Stock Picks Bob's Advice

Monday, 27 October 2008

Haemonetics (HAE) and BE Aerospace (BEAV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website.

I must be a glutton for punishment. After having sold two of my positions earlier today, I started looking at the lists of top % gainers to see if I could find any new candidates for the portfolio, utilizing my new reduced investment size strategy I discussed in the previous entry.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

Briefly, Haemonetics today reported 2nd quarter results for the quarter ended September 27, 2008. Revenue climbed 20% to $145.9 million, and earnings came in at $14.8 million or $.57/share up from $11.2 million or $.42/share last year. This exceeded expectations of profit of $.52/share on revenue of $136.3 million according to analysts polled by Thomson Reuters.

The company also went ahead and raised guidance for fiscal 2009 to $2.38 to $2.44/share, up from prior guidance of $2.33 to $2.43/share. They also expect revenue growth of 12 to 14% from prior range of 10 to 13% expected revenue increases.

The "5-Yr Restated" financials from Morningstar.com appear solid.

The stock looked good to me and I added Haemonetics to my portfolio.

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

With BEAV at $9.74, this would represent a loss of $(1.45) or (13)% since purchase. This is still above my (16)% loss limit with these last five holdings but just barely above a sale.

What drove the stock to the top % gainers list (at least when I was looking at it) was the announcement of 3rd quarter results today with revenue climbing 37% to $587.8 million. Net income came in at $51.8 million or $.54/share up from $44.5 million or $.48/share last year. Analysts had been expecting earnings of $.53/share, so they exceeded analysts expectations.

The Morningstar.com "5-Yr Restated" financials on BEAV appear relatively solid.

It was my hunch that purchasing shares of an airplane interiors manufacturer might well be the benefit from the declining oil price. I hope that wasn't a stretch!

Anyhow, that brings you up to date. I shall continue to do the impossible, swim upstream against this bear market like the most dedicated of Salmon.

Thanks so much for stopping by and sharing with me my own investing adventure. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Refining My Investment Strategy in the Face of a Bear Market

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on infrmation on this website.

One of my biggest goals from blogging about investing and sharing with all of you my decisions and trades is to develop a coherent approach to selecting stocks and managing my holdings in a fashion that preserves my gains, limits my losses, and adjusts my exposure to equities depending on the market environment.

If you have read some of my latest posts, you will notice that my approach has struggled in this awful market environment. My investment strategy is to vary my holdings between 5 and 20 positions and to use sales on gains as signal to buy new positions (except if I am at my maximum of 20), and to use sales on losses as a signal of a poor market environment and simply to 'sit on my hands' with the proceeds of these sales unless I am at the minimum of 5 positions in which case, a 'buy' signal would be generated to keep me at my minimum equities exposure.

It is in this 'under 5 positions' environment that my system has apparently broken down. To take serial (8)% losses only to replace these positions with new holdings that quickly accrue another loss is to compound my poor performance. And I have been busy compounding :(.

So as of today I have implemented two changes that I would like to present and look forward to some of your comments.

As I have alluded to recently, when I am at 6-20 positions, no changes will be made. However, at 5 or less, I shall first of all be more tolerant of losses. That is, while normally I sell holdings after an initial purchase at an (8)% loss, in this minimal position mode, I shall increase my tolerance to losses to (16)%. This is necessary due to the increased volatility of the entire market where the Dow routinely swings hundreds of points each trading day.

The other refinement is regarding the size of positions. Up to this point, I really haven't had a consistent approach. Position sizing will affect all of my purchases whether below 5 or approaching 20.

Again, I mentioned earlier that I would buy a '1/2 position' in the under 5 environment. To make this more exact, I will drop my fascination with buying shares divisible by 7 (to prepare me for my 1/7th sale at a gain), but rather if buying a holding to get my portfolio back to the 5 position minimum, I will determine the actual average size of my remaining holdings, and then purchase enough shares of the new position to equal 1/2 of that average.

After getting back to 5 positions, assuming an appreciation of one of my holdings to my partial sale at a gain (30% appreciation over the initial purchase price) I shall continue to sell 1/7th of my holding, and then add a position equal to the average size of my existing holdings.

This will deal with two situations. First in a poor environment as holdings are sold sequentially at less than 5 positions, I shall continue to add new positions that are smaller in size each time---equalling in size to 1/2 of the average of the current holdings.

As the market improves in tone, I shall add new positions equal to the average holding size, which assuming market improvements, will also increase in size over time.

Will this work? I am not sure. However, it has to be better than my current approach. Rules are no guarantees to success, but thinking about trading rules ahead of time is more likely to provide me guidance better than 'from the hip' trading decisions.

I will keep you posted. Meanwhile, if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Covance (CVD) and Imperial Oil (IMO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Clearly my investment approach shows the greatest weakness on severe contractions and large degrees of volatility in the market. While trying to step aside and then re-enter equities, I feel like I have been getting my face slammed in a revolving door over and over again.

I may have gotten smacked once more :(.

As I discussed previously, I have adjusted my own trading system to reduce the number of trades in a very down market by increasing my loss tolerance to (16)% losses on my last five positions.

Even this apparently is not enough.

Earlier today I sold two of my five remaining positions. I sold my 102 shares of Covance (CVD), which has been behaving particularly weak this past week, at $48.23/share. These shares had been acquired 4/9/07 at a cost basis per share of $62.61. Thus, I had managed to incur a loss of $(14.38)/share or (23)% since purchase. Out they went.

I also unloaded my recently acquired shares of Imperial Oil (IMO) at $29.31. These shares were just acquired 10/20/08 at a cost basis per share of $35.17. Thus, I had quickly incurred a loss of $(5.86)/share or (16.7)% since purchase.

Yikes.

So I am now down to three positions: Graham (GHM), National Oilwell Varco (NOV), and Rollins (ROL). I shall try to hang onto those unless they too incur a (16)% loss.

At least for the time being.

And on any new positions, I shall try to limit their size to 1/2 of the average size of the remaining positions. In this way, my committments to the market should diminish if I tend to be 'whip-sawed' frequently into buying and then selling positions as the market gyrates.

Will this work?

I frankly don't know. My brilliance is rapidly losing its shine. My performance is moving right to the mean and I am ready for this bear market to be over. (Even though that may take months or years!)

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 26 October 2008

Intuitive Surgical (ISRG) "A Personal Experience with Prostate Cancer"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I haven't been blogging for a few days. I haven't even been paying attention to my portfolio. In fact, I have even missed sale points for some of my own stocks (especially Covance (CVD)) which passed a sale point on the downside. I can attend to that next week.

But what I want to share with you this afternoon is not about investing in any particular fashion, but rather my own personal journey with cancer, in particular Prostate Cancer that has entered my life and is an issue that I am now confronting and dealing with. As with my financial advice, my thoughts on prostate cancer should be considered my own reflections and not medical advice for you. Please consult with your medical professionals for that advice and information.

Back on April 30, 2004, more than four years ago, I wrote up an entry about Intuitive Surgical (ISRG), a stock pick which turned out to be a great pick for this blog. I do not own any shares of ISRG at this time, nor do I own any options.

Back on April 30, 2004, more than four years ago, I wrote up an entry about Intuitive Surgical (ISRG), a stock pick which turned out to be a great pick for this blog. I do not own any shares of ISRG at this time, nor do I own any options.

But last week, I became a customer of Intuitive Surgical (ISRG), undergoing a robotic prostatectomy at St. Mary's Hospital affiliated with Mayo Clinic in Rochester, Minnesota.

I will not offer an opinion on the investment opportunity that Intuitive presents. In the rocky environment of this stock market, any investment is suspect, and in our difficult economic times of more people possibly losing jobs, and losing their healthcare insurance, there will be increasing pressures on hospitals that may be looking to forego expensive equipmnent purchases regardless of the value of these purchases to patient care

I am lucky that I have access to as amazing an institution as Mayo.

I am lucky that I have access to as amazing an institution as Mayo.

This year I became part of an frightening statistic. In the United States, 186,320 cases are estimated to be diagnosed in 2008, and 28,660 men will die of this disease.

Two years ago, at the age of 52, I had a PSA test (generally recommended to be a routine part of the examination after the age of 50), which was slightly elevated at over 3.0. Repeat testing this year came in at 5.3 and it wasn't as much as the absolute level (which was important), but what is referred to as the PSA velocity which raised some alarms in my own physician. My digital examination was normal, I was essentially asymptomatic, but the laboratory screening test raised concerns that needed to be addressed.

An appointment was made with my Urologist, and the decison was made, as it is made each day in so many doctor's offices, to obtain an ultrasound exam with biopsy to obtain some actual prostate tissue to determine whether I had prostate cancer or not.

Needless to say THAT wasn't much fun. But it wasn't that bad either. A total of 12 biopsies were taken that afternoon back three months ago. A few days later, my Urologist met with me to let me know that two of the twelve had come back positive. In other words, I had cancer of the prostate.

It appeared that it had been discovered relatively early, with only 10% of the two positive biopsies showing cancerous changes. Technically, I was told it was a Gleason 3+3=6, as the pathologist reported.

Faced with a diagnosis of Prostate Cancer, a patient has three basic options. For older patients, watchful waiting may be suggested. Since prostate cancer is a relatively slow-growing cancer (as I undertand it), patients in their 70's or 80's may choose to simply do nothing or even skip routine testing.

Treatment is essentially divided into two basic approaches: radiation treatment and surgery. Each of these is also broken down into different strategies: radiation treatment through either external beam or by implantation of radioactive particles; likewise surgery can be broken down into open radical prostatectomy and the newer robotic surgery on the Intuitive Surgical (ISRG) machine.

The best I could tell there is no definitive 'winner' between the two treatment modalities. The figure I was given was an '85% chance of being cancer-free' at ten years with either approach. Complications were somewhat different.

I chose surgery. There wasn't really a right or wrong decision. However, at my younger age for prostate cancer (54), my life expectancy was greater than a 70 year old patient, and I intended to be around to at least see some of my current stock investments recover :). My own tumor was confined to the prostate gland and the margins were clear. The grade was upped to 4+3=7 so it was a bit more serious than the biopsy suggested. All lymph nodes checked were negative. So things were as good as could possibly be expected.

Fortunately I had access to the robotic surgery with the Intuitive Surgical unit at Mayo. I do not know if the results overall will provide me with longer longevity and success but the morbidity of the operation with the laparascopic robotic procedure is less with reduced bleeding and quicker recovery reported.

My own surgery was on Wednesday, just four days ago. I am sitting on my couch in my own home blogging this entry that I felt important to write. My catheter should come out this Wednesday. I am staying off work for the month but hope to gradually continue to up my activity. The pain was worse than I expected with all of the hype about robotic surgery but I expect that my ill effects would have been greater if I had chosen the open radical approach.

Wish me well. I shall try to keep you all posted of my continued progress.

For once I have been focusing on something other than the Dow or the Nasdaq. If you are over 50 or know any men 50 or older, please make sure they get their PSA tested. It might just save their lives. I hope it saved mine.

I shall get back to talking about stocks soon. I have missed some sale points, my performance is dropping back to the mean, but it just doesn't seem to matter that much anyhow.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 20 October 2008

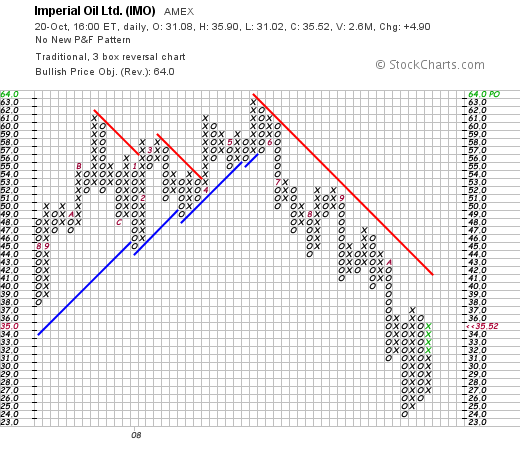

Imperial Oil LMT (IMO) "Trading Transparency"

Hello Friends! Just a brief note to let all of you know that I purchased 140 shares of Imperial Oil (IMO) at $35.115 to get me up to the 5 position minimum that I utilize in my trading account.

Imperial is the Canadian subsidiary of ExxonMobil (XOM) which owns about 60% of the stock.

Imperial is the Canadian subsidiary of ExxonMobil (XOM) which owns about 60% of the stock.

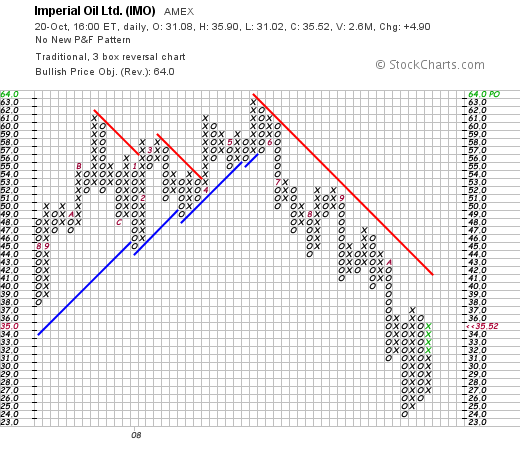

The company is traded on the AMEX where it made the list of top % gainers closing at $35.52, up $4.90 or 16% on the day, a few cents higher than my purchase.

Basically, the 2nd quarter results for Imperial were strong, the Morningstar.com looked nice, and the stock is trading at a deep discount to levels it was at earlier this year.

The company has been growing its revenue, increasing its earnings, and raising its dividend regularly while maintaining a relatively stable outstanding number of shares. Free cash flow is positive and growing and the balance sheet, when we check the 10 year balance sheet from Morningstar.com, appears to be satisfactory.

Certainly, if we look at the "point & figure" chart from StockCharts.com, we can see that the stock is trading well off its highs near $63 earlier this year, and has come down along with all of the oil-related stocks.

Oil and commodity stocks helped move the market higher today as investors were expecting that the near-term bottom in the price of oil might be near. As this news story reports:

"Crude's rise came as investors appeared all but assured that OPEC will announce a sizable production cut in an effort to keep oil prices from falling too fast. Chakib Khelil, president of the Organization of the Petroleum Exporting Countries, said Sunday that members plan to announce a "substantial" output cut at a meeting beginning Friday in Vienna.

Light, sweet crude for November delivery rose $2.40 to settle at $74.25 a barrel on the New York Mercantile Exchange. The contract Friday gained $1.53 to settle at $71.38.

Crude has fallen about 50 percent from its July 11 high of $147.27."

Also driving energy stocks higher was an Oppenheimer upgrade this morning of a lot of oil-related stocks that helped this sector throughout the day.

As reported:

"Oppenheimer upgraded a number of oil and gas companies this morning, saying they expect industry consolidation in the next 12 months

Upgraded to Outperform:

Anadarko Petroleum Corp. (NYSE: APC)

Apache Corp. (NYSE: APA)

BP plc (NYSE: BP)

Cabot Oil & Gas Corp. (NYSE: COG)

Chevron Corp. (NYSE: CVX)

Comstock Resources Inc. (NYSE: CRK)

ConocoPhillips (NYSE: COP)

Devon Energy Corporation (NYSE: DVN)

EOG Resources, Inc. (NYSE: EOG)

Exxon Mobil Corp. (NYSE: XOM)

Frontier Oil Corp. (NYSE: FTO)

Hess Corporation (NYSE: HES)

Murphy Oil Corp. (NYSE: MUR)

Noble Energy, Inc. (NYSE: NBL)

Pioneer Natural Resources Co. (NYSE: PXD)

Royal Dutch Shell (NYSE: RDS.a)

Sunoco Inc. (NYSE: SUN)

Tesoro Corporation (NYSE: TSO)

Valero Energy Corp. (NYSE: VLO)

XTO Energy Inc. (NYSE: XTO)"

Now Imperial (IMO) was not on the list, nor was National Oilwell Varco (NOV) nor Graham (GHM). But these stocks moved higher 'in sympathy' with the rest of the stocks upgraded and as Paul Harvey would say,'that's the rest of the story'!

When choosing stocks, I am certainly looking for momentum, and oil and financial stocks were up and down the list today! Maybe I should have purchased some financial shares, but they don't really fit my revenue and earnings momentum and while they may be great value plays, I am not really oriented to those selections and usually have little patience or the stomach for buying stocks as deeply discounted and 'banged up' as these.

In any case, I wanted to get you caught up on my own activity in my trading account. Good-luck to all of you in this stock market!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Saturday, 18 October 2008

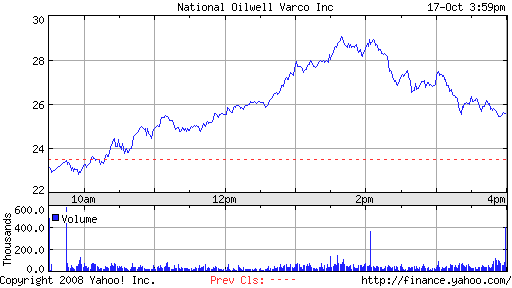

National Oilwell Varco (NOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the market moving higher (at least temporarily yesterday), I visited the lists of top % gainers and since I was under my 5-position minimum, I had a 'permission slip' to be buying a new position, I was looking for a possible new holding.

With the market moving higher (at least temporarily yesterday), I visited the lists of top % gainers and since I was under my 5-position minimum, I had a 'permission slip' to be buying a new position, I was looking for a possible new holding.

Seeing National Oilwell Varco (NOV), an old favorite of mine, moving ahead strongly, I purchased 210 shares at $28.796, near the high for the day.the company's latest quarterly report was strong, and their Morningstar.com "5-Yr Restated Financials" are also impressive.

Even I wasn't prepared for the same-day price volatility in this stock.

Reviewing the Yahoo Finance Chart for NOV for 10/17/08, you can see the wide price swing of this company yesterday as it swung higher and then dipped in an almost as strong fashion.

National Oilwell Varco (NOV) actually closed at $25.58, up $2.05 or 8.71% on the day. But my performance was obviously rather less than that. Based on that purchase price of $28.796, I already have a loss of $(3.216) or (11.2)%.

Should I be selling at this point? Somehow I don't think so. Maybe this amateur is learning something. My entire strategy is based on avoiding compounding my losses by stepping away from the market when times are bad. So called 'sitting on my hands'. However, I am getting clobbered in the extreme portion of my own strategy, my insistence on keeping myself at 5 positions is allowing me to compound my losses, buying stocks in sequence after they hit sales points on losses, instead of avoiding reinvesting in a declining market.

Something is very wrong with my approach!

Two proposed changes. In the bottom five stocks of my range, that is when I am down to five or less holdings, I shall continue to sell portions at the same intervals as they appreciate. In addition, on the downside I shall be doubling my loss tolerance to (16)%.

Next change. When I am adding stocks to get to my '5 minimum' holding, I shall decrease the size of my purchases. That is, if my 'average' holding is approximately $5,000, then my purchases that I make 'just to get back to 5' shall be 1/2 that size, or $2,500, for example.

These holdings shall still be good as indicators for my portfolio, but they haven't really shown that the market is truly ready for a new holding.

Will this help?

I don't really know. This is all new territory for me. For us all. And while my overall performance has been above the S&P for the last 18 months, I am quickly declining to match the mean, if I haven't done so already.

Thanks for bearing with me.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 9:18 AM CDT

|

Post Comment |

Permalink

Updated: Saturday, 18 October 2008 9:19 AM CDT

Thursday, 16 October 2008

Rollins (ROL) "Trading Transparency"

I keep looking for the right picture to describe my own feeling of being whipped around in this market. Would a bucking bronco from National Geographic explain it properly?

I keep looking for the right picture to describe my own feeling of being whipped around in this market. Would a bucking bronco from National Geographic explain it properly?

This is far worse than any roller coaster I have ever been on. The daily gyrations are enough to give anyone motion sickness. The lurches and dips are a challenge for a professional investor, let alone an amateur to deal with in any rational fashion.

After being led to dump shares in holdings on losses, the market took me for another ride moving higher this afternoon, the Dow closing at 8,979.26, up 401.35, and the Nasdaq finishing the day at 1,717.71.

Noticing that the market was lurching in an upwards direction, I took a look at the lists of top % gainers, trying this time to stick with my own rules, and with a "permission slip" to be buying a position (since I was once again under my minimum of 5 holdings), I saw that Rollins (ROL) was making a nice move higher, and with a brief inspection of the latest quarter, the Morningstar.com "5-Yr restated", it appeared to be appropriate and purchased 350 shares at $14.67/share.

Noticing that the market was lurching in an upwards direction, I took a look at the lists of top % gainers, trying this time to stick with my own rules, and with a "permission slip" to be buying a position (since I was once again under my minimum of 5 holdings), I saw that Rollins (ROL) was making a nice move higher, and with a brief inspection of the latest quarter, the Morningstar.com "5-Yr restated", it appeared to be appropriate and purchased 350 shares at $14.67/share.

Just one position for today. No more "all in"!

Anyhow, wish me luck. I shall try to hang onto this bronco at least for a few more hours.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

ResMed (RMD), Newell Rubbermaid (NWL), and Ecolab (ECL) "Trading Transparency"

Oil and vinegar!

Oil and vinegar!

They don't mix well do they? I could have said oil and water, or some other analogy, but that is what I have been doing the past few days in my own amateur fashion.

What do I mean? What qualifies me as an amateur, is my ability to change my previously developed strategy on a virtual hunch, for all of the wrong reasons and believe that 'this time, somehow things are different.'

My trading strategy has generally been about a disciplined approach to equities involving identifying high quality companies hitting the top % gainers list that met my own criteria.

If you didn't notice, when I went 'all in', I simply picked some of my 'old favorites' from this blog and simply added them en masse to my portfolio. So much for anything very disciplined, rational, or consistent with my past picks. I justified each of them really on the basis of value, not momentum. That these were great growth stocks of the past that were beaten up beyond real recognition and were a 'great price' at these levels.

Like 'oil and vinegar', I was mixing a value approach to a momentum approach. And I am not really a value investor at all.

A value investor must identify stocks of great value and purchase them (as I see it) and hang onto them if they should decline without any particular fundamental reason presented. In fact, many value investors would consider adding to their investment on a decline, as the stock considered would be an even more attractive investment for them.

It isn't a bad approach at all.

But it isn't my approach.

It is one thing to be flexible, it is another to be erratic. Consistency is the key to any approach one wishes to employ in dealing with investing.

Earlier today, with the market continuin to show an anemic performance, I unloaded my 154 shares of ResMed (RMD) at $33.04. I had purchased them 10/14/08, two days ago!, at a price of $36.396. Thus, I had a loss of $(3.36) or (9.2)% since purchase.

Similarly, I sold my 154 shares of Ecolab (ECL) at $37.0824. These shares also were purchased 10/13/08 at a cost of $40.646/share. Thus, I had a loss of $(3.56)/share or (8.8)% since purchase.

Finally, I sold my 420 shares of Newell Rubbermaid (NWL) at $13.5222. These shares were similarly purchased 10/13/08 at a cost of $15.20. This represented a loss of $(1.68) or (11)% since purchase.

It is hard being an amateur investor and sharing with you readers my own foibles and expensive lessons. I hope you are learning alongside with me without losing your own money as well!

I shall not be putting any buy, sell, or hold ratings on these stocks. My own sales are a reflection of my desire to continue to implement my investment strategy in a coherent fashion. I shall continue to limit losses, but I shall refrain from rushing to buy shares even if I have a "permission slip" from my own trading system, unless the requirements I have previously established are met.

If I am not finding my kind of stocks on the lists of top % gainers, perhaps that suggests it is not my kind of market to be buying stocks!

In the meanwhile, I hope that all of you are learning from my own blunders as I struggle to deal with the incredible volatility of this market that humbles the cockiest of individual investors who might believe that he is able to develop a strategy to deal with investing that might apply to any kind of market and any kind of investment.

If you have any comments or questions, please feel free to leave them here on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 15 October 2008

Coach (COH) "Trading Transparency"

With thanks to Hellkvist.org for the photo of the Japanese Roller Coaster! Thanks Stefan! I do not think I found a better picture illustrating my own vertiginous feelings as the market has soared and swooned in an increasingly volatile fashion day after day!

With thanks to Hellkvist.org for the photo of the Japanese Roller Coaster! Thanks Stefan! I do not think I found a better picture illustrating my own vertiginous feelings as the market has soared and swooned in an increasingly volatile fashion day after day!

After climbing 900 points Monday, and sitting near that peak Tuesday, the roller coaster turned south once again and the market dropped more than 700 points today.

I should know better than to go "all in" in this environment. I guess that is what makes me an amateur when cooler hands are around.

Before all hell broke lose in the last hour of trading, I pulled the plug on my Coach (COH) stock that I just wrote up, selling my 280 shares at $17.6142. I purchased these shares yesterday at $20.0454, giving me a loss of $(2.43)/share or (12.1)% since purchasing these shares just hours ago. Ouch.

My Newell Rubbermaid shares were purchased yesterday at $15.20. They closed today (still in my account) at $13.87. They now have incurred a loss of $(1.33)/share or (8.75)%. This stock, if it holds at this price or moves lower tomorrow, shall also be history.

These (8)% loss limits are not very helpful in these wild swings of stock prices. But then what is?

Frankly, I do not know what to rate these stocks---Buy? Hold? Sell?

I shall keep you posted regarding the continued progress or lack thereof in my dealing with the market.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Tuesday, 14 October 2008

Coach (COH), Ecolab (ECL), Newell Rubbermaid (NWL), and ResMed (RMD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday with the Dow up 500+ points (on the way to a 900+ point gain), I decided that it might be wise to go "all in" with my investments. That is, after my partial sale of Graham (GHM) at a gain, I had another 'permission slip' to be adding a position. With two positions in my portfolio, my minimum being 5, that meant I could move my holdings up to six positions.

These are different times, and while I chose stocks that are generally "growth stocks" and stocks that were indeed moving higher yesterday (weren't all stocks moving higher?), they were what I would call 'favorites' of mine. Stocks that I have owned in the past either in this account or elsewhere and stocks that I have written up here on the blog. All of them were what I would call 'value/growth' investments---that is stocks of great value due to their decline in price and yet shared many of the growth characteristics that I have written about in the past.

On October 13, 2008, I purchased 154 shares of Ecolab (ECL) at a price of $40.646. As I write, ECL is trading at $44.03, up $.02 or 0.05% on the day today. This represents a gain of $3.384 or 8.3% since purchase.

On October 13, 2008, I purchased 154 shares of Ecolab (ECL) at a price of $40.646. As I write, ECL is trading at $44.03, up $.02 or 0.05% on the day today. This represents a gain of $3.384 or 8.3% since purchase.

ECOLAB (ECL) IS RATED A BUY

On October 13, 2008, I purchased 280 shares of Coach (COH) at a price of $20.0454. As I write, Coach is trading at $20.67, up $.43 or 2.12% on the day. This represents a gain of $.625 or 3.1% since purchase.

On October 13, 2008, I purchased 280 shares of Coach (COH) at a price of $20.0454. As I write, Coach is trading at $20.67, up $.43 or 2.12% on the day. This represents a gain of $.625 or 3.1% since purchase.

Coach (COH) is an old favorite of mine. I have owned shares of this stock in the past and have written up this investment previously as well. Trading as high as $50/share in mid-2007, the stock is well below its recent price levels and may represent a 'value' purchase.

COACH (COH) IS RATED A BUY

Newell Rubbermaid (NWL) is an old favorite of mine, a stock that my kids have owned shares in and a stock that I have owned on and off in the past. I don't believe I have written this one up on the blog previously.

On October 13, 2008, I purchased 420 shares of Newell Rubbermaid (NWL) at a price of $15.20. NWL is currently trading at $15.64, up $.51 or 3.37% on the day. This represents a gain from my purchase of $.44/share or 2.9% since purchase.

Newell Rubbermaid is also a 'value' investment with an underlying growth profile. The stock has been beaten up pretty severely both with the economic slowdown and the soaring price of oil driving up resin costs for all of their plastic products. NWL currently trades at a trailing p/e of 10.08, and yields 6.6% in dividends. Over the past two years, this stock had been trading just above $30/share.

Boy do I sound like a different investor today!

NEWELL RUBBERMAID (NWL) IS RATED A BUY

Finally, I chose to pur ResMed (RMD) back into my portfolio. I purchased 154 shares of ResMed (RMD) at a price of $36.396. As I write, ResMed (RMD) is trading virtually unchanged from my purchase at $36.42, actually down $(.12) or (.33)% on the day.

ResMed which traded as high as $55 in early 2007, has not traded at these levels since 2005. But then again, most stocks are trading at multi-year lows as well!

RESMED (RMD) IS RATED A BUY

If I get a chance, I shall try to write up each of these individually to give you a better assessment of my own view of the prospects. They are not my usual picks; I promise you I shall be getting back to my usual 'strategy' as more 'usual' times return!

But I shall be managing them in my usual approach of limiting losses and taking gains when appropriate.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 9:42 AM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 14 October 2008 10:31 AM CDT

Newer | Latest | Older

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day.

The first stock that appeared to fit my usual criteria for inclusion in my blog and my own trading portfolio was Haemonetics (HAE), and I purchased 50 shares at $51.54. This purchase was determined as 1/2 of the average size of my remaining positions. HAE closed at $52.38, up $2.79 or 5.63% on the day. Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

Again using my reduced position size strategy, I found BE Aerospace (BEAV) on the top % gainers lists and decided to purchase 215 shares of BEAV at $11.19. BEAV actually closed at $9.74, down $(.02) for the day. (BEAV appears to be trading at $10.99 after hours, so it is not clear whether I shall be clearing this stock out of my own portfolio or not.)

Back on April 30, 2004, more than four years ago, I wrote up an

Back on April 30, 2004, more than four years ago, I wrote up an  I am lucky that I have access to as amazing an institution as

I am lucky that I have access to as amazing an institution as  Imperial is the Canadian subsidiary of ExxonMobil (XOM) which owns about 60% of the stock.

Imperial is the Canadian subsidiary of ExxonMobil (XOM) which owns about 60% of the stock.

With the market moving higher (at least temporarily yesterday), I visited the lists of top % gainers and since I was under my 5-position minimum, I had a 'permission slip' to be buying a new position, I was looking for a possible new holding.

With the market moving higher (at least temporarily yesterday), I visited the lists of top % gainers and since I was under my 5-position minimum, I had a 'permission slip' to be buying a new position, I was looking for a possible new holding. I keep looking for the right picture to describe my own feeling of being whipped around in this market. Would a

I keep looking for the right picture to describe my own feeling of being whipped around in this market. Would a  Noticing that the market was lurching in an upwards direction, I took a look at the

Noticing that the market was lurching in an upwards direction, I took a look at the

With thanks to

With thanks to  On October 13, 2008, I purchased 280 shares of Coach (COH) at a price of $20.0454. As I write, Coach is trading at $20.67, up $.43 or 2.12% on the day. This represents a gain of $.625 or 3.1% since purchase.

On October 13, 2008, I purchased 280 shares of Coach (COH) at a price of $20.0454. As I write, Coach is trading at $20.67, up $.43 or 2.12% on the day. This represents a gain of $.625 or 3.1% since purchase.