Stock Picks Bob's Advice

Thursday, 16 June 2005

"Trading Transparency" Progress Software (PRGS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Just to keep you posted. That "nickel" was burning a hole in my pocket as soon as it got there. Since I just sold a portion of my COH stock at a gain (see the prior post), this entitled me to add a new position to my portfolio. (since I am under my 25 position goal).

Looking through the lists of top % gainers today, I came across Progress Software (PRGS). It appears to fulfill my "criteria" to purchase, and I just picked up 240 shares at $30.96. As I write this post, PRGS is trading at $31, up $2.80 on the day or 9.93%. I will try to write up this stock later on if I get a chance :).

Regards!

Bob

"Trading Transparency" COH

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, my investment in Coach (COH) in my Trading Account hit a sale point, and I sold 1/4 of my position of 136 shares (34 shares), at $33.25/share. Coach has been the strongest stock in my portfolio, which I purchased at a cost basis of $8.33/share on 2/25/03. Thus, this represented a gain of $24.92/share or 299.2%. This was my seventh (!) partial sale of Coach, having sold portions at 30%, 60%, 90%, 120%, 180%, 240%, and now at 300% gains (!). My next sale target will be either at a 360% gain on the upside, or failing any particular bad news which might trigger a sale, I shall allow the stock to drift back to a 150% gain level prior to selling on the downside. This would represent a 50% retracement of my highest sale target.

In any case, that frees me up to purchase a new position, which would be position #24 in my trading account with my goal of 25 positions. After reaching 25 positions, I shall be using any proceeds to at long last pay down that margin!

Thanks so much for stopping by. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or just plain leave a message here on the blog.

Bob

Wednesday, 15 June 2005

June 15, 2005 Landauer (LDR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so PLEASE consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NYSE this evening, I came across Landauer (LDR) which closed at $52.90, up $2.45 or 4.86% on the day. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on LDR, the company "...provides analytical services to determine personnel exposure to occupational and environmental radiation hazard in the workplace and home in the United States."

How about the latest quarterly report? On April 25, 2005, Landauer

reported 2nd quarter 2005 results. For the quarter ended March 31, 2005, revenues came in at $19.7 million, up 8% from $18.2 million the prior year. Net income came in at $5.1 million or $.57/diluted share, up from $4.8 million or $.54/diluted share the prior year same quarter.

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar.com, we can see that revenue has been growing steadily from $47.2 million in 2000 to $71.4 million in the trailing twelve months (TTM).

LDR has a pretty picture of steady earnings growth, except for a dip from $1.83 in 2002 to $1.69 in 2003. However, earnings once again rebounded and have grown to $2.02 in the TTM.

In addition, LDR has been paying dividends, which while also dipping between 2001 and 2002, have grown from there from $1.40/share to $2.03 in the TTM.

Free cash flow has been positive and growing, from $13 million in 2002 to $20 million in the TTM.

The balance sheet looks adequate if not fabulous, with $10.3 million in cash and $23.5 million in other current assets, balanced against $31.4 million in current liabilities and $5.7 million in long-term liabilities.

What about some

"Key Statistics" on LDR from Yahoo? There we can see that this is a small mid-cap stock with a market capitalization of only $473.98 million.

The trailing p/e isn't bad at 25.75, and the forward p/e (fye 30-Sep-06) is a bit better at 22.90. However the PEG ratio is 2.60, and the Price/Sales is 6.16.

Other key statistics from Yahoo show Landauer with only 8.96 million shares outstanding with 8.28 million of them that float.

Currently, as of 5/10/05, there are 261.38 thousand shares out short representing 3.00% of the float, or 11.3 trading days of volume. With my 3-day cut off, this appears, at least at first glance to be quite significant.

The company pays a large dividend of $2.08/share yielding 4.15%. No stock splits are reported on Yahoo.

And what does the chart look like? Taking a look at a

"Point & Figure" chart on LDR from Stockcharts.com:

All I can say is "WOW!". Look at that chart! This chart, which bottomed in July, 2000, at around $14, has been heading almost directly higher, with the current move to $52.90 continuing its trend. The chart looks very strong to me!

So what do I think? Well, if my COH holds up I shall be in the market for a new holding, and if this stock was moving higher on the day I sell my next partial position, I certainly would look twice at this one!

Let's review: stock made a nice move higher today, last quarter was solid, past five years was almost perfectly steady with revenue and earnings growth, free cash flow is positive and growing and the balance sheet looks reasonable if not fantastic. The stock, valuation-wise is no bargain, and the PEG is over 2.0. But the chart looks phenomenal. All-in-all not such a shabby report at all!

Thanks again for stopping by! I can only talk about this stock at the moment, as I am not in the market until I sell a portion of one of my holdings at a gain. COH is flirting with a 300% gain for me (which is my next sale point)....so I may be buying something soon (?). Anyhow,

Thanks for visiting. Please feel free to leave comments right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 14 June 2005

June 14, 2005 Diodes (DIOD)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am not a professional investment advisor. I am not a certified financial specialist. I am truly an amateur investor who loves to invest and share ideas with fellow investors who share this same passion. However, please do consult with your professional investment advisors prior to making any investment decisions based on information on this website!

What this website is about is a process. A way of looking at the overwhelming number of stock market investment possibilities and trying to make heads or tails of the chaos. Just maybe, I shall be able to do a little better than random by having a strategy of identifying companies that may have a better than average chance of appreciating in price. Together, we shall see if this approach is successful.

Furthermore, my strategy is NOT about picking the perfect stock. Even thought that might be what YOU are looking for :). I strongly believe in building a portfolio of stocks that as a group can outperform the market. My loyalty to any particular stock in my portfolio goes only as far as the stock continues to perform.

Looking through the

list of top % gainers on the NASDAQ today, I came across Diodes (DIOD) which closed at $33.30, up $3.37 or 11.26% on the day. I do NOT own any shares, nor do I have any options in this company.

According to the

Yahoo "Profile" on DIOD, the company "...engages in the manufacture, sale and distribution of discrete semiconductors, primarily to manufacturers in the communications, computing, industrial, consumer electronics, and automotive markets, as well as to distributors of electronic components to end customers in these markets."

Apparently, what drove the stock higher today was an

upgrade by Raymond James, the brokerage house, which raised the stock to "strong buy".

In my review of a stock, besides watching for a large % move that day, I check the latest quarter results. I am looking for good news :), obvious stuff like increasing revenue and earnings. On April 28, 2005, DIOD

reported 1st quarter 2005 results. Revenues for the quarter ended March 31, 2005, increased 17.3% to $48.6 million from $41.4 million last year in the same quarter. Sequentially, the company also raised revenue by 1.5%. Net income for the company increased 49.1% to $7.2 million or $.46/share, up from last year's $4.9 million or $.32/share. These were very strong results!

One of my observations in looking at stocks, is that stock prices often appreciate when a company can demonstrate persistence of "good" results. This is another way of saying earnings "momentum". That is, a company that has grown for many years may well continue to grow. Of course, nothing is guaranteed. But in general, my goal is to identify these kind of companies.

I have found Morningstar.com to be very helpful in this regard. On the Morningstar site, I have used the

"5-Yr Restated" financials, in this case for Diodes.

Here, I check the revenue growth, as illustrated by the series of purple bars superimposed on the yellow background near the top of the page. For DIOD, this isn't perfect, but it is quite good. Except for the drop in revenue between 2000 and 2001, when revenue declined from $116.1 million in 2000 to $93.2 million in 2001, this company has been a steady grower, reaching $192.9 million in the trailing twelve months (TTM).

Next step is earnings. Again, the company had a weak year in 2001, when earnings dropped from $1.62 to $.01, but since that year, the company has been steadily improving earnings numbers with $1.79 reported in the TTM.

Further down the page, I like to look at free cash flow. This is calculated by Morningstar by subtracting Capital Spending from Operating Cash Flow. For DIOD, this has been a bit erratic but has stayed positive the last few years in the face of growing capital spending. $12 million in free cash flow is reported in the TTM.

Finally, the last piece of information I use on Morningstar is a glance at the balance sheet. Again, I am an amateur. It is my understanding that current is distinguished from "long-term" by either being available to spend (asset) or coming due (liability) in the next 12 months. Beyond 12 months, assets and liabilities become "long-term".

In any case, obviously, if you had to own a company, you would want lots of assets and not very much in the way of liabilities. For a manager of a company, this gives a degree of flexibility to manage growth and invest for the future. In any case, for DIOD, we can see that the company has $27.9 million in cash and $72.2 million in other current assets. This is WAY greater than the $41.9 million in current liabilities and the 'smallish' $9.8 million in long-term debt. IMHO, this looks like a solid balance sheet to me.

My next step is to look up some key statistics on the company using Yahoo once again. For DIOD, let's take a look at some

"Key Statistics" on Yahoo. Here we can see that this is a small "mid-cap" stock with a market cap of $477.36 million.

The trailing p/e is reasonable (in the teens is reasonable to me), at 18.56, with a forward p/e (fye 31-Dec-06) of an even nicer 15.71. The PEG (5 yr expected) is just over 1.0 at 1.05.

The Price/Sales is 2.22. As I have stated previously, I greatly respect Paul Sturm who writes for Smart Money and has

written on Price/Sales ratios. His point, which I would agree with, is that to assess the meaning of a Price/Sales ratio, one must evaluate a company by its peers, that is other companies in the same industry!

I have found my Fidelity account to be a great source for research on Price/Sales ratios. I am sure there are lots of other places you can find this data. It turns out that DIOD is a member of the "Semiconductor-Integrated Circuit" industrial group. In this particular parameter of valuation, DIOD doesn't look too expensive. This group includes Marvell Technology (MRVL) at 9.2, Semtech (SMTC) at 5.2, Broadcom (BRCM) at 4.9, and then lower than Diodes, we have RF Micro (RFMD) at 1.4 and Skyworks (SWKS) at 1.3. Thus, DIOD, at 2.5 Price/Sales is on the reasonable side of valuation!

Other data from the "key statistics" site on Yahoo reveals that there are 14.34 million shares outstanding with only 9.62 million of them that float. Currently there are (as of 5/10/05) 1.31 million shares out short representing 8.30% of the float. This works out to a ratio of 8.2 (meaning 8.2 days of average trading volume to cover the short sales). This is significant, using my own arbitrary 3 days of volume cut-off. Thus, the short sellers may be adding to the buying "panic" if the stock continues to move higher.

No cash dividends are reported on Yahoo, and the last stock split noted was a 3:2 split on 11/26/03.

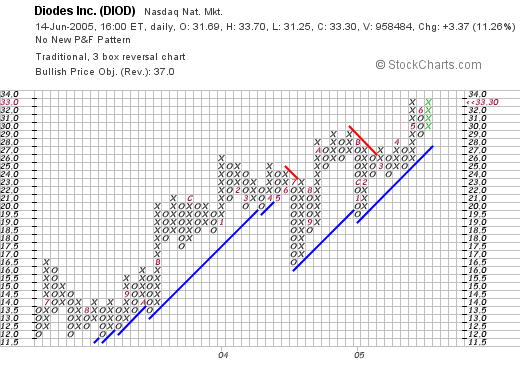

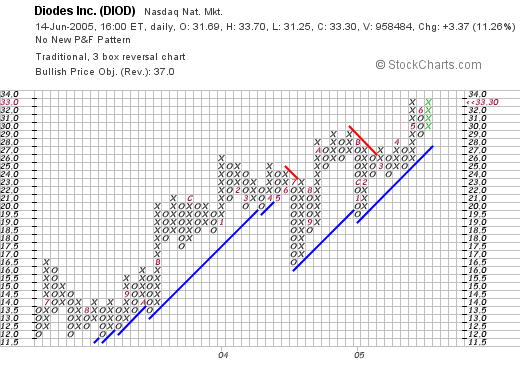

What about a graph? Taking a look at a

DIOD "Point & Figure" chart from Stockcharts.com:

we can see what looks like a very strong long-term chart on DIOD. The stock, which was trading at around $12.00 in August, 2003, has moved higher, except for weakness in July, 2004, when it broke down to $16, the stock has been moving higher in a very regular fashion.

I am no expert at reading any kind of charts :). I look at them and determine whether the graph looks like the stock is moving higher, moving sideways, or moving lower. That's about the extent of my expertise. But I think that basic take is worth a look!

Anyhow, what do I think about this stock? Well, I think the stock looks terrific. Let me review: stock moved higher on an upgrade, recently reported great numbers in the latest quarterly report, has been growing fairly steadily in both earnings and revenue for the last 4-5 years, the cash flow is positive, the balance sheet looks strong, valuation is reasonable both with a PEG just over 1.0, and a Price/Sales ratio in the low-end of its group. In addition the chart looks great and there are a lot of short sales out there looking to be 'covered'.

Now, if I just had a reason to be buying something :). Anyway, I shall be sitting on my hands until one of my stocks hit a sale target. Ventana is actually flirting with a 90% gain...so hopefully that one is next. Meanwhile, thanks again for stopping by. I love your emails and comments. I hope that I am not being too verbose, but that my comments and observations are helpful to you!

Please feel free to leave comments or questions on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 4:39 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 14 June 2005 5:08 PM CDT

Monday, 13 June 2005

"Revisiting a Stock Pick" SRA International (SRX)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was browsing through the

list of top % gainers on the NYSE today and was really trying hard to get a new name. I like the excitement of new ideas around here, but the best stock I could find on the NYSE, the NASDAQ, and the AMEX top % gainers today was SRA International (SRX). This

is a stock that I own now in my trading portfolio. I did not own any shares when I

posted SRX on Stock Picks on June 1, 2004, at a price of $41.80. SRX recently split 2:1 making our effective stock pick price actually $20.90. SRX closed today at $34.74, up $1.74 or 5.27% on the day. Thus, we have a gain of $13.84 or 66.2% since my first listing of SRX on Stock Picks in June, 2004.

I actually purchased 160 shares of SRX, which split to 320 shares that now have a cost basis of $29.82/share. These shares were acquired on 2/1/05.

On May 2, 2004, SRX

announced 3rd quarter 2005 results. Revenue climbed 41% to $226 million from $160 million last year. Net income increased 44% to $14.7 million or $.52/share, up from $10.2 million or $.37/share a year ago. The company also raised guidance for the fourth quarter and the full year 2005 results.

If we recheck the

"5-Yr Restated" financials on Morningstar.com for SRX, we can see that the pattern of revenue growth from $312.5 million in 2001 to $821.6 million in the trailing twelve months (TTM) is undisturbed.

Earnings have increased from $.63/share in 2003 to $.96 in the TTM.

Free cash flow has also grown impressively from $4 million in 2002 to $52 million in the trailing twelve months.

The balance sheet is solid with $217.5 million in cash alone, enough to cover both the current assets of $151.6 million and the 'smallish' $7.2 million in long-term liabilities reported on Morningstar.com. In addition, Morningstar reports that the company has an additional $228.5 million in other current assets.

How about other "key statistics"? Looking at

Yahoo "Key Statistics" on SRX, we can see that this is now a large cap stock (if we use a $1.5 billion cut-off), with a market cap of $1.87 billion. The trailing p/e is a bit rich at 36.23 with a forward p/e (fye 30-Jun-06) shown at 35.81. I do not think these numbers take into consideration some of the increased guidance from the company (?).

The PEG isn't too bad at 1.51, and the Price/Sales is at 2.16.

Other statistics show SRX with 53.77 million shares outstanding, with 35.53 million of them that float. Currently, as of 5/10/05, there were 2.37 million shares out short, representing 4.50% of the float or 4.7 trading days of volume. Thus, with a 3-day "cut-off" that I like to use, there are still some significant short-shares out there that could come in and contribute to buying pressure in this security.

Yahoo does not show any cash dividend, and the company recently split 2:1.

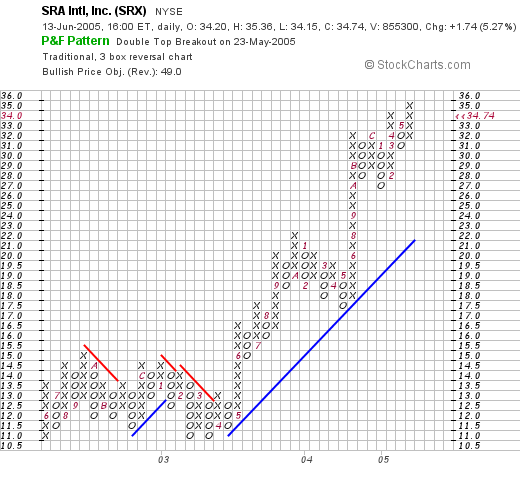

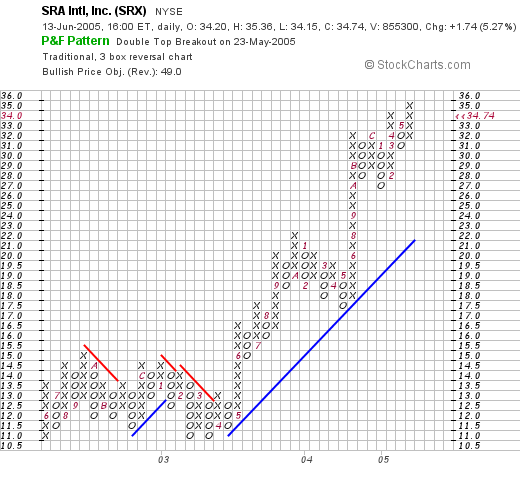

Let's take a quick look at the chart. Looking at a

SRX "Point & Figure" chart from Stockcharts.com, we can see that this stock has been moving strongly higher since April, 2003, when it broke through resistance at $12.50 and has moved to its current $35 level in a very strong fashion.

So what do I think? Well, first of all I do own the stock. The numbers on this company are fabulous, the latest quarter was very strong and the company raised guidance for the next quarter and the year. The only drawback I can think is that the company is dependent on government contracts, which can always be a bit fickle. But the numbers look nice, and I chose to purchase some shares.

Thanks again for stopping by and visiting! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 12 June 2005

"Looking Back One Year" A review of stock picks from the week of April 19, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I just finished responding to William Z. about performance of all of the stock picks that I write about. I guess this is where the "amateur" status really shows up. I do not have a master spreadsheet or other methods at this time of monitoring all of my stock picks. However, you can review all of them by clicking on the dates along the left side of the blog itself.

What I do like to do is to systematically review stock picks looking back about a year, a week at a time. Last weekend I was reviewing the week of April 12, 2004, and this week I shall be looking at the week of April 19, 2004.

My actual performance using these picks is different than this review would infer. First of all, I only own a small fraction of all of the stocks I review. I have tried to keep you posted regarding my trading portfolio which currently consists of 23 positions and which stocks I own and when I buy and sell them. Just review the past picks and you will come across all of those posts. (In addition, if I can get around to it, I have a trading portfolio up on the blog that you can reach through the link along the left side of the blog.)

This review assumes a buy and hold strategy. For my own portfolio, I sell stocks quickly if they reach or exceed an 8% loss; I also sell stocks "slowly", that is 1/4 positions, when they have gains of 30%, 60%, 90% 120%, then 180%, 240%, 300%, 360%, then by 90% intervals, etc.

On April 19, 2004, I

posted Misonix on Stock Picks at a price of $11.35. MSON closed at $5.90 on 6/10/05, for a loss of ($5.45) or (48%).

On May 5, 2005, MSON

reported 3rd quarter 2005 results. Revenue for the quarter ended March 31, 2005, came in at $10.9 million, a 5% increase from the $10.3 million reported in the same quarter the prior year. However, net income came in at $3,000 or $.0/diluted share compared with net income of $388,000 or $.06/diluted share for the same quarter in 2004.

On April 19, 2004, I

posted Carbo Ceramics (CRR) on Stock Picks at a price of $68.75. CRR closed at $74.40 on 6/10/05 for a gain of $5.65 or 8.2%.

On April 28, 2005, CRR

announced 1st quarter 2005 results. For the quarter ended March 31, 2005, revenues grew 22% to $61.2 million and net income increase 21% to $11.6 million or $.72/diluted share.

On April 21, 2004, I

posted FLIR Systems (FLIR) on Stock Picks at a price of $43.13. FLIR split 2:1 on 2/3/05, making our resultant stock pick price actually $21.57. FLIR closed at $27.04 on 6/10/05, for a gain of $5.47 or 25.4%.

On April 20, 2005, FLIR

announced 1st quarter 2005 results. Revenue dropped slightly to $108.3 million in the quarter from $108.9 million the prior year. Net earnings grew 16% to $14.7 million, from $12.7 million. On a per diluted share basis, this came in at $.19/share compared to $.17/share in the prior year.

I gave FLIR and any of my other stocks a "thumbs-down" when either the revenue or earnings decline in a given quarter.

On April 21, 2004, I

posted J&J Snack Foods (JJSF) on Stock Picks at $44.07. JJSF closed at $49.96 on 6/10/05, for a gain of $5.89 or 13.4%.

On April 20, 2005, JJSF

announced 2nd quarter 2005 results. Revenue for the quarter ended March 26, 2005, increased 4% to $99.4 million from $95.2 million in the prior year second quarter. Net earnings jumped 13% to $3.8 million from $3.3 million in 2004. On a diluted per share basis, earnings came in at $.41/diluted share up from $.36/diluted share in the 2nd quarter of 2004.

Finally, on April 22, 2004, I

posted Meridian Bioscience (VIVO) on Stock Picks at $11.22. This is the only stock of the group that I currently own in my trading account. VIVO closed at $20.12 on 6/10/05 for a gain of $8.90 or 79.3%.

On April 21, 2005,

VIVO announced 2nd quarter 2005 results. Net sales for the quarter ended March 31, 2005, came in at $23.7, up 13% from $20.9 million the prior year. Net earnings came in at $3.2 million, up 40% from $2.3 million the prior year. On a diluted per share basis this came in at $.20/share, up 33% from the prior year's $.15/diluted share.

So how did I do with my stock picks that particular week? Actually, quite good, with only one loss, albeit a significant one with MSON, and the other four showing gains for an average gain of 15.7% since posting!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them right here on the blog otherwise, feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Saturday, 11 June 2005

A Reader Writes "Could you tell me....?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I had a nice email a few days ago that I would like to share with you! (If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

William Z. wrote:

Thank you very much to share your thought. It is great analysis.

If you do not mind, could you tell me the ratio of your pick (winners/losers) and/or rate of return?

Thank you very much!

William Z

First of all, thank you William for your kind words. I like to share with you all my basic understanding of stocks and this helps me to evaluate stocks as well.

Unfortunately, I do not have the ratio of my picks (winners/losers) to share with you. I also do not have the rate of return. All of this information can be calculated because all of my past picks are located on the blog and organized by date along the left side of the page.

I suppose if anyone was ambitious enough, it wouldn't be hard to set up a spread sheet and calculate all of that out. It would also be interesting to calculate what the rate of return would be if we also applied my own personal selling strategy: selling losers quickly, and selling gainers slowly at targeted percentage gains.

But I don't have that information either :(.

What I do have, is the weekend review, where I look at stocks with about a trailing one year period, one week at a time, assume a buy and hold strategy, and calculate return.

Another thing I do is post my trading portfolio, which is accessible in a link along the left side of the blog, and keep readers updated with all of my trades and the current performance of my actual portfolio. I also have a "fantasy" mutual fund with marketocracy, and I use a rough form of portfolio management with my RMF fund. You can view the performance of that fund as well with a link along the left side of the blog.

Please remember that I am an amateur investor. If things continue to grow around here, I am sure that I will be able to get somebody to help me set up that other report. Meanwhile, I hope that my thinking stimulates you to thinking about stocks in an organized fashion. Please let me know if and how the information I write is helpful to you!

Again, remember I am an amateur. Consult with your professional investment advisors, and follow up with all investment suggestions with your own investigation.

Regards!

Bob

Friday, 10 June 2005

Boston Beer (SAM)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

Looking through the

list of top % gainers on the NYSE today I came across The Boston Beer Company (SAM), which closed today at $23.08, up $1.57 or 7.30% on the day. I do not own any shares of SAM nor do I own any options.

According to the

Yahoo "Profile" on SAM, The Boston Beer Company "...engages in brewing and selling malt beverages and hard cider products primarily in the United States. It offers beers under the Samuel Adams name, flavored malt beverage products under the Twisted Tea name, and cider products under the HardCore Cider name with a focus on Samuel Adams Boston Lager, Sam Adams Light, and Samuel Adams Seasonal Beers."

What drove the stock higher today was an

analyst upgrade from Prudential, raising the stock to an "overweight" from "neutral".

Boston Beer

reported 1st quarter 2005 results on May 3, 2005. Net revenues increased 9% to $48.7 million from $44.7 million. Net income jumped 200% to $4 million or $.27/share, up from $1.3 million or $.09/share the prior year same quarter. The company forecast full year earnings of $.94 to $1.00/share for 2005. This was in line with analysts' expectations of $.99/share for the year.

How about longer-term results? Looking at the

Morningstar.com "5-Yr Restated" financials we can see a pattern of revenue growth, albeit somewhat inconsistent, from $190.6 million in 2000 to $221.3 million in the trailing twelve months (TTM).

Earnings have been a bit erratic as well dropping from $.62/share in 2000 to $.47/share in 2001. However, earnings have grown steadily since 2001, reaching $1.04 in the TTM.

Free cash flow has been positive and slowly growing, again a bit inconsistently, from $12 million in 2002 to $15 million in the TTM.

The balance sheet, as presented on Morningstar, looks excellent with $62.4 million in cash. The cash alone is able to cover both the $28.1 million in current liabilities as well as the $2.3 million in long-term liabilities. In addition, Morningstar reports SAM with an additional $30.7 million in other current assets.

How about other valuation statistics? Taking a look at the

"Key Statistics" on SAM from Yahoo, we can see that this is a small cap stock with a market capitalization of only $329.84 million. The trailing p/e is a moderate 22.19, with a forward p/e of 20.42. The PEG is a bit rich at 1.81.

The stock is reasonably priced with a Price/Sales ratio of 1.4. As compared to other companies in the "Beverages-Brewers" Industry group, at the top is Anheuser Busch (BUD) at 2.5, Comp de Bebidas das Americas (ABV) is 2.1, Diageo (DEO) came in at 2, Molson (TAP) at 0.8, and Fomento Economico Mex (FMX) came in at 0.7.

Other additional statistics, include the 14.29 million shares outstanding with a float of only 9.06 million shares. As of 5/10/05, there were 392,550 shares out short representing 2.90% of the float or 8.2 days of average trading volume. This appears a bit significant (using my arbitrary 3 day cut-off), and may be contributing to the current price rise.

No cash nor any stock dividends are reported on Yahoo.

What about a chart? Looking at a

Stockcharts.com "Point & Figure" chart on SAM:

we can see that this stock has been strong since mid-2000, when it was trading to as low as $7.50. The stock moved higher over the next two years, but appeared to break down n price in April 2003, when it hit an intermedicate low at $10.50. The stock has traded higher since and the graph, to me, looks solid.

So what do I think? First of all, a stock upgrade, like today is always helpful. Last quarter's revenue and earnings growth was solid. The past five years, while a bit erratic, show a trend towards higher revenue and earnings growth. The free cash flow is nice and the balance sheet is gorgeous. Valuation appears reasonable, and I suspect the PEG is a bit overstated, especially if the earnings growth like the last quarter can be repreated. Now, if I only had some cash to spend :).

I shall defer to all of you the readers on whether the beer itself is good :).

Thanks so much for stopping by and visiting. If you have any questions or comments, please feel free to post them here on the blog or email me at bobsadviceforstocks@lyco.com.

Have a great weekend everyone!

Bob

Wednesday, 8 June 2005

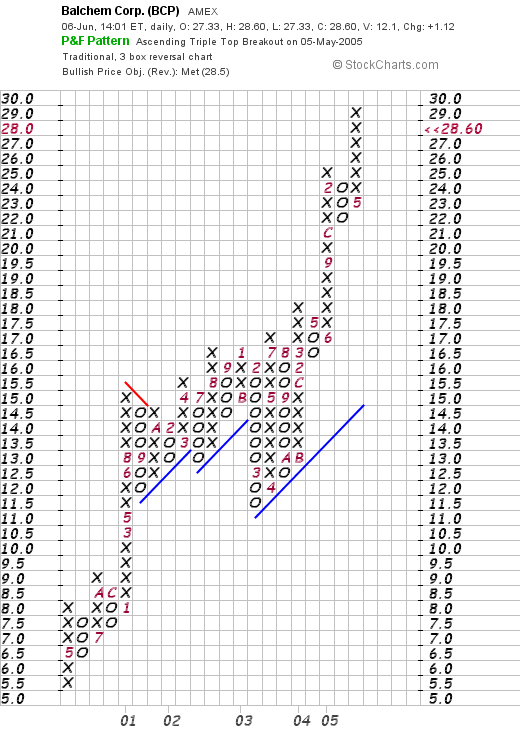

June 8, 2005 Balchem (BCP)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. Needless to say, I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market is closed, and scanning the top % gainers on the NYSE and the NASDAQ, I didn't see any new names that I felt were worth posting here this afternoon. However, on the

AMEX list of top % gainers today, I came across Balchem (BCP) which closed at $29.50, up $1.12 on the day or 3.95%. I do not own any shares or options in Balchem.

According to the

Yahoo "Profile" on Balchem, the company "...engages in the development, manufacture, and marketing of specialty performance ingredients and products for the food, feed, and medical sterilization industries in the United States and internationally. It operates in three segments: Specialty Products, Encapsulated/Nutritional Products, and BCP Ingredients."

On April 28, 2005, BCP

announced 1st quarter 2005 results. Net sales grew 23.6% for the quarter ended March 31, 2005, to $19.3 million, from $15.6 million in the prior year. Net earnings for the quarter came in at $2.6 million, a 41.4% increase over $1.8 million reported the prior year. On a diluted net earnings per share basis this came in at $.32/share, up 33% from the $.24/share reported in the prior year. These were solid results imho!

How about longer-term results? Reviewing the

"5-Yr Restated" financials on BCP from Morningstar.com, we can see that revenue has grown steadily from $33.2 million in 2000 to $67.4 million in 2004.

Earnings have been a bit more erratic, growing from $.52/share in 2000 to $1.00/share in 2002, dropping to $.75/share in 2003, but improving from that time.

As reported by Morningstar, free cash flow has improved from $0 in 2002 to $11 million in the trailing twelve months (TTM).

The balance sheet of this small company is solid, with $12.7 million in cash, enough to cover both the $5.7 million in current liabilities and the $4.5 million in long-term liabilities combined. In addition, BCP reports an additional $16.5 million in other current assets.

How about some statistics on this company? Looking at

Yahoo "Key Statistics" on BCP, we can see that this is a small cap stock with a market capitalization of only $227.09 million.

The trailing p/e is 26.32, and the forward p/e (fye 31-Dec-06) is more moderate at 17.77. No PEG is noted, I assume due to the lack of any analysts making predictions about earnings.

The Price/Sales ratio reported on Yahoo is 3.07. BCP is actually the priciest of its group of "Specialty Chemicals" stocks at a 3.1 Price/Sales level. Other companies in this group included Sigma Aldrich (SIAL) at 2.9, Monsanto (MON) at 2.8, Cabot Microelectronics (CCMP) at 2.6, Lubrizol (LZ) at 0.8, and Lyondell Chemical (LYO) at 0.6.

Other statistics from the Yahoo site show that there are only 7.70 million shares outstanding with 7.58 million of them that float. Currently (as of 5/10/05) there are only 24,250 shares out short, representing 0.30% of the float or only 1.9 trading days. This is not significant in my book.

The company does pay a small dividend of $.06/share yielding 0.21%. The last stock split, was in January, 2005, when the stock split 3:2.

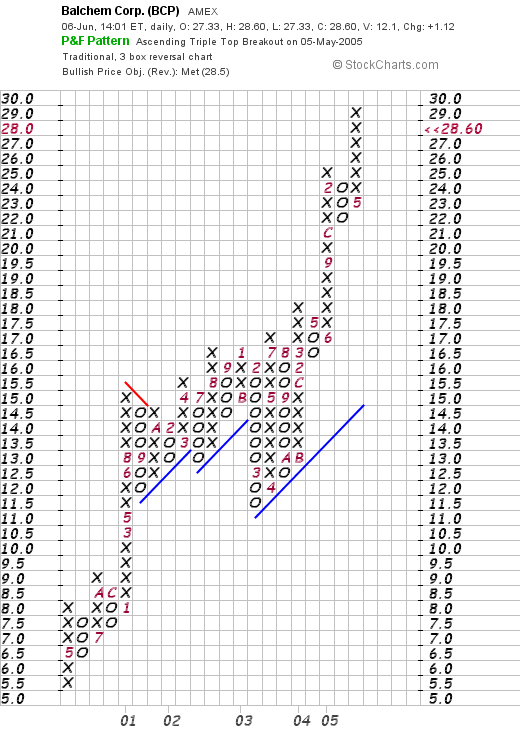

How about a graph? Taking a look at the

"Point & Figure" chart on BCP from Stockcharts.com:

we can see a gorgeous graph going all of the way back to April, 2000, when the stock based at $5.50, and has been climbing ever since to its current level of $29.50. This stock chart has yet to "look back" as it climbs higher!

So what do I think? Well, except for the fact that the stock is such a small company with a relatively small float, and that the Price/Sales ratio is a bit rich, the company is doing terrific both fundamentally and technically. The latest quarter was quite strong, and the company has been growing fairly steadily the past five years. Free cash flow is positive and growing, and the balance sheet looks nice.

In fact, if I had some cash to invest, and my system indicated to me it was time to buy, then this stock would be high on my list.

Thanks so much for stopping by and visiting. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 7 June 2005

June 7, 2005 Harman International (HAR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, and that you should consult with a professional investment advisor prior to taking any action based on information on this website.

I was looking through the

list of top % gainers on the NYSE today and came across Harman International, which was leading the 'pack', trading at $94.77, up $13.77 or 17.0% on the day! I do not own any shares of Harman, nor do I own any options.

According to the

Yahoo "Profile" on Harman (HAR), the company "...engages in the design, manufacture, and marketing of audio products and electronic systems for the consumer and professional markets."

What pushed the stock higher today was a

news story that came out this morning about two new contracts from Chrysler and Audi, worth more than $500 million in annual revenue combined ($200 million from Chrysler, and $350 million from Audi beginning in 2008).

On April 21, 2005, Harman (HAR) announced

3rd quarter 2005 results. For the quarter ended March 31, 2005, net sales increased 8% to $742.6 million from $690.4 million the prior year. Net income for the quarter was $63.5 million, up 45% from $43.7 million the prior year same quarter. On a per share diluted basis this came in at $.90/share, up 43% from last year's $.63/share.

How about longer-term? Reviewing the

"5-Yr Restated" financials from Morningstar.com, we can see the steady revenue growth, accelerating recently, from $1.7 billion in 2000 to $2.9 billion in the trailing twelve months (TTM).

Earnings have been a bit more erratic, dipping to $.48/share in 2001, from $1.03 in 2000. However, since 2001, HAR has been steadily increasing earnings to the $2.78/share in the TTM.

Free cash flow has been solid and growing, increasing from $65 million in 2002 to $313 million in the trailing twelve months (TTM).

The balance sheet is solid if not overwhelming. The company has $299.9 million in cash and $837.1 million in other current assets. This is plenty to cover both the $643.3 million in current liabilities and the $414.5 million in long-term liabilities combined.

What about "valuation" and other statistics? Taking a look at the

Yahoo "Key Statistics" on HAR, we can see that this is a large cap stock with a market capitalization of $6.18 billion.

The trailing p/e is 30.01, with the forward p/e (fye 30-Jun-06) only 23.97. Thus, with a rapid growth in earnings estimated, the "5 yr expected" PEG is only 1.12.

Price/Sales is reported at 1.85. Using my Fidelity.com research, I found that Harman is sitting in the "Electronic Equipment" industry group. Other companies in this group and their Price/Sales ratios reveals that HAR is reasonably priced: Digital Theater Systems (DTSI) is selling at a P/S of 4.3, Avid Technology (AVID) at 3.1, Echostar Communications (DISH) at 1.8, and Pemstar (PMTR) at 0.1.

Other statistics from Yahoo show that there are 67.35 million shares outstanding with 62.97 million of them that float. Of these, as of 5/10/05, there were 2.03 million shares out short representing 3.30% of the float or 2.4 trading days of volume.

The company has paid a $.05/share dividend yielding 0.06%. The last stock split was a 2:1 split in December, 2003.

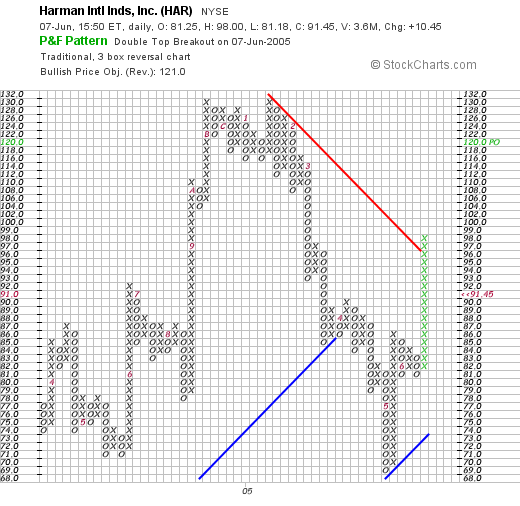

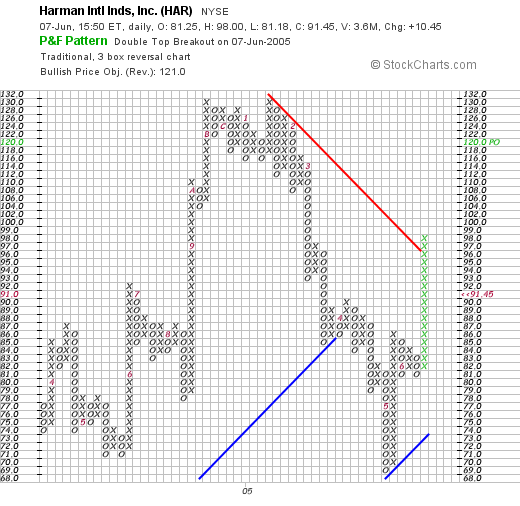

How about a chart? Taking a look at a

"Point & Figure" chart from Stockcharts.com:

we can see that this stock was trading much stronger throughout 2004, climbing from a low of $71 in May, 2004, to a high of $132 in January, 2005. However, the stock has traded lower since, breaking its support at $86 in April, 2005. Recently, the stock found support as low as $69 in May, 2005, and has been climbing strongly, breaking through resistance at $95. Not exactly an overwhelming show of strength at all, but recently, at least over the short-term, the stock has been trading stronger.

So what do I think? Well, the news today, with possibly $500 million of new business annually by 2008 with Chrysler and Audi is a very bullish announcement. The latest quarter was strong, and the past five years has also shown fairly steady growth. Free cash flow is positive and growing and the balance sheet is reasonably solid.

Valuation-wise, the stock is reasonably priced at this level (imho), with a Price/Sales ratio below average, and a PEG just over 1.0. The chart could look nicer, and is far from impressing me with anything but short-term strength, but except for my own concerns about the automotive business and the chart, the company does look interesting!

Thanks again for visiting. If you have any questions or comments, please feel free to leave them right here on the blog, or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Looking through the

Looking through the  According to the

According to the  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the  What about some

What about some

Looking through the

Looking through the

I was browsing through the

I was browsing through the

On April 19, 2004, I

On April 19, 2004, I  On May 5, 2005, MSON

On May 5, 2005, MSON  On April 19, 2004, I

On April 19, 2004, I  On April 28, 2005, CRR

On April 28, 2005, CRR  On April 21, 2004, I

On April 21, 2004, I  On April 21, 2004, I

On April 21, 2004, I  Finally, on April 22, 2004, I

Finally, on April 22, 2004, I  Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Looking through the

Looking through the  According to the

According to the  How about longer-term results? Looking at the

How about longer-term results? Looking at the  The balance sheet, as presented on Morningstar, looks excellent with $62.4 million in cash. The cash alone is able to cover both the $28.1 million in current liabilities as well as the $2.3 million in long-term liabilities. In addition, Morningstar reports SAM with an additional $30.7 million in other current assets.

The balance sheet, as presented on Morningstar, looks excellent with $62.4 million in cash. The cash alone is able to cover both the $28.1 million in current liabilities as well as the $2.3 million in long-term liabilities. In addition, Morningstar reports SAM with an additional $30.7 million in other current assets.

The market is closed, and scanning the top % gainers on the NYSE and the NASDAQ, I didn't see any new names that I felt were worth posting here this afternoon. However, on the

The market is closed, and scanning the top % gainers on the NYSE and the NASDAQ, I didn't see any new names that I felt were worth posting here this afternoon. However, on the  According to the

According to the  Earnings have been a bit more erratic, growing from $.52/share in 2000 to $1.00/share in 2002, dropping to $.75/share in 2003, but improving from that time.

Earnings have been a bit more erratic, growing from $.52/share in 2000 to $1.00/share in 2002, dropping to $.75/share in 2003, but improving from that time. The Price/Sales ratio reported on Yahoo is 3.07. BCP is actually the priciest of its group of "Specialty Chemicals" stocks at a 3.1 Price/Sales level. Other companies in this group included Sigma Aldrich (SIAL) at 2.9, Monsanto (MON) at 2.8, Cabot Microelectronics (CCMP) at 2.6, Lubrizol (LZ) at 0.8, and Lyondell Chemical (LYO) at 0.6.

The Price/Sales ratio reported on Yahoo is 3.07. BCP is actually the priciest of its group of "Specialty Chemicals" stocks at a 3.1 Price/Sales level. Other companies in this group included Sigma Aldrich (SIAL) at 2.9, Monsanto (MON) at 2.8, Cabot Microelectronics (CCMP) at 2.6, Lubrizol (LZ) at 0.8, and Lyondell Chemical (LYO) at 0.6.

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  I was looking through the

I was looking through the  On April 21, 2005, Harman (HAR) announced

On April 21, 2005, Harman (HAR) announced  What about "valuation" and other statistics? Taking a look at the

What about "valuation" and other statistics? Taking a look at the