Hello

Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received a nice email from Bret M., who is a friend of my son Ben.

Bret wrote:

Bret wrote:"Ben told me about your blog a few weeks ago and Ive been enjoying reading it.Brett, thanks so much for writing. First of all, I am not privy to any inside information. I do not know if EYE might be an acquisition target. It is a general rule that acquisitions are favorable for the acquired company which generally sees a significant increase in its stock price. Should you be selling a little bit of your holding as the company's stock price rises? You of course know my answer. If it is wise to sell your losing stocks quickly, it is also wise to sell your gaining stock slowly. It is often hard to both sell a stock that has dropped and it is equally hard to justify selling a stock when you are in the midst of feeling so good about it. I am sure you understand this.

Your strategy is very interesting and I really like the way it automatically

keeps you in a bull market and pulls you out of a bear.

I've got a couple of stocks that I would love to get your opinion on.

My dad is

an optometrist and he owns a little stake in Advanced Medical Optics (EYE). It

has done very well and I know you would say to peel off a small chunk of it. Have you heard anything about it posibly

being bought

out by J&J? Do you suspect that would that be good for EYE stock?

Another stock that my dad and I have been in and out of a little is DXPE. We

found it on a Yahoo "top 10 stocks under 10 bucks" list last summer

and it then

shot up after Katrina. We rode it from like 10 to 18. It is extremely

volitile,

but has made its way up to 38. What do you think about its fundementals? Is it

too late or too expensive now to get back in?

Thanks for the help. I look forward to hearing back from you. Thanks.

Bret M."

This past Thursday, April 27, 2006, EYE announced 1st quarter 2006 results. Sales increased nicely to $238.2 million for the quarter, a 23.7% increase over the prior year same quarter. However, first quarter net income came in at $2.6 million or $.04/share, down sharply from $13.8 million or $.35/share last year. The company had a lot of excellent reasons and did provide reasonably strong guidance for future results, but I am always looking at the 'bottom line'.

This past Thursday, April 27, 2006, EYE announced 1st quarter 2006 results. Sales increased nicely to $238.2 million for the quarter, a 23.7% increase over the prior year same quarter. However, first quarter net income came in at $2.6 million or $.04/share, down sharply from $13.8 million or $.35/share last year. The company had a lot of excellent reasons and did provide reasonably strong guidance for future results, but I am always looking at the 'bottom line'.I also have a tough time with the EYE Morningstar.com "5-Yr Restated" financials, which, while showing strong revenue growth show that the company dropped from $.35/share in 2003 to a loss of $(3.89)/share in 2004 and $(8.28)/share in 2005. In addition, free cash flow which was $22 million in 2004, dropped to a negative $(2) million in 2005.

The balance sheet as reported on Morningstar.com shows the company with a bit of a heavy debt load with a current ratio of 1.84, which isn't bad, but also a $710.5 million in long-term liabilities.

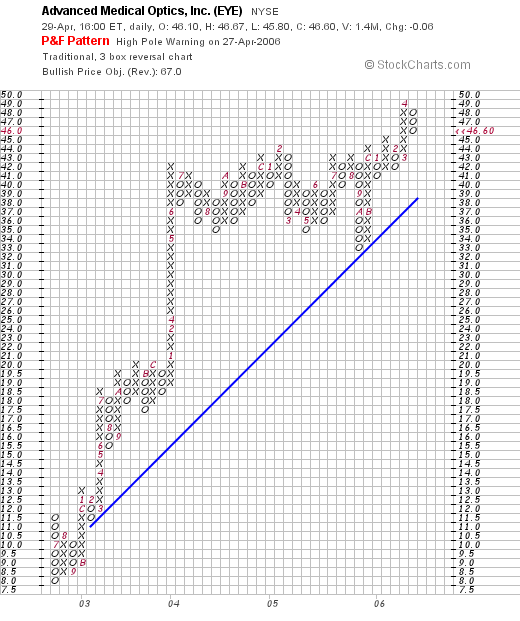

And the "Point & Figure" chart on EYE from StockCharts.com:

Clearly this stock looks very strong on the chart-side of things. All the more reason to take some small profits. I do not invest based on stories or hypotheses. I did at one time in the past.

I like to look hard at actual corporate performance, with the limited tools at my disposal. I am not looking for what 'could be' but what is actually occurring. Basic stuff like earnings, free cash flow, valuation numbers, and balance sheets. This is how I approach my investments. That, along with careful tending of my holdings with partial sales of stocks as they approeciate and quick sales of stock posting losses. I have had several of my stocks acquired....most recently Sybron Dental (SYD) that I wrote up a month or so ago. But I believe they are getting acquired because others are examining these companies with the same perspective I am applying.

Now for that other stock you mentioned: DXPE....a stock that I don't think I am familiar with...so let's take a look. According to the Yahoo "Profile" on DXPE, the company

According to the Yahoo "Profile" on DXPE, the company

"...distributes maintenance, repair, and operating (MRO) products, equipment, and service to industrial customers in the United States. It operates in two segments, MRO and Electrical Contractor."

What about the latest quarter? On April 26, 2006, DXPE announced 1st quarter 2006 results. Sales grew 49.6% to $62.5 million from $41.8 million in the same quarter the prior year. For this quarter that ended March 31, 2006, net income came in at $2.5 million or $.44/share, up 193% from $854,000 or .15/share in the prior year same period. I would have to admit that this was a fabulous report!

What about longer-term?

Except for a dip in revenue from $174.4 million in 2001 to $148.1 million in 2002, the company has been growing its revenue to $185.4 million in 2005.

Earnings have grown steadily during the past five years from $.21/share in 2001 to $.94/share in 2005. This is a very small company with 4 million shares in 2001, increasing to 5 million in the trailing twelve months (TTM).

Free cash flow has been deteriorating recently, dropping from $7 million in 2003, $3 million in 2004, and $(2) million in 2005.

The balance sheet is fine with $.6 million in cash and $55.6 million in other current assets, balanced against $28.1 million in current liabilities (giving us a 'current ratio' of 2.0) and $25.3 million in long-term liabilities.

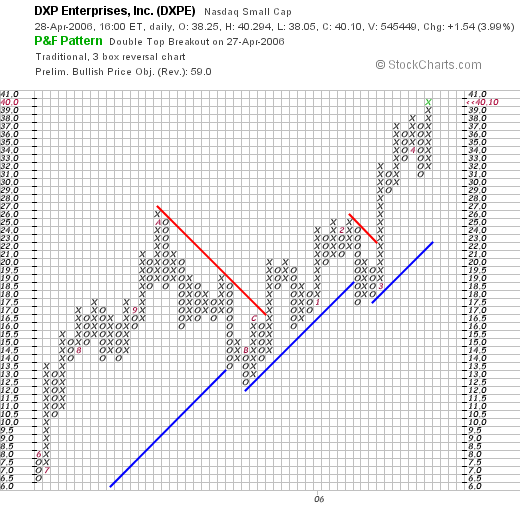

And the chart: looking at the "Point & Figure" chart on DXPE from StockCharts.com:

Basically, this chart looks quite strong as well.

What about DXPE 'valuation'? Looking at the Yahoo "Key Statistics" on DXPE, we can see that this is a small company with a market cap of only $198.49 million. The trailing p/e is a bit rich at 42.48, but with the rapid growth in earnings, the forward p/e is much nicer at 21.68. There is no PEG available (probably no analyst with 5 yr results estimated). The Price/Sales is 1.03. According to the Fidelity.com eresearch website, DXP is in the "Industrial Equipment Wholesale" industrial group, and is priced midway between MSC Industrial with a Price/Sales ratio of 3 and CE Franklin (CFK) at 0.7. Thus, by this measure the stock isn't really overpriced.

So what do I think? I am a bit concerned about some of the things I have found and mentioned on EYE. However, the company remains optimistic. Being more concerned about actual results, I wouldn't be entering EYE at this point, but waiting for those results to happen. DXPE is a bit of a different story. The results in the latest quarter were fabulous.

Your question about "getting back in" is the problem of doing stocks "for a trade". Although I did the same in BOOM with 300 shares just yesterday :). But my core holding wasn't affected. It is better to just sell portions of stocks on large gains and sell ALL of your shares when stocks do poorly, not when they do WELL. Do you follow?

Should you enter now? I would if the stock hit the new high list and met my own criteria. I might pass on DXPE and miss a great company with their reported negative cash flow. There are just too many stocks to choose from and I go for perfect :). As for you, it is your call. I don't think this particular stock is so big it doesn't have any room to grow further. I would, however, establish sale points on any position you take, both on the upside and the downside. Forget the trades (except occasionally) imho. Generally think about managing your holdings instead.

Just my call.

Thanks so much for writing. Let me know if what I wrote was helpful and what you decided to do!

Regards.

Bob