Stock Picks Bob's Advice

Thursday, 4 October 2007

Quality Systems (QSII) and Immucor (BLUD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I have written about previously, I am now being tracked by Covestor. You can visit my Covestor Page and note my own trading account performance. One of the uses of Covestor has been to help me identify the weaker stocks within my own portfolio. Quality Systems (QSII) has been one of my top performing stocks in my entire portfolio. However, it has been lagging as of late.

There have been some 'clouds' around QSII that I have noted as an amateur investor reading the news stories on Yahoo. I didn't like the story about the Executive Vice President taking indeterminate leave for medical reasons. Previously on August 6, 2007, QSII reported 1st quarter results that missed expectations. The story isn't really over for QSII, I was just looking for something with a little bit more zip for my portfolio. While I am swapping out of QSII, I am thus reducing my rating for the stock:

QUALITY SYSTEMS (QSII) IS RATED A HOLD

Checking the list of top % gainers today, with an eye on something instead of QSII, I saw that Immucor (BLUD) a stock that I recently briefly reviewed, was acting well on the back of a solid 1st quarter earnings report that beat expectations. While not having a sale signal for my QSII, I sold my 88 shares of QSII at $38.70. These shares have been a terrific investment for me. I have sold my original shares of QSII multiple times (portions of my holding as it hit targeted appreciation prices over and over) and actually have a cost basis of $7.75 on them, purchased on 7/28/03. Thus, I had a gain of $30.95 or 399.4% since purchase! (How can I complain about that?)

Since I was making a 'swap' on my own judgment, I purchased 154 shares of Immucor (BLUD) at $37.9499 shortly after my QSII sale.

These sales and purchase are not strictly within my own trading rules. But since there appeared to be fundamental issues with QSII, and indeed the stock was lagging the rest of my portfolio, I decided it was a reasonable move. My only other stock at the present time that seems to be lagging is ResMed. However, ResMed, I believe, is involved in a temporary recall that is adversely affecting sales/profits. I will try to sit tight with that one for now.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 11:04 AM CDT

|

Post Comment |

Permalink

Updated: Thursday, 4 October 2007 11:05 AM CDT

Monday, 1 October 2007

Apogee (APOG) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In the last week I have chosen to 'swap out' of a couple of my holdings into stocks that I believe have greater potential, at least over the intermediate term. There isn't really anything wrong with Starbucks, or Coach. These are classic growth stocks and classic Peter Lynch kind of stocks with a great, understandable product and steady growth in revenue and numbers. It is just that I sense a certain fatigue in their performance. As if they have grown quickly and need to rest awhile before moving once again to higher levels.

Today, with the market charging higher, and Coach literally dragging, I chose to sell this stock and look on the top % gainers list for another pick. Apogee Enterprises (APOG) a stock that I recently wrote up has been having a nice day today, and as I write, is trading at $27.34, up $1.40 or 5.4% on the day. Earlier it was on the top % gainers list of the NASDAQ.

Looking for a replacement for my Coach position, I purchased 280 shares of APOG at $27.53 in my account. Time will tell whether this was a wise move. It would be interesting to hear from some of you readers about this particular swap. Would you have done this? What about Starbucks? What about all of the trading rules?

I think it was the right decision. Wish me luck! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Coach (COH) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, on my own arbitrary decision (I always reserve the right to make these!), I sold my remaining 61 shares of Coach (COH) at $46.25. Coach has been under pressure recently. Much like Starbucks it is a phenomenal success story. However, with my own sale of shares, I am reducing my rating on the stock.

COACH (COH) IS RATED A HOLD

Mostly, ever since Hank Greenberg wrote his column on August 26, 2007 on the possible challenges facing Coach, the stock has struggled to regain momentum. I think that once Coach demonstrates that it shall continue to post strong same store sales number and great quarterly results, the upward move of this stock shall resume. I do not believe the Coach story is over.

However, there are so many other intriguing stocks on the horizon. And with Coach stock down today while the market was moving strongly higher, I chose to 'pull the plug' on my remaining shares which actually are a very small position for me. I actually purchased my original shares of Coach (COH) at a cost basis of $8.33 on February 25, 2003, just before starting this weblog. Thus, the shares sold today were sold at a gain of $37.92 or 455.2% since purchase. It has indeed been a great investment for me!

I shall need to be cautious with these arbitrary moves like my sale of Starbucks. But I believe that if I can mainly stick with my investment strategy and use a little of my own thinking on these holdings, I shall be the better for it. It isn't exactly along the line of rules, but one of the problems facing me is the judgment of perhaps selling stocks which have made very large gains which do not fall to sale points yet appear to be struggling at least in the intermediate term. Time will tell if this was a good decision. As time will also reveal whether selling Starbucks was wise.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

IHS (IHS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I didn't waste any time with that 'nickel'! Since I just sold a portion of my PCP stock at a targeted gain, this generated the 'internal signal' as I call it, giving me the 'permission slip' to add a new position. And I didn't waste any time! Looking through the list of top % gainers on the NYSE today, I came across IHS, an old favorite of mine, currrently, as I write, trading at $58.69, up $2.37 or 4.20% on the day.

IHS (IHS) IS RATED A BUY

I am giving IHS another shot. This is an old favorite of mine, having written up this stock on March 24, 2007, and also having had shares for a brief time before hitting a loss and selling them. As I have indicated before, I am almost always willing to revisit past stock picks and past stock purchases for consideration if all of the factors are present. Sort of like having the planets aligned in some astrological sense :).

In any case, I purchased 140 shares of IHS at $58.45. Wish me luck. I shall try to give a quick update on this stock. Meanwhile, you can visit my March 24, 2007 post, for a review at least at that date.

Bob

Precision Castparts (PCP) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

PRECISION CASTPARTS (PCP) IS RATED A BUY

A few moments ago I sold 10 shares of my Precision Castparts (PCP) stock at $151.79. This was 1/7th of my position of 74 shares. I now have 64 shares in my trading account. This is my 4th partial sale of PCP which has been an outstanding investment for me which was acquired at a cost basis of $69.05 on 10/24/06. Thus, on these particular shares, I had a gain of $82.74 or 119.8% since purchase. This was a sale at the 120% appreciation level, with my targeted sales being at 30, 60, 90, 120%. On the upside, my next partial sale would be at a 180% appreciation level or 2.8 x $69.05 = $193.04. On the downside, my targeted sale would be at 1/2 of this 120% appreciation level or at a 60% appreciation target. This works out to 1.6 x $69.05 = $110.48.

Since I am under my 20 position maximum (at 14 positions), this gives me a "permission slip" to add a new position. As I like to say, 'that nickel is burning a hole in my pocket already!'.

I shall be scanning the top % gainers list today and see if there is anything that meets my requirements. I shall keep you posted!

Bob

Sunday, 30 September 2007

A Nice Reference to Stock Picks from the Blogosphere!

I especially appreciate it when a fellow financial blogger writes something nice about Stock Picks Bob's Advice! I realized that Dereck over at "The Best Stock Trading In The World" did exactly that!

Dereck wrote:

"Almost everywhere where I read about the stock market, I read analyses. I know that doesn’t sound too bad (as if I just led you on), but if such analyses were as useful as their prevalence would seem to indicate, why aren’t more people right? Granted, thus far, I’ve seen some pretty damned good ones. Bob’s stock picks is one I found recently. The guy is a bad ass. Smart and dedicated. Then too, I’ve seen some stinkers (I hope I don’t disappoint you but I won’t name them). Many analyses, or stock market perspectives generally, all seem to be solving the same math problem. But differently and sometimes badly."

Well let me publicly thank you Dereck for your kind words! I hope that a few of my regular readers will drop by and check out your website. I enjoy your philosophy on investing and at the least, you have one of the most colorful websites I have read! My blog practically pales in comparison.

Bob

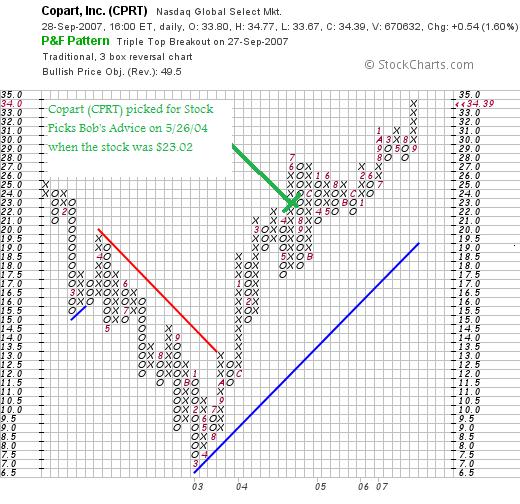

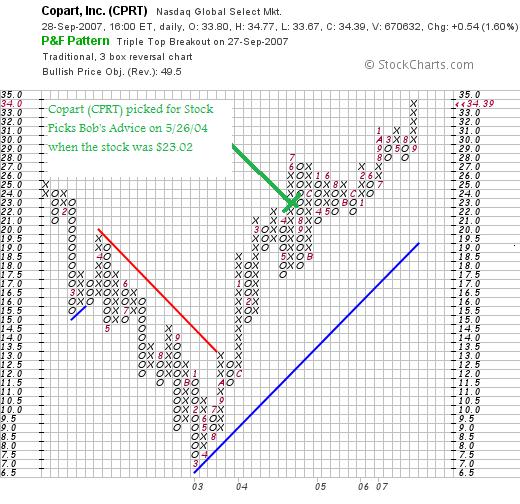

Copart (CPRT) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website.

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago.

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago.

Let me go through some of the data underlying my decision to purchase shares and explain why

COPART (CPRT) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on CPRT, the company

"...provides salvage vehicle sale services primarily in the United States. It offers vehicle suppliers, primarily insurance companies, with a range of services to process and sell salvage vehicles over the Internet through its virtual bidding Internet auction-style sales technology."

"...provides salvage vehicle sale services primarily in the United States. It offers vehicle suppliers, primarily insurance companies, with a range of services to process and sell salvage vehicles over the Internet through its virtual bidding Internet auction-style sales technology."

How did they do in the latest quarter?

On September 26, 2007, after the close of trading, Copart announced 4th quarter 2007 results. Revenue for the quarter ended July 31, 2007, came in at $154.0 million, up 12.2% from last year's results. Income came in at $36.7 million or $.40/diluted share up 21.2% from last year's result of $31.6 million or $.35/share.

Analysts according to Thomson Financial had expected profit of $.35/share on revenue of $138.1 million. Thus the company handily beat expectations.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on CPRT, we can see the steady increase in revenue from $306.5 million in 2002 to $528.6 million in 2006 and $547.8 million in the trailing twelve months (TTM). Except for a dip in 2006 to $1.00 from $1.10/share, earnings have been growing nicely since 2003 when the company earned $.60/share. The latest twelve months shows Copart with earnings of $1.40/share.

No dividend is paid but the shares outstanding are stable with 89 million reported in 2002 increasing only to 90 million in the TTM.

Free cash flow is positive with $70 million in 2005, $45 million in 2006 and $84 million in the TTM. The balance sheet from Morningstar appears very strong, with $124 million in cash which by itself could easily pay off both the $80.7 million in current liabilities and the $1.5 million in long-term liabilities combined.

What about some valuation numbers?

Using the numbers from Yahoo "Key Statistics" on Copart, we find that the company is a mid cap stock with a market capitalization of $3.04 billion. The trailing p/e is a moderate 23.57 with a forward p/e (fye 31-Jul-09) estimated at 17.91. Estimating the earnings going forward over the next five years, the PEG works out to an acceptable 1.42.

According to the Fidelity.com eresearch website, Copart has a Price/Sales (TTM) ratio of 5.54, much higher than the average in the industry of 2.35. On a positive note, the company is reported to be somewhat more profitable than average, with a Return on Equity (TTM) of 15.40%, higher than the industry average of 13.09%.

Finishing up with Yahoo, we find that there are 88.33 million shares outstanding with 69.21 million that float. As of 9/11/07, there were 1.02 million shares out short, representing 1.4% of the float or 4 trading days of volume. This is slightly higher than my own 3 day rule for short interest. No dividends are paid and the last stock split reported on Yahoo was a 3:2 stock split on January 22, 2002.

What does the chart look like?

Reviewing the "Point & Figure" chart on CPRT from StockCharts.com, we can see the weakness in the price chart through much of 2002 as it dipped from $25/share in January, 2002, to a low of $7.00 in March, 2003. Since that time, the stock has been moving steadily higher . The chart does not appear particularly 'overexteded' to me.

Summary: What do I think?

Well I like this stock! In almost a 'recession play', the stock fills a niche for automobiles and is involved in car auctions. I am confident that in any weakness in the economy, more and more car purchasers are looking at used cars...of courst that is only my speculation.

Earnings were great as the company handily beat expectations. Valuation isn't bad with a moderate p/e and a PEG under 1.5. The Price/Sales is a bit rich but the Return on Equity was a bit better than average. Finally, the stock chart looks nice.

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you can, be sure and visit my Stock Picks Podcast site, my Covestor Page where my trading portfolio is analyzed, and my SocialPicks page where all of my stock picks from early 2007 are stored.

Have a great week trading!

Bob

Posted by bobsadviceforstocks at 11:00 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 30 September 2007 9:17 PM CDT

Friday, 28 September 2007

Another Person-to-Person Lender for the Developing World!

In earlier posts, I have discussed Prosper.com where individuals like you or me can participate in loans to individual consumers. If you haven't visited Prosper.com, please check it out. Be aware of the risk, but it is another way to possibly receive a higher interest return on your money when you carefully invest in loans that are credit-checked and collected by Prosper.com. (Full disclosure, I receive credit for referrals as you can as well after you set up an account. I also have $200 in 4 loans outstanding and am continuing to try to understand that process as well as I have a grasp on investing in stocks.)

I write tonight, not to mention Prosper.com, but to introduce you to Kiva.org, a website that facilitates micro-loans to entrepreneurs in developing regions that require small loans to lift them possibly out of poverty. (Full disclosure, I receive nothing for this plug for Kiva.org. I heard about it today during an interview with the former President Bill Clinton on Keith Olbermann, a favorite show of mine!)

The loans on Kiva are loans without interest. As Kiva reports:

"Kiva lets you connect with and loan money to unique small businesses in the developing world. By choosing a business on Kiva.org, you can "sponsor a business" and help the world's working poor make great strides towards economic independence. Throughout the course of the loan (usually 6-12 months), you can receive email journal updates from the business you've sponsored. As loans are repaid, you get your loan money back."

So make your own choice about these websites. Consider putting a bit of money in both of them. One where you can get the satisfaction of receiving above average interest. Or Kiva, where you get the satisfaction of helping out others in need lift themselves out of poverty.

Have a great weekend everyone.

Bob

Thursday, 27 September 2007

A Reader Writes "Trigger Points...%price increase?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

Doug S. wrote:

"Bob: Back to an old topic for a second. As previously discussed mine

is earnings/revenue announcement, your's % price increase. How did you

original choose that and are there any rules/principals you developed

to further refine before you buy? Thanks"

Once again, thank you for writing Doug! You have been a loyal reader and writer of questions of comments for quite awhile now. I appreciate your enthusiasm and home that my continued blogging is helpful for you.

I have written about stock selection before on this blog, but I am quite happy to revisit this topic because there are so many different readers who stop by and many probably don't have the faintest idea about what I am doing and why I am doing it :). (Sometimes I also am wondering about the same thing!)

Selection of a stock for inclusion in the blog as part of what I call my "investing vocabulary" is the same technique that I utilize for selecting stocks to purchase. Some years back when the NASDAQ and the high-tech bubble was expanding, I noticed that simply looking at stocks that were making large gains was a useful method of selecting stocks to trade over the short-term. However, with the implosion of this bubble, this wasn't useful by itself, but it made me aware that this factor, when in conjunction with other fundamental findings on the stocks selected, might well be a good initial screen.

I start with the top % gainers lists. This is the CNNMoney.com site where the gainers are listed, and which I frequently use. If you click on the individual NYSE, NASDAQ, or AMEX links, you will get the individual lists for those exchanges. But this is just the starting place for my search. I try to avoid stocks that are much below $10 in this screening process.

My next step is generally to take a look at the Morningstar.com "5-Yr Restated financials" page. Using CPRT as an example, this page gives me a large supply of information that I utilize for making my decisions. In a nutshell, I am looking for a quality investment (aren't we all?). For me, quality is about consistency in reporting improved financial numbers. In other words, a stock that steadily grows its revenues, increases earnings, maintains a steady # of shares, has positive free cash flow that hopefully is increasing, and has a balance sheet where there are lots of assets and relatively less liabilities. Especially current assets over current liabilities.

Early on in the blog history, I was looking for perfection. I have become more realistic and look for near-perfection but am willing to tolerate a few 'blemishes' on these financial records. But not many!

If this page passes muster, I check over to the latest earnings report. As you mention, you are attracted to stocks with strong earnings/revenue reports. I am looking for stocks moving higher, but their latest quarterly report is critical in this review. Again, using Copart (CPRT), we can find their latest earnings report here on Yahoo. What am I looking for? Simple stuff really. Because I don't really understand complex financial statements. I am looking for increasing revenue, and increasing earnings. Hopefully, I can find something about expectations. I like it when results beat expectations. Hopefully for both earnings and revenue. Here you can see that Copart handily beat expectations. I have occasionally called this a 'trifecta' or 'trifecta plus'. Just silly terms that I made up using some horse-racing talk. (I don't really know much about horses either!)

Next step I take a look at valuation. Using Yahoo again, here is the page on "Key Statistics" on Copart. I prefer to see low p/e's (usually in the 20's or lower), I like to see a reasonable PEG (1.0 to 1.5). And sometimes we can find stocks with lots of short interest on this sheet, which for me is a short ratio of greater than three days. I have been using Fidelity.com for valuation numbers which you can find here for Copart. And here for profitability numbers. In general, these are ancillary numbers that do not determine my decision as much as the Morningstar page and the latest quarter earnings report.

Finally, I like to look at a "point & figure" chart. I developed a 'taste' for these charts in my stock club meetings where we had a broker from Piper Jaffrey (Bob A.), who would often present these charts to us. Perhaps it is an acquired taste, but I like looking at them.

Here is the chart for Copart. In no ways am I an accomplished technician or chartist. Quite to the contrary. Simply put, I like to see a chart which looks like the price is moving higher. That is, there appears to be a trend which is yet unbroken of increasing price as we move from left to right across the chart :). That is about how sophisticated I am :).

Topping off my process is a little bit of Peter Lynch. Maybe it is just a 'gut check' or some sort of Gestalt process. But that is what I do.

I do not necessarily think this is better than what you are doing. But I am trying to make some reason out of chaos, to develop rules for stock selection, and stock sales. Reasons for buying and reasons for selling stocks. Reasons for sitting on my hands and reasons for replacing positions.

Thanks again for writing! I hope this is helpful in explaining my own thought processes. You might visit websites where methods are proprietary. Maybe those writers are smarter and will be rich with their secret recipes. My desire is to be transparent. To be explaining everything so that I can learn and bounce my ideas and thoughts off of all of you readers. Hopefully, I shall be successful in doing this and shall continue to refine my own approach to stock market investment strategy.

Bob

Posted by bobsadviceforstocks at 1:49 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 27 September 2007 5:47 PM CDT

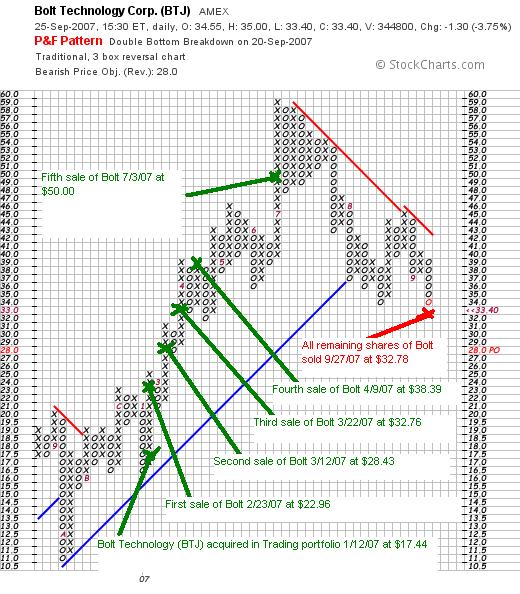

Bolt Technology (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my remaining 129 shares of Bolt (BTJ) at $32.78/share. These shares had been purchased 1/12/07 at a cost basis of $17.44, so I had a gain of $15.34 or 88% since purchase. This was a sale on a decline and no matter how I would like to spin this (!) I shall be 'sitting on my hands' with the proceeds of this sale, waiting for something more positive, like a sale of a portion of a holding, before adding another position.

Why did I sell? (I can already see the emails showing up in my mailbox!) As part of my own trading strategy, I sell stocks on declines on one of four reasons. Either there is some fundamental information out there that indicates that a sale is simply a wise thing to do (see Starbucks sale today), or if after an initial purchase the stock declines 8% (See ICOC sale yesterday). Other declines include after one partial sale at a 30% gain, I move the selling point up from an 8% loss to 'break-even'. After multiple sales, I will sell the remaining shares if a stock should decline to 50% of its highest % gain. In this particular case, I had sold portions of Bolt (BTJ) five times this year. First at 30%, then 60%, 90%, 120% and 180% appreciation points. Thus with a decline to under a 90% appreciation, much like my experience with Jones Soda (JSDA), I had a signal to sell my remaining shares.

I have been trying very hard to ignore this signal. I like this stock a lot. But even after trying to bounce back after closing yesterday under a 90% gain for me, the stock sold off once more to under a 90% appreciation level, and I didn't want to ignore the signal that my own stock holding was generating.

Let's take a look at the "point & figure" chart on BTJ from StockCharts.com:

With my own sale of Bolt, yet without any fundamental change in the outlook for this company, I am reducing my rating:

BOLT TECHNOLOGY (BTJ) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, or my Covestor Page where my Trading Portfolio is monitored and evaluated, or my SocialPicks Page where all of my picks are reviewed as of early 2007.

My latest investing experiment is the Prosper.com person-to-person loan plan. I only have $200 invested in that program but you are encouraged to least explore the Prosper.com website and see how intriguing this E-Bay style loan system is. (Full disclosure, I do receive a small payment for referrals that I generate...but I would tell you about this anyhow.) Be sure you understand the risks over at Prosper.com as well prior to investing any money in loans there.

Have a great day. I hope to get something up on Copart later today if I get a chance!

Bob

Newer | Latest | Older

Last Thursday I

Last Thursday I

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.