Stock Picks Bob's Advice

Tuesday, 11 December 2007

Bernanke--'Pushing On A String'

As cross-posted in TradingGoddess:

I join with other investors in disappointment of seeing a 1/4% drop in the Fed Discount Rate.

The market didn't like it and turned from about a 50 point gain in the Dow to a 220 point loss. And the market has another hour to trade.

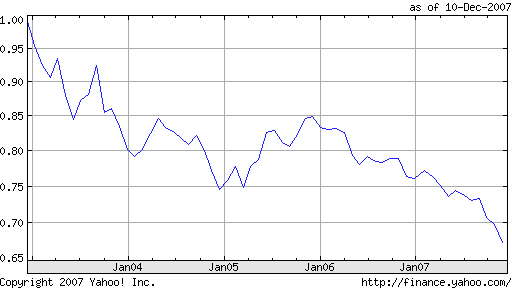

But what can Bernanke do? Rate cuts drive the dollar down in value. And raise the risk of inflation as imported products climb in price.

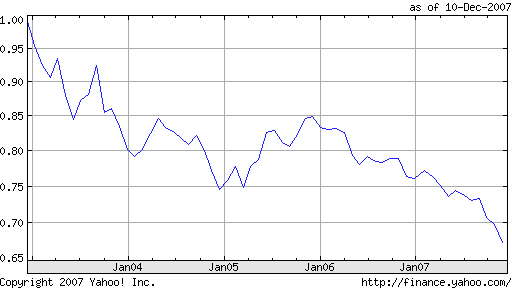

The interest rate supports the value of the dollar which has plunged approximately 44% against the Euro in the past 7 years under President Bush's leadership.

5-Yr $-Euro Chart

That means that in a global economy, the value of everything we own has been devalued by about 1/2. When we travel abroad, we can see the effect of the weak dollar when it takes $5 to buy a Coke in Italy.

With the subprime mortgage mess unraveling and the derivatives and hedge funds shenanigans continuing to come to light, our economy needs a stimulus like a rate cut. But if we fail to support the dollar, the Chinese are likely to resist continuing to fund our debt instead turning to Euro-backed securities and the OPEC folks are likely to once again consider pricing oil in Euros and not dollars.

I am greatly concerned for our economic vitality and prosperity.

We have unfortunately continued to be led by politicians who subscribe to the Grover Norquist pledge of 'no new taxes'. Why 'taxes are bad--aren't they?'

But can we continue to cut taxes and pour money and resources into military activity without paying the piper somehow? Should we really believe that tax cuts are essential to grow the economy when this endless printing of dollars in terms of an expanding budget deficit is a threat to our well-being.

Should we be concerned about the ever-growing disparity between the wealthy and the poor?

Even Henry Ford knew he needed to pay workers enough so they could buy a Model T.

We cannot depend solely on high-end retailers catering to the wealthy to sustain this economy.

Balancing the budget needs to be a national priority. Tax policy must not work to encourage the continued outsourcing of quality jobs overseas. Efforts to repeal the Estate Tax will only insure more of a continued Plutocracy in America with the wealthy getting richer and the poor poorer and out economy will suffer. Cuts to education will not help the poor rise up out of their economic morass.

This country has been headed in the wrong direction under this President and we are all paying the piper.

Bob

Abaxis (ABAX) and Movado Group (MOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I noticed that my Abaxis stock was closing in on my first targeted appreciation point--a 30% gain--and I sold 1/7th of my position or 30 out of my 210 shares at $36.74. This left me 180 shares in my trading account. I had purchased these shares just 6 weeks ago (!) at a cost basis of $28.29. Thus, I had a gain of $8.45 or 29.9% since purchase.

ABAXIS (ABAX) IS RATED A BUY

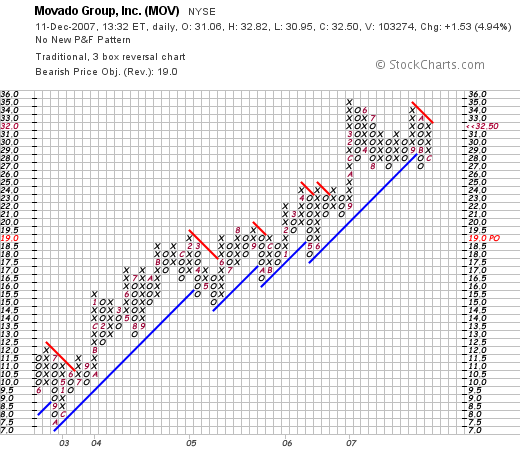

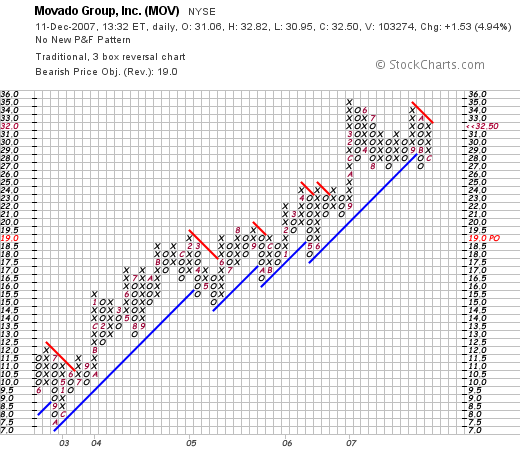

Since I was at 13 positions out of my potential of 20 position portfolio, this sale at a gain entitled me to add a new position to the account. Checking the list of top % gainers on the NYSE today I noticed that Movado Group (MOV) was an acceptable candidate for my account and purchased 210 shares at $32.09. At the moment, Movado (MOV) is trading at $32.49, up $1.52 or 4.91% on the day.

MOVADO GROUP (MOV) IS RATED A BUY

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Briefly, on December 6, 2007 (5 days ago) Movado reported what appears to me to be a very strong 3rd quarter earnings report. Net sales were up 8.3%, and that included a comparable store increase at the Movado boutique stores of 8.8%. Net income and earnings per share were also up nicely.

In addition, the company announced a 'share repurchase program', beat expectations and raised guidance. What else could an investor want?

Longer-term, the company has steadily raised revenue, has recently been growing its earnings, raised dividends, kepts its shares outstanding fairly stable, and has been reporting positive and increasing free cash flow and a solid balance sheet.

Valuation appears reasonable with a market cap of $846.56 million, a trailing p/e of 17.45, and a PEG ratio of 1.32.

The chart appears reasonably strong with the price under a small amount of pressure recently.

Anyhow, I now own shares in Movado Group (MOV). Wish me luck!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Have a great afternoon and a great week trading and investing.

Bob

Monday, 10 December 2007

A Reader Writes "Would you be willing to help out?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had an interesting note from Traci Scharf from Lunametrics who asked me very nicely if I could possibly share a request from her about website reviews. I don't usually do this kind of thing, but she was very polite and persistent---two traits that even a skeptic like myself finds hard to resist---and thus here is her request. I don't usually do this sort of thing, but here is her letter, and any of you are free to pursue this or not.

I had an interesting note from Traci Scharf from Lunametrics who asked me very nicely if I could possibly share a request from her about website reviews. I don't usually do this kind of thing, but she was very polite and persistent---two traits that even a skeptic like myself finds hard to resist---and thus here is her request. I don't usually do this sort of thing, but here is her letter, and any of you are free to pursue this or not.

Traci wrote:

"Bob,

Please pardon the out-of-the-blue e-mail. I stumbled onto your blog today (very cool!) and wanted to see if you could help me with something.

I'm doing some market research for a client and need to find a handful of people to give me (paid) feedback. I specifically need to find individuals who closely manage their stock portfolio based on technicals and fundamentals (revenue, market cap, ROE, EPS, etc) -- like you and people who probably subscribe to your blog!

I'm looking for five people who can spare a half hour of their time to give us feedback on our client's website. It takes about a half hour and we offer $50 compensation in return.

Would you be willing to help out? And / or: you are welcome to post this offer and my contact info on your blog (using my personal e-mail -- traci.m.scharf@gmail.com -- in order to keep my work account protected) if you are willing.

Since you don't know me from a hole in the wall, please know that I'm not selling anything and that I keep our user testers' names and contact information absolutely private.

Any help you can provide would be greatly appreciated!

Thanks,

-Traci

e-mail (work): scharf@lunametrics.com

e-mail (personal): traci.m.scharf@gmail.com"

Perhaps some of you can earn $50 on this. I don't like to advertise things for other people, but it seemed like a legitimate letter from a legitimate person. If you do participate, would you please let me know if you feel this letter doesn't belong on my blog.

Have a great evening and a great week ahead!

Bob

Silicom Ltd (SILC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is doing a little better today with the Dow up 77.07 and the NASDAQ ahead by 9.57. In addition, we have oil down at $87.55, down $(.73)/barrel. Not a huge rally, but a nice day nonetheless.

It is in this context that I thought I might find and write up a new stock this afternoon. I shall try to be briefer than usual but still cover the important points.

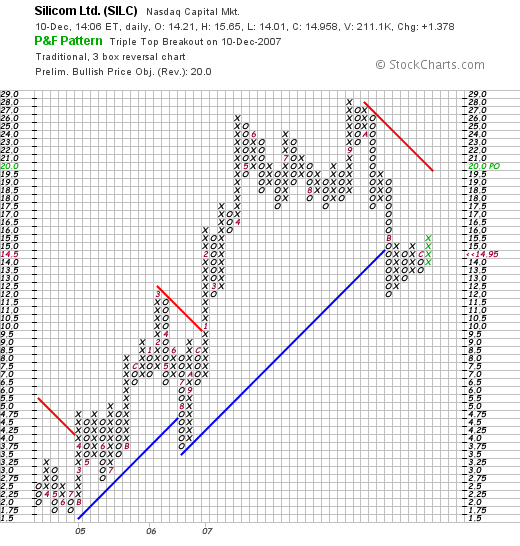

Silicom (SILC) made the list of top % gainers on the NASDAQ today and as I write is trading at $15.13, up $1.55 or 11.41% on the day. I do not own any shares nor do I have any options on this stock.

Silicom (SILC) made the list of top % gainers on the NASDAQ today and as I write is trading at $15.13, up $1.55 or 11.41% on the day. I do not own any shares nor do I have any options on this stock.

Let's take a closer look and I will explain why

SILICOM (SILC) IS RATED A BUY

First of all,

What exactly do they do?

According to the Yahoo "Profile" on SILC, the company

"...through its subsidiary, Silicom Connectivity Solutions, Inc., engages in the design, manufacture, marketing, and support of connectivity solutions for a range of servers and server-based systems in Israel, the United States, and internationally. It primarily manufactures server networking cards with and without bypass (Server Adapters), and legacy products, including connectivity solutions for portable personal computers and broadband Internet access products."

"...through its subsidiary, Silicom Connectivity Solutions, Inc., engages in the design, manufacture, marketing, and support of connectivity solutions for a range of servers and server-based systems in Israel, the United States, and internationally. It primarily manufactures server networking cards with and without bypass (Server Adapters), and legacy products, including connectivity solutions for portable personal computers and broadband Internet access products."

How did they do in the latest quarter?

On October 29, 2007, Silicom reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, revenues came in at $6.6 million, up 59% from the $4.2 million in the same quarter of 2006. Net income climbed 147% to $1.6 million or $.25/diluted share compared to $666,000 or $.12/diluted share for the 3rd quarter of 2006.

How about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on SILC, we can see that revenue has steadily grown since 2002 when the company reported $2.7 million in revenue. This increased more than five-fold to $16 million in 2006. Earnings have also imporved from a loss of $(.61)/share in 2002 to $(.30)/share in 2004, $.30/share in 2005 and $.49/share in 2006.

Outstanding shares which were at 4 million increased to 5 million in 2006. Free cash flow which was at $-0- in 2005, improved to $2 million in 2006.

The balance sheet, as reported on Morningstar, looks solid with $5.0 million in cash, plenty to cover both the $3.5 million in current liabilities and the $1.2 million in long-term liabilities. Calculating the current ratio, the company has a total of $13 million of current assets, which when compared to the current liabilities of $3.5 million works out to a ratio of 3.71--very healthy from my perspective.

What about some valuation numbers?

Checking Yahoo "Key Statistics" on SILC we can see that this stock is a micro cap stock with a market cap of only $96.44 million. The trailing p/e is a very reasonable (imho) 16.05 with a forward p/e of only 13.75. The PEG works out (5 yr expected) to a modest 0.93.

Examining the Fidelity.com eresearch website for valuation, we find that the Price/Sales (TTM) is a very reasonable 2.77 compared to the industry average of 7.66. In terms of profitability, SILC comes in a bit under the average in terms of "Return on Equity" TTM of 21.64% compared to the industry average of 26.70%.

Finishing up with the numbers from Yahoo, there are 6.49 million shares outstanding with only 4.45 million that float. As of 11/9/07, therewere 142,440 shares out short representing 3.1% of the float or 0.6 trading days of volume. No dividends are reported and no stock splits are recorded on Yahoo.

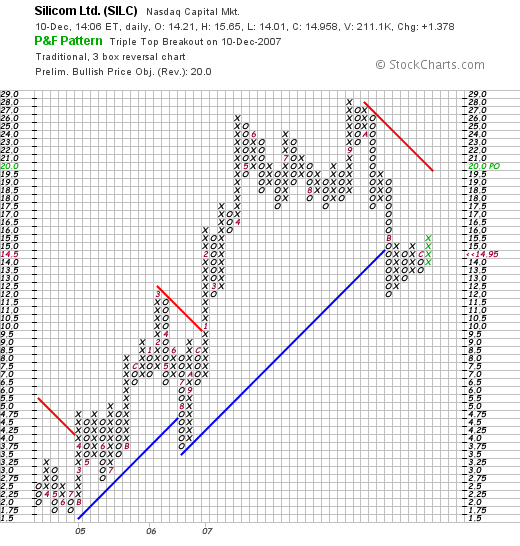

What about the chart?

Looking at the "point & figure" chart on Silicom from StockCharts.com, we can see that since July, 2004, when the stock was selling at as low as $1.70, the stock has appreciated strongly to a recent high of $28 in September, 2007. The stock recently sold off to a low of $12.00 in November, 2007. The stock is still welling below support levels and under resistance at around $19. Of all of the things I reviewed on this stock, the chart appears to be the weakest part of the equation. However, it is not enough to keep me from posting that "buy" assessment.

Summary: What do I think?

This is a really small company with a market capitalization under $100 million. However, the earnings results were very nice, the Morningstar report was solid, and valuation is very reasonable. The only thing keeping me back at all is the chart which is a bit less than encouraging--although recently the stock has been consolidating and moving higher.

Thanks again for visiting my blog! If you have any comments or questions, please be sure to leave them on the website or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Stock Picks Podcast Page where some of the many stocks I write about are presented in a radio show format. Other places to visit include my Covestor Page where the performance of my actual trading portfolio is tracked and compared to other participating investors, and my SocialPicks page where my stock picks from the past year are all reviewed and the results monitored.

If you are looking for a unique place to invest your money, consider exploring Prosper.com where you can join with other like-minded investors and lend money to individuals. These non-secured loans are quite high risk so please make sure you understand the risks involved before participating in this website.

Thanks again for visiting! Have a great week trading and investing!

Bob

Kinetic Concepts (KCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

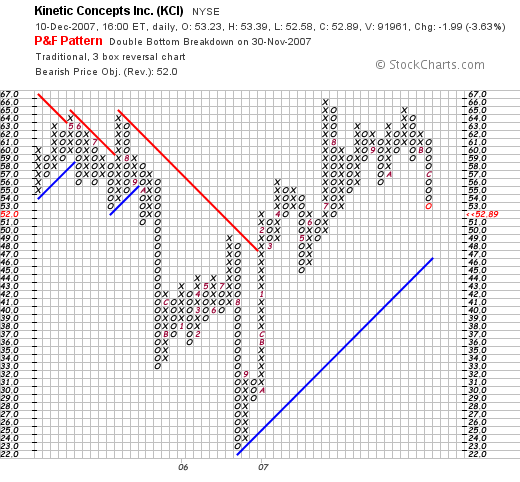

A few moments ago I sold my 140 shares of Kinetic Concepts (KCI) at $53.21. Because of a 'trade' in my account, these shares are carried with a purchase dat of 10/23/07 and a cost basis of $58.05. Thus, with the stock trading at $53.21, this represented a loss of $(4.84) or (8.3)% since the recorded purchase. The 8% level is my loss limit for stocks after an initial purchase.

With the stock declining to this level, I sold my shares--all of them--and shall 'sit on my hands' with the proceeds. I use these sales on 'bad news' as a signal to be cautious in my own portfolio. I shall be waiting for one of my other positions to hit a sale point on a gain to give me the 'green light' to make an addition to my portfolio.

What caused this drop? Over the short-term, there was a Barron's article this weekend about whether KCI's patents would hold up and whether thus their 'moat' would be safe.

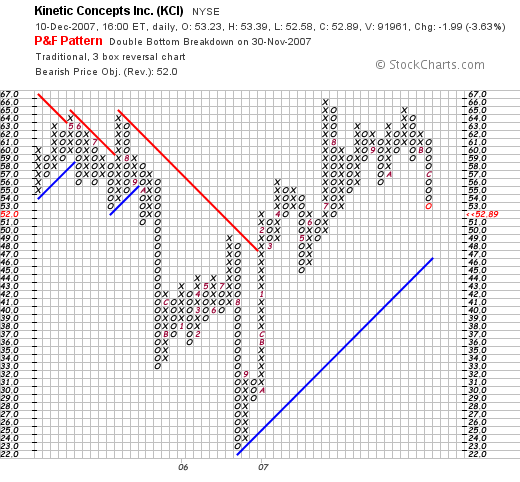

However the latest quarter result was solid. The company beat expectations on earnings and revenue. They also went ahead and raised guidance. A glance at the Morningstar.com "5-Yr Restated" financials looks perfect. And the 'point & figure' chart on KCI from StockCharts.com shows that while the stock is under recent pressure, the price movements have been quite wide in this stock and it still appears to be above support levels.

However, since I am selling my own shares, I need to reduce my rating on this stock even though the story, except for the recent questions about patents, really appears intact.

KINETIC CONCEPTS (KCI) IS RATED A HOLD

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Saturday, 8 December 2007

"Looking Back One Year" A review of stock picks from the week of June 5, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In this spot on the weekend, I am usually reviewing past stock picks for their eventual performance. However, the week of June 5, 2006, was devoid of any new selections. So not one to pass by an excellent opportunity, I shall be skipping the review this weekend and shall wait for next weekend for an examination of some more past stock selections.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 6 December 2007

Commscope (CTV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my remaining 300 shares in Commscope (CTV) at $47.65. These shares were the second half of my 600 shares purchased as a 'trade' the other day. In fact they were purchased 12/5/07 (yesterday) at a cost basis of $46.39, and thus I had a gain of $1.26 or 2.7% since purchasing them. Even though I have parted with these shares, let me emphasize that

COMMSCOPE (CTV) IS RATED A BUY

I sold these shares because the market was up strongly today in spite of what I feel may be fundamental problems addressing the economy. We have not really resolved the subprime mortgage problems, we have not figured out to help stop the plunging dollar, and we still have problems with budget deficits, trade deficits, and ongoing war in the Middle East. I know that market climb 'walls of worry', but I am worrying plenty.

Since this is just a 'trade' outside of my core trading portfolio, I wanted to sell out these shares as my margin balance is still considerable and it is wise to sell when others are buying....at least for this particular position.

Anyhow, that's the news. I shall still reserve the opportunity to be doing a 'trade' within the context of investing. I hope that this dual approach to investing shall be profitable. Wish me luck!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 5 December 2007

Chipotle Mexican Grill (CMG) "A Reader Suggests a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Definitely my favorite part of blogging is to read comments and receive questions and suggestions from readers. Some of you become my online friends and some of you are friends and family in real life. I received a letter from Aaron B., who was home from work over Thanksgiving and my family joined his family for turkey and fixings which is a tradition for our families during this holiday. As background, Aaron is probably one of the brightest young investors I know and is developing an interest in investing.

I recall discussing investing with Aaron (his dad and I are members of the same stock club as well), and we talked about things an investor can do to identify potential investments. Apparently Aaron was listening. He dropped me an email and wrote:

I recall discussing investing with Aaron (his dad and I are members of the same stock club as well), and we talked about things an investor can do to identify potential investments. Apparently Aaron was listening. He dropped me an email and wrote:

"Hi Bob, I’ve been looking through the different tools you showed me, and found a stock I like for my next buy. Have you ever looked at Chipotle (CMG)? I couldn’t find anything on your site about it, but you said the search usually doesn’t work. It seems to meet all of your criteria, what do you think?

Thanks, Aaron"

Thanks so much for writing. I have not written up Chipotle (CMG) but I would be happy to briefly take a look at this company/stock and see if it indeed fits into my 'scheme' for investing.

First of all Chipotle closed today (12/5/07) at $138.79, up $1.28 or .93% on the day today. This was not enough to make the top % gainers by any means. And as you probably know (or not) I generally start with those stocks on that list for inclusion on the blog. I am looking for stocks with lots of price momentum!

I am also not bothered by the $138 price level. Some investors want to buy stocks that are just at the pennies/share level so that they can buy thousands of shares. I would rather see you purchase just a few shares of a stock that is high quality (as I define it) rather than thousands of shares of a low-quality 'penny stock'.

What does Chipotle do?

As reported on the Yahoo "Profile" on CMG, the company

"...engages in the development and operation of fast-casual, Mexican food restaurants in the United States. As of December 31, 2006, it operated 581 restaurants, including 8 franchise restaurants. Chipotle Mexican Grill, Inc. was formerly a subsidiary of McDonald's Corp."

"...engages in the development and operation of fast-casual, Mexican food restaurants in the United States. As of December 31, 2006, it operated 581 restaurants, including 8 franchise restaurants. Chipotle Mexican Grill, Inc. was formerly a subsidiary of McDonald's Corp."

Another thing I like to investigate when reviewing a company is the latest quarterly report. I am looking for a company growing its revenue and earnings and possibly beating expectations as well as raising guidance.

How did Chipotle do in the latest quarter?

On October 30, 2007 Chipotle reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, revenue increased 35.6% to $286.4 million. Perhaps even more important than that impressive growth figure, the same store sales increased 12.4%. Whenever we have a retail venture, whether it is selling purses or burritos, reporting sales, it is absolutely imperative to ask about same store sales. This figure represents the change experience in sales by comparable stores year-over-year. This is a better representation of the health of a company compared to the gross sales figure because it gives us an idea of how individual stores are performing.

Net income for the quarter came in at $20.6 million or $.62/diluted share, up sharply from the $11.8 million or $.36/diluted share during the same period in 2006.

These were great results! But sometimes just as important as the results on subsequent price performance is what the expectations were. And Chipotle delivered the 'burrito' in this department as well. In fact, they beat expectations according to analysts polled by Thomson Financial which had been expecting profits of $.53/share on revenue of $279.3 million.

What about longer-term results?

Aaron, as we discussed Thanksgiving, I like to find stocks that not only have had a great quarter but that show persistence of earnings growth. As we discussed, I am always looking for a certain 'profile' of a company to choose to invest in. It isn't really about the product, whether it be fast Mexican casual like Chipotle (I do like their restaurants!), but rather the financial results that result from their business. That's probably where I differ from the Peter Lynch approach.

In any case, what I want to find when researching a company is a record of steady revenue growth, steady earnings growth, stable outstanding shares, possibly a dividend and if so possibly a steadily increasing dividend, positive free cash flow that is also hopefully showing a record of steady growth, and a solid balance sheet which for me means lots of cash and current assets and much less current liabilities.

For this information, I have found the Morningstar.com "5-Yr Restated" financials most helpful. Be sure and familiarize yourself with this page. I believe it is one of the most important keys to my investment decisions!

Starting with revenue growth, I am sure you noted the steady growth in CMG from $205 million in revenue in 2002 to $823 million in 2006 and $1.02 billion in the trailing twelve months (TTM). Revenue growth is solid!

Earnings were initially losses starting with $(.87)/share in 2002, $(.34)/share in 2003, then turning profitable at $.24/share in 2004, $1.43/share in 2005, a dip to $1.28 in 2006, then back up to $1.93/share in the TTM. Earnings look great!

The company does not pay any dividends. Outstanding shares have increased modestly from 20 million in 2002 to 32 million in 2006 and 33 million in the TTM. This 13 million increase in the shares, amounting to a 65% increase was coupled by revenue which was up about 400%, and earnings, which were up even more than that. This share dilution is certainly acceptable relative to the other financial results.

Looking at the 'free cash flow' we can see an acceptable but not terribly exciting picture. CMG had a negative $(56) million in free cash flow in 2004, improved to a negative $(6) million in 2005, then positive $6 million in 2006 and $3 million in the TTM. You can see that the free cash flow is being consumed by the large increase in capital spending. However, the company is free cash flow positive.

During the big tech bubble in 2001, many high tech stocks had lots of cash from public offerings but never generated any money and instead consumed their available cash. This 'negative free cash flow' was called their burn rate. From my perspective, part of calling a stock 'healthy' and 'investable' requires it to be generating and not consuming its cash.

Finally, let's examine the balance sheet as provided by Morningstar. We can see that the company has $168 million in cash which by itself is more than adequate to cover both the $70.3 million in current liabilities and the $76.3 million in long-term liabilities combined. There aren't a lot of stocks out there that have that level of cash.

We can talk of the 'current ratio' which is the comparison between the total of the current assets (the cash and the other current assets combined) divided by the current liabilities. In this case, this works out to a ratio of $189/$70.3 = 2.69. Generally ratios above 1.5 or 2.0 are 'healthy'. At least that is my perspective as a quick check of the balance sheet allows. (remember I am also an amateur :))

What about some valuation numbers?

I am not really a value investor. But I do believe that valuation is something that all of us should be aware of. When we discover a great stock, valuation may be the key that let's us know whether we are 'early' or 'late' to arrive to the party :). I like to utilize the Yahoo "Key Statistics" for this purpose.

In Chipotle's case, the market cap is at the mid cap size at $4.57 billion. The trailing p/e is rich at 51.21. But more to determine how reasonable that p/e is in terms of growth expected, the PEG also comes in rich at 2.36 (5 yr expected). I prefer, if possible, to find stocks with PEG's between 1.0 and 1.5 or lower.

A couple of years ago I read a great article by Paul Sturm on SmartMoney.com explaining how a Price/Sales ratio may also help get a feel for valuation of a stock. I recommend this article to you highly. It is the company's Price/Sales ratio compared to similar companies that helps us assess whether this ratio is high or not.

According to the Fidelity.com eresearch website, Chipotle has a Price/Sales (TTM) ratio of 4.42, just under the industry average of 4.44. Thus valuation is reasonable from this perspective. In terms of profitability, at least as measured by the "Return on Equity", Chipotle is a bit light on this ratio with a value of 12.73% compared to the industry average of 15.80%.

Some other things I can glean off of Yahoo include outstanding shares which for this company is 32.91 million with a float of 31.42 million. Currently there are a good number of shares out short totaling 5.77 million as of 11/9/07, representing 40.60% of the float or 6.8 trading days of volume (the short ratio). I have arbitrarily set '3 days' as the limit of acceptable short interest. From my perspective, a ratio above 3, especially above 6 means there are a lot of investors who have sold lots of borrowed shares expecting a decline in the stock. If instead, we continue to have good results from CMG, we could be observing a short 'squeeze' . However, if these shorts 'know something we don't', well then we may well have an unraveling in process. However, I believe these short-sellers are simply betting against the 'valuation' of this stock with the high p/e and high PEG ratios. Just my hunch though. Generally a large short interest is bullish in my view.

Finally, we can see that no dividend is paid and no stock splits are reported in this relatively recent publicly offered stock.

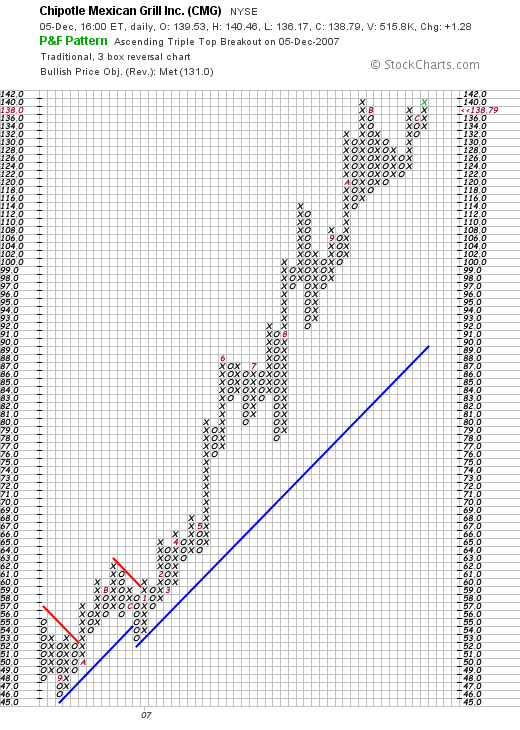

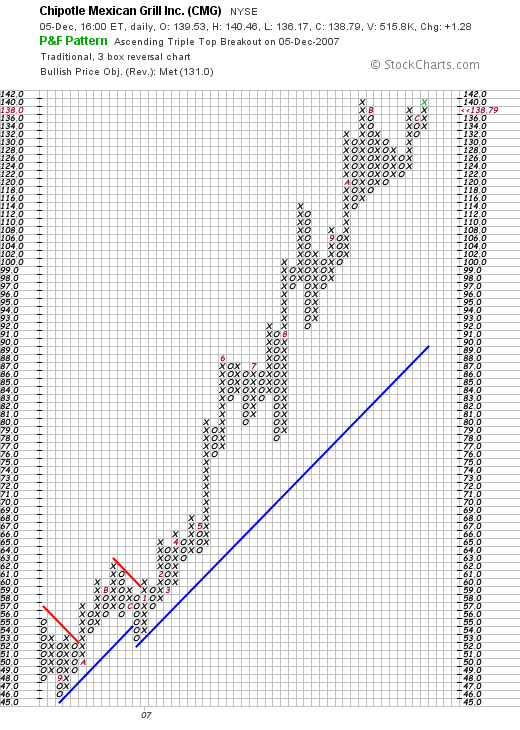

What does the chart look like?

Influenced by your dad's and my stock club, I have really grown to appreciate 'point and figure' charting. Examining the 'point and figure' chart on Chipotle (CMG) from StockCharts.com, we see an incredible picture of price appreciation strength.

Summary: What do I think?

Well Aaron, I think Chipotle is a great stock! They reported terrific earnings, have a great Morningstar.com report although free cash flow is a bit anemic, and the balance sheet is solid. Valuation is quite rich in terms of p/e and PEG. However, the Price/Sales and the Return on Equity appear to be reasonably priced relative to similar companies. Finally, the short interest is significant and the chart looks great. Putting all of this together,

CHIPOTLE (CMG) IS RATED A BUY

Now as you know, except as an occasional trade, my purchases are limited to my own stocks giving me a 'signal' to buy. If I did have a 'signal' this is indeed the kind of stock I would be buying.

I hope this answered your question! If you have any other questions, or if any of you readers have comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Podcast Website, where you can listen to me discussing many of the same stocks I write about here on the blog. Also, be sure and visit my Covestor Page where you can view how my real Trading Portfolio is performing and how it is doing relative to the indices and other investors! Also, be sure and visit my SocialPicks page where all of my stock picks are monitored over the past year.

Thanks so much for writing and visiting! All of you readers and visitors make blogging worthwhile for me. I am sure I am learning more as I write up all of these stocks and answer questions. I hope that all of you find it helpful as well! Have a great Thursday trading!

Bob

Posted by bobsadviceforstocks at 4:55 PM CST

|

Post Comment |

Permalink

Updated: Wednesday, 5 December 2007 8:34 PM CST

Commscope (CTV) "Trading Transparency"

Hello Friends! A quick update on my Commscope (CTV) purchase. The stock really seemed to be out of steam today and with this oversized purchase sitting in my portfolio, I decided to sell 1/2 of the position, 300 shares, which I sold at $45.86. This was a loss of $(.51)/share or (1.1)% since purchase.

I am still learning.

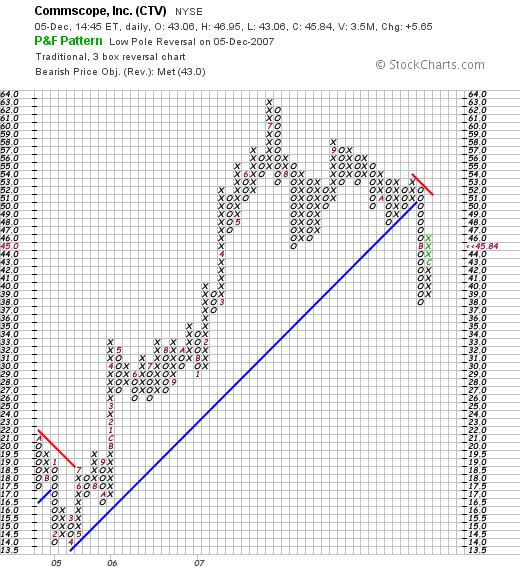

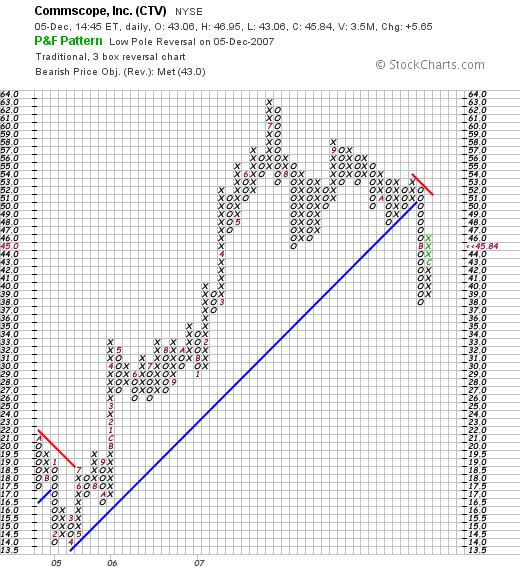

In retrospect the biggest weakness in the Commscope purchase is not about the fundamentals which still look strong. It is just technically, the stock is fighting for support, so to speak, needing to move higher to confirm the resumption of a bullish move to the upside. Take a look at the "point & figure" chart from StockCharts.com:

Quick confession. I didn't look at the chart before making this trade. Last time I do THAT. The stock price appears to have broken down in October at about the $51 level. A good move higher above that level would be required to establish a reliable challenge to this change in price momentum. Anyhow, that's my amateur assessment of the situation.

I have left 1/2 of my 600 shares of CTV. And unless the stock breaks down further, will try to ride this portion higher as I did with my Bolt (BTJ) shares. I am still learning and hope you are learning with me as well.

If you have any comments or questions, please leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Commscope (CTV) and Bolt (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of my 'adventure' blogging here I am trying to learn how to execute what I would call 'trades', that is, relatively large positions purchased for short period of time. This is in addition to my regular disciplined investment management strategy for the bulk of my holdings.

My last purchase of Bolt (BTJ) has been of mixed success after a resounding success with Graham (GHM). I sold 400 shares of my 800 share position of Bolt at a small loss; I held on to the rest of the shares until today when I decided to go ahead and sell the remaining shares. My 400 shares of Bolt (BTJ) were sold a few moments ago at an approximate price of $39.92. These shares were acquired 11/27/07, just a few days ago, at a price of $37.34. Thus I had a gain of $2.56/share or 6.9% on these shares.

BOLT (BTJ) IS RATED A BUY

I have discussed this purchase earlier. I do think the market is recognizing the value of Bolt (BTJ) and the stock is still rated a BUY. However, after looking at the list of top % gainers on the NYSE today, I saw a stock moving strongly higher in a strong market, that I have reviewed previously: Commscope (CTV). CTV is trading at $46.60, up $6.41 or 15.95% on the day. Trying to ride the momentum on a stock that has strong fundamentals and reasonable valuation, I purchased 600 shares at $46.37.

I recently wrote up Commscope on May 31, 2007, on Stock Picks Bob's Advice so I am familiar with the stock.

COMMSCOPE (CTV) IS RATED A BUY

Wish me luck! I am modifying my rigid portfolio management system to give me the flexibility of doing a 'trade' in my account. For the rest of my holdings I shall be keeping to my portfolio management system. Time will tell if these moves are reasonable and wise in the context of a portfolio investment discipline.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

I had an interesting note from Traci Scharf from

I had an interesting note from Traci Scharf from