Stock Picks Bob's Advice

Tuesday, 11 January 2005

January 11, 2005 Plantronics (PLT)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NYSE today, I came across Plantronics (PLT) which, as I write, is trading at $40.05, up $1.26 or 3.25% on the day. I do not own any shares nor any options on this stock!

It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you!

According to the

Yahoo "Profile", PLT "...is a worldwide designer, manufacturer and marketer of lightweight communications headsets for phones and cellphones, telephone headset systems, accessories and related services for business and personal use."

On October 19, 2004, PLT

reported 2nd quarter 2005 results. Revenues for the quarter increased 37% to $130.2 million up from $95.1 million in the same quarter for fiscal year 2004.

Diluted eps came in at $.49/share, up from $.27/share the prior year. The company also gave fairly bullish guidance for the 3rd quarter 2005 that is upcoming and due to be reported shortly.

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar, we can see that revenue has grown, a little inconsistently, from $315 million in 2000 to $490.7 million in the trailing twelve months. Earnings were also a bit erratic, dropping from $1.22 in 2000 to $.74/share in 2002, but then steadily increasing to the $1.72/share in the trailing twelve months (TTM).

(This is a real Plantronics headset!)

Free cash flow, as reported on Morningstar, has also been fairly solid with $55 million in 2002, and $54 million in the trailing twelve months.

The balance sheet, per Morningstar is really quite impeccable. PLT has $214.3 million in cash, enough to cover BOTH the current liabilities of $74.0 million, AND the long-term liabilities of $8.1 million, almost three times over. In addition, Morningstar reports that they have an additional $158.6 million of other current assets.

How about "valuation" issues? Looking at

"Key Statistics" from Yahoo, we can see that this is a mid-cap stock with a market cap of $1.94 billion. The trailing p/e is moderate at 23.33, the forward p/e (fye 3-Apr-06) is better at 19.66. The PEG (5 yr expected) is nice at 1.31.

Yahoo reports 48.37 million shares outstanding, with 47.70 million of them that float. Currently there is a smallish 820,000 shares out short as of 12/8/04, representing 1.72% of the float or 1.934 trading days. This doesn't look like an issue to me.

In addition, the company DOES pay a small dividend of $.20/share yielding 0.52%. The last stock split was a 3:1 split, per Yahoo, in August, 2000.

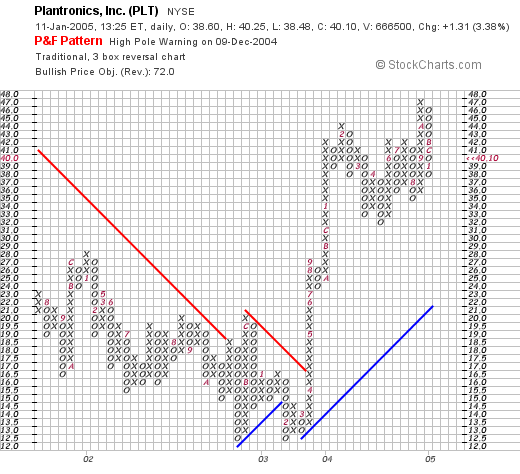

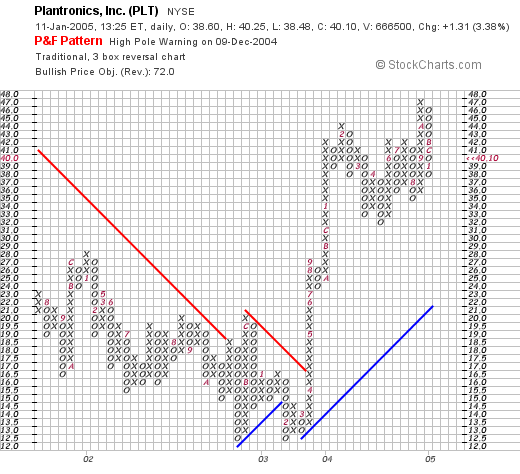

How about "technicals"? Taking a look at a

PLT Point & Figure chart from Stockcharts, we can see that this stock was actually trading lower, from late 2001 through March, 2003. The stock broke through resistance in mid-April 2003, and has been trading higher since. The stock looks strong technically to me!

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

So if I had some cash to spend, would I be buying? Well, this does fit my criteria, so it would probably be a buy!

Thanks again for stopping by. If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com. Please excuse my extra photos, I have just been so disappointed with the market tone, that I needed just a little levity. (not levitation, I will leave that to Bewitched.)

Bob

Monday, 10 January 2005

January 10, 2005 Pilgrim's Pride (PPC)

Hello Friends! Thanks for stopping by and visiting my blog,

Stock Picks Bob's Advice. Maybe I am just getting "chicken" today after all of the sell-off's in the NASDAQ, but I have got a poultry producer to present!

(If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the

list of top NYSE % gainers. According to the

Yahoo "Profile", PPC "...is a producer of poultry in both the United States and Mexico. In the United States, the Company produces both prepared and fresh chicken and turkey, while in Mexico it produces fresh chicken."

What drove the stock higher, was the

report from PPC in which it raised earnings estimates for the 1st quarter 2005. Upward revisions of earnings are a very bullish indicator imho!

On November 8, 2004, Pilgrim's Pride

reported 4th quarter 2004 results. For the quarter ended October 2, 2004, net sales came in at $1.5 billion, up from $709 million the prior year. Net income per diluted share climbed to $1.09/share, up from $.61/diluted share in 2003. These results are NOT "chicken-feed"!

How about longer-term? Taking a look at the

"5-Yr Restated" financials from Morningstar, we can see the steady revenue growth from $1.5 billion in 2000 to $5.4 billion in the trailing twelve months (TTM).

Earnings, however, have been a bit erratic, dropping from $1.27 in 2000 to a low of $.35 in 2002. However, they have climbed steadily since, with $2.05 reported in the TTM.

Free cash flow has also been growing nicely with $18 million reported in 2002, increasing to $193 million in 2004.

The balance sheet is basically solid imho, with $38.2 milion in cash and $979.1 million in other current assets, balanced against $633.5 million in current liabilities and $689.5 million in long-term debt.

How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

Yahoo reports 66.56 million shares outstanding with 40.60 million that float. Of these, there are 3.31 million shares out short as of 12/8/04, representing 8.16% of the float. These are significant, with a short raio of 4.359. The number of shares out short dropped by a million between November and December...so many of the short sellers are covering their previously based bets on a decrease in the stock price!

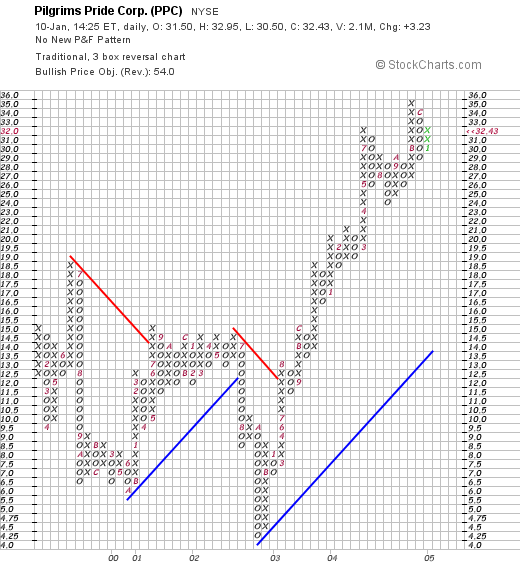

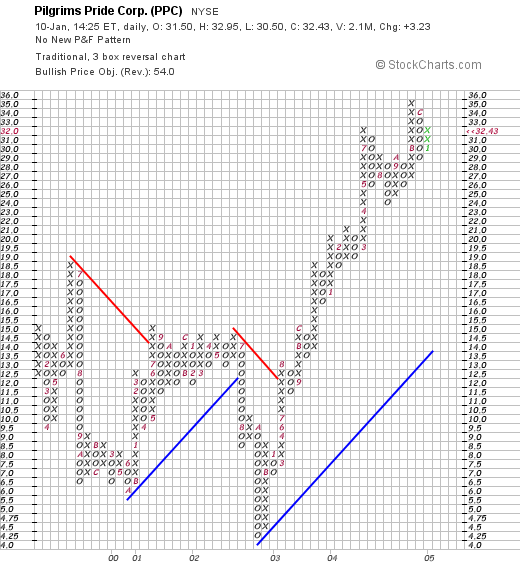

How about "technicals"? If we take a look at a

Point & Figure Chart from Stockcharts.com, we can see what appears to be a very stong chart since about March, 2003, when PPC was trading at around $7.00/share, until today, where it currently trades at $32.61.

The stock chart looks quite strong to me if not a little overextended.

So what do I think?  I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

Thanks again for stopping by! Please feel free to email me at bobsadviceforstocks@lycos.com or leave a message right here on the blog if you have a question or comment.

Bob

Saturday, 8 January 2005

"Looking Back One Year" A review of stock picks from the week of November 17, 2003

Hello Friends! It is the weekend and I for one could use a break from all of the bearish trading activity we have witnessed the past few days. I like to use the weekend to review some past stock picks. The week of November 17, 2003 was not a busy week on my blog,

Stock Picks Bob's Advice. In fact, I only discussed three stocks: Sybron Dental Specialties (SYD), Daktronics (DAKT), and Hot Topic (HOTT). Of these, I purchased shares of SYD for my

Current Trading Portfolio, and still own some shares. As always, remember that I am an amateur investor, so PLEASE consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

On November 18, 2003, I

posted Sybron (SYD) on Stock Picks at a price of $25.80. (I know that is the price, as that is the price that I purchased shares that day even though as I sometimes have done, left out the price on the post!). SYD closed at $33.23 on 1/7/05, for a gain of $7.43 or 28.8% since the post.

So are they still worthy of a spot on this blog? Well, taking a look at the latest quarterly report, SYD

reported 4th quarter 2004 results on November 15, 2004. For the quarter ended September 30, 2004, net sales came in at $145.7 million, a 5.8% increase over the $137.7 million in net sales the prior year. Net income for the quarter was $16.1 million or $.40/diluted share, compared with $17.3 million, or $.43/diluted share the prior year. This is nothing to "write home about" with a small growth in revenue and a small drop in earnings per share. While I wouldn't run out and sell this stock based on the news (and I haven't), I wouldn't run out and be buying any shares at this point either!

On November 19, 2003, I

picked Daktronics (DAKT) for Stock Picks at $17.74. DAKT closed at $23.34 on 1/7/05, for a gain of $5.60 or 31.6%.

And how does their latest quarter look? Well, on November 17, 2004, DAKT

reported 2nd quarter results. For the quarter ended October 30, 2004, net sales came in at $59.5 million, compared with net sales the prior year of $58.3 million. Net income worked out to $5.2 million or $.26/diluted share vs. $6.7 million, or $.34/diluted share last year. Just like with SYD, we have a company with a quarter with a slow growth in revenue associated with a decline in earnings. Again, I wouldn't sell on this but I wouldn't be buying either!

Finally, on November 20, 2003, I

posted Hot Topic (HOTT) on Stock Picks at $28.61. HOTT closed at $17.48, for a loss of $(11.13) or (38.9)%.

Insofar as their latest quarterly report, on November 17, 2004, HOTT

reported 3rd quarter 2004 results. Net sales for the quarter ended October 30, 2004, came in at $180.8 million, a 12% increase from $161.5 milllion the prior year. However, this was done on new store openings, as comparable store sales DECREASED 4.2% during the quarter. I hate lower same store sales reports! Net income for the quarter decreased to $12.6 million or $.27/diluted share, down from

$15.3 million, or $.31/diluted share the prior year. Thus, we have a miserable report, imho, with declining revenue AND declining earnings AND declining same store sales. That was strike 1, 2, and 3, in my book! They would be OUT if I had any!

So how did we do that week if we had purchased those shares and held on? Two of the three stocks (SYD and DAKT) both had significant gains of approximately 30%, and HOTT had a 40% loss. Thus, the average performance worked out to a 7.2% gain since the pick week. Not too bad, considering all three have just had fairly mediocre earnings reports and would not be my first choices for this blog at this time!

Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience

this is the link to CARE, one of my favorite charities in America.

Bob

January 8, 2004 Constellation Brands (STZ)

Hello Friends! I wanted to get this one out yesterday, but you know how that goes. One thing led to another, and I was calling it a day! I sure am glad you took the time to stop by and visit my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the

list of top % gainers on the NYSE where I found this stock.

According to the

Yahoo "Profile", "Constellation Brands, Inc. is an international producer and marketer of beverage alcohol brands with a portfolio across the wine, spirits, and imported beer categories." Some of the brands that

I recognized, included St Pauli Girl, Almaden, Inglenook, Black Velvet, Fleischmannis and Schenley. They have many other labels and vineyards as well!

On Thursday, January 6th, after the close of trading, STZ

announced 3rd quarter results. For the quarter ended November 30, 2004, net sales were up 10% from the prior year at $1.36 billion, up from $1.21 billion the prior year. Net income came in at $96.9 million, up from $82.8 million the prior year, a 17% jump. Earnings per share were up 14% to $.83/share. The street liked these results, and the stock jumped in price in response to the good news!

Taking a look at

"5-Yr Restated" financials on Morningstar, we can see that revenue has grown fairly steadily from $2.3 billion in 2000 to $3.8 billion in the trailing twelve months (TTM). Earnings have also grown from $.52/share to $2.45/share in the TTM.

Free cash flow has been solid and slowly improving from $142 million in 2002 to $196 million in the TTM.

The balance sheet looks solid if not perfect imho, with $9.8 million in cash and $2.28 billion in other current assets balanced against $1.2 billion in current liabilities and $2.07 billion in long-term debt.

What about "valuation"? Taking a look at the

"Key Statistics" on STZ from Yahoo, we can see that this is a large cap stock with a market cap of $5.30 billion. The trailing p/e is 'nice' at 19.51, with a forward p/e (fye 29-Feb-06) of 16.38. The '5-yr expected' PEG is 1.33, which isn't too high at all. Price/sales also reasonable imho at 1.28.

Yahoo reports 107.92 million shares outstanding with 92.80 million of them that float. Of these, 2.51 million shares are out short as of 12/8/04, representing 2.71% of the float or 5.786 trading days of volume. Using my arbitrary 3 day figure, this short interest is getting a bit significant and might explain the sharp pop in stock price yesterday.

No dividends are paid and the last stock split was a 2:1 split in May, 2002.

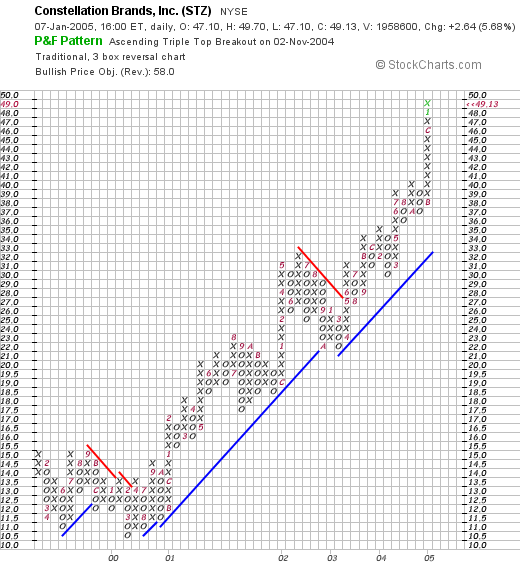

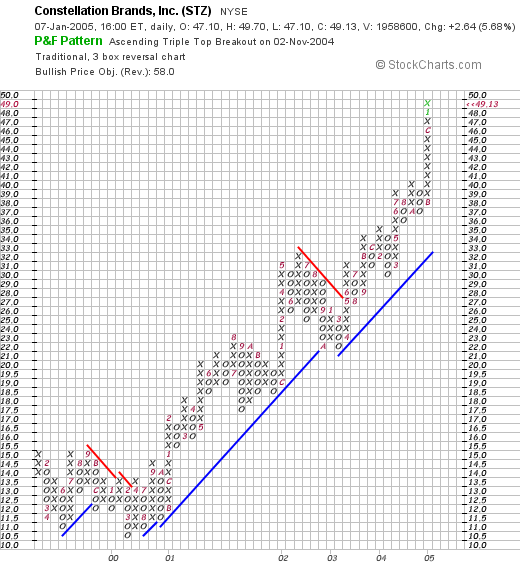

How about "technicals"? If we take a look at a

Point & Figure chart from Stockcharts.com, we can see that this stock has been roaring higher since September 2000. If anything, it is a little over-extended, but certainly, imho, this does not appear to be a weak chart.

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

Anyhow, I don't have any money to be buying stock now. The NASDAQ has been awful this past week, and I don't think I will be buying anything soon.

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com!

Bob

Posted by bobsadviceforstocks at 11:15 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 8 January 2005 2:38 PM CST

Thursday, 6 January 2005

January 6, 2005 "Revisiting a Stock Pick" Chico's FAS (CHS)

Hello Friends! I want to start something a little new here. I don't think it is enough to "pick" a stock and then forget about it forever, hoping that you all will be scanning through the large numbers of entries I have made here on my blog,

Stock Picks Bob's Advice. Sometimes, my best ideas for the day are ideas which I have already posted. Since it has been more than a year since I took a look at Chico's (CHS) here, and since it was on the

list of top % gainers on the NYSE, I thought I would take a second look!

As always, please remember that I am an amateur investor. I cannot be responsible for any of your losses, and will not seek to take credit for any of your gains. Please consult with professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

On July 31, 2003, about a 1 1/2 years ago, I

posted Chico's FAS (CHS) on Stock Picks at a price of $27.22. Since then, it has appreciated and closed today at $48.98, for a 10.54% or $4.67 gain today. Since the first selection, this stock has appreciated $21.76 or 79.9%. What pushed the stock higher was an outstanding same-store-sales report and an

announcement of a 2 for 1 stock split. I still think this stock is worth another look. Unfortunately, I didn't buy any shares back then, and I still don't own any shares or options on this rocket of a stock!

According to the

Yahoo "Profile", Chico's "...is a retailer of exclusively designed private label, sophisticated women's clothing, complementary accessories and other non-clothing gift items under the Chico's and White House brand names."

Today is the first Thursday of the month. And for those who watch retail sales, this is often the day that stores announce their sales, and even more importantly, their "same store sales" numbers. Same store sales are a way of assessing the "true" growth in a retail chain. This number represents the sales growth at existing stores from the prior year, that is stores open at least a year. A retail venture can grow the revenue just by adding stores even if internal growth is slowing. Today, January 6th, 2005, Chico's

announced December, 2004 sales results. For the five week period ended January 1, 2005, sales jumped 41.3% to $128.5 million from $91.0 million. Better yet, comparable store sales for the company-owned stores increased 18.6% for the five week period compared to the prior year same period. This is an outstanding result!

How about the latest quarter results? On November 30, 2004, CHS

announced 3rd quarter 2004 results. For the third quarter ended October 30, 2004, sales increased 28.1% to a record $270 million from $211 million the prior year. Net income jumped 38.6% to $37 million or $.41/diluted share, compared with net income of $27 million or $.30/diluted share the prior year. For the quarter, comparable store sales for company-owned stores increased 6.1% compared to sales the prior year. These were solid results.

What about longer-term? Looking at the

"5-Yr Restated" financials on Morningstar.com, we see some compelling numbers. Revenue has grown steadily and impressively from $155.0 million in 2000 the $996.8 million in the trailing twelve months (TTM).

At the same time, net income has grown from $15 million to $134 million in the TTM. On a per share basis, this growth came in at $.20 in 2000 increasing to $1.49/share in the trailing twelve months.

Free cash flow has been positive and strongly growing: $28 million in 2002, $44 million in 2003, $93 million in 2004, and $119 million in the TTM.

The balance sheet is solid with $225.3 million in cash, enough to pay twice over both the current liabilities of $98 million AND the long-term liabilities of $28.3 million combined. In addition, CHS has $107.4 million in other current assets. What is there NOT to like in this stock???

How about valuation? Taking a look at

"Key Statistics" from Yahoo, we can see that this is a large cap stock with a market cap of $4.37 billion. The trailing p/e is moderate at 32.87, and the forward p/e (fye 31-Jan-06) is an estimated 25.25. The "5-yr expected" PEG is only 0.90. Price/sales ratio a little richer at 3.97.

Yahoo reports 89.30 million shares outstanding with 86.50 million of them that float. There are currently 16.83 million shares out short representing 19.45% of the float as of 12/8/04. This is a significant 13.126 trading days of volume, and today's big spike in the stock might just be a bit of a squeeze on the short-sellers.

Yahoo reports no dividend. And the prior stock split, before the one announced today, was in July, 2002, when CHS split 2:1.

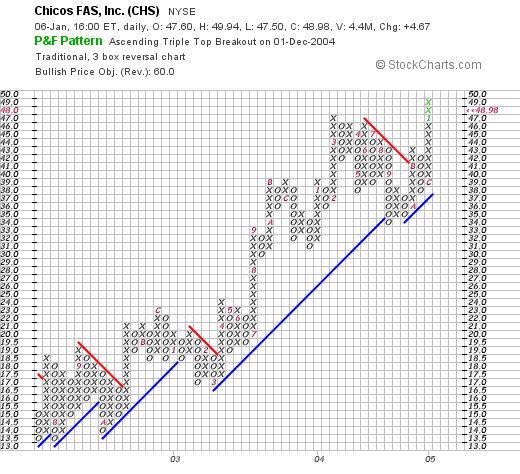

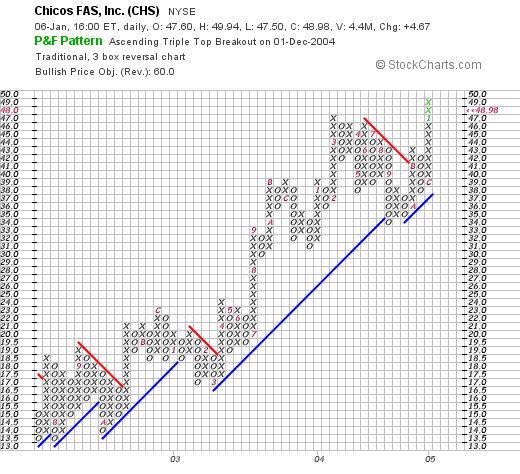

And how about "technicals"? If we take a look at a

"Point & Figure" chart from Stockcharts.com:

We can see what appears to me to be a solid technical performance without much of a pause since at least mid 2002. It looks strong to me!

So what do I think? Well, I have had this stock on my blog since mid-2003, and I am still kicking myself for never buying a share! The latest earnings report was superb. The same-store-sales number last month in the high teens was incredible. The revenue and earnings growth is impeccable, as is the free cash flow and balance sheet. The valuation IS a bit rich, but probably, this stock is worth the price! I just might break my rules tomorrow and nibble on some....but I will probably sit on my hands until I have a signal to buy! But it sure is a pretty picture!

Thanks again for stopping by! Be sure to drop me a line or comment right here on the blog if you have any questions or comments. Maybe we will even have an up day in the NASDAQ tomorrow. All of this selling is wearing down my usual bullish demeanor!

Bob

Wednesday, 5 January 2005

January 5, 2005 Build A Bear Workshop (BBW)

Hello Friends! Thanks so much for stopping by my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, and prior to making any investment decisions based on information on this website, please consult with your professional investment advisors to make sure that such decisions are appropriate, timely, and likely to be profitable for you! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Looking through the

list of top % gainers on the NYSE todlay, I came across Build A Bear Workshop (BBW) that closed at $34.18, up $1.28 or 3.89% on the day. I do not own any shares nor own any options on this stock.

According to the

Yahoo "Profile" on BBW, the company "...provides a make-your-own-stuffed-animal interactive retail entertainment experience. As of October 12, 2004, the Company operated 165 stores in 39 states and Canada, and had eight franchised stores internationally, all under the Build-A-Bear Workshop brand."

On November 9, 2004, BBW

reported 3rd quarter results. For the quarter ended October 2, 2004, total revenues came in at $66.5 million, up 38.7% over the $48.0 million the prior year. Net income came in at $3.6 million, up 300% from the $0.9 million last year. Diluted earnings per share of $.19 were up over 500% from $.03/share last year.

In addition, last month, on December 6, 2004, BBW

provided 4th quarter and 2004 guidance. They announced that they expected comparable store sales for the year to be up 16% to 18%, based on expected fourth quarter sales growth of an even STRONGER 20% to 22%. For the year, they predicted EPS in the $1.02 to $1.05 range, compared to 2003 full year diluted EPS of $.45/share. This is GREAT guidance!

How about longer-term? Taking a look at the

Morningstar.com "5-Yr Restated" financials, we can see that the revenue stream appears to start in 2002 at $169.1 million. This has increased steadily until the trailing twelve months of $275.4 million.

Unfortunately, Morningstar.com does not show earnings results, but we know these to be quite strong based on the latest earnings report. Free cash flow, which was -0- in 2002, improved to $7 million in 2003 and $23 million in the trailing twelve months (TTM).

The balance sheet is reasonably good with $15.7 million in cash and $41 million in other current assets balanced against $44.4 million in current liabilities and $47.6 million in long-term liabilities.

How about "valuation"? Looking at

"Key Statistics" from Yahoo, we find that this is a mid-cap stock with a market capitalization of $668.29 million. The trailing p/e is at 42.78, with a forward p/e (fye 3-Jan-06) of 25.89. The "5-Yr expected" PEG isn't bad at 1.26 (but as recently noted, how can anyone really know about earnings 5 years out?). The price/sales of 2.34 is a bit rich.

Yahoo reports 19.55 million shares outstanding with 7.50 million of them that float. As of 12/8/04 there were 1.05 million shares out short representing 13.96% of the float or 2.908 trading days of volume. Using 3.0 days as a 'cut-off', this doesn't seem too significant.

Yahoo does not report any dividends and no stock-splits are noted.

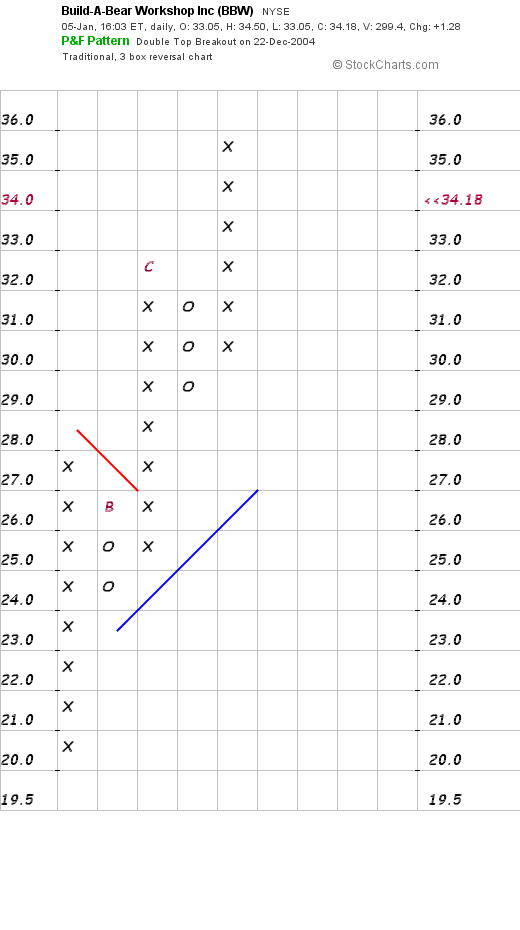

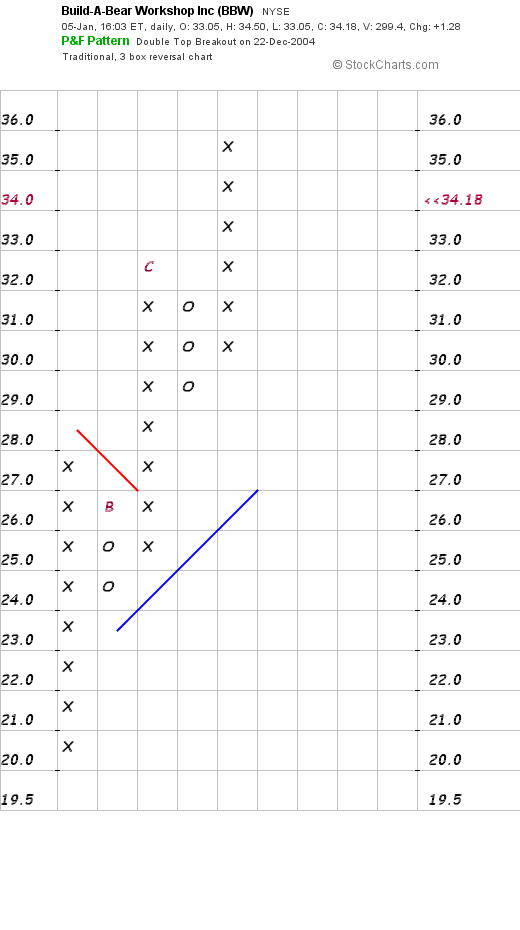

How about "technicals"? If we take a look at a

"Point & Figure" Chart on BBW, we can see that this is a strong if short duration graph of a stock that has recently come public.

So what do I think? Well this is a bit of a "cute" stock indeed! I mean WHO couldn't like a teddy bear company? Especially with these numbers. The stock made a nice move today in a relatively weak market environment, and has a nice, if short, chart as well. The latest quarterly report was quite strong as was the company's bullish guidance. With same store sales growth in the mid teens, this is very impressive! In addition, the company has been growing its revenue and presumably its earnings (?) the last couple of years, and the balance sheet looks nice. Valuation could be better, but then again, with such a fast growing company, well that might be just fine as well. I just personally don't know how long a teddy bear making company can last. Is this a fad?

So what do I think? Well this is a bit of a "cute" stock indeed! I mean WHO couldn't like a teddy bear company? Especially with these numbers. The stock made a nice move today in a relatively weak market environment, and has a nice, if short, chart as well. The latest quarterly report was quite strong as was the company's bullish guidance. With same store sales growth in the mid teens, this is very impressive! In addition, the company has been growing its revenue and presumably its earnings (?) the last couple of years, and the balance sheet looks nice. Valuation could be better, but then again, with such a fast growing company, well that might be just fine as well. I just personally don't know how long a teddy bear making company can last. Is this a fad?

Now if I had some money to be buying I probably would add a position. I am just such a sucker for a stuffed animal LOL.

Thanks again for stopping by! I hope that all of your stocks are as loveable as this one!

Bob

Tuesday, 4 January 2005

A reader writes. "I have several questions for you..."

Hello friends! Boy was THAT a sell-off in the market today! I hit two more stops on both LSCP and PARL, two of my recent purchases that now are down 8% or more and are history. Even if I do think they are great companies, my strategy comes first!

Checking my email, I was pleased to see an excellent comment from Gus who wrote:

Hi Bob,

Thanks for providing your approach to profiting in stocks. I pass by here on occasions but have decided to make it a habit and try to learn to see what you see in the stocks you select. Your method is as good as any stock pickers service and it's free. I have several questions for you which are:

Yahoo's PEG is a 5 year PEG. So much will change in 5 years so, how can it be much of any indicator of value?

Recently, you profiled several stocks and then bought LSCP for your portfolio. What carries the most weight for your final decision?

Is there a limit to the amount a stock gains on breakout that would prevent you from buying?

WAG broke out on volume today. How would you evaluate it and why did you not profile it tonight?

Thanks for the blog and providing a place for us to learn. May you have a happy and prosperous New Year.

GusFirst of all, thank you for your kind words and coming and visiting. As I always remind all of my readers here, I AM an amateur investor (no kidding!), and even if I have some interesting ideas (I hope), please consult with your professional investment advisors to double-check everything I write here!

First, you make an excellent comment about Yahoo PEG ratios. Quite frankly, I haven't been giving that much thought because the PEG is just one small part of my whole evaluation of a stock. I like a low PEG but is it truly meaningful being 5 years out? I hope so. But if not, I don't think it is a waste to review it. Perhaps if you can find a better source for 12 month or 24 month PEGS which might be more reliable, I certainly would consider that. It is, I guess, just that Yahoo is so convenient.

Next, you ask another good observation about how I ended up with LSCP (and now have sold that stocks!), as opposed to any of the many other stocks I review. Again, I am truly very arbitrary when it comes down to a final selection if there are a few different ones I am considering. Generally, I like to find a stock to buy (when my portfolio signals me to add a position), on the same day I make the sale. Why? It is just something I do I guess. And among those stocks, I try to buy the company that might have the most sustainable earnings growth. I find myself biased towards halth technology and retail companies. I guess I feel I can understand those businesses. But I have ventured farther off the path with companies as diverse as Egg companies (CALM), perfume companies (PARL), and even military defense contractors (DRS).

Generally, I am not afraid to add a stock because I know I am quite prepared to "pull the plug" if a stock drops 8%. You also asked about stocks breaking-out, and if there was too much of a stock rise to discourage me from buying. Not really. Again, I am impressed by strong gains, not intimidated!

Finally, you asked about WAG. I didn't list WAG because I have already done so. I believe in August, 2003, and if you like, you can go to my "Stock Picks 2003" portion of the blog and find the actual posting. I have considered relisting stocks each day....but then I find my own time constraints often bumping into my grand ideas!

Thanks again for writing! I shall work hard to continue to hold your confidence.

Bob

"Trading Transparency" LSCP and PARL

Well the bear was growling today! And now all of my recent purchases have hit sell points and out they went.

Being busy today, I checked in on my portfolio only to see red all over. In fact, Laserscope (LSCP) which was just purchased on 12/31/04 for $36.30 was over 8% in the loss column and I went ahead and sold my 160 shares for $31.505, for a loss of $(4.495)/share or (12.4)%.

Parlux (PARL), which I had just purchased 300 shares at $22.23 was sold about the same time today at $20.25/share for a loss of $1.98) or (8.9)%. Yikes. I just sold three of my latest purchases the last couple of days. If THAT isn't a bearish ROAR, I don't know what is!

Thanks so much for stopping by. I will be "sitting on my hands" waiting for a sale of one of my stocks at a gain before adding any new positions!

Bob

Monday, 3 January 2005

A Reader Writes "I have a few questions"

Hello Friends! Thanks for visiting my blog,

Stock Picks Bob's Advice. Wasn't today's stock market results a LOUSY way to start off an investing year? Anyhow, I had the pleasure of getting a nice email from Joyce who wrote me today with some questions. She wrote:

Hi Bob:

I started visiting your blog recently, thanks a lot for all the information. They are very helpful.

I have a few questions:

1. What do you do when a stock starts rising but does not get to 30%, say it gets to only 10% then starts sliding? Would you sell?

2. I have noticed that you posted RIMM on one of you blogs, what do you think of the recent news on that stock?

Thanks a lot for answering the above questions and happy new year.

Joyce

Well the first question is an easy one. When I purchase a stock in my trading account, I set an 8% loss limit; in reality I use a 'mental' stop. I simply check the stock and see what the gain or loss is and when it passes 8% on the downside, I sell the holding.

In fact, I allow a stock to wander all over the range between a loss of 8% and a gain of 30% before doing anything at all. That is, if a stock is up 12 or 15% then wanders down, as you are inquiring, I am still sticking with that 8% loss point to sell the stock. That's just what I do. You might very well want to do something different.

Your second question is about RIMM. Maybe you can give me the date I discussed this, but I don't see this particular stock on the list of Stock Picks for 2003 or 2004. I do believe you are correct about your point though. And your question still is "what should a person do?"

Please remember that I am an amateur investor, so I am not qualified to dispense advice to you personally, but let me take a better look at RIMM.

Basically, on December 21, 2004, RIMM

reported 3rd quarter results. Revenue came in at $365.9 million, up 18% sequentially and 138% year-over-year. THOSE are fabulous revenue numbers.

Net income came in at $.46/diluted share, up from $.36/diluted share the prior quarter, and up over 300% from the $.10/diluted share the prior year. Once again, those are FANTASTIC results.

So WHAT was the bad news? Basically, as Reuters

reported on December 22, 2004, the revenue guidance for the 4th quarter was a bit of a disappointment for many analysts. RIMM forecast 4th quarter revenue between $390 to $410 million; three months ago RIMM had guided between $385 to $410 million. Analysts had expected revenue of $411.3 million, so this was a disappointment. However, recall that I just noted that the 3rd quarter revenue came in at $365.9 million, so they are still talking about strong sequential revenue growth!

One of the problems shows up if we look at

"Key Statistics" on Yahoo for RIMM. Here we see that the trailing p/e is at 59.86 with a PEG of 1.52. Price/sales also is rich at 13.38, and Price/book at 7.76 is no bargain. Thus, the stock is priced "near perfection" so the market is skittish at even the hint of a disappointment. Recall that stock prices are determined both by actual past results and expectations of future results.

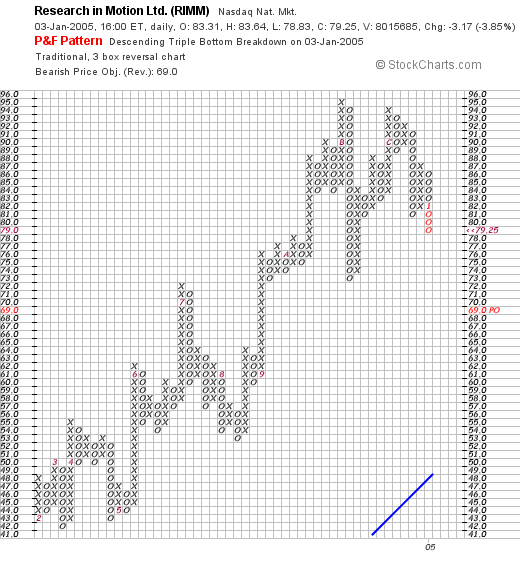

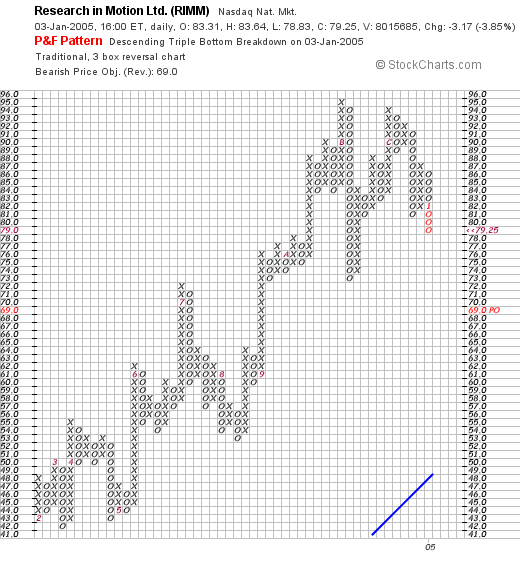

Also, let's take a look at a

"Point & Figure" Chart from Stockcharts.com:

I am NOT a big technician, but the stock has been incredibly strong up to now, moving higher way above that lower blue "support line". It bothers me a little that the stock made a high around $95 sometime in November, 2004, and then only made it to $94 the second move upward, and seemingly "rolled-over" to its current downward move. But I am not one to predict future moves based on stock charts like this. I would just be cautious if I were to be buying the stock for the first time.

What to do if you hold the stock? I can only tell you what I tend to do. Since the news is really not some fundamental bad story, just that the buying public is starting to get ridiculously high expectations, I wouldn't necessarily sell based on the story. I still manage my stocks based on the stock price itself. I use all of those sell-points I discussed and try not to anticipate stock moves which almost always surprise me.

Is that an adequate answer for you? It sure WAS long-winded. If it isn't clear, feel free to re-email me or comment right here on the blog and I will try to answer your question. Remember, I cannot tell you whether RIMM or any stock is a good investment for you! I am just an amateur and you will need to see a professional investment advisor to tell you that. I can just look at a stock and tell you what I see...and what I see isn't always the best view!

Thanks so much for stopping by! Good-luck and let me know what you have done and what you are planning to do with RIMM and we will see as everything unfolds what RIMM will be doing into the future!

Bob

Posted by bobsadviceforstocks at 5:05 PM CST

|

Post Comment |

Permalink

Updated: Monday, 3 January 2005 5:12 PM CST

"Trading Transparency" DRS

Just as I expected, or perhaps should say feared, one of my recent purchases hit the 8% loss point, and was sold out of the trading portfolio. DRS Technologies (DRS) was purchased just days ago at $44.73/share. I sold 200 shares a few moments ago at $41.05 for a loss of $(3.68) or (8.2)%. This is a way that my portfolio automatically starts raising cash in a down-draft...and is a 'signal' for me to sit on my hands and hold off buying another position until such time as I sell a portion of one of my other positions at a gain target.

Thanks so much for stopping by!

Bob

Newer | Latest | Older

Looking through the list of top % gainers on the NYSE today, I came across Plantronics (PLT) which, as I write, is trading at $40.05, up $1.26 or 3.25% on the day. I do not own any shares nor any options on this stock!

Looking through the list of top % gainers on the NYSE today, I came across Plantronics (PLT) which, as I write, is trading at $40.05, up $1.26 or 3.25% on the day. I do not own any shares nor any options on this stock! It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you!

It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you! (This is a real Plantronics headset!)

(This is a real Plantronics headset!) How about "valuation" issues? Looking at "Key Statistics" from Yahoo, we can see that this is a mid-cap stock with a market cap of $1.94 billion. The trailing p/e is moderate at 23.33, the forward p/e (fye 3-Apr-06) is better at 19.66. The PEG (5 yr expected) is nice at 1.31.

How about "valuation" issues? Looking at "Key Statistics" from Yahoo, we can see that this is a mid-cap stock with a market cap of $1.94 billion. The trailing p/e is moderate at 23.33, the forward p/e (fye 3-Apr-06) is better at 19.66. The PEG (5 yr expected) is nice at 1.31.

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

(If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

(If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com. Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the

Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the  How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

On November 18, 2003, I

On November 18, 2003, I  On November 19, 2003, I

On November 19, 2003, I  Finally, on November 20, 2003, I

Finally, on November 20, 2003, I  Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience

Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience  Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the

Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the  According to the

According to the  Taking a look at

Taking a look at

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion? On July 31, 2003, about a 1 1/2 years ago, I

On July 31, 2003, about a 1 1/2 years ago, I  According to the

According to the  Today is the first Thursday of the month. And for those who watch retail sales, this is often the day that stores announce their sales, and even more importantly, their "same store sales" numbers. Same store sales are a way of assessing the "true" growth in a retail chain. This number represents the sales growth at existing stores from the prior year, that is stores open at least a year. A retail venture can grow the revenue just by adding stores even if internal growth is slowing. Today, January 6th, 2005, Chico's

Today is the first Thursday of the month. And for those who watch retail sales, this is often the day that stores announce their sales, and even more importantly, their "same store sales" numbers. Same store sales are a way of assessing the "true" growth in a retail chain. This number represents the sales growth at existing stores from the prior year, that is stores open at least a year. A retail venture can grow the revenue just by adding stores even if internal growth is slowing. Today, January 6th, 2005, Chico's  How about valuation? Taking a look at

How about valuation? Taking a look at

Looking through the

Looking through the  According to the

According to the  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the

So what do I think? Well this is a bit of a "cute" stock indeed! I mean WHO couldn't like a teddy bear company? Especially with these numbers. The stock made a nice move today in a relatively weak market environment, and has a nice, if short, chart as well. The latest quarterly report was quite strong as was the company's bullish guidance. With same store sales growth in the mid teens, this is very impressive! In addition, the company has been growing its revenue and presumably its earnings (?) the last couple of years, and the balance sheet looks nice. Valuation could be better, but then again, with such a fast growing company, well that might be just fine as well. I just personally don't know how long a teddy bear making company can last. Is this a fad?

So what do I think? Well this is a bit of a "cute" stock indeed! I mean WHO couldn't like a teddy bear company? Especially with these numbers. The stock made a nice move today in a relatively weak market environment, and has a nice, if short, chart as well. The latest quarterly report was quite strong as was the company's bullish guidance. With same store sales growth in the mid teens, this is very impressive! In addition, the company has been growing its revenue and presumably its earnings (?) the last couple of years, and the balance sheet looks nice. Valuation could be better, but then again, with such a fast growing company, well that might be just fine as well. I just personally don't know how long a teddy bear making company can last. Is this a fad?  Hello friends! Boy was THAT a sell-off in the market today! I hit two more stops on both LSCP and PARL, two of my recent purchases that now are down 8% or more and are history. Even if I do think they are great companies, my strategy comes first!

Hello friends! Boy was THAT a sell-off in the market today! I hit two more stops on both LSCP and PARL, two of my recent purchases that now are down 8% or more and are history. Even if I do think they are great companies, my strategy comes first! Well the bear was growling today! And now all of my recent purchases have hit sell points and out they went.

Well the bear was growling today! And now all of my recent purchases have hit sell points and out they went.  Your second question is about RIMM. Maybe you can give me the date I discussed this, but I don't see this particular stock on the list of Stock Picks for 2003 or 2004. I do believe you are correct about your point though. And your question still is "what should a person do?"

Your second question is about RIMM. Maybe you can give me the date I discussed this, but I don't see this particular stock on the list of Stock Picks for 2003 or 2004. I do believe you are correct about your point though. And your question still is "what should a person do?"