Stock Picks Bob's Advice

Monday, 2 February 2009

Alamo Group (ALG) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

Lately, things have seemed to be doing a bit better. Like the spring, the snow is starting to melt a bit on Wall Street. (Or am I too much of a Polyanna to appreciate how bad things still are?)

Anyhow, I was relieved to see an 'old friend' of mine, Alamo Group (ALG), make the list of top % gainers on the NYSE, trading as I write this up at $13.66, up $1.11 or 8.85% on the day. I write 'old friend' (or should I say 'old favorite'?) because I first wrote up this stock on February 28, 2005, almost exactly four years ago, when the stock was trading at $24.80/share. Unfortunately, the stock has not split its shares since my review and is trading at just over 50% of that 'pick price' from four years ago.

So why should I think the stock is still worth a place in this blog after that dismal performance?

This company according to the Yahoo "Profile"

"...provides tractor-mounted mowers, such as boom-mounted mowers, and other types of cutters for maintenance around highway, airport, recreational, and other public areas; heavy-duty, tractor and truck-mounted mowing, and vegetation maintenance equipment; air, mechanical broom, and regenerative air sweepers; and environmental sweepers."

ALG announced 3rd quarter results on November 10, 2008. Sales for the quarter ended September 30, 2008, climbed 18% to $148.7 million from $126 million for the same period last year. Earnings came in at $.45/diluted share up from $.42/share the prior year.

If we review the Morningstar.com '5-Yr Restated' financials, we can see the remarkably consistent record of financial results. Revenue has increased steadily from $279 million in 2003 to $504 million in 2007 and $561 million in the trailing twelve months (TTM).

Earnings, except for a dip between 2004 and 2005, have grown from $.82/share in 2003 to $1.24/share in 2007 and $1.62/share in the TTM. The company pays a dividend of $.24/share which for a $13.66/share stock works out to a 1.9% yield. Unfortuantely the dividend has been unchanged since at least 2003. The company has held the 10 million shares outstanding over the past five years as well.

In terms of free cash flow, the company which has a negative $(1) million in free cash flow in 2005 and a $(7) million in free cash flow in 2006, turned positive with $8 million in free cash flow in 2007 and $10 million in the TTM.

Finally, the balance sheet shows the company with $5 million in cash and $267 million in other current assets, easily covering the $100.3 millio in current liabilities as well as the $96.5 million in long-term liabilities combined. The current ratio works out to somewhere north of 2.5.

In terms of valuation this is a micro cap stock with a market capitalization of $135.22 million. The trailing p/e is a modest 8.40 with a forward p/e (fye 31-Dec-09) at 18.42. No PEG ratio is recorded. Probably because it is such a small stock that it is largely overlooked, I suspect, by most analysts!

Looking at the Price/Sales ratio, utilizing the Fidelity.com eResearch website, we can see that the Price/Sales (TTM) is 0.22 compared to an industry average of 0.77. Also from Fidelity, the Return on Equity (TTM) is 7.96% compared to the average of 20.35% for similar companies suggesting that while a good value in terms of profitability, the actual 'return' is less than some of its peers.

Returning to Yahoo, we can see that there are only 9.92 million shares outstanding with 6.65 million that float. As of 1/12/09 there were 225,800 shares out short representing a short interest ratio of 9.6 days well above my own arbitrary 3 day rule for significance. As I noted, the company pays a $.24/share dividend with a forward dividend yield of 1.9%. No stock splits are reported.

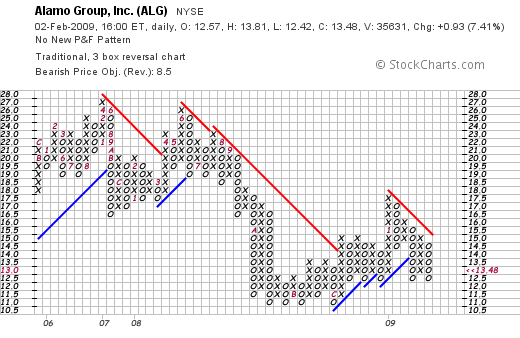

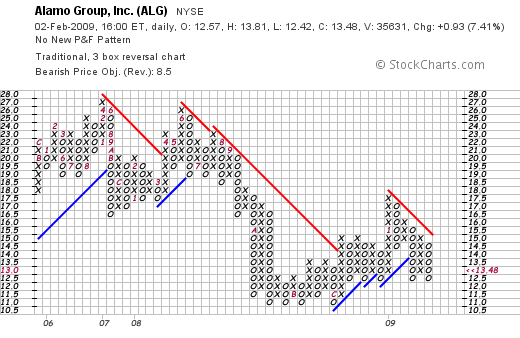

Looking at a 'point & figure' chart on Alamo Group (ALG) from StockCharts.com, we can see that the stock peaked at around $27 in the last few years in April, 2007. Since then it has been heading in a downward direction bottoming at around $11 in October, 2008, and repeatedly bottoming (a quadruple bottom?) at that level, with the latest dip in December, 2008. Recently the stock appears to have failed the latest rally with a peak of $17.50 in January, 2009. The stock is now forming a new 'quadruple bottom' at the $12.50 level--and rallying off that level. Overall the stock has met resistance and would need to climb above the $15 level for even a short-term technical bull signal in my amateur opinion.

I do not own any shares of Alamo Group (ALG) nor do I own any options on this stock. But I do like the numbers and the consistent growth and solid balance sheet and downright cheap valuation. The stock even pays a dividend!

But I don't think this is why maybe there is a bit of interest in this stock. I suspect that the Stimulus Plan making its way through Congress might just favorably affect a company like Alamo which sounds like it has its fingers in everything related to 'infrastructure spending'. Especially when you read some more of the 'profile' of the company from Yahoo:

"It also offers pothole patchers and snowblower products; hydraulics and telescoping booms; catch basin cleaners and roadway debris vacuum systems; sewer cleaners; parking lot sweepers; and snowplows, heavy duty snow-removal equipment, and hitches, as well as attachments for trucks, loaders, and graders. In addition, the company provides rotary cutters, front end loaders, backhoes, posthole diggers, and scraper blades, as well as finishing, flail, and disc mowers; cutting parts, plain and hard-faced replacement tillage tools, disc blades, and fertilizer application components; and heavy-duty mechanical rotary mowers, snow blowers, and rock removal equipment. Further, it offers hydraulic, boom-mounted hedge, and grass cutters; and other tractor attachments and implements, such as hydraulic backhoes, cultivators, subsoilers, buckets, and other digger implements."

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:28 PM CST

|

Post Comment |

Permalink

Updated: Monday, 2 February 2009 6:13 PM CST

Wednesday, 28 January 2009

My Prosper.com Account: Update #6

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the things I have been doing on this blog has been outlining some of my other investments that I have been making besides my 'trading account'. One of these has been my Prosper.com account. This "person-to-person" lending account has been described here first on February 10, 2008, when I related how my nephew Ryan introduced me to this website and most recently on July 13, 2008.

I had been contributing $50/month and a few of you may also have been inspired by my activity to also invest in Prosper.

In February I had 44 loans totaling $2,323.55 and by my las Update #5 in July, 2008, I was up to 96 loans totaling $5,964.23. (I had made additional transfers of funds into Prosper in addition to the regular deposits.)

Unfortunately, things are in a state of limbo for Prosper and for those of us who have been participating on this website. While existing loans continue to be serviced and payments credited to Prosper lenders, new funds and new loans are now suspended until Prosper.com meets SEC requirements and conforms to appropriate regulations.

Since I am no longer able to re-invest my funds into new loans, I have chosen to let my loan repayments collect waiting for the process to restart (?). As of January 28, 2009, my Prosper.com statistics are as follows:

Cash Balance: $945.61

Value of loans: $5,412.08

Payments in transit: $27.69

Total Account Value: $6,385.39

In regards to existing loans, I currently have 106 active loans. Of these, 93 are current, 3 are less than 1 month late, 4 are 1 month late, 2 are 2 months late, 2 are 3 months late and 2 are 4+ months late.

Prosper has been active writing off the 4+ months late loans. Currently I have received Net Income (interest + fees + awards): $607.95.

Net charge-offs: $(482.33)

Net gain/loss: $125.63.

The value of all of the loans is $5,412.08 with $1,964.91 of payments received. The average interest rate on remaining loans is 14.13% and the daily interest accrual is $2.07.

There has been little recent "news" regarding the status of Prosper.com. A summary of this event is well described on this "the Next web.com" entry by Zee. Zee also included the PDF of the actual SEC statement. Zee explains:

"It seems the shutdown is based on the amount of reliance both the lender and borrower have on the site. Since the lender does not know who the borrower it leaves the lender vulnerable and unable “to pursue his or her rights as a noteholder” if the borrower fails to meet the agreed payment terms. In addition, the document states that for the loan agreement to continue it would require Prosper.com to still exist and operate which in this climate, is no guarantee."

Another explanation of events at Prosper is found on the Inc. Website entry where Jason Del Rey explains:

"In November, the SEC filed a cease-and-desist order against San Francisco-based Prosper Marketplace, which runs Prosper.com, ruling that the loan notes being offered on the site were securities and needed to be registered with the commission. Prosper had stopped facilitating new loans the previous month in anticipation of the ruling, and to start the registration process to set up a secondary marketplace where lenders could package and sell loans to each other. Prosper also reached a $1 million settlement with the North American Securities Administrators Association, the membership organization for state securities commissioners. As a result, another peer-to-peer startup, New York-based Loanio, decided to do the same in November, only a month after launching. London-based Zopa.com also closed its U.S. peer-to-peer lending site in October."

Currently the only active person-to-person site in the United States is Lending Club. As Del Rey relates:

"As of the end of the year, San-Francisco based Lending Club was the only one left standing. The company first started talking to the SEC in October 2007 about setting up a secondary market for lenders who, in search of liquidity, wanted to package and sell their loan notes to other lenders, according to Renaud Laplanche, Lending Club's founder and CEO. After SEC staff members started hinting that Lending Club should register its loan notes for the primary market as well, the company decided in April to stop facilitating new loans and enter the registration process. It cost Lending Club several million dollars, but the company was able to restart its operations in October."

Additional explanations have been blogged by TreeHugger, by Erick Schonfeld on TechCrunch, and even the Daily Kos got into the action with an entry by bink.

Prosper has little to say itself. They simply report on their website:

"Prosper has started a process to register, with the appropriate securities authorities, promissory notes that may be offered and sold to lenders through our site in the future.

Until we complete the registration process, we will not accept new lender registrations or allow new commitments from existing lenders. If you're an existing lender, your current lender agreements will be unaffected; your existing loans will continue to be serviced; you'll be able to track and monitor your loans; and you'll be able to withdraw funds from your Prosper account.

If you're a borrower with an existing loan, you will continue with your current borrower agreement and be unaffected by the registration process. If you're a borrower seeking a loan, you will still be able to create a new loan listing, which we will endeavor to fulfill through alternative sources. As the appropriate securities authorities may consider a new loan listing to constitute the offer of a security, we are unable to post new loan listings on our site until our registration statement becomes effective.

A successful registration can take several months, but we assure you we will do our best to move forward as quickly as possible. Until this process is complete, we're required to be in a quiet period and will be unable to respond to press, blogger or other inquiries about Prosper or the registration filing until it becomes effective."

As for me, I shall continue to 'hang in there' with my nominal funds waiting to see what happens with Prosper. I suspect that if Lending Club can figure this out, then Chris Larsen the CEO and Co-Founder of Prosper as well as a co-founder of E-Loan should be the one to figure this out.

Meanwhile, I shall continue to report to you on intervals on the progress or lack thereof of this alternative investment which for me and for my nephew seemed so promising.

Yours in investing,

Bob

Thursday, 22 January 2009

Microsoft (MSFT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment deciisons based on information on this website.

This morning Microsoft announed 2nd quarter 2009 results.

This morning Microsoft announed 2nd quarter 2009 results.

As was reported:

"Microsoft Corp. today announced revenue of $16.63 billion for the second quarter ended Dec. 31, 2008, a 2% increase over the same period of the prior year. Operating income, net income and diluted earnings per share for the quarter were $5.94 billion, $4.17 billion and $0.47, declines of 8%, 11% and 6%, respectively, compared with the prior year."

In light of deteriorating economic conditions Microsoft (MSFT) announced first-ever job cuts:

"In light of the further deterioration of global economic conditions, Microsoft announced additional steps to manage costs, including the reduction of headcount-related expenses, vendors and contingent staff, facilities, capital expenditures and marketing. As part of this plan, Microsoft will eliminate up to 5,000 jobs in R&D, marketing, sales, finance, legal, HR, and IT over the next 18 months, including 1,400 jobs today."

The news spooked the street over-riding the good earnings report from AAPL. The Dow closed down 105.30 today at 8,123 and the Nasdaq was off 41.56 at 1,465.

MSFT closed at $17.12 today, down $(2.26) or (11.66)% on the day.

It all seemed overdone. MSFT is already down from its 52 week high of $35.00. It is currently trading with a trailing p/e of 9.01 and has a dividend yield of 3.04%. The report wasn't great, but the company doesn't seem to be going out of business.

If we check the "5-Yr Restated" financials from Morningstar, we can see that Microsoft has grown its revenue from $36.8 billion in 2004 to $60.4 billion in 2008 and $61.7 billion in the trailing twelve months.

Earnings--up to the latest quarter--have increased from $.75/share in 2004 to $1.87/share in 2008 and $1.89/share in the TTM. Dividends were $.16/share in 2004 and increased to $.44/share in 2008 and $.46/share in the TTM.

Meanwhile outstanding shares have decreased from 10.89 billion in 2004 to 9.47 billion in 2008 and 9.39 billion in the TTM.

Free cash flow is particularly impressive with the company reporting $12.8 billion in free cash flow in 2006 increasing to $18.4 billion in 2008 decreasing slightly to $15.7 billion in the TTM. The balance sheet is solid with $9 billion in cash and $28 billion in other current assets. This is compared to the $24.4 billion in current liabilities and the $7.1 billion in long-term liabilities. The current ratio is approximately 1.5.

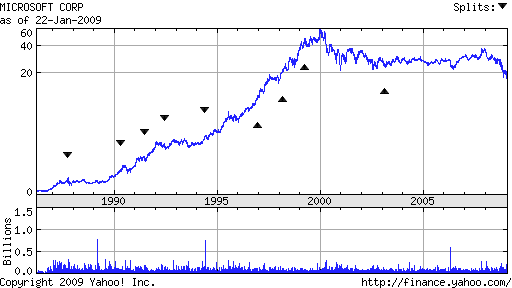

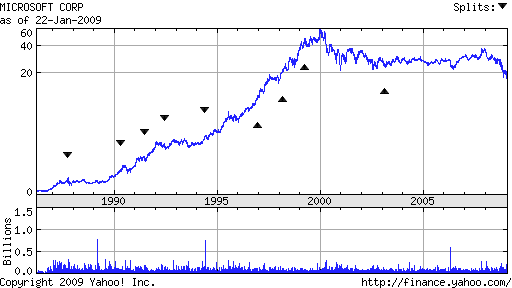

If we look at a Microsoft chart from Yahoo, we can see that the stock has now plunged to its lowest level since about 1997.

The price decline really seemed overdone. Maybe I am crazy, but I decided to buck the tide with a purchase of Microsoft (MSFT) shares. I don't think this one is going out of business!

I purchased 1,000 shares of Microsoft (MSFT) at $17.69. I certainly didn't catch the bottom today because the stock went lower and closed at $17.11 on the day, down $(2.27) or (11.71)%.

This was certainly out of my usual trading strategy. I am not abandoning that strategy but from time to time I have chosen to purchase lots of shares that just seemed to have a compelling story. I could be wrong, but I think this is one of those times! Wish me luck!

Yours in investing,

Bob

Wednesday, 21 January 2009

Morningstar (MORN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

If you are a regular reader of my blog, then I am sure you will realize that five days ago I sold my shares of Johnson Controls (JCI) after they announced a disappointing earnings report and reduced guidance. I wrote about it here.

If you are a regular reader of my blog, then I am sure you will realize that five days ago I sold my shares of Johnson Controls (JCI) after they announced a disappointing earnings report and reduced guidance. I wrote about it here.

Most of my sales of shares are either at appreciation or depreciation targets. They are more or less mechanical in that I know in advance what I need to do and with how many shares. This time, I used my discretionary decision-making power to determine that it was time to part company with these shares and unloaded them before any targeted price. (By the way, I sold my shares of JCI at $15.60, and as I write, JCI is trading at $14.195, so thus far it wasn't a bad decision at all!)

I chose today to replace this position with a new holding and chose Morningstar (MORN), an old favorite of mine and purchased 116 shares at $33.464. (As I write, MORN is trading at $33.88, up $.87 or 2.64% on the day.)

In some fashion I have liberalized my trading system recently. I still follow my rules for selling 1/7th of my holding when a stock hits an appreciation target and using that sale as a buy signal to purchase a new stock. I still employ a strategy of selling complete holdings when they have declined to an 8% loss after an initial purchase or to some higher predetermined level if they decline after partial sales on appreciation. However, it has always been my approach to sell stocks arbitrarily when I felt some fundamental information dictated that trade. And that is what happened with Johnson Controls (JCI).

I have not clearly determined whether after such arbitrary sales I should 'sit on my hands' or replace those holdings with another position. With the market having corrected as much as it has, and my belief that we are closer to the bottom of this market than to the top, I chose to replace this holding. I might not do the same in the future.

Also, unlike many of my purchases, I have chosen to arbitrarily pick one of my favorites as my latest purchase, rather than restricting myself to the top % gainers lists. Again, with the market having declined as much as it has (The Dow as I write is trading at 8,031, down about 6,000 points or 43% since its high in late 2007), I find myself becoming more value oriented and with my growth approach I am more of a GARP investor than a momentum investor as virtually all stocks at this time have had the momentum literally beaten right out of them!

My basic philosophy in any case remains unchanged. I am still looking for stocks that have demonstrated consistent revenue growth, earnings growth, possibly dividend growth, stable outstanding shares, free cash flow, and a solid balance sheet. One of my favorite resources for identifying this information has been the Morningstar website. In fact, I like Morningstar so much I bought shares today. (My kids would of course have asked me if I liked Morningstar that much, why didn't I marry it!)

Let me briefly review some of the updated facts about this stock that led me once again to include it in my portfolio.

I first wrote up Morningstar on Stock Picks Bob's Advice on November 22, 2005. I have also previously owned shares in my trading account.

Regarding the latest quarter's results, Morningstar reported 3rd quarter 2008 results on October 30, 2008. Revenue climbed 12.2% in the quarter to $125.5 million from the $111.9 million reported a year earlier. Net income came in at $22.2 million or $.45/share, up from $19.9 million or $.41/share the prior year.

Checking the "5-Yr Restated" financials on Morningstar on the Morningstar webiste (!), we can see the steady growth in revenue from $139 million in 2003 to $435 million in 2007 and $501 million in the trailing twelve months (TTM).

During this period earnings have increased steadily from a loss of $(.31)/share in 2003 to $.21/share in 2004, increasing to $1.53/share in 2007 and $1.90 in the TTM.

Outstanding shares have nominally increased from 38 million in 2003 to 49 million in the TTM.

Free cash flow has been positive and growing recently with $41 million reported in 2005 increasing to $101 million in 2007 and $107 million in the TTM.

The balance sheet appears solid with $234 million in cash and $186 million in other current assets. This easily covers the $218.7 million in current liabilities yielding a current ratio of 1.92. Long-term liabilities are reported to be relatively nominal at $30.7 million.

In terms of some valuation numbers, checking the Yahoo "Key Statistics" on Morningstar (MORN), the company is a mid cap stock with a market capitalization of $1.59 billion. The trailing p/e is a moderate 17.92 with a forward p/e reported to be 18.89 (fye 31-Dec-09). The PEG ratio works out to a reasonable 1.01.

According to the Fidelity.com eresearch website, the Price/Sales ratio (TTM) at 3.02 is a bit rich compared to the average of 1.49 in the same industry. Also on the Fidelity website, the profitability is above average coming in with a Return on Equity (TTM) of 19.85% compared to the industry average of 18.34%.

Finishing up with Yahoo, there are 46.77 million shares outstanding but only 17.94 million float. Currently there are 1.54 million shares out short (as of 12/10/08) representing 5 trading days of volume (the short ratio). I use an arbitrary 3 days for significance, so from my perspective, as with many stocks today, there are a lot of shares out short which may provide some buying support if any sort of good news is reported and a 'squeeze' develops.

No dividends are paid and no stock splits are reported on Yahoo.

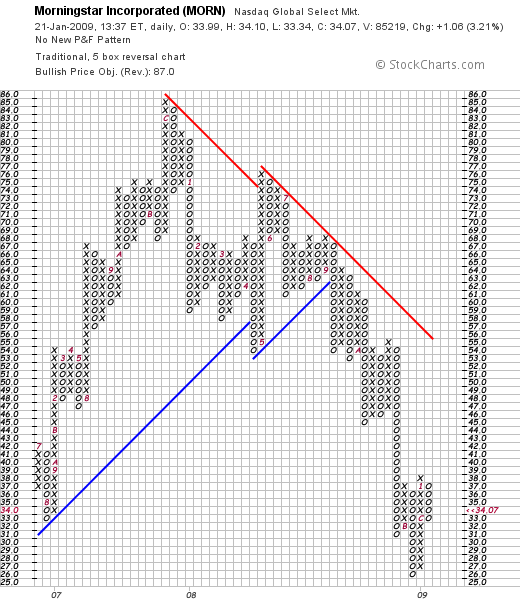

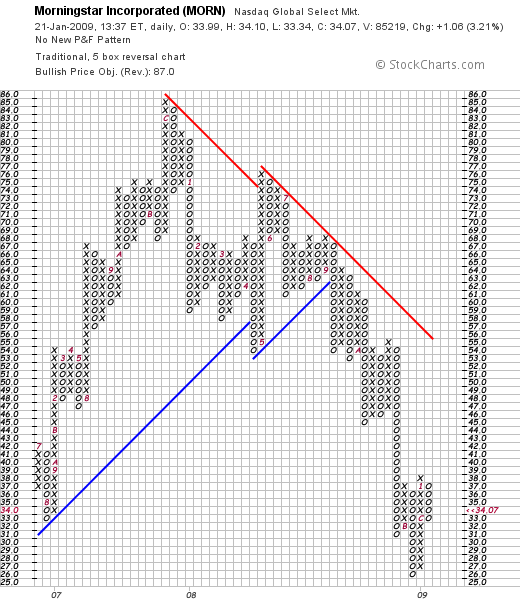

If we review the Morningstar 'point & figure' chart from StockCharts.com, we can see that the stock hit a high of $85 in November, 2007, only to trade lower with the rest of the market and especially the financials to hit a low of $26 in November, 2008. The stock has come up a little from the low but technically the chart does look very weak.

Incrementally, I chose to add a new holding to my portfolio and thereby return my equities exposure back to the 6 holding I had prior to my sale of JCI. I believe this is a good decision but shall manage this purchase as with all of my other holdings in the same strategy as I have previously followed.

In many ways, for me Morningstar is a Peter Lynch type of purchase. I am familiar with their services---at least their internet website, and like the underlying numbers and consistency in their growth. I have owned Morningstar shares previously, and once again am a stockholder!

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:35 PM CST

|

Post Comment |

Permalink

Updated: Wednesday, 21 January 2009 12:44 PM CST

Friday, 16 January 2009

Johnson Controls (JCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my 82 shares of Johnson Controls at $15.60/share. I purchased these shares at $14.83/share on 11/20/08, so I had a gain of $.77/share or 5.2% since the purchase.

This wasn't a sale based on any pre-determined appreciation or loss point. This was simply my own decision that the fundamentals of the stock had changed such that I no longer felt it was an acceptable stock for my own trading portfolio. As I write, JCI is trading at $15.69, down $(1.38) or (8.08)% on the day on the back of the 1st quarter 2009 earnings report released earlier today.

JCI announced that it had lost $608 million in the first quarter working out to $(1.02)/share. A year ago, the company reported a profit of $235 million or $.39/share. Johnson controls had pre-announced that it expected a loss, but the level of the loss exceeded the street's expectations. Thomson Reuters analysts had expected a profit of $.01/share removing charges. Even excluding those charges, JCI came in at a loss of $(.14)/share.

In addition, the company reduced expectations for the second quarter with guidance now to a second-quarter loss similar to the first quarter. This is below the profit of $.18/share expected by analysts.

The decline in sales for this company has involved far more than just the automotive sector, with automotive sales dropping 25%, Power Solutions business (vehicle batteries) declining 32%, and building efficiency sales off 4.8%.

I still like Johnson Controls (JCI) for the long haul, but for the time being, I shall be stepping aside from this Wisconsin-based corporation.

This sale brings me back to my minimum of five holdings. I shall look to add a new position if any of my remaining five should so indicate. I shall also replace any sales of those five with a new but smaller-sized purchase should any of them reach a sale point.

Yours in investing,

Bob

Wednesday, 14 January 2009

Varian Medical Systems (VAR) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market was very weak today; the Dow dropped 250 points or 2.9% to 8200. The Nasdaq wasn't any stronger, dipping 3.67% or nearly 59 points to 1,489, and the S&P was off 3.35% or 29.17 points to 842.62.

However, in the midst of this ongoing bear market, I continue to look for companies which appear to meet most of my own criteria. Yesterday Varian (VAR) made an 8+% move higher on an upbeat forecast for fiscal 2009. Unfortunately, with the market weak today, the stock gave back about a half of its gain closing at $35.62, down $1.34 or (3.63)% on the day. This stock however deserves a second look.

Varian is definitely an 'old favorite' of mine on this blog. I write this because I first wrote about Varian (VAR) on October 20, 2003, more than five years ago! Two years later, on May 11, 2005, I once again wrote up Varian on Stock Picks. I do not currently own any shares or options on this stock.

But I do still like Varian's business and their fundamentals remain impressive.

Regarding its business, as described by the Yahoo "Profile" on Varian (VAR), the company

"...and its subsidiaries provide cancer therapy systems worldwide. Its Oncology Systems segment designs, manufactures, sells, and services hardware and software products to treat cancer with radiation, including linear accelerators, brachytherapy afterloaders, treatment simulation and verification equipment, and accessories, as well as information management, treatment planning, and image processing software."

In a very morbid fashion, cancer is a growth business. There are few people that will get through life without dealing with this disease themselves or with one of their own close family members as I have personally related. In fact as the World Health Organization relates on their website:

"In 2005, 7.6 million people died of cancer out of 58 million deaths worldwide.

More than 70% of all cancer deaths occur in low and middle income countries, where resources available for prevention, diagnosis and treatment of cancer are limited or nonexistent.

Based on projections, cancer deaths will continue to rise with an estimated 9 million people dying from cancer in 2015, and 11.4 million dying in 2030."

Healthcare business, while relatively insulated from economic trends, is also feeling the effects of the economic downturn as this story relates. However, the pain felt in many cyclical businesses is far greater than the effects of the global economic slowdown on health-related businesses and employment.

This relative strength in healthcare was reflected in the recent employment report which noted every industry losing jobs "...except education, health care, and govenrment."

Which brings me back to Varian Medical Systems (VAR).

On January 12, 2009, Varian announced that in the first quarter of fiscal 2009, there would be a net growth in orders between 12 and 13% ahead of the year-ago period. Tim Guertin, president and CEO of Varian noted that this performance was in the face of continuing economic stress:

"While there is unprecedented volatility and uncertainty in this economic climate, the solid net orders growth in the first quarter gives us cautious optimism about the prospects for our businesses in 2009," said Guertin.

Furthermore, Varian late last year announced a continuation of a stock repurchase plan, with the authorization to pick up an additional 8 million shares of stock in 2009. As the company reported:

"Since initiating share repurchase authorizations at the end of fiscal year 2001, the company has spent $1.4 billion to repurchase 36 million shares of common stock at an average price of $40.13 per share."

Stock repurchases are helpful in supporting and advancing the price of a company.

Let's take a closer look at some numbers behind this company as reported on the Morningstar.com "5-Yr Restated" financials. First of all, we can see a very pretty picture of steady revenue growth from $1.24 billion in 2004 to $2.07 billion in 2008. Earnings have also increased in an uninterrupted fashion from $1.18/share in 2004 to $2.19/share in 2008. At the same time, outstanding shares, as explained above, has been decreasing from 142 million shares in 2004 to 128 million in 2008.

Free cash flow, as reported by Morningstar, has been positive and growing with $160 million in 2006 increasing to $291 million in 2008.

The balance sheet appears solid with $397 million in cash and $997 million in other current assets. This total of $1,394 million, when compared to the $781.7 million in current liabilities yields a current ratio of 1.78. Varian has a relatively small amount of long-term liabilities reported to be $166.7 million.

Reviewing a few "Key Statistics" on Varian from Yahoo, we can see that this stock is a mid cap stock with a market capitalization of $4.43 billion. The trailing p/e is a moderate 16.26, but with strong growth expected, the PEG is reported at a very nice 0.87 level.

Checking the Fidelity.com eresearch website, we can see that in terms of the Price/Sales ratio, Varian is relatively inexpensive with a Price/Sales (TTM) ratio of 2.24 compared to the industry average of 6.15.

The company is also relatively more profitable than its peers with a Return on Equity (TTM) of 31.49% compared to the industry average of 14.24% per Fidelity.

Returning to Yahoo, we find that there are 124.25 million shares outstanding with 123.37 million that float. As of December 10, 2008, there were 7.11 million shares out short representing 4.6 trading days of volume (the short ratio), which is a bit more than my own '3 day rule' for significance. We may have seen a bit of a 'squeeze' of the shorts yesterday on the back of the good news announcement.

No dividend is paid and the last stock split was a 2:1 split back on August 2, 2004.

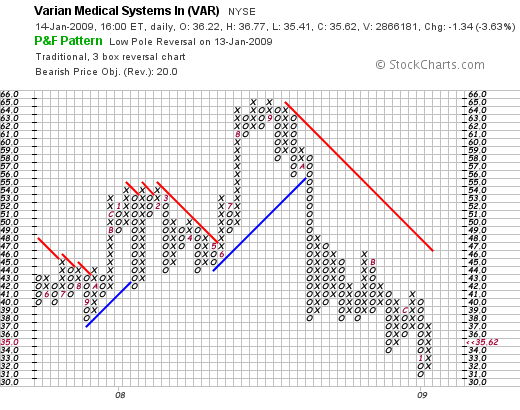

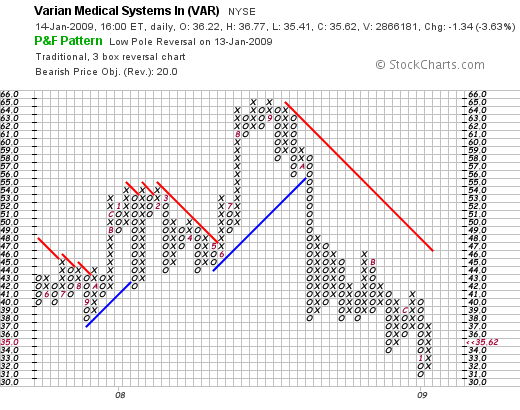

Finally, let's take a look at the chart with a 'point & figure' graph from StockCharts.com:

Here we can see that after hitting a 'double-top' in August, 2008, at $65.00, the stock broke down and continues to trade with lower lows and lower intermediate highs to the current level around $35.62. I see little to indicate any technical strength in this chart unfortunately.

However, I am not currently prepared to buy shares in Varian (VAR) nor any other new position. The decision to buy a new holding will only result after one of my current holdings hits an appreciation target on the upside. Needless to say in the current market, my holdings are moving in rather the opposite direction!

But in the midst of this depressing trading milieu, I continue to remain optimistic long-term and continue to look to identify the quality companies that are able to persistently grow revenue, earnings, free cash flow, and possibly dividends, while maintaining solid balance sheets and reasonable valuation. Except for the weak chart, Varian (VAR) is quite impressive and has easily earned a place in my blog!

Yours in investing,

Bob

Friday, 9 January 2009

Satyam (SAY) "Taking Another Look"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Satyam (SAY) is what I would have to call an 'old favorite' of mine.

In fact, this is what I had to say about Satyam (SAY) when I blogged about it on December 15, 2005:

"So what do I think? The stock is certainly showing strong fundamental and technical strength with a superb quarterly report which also raised guidance, a solid Morningstar.com "5-Yr Restated" financials, including growing free cash flow and a solid balance sheet. Valuation-wise, the PEG being just a bit over 1.0 is encouraging. However, the Price/Sales appears very rich at 6.1, way ahead of other stocks in the same business."

I was sold on the numbers. And yet were the numbers actually safe to believe?

On April 19, 2008, I "revisited" Satyam on this blog. The 'numbers' once again caught my attention.

This time I wrote:

"The latest quarter was strong and the company raised guidance. The longer-term view is equally impressive with steady revenue growth, earnings growth, and even dividend growth! Outstanding shares have been relatively quite stable and free cash flow is positive. The balance sheet is solid.

Valuation-wise, the company sells at a modest p/e with a great PEG ratio reported. Price/Sales is a bit rich but the company is more profitable than its peers as judged by the Return on Equity and Return on Assets ratios.

Finally, the chart looks satisfactory with the price undergoing a recent period of price consolidation and with the chart on the verge of 'breaking out' assuming the rest of the market holds up.

In other words this is my kind of stock! Now, if only I had been able to hang on to the shares I have owned in the past."

No I do not currently own any shares. In the past, I actually purchased shares in April, 2007, only to sell the same shares in August, 2007, with an (8.15)% loss. I wrote about this trade here.

If you have been following the financial news, you will be aware of what has been called India's Enron. The 'cooking of the books' that has led to the collapse of Satyam stock and the arrest of B. Ramalinga Raju, Satyam's former Chairman and founder and his brother B. Rama Rajku, a co-founder of the company.

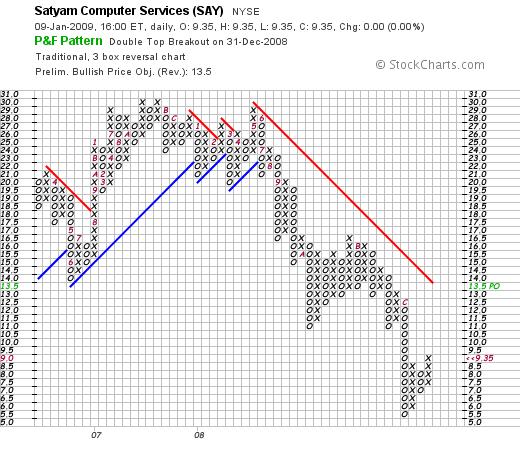

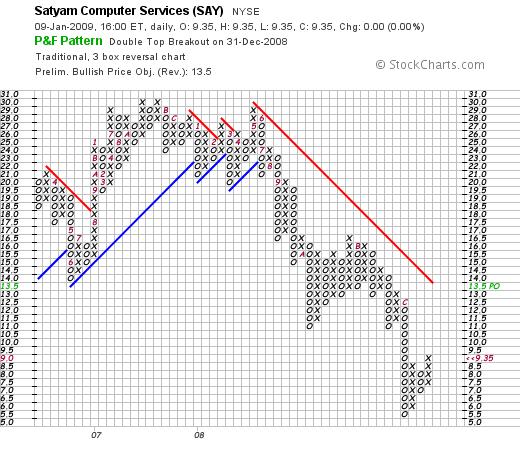

If we examine a 'point & figure' chart on Satyam (SAY), we can see that the breakdown in the stock price actually became apparent in July, 2008. For me, my own discipline of limiting losses saved me from even larger financial damage. This once again shows the potential problems of depending purely on 'value' and ignoring the decline in stock prices that may well be indicating greater problems, either with the equity itself or the market as a whole.

I was fooled along with other investors in Satyam (SAY). I read the basic news from Yahoo, saw the Morningstar reports and like what I read. I even bought shares in the stock and got 'stopped-out' with a loss.

Perhaps the most important lesson is to be aware that there is a leap of faith with every investment we make. That we need to not fall in love with any holding, pull the plug when the stock price deteriorates regardless of the news or numbers, and diversify adequately to protect ourselves from implosions of this sort that may well be totally unexpected.

I continue to learn from every investment and every blog entry that I make. As always, as I write over and over, I must let you know that I am an amateur. Please do check with your professional advisers who may also be unable to know what nobody has the power of knowing---that from time to time there are those who report information that they know is incorrect.

I trust that what I read from the best sources is true and reliable. Reality fails us from time to time in meeting even these basic expectations.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:56 PM CST

|

Post Comment |

Permalink

Updated: Friday, 9 January 2009 10:58 PM CST

Wednesday, 7 January 2009

A Brief Update: Waiting for the Right Moment

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have been extremely quiet on this blog. For that I apologize to all of my readers.

However, there are times for activity and times for simply sitting quietly. I believe that we are in that latter period.

Certainly there is no uniform agreement on the proposed economic stimulus of President-elect Obama. Personally, I believe that government does indeed have a role in a fiscal stimulus of the beleaguered economy. Unfortunately, during the past eight years of relative economic stability, the current Administration has followed a 'supply-side' economic theory that utilized tax cuts without regards to expenditures to keep the economy moving. With this policy, the government changed a surplus to a massive deficit.

Now that we need to utilize deficits to stimulate the economy, we find ourselves already dealing with deficits that have been incurred in times of relative economic health. We likely need to push federal spending to get the economic recovery we all desire in spite of past deficits.

In the meantime, I continue to implement my strategy of monitoring my own holdings, using them as the indicators for future purchases and sales and the shifting between equities and cash. I also continue to monitor the top % gainers list--I should point out that rarely do I find stocks that appear to fit my own strategy, but yesterday did note that Chase (CCF) an old favorite of mine, and yet a stock that I do not own, made a nice move higher.

Otherwise, I am waiting patiently with much of my portfolio in cash and with my 6 positions being monitored closely.

I shall continue to keep you posted.

Yours in investing,

Bob

Thursday, 1 January 2009

My Trading Portfolio "An End of the Year Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, pleased remember to consult with your professional investment advisers before making any investment decisions based on information on this website.

Before I get any further, I would like to wish all of my friends and readers a very Happy and Healthy 2009.

With the New Year upon us already, I didn't want to let a moment pass before getting my year-end status online.

I last reviewed my holdings November 30, 2008 As I often explain here, I write about many different stocks as well as the stocks I actually own in my 'trading account'. As part of my effort to be as transparent as possible I try also on a regular basis to offer all of you a summary of how my own portfolio is doing.

The following list shows my holdings as of December 31, 2008, with the names of the stocks, their symbols, the number of shares held, date of purchase, the cost basis, latest price (12/31/08), and the % gain (or loss).

Haemonetics (HAE), 50 shares, 10/27/08, $51.70, $56.50, 9.28%

Johnson Controls (JCI), 82 shares,11/20/08, $14.83, $18.16, 22.42%

PetSmart (PETM), 104 shares, 11/20/08, $15.58, $18.45, 18.44%

Rollins (ROL), 350 shares, 10/16/08, $14.69, $18.08, 23.09%

Sysco (SYY), 154 shares, 12/10/08, $22.72, $22.94, .97%

WMS Industries (WMS), 72 shares, 10/28/08, $20.12, $26.90, 33.68%

Currently I have $18,487.43 in a Fidelity Municipal Money Market account. This is in addition to my $18,030.48 in equities described above. The account as of 12/31/08 had a total value of $36,517.91.

As of 12/31/08, my portfolio had $2,520.32 in unrealized gains. For 2008, my account had a net of $42.76 of realized gains after accounting for the $(9,246.00) in net realized short-term losses and $9,288.76 in net long-term gains.

I continue to regularly add $200/month to the account which goes into the money market fund. In 2008 I received $160.75 in ordingary dividends, $.44 in capital gain distributions as well as $118.33 in tax-exempt income for a total of $279.52 in income.

Balancing this was the total of $(244.79) in margin interest paid during 2008.

Overall 2008 was essentially a wash for me in terms of realized activity. However, what suffered the most was the loss of so much of my unrealized gains on my holdings. Thus, my account value dipped during the year as it did with so many investors.

Thanks for taking the time to visit my blog and I look forward to many more entries going into 2009 and the future.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 8:37 PM CST

|

Post Comment |

Permalink

Updated: Friday, 2 January 2009 9:56 AM CST

Friday, 19 December 2008

Apogee Enterprises (APOG) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Many of my recent entries have been about my trades---some successful and some not----and I haven't been writing quite as much about the kind of stocks that I refer to as my vocabulary of investable companies. These are companies that meet my fairly well-accepted criteria of consistent revenue and earnings growth, stable shares, positive free cash flow, and healthy balance sheet. It was a relief yesterday when I saw an 'old favorite' of mine, Apogee Enterprises (APOG) make the list of top % gainers. While I do not limit myself at this time to selecting stocks off these gainers lists, I do find them helpful in identifying companies that may have enough momentum to exhibit price appreciation in a prolonged fashion.

Many of my recent entries have been about my trades---some successful and some not----and I haven't been writing quite as much about the kind of stocks that I refer to as my vocabulary of investable companies. These are companies that meet my fairly well-accepted criteria of consistent revenue and earnings growth, stable shares, positive free cash flow, and healthy balance sheet. It was a relief yesterday when I saw an 'old favorite' of mine, Apogee Enterprises (APOG) make the list of top % gainers. While I do not limit myself at this time to selecting stocks off these gainers lists, I do find them helpful in identifying companies that may have enough momentum to exhibit price appreciation in a prolonged fashion.

I first discussed Apogee on this blog back on September 20, 2007, when the stock was trading at $25.76. As I write this entry, Apogee is trading at $10.10, up $.56 or 5.87% on the day. However, the stock has declined markedly since my entry, actually down $(15.66) or (60.8)% since posting. Not exactly a stellar pick from last year, is it? I do not own any shares or options of this company.

Apogee is heavily involved in architectural glass, and associated products and services. It does also have some exposure to the picture framing market and optical display business. However, the construction slump that we have been experiencing in the United States has brought down shares of construction-related stocks like Apogee.

I would like to take you through some of the things about this company that I still find attractive even though the nature of the business itself, being associated with the building industry, concerns me.

First of all, the company jumped yesterday after they announced 3rd quarter 2009 results and maintained guidance on the rest of the year. Revenues for the quarter came in at $240.4 million, up 14% from the prior year. Earnings from continuing operations were $.63/share, up from $.26/share. Net earnings, including discontinued operations, came in at $.63/share, up from $.38/share last year.

If we review the Morningstar.com "5-Yr Restated" financials on APOG, we can see the picture of steady revenue growth from $490.8 million in 2004 to $881.8 million in 2008 and $937.7 million in the trailing twelve months (TTM).

Earnings have similarly increased during this period from a loss of $(.20)/share in 2004 to $1.67/share in 2008 and a dip to $1.66/share in the TTM.

The company also pays a dividend and has been increasing it annually from $.24/share in 2004 to $.28/share in 2008 and $.30/share in the TTM. Outstanding shares have been very stable with 28 million shares reported by Morningstar in 2004, and 29 million in the TTM.

Free cash flow has been positive and generally increasing with $5 million in 2006 growing to $31 million in 2008 and only dipping slightly to $23 million in the TTM. The balance sheet appears adequate with $6 million in cash and $244 million in other current assets resulting in a current ratio of 1.46.

The valuation of this stock has become even more compelling now with the discounted stock price. Per Yahoo "Key Statistics", this is a small cap stock with a market capitalization of only $280.81 million. The trailing p/e is reported at 5.93 (!), with a forward p/e expected at 8.71 (fye 01-Mar-10). The PEG works out to a very attractive 0.39. (Generally I have found stocks with PEG ratios between 1.0 and 1.5 to be 'acceptable'.)

Currently, the company pays a small but increasing dividend but with the decrease in the stock price this works out to an attractive 3.6% yield. The last stock split was back on February 18, 1997, when the company split its stock 2:1.

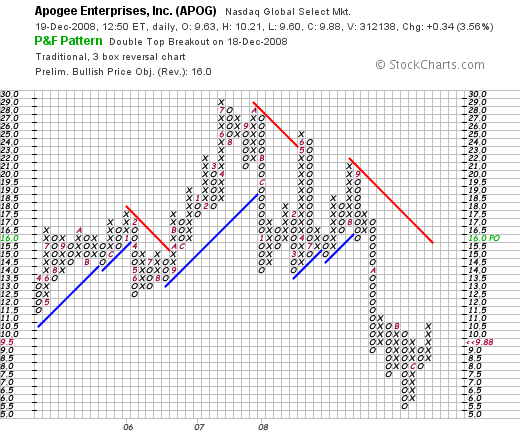

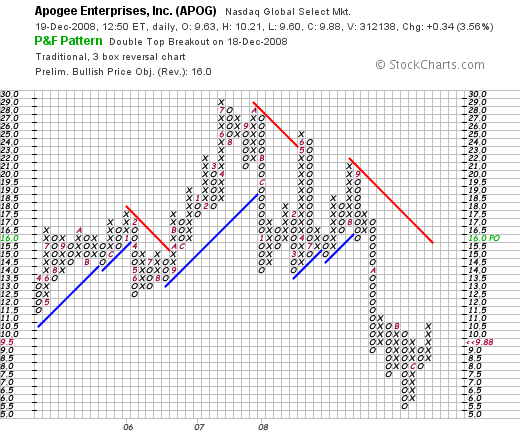

Looking at the point & figure chart on APOG from StockCharts.com, we can see that the stock price peaked back in July, 2007, at $29. The stock experienced growing weakness through August, 2008, when it managed to reach a level of $21, then broke down completely in September of this year, dipping as low as $5.50/share. The stock appears to be showing some recent strength but it would need to trade above $15.50, at least per this chart, to suggest some technical evidence of breaking-out above resistance.

Two additional stories from Yahoo also suggest an effort by management to continue to support the price of this stock. First of all, was this story from October 8, 2008, when the company announced an increased dividend, and this story also from October 8, 2008, when the company announced an increase in its share repurchase authorization.

Thus, I find myself once again writing about this small Minneapolis-based firm. I enjoy writing up stocks from the Midwest regardless of how many inches of snow we may have received last night!

But seriously, even though I do not own any shares, they reported a great quarter in the face of a dismal construction environment, have a terrific longer-term track record of increasing revenue, earnings, and even their dividend, and have compelling valuation numbers. On the downside is the ever-present reality of the awful building and home-construction market. In addition, I have been a bit wary of stocks trading at just-above $10, and I have had problems as well with these very small-cap companies. But this may well represent a good opportunity in this stock, and it deserves another mention on my blog!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them right here on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:55 AM CST

|

Post Comment |

Permalink

Updated: Friday, 19 December 2008 12:16 PM CST

Newer | Latest | Older

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

This morning Microsoft announed

This morning Microsoft announed

If you are a regular reader of my

If you are a regular reader of my

Many of my recent entries have been about my trades---some successful and some not----and I haven't been writing quite as much about the kind of stocks that I refer to as my vocabulary of investable companies. These are companies that meet my fairly well-accepted criteria of consistent revenue and earnings growth, stable shares, positive free cash flow, and healthy balance sheet. It was a relief yesterday when I saw an 'old favorite' of mine, Apogee Enterprises (APOG) make the

Many of my recent entries have been about my trades---some successful and some not----and I haven't been writing quite as much about the kind of stocks that I refer to as my vocabulary of investable companies. These are companies that meet my fairly well-accepted criteria of consistent revenue and earnings growth, stable shares, positive free cash flow, and healthy balance sheet. It was a relief yesterday when I saw an 'old favorite' of mine, Apogee Enterprises (APOG) make the