Stock Picks Bob's Advice

Saturday, 29 April 2006

A Reader Writes: "...a couple of stocks that I would love to get your opinion..."

Hello

Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received a nice email from Bret M., who is a friend of my son Ben.

Bret wrote:

"Ben told me about your blog a few weeks ago and Ive been enjoying reading it.

Your strategy is very interesting and I really like the way it automatically

keeps you in a bull market and pulls you out of a bear.

I've got a couple of stocks that I would love to get your opinion on.

My dad is

an optometrist and he owns a little stake in Advanced Medical Optics (EYE). It

has done very well and I know you would say to peel off a small chunk of it. Have you heard anything about it posibly

being bought

out by J&J? Do you suspect that would that be good for EYE stock?

Another stock that my dad and I have been in and out of a little is DXPE. We

found it on a Yahoo "top 10 stocks under 10 bucks" list last summer

and it then

shot up after Katrina. We rode it from like 10 to 18. It is extremely

volitile,

but has made its way up to 38. What do you think about its fundementals? Is it

too late or too expensive now to get back in?

Thanks for the help. I look forward to hearing back from you. Thanks.

Bret M."

Brett, thanks so much for writing. First of all, I am not privy to any inside information. I do not know if EYE might be an acquisition target. It is a general rule that acquisitions are favorable for the acquired company which generally sees a significant increase in its stock price. Should you be selling a little bit of your holding as the company's stock price rises? You of course know my answer. If it is wise to sell your losing stocks quickly, it is also wise to sell your gaining stock slowly. It is often hard to both sell a stock that has dropped and it is equally hard to justify selling a stock when you are in the midst of feeling so good about it. I am sure you understand this.

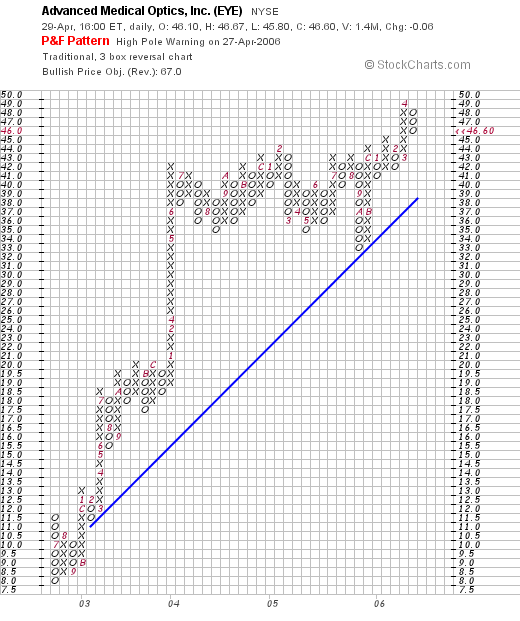

This past Thursday, April 27, 2006, EYE

announced 1st quarter 2006 results. Sales increased nicely to $238.2 million for the quarter, a 23.7% increase over the prior year same quarter. However, first quarter net income came in at $2.6 million or $.04/share, down sharply from $13.8 million or $.35/share last year. The company had a lot of excellent reasons and did provide reasonably strong guidance for future results, but I am always looking at the 'bottom line'.

I also have a tough time with the EYE

Morningstar.com "5-Yr Restated" financials, which, while showing strong revenue growth show that the company dropped from $.35/share in 2003 to a loss of $(3.89)/share in 2004 and $(8.28)/share in 2005. In addition, free cash flow which was $22 million in 2004, dropped to a negative $(2) million in 2005.

The balance sheet as reported on Morningstar.com shows the company with a bit of a heavy debt load with a current ratio of 1.84, which isn't bad, but also a $710.5 million in long-term liabilities.

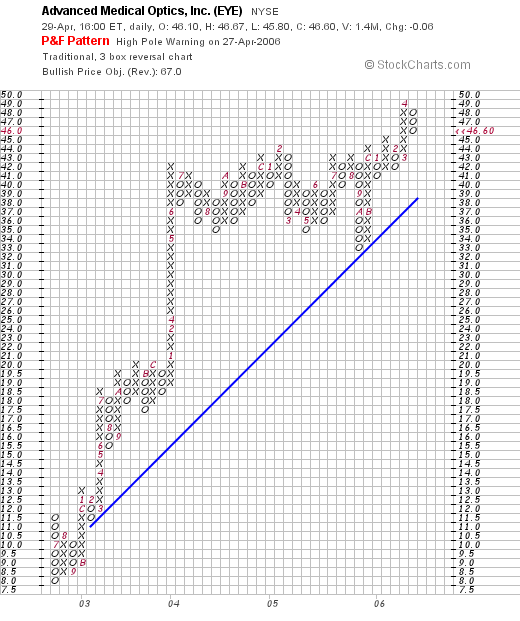

And the

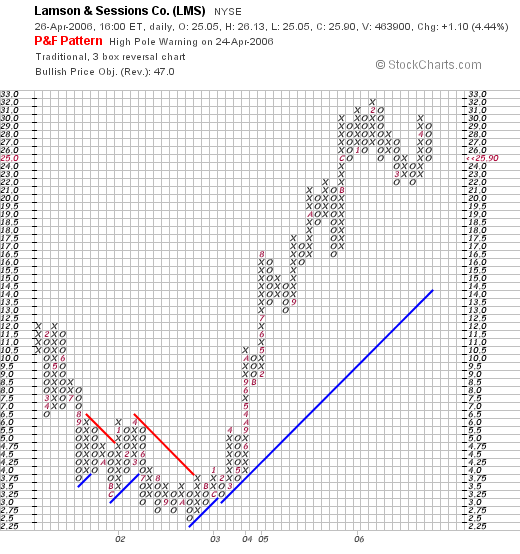

"Point & Figure" chart on EYE from StockCharts.com:

Clearly this stock looks very strong on the chart-side of things. All the more reason to take some small profits. I do not invest based on stories or hypotheses. I did at one time in the past.

I like to look hard at actual corporate performance, with the limited tools at my disposal. I am not looking for what 'could be' but what is actually occurring. Basic stuff like earnings, free cash flow, valuation numbers, and balance sheets. This is how I approach my investments. That, along with careful tending of my holdings with partial sales of stocks as they approeciate and quick sales of stock posting losses. I have had several of my stocks acquired....most recently Sybron Dental (SYD) that I wrote up a month or so ago. But I believe they are getting acquired because others are examining these companies with the same perspective I am applying.

Now for that other stock you mentioned: DXPE....a stock that I don't think I am familiar with...so let's take a look.

According to the Yahoo "Profile" on DXPE, the company

According to the Yahoo "Profile" on DXPE, the company

"...distributes maintenance, repair, and operating (MRO) products, equipment, and service to industrial customers in the United States. It operates in two segments, MRO and Electrical Contractor."

What about the latest quarter? On April 26, 2006, DXPE

announced 1st quarter 2006 results. Sales grew 49.6% to $62.5 million from $41.8 million in the same quarter the prior year. For this quarter that ended March 31, 2006, net income came in at $2.5 million or $.44/share, up 193% from $854,000 or .15/share in the prior year same period. I would have to admit that this was a

fabulous report!

What about longer-term?

Except for a dip in revenue from $174.4 million in 2001 to $148.1 million in 2002, the company has been growing its revenue to $185.4 million in 2005.

Earnings have grown steadily during the past five years from $.21/share in 2001 to $.94/share in 2005. This is a very small company with 4 million shares in 2001, increasing to 5 million in the trailing twelve months (TTM).

Free cash flow has been deteriorating recently, dropping from $7 million in 2003, $3 million in 2004, and $(2) million in 2005.

The balance sheet is fine with $.6 million in cash and $55.6 million in other current assets, balanced against $28.1 million in current liabilities (giving us a 'current ratio' of 2.0) and $25.3 million in long-term liabilities.

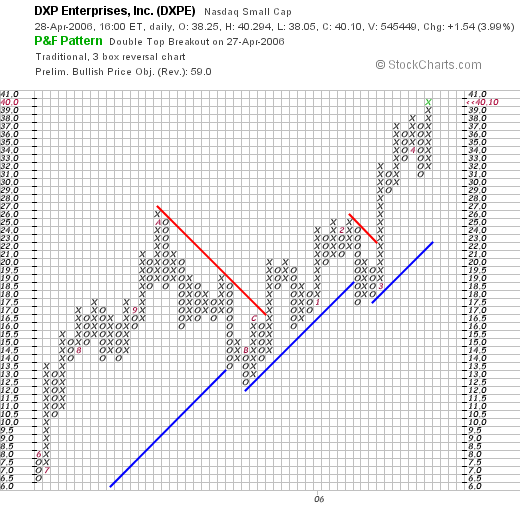

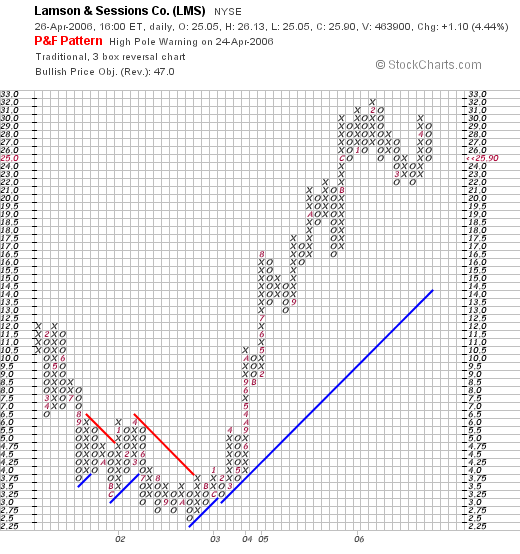

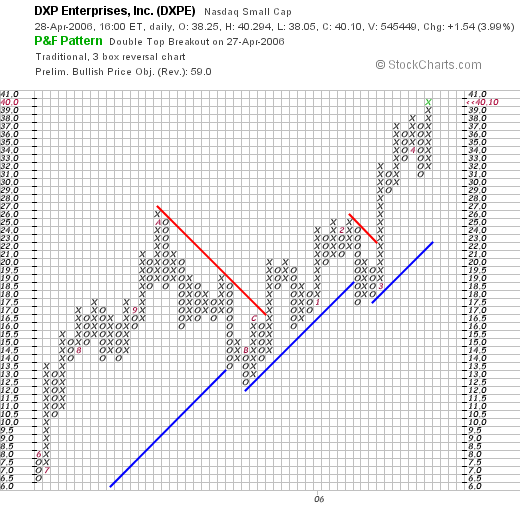

And the chart: looking at the

"Point & Figure" chart on DXPE from StockCharts.com:

Basically, this chart looks quite strong as well.

What about DXPE 'valuation'? Looking at the Yahoo "Key Statistics" on DXPE, we can see that this is a small company with a market cap of only $198.49 million. The trailing p/e is a bit rich at 42.48, but with the rapid growth in earnings, the forward p/e is much nicer at 21.68. There is no PEG available (probably no analyst with 5 yr results estimated). The Price/Sales is 1.03. According to the Fidelity.com eresearch website, DXP is in the "Industrial Equipment Wholesale" industrial group, and is priced midway between MSC Industrial with a Price/Sales ratio of 3 and CE Franklin (CFK) at 0.7. Thus, by this measure the stock isn't really overpriced.

So what do I think? I am a bit concerned about some of the things I have found and mentioned on EYE. However, the company remains optimistic. Being more concerned about actual results, I wouldn't be entering EYE at this point, but waiting for those results to happen. DXPE is a bit of a different story. The results in the latest quarter were fabulous.

Your question about "getting back in" is the problem of doing stocks "for a trade". Although I did the same in BOOM with 300 shares just yesterday :). But my core holding wasn't affected. It is better to just sell portions of stocks on large gains and sell ALL of your shares when stocks do poorly, not when they do WELL. Do you follow?

Should you enter now? I would if the stock hit the new high list and met my own criteria. I might pass on DXPE and miss a great company with their reported negative cash flow. There are just too many stocks to choose from and I go for perfect :). As for you, it is your call. I don't think this particular stock is so big it doesn't have any room to grow further. I would, however, establish sale points on any position you take, both on the upside and the downside. Forget the trades (except occasionally) imho. Generally think about managing your holdings instead.

Just my call.

Thanks so much for writing. Let me know if what I wrote was helpful and what you decided to do!

Regards.

Bob

A Reader Writes "I just wanted to get some advice from you..."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received a nice letter a few days ago from Isaac N. who wrote:

"I just wanted to get some advice from you concerning a stock I own.

I know you advise to sell partially after 30% gain is attained. I

bought ADM at 22.65 (44 shares) and now is at 36.67, a 61.9% gain.

Is it wrong for me to hold this stock as it has crossed the 30% gain

value? This is one of three stocks I own. I am also looking into

buying one more stock. Which sectors do you think will be hot in the

future. I'm very patient so I'm not necessarily looking for a stock

that will have immediate gains.

Thanks,

Isaac N"

Isaac, thanks so much for writing!

I want to try to take a look at several of the points that you raise in your comments. First of all, is ADM a good stock to own? And should you sell some shares now that you have 60% gain? And what sector do I think will be hot in the future?

Let me comment briefly on these things.

First of all Archer-Daniels-Midland (ADM). The stock closed at $36.34 on 4/28/06, up $.15 or .41% on the day. Currently ADM appears to be riding the ethanol bandwagon.

Latest quarter:

On January 31, 2006, ADM

reported 2nd quarter 2006 results. Sales grew 3% to $9.3 billion from $9.06 billion the year earlier. Net income for the quarter ended December 31, 2005, increased 17% to $367.7 million or $.56/share, up from $313.5 million or $.48/share the prior year. So far so good. Better yet than the results themselves was the fact that the company exceeded estimates:

"Analysts surveyed by Thomson Financial had expected the company to post earnings of 42 cents per share on sales of $9.18 billion."

So this

was a nice report!

How about longer-term? Looking at the

Morningstar.com "5-Yr Restated" financials, we can see that revenue grew strongly between 2001 and 2004, then flattened out in 2005 and the trailing twelve months (TTM). Meanwhile, earnings have skyrocketed between 2004 when they were $.76/share and 2005 when earnings came in at $1.59. Dividends have also been increasing steadily throughout this period. In addition the number of shares outstanding has been shrinking from 661 million in 2001 to 653 million in 2005 and 654 million in the TTM.

Free cash flow has been a bit erratic, but overall appears to be strongly positive (except for a negative $(476) million in 2004). The balance sheet also looks reasonable with a current ratio of about 1.5. The company does have a bit of a debt load with $5.2 billion in long-term liabilities. But the finances overall look just fine.

Reviewing

Yahoo "Key Statistics" on ADM, this is a large company with a market cap of $23.76 billion. The trailing p/e isn't bad at 17.73, but the PEG is a bit rich at 2.11. However, with the latest strong earnings, this may well be adjusted downward. The Price/Sales at 0.66 appears reasonable as well. There are a lot of shares out at 653.8 millio outstanding with 633.22 million that float. Only 5.65 million shares are out short, representing 0.9% of the float or 1.3 trading days of volume. As noted, the company pays a 1.1% dividend and last declared a 5% stock split in August, 2001.

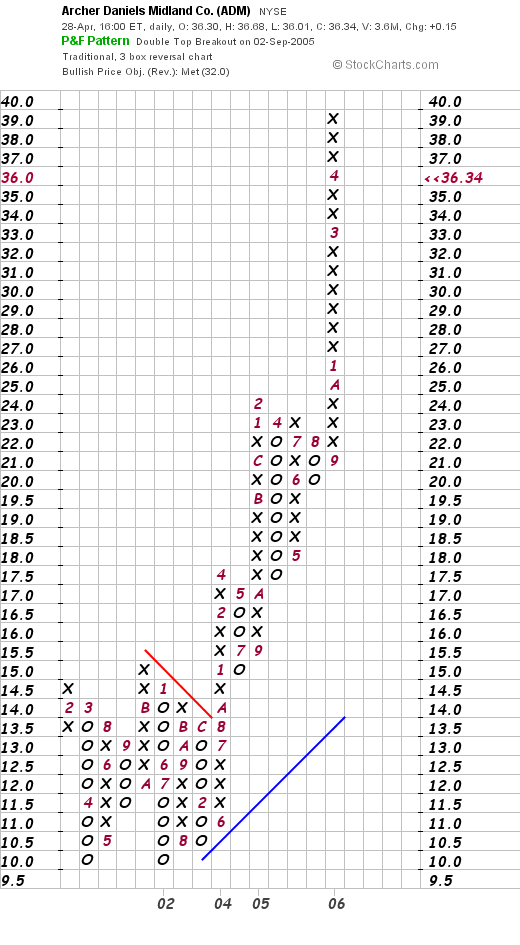

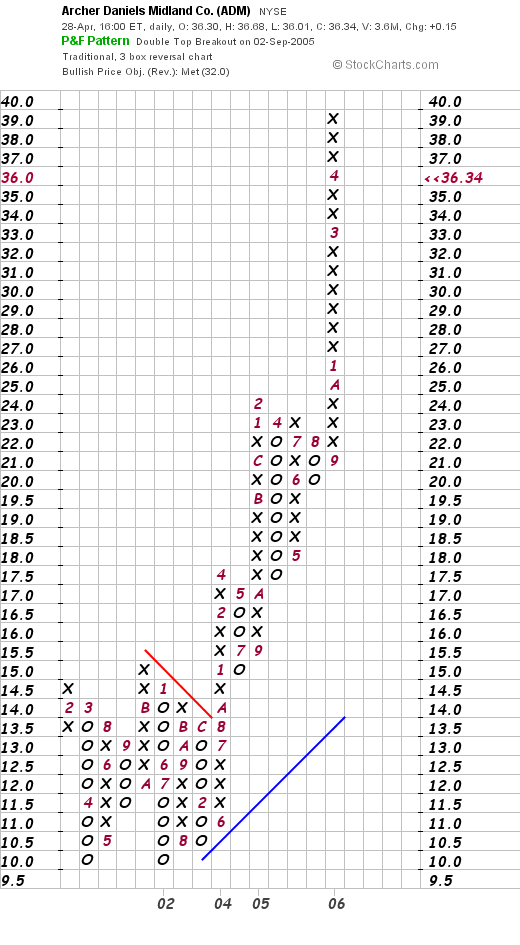

The chart? Taking a look at the

"Point & Figure" chart on ADM from StockCharts.com:

Clearly, this stock has been 'on a tear' recently. The stock broke through resistance at $14 in August, 2004, and has skyrocketed to its current level of $36.34. If anything, the stock price appears a bit over-extended. This is something that I describe when the price elevates far above the "blue" arbitrary support line. Overall the chart looks very strong.

Anyhow, insofar as ADM is concerned it is an interesting play especially on the Ethanol business. The numbers basically look fine except for the relatively stagnant growth in revenue. Earnings, however, have climbed.

Should you sell 1/6th? You probably know my answer. But that is just what I do. Doesn't mean you need to do it. I believe in selling my gaining stocks slowly and partially and my losing stocks completely and quickly. It is this bias that will keep your overall performance maximized imho.

What stock or industry should you consider? I am biased towards the medical technology firms but I still depend on what I call my "zen" approach on investing. I buy stocks that are climbing strongly on the day that I have my "permission" to add a new position. So my choice of industry, although I do have my own bias, depends on which stocks show up on the top % gainers list and also meet my own criteria.

I will refrain from naming a particular stock as I am sure you are more than capable of selecting a stock for consideration. If you would like, scan through my past entries, take a look at current information, and you will have hundreds of stocks to choose from!

Good luck and keep me posted. Thanks so much for taking the time to write.

Bob

Posted by bobsadviceforstocks at 11:04 AM CDT

|

Post Comment |

Permalink

Updated: Saturday, 29 April 2006 11:06 AM CDT

"Looking Back One Year" A review of stock picks from the week of February 7, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to remind readers, the weekend is a time for reflection for me here on this blog. I like to review both past stock picks as well as actual holdings in my trading portfolio. The review of my past picks assumes a "buy and hold" strategy. In fact, I employ and recommend using an investment approach that involves selling losers quickly and completely and gaining stocks slowly and partially. However, for the sake of this blog, the "buy and hold" strategy is easier to evaluate and this is what I am doing in these reviews each weekend.

On February 7, 2005, I

posted Manor Care (HCR) on Stock Picks Bob's Advice when in was trading at $34.90. HCR closed at $43.85 on April 28, 2006, for a gain of $8.95 or 25.6% since posting.

On April 26, 2006, HCR

reported 1st quarter 2006 results. Revenues for the quarter came in at $869 million, down from $879 million in the same quarter last year. Net income was $25 million, down from $40 million or $.30/diluted share, down from $.46/diluted share the prior year same period. The company offered several good explanations within the report for this change in performance, however, I am stuck on the bottom line and for my purposes this stock gets a "thumbs-down" on this quarterly report.

On February 11, 2005, I

posted Trex (TWP) on Stock Picks Bob's Advice when Trex was trading at $48.46. Trex closed at $29.88 on April 28, 2006, for a loss of $(18.58) or (38.3)% since posting.

On April 27, 2006, TWP

announced 1st quarter 2006 results. For the quarter ended March 31, 2006, sales came in at $105.3 million, up from $89.9 million in the year-ago same period. Net income, however, came in at $4.2 million or $.29/diluted share compared with net income of $8.4 million or $.56/diluted share in the same quarter last year. Apparently, this is one company that is suffering from the increased cost of plastic raw materials.

So how did I do with these two stocks for that week a little over a year ago? Well, HCR showed a 25.6% gain and TWP showed a loss of (38.3)%. Thus, the average performance for these two was a

loss of (6.35)%.

A couple of comments. First of all, this shows how seemingly strong companies

can lose money over time! And that I am completely capable of posting a stock that can lose money! And how it is important imho to establish loss limits on your stocks. If I had in fact actually purchased these two stocks in my portfolio, I would have sold my TWP quickly and it would have been gone long before this particular loss, and my HCR would have been still in my portfolio biasing my performance to the gain. (I do NOT own either of these stocks in my trading portfolio....I believe I did have some shares of TWP in the near past in a managed account....I am not sure if it is still there.)

Anyhow, thanks so much for stopping by! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com or feel free to leave your comments right here on the blog. Also, please be sure and drop by my

Stock Picks Bob's Advice Podcast Website wehre you can hear me talk about many of the same stocks I write about in my blog!

Bob

Friday, 28 April 2006

AngioDynamics (ANGO) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today, as I noted in another post, I purchased 200 shares of AngioDynamics (ANGO) at $30.24/share. AngioDynamics (ANGO) closed at $2.91, up 10.33% on the day.

I recently had ANGO in my 'trading portfolio' and in fact,

reviewed AngioDynamics on Stock Picks Bob's Advice on February 11, 2006, a little over two months ago.

I purchased 240 shares of AngioDynamics at a cost of $26.26 on 1/6/06. These shares were sold on 3/2/06, last month (!), at a price of $23.46, for a loss of $(2.80) or (10.6)%. Showing up again on the list of top % gainers, and having a 'permission slip' to add a new position having sold 1/6th of my Ventana (VMSI) at a 90% gain, I decided to give ANGO another shot!

Let's review some of the latest information on this company and see if it is worth another purchase.

1. What does this company do?According to the

Yahoo "Profile"on AngioDynamics, the company

"...engages in the design, development, manufacture, and marketing of medical devices for the minimally invasive diagnosis and treatment of peripheral vascular disease. Its products include angiographic catheters, hemodialysis catheters, plasma thromboplastin antecedent dilation catheters, thrombolytic products, image-guided vascular access products, endovascular laser venous system products, and drainage products."

2. How did the company do in the latest quarter?

2. How did the company do in the latest quarter?On March 21, 2006, AngioDynamics

reported 3rd quarter 2006 results. For the quarter ended February 25, 2006, net sales increased 28% to $19.8 million, up from $15.5 million in the same quarter the prior year. Net income for the quarter was $1.9 million or $.14/diluted share, up 73% from $1.09 million the prior year and up 56% from the $.09/diluted share reported in the same quarter last year. To finish out what I call a "trifecta" in earnings reports, the company raised guidance stating:

"The Company is revising upwards its fiscal 2006 financial guidance. AngioDynamics now expects net sales growth to exceed 29% over fiscal 2005, to at least $78.0 million. Year-over-year net income growth is expected to exceed 60%, to $7.3 million, which includes an anticipated one-time charge totaling $400,000, net of income taxes, to be incurred in connection with the Company's requirement to comply by May 2006 with Section 404 of the Sarbanes-Oxley Act. This compares with the Company's prior guidance for net sales of at least $76.0 million, and net income of at least $6.7 million for fiscal 2006. The Company now expects its earnings per diluted share to increase to $0.57 for fiscal 2006, compared with its prior guidance of $0.52 per diluted share."

3. How about longer-term results?

3. How about longer-term results?Reviewing the

Morningstar.com "5-Yr Restated" financials on ANGO, we see the steady progression in revenue from $23.4 million in 2001 to $60.3 million in 2005 and $72.2 million in the trailing twelve months (TTM). We have only two years of earnings to examine: the company reported $.37/share in 2005 and $.50/share in the TTM. Total shares were 12 million in 2005 and 13 million in the TTM.

Free cash flow is now positive and has been improving, with $(3) million in 2003, $1 million in 2004, $3 million in 2005 and the TTM.

The balance sheet is solid with $28.9 million in cash, enough by itself to pay off the combined $10.1 million in current liabilities and the $2.8 million in long-term liabilities more than 2x over. When combined with the $27.2 million in other current assets, the current ratio is calculated at 5.55. This looks solid to me!

4. How about some valuation numbers on this company?

Looking through the

Yahoo "Key Statistics" on ANGO, we find that this is a small cap stock with a market capitalization of only $388.50 million. The trailing p/e is rich at 61.52. The forward p/e (fye 28-May-07) is estimated at 41.43. However, with the rapid '5 yr expected' earnings growth, the PEG is a reasonable 1.39.

The company appears rather richly valued by Price/Sales ratio according to the

Fidelity.com eresearch website. Fidelity reports AngioDynamics with the richest Price/Sales ratio in the group of "Medical Instruments/Supplies" industrial group. AngioDynamics (ANGO) leads the group with a Price/Sales ratio of 5.1. This is followed by Stryker (SYK) at 3.7, Boston Scientific (BSX) at 3.1, Becton Dickinson (BDX) at 2.9, Baxter (BAX) at 2.4, and Bausch & Lomb (BOL) at 1.2. Certainly, by this measure, ANGO is not a screaming bargain.

Referring back to Yahoo, we find that there are only 12.50 million shares of this company outstanding with 10.23 million that float. Of these shares, 187,230 or 1.60% of the float was out short as of 3/10/06, representing 2.4 trading days of volume (the short ratio). This does not appear to be much of a factor imho. No cash dividends and no stock dividends are reported on Yahoo.

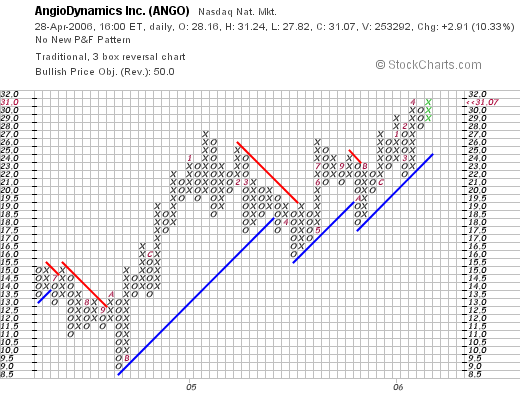

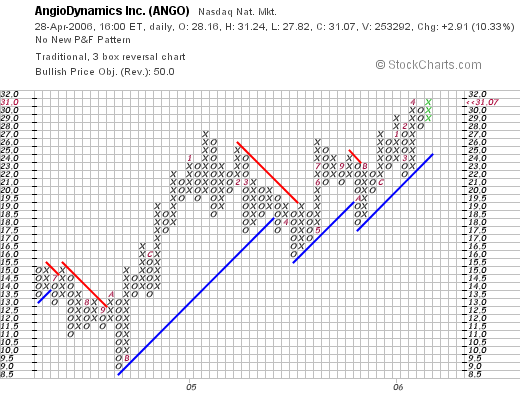

5. What does the chart look like?Looking at the

"Point & Figure" chart on AngioDynamics from StockCharts.com:

We can see that the stock which was trading at $15/share in June, 2004, dropped to a low of $9.00/share in October, 2004, and since then, through fits and starts has been heading higher to the current $31.07 level. The chart looks strong to me but not over-extended.

6. Summary

So what do I think? Well, I liked this stock enough to take another position in this stock even after being stopped out last month at a loss! The latest quarter was very nice with the company even boosting guidance. The Morningstar record is also solid but there isn't a long record of increasing earnings as it appears that this company has not been public too long (a negative). However, revenue has been growing nicely, and whatever results on earnings shows steady growth. Free cash flow is now positive and growing and the balance sheet looks nice.

Valuation-wise, the p/e is rich although the PEG at under 1.5 isn't too bad. The Price/Sales ratio is also rich with the company at the top of its group. Finally, the chart looks nice.

I basically like this company that is doing just fine. Hopefully, the stock price will cooperate better allowing me to stay a little longer than last time!

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave your comments on the blog or email me at bobsadviceforstocks@lycos.com. Also feel free to listen to my January 6, 2006 PODCAST on ANGO. Please excuse a few technical glitches on this early podcast of mine. For a list of all of my podcasts, be sure to come and visit my Stock Picks PODCAST Website.

I hope you all have a wonderful weekend!

Bob

"Trading Transparency" ANGO

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember to check with your professional investment advisors prior to making any investment decisions based on information on this website.

I have had a very busy Friday! After selling my 300 shares of Dynamic Materials (BOOM) that I bought yesterday (!), and selling a 1/6th position of my Ventana (VMSI) that hit a 90% appreciation point, this gave me "permission" to add a new position (being under my 25 position maximum).

Looking through the list of top % gainers I came across AngioDynamics (ANGO) a stock that I owned about 6 weeks ago, and had sold. The stock still met criteria, and deciding to give it another go (?), I bought 200 shares at $30.24. As I write, ANGO is trading at $31.00, up $2.84 or 10.09% on the day.

Anyhow, that's how it all worked out! Thanks so much for stopping by. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also be sure to visit my

Stock Picks Bob's Advice Podcast Site where you can listen to me talk about many of the stocks I discuss on my blog.

If I get a chance, I shall try to write up something about this ANGO trade in greater detail this weekend.

Bob

"Trading Transparency" BOOM

Hello Friends! Thanks again for visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Not wishing to mix apples and oranges in my trading account, and not wishing to NOT buy a new position, I undid my 300 share purchase of BOOM a few moments ago, selling them at $38.17. I had added these 300 shares with a cost basis of $36.89 yesterday on a strong belief that the selling was totally overdone. I was right. I made my point. I made a few $'s. And I am back on the wagon. LOL.

Back to disciplined purchases and sales :).

Anyhow, I am back in the market for a new position now since I

did sell my Ventana at a gain target!

Bob

"Trading Transparency" Ventana Medical Systems (VMSI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier this morning, I sold 37 shares of my Ventana Medical Systems (VMSI) stock at $46.49. These shares were purchased 4/16/04 with a cost basis of $23.47/share. Thus I had reached an actual gain of $23.02 or 98% since my purchase. This exceeded my 90% appreciation target, so I sold 1/6th of my holding. This was my third partial sale of my Ventana stock, having sold 50 shares 11/29/04 and 75 shares on 4/4/05.

In general this entitles me to add a new position to my portfolio. However, I am thinking about unloading my new 300 shares of BOOM, otherwise my margin will begin excessive. BOOM is moving higher today as the sell-off yesterday was overdone. I don't want to mix up my portfolio management system too badly, so I am thinking hard about this last trade with Dynamic Materials.

I shall keep you posted :).

Bob

Thursday, 27 April 2006

"Trading Transparency" BOOM---Breaking ALL of my Rules!!!

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website. A few minutes ago I lost my cool. I am just about as human as the next guy (?) I guess. In the midst of a massive decline in Dynamic Materials (BOOM) I went ahead and purchased 300 shares. Let's just call this an experiment (?). The company reported fabulous earnings. An announcement was made by France's Group SNPE that they will be selling 5.15 million shares and the stock price literally fell through the floor. I don't see anything

fundamentally wrong with the stock. Maybe I am missing something. It appears that all of the momentum players threw in the towel. Anyhow, on a lark, I put on my contrarian hat, dropped all of my trading rules (YIKES!) and purchased 300 shares at 36.856. I plan on sticking with all of the remaining rules....but every once in awhile....I mean what IS an investor supposed to do? If you have any words of encouragement, condemnation, questions or humor, drop me a line at bobsadviceforstocks@lycos.com or leave them on the blog. Happy Trading everyone! Bob

Posted by bobsadviceforstocks at 2:57 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 27 April 2006 6:55 PM CDT

Wednesday, 26 April 2006

j2 Global Communications (JCOM) Revisiting a Stock Pick

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the

list of top % gainers on the NASDAQ this evening from trading earlier today, and came across j2 Global Communications (JCOM) which closed at $49.40, up $3.76 or 8.24% on the day.

I wanted to write this one up before I crashed for the night, because it really, truly, is an

old favorite of mine! I do not own any shares or options on this stock. However, I

posted JCOM on Stock Picks Bob's Advice on May 14, 2003. This was my second selection on the blog (!) the first being St. Jude Medical (STJ) which I recently sold on weakness. Being rather new at the blog, I forgot even to mention the stock price on that date. Looking up for

historic prices of JCOM on Yahoo, I discovered that JCOM closed at $34.93 on May 14, 2003, or $17.47 adjusted for a 2:1 stock split on September 2, 2003. Thus, I actually have a "gain" on the stock pick price of $31.93 or 182.8% since posting!

But let's take a brief look at this stock and see why it deserves another 'revisit'!

1. What does the company do?According to the

Yahoo "Profile" on JCOM, the company

"...provides outsourced and value-added messaging and communications services worldwide. It offers faxing and voicemail solutions; document management solutions; hosted email, email perimeter protection, and email marketing services; call management; and conference calling services."

2. How did the company do in the latest quarter?Just yesterday, April 25, 2006, JCOM

reported 1st quarter 2006 results. For the first quarter ended March 31, 2006, revenues grew 30% to $42.0 million from $32.2 million in the same quarter the prior year. Net earnings came in at $12.3 million or $.48/diluted share compared with net earnings the prior year same period of $10.2 million or $.40/diluted share.

The company reaffirmed previous revenue guidance of $43.6 -$44.6 million for second quarter 2006 revenue with "non-GAAP EPS of $.55-$.57/share". (non-GAAP EPS came in at $.52/share the just-reported quarter for comparison). In addition, in a move appreciated by stock investors, the company announced, subject to stockholder approval, a 2:1 stock split. This doesn't really add any real 'value' to a stock, but it is still an indication of confidence by management and is often appreciated by investors who like to psychologically see those numbers of shares grow :).

3. How about longer-term results?Reviewing the

"5-Yr Restated" financials from Morningstar.com, we can see the rapid and steady revenue growth of this company from $33.3 million in 2001 to $143.9 million in 2005.

Earnings have been a bit more erratic, with a loss of $(.35)/share reported in 2001, increasing to a gain of $1.42 in 2003, dropping to $1.27 in 2004 and growing to $2.00/share in 2005. The number of shares outstanding has been fairly steady with 23 million reported in 2001 increasing to 25 million shares in the trailing twelve months (TTM).

Free cash flow has been positive and growing with $29 million in 2003, $44 million in 2004 and $55 million in 2005.

The balance sheet as presented on Morningstar looks great with $112.8 million in cash, enough to cover the $18.2 million in current liabilities more than 5 times over, without even including the $14.7 million in other current assets. Thus, the 'current ratio' works out to 7! The company reports a tiny $100,000 in long-term liabilities per Morningstar.

4. How about some valuation numbers on this stock?Reviewing

Yahoo "Key Statistics" on j2 Global Communications, we find that this company is a mid-cap sized company with a market cap of $1.23 billion. The trailing p/e isn't bad at 24.65 (imho), and the forward p/e (fye 31-Dec-07) is even nicer at 17.27. Thus, the "5 yr expected" PEG works out to what I would call a dirt-cheap 0.79 level.

According to the

Fidelity.com eresearch website, JCOM is in the "Internet Software & Services" industrial group. Within this group, JCOM is priced midway in terms of the Price/Sales ratio which works out to 8.1 for JCOM. Leading this group is Salesforce.com (CRM) at 13.5, Ebay (EBAY) at 10.1, followed by JCOM at 8.1, then Symantec (SYMC) at 4.9, VeriSign (VRSN) at 3.9 and Internet Security Systems (ISSX) at 3.1. Thus, JCOM appears to be valued in an average fashion by this ratio.

Looking for some more numbers from Yahoo, we find that there are 24.81 million shares outstanding with 23.05 million of them that float. Currently there are 4.78 million shares out short (as of 3/10/06), up from 4.44 million shares the prior month. This is a relatively large number for this company representing 20% of the float or 9.4 trading days of volume (the short ratio). With the latest strong earnings report, and now the announcement of a stock split, this may panic the short-sellers who may well be scrambling to buy shares to cover those borrowed and already sold. Just my take on it I guess :).

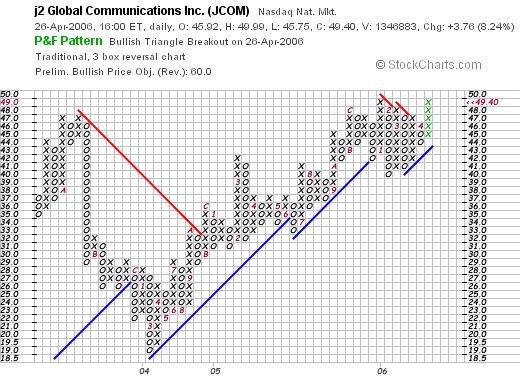

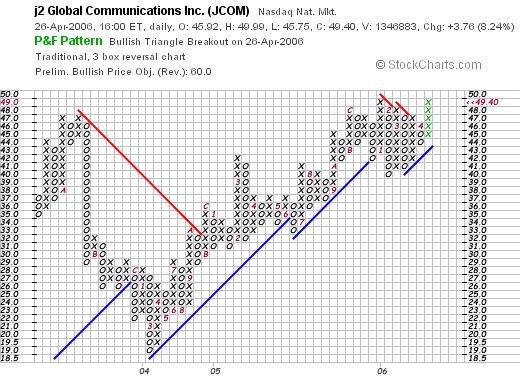

5. What about a chart?Looking at a

"Point & Figure" chart on JCOM from StockCharts.com:

We can see that the stock actually broke down between October, 2003, when it was trading at $47.00 down to a low of $19.00 in February, 2004. However, from that low in early 2004, the company stock has been bullishly been moving higher to the current level of $49.40, higher than the levels reached in late 2003.

6. So in summary, what do I think about this stock now?

Well, quite frankly, I find the company very interesting! I am not in a position to be buying any stocks, but if I were, it would be the kind of stock I would be buying. The stock moved ahead strongly today on the back of a very solid earnings report. They announced a 2:1 stock split, and re-affirmed strong earnings and revenue growth. The Morningstar.com evaluation looks strong for the past several years and free cash flow is positive and growing. The company is flush with cash and has little debt and valuation isn't bad with a p/e in the low 20's and a PEG under 1.0. The Price/Sales ratio is a tad rich, but for the group, nothing special. On top of this there are loads of people betting against this stock and they are likely in a bit of a panic right now as the company stock price charges ahead and a split has been announced. Finally the chart looks fine to me.

Thanks again for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, remember to stop by and visit my Stock Picks Bob's Advice Podcast Site.

Bob

A Reader Writes "...your advice on a company called Lamson & Sessions."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I had a nice email earlier today. It reminded me how disorganized my blog really is. How difficult it can be to search throught it. My son Ben is probably right! He says I should get it fixed up. That maybe it has some real potential.

I am currently working on developing a new "Stock Picks" format. If all goes well, I shall have more for you on this in the near future!

Meanwhile, remember to use Google and search through the blog by entering in the words "Stock Picks Bob's XXXX" where xxxx represents the symbol for the name of the stock you are investigating. Usually, but not always, I will be near the top of the search engine...

Anyhow, Jeff was kind enough to drop me a line:

"Bob,

I would like your advice on a company called Lamson Sessions (Symbol LMS). The company is a maker of electrical products used in construction and the telecom industry.

The company just raised guidance and is set to report a blockbuster quarter on Friday, April

28th. It seems to have the qualities that you look for when you are selecting stocks.

Please advise as I appreciate your insight.

Sincererly,

Jeff in Indiana"

Well Jeff, thank you again for writing! In fact, LMS is a favorite of mine! I

wrote up Lamson & Sessions on Stock Picks Bob's Advice on November 28, 2005, when the stock was trading at $23.70. Not only that (!), but I even did a

podcast on Lamson & Sessions the same day! It has been my policy

not to repeat my "revisits" for at least a year. But with LMS, let me make a bit of an exception and take another brief look at the stock! I do not own any of this stock nor do I have any options.

First of all, LMS closed today at $25.90, up $1.10 or 4.44% on the day. Thus the stock has actually appreciated $2.20 or 9.3% since my original post.

1. What does this company do?

1. What does this company do?According to the

Yahoo "Profile" on Lamson & Sessions, the company

"...engages in the manufacture and distribution of thermoplastic electrical, consumer, telecommunications, and engineered sewer products primarily in the United States, Canada, and Caribbean. It operates in three segments Carlon, Lamson Home Products, and PVC Pipe."

2. How did the company do in the latest quarter?On February 16, 2006, the company reported

reported 4th quarter 2005 results. Net sales for the quarter ended December 31, 2005, increased 48% to $143.3 million from $97.1 million in the same quarter the prior year. Net income came in at $14.6 million or $.93/share in the quarter representing a 1000% increase over the $1.3 million or $.09/diluted share in the same quarter the prior year. These were great results!

As Jeff pointed out in his email, LMS has even

raised guidance for first quarter 2006, with earnings now expected at $.53-$.56/share, up from the $.41-$.44/share previous guidance. Net sales are now expected to be $132 to $135 million, up from the prior guidance of $123 million to $127 million previously announced. This is another strong point for the stock and the company imho.

3. How about "longer-term"?

Taking a look at the

Morningstar.com "5-Yr Restated" financials on LMS, we can see that revenue dipped from $350.9 million in 2001 to $312.4 million in 2002. However, since 2002, revenue has steadily improved to the $494.2 million reported in 2005.

Earnings also dipped from a loss of $(.28) in 2001 to a loss of $(2.99) in 2002. After that, LMS turned profitable at $.07/share in 2003, and has had earnings improve strongly to $1.82/share in 2005. The number of shares has been very stable with 14 million reported in 2001 and increasing only to 15 million in the trailing twelve months (TTM).

Free cash flow has been positive and improving nicely, with $1 million in 2003, increasing to $5 million in 2004 and $20 million in 2005.

The Morningstar report shows that the company has only $1.2 million in cash, but has $128.0 million in other current assets. Balanced against the $72.0 million in current liabilities gives us a "current ratio" of 1.79. This appears healthy with my cut-off as I have reviewed elsewhere of 1.5. The company has an additional $77.7 million in long-term liabilities.

4. What about some 'valuation' statistics?

4. What about some 'valuation' statistics?Generally, for this I have been using Yahoo and for this company, the

"Key Statistics" on Lamson & Sessions. Some of the things that are important include the size of the company: LMS is a small cap stock (under $500 million) with a market capitalization of only $396.71 million. The trailing p/e is a downright reasonable 14.22 with a forward p/e of only 13.78. I don't have a PEG ratio reported (probably because there aren't any analysts giving 5 year expected results on this small company).

By the Price/Sales ratio, at least according to the

Fidelity.com eresearch website, LMS is in the "Diversified Electronics" industrial group, and has the most reasonable Price/Sales ratio of the group coming in at a dirt cheap 0.8. Topping this group is Evergreen Solar (ESLR) at 21, followed by JDS Uniphase (JDSU) at 6.5, International Game Technology (IGT) at 6, Amphenol (APH) at 2.9, and WMS Industries (WMS) at 2.8. Way back is sitting Lamson & Sessions, another plus, imho, for this stock.

Additional information from Yahoo includes the fact that the company has 15.32 million shares outstanding with only 12.91 million that float. Currently there are 2.60 million shares out short as of 3/10/06, representing 20.20% of the float, or 5.4 trading days of volume (the short ratio). This is up over a million shares out short from 1.52 million shares the prior month. I do not know what these short-sellers are seeing. Unless they know something I don't, they are in for a rude awakening, and may be a factor in the stock's continued rise (?).

No dividend is paid, and no stock splits are reported on Yahoo.

5. What about a chart?Taking a look at the

"Point & Figure" chart on Lamson & Sessions from StockCharts.com:

We can see that while the stock traded lower (parallel to the poor earnings and revenue growth during that period) between 2001 and 2002, in late 2002, sometime in October, the company bottomed at $2.50/share and then started moving higher, breaking into higher territory in January, 2003, and moving to a peak of $32 in February, 2006. The stock recently pulled back to $22, where it appears to have had a "double bottom" as the technicians say (sort of bouncing twice off the same support area as I understand it) and then moved higher to the current $25.90 level. The chart looks good to me!

6. What do I think?

Well, I don't really know if Jeff has any shares of this stock....if I were a gambling man, I would bet he did :). I would even hazard a guess (?) that Jeff knew that I wrote this up....???....and that he knew I would like it and would write it up again ????....Well maybe not. But figure he has some shares :). Good for him. And thank you Jeff for writing. If you are indeed sincere at this question, I give you credit for picking this one and knowing I would like it. And if not, well I guess it was just about time to revisit this stock in any case!

But back to the stock. The company's latest quarter was great, the Morningstar.com looks very nice with steady growth in both revenue, earnings, and free cash flow the past few years. The balance sheet looks nice, and valuation is terrific with a p/e in the low teens and a Price/Sales under 1.0 and the lowest in its group. Finally, the chart looks nice and the company has just raised guidance. What else could an investor want?

Thanks again for writing. And Jeff, you can write some more anytime! I sure like having you as a reader around here!

If you or anyone else has any questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please be sure to drop by and visit my Stock Picks Bob's Advice Podcast Site where you can download and listen to many of my podcasts on much the same subjects I write about!

Have a great day trading tomorrow!

Bob

Posted by bobsadviceforstocks at 8:41 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 26 April 2006 9:00 PM CDT

Newer | Latest | Older

Bret wrote:

Bret wrote: This past Thursday, April 27, 2006, EYE announced 1st quarter 2006 results. Sales increased nicely to $238.2 million for the quarter, a 23.7% increase over the prior year same quarter. However, first quarter net income came in at $2.6 million or $.04/share, down sharply from $13.8 million or $.35/share last year. The company had a lot of excellent reasons and did provide reasonably strong guidance for future results, but I am always looking at the 'bottom line'.

This past Thursday, April 27, 2006, EYE announced 1st quarter 2006 results. Sales increased nicely to $238.2 million for the quarter, a 23.7% increase over the prior year same quarter. However, first quarter net income came in at $2.6 million or $.04/share, down sharply from $13.8 million or $.35/share last year. The company had a lot of excellent reasons and did provide reasonably strong guidance for future results, but I am always looking at the 'bottom line'.

According to the Yahoo "Profile" on DXPE, the company

According to the Yahoo "Profile" on DXPE, the company

First of all Archer-Daniels-Midland (ADM). The stock closed at $36.34 on 4/28/06, up $.15 or .41% on the day. Currently ADM appears to be riding the ethanol bandwagon.

First of all Archer-Daniels-Midland (ADM). The stock closed at $36.34 on 4/28/06, up $.15 or .41% on the day. Currently ADM appears to be riding the ethanol bandwagon.

On February 7, 2005, I

On February 7, 2005, I  On April 26, 2006, HCR

On April 26, 2006, HCR  On February 11, 2005, I

On February 11, 2005, I  Earlier today, as I noted in another post, I purchased 200 shares of AngioDynamics (ANGO) at $30.24/share. AngioDynamics (ANGO) closed at $2.91, up 10.33% on the day.

Earlier today, as I noted in another post, I purchased 200 shares of AngioDynamics (ANGO) at $30.24/share. AngioDynamics (ANGO) closed at $2.91, up 10.33% on the day.  I purchased 240 shares of AngioDynamics at a cost of $26.26 on 1/6/06. These shares were sold on 3/2/06, last month (!), at a price of $23.46, for a loss of $(2.80) or (10.6)%. Showing up again on the list of top % gainers, and having a 'permission slip' to add a new position having sold 1/6th of my Ventana (VMSI) at a 90% gain, I decided to give ANGO another shot!

I purchased 240 shares of AngioDynamics at a cost of $26.26 on 1/6/06. These shares were sold on 3/2/06, last month (!), at a price of $23.46, for a loss of $(2.80) or (10.6)%. Showing up again on the list of top % gainers, and having a 'permission slip' to add a new position having sold 1/6th of my Ventana (VMSI) at a 90% gain, I decided to give ANGO another shot! 2. How did the company do in the latest quarter?

2. How did the company do in the latest quarter? 3. How about longer-term results?

3. How about longer-term results? Looking through the

Looking through the

I was looking through the

I was looking through the

First of all, LMS closed today at $25.90, up $1.10 or 4.44% on the day. Thus the stock has actually appreciated $2.20 or 9.3% since my original post.

First of all, LMS closed today at $25.90, up $1.10 or 4.44% on the day. Thus the stock has actually appreciated $2.20 or 9.3% since my original post. 1. What does this company do?

1. What does this company do? Taking a look at the

Taking a look at the  4. What about some 'valuation' statistics?

4. What about some 'valuation' statistics?