Stock Picks Bob's Advice

Monday, 7 February 2005

February 7, 2005 Manor Care (HCR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please always consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NYSE today, I came across Manor Care Inc. (HCR) which was actually #2 on the list, and is currently trading at $34.90, up $2.48 or 7.65% on the day. I do not own any shares or options of this stock.

According to the

Yahoo "Profile" on HCR, Manor Care "...provides a range of healthcare services, including skilled nursing care, assisted living, subacute medical and rehabilitation care, rehabilitation therapy, hospice care, home healthcare and management services for subacute care and rehabilitation therapy."

Apparently, what drove the stock higher today was a

earnings report from Genesis HealthCare (GHCI), a competing nursing home corporation, that beat their estimates.

As far as HCR's latest earnings, they

reported 4th quarter 2004 results on January 28, 2005. Revenue rose to $806 million, compared with $787 million the prior year. And Net Income jumped 26% to $48 million compared with $38 million last year. On a per share diluted basis, this came out to $.55/diluted share vs. $.42/diluted share a year ago. In addition, the Board increased the quarterly dividend by 7%.

How about longer-term results? Looking at a

"5-Yr Restated" financial statement on Morningstar.com, we can see that revenue has grown steadily from $2.1 billion in 1999 to $3.2 billion in the trailing twelve months (TTM).

Earnings during this period of time have improved from a loss of $(.41)/share to $1.77/share in the TTM. Dividends commenced at $.25/share in 2003 and amounted to $.55/share in the TTM.

Free cash flow has been strong with $194 million in 2001 and $177 million in the TTM.

The balance sheet is adequate. Morningsar reports HCR with $25.8 million in cash and $510.4 million in other current assets. Balanced against this is $418.6 million in current liabilities and $960.2 million in long-term liabilities.

What about "valuation"? For this I turn to

Yahoo "Key Statistics" on HCR. Here we can see that the market cap is a large cap $3.01 billion. The trailing p/e is moderate at 18.32 with a forward p/e (fye 31-Dec-06) of 14.46. The PEG (5-yr estimated) is very reasonable at 1.03, and the Price/Sales is 0.88.

Yahoo reports 86.44 million shares outstanding with 83.70 million of them that float. Of these, as of 1/10/05, there were 1.74 million shares out short...a little heavy on the short shares with a ratio of 4.866.

The company pays $.60/share yielding 1.85%. The last stock split reported on Yahoo was a 3:2 in June, 1996.

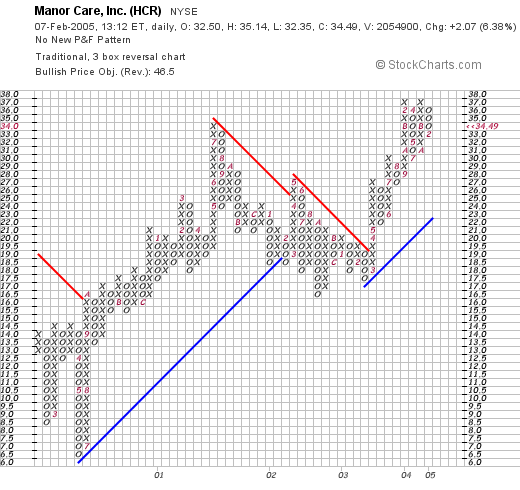

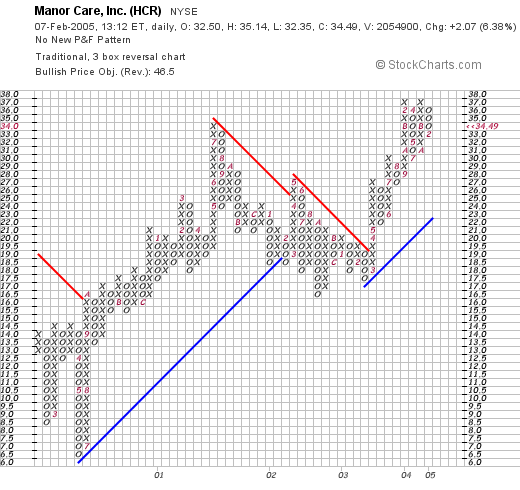

How about "technicals"? If we look at a

HCR "Point & Figure" chart from Stockcharts.com:

we can see that this stock was trading strongly higher between July, 2000, when it was trading at around $6.50 until February, 2002, when it broke support and appeared to be heading lower from $19/share. The stock bottomed at around $16 in late September, 2002, then headed higher, breaking resistance in February, 2003, at around $19. It has traded higher since then fairly strongly.

So what do I think? The stock is trading nicely today, came in with a very nice earnings report just a week ago, revenue has been steadily improving the past five years, and earnings have also been steadily increasing. Free cash flow is solid, the company pays a dividend, and valuation is nice. On a negative note, the company does have a lot of debt, but the current situation appears well-covered. I am also a bit leary of nursing-home stocks that are in a business that depends greatly on government largess...especially with all of the budget crunch publicity....and budget cuts that these may entail...so I would be cautious in this field imho.

However, the chart looks nice, and if you stick with some strong stops to prevent losses from building up, it might just be a worth investment to consider!

Again, thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel to leave them right here on the blog, or email me at bobsadviceforstocks@lycos.com .

Bob

Saturday, 5 February 2005

"Looking Back One Year" A review of stock picks from the week of December 15, 2003

Hello Friends! Thank you for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any decisions based on information on this website.

Each weekend, as much as possible, I like to look back about a year just as you can do on the blog, by clicking on the date links along the left side of the posts. I like to review my past picks a week at a time with about a one year trailing time period. Some weeks we look brilliant, and some just are awful!

Please remember that past performance is not a guarantee of future performance. That this review assumes a "buy and hold" strategy which is

not what I suggest here...that is I believe in selling losers quickly on an 8% loss (or other sell points), and gainers slowly. This definitely affects portfolio performance.

On December 16, 2003, I

posted iPass (IPAS) on Stock Picks at $16.47. IPAS closed at $6.41 on 2/4/05 for a loss of $(10.06) or (61.1)%. Certainly not a very exciting performance.

On October 26, 2004, IPAS

announced 3rd quarter 2004 results.

Revenues for the quarter ended September 30, 2004, came in at $41.9 million, compared with $35.0 million for the same quarter the prior year. Net income (GAAP), came in at $5.2 million or $.08/diluted share up from $4.5 million or $.07/diluted share the prior year. (the "thumbs-up" or "down" just are my way of pointing out whether revenue and earnings are both positive or not...)

On December 16, 2003, I

posted Advanced Digital Information (ADIC) on Stock Picks at a price of $13.96. ADIC closed at $11.035 on 2/4/05 for a loss of $(2.925) or (21)%.

On December 9, 2004, ADIC

reported 4th quarter 2004 results.

Net sales dropped 2% to $115.4 million from $118 million in the quarter ended October 31, 2004. Net income was also down at $4.91 million from $5.8 million. On a per share basis this came in at $.07/diluted share down from $.09/diluted share the prior year.

On December 17, 2003, I

posted Digene (DIGE) on Stock Picks at a price of $37.99. DIGE closed at $26.35 on 2/4/05, for a loss of $(11.64) or (30.6)%.

On February 2, 2005,

DIGE announced 2nd quarter 2005 results.

Revenue for the quarter increased 28% to $27 million from $21.1 million the prior year. Net income, however, dropped to $.3 million or $.01/diluted share, down from $.9 million or $.05/diluted share the prior year.

Finally, on December 17, 2003, I

at a price of $17.889. OVRL closed at $14.81 on 2/4/05 for a loss of $(3.08) or (17.2)%.

On 2/3/04, OVRL

reported 2nd quarter 2005 results.

Revenue for the quarter came in at $62.5 million, down from $67.8 million last year. Net income came in at $2.6 million down from $3.5 millin last year, or $.18/diluted share down from $.24/diluted share last year.

Needless to say, THAT was a lousy week on Stock Picks! I don't recall a week where EVERY SINGLE PICK was down a year later! What was the final performance result? I was afraid you would ask....for the four stocks, the average LOSS was a significant (33.73)%. Yikes. Weeks like that really make me feel quite humble. And remind me of the importance of those 8% stops to limit losses on all purchases!

Thanks so much for stopping by! If you have any questions, comments, or especially (after THAT review) words of encouragement, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 4 February 2005

"Revisiting a Stock Pick" ResMed (RMD)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any decisions based on information on this website.

If you have been reading my earlier posts from today, you will see that I had a nice move in HIBB and sold a portion at a gain, and then went ahead and purchased 120 shares of ResMed (RMD). Currently RMD is trading at $59.84, up $6.85 or 12.93% on the day. RMD is an old favorite of mine, although this is the first time that I have purchased shares. I first

mentioned ResMed (RMD) on Stock Picks on December 5, 2003, when RMD was trading at $41.76.

According to the

Yahoo "Profile" on ResMed, RMD "...is a developer, manufacturer and distributor of medical equipment for treating, diagnosing and managing sleep-disordered breathing (SDB)."

What drove the stock higher was an

earnings announcement from RMD. Yesterday (2/3/05), after the close, RMD announced results for the quarter ended December 31, 2004. Revenue for the quarter jumped 26% to $103.9 million from $82.3 million in the same quarter in 2003. Net income came in at $18.3 million, a 27% increase over the prior year. Diluted earnings per share came in at $.49/share, up from $.40 the prior year. These were nice results and the stock moved higher today in response to the news.

How about longer-term? Taking look at a

Morningstar.com "5-Yr Restated" financials, we can see the beautiful ramp-up of revenue from $115.6 million in 2000 to $354.2 million in the trailing twelve months (TTM).

Earnings dipped slightly from $.69 in 2000 to $.35/share in 2001, but have improved steadily since to $1.67 in the TTM.

Free cash flow has been solidly positive, increasing from $7 million in 2002 to $27 million in the TTM.

The balance sheet, as reported by Morningstar, shows $144.4 million in cash and $145.2 million in other current assets. This is more than enough to cover both the $64.3 million in current liabilities and the $122.5 million in long-term liabilities combined...and still have some $'s left over!

Looking at

Yahoo "Key Statistics" to get some sense of valuation questions, we find that the market cap is a mid-cap $2.03 billion. The trailing p/e is moderate at 33.96, with a forward p/e (fye 30-Jun-06) more reasonable at 26.37. The PEG (5 yr expected) isn't bad at 1.33. Price/sales is rich at 5.08.

Yahoo reports 33.93 million shares outstanding with 32.60 million of them that float. Of these 2.20 million are out short (as of 1/10/05) representing 6.74% or a hefty 17.862 trading days of volume. I really do think this short interest is a factor today with the stock climbing sharply on good news. These short sellers must (?) be scrambling to cover their "shorts".

Yahoo reports no cash dividend and the last stock split was a 2:1 in April, 2000.

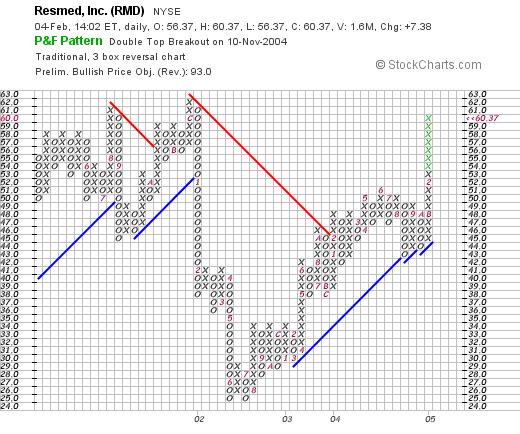

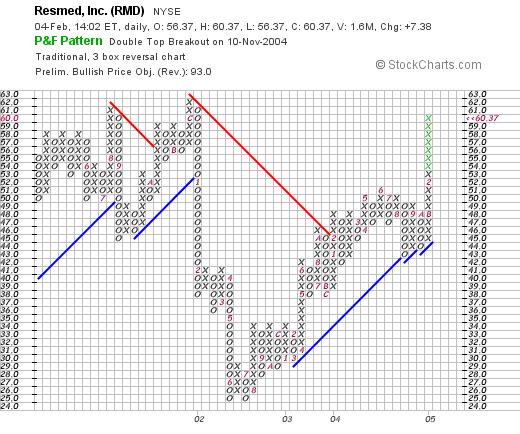

How about "technicals"? Taking a look at a

Stockcharts.com Point & Figure chart on RMD:

we can see that the stock was slowly appreciating between June and December 2001, reaching a high of $62. The stock then broke down in January, 2002, dropping from $62 to a low of $25.00 in June, 2002. The stock has been subsequently trading higher, and is testing those prior highs at the $57 level. The chart looks fine to me.

So what do I think? Well, first of all, this is a long-time Stock Picks selection, so I have liked this stock for awhile. In a Peter Lynch fashion, I actually USE their product as do many other sleep-apnea people...so I am biased. But in any case, the numbers look great, the company has been steadily ramping up revenue and earnings, the balance sheet is fine, free cash flow is growing, and the chart looks nice. The stock isn't downright cheap, but with the fast growth...well I think it may be worth the price.

So what do I think? Well, first of all, this is a long-time Stock Picks selection, so I have liked this stock for awhile. In a Peter Lynch fashion, I actually USE their product as do many other sleep-apnea people...so I am biased. But in any case, the numbers look great, the company has been steadily ramping up revenue and earnings, the balance sheet is fine, free cash flow is growing, and the chart looks nice. The stock isn't downright cheap, but with the fast growth...well I think it may be worth the price.

In any case, I liked it enough to buy some shares! Thanks again for stopping by! If you have any questions or comments, please feel free to leave them here on my blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" RMD

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As you probably realize from the prior post, I sold a portion of my Hibbett (HIBB) at a very nice gain. Since I am now under 25 positions, that "entitles" me to add a new position.

Scanning the

list of top % gainers on the NYSE, I recognized ResMed, Inc. (RMD) which was second on the list, trading, as I write, at $59.65, up $6.66 or 12.57% on the day.

ResMed has great numbers, recently came out with a postive quarterly report, and is involved in sleep apnea machines and equipment....selling CPAP treatments, a growing area in the medical field.

So, a few moments ago, I purchased 120 shares for my "trading portfolio", my REAL account (!), at $59.67/share.

Thanks so much for stopping by! Please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website! If you have any comments or questions, please feel free to leave them right here on the blog, or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" HIBB

Hello Friends! I just wanted to keep you up-to-date with my current trading in my real

"Trading Portfolio". A few moments ago I sold 42 shares of my Hibbett (HIBB) at $27.89/share. I have a cost basis of $9.74/share on this one, which I purchased on 3/6/03. This works out to a gain of $18.15 or 186%...which is my 5th sell point(!). (For anybody new to my blog,

Stock Picks Bob's Advice, my sell points on the upside are at 30%, 60%, 90%, 120%, then 180%, 240%, 300%, and 360%. After that, I plan on going to 120% intervals...if I ever get there!).

Prior sales of HIBB included 50 shares 5/30/03, 50 shares 9/4/03, 40 shares 10/15/03, and 20 shares 4/5/04. Each at our prior sell points.

Anyhow, that means, I can buy another position, and that nickel is burning a hole in my pocket already!

Thanks so much for stopping by. Please remember that I am an amateur investor so please consult with your professional investment advisors prior to acting on any information on this website. If you have any questions or comments, please feel free to leave them right here on the blog, or email me at bobsadviceforstocks@lycos.com .

Bob

Thursday, 3 February 2005

Nominated for the 2005 Business Blogging Awards

I am pleased to announce that

Stock Picks Bob's Advice has been nominated for Best Business/Investing blog for 2005. So folks, if you like what I write, head on over to the

2005 Business Blogging Awards Site and vote!

Sorry about that shameless self-promotion :).

Bob

February 3, 2005 Mercury Interactive (MERQ)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NASDAQ today, I came across Mercury Interactive (MERQ) which was trading sharply higher. As I write, MERQ is trading at $47.89, up $3.69 or 8.35% on this otherwise bearish day. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on MERQ, Mercury Interactive "...is a provider of software and services for the business technology optimization (BTO) marketplace."

What drove the stock higher today, was the

4th quarter 2004 earnings report, which was released yesterday (2/2/05) after the close. For the quarter ended December 31, 2005, revenue came in at $204.3 million, a 34% increase over the $152.0 million reported in the same quarter in 2003. Net income for the fourth quarter was $35.0 million or $.36/diluted share compared to $13.1 million or $.13/diluted share last year. In addition, the company raised guidance for 2005.

As

reported:

"The skeptic might argue that the forward guidance almost looks too good to be true, and may be difficult to achieve, but Mercury benefits from more revenue coming from the balance sheet than most, and is coming off an exceptionally strong fourth quarter," said JP Morgan Adam Holt in a research note.

How about "longer-term"? For that, I like to turn to the

Morningstar.com "5-Yr Restated" financials on MERQ. Here we can see a steady revenue increase from $188 million in 1999 to $633 million in the trailing twelve months (TTM).

Earnings have been more erratic, but have been increasing recently, and increased from $.39/share in 1999 to $.66 in the trailing twelve months.

Free cash flow has also been positive and growing. They reported $61 million in free cash flow in 2001, $124 million in 2002, $163 million in 2003 and $183 million in the trailing twelve months.

How about their balance sheet? Looking at Morningstar, we can see that the company does have some significant long-term debt, but the cash level is at $476 million, other current assets are at $222.3 million, which is more than enough to cover the current liabilities of $445.2 million, and make a dent in the long-term liabilities of $896.7 million.

How about "valuation"? Looking at

MERQ "Key Statistics" on Yahoo, we can see that this is a large cap stock with a market cap of $4.06 billion. The trailing p/e is rich at 54.87, the forward p/e (fye 31-Dec-06) is slightly better at 35.61, the PEG (5-yr) is 1.95, with a price/sales at 5.89. Certainly, this isn't a cheap stock but the performance is still impressive.

Yahoo reports 84.42 million shares outstanding with 77.70 million of them that float. Of these, 6.99 million are out short as of 1/10/05. This represents 8.995 of the float or 3.845 trading days of volume.

No cash dividend is reported, and the last stock split was a 2:1 split on February 14, 2000.

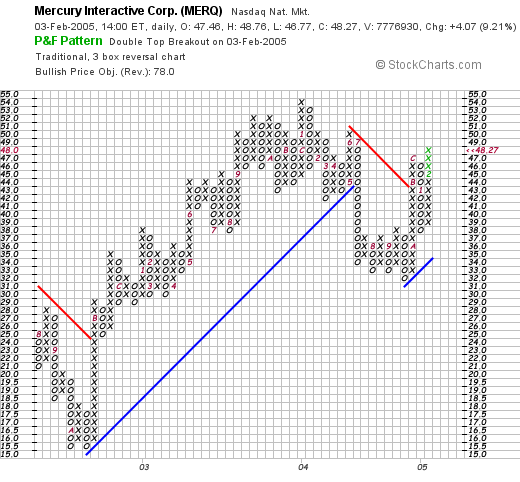

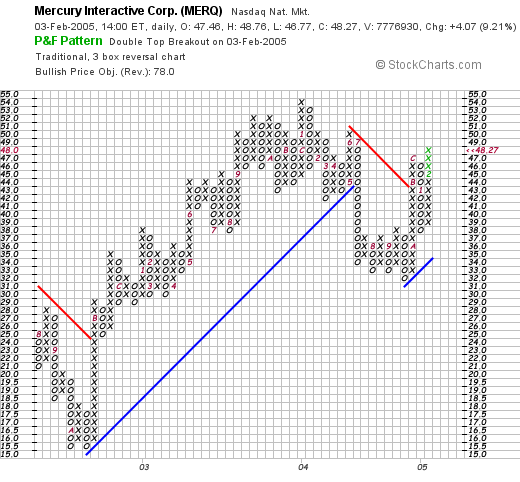

How about "technicals"? Taking a look at a

point & figure chart from Stockcharts.com:

we can see that this stock was moving ahead strongly between August, 2002, when it was trading around $15 to July, 2004, when the stock price broke down as it broke through a support level at around $43. The stock appears to have bottomed at around $31, and is now heading higher, having broken through resistance at around $43 again. Not as strong a chart as some, but not bad overall, imho.

So what do I think? Well the latest earnings report was solid. They have been growing steadily the past five years. Free cash flow is nice and the balance sheet is respectable. However, valuation is a bit steep, and the chart, looking good short-term, has a little bit more to do to convince me! Anyhow, that is just sour grapes because I spent my money this morning on another stock, MNT, and now must wait for a sale of another portion of my positions to add a new stock!

So what do I think? Well the latest earnings report was solid. They have been growing steadily the past five years. Free cash flow is nice and the balance sheet is respectable. However, valuation is a bit steep, and the chart, looking good short-term, has a little bit more to do to convince me! Anyhow, that is just sour grapes because I spent my money this morning on another stock, MNT, and now must wait for a sale of another portion of my positions to add a new stock!

Thanks again for stopping by! If you have any questions,comments, or words of encouragement, please feel free to post them here or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Mentor (MNT)

Hello Friends! I never let that nickel sit in my pocket very long! Probably should make a new rule about buying a stock only on an up day...but oh well. I looked at the list of top percentage gainers and came across Mentor, a pick that I selected back in August, 2004, that was doing well on the back of a good earnings report and raised guidance. Sounded good to me, so I just purchased 200 shares at $34.33 a few moments ago. Now I shall be sitting on my hands again!

Bob

"Trading Transparency" CMN

Hello Friends! I just wanted to update you on a trade I just executed in my

Current Trading Portfolio. A few moments ago, I sold 55 shares of my 255 shares of Cantel Medical (CMN)at $25.91. This was my third sale and thus, my goal was a 90% gain. These shares were purchased 6/4/04 at a cost basis of $13.36. Thus, my gain worked out to $12.55/share or 94%. On July 8, 2004, I sold 75 shares at $25.20 (prior to the split) which had a cost basis of $20.03 (again pre-split) for a 25.8% gain (fist sell point about 30%), and then on 12/20/04, I sold 55 shares at $33.60 (pre-split), which had a basis of $20.03 (again pre-split) for a gain of $13.57/share or 67.7%. (60% is the second sell-point in my strategy).

Thanks so much for stopping by! And you know what a sale at a gain means?! I have that nickel in my pocket again and I am on the lookout for a new position (as long as I am not at my 25 position goal!)

As always, remember I am an amateur investor so please consult with your professional investment advisors! Have a great Thursday everyone!

Bob

Wednesday, 2 February 2005

February 2, 2005 Pacer Intl (PACR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. I know I probably don't need to remind you, but I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NASDAQ, I came across Pacer Intl (PACR). I do not own any shares nor do I have any options on this stock! PACR closed at $22.24, up $2.70 or 13.82% on the day. According to the

Yahoo "Profile" on PACR, Pacer "...is a non-asset-based North American logistics provider. The Company provides its logistics services from two segments, wholesale services and retail services."

What drove the stock higher today, was the

4th quarter 2004 earnings report which was released yesterday after the close of trading. For the quarter ended December 31, 2004, total revenue increased 16.3% to $530.8 million from $456.3 million last year. Net income increased to $17.0 million, from $11.4 million the prior year, a 49.1% increase. On a diluted earnings per share basis, this quarter PACR came in at $.44/share, up from $.30/share, a 46.7% increase. These were great results and the stock moved higher accordingly.

How about longer-term results? Taking a look at the

"5-Yr Restated" financials on Morningstar, we can see that revenue has been steadily growing from $194 million in 1999 to the $440 million in the trailing twelve months. Earnings, which are only recorded since 2003, have increased from $.82 to $1.08 in the trailing twelve months.

Free cash flow has also been solidly positive with $7 million reported in 2001, increasing to $47 million in the trailing twelve months (TTM).

The Morningstar balance sheet looks adequate with no cash reported but $234.1 million in other current assets, as opposed to the $180 million in current liabilities and the $171.6 million in long-term debt.

How about "valuation" questions? Taking a look at

Yahoo "Key Statistics", we can see that this is a mid cap stock with a market capitalization of $829 million. The trailing p/e is reasonable (imho) at 18.05, with a forward p/e (fye 26-Dec-05) of 16.23. Thus, the PEG is nice at 1.11, and Price/sales even cheaper at 0.42.

Yahoo reports 37.28 million shares outstanding with 27.60 million of them that float. Of these, as of 1/10/05, there were only 673,000 shares out short representing 2.44% of the float or only 1.834 trading days of volume.

No cash dividend, and no stock dividends are reported on Yahoo.

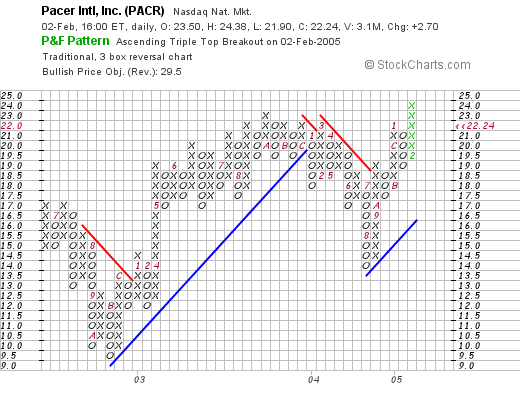

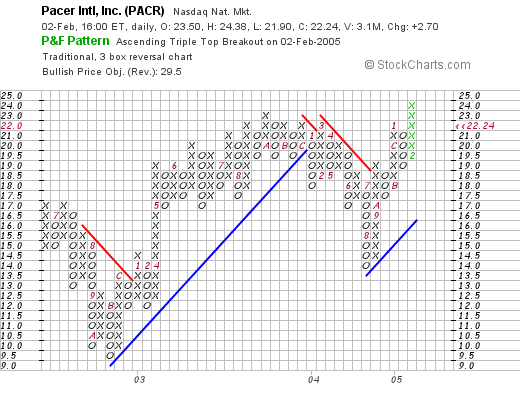

What about "technicals"? Taking a look at a

Stockcharts.com Point & Figure chart on PACR:

we can see that the stock bottomed late in 2002 at around $9.50, then climbed to $22.50, where it ran into resistance, broke down, and dropped to $13.50 in late August 2004. The stock has been moving higher since then to its current level around $22.24.

So what do I think? Well the stock just came out with a FABULOUS earnings report. The Morningstar five year record looks solid. We don't have much of an 'earnings' record however, although free cash flow looks nice, and the balance sheet is favorable. Valuation questions appear reasonable with a p/e that appears to be significantly lower than the current growth rate. In addition, the chart looks positive if not perfect, to me.

Well I guess in conclusion I like this stock and would consider purchasing some shares if I were in the market to do that! I am waiting on my Cantel which is close to a sell point now....maybe soon?

Thanks again for stopping by! Please remember that I am an amateur investor! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Looking through the list of top % gainers on the NYSE today, I came across Manor Care Inc. (HCR) which was actually #2 on the list, and is currently trading at $34.90, up $2.48 or 7.65% on the day. I do not own any shares or options of this stock.

Looking through the list of top % gainers on the NYSE today, I came across Manor Care Inc. (HCR) which was actually #2 on the list, and is currently trading at $34.90, up $2.48 or 7.65% on the day. I do not own any shares or options of this stock.

On December 16, 2003, I

On December 16, 2003, I  Revenues for the quarter ended September 30, 2004, came in at $41.9 million, compared with $35.0 million for the same quarter the prior year. Net income (GAAP), came in at $5.2 million or $.08/diluted share up from $4.5 million or $.07/diluted share the prior year. (the "thumbs-up" or "down" just are my way of pointing out whether revenue and earnings are both positive or not...)

Revenues for the quarter ended September 30, 2004, came in at $41.9 million, compared with $35.0 million for the same quarter the prior year. Net income (GAAP), came in at $5.2 million or $.08/diluted share up from $4.5 million or $.07/diluted share the prior year. (the "thumbs-up" or "down" just are my way of pointing out whether revenue and earnings are both positive or not...) On December 16, 2003, I

On December 16, 2003, I  Net sales dropped 2% to $115.4 million from $118 million in the quarter ended October 31, 2004. Net income was also down at $4.91 million from $5.8 million. On a per share basis this came in at $.07/diluted share down from $.09/diluted share the prior year.

Net sales dropped 2% to $115.4 million from $118 million in the quarter ended October 31, 2004. Net income was also down at $4.91 million from $5.8 million. On a per share basis this came in at $.07/diluted share down from $.09/diluted share the prior year. On December 17, 2003, I

On December 17, 2003, I  Finally, on December 17, 2003, I

Finally, on December 17, 2003, I  Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  If you have been reading my earlier posts from today, you will see that I had a nice move in HIBB and sold a portion at a gain, and then went ahead and purchased 120 shares of ResMed (RMD). Currently RMD is trading at $59.84, up $6.85 or 12.93% on the day. RMD is an old favorite of mine, although this is the first time that I have purchased shares. I first

If you have been reading my earlier posts from today, you will see that I had a nice move in HIBB and sold a portion at a gain, and then went ahead and purchased 120 shares of ResMed (RMD). Currently RMD is trading at $59.84, up $6.85 or 12.93% on the day. RMD is an old favorite of mine, although this is the first time that I have purchased shares. I first  How about longer-term? Taking look at a

How about longer-term? Taking look at a  Looking at

Looking at

So what do I think? Well, first of all, this is a long-time Stock Picks selection, so I have liked this stock for awhile. In a Peter Lynch fashion, I actually USE their product as do many other sleep-apnea people...so I am biased. But in any case, the numbers look great, the company has been steadily ramping up revenue and earnings, the balance sheet is fine, free cash flow is growing, and the chart looks nice. The stock isn't downright cheap, but with the fast growth...well I think it may be worth the price.

So what do I think? Well, first of all, this is a long-time Stock Picks selection, so I have liked this stock for awhile. In a Peter Lynch fashion, I actually USE their product as do many other sleep-apnea people...so I am biased. But in any case, the numbers look great, the company has been steadily ramping up revenue and earnings, the balance sheet is fine, free cash flow is growing, and the chart looks nice. The stock isn't downright cheap, but with the fast growth...well I think it may be worth the price.  I am pleased to announce that

I am pleased to announce that  Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Looking through the

Looking through the  According to the

According to the  How about "longer-term"? For that, I like to turn to the

How about "longer-term"? For that, I like to turn to the

So what do I think? Well the latest earnings report was solid. They have been growing steadily the past five years. Free cash flow is nice and the balance sheet is respectable. However, valuation is a bit steep, and the chart, looking good short-term, has a little bit more to do to convince me! Anyhow, that is just sour grapes because I spent my money this morning on another stock, MNT, and now must wait for a sale of another portion of my positions to add a new stock!

So what do I think? Well the latest earnings report was solid. They have been growing steadily the past five years. Free cash flow is nice and the balance sheet is respectable. However, valuation is a bit steep, and the chart, looking good short-term, has a little bit more to do to convince me! Anyhow, that is just sour grapes because I spent my money this morning on another stock, MNT, and now must wait for a sale of another portion of my positions to add a new stock! Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Looking through the

Looking through the  What drove the stock higher today, was the

What drove the stock higher today, was the  How about "valuation" questions? Taking a look at

How about "valuation" questions? Taking a look at