Stock Picks Bob's Advice

Sunday, 3 August 2008

comScore (SCOR) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I wrote up previously, my shares of Graham (GHM) hit a sale point on the upside (even while the market continued to correct!), and being under my maximum of 20 positions, this trade generated a 'permission slip' entitling me to add a new position.

As I wrote up previously, my shares of Graham (GHM) hit a sale point on the upside (even while the market continued to correct!), and being under my maximum of 20 positions, this trade generated a 'permission slip' entitling me to add a new position.

And add a position is what I did!

Like this Richard Seaman photo of surfers, I try to jump off one wave and catch the next! O.K., I have NEVER, EVER been surfing, but I have watched surfers :).

Like this Richard Seaman photo of surfers, I try to jump off one wave and catch the next! O.K., I have NEVER, EVER been surfing, but I have watched surfers :).

So looking for the next 'wave, I headed to my 'wave chart', that is the stocks making the top percentage gainers list.

Checking the list of top % gainers from the NASDAQ on Friday, I came across comScore (SCOR), a stock that I have not previously reviewed, and liked what I saw. I purchased 280 shares of comScore (SCOR) at $21.505. SCOR traded a bit erratically through the day and closed at $20.60, up $1.52 or 7.97% on the day. I am a bit 'underwater' on this stock, with an unrealized loss of $(.905) or (4.2)% since my purchase earlier the same day!

Let's go over this stock, and let me explain why

COMSCORE (SCOR) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on comScore (SCOR), the company

"...provides a digital marketing intelligence platform that helps customers make informed business decisions and implement digital business strategies in the United States, the United Kingdom, France, Germany, and Canada. Its products and solutions offer insights into consumer behavior, including objective, detailed information regarding usage of their online properties and those of their competitors, coupled with information on consumer demographic characteristics, attitudes, lifestyles, and offline behavior."

How about their latest quarter?

It was the release of 2nd quarter 2008 results after the close of trading that drove the stock higher Friday. Total revenue for the quarter climbed 38% to $28.8 million, from $20.8 million in the prior year same period. Net income climbed 38% to $1.7 million from $1.24 million the prior year. Earnings per share came in at $.06/share compared to $-0- the prior year. Excluding a recent acquisition of M:Metrics, this was $.09/share.

The company beat analysts' expectations of $.07/share on $27.69 million in revenue according to Thomson Reuters.

Topping off the rest of the good news, the company also raised guidance for the upcoming 3rd quarter.

"For the third quarter, comScore expects a profit of 1 to 2 cents per share, or 13 cents to 14 cents per share when excluding items, on revenue of $30.2 million to $30.7 million.

Analysts, whose estimates typically exclude special items, expect a profit of 8 cents per share on $29.5 million in revenue."

However not all of the news was good as the company, while raising 2008 revenue expectations to $119.7 to $120.4 million (ahead of analysts who were expecting $116 million), did lower earnings to $.22 to $.23/share (or $.71 to $.73/share on an adjusted basis, while analysts had been expecting $.36/share.

One analyst reiterated his "Buy" rating--as reported:

"In a note to investors, Jefferies & Co. analyst Youssef H. Squali reiterated his "Buy" rating for comScore and raised his price target by $1 to $28, saying that demand for the company's products is strong despite a difficult economic environment.

"While not cheap, comSore is a compelling value considering its sound fundamentals, leadership position in a growing segment of the Internet and relative resiliency to a weakening economy," he said."

What about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on SCOR, we can see the steady picture of revenue growth from $23 million in 2003 to $87 million in 2007 and $95 million in the trailing twelve months (TTM).

This company is just turning profitable with losses diminishing from $(6.96)/share in 2003 to break-even in 2006, $.88/share in 2007 and $.96/share in the TTM.

No dividends are paid and the company aggressively expanded its shares outstanding in 2007 to 18 million from 4 million in 2006.

Free cash flow is positive and growing with $3 million in 2005, $9 million in 2006, $18 million in 2007 and $22 million in the TTM. The balance sheet is solid with $54.0 million in cash and $76 million in other current assets, which when compared to the $45.5 milllion in in current liabilities yields a current ratio of 2.86.

What about some valuation numbers?

Checking Yahoo "Key Statistics", we can see that this is a small cap stock with a market capitalization of only $589.63 million. The trailing p/e is a bit rich at 28.07, with a forward p/e (fye 31-Dec-09) estimated at 39.62. The PEG (5 yr expected) is also richly priced at 2.29.

Utilizing the Fidelity.com eresearch website for some additional valuation numbers, we can see that the Price/Sales (TTM) is reasonable relative to its peers, with SCOR coming in at 6.03 relative to an industry average of 7.53.

When measured by the Return on Equity (TTM), the company also does well relative to its peers coming in at 41.24% vs. the industry average of 28.31%.

Returning to Yahoo, we can see that there are 28.62 million shares outstanding but only 8.31 million that float. As of 7/10/08, there were 2.28 million shares out short, representing 5.2 trading days of volume (the short ratio). This is well above my own '3 day rule' for short interest, so we may have actually been seeing a bit of a short squeeze on Friday.

No cash dividends are paid and no stock dividends are reported on Yahoo.

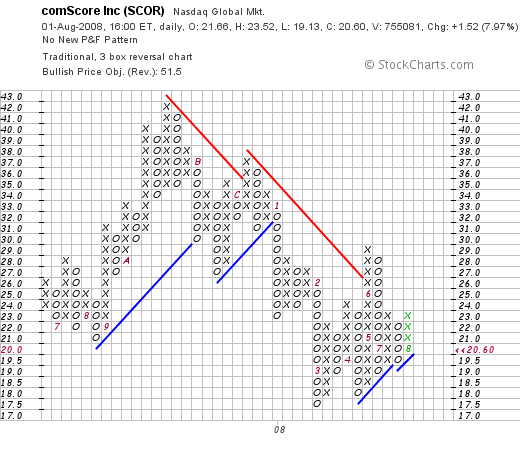

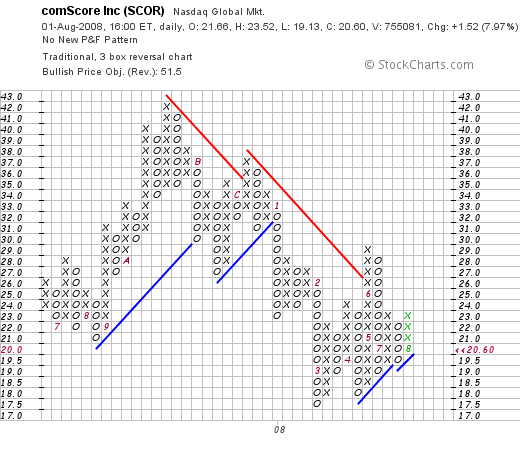

What does the chart look like?

The chart is actually one of the weakest findings on this particular stock. Reviewing the 'point & figure' chart on comScore (SCOR) from StockCharts.com, we can see how the stock price actually peaked in October, 2007, at $42/share, before dipping all of the way down to $17.5 in March, 2008. The stock has recently been attempting to move higher, breaking through resistance and and making higher lows, but the upward move is certainly not confirmed yet.

Summary: What do I think?

Well, I like this stock enough to buy some shares! Seriously, they are a very small company in a very interesting niche doing research on internet traffic. They certainly also have to deal with Google, the '800-pound gorilla' in the field of internet traffic. Their price has been very volatile and recently has been under pressure.

However, the latest quarter was strong, beating expectations and the company also raised guidance. Their Morningstar.com numbers show a certain consistency in improving financial results that I like. Valuation appears a bit rich, but the company is just turning profitable. Finally the chart, while recently a bit more optimistic, is far from being over-extended.

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can monitor my actual trading portfolio performance. In addition, consider dropping by my SocialPicks page where my past stock picks from the last two years are reviewed. Finally, consider visiting my Podcast Website, where you can download some mp3's of me discussing some of the many stocks reviewed on this website.

Wishing you all a healthy and financially profitable week ahead!

Yours in investing,

Bob

Friday, 1 August 2008

Graham (GHM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market had another dismal performance today with the Dow closing at 11,326.32, down (51.70), and the Nasdaq down (14.59) at 2,310.96. The S&P index dipped (7.07) to 1,260.31. Oil rebounded from the recent correction and climbed $1.02 on the day to $125.10/barrel.

In spite of this miserable trading environment, my shares in Graham (GHM) enjoyed a nice move higher, closing at $101.97, up $12.97/share or 14.57% on the day.

I acquired my original 105 shares of Graham (GHM) 5/30/08 (just two months ago) at a cost basis of $64.48/share. Two weeks ago, I sold 15 shares of Graham (1/7th of my holding) at $85.46, representing a gain of $20.98/share or 32.5% since purchase.

The 30% appreciation level is, as you may know, my first 'targeted' appreciation level at which time I sell 1/7th of my holding and use this as a "signal" to be buying a new position. The next appreciation target is at a 60% appreciation level.

Today, after announcing 1st quarter 2009 results with sales climbing 38.3% to $27.6 million from $20.0 million in the year-earlier same period, and net income up over 100% to $5.7 million or $1.11/diluted share compared to earnings of $2.7 million or $.53/diluted share the year earlier, the stock literally exploded on the upside. And that in the midst of a nasty market environment.

With the stock climbing to the 60% appreciation level, I sold 1/7th of my now 90 share position, which when 'rounded down' worked out to just 12 shares, at $104.45. With my cost basis of $64.48, this represented a gain of $39.97/share or 62.0% since purchase. Even though I personally have sold shares today on what I call 'good news', I am still bullish on this company and

GRAHAM (GHM) IS RATED A BUY

When would I sell shares next?

Going along with my system of selling small portions at targeted appreciation levels, my next sale point would be at a 90% appreciation level from my original purchase price which would work out to 1.90 x $64.48 = $122.51. On the downside, having sold a portion of Graham (GHM) twice, both at the 30 and 60% appreciation levels, my sale would be at 1/2 of the highest appreciation percentage or at a 30% gain. (NOT at 1/2 of the highest appreciation PRICE...you can see the difference). This would work out to 1.3 x $64.48 = $83.82.

One other thing.

My 'portfolio management system' generates buy and hold signals upon the sale of my own holdings. In other words, when I generate a sale on 'good news' like this Graham transaction, I generate a 'permission slip' to be adding a new position. When I generate sales on declines, I simply am required to 'sit on my hands' unless I am at the minimum, which for me is 5 positions.

Since I was at 6 positions, not at the maximum (20), this sale on good news generated a 'buy signal' and that nickel started burning a hole in my pocket immediately. I did find a stock to buy.....but THAT is a discussion for another blog entry entirely!

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com.

If you can, be sure and visit my Covestor Page where my actual trading portfolio is monitored and evaluated. Also, consider checking out my SocialPicks page where my stock picks from the last two years are reviewed. Finally, if you are interested, you might wish to visit my Podcast page where you can download some mp3's of me discussing some of the many topics and stocks reviewed on this website.

Have a great weekend everyone!

Yours in investing,

Bob

Wednesday, 23 July 2008

Meridian Bioscience (VIVO) "Trading Transparency---Closing Out My Trade"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

If you have been following my ongoing 'saga' with Meridian (VIVO), you will know that last week, after the 17% decline in the stock price from about $29 to $24, I chose to put on my 'contrarian hat' and bought 2000 shares of Meridian (on margin!). The stock didn't decline further, actually had an upgrade to "long-term buy" and managed to rebound to its current level. (VIVO is trading at $26.00, down $(.37) or (1.4)% on the day as I write (last quote as of 12:27 pm EST).

This kind of "trading" is not my forte. I work my portfolio as more of a system trader until every once in awhile I get the 'bug', and take a shot at what I believe is an opportunity I should not ignore. I have been wrong as often as I have been right. As one reader told me "stick to your system"....and I generally do.

Anyhow, I wanted to update you on the last 500 of the 2000 shares that I sold just a few moments ago (leaving me with my 171 shares of Meridian (VIVO) that I shall continue to manage in my usual fashion). This morning I sold my last 500 shares in two lots: 250 at $26.531, and 250 at $26.1854.

Unfortunately, my Fidelity account does what is called "first in first out" accounting, It really isn't bad like I say because long-term gains are taxed at a lower rate than short-term gains. So I saved a bunch of money....at least a little :).

However, I have been using those % numbers on the website to figure my own sale points. So go figure.

Needing to figure my sales points is important to my own idiosyncratic trading strategy. Going back to my entry of June 29, 2008, "Trading Portfolio Update", I summarized my current status on the 171 shares of Meridian (VIVO) that I own:

Meridian Bioscience (VIVO): 171 shares, purchased 4/21/05 at a cost basis of $7.42. VIVO closed at $27.74 for a gain of $20.32 or 273.9% since purchase. I have sold portions of VIVO eight times (!) at levels of 30, 60, 90, 120, 180, 240, 300, and 360% appreciation targets. Thus on the downside, if VIVO slips further to the 180% appreciation level or $7.42 x 2.8 = $20.78, then I would sell all of my shares. On the upside, a partial sale would next be at a 450% appreciatio level or 5.5 x $7.42 = $40.81.

Boy am I glad I had written that one up!

So thanks again for dropping by and visiting. Trades like the above are quite dangerous and prone to loss. Especially buying shares of a declining stock. But getting lucky is probably helpful.

Perhaps I should have held on longer. I am not interested in getting away from my own investment strategy that has been working. I just would like to try to dabble in 'trading' and see if I can master any of those skills. And I know, I should 'stick to my system' and shall try very hard to do that as well!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 21 July 2008

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to update you about my holding in Meridian (VIVO), and my 'trade' that I made going against the tide, buying shares in a company that I truly admire, and a company that has been my best performer long-term.

Sitting with a bunch of margin didn't really make me feel great in contrast to my trading strategy of methodically buying and selling portions of my relatively small positions. It just isn't me!

So with Meridian bouncing higher today, I sold 1000 shares of my 1500 remaining 'trade' position (out of the original 2000 shares). 500 shares were sold at $25.20, and 500 shares were sold at $26.03. Recall that these shares were JUST purchased at approximately $23.98 (I had several lots purchased to make the 2,000 share position), on 7/17/08, just last Thursday!

I still have 500 shares of this trade remaining. I shall try to be a bit more patient with the stock which as I write is trading at $25.00, up $1.04 or 4.34% on the day. It still represents a big 'chunk of change' for me but it is a level I can tolerate for now.

Trading stocks, as opposed to investing, involves an entirely different set of disciplines, and I do not believe I have those skills....although I continue to work at them....and you have to admit, this last trade has worked out nicely thus far!

Anyhow, I wanted to keep you all posted. I am planning to get back to my original 171 share position and then manage it as I have been all along, with the cautious and timely transactions that define my 'strategy'.

Regards.

Yours in Investing,

Bob

Friday, 18 July 2008

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This morning, with the market acting weakly once again, and with me sitting on approximately $50,000 of Meridian (VIVO)...I thought I might take a little off the table. So I sold 500 of my recent 2000 share position at $24.33. These shares were purchased yesterday at an average price of approximately $23.99, so they did have a small gain.

As I write, VIVO is trading at $24.04, up $.04 on the day, so it appears, for the moment, to be finding support at the $24.00 level.

I shall keep you posted.

I did promise last time NOT to be doing these "trades", but I am trying to learn how to identify these short-term trades successfully. My record is mixed at best.

Wish me luck.

Have a great weekend everyone.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:24 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 18 July 2008 1:25 PM CDT

Thursday, 17 July 2008

A Reader Writes "I am trying to figure out how the blogs are ranked..."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had a nice letter from Neil this afternoon who had some general questions about my blog. He wrote:

I had a nice letter from Neil this afternoon who had some general questions about my blog. He wrote:

"I am trying to figure out how the blogs are ranked and who gets the most readers. How is yours? Also it sounds like your an amateur, do you work also?

Neil

I trade some, but find it difficult to beat the overall markets, I think I over trade, ever heard that before......"

Thanks so much for writing Neil. I also am not sure how 'blogs are ranked'. I guess that is determined by the particular website doing the ranking. One of the more reliable blog ranking services is Technorati.

I found this explanation about how Technorati goes ahead and rates blogs:

"Technorati Authority is the number of blogs linking to a website in the last six months. The higher the number, the more Technorati Authority the blog has.

It is important to note that we measure the number of blogs, rather than the number of links. So, if a blog links to your blog many times, it still only count as +1 toward your authority. Of course, new links mean the +1 will last another 180 days.

Technorati Rank is calculated based on how far you are from the top. The blog with the hightest Technorati Authority is the #1 ranked blog. The smaller your Technorati Rank, the closer you are to the top."

Well that at least is how Technorati does it.

What about some other rankings? I found this explanation about how Google Blog Search ranks blogs:

"Positive factors affecting blog rank:

- How many RSS subscriptions there are to the blog.

- How often people click on a link to the post in search results.

- How many blogrolls the blog is in.

- How many “high quality” blogrolls the blog is in.

- If the blog offers visitors the chance to tag posts, whether people are tagging them.

- References to the blog by sources other than blogs.

- PageRank.

Negative factors affecting blog rank:

- If new posts appear in short bursts or at predictable intervals.

- If the content of the posts doesn’t match the content of feeds from the posts.

- If the content includes a lot of spam related keywords.

- If a lot of content is duplicated in multiple posts from a blog.

- Whether posts are the same size, or roughly the same size.

- Link distribution of the blog.

- If posts primarily link to one page or site."

Then of course there are other lists of top blogs. For instance Wikio offers a list of the top 300 blogs.

Here is a list of the Top 100 Personal Finance Blogs by FIRE Finance (a website I am not very familiar with).

I even found a list of "Finance Blogs Readability Ranked" to help determine how "readable" some of the more popular blogs are.

Finishing up with Technorati, this is a list of the top 100 blogs broken down by "number of fans". I suspect this is the sort of list you were looking for.

You asked about how "popular" my blog is. At least on this main website, you can find out about my visits on my Sitemeter Page. Checking this evening, the 'counter' relates that I have had 209,921 total visitors and average 126 visitors/day.

In terms of getting a good review, probably the nicest review I have ever received came fromValueWiki that discussed the Most Popular Finance Blogs. They commented about my blog:

"Some of you point out that Alexa rankings are occasionally dubious. I agree the system is not perfect (I blogged about Alexa accuracy here), but it’s the least bad system we’ve got. BobsAdviceforStocks made number 1 on my list of Ten Great Finance Blogs Flying Under the Radar but is not included on the list below because the tripod.com domain does not give him an Alexa ranking. Unfair! I’ve included technorati whereever possible. Let me know if you have suggestions on how to make the list more comprehensive (or fair!). Look for an update Tuesday."

They wrote me up in this Ten Great Finance Blogs Flying Under the Radar as their #1 choice. So that was a great comment from them. I hope I can live up their review.

And the other part of your question---yes I do have a full-time job not involving investing. And I do spend far too many hours blogging about investing and stocks! And yes I am an amateur---if by amateur you mean a non-investment-professional!

I am sorry to hear about you not keeping up with the market.

You are not alone.

Most mutual funds also underperform the market.

As this Motley Fool article points out:

"Though countless millions of dollars of shareholders' money is spent annually by mutual funds promoting themselves and the notion that they have "expert" stock pickers, the sad truth (or the funny truth, if you're in a laughing mood) is that the vast majority of mutual funds underperform the returns of the stock market (as represented by the S&P 500 index). Because of their excessive annual fees and poor execution, approximately 80% of mutual funds underperform the stock market's returns in a typical year. Over the past couple of years, that number has been going up, as mutual funds have been raising their fees to even higher levels.

The average actively managed stock mutual fund returns approximately 2% less per year to its shareholders than the stock market returns in general. There is currently no reason to believe that this differential will improve, or that actively managed mutual funds as a group can ever outperform the stock market's average returns. For that reason, investors who are going to invest in mutual funds rather than in individual stocks should hold a very, very, very strong bias toward investing in index funds, which invest across the board in a stock market index."

I hope that helps answer your questions and comments Neil! I greatly appreciate the time you took to write and I hope that my answers are helpful.

We all work hard to do a bit better than the market. Generally, when I follow my disciplined approach (which I didn't do today!), I have been pretty good at least keeping up with the S&P.

If you have any other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing.

Bob

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers.

Every once in awhile I just break all of my rules. (And I usually regret it as well!)

Every once in awhile I just break all of my rules. (And I usually regret it as well!)

I wanted to report on my latest indiscretion. Meridian (VIVO) a holding of mine reported today. Latest sales for the third quarter increased 11%. EPS came in at $.19/share, down from $.22/share, but last year included a tax benefit of $2.4 million. Taking this out it worked out to $.19/share this year vs. $.16/share a year ago.

Anyhow, the market has absolutely taken this stock apart.

Daring to go into the jaws of this awful negative momentum, I purchased 2,000 shares of VIVO a few moments ago at an average cost of $23.99/share. As I write, VIVO has already slipped BELOW this price, currently trading at $23.81/share, down $(4.93) or (17.15)% on the day.

I think this is way overdone.

I am trying to think rationally in the face of apparent market madness.

That can be a recipe for failure for me. But I shall put my contrarian hat on, hold my nose, and keep you posted.

Wish me luck.

And probably wish me better discipline at following my own rules. I guess that is what defines me as an amateur after all.

And I did it on margin :(.

Bob

Wednesday, 16 July 2008

Lufkin Industries (LUFK) "Trading Transparency

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday I wrote about how I had sold a portion of my Graham (GHM) at a gain, and thus had a 'permission slip' to be adding a new holding to my portfolio. And I commented how that nickel was already 'burning a hole in my pocket'!

Reminds me of that old Cracker Jack Jingle:

What do you want,

When you gotta eat somethin',

And it's gotta be sweet,

And it's gotta be a lot,

And you gotta have it now?

What do you want?

Lip-smacking'

Whip-crackin'

Paddywhackin'

Knickaknackin'

Silabawhackin'

Scalawhackin'

Crackerjackin'

Cracker Jack!

What do you get,

When you open the top,

And look inside,

And smack your lips,

And turn it over,

And spill it out?

What do you get?

Lip-smacking'

Whipcrackin'

Paddywhackin'

Olagazackin'

Infolackin'

Alliganackin'

Crackerjackin'

Cracker Jack!

Candy-coated popcorn, peanuts, and a prize...

That's what you get in Cracker Jack!

But it isn't Cracker Jacks that I am talking about.

I wanted it 'now' and it was a new stock! So this morning, with the market seeming to want to turn around and move higher I set out on my search for a new candidate for my portfolio.

Looking through the list of top % gainers on the NASDAQ today, I came across Lufkin Industries (LUFK). (By the end of the day, Lufkin was no longer on the list as other stocks had started to move sharply higher!)

Looking through the list of top % gainers on the NASDAQ today, I came across Lufkin Industries (LUFK). (By the end of the day, Lufkin was no longer on the list as other stocks had started to move sharply higher!)

Lufkin Industries (LUFK) closed at $90.82, up $7.92 or 9.55% on the day. I would llike to share with you my rationale behind my purchase of shares in this stock and why

LUFKIN INDS (LUFK) IS RATED A BUY

First of all, what does this company actually do?

According to the Yahoo "Profile" on Lufkin (LUFK), the company

"...and its subsidiaries engage in the manufacture and sale of oil field pumping units, power transmission products, and highway trailers. It operates through three segments: Oil Field, Power Transmission, and Trailer. The Oil Field segment manufactures and services artificial reciprocating rod lift equipment and related products. It also transports and repairs pumping units; and refurbishes used pumping units. In addition, this segment designs, manufactures, installs, and services computer control equipment and analytical services for pumping units, as well as operates an iron foundry to produce castings for new pumping units. The Power Transmission segment designs, manufactures, and services speed increasing and reducing gearboxes for industrial applications. It also manufactures capital spares for customers in conjunction with the production of new gearboxes, as well as produces parts for after-market service. In addition, this segment provides on and off-site repair and service for its own products, and also those manufactured by other companies. The Trailer segment manufactures and services various highway trailers for the freight-hauling market. It provides general-purpose dry-freight vans, flat-bed style trailers, and dumps, as well as replacement parts."

"...and its subsidiaries engage in the manufacture and sale of oil field pumping units, power transmission products, and highway trailers. It operates through three segments: Oil Field, Power Transmission, and Trailer. The Oil Field segment manufactures and services artificial reciprocating rod lift equipment and related products. It also transports and repairs pumping units; and refurbishes used pumping units. In addition, this segment designs, manufactures, installs, and services computer control equipment and analytical services for pumping units, as well as operates an iron foundry to produce castings for new pumping units. The Power Transmission segment designs, manufactures, and services speed increasing and reducing gearboxes for industrial applications. It also manufactures capital spares for customers in conjunction with the production of new gearboxes, as well as produces parts for after-market service. In addition, this segment provides on and off-site repair and service for its own products, and also those manufactured by other companies. The Trailer segment manufactures and services various highway trailers for the freight-hauling market. It provides general-purpose dry-freight vans, flat-bed style trailers, and dumps, as well as replacement parts."

Well, as the day went on it appeared that maybe buying an oil-related stock wasn't quite as brilliant as I thought it might be, with oil posting a very large drop in price today on top of yesterday's huge dip.

But maybe this dip in prices is short-lived? As Steve Mufson of the Washington Post related:

"Today prices got another push downward because the Energy Department’s Energy Information Administration reported that U.S. commercial inventories of crude oil and petroleum products climbed by 7 million barrels last week. One reason: an increase in oil imports, perhaps partly as a result of slightly higher Saudi oil output last month (it takes 45 days for oil to get to the United States from Saudi Arabia). The EIA data also showed that U.S. gasoline demand was down 375,000 barrels a day from the same week a year earlier, continuing a trend of gradually declining U.S. fuel consumption. That comes a day after Mastercard reported that last week’s purchases of gasoline fell 5.2 percent last week compared to a year earlier. It was the twelfth consecutive weekly decline reported by Mastercard.

That doesn’t mean high oil prices are over. U.S. commercial oil inventories are still down 55 million barrels from last year this time.

“We’re at no place to be sitting back in a comfortable recline here,” said Ed Crandell, an oil analyst at Lehman Brothers. The economy could also pick up. Hurricanes could take out some production in the Gulf of Mexico.

But if there is fizz in the price of oil (and it must seem like champagne to those producing it), the realities of supply and demand should ultimately correct that price, just as happened with the recent housing bubble and other bubbles in the past. Just don't ask me when."

In any case, oil production is far more profitable at even $100/barrel then the $60/barrel price it was at the start of 2007.

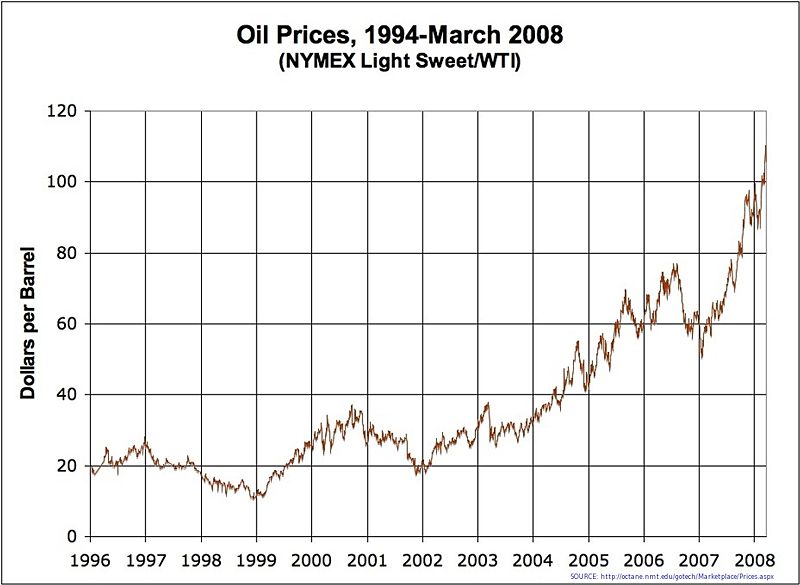

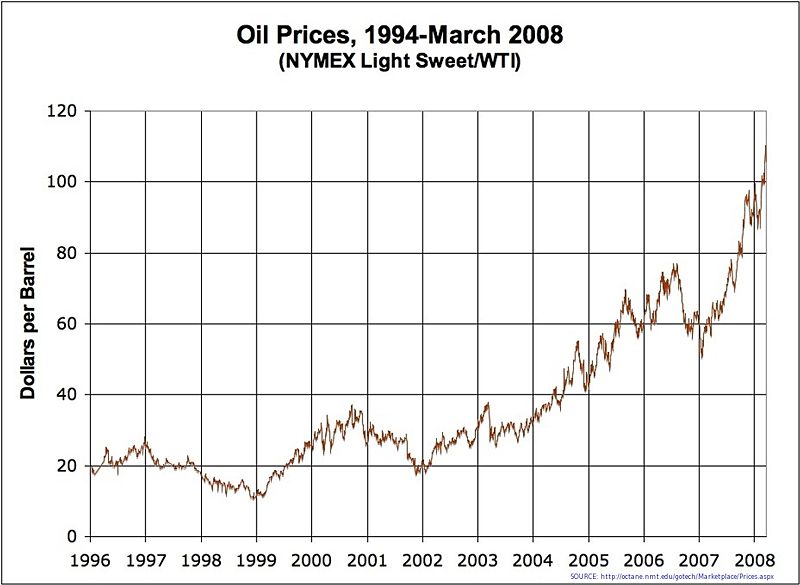

Take a look at this graph to see the meteoric rise in oil prices:

And this graph doesn't even show the last few months as oil prices soared towards $150/barrel!

Anyhow, back to Lufkin (LUFK).

As you probably realize, if you are a regular reader of my blog, I am very interested in the latest quarterly results. So,

How did Lufkin do in the latest quarter?

It was the announcement today of 2nd quarter 2008 results by Lufkin (LUFK) that drove the stock higher! For the quarter ended June 30, 2008, sales increased 30.6% to $174.5 million from $133.6 million in the same quarter last year. Net earnings came in at $21.2 million, or $1.44/share, up from $17.1 million, or $1.17/share the prior year. The company beat expectations of $1.36/share according to analysts polled by Thomson Financial. To top it off, the company also raised guidance for the full 2008 year to earnings of $5.50 to $5.70, up from prior guidance of $5.10 to $5.30/share. This exceeds analysts' current expectations of $5.28/share according to thomson financial.

It is this combination of strong financial results that exceed expectations and the company's raising of guidance that really got my attention!

As John Glick, the company's President commented:

"The high demand from the North American market, coupled with a change in buying practices that resulted in larger quantity orders from U.S. customers…resulted in very strong new orders during the quarter,"

The article continued:

"The flood of new orders more than tripled the company's oil-field-unit backlog, which stood at $170.9 million, compared with $55.8 million a year ago"

Somehow, I am not a big believer that this correction in the oil price will result in any real significant and long-term decline in the price of oil. But I could well be wrong and terribly out of synch with this purchase. Time will tell.

And how has this company done long-term?

Reviewing the Morningstar.com "5-Yr Restated" reveals a picture of steady growth from 2003 to 2006, and then in 2007 the company appeared to stall a bit as revenue, which had increased from $262 million in 2003 to $605 million in 2006, dipped to $597 million in 2007 and to $596 million in the trailing twelve months (TTM).

Similarly earnings have increased sharply from $.73/share in 2003 to $4.83/share in 2006 and $4.92/share in 2007, but then have dipped to $4.81/share in the TTM.

But it was the recent quarterly result that suggested the company was 'back on track' financially and heading to steady growth that led me to overlook this 'blemish' on the record.

The company has been paying dividends and increasing them from $.36/share in 2003 to $.88/share in 2007 and $.92/share in the TTM.

Outstanding shares have been very stable with 13 million in 2003 increasing about 12% to 15 million in the TTM. During this same period, revenue was up over 100% and earnings increased more like 500%. Not much of a 'dilution' of results from my perspective.

Free cash flow has increased from $8 million in 2005 to $71 million in 2007 and $54 million in the TTM.

The balance sheet appears solid with $103 million in cash and $205 million in other current assets, easily covering the $72.5 million in current liabilities, working out to a current ratio of 4.25. The company has a relatively small amount of easily-covered long-term liabilities listed at $48 million.

The balance sheet appears solid to me!

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Lufkin (LUFK), we can see that this is actually a small cap stock with a market capitalization of only $1.34 billion. The trailing p/e is a moderate 18.90, with a more reasonable forward p/e of 15.01 (fye 31-Dec-09) estimated. The PEG ratio works out to an acceptable (imho) level of 1.53 based on "5 yr expected" earnings. With the recent earnings report, estimates should be moved higher and the PEG should fall back well under 1.5.

Looking at some other statistics, according to the Fidelity.com eresearch website, the company is reasonably valued in terms of the Price/Sales ratio relative to its peers. The Price/Sales (TTM) works out to a 2.05, much lower than the industry average reported by Fidelity at 3.62.

(Several years back I read a great article on Price/Sales ratios and how they might be used in terms of relative value compared to similar companies. I would encourage you to read the Smart Money article by Paul Sturm on this topic.)

Fidelity suggests that the company might not be as profitable as its peers as it came in with a Return on Equity (TTM) ratio of 19.06%, below the industry average of 27.91%.

Finishing up with Yahoo, there are 14.78 million shares outstanding with 14.05 million of them that float. Currently, as of 6/25/08, Yahoo reports that there are 1.2 million shares out short representing 8.6% of the float or 6.9 trading days of volume. With the great earnings report, we may well have been observing a bit of a 'squeeze' with the short-sellers scrambling to cover their negative 'bets'.

As I have noted above, the company pays a small dividend with a forward rate of $1/share yielding 1.2%. The last stock split was 4/20/05 when the company had a 2:1 stock split.

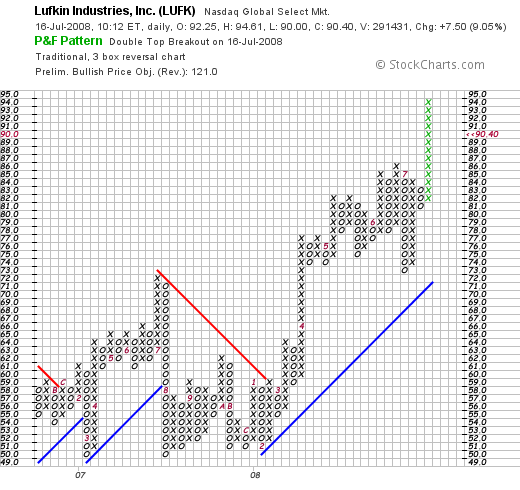

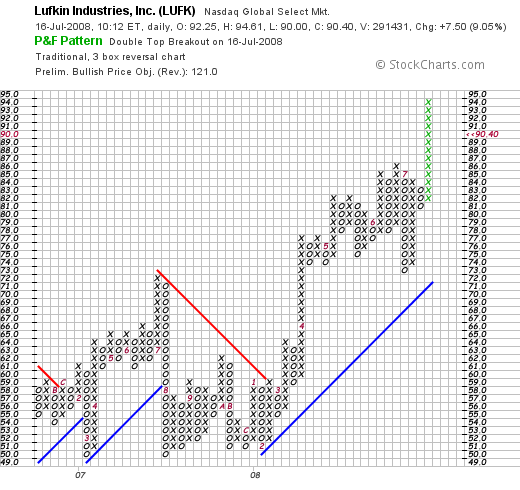

What does the chart look like?

If we take a look at the 'point & figure' chart on Lufkin (LUFK), we can see that the company has been relatively flat betwen 2007 and early 2008 trading between $50 and $72. In March, 2008, the stock broke through resistance at the $58 level and has now moved strongly higher, peaking at $94 before closing at $90.40 today.

Summary:

I had the opportunity to buy a stock to add to my portfolio today. This was based not on my assessment that it was time to buy, but literally from a signal generated by own account.

Lufkin (LUFK) made the list of top % gainers. It reported solid earnings today that beat expectations and they went ahead and raised guidance for the whole year.

The results today put the longer-term financial picture back on a track of solid growth in revenue and earnings, stable outstanding shares, growth in dividends, and a solid balance sheet. Valuation appears reasonable.

On the downside, simultaneously with this earnings announcement has been a short-term (?) sharp decline in the price of oil. A further large decline in oil prices would undermine some of the support for a company like Lufkin that is involved in the sale of oil production equipment. Otherwise, the picture is solid, and I like the stock.

In fact, I purchased shares today!

I don't know if I may have struck a 'gusher' or have slipped in an oil slick.

Time will tell. I am now up to six positions and am feeling a bit more optimistic about investing today after the solid market performance and my own signal to be buying!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Covestor page where my actual trading account is monitored, my SocialPicks page where my past 'stock picks' are evaluated, and my Podcast Page where you can download some mp3's on some of the many stocks discussed on this blog.

Yours in investing,

Bob

Tuesday, 15 July 2008

Graham (GHM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of my continued effort at sharing with all of you readers my actual trades in my actual trading account, I wanted to let you know that this morning, shortly after the opening, I sold 15 shares of my 105 share position of Graham (GHM) at $86.00/share. Grahm (GHM) continued to do well today in spite of the awful market tone and actually closed at $90.50, up $2.45 or 2.78% on the day.

As part of my continued effort at sharing with all of you readers my actual trades in my actual trading account, I wanted to let you know that this morning, shortly after the opening, I sold 15 shares of my 105 share position of Graham (GHM) at $86.00/share. Grahm (GHM) continued to do well today in spite of the awful market tone and actually closed at $90.50, up $2.45 or 2.78% on the day.

Why did I sell any shares? Why 15 shares? Why today?

If you are a regular reader of my blog, you will know that I sell shares of stocks for two basic reasons: "good news" or "bad news". I define "good news" as a stock reaching appreciation targets...that is going higher in price...and reaching levels that I have set up artificially at certain percentage gain levels. To explain, I use 30, 60, 90, 120, 180, 240, 300, 360, and then 450, 540, 630%...etc., appreciation levels from the original purchase price as intermediate goals. That is when a holding reaches these levels, if it ever does, I initiate a sale of a portion of that holding.

When I first started this blog I believed if a stock moved higher 1/3 to 4/3 of its original price (an approximately 30% appreciation), then it made sense to always be selling 1/4. But that was, as I found out, far too extreme a portion of a holding to sell at these same intervals as my position shrunk in size as the stock appreciated in price.

I tried 1/6th....but again no luck. It appears that selling 1/7th of a holding is working at taking a portion 'off the table' yet leaving enough behind to see it actually grow absolutely.

The "bad news" part of a sale is when a stock is sold either because of some fundamental news announcement (like a poor earnings announcement or the management accused of wrong-doing), or simply because the stock has declined from a higher level.

Generally, after a stock has declined 8% I sell the stock if I have never sold any portion of it at an appreciation target. If, on the other hand, I sold 1/7th of a position (like I did today with Graham) and then the stock dips in price...I do not plan on waiting for an (8)% loss to sell, but instead move the sale price (of the ENTIRE position) to 'break-even'...that is, the price that I purchased the holding.

On the other hand, if I have sold a stock more than once at different appreciation levels...for instance if I sold a stock three times at 30, 60, and 90% appreciation levels...selling 1/7th of my holding each time....then instead of waiting for an (8)% loss, or even waiting for the stock to move back to 'break-even', I sell the stock should it reach 50% of the highest appreciation sale level. In this case, since the highest appreciation sale of this hypothetical holding was at a 90% appreciation level, then my sale point on the downside is if the stock declines to a 45% appreciation level. All of my sales on the downside are ENTIRE positions---unlike my partial 1/7th position sales on the upside.

Anyhow, I am sure that for you regular readers this commentary is entirely redundant. But if you are new to this blog, I hope you appreciate some of what I would call my "inner-workings" of my portfolio management strategy.

Finally, I use sales of stocks as signals. Signals that in the case of sales on the upside or "good news" sales, suggest that the environment might be o.k. to add a new position. I call this my "permission slip" to add a new position (if I am below my maximum of 20 positions).

Likewise, I use a sale of stock on "bad news" as a signal as well. In this case telling me that there is something 'bad' in the environment and that I am well-advised to do what I call "sitting on my hands" with the proceeds (again, of course, unless I am at my minimum of 5 positions--in which case I would replace the holding with a suitable candidate).

It is this way that I can shift my holdings in a fairly automatic fashion between cash and equities. This part appears to be working as I am now at 5 positions and the market environment is frightful.

Back to Graham.

My 105 shares of Graham (GHM) were purchased in my Trading Account at $64.48/share. With stock hitting $86, this represented a gain of $21.52 or 33.4% since purchase. This exceeded my 30% appreciation target yesterday, so this morning I sold 15 shares or 1/7th of my 105 shares, leaving me 90 shares which actually went ahead to move higher.

Ironically, I have now been handed a 'permission slip' to be adding a new positions. I didn't find anything 'suitable' today on the top % gainers list (where I start looking), and thus decided to continue to 'sit on my hands' with the proceeds.

That nickel is burning a hole in my pocket already and I shall be on the lookout tomorrow as well for something suitable for my portfolio.

Thanks so much for stopping by! If you ahve any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

If you can, be sure and visit my Covestor Page where my Trading Portfolio is monitored, my SocialPicks Page where my many picks from the past year or so are reviewed, and my Podcast Page where you can listen to some of my past and recent podcast shows on stocks.

Wishing you all good health and strong financial prospects,

Yours in investing,

Bob

Sunday, 13 July 2008

My Prosper.com Account: Update #5

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Last month, on June 7, 2008, I shared with all of you readers an update on my Prosper.com account. (Full disclosure, if you do choose to sign-up and become a lender on Prosper.com through these links, you will be eligible for a $25 incentive with your first loan, and I shall also receive a similar $25 award.)

Last month, on June 7, 2008, I shared with all of you readers an update on my Prosper.com account. (Full disclosure, if you do choose to sign-up and become a lender on Prosper.com through these links, you will be eligible for a $25 incentive with your first loan, and I shall also receive a similar $25 award.)

I always like to update you with a sample of some of the news stories I have found on Prosper.com.

First of all I came across an article from ScienceDaily suggesting that consumers might fare better with a website like Prosper.com than seeking traditional loans through banks and other financial institutions.

"The study -- “The Democratization of Personal Consumer Loans?” -- analyzed a database of 5,370 peer-to-peer loan auctions from the Web site Prosper.com. Prosper.com, and other companies like it, allows people to lend and borrow money at more attractive interest rates than they find at a bank. The study also found that decisions made by lenders about whom to give loans to are much less likely to be influenced by race or gender."

However, on a balancing note, I also found an interesting story about "Racism in Peer-To-Peer Lending"

"Looking at data from Prosper, Devin Pope of Wharton and Justin Sydnor of Case Western Reserve University found that a listing with a picture of a black person was 25 to 35 percent less likely to get funded than a listing with a white person with similar a profile. And when a black person did get funding, the interest rate charged was about 0.6 to 0.8 percent higher.

(More likely to find funding were women and those with photos that showed a link to the military. The funding success for latinos and asians wasn't statistically different from the average. Another recent study of Prosper by Enrichetta Ravina of NYU found that attractive people are more successful in landing loans and lower rates than their homelier peers.)"

Personally, virtually ALL of my loans are done on 'auto-pilot' with portfolio plans. I am relatively risk-averse and have chosen to bias my lending towards higher-rated borrowers in a more 'conservative' fashion.

Another recent article about Prosper.com came discusses some other aspects of peer-to-peer lending:

"With the increasing scarcity of bank loans because of the economy's credit crunch, entrepreneurs are thirsty for new sources of capital. One such alternative is peer-to-peer lending, in which people lend other people money directly, without the involvement of a financial institution. Transactions take place online, incorporating elements of social-networking sites. Websites such as Prosper.com and Kiva.com connect borrowers and lenders, and the prize on the table is investments.

Peer-to-peer lending sites tap into the popularity of social networking on the Web, hoping to imitate the success of MySpace and Facebook. But there is concern that these sites could fizzle out in popularity, as many Web start-ups do."

But I do see how pictures can bias a lender who is looking through the listings. That is if he/she isn't very careful about paying attention to more important details!

O.K. let's get back to my own Prosper.com portfolio. I continue with my twice-monthly $50 automatic transfers. I have also been aggressively been adding funds in order to keep one bid going at all times. I hope that with my larger loan portfolio, I can drop back to the $50 transfers.

As of July 13, 2008, I now have 96 loans. 86 are current, 3 are less than 15 days late, 3 are between 15 and 30 days late, 1 is one month late (and in collections), 2 are 3 months late (and in collections) and 1 is 4+ months late (and in collections and I suspect soon to be sold!)

I have now made a total of $5,964.23 in loans, received payments totaling $772.73, with an average interest rate of 14.24%. My daily interest accrual is now up to $2.12. Net income totals (interest + fees + rewards) $235.02. I havehad -0- defaults (although the 4 month late loan must surely be heading that direction!). The loan heading for default totals $(46.76).

I mention "rewards" again and indeed I have received a total of $75.00 (unchanged from last month) in rewards for referrals to the Prosper.com website.

Again to get a 'third-party' analysis of my Prosper.com portfolio with my lending activity and loans listed, you can visit LendingStats and view their analysis. Actually, they currently are estimating a ROI of (1.8)% on this account! I hope they are overly pessimistic. However, as you can see, I do have a number of non-performing or late loans. This does represent the challenge of investing in a peer-to-peer lending fashion!

So if you are interested in exploring Prosper.com, please feel free to use the links on this page which may entitle you to a $25 head-start. Please be very careful, spread out your loans, try to avoid excessively risky loans, and be aware of the potential for loss in a process like this.

I shall continue to try to provide you with updates on my own account and my success or lack thereof. This is all a new process and hopefully, by sharing with you my own successes and failures we can all learn together. And even find out if Prosper.com is a useful place for an amateur like me!

If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

As I wrote up previously, my shares of Graham (GHM) hit a sale point on the upside (even while the market continued to correct!), and being under my maximum of 20 positions, this trade generated a 'permission slip' entitling me to add a new position.

As I wrote up previously, my shares of Graham (GHM) hit a sale point on the upside (even while the market continued to correct!), and being under my maximum of 20 positions, this trade generated a 'permission slip' entitling me to add a new position. Like this Richard Seaman photo of surfers, I try to jump off one wave and catch the next! O.K., I have NEVER, EVER been surfing, but I have watched surfers :).

Like this Richard Seaman photo of surfers, I try to jump off one wave and catch the next! O.K., I have NEVER, EVER been surfing, but I have watched surfers :).

I had a nice letter from Neil this afternoon who had some general questions about my blog. He wrote:

I had a nice letter from Neil this afternoon who had some general questions about my blog. He wrote: Every once in awhile I just break all of my rules. (And I usually regret it as well!)

Every once in awhile I just break all of my rules. (And I usually regret it as well!)

As part of my continued effort at sharing with all of you readers my actual trades in my actual trading account, I wanted to let you know that this morning, shortly after the opening, I sold 15 shares of my 105 share position of Graham (GHM) at $86.00/share. Grahm (GHM) continued to do well today in spite of the awful market tone and actually closed at $90.50, up $2.45 or 2.78% on the day.

As part of my continued effort at sharing with all of you readers my actual trades in my actual trading account, I wanted to let you know that this morning, shortly after the opening, I sold 15 shares of my 105 share position of Graham (GHM) at $86.00/share. Grahm (GHM) continued to do well today in spite of the awful market tone and actually closed at $90.50, up $2.45 or 2.78% on the day.