Stock Picks Bob's Advice

Sunday, 16 December 2007

A Reader Writes "...write something about margin?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite parts of blogging is to receive comments and emails from readers who range from the novice to the expert. I often learn as much from their questions as they might hope to learn from what I write! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Recently, Thierry, an avid reader, wrote me a note:

"hello Bob

always a pleasure to read your comments

i wanted to ask you if you can write something about margin

how much are you charged when you are on margin ???????

is it better to try to trade a stock who give you dividends when you are on margin , to try to lower the cost of the margin ?????

sorry for my english ....i am better in french

have a good day

thierry

ps: i did not succeed at leaving a comment ...it does not work , or maybe i do not know how to use it .."

Let me see if I can address Thierry's questions and add anything to the question about margin.

To answer your question, my current margin interest rate (12/14/07) is 9.075% in my Fidelity account. However, margin interest levels on Fidelity vary according to the amount of margin debt in the account. For instance, if your margin or borrowed amount totals $100,000 to $499,999, the rate is currently listed at 8.075%. If you have much less margin (as I do) the rate for a margin balance of $0-$9,999 is currently at 10.075%.. I am also sure that these rates may well vary between brokerage houses.

Your question about dividends is astute. All things being equal it is indeed better to have a stock that pays a dividend to offset the interest charges being accrued by being on margin. But even more important is the wisdom of buying a stock that will appreciate more than the next stock, regardless of dividend status. So in reality, the dividend issue is simply not as important as the price performance of the underlying stock itself.

While I have utilized margin in my own accounts, my goal remains to eliminate this debt which only magnifies the volatility of my own account.

A good explanation of margin comes from the SEC itself in this

website:

"Let's say you buy a stock for $50 and the price of the stock rises to $75. If you bought the stock in a cash account and paid for it in full, you'll earn a 50 percent return on your investment. But if you bought the stock on margin – paying $25 in cash and borrowing $25 from your broker – you'll earn a 100 percent return on the money you invested. Of course, you'll still owe your firm $25 plus interest.

The downside to using margin is that if the stock price decreases, substantial losses can mount quickly. For example, let's say the stock you bought for $50 falls to $25. If you fully paid for the stock, you'll lose 50 percent of your money. But if you bought on margin, you'll lose 100 percent, and you still must come up with the interest you owe on the loan.

In volatile markets, investors who put up an initial margin payment for a stock may, from time to time, be required to provide additional cash if the price of the stock falls. Some investors have been shocked to find out that the brokerage firm has the right to sell their securities that were bought on margin – without any notification and potentially at a substantial loss to the investor. If your broker sells your stock after the price has plummeted, then you've lost out on the chance to recoup your losses if the market bounces back."

I hope that answers you question! If not, please feel free to leave additional comments/questions. Have a great week trading everyone!

Bob

Posted by bobsadviceforstocks at 1:08 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 16 December 2007 5:29 PM CST

Saturday, 15 December 2007

"Looking Back One Year" A review of stock picks from the week of June 12, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Thank goodness for the weekend! We have certainly had a volatile week or two! We have had so many different forces acting upon the market that it is difficult to know which way to turn. Early in the week we had the American stock market moving higher on the news of the Fed injecting liquidity to ease some of the financial challenges facing the economy. But then later in the week we found ourselves faces with inflation data suggesting that the Fed was indeed caught between a rock and a hard place trying to ease liquidity issues without fueling the fires of inflation.

In the midst of all this, I foolishly thought I could do a few 'day-trades'. I am still learning, and still an amateur :). Fortunately, I had the discipline to quickly close out these trades before they did any significant damage to my account. When I write that I am an amateur investor, I think I have convinced all of you that I am honest!

Anyhow, it is the weekend and no use dwelling on things like that. Let's do what I like to do on the weekend which is to review past stock selections from the blog. I have been going a week ahead at a time from a period about a year-and-a-half ago. (This started out as a year-ago review, but after missing a week here and a week there....well you get the picture!)

Last weekend I took a look at the week of June 5, 2006 here on the blog. Let's move ahead a week and examine the week of June 12, 2006, which, fortunately I did review a stock!

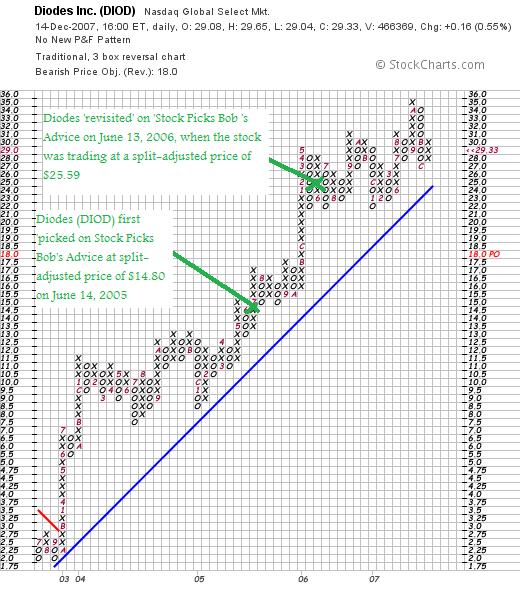

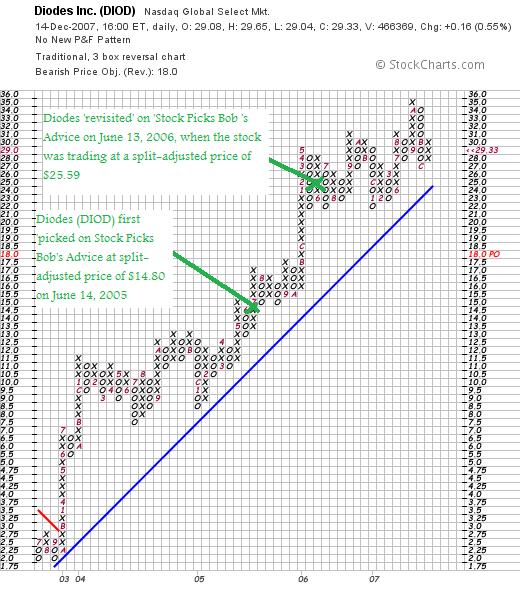

On June 13, 2006, I posted Diodes (DIOD) on Stock Picks Bob's Advice when the stock was trading at $38.39. This was the second post for me of Diodes, which was first 'picked' on this blog at $33.30/share on June 14, 2005. The stock has split 3:2 on December 1, 2005, and again 3:2 on July 31, 2007, making my first pick in 2005 having an effective pick price of $33.30 x 2/3 x 2/3 = $14.80 and my second pick in June, 2006, having an effective price of $38.39 x 2/3 = $25.59.

On June 13, 2006, I posted Diodes (DIOD) on Stock Picks Bob's Advice when the stock was trading at $38.39. This was the second post for me of Diodes, which was first 'picked' on this blog at $33.30/share on June 14, 2005. The stock has split 3:2 on December 1, 2005, and again 3:2 on July 31, 2007, making my first pick in 2005 having an effective pick price of $33.30 x 2/3 x 2/3 = $14.80 and my second pick in June, 2006, having an effective price of $38.39 x 2/3 = $25.59.

Diodes (DIOD) closed at $29.33 on December 14, 2007, representing a gain of $3.74 or 14.6% since my 'pick' last year and a gain of $14.53 or 98.2% since my first 'pick' in 2005. I do not currently own any shares of Diodes (DIOD) nor do I own any options on this stock.

Let's take a closer look at this company and see if it still deserves consideration and a spot on my blog.

DIODES (DIOD) IS RATED A BUY

Since we were discussing the price and appreciation of this stock,

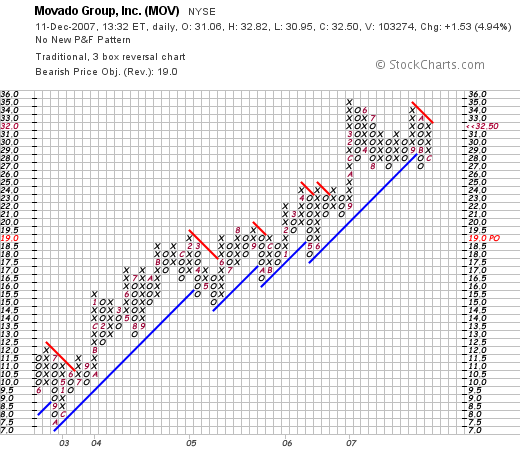

What does the chart look like?

Looking at the "point & figure" chart on DIOD from StockCharts.com, we can see an impressively steady appreciation in this stock from a low of $2.00 in September, 2003, to the recent high at $35 in October, 2007.

What does this company do?

According to the Yahoo "Profile" on DIOD, the company

"...and its subsidiaries engage in the manufacture and distribution of standard semiconductor products to manufacturers in the consumer  electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

How did they do in the latest quarter?

On November 1, 2007, Diodes (DIOD) reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, DIOD reported:

-

- Revenues increased 13.7 percent year-over-year and 9.3 percent sequentially to a record $105.3 million

- Gross profit margin increased 50 basis points sequentially to 32.4 percent

- Net income increased 26.1 percent year-over-year to a record $16.1 million

- Adjusted net income increased to a record $17.1 million, or $0.40 per share, up from $14.2 million, or $0.33 per share on a stock split-adjusted basis, in the third quarter of 2006

This was a solid report! In addition, on December 12, 2007, Diodes raised guidance for the 4th quarter.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on DIOD, we can see what to me really appears to be a beautiful report. Revenue has steadily increased with $115.8 million reported in 2002 climbing to $343.3 million in 2006 and $388.0 million in the trailing twelve months (TTM). Earnings have increased steadily from $.20/share in 2002 to $1.16/share in 2006 and $1.34/share in the TTM. Total shares are up a bit more than a third during the period in which revenue more than tripled and earnings more than quintupled. This is acceptable.

Free cash flow which was a negative $(5) million in 2004 increased to $28 million in 2005 and $26 million in 2006 and the TTM.

The balance sheet is solid with $45 million in cash and $475 million in other current assets, more than enough to cover both the $83.7 million in current liabilities and the $249.5 million in long-term liabilities. The current ratio works out to approximately 6. (over 1.25 is adquate).

What about valuation?

Looking at the Yahoo "Key Statistics" on DIOD, we see that this is a small cap stock with a market capitalization of $1.18 billion. The trailing p/e is a very reasonable 21.73 with a forward p/e (fye 31-Dec 08) of 16.03. The PEG (5 yr expected) works out to a nice 1.06.

Using the Fidelity.com eresearch website, we can see that this company has a Price/Sales (TTM) of 2.98 compared to the industry average of 4.17. The company is also more 'profitable' than its peers (Fidelity) as measured by the Return on Equity (TTM) ratio which works out to 17.41% for DIOD compared to the industry average of 15.10%.

Finishing up with Yahoo, we can see that there are 40.07 million shares outstanding and the float is 30.62 million. As of 11/27/07, there were 5.88 million shares out short representing 14 trading days of volume or 15.10% of the float. Using my own '3 day rule' for short interest, this appears significant and could be setting the stock up for a short squeeze should good news continue to be announced.

No dividends are paid and as already noted, the last stock split was a 3:2 split on July 31, 2007

Summary: What do I think?

Well, I really like this stock. Perhaps the only possible weakness might be a potential cyclical slowdown in semiconductor stocks, but even this appears remote with the company signalling strong results by raising guidance for the upcoming quarter. Going through some of the things I have just presented, the latest quarter was strong, the longer-term results are gorgeous with steady revenue and earnings growth, positive free cash flow, and a solid balance sheet. Valuation is excellent with a p/e just over 20, a PEG just over 1.0, a Price/Sales ratio low for its industry, and a Return on Equity high for the industry. The chart is gorgeous, and there are lots of naysayers out there who represent a large short interest on the stock.

I don't really like the overall tone of the market. But I like this stock a lot!

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I cannot respond to every email I receive, but I do read them all and try to respond to comments when posted.

If you get a chance, try to visit some of my related intenet sites: my Covestor Page where Covestor.com reviews my actual trading portfolio and compares it to other investors and how I am doing relative to the S&P; my SocialPicks Page where SocialPicks evaluates my stock picks from the past 12 months, my Podcast Page where I have been podcasting on many of the same stocks I write about on this blog.

Finally, if you are willing to take additional risks and are aware of the potential of loss, check out Prosper.com where if you sign up and initiate a loan both of us receive $25 credit. (Talking about win-win!). But be sure to take into consideration the high risk of loss on non-secured loans, be sure and spread out your loans to reduce that risk, and consider emphasizing higher-rated borrowers in your lending plans. That being said, it is a fascinating website even if you don't end up participating.

I hope you all have a wonderful weekend and a very wonderful Holiday Season. The best gift we can receive is not of the financial type at all. Remember to spend time with family, appreciate your good health if you are fortunate to enjoy good health, and be considerate of others who have less than you--whether it be of the financial or non-material type.

Peace.

Bob

Thursday, 13 December 2007

A Reader Writes "Stick to what you know."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I received an excellent comment today from another reader named 'Bob' who gave me some excellent advice. I should say I am prepared to follow it.

He wrote:

"Bob,

Stick to what you know. Stop the trading sideline or you will go broke. Nobody wins at trading except the brokers. Anyway, you should have had a plan for FTK before you bought it. You must know your selling price before buying the stock. After buying it, put in the sell stop at your sell price and never lower it. FTK may still work out if the fundamentals are so sound. It's just bouncing off the 50 dma. If it's sound fundamentally eventually it will break through the resistance. If however, there are more sellers (because the fundamentals are not what they appear to be) then the stock will sink like a rock off the 50 dma touch. Keep up the good work but quit trading and start investing again.

Bob"

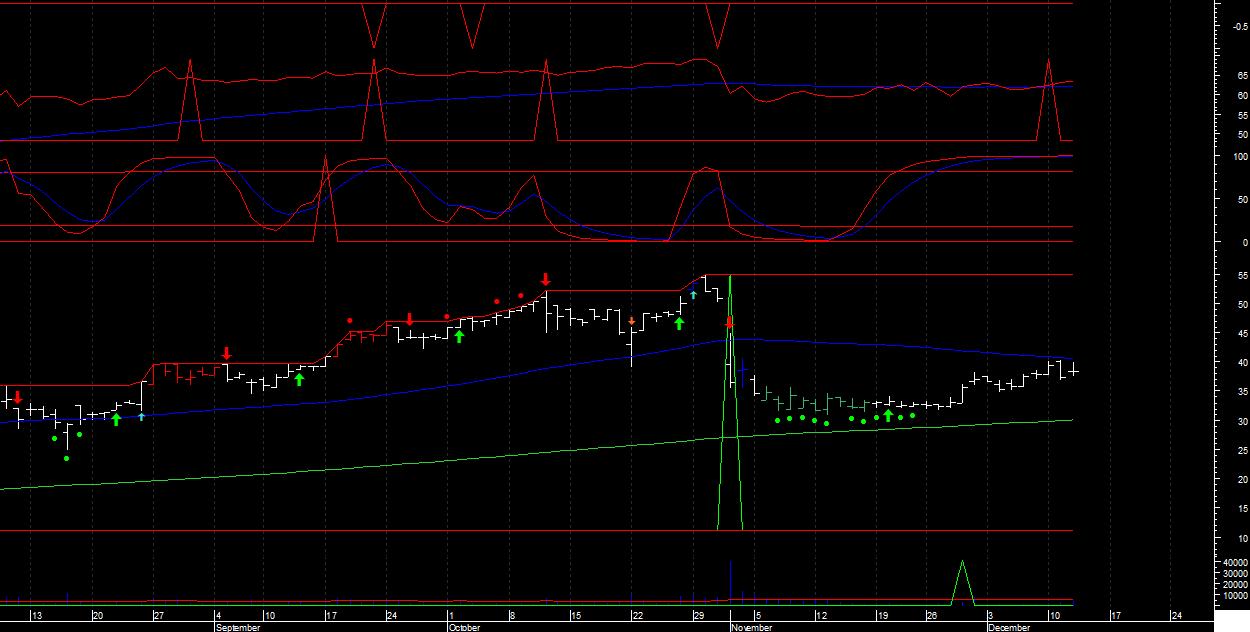

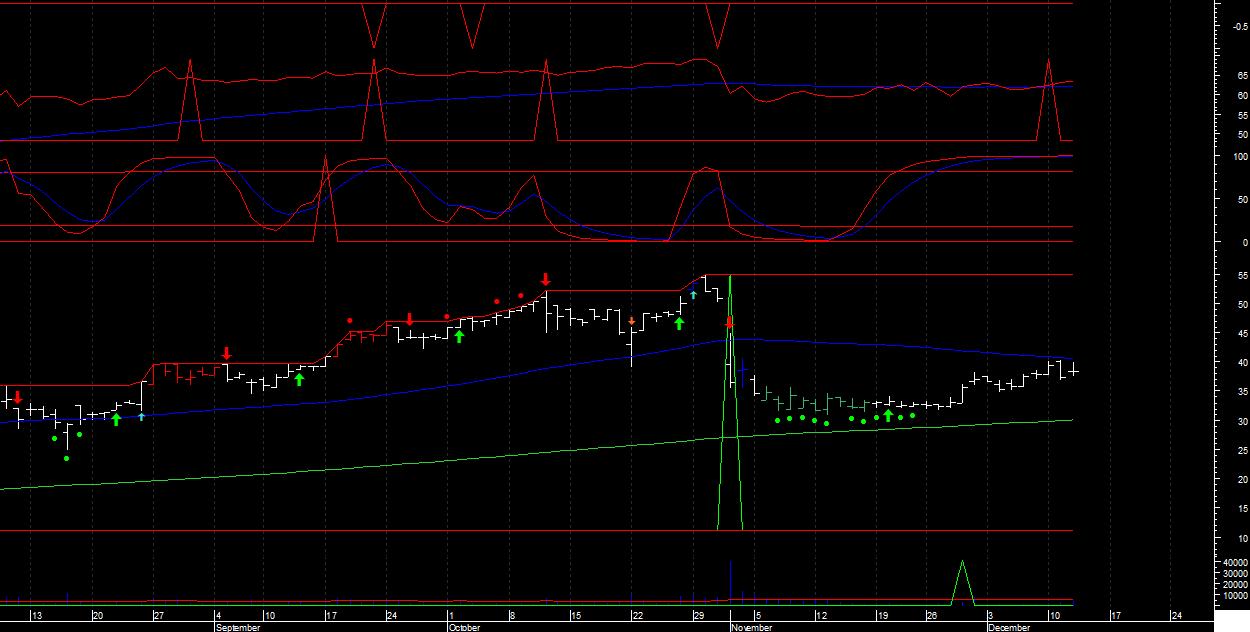

(I have enclosed his chart attached to his letter.)

Thank you Bob for writing! Indeed technical analysis may well be required to execute successful trades over the extremely short-term. He is also correct about putting in the sell point at the time of purchase. I didn't do that either.

More importantly, he is kind to suggest that I have done well with investing (even though I clearly haven't done well with 'trading'.)

Once again, I am convinced of this fact. That is that there are definitely different skills and knowledge that is required of a trader that may possibly be unnecessary as an investor. If you can do either, continue to do so successfully. And don't think that if you are better than average in one skill, that there should be anything automatic about doing the 'other'.

Anyhow, thanks for writing Bob. You are very helpful and confirm my own assessment of my trades.

Bob

Wednesday, 12 December 2007

Flotek "Trading Transparency--update #2"

Just a quick update from this amateur investor. I am still quite amateur at trading stocks rather than investing. The market does not appear to be impressed with the liquidity added by the Fed and the bounce this morning after yesterday's plunge appears to be exactly that....a bounce.

Anyhow, I just sold the 200 shares of my Flotek (FTK) that I didn't sell earlier at $38.20 that were purchased earlier today at $39.55. The trade didn't work out and with the market acting less than vigorous, and me with significant margin anyhow....well it all added up to a sell...and that's what I did.

If you have any comments, suggestions, encouragement, scorn, amusement, or reactions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Flotek (FTK) "Trading Transparency--update"

Hello Friends! Thanks again for visiting my blog! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With a significant margin load, I am a big talker about trades until the rubber hits the road as they say. Flotek was trading weakly this morning and I hedged my 'trade' by selling 400 of the 600 shares. And just as sure as night follows day, the stock seemed to turn around and move higher after my move. I still have 200 shares of this stock and am still optimistic about its fortunes. However, I am most concerned about limiting losses and the sale made sense....at least at that time.

I sold these 400 shares at $38.45 earlier. They had been purchased this morning at an average cost of about $39.55. Thus I had a loss on this purchase of $(1.10) or (2.8)% since purchase. I have a much lower tolerance for losses on these trades which are not part of my regular trading strategy.

Fortunately, the rest of my portfolio is moving higher as I write so I shall be able to absorb this small loss without much difficulty. It is difficult to trade stocks like this in a market as volatile as we are experiencing without getting 'whip-sawed'.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Flotek (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your investment advisers prior to making any investment decisions based on information on this website.

As part of my latest 'strategy' for making a trade alongside my tightly managed portfolio, I noted that Flotek (FTK) an old favorite of mine, was on the list of top % gainers of the AMEX today. With that in mind, I just purchased 600 shares at $39.55 in my trading account. As I write, FTK is trading at $39.24, up $1.97 or 5.29% on the day. So I am already a few cents underwater :(. Anyhow, let's see how this works in the account.

On October 31, 2007, FTK reported strong 3rd quarter earnings. Longer-term results are just as impressive and the chart (from StockChart.com) shows the recent pull-back in price, but the upward momentum appears intact.

FLOTEK (FTK) IS RATED A BUY

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:44 AM CST

|

Post Comment |

Permalink

Updated: Wednesday, 12 December 2007 10:53 AM CST

Tuesday, 11 December 2007

Bernanke--'Pushing On A String'

As cross-posted in TradingGoddess:

I join with other investors in disappointment of seeing a 1/4% drop in the Fed Discount Rate.

The market didn't like it and turned from about a 50 point gain in the Dow to a 220 point loss. And the market has another hour to trade.

But what can Bernanke do? Rate cuts drive the dollar down in value. And raise the risk of inflation as imported products climb in price.

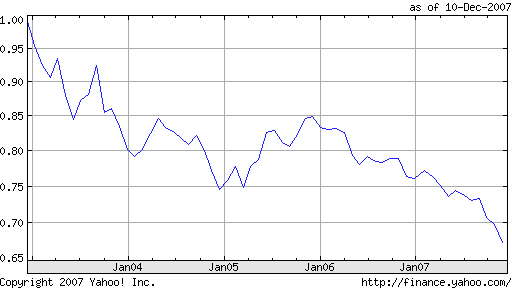

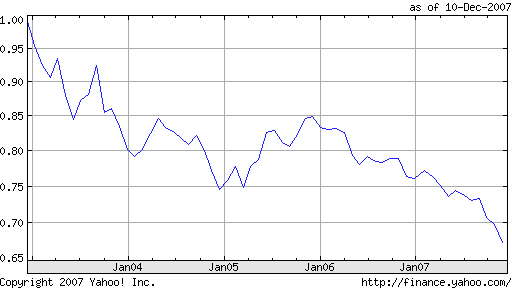

The interest rate supports the value of the dollar which has plunged approximately 44% against the Euro in the past 7 years under President Bush's leadership.

5-Yr $-Euro Chart

That means that in a global economy, the value of everything we own has been devalued by about 1/2. When we travel abroad, we can see the effect of the weak dollar when it takes $5 to buy a Coke in Italy.

With the subprime mortgage mess unraveling and the derivatives and hedge funds shenanigans continuing to come to light, our economy needs a stimulus like a rate cut. But if we fail to support the dollar, the Chinese are likely to resist continuing to fund our debt instead turning to Euro-backed securities and the OPEC folks are likely to once again consider pricing oil in Euros and not dollars.

I am greatly concerned for our economic vitality and prosperity.

We have unfortunately continued to be led by politicians who subscribe to the Grover Norquist pledge of 'no new taxes'. Why 'taxes are bad--aren't they?'

But can we continue to cut taxes and pour money and resources into military activity without paying the piper somehow? Should we really believe that tax cuts are essential to grow the economy when this endless printing of dollars in terms of an expanding budget deficit is a threat to our well-being.

Should we be concerned about the ever-growing disparity between the wealthy and the poor?

Even Henry Ford knew he needed to pay workers enough so they could buy a Model T.

We cannot depend solely on high-end retailers catering to the wealthy to sustain this economy.

Balancing the budget needs to be a national priority. Tax policy must not work to encourage the continued outsourcing of quality jobs overseas. Efforts to repeal the Estate Tax will only insure more of a continued Plutocracy in America with the wealthy getting richer and the poor poorer and out economy will suffer. Cuts to education will not help the poor rise up out of their economic morass.

This country has been headed in the wrong direction under this President and we are all paying the piper.

Bob

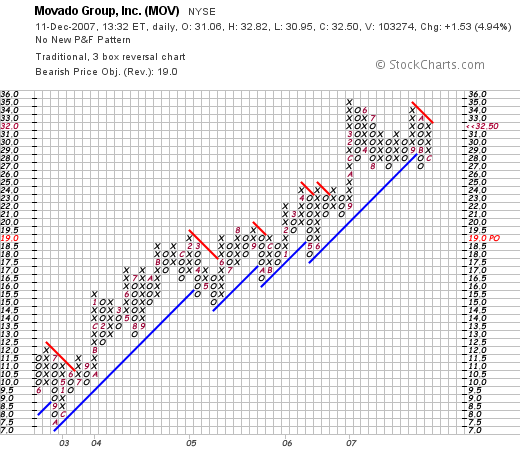

Abaxis (ABAX) and Movado Group (MOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I noticed that my Abaxis stock was closing in on my first targeted appreciation point--a 30% gain--and I sold 1/7th of my position or 30 out of my 210 shares at $36.74. This left me 180 shares in my trading account. I had purchased these shares just 6 weeks ago (!) at a cost basis of $28.29. Thus, I had a gain of $8.45 or 29.9% since purchase.

ABAXIS (ABAX) IS RATED A BUY

Since I was at 13 positions out of my potential of 20 position portfolio, this sale at a gain entitled me to add a new position to the account. Checking the list of top % gainers on the NYSE today I noticed that Movado Group (MOV) was an acceptable candidate for my account and purchased 210 shares at $32.09. At the moment, Movado (MOV) is trading at $32.49, up $1.52 or 4.91% on the day.

MOVADO GROUP (MOV) IS RATED A BUY

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Briefly, on December 6, 2007 (5 days ago) Movado reported what appears to me to be a very strong 3rd quarter earnings report. Net sales were up 8.3%, and that included a comparable store increase at the Movado boutique stores of 8.8%. Net income and earnings per share were also up nicely.

In addition, the company announced a 'share repurchase program', beat expectations and raised guidance. What else could an investor want?

Longer-term, the company has steadily raised revenue, has recently been growing its earnings, raised dividends, kepts its shares outstanding fairly stable, and has been reporting positive and increasing free cash flow and a solid balance sheet.

Valuation appears reasonable with a market cap of $846.56 million, a trailing p/e of 17.45, and a PEG ratio of 1.32.

The chart appears reasonably strong with the price under a small amount of pressure recently.

Anyhow, I now own shares in Movado Group (MOV). Wish me luck!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Have a great afternoon and a great week trading and investing.

Bob

Monday, 10 December 2007

A Reader Writes "Would you be willing to help out?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had an interesting note from Traci Scharf from Lunametrics who asked me very nicely if I could possibly share a request from her about website reviews. I don't usually do this kind of thing, but she was very polite and persistent---two traits that even a skeptic like myself finds hard to resist---and thus here is her request. I don't usually do this sort of thing, but here is her letter, and any of you are free to pursue this or not.

I had an interesting note from Traci Scharf from Lunametrics who asked me very nicely if I could possibly share a request from her about website reviews. I don't usually do this kind of thing, but she was very polite and persistent---two traits that even a skeptic like myself finds hard to resist---and thus here is her request. I don't usually do this sort of thing, but here is her letter, and any of you are free to pursue this or not.

Traci wrote:

"Bob,

Please pardon the out-of-the-blue e-mail. I stumbled onto your blog today (very cool!) and wanted to see if you could help me with something.

I'm doing some market research for a client and need to find a handful of people to give me (paid) feedback. I specifically need to find individuals who closely manage their stock portfolio based on technicals and fundamentals (revenue, market cap, ROE, EPS, etc) -- like you and people who probably subscribe to your blog!

I'm looking for five people who can spare a half hour of their time to give us feedback on our client's website. It takes about a half hour and we offer $50 compensation in return.

Would you be willing to help out? And / or: you are welcome to post this offer and my contact info on your blog (using my personal e-mail -- traci.m.scharf@gmail.com -- in order to keep my work account protected) if you are willing.

Since you don't know me from a hole in the wall, please know that I'm not selling anything and that I keep our user testers' names and contact information absolutely private.

Any help you can provide would be greatly appreciated!

Thanks,

-Traci

e-mail (work): scharf@lunametrics.com

e-mail (personal): traci.m.scharf@gmail.com"

Perhaps some of you can earn $50 on this. I don't like to advertise things for other people, but it seemed like a legitimate letter from a legitimate person. If you do participate, would you please let me know if you feel this letter doesn't belong on my blog.

Have a great evening and a great week ahead!

Bob

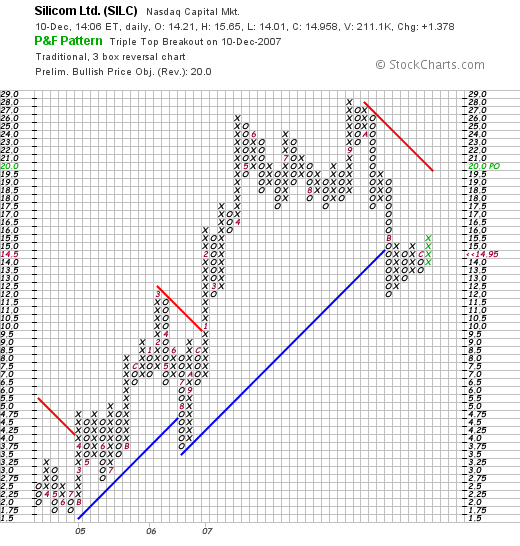

Silicom Ltd (SILC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is doing a little better today with the Dow up 77.07 and the NASDAQ ahead by 9.57. In addition, we have oil down at $87.55, down $(.73)/barrel. Not a huge rally, but a nice day nonetheless.

It is in this context that I thought I might find and write up a new stock this afternoon. I shall try to be briefer than usual but still cover the important points.

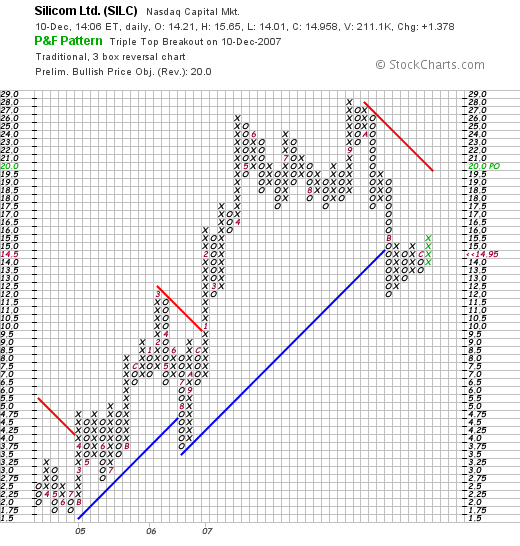

Silicom (SILC) made the list of top % gainers on the NASDAQ today and as I write is trading at $15.13, up $1.55 or 11.41% on the day. I do not own any shares nor do I have any options on this stock.

Silicom (SILC) made the list of top % gainers on the NASDAQ today and as I write is trading at $15.13, up $1.55 or 11.41% on the day. I do not own any shares nor do I have any options on this stock.

Let's take a closer look and I will explain why

SILICOM (SILC) IS RATED A BUY

First of all,

What exactly do they do?

According to the Yahoo "Profile" on SILC, the company

"...through its subsidiary, Silicom Connectivity Solutions, Inc., engages in the design, manufacture, marketing, and support of connectivity solutions for a range of servers and server-based systems in Israel, the United States, and internationally. It primarily manufactures server networking cards with and without bypass (Server Adapters), and legacy products, including connectivity solutions for portable personal computers and broadband Internet access products."

"...through its subsidiary, Silicom Connectivity Solutions, Inc., engages in the design, manufacture, marketing, and support of connectivity solutions for a range of servers and server-based systems in Israel, the United States, and internationally. It primarily manufactures server networking cards with and without bypass (Server Adapters), and legacy products, including connectivity solutions for portable personal computers and broadband Internet access products."

How did they do in the latest quarter?

On October 29, 2007, Silicom reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, revenues came in at $6.6 million, up 59% from the $4.2 million in the same quarter of 2006. Net income climbed 147% to $1.6 million or $.25/diluted share compared to $666,000 or $.12/diluted share for the 3rd quarter of 2006.

How about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on SILC, we can see that revenue has steadily grown since 2002 when the company reported $2.7 million in revenue. This increased more than five-fold to $16 million in 2006. Earnings have also imporved from a loss of $(.61)/share in 2002 to $(.30)/share in 2004, $.30/share in 2005 and $.49/share in 2006.

Outstanding shares which were at 4 million increased to 5 million in 2006. Free cash flow which was at $-0- in 2005, improved to $2 million in 2006.

The balance sheet, as reported on Morningstar, looks solid with $5.0 million in cash, plenty to cover both the $3.5 million in current liabilities and the $1.2 million in long-term liabilities. Calculating the current ratio, the company has a total of $13 million of current assets, which when compared to the current liabilities of $3.5 million works out to a ratio of 3.71--very healthy from my perspective.

What about some valuation numbers?

Checking Yahoo "Key Statistics" on SILC we can see that this stock is a micro cap stock with a market cap of only $96.44 million. The trailing p/e is a very reasonable (imho) 16.05 with a forward p/e of only 13.75. The PEG works out (5 yr expected) to a modest 0.93.

Examining the Fidelity.com eresearch website for valuation, we find that the Price/Sales (TTM) is a very reasonable 2.77 compared to the industry average of 7.66. In terms of profitability, SILC comes in a bit under the average in terms of "Return on Equity" TTM of 21.64% compared to the industry average of 26.70%.

Finishing up with the numbers from Yahoo, there are 6.49 million shares outstanding with only 4.45 million that float. As of 11/9/07, therewere 142,440 shares out short representing 3.1% of the float or 0.6 trading days of volume. No dividends are reported and no stock splits are recorded on Yahoo.

What about the chart?

Looking at the "point & figure" chart on Silicom from StockCharts.com, we can see that since July, 2004, when the stock was selling at as low as $1.70, the stock has appreciated strongly to a recent high of $28 in September, 2007. The stock recently sold off to a low of $12.00 in November, 2007. The stock is still welling below support levels and under resistance at around $19. Of all of the things I reviewed on this stock, the chart appears to be the weakest part of the equation. However, it is not enough to keep me from posting that "buy" assessment.

Summary: What do I think?

This is a really small company with a market capitalization under $100 million. However, the earnings results were very nice, the Morningstar report was solid, and valuation is very reasonable. The only thing keeping me back at all is the chart which is a bit less than encouraging--although recently the stock has been consolidating and moving higher.

Thanks again for visiting my blog! If you have any comments or questions, please be sure to leave them on the website or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Stock Picks Podcast Page where some of the many stocks I write about are presented in a radio show format. Other places to visit include my Covestor Page where the performance of my actual trading portfolio is tracked and compared to other participating investors, and my SocialPicks page where my stock picks from the past year are all reviewed and the results monitored.

If you are looking for a unique place to invest your money, consider exploring Prosper.com where you can join with other like-minded investors and lend money to individuals. These non-secured loans are quite high risk so please make sure you understand the risks involved before participating in this website.

Thanks again for visiting! Have a great week trading and investing!

Bob

Newer | Latest | Older

On

On

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.

Why Movado? And why now? Very simply, when I had my 'permission slip' to buy a new stock, I started scanning the lists of top % gainers. That includes stocks on the NYSE, NASDAQ, and AMEX. I was looking for a stock that met my criteria that was on those lists today! I eliminated stocks under $10--I get shaken out of those too quickly, and came across Movado that seemed to fit the bill.