Stock Picks Bob's Advice

Sunday, 27 August 2006

Rothstein Recognizes "Stock Picks"!

I had a nice email from Juliana Kim from Rothstein Asset Management, LP, who noted that Jack Rothstein has nominated Stock Picks Bob's Advice for recognition as one of the best Stock Market Blogs. This note is certainly very much appreciated!

If you haven't visited Jack's blog at Wealthcast.com, consider stopping by to read what Jack has to say. He is bright, a true professional (unlike my amateur status!), and writes a very comprehensive and insightful column. I have been linking to him for quite awhile and Jack has been kind enough to link to me as well!

Full Disclosure: Kim says that if Stock Picks is recognized by Rothstein as an outstanding stock blog, I might be eligible to receive an iPod. With three kids of my own, an iPod will be a big hit around this household.

If you have a blog that you would like me to review or link to, please feel free to drop me a line at bobsadviceforstocks@lycos.com and I will give it a look!

Bob

Saturday, 26 August 2006

ICT Group (ICTG)

CLICK HERE FOR MY PODCAST ON ICT GROUP!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I have done previously, I should like to once again apologize for my two week absence. It is a bit strange apologizing to anonymous people who read my blog, but I still feel a connection with all of you who have become regular readers here...who are sharing with me my own exploration of stocks and working to develop a coherent strategy in selecting and owning equities. But before I was philosophic, let me share with you a stock that deserves a place in this blog.

As I like to do on most trading days, I reviewed the list of top % gainers on the NASDAQ from yesterday. I generally stay away from stocks much under $10....leaving just a few to examine with some of my screening techniques.

As I like to do on most trading days, I reviewed the list of top % gainers on the NASDAQ from yesterday. I generally stay away from stocks much under $10....leaving just a few to examine with some of my screening techniques.

ICT Group (ICTG) had a nice day yesterday, closing at $28.94, up $2.49 or 9.41% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this company and I shall try to show you why I find it worthy of a review.

1. What exactly does the company do?

According to the Yahoo "Profile" on ICTG, the company

"... and its subsidiaries provide outsourced customer management and business process outsourcing solutions. The company offers a mix of sales, service, marketing, and technology solutions, which include customer care/retention, technical support and customer acquisition, and cross-selling/upselling, as well as market research, database marketing, data capture/collection, email management, collections, and other back-office business processing services."

2. What about the latest quarterly report?

On July 27, 2006, ICT group reported 2nd quarter earnings results. For the quarter ended June 30, 2006, revenue increased 15% to $111.3 million from $97 million in the same quarter last year. In addition, net income came in at $3.9 million or $.25/share, up from $1.7 million or $.14/diluted share in the year ago period. According to the same news story, the company beat expectations by $.04/share. In addition, the company raised guidance to $1.08 to $1.13 for the full year on sales of $445 to $451 million. In April, 2006, guidance was $1.03 to $1.09/share on revenue of $440 to $448 million. While not a huge guidance higher, the fact the company beat expectations and also raised guidance for the full year is very significant imho.

3. How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ICTG, we can see a fairly steady growth in revenue (except for a small dip between 2001 and 2003) from $239.3 million in 2001 to $401.3 million in 2005 and $434.7 million in the trailing twelve months. Earnings, however, have been more erratic, dropping from $.63/share in 2001 to a loss of $.21/share in 2004. Since 2004, earnings have come in at $.94/share in 5006 and $1.18 in the trailing twelve months. The number of shares outstanding has increased modestly from 12 million in 2001 to 13 million in 2005 and 15 million in the trailing twelve months (TTM).

Free cash flow which was negative at $(4) million in 2003 and $(12) million in 2004, turned positive at $5 million in 2005 and grew to $6 million in the TTM.

The current assets total $125.6 million, which could easily pay off all of the current liabilities listed as $40.1 million and the $4.1 million of long-term liabilities combined. Calculating the 'current ratio' yields a value of 3.13 suggesting a picture of financial health. This is especially true in light of the nominal long-term liabilities listed as $4.1 million on Morningstar.com.

4. What about some valuation numbers?

Using Yahoo "Key Statistics" on ICT Group, we observe that the company is a small cap stock with a market capitalization of only $445.50 million. The trailing p/e is a moderate 24.74 and the forward p/e (fye 31-Dec-07) works out to 20.82. The PEG is also reasonable (imho) at 1.20.

As noted by the Fidelity.com eresearch website, this company is in the "Business Services" industrial group. Within this group, this stock is the most reasonably priced in regards to the Price/Sales ratio with a ratio of 1. This group is led by Getty Images (GYI) with a Price/Sales ratio of 3.6. Getty is followed by Global Payments (GPN) with a ratio of 3.3, Choicepoint (CPS) at 3, Fidelity National Information Services (FIS) at 2.8, Cintas (CTAS) at 1.8 and finally ICT Group with a ratio of 1.

Profitability, as measured by the "Return on Equity" (ROE), shows that while ICTG is relatively cheap when measured by Price/Sales; the company is actually quite profitable with an ROE of 16.6%. This is only exceeded by Global Payments at 18.1%, and followed by Cintas with a result of 15.3%, Choicepoint at 12.9%, Getty at 11.6% and Fidelity National Information Services with a result of 9.6%.

Returning to Yahoo for a few more statistics, we see that there are only 15.39 million shares outstanding and only 6.39 million of them float. Currently there are 364.06 thousand shares out short representing 4% of the float and a short ratio of only 3.6. The short-sellers do not appear to be very significant in this stock.

No cash dividends and no stock dividends are reported on Yahoo.

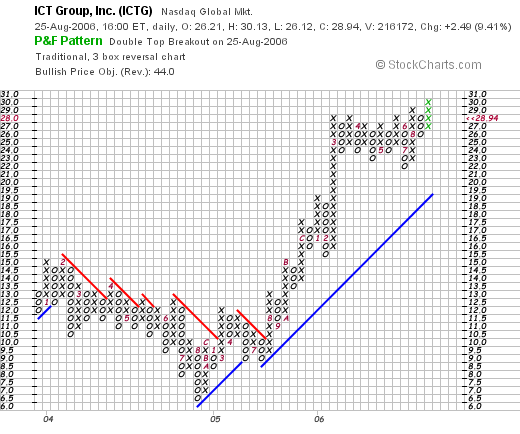

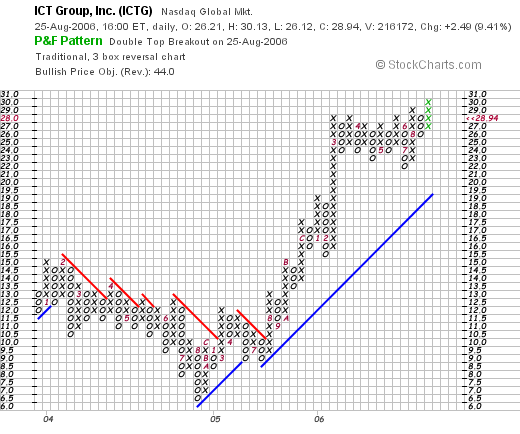

5. What does the chart look like?

If we review the "Point & Figure" chart on ICTG from StockCharts.com, we can see the decline in the stock price from $14 in February, 2004, to a low of $6.50 in August, 2004. The stock subsequently has been trading higher to the $28 level in March, 2006. Consolidating at this level, it now appears to be moving higher to new price levels.

6. Summary: What do I think about this stock?

In summary, I like this stock due to the strong price move Friday (yesterday) in an otherwise anemic trading environment. The last quarter's results were strong with both increasing revenue and earnings and the company did beat expectations as well as raise guidance!

The Morningstar.com report shows a company turning itself around, from losses to increasing profits while growing its revenues at the same time. The number of shares outstanding is fairly stable, and the free cash flow picture also shows the negative free cash flow becoming positive and increasing in size. Balance-sheet-wise, the company has lots of current assets, almost no long-term liabilities and a current ratio of over 3. Valuation-wise, the p/e is barely over 20, the PEG is at 1.2, and while the Price/Sales ratio is one of the lowest in its industrial group, the profitability of the company, as measured by ROE is one of the highest in the same group....a nice combination of results.

Finally, the chart looks strong, and the company appears to be moving into new high territory.

So there are lots of things I like about this company. I am not exactly sure of their business :), but it appears that they are doing quite well.

Thanks again for stopping by and visiting! If you have any comments or questions, please be sure to email me at bobsadviceforstocks@lycos.com. If you get a chance, please also feel free and know you are invited to listen to my Stock Picks Podcast, where I discuss many of the same stocks and investment strategy as I like to discuss on this blog!

Bob

Posted by bobsadviceforstocks at 8:06 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 27 August 2006 4:50 PM CDT

Quality Systems (QSII) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It has been a few weeks since my last portfolio review. On August 5, 2006, I reviewed my Morningstar holding on this blog. With the many sales I have had in my trading portfolio, I am now down to 11 positions, and going alphabetically through my portfolio, I am up to Quality Systems (QSII) which happens to be my most successful investment in my account.

I currently own 88 shares of Quality Systems (QSII) which closed at $39.51 on August 25, 2006. These shares were purchased with a cost basis of $7.75/share, acquired on 7/28/03. Thus, I have an unrealized gain of $31.76/share or 409.8% since purchase. As has been my practice, I have been selling portions of QSII as the stock has been appreciating. I have sold portions on 8/19/03, 8/22/03, 1/21/04, 2/1/05, 3/4/05, 4/21/05, 8/16/05, 10/3/05 and 11/22/05. These nine sales represent sales at 30%, 60%, 90%, 120%, 180%, 240%, 300%, 360%, and 450% appreciation levels. Thus, on the upside, my next targeted gain is at a 540% level which works out to 6.40 x $7.75 = $49.60. On the downside, my strategy dictates a sale at 50% of the highest appreciation point or at a 225% gain level = 3.25 x 7.75 = $25.19. Unfortunately, many of my earlier sales were 25% of my remaining position causing my position to diminish in size. I am now at a 1/6th of the remaining position at each targeted gain, and hopefully this position will continue to grow in size as the stock appreciates.

Let's take a closer look at this stock and see if it still deserves to be on this blog:

1. What does this company do?

According to the Yahoo "Profile" on QSII, this company

"... and its subsidiary NextGen Healthcare Information Systems, Inc. engage in the development and marketing of healthcare information systems that automate medical and dental practices, physician hospital organizations and management service organizations, ambulatory care centers, community health centers, and medical and dental schools."

2. How did they do in the latest quarter?

On August 3, 2006, Quality Systems reported results for first quarter 2007. Net revenues came in at $36.1 million, up 32% from $27.4 million in the same quarter the prior year. Net income worked out to $7.7 million, up 51% over the net income of $5.1 million in the prior year same period. Fully diluted earnings were $.28/share, up 47% from the $.19/share reported last year. This exceeded analysts' expectations of $.24/share.

3. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on QSII, we can see the beautiful picture of steady revenue growth with revenue of $44.4 million in 2002, growing to $119.3 million in 2006 and $127.9 million in the trailing twelve months (TTM).

Earnings have also steadily grown from $.21/share in 2002 to $.85/share in 2006 and $.94/share in the trailing twelve months. The company stqarted paying dividends in 2005 with $.75/share paid. This was increased to $.88/share in 2006. The company has slightly increased its outstanding shares from 24 million in 2002 to 27 million in the TTM. This 10% increase in shares during a period in which the company almost tripled its revenue and quadrupled its earnings is quite tolerable :).

The picture of free cash flow has also been very nice with $16 million in 2004 increasing to $28 million in 2006 and $32 million in the TTM.

The balance sheet is solid with $67 million in cash, more than enough by itself to pay off both the $50.2 million in current liabilities and the $3.5 million in long-term liabilities combined. Calculating the 'current ratio' we can see that QSII has a combined $112.5 million in total current assets, which, when compared to the $50.2 million in current liabilities yields a current ratio of 2.24. (Anything over 1.5 is generally considered 'healthy').

4. What about some 'valuation numbers' on this stock?

Taking a look at the Yahoo "Key Statistics" on QSII we see that this is a mid-cap stock with a market capitalization of $1.06 billion. The trailing p/e is a bit rich at 41.81, but the forward p/e (fye 31-Mar-08) is a bit nicer at 27.06. But then again, this is going out to 2008! However, analysts appear to be expecting continued rapid growth in earnings as the PEG on this stock is a very nice 0.98.

According to the Fidelity.com eresearch website, QSII is in the "Healthcare Information Services" industrial group. Within this group, Quality Systems is the 'priciest' of the group with a Price/Sales ratio of 8.4. Following QSII is Merge Technologies (MRGE) at 3.4, Cerner (CERN) at 2.9, Emdeon (HLTH) at 2.5, Eclipsys (ECLP at 2 and Trizetto Group (TZIX) at 1.8.

Fortunately, QSII is also the most profitable of the group with a Return on Equity (ROE) of 32.9%. Following Quality Systems is Trizetto at 23.1%, Cerner at 12.7%, Emdeon at 7.2%, Eclipsys at 2.1% and Merge at 0.3%.

Returning to Yahoo, we find that there are 26.74 million shares outstanding with 16.85 million that float. Of these, there were 3.49 million shares out short as of 7/11/06, representing 20.7% of the float or 11.7 trading days of volume (the short ratio). Using my own 3 day rule on short interest, I find that this large level of short interest may well support this stock in the event of any good news with a 'squeeze' of the shorts possible.

The company has a trailing dividend of $.88/share yielding 2.20%. The last stock split was a 2:1 stock split on 3/27/06.

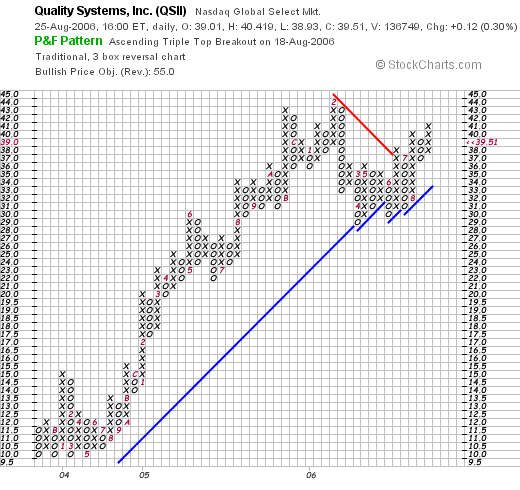

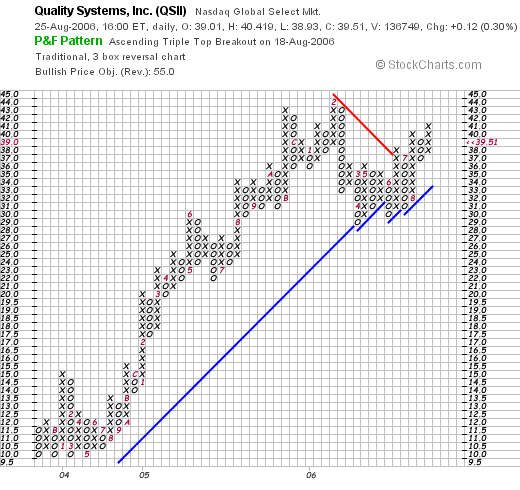

5. What does the chart look like?

If we examine the "Point & Figure" chart on QSII from StockCharts.com, we can see that the stock moved strongly higher from $10/share in late 2003, (about the time I purchased shares) to a high of $44/share in February, 2006. The stock pulled back to the $30 level in April, 2006, and has been finding support at this level before breaking through resistance and moving near the old highs. The stock looks strong to me!

6. Summary: what do I think about this stock?

First of all, I own this stock have watched the stock price quadruple over the last three years. So certainly I am biased! And there is of course no guarantee that the stock price will continue to rise! THAT is why I have and shall continue to take small portions of my investment off the table as this and any of my stocks appreciate!

However, the last quarter's earnings report is solid. The company is in the EMR (electronic medical record) field, and is at the cutting edge of the transition from paper records in the medical field to electronic records. Thus the "story" is compelling as well as the numbers. The Morningstar.com report is beautiful without even a blemish with steady revenue, earnings, and free cash flow growth. The balance sheet is solid with lots of cash. Valuation-wise, the p/e is certainly rich above 40, but the PEG is under 1.0 making the valuation seem reasonable. The Price/Sales ratio is rich compared to other stocks in its group, but the company is also the most profitable in terms of the ROE figure of its group. Interestingly, there are lots of short-sellers out there who have borrowed shares to sell this stock and now may have to scramble to find shares to cover their sales if the stock should continue to rise on any good news.

Even the chart looks nice, as the stock has now consolidated for a few months and now appears to be once again moving higher. There is little, imho, to discourage me on this particular stock, but I always remain poised to sell my shares on fundamental negative news or on negative price performance.

Thanks so much for stopping by and visiting. Once again I apologize for my absence from this website, but if I get a chance, I shall have to share with you my vacation experience. In any case, if you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and feel welcome to visit and listen to me on my Stock Picks Podcast Site!

Bob

"Looking Back One Year" A review of stock picks from the week of April 25, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website!

I am glad to be back blogging after being away for a couple of weeks. Thank you so much for rechecking with me after my absence. I know so little about all of you readers but I assume there are some of you who regularly stop by to read what I have to write. For all of you regulars, your loyalty is appreciated. For those of you who are new to this website, well welcome and make yourself at home!

One of those things that I regularly try to do around here is to review past stock picks and find out how they turned out. This review assumes a "buy and hold" strategy assuming buying equal dollar amounts of the stock picks the day they were selected and holding without concern for stock appreciation or loss. This isn't what I actually recommend for my own stock purchases. I employ a disciplined buying and selling strategy involving the quick sale of declining stocks at an 8% loss and the partial sales of gaining stocks at targeted appreciation points. However, for the sake of this review, and to continue my past review practices, this is what I use for evaluation.

I should also point out that when I started this review process some years back (!), I actually was a year out. Missing weeks here and there, I am now, as you can see, almost 1 1/2 years out from my picks and reviews.

On April 29, 2005, I posted CNS (CNXS) on Stock Picks Bob's Advice when it was trading at $18.09. CNXS closed at $27.88 on August 25, 2006, for a gain of $9.79 or 54.1% since posting.

On April 29, 2005, I posted CNS (CNXS) on Stock Picks Bob's Advice when it was trading at $18.09. CNXS closed at $27.88 on August 25, 2006, for a gain of $9.79 or 54.1% since posting.

On August 2, 2006, CNXS reported 1st quarter 2007 results. Net sales came in at $29.3 million for the quarter, up 25% from $23.5 million the prior year. Net income, however, for the quarter came in at $3.5 million or $.24/diluted share down from $4.0 million or $.27/share in the same quarter last year. Certainly the growth in revenue was solid, as has been the stock performance since my "pick"; however, due to the decline in earnings, I have to assign this stock a "thumbs-down". (Stocks only get "thumbs-up" on these reviews if both the earnings and revenue have improved.

On August 2, 2006, CNXS reported 1st quarter 2007 results. Net sales came in at $29.3 million for the quarter, up 25% from $23.5 million the prior year. Net income, however, for the quarter came in at $3.5 million or $.24/diluted share down from $4.0 million or $.27/share in the same quarter last year. Certainly the growth in revenue was solid, as has been the stock performance since my "pick"; however, due to the decline in earnings, I have to assign this stock a "thumbs-down". (Stocks only get "thumbs-up" on these reviews if both the earnings and revenue have improved.

On April 27, 2005, I posted Hologic (HOLX) on Stock Picks Bob's Advice when it was trading at $35.85. HOLX had a 2:1 stock split December 1, 2005 and another 2:1 stock split March 26, 2006. Thus, my effective pick price was actually $35.85 x 1/2 x 1/2 = $8.96. HOLX closed at $42.21 on August 25, 2006, for a gain on this pick of $33.25 or 371%! (Every once in a while it is nice to smack one out of the park!)

On April 27, 2005, I posted Hologic (HOLX) on Stock Picks Bob's Advice when it was trading at $35.85. HOLX had a 2:1 stock split December 1, 2005 and another 2:1 stock split March 26, 2006. Thus, my effective pick price was actually $35.85 x 1/2 x 1/2 = $8.96. HOLX closed at $42.21 on August 25, 2006, for a gain on this pick of $33.25 or 371%! (Every once in a while it is nice to smack one out of the park!)

On July 25, 2006, Hologic announced third quarter fiscal 2006 results. Revenues totalled $119.7 million, a 62% increase over revenues of $74 million in the same quarter in 2005. Net income came in at $12 million or $.25/share, up sharply from $8.2 million or $.18/share reported in the same quarter in 2005.

On July 25, 2006, Hologic announced third quarter fiscal 2006 results. Revenues totalled $119.7 million, a 62% increase over revenues of $74 million in the same quarter in 2005. Net income came in at $12 million or $.25/share, up sharply from $8.2 million or $.18/share reported in the same quarter in 2005.

So how did we do during that week picking stocks? Well in a word, PHENOMENAL! (I do not always do so well, but it is nice to have a great week picking stocks don't you think? Please remember that I am an amateur and that past performance is NOT a guarantee of future performance!) I had two stocks that week, one gained 54.1% and the other gained 371%, for an average appreciation of 212.5%. What a week that was. If only investing was always that successful!

Thanks again for visiting! I am glad to be back blogging and look forward to your comments, questions, and thoughts, at bobsadviceforstocks@lycos.com. Also, when you get a chance, stop by and visit my Stock Picks Podcast Site where you can also hear me talk about many of the same stocks I write about here on the blog. Regards!

Bob

Monday, 21 August 2006

A Short Break....back in a few days

Friends, I am away from my computer for a few days. I haven't posted for a week....but I shall be back and ready to go in a while. Regards and I promise to be back blogging this time next week!

Bob

Monday, 14 August 2006

August 14, 2006 Sonic Corp. (SONC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market is up strongly today on news that the cease-fire in the middle east appears to be holding. As I write, the Dow is up 97.89 at 11,185.92, and the NASDAQ is at 2087.35, up 29.64. Hopefull the move towards a peaceful resolution will hold, and oil prices will continue to pull back.

I was looking through the list of top % gainers on the NASDAQ earlier today and came across Sonic Corp. (SONC) which is currently trading at $21.75, up $2.02 or 10.24% on the day. I do not own any shares of Sonic nor do I have any options on this stock.

What appears to be driving the stock higher today was the announcement on Friday of a potential 'buy-back' of up to 30% of the outstanding shares by the company. I found this news story that explains some of the reasons why companies buy back their shares. This article points our the three main reasons why a company buy-back is helpful in boosting share prices of its stock: 1) with less shares outstanding, earnings per share are boosted numerically, 2) the buy-back is in itself a form of purchasing support for the price...the old supply and demand principle, driving stock prices higher, and 3) the buy-back demonstrates management confidence in the value of the stock price itself. In any case, the market liked the news, and the stock price is moving strongly higher today.

What appears to be driving the stock higher today was the announcement on Friday of a potential 'buy-back' of up to 30% of the outstanding shares by the company. I found this news story that explains some of the reasons why companies buy back their shares. This article points our the three main reasons why a company buy-back is helpful in boosting share prices of its stock: 1) with less shares outstanding, earnings per share are boosted numerically, 2) the buy-back is in itself a form of purchasing support for the price...the old supply and demand principle, driving stock prices higher, and 3) the buy-back demonstrates management confidence in the value of the stock price itself. In any case, the market liked the news, and the stock price is moving strongly higher today.

What exactly does this company do?

According to the Yahoo "Profile" on SONC, Sonic

According to the Yahoo "Profile" on SONC, Sonic

"...engages in the operation and franchising of a chain of quick-service drive-ins in the United States and Mexico. The company, through its subsidiary, Sonic Industries, Inc., serves as the franchiser of the Sonic restaurant chain. It’s another subsidiary, Sonic Restaurants, Inc., develops and operates the company-owned restaurants. As of August 31, 2005, Sonic Corp. had 3,039 Sonic Drive-Ins, including 574 Partner Drive-Ins and 2,465 Franchise Drive-Ins."

How did Sonic do in the latest reported quarterly result?

On June 20, 2006, Sonic reported 3rd quarter 2006 results. For the quarter ending in May, 2006, sales grew 11% to $186.5 million from $167.7 million last year. Net income came in at $23.8 million, or $.27/share, up from $21.3 million or $.23/share in the same period in 2005. According to the news story, analysts per Thomson Financial had forecast earnings of $.26/share on revenue of $189.7 million. Thus, the company beat expectations on the earnings side and under-performed on revenue growth. Same-store sales increased 4.3% during the quarter. Providing some guidance, Sonic forecast profit of $.28 to $.29/share in the upcoming 4th quarter. This was a little ahead of the $.28/share which had been the consensus of analysts. Thus the company raised guidance.

How about longer-term financial results?

When we review the Morningstar.com "5-Yr Restated" financials on SONC, we can see a very nice picture of steady revenue growth with $331 million reported in 2001, steadily increasing to $623 million in 2005 and $676 million in the trailing twelve months (TTM).

Earnings have also been steadily improving with $.41/share reported in 2001 increasing to $.81/share in 2005 and $.89/share in the TTM.

The number of shares outstanding, which will apparently be decreasing, has been steady with 89 million in 2001, 90 million shares in 2005 and 85 million in the TTM.

Free cash flow is also impressive, with $36 million in 2003, increasing to $46 million in 2005 and $52 million in the TTM.

SONC's balance sheet is the only area of question on this page imho. The company has $25.4 million in cash and $29.5 million in other current assets. This is not in itself enough to cover the $80.7 million in current liabilities, and the resultant 'current ratio' works out to an anemic .68. Generally, a ratio of 1.5 is considered healthy as this review points out. In light of the healthy and growing free cash flow, this doesn't appear to be a big problem for Sonic, but it is something we shouldn't ignore either.

What about some Valuation Numbers for this stock?

Reviewing Yahoo "Key Statistics" on Sonic, we can see that this company is a mid-cap stock with a market capitalization of $1.86 billion. The trailing p/e is a moderate 24.29, with a forward p/e (fye 31-Aug-07) estimated at an even more reasonable 21.31. The PEG ratio is estimated by Yahoo at 1.28 (5 yr expected results). Generally, PEG ratios between 1.0 and 1.5 are "reasonable", under 1.0 are great, and over 1.5 are less attractive. This is a brief review of this ratio.

Using information from the Fidelity.com eresearch site on SONC, we can see that Sonic is in the "Restaurants" industrial group. Within this group, as measured by the Price/Sales ratio, Sonic is richly valued, leading the group with a ratio of 2.6, this is followed by McDonald's (MCD) at 2, Applebee's (APPB) at 1.1, Darding Restaurants (DRI) at 0.9, Brinker (EAT) at 0.7, and OSI Restaurant Partners (OSI) at 0.6.

Insofar as profitability is concerned, if we look at the Return on Equity (ROE) figures, we find that Sonic fortunately is one of the more profitable restaurants with an ROE of 21.1%. This is exceeded by Darden at 27.1% and following Sonic is Applebee's at 20%, McDonald's at 18.5%, Brinker at 18.2% and OSI at 10%.

Finishing up the Yahoo numbers, we see that there are 85.4 million shares outstanding with 81.93 million that float. Currently, there are 6.25 million shares (7/11/06) out short, representing 7.70% of the float or 7.2 trading days of volume. This short ratio over 3, is in my opinion, significant. Thus, with the stock moving higher today on an announcement of a stock buy back, these traders who have already sold shares and are looking to buy cheaper, might well be "squeezed" by the buying pressure.

No cash dividend is reported on Yahoo and the last stock split was a 3:2 split, just happening, on May 1, 2006.

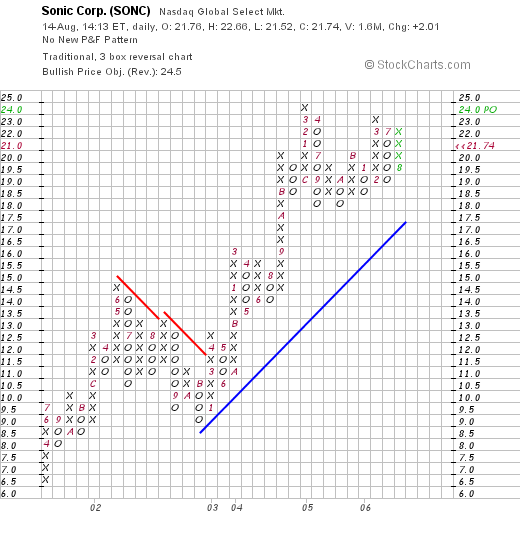

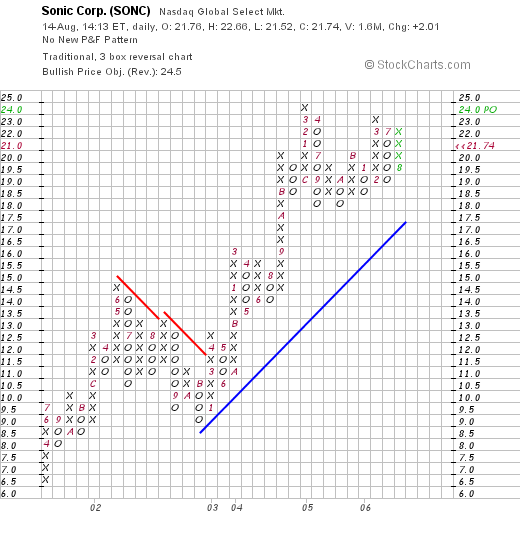

And what does the chart look like?

If we review the "Point & Figure" chart on Sonic from StockCharts.com, we see what appears to me to be a strong graph, which, after some mild weakness in 2002, when the stock fell from $14.50 in June to a low of $8.50 in November, the stock has been trading steadily higher, currently approaching but under its high of $24.00 hit in March, 2005. The chart looks just fine to me.

Summary: So what do I think of this stock?

Let's review some of the above discussion. First of all the stock is moving higher on a nice announcement of a big stock buy-back from management. Less shares outstanding should mean better results, and the buying pressure in itself could help push this stock higher. Next, the latest quarter was reasonably strong with earnings exceeding expectations but revenue coming in a little light. The Morningstar.com shows steady revenue and earnings growth and nice free cash flow improvement. However, the balance sheet leaves a little to be desired with a current ratio under 1.0 and a significant level of long-term liabilities as well.

Valuation is ok with a rich Price/sales but a nice return on equity figure. Another attractive point is the high level of the short interest which may well be continued to be "squeezed" by the stock buy back. Finally, the chart looks quite nice to me.

These are the reasons I thought the stock deserved to be on the blog. I am not buying any shares, but I have now added this company to my "investing vocabulary"...those stocks that may well be 'investable' given the appropriate portfolio management signals that might lead to me adding a new position!

Thanks so much for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please give my Stock Picks Podcast a listen as well!

Bob

Saturday, 12 August 2006

"Looking Back One Year" A review of stock picks from the week of April 18, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Bob's Advice for Stocks! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the tasks I try to accomplish each weekend is to look back at past stock selections and see what happened after I posted them to the blog. For ease of performance calculation, I assume a "buy and hold" strategy to this approach. In fact, in practice I utilize and recommend a more disciplined trading approach to stocks; selling losing stocks quickly and completely, and selling gaining issues slowly and partially. This difference would obviously change the performance evaluation. But for the purposes of this weekend review, the 'buy and hold' strategy works just fine!

On April 18, 2005, I posted Too, Inc. (TOO) on Stock Picks Bob's Advice when it was trading at $23.74. In July 10, 2006, Too, Inc. changed its name to Tween Brands (TWB) and started trading under the new stock symbol. TWB closed at $35.98 on 8/11/06, for a gain of $12.24 or 51.6% since posting.

On April 18, 2005, I posted Too, Inc. (TOO) on Stock Picks Bob's Advice when it was trading at $23.74. In July 10, 2006, Too, Inc. changed its name to Tween Brands (TWB) and started trading under the new stock symbol. TWB closed at $35.98 on 8/11/06, for a gain of $12.24 or 51.6% since posting.

On May 17, 2006, what was then called "Too, Inc." reported 1st quarter 2006 results. For the quarter ended April 29, 2006, net sales increased 19% to $195.1 million, up from $164.4 millionduring the same period last year. Net income climbed 67% to $.35/diluted share from $.21/diluted share last year. This was $11.7 million this year and $7.4 million of net income in the prior year same period. Comparable store sales increased 10% during the quarter with 9% increase for Limited Too stores and a 30% increase for the 46 Justice stores open during both periods. Another plus imho for the stock was that during the quarter, the company repurchased about 630,000 shares.

On May 17, 2006, what was then called "Too, Inc." reported 1st quarter 2006 results. For the quarter ended April 29, 2006, net sales increased 19% to $195.1 million, up from $164.4 millionduring the same period last year. Net income climbed 67% to $.35/diluted share from $.21/diluted share last year. This was $11.7 million this year and $7.4 million of net income in the prior year same period. Comparable store sales increased 10% during the quarter with 9% increase for Limited Too stores and a 30% increase for the 46 Justice stores open during both periods. Another plus imho for the stock was that during the quarter, the company repurchased about 630,000 shares.

On April 20, 2005, I posted St. Jude Medical (STJ) on Stock Picks Bob's Advice when the stock was trading at $39.67. STJ closed at $33.68 on 8/11/06, for a loss of $(5.99) or (15.1)% since posting.

On April 20, 2005, I posted St. Jude Medical (STJ) on Stock Picks Bob's Advice when the stock was trading at $39.67. STJ closed at $33.68 on 8/11/06, for a loss of $(5.99) or (15.1)% since posting.

On July 19, 2006, St. Jude Medical announced 2nd quarter 2006 results. For the quarter ended June 30, 2006, net sales came in at $833 million, up 15% from $724 million reported in the same quarter in 2005. Net earnings were $141 million or $.38/diluted share compared with $101 million or $.27/diluted share in the previous year. On a down note, the same day the company cut its estimates for the year reporting:

On July 19, 2006, St. Jude Medical announced 2nd quarter 2006 results. For the quarter ended June 30, 2006, net sales came in at $833 million, up 15% from $724 million reported in the same quarter in 2005. Net earnings were $141 million or $.38/diluted share compared with $101 million or $.27/diluted share in the previous year. On a down note, the same day the company cut its estimates for the year reporting:

"Updating its forecast, St. Jude expects consolidated earnings for the third quarter to be in the range of 36 cents to 39 cents a share, and full-year profit to be in the range of $1.49 to $1.55 a share. In April, the company forecast a consolidated profit of $1.55 to $1.60 for the year."

Finally, on April 21, 2005, I posted Meridian Bioscience (VIVO) on Stock Picks Bob's Advice at a price of $16.265. On September 6, 2005, Meridian split 3:2 making my effective pick price actually $10.84. VIVO closed on 8/11/06 at $19.50/share for a gain of $8.66 or 79.9% since posting!

On July 20, 2006, VIVO reported 3rd quarter 2006 results. For the three months ended June 30, 2006, net sales increased 5% to $26.6 million from $25.4 million in the same quarter in the previous year. Operating incomecame in at $6.9 million, up 21% from $5.7 million last year. The company also raised guidance for 2007 sales to $106 to $109 million from the previous guidance of $103 to $107 million. Per share earnings guidance were also increased to $.63 to $.66/share, up from the prior guidance of $.60 to $.63/share. Overall, a nice earnings report for Meridian!

So how did I do for that week a little over a year ago? Pretty darn good actually. Two gaining stocks and one losing stock for an average gain of 38.8% on these stocks assuming equal dollar purchases and a "buy and hold" strategy!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure and visit my podcast site.

Bob

Kohl's (KSS)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Here is an entry that I really intended to get to yesterday, but one thing led to another....same old story I guess! Kohl's (KSS) had a great day yesterday, closing at $60.76, up $2.57 or 4.42% on the day. I do own some shares of KSS in a managed account that I do not direct.

Here is an entry that I really intended to get to yesterday, but one thing led to another....same old story I guess! Kohl's (KSS) had a great day yesterday, closing at $60.76, up $2.57 or 4.42% on the day. I do own some shares of KSS in a managed account that I do not direct.

What exactly does the company do?

According to the Yahoo "Profile" on Kohl's, the company

"...operates specialty department stores in the United States. Its stores sell apparel, footwear, accessories, and beauty products for women, men, and children, as well as soft home products, such as towels, sheets and pillows, and housewares."

How did Kohl's do in the latest quarterly earnings report?

As is often the case, the stock rose Friday after the company announced 2nd quarter earnings after the close of trading Thursday. For the quarter ended July 29, 2006, net sales for the quarter grew 14% to $3.3 billion from $2.9 billion. Earnings jumped 27.8% to $.69/share, up from $.54/share the same quarter last year.

2nd quarter earnings after the close of trading Thursday. For the quarter ended July 29, 2006, net sales for the quarter grew 14% to $3.3 billion from $2.9 billion. Earnings jumped 27.8% to $.69/share, up from $.54/share the same quarter last year.

A couple of points about the earnings report: first of all, the company reported on their same store sales which climbed 5.5% in the quarter. This is reasonably strong and reproducible same store sales growth number. The report was good because it was what I call a "trifecta-plus"....that is the company increased revenue and earnings, beat expectations, and also raised guidance. Everything one could want in an earnings report!

According to this report, the company, which came in at $.69/share, exceeded analysts expectations of only $.65/share. In addition, Kohl's raised guidance to $3.04 to $3.13/share for the year, up from previous guidance of $2.91 to $3.02.

How about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that Kohl's has steadily grown its revenue from $7.5 billion in 2002 to $13.4 billion in 2006 and $13.8 billion in the trailing twelve months (TTM).

Except for a slight dip in earnings between 2003 and 2004, when earnings dropped from $1.75 to $1.59, the company has been growing its earnings from $1.35/share in 2002 to $2.43/share in 2006 and $2.55/share in the TTM.

The number of shares outstanding has been fairly steady with 335 million in 2002, growing to 344 million in 2006 and dropping back to 340 million in the TTM.

Free cash flow, which was a negative $(92) million in 2004, improved to 47 million in 2005 and $82 million in 2006. Morningstar reports a huge increase in free cash flow in the TTM at $1.8 billion.

The balance sheet, as presented on Morningstar.com, looks solid with $1.6 billion in cash and a total of $4.1 billion in current assets. When compared to the $1.6 billion in current liabilities, this yields a current ratio of 2.52. The company can easily pay off all of its liabilities with all of its current assets.

How about some valuation numbers and statistics on the company?

Reviewing the Yahoo "Key Statistics" on KSS, we see that this is a large cap stock with a market capitalization of $20.69 billion. The trailing p/e is a moderate 23.85 with a forward p/e (fye 28-Jan-08) of only 16.97. However, the growth rate in the earnings (5 yr expected) is adequate to give us a PEG of .89.

Looking at the information on the Fidelity.com eresearch site, we can see that Kohl's is in the "Department Stores" industrial group. Within this group, Kohl's is relatively richly priced relative to similar companies. Topping this group is Federated Department Stores (FD) with a Price/Sales ratio of 1.6, this is followed by Kohl's (KSS) at f1.5, J. C. Penney (JCP) at 0.8, Saks (SKS) at 0.4 and Dillard's (DDS) at .3.

Insofar as profitability is concerned, at least as measured by return on equity (ROE), this measure is led by J.C.Penney at 25.4%, followed by Kohl's at 15.4%, Federated Department Stores at 10.1%, Dillard's at 6.2%, and Saks (SKS) at 4.3%.

Finishing up with Yahoo, we find that there are 340.44 million shares outstanding and 308.51 million of them that float. Currently (7/11/06) there are 9.93 million shares out short representing 3.20% of the float or 2.8 trading days. This does not rise to my cut-off of 3 days of short interest for significance. No cash dividend and the last stock split was a 2:1 split April 25, 2000.

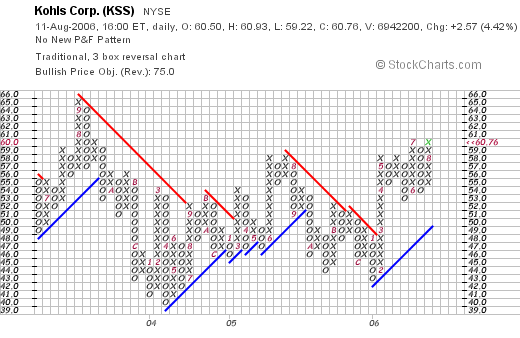

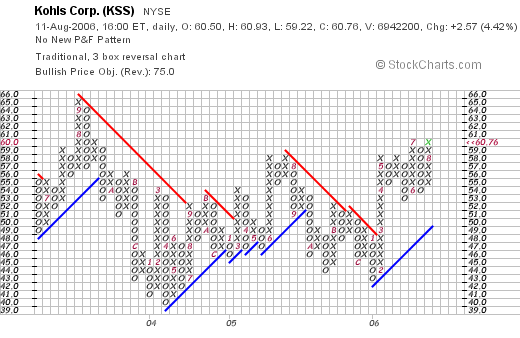

What does the chart look like?

Examining the "Point & Figure" chart on KSS from StockCharts.com, we see a chart just moving sideways. Since September, 2003, when the stock hit a peak of $65/share, down to a low of $39/share in March, 2004, the stock has zigged and zagged between these two extremes. With the latest quarterly report and the strong move Friday, Kohl's appears to be poised to move into higher ground. Of course, time will tell, but I like the overall optimistic appearance of the stock price.

Summary: What do I think of this stock?

This company appears to be doing everything right in an overall challenging retail and economic environment. A few years back, the company appeared to be stumbling badly with their California expansion. However, with the latest financial report, the company is now 'firing on all cylinders'. They have steady same store sales growth, they are beating expectations and raising guidance! And the street is responding to the good news bidding up the stock price.

The Morningstar.com report appears solid with steady revenue and earnings growth and a recent surge in free cash flow. The number of shares outstanding is quite stable and the balance sheet is solid. Valuation appears reasonable, especially the PEG under 1.0.

The Morningstar.com report appears solid with steady revenue and earnings growth and a recent surge in free cash flow. The number of shares outstanding is quite stable and the balance sheet is solid. Valuation appears reasonable, especially the PEG under 1.0.

In a nutshell, I like this stock :). I do own some shares, so that may color my perspective, but that decision was made independent of my input.

Am I buying any shares? My trading strategy does not direct me to be buying anything at this time. But it is the kind of stock that I might buy if I were in the market to purchase shares.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure to stop by and visit my Stock Picks podcast site.

Bob

Tuesday, 8 August 2006

"Revisiting a Stock Pick" inVentiv Health (VTIV)

CLICK HERE FOR THE INVENTIV PODCAST

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers this evening and I came across an old favorite of mine inVentiv Health (VTIV) that had traded strongly higher today, in fact closing at $29.88, up $2.89 or 10.71% on the day in an otherwise weak stock market. I do not personally own any shares of this stock but my son does own 40 shares of VTIV in an account that I manage for him. This company, which used to be called Ventiv Health, formally changed its name to inVentiv Health (VTIV), a act approved by shareholders on June 16, 2006.

I was looking through the list of top % gainers this evening and I came across an old favorite of mine inVentiv Health (VTIV) that had traded strongly higher today, in fact closing at $29.88, up $2.89 or 10.71% on the day in an otherwise weak stock market. I do not personally own any shares of this stock but my son does own 40 shares of VTIV in an account that I manage for him. This company, which used to be called Ventiv Health, formally changed its name to inVentiv Health (VTIV), a act approved by shareholders on June 16, 2006.

I first posted Ventiv Health on Stock Picks Bob's Advice exactly one year ago on August 8, 2005, when the stock was trading at $24.19. With today's close at $29.88, this represents an appreciation of $5.69 or 23.5% since posting. Let's take another look at this stock and I will try to share with you my thoughts why this company deserves a spot on this blog.

First of all, what they do?

According to the Yahoo "Profile" on inVentiv, the company:

"...provides commercialization services to the pharmaceutical and life sciences industries in the United States and internationally. It operates through three segments: inVentiv Clinical, inVentiv Communications, and inVentiv Commercial."

And how about the latest quarterly report?

Actually, it was the earnings report announced just before the opening of trading that pushed the stock higher today. This morning, VTIV announced 2nd quarter 2006 results. For the three months ended June 30, 2006, total revenue increased 39% to $183.0 million in the second quarter of 2006 compared to $131.8 million for the same quarter in 2005. Net income increased 100% from $10.5 million to $21 million this year. Net income increased almost 100% to $.69/share, up sharply from $.38/diluted share the prior year. Also adding to the bullish sentiment on the stock was the announcement today of a multiyear contract with Novartis pharmaceuticals Corp. All-in-all a very nice day for this company!

How about longer-term results?

For this, the Morningstar.com "5-Yr Restated" financials report on VTIV is most helpful. On this page, we can see that revenue results, which first declined from $294.8 million in 2001 to $215.4 million in 2002, has since been increasing steadily to $556.3 million in 2005 and $609.1 million in the trailing twelve months (TTM).

Earnings, which were at a loss of $(2.58) in 2001, improved to $.35/share in 2002, then dipped to $.24/share in 2003. However, since 2003, earnings have climbed strongly to $1.56/share in 2005 and $1.57/share in the TTM. The latest quarter just commented on continues this strong growth record.

The company has increased its shares slightly from 23 million in 2001 to 27 million in 2005 and 29 million in the trailing twelve months.

Free cash flow has been improving steadily the past few years from $13 million in 2003 to $49 million in 2005 and $68 million in the TTM.

Looking at the balance sheet as reported on Morningstar.com, we find VTIV with $43.9 million in cash and $172.5 million in other current assets. This combined $216.4 million, when compared to the $127.4 million in current liabilities yields a current ratio of 1.7. In addition, the company $205.4 million in long-term liabilities. While the level of liabilities appears manageable imho, there are stronger balance sheets on the stocks we have reviewed elsewhere. However, with the growing free cash flow, this really doesn't seem to be a problem for this company.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on VTIV, we find that the company is a small mid-cap stock with a market capitalization of only $871.24 million. The trailing p/e is a very reasonable 19.06 imho, with a forward p/e (fye 31-Dec-07) of only 17.79. The PEG ratio (5 yr expected) is reported at 1.27.

According to the Fidelity.com eresearch website, VTIV is in the "Management Services" industrial group. Within this group, VTIV has a reasonable Price/Sales ratio of only 1.3. Topping this group is Ceridian (CEN) with a Price/Sales ratio of 2.3. This is followed by Heidrick & Struggle (HSII) at 1.5, Accenture (ACN) at 1.4 and then inVentiv at 1.3. Companies with lower Price/Sales ratio than Ventiv include Hewitt Associates (HEW) at 0.8, and Bearing Point (BE) at 0.5.

inVentiv is also one of the most profitable (as measured by the higher return on equity) stocks in this group with a ROE of 18%. Topping the group is Accenture at 62.2%. After inVentiv is Heidrick & Struggle at 16.9%, Ceridian at 10.9%, Hewit Associates at 10.3% and Bearing Point at a negative (53.7)%.

Returning to Yahoo, we see that there are 29.16 million shares outstanding with only 27.50 million that float. Currently there are 1.91 million shares out short (as of 7/11/06), representing 7% of the float or 8.9 trading days of volume. With today's excellent earnings report, the large number of shares out short (greater than my own 3 day short interest rule), this may well have been a bit of a squeeze on all those shorts scrambling to cover their pre-sold shares with new purchases of this stock! Just a thought :).

No cash dividend is paid and no stock split is reported on Yahoo.

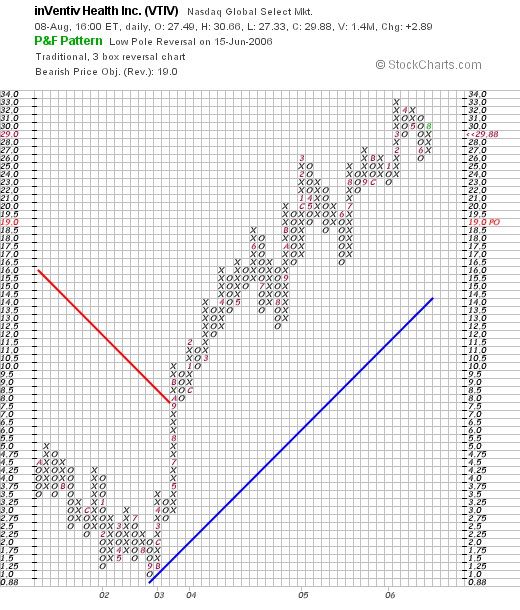

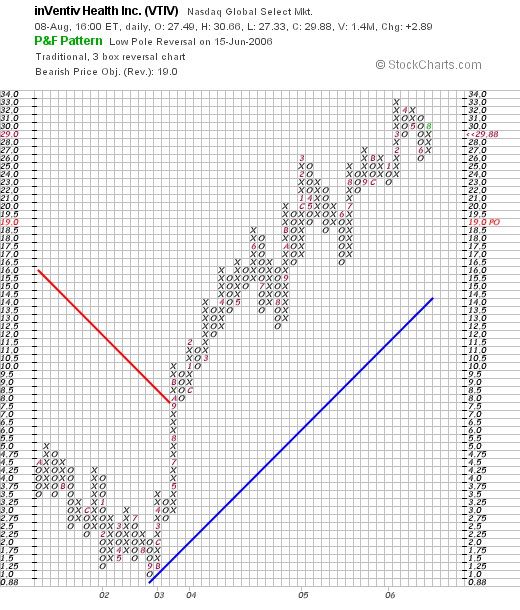

What does the chart look like?

If we take a look at the "Point & Figure" chart on VTIV from StockCharts.com, we can see that the chart, which was declining though 2001 and 2002, turned around in 2003 and moved sharply higher. This coincides with the turn-around in earnings which once again emphasizes the close relationship between earnings performance and stock price imho. Since breaking through resistance in September, 2003, at $8.00/share, the stock has been trading very steadily higher to its current level around $29.88, a little below its recent high of $33 made in March, 2006.

Summary: 'So what do I think about this stock?'

Let's review some of the things I have discussed in this blog entry. First of all, the stock moved higher today in an otherwise anemic trading day. A plus. The company did this on a strong earnings report and the announcement of a multiyear contract with Novartis. Both pieces of good news.

Longer-term, the Morningstar.com "5-Yr Restated" financials look strong with steady five year revenue and earnings growth (except a dip 3 or 4 years ago). Earnings have been expanding strongly the past several years as well. The company is releasing a few shares the past few years, but certainly the financial reports have been staying ahead of the expanded float. Free cash flow is positive and growing strongly. The balance sheet is adequate if not fabulous.

Finally, valuation is reasonable with a p/e in the teens, a PEG just over 1.2, and a relatively reasonable Price/Sales ratio with a strong ROE.

In addition, the graph shows a strong upward movement to the stock price. Helping this along today appears to be a relatively large short interest of investors betting against this company.

In conclusion, I like this stock. I am not in the market to be purchasing any but I have bought just a few shares for my son this past year. Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please remember to drop by and visit my Stock Picks Bob's Advice podcast site, where you can hear me drone on and on, if reading me wasn't enough. jk.

Bob

Posted by bobsadviceforstocks at 8:54 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 8 August 2006 10:17 PM CDT

Saturday, 5 August 2006

Morningstar (MORN) "Weekend Trading Portfolio Analysis"

CLICK HERE FOR MY PODCAST ON MORNINGSTAR

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Over the past year or so, I have been trying to review my actual holdings in my trading portfolio on weekends. These are the stocks that I actually own and that I try to be as transparent as possible letting you know what I own, when I buy it, and when I sell it. Sometimes my trades appear brilliant, and other times, like the latest trade in Kendle, I share with you my failures. Hopefully, together we shall continue to learn about investing!

On June 25, 2006, I reviewed my Kyphon stock here on the blog. Going alphabetically through my smaller list of 11 positions, I am up to Morningstar (MORN), a stock that I own which is also the website that I use regularly in evaluating my stock picks.

On June 25, 2006, I reviewed my Kyphon stock here on the blog. Going alphabetically through my smaller list of 11 positions, I am up to Morningstar (MORN), a stock that I own which is also the website that I use regularly in evaluating my stock picks.

Currently, I have 167 shares of Morningstar. These shares were purchased 11/22/05 with a cost basis of $32.57/share. With the stock closing 8/4/06 at $36.13, I have an unrealized gain of $3.56 or 10.9% on this purchase. The stock has been under pressure recently, and in fact, closed Friday at $36.13, down $(2.61) or (6.74)% on the day. Let's take a closer look at this stock, my history with this investment, and whether it still looks attractive to purchase.

My initial purchase of Morningstar was on 11/22/05, when I purchased 200 shares of the stock. I sold 33 shares of MORN on 2/16/06 with proceeds of $42.94/share, representing a gain of $10.37 or 31.8% since purchase. This was my first targeted gain at approximately a 30% appreciation, and thus, my next targeted sale on the upside would be at about a 60% gain or 1.60 x $32.57 = $52.11/share. On the downside, after one targeted sale at a gain, my sale point moves up from the (8)% loss level to break even or $32.57/share.

Let's take a closer look at this stock--first of all, what does this company do?

According to the Yahoo "Profile" on MORN, the company

"...provides independent investment research to investors worldwide. It offers Internet, software, and print-based products for individual investors, financial advisors, and institutional clients, as well as asset management services to advisors and institutions. It operates through three segments: Individual, Advisor, and Institutional."

I certainly can attest to the usefulness of the Morningstar material; I have been using "5-Yr Restated" statements from Morningstar since I have started this blog, long before I ever owned any shares!

How about the latest quarter?

On August 3, 2006 (just a couple of days ago), Morningstar reported 2nd quarter 2006 results. For the three months ended June 30, 2006, consolidated revenue came in at $76.3 million, a 36% increase from the same quarter the prior year. Net income for the quarter worked out to $11.2 million, or $.24/diluted share, up from $9.5 million, or $.22/diluted share in the same period the prior year.

How about longer-term results?

Reviewing the "5-Yr Restated" financials from Morningstar.com on MORN :), we can see the steady growth in revenue from $91.2 million in 2001 to $227.1 million in 2005 and $244.0 million in the trailing twelve months (TTM).

Earnings/share have improved from a loss of $(.32)/share in 2001 to a profit of $.21/share in 2004, $.70/share in 2005, and $.90/share in the TTM. During this time, the number of shares have fluctuated but are fairly stable with 39 million shares in 2001, 39 million shares in 2005, increasing slightly to 41 million shares in the TTM.

Free cash flow has been growing nicely with $21 million reported in 2003, increasing to $41 million in 2005 and $53 million in the TTM.

The balance sheet looks ok, especially with the low level of long-term debt, but the cash of $82.9 million and the other current assets of $68 million, when compared to the $123.1 million in current liabilities yields a rather anemic current ratio of 1.23. Generally a current ratio between 1.0 and 1.5 is considered acceptable. This is probably ok as I noted because the long-term debt for MORN is listed as only $4.8 million.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Morningstar, we find that the company is a mid-cap stock with a market capitalization of $1.47 billion. The trailing p/e is a bit rich at 40.37, but the forward p/e is a bit better (fye 31-Dec-07) of 24.09. I cannot find a PEG on Morningstar either on the Yahoo or the Fidelity website.

Reviewing the Price/Sales ratio from the Fidelity.com eresearch website, we find that MORN is in the "Asset Management" industrial group. Morningstar is the most expensive in this group as measured by this ratio with a Price/Sales of 6.9. This is followed by T. Rowe Price (TROW) at 6.8, Franklin Resources (BEN) at 5.3, Federated Investors (FII) at 3.5, Janus (JNS) at 3.2, and Principal Financial Group (PFG) the most reasonably priced with a Price/Sales ratio of only 1.5.

Fortunately, Morningstar is also one of the most profitable of the group with a Return on Equity (ROE) of 24%. This is exceeded by Federated Investors (FII) at 39.6%, and followed by T. Rowe at 23.5%, Franklin Resources at 18.7%, Principal Financial at 13%, and Janus at 4.3%.

Finishing up with the Yahoo numbers, the company has 40.76 million shares outstanding but only 20.01 million that float. Of these, 1.06 million of these shares were out short as of 7/11/06, representing 10.5% of the float or 7.7 trading days of volume. Using my 3 day rule of significance, there is actually quite a few shares out short and the stock could rally with a 'squeeze' if good news was reported. Unfortunately, the recent earnings report was apparently not very impressive to those following this stock.

No cash dividends and no stock dividends are reported on Yahoo.

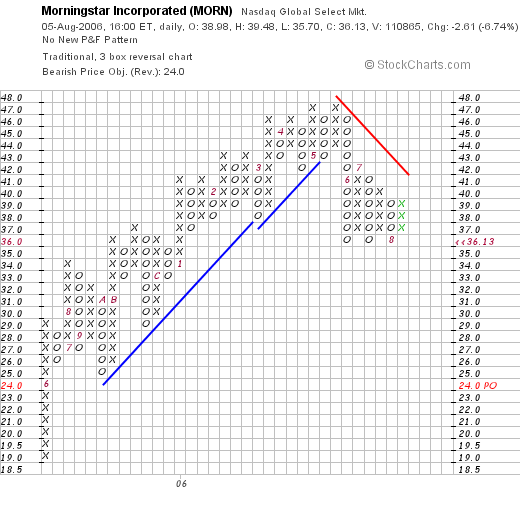

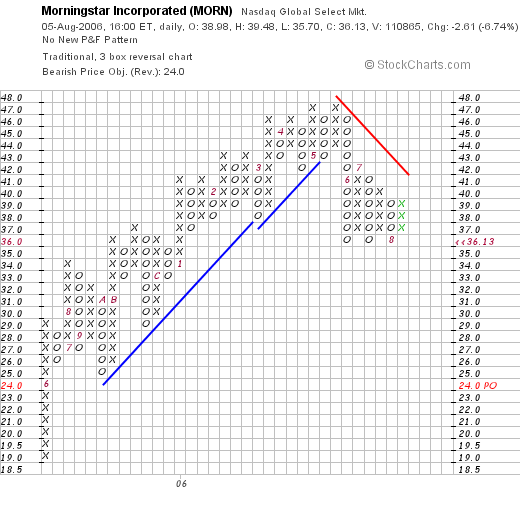

What about the chart? Does the recent correction in the stock price signify a break-down in the chart pattern?

If we examine the "Point & Figure" chart on Morningstar from StockCharts.com, we can see a very steady improvement in the stock price from $19 in May, 2005, to a peak of $47 in May, 2006. However, the stock does appear to have rolled-over and is now testing a "triple-bottom" short-term. I would be rather concerned if the stock breaks down below the current level. On the other hand, if the stock can rally back above $41, I shall be breathing easier :).

So what do I think? Well, I own the stock :). I have sold the stock once on a gain but the company is just above 10% ahead of my purchase price. Thus, with no fundamental news, if the stock drops by about 9% from here I shall be selling my position. On the other hand, the latest quarter was good, the Morningstar.com 5-yr report looks good to me as well, the free cash flow is positive and growing and the balance sheet looks reasonable if not spectacular. Valuation is a bit rich with a p/e over 40 so possibly investors are thinking that the stock was priced for perfection and did not actually deliver perfection in the latest earnings report.

So that's the next stock in my trading portfolio! I hope that you enjoyed my review of my experience with this stock and some of the current numbers. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, don't forget to visit my Stock Picks Bob's Advice podcast site.

Bob

Posted by bobsadviceforstocks at 3:58 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 7 August 2006 7:14 AM CDT

Newer | Latest | Older

On August 2, 2006, CNXS

On August 2, 2006, CNXS  On April 27, 2005, I posted Hologic (HOLX) on Stock Picks Bob's Advice when it was trading at $35.85. HOLX had a 2:1 stock split December 1, 2005 and another 2:1 stock split March 26, 2006. Thus, my effective pick price was actually $35.85 x 1/2 x 1/2 = $8.96. HOLX closed at $42.21 on August 25, 2006, for a gain on this pick of $33.25 or 371%! (Every once in a while it is nice to smack one out of the park!)

On April 27, 2005, I posted Hologic (HOLX) on Stock Picks Bob's Advice when it was trading at $35.85. HOLX had a 2:1 stock split December 1, 2005 and another 2:1 stock split March 26, 2006. Thus, my effective pick price was actually $35.85 x 1/2 x 1/2 = $8.96. HOLX closed at $42.21 on August 25, 2006, for a gain on this pick of $33.25 or 371%! (Every once in a while it is nice to smack one out of the park!) On July 25, 2006, Hologic announced third quarter fiscal 2006 results. Revenues totalled $119.7 million, a 62% increase over revenues of $74 million in the same quarter in 2005. Net income came in at $12 million or $.25/share, up sharply from $8.2 million or $.18/share reported in the same quarter in 2005.

On July 25, 2006, Hologic announced third quarter fiscal 2006 results. Revenues totalled $119.7 million, a 62% increase over revenues of $74 million in the same quarter in 2005. Net income came in at $12 million or $.25/share, up sharply from $8.2 million or $.18/share reported in the same quarter in 2005.  What appears to be driving the stock higher today was the

What appears to be driving the stock higher today was the  According to the

According to the

On April 18, 2005, I

On April 18, 2005, I  On April 20, 2005, I

On April 20, 2005, I

Here is an entry that I really intended to get to yesterday, but one thing led to another....same old story I guess! Kohl's (KSS) had a great day yesterday, closing at $60.76, up $2.57 or 4.42% on the day. I do own some shares of KSS in a managed account that I do not direct.

Here is an entry that I really intended to get to yesterday, but one thing led to another....same old story I guess! Kohl's (KSS) had a great day yesterday, closing at $60.76, up $2.57 or 4.42% on the day. I do own some shares of KSS in a managed account that I do not direct.  2nd quarter earnings after the close of trading

2nd quarter earnings after the close of trading

The Morningstar.com report appears solid with steady revenue and earnings growth and a recent surge in free cash flow. The number of shares outstanding is quite stable and the balance sheet is solid. Valuation appears reasonable, especially the PEG under 1.0.

The Morningstar.com report appears solid with steady revenue and earnings growth and a recent surge in free cash flow. The number of shares outstanding is quite stable and the balance sheet is solid. Valuation appears reasonable, especially the PEG under 1.0. I was looking through the list of top % gainers this evening and I came across an old favorite of mine inVentiv Health (VTIV) that had traded strongly higher today, in fact closing at $29.88, up $2.89 or 10.71% on the day in an otherwise weak stock market. I do not personally own any shares of this stock but my son does own 40 shares of VTIV in an account that I manage for him. This company, which used to be called Ventiv Health, formally changed its name to inVentiv Health (VTIV), a act

I was looking through the list of top % gainers this evening and I came across an old favorite of mine inVentiv Health (VTIV) that had traded strongly higher today, in fact closing at $29.88, up $2.89 or 10.71% on the day in an otherwise weak stock market. I do not personally own any shares of this stock but my son does own 40 shares of VTIV in an account that I manage for him. This company, which used to be called Ventiv Health, formally changed its name to inVentiv Health (VTIV), a act

On June 25, 2006, I

On June 25, 2006, I