Stock Picks Bob's Advice

Sunday, 10 October 2004

"Looking Back One Year" A review of stock picks from the week of September 1, 2003

Hello Friends! It has been a couple of weeks since I looked back at some past picks. I don't know about you, but my life sure gets busier and busier! O.K. so that ISN'T a very good excuse...well anyway, I am glad I am back on track for now. What I do in these reviews, if you are new to this website, is try to assess how selections that I posted here on

Stock Picks Bob's Advice have performed about a year later. I like to look at selections at a week at a time. This week, I am up to the week of September 1, 2003, about 13 months ago. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. And as I sometimes like to add, past performance, both good and bad, is no guarantee of future performance!

The first stock to be posted that week was Sohu.com, which I

posted on this blog on September 2, 2003, at a price of $33.47. This was a loss of $(16.01) or (47.8)%. NOT a very exciting selection. Please remember, that in actual practice, I utilize an 8% stop loss on all of my actual investments, but for the sake of this review, I assume a "buy and hold" strategy.

On July 28, 2004, SOHU

reported 2nd quarter 2004 results. They reported that revenues jumped 41% from the prior year to $27.3 million. Net income for the quarter came in $9.9 million or $.25/share compared with $7.5 million or $.19/share the prior year. In the same announcement, SOHU cut guidance to $28.1 to $29.1 million, with net income between $.23 and $.25/diluted share. They are thus predicting a sequential drop in net income. The "street" didn't like this report and the stock corrected.

On September 3, 2003, I

posted Take-Two Interactive (TTWO) on Stock Picks at a price of $35.75. On October 8, 2004, TTWO closed at $34.18, for a loss of $(1.57) or (4.4)%.

On September 9, 2004, TTWO

announced 3rd quarter 2004 results. For the third quarter ended July 31, 2004, sales grew 6% to $160.9 million from $152.1 million the prior year. However, the company lost $(14.4) million or $(.32)/share compared with a profit of $5.7 million or $.13/share in the year-ago period. This even exceeded First call estimates for a loss of $(.30)/share. Not exactly stellar results!

On September 4, 2003, I

posted Interpore International (BONZ) on Stock Picks at $17.50. Interpore was acquired by Biomet (BMET) on June 18, 2004, at a price of $14.50/share. This represented a loss of $(3.00)/share or (17.1)%.

So how did we do that week? Well in one word, AWFUL. This is one of the few weeks I can recall when ALL of the stock picks came in with losses. For the three stocks the average loss was (23.1)%. This only shows you the importance of having a loss limit in your strategy. As I have said many a time, I hold my stocks to an 8% loss and then out they go!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 5:44 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 10 October 2004 9:52 PM CDT

Thursday, 7 October 2004

A Reader Writes, "...I think you do a great job with your blog."

Hello Friends! I really like getting mail, and Jeff was kind enough to write me this evening. (Ever since I was a kid, I have always liked getting regular mail....and now, with the blog, I am just as tickled!) (I enclosed a copy of "Refrigerator Pies" by Wayne Thiebaud, a wonderful artist I admire...wouldn't it be fun to share some art here as well?)

He wrote:

I'm a semi-professional too. And, I think you do a great job with your blog. I have been reading it for about a week. You do a great job of presenting good information on companies. You're fair and honest about it. In comparison to the Kirk Report. He has some good ideas. But, he seems to be trying to make money on the market instead of in the market, with donations,without legitimate credentials. Anyway, I think you do a great service. I hope you will keep it up..Now I don't want to make any comments about the

The Kirk Report, as he is a fellow blogger, but I appreciate the kind words that Jeff has written. (I really should warn readers that I may post their letters but I don't want to discourage them from writing!)

I will try hard to hang in there and write away....writing actually gets easier over time, and I hope that my entries are more informative as I go on. I am learning a lot right with you as well!

Thanks again for stopping by Jeff, and please keep those cards and letters coming...at bobsadviceforstocks@lycos.com .

Bob

October 7, 2004 Parlux Fragrances (PARL)

Hello Friends! I felt like I needed to liven up the website...so here it is a portrait of Christopher Columbus to commemorate the upcoming Columbus Day Holiday on October 12th. Hard to believe that it has been 500 years since Columbus "discovered" America. Seems like yesterday!

Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. I have provided a link because some of you may well be reading this post on a third party site and might wish to stop by and visit the original! As always, please remember that I am an amateur investor, so please do your own investigation of all stocks discussed on this website and consult with your professional investment advisors prior to making any investment decisions to make sure that all investments are appropriate, timely, and likely to be profitable for you! Remember, I love to hear from all of you, so if you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

As a quick review for any of you that are new to this blog, I like to present stocks for "consideration". Stocks that I believe may represent companies that have demonstrated qualities that could result in positive price appreciation.

In a nutshell, I start my search scanning the

lists of top % gainers in the market. From this list, lately, I try to stay with stocks at least $10. I have avoided financial issues because my methodology does not conform well to these types of investments. Otherwise, I check most of the stocks on the list looking first to the latest quarterly result, looking for increasing revenue and earnings; then the last several years on Morningstar.com, again looking at revenue and earnings, but also free cash flow, dividend growth, and the balance sheet; then checking Yahoo.com for a look at valuation, and finally, a quick inspection of a point & figure chart from Stockcharts.com.

Today, while looking through the lists of top percentage gainers I came across Parlux Fragrances (PARL). I do not have any shares or options in this investment. PARL, as I write, is trading at $14.95, up $.98 or 7.02% on the day. According to the

Yahoo "Profile", PARL "...is engaged in the creation, design and manufacture, distribution and sale of prestige fragrances and beauty-related products marketed primarily through specialty stores, national department stores and perfumeries on a worldwide basis."

On August 5, 2004, PARL

reported 1st quarter 2005 results. For the quarter ended June 30, 2004, net sales increased to $23.0 million from $16.9 million last year. Net income was up 200% to $2.2 million compared with $.7 million last year. On a per share fully diluted basis this came in at $.21/share vs. $.08/share in the prior year.

How about longer-term? Checking the

"5-Yr Restated" financials on Morningstar.com, we can see a steady revenue growth from $66 million in 2000 to $87 million in the trailing twelve months (TTM). Earnings have been less steady, dropping to a loss of $(.57)/share in 2002, but increasing since then to $.76/share in the trailing twelve months.

Free cash flow has also been improving. Again, a negative $(6) million in 2002, but improving to $13 million in the TTM.

Balance-sheet-wise, they appear quite solvent with $7.6 million in cash and $60.4 million in other current assets balanced against $13.1 million in current liabilities and only $1.6 million in long-term liabilities.

How about "valuation"? Looking at

Yahoo "Key Statistics", we can see that this is a very SMALL cap stock, some might even say MICRO cap!, with a market cap of only $137.70 million. The trailing p/e is reasonable at 20.21. No forward p/e (? any analysts making estimates?), and thus, no PEG. Price/sales isn't bad at 1.46.

There are only 9.06 million shares outstanding with 7.80 million that float. Currently there are 215,000 shares out short, representing 2.76% of the float or 5.375 trading days of volume. This is a bit higher than my 3 day short coverage ratio that I use to consider a significant short position.

No cash dividend is reported and the last stock split was a 2:1 reported by Yahoo for November, 1995.

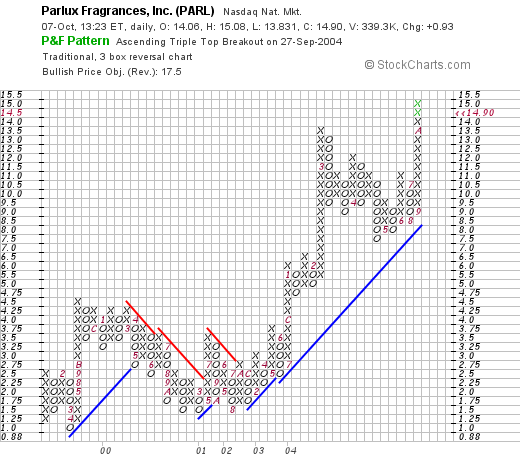

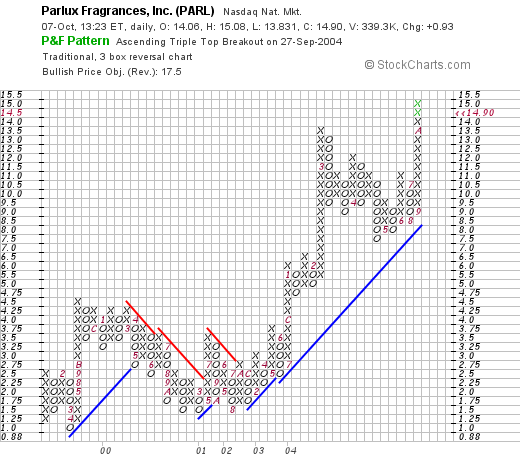

How about "technicals"? Looking at a point & figure chart from

Stockcharts.com:

we can see that the stock, which was trading sideways between early 1999 and late 2002, in the range of $1.25 to $4.75, broke through resistance in September, 2003, at about $3.50, and has traded strongly higher since that time. The chart looks nice to me!

So what do I think? This is a very small stock and may represent opportunity, or volatility. The latest quarter looks solid, the five year record of increasing revenue is great. Earnings have been on the rise the last few years, free cash flow is improving, the balance sheet is nice, and valuation is reasonable. Furthermore, the chart looks strong to me!

But as you may know, I just SOLD my ANN to preserve my gain, and I cannot buy anything until the market signals me that the "coast is clear" by a sale of one of my holdings at a gain. That is why my latest transactions have been sales!

Thanks so much for stopping by! Always remember that I am an amateur investor so please consult with your invesment advisors prior to making any investment decisions based on information on this website. Again, if you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Thanks so much for stopping by! Always remember that I am an amateur investor so please consult with your invesment advisors prior to making any investment decisions based on information on this website. Again, if you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

"Trading Transparency" ANN

Hello Friends! Just a quick note to update you on a trade in my Trading Portfolio. I just sold 225 shares of my Ann Taylor Stores (ANN) at $21.80 as it just got into the loss column. I had purchased these shares 10/1/03, a little over a year ago at $21.85/share. On December 1, 2003, I sold 50 of my original 200 shares for a gain of $376.40. Since I had already sold a portion at a gain, my trading rules dictates a sale as it approaches the break-even on the way down. And sell I did!

Will keep you posted!

Bob

Wednesday, 6 October 2004

October 6, 2004 Wolverine World Wide (WWW)

Hello Friends! Thanks so much for stopping by. If you are new to this website, you might want to see my main page:

Bob's Advice for Stocks, where I review some of the parameters I like to consider when evaluating a stock. In a nutshell, I like to start first evaluating the

lists of top % gainers for the day. Often I will start first with the NASDAQ, but sometimes, like today, I review the NYSE lists first. In any case, I go through a screening process, first checking the latest quarter financial results, then looking at the last 5 years on Morningstar, checking valuation issues with yahoo, and then look at a chart from Stockcharts.com.

There really isn't anything 'magic' about what I do. I had a semi-professional investor tell me what I was doing was just "due diligence". I guess that was a compliment. But please remember that I am an amateur investor, so consult with your own professional investment advisors prior to making any investment decisions based on information on this website.

How about a shoe company for a change? I was scanning the

list of top % gainers on the NYSE, when I came across Wolverine World Wide (WWW). WWW was the second-best %-gainer on the NYSE today, closing at $28.90, up $2.53 or 9.59% on the day.

According to the

Yahoo "Profile", WWW "...is a designer, manufacturer and marketer of a broad line of casual shoes, outdoor and work footwear and constructed slippers and moccasins. The Company's footwear products are organized under five operating units: The Wolverine Footwear Group, the Outdoor Group, Caterpillar Footwear, The Hush Puppies Company and Other Branded Footwear."

What drove the stock higher today, was that the company

announced 3rd quarter 2004 earnings. For the quarter, revenue rose 13% to $260.9 million from $230.6 million last year. Earnings rose 34% to $21.9 million or $.55/share from $16.4 million, or $.40/share in the year-ago period. Even nicer, the company RAISED guidance for 2004 to a range of $1.60 to $1.62 per share on revenue of $975 to $985 million. Previously, they had guided to $1.44 to $1.52/share on revenue of $960 to $980 million.

'

How about longer-term? Well, if you have visited here before, you will know that the next place I like to look is the

Morningstar.com "5-Yr Restated" financials. There we can see the steady improvement in revenue from $665.6 million in 1999 to $937 million in the trailing twelve months (TTM).

Earnings have been a bit more erratic, dropping from $.78/share in 1999 to $.26/share in 2000, but then steadily improving to the current $1.43/share in the TTM.

Free cash flow has been outstanding, improving from $43 million in 2001 to $94 million in the TTM. The balance sheet also looks nice per Morningstar.com with $63.6 million in cash and $342.2 million in other current assets, enough to cover the current liabilities about four times over. In addition, the company has $62.9 million in long-term debt.

How about the "valuation" of WWW? Looking at

Yahoo "Key Statistics", we can see that the market cap is a mid-cap $1.13 billion. The trailing p/e is 20.21 with a forward p/e (fye 3-Jan-06) of 16.71. The PEG is at 1.35, a little steep.

Yahoo reports 39.12 million shares outstanding with 38.00 million of them that float. As of 9/8/04, there are 1.17 million shares out short, representing 3.07% of the float or 7.535 trading days (!). This appears significant to me as I use a 3 day cut-off for signifance for this figure.

WWW also pays a small dividend of $.26/share yielding 0.99%. The last stock split reported on Yahoo was a 3:2 split as of May 27, 1997.

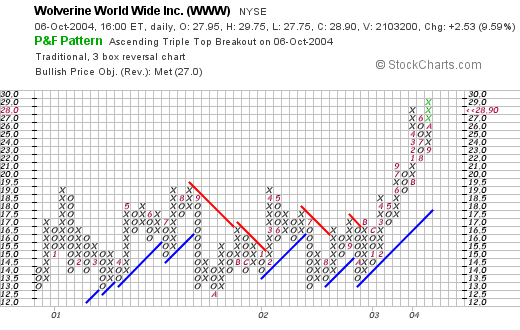

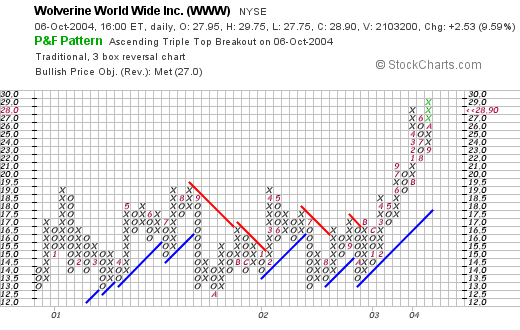

Looking at a "Point & Figure" chart from

Stockcharts.com:

We can see that this stock has been trading sideways from 2001 through 2003 and in early 2004, this stock broke out to a higher level.

At this point in the discussion, I like to summarize. First, the stock had a nice move today, showing good daily momentum. The recent earnings are solid (came out today), the latest five years shows steady revenue growth and fairly steady free cash flow improvement, with an outstanding balance sheet. Valuation is reasonable. There are even a few shorts outstanding that may add to an upward move of this company.

By the way, I do not own any shares of this company nor do I own any options.

Currently, in my "Trading Portfolio", I am patiently waiting hopefully for American Healthways to hit a sale point (30% appreciation) which would permit me in my trading allowance to add a new position. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Posted by bobsadviceforstocks at 11:51 AM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 6 October 2004 10:39 PM CDT

Monday, 4 October 2004

October 4, 2004 Wipro Ltd. (WIT)

Hello Friends! Thanks again for stopping by. We have had a few days in the market with some upward momentum and actually my Trading Portfolio is getting close to a sale on one or two issues at a gain....so MAYBE I will be adding a new position soon (?) As always, please remember that I am an amateur investor, so consult with your professional investment advisors prior to making any investment decisions based on information on this website; please make sure all of your investment decisions are appropriate, timely, and likely to be profitable for you! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

If you listened to the Presidential debate last week or the Vice-Presidential debate tomorrow evening, you are sure to know that "outsourcing" is one hot topic. Scanning through the

list of top % gainers on the NYSE today, I came across Wipro Ltd. (WIT). I do not own any shares of this stock nor do I own any options. WIT closed at $20.86 today, up $1.56 or 8.08%.

According to the

Yahoo "Profile", WIT "...is a global information technology (IT) services company." Based in India, it does a lot of business in "outsourcing" of software for many large corporations.

On July 23, 2004, WIT

announced 1st quarter 2005 results. For the quarter, WIT earned $71 million, up from $38.8 million the prior year. Revenues were up 51% to $385 million during the latest quarter up from $255 million the prior year. On July 22, the company

announced results in Rupees. On a per share basis, earnings per share were 4.69 Rupees, up 83% over the earnings per share of 2.57 Rupees the prior year.

How about longer-term? Taking a look at a Morningstar

"5-Yr Restated" financials, we can see that revenue has grown steadily from $424.3 million in 1999 to $883.9 million in 2003.

Earnings have been a little less dynamic but have improved from $.06/share in 1999, to $.24/share in the trailing twelve months. Free cash flow has also grown steadily from $71 million in 2001 to $105 million in 2003.

The balance sheet is solid with $295.8 million in cash, almost enough to pay BOTH the current liabilities of $150.2 million and the miniscule long-term debt of $4.1 million two times over. In addition, WIT has $294.9 million in other current assets. This company is quite solvent!

How about "valuation"? Looking at

"Key Statistics" from Yahoo, we can see that the market cap is a Large Cap $14.48 billion. The trailing p/e isn't cheap at 58.11 (quite steep actually), with a forward p/e (fye 31-Mar-06) of 37.25. Thus, the PEG, if these estimates are right, isn't too bad at 1.46. The Price/Sales is also quite rich at 9.53.

According to Yahoo, there are 694.33 million shares outstanding (!), with 111.0 million of them that float. Of these shares, 1.47 million are out short as of 9/8/04, representing 1.32% of the float or 10.131 trading days. In my view, this is significant (with anything over 3 days to cover significat.)

Yahoo reports a small dividend of $.0303/share yielding 0.16%. WIT recently had a 3:1 split on 7/2/04.

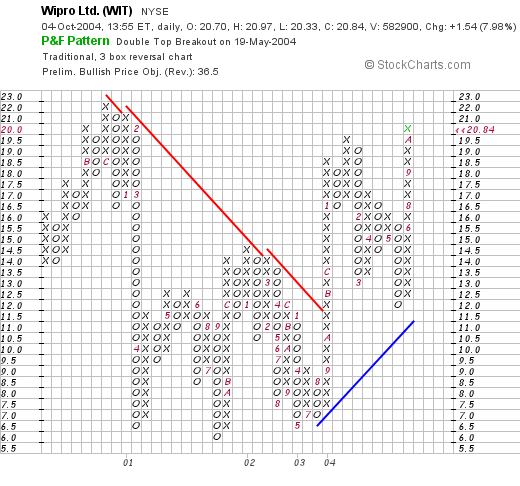

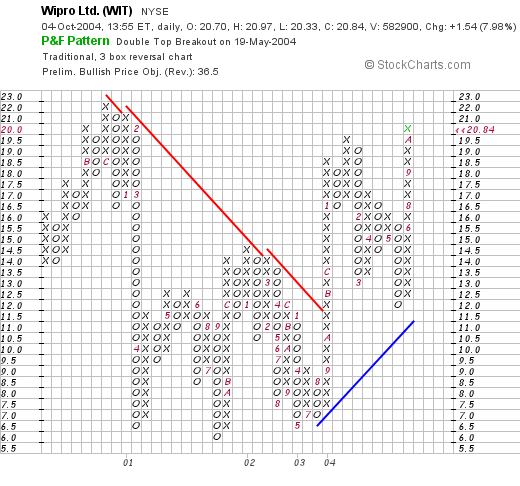

What about "technicals"? If we look at a graph from

Stockcharts.com:

we can see that this stock actually peaked in February, 2001, at around $22/share and then declined sharply down to $6.50. It has consolidated at this level through August, 2003, and then broke through resistance in October, 2003, moving steadily higher along a new support level to its current level. Presently, it appears over-extended at the $22 level, and would look for it to pull back towards the $15 range before moving higher....but then again, that is just my take on the chart...please review as well!

So what do I think about this stock? (Isn't this a great picture from the WIPRO website?) Overall, if we take away the lack of political correctness, this is a very dynamic company in a growing field. The earnings recently reported and the 5 year revenue growth is impressive. The balance sheet is superb, they are generating loads of cash and have relatively little debt with virtually NO long-term debt. Unfortunately, I am not the first to discover this stock and the valuation IS a bit steep. But then again, they are growing quickly so maybe it IS worth the price?

So what do I think about this stock? (Isn't this a great picture from the WIPRO website?) Overall, if we take away the lack of political correctness, this is a very dynamic company in a growing field. The earnings recently reported and the 5 year revenue growth is impressive. The balance sheet is superb, they are generating loads of cash and have relatively little debt with virtually NO long-term debt. Unfortunately, I am not the first to discover this stock and the valuation IS a bit steep. But then again, they are growing quickly so maybe it IS worth the price?

Currently, I have no cash to invest, that is, under my system, I need a partial sale from my trading portfolio before I add a new position....so I am sitting on my hands once again! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Thursday, 30 September 2004

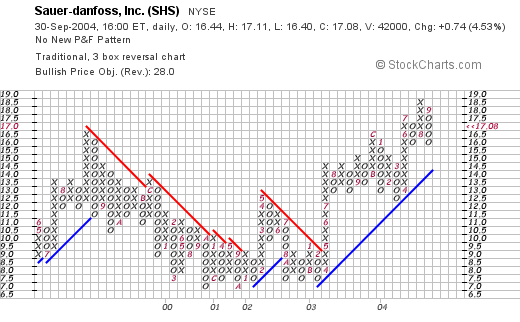

September 30, 2004 Sauer-Danfoss (SHS)

Hello Friends! I am so glad you stopped by. I hope that what I write is meaningful to you. If you have any comments on how you use this information, please email me at bobsadviceforstocks@lycos.com so that I may post a few of these comments on the website...matter of fact, I may do that anyhow! Please remember that I am an AMATEUR investor, so please consult with your professional investment advisors and do your own investigation on all stocks discussed on this website to make sure the investments are timely, appropriate, and likely to be profitable for you!

Looking through the NYSE

list of top % gainers, I came across Sauer-Danfoss (SHS), a stock that I had honestly NEVER heard of before, and that I do NOT own any shares or options. SHS had a nice day today, closing at $17.08, up $.74 or 4.53% on a day where the DJIA closed down 55.47, with the NASDAQ up only 2.90. According to the

Yahoo "Profile", SHS "...is a global manufacturer of components and integrated hydraulic, electric and electronic systems that generate, transmit and control power in mobile equipment."

On August 4, 2004, SHS

reported 2nd quarter 2004 results. Net sales for the quarter increased 23% to $379.1 million, compared to sales of $308.5 million the prior year. Even excluding currency effects, sales were still up 18% year-over-year. Net income for the quarter came in at $21.6 million, or $.46/share compared with second quarter 2003 results of net income of $11.3 million or $.24/share. This is almost a 100% increase in earnings! This was a solid report, with company raising guidance stating "...we are increasing our earnings expectations for the full year to $.70 to $.80 per share. The most recent earnings expectation, from May 3, 2004, was $.60 to $.75 per share." It is SO important, imho, to see earnings guidance RAISED. It is the icing on the cake of a good earnings report!

In another "bullish" move, the company, on September 23, 2004,

announced an increase in its quarterly dividend by 43% to $.10/share from $.07/share. While dividends aren't absolutely required for a great stock, if you can get them, they only help, and a company that RAISES its dividend is sending another bullish signal to the investment community!

How about longer-term? If we look at the

Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown steadily from $0.5 billion in 1999 to $1.3 billion in the trailing twelve months (TTM).

Earnings have been positive but erratic, dropping from $.67/share in 1999 to $.09 in 2001, but have improved to $.48/share in the TTM.

Free cash flow has also been improving recently with $(2) million reported in free cash flow in 2001, improving steadily to $41 million in the TTM.

Looking at the balance sheet, we find what I would call a solid if not spectacular balance sheet (in my humble opinion), with $15.8 million in cash and $478.8 million in other current assets vs. $479.3 million in current liabilities and $237.1 million in long-term liabilities.

How about "valuation"? Checking

"Key Statistics" from Yahoo, we can see that this is a mid-cap stock with a market capitalization of $810.38 million. No trailing p/e, or PEG is reported but the forward p/e (fye 31-Dec-05) is quite reasonable at 14.98.

Yahoo reports 47.45 million shares outstanding with only 10.00 million shares that float. There are only 123,000 shares out short as of 9/8/04, however, with the low average trading volume this still works out to a ratio of 4.393 days. Sort of significant (?).

The stock currently yields $.40/share or 2.45%. No stock dividends are reported on Yahoo.

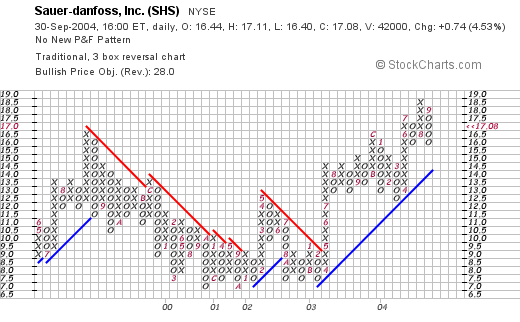

How about "technicals?" If we look at

Stockcharts.com for SHS we can see:

this stock had been trading lower between August, 1999, and bottomed several times around $7.00 between October 2000, and February, 2003. Since that time, it has been trading higher along a new support line closing today at $17.08. The graph looks nice to me!

So what do I think? The latest earnings report is solid. The five year record is good, except for a bit erratic record of earnings. The free cash flow is growing, the balance sheet is solid, valuation is reasonable, and the stock even pays a dividend, which has been recently increased! Technically, the chart looks great and doesn't appear over-extended.

I don't know much about the products directly, but the rest of the numbers look nice. Now, if I just had some money to be buying! LOL, but I am waiting for a buy signal...meaning a sale of one of my remaining positions at a sale target price. Otherwise, once again, I stay sitting on my hands!

Thanks so much for stopping by! If you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Wednesday, 29 September 2004

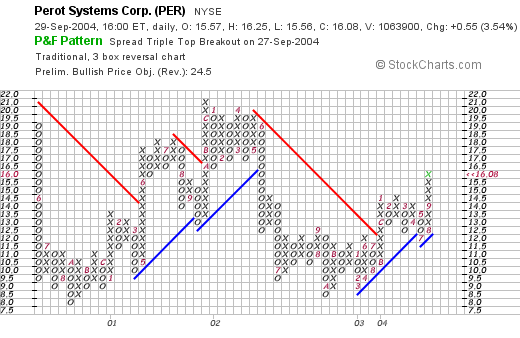

September 29, 2004 Perot Systems (PER)

Hello Friends! I cannot think of a more timely post...maybe a few years late? We are focussed on the stock market on this

, but sometimes, quite frankly, I have "blog-envy". I kind of wish I could dabble into the political issues facing America today. But that would be enough for a whole different blog, so I will try to stay on topic and get down to some stock picks! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors. If you have any comments, questions, or words of encouragement (discouragement?), please feel free to email me at bobsadviceforstocks@lycos.com .

As is my usual habit, I start my search for the "great stock pick" by looking through the

lists of top % gainers. Emphasizing stocks over $10, I came across Perot Systems (PER) which is currently trading at $16.14, up $.61 on the day or 3.93%. I do not own any shares of PER nor do I own any options.

This company is the same on associated with the third party candidate Ross Perot.

On September 24, 2004, PER

announced management changes That included Ross Perot's giving up the title of President and CEO; a position to be assumed by Peter Altabef, the current Vice President of the Company. According to the

Yahoo "Profile", PER "...is a worldwide provider of information technology (IT) services and business solutions to a range of customers.

Another thing driving the stock higher, besides the semi-retirement of the founder, is the

announcement by Perot that 3rd quarter results would be higher than expected. The latest company guidance was for $.21 to $.21/share in earnings on revenue of $448 to $460 million. Previously, they had guided to $.17 to $.18/share of earnings with a revenue target of $430 to $445 million for the quarter. Quite frankly, the raising of estimates is one of the strongest indicators I know that is predictive for future price appreciation.

On August 3, 2004, Perot Systems

announced 2nd quarter 2004 results. For the quarter ended June 30, 2004, revenue was $434 million, a 20% increase in revenue. Net Income came in at $21.9 million vs. $4.9 million the prior year. On a per share basis, this worked out to $.18/share this year compared to only $.04/share last year.

How about longer-term? For this, I like to turn to the

"5-Yr Restated" financials from Morningstar.com. Her we can observe the fairly uninterrrupted revenue growth (except for a dip between 1999 and 2000) from $1.2 billion in 1999 to $1.6 billion in the trailing twelve months (TTM). Earnings per share have been erratic dropping from $.49 in 2000 to $(.03) in 2001, up to $.68 in 2002 and only $.62/share in the TTM.

Free cash flow looks nice, with $64 million in 2001, improving to $89 million in the TTM. The balance sheet, as a result of the free cash flow, also looks excellent, with $166.9 million in cash, $313.2 million in other current assets, $295.9 million in current liabilities and only $19.5 million in long-term liabilities.

How about "valuation"? For this I like to check

Yahoo "Key Statistics" where some interesting data is found. First, this is a mid-cap stock with a market cap of $1.85 billion. (Per

Ameritrade definitions, Small-cap is less than $500 million, Mid-cap between $500 million and $3 billion, and Large-cap over $3 billion.) The trailing p/e is 26.18, and a forward (fye 31-Dec-05) p/e is at 18.94. The PEG isn't bad at 1.40. Price/sales is even more reasonable at 1.10.

Yahoo reports 114.97 million shares outstanding with 75.70 million of them that float. There are currently 2.52 million shares out short, representing 3.33% of the float, and 8.853 trading days. (I arbitrarily use 3 days of short interest as a cut-off for significance, and this stock with almost 9 days of short sales, is thus quite significant!)

Yahoo does not report any stock splits or cash dividends.

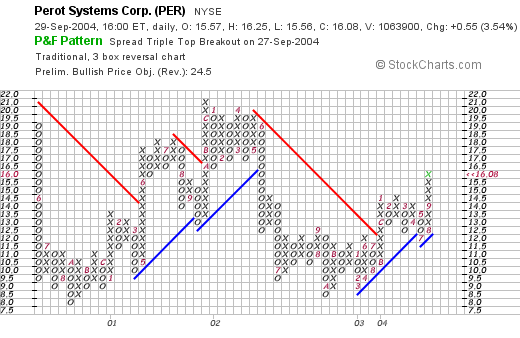

What about "technicals"? For this I turn to

Stockcharts.com, where I like to look at a "Point & Figure" chart. I find these charts helpful to assess the short and long-term moves of a stock price.

For PER this looks like:

Basically, this stock appears to be trading sideways having hit $8.00 twice, once in 2000, and once again in early 2003. Since early last year, PER has been climbing steadily along its support line. The stock graph looks nice to me, with a short term breakout beyond the resistance line and a recent move higher.

So what do I think about Perot Systems? Well, I never DID vote for Ross, and have never owned any of his shares, but this one looks just fine to me. The latest increased guidance for the 3rd quarter is bullish, the latest quarterly report is just fine. Longer-term, the company continues to grow. And valuation isn't too bad at all. The graph looks positive and certainly not overdone. Now, if I just had some cash to buy some shares!

Thanks so much for stopping by! If this is your first visit, please feel free to browse through my many prior posts! Again, if you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Friday, 24 September 2004

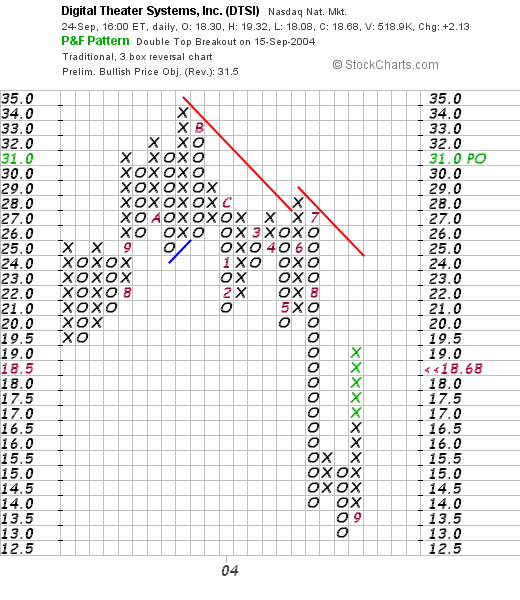

September 24, 2004 Digital Theatre Systems (USA) (DTSI)

Hello Friends! Thanks again for stopping by my blog,

Stock Picks Bob's Advice. Please remember that I am an amateur investor, so before making any decisions based on information on this website, please make sure you consult with your professional investment advisors to make sure such trades are appropriate and likely to be profitable for you. If you have any questions about this blog, or have any comments, please feel free to email me at bobsadviceforstocks@lycos.com .

I came across Digital Theatre Systems (DTSI) this afternoon while scanning the list of

top % gainers on the NASADAQ. DTSI closed today at $18.68, up $2.13, or 12.87% on the day. I do not own any shares of DTSI nor do I own any options.

According to the

Yahoo "Profile" on DTSI, DTSI "...provides entertainment technology, historically focused on digital multi-channel audio technology, products, and services for entertainment markets worldwide."

On August 5, 2004, DTSI

reported 2nd quarter 2004 results. For the quarter ended June 30, 2004, total revenues increased 13% to $13.3 million from $11.7 million in the same quarter in 2003. Net income was $3.1 million, a 126% increase over the $1.4 million in the same quarter the prior year. This worked out to $.17/diluted share compared with $.13/diluted share in the same quarter in 2003.

How about longer-term? Looking at a

"5-Yr Restated" financials from Morningstar.com, we can see that revenue has grown steadily from $22.8 million in 1999 to $55.5 million in the Trailing Twelve Months (TTM).

DTS came public in July, 2003. No earnings are reported on Morningstar.com.

Morningstar reports free cash flow of $3 million in 2001, $4 million in 2002, $8 million in 2003 and $9 million in the TTM.

The balance sheet looks great with $95.6 million in cash and $21.6 million in other current assets with $10.7 million in current liabilities and $0 million in long-term liabilities.

How about "valuation"? Taking a look at

Yahoo "Key Statistics" on DTSI, we can see that this is a small cap stock with a market cap of only $317.54 million. The trailing p/e is a moderate 25.38 and the forward p/e (fye 31-Dec-05) is only 21.47. The PEG is 1.07, and price/sales is 4.93.

Yahoo reports 17.00 million shares outstanding with only 6.50 million of them that float. There are 940,000 shares out short as of 8/9/04, representing 3.357 trading days to cover the short interest. Yahoo reports no cash nor any stock dividend in this issue.

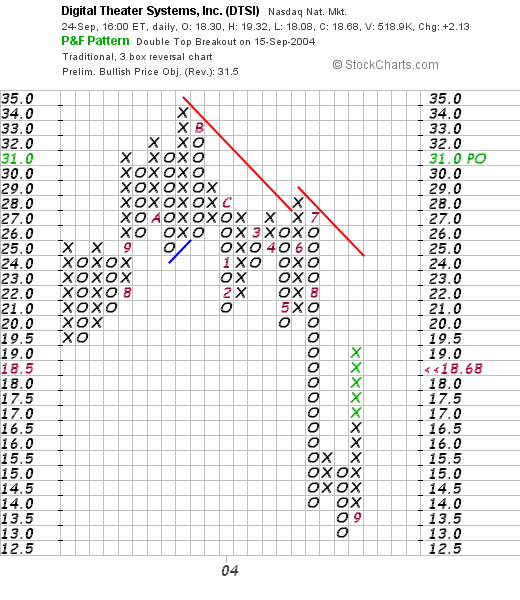

My favorite place to look at charts is on

Stockcharts.com. Of the many charts available to review, I find the "Point & Figure" chart the most reliable in providing guidance in terms of price activity. For DTSI this "point & figure" chart:

shows that DTSI came public in July, 2003 at around $19.5, rose to the $34.00 level in October, 2004, before failing to maintain a support level and instead falling to a los of $13.5, before moving higher recently.

O.K. what do I think? I think this is quite a small company but they DO have an interesting product. Their growth is steady, valuation is reasonable, the balance sheet is superb, but technicals look mediocre. I would like to see this stock close strongly above the $25 level to break through its recent resistance level.

Thanks so much for stopping by! Please feel free to email me at bobsadviceforstocks@lycs.com if you have any particular questions.

Bob

Thursday, 23 September 2004

September 23, 2004 Carter's (CRI)

Hello Friends! I apologize for not posting as often as I would like, but I shall do my best to keep adding to the HUGE number of stock market ideas on this blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please do your own investigation of all stocks discussed on this website, and please consult with your professional investment advisors to make sure all of your decisions have the greatest likelihood of profitability and appropriateness for you!

As many of you may know, the first thing I like to do when looking for a new stock pick is to search through the lists of

top % gainers of the NYSE. On the list today was Carter's (CRI), which closed at $26.30, up $1.19 or 4.74% on the day. Looking at the

Yahoo "profile", we can see that Carter's IS indeed the baby clothing store (it has been YEARS since my kids have been running around in those outfits), and "...markets apparel for babies and young children in the United States."

On July 28, 2004, Carter's

announced 2nd quarter 2004 results. Net sales for the quarter increased 12% to $156.3 million from $140.0 million in the same quarter the prior year. For the second quarter ended July 3, 2004, net income increased 183% to $5.9 million or $.20/diluted share from $2.1 million or $.09/diluted share the prior year. ($.03/share represented a benefit of the "cumulative effect of a correction in the cost of inventory"). The company estimated a 10% year-over-year increase in third quarter 2004 sales to $234 million with earnings rising 19% compared to the prior year at $.57/share. For the full year, CRI estimated sales of $775.0 million (+10%), and earnings $1.56 to $1.58, a 28% to 30% increase from the prior year. Overall this report looked quite postive to me!

How about longer-term? For this I like to turn to the

Morningstar.com "5-Yr Restated" financials. Here we can see that revenue has increased steadily from $406.9 million in 1999 to $703.8 million in 2003. The latest quarterly report has the company doing over $770.0 million in 2004!

Earnings have increased from $.82 in 2002 to $.92 in 2003. Again, estimates for 2004, reported in the latest quarterly earnings release by the company, should be about $1.56 to $1.58, a nice increase the last few years.

Free cash flow has been positive according to Morningstar.com, increasing from $12 million in 2001, to $23 million in 2003. The balance sheet also looks fine, if not perfect, with $36.1 million in cash and $185.7 million in other current assets, with only $71.2 million in current liabilities and $302.4 million in long-term liabilities.

How about "valuation"? Looking at

Yahoo "Key Statistics", we can see that this is a small cap stock with a market capitalization of $738.69 million. The trailing p/e isn't bad at 23.42 (imho), with a forward p/e (fye 3-Jan-06) of only 14.53 thus yielding a reasonable PEG at 1.07. Price/sales is also cheap at 0.96. There are 28.09 million shares outstanding (I do not personally own any shares nor do I have any options), with 26.90 million of these that float. As of 8/9/04, Yahoo reports 588,000 shares out short representing only 2.19% of the float, but due to the low average trading volume, this is still significant at 8.647 trading days.

No cash dividend and no stock dividend is reported on Yahoo.

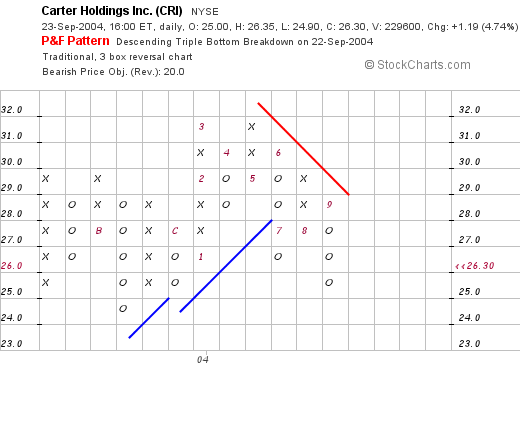

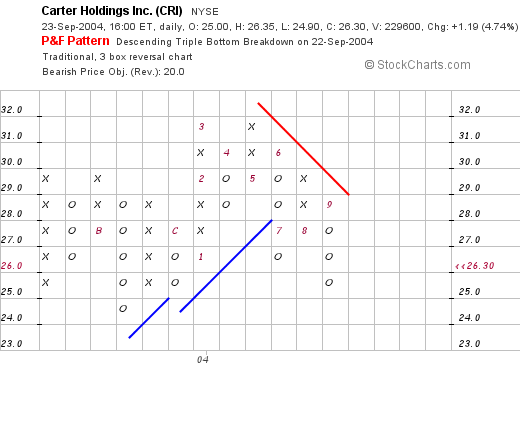

How about "technicals"? Looking a "point & figure" chart from

Stockcharts.com:

it appears that this stock probably came public in its current 'incarnation' in 2003 at around $25/share. The stock traded higher until June, 2004, when it broke through a resistance level at $28, and actually has been trading UNDER a resistance level since that time. The stock, at $26.30 today, will not have broken through the resistance level at around $29. As a technician, I might want to wait until it got through that level to make sure it wasn't just a temporary improvement in stock price.

So what do I think? Well their clothes are sure cute! LOL. But seriously, the earnings reported is solid, the free cash flow is nice, the balance sheet is healthy, and the valuation is in line. It is just that the technicals, the price chart itself does look a bit weak. And besides, I don't have any money to be buying anything right now!

Thanks so much for stopping by! If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Regards!

Bob

Newer | Latest | Older

The first stock to be posted that week was Sohu.com, which I posted on this blog on September 2, 2003, at a price of $33.47. This was a loss of $(16.01) or (47.8)%. NOT a very exciting selection. Please remember, that in actual practice, I utilize an 8% stop loss on all of my actual investments, but for the sake of this review, I assume a "buy and hold" strategy.

The first stock to be posted that week was Sohu.com, which I posted on this blog on September 2, 2003, at a price of $33.47. This was a loss of $(16.01) or (47.8)%. NOT a very exciting selection. Please remember, that in actual practice, I utilize an 8% stop loss on all of my actual investments, but for the sake of this review, I assume a "buy and hold" strategy. On September 3, 2003, I posted Take-Two Interactive (TTWO) on Stock Picks at a price of $35.75. On October 8, 2004, TTWO closed at $34.18, for a loss of $(1.57) or (4.4)%.

On September 3, 2003, I posted Take-Two Interactive (TTWO) on Stock Picks at a price of $35.75. On October 8, 2004, TTWO closed at $34.18, for a loss of $(1.57) or (4.4)%.  On September 4, 2003, I posted Interpore International (BONZ) on Stock Picks at $17.50. Interpore was acquired by Biomet (BMET) on June 18, 2004, at a price of $14.50/share. This represented a loss of $(3.00)/share or (17.1)%.

On September 4, 2003, I posted Interpore International (BONZ) on Stock Picks at $17.50. Interpore was acquired by Biomet (BMET) on June 18, 2004, at a price of $14.50/share. This represented a loss of $(3.00)/share or (17.1)%.

Hello Friends! I felt like I needed to liven up the website...so here it is a portrait of Christopher Columbus to commemorate the upcoming Columbus Day Holiday on October 12th. Hard to believe that it has been 500 years since Columbus "discovered" America. Seems like yesterday!

Hello Friends! I felt like I needed to liven up the website...so here it is a portrait of Christopher Columbus to commemorate the upcoming Columbus Day Holiday on October 12th. Hard to believe that it has been 500 years since Columbus "discovered" America. Seems like yesterday!  Today, while looking through the lists of top percentage gainers I came across Parlux Fragrances (PARL). I do not have any shares or options in this investment. PARL, as I write, is trading at $14.95, up $.98 or 7.02% on the day. According to the

Today, while looking through the lists of top percentage gainers I came across Parlux Fragrances (PARL). I do not have any shares or options in this investment. PARL, as I write, is trading at $14.95, up $.98 or 7.02% on the day. According to the  On August 5, 2004, PARL

On August 5, 2004, PARL  How about "valuation"? Looking at

How about "valuation"? Looking at

Thanks so much for stopping by! Always remember that I am an amateur investor so please consult with your invesment advisors prior to making any investment decisions based on information on this website. Again, if you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Thanks so much for stopping by! Always remember that I am an amateur investor so please consult with your invesment advisors prior to making any investment decisions based on information on this website. Again, if you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com . How about a shoe company for a change? I was scanning the

How about a shoe company for a change? I was scanning the  According to the

According to the  How about longer-term? Well, if you have visited here before, you will know that the next place I like to look is the

How about longer-term? Well, if you have visited here before, you will know that the next place I like to look is the  How about the "valuation" of WWW? Looking at

How about the "valuation" of WWW? Looking at

If you listened to the Presidential debate last week or the Vice-Presidential debate tomorrow evening, you are sure to know that "outsourcing" is one hot topic. Scanning through the

If you listened to the Presidential debate last week or the Vice-Presidential debate tomorrow evening, you are sure to know that "outsourcing" is one hot topic. Scanning through the  According to the

According to the  The balance sheet is solid with $295.8 million in cash, almost enough to pay BOTH the current liabilities of $150.2 million and the miniscule long-term debt of $4.1 million two times over. In addition, WIT has $294.9 million in other current assets. This company is quite solvent!

The balance sheet is solid with $295.8 million in cash, almost enough to pay BOTH the current liabilities of $150.2 million and the miniscule long-term debt of $4.1 million two times over. In addition, WIT has $294.9 million in other current assets. This company is quite solvent!

So what do I think about this stock? (Isn't this a great picture from the WIPRO website?) Overall, if we take away the lack of political correctness, this is a very dynamic company in a growing field. The earnings recently reported and the 5 year revenue growth is impressive. The balance sheet is superb, they are generating loads of cash and have relatively little debt with virtually NO long-term debt. Unfortunately, I am not the first to discover this stock and the valuation IS a bit steep. But then again, they are growing quickly so maybe it IS worth the price?

So what do I think about this stock? (Isn't this a great picture from the WIPRO website?) Overall, if we take away the lack of political correctness, this is a very dynamic company in a growing field. The earnings recently reported and the 5 year revenue growth is impressive. The balance sheet is superb, they are generating loads of cash and have relatively little debt with virtually NO long-term debt. Unfortunately, I am not the first to discover this stock and the valuation IS a bit steep. But then again, they are growing quickly so maybe it IS worth the price?  Looking through the NYSE

Looking through the NYSE  On August 4, 2004, SHS

On August 4, 2004, SHS  In another "bullish" move, the company, on September 23, 2004,

In another "bullish" move, the company, on September 23, 2004,  How about "valuation"? Checking

How about "valuation"? Checking

Hello Friends! I cannot think of a more timely post...maybe a few years late? We are focussed on the stock market on this

Hello Friends! I cannot think of a more timely post...maybe a few years late? We are focussed on the stock market on this  As is my usual habit, I start my search for the "great stock pick" by looking through the

As is my usual habit, I start my search for the "great stock pick" by looking through the  On September 24, 2004, PER

On September 24, 2004, PER  How about "valuation"? For this I like to check

How about "valuation"? For this I like to check

I came across Digital Theatre Systems (DTSI) this afternoon while scanning the list of

I came across Digital Theatre Systems (DTSI) this afternoon while scanning the list of  According to the

According to the  How about longer-term? Looking at a

How about longer-term? Looking at a  Yahoo reports 17.00 million shares outstanding with only 6.50 million of them that float. There are 940,000 shares out short as of 8/9/04, representing 3.357 trading days to cover the short interest. Yahoo reports no cash nor any stock dividend in this issue.

Yahoo reports 17.00 million shares outstanding with only 6.50 million of them that float. There are 940,000 shares out short as of 8/9/04, representing 3.357 trading days to cover the short interest. Yahoo reports no cash nor any stock dividend in this issue.

As many of you may know, the first thing I like to do when looking for a new stock pick is to search through the lists of

As many of you may know, the first thing I like to do when looking for a new stock pick is to search through the lists of  On July 28, 2004, Carter's

On July 28, 2004, Carter's  How about longer-term? For this I like to turn to the

How about longer-term? For this I like to turn to the  How about "valuation"? Looking at

How about "valuation"? Looking at