can see that revenue has grown strongly from $261 million in 1999 to $705.7 million in the trailing twelve months. Earnings per share have grown from $.56/share in 1999 to $1.21 in the trailing twelve months. Dividends have also increased from $.18/share in 1999 to $.25/share in the TTM.

Free cash flow, while not increasing, has been steady ranging from $35 million in 2001 to $30 million in 2003. The company, according to the Morningstar.com data, has $149.4 million in cash and $331.1 million in other current assets. These are compared with $172.3 million in current liabilities and $229.9 million in long-term liabilities. This looks adequate if not spectacular.

How about valuation questions? For this I like to turn to

Yahoo "Key Statistics" on WTS. Here we can see that this is a mid-cap stock with a market capitalization of $967.03 million. The trailing p/e is reasonable at 19.47, and the forward p/e is nicer at 16.33. They have this company down as a PEG of 1.33, but with the current earnings results, I suspect this is currently closer to 1.0.

There are only 32.35 million shares outstanding with 20.20 million of them that float. Yahoo reports 377,000 shares out short representing 1.87% of the float or a bit heavy at 4.833 trading days. The company does pay a dividend of $.28/share yielding 0.99% and the last stock split reported on Yahoo was a 2:1 split in March, 1994.

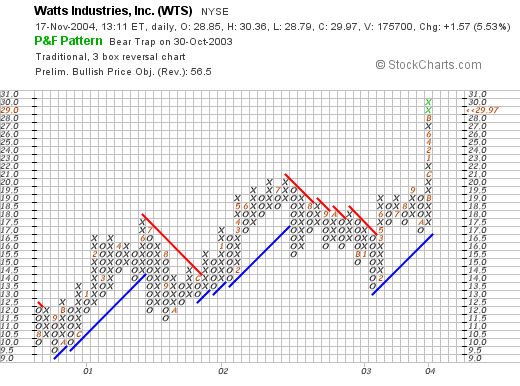

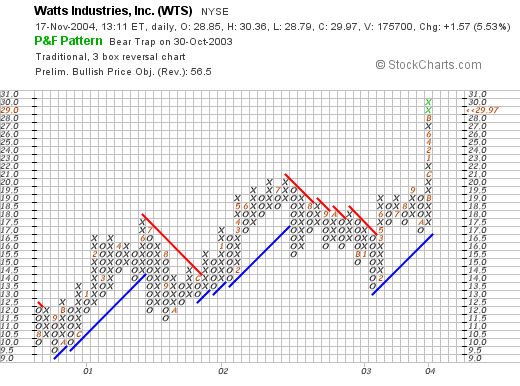

How about Technicals? For charts, I turn to

Stockcharts.com and I prefer to look at a Point & Figure Chart:

With this chart, we can see that the stock appeared to be slowly appreciating between 2001 and July, 2002, when it broke through a support level at around $17/share dropping to $13.50 around January, 2003, and has traded higher steadily, recently breaking out past $19.50 to its current level. The chart looks strong, perhaps a bit over-extended?

So what do I think? This is a basic manufacturing company which has recently been fairly active purchasing other companies. They appear to be doing this quite effectively and are growing their revenue along with their earnings, maintaining their free cash flow, having an "adequate" balance sheet (imho), and what appears to be reasonable valuation. I like this stock even though it is not in the medical field where I have had some success around here, and would be in the market to purchase some shares if only my trading system allowed me to add another position. I am close to a sell point for a couple of my issues, and I may be in the market soon!

Thanks again for stopping by! If you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

A Reader Writes "a friend e-mailed me today..."

Hello Friends! If you are a regular reader around here I am sure you know how much I appreciate getting some feedback from all of you readers who stop by. I received a nice email from Forrest who wrote:

a friend e-mailed me today your latest letter detailing NAVR, it was the first time I had heard about you. Anyway I have an expensive subscription to CNBCU so I checked out NAVR. It came back with the best fundamental scores of any stock I have seen in the approximately 3 months I have had the CNBCU resource. Needless to say I will jump on board and have recommended others take a look at it also. Technically I find it a little overbought at the moment and will be watching to enter at the end of this pullback. I have bookmarked your site and expect to be a frequent visitor. Many thanks ForrestThanks Forrest for the kind words! Please remember that I am an amateur investor so please do your own investigation of all stocks discussed and discuss them further with professional investment advisors. It is nice to know that NAVR has a good rating, because I just bought some!

Thanks again for stopping by and please visit and write often! If you have any other questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to get back to you either on the blog or by email ASAP.

Bob

Monday, 15 November 2004

"Trading Transparency" Navarre Corp (NAVR)

Hello Friends! Well you KNOW how that nickel ALWAYS burns a hole in my pocket. Well with the sale of a portion of my Dell last week at a gain, that enabled me to add a position to the portfolio. As you may recall, I have about 16 positions, with a maximum of 25 planned.

I checked the top % gainers today and saw an old favorite of mine, Navarre Corp. (NAVR). I had

posted NAVR on Stock Picks on June 30, 2004. Today, I picked up 400 shares in my trading account for $17.897, for a total cost of $7,158.80.

As always, remember I am an AMATEUR investor, so please consult with YOUR professional investment advisors prior to making any investment decisions based either on information posted here or my own trading activity! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Regards!

Bob

Sunday, 14 November 2004

November 14, 2004 GameStop (GME)

Hello Friends! Thanks for stopping by my blog,

Stock Picks Bob's Advice. Well it is Sunday evening, and I really INTENDED to post this one on Friday, but I just never got around to it. Well there is still time to talk about GameStop (GME). Needless to say one more time, I am an AMATEUR investor, so please consult with your professional investment advisors prior to making any investment decisions based on information found on this website. I cannot be responsible for YOUR investment decisions, so please do your homework, and make sure that all investments are appropriate, timely, and likely to be profitable, before making investment decisions. As always, I would be delighted to hear from any of you if you have any comments, questions, or words of encouragement. In addition, tell me what you are doing and how my blog might be helping you think about investing and I will share it with our readers! Email me at bobsadviceforstocks@lycos.com if you get inspired!

For any of you who are new to this website, I have lots of additional discussions, and you can access these "picks" by clicking on the dates along the left side of the page on

Stock Picks Bob's Advice. If you are reading this blog posting on a third party site, well I certainly apprreciate the third parties who run my blog, but feel free to come to my own website to get a better idea of what this is about!

Phew. That was wordy.

If you are a regular around here, excuse me as I explain the steps I use to find stocks, and why I do this. First step, was to review the

lists of top % gainers on the NYSE (as well as the

list of top % gainers on the NASDAQ). I haven't found the

list of top % gainers on the AMEX to be quite as helpful. A couple of years ago I noticed that it might be profitable to look at these lists to identify stocks with strong same day momentum that might have the ability to yield stock price appreciation. In other words, if it is going up strongly today, it just might have enough momentum to keep going up!

Generally, I have found it best to restrict my analysis to stocks near or higher than $10.00. Looking through the lists, I came across GameStop (GME), a stock which I do NOT own any shares. GameStop closed on 11/12/04 at $23.50, up $2.11 or 9.86% on the day. According to the

"Snapshot" on CNN.money, GameStop's "...principal activity is to sell video games and PC entertainment software."

Before I "approve" of a stock as a pick, I insist that the latest quarterly report is a good report. What is good for me? I like to see increasing revenue AND increasing earnings year-over-year, and sequentially if possible.

For the latest quarterly report, I like to search through the Yahoo finance section, scrolling back to an earnings report. GME

reported 2nd quarter 2004 results on August 17, 2004. For the quarter ended July 31, 2004, sales increased 13% to $345.6 million comparted to $305.7 million the prior year same quarter. Net earnings increased to $7.7 million compared to $6.6 million the prior year. On a diluted earnings per share basis, this was an 18% increase to $.13/diluted share compared with $.11/diluted share in the same quarter last year. This was a solid result!

What about some more information...has this been a consistent grower? I believe that the market values consistency, and I do too. What we are hoping when we look at a consistent record, is that the future will also continue to be positive. For this information, I turn to

Morningstar.com. On this site, I checked for the

"5-Yr Restated Financials".

First thing I like to review are the bar-graphs at the top of this page. Here we can see that revenue has grown steadily from $553 million in 2000, to $1.67 million in the trailing twelve months (TTM). A steady increase is important to me!

Next earnings: On a per share basis, they increased from $.87/share in 2003 to the $1.08 in the TTM. (Since there is no data on this previous to 2003, I can deduce that this was when the company came public, and indeed was a spin-off from Barnes and Noble).

Third, "Free Cash Flow". This is in the middle section on the page, and whereas I would prefer to see a steady increase in free cash flow, at least it is positive, at $45 million in the TTM, compared to $7 million in 2004, even though it is lower than the $58 million in 2002, and the $53 million in 2003. Still, as long as it is improving over the short-term, and is positive, the company may be considered to be 'creating' cash rather than 'burning' up its available cash resources.

Fourth, I check the balance sheet. I am NOT an accountant or even a business person. But I know that I would like to see MORE assets than liabilities and would prefer to see current assets and cash much more than current liabilities. In this case, GME has $159.7 million in cash, not quite enough to cover the current liabilities of $220.3 million, but they also have an additional $224.9 million of other current assets so that coverage of current liabilities is a breeze, and the $20.9 million in long-term debt is no big deal either. (In my humble opinion!)

What do I do next? Now that I have looked at some basic fundamental questions, I like to look at a value perspective. For this I turn to the

"Key Statistics" from Yahoo. Some numbers I like to review include the market cap: for GME this is $1.32 billion making it a mid-cap stock, the P/E ratio which isn't bad at 21.60, and the forward P/E is even better (fye 31-Jan-06) at 16.10.

The Price/Earnings Ratio (P/E) means different things to different investors. William O'Neill, who developed the CANSLIM technique and is the publisher of the

Investor's Business Daily, advocates little weight to the P/E, but rather invest with the strongest technical and fundamental growth. However, imho, if all things are equal, why NOT be impressed by a low p/e stock?

A better question though is "What is low?" Many growth investor's have used the PEG ratio, called by the Motley Fools, the

"The Fool Ratio". This is a ratio of the P/E to the anticipated growth rate. This takes into consideration the fact that a stock that is growing very quickly really DOES deserve a higher p/e that a company whose earnings is NOT growing that fast. Stocks generally with a PEG at or near 1.0 are 'fairly' valued, less than 1.0 is even nicer! For GME, the PEG ratio is 0.95 which is excellent!

Also on this page of Yahoo, we can see the number of shares. For GME there are 56.32 million shares outstanding and 20.10 million that float. That means, imho, that there are something like 36 million shares or so that are 'tightly held' and not out on the market being traded.

Another statistic I like to review on this page are the number of shares out short. Short sellers are speculating that the stock will be declining in price, thus they borrow shares to sell and then to close the transaction, they purchase shares (they hope at a lower price), to replace the borrowed shares. Short sellers represent pessimists on the stock, they also represent individuals that MUST buy shares if the stock moves against them to limit their losses. (A rising stock price is a losing investment for short-sellers!) Thus, for GME, there are 2.74 million shares out short as of 10/8/04. This is an increase in shares out short from 2.38 million shares and represents 13.62% of the float. More importantly, the short raio is 9.036. That means it would take 9.036 days of the current average trading volume for the short sellers to buy enough shares to cover their borrowed position. For my purposes, I use (and this is just me!) 3 days as a cut-off. That is 9 days is quite a few, and is a BULLISH factor for the stock.

Finally, I take a look at the dividend (none) and the latest stock split (none).

So now, I have basically covered the issue of momentum, a fundamental analysis of the stock with a look at the earnings, free cash flow, and balance sheet, and a value oriented approach looking at the p/e, PEG ratio, and short-interest.

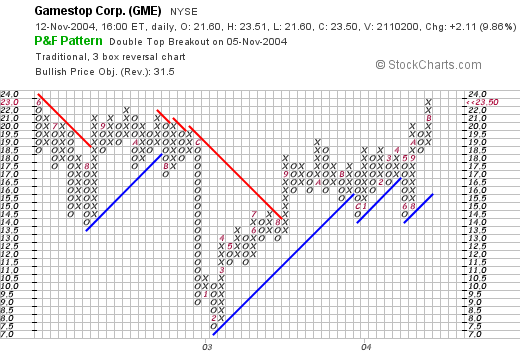

Finally I like to look at a bit of the technical analysis that chartists like to do. I do a very simple job of looking at a Point and

Figure Chart, made popular by

Tom Dorsey.

I use

Stockcharts.com to view a

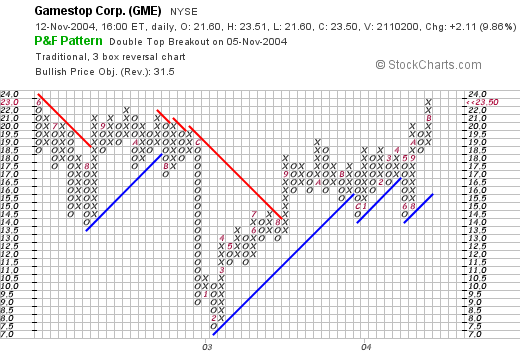

point and figure chart on GameStop:

Here we can see that the stock was trading lower between June (represented by a red #6) of 2002, through August of 2003 (a red #8). At that point the stock broke through a resistance level at around $14/share and it has basically headed sideways, breaking out higher in August, 2004. That is about the extent of my chart-reading, but the stock chart looks bullish to me.

At this point I like to think back about the research I have done and summarize. The latest quarterly report looked strong with both earnings and revenue growth. Morningstar showed that the revenue has been growing the past five years, and the earnings at least since 2003. Free cash flow is positive, recently growing and the balance sheet looks nice! Valuation-wise, the P/E is just over 20 and the PEG is under 1.0. In addition, there are a lot of shares out short, and that is a bullish factor imho. Finally, the chart looks just fine!

As far as my own trading portfolio, I DID just sell some of my DELL at a gain, so I CAN add a position. If GME still appears the best choice tomorrow, I might be adding a few shares!

Thanks again for stopping by! If you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Have a great week everyone!

Bob

Newer | Latest | Older

Try PicoSearch to locate Previous Entries

Try PicoSearch to locate Previous Entries

SUNW closed today, 11/24/04, at $5.21, up $.03 or 0.58% on the day. Taking a look for the most recent earnings report, I found that on Yahoo, Sun reported 1st quarter 2005 results on October 14, 2004. For the 1st quarter ended September 26, 2005, revenue came in at $2.628 billion, a 3.6% increase over the first quarter in 2004 fiscal year. Net LOSS for the first quarter came in at $(174) million or $(.05)/share compared with a net loss of $(286) million or $(.09)/share the prior year same quarter. So the revenue is growing sequentially and the loss is shrinking, so things are improving somewhat.

SUNW closed today, 11/24/04, at $5.21, up $.03 or 0.58% on the day. Taking a look for the most recent earnings report, I found that on Yahoo, Sun reported 1st quarter 2005 results on October 14, 2004. For the 1st quarter ended September 26, 2005, revenue came in at $2.628 billion, a 3.6% increase over the first quarter in 2004 fiscal year. Net LOSS for the first quarter came in at $(174) million or $(.05)/share compared with a net loss of $(286) million or $(.09)/share the prior year same quarter. So the revenue is growing sequentially and the loss is shrinking, so things are improving somewhat.  How about longer-term? For that I like to turn to the Morningstar.com "5-Yr Restated" financials which show that first, revenue hit a peak of $18.2 billion in 2001, and has been decreasing each year until 2004 when it came in at $11.185 billion. Apparently the last two quarters are showing signs of a turn-around which is positive. However, when I pick stocks for this blog, I avoid stocks that haven't been steadily increasing revenue the last five years.

How about longer-term? For that I like to turn to the Morningstar.com "5-Yr Restated" financials which show that first, revenue hit a peak of $18.2 billion in 2001, and has been decreasing each year until 2004 when it came in at $11.185 billion. Apparently the last two quarters are showing signs of a turn-around which is positive. However, when I pick stocks for this blog, I avoid stocks that haven't been steadily increasing revenue the last five years.

I came across Manitowoc Co. (MTW) this morning when it was on the list of top % gainers, but as I write it has pulled back a little and is trading at $38.29, up $.91 or 2.43% on the day. It doesn't make the cut as I write, but I like what I saw earlier and would like to share it with you! I do not own any shares or options on this company.

I came across Manitowoc Co. (MTW) this morning when it was on the list of top % gainers, but as I write it has pulled back a little and is trading at $38.29, up $.91 or 2.43% on the day. It doesn't make the cut as I write, but I like what I saw earlier and would like to share it with you! I do not own any shares or options on this company. According to the Yahoo "profile", MTW "...is a diversified industrial manufacturer with three operating segments: Cranes and Related Products, Foodservice Equipment and Marine." Personally, I have seen the name mostly on ice machines (!) but they are active in industrial ship-building and cranes as well!

According to the Yahoo "profile", MTW "...is a diversified industrial manufacturer with three operating segments: Cranes and Related Products, Foodservice Equipment and Marine." Personally, I have seen the name mostly on ice machines (!) but they are active in industrial ship-building and cranes as well! How about longer-term? Taking a look at the "5-Yr Restated" financials on Morningstar.com, we can see that revenue has grown steadily, and impressively, from $680 million in 1999 to $1.8 billion in the trailing twelve months (TTM).

How about longer-term? Taking a look at the "5-Yr Restated" financials on Morningstar.com, we can see that revenue has grown steadily, and impressively, from $680 million in 1999 to $1.8 billion in the trailing twelve months (TTM). How about valuation questions? Looking at Yahoo "Key Statistics", we find that the market cap is a mid-cap sized $1.03 Billion. The trailing p/e is a moderate 27.52, but the forward p/e is a very reasonable 14.62 (fye 31-Dec-05), giving us a PEG of 0.83, which is very reasonable imho, and a Price/Sales of 0.55...also under 1.0.

How about valuation questions? Looking at Yahoo "Key Statistics", we find that the market cap is a mid-cap sized $1.03 Billion. The trailing p/e is a moderate 27.52, but the forward p/e is a very reasonable 14.62 (fye 31-Dec-05), giving us a PEG of 0.83, which is very reasonable imho, and a Price/Sales of 0.55...also under 1.0.

Hello Friends! As we start another week, I want to wish all of you the best. I also wanted to share another painting by one of my all-time favorite painters, Wayne Thiebaud. He is a California artist who I much admire and you can see all of the fun and whimsy in his creations. Doesn't it just want to make you smile?

Hello Friends! As we start another week, I want to wish all of you the best. I also wanted to share another painting by one of my all-time favorite painters, Wayne Thiebaud. He is a California artist who I much admire and you can see all of the fun and whimsy in his creations. Doesn't it just want to make you smile?

On October 6, 2003, I posted Fargo (FRGO) on Stock Picks at a price of $14.82. FRGO closed at $14.42 on 11/19/04 for a loss of $(.40) or (2.7)%.

On October 6, 2003, I posted Fargo (FRGO) on Stock Picks at a price of $14.82. FRGO closed at $14.42 on 11/19/04 for a loss of $(.40) or (2.7)%.  I posted InterParfums (IPAR) on Stock Picks on 10/6/03 at a price of $10.98. IPAR closed at $15.10 on 11/19/04 for a gain of $4.12 or 37.5%.

I posted InterParfums (IPAR) on Stock Picks on 10/6/03 at a price of $10.98. IPAR closed at $15.10 on 11/19/04 for a gain of $4.12 or 37.5%. On October 7, 2003, I posted CVS Corp. (CVS) on Stock Picks at a price of $33.57. CVS closed at $45.80 on 11/19/04 for a gain of $12.23 or 36.4%.

On October 7, 2003, I posted CVS Corp. (CVS) on Stock Picks at a price of $33.57. CVS closed at $45.80 on 11/19/04 for a gain of $12.23 or 36.4%. On October 7, 2003, I picked Regis Corp. (RGS) for Stock Picks at a price of $35.17. RGS closed at $45.30 on 11/19/04 for a gain of $10.13 or 28.8%.

On October 7, 2003, I picked Regis Corp. (RGS) for Stock Picks at a price of $35.17. RGS closed at $45.30 on 11/19/04 for a gain of $10.13 or 28.8%. On October 8, 2003, I posted Ceradyne (CRDN) on Stock Picks at a price of $30.50. CRDN split 3:2 on 4/8/04 and oour resultant selection price was actually $20.34. CRDN closed at $47.63 for a gain of $27.29 or 134.2%.

On October 8, 2003, I posted Ceradyne (CRDN) on Stock Picks at a price of $30.50. CRDN split 3:2 on 4/8/04 and oour resultant selection price was actually $20.34. CRDN closed at $47.63 for a gain of $27.29 or 134.2%.  On October 9, 2003, I posted NetGear (NTGR) on Stock Picks at $17.88/share. NTGR closed on 11/19/04 at $15.62/share for a loss of $(2.26) or (12.6)%.

On October 9, 2003, I posted NetGear (NTGR) on Stock Picks at $17.88/share. NTGR closed on 11/19/04 at $15.62/share for a loss of $(2.26) or (12.6)%.  Finally, on October 10, 2003, I posted Infosys Technologies Ltd (ADR) (INFY) on Stock Picks at $77.40. INFY split 2:1 on 7/7/04, so our effective pick price was actually $38.70. INFY closed on 11/19/04 at $65.51 for a gain of $26.81/share or 69.3%.

Finally, on October 10, 2003, I posted Infosys Technologies Ltd (ADR) (INFY) on Stock Picks at $77.40. INFY split 2:1 on 7/7/04, so our effective pick price was actually $38.70. INFY closed on 11/19/04 at $65.51 for a gain of $26.81/share or 69.3%. I came across Genesco (GCO) this morning while scanning the list of top % gainers on the NYSE. I do not own any shares or options on this stock. According to the Yahoo "Profile", GCO "...is a retailer and wholesaler of branded footwear. The company operates four business segments: Journeys, consisting of Journeys and Journeys Kidz retail footwear chains; Underground Station?Jarman Group, consisting of the Underground Station and Jarman retail footwear chains; Johnston and Murphy, composed of Johnston and Murphy retail operations and whole sale distribution, and Dockers Footwear."

I came across Genesco (GCO) this morning while scanning the list of top % gainers on the NYSE. I do not own any shares or options on this stock. According to the Yahoo "Profile", GCO "...is a retailer and wholesaler of branded footwear. The company operates four business segments: Journeys, consisting of Journeys and Journeys Kidz retail footwear chains; Underground Station?Jarman Group, consisting of the Underground Station and Jarman retail footwear chains; Johnston and Murphy, composed of Johnston and Murphy retail operations and whole sale distribution, and Dockers Footwear." Like so many stocks on this blog, what pushed this stock higher was the announcement of 3rd quarter earnings. Net income rose to $12.1 million or $.54/share up from $9.4 million or $.42/share a year ago. Genesco also raised guidance for future sales and earnings. This was a bullish report! In a slightly more recent report, GCO detailed their revenue and reported that sales jumped 36% during the quarter.

Like so many stocks on this blog, what pushed this stock higher was the announcement of 3rd quarter earnings. Net income rose to $12.1 million or $.54/share up from $9.4 million or $.42/share a year ago. Genesco also raised guidance for future sales and earnings. This was a bullish report! In a slightly more recent report, GCO detailed their revenue and reported that sales jumped 36% during the quarter.  How about longer-term? Is this earnings and revenue growth a fluke? I believe it is the consistency in earnings and revenue growth that is the best prognosticator of an outstanding price appreciation in an investment. For this information, I like to turn to the "5-Yr Restated" Financials on Morningstar.com. Here we can see clearly illustrated the consistent growth in revenue from $553.0 million in 2000 to $837.4 million in 2004 and $936.6 million in revenue in the trailing twelve months (TTM).

How about longer-term? Is this earnings and revenue growth a fluke? I believe it is the consistency in earnings and revenue growth that is the best prognosticator of an outstanding price appreciation in an investment. For this information, I like to turn to the "5-Yr Restated" Financials on Morningstar.com. Here we can see clearly illustrated the consistent growth in revenue from $553.0 million in 2000 to $837.4 million in 2004 and $936.6 million in revenue in the trailing twelve months (TTM). What about valuation issues? First, using the Ameritrade definition of market capitalization, which places mid cap stocks between $500 million and $3 billion in market cap, this stock just makes the cut for a mid cap stock with a market cap of $640.16 million. The trailing p/e is nice at 17.24 (imho), and the forward p/e is nicer at 14.03.

What about valuation issues? First, using the Ameritrade definition of market capitalization, which places mid cap stocks between $500 million and $3 billion in market cap, this stock just makes the cut for a mid cap stock with a market cap of $640.16 million. The trailing p/e is nice at 17.24 (imho), and the forward p/e is nicer at 14.03.

So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain!

So what do I think? Reviewing some of the things I just went over, the recent quarterly report was strong and the company raised guidance, which I really like. In addition, Morningstar shows a steady growth in revenue, a growth in earnings not quite as steady, free cash flow being generated, a good if not spectacular balance sheet and reasonable valuation. Add in some shares out short that may need to be covered and a chart that looks strong to me....well I like this stock. Now, if I only had the means to buy some shares....but will sit on my hands until I can sell a portion at a gain! The market has been behaving well. Today, after a small correction yesterday, the Dow and the NASDAQ have been moving higher. Scanning the lists of top percentage gainers, I came across Watts Water Technologies Inc (WTS) which is, as I write, trading at $29.90, up $1.50 or 5.28% on the day. I do NOT own any shares of this stock. According to the Yahoo "Profile" on Watts, WTS "...is a global manufacturer of safety and flow control products for residential and commercial plumbing, heating and water quality markets."

The market has been behaving well. Today, after a small correction yesterday, the Dow and the NASDAQ have been moving higher. Scanning the lists of top percentage gainers, I came across Watts Water Technologies Inc (WTS) which is, as I write, trading at $29.90, up $1.50 or 5.28% on the day. I do NOT own any shares of this stock. According to the Yahoo "Profile" on Watts, WTS "...is a global manufacturer of safety and flow control products for residential and commercial plumbing, heating and water quality markets."  On November 2, 2004 WTS announced 3rd quarter 2004 results. Sales came in at $214.8 million, a $39.3 million or 22% increase over sales in the same quarter in 2003. Net income was $13.7 million, a 54% or $4.8 million in crease compared to the comparable 2003 3rd quarter. This company has been busy making acquisitions, but clearly they appear to be handling these purchases satisfactorily, in my humble opinion.

On November 2, 2004 WTS announced 3rd quarter 2004 results. Sales came in at $214.8 million, a $39.3 million or 22% increase over sales in the same quarter in 2003. Net income was $13.7 million, a 54% or $4.8 million in crease compared to the comparable 2003 3rd quarter. This company has been busy making acquisitions, but clearly they appear to be handling these purchases satisfactorily, in my humble opinion. How about longer-term? Taking a look at the "5-Yr Restated Financials" from Morningstar.com, we can see that revenue has grown strongly from $261 million in 1999 to $705.7 million in the trailing twelve months. Earnings per share have grown from $.56/share in 1999 to $1.21 in the trailing twelve months. Dividends have also increased from $.18/share in 1999 to $.25/share in the TTM.

How about longer-term? Taking a look at the "5-Yr Restated Financials" from Morningstar.com, we can see that revenue has grown strongly from $261 million in 1999 to $705.7 million in the trailing twelve months. Earnings per share have grown from $.56/share in 1999 to $1.21 in the trailing twelve months. Dividends have also increased from $.18/share in 1999 to $.25/share in the TTM. How about valuation questions? For this I like to turn to Yahoo "Key Statistics" on WTS. Here we can see that this is a mid-cap stock with a market capitalization of $967.03 million. The trailing p/e is reasonable at 19.47, and the forward p/e is nicer at 16.33. They have this company down as a PEG of 1.33, but with the current earnings results, I suspect this is currently closer to 1.0.

How about valuation questions? For this I like to turn to Yahoo "Key Statistics" on WTS. Here we can see that this is a mid-cap stock with a market capitalization of $967.03 million. The trailing p/e is reasonable at 19.47, and the forward p/e is nicer at 16.33. They have this company down as a PEG of 1.33, but with the current earnings results, I suspect this is currently closer to 1.0.

For any of you who are new to this website, I have lots of additional discussions, and you can access these "picks" by clicking on the dates along the left side of the page on Stock Picks Bob's Advice. If you are reading this blog posting on a third party site, well I certainly apprreciate the third parties who run my blog, but feel free to come to my own website to get a better idea of what this is about!

For any of you who are new to this website, I have lots of additional discussions, and you can access these "picks" by clicking on the dates along the left side of the page on Stock Picks Bob's Advice. If you are reading this blog posting on a third party site, well I certainly apprreciate the third parties who run my blog, but feel free to come to my own website to get a better idea of what this is about!  Generally, I have found it best to restrict my analysis to stocks near or higher than $10.00. Looking through the lists, I came across GameStop (GME), a stock which I do NOT own any shares. GameStop closed on 11/12/04 at $23.50, up $2.11 or 9.86% on the day. According to the "Snapshot" on CNN.money, GameStop's "...principal activity is to sell video games and PC entertainment software."

Generally, I have found it best to restrict my analysis to stocks near or higher than $10.00. Looking through the lists, I came across GameStop (GME), a stock which I do NOT own any shares. GameStop closed on 11/12/04 at $23.50, up $2.11 or 9.86% on the day. According to the "Snapshot" on CNN.money, GameStop's "...principal activity is to sell video games and PC entertainment software." Before I "approve" of a stock as a pick, I insist that the latest quarterly report is a good report. What is good for me? I like to see increasing revenue AND increasing earnings year-over-year, and sequentially if possible.

Before I "approve" of a stock as a pick, I insist that the latest quarterly report is a good report. What is good for me? I like to see increasing revenue AND increasing earnings year-over-year, and sequentially if possible.  What about some more information...has this been a consistent grower? I believe that the market values consistency, and I do too. What we are hoping when we look at a consistent record, is that the future will also continue to be positive. For this information, I turn to Morningstar.com. On this site, I checked for the "5-Yr Restated Financials".

What about some more information...has this been a consistent grower? I believe that the market values consistency, and I do too. What we are hoping when we look at a consistent record, is that the future will also continue to be positive. For this information, I turn to Morningstar.com. On this site, I checked for the "5-Yr Restated Financials".  What do I do next? Now that I have looked at some basic fundamental questions, I like to look at a value perspective. For this I turn to the "Key Statistics" from Yahoo. Some numbers I like to review include the market cap: for GME this is $1.32 billion making it a mid-cap stock, the P/E ratio which isn't bad at 21.60, and the forward P/E is even better (fye 31-Jan-06) at 16.10.

What do I do next? Now that I have looked at some basic fundamental questions, I like to look at a value perspective. For this I turn to the "Key Statistics" from Yahoo. Some numbers I like to review include the market cap: for GME this is $1.32 billion making it a mid-cap stock, the P/E ratio which isn't bad at 21.60, and the forward P/E is even better (fye 31-Jan-06) at 16.10.