Stock Picks Bob's Advice

Monday, 6 December 2004

December 6, 2004 DaVita (DVA)

Hello Friends! Well, if you are reading this blog, you will know that earlier today I reported on

Stock Picks Bob's Advice that I had purchased shares of DaVita (DVA) in my

"Trading Portfolio". Now I could have sworn that I already had posted this stock somewhere on this blog...and I indeed may have, but even I find it a bit tough to sort through all of the entries, and I didn't locate any post or discussion, so I promised you I would talk about DaVita right here. I did own some shares in my trading account in the last year, and sold on a dip even though I was in a profit situation...so I am back into this stock! Please remember that I am an amateur investor so please consult with your professional investment advisors before making any investment decisions based on information on this website.

DaVita (DVA), according to the

Yahoo "Profile" on DVA "...is a provider of dialysis services in the United States for patients suffering from chronic kidney failure, also known as end-stage renal disease (ESRD)." As I noted earlier, I just purchased 200 shares of DVA in my own trading account. DVA is doing well today and showed up in the

list of top % gainers on the NYSE. Currently, as I write, DVA is trading at $36.42, up $2.92 on the day or 8.72%.

On November 2, 2004, DVA

reported 3rd quarter results. For the quarter ended September 30, 2004, net operating revenue came in at $595.5 million up from $513.3 million last year. Net income was $60.4 million or $.59/diluted share up from $38.1 million in the same quarter in 2003 or $.36/diluted share. These results look solid to me!

After determining that the latest quarterly earnings report was satisfactory, I like to turn to Morningstar.com to get a longer-term view. The

"5-Yr Restated" financials on DVA show that revenue has steadily been growing from $1.4 billion in 1999 to $2.2 billion in the trailing twelve months (TTM). During this time, the company has also steadily improved its earnings from a loss of $(1.21) in 1999 to $1.96/share in the TTM. Free cash flow has also been positive with $214 million in 2001 and $193 million in 2003.

The balance sheet on Morningstar whows $200.7 million in cash and $547.7 million in other current assets, plenty to cover the $384.4 million in current liabilities and enough to make a bit of a dent on the sizeable $1.3 billion in long-term debt. Hopefully, with the generation of nearly $200 million in free cash flow annually, we will see the balance sheet continuing to improve.

How about "valuation"? For this I turn to

Yahoo "Key Statistics" on DVA. Here we can see that this is a large cap stock, if we cut off mid-cap at $3 billion. The market cap is $3.57 billion. The trailing p/e is nice at 16.51 with a forward p/e of 15.91 (fye 31-Dec-05). The PEG, with the steady growth, is reasonable at 1.18, and price/sales also nice at 1.46.

Yahoo reports 97.6 million shares outstanding with 96.90 million of them that float. Currently there are 1.64 million shares out short (11/8/04), representing 1.70% of the float or 1.549 trading days, so this doesn't look very significant to me.

No cash dividend is paid. The company did recently split its stock with a 3:2 split reported in June, 2004.

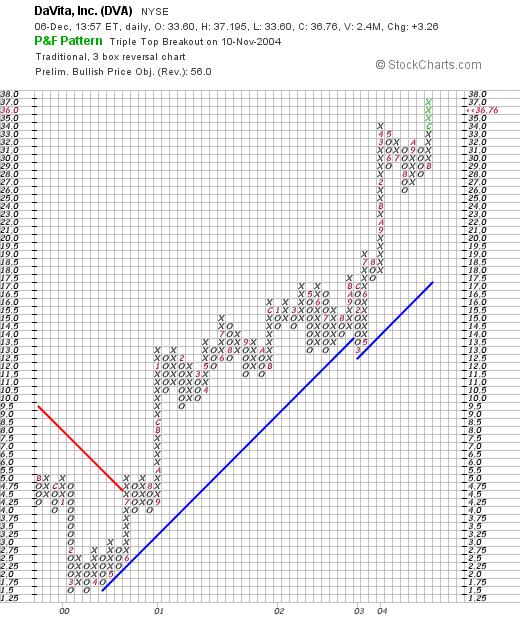

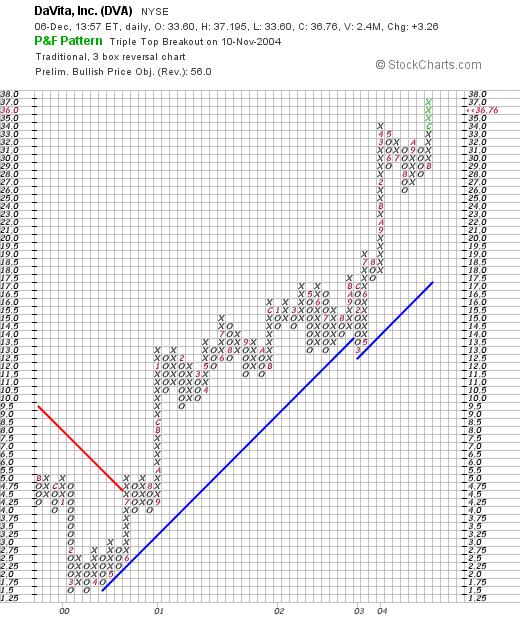

How about "technicals"? If we use a Point & Figure chart from

Stockcharts.com:

We can see that this stock has a very strong chart, having "bottomed" in March, 2000, at around $1.50/share, it has climbed steadily to its current level with hardly a pull-back! Might even be a tad ahead of itself (?).

So what do I think? Well, I liked this stock enough to purchase some shares. I have been kicking myself when I got "whip-sawed" earlier and dumped this stock when I thought an earnings report was bad...and had moved a bit too quickly. The latest report is solid, the steady revenue and earnings growth looks great, valuation is nice with a p/e in the mid-teens, and the chart and balance sheet is terrific!

Thanks again for stopping by! Again remember I am an amateur so PLEASE consult with your professional advisors as I CANNOT be responsible for your losses and shall not take credit for your gains! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

"Trading Transparency" Davita (DVA)

Hello Friends! Well you know how that nickel burns a hole in my pocket (boy is THAT line ever getting old)! Well, I sold a small position in my smallish position in SBUX and this entitled me to purchase a new position! Looking through the lists of top % gainers, I came across Davita (DVA), which I could have sworn that I had reviewed in the blog....but I just don't see where! So I shall need to review this stock a little later.

Making a short story long, I purchased 200 shares a few moments ago at $36.25/share. I am slowly but surely working back up to my 25 position goal. However, if we sell a stock on the downside, I shall be sitting on my hands once again!

Thanks so much for stopping by! Please remember that I am an amateur investor, so please consult with your professional investment advisors before using any information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Saturday, 4 December 2004

"Looking Back One Year" A review of stock picks from the week of October 20, 2003

Hello Friends! Thanks so much for visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional, certified investment advisors, to make sure that all of your investment decisions are timely, appropriate, and likely to be profitable for you! Please feel free to email me with any of your questions, comments, or words of encouragement at bobsadviceforstocks@lycos.com .

If you are new to this website, well welcome and make yourself at home! What I like to do here, is to look at the active stocks of the day, review their fundamental findings (things like earnings, revenue growth, free cash flow, balance sheet, and valuation); take a brief look at their chart and see if it looks like a "solid" company to me! Of course that is only MY opinion, and you or professional investors might think otherwise. THAT is the fun of all of this. If we all thought the same way, who would care? Since the blog has been up now since May, 2003, and have something like 671 entries here (!), it is nice to review the past picks and see how they would have turned out if we had simply "bought and held". As many of you know, I am NOT a buy and hold investor. I sell stocks quickly at losses of 8% and sell slower on gains. But for the sake of analysis, that is what I like to do on weekends; look back one year and figure out if the ideas listed were 'good' ones!

On October 20, 2003, I

posted SFBC Int'l (SFCC) on Stock Picks at a price of $34.60. SFCC had a 3:2 stock split on 5/20/04 making our effective pick price actually $23.07. SFCC closed at $39.40 on 12/3/04 for a gain of $16.33 or 70.8%.

On 10/27/04, SFCC

reported 3rd quarter 2004 results. Revenue was up 38.8% to $40.4 million from $29.1 million the prior year. Net earnings for the quarter came in at $5.27 million vs. $3.42 million last year or $.34/diluted share vs $.28/diluted share the prior year. These were solid results!

On October 20, 2003, I

posted Renal Care Group (RCI) on Stock Picks at a price of $36.31. RCI had a 3:2 split on 5/25/04 giving us an effective stock pick price of $24.21. RCI closed on 12/3/04 at $33.40 for a gain of $9.19 or 38.0%.

On 10/26/04, RCI

announced 3rd quarter results. Net revenues climbed 40.3% to $356.1 million from $253.8 million the prior year. Net income rose 14.8% to $30.5 million compared with net income of $26.5 million in the 3rd quarter of 2003. Diluted net income per share was up 25.7% to $.44/share compared with $.35/share in the same quarter of 2003.

On 10/20/03 I

posted Varian Medical Systems (VAR) on Stock Picks at a price of $60.78. VAR had a 2:1 stock split on 8/2/04. Thus, the effective stock pick price was actually $30.39. VAR closed at $42.86 on 12/3/04 for a gain of $12.47 or 41.0%.

On October 27, 2004, VAR

reported 4th quarter 2004 results. Revenues for the quarter came in at $345 million, up 14% from the prior year. Net earnings for the quarter came in at $51.8 million, up from $43.6 million the prior year or $.37/diluted share vs. $.31/diluted share in 2003. Solid results imho.

On October 21, 2003,

Exponent (EXPO) was posted on Stock Picks at a price of $20.04. (This is currently the only stock on this weeks group that I currently own in my

"Trading Portfolio") EXPO closed on 12/3/04 at $27.95 for a gain of $7.91 or 39.5%.

On October 18, 2004, EXPO

reported 3rd quarter 2004 results. Revenues came in at $38.04 million, a 7% increase over the $35.66 million reported in the same quarter in 2003. Net income was up 11% to $3.17 million or $.37/diluted share compared with $2.85 million or $.36/diluted share the prior year. These were good results if not quite as spectacular as a couple of the prior posts.

On October 21, 2003, I

posted AirTran Holdings (AAI) on Stock Picks at a price of $19.56. AAI closed at $12.34 on 12/3/04 for a loss of $(7.22) or (36.9)%.

On 10/27/04, AAI

reported 3rd quarter 2004 results. AAI reported revenue of $245.6 million, up from $237.3 million last year. However, the company lost $(9.8) million or $(.11)/share down from a profit of $19.6 million or $.24/share last year. These were NOT good results and the stock price reflected this.

On October 22, 2003, I

posted Headwaters (HDWR) on Stock Picks at a price of $17.41. HDWR closed at $30.47 on 12/3/04 for a gain of $13.06 or 75.0%.

On November 10, 2004, HDWR

announced 4th quarter 2004 results. Revenue for the fourth quarter ended September 30, 2004, came in at $198.6 million (including acquisitions), up 86% from the $106.5 million the prior year. Net Income increased to $19.5 million or $.57/diluted share compared with $11.2 million or $.40/diluted share in the prior year. These results were good and the stock price reflects these developments.

Shenandoah Telecommunications (SHEN) was posted on Stock Picks

Shenandoah Telecommunications (SHEN) was posted on Stock Picks on 10/23/03 at $43.50/share. SHEN had a 2:1 split February 23, 2004, making out effective stock pick price $21.75. SHEN closed at $31.01 on 12/3/04 for a gain of $9.26 or 42.6%.

On October 19, 2004, SHEN

announced 3rd quarter results. For the quarter ended September 30, 2004, total revenues increased 13.4% from last year. Earnings came in at $.41/share up from $.35/share last year. In addition, SHEN announced a dividend increase. All of these are positive developments for the stock price!

I

posted SM&A (WINS) on Stock Picks on October 23, 2003 at a price of $13.248. WINS closed on 12/3/04 at $8.09, for a loss of $(5.158) or (38.9)%.

On October 18, 2004, WINS

reported 3rd quarter 2004 results. Revenue came in at $16.1 million DOWN from the $18.7 million reported for the same quarter last year. Net income came in at $1.7 million or $.08/diluted share compared with net income last year of $2.9 million or $.13/diluted share. These results are reflected in the lower stock price!

Finally, on October 24, 2003, I

posted Business Objects (BOBJ) on Stock Picks Bob's Advice at $32.15/share. BOBJ closed at $23.65 on 12/3/04 for a loss of $(8.50) or (26.4)%.

On November 3, 2004, BOBJ

reported 3rd quarter 2004 results. Revenue came in at $219.5 million and earnings per share were $.12. This compares with revenue of $129.1 million in 2003. Earnings, however, came in at $.17/share in 2003. Thus, imho, the lower stock price at this time!

So how did we do that week a little over a year ago? Of the nine stock picks that week we had six with gains ranging from 38.0% to 75.0%, and three with losses ranging from (26.9)% to (38.9)%. Our average percentage gain came out at 22.7%. THAT was a great week! Of course, past performance is NOT any kind of guarantee for future performance!

Thanks so much for stopping by! I hope you all have a wonderful weekend and get all of your Holiday Shopping and visiting done! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Friday, 3 December 2004

"Trading Transparency" SBUX

Hello Friends! Well it was a bit of a roller-coaster day in the market. I kept waiting for my Cantel (CMN) to hit a second sale point (at around 60% gain), but the stock would not oblige me and stayed at the 58% gain point. So I sat on my hands!

However, I was browsing through my stocks and realized that I had overlooked my Starbucks (SBUX). Now unfortunately, I never bought a lot of SBUX, and have sold it several times since purchasing....in fact, my shares were all acquired on January 24, 2003, at a cost basis of $22.81/share. I sold my first 25 shares on 9/8/03 at a price of $28.47, for a gain of $5.66 or 24.8%, the second sale was 15 shares on 1/23/04 at a price of $36.16, or a gain of $12.35 or 54.2%, the third sale was 15 shares at a price of $43.89 for a gain of $20.58 or 90.2%. So you can see, I was selling about 1/4 of my holdings each time at nearly 30%, 60%, and 90% positions.

Today, having only 45 shares remaining (unfortunately), I noticed that the stock was selling at $58.69 (where I sold it) or a gain of $35.88 or 157.3%. I totally slept through the 120% point!!!. So I sold 10 shares at $58.69, leaving 35 shares remaining. My next target will be at a 180% gain (!)...and I might even get there!

Thus, even though this morning I sold a stock at a loss (NAVR), I sold a portion at a gain this afternoon putting me once again in the position of being able to add a new position to my portfolio! And CMN might even hit a sale point soon!

Thanks so much for stopping by! Please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Have a great weekend everyone!

Bob

"Trading Transparency" NAVR

Just a quick update. I was monitoring my NAVR stock closely, hoping against hope that it wouldn't hit that 8% stop. Unfortunately, it hit that price this morning, and I just sold 400 shares of NAVR at $16.24. These shares were JUST acquired on 11/15/04 at a price of $17.92, and thus, I had a loss of ($1.68)/share or (9.4)%. As much as I like this stock, out it went! There is a lesson there somewhere.....Anyhow, I won't be buying a "replacement" for this issue until one of my stocks hits a sale at a "gain". CMN is close to a second sale at about a 58% gain currently....so I may be back in the market soon :).

Regards!

Bob

Thursday, 2 December 2004

December 2, 2004 Gildan Activewear (GIL)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice! I hope that your visit is enjoyable and that my thoughts also help you to think about ways of looking at stocks. Please remember that I am an AMATEUR investor, so please consult with your professional investment advisors before making any investment decisions based on information on this website. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Today, while looking through the

top % gainers of the NYSE list, I came across Gildan Activewear, Inc. (GIL), which currently is trading at $32.65, up $.97 or 3.06% on the day. I do not own any shares of GIL nor do I own any options.

According to the

Yahoo "Profile" on Gil, Gildan "...is a vertically integrated manufacturer and marketer of branded basic activewear for sale princiapply in the wholesale imprinted activewear segment of the Canadian, United States, European and other international apparel markets."

What pushed the stock higher today, was the

announcement of 4th quarter earnings. Sales for the quarter came in at $145.6 million, up 33.3% from $109.2 million in the same quarter last year. Net earnings came in at $16.8 million or $.56/diluted share up 18.3% and 16.7% from $14.2 million or $.48/diluted share last year. These were solid results! In addition, the company provided guidance for 2005 predicting $2.60/share in earnings on sales of $620 million. This is in contrast to $2.02/diluted share in 2004 on $533.3 million in sales.

How about longer-term? If we look at a

Morningstar "5-Yr Restated" Financials on GIL, we can see that revenue has been steadily increasing from $221.6 million in 1999 to $533.3 million as just reported in 2004. Earnings have grown steadily (except for a dip in 2001) from $.67/share in 1999 to the just-reported $2.02/share in 2004.

Free cash flow, which was a negative $(40) million in 2001, has improved and came in at $21 million in the trailing twelve months. In addition, the balance sheet, per Morningstar, shows $68.8 million in cash and $174.9 million in other current assets, as balanced against $88.9 million in current liabilities and $74.2 million in long-term liabilities. This looks just fine to me!

How about "valuation"? Using

Yahoo "Key Statistics" on GIL, we can see that this is a "mid-cap" stock with a market cap of only $968.01 million. The trailing p/e is a reasonable 16.31, and the forward p/e (fye 5-Oct-05) is even nicer at 12.47. With the current growth rate, the PEG has to be substantially under 1.0, but none is reported on Yahoo. Price/sales is 1.83.

Yahoo reports 29.63 million shares outstanding with only 10.10 million of them that float. Of these, 738,000 shares are out short, representing 7.31% of the float, or a whopping 25.448 days of trading volume. If we were going to see a squeeze, this is one of the higher short "ratios" I have seen for awhile! No cash dividend is reported, and no stock dividend is noted on Yahoo.

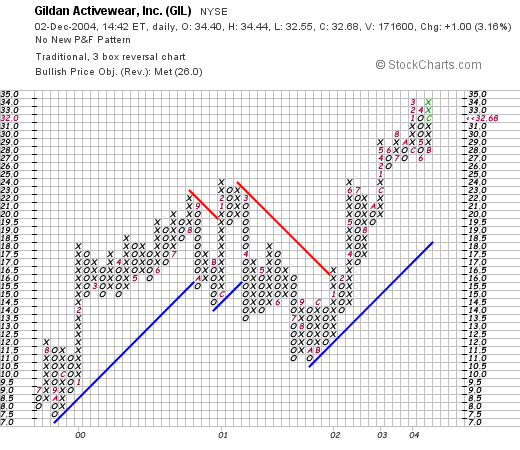

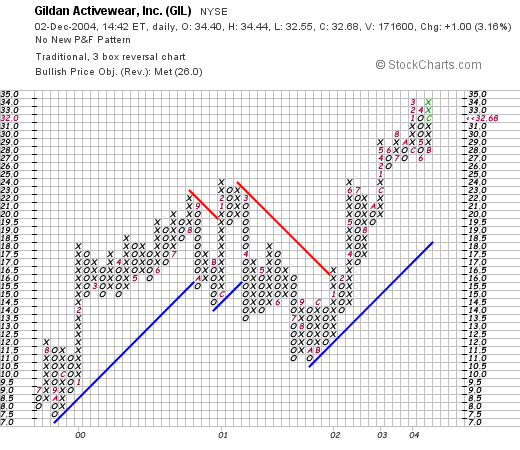

How about a chart? Taking a look at

Stockcharts.com for a Point & Figure chart on GIL:

We can see that this stock was trading higher from June, 1999, and hit a temporary peak at $25 in February, 2001, (recall that earnings dropped precipitously in 2001 and then reversed upward just as fast), the stock dropped to $11/share in September, 2001, then has climbed steadily higher to its current level around $34. The chart looks nice to me!

So what do I think? The stock looks very nice to me. I don't know anything first-hand about the company or their products, but it is a bit different than one of those high-tech firms! I guess I know what a tee-shirt is! Their latest earnings report is solid, they are guiding for higher growth in 2005, their Morningstar numbers look great with steady earnings and revenue growth for the past five years (except for the 2001 dip). They are generating free cash flow and they have a nice balance sheet. Valuation is great with the p/e essentially in the mid-teens, and there are a lot of shares out short!

So what do I think? The stock looks very nice to me. I don't know anything first-hand about the company or their products, but it is a bit different than one of those high-tech firms! I guess I know what a tee-shirt is! Their latest earnings report is solid, they are guiding for higher growth in 2005, their Morningstar numbers look great with steady earnings and revenue growth for the past five years (except for the 2001 dip). They are generating free cash flow and they have a nice balance sheet. Valuation is great with the p/e essentially in the mid-teens, and there are a lot of shares out short!

Anyhow, if I just hit a sale on my CMN, which IS close, except for the very sloppy market today, I might just be buying some shares....however, rules are rules, and I shall be sitting on my hands for now! Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Wednesday, 1 December 2004

A Reader Writes "Any input about AHFI?"

Hello Friends! I always enjoy getting email and today was no exception. I received a note from Chris who wrote:

Hey Bob,

To start, I want to say that I love your web site.

I'm just starting to learn about investing, and I was wondering if you had any input about a stock I just heard about...

The ticker is AHFI

I learned about it on this site.

http://www..........

Also.

I wanted to open an on-line account, I was thinking about going with Scottrade.com

Do to a low amount of funds, I think that's the best option. Do you have any thoughts?

Thanks for your time.

Chris (I deleted the link to the penny stock site as I do not wish to endorse or judge another website like that here.)

Chris, first of all, I am not in a position to advise you whether AHFI is a good investment for you or not. For that, you should consult with your professional investment advisor as I am just an AMATEUR investor! However, I will tell you what I can find about this company.

First of all, checking Yahoo, we can see that AHFI is not longer listed as that, it is on the "pink sheets" which means generally that it does not qualify for the fairly loose requirements of the NASDAQ, meaning it is more of a penny stock and is highly speculative. I do not review speculative penny stocks on this website.

I did find out that AHFI.PK stands for "Absolute Health and Fitness Inc. The stock currently is trading at $3.53/share. This company is so small that Yahoo does not even carry headlines on it. In fact, even Stockcharts does not carry a chart. The best chart I could find was from Yahoo:

Thus, we can see that we have a chart. And that is about all I can easily find. This is not a stock that I am interested in. If you have some additional information that I can review, please send it to me. However, penny stocks and I just don't get along. Maybe I am just getting too old. I just want to make a "base hit" with a stock. And do it consistently! That is how you can win the investing game in my humble opinion.

I found this description on a message board post: Absolute Health & Fitness currently owns and operates 3 fitness centers in the Southeast, and expects to add another 8 centers via acquisition, resulting in a company generating revenues in excess of $10 million / year. A business combination with one other major fitness center operator is expected to more than double the Company's revenues to over $23 million this year, and increase the number of its operating Business Units to 24. Thus, you would be basically investing in a three store fitness chain. Yikes. Now THAT is speculative imho!

I want to own a stock that has earnings I can review, a Morningstar report that I can analyze, a point and figure chart and estimates of valuation. I would even like to visit their website. This company has none of that. In addition, in general, I like to invest in stocks trading over $10.

Good luck with whatever decision you happen to make. Insofar as Scottrade or Schwab or Fidelity or Waterhouse or Ameritrade, that is all up to you. I have found that Fidelity works well with me, especially their nice presentation of gains/losses/history questions that I use in determining my investing decisions!

It is far more important HOW and WHAT decisions that you make than where you make your trades imho. Good luck and email me at bobsadviceforstocks@lycos.com if you have any other questions or comments regarding this or anything else on your mind!

Bob

Monday, 29 November 2004

"Trading Transparency" VMSI and XXIA

Hello Friends! Just a quick note to update you. I sold 50 shares of my 200 shares of VMSI a few moments ago at about a 30% gain. Thus with a buy signal, I decided to go ahead and purchase 400 shares of XXIA, a stock I just reviewed today that is doing well in the market! I sold the 50 shares of VMSI at $61.02 which I had purchased at a cost of $46.94/share on 4/16/04, and thus had a gain of $14.08 or 30.0%, the first sale point. The 400 shares of XXIA were purchased a few moments later at a cost of $15.17/share.

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

November 29, 2004 Ixia (XXIA)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. I survived "Black Friday" without too much financial damage. As always, please remember that I am an AMATEUR investor, so I cannot be responsible for any of your trades or investment decisions. Please consult with a professional investment advisor to make sure that all investment decisions you make are timely, appropriate, and likely to be profitable for you! If you have any questions or comments, please email me at bobsadviceforstocks@lycos.com .

While looking through the

list of top % gainers on the NASDAQ today, I cam across Ixia (XXIA), a stock that I hadn't heard of previously, and needless to stay a stock that I do not own any shares nor any options. As I am writing, this, Ixia (XXIA) is trading at $15.13, up $1.38 or 10.04% for the day in an otherwise very lackluster market.

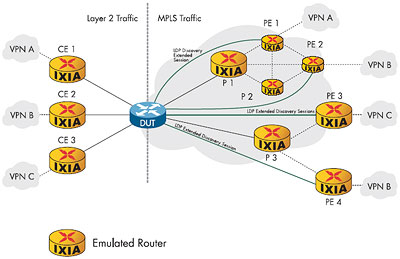

According to the

"Yahoo Profile" on XXIA, Ixia "...is a provider of multi-port traffic generation and performance analysis systems for the high-speed data communications market, including the Internet infrastructure and local, metropolitan and wide area networks." Well, since I am NOT a computer "geek" (excuse the term please), I cannot tell you on an intuitive level exactly what they do, but their numbers deserve a second look!

On October 21, 2004, XXIA

announced 3rd quarter 2004 results. Net revenue for the third quarter ended September 30, 2004, increased 39% year-over-year and 12% sequentially from the prior quarter to $30.1 million. Net income on a GAAP basis for the quarter came in at $4.7 million or $.07/diluted share a 96% increase over the $2.4 million or $.04/diluted share for the third quarter in 2003.

How about longer-term? For this, as you probably already know, I like to turn to Morningstar. The

Morningstar.com "5-Yr Restated" financials on XXIA show a slightly erratic revenue picture but basically, revenue has grown from $24 million in 1999 to $96 million in the trailing twelve months (TTM). Extrapolating the current quarter would get us to $120 million in revenue on an annualized basis.

Earnings have also been erratic increasing from $.16/share in 2001 to $.17/share in the trailing twelve months. Again, annualizing the latest quarter gets us to a $.28/year rate.

Free cash flow has remained positive with $20 million in free cash flow in 2001, and $15 million in free cash flow in the TTM.

The balance sheet as presented by Morningstar.com also looks solid with $78.5 million in cash and $34.0 million in other current assets. The cash alone would cover the $19.5 million and ZERO long-term debts about four times over!

What about "valuation" questions? Looking at the

Yahoo "Key Statistics" on Ixia, we can see that this is a mid-cap stock with a market capitalization of $931.97 million. The trailing p/e is rich at 71.27, the forward p/e is a shy better at 35.14, and the PEG shows the valuation questions with a 2.54 number. Price/sales also steep at 8.09. This stock is not a bargain. (But that might not mean it isn't still a good investment!)

The company has 61.68 million shares outstanding with only 28.00 million that float. Of these, as of 11/8/04, there were 614,000 shares out short representing only 2.19% of the float and only 1.23 trading days of volume. There isn't a lot of short sellers on this stock.

Yahoo does not show any dividend and no stock splits are reported.

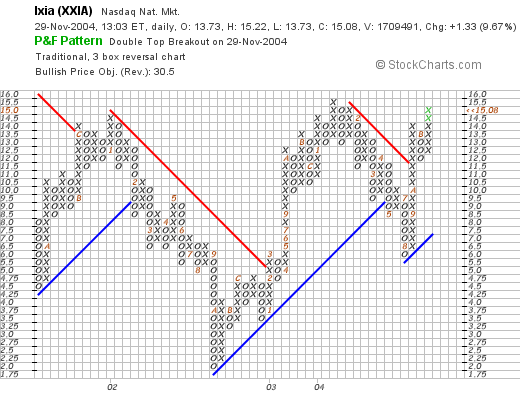

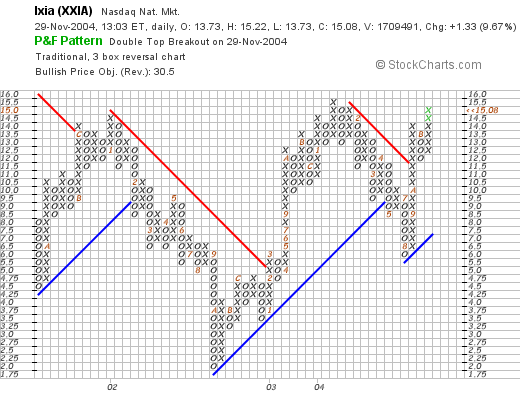

How about "technicals"? For this I like to review a

Point and Figure Chart from Stockcharts.com:

Here we can see that this stock really has been trading somewhat sideways since mid 2001, when it ran into resistance in January, 2002, at around the $15 level, declined to $2.00 in October, 2002, and again hit a resistance level at around $15.50. The stock did not pull back quite as far, finding support at around $5.00 and now has been moving higher, possible to new heights, but again is now at the $15.00 level...but earnings are strong, and I suspect we will see continued price appreciation, market conditions supporting it, in the future.

What do I think? Well it is an interesting picture. A small high-tech stock with a great recent report, bucking the current day's market with a nice move to the upside. The valuation is a bit pricey, but then again, the stock is just going profitable and is growing both revenue and earnings strongly...so I defer to you whether that is a good enough growth picture to justify the price! The free cash flow is nice, the balance sheet is pristine, and technicals look fine to me. I kind of like this stock and would be a buyer in here if my own portfolio would allow me. I am close to a sale on VMSI, but will sit on my hands until I have a sale on a gain to allow me to add a new position!

Thanks so much for stopping by. Again, if you have any questions, comments, or words of encouragement on this or any other aspect of this website, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Sunday, 28 November 2004

Pleasant thought.

As we head into another week of trading, I wanted to share with you another painting of an artist I enjoy, Mark Rothko. There is something simple yet elegant about his paintings. Seriously. When we are thinking about profits, cash flow, momentum, or federal reserve rates of interest, it is nice to come back to a simpler world of color size and proportion. Wishing all of you a wonderful week!

Bob

Newer | Latest | Older

DaVita (DVA), according to the Yahoo "Profile" on DVA "...is a provider of dialysis services in the United States for patients suffering from chronic kidney failure, also known as end-stage renal disease (ESRD)." As I noted earlier, I just purchased 200 shares of DVA in my own trading account. DVA is doing well today and showed up in the list of top % gainers on the NYSE. Currently, as I write, DVA is trading at $36.42, up $2.92 on the day or 8.72%.

DaVita (DVA), according to the Yahoo "Profile" on DVA "...is a provider of dialysis services in the United States for patients suffering from chronic kidney failure, also known as end-stage renal disease (ESRD)." As I noted earlier, I just purchased 200 shares of DVA in my own trading account. DVA is doing well today and showed up in the list of top % gainers on the NYSE. Currently, as I write, DVA is trading at $36.42, up $2.92 on the day or 8.72%. On November 2, 2004, DVA reported 3rd quarter results. For the quarter ended September 30, 2004, net operating revenue came in at $595.5 million up from $513.3 million last year. Net income was $60.4 million or $.59/diluted share up from $38.1 million in the same quarter in 2003 or $.36/diluted share. These results look solid to me!

On November 2, 2004, DVA reported 3rd quarter results. For the quarter ended September 30, 2004, net operating revenue came in at $595.5 million up from $513.3 million last year. Net income was $60.4 million or $.59/diluted share up from $38.1 million in the same quarter in 2003 or $.36/diluted share. These results look solid to me! After determining that the latest quarterly earnings report was satisfactory, I like to turn to Morningstar.com to get a longer-term view. The "5-Yr Restated" financials on DVA show that revenue has steadily been growing from $1.4 billion in 1999 to $2.2 billion in the trailing twelve months (TTM). During this time, the company has also steadily improved its earnings from a loss of $(1.21) in 1999 to $1.96/share in the TTM. Free cash flow has also been positive with $214 million in 2001 and $193 million in 2003.

After determining that the latest quarterly earnings report was satisfactory, I like to turn to Morningstar.com to get a longer-term view. The "5-Yr Restated" financials on DVA show that revenue has steadily been growing from $1.4 billion in 1999 to $2.2 billion in the trailing twelve months (TTM). During this time, the company has also steadily improved its earnings from a loss of $(1.21) in 1999 to $1.96/share in the TTM. Free cash flow has also been positive with $214 million in 2001 and $193 million in 2003.

On October 20, 2003, I

On October 20, 2003, I  On October 20, 2003, I

On October 20, 2003, I  On 10/20/03 I

On 10/20/03 I  On October 21, 2003,

On October 21, 2003,  On October 21, 2003, I

On October 21, 2003, I  On October 22, 2003, I

On October 22, 2003, I

I

I  Finally, on October 24, 2003, I

Finally, on October 24, 2003, I  So how did we do that week a little over a year ago? Of the nine stock picks that week we had six with gains ranging from 38.0% to 75.0%, and three with losses ranging from (26.9)% to (38.9)%. Our average percentage gain came out at 22.7%. THAT was a great week! Of course, past performance is NOT any kind of guarantee for future performance!

So how did we do that week a little over a year ago? Of the nine stock picks that week we had six with gains ranging from 38.0% to 75.0%, and three with losses ranging from (26.9)% to (38.9)%. Our average percentage gain came out at 22.7%. THAT was a great week! Of course, past performance is NOT any kind of guarantee for future performance!  Hello Friends! Well it was a bit of a roller-coaster day in the market. I kept waiting for my Cantel (CMN) to hit a second sale point (at around 60% gain), but the stock would not oblige me and stayed at the 58% gain point. So I sat on my hands!

Hello Friends! Well it was a bit of a roller-coaster day in the market. I kept waiting for my Cantel (CMN) to hit a second sale point (at around 60% gain), but the stock would not oblige me and stayed at the 58% gain point. So I sat on my hands!  Today, while looking through the

Today, while looking through the  According to the

According to the  How about longer-term? If we look at a

How about longer-term? If we look at a

So what do I think? The stock looks very nice to me. I don't know anything first-hand about the company or their products, but it is a bit different than one of those high-tech firms! I guess I know what a tee-shirt is! Their latest earnings report is solid, they are guiding for higher growth in 2005, their Morningstar numbers look great with steady earnings and revenue growth for the past five years (except for the 2001 dip). They are generating free cash flow and they have a nice balance sheet. Valuation is great with the p/e essentially in the mid-teens, and there are a lot of shares out short!

So what do I think? The stock looks very nice to me. I don't know anything first-hand about the company or their products, but it is a bit different than one of those high-tech firms! I guess I know what a tee-shirt is! Their latest earnings report is solid, they are guiding for higher growth in 2005, their Morningstar numbers look great with steady earnings and revenue growth for the past five years (except for the 2001 dip). They are generating free cash flow and they have a nice balance sheet. Valuation is great with the p/e essentially in the mid-teens, and there are a lot of shares out short!

While looking through the

While looking through the  According to the

According to the  How about longer-term? For this, as you probably already know, I like to turn to Morningstar. The

How about longer-term? For this, as you probably already know, I like to turn to Morningstar. The  What about "valuation" questions? Looking at the

What about "valuation" questions? Looking at the

As we head into another week of trading, I wanted to share with you another painting of an artist I enjoy, Mark Rothko. There is something simple yet elegant about his paintings. Seriously. When we are thinking about profits, cash flow, momentum, or federal reserve rates of interest, it is nice to come back to a simpler world of color size and proportion. Wishing all of you a wonderful week!

As we head into another week of trading, I wanted to share with you another painting of an artist I enjoy, Mark Rothko. There is something simple yet elegant about his paintings. Seriously. When we are thinking about profits, cash flow, momentum, or federal reserve rates of interest, it is nice to come back to a simpler world of color size and proportion. Wishing all of you a wonderful week!