Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to always consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had a bit of a tumultuous day in the market. My Bolt Stock (BTJ) hit a 120% sale point enabling to me to add a new position. Later in the day my IHS (IHS) hit an 8% loss and the shares were sold without reinvesting those funds. With the sale of Bolt (BTJ) I had the "permission slip" to add a new position since I was under 25 positions (my maximum). Looking through the list of top % gainers, I came across Covance (CVD) which closed at $61.91, up $1.74 or 2.89% on the day. Before the close of trading (on April 9, 2007) I purchased 119 shares of CVD at $62.52/share.

I had promised you that I would review Covance (CVD) a few days ago, and you know how one thing leads to another, and one excuse to another excuse for not writing. Anyhow, before I get to sleep tonight, I wanted to share with you a more in depth look at this company and explain why I felt it was a good fit for the blog. Why it deserved to be part of my 'vocabulary' of stocks and why I chose to purchase shares. As noted above, I own 119 shares of CVD in my trading account. CVD closed today at $61.36, up $.69 or 1.14% on the day, but still a bit below my purchase price.

I had promised you that I would review Covance (CVD) a few days ago, and you know how one thing leads to another, and one excuse to another excuse for not writing. Anyhow, before I get to sleep tonight, I wanted to share with you a more in depth look at this company and explain why I felt it was a good fit for the blog. Why it deserved to be part of my 'vocabulary' of stocks and why I chose to purchase shares. As noted above, I own 119 shares of CVD in my trading account. CVD closed today at $61.36, up $.69 or 1.14% on the day, but still a bit below my purchase price.

What does this company do?

According to the Yahoo "Profile" on Covance (CVD), the company is

"...a drug development services company, provides early-stage and late-stage product development services to the pharmaceutical, biotechnology, and medical device industries worldwide. Its early stage development services include preclinical services, such as toxicology services, and pharmaceutical chemistry and related services; and clinical pharmacology services, including first-in-human trials of new pharmaceuticals."

How did they do in the latest quarter?

On January 24, 2007, Covance reported 4th quarter 2006 results. For the quarter ended December 31, 2006, total revenues increased to $359.1 million from $343.1 million in the same quarter the prior year. Net income came in at $38.3 million up from $30.0 million ($34.4 million in 2005 with one-time tax charge not included), or $.59/share, up from $.47/share in 2005 (again vs. $.54/share minus the one-time tax charge in the 2005 4th quarter).

The company met expectations on earnings at $.59/share, but missed revenue expectations of $366.2 million.

What about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials, we find that revenue has steadily increased from $925 million in 2002 to $1.4 billion in 2006. Earnings have also steadily increased from $1.03/share in 2002 to $2.24/share in 2006. While revenue was increasing 50%, and earnings up 100%, the outstanding shares was up only 7% from 60 million shares in 2002 to 64 million shares in 2006.

Free cash flow, while a bit erratic has been positive and increasing recently with $90 million in 2004, $29 million in 2005, and $117 million in 2006.

The balance sheet, as reported on Morningstar, appears solid with $219.8 million in cash and $419.8 million in other current assets easily covering both the $289.7 million in current liabilities and the $84.7 million in long-term liabilities combined. Calculating the current ratio, the total of the current assets of $639.6 million, divided by the $289.7 million in current liabilities, yields a current ratio of 2.21. A ratio over 2.0 is generally considered "healthy".

How about some valuation numbers on this stock?

According to Yahoo "Key Statistics" on Covance (CVD), this stock is a mid cap stock with a market capitalization of $3.93 billion. The trailing p/e is moderate at 27.42, and the forward p/e (fye 31-Dec-08) is estimated at 19.60. The company is growing its earnings quickly enough that the PEG ratio is reasonable from my perspective at 1.28 (5 yr expected).

Checking the Fidelity.com eresearch website for more information, we can see that the Price/Sales ratio (TTM) for CVD is reasonable at 2.75 compared to an industry average of 7.48. In addition, the company's Return on Equity (ROE) (TTM) is equally convincing, with a value of 16.72% ahead of what Fidelity calls the industry average of only .69%. Thus, the company is both 'cheaper than average' as well as more 'profitable than average' from the perspective of these two measurements.

Finishing up with Yahoo, it is noted that the company has 63.97 million shares outstanding with 63.59 million of them that float. As of 3/12/07, there were 2.16 million shares out short, representing 3.4% of the float or 6.1 trading days of volume. This short ratio above 3 is significant from my perspective, and may well be pushing the stock higher with a short squeeze if any good news is announced. Finally, no cash dividends are reported and no stock splits are reported as well.

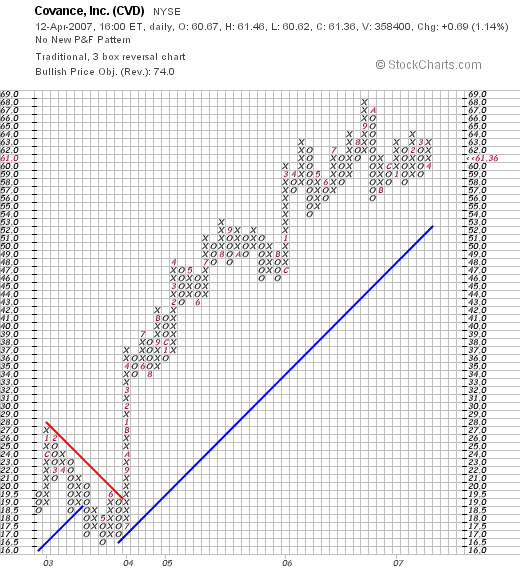

What does the chart look like?

Reviewing the "Point & Figure" Chart on Covance (CVD) from StockCharts.com, we can see that except for a period of weakness from late 2002 into July, 2003, the stock has been moving strongly and steadily higher. The chart looks encouraging to me and not very over-extended.

Summary: What do I think?

COVANCE (CVD) IS RATED A BUY

Needless to say, I liked this stock enough to buy shares! The last quarter was solid with steady revenue and earnings growth. The company did come in a little light on revenue but earnings met expectations. In addition, the company guided to a higher rate of growth. In addition, the past several years have been solid with steady revenue and earnings growth while shares outstanding havs been reasonably stable. Free cash flow has been positive and growing, and the balance sheet is solid with very little long-term liabilities outstanding.

Valuation is good with a Price/Sales ratio low for its group while the profitability as measured by the Return on Equity was greater than other companies in its industry. The p/e wasn't very high and the PEG was under 1.5. Finally, there is even a significant short interest which may well support the price of this stock in the event of any good news announcement.

Overall I like this stock. Not as a 'get rich quick' kind of stock, but as a steady performer which has year after year been reporting steady growth. The kind of stock I enjoy having in my own portfolio.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com or just visit my blog! If you get a chance, be sure and visit my Stock Picks Podcast Website!

Bob

Updated: Thursday, 12 April 2007 9:52 PM CDT