Stock Picks Bob's Advice

Sunday, 13 May 2007

"Looking Back One Year" A review of stock picks from the week of December 19, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of my blogging, I have been trying on most weekends to spend some time examining past stock selections to see how they turned out. This evaluation depends on an assumed "by and hold" strategy which assumes simply purchasing equal dollar amounts of each stock picked and then holding it indefinitely. However, in practice, I recommend and utilize a disciplined portfolio management system that would of course affect the performance not necessarily in a negative fashion. This system requires me to sell my losing stocks quickly and completely and sell my appreciating stocks partially and slowly at targeted appreciation levels. The difference in the two strategies should also be considered when reading the review each weekend.

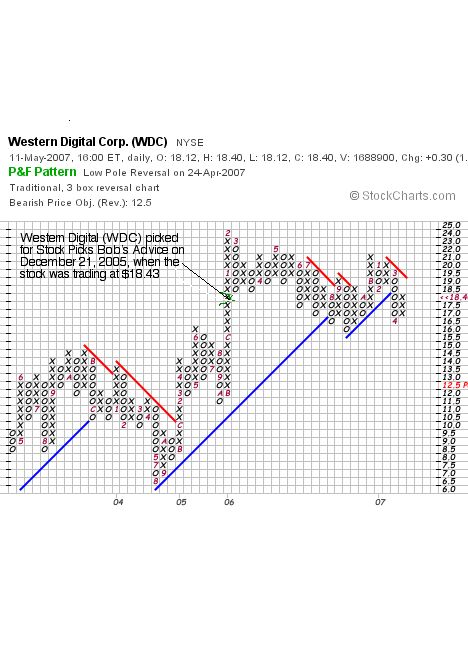

On December 21, 2005, I made the only selection of the week, picking Western Digital (WDC) for Stock Picks Bob's Advice at a price of $18.43. WDC closed at $18.40, down $(.03) since the original post representing a loss of (.2)% since posting. I do not own any shares nor do I have any options on this stock.

On December 21, 2005, I made the only selection of the week, picking Western Digital (WDC) for Stock Picks Bob's Advice at a price of $18.43. WDC closed at $18.40, down $(.03) since the original post representing a loss of (.2)% since posting. I do not own any shares nor do I have any options on this stock.

In light of the latest quarter results, and the strong Morningstar.com report,

WESTERN DIGITAL (WDC) IS RATED A BUY

On April 26, 2007, Western Digital (WDC) reported 3rd quarter 2007 results. For the quarter ended March 30, 2007, revenue came in at $1.4 billion, a 25% increase in revenue from the prior year which was $1.1 billion. Net income for the quarter was $121 million, or $.53/share, up from $102 million or $.45/share last year. The company beat expectations of $.47/share according to Reuters Estimates.

On April 26, 2007, Western Digital (WDC) reported 3rd quarter 2007 results. For the quarter ended March 30, 2007, revenue came in at $1.4 billion, a 25% increase in revenue from the prior year which was $1.1 billion. Net income for the quarter was $121 million, or $.53/share, up from $102 million or $.45/share last year. The company beat expectations of $.47/share according to Reuters Estimates.

So how did I do during that week in December, 2005? Well, I picked a single stock which was only fractionally lower since. No other stock picks were selected so it really was a wash.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website.

Bob

Friday, 11 May 2007

A Reader Writes "What three stocks....?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment adviser prior to making any investment decisions based on information on this website.

I had a nice letter from Pat B. who asked me some questions about getting started investing. Pat wrote:

I had a nice letter from Pat B. who asked me some questions about getting started investing. Pat wrote:

"Hey, I'm 16 years old and starting stocks for the first time in my life. I come to you because from what I looked at was the most fan friendly site to read. I'm currently in a business class, so I'm not totally unaware of everything. I'm kinda looking to get started however. If you were to predict ahead: What three stocks do you think have the best chance of soaring upwards. Obviously this can be a total hit and miss science. I"m just looking to get started and do some research.

I've also been interested in ROY: International Royalty. They seem to me like they are on the verge of breaking out. What do you think?

Thank you so much,

Pat

Pat, thanks so much for writing. You have asked me the one thing I really try very hard at avoiding...giving specific investment advice to specific investors about specific stocks :).

There is a well-quoted Chinese proverb, which I am sure you have heard repeated ad nauseum in your business classes:

"Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime."

I know it is a bit trite now, but that is exactly what I want you t get from reading my blog. Not the individual stocks that as I like to say will go stale as fast as a dozen bagels sitting on the kitchen table, but rather the process of selecting stocks and starting to learn how to manage your own portfolio. If you can get this, even if it is very different from my own peculiar techniques, then you will have something that indeed will 'feed you' for your lifetime.

That being said, I would encourage you to read through my blog. There are literally hundreds of stocks discussed and from there see if there are any that strike your fancy. Be sure and take a look at the latest quarter, an updated Morningstar exam, and look at the chart and see if intuitively the stock chart is intact. If so, you may have a great stock on your hands.

You asked about ROY. Let me take a quick look at this stock that I am not at all familiar with and see if I can get a feeling for it. I obviously do not own any shares nor do I have any options on ROY.

As I write, ROY is trading at $7.72/share, a bit less than what I like to see for a stock. On February 22, 2007 ROY reported 4th quarter 2006 results. They also turned profitable this year coming in at $.05/share up from a loss of $(.01) last year.

Unfortunately, I depend on Morningstar.com for information that I can depend on for free cash flow, balance sheet, etc. etc. etc. And ROY doesn't have any information on this.

I guess they are in the Uranium business and if I had to hazard a guess, somebody like Cramer has been hollering booyahs from here to Canada about Uranium stocks. He is a smart guy and may well be right about this one.

However, since you are 16 and starting out, do you really want to 'swing for the fences' on your first at bat? Isn't it wiser to buy something that makes sense, and that you can own for a long time (?) or at least demonstrates a greater level of what I would call "quality". Maybe this just shows my age, my experience, or my distrust of aggressive investing in small untested companies. But I would suggest a new investor to be more concerned about investing in a solid, high-quality, and growing business that has a record of profitability and has verifiable information.

Now that's my take. I hope that isn't too much of a disappointment for you. If you were my son, those are the things I would be telling you. Do not be afraid of a stock that is priced over $10 or $20. The number of shares that you can purchase is far less important than the value of each share that you purchase. And go for base hits on your first times at bat. Don't swing for the fences.

Good luck, tell me what you decide, keep on visiting, don't get discouraged, and thank you for all of your kind words.

A fellow amateur investor,

Bob

Wednesday, 9 May 2007

Barnes Group (B) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I really do intend to cut back on the posting around here for a couple of weeks...at least that is the plan :). But before I get to cutting back, I did want to write up this stock that made the list of top % gainers on the NYSE, Barnes Group (B), which actually was #1 on the list closing at $28.61, up $3.81 or 15.36% on the day. I do not own any shares (I actually have owned shares in my trading account in the past), nor do I have any options on this stock. But I still like this stock and that is why I think

I really do intend to cut back on the posting around here for a couple of weeks...at least that is the plan :). But before I get to cutting back, I did want to write up this stock that made the list of top % gainers on the NYSE, Barnes Group (B), which actually was #1 on the list closing at $28.61, up $3.81 or 15.36% on the day. I do not own any shares (I actually have owned shares in my trading account in the past), nor do I have any options on this stock. But I still like this stock and that is why I think

BARNES GROUP (B) IS RATED A BUY

Let me go over a few of the things that after reviewing the stock I believe that this company deserves a spot on my blog.

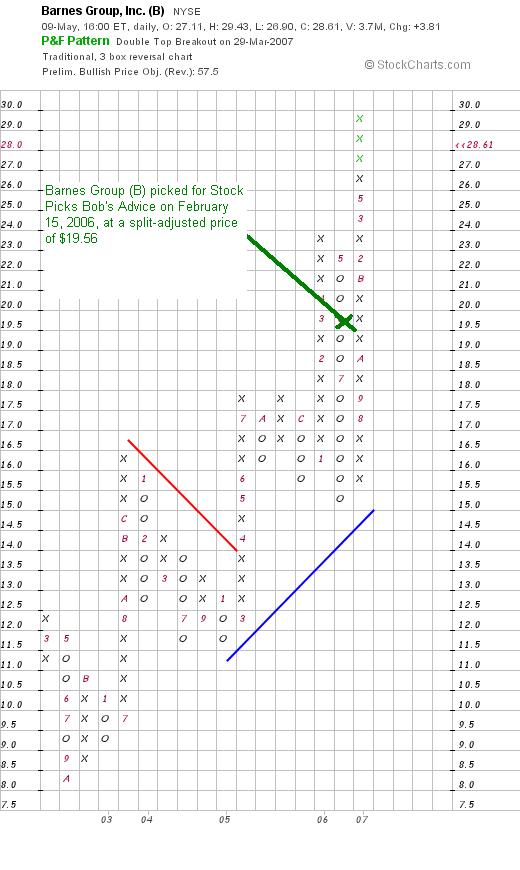

I first wrote up Barnes Group (B) on February 16, 2006, when the stock was trading at $39.11/share. Barnes split 2:1 on June 12, 2006, making my effective pick price actually $19.56. With the stock closing today at $28.61, this represents a gain of $9.05 or 46.3% since posting a little over a year ago.

What exactly does this company do?

According to the Yahoo "Profile" on Barnes, the company

"...engages in the manufacture and distribution of aerospace and industrial products worldwide. It operates in three segments: Barnes Distribution, Associated Spring, and Barnes Aerospace."

"...engages in the manufacture and distribution of aerospace and industrial products worldwide. It operates in three segments: Barnes Distribution, Associated Spring, and Barnes Aerospace."

How did the company do in the latest quarter?

It was the announcement of 1st quarter 2007 results this morning prior to the start of trading that drove the stock higher this morning. Sales for the quarter came in at $360.7 million, up 20% from $299.9 million in the first quarter of 2006. Net income climbed 50% to $27.7 million or $.50/diluted share, compared to $18.5 million or $.36/diluted share last year.

The company beat expectations of $.40/share and also raised guidance for the full fiscal year to a new range of $1.74 to $1.83/share, from the previously announced range of $1.53 to $1.60/share. It is what I call the "trifecta-plus" when a company comes in with a great earnings report that beats expectations and they go ahead and raise guidance on future earnings; the street liked the announcement and bid up the price of Barnes Group accordingly.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on B, we can see that revenue has steadily increased from $784 million in 2002 to $1.26 billion in 2006. Earnings have increased steadily, except for a slight dip between 2003 and 2004 when earnings dropped from $.66/share to $.63/share, from $.58/share in 2002 to $1.39/share in 2006.

The company also pays a dividend and has raised it several times from $.40/share declared in 2002 to $.42/share in 2005 and $.49/share in 2006. The company has increased the share float from 37 million in 2002 to 51 million in 2006 and 53 million in the trailing twelve months (TTM). This 43% increase in outstanding shares was accompanied by a 79% increase in revenue and a 140% increase in earnings. So while I do believe that this share issuance was a bit dilutive, the company was able to successfully manage the new shares growing faster in both revenue and earnings than outstanding shares.

The company is free cash-flow positive and growing it with $24 million in free cash in 2004, increasing to $44 million in 2005 and $73 million in 2006.

The balance sheet is solid with $35.4 million in cash reported along with $425.9 million in other current assets. This total of $461.3 million in total current assets, easily covers the $295.1 million in current liabilities yielding a current ratio of 1.56.

What about some valuation numbers on this stock?

Checking Yahoo "Key Statistics" on Barnes (B), we find that the company is a mid cap stock with a market capitalization of $1.51 billion. The trailing p/e is a moderate 20.51, with an even nicer forward p/e (fye 31-Dec-08) estimated at 15.63. The PEG is a very reasonable (5 yr expected) 1.03.

Using the Fidelity.com eresearch website, we can see that the Price/Sales (TTM) also suggests reasonable valuation with a ratio of 1.01 for Barnes, compared to the industry average of 1.41. However, according to Fidelity, the Return on Equity (TTM) for Barnes is a bit low at 15.25% compared to the industry average of 23.44%.

Finishing up with Yahoo, we can see that there are 52.62 million shares outstanding with 40.12 million that float. Of those that float, 4.44 million were out short as of April 10, 2007, representing 9.6% of the float or 17.6 trading days of volume. This is very significant from my perspective as I use a "3 day rule" to determine significant short interest. That is if it would take more than 3 days of average volume to cover the shares already sold short by speculators, I believe the setting is ripe for a 'squeeze' of the shorts. And in this particular case, there are (as of 4/10/07) actually 17.6 trading days of volume. I suspect lots of short-sellers were scrambline to buy today as the stock had a volume of 3.7 million shares traded today, almost 9 times the average trading volume of 441,447 shares.

Yahoo reports that the company pays a forward dividend of $.56/share yielding 2.3%. The last stock split was the 2:1 split I discussed above which occurred on June 12, 2006

What about the chart?

Reviewing a "Point & Figure" Chart on Barnes Group (B) from StockCharts.com, we can see that this stock has been a bit volatile, but recently bounced off the support line at around $15.5 in July, 2006, and has since moved almost straigt higher to the current level of around $29.00.

Summary: What do I think?

Well, needless to say, I like this stock a lot. In fact, I even owned shares for awhile, which goes to show you that I am indeed willing to re-examine past stock selections even if I end up getting stopped out and selling shares. Unfortunately, I am currently at my maximum holdings (20) because with the selling of a portion of my Precision Castparts, this would have 'entitled' me to add a new position to my holdings. But since I am at 20....well I guess I shall not be doing anything.

The company reported a great quarter today. They beat expectations and raised guidance. They have been doing this steadily for the past five years and also have been increasing their dividend. They have increased the float modestly but revenue and earnings have grown quicker. Free cash flow is positive and growing and the balance sheet appears solid.

Valuation-wise the p/e is moderate and the PEG is just over 1.0. The Price/Sales is nice but the Return on Equity was a bit anemic. Finally, there are LOTS of shares out short probably providing a good floor to the stock price as the short-sellers scramble to cover. Finally the chart looks nice!

Thanks again for stopping by and visiting. If you would like to comment, please feel free to do so on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website.

Bob

Precision Castparts (PCP) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website!

First of all, let me apologize for not getting the "Weekend Review" up this weekend. Did anyone notice? (As a blogger, especially one who doesn't require any registration for what I write, I never know if people know when I don't do something :).) Anyhow, I shall be going a bit light on the posts for the next week or two but shall try to continue to get in the "Trading Transparency" comments as they are applicable.

A few moments ago I sold I sold 14 shares of my 100 shares of Precision Castparts (PCP) at a price of $112.98. These shares were originally purchased on 10/24/06 at a cost basis of $69.05. Thus these shares were sold with a gain of $43.93 or 63.6% since purchase. I had originally purchased 120 shares and sold 20 shares of PCP on 2/1/07 after it hit my 30% appreciation target. At that time, I was still selling 1/6th of positions at appreciation targets instead of my new reduced 1/7th sale strategy.

In addition, if I were at my 25 position goal, this would entitle me to add a new position, giving me the proverbial "permission slip" to buy a new stock. However, since I have chosen to stick at 20 positions in light of my significant margin level, I shall be sitting on my hands and applying the proceeds of this sale to that margin balance.

If you are new to my blog, you may not know about my idiosyncratic selling system. On 'good news', or appreciation targets being reached I sell 1/7th of my remaining shares in any given position. These targets are grouped by four, and then intervals are increased by 30% after four levels are reached. Let me explain again: first targeted appreciation levels that trigger a partial sale are at 30, 60, 90, and 120% appreciation levels. After that, going by 60% intervals, the targeted appreciation levels are 180, 240, 300, and 360% appreciation....then by 90%, 450, 640, 730, and 820%....etc.

For Precision Castparts my next sale would either be at a 90% appreciation level, which works out to 1.90 x $69.05 = $131.20, or on the downside, if the stock should retrace to 50% of its highest targeted sale, or to a 30% appreciation level, then I would plan on unloading all remaining shares. For PCP, this would work out to a sale if the stock declined back to a 30% appreciation level or 1.30 x $69.05 = $89.77.

The reason PCP jumped today, was, as you might have guessed, a great earnings report in which the company reported terrific revenue growth and beat expectations on earnings.

Thank you again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, where I discuss many of the stocks I write about here on the blog.

Bob

Saturday, 5 May 2007

A Reader Writes "BEZ revenue figures--Dig a little deeper..."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I received an excellent comment from Doug S. who wrote about my recent write-up on Baldor (BEZ). Doug wrote:

I received an excellent comment from Doug S. who wrote about my recent write-up on Baldor (BEZ). Doug wrote:

"Dig a little deeper and I think you'll discover that those revenue

figures are not what they appeared. The revenue from the two acquistions were included and not calculated on a preadjusted basis.

The true revenue growth was 10% not 100%. I called the company Friday morning the the person I spoke with after being transfered about five times pretty much confirmed my suspicions. If you will notice after the initial premarket pop and the conference call the stock went nowhere on huge volume."

Doug, you have made some excellent points in your letter.

If we take a look at the press release from the company we can see what you are writing. The company reports:

'John McFarland, Chairman and CEO, commented on the Company's results, "We are pleased to report our first quarterly results following our acquisition of Dodge and Reliance. Sales of $396 million were up 106%, earnings at $21 million were up 84%, and earnings per share were up 47% to $0.50. Operating margin for the quarter was 13.2%. Earnings per share were reduced by $0.02 for non-recurring purchase accounting adjustments related to the acquisition. Diluted average shares outstanding increased to 41.6 million in the first quarter."'

You can see that in the same line as writing about the big increase, the Chairman and CEO clearly includes the comment "...following our acquisition of Doge and Reliance." I don't think there is any subterfuge with the news, or attempt to mislead anyone.

Furthermore, on questioning about the business during the quarter, Mr. McFarland stated, as reported in the same release:

"Q ... How was business during the first quarter?

Sales for the quarter ended March 31, 2007 increased 8%. This comparison is based on 13 weeks of Baldor sales and 9 weeks of Dodge/Reliance sales during the first quarter of 2006. Industrial motor sales (63% of revenue) were up 13%, power transmission products (23% of revenue) were flat, drives sales (8% of revenue) were down slightly, and generator sales (3% of revenue) were up 13%.

International sales (13% of revenue) were up 8% for the quarter, with the highest growth in Latin America and Europe.

We saw sales growth across most industries, including the farm machinery, HVAC, aggregate and oil and gas markets, particularly in oil sands development in Canada. We also saw some softening in the mining industry."

Again, he states that sales '...increased 8%.' And he details the time period in which the big acquisition was involved.

But certainly you make an excellent point. The growth in revenue is related to the acquisition. But just as important, was the acquisition helpful to the bottom line? Was the share dilution that occurred after the acquisition made up for by the acquisition itself. In the 'lingo', I believe the question is whether the acquisition was accretive to earnings? Or was it dilutive?

Certainly, we cannot fault a management team that can make wise acquisitions that result in greater earnings, can we?

In this particular case, diluted earnings per share grew 47% to $.50/share from $.34/share. In addition, the company was able to raise the dividend 6% from $.16/share to $.17/share. Overall, I do not think that there is any gross mis-step of management in this particular acquisition. The bottom line is after all the bottom line, isn't it?

I have no great loyalty to Baldor. I do own shares now, after-all, and I appreciate your input on this stock. I will sell my shares in a heart-beat if I hit my 8% loss. On the other hand, I feel comfortable with this acquisition, even if you rightly point out, that the incredible growth in revenue is due to an acquisition. The rest of the story appears intact.

Thanks again for writing, and if you or anyone else has comments or questions on this topic or on anything that I write, please do feel free to leave your comments on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 4 May 2007

Baldor Electric (BEZ)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I wrote up earlier today, after my sale of a portion of my Universal Electronics (UEIC) at a gain, I had the "permission slip" to add a new position to my trading portfolio. Earlier today, I purchased 140 shares of Baldor (BEZ) at $44/share to fill out my portfolio. I promised I would let you briefly know why I chose Baldor and how it fit into my portfolio and why

As I wrote up earlier today, after my sale of a portion of my Universal Electronics (UEIC) at a gain, I had the "permission slip" to add a new position to my trading portfolio. Earlier today, I purchased 140 shares of Baldor (BEZ) at $44/share to fill out my portfolio. I promised I would let you briefly know why I chose Baldor and how it fit into my portfolio and why

BALDOR (BEZ) IS RATED A BUY

What exactly does Baldor (BEZ) do?

According to the Yahoo "Profile" on BEZ, the company

According to the Yahoo "Profile" on BEZ, the company

"...designs, manufactures, and sells electric motors, drives, and generators to original equipment manufacturers and independent distributors worldwide. The company�s motor products include AC and DC electric motors; drives consist of inverter, vector, and servo drives, as well as linear and rotary servo motors and motion control products; and generator products comprise portable generators, as well as industrial towable, mobile light towers, emergency and standby, prime power, and peak-shaving generators."

How did they do in the latest quarter?

The company reported 1st quarter results today and reported revenue growth up nearly 100% to $395.7 million from $192.3 million, and earnings increasing 84% to $11.4 million or $.34/share (or $.52/share excluding 'items'). This beat expectations of analysts on both revenue and earnings, who were expecting profit of $.37/share on revenue of $388.5 million.

How about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials on BEZ, we can see steady revenue growth, steady earnings growth, steady dividend growth, but with a slight expansion of outstanding shares from 33 million in 2006 to 46 million in the trailing twelve months (TTM). Free cash flow is positive and the balance sheet is solid from my perspective.

What about valuation?

Checking Yahoo "Key Statistics", this is a mid cap stock with a market capitalization of $2.01 billion. The trailing p/e is moderate at 30.14, but the forward p/e is estimates (fye 30-Dec-08) at 19.30. Thus, with rapid growth the PEG comes in at a nice 1.12.

Baldor, according to the Fidelity.com eresearch website, has a nice Price/sales ratio of only 1.60 (TTM) compared to the industry average of 22.35. However, Baldor's Return on Equity (TTM) is at 15.84%, somewhat below the industry average reported at 20.30%.

There are 45.74 million shares outstanding with 41.20 million that float. As of 4/10/07, there were 2.69 million shares out short representing 10.5 trading days of volume (the short ratio) well ahead of my own 3 day rule for significance. The company has already traded 1.2 million shares, well ahead of the average volume of 357,000, and also well behind the probably residual level of short shares outstanding. This may well be part of a 'squeeze' of the shorts.

The company pays a forward dividend of $.68/share yielding 1.7%. The company, per Yahoo, last split its stock 4:3 in December 1997.

What about the chart?

If we look at the "Point & Figure" chart on Baldor from StockCharts.com, we can see that the stock, which actually traded lower from $23/share in April, 2002, dipped as low as $16.50 in October, 2002, before starting to trade higher to the current $44 level today. The chart looks strong to me.

Summary: What do I think?

Well, I certainly liked this stock enough to buy some shares! Seriously, the company reported very strong earnings beating expectations, they have grown nicely the last several years increasing both revenue, earnings and dividends, the balance sheet is solid and valuation is reasonable. Finally, the chart looks nice. On top of this, there are lots of shares out short which will need to be covered as the stock appreciates, adding to the buying pressure.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where I discuss some of the many stocks I write about here on the website.

Have a great weekend everyone!

Bob

Baldor Electric (BEZ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I never let that nickel sit in my pocket very long! In fact, a few moments ago, with my 'permission slip' to add a new position in hand, I checked the list of top % gainers on the NYSE and came across Baldor Electric (BEZ), which as I write, is trading at $44.25, up $4.46 or 11.21%. I quickly checked the latest quarter, which as I suspected they announced 1st quarter 2007 results today. They reported great numbers and exceeded expectations on both earnings and revenue. I took a look at the Morningstar.com "5-Yr Restated" financials on BEZ (isn't it neat how quick you can do this stuff after awhile!), and everything appeared to be just beautiful except for a jump in the outstanding shares recently. (That doesn't appear to be a problem). The company even pays a dividend and has been increasing it annually!

Anyhow, I took the plunge and bought 140 shares at $44.00/share a few moments ago. With my new strategy of selling 1/7th of my holdings at appreciation targets, I am trying, not that it makes a real difference, to start out with positions that are divisible by 7. Actually, as I write it up, that is a pretty silly way to pick a number of shares to buy isn't it?

Wish me luck! I am back to my 20 position status. I am not going to my old goal of 25 positions until I get that margin balance down. At that point, maybe will go to 25 (?). If you have any comments or questions please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I shall try to do a more thorough write-up of Baldor if I get a chance later today or this weekend.

Regards to all of you!

Bob

Posted by bobsadviceforstocks at 9:21 AM CDT

|

Post Comment |

Permalink

Updated: Friday, 4 May 2007 9:26 AM CDT

Universal Electronics (UEIC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I noticed that my Universal Electronics Stock (UEIC) had passed my first appreciation target of a 30% gain. At each of these appreciation targets, my current strategy is to sell 1/7th of my holding. Owning 180 shares, I sold 25 shares of UEIC at $33.39. These shares were purchased 2/23/07 at a cost basis of $25.24, so this represented a gain of $8.15 or 32.3% since purchase.

My next sale on the upside would be at an appreciation target of 60% at which time I plan on selling 1/7th of my remaining shares, or 22 shares at 1.6 x $25.24 = $40.38. On the downside, after a single sale, my targeted sale point would be at break-even or at a price of $25.24.

Anyhow, the other thing about my strategy is that now at 19 positions, under my new maximum of 20 positions, this sale is a 'signal' or a 'permission slip' to look for a new holding! That nickel is already burning a hole in my pocket!

Thanks so much for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I shall be on the lookout for that new position and I shall keep you posted!

Bob

Wednesday, 2 May 2007

Buffalo Wild Wings (BWLD) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I was looking through the list of top % gainers on the NASDAQ and was pleased to see an "old favorite" of mine, Buffalo Wild Wings (BWLD) on the list. BWLD closed at $74.20, up $9.36 or 14.44% on the day.

Earlier today I was looking through the list of top % gainers on the NASDAQ and was pleased to see an "old favorite" of mine, Buffalo Wild Wings (BWLD) on the list. BWLD closed at $74.20, up $9.36 or 14.44% on the day.

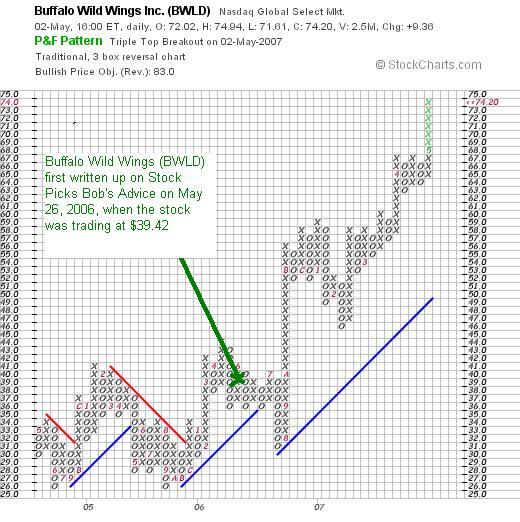

I use the term "old favorite" to describe stocks that I have reviewed here previously. As much as possible, I try to wait about a year before revisiting them when the opportunity arises. In fact, I wrote up Buffalo Wild Wings (BWLD) on Stock Picks Bob's Advice on May 26, 2006, when the stock was trading at $39.42. With today's close at $74.20, this represents a gain of $34.78 or 88.2% since posting just under a year ago! (Unfortunately, I did not buy any shares last year and I still do not own any shares or have any options on this stock!) In light of all of this and the following information,

BUFFALO WILD WINGS (BWLD) IS RATED A BUY

Let's take another look at this stock and I will show you why I still believe it deserves a spot on the blog and a place in my "vocabulary". If I were buying a stock today, this would be the kind of stock I would be looking to purchase!

What exactly does this company do?

According to the Yahoo "Profile" on Buffalo Wild Wings (BWLD), the company

According to the Yahoo "Profile" on Buffalo Wild Wings (BWLD), the company

"...through its subsidiaries, engages in the ownership, operation, and franchising of restaurants in the United States. It provides quick casual and casual dining service, as well as serves bottled beers, wines, and liquor."

How did the company do in the latest quarter?

As I have reported over and over again, it was the announcement of earnings that once again drove one of my posted stocks higher. In this case, BWLD announced 1st quarter 2007 results after the close of trading yesterday that drove the stock sharply higher today. Total revenue for the quarter ended April 1, 2007, came in at $79.9 million, up 24.3% from last year's $64.3 million figure. Same-store sales grew 8.7% at company-owned stores and a not-quite-as-impressive 3.3% at franchised stores. Net earnings were up strongly at $5.5 million in the 1st quarter 2007 vs. $3.5 million last year. On a diluted earnings per share basis, this was more than a 50% increase from $.40/share to $.63/share in 2007.

The company easily beat estimates of $.52/share on revenue of $78.4 million according to analysts polled by Thomson Financial. On the back of this news, the company was upgraded by Morgan Keegan to "Outperform". Even Cramer had a big "booyah" for Buffalo Wild Wings, as reported:

"Cramer also sang the praises of Buffalo Wild Wings (BWLD - Cramer's Take - Stockpickr - Rating), up 15% Wednesday on strong earnings. Cramer said he believes the stock is "heavily overshorted" and going higher."

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on BWLD, we can see that this company has grown its revenue vigorously and steadily from $96.1 million in 2002 to $278.2 million in 2006. Earnings were first reported at $.84/share in 2004 to $1.02/share in 2005 and $1.85 in 2006. During this same period, the company maintained the outstanding shares with only nominal increase in the float from 8 million in 2004 to 9 million in 2006.

Free cash flow improved from $(2) million in 2004 to $3 million in 2005 and $9 million in 2006. The balance sheet is great with $64.6 million in cash which by itself is able to cover both the $25.8 million in current liabilities and the $19.2 million in long-term liabilities combined. Calculating the current ratio, we have a total of $75 million in current assets, divided by the $25.8 million in current liabilities yields a current ratio of 2.91, a very 'healthy' current ratio imho.

What about some valuation numbers on this stock?

Reviewing the Yahoo "Key Statistics" on BWLD, we can see that this is a small cap stock with a market capitalization of only $646.73 million. The trailing p/e is a bit rich at 40.20, but the forward p/e is better (fye 31-Dec-08) estimated at 29.33. Even with the rich p/e, the growth rate is anticipated to be rapid enough to bring the PEG (5 yr expected) down to a reasonable 1.26.

Using the Fidelity.com eresearch website, we find that valuation isn't bad based on the Price/Sales (TTM) ratio which for Buffalo Wild Wings comes in at 2.04, compared to an industry average of 3.48. The company is also reported to do better than the industry average on profitability as measured by Return on Equity (TTM). BWLD is reported by Fidelity to have a Return on Equity of 15.08%, compared to the industry average of -.55%.

Finishing up with Yahoo, we can see that there are only 8.72 million shares outstanding and 7.02 million that float. As of 4/10/07, there were 2.31 million shares or 30.1% of the float, out short, representing 6.8 trading days (the short ratio). This is well above my own '3 day rule' for short interest. I have to agree with Cramer on this one that the short-sellers may well be pressured to buy shares to cover their negative bets on this stock as the price appreciated today. We can see that there were 2.5 million shares traded today, well above the average of 390,000 reported by Yahoo. In fact, many of the short-sellers may have been covering (?). I would expect that there are still many shorts still uncovered outstanding but then I would just be guessing on this one :).

No dividends are reported by Yahoo and no stock splits are reported either.

What does the chart look like?

Reviewing the "Point & Figure" chart on Buffalo Wild Wings (BWLD) from StockCharts.com, we can see that after initially trading between $33 and $26 between May, 2004, and September, 2005, the stock then started moving higher, breaking through resistance in November, 2005 at $32, and has traded strongly higher since to the current $74 level. If anything, the stock does look a little over-extended trading well above the support line around the $50 level.

Summary: What do I think?

Needless to say, I like this stock a lot. I don't know if I would like their chicken or their drinks at the bar. I like this stock not because of the restaurant, but it would be nice to visit one first-hand, but because of their superb financial performance. They reported great earnings results with solid revenue growth based not just on opening new restaurants but internal growth of existing restaurants as demonstrated by solid same-store sales growth figures.

The earnings report exceeded expectations on both earnings and revenue numbers. Furthermore, the company has an excellent and consistent track record of revenue and earnings growth, free cash flow growth, stable outstanding shares, and a great balance sheet.

Valuation-wise, the p/e is a bit rich at about 40, but the forward p/e is better, and more importantly, considering the growth rate anticipated in earnings, the PEG works out to be under 1.5. Other valuation numbers include a Price/Sales (TTM) low for its group, and a profitability as measured by Return on Equity (TTM) that is high for its group. Finally, the chart looks great and to top it off, it is another great midwestern firm (well, not from Wisconsin, but Minnesota isn't that far :).)

Thanks so much for stopping by and visiting! If you have any comments or questions, feel free to leave them on the blog or drop me a line at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where you can download some mp3's of me discussing some of the many stocks I write about here on the blog. In fact, I even did a Podcast on BWLD last year when I was writing up the entry.

Have a great week trading!

Bob

Tuesday, 1 May 2007

Amedisys (AMED) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor and that you should always consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NASDAQ this afternoon and came across Amedisys (AMED) which is an old favorite of this blog. AMED is currently trading at $33.80, up $2.44 or 7.78% on the day. I do not own any shares of Amedisys nor do I have any options on this stock.

I was looking through the list of top % gainers on the NASDAQ this afternoon and came across Amedisys (AMED) which is an old favorite of this blog. AMED is currently trading at $33.80, up $2.44 or 7.78% on the day. I do not own any shares of Amedisys nor do I have any options on this stock.

AMEDISYS (AMED) IS RATED A BUY

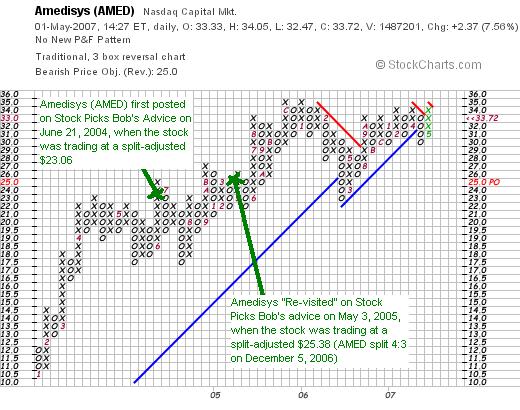

I say "old favorite" because I have posted twice about this stock previously. I first wrote up Amedisys on Stock Picks Bob's Advice on June 21, 2004, when the stock was trading at $30.74. With the stock splitting 4:3 on December 5, 2006, this represents an adjusted price of $23.06. With the current price at $33.69 (as I write), this is an appreciation of $10.63 or 46.1% since that post.

The following year, on May 3, 2005, I wrote up Amedisys on Stock Picks Bob's Advice at a price of $33.84 (or $25.38 adjusted for the 4:3 stock split). Again, with the stock currently at $33.77 (the stock keeps changing prices as I write :)), this represents an appreciation of $8.39 or 33.1% since that posting two years ago.

Let's take a third look (!) at this company and I shall once again share with you why I believe it still deserves a spot on this blog!

What exactly does this company do?

According to the Yahoo "Profile" on Amedisys (AMED), the company

"...provides home health and hospice services in the United States. Its home health services include nursing services, such as infusion therapy, skilled monitoring, assessments, and patient education; practical nursing services, including performance of technical procedures, administration of medications, and changing of surgical and medical dressings; and physical and occupational therapy."

How did they do in the latest quarter?

As I have found out over and over again, it was the announcement of 1st quarter results this morning, prior to the open of trading, that boosted the share price today. For the quarter ended March 31, 2007, "net service revenue" came in at $153.6 million, up 21% from the first quarter of 2006 and net income was $13.3 million or $.51/diluted share, up sharply from $7.3 million or $.34/diluted share for the same quarter in 2006.

The company beat estimates on both revenue (expected $150.3 million) and earnings (expected $.50) and reaffirmed guidance. With this earnings report, Jefferies & Co. upgraded their opinion on AMED from "Hold" to "Buy". The combined earnings report and upgrade was enough to boost the stock price today.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on AMED, we find revenue growing steadily from $129 million in 2002 to $382 million in 2005 and $541 million in 2006. Earnings during this period also sharply increased from $.06/share in 2002 to $1.72/share in 2006. It should be noted that the company has indeed expanded the number of shares outstanding significantly from 11 million in 2002 to 26 million in the trailing twelve months (TTM). However, during this time while shares slightly more than doubled, revenue almost quadrupled and earnings were up more than 20-fold.

Free cash flow, while positive, has dropped recently from $24 million in 2004, $23 million in 2005 and $14 million in 2006. The balance sheet, as presented by Morningstar.com, appears solid. The company has $84.2 million in cash and $95.0 million in other current assets. This combined $179.2 million in current assets is more than adequate to cover both the short-term liabilities of $81.9 million and the $17.8 million in long-term liabilities combined. The current ratio works out to a healthy 2.19. (Generally current ratios of 1.25 or higher are considered 'healthy').

What about some valuation numbers on this stock?

Looking at the Yahoo "Key Statistics" on Amedisys, we can see that this is a small cap stock with a market capitalization of $876.02 million. The trailing p/e is a very reasonable 19.73 with a forward p/e (fye 31-Dec-08) estimated at an even nicere 13.99. With the solid growth in earnings anticipated, the PEG ratio works out to a very 'cheap' 0.71. (Generally I view PEG's of 1.0 to 1.5 as being 'reasonable').

Examining the Fidelity.com eresearch website information, we find that the Price/Sales ratio isn't quite as cheap, with a Price/Sales (TTM) of 1.31, compared to an industry average of 1.04. In terms of profitability, the company comes in with a Return on Equity (TTM) of 15.08%, much higher than the industry average reported by Fidelity to be 7.52%.

Finishing up with Yahoo, we find that there are 25.83 million shares outstanding with 25.32 million that float. Of these 4.50 million are out short representing 17.8% of the float or 11.7 trading days of volume. This is a significant level of short interest and with today's trading volume of 1.5 million, almost 4 times the average volume of 393,836 shares, we may well be witnessing a 'short squeeze' driving this stock price higher. There are likely still many shares out short still subject to buying pressure by a climbing stock price.

No dividend is paid, and as I noted earliere in this post, the company split its stock 4:3 on December 5, 2006.

What does the chart look like?

Examining the "Point & Figure" chart from StockCharts.com on AMED, we can see a chart that appears to be plateauing. I am not sure if the stock is more or less 'rolling over' and headed lower, or if the current stock price movement will break out to higher highs. I would like to see this stock trade convincingly into the $36-$37 level or higher to be assured that the stock is indeed on the upward path.

Summary: What do I think about this stock?

Well, I like this stock as it is indeed one of the few stocks that I have had the opportunity of reviewing three times (and not even purchasing any shares!). They reported solid earnings and revenue growth today, beating expectations, they have grown revenue and earnings steadily the last few years. On the downside, they have indeed increased their shares outstanding but have done so at a rate far slower than the growth in revenue and earnings.

Free cash flow is positive, but hasn't been growing recently. The balance sheet on Morningstar appears solid.

Valuation-wise, the p/e is only in the teens and the PEG is under 1.0. The Price/Sales is a bit rich for its group, but the profitability is almost double the average in its industry. Finally, there are lots of short-sellers out there who need to cover their bets against this company and I believe there may literally be over a million shares needing to be covered at this point.

Technically the graph could be stronger. On the other hand, the stock does not appear to be over-extended and with a bit of a price appreciation, could well be building a strong base to expand upon. In conclusion, if I were in the market to be buying a stock, this is the kind of stock I would be purchasing today. In the meanwhile, it shall stay on my list of "purchaseable" stocks, becoming part of my "vocabulary" of stocks.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Website.

Bob

Newer | Latest | Older

On December 21, 2005, I made the only selection of the week, picking Western Digital (WDC) for Stock Picks Bob's Advice at a price of $18.43. WDC closed at $18.40, down $(.03) since the original post representing a loss of (.2)% since posting. I do not own any shares nor do I have any options on this stock.

On December 21, 2005, I made the only selection of the week, picking Western Digital (WDC) for Stock Picks Bob's Advice at a price of $18.43. WDC closed at $18.40, down $(.03) since the original post representing a loss of (.2)% since posting. I do not own any shares nor do I have any options on this stock. On April 26, 2007, Western Digital (WDC) reported 3rd quarter 2007 results. For the quarter ended March 30, 2007, revenue came in at $1.4 billion, a 25% increase in revenue from the prior year which was $1.1 billion. Net income for the quarter was $121 million, or $.53/share, up from $102 million or $.45/share last year. The company beat expectations of $.47/share according to Reuters Estimates.

On April 26, 2007, Western Digital (WDC) reported 3rd quarter 2007 results. For the quarter ended March 30, 2007, revenue came in at $1.4 billion, a 25% increase in revenue from the prior year which was $1.1 billion. Net income for the quarter was $121 million, or $.53/share, up from $102 million or $.45/share last year. The company beat expectations of $.47/share according to Reuters Estimates.

I had a nice letter from Pat B. who asked me some questions about getting started investing. Pat wrote:

I had a nice letter from Pat B. who asked me some questions about getting started investing. Pat wrote: I really do intend to cut back on the posting around here for a couple of weeks...at least that is the plan :). But before I get to cutting back, I did want to write up this stock that made the

I really do intend to cut back on the posting around here for a couple of weeks...at least that is the plan :). But before I get to cutting back, I did want to write up this stock that made the

As I wrote up earlier today, after my sale of a portion of my Universal Electronics (UEIC) at a gain, I had the "permission slip" to add a new position to my trading portfolio. Earlier today, I purchased 140 shares of Baldor (BEZ) at $44/share to fill out my portfolio. I promised I would let you briefly know why I chose Baldor and how it fit into my portfolio and why

As I wrote up earlier today, after my sale of a portion of my Universal Electronics (UEIC) at a gain, I had the "permission slip" to add a new position to my trading portfolio. Earlier today, I purchased 140 shares of Baldor (BEZ) at $44/share to fill out my portfolio. I promised I would let you briefly know why I chose Baldor and how it fit into my portfolio and why  According to the

According to the

Earlier today I was looking through the

Earlier today I was looking through the  According to the

According to the  I was looking through the

I was looking through the