Stock Picks Bob's Advice

Tuesday, 3 July 2007

Bolt (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago Bolt (BTJ) hit one of my appreciation targets. I had 150 shares in my trading account, and with the stock passing the 180% appreciation level, I sold 1/7th or 21 shares of Bolt at $50.52. These shares had been purchased 1/12/07 (!) at a cost basis of $17.44 (!). Thus, I had an appreciation of $33.08 or 189.7% on these shares. As you probably know, I target my stocks for partial sales at 30, 60, 90, 120, then 180, 240, 300, 360, 450%, etc., appreciation levels. Currently, I am selling 1/7th of my holding when shares reach these points.

With this in mind, my next targeted sale on the upside would be at a 240% appreciation level or 3.40 x $17.44 = $59.30. On the downside, I have been trying to sell stocks either on some fundamental bad news or if they should decline to 50% of the highest appreciation level at which there was a sale. This way, I am continually pushing up the stops as the stock appreciates. With Bolt having now been sold at the 180% appreciation level, on the downside, I plan on selling all remaining shares if the stock should decline to a 90% appreciation above my purchase price or 1.9 x $17.44 = $33.14. Thus, I give the highly performing stocks in my portfolio more 'room to play' so to speak :).

Anyhow, it is nice to report good news once again! The market is kind to me and I have been starting to pay down my darn margin which is far higher than I would prefer.

Currently I am at 20 positions in my account which is my new 'maximum' size for the portfolio. If I were below 20, this sale would be giving me a "permission slip" to add a new holding. At the maximum, I use sales like this to either accumulate cash or in my case pay down margin!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Site. Also, take a look at my Social Picks account, where Social Picks evaluates my stock selections from the time I started with them which was a bit more than six months ago. Also, check out my Covestor account which tracks my actual trading portfolio and compares it to other investors and the indices!

For those of you in the States, I wish you a very Happy 4th of July. As we celebrate our freedom, let's wish everyone all over the world the blessings of peace and freedom that we enjoy for ourselves here in America!

Bob

Saturday, 30 June 2007

Some Thoughts on Investing for a Saturday Afternoon!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Instead of the usual discussion of specific stocks and answering specific questions about investing, I wanted to take a moment to share with you some of my philosophy, some of the things I believe are important about investing and blogging.

First of all a word about me. I am a physician, so I don't support myself by investing, I am not an advisor, I don't manage money for anyone, I don't have any newsletters or salesmen or letters to send you. I don't even really ask you for contributions. I write this blog because this is my passion, my hobby, and part of my life. I write that I am an amateur because I am an amateur. I hope and believe that I am becoming a good amateur, but that is up to you to judge.

Honesty is part of my life. It is integral to my professional life and essential to this blog. I share with you my thinking and my opinions on stocks and my own trading portfolio. When I buy shares I let you know, when I sell shares I let you know, when I make money I let you know, and most importantly, when I lose money, I share with you as well. Because so many of you are my friends. I share these thoughts with all of you readers and hope that you realize that what I do or suggest might not be right for you. When I ask you to consult with advisers I really mean just that. What I do might not work for you. I am not positively sure that it will work for me. But thus far it has been working well.

I am an investor. I buy shares for the long haul. But I am prepared to trade. I do this in as quiet as fashion as possible. This is not about screaming and hollering and phrenetic activity. I spend a lot of time observing the market and listening to my own portfolio. I am not trying to be smarter than the smartest investors. For I am not. But I am trying to observe which stocks are climbing and among those, which might have healthy characteristics which might support further price appreciation.

But I make my share of mistakes.

That is why I have a portfolio of stocks. Not because I am trying to diversify. Because I use the same strategy with each of my stocks. But because any particular stock investment may be a mistake. And I am prepared to part with any and all of them. I am not a buy and hold investor. But I hope to buy and hold many of my investments for a very long time.

I have chosen to listen to my portfolio as I adjust my exposure to equities.

When stocks sell on bad news, that is price declines, I do not fight the market. I 'sit on my hands' as I like to say, and wait for another signal. A signal to let me know that everything is o.k. and it is time to buy. I use my own portfolio for that signal as well. I wait for a stock to hit an appreciation target and sell a portion of that holding and then at that time, buy another stock.

I do not think I can outguess the smartest minds in the market.

But I am willing to give them credit. I will tell you that William O'Neil inspired my own thinking. I like to talk about Robert Lichello, and will mention Paul Sturm and others. They are my mentors. They may not even know I have them as mentors, but I know. And I appreciate the wisdom of others.

When I pick a stock to buy I purchase it off the top % gainers lists. They have already been discovered by someone else. I do not try to discover things that others haven't noticed.

And I manage my holdings carefully. I sell my poorly performing stocks quickly and completely, and my appreciating stocks slowly and partially. This bias results in a portfolio of strong, performing stocks.

I demand the most of my holdings.

Will all of this work? I don't know. I am not even sure why I do all of this or why I write. I love to share with all of you my ideas, my trades, my perspective on stocks. I hope you all enjoy my effort. Where this takes me I still am not sure. I hope that all of this is successful for me and if any of you have adopted some of my techniques in a successful fashion, please drop me a line or leave a comment and let me know how it is working out.

Your friendship is greatly appreciated.

Bob

Thursday, 28 June 2007

A Reader Writes: "How often do you get sucker punched with your method?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I received another great inquiry from Doug S., a regular reader and contributor of questions to this website.

Earlier today I received another great inquiry from Doug S., a regular reader and contributor of questions to this website.

Doug wrote:

"Bob: Saw your write up and have a thought to share/bounce off you. I

have found over the years that it's best to buy on what I term a

"trigger point" as it gives you an important reference point for the

immediate future. In my scheme of things which I've shared with you it is an earnings announcement(on 4/23 you would have purchased CLB at

about 88) about 95% of the time(news item on a rare occasion).

I notice you seem to use largest % price increase confirmed by your excellent tech and fundamental analysis. My question is how often do you get sucker punched with your method. I've found on my system about

15% of the time and probably another 10% where the following action is generally disappointing.

PS: disclosure: Purchased 800 NATH day just after my last e-mail.

Trading more liquid than i thought."

Thanks so much for writing Doug! Your idea about "trigger points" to initiate a position or purchase of shares isn't too far from my own approach. While you may be scanning the news for these earnings releases, I am scanning the lists of top % gainers for stocks on the move. Often, if you review some of my past posts, the reason a stock makes a big move is exactly because of an earnings release that is viewed favorably by 'the street'.

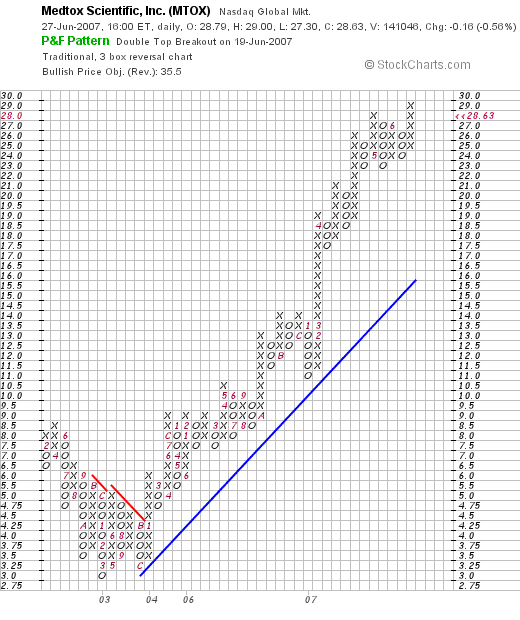

I am not sure how often I get "sucker punched" as you write. I will tell you that if you go back about a month to my prior experience with MedTox (MTOX) you will see that I owned shares for a very short period of time, just a few days as I recall, until the stock declined to a sell point. I guess that is what you would call getting sucker punched :).

In fact, every single one of my trades is on the blog for the past four years. I cannot give you the exact entries, but if you scan through the blog you will find them under the heading of "trading transparency". I do not know the exact % of these that I have had that have ended up in rather rapid sales. I suspect they are 10% or less of my purchases, but that is, of course, just a guess.

Since I am doing my homework, examining more than a price move but the Morningstar.com report, the latest quarter, and some valuation numbers, I believe that sharp moves higher are often followed by further appreciation of the stock due to all of the other factors contributing to the attractiveness of that investment. At least that is what I am hoping for!

Wish me luck and keep me posted and keep on writing.

p.s. I haven't looked at NATH, and do not own any shares of NATH nor do I have any shares of CLB.

Regards!

Bob

Wednesday, 27 June 2007

Core Laboratories N V (CLB)

CLICK HERE FOR MY PODCAST ON CORE LABORATORIES

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NYSE this evening and came across Core Laboratories (CLB) which closed at $98.62, up $7.53 on the day or 8.27%. I do not own any shares nor do I have any options on this stock.

I was looking through the list of top % gainers on the NYSE this evening and came across Core Laboratories (CLB) which closed at $98.62, up $7.53 on the day or 8.27%. I do not own any shares nor do I have any options on this stock.

However, I do like the numbers that I found when doing my 'homework' and thus,

CORE LABORATORIES N V (CLB) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on Core Laboratories, the company

"...provides reservoir description, production enhancement, and management services to the oil and gas industry worldwide. It engages in determining quality and measuring quantity of the fluids, such as natural gas, crude oil, and water and their derived products in the oil and gas fields."

"...provides reservoir description, production enhancement, and management services to the oil and gas industry worldwide. It engages in determining quality and measuring quantity of the fluids, such as natural gas, crude oil, and water and their derived products in the oil and gas fields."

How did the company do in the latest reported quarter?

On April 23, 2007, CLB reported 1st quarter 2007 results. Revenue for the quarter ended March 31, 2007, increased to $155.7 million, up 13% from $137.3 million in the same quarter in 2006. Earnings came in at $1.04/diluted share, up 79% from the year-earli results and also increased 6% sequentially from the 4th quarter of 2006. Net income climed 56% to $25.3 million from $16.1 million last year.

The company also raised guidance for the full year in the same report. In that report two months ago they guided to earnings of $4.30 to $4.50, and revenue in the $650 to $670 million range.

Yesterday, after the close of trading the company raised guidance further with 2nd quarter 2007 results expected now to come in between $1.15 and $1.17, ahead of prior guidance of $1.05 to $1.10. This would represent about a 66% increase year-over-year in earnings.

As was reported in the announcement:

"Core's anticipated quarterly results are due to even stronger than expected performances from each of its three operating segments. There is strong demand for the Company's Reservoir Description services, especially in the Middle East region, where Core continues to expand operations. The Company's Canadian operations, which generated 13% of the Company's revenue in 2006, are expected to post a strong quarter."

The company also raised full year 2007 guidace to revenue in the $660 million to $670 million range, up about 15% from the 2006 levels. 2007 earnings per share are now expected to come in at $4.50 to $4.70, an approximately 47% to 53% increase over 2006 results. The street liked what it heard yesterday and wasted no time bidding up the price of CLB today!

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Core Laboratories, we find that revenue has steadily grown from $331 million in 2002 to $576 million in 2006 and $594 million in the trailing twelve months (TTM).

Earnings during this period were less consistent, with a loss of $(.27) in 2002, increasing to a profit of $.60/share in 2003, then dropping to $.43/share in 2004. However, since then earnings have shown strong growth with $3.07/share reported in 2006 and $3.53/share in the TTM.

Free cash flow has been positive and growing with $43 million in 2004, $96 million in 2006 and $91 million in the TTM.

The balance sheet is solid with $29 million in cash and $184.1 million in other current assets. This total of $213.1 million in total current assets, when compared to the $83.4 million in current liabilities yields a current ratio of 2.56. In addition, the company is reported to have $349 million in long-term liabilities and $275.2 million in long-term assets.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Core Laboratories, we can see that this is a mid cap stock with a market capitalization of $2.36 billion. The trailing p/e is 27.97 with a forward p/e (fye 31-Dec-08) estimated at 17.58. Earnings growth is expected to continue strong as the PEG ratio is a very reasonable 0.83 (5 yr expected).

According to the Fidelity.com eresearch website, the valuation is a bit rich with CLB having a Price/Sales ratio (TTM) of 3.74 compared to the industry average of 3.65. However, the company is also significantly more profitable than average with a Return on Equity (TTM) of 71.96%, compared to the industry average of 30.86% according to Fidelity.

Finishing up with Yahoo, we can see that there are only 23.91 million shares outstanding with 18.70 million that float. As of 5/10/07, there were 1.3 million shares out short, representing 5.8% of the float or 4 days of trading volume (the short ratio). In excess of my own '3 day rule', this short interest may well contribute to the price rise on good news today!

No dividend is reported on Yahoo, and the last stock split was a 2:1 split on December 22, 1997.

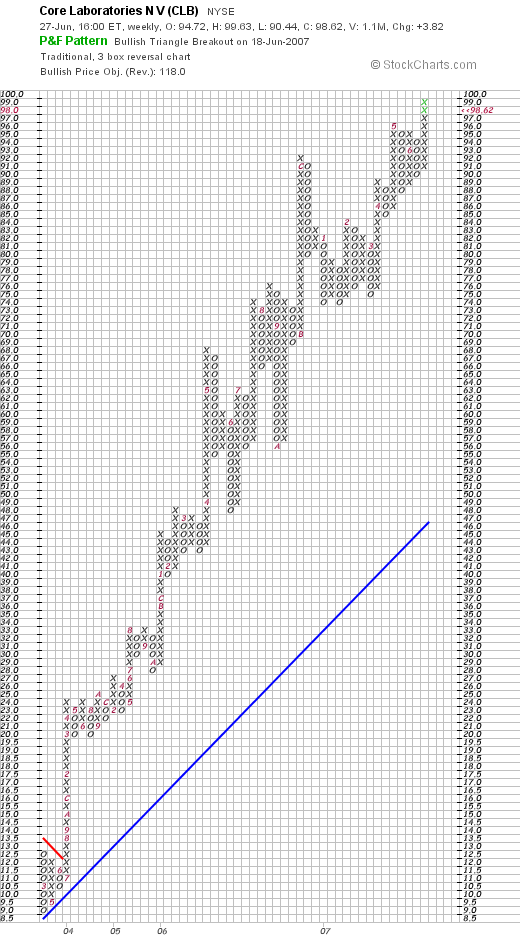

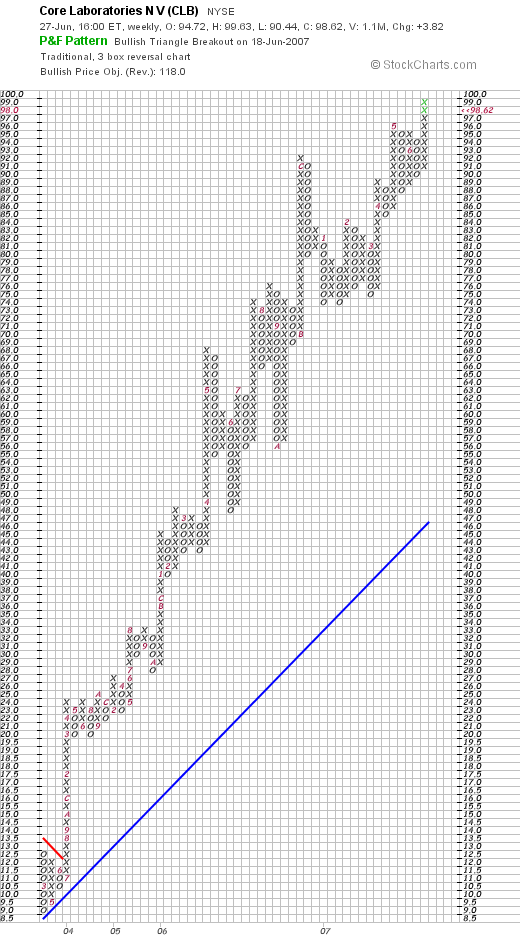

What does the chart look like?

If we review the StockCharts.com "point & figure" chart on Core Laboratories, we can see that the stock has exhibited a phenomenally strong chart since breaking out at the $12.50 level way back in July, 2003. The stock has moved almost vertical the past four years. I see no evidence of weakness although there is plenty of evidence that the chart may be over-extended.

Summary: What do I think about Core Laboratories N V (CLB)?

As you might be able to tell I am practically infatuated with the company :). Seriously. This company reported a great quarter just a couple of months ago, raised guidance, and two months later, business is so strong they are raising guidance once again!

Longer-term, the Morningstar.com report is very nice except for some earnings weakness a few years ago, the company has shown incredible strength in delivering growth in both earnings and revenue.

They are solidly free cash flow positive, and have a solid balance sheet.

Valuation-wise, the p/e is a bit rich but the forward p/e is in the teens and the PEG is under 1.0. Price/sales is average for the business but the Return on Equity is 'head and shoulders' ahead of its competition. There are even a bunch of short-sellers waiting to buy shares and the chart is unbelievable. Unless something bad is announced and I see no sign of that, the company appears to be moving full steam ahead!

Anyhow, there's a new name for the blog and all of you readers.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast Website where you can listen to me discuss a few of the many stocks I write about here on the blog. If you are interested in a third party review of my accuracy and the results of my stock picks, at least for the last few months, drop by SocialPicks and you can see what they say about my blogging. Better yet, if you would like a review of my actual trading portfolio by a third party, visit my Covestor Page and see how Covestor rates my own actual holdings (Covestor only has records since June 12, 2007...it is quite new!)

Thanks so much for visiting! Have a great day trading tomorrow!

Bob

Posted by bobsadviceforstocks at 10:07 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 28 June 2007 9:42 PM CDT

A Reader Writes: "My favorite timing is when a stock is on a nice uptrend...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I received a nice letter from a new reader this morning and I hope he doesn't mind me answering him right on the website.

I received a nice letter from a new reader this morning and I hope he doesn't mind me answering him right on the website.

Ed A. wrote:

"Bob,

Just signed onto your blog for the first time. My first impression is one of admiration for the work you have been doing. I do need to spend some more time looking at your past work more thoroughly as well as running bye what other "stock" blogs are doing.

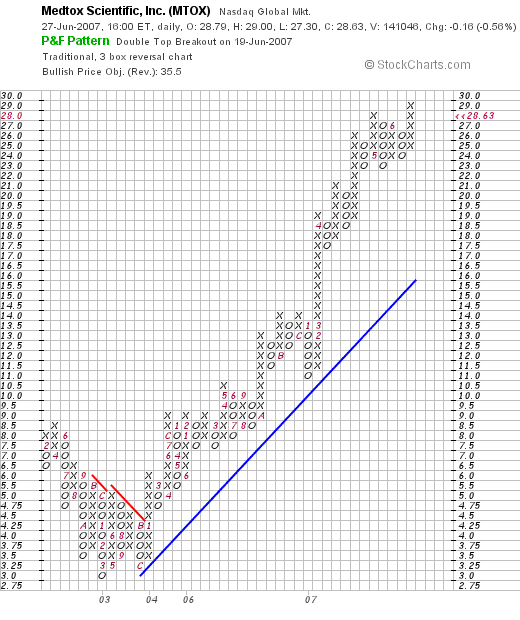

This is merely a quick email to comment on the timing of your MTOX buy. The way I technically look at stocks, this timing looks good although I would not be surprised to see a bit of price chopiness as this stock gathers momentum for moving up. My favorite timing is when a stock is on a nice uptrend but not quite so extended such as MTOX was at the start of 3/07.

Ed A."

Thanks so much for writing Ed. You are quite welcome to review the abundance of material on this website and I would look forward to some of your feedback as well. I apologize for the amateur organization here on the website. It is not a polished place at all, and sometimes it is difficult finding entries about certain stocks. I find myself often just Googling "Stock Picks Bob's Advice" and adding the name of the stock I am looking at to find an old post or comment. It would be better to have an index.

I completely agree with your comments on MTOX. Looking at the chart it does appear technically to be a bit overextended but I have not been relying on these charts to make a decision about a purchase. I owned MTOX a month ago at a much lower price and got 'shaken out' as the investment hit an 8% loss. I am sure that this purchase is also vulnerable to such a sale. If so, it truly won't be the first time :).

When I buy stocks with strong daily momentum, I am hoping that the momentum will continue at least a while longer after my purchase so that the stock doesn't immediately retrace its move higher and leave me selling the stock prematurely. In general this has been a successful approach. After getting a bit of a gain, I have a bit more buffer between me and my sale of my holding. I generally can rest better with a stock at that point.

Again, thank you for writing and visiting. I look forward to your future visits and await your feedback. I value the opinions of my readers and look forward to their emails and comments.

If any other of you readers, or Ed, have any other comments or questions, please feel free to leave them on the blog or email me at

bobsadviceforstocks@lycos.com.

Bob

Tuesday, 26 June 2007

Medtox Scientific (MTOX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I am often asked whether I "revisit" stocks that I have sold. This trade today is an answer in the affirmative. Sometimes I am "shaken" out of stocks. Out I go. But if the numbers are good, and the opportunity re-presents itself, I am willing to have another 'go' at it.

With my sale of Ventana earlier today, I was down to 19 positions and since Ventana was selling on "good news" I was entitled to replace the stock. Looking at the list of top % gainers on the NASDAQ, I came across Medtox (MTOX) which I owned as recently as a little over a month ago, I saw that Medtox Scientific was trading at $28.67, up $1.57 or 5.79% on the day. With the Morningstar.com "5-Yr restated" financials intact, with the latest quarter solid, I decided to venture once more into the MTOX world and purchased 350 shares at $28.5534. Wish me luck! I am now back to 20 positions and monitoring my holdings in this choppiest of trading environment.

Thanks again for visiting! Please feel free to comment on the blog or email me at bobsadviceforstocks@lycos.com if you have any other comments or questions.

Bob

Ventana Medical (VMSI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I sold my 1/7th position in Ventana, leaving me with 139 shares remaining. After some thought, and seeing how flat the stock was trading, I decided that with the acquisition offer on the table by Roche at $75, the stock while unlikely to decline in the short time, was now more an investment in arbitrage rather than any investment strategy at all. It was time for me to sell my remaining shares and identify a replacement in the portfolio. While small sales when at my maximum will result in me sitting on my hands, since this sale will drop me back to 19 holdings, this 'entitles' me to replace that holding with a new name. The nickel is already burning a hole in my pocket!.

These last shares were sold at $76.502, and had been purchased 4/16/04 at $23.47. Thus, these shares were sold with a gain of $53.032 or 226% since purchase.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website!

Bob

Ventana Medical Systems (VMSI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any decisions based on information on this website.

A few moments ago, I sold 23 shares (1/7th of my 162 shares) of my Ventana Medical Systems (VMSI) at $76.83. This represented a gain of 227.4% or $53.36 from my initial cost of $23.47 for these shares which were purchased on 4/16/04. I had already sold shares four times previously at 30, 60, 90, and 120% points and the stock hid the 180% appreciation level and went right through it with the bid from Roche. (They are making a hostile offer for Ventana at $75/share).

I have given thought to selling the entire position, but meanwhile, I shall continue to follow my own trading strategy and see how this plays out. If I were under my 20 position maximum, this would be a signal to buy a new position. However, I am at 20, and this offers me the chance to sell some shares and pay down my margin a small amount.

I am considering selling all shares, but since this is not a done deal yet, I do not know if there will be other bidders. However, with this huge gain, the risk is that the entire bid falls apart. But I believe that is unlikely.

Thanks again for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 8:52 AM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 26 June 2007 10:00 AM CDT

Friday, 22 June 2007

Readers Write: "Life Partners Holdings (LPHI)?" and "Could you elaborate....?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This week has felt like being on the deck of the fishing boat on The Perfect Storm:

I have been battening the hatches, sitting tight while the waves have been washing over the deck :).

There haven't been many new stocks moving strongly higher to write about. There are a couple of names that have indeed moved higher, but either I never got around to it, or simply, I have written up the stocks within the past year and don't want to repeat myself too often. Anyhow, I did get a couple of letters from great readers who write great questions. As an amateur, I shall try my best to respond to these inquiries. If any of you would like to add your thoughts, please feel free to add comments to these or any of my entries, or drop me a line at bobsadviceforstocks@lycos.com. Your comments and ideas are always welcome. If you could, let me know your first name and your general location. Just makes everything a bit more personal I guess.

My first letter came from a great reader, Doug S. who wrote:

My first letter came from a great reader, Doug S. who wrote:

"Bob:

Do you have any thoughts on a stock like this (LPHI) that is blowing numbers away but is already up over 200% since the first of the year.

I have no position and am tearing my hair out trying to decide. It could either double again or pull back 20% in a heartbeat. Any thoughts on situations like this."

Doug,

Thanks so much for writing. First of all let me take a very brief look at LPHI for myself and for the rest of my readers.

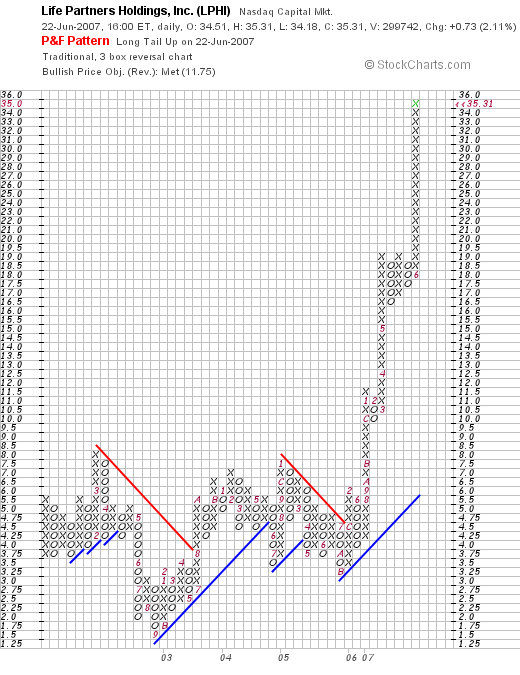

First of all Life Partners Holdings (LPHI) closed at $35.31 on 6/22/07, up $.73 or 2.11% on the day. Not a bad performance in such a miserable market.

The company, according to the Yahoo "Profile",

"...through its subsidiary, Life Partners, Inc., operates as a financial services company that provides purchasing services for life settlements in the United States. It facilitates viatical and life settlement transactions by identifying, examining, and purchasing the policies as an agent. Life Partners Holdings' financial transactions involve the purchase of life insurance policies of terminally ill persons or elderly persons at a discount to their face value."

O.K. a little ghoulish, but still a great service to those who need funds and want to sell their life insurance.

Last quarter? 1st quarter 2007 results were announced June 14, 2007. Revenue climbed to $17.6 million from $6.2 million in the same quarter the prior year. Net income was up fabulously to $4.7 million or $.49/share, up from $.2 million or $.05/share the same quarter the prior year. WOW!

How about longer-term?

Not quite as pretty a picture actually. Looking at the Morningstar.com "5-Yr Restated" financials, we see that revenue climbed sharply from $2 million in 2002 to $9 million in 2005. However, revenue dipped to $8 million in 2006 and then back up to $9 million in the TTM. However, with revenue in the latest quarter at $17.6 million, the numbers are back on track in a big way!

Earnings have also been all over the place with improvement from a loss of $(.11)/share in 2002 to $.28/share in 2005, before dipping to $.12/share in 2006 and $.14/share in the TTM. Again, with $.49/share in the latest quarter (!), all bets are off. So while not a perfect steady picture, the latest numbers are way above the previous trends.

The company has been paying a dividend since 2002 and increasing it from $.03/share in 2002 to $.15/share in 2006 and $.21/share in the TTM. The number of shares outstanding has been fairly stable at 9 to 10 million.

I don't have any numbers on free cash flow and nothing shows up on the balance sheet on Morningstar.com.

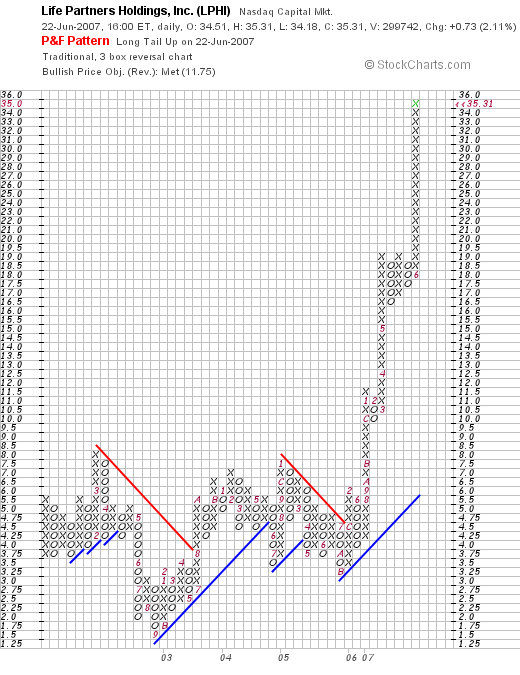

Let's take a look at the chart, checking the "Point & Figure" chart on LPHI from StockCharts.com, we can see the meteoric recent rise which hasn't quit.

O.K., back to your question. I find this particular stock intriguing because of the latest quarter report and the fabulous technical price action. However, it doesn't really fit into my own strategy of steady growth and I don't have some numbers on that Morningstar.com page that I depend on for my write-ups. Probably you can get that information elsewhere, and that doesn't mean it is a bad investment. It just doesn't fit into my particular strategy exactly. So I can't give it a "buy."

But that isn't really your question is it? You want to know what to do about a "rocket' like LPHI that is moving straight up. Would I buy shares in something like this?

The answer is you bet your sweet bippy I would. I buy stocks that are showing strong daily momentum on days when I have a "permission slip" to be buying. Of course I require everything else to be intact. And I am missing some data on this particular company. So I probably would pass over it.

I am not afraid of buying a stock that has already moved higher 200% that year.

Where does this fear come from? Personally I believe that there is a little bit of superstitious belief that stock motion is somehow like random Brownian movement. Kind of like "what goes up must come down!" And the belief that it is wisest to "buy low and sell high".

But in reality, I regularly buy stocks that are moving higher. And have already moved significantly higher before I purchase them. I am not so brilliant to anticipate higher price moves. I would rather be observant and identify stocks that are already moving higher that have the fundamentals behind them that I believe may increase the probability of a higher price move yet!

How do I do this and yet sleep soundly each night?

It is because when I buy a stock I do not marry them for life. I am ready to part with my stocks at the drop of a dime....actually at the drop of 8%. Sometimes that happens a day or two after my purchase. Seriously.

Knowing that I can exit any of my stocks and that I have a plan to exit before I enter adds a bit of confidence to me. Of course stocks can gap down further than 8% and then I could take a larger loss at any time. However, in general if the fundamentals are as strong as I require, then that gapping down is unlikely. But I am prepared anyhow.

So don't look back. Don't look down when in high places. But look ahead and think confidently. Buy the strongest stocks. Be confident that you are prepared to pull the plug at any time as required by your own trading rules. And good luck!

That actually brings me to my second letter I received this past week. This one came in from Glen M. who I believe is writing from Canada who wrote:

"Hi Robert, I really appreciate your views and I have to say you write in a very understandable way - much appreciated!

Your canslim method is very similar to the one I employ. I have just read Lichello's book based on the AIM system. Do you apply that to your portfolio? I noticed that you mention in one or two of your blog entries that your portfolio has not given a buy signal. Could you elaborate how you apply AIM to Canslim?

Thanks in advance

Glen"

Thanks so much for writing Glen!

Thank you for your kind words. First of all, for those people who don't know what CANSLIM is here is a nice reference from the Investor's Business Daily on this strategy.

Basically, the CANSLIM system is looking for stocks with strong price momentum as well as strong earnings results who are at new highs, or doing something new, with not too many shares, a leader, institutional sponsorship and a market that is supportive of the price move.

I have drawn a few things from this strategy and have emphasized examining stocks not that are just making 'new highs' but rather moving strongly higher that particular day. I am also interested in finding stocks with other factors like increasing dividend, reasonable PEG ratio, and stable outstanding shares, positive free cash flow, and a nice balance sheet.

I also read Robert Lichello's book, How to Make $1,000,000 in the Stock Market Automatically, and appreciated some of his insight. Lichello developed his proprietary AIM system, which really was about automatically responding to market influences by shifting money between two funds, as I recall, basically a cash or money market account and an aggressive mutual fund account. This way, when stocks declined, an automatic "signal" would be triggered to transfer money into equities and when stocks climbed enough, a similar signal would be triggered to transfer money back into cash.

I am probably not doing justice to Lichello, but that was the gist of the book as I understood it.

The important part that I drew upon was the need to develop some sort of system to respond to market forces. Yet utilize the wisdom of CANSLIM and identify stocks that were the strongest to own. How could I integrate these two disparate strategies?

I recall reading in O'Neil's classic text, How to Make Money in Stocks, that I have found so inspirational a comment about the "M" in CANSLIM. That sometimes your portfolio is talking to you so to speak :).

The problem in selling at 8% loss limits as O'Neil suggests is the need to avoid the temptation of buying another 'great' stock immediately when the M or Market is declining. O'Neil points out that when you are hitting these sale points you should listen to your portfolio as it is telling you that the market is LOUSY. And it isn't the time to be buying stock.

But that was only 1/2 of the equation. I needed to have another signal. That is a signal that would tell me when it was a good time to be buying a new position.

I chose to set up sale signals on the upside. I sell portions of my holdings (currently 1/7th of the remaining position) if a stock hits a 30, 60, 90, or 120% level, then increasing intervals to 180, 240, 300 and 360%, then again increasing intervals to 450%, 540%, 630%, and 720%, etc.

At each of these levels I sell a portion of my holdings and use this as a signal that times are indeed good and have a "permission slip" to add a new holding.

This isn't exactly the AIM system at all. This is just what I do. But it was the AIM system and the O'Neil comments that inspired me to think about "listening" to my portfolio. I call this the "Zen" approach. Observing the things around us that we otherwise miss.

Assuming a maximum of 20 positions, I would 'start' at 10 with 1/2 cash and 1/2 stock and then only add a new position if one of my holdings hit a sale at a gain. Contrarily, if the stocks hit a sale, I would 'sit on my hands' unless at the minimum of 5 positions (1/4 of my maximum). In that case I would sell the holding and replace it. Similarly at a maximum portfolio number, which for me is at 20, when I hit a sale at a gain, if I am at 20 positions, I do not use this signal to add a new position but instead would add the funds to cash (or pay down my unfortunate margin balance!)

This is how I combine AIM and CANSLIM. I hope my thoughts and approach are helpful to you. I truly am an amateur so take that into consideration. Thanks so much for reading and writing.

Bob

Monday, 18 June 2007

Hardinge (HDNG)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Looking through the list of top % gainers on the NASDAQ, I came across Hardinge (HDNG), a stock that I have seen make the top % list a few times in the past few weeks. Hardinge closed at $35.45, up $2.61 or 7.95% on the day. I do not have any shares nor do I own any options on this stock.

HARDINGE (HDNG) IS RATED A BUY

Let's take a closer look at this stock which has also been part of the IBD 100 list recently.

What exactly does this company do?

According to the Yahoo "Profile" this company

"...through its subsidiaries, engages in the design, manufacture, distribution, and marketing of computer controlled metal-cutting lathes, machining centers, grinding machines, collets, chucks, indexing fixtures, and other industrial products. It also offers workholding devices for machine tools. The company provides its services to aerospace, automotive, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, telecommunications, and transportation industries, as well as to small and medium-sized independent job shops."

"...through its subsidiaries, engages in the design, manufacture, distribution, and marketing of computer controlled metal-cutting lathes, machining centers, grinding machines, collets, chucks, indexing fixtures, and other industrial products. It also offers workholding devices for machine tools. The company provides its services to aerospace, automotive, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, telecommunications, and transportation industries, as well as to small and medium-sized independent job shops."

How did the company do in the latest quarter?

On May 10, 2007, Hardinge reported 1st quarter 2007 results. Net sales for the quarter came in at $87 million, up 15% over the $75.4 million in net sales for the same quarter in 2006. Net income was $5.3 million or $.60/diluted share, up 173% from net income of $1.9 million or $.22/diluted share in the same quarter in 2006. Orders for the quarter came in at $95.6 million, up 25% compared to the $76.7 million in orders for the same quarter in 2006.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Hardinge (HDNG), we can see that revenue has been steadily increasing from $169 million in 2002 to $327 million in 2006 and $338 million in the trailing twelve months (TTM).

Earnings have been a little less consistent, dropping from $.23/share in 2002 to a loss of $(1.30)/share in 2003. The company returned to profitability in 2004 with $.50/share in earnings and has grown earnings steadily to $1.58/share in 2006 and $1.96/share in the TTM.

Hardinge, after paying $.10/share in dividends in 2002, cut it back to $.02/share (at the same time as it turned to a loss from a profit). However, since 2002, the company has raised its dividend each year with $.14/share paid in 2006 and $.16/share in the TTM.

The company has maintained outstanding shares at a steady 9 million.

Free cash flow which was a negative $(12) million in 2004 and $(11) million in 2005, turned positive in 2006 at $3 million, and has been $2 million in the TTM.

The balance sheet appears solid with $15.4 million in cash and $227.2 million in other current assets reported. This total of $242.6 million, when compared to the current liabilities of $75.5 million yields a healthy current ratio of 3.21. In addition, the company has a modest $106.6 million in long-term liabilities.

What about some valuation numbers?

Checking the Yahoo "Key Statistics" on Hardinge, we can see that this is a small cap stock with a market capitalization of $315.15 million. The trailing p/e is a moderate 18.04 with a forward p/e of only 15.76. No PEG ratio is reported.

Looking at Fidelity.com eresearch website for more information, we find that the Price/Sales ratio (TTM) also is reasonable for HDNG coming in at 0.86, with an industry average of 1.51. In terms of profitability, the company doesn't do quite as well with a Return on Equity (TTM) of 11.18% compared to the industry average reported on Fidelity of 23.12%.

Finishing up with Yahoo, we find that there are 8.89 million shares outstanding with 7.19 million that float. As of 5/10/07, there were 175,950 shares out short representing 2% of the float or only 0.9 trading days of volume. This doesn't appear significant to me.

The company currently pays a forward annual dividend of $.20/share yielding 0.6%. The last stock split was a 3:2 split in June, 1998.

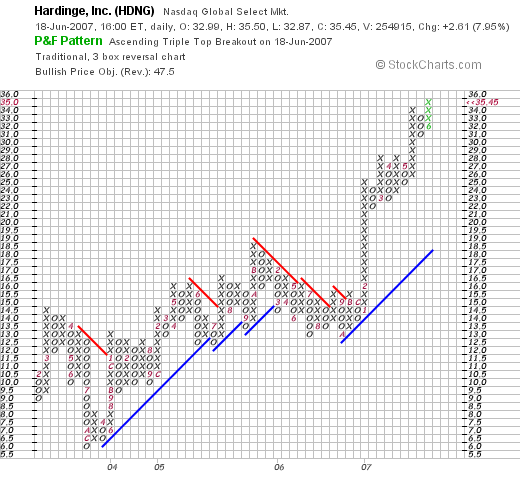

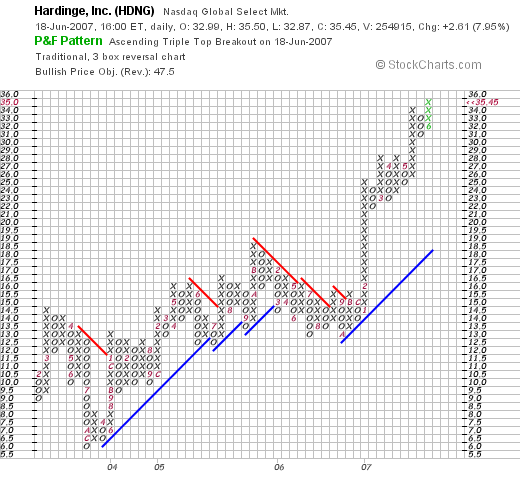

What does the chart look like?

If we review a "Point & Figure" chart on Hardinge (HDNG) from StockCharts.com, we can see that the stock which dipped to $6.00 in December, 2003, climbed to $18.50 in November, 2005, only to pull back to $12.50 in October, 2006. Since that time, the stock has broken through resistance climbing sharply in February, 2007, from $16 to $25. Recently, the stock has been pushing higher once again into the $35 range this past month. The chart looks quite strong to me.

Summary: What do I think about this stock?

Quite frankly, I like this stock a lot. You all may figure I haven't yet met a stock I haven't liked....and that is almost true :). But seriously, the company had a terrific quarter with blow-out numbers on earnings. They have been steadily increasing revenue. They even pay a dividend and have been increasing it!

The number of shares is small but steady, free cash flow is now positive, and the balance sheet is solid.

Valuation-wise, the Price/Sales ratio is quite reasonable although the Return on Equity is a bit under the average. Finally, the chart looks very strong! If I were in a position to be buying a stock, this is the kind of stock I would be buying today! Meanwhile, I shall add it to the blog and keep it in my "vocabulary" of investable stocks.

Thanks so much for stopping by and visiting my blog. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave a note right on the website. If you get a chance, be sure and visit my Stock Picks Podcast Website, where I discuss many of the same stocks I write about here on the blog.

Bob

Newer | Latest | Older

Earlier today I received another great inquiry from Doug S., a regular reader and contributor of questions to this website.

Earlier today I received another great inquiry from Doug S., a regular reader and contributor of questions to this website. I was looking through the

I was looking through the  "...provides reservoir description, production enhancement, and management services to the oil and gas industry worldwide. It engages in determining quality and measuring quantity of the fluids, such as natural gas, crude oil, and water and their derived products in the oil and gas fields."

"...provides reservoir description, production enhancement, and management services to the oil and gas industry worldwide. It engages in determining quality and measuring quantity of the fluids, such as natural gas, crude oil, and water and their derived products in the oil and gas fields."

"...through its subsidiaries, engages in the design, manufacture, distribution, and marketing of computer controlled metal-cutting lathes, machining centers, grinding machines, collets, chucks, indexing fixtures, and other industrial products. It also offers workholding devices for machine tools. The company provides its services to aerospace, automotive, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, telecommunications, and transportation industries, as well as to small and medium-sized independent job shops."

"...through its subsidiaries, engages in the design, manufacture, distribution, and marketing of computer controlled metal-cutting lathes, machining centers, grinding machines, collets, chucks, indexing fixtures, and other industrial products. It also offers workholding devices for machine tools. The company provides its services to aerospace, automotive, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, telecommunications, and transportation industries, as well as to small and medium-sized independent job shops."