Stock Picks Bob's Advice

Tuesday, 28 July 2009

TJX Companies (TJX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day.

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day.

Most of us know TJX through the 'flagship' store of the chain TJ Maxx, however, TJX is more than just the Maxx chain. As noted on this Yahoo "Profile" for TJX:

"The TJX Companies, Inc. operates as an off-price retailer of apparel and home fashions in the United States and internationally. It sells off-price family apparel and home fashions through T.J. MAXX and MARSHALLS, HOMEGOODS, and A.J. WRIGHT in the United States; WINNERS and HOMESENSE in Canada; and T.K. MAXX and HOMESENSE in Europe."

In general we have an AWFUL retail environment in the US as well as elsewhere. As this article from the NYTimes points out, June, the latest recorded figures available, continued the trend of weak sales numbers for United States retail firms.

"On Thursday, the industry posted a 4.9 percent sales decline in June, in contrast to a 1.9 percent increase a year ago, according to Thomson Reuters, which said the decline capped the longest negative streak on record."

Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

In fact, on July 9th, 2009, TJX raised guidance for the upcoming 2nd quarter report. As reported:

"TJX now anticipates second-quarter earnings from continuing operations of 56 cents to 59 cents per share. Its previous guidance was for earnings of 43 cents to 49 cents per share."

Apparently, as the story relates, analysts from Thomson Reuters had been expecting a profit of 49 cents per share. And the stock has recently been responding to this series of good news reports!

Looking at the latest quarterly report, TJX reported 1st quarter results on May 19, 2009. In the quarter, net sales climbed 1% to $4.35 billion and comparable store sales growth increased 2% over last year. (We can see that for the last couple of months, same store sales growth has been closer to 4-5% each month).

Net income from continuing operations was $209 million, and diluted earnings per share worked out to $.49/share compared to $.44/share last year. Excluding last year's "tax benefit", diluted earnings actually increased 17% over last year's results. The company beat expectations of $.45/share on $4.3 billion in sales according to analysts polled by FactSet Research.

Reviewing the Morningstar.com "5-Yr Restated" financials from Morningstar.com, we can see that sales have grown steadily from $14.8 billion in 2005 to $19 billion in 2009 and $19.05 billion in the trailing twelve months (TTM). Earnings have also steadily increased from $1.41/share in 2006 to $2.00/share in 2009 and $2.05 in the TTM. Dividends have been paid and increased yearly at least since 2005 when $.17/share was paid. This has been increased annually to $.45/share in the TTM. The company has also been reducing outstanding shares from 512 million in 2005 to 438 million in the TTM.

Free cash flow has been steady with $817 million reported in 2007, and $714 million in the TTM. In terms of the balance sheet, TJX is reported by Morningstar to have $1.012 billion in cash and $3.394 billion in other current assets, compared to $3.33 billion in current liabilities and $1.28 billion in long-term liabilities. This works out to a current ratio of approximately 1.3.

Looking at Yahoo "Key Statistics" for some valuation numbers, we can see that this is a Large Cap stock with a market capitalization of $14.99 billion. The trailing p/e is a moderate 17.61 with a reasonable PEG ratio of 1.27. There are 413.5 million shares outstanding with 410.97 million that float. Currently, as of 6/25/09 there are 10.25 million shares out short representing 1.9 trading days (the short interest ratio), less than my own 3 day rule for significance.

The forward annual dividend is $.48/share with a forward dividend yield of 1.3%. The last split according to Yahoo was in May, 2002, when the stock split 2:1.

If we review a "point & figure" chart on TJX from StockCharts.com, we can see that after hitting a low of $15.00 in February, 2003, the stock climbed the next 5 years to hit a high of $37 in August, 2008. With the retail 'melt-down' TJX melted with the rest of the stocks to a low of $18.00 where it bounced twice first in November, 2008, and then again in December, 2008, only to tun higher in February, 2008, where it has moved strongly from a $19.50 level to its current level of $36.25! The chart looks quite strong if possibly a bit over-extended in its current move.

To summarize, retail is a very difficult place to be 'playing' today. However, maybe the 'cheap chic' so often attributed to Target (TGT) might actually be better-played with TJX. Here is a company that has shown positive same store comparisons the last couple of months, come in with earnings that beat expectations and has raised guidance. Just like old times!

Anyhow, this is the kind of stock that I like and would love to add to my portfolio if I get the right signal at the right time.

Thanks again for visiting and my apologies once more for being so lax about posting here! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 27 July 2009

3M (MMM) and Sysco (SYY) "Trading Transparency" and a Reader Writes: "Just Curious"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A brief note as I am having some technical problems with this blog:

Earlier today I sold 4 shares of MMM at $69.92 representing 1/7th of my holding at a 60% gain. I then purchased 125 shares of Sysco (SYY) at $23.19. I recently wrote up SYY (see the prior entry) and continue to be careful in this difficult environment seeking stocks of value with steady and increasing dividends.

Answering "Just Curious" I am indeed well, busier than ever at work, and have no good excuse to tell you why I have neglected my blog. I shall redouble my efforts at this.

Meanwhile, drop me a line at bobsadviceforstocks@lycos.com if you have any comments or questions.

Yours in investing,

Bob

Monday, 15 June 2009

Sysco (SYY) and a New Podcast!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I posted a PODCAST ON SYSCO (SYY). Usually I write up an entry first and then follow with a podcast. Tonight I did it the other way around :).

A few moments ago I posted a PODCAST ON SYSCO (SYY). Usually I write up an entry first and then follow with a podcast. Tonight I did it the other way around :).

We live in difficult times! I don't really need to tell you about the growing unemployment, the latest bank failures, or what the New York Fed reported on manufacturing. These are things that everyone knows.

What is harder is trying to some reasonable place to park one's funds. I would like to suggest that an investment in Sysco (SYY) might be a place to find some value and potential growth while waiting for the eventual economic recovery.

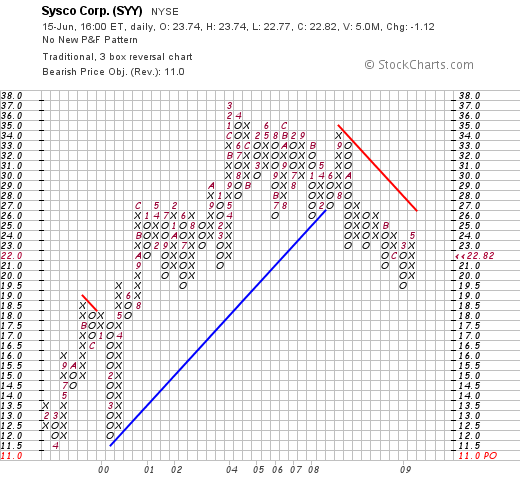

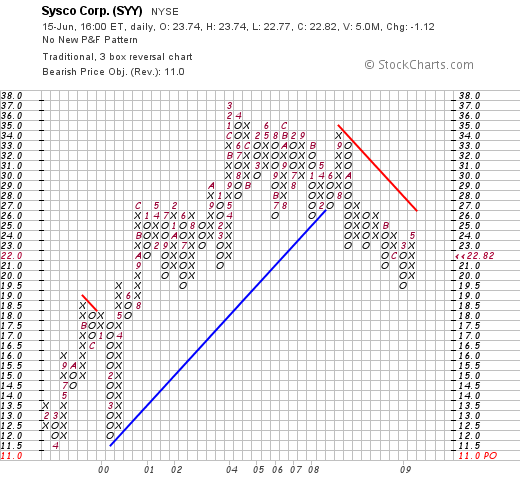

Sysco (SYY) closed today at $22.82, down $(1.12) or (4.68)% on the day. I do not own any shares of this stock but have owned it in the past and would consider buying shares once again in the future.

Looking at a few of the things I like to review, the latest quarterly report was fair. They met expectations on earnings which did decline slightly and came in a little light on revenue. Longer term, looking at the Morningstar.com '5-Yr restated' we see that the company has a record of steadily growing its revenue, increasing its earnings---both of which did recently take a slight dip--paying a nice dividend and increasing it (the company now yields 4%), buying back its shares, increasing free cash flow, and maintaining a solid balance sheet.

Valuation-wise, looking at Yahoo "Key Statistics" on SYY, the company has a modes p/e of only 12.74 (trailing) with a PEG estimated at only 1.14. The last split was over 8 years ago.

Certainly, the 'point & figure' chart from StockCharts.com is somewhat less than inspiring. I am not sure I agree with the bearish objective of $11/share, but we don't see much in the way of technical support on this particular chart!

In some ways this type of 'pick' is out of my usual momentum play. But then again, my own philosophy is being tempered by the difficult environment we are experiencing and the fact that little of the usual momentum type investment is apparent. I would characterize this sort of stock as more of a GARP pick. It shares many of the important characteristics that I look for in a company: the steady growth in revenue, earnings, dividends, and free cash flow. It has been buying back its own shares and carries a solid balance sheet. I even can see evidence of its business with its many shiny trucks on the road right where I work!

Anyhow, that's my idea of a 'comfort stock' in these uncomfortable times! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 28 May 2009

PetSmart (PETM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I mentioned in an earlier blog, my 'trade' in PetSmart (PETM) was intended to be a short-term affair. I had hoped that I could be reporting a large profit from this move which did indeed initially move higher after my purchase of 180 shars on 5/21/09 at a cost of $20.3676. However with the market acting at best erratically this morning and with PETM trading below my cost on this block, I decided to step aside from this additional over-weighted addition and sold my 180 shares at $19.9524/share. This represented a loss of $.4152/share or multiplied by 180 shares came out to a loss of $(74.736). Percentage-wise, this was a loss of (2.03)% so the damage really wasn't significant at all.

As I mentioned in an earlier blog, my 'trade' in PetSmart (PETM) was intended to be a short-term affair. I had hoped that I could be reporting a large profit from this move which did indeed initially move higher after my purchase of 180 shars on 5/21/09 at a cost of $20.3676. However with the market acting at best erratically this morning and with PETM trading below my cost on this block, I decided to step aside from this additional over-weighted addition and sold my 180 shares at $19.9524/share. This represented a loss of $.4152/share or multiplied by 180 shares came out to a loss of $(74.736). Percentage-wise, this was a loss of (2.03)% so the damage really wasn't significant at all.

I still like PetSmart (PETM) and have my 90 share position which I am quite bullish on. However, as a trader, I have always had mixed results and always subscribe to the belief that one is best minimizing losses.

Will PetSmart (PETM) turn around tomorrow and prove me wrong? I wouldn't be surprised. But I shall participate in that appreciation if that is the future for this stock. Meanwhile, I have a little more cash built up once again in the account for future investments and yes, an occasional 'trade'!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 24 May 2009

A New Podcast on PetSmart (PETM) and a poem by Stephen Crane and and essay by Carolyn Forche

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had the pleasure of putting together a new

I had the pleasure of putting together a new

PODCAST ON PETSMART

Please click above and listen to what I have to say about why I bought when other sold and what the outlook might be for this pet supply retailer.

Thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

McDonald's (MCD) 'A New Podcast!'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to let all of you blog readers to know that I managed to get off my duff and post a new

I wanted to let all of you blog readers to know that I managed to get off my duff and post a new

PODCAST ON MCDONALD'S

That you are all welcome to listen to. If you have any comments or questions, please feel free to leave them here or drop me a line at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 21 May 2009

PetSmart (PETM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

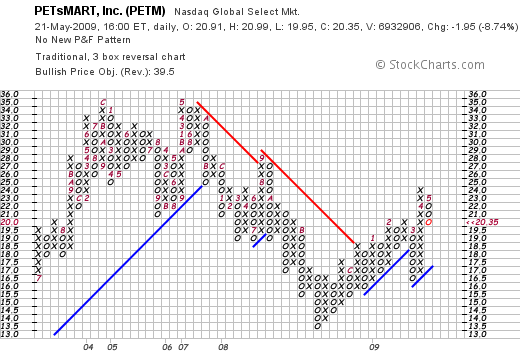

PetSmart (PETM) is currently one of my six holdings in my 'trading portfolio'. Up till today I owned 90 shares of PetSmart that I purchased back on November 20, 2008, at a cost basis of $15.50. PETM closed at $20.35 today, down $(1.95) or (8.74)% so I still have a significant gain on this particular purchase.

PetSmart (PETM) is currently one of my six holdings in my 'trading portfolio'. Up till today I owned 90 shares of PetSmart that I purchased back on November 20, 2008, at a cost basis of $15.50. PETM closed at $20.35 today, down $(1.95) or (8.74)% so I still have a significant gain on this particular purchase.

Yesterday (5/20/09) after the close of trading PetSmart (PETM) announced 1st quarter 2009 results. For the quarter ended May 3, 2009, the company earned $46.3 million or $.37/share on revenue of $1.33 billion, up from $41.2 million or $.32/share last year. According to this report, Thomson Reuters analysts had been expecting a profit of $.30/share on revenue of $1.35 billion.

Thus the company actually exceeded earnings estimates but did in fact miss revenue expectations by a small amount. Same-store sales did increase 3.9% during the quarter.

PetSmart also went ahead and estimated profit of $.26 to $.30/share for the next quarter and raised full-year profit estimates to $1.42 to $1.52/share from prior guidance of $1.40 to $1.50/share. The company guided expectations on revenue growth to the 'mid- to high-single digit sales'. They also suggested that same-store sales growth is likely to continue albeit in the low-single digits.

Thus the company announced positive earnings growth both absolutely as well as positive same-store sales growth, beat expectations on earnings, came in a little bit light on revenue and then raised guidance for the year on earnings. Really not too shabby a result from my amateur perspective.

And yet for this the stock was punished severely.

To be fair, an amateur is no match for a Goldman Sachs analyst who downgraded the retailer "despite its better-than-expected earnings in the first quarter."

As this article reported:

"Goldman analyst Matthew Fassler said the Phoenix-based company has "executed well," with strong sales and earnings compared to the rest of the retail sector and well-controlled costs. Its stock has outperformed the broader S&P 500 index in the past year, falling 3 percent instead of the 36 percent decline in the benchmark.

However, the company has little to drive its shares higher, given that recent same-store sales increases have been driven by food inflation and promotions, which don't add to profit margins. As inflation drops and foot traffic trends slowed in spring, he said, there's not much room for more growth in same-store sales."

The reaction seemed a bit severe.

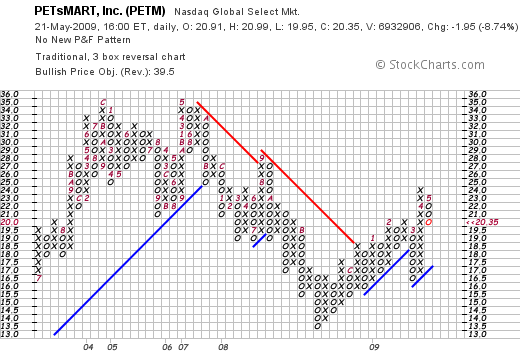

If we review the 'point & figure' chart for PetSmart from StockCharts.com:

We can certainly see that the stock has been fairly strong since November, 2008, when it bottomed at $13.50 and has been moving higher through resistance at $18.00. But the upward trend appears intact for now.

Simply looking at the Yahoo "Key Statistics" on PetSmart (PETM), we can see that the trailing p/e is a reasonable 13.39 imho, with a forward p/e of 12.72. The PEG is far from overpriced at 1.24.

To make a long story short, the move appeared overdone as investors were likely selling on the good news, a move that was accentuated by the GS analyst who couldn't find anything good about the earnings report which in an unusual fashion reported actual earnings that exceeded expectations and had the management actually raising guidance.

As I recently did with my Haemonetics (HAE) stock, I chose to buy when others were selling. Instead of joining the selling panic, I purchased 180 shares of PETM at $20.3676, close to its close for the day. This is outside of my usual trading pattern and whether or not this 'works' I expect that this now 'over-sized' position will be reduced to essentially the original holding size for the long-haul.

Thanks again for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 14 May 2009

McDonald's (MCD) and a Birthday Greeting!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your investment advisers prior to making any investment decisions based on information on this website.

I wanted to share with all of you an interesting cake to celebrate the birthday of this blog that quietly slipped by two days ago. This blog turned six years old and just like the average six-year-old, I feel like I am ready for first grade in investing! But fortunately, school starts in September, so we all have the Summer to keep us entertained.

I wanted to share with all of you an interesting cake to celebrate the birthday of this blog that quietly slipped by two days ago. This blog turned six years old and just like the average six-year-old, I feel like I am ready for first grade in investing! But fortunately, school starts in September, so we all have the Summer to keep us entertained.

Six years ago I wrote my first entry here and decided to comment a little about St. Jude (STJ). This is what I wrote:

May 12, 2003 St Jude Medical

This is one I picked up today. STJ is the stock symbol. I do not as I write and publish this own any shares. Am thinking about suggesting this to my stock club. Company had a great day today with a nice move on the upside. Last Quarter was good and the past five years have been steady growth. Closed at $55.30 up $2.92. So the daily momentum helped it make the list.

I still don't own any shares of St. Jude. It is still an interesting stock that deserves a mention on this blog. Meanwhile, Happy Birthday to Me! Lately, my entries are a bit longer, and the intervals between them have grown. I very much enjoy the opportunity to be a blogger, the chance at sharing with all of you a few thoughts on investing and how an amateur like me might choose to face the vagaries of the investment world. Thank you all for your visits, your letters and comments and your encouragement. I do not know what the future holds for me and investment blogging. But I can tell you this: the past six years have been exciting for me as an amateur investor and writer. I hope the next six are just as exciting, and perhaps, just a little more profitable!

Much has been written about McDonald's (MCD) being a recession-resistant stock. You can read about it here, here, here, here, and here for example.

Much has been written about McDonald's (MCD) being a recession-resistant stock. You can read about it here, here, here, here, and here for example.

There is some truth to the thesis. After all, people still need to eat, so doesn't it make sense to be eating at an affordable place like McDonald's when times are tough. In the same manner, Wal-Mart (WMT) has proven to be recession-resistant. People still need to 'buy things' but instead of shopping at the more expensive retail firms, or eating out at more expensive restaurants, the McDonald's and the Wal-Marts are likely increasing their market share in these recession-ridden times.

With that in mind, I wanted to briefly look at McDonald's and see if it truly was an investment, that I personally believed, was worth considering even in today's turbulent stock market.

First of all, what about the latest quarterly result? On April 22, 2009, McDonald's (MCD) reported 1st quarter 2009 results. Revenue did dip to $5.08 billion from $5.61 billion the prior year. Net income came in at $979.5 million, or $.87/share, ahead of analysts expectations of $.82/share. However, revenue failed to meet expectations of $5.23 billion.However, same-store sales worldwide grew 4.3%. It is difficult to know how same store sales can rise and overall sales can dip, unless factors such as currency exchange rates are affecting the total.

Latest numbers for the United States continue to be strong as April, 2009, 'same-store sales' grew 6.9% as reported. The article does relate that McDonald's same-store sales grew even faster in Europe at 8.4% and came in at a 6.5% increase in Asia/Pacific. However, China apparently is underperforming this rate as things continue to slow there in the face of a growing economic correction.

Longer-term, reviewing the Morningstar.com '5-Yr Restated' financials on MCD, we can see that revenue has been steadily growing from $19.1 billion in 2004 to $23.5 billion in 2008. In the trailing twelve months, McDonald's has experienced a slight dip in revenue to $23.0 billion. Earnings, except for a dip from 2007 to 2008, have grown steadily from $1.79/share in 2004 to $2.83/share in 2007--dipping to $1.98/share in 2008--and rebounding to $3.76 in 2008 and $3.83/share in the TTM.

In addition, the companyt pays a dividend which they have rapidly and consistently increased from $.55/share in 2004 to $1.63/share in 2008 and $1.75/share in the TTM. In terms of outstanding shares, the company had 1.27 billion shares outstanding in 2004, and has been gradually decreasing this amount to 1.146 billion in 2008 and 1.136 billion in the TTM.

Free cash flow remains solidly positive although this has slowed slightly in the TTM. MCD reported $2.6 billion in free cash flow in 2006, $2.93 billion in 2007, $3.78 billion in 2008 and $3.43 billion in the TTM.

Insofar as the balance sheet is concerned, Morningstar reports this company with $1.98 billion in cash and $1.47 billion in other current assets. This total of $3.45 billion easily covers the $2.21 billion in current liabilities reported. In terms of the current ratio, this yields a ratio of 1.56. McDonald's also has a significant $12.9 billion in long-term liabilities on its books, but with the ample cash and current assets, the positive free cash flow, and its record of growing its revenue and earnings, this doesn't seem to be a significant burden for them.

In terms of valuation, looking at the Yahoo 'Key Statistics' on MCD, we can see that this is a large cap stock with a market capitalization of $59.3 billion. The trailing p/e is a very reasonable 13.98 with a forward p/e of 12.86. The PEG ratio (5 yr expected) suggests that even with this relatively low p/e, the company is a bit richly priced with a PEG of 1.56.

Using the Fidelity.com eresearch website for some additional valuation numbers, we find that the Price/Sales ratio (TTM) works out to 2.60 compared to the industry average of 1.70. The company is also slightly less profitable than its peers when viewed from the perspective of Return on Equity (TTM) with MCD coming in at 32.35% vs. the industry average of 47.67. However, their return on assets, and their return on investment handily outpace their peers.

Finishing up with the Yahoo information, there are 1.11 billion shares outstanding with 1.09 billion that float! As of 4/27/09 there were 13.43 million shares out short representing a short interest ratio of 1.4 days or 1.2% of the float---hardly the numbers I would look for that might cause a 'squeeze'.

Finally, with the $2.00 forward dividend rate, the company pays a significant dividend yielding 3.7%. There appears to be good coverage for this dividend with a payout ratio of 46%. The last stock split was a 2:1 split just about ten years ago on March 8, 1999.

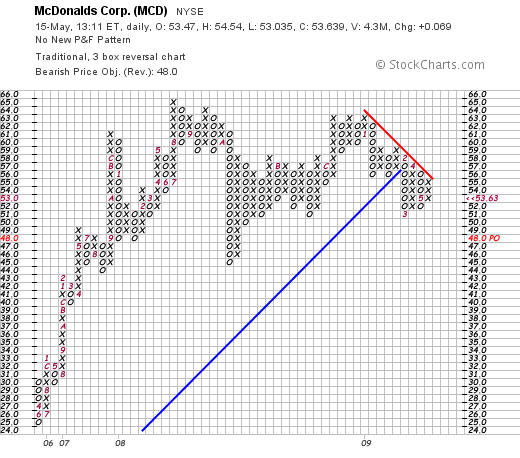

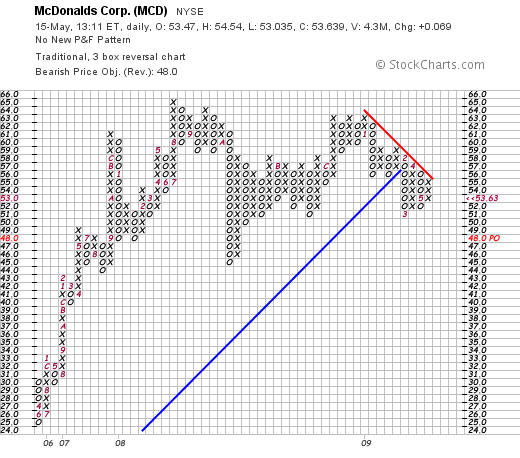

What does the chart look like?

Reviewing the 'point & figure' chart on McDonald's (MCD), we can see that the company experienced a sharp rise in its stock price between May, 2005 and August, 2008, when the stock rose from $25 to $65. The stock dipped briefly to the $45 level in October, 2008, but since then has foght back but has struggled a bit since hitting the $63 level three times in December 2008 and January, 2009. I would have to say I am less than enthusiastic about the technical appearance of this chart--at least from my amateur perspective.

In conclusion, McDonald's (MCD) is indeed a recession-resistant company. They are continuing to show positive same-store growth and appear to be taking a bigger market share from its competitors. Unfortunately, the strong dollar is depressing their financial results--due to exchange rates when results are reported in dollars--and they are feeling the pressure from their multinational business as many such corporations are experiencing today.

Due to what appears to be brilliant management, this gigantic restaurant chain is reinventing itself, adding salads, healthier items and a coffee bar to many of its newly named 'Cafes'.

This company has been a steady grower from well before 2004 and continues to produce solid results. However, valuation is a tad rich in terms of p/e relative to growth, Price/Sales ratios are also a bit rich relative to other companies in the same industry, and the chart appears a bit 'tired'. Clearly, I am not the first amateur to think about buying McDonald's stock! But regardless of all of that, I do like this company, like their ability to innovate and produce a consistent product, and like their steady revenue growth, earnings growth, dividend growth, decline in outstanding shares, and solid balance sheet.

You should do worse in a market like we have today!

By the way, McDonald's is currently trading at $53.50, down $.069 or (.13)% on the day. I do not own any shares of McDonald's (MCD) currently but some of my immediate family members do own small lots of shares in their own accounts.

Thanks again for visiting! And thanks for 6 years of your interest and encouragement that has allowed me to continue to find the time and energy to blog! Go ahead and have a slice of birthday cake---but I wouldn't eat it. Mostly flowers.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 9:32 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 15 May 2009 12:41 PM CDT

Friday, 8 May 2009

Haemonetics (HAE) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I recently shared with you my decision to make a purchase of 150 shares of Haemonetics (HAE) as a "trade". This was in addition to my holding of 50 shares of the stock as more of an "investment". This is outside of my regular strategy of timing stock purchases and sales based on internal signals from my own account, and the sizing of such positions again based on the other position size. In fact, with the purchase of these shares, my Haemonetics (HAE) holding represented approximately 50% of my entire portfolio!

The stock fortunately moved as I had hoped it would, undoing the apparently irrational price plunge in the midst of a fairly good earnings report. Wanting to stay within my own trading strategy, I undid that purchase and sold my 150 shares a few moments ago at $51.5252 (5/8/09). Thus, having purchased these shares on 5/4/09 at a cost basis of $48.5968, this represented a gain of $2.93 or 6.02% on this particular purchase. While seeming like a small move to make such a sale and purchase, I again acted with my brain and not my gut to close out this 'trade' that wasn't consistent with my underlying core trading strategy.

I shall continue to reserve the right to make such trades within my account even as I try to methodically manage my holdings.

Thank you for taking the time to visit my blog! If you have any comments or questions, please leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 4 May 2009

Haemonetics (HAE) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

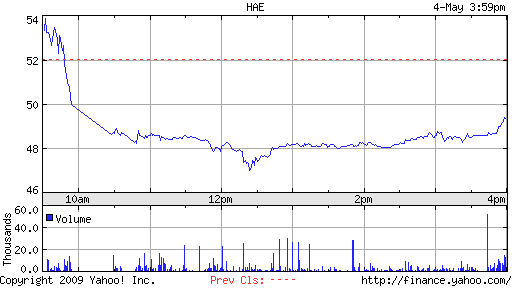

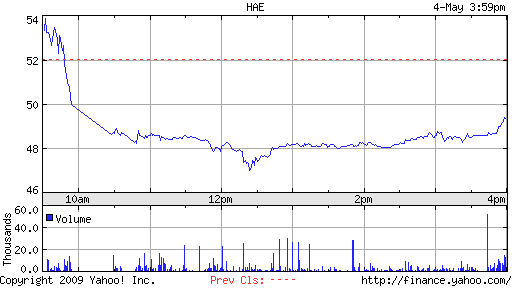

Today Haemonetics (HAE), one of the six holdings in my trading account, announced 4th quarter results. Revenue for the quarter rose 10% to $152.4 million. Excluding items the company earned $.65/share. Analysts had been expecting $.63/share so the company beat expectations on earnings. Analysts had been expecting $151.1 million according to Reuters estimates; thus the company beat on revenue as well. The company went ahead and guided pretty much to expectations.

In spite of this the stock plummeted. Looking at the chart for the action today, we can see how the stock price hit its low today around 12:25 pm when the price high $47/share. After that point, the price gradually closed into the close of the day.

Like so many amateur investors, I really wasn't sure what I should be doing with this stock! My gut was full of panic and directed me to sell quickly! Yet my brain screamed out that this was irrational. That the continued dip on good news was nuts and that I needed instead to buy.

I chose to use my brain and while holding my nose, picked up 150 shares of Haemonetics (HAE) at $48.60/share. This wasn't really my 'system' at work, but there are times when stock actions defy logic and I hoped this was one of them.

Fortunately, HAE gathered strength into the close and ended up at $49.37, down $(2.67) or (5.13)% on the day.

Where does HAE go from here? I don't really know. But the news released was solid and I chose to add to my small position of HAE making it now my largest holding in my portfolio.

Yours in investing,

Bob

Newer | Latest | Older

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day.

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day. Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

A few moments ago I posted a

A few moments ago I posted a

As I mentioned in an earlier blog, my 'trade' in PetSmart (PETM) was intended to be a short-term affair. I had hoped that I could be reporting a large profit from this move which did indeed initially move higher after my purchase of 180 shars on 5/21/09 at a cost of $20.3676. However with the market acting at best erratically this morning and with PETM trading below my cost on this block, I decided to step aside from this additional over-weighted addition and sold my 180 shares at $19.9524/share. This represented a loss of $.4152/share or multiplied by 180 shares came out to a loss of $(74.736). Percentage-wise, this was a loss of (2.03)% so the damage really wasn't significant at all.

As I mentioned in an earlier blog, my 'trade' in PetSmart (PETM) was intended to be a short-term affair. I had hoped that I could be reporting a large profit from this move which did indeed initially move higher after my purchase of 180 shars on 5/21/09 at a cost of $20.3676. However with the market acting at best erratically this morning and with PETM trading below my cost on this block, I decided to step aside from this additional over-weighted addition and sold my 180 shares at $19.9524/share. This represented a loss of $.4152/share or multiplied by 180 shares came out to a loss of $(74.736). Percentage-wise, this was a loss of (2.03)% so the damage really wasn't significant at all.  I wanted to let all of you blog readers to know that I managed to get off my duff and post a new

I wanted to let all of you blog readers to know that I managed to get off my duff and post a new

I wanted to share with all of you an

I wanted to share with all of you an