Stock Picks Bob's Advice

Sunday, 15 January 2006

"Weekend Trading Portfolio Analysis" Meridian Biosciences (VIVO)

Click

HERE for my ***PODCAST ON MERIDIAN***Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I try to do several things at the same time on this website. I like to discuss philosophy of investing, review stock "picks" that I have identified, and also share with you my actual trading portfolio so that you can, in a virtual reality kind of way, share with me my experience in investing, making investment decisions, and deciding whether my strategy is successful. Some of my stock selections are successful, some do poorly; just like any investor, I experience my share of successes and failures. This past year I have been trying to review a stock in my actual trading portfolio each weekend. Going alphabetically through the symbols, I am up to Meridian Biosciences (VIVO). I actually first

discussed Meridian Bioscience (VIVO) on Stock Picks Bob's Advice on 4/22/04 when it was trading at $11.22. I then

"revisited" VIVO on Stock Picks Bob's Advice when it was traded at $16.26 on 4/21/05.

I currently own 210 shares of Meridian Biosciences (VIVO) that were acquired on 4/21/05, a bit under a year ago, at a cost basis of $11.13. VIVO closed on 1/13/06 at $24.40, giving me a gain of $13.27 or 119.2%. I have sold portions of VIVO four times (as is my strategy) on 7/25/04, 9/1/05, 10/3/05, and 1/6/06. These sales were approximately at the 30%, 60%, 90%, and 120% gain points. Initially, I have been selling 1/4 positions, but lately, I have reduced these portions of remaining shares down to 1/6 of my positions to allow my positions to grow.

By my strategy, my next planned sale will be 1/6 of my remaining shares at a gain of 180% or to calculate, that will work out to 2.8 x $11.13 = $31.16. On the downside, if the stock retraces to 50% of the highest gain sale point, which would be 50% of 120% or 60%, my sale target would be 1.6 x $11.13 = $17.81.

Let's take a closer look at this company!

Let's first take a look at what this company does. According to the

Yahoo "Profile" on VIVO, the company

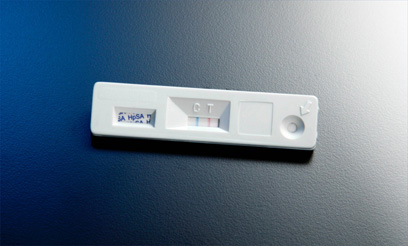

"...operates as an integrated research, development, manufacturing, marketing, and sales organization in the field of life science. It develops, manufactures, and distributes diagnostic test kits primarily for respiratory, gastrointestinal, viral, and parasitic infectious diseases; and bulk antigens, antibodies, and reagents used by researchers and other diagnostic manufacturers, as well as provides contract manufacturing service of proteins and other biologicals for use by biopharmaceutical and biotechnology companies that are engaged in research for new drugs and vaccines."

And how was the latest quarterly result? On November 10, 2005, Meridian

reported 4th quarter 2005 results. Net sales came in at $25.0 million up 12% from $22.2 million in the same quarter last year. Net earnings came in at $3.8 million, up 28% from the $2.9 million in the prior year. Diluted earnings per share rose 15% to $.15/share, up from $.13/share last year. In addition, the company actually

raised its dividend for 2006 by 44% to estimated $.46/share. Overall, a nice report.

And how about longer-term results? Does Meridian still show consistency in the Morningstar report? Reviewing the

Morningstar.com "5-Yr Restated" financials, we can see the steady growth in revenue from $56.1 million in 2001 to $93 million in 2005. Earnings have also steadily improved from a loss of $(.47) in 2001 to $.52/share in 2005. Dividends have also been consistently increased from $.17/share in 2001 to $.31/share in 2005. Dividends by themselves are a bit unusual in as small a company as this!

Free cash flow looks good with $11 million in 2003 improving to $16 million in 2005.

The balance sheet is solid with $33.1 million in cash and $37.1 million in other current assets. The cash alone is adequate to cover both the $19.8 million in current liabilities and the $7.0 million in long-term liabilities.

And what about "valuation"? Reviewing the

Yahoo "Key Statistics" on Meridian, we can see that this is a mid-cap stock with a market capitalization of $635.86 million. For those that are new to all of this, recall that market capitalization is calculated by multiplying the total number of shares outstanding by the market price of each share.

VIVO has a p/e of 46.83 which is certainly a bit rich. The forward p/e is 31.28 (fye 30-Sep-07), which is still a bit pricey. The PEG is calculated (5 yr estimated) at 2.12.

Looking at the

Fidelity.com eResearch website, we can see that VIVO has a rich price/sales ratio of 6.3, but this isn't that high compared to the other stocks in the "Diagnostic Substances" group. Leading this group is Nuvelo (NUVO) with a Price/Sales ratio of 1605.3, then Human Genome Sciences (HGSI) at 126.4, Oscient (OSCI) at 11.6, the Meridian (VIVO) at 6.3, QLT (QLTI) at 2.6 and Dade Behring (DADE) at 2.2.

Finishing up with Yahoo, we can see that there are 26.06 million shares outstanding. Currently (12/12/05) there are 892,350 shares out short, representing 4.20% of the float or 3.1 trading days of volume (short ratio). Using my 3 day rule of significance, this doesn't look like much of a short interest to pressure this stock higher.

As noted, the company is anticipated to pay $.46/share in dividends in the next year, yielding 1.90%. The stock last split 3:2 on 9/6/05.

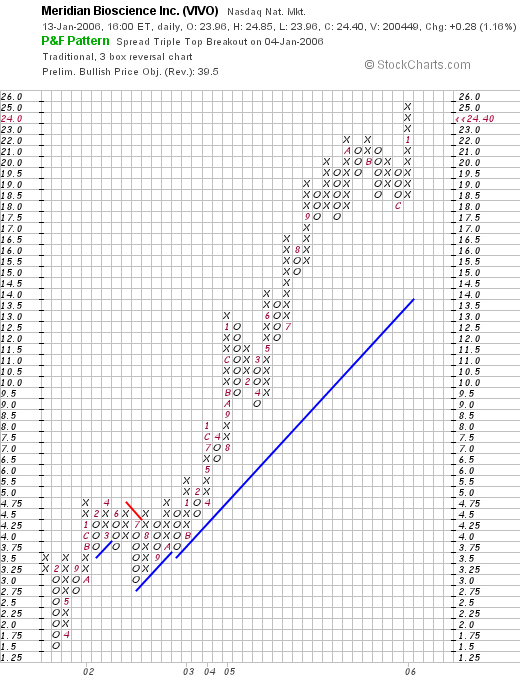

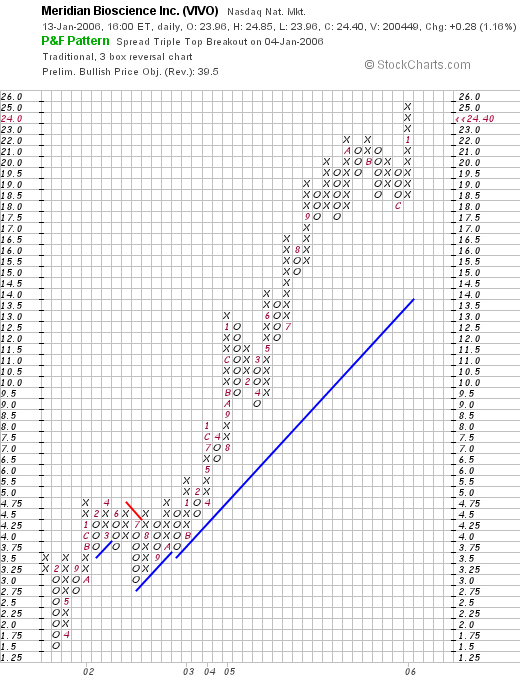

And what about a chart? If we review the

"Point & Figure" chart on VIVO from Stockcharts.com:

, this is simply a gorgeous graph with the stock climbing sharply from $1.50 in February, 2001, to the current $26 level. If anything the stock looks a bit over-extended. And what I mean by that is that the stock appears to be moving higher faster than the 45 degree blue support line. Is that significant? Not necessarily. I don't know why a stock has to follow any particular line :).

So what do I think? I think I have been lucky to own shares of this company and I don't think its growth is over. This is a small company with lots of room to grow!

Reviewing some of the criteria I discussed, the last quarter results look great, the Morningstar.com report is solid, valuation-wise, the p/e is a bit high as is the price/sales ratio suggesting this is an expensive stock, no bargain here. Finally the chart looks great! Anyhow, that's the review.

Thanks for stopping by. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 11:09 AM CST

|

Post Comment |

Permalink

Updated: Sunday, 15 January 2006 1:34 PM CST

Saturday, 14 January 2006

"Looking Back One Year" A review of stock picks from the week of November 1, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Each weekend, unless I just plain fail to get around to it, I like to review stock picks from about a trailing one year period. This week I am up to the week of November 1, 2004. This review assumes a "buy and hold" strategy which is not thae actual strategy that I employ in my own portfolio. I like to sell my losing stocks quickly and completely, and my gaining stocks slowly and partially. But for the sake of this analysis, I believe a buy and hold review gives you a good feeling for the performance of stocks selected on this blog.

CalDive (CDIS) is a stock that besides writing it up as a 'pick', I also do own in my trading portfolio. I

picked CalDive (CDIS) on Stock Picks Bob's Advice on November 3, 2004, when it was trading at $38.25. CDIS had a 2:1 stock split, giving me an effective 'pick price' of $19.13. CDIS closed at $42.10 on 1/13/06, for a gain of $22.97 or 120%.

On November 1, 2005, CalDive

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenue climbed 58.6% to $209.3 million from $132.0 million the prior year. Net income grew 87% to $42.7 million from $22.8 million the prior year. Diluted earnings per share rose 78% to $1.05/share from $.59/share last year in the same period. This was a very strong report!

On November 5, 2004, I

posted ValueClick (CCLK) on Stock Picks Bob's Advice when it was trading at $10.91. VCLK closed at $20.64 on 1/13/06 for a gain of $9.73 or 89.2% since picking this stock for the blog!

On November 1, 2005, ValueClick

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenue grew 87% to $81.4 million from $37.9 million in the prior year same quarter. Net income for the quarter came in at $11.0 million or $.13/diluted share, compared with $7.6 million or $.09/diluted share in the prior year same quarter. In addition, the company raised fiscal 2005 guidance; all-in-all this was a very nice earnings report!

So how did we do on these two stocks? Well quite well actually. CDIS had a gain of 120% and VCLK had a gain of 89.2% during this same period. this works out to an average gain of 104.6%. Not too shabby at all :).

Anyhow, thanks again for stopping by! I shall try to get to my trading portfolio review tomorrow if I get a chance. You know how that is. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Regards!

Bob

Nike (NKE) A Reader Writes "The Nike buy was on the advice of my broker. And it made me vera vera nervous."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I had a nice letter from a Xanga reader "Y" who writes:

I am sitting here, waiting for the chair-thrower to come on, eating spaghetti out of the pan. At least it's homemade. Bob, I was thrilled to read this: "Don't stick to any specific strategy. Use all strategies." Because I've begun to trade faster. And lose faster :) Today I bought Nike, after selling off my mutual funds that hadn't done much for me lately. The Nike buy was on the advice of my broker. And it made me vera vera nervous. Because I didn't take the time to research it. I just trusted his advice. He said get in at 85 something and get out at 88 or 90. He read me the chart for the last few months and by the time I said okay it had gone up to 86 something. I had to meet a friend for lunch and prayed the whole time I was gone it wouldn't go up. Or down. How do you leave the house? Do you trade over the phone?

I took some off the top yesterday AND today. I took 1/6th off Starbucks and Vertex. The other theory of yours I am using is this idea that you buy a stock when it is soaring. I didn't like that idea because it seemed so after-the-fact but for the short term it makes sense to me.

So I watched the chairs fly. And, as I checked back to see what his yesterday's picks had done, I saw a uniform rise of two points. No matter what the percentage, if it was 60 last night, by closing today it was 62. How do you say that? Is that points or something else? Anyway, the only way to win at that game is to go online and place your buy after the show. But don't the -- And I can never keep these straight -- I think the bid is the buy, doesn't that get jacked up because of his show? So by morning you're probably getting it at 61 and selling it at 62 because it probably drops the next day. Maybe not. Have you tracked his picks?

Wow! That was a whole lot of a comment. Let me try to address what you have written and then take a short look at Nike (NKE).

I believe that Jim Cramer, the "chair-thrower" is a bright guy. He does his homework. He has some interesting ideas. But it isn't my style.

You write that you have begun to trade "faster", "And lose faster :)". That isn't what I would call a good idea! One of the things I strongly believe is that if you have made a sale at a loss, sit on your hands and don't reinvest that money until you have sold a portion of a stock at a gain.

And do not arbitrarily sell this and buy that. Have a plan, an approach to your portfolio, even if you have a broker assisting you with all of this, which I fully support.

I don't believe in getting into a stock at say 85 and get out at 90. That isn't my approach at all. I don't get out of a stock completely unless something goes

wrong not if something goes

right. I believe in bailing out of a stock on "bad news". That may be something fundamentally wrong that is announced by the company, or it may be just that price performance lags and the stock hits one of my sale points on the downside. You know about those. If you don't I can explain again another time.

So I would hope that you would build a portfolio of the finest companies on Wall Street. And that you hold those stocks until your ripe old age. That at least is my goal. I am always prepared to unload a company that fails to perform properly, but I don't want to punish a strong stock by selling all of it just because it went up a few points.

By the way, I do leave the house. I generally trade online. When I am on vacation, I do tend to be a pain to the rest of my family and look for a laptop or a quick WiFi connection in my hotel room. I don't own a laptop now, but two of my kids do!

I think it is a good idea to peel off some of your gains like you have done. Don't just do it arbitrarily as you go forward in the future, but use these sales as signals to add positions. And I don't just buy stocks when they are "soaring". They may be pretty high, that is a CANSLIM attitude about buying stocks at new highs, but what I am looking for is stocks that are

gaining not soaring. Those stocks that are moving higher out of proportion to the rest of the stock market. That is where I start my search for new stock picks.

So what to do about Kramer? Watch and enjoy. But don't try to get into that pack. Think about the three hundred or so "pilgrims" who got trampled in the latest Saudi Arabian disaster in Mecca. You don't want to go into a mob and try to buy a stock fighting other investors who don't necessarily have any individual understanding of stocks but who are tuned into the latest chair-throwing episode.

You will have a better chance at making a profitable trade buy examining stocks in a quiet environment, thinking on your own, consulting with your professional advisor, and developing your own strategy for investing. You are welcome to adopt any part of mine, or use Cramer's ideas, or anyone else's. And finally, I don't have the time to track his picks. And he probably doesn't track mine either :).

But let's take a look at Nike and see what I think about how it fits into my particular perspective on stocks. Always remember, I am completely unable to say whether Nike is going to go up or down in price. But maybe I can tell you whether this stock fits into my perspective of investing decisions. I do not own any shares of Nike nor do I have any options on this stock.

O.K. Nike. Nike (NKE) closed at $86.20, down $.11 or 0.13% yesterday (January 13, 2006).

What do they do? Looking at the

Yahoo "Profile" on Nike, we see that the company

"...and its subsidiaries engage in the design, development, and marketing of footwear, apparel, equipment, and accessory products worldwide. It designs athletic footwear for running, cross training, basketball, soccer, sport inspired urban shoes, and children’s shoes. The company also offers shoes and sports apparel for tennis, golf, baseball, football, bicycling, volleyball, wrestling, cheerleading, aquatic activities, hiking, outdoor activities, and other athletic and recreational uses primarily under the ‘NIKE’ brand name. In addition, it sells sports inspired lifestyle apparel, as well as athletic bags and accessory items. Further, NIKE sells a line of performance equipment, including golf clubs, sport balls, eyewear, timepieces, electronic media devices, skates, bats, gloves, swimwear, cycling apparel, children’s clothing, school supplies, and eyewear. Additionally, the company sells a line of dress and casual footwear, apparel and accessories for men and women."

Latest quarter? On December 20, 2005, Nike

reported 2nd quarter 2006 results. Sales grew 10% to $3.5 billion, from $3.1 billion. Profits climbed 15% to $301 million, and they earned $1.14/share up from $.97/share the prior year. This was $.11 ahead of analysts expectations. It is always better to surprise on the upside than to disappoint on the downside!

However, the company

did signal a cautionary note:

"But Nike said currency exchange rates "significantly reduced growth" in future orders, which increased 2.5 percent to $5.2 billion compared to the same period last year."

So while it was a nice report with growing revenue and earnings and the company did exceed expectations, the cautionary note is enough to give an investor at least a little bit of a pause. I am sure the market has absorbed that news and is already looking beyond that issue.

How about longer-term? Taking a look at the

Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown steadily from $9.5 billion in 2001 to $13.7 billion in 2005 and $14.0 billion in the trailing twelve months (TTM).

Earnings have been a bit erratic, dropping from $2.44 in 2002 to $1.77 in 2003. However, since that time they have grown strongly to 44.48 in 2005 and $4.88 in the TTM.

Free cash flow also looks nice with $736 million in 2003 increasing to $1.2 billion in the TTM.

The balance sheet is also solid with $1.9 billion in cash and $4.8 billion in other current assets. This easily covers both the $2.2 billion in current liabilities and the $.9 billion in long-term liabilities combined with over $3.5 billion left over!

Let's take a look at some valuation numbers.

Looking at

Yahoo "Key Statistics" on NKE, we find that this is a large cap stock with a market capitalization of $22.35 billion. The trailing p/e doesn't look bad at 17.01, and the forward p/e (fye 31-May-07) is even nicer at 14.91. The PEG which considers the future growth rate compared to the p/e is nice at 1.14, with 1.0 being ideal.

According to the

Fidelity.com eResearch website, Nike is in the "Textile-Apparel Footwear/Accessories" industrial group. Topping out this group in terms of Price/Sales is Coach (COH) with a ratio of 7.1. This is followed by a bunch of companies grouped closely, starting with Nike at 1.6, Timberland at 1.5, Wolverine World Wide at 1.3 and Reebok at 1.0. Thus by this parameter as well, Nike doesn't look too over-valued.

Some other numbers: Nike has 259.3 million shares outstanding. Currently there are 3.45 million shares out short (12/12/05), representing 1.80% of the float. This doesn't look to be much of a factor.

The stock does pay a small dividend of $1.24/share yielding 1.40%. The last time the stock split, per Yahoo, is 10/24/96, when Nike distributed shares for a 2:1 stock split.

What about the chart? Looking at the

"Point & Figure" chart on Nikewe can see that the stock has been trading strongly higher since February, 2003, when it broke out of a "triangle formation" at around $43 and traded sharply higher since that time to its current levels around $86. This is a very strong graph imho.

So what do I think? Well, first of all I hope I answered your questions on Cramer. I am actually a fan of his and I like to watch his show. If nothing else to see what he is thinking about things. Sometimes his ideas and mine coincide and that is a plus imho, like when he also like Palomar (PMTI). But I don't trade based on his recommendations. I have my own system.

As far as Nike is concerned. It looks to be a great stock. I just wouldn't be in it "for a trade" as they say in the business. This is investable material and you might just want to do what I do (?) and sell your gainers slowly and partially and sell your losers completely and quickly!

Thanks again for writing. Keep me posted on how things work out and if you or anyone else have questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 13 January 2006

New ***PODCAST*** on JLG and Investment Philosophy

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website!

Here is the

LINK for the ***PODCAST*** on JLG and INVESTMENT PHILOSOPHY.If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Brief Philosophical Interlude on Investing

This entry isn't about any particular stock at all.

Mt. Fuji

I just want to talk about my view of investing and a methodical approach to building a portfolio.

Investing isn't about screaming and yelling and throwing chairs around and pulling heads off stuffed animals. That's entertainment.

But when you invest, please think about making decisions in a quiet place. A place where you can think clearly and understand what your strategy for investing may entail.

Observe the stock market. Observe stocks. And listen to your portfolio.

When I go through my screens, I am trying very hard to listen to what the stock market is telling me. The stocks that are moving higher are worth consideration from my perspective. But not all stocks that move higher.

Don't stick to any specific strategy. Use all strategies.

The market rewards consistency of earnings and revenue growth. That is the definition of quality.

Believing that a stock is a good "value" is a form of speculation. Albeit a good bet in wise hands. But speculation nonetheless. You are betting that you are wiser than the other investors in the market and can value a stock more accurately than market forces. You may be right. But it is a difficult approach.

An investor that purchases a "beat-up" stock that has declined on bad news is speculating that the market is wrong. It is a high-return investment with lower odds than the low-return investment of purchasing a stock that has consistently been producing quality results.

Go for the 'base hits' and forget the 'home-runs'.

Hedge your bets.

Diversify your investments. Don't sink all of your money into one basket.

Sell your losers quickly and completely and sell your gainers slowly and partially.

Develop a system that allows you to move into and out of the market mechanically. Don't think too much. Let the market dictate your action.

Don't anticipate stock moves. React to stock moves.

Maybe these are just a few words that don't mean much to you. But they form the basis of my thinking. I am not smarter than the market. But maybe my approach is to be more sensitive to market action than the average investor. If so, I shall be successful.

I don't know what the market will do tomorrow, next week or next year. I haven't the foggiest what the DJIA will be. But I am prepared to respond to the market with decisions based on the market action.

Have a great weekend everyone!

Bob

P.S. Please feel free to comment on this right on the blog or email me at bobsadviceforstocks@lycos.com.

JLG Industries (JLG)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Yesterday, as I

posted on Stock Picks Bob's Advice, I sold a 1/6th position of my Cal Dive (CDIS) holding, and this "entitled" me to make a new purchase (since I was under my 25 position maximum.) That morning, I purchased 160 shares of JLG Industries (JLG) at $51.55/share, for at that time it was on the top % gainers list.

Unfortunately, the market continued to weaken and JLG declined with it. The market is weak again today and JLG is trading at $49.45, down $1.16 on the day for a loss of (2.29)%. Since I haven't written up this stock yet, I wanted to hurry up and get something on the blog before I might even be forced to sell it at an 8% loss! My unrealized loss on this stock as I write is a $(2.10) or (4.1)% since purchase. The stock will need to drop to .92 x $51.55 = $47.43 before I shall neeed to sell at my own 8% loss limit. I am considering adding a new rule to my trading strategy, even if I sell a stock at a gain point, I have "permission" to add a new position

only if the stock market is "up" on the day. What do you think?

Anyhow, let's take a closer look at this company. According to the

Yahoo "Profile" on JLG, the company

"...provides access equipment and highway-speed telescopic hydraulic excavators. The company operates through three segments: Machinery, Equipment Services, and Access Financial Solutions."

I went through my usual screens to come up with this particular company, and let me go over them with you.

First of all, let's take a look for the latest quarterly report. On November 16, 2005, JLG

announced 1st quarter 2006 results. For the quarter ended October 30, 2005, revenue came in at $478 million, a 56% increase over revenue of $307 million the prior year same period. Net income worked out to $27.9 million, or $.53/diluted share, up sharply (over 200%) from the prior year's results of $8.7 million, or $.20/diluted share. The company also raised guidance, as was reported in the same news article:

"In addition, the investments for the recently announced Caterpillar alliance will provide additional capacity for JLG telehandlers beginning in the fourth quarter of fiscal 2006. As a result, we now project revenue growth in the 20 to 25 percent range for fiscal 2006 over 2005, up from our previous guidance of 15 to 20 percent growth.

"With this projected revenue growth, we are raising our targeted fiscal 2006 earnings per diluted share to a range of $2.15 to $2.25 from the previous guidance of $1.95 to $2.05."

Thus we have what I call a "trifecta" in my parlance, for an outstanding earnings report that demonstrates revenue growth, earnings growth, and increased guidance!

My next step in screening for a selection on the blog is to look at Morningstar for a longer-term assessment. Looking at the

Morningstar.com "5-Yr Restated" financials on JLG, we can see that revenue did dip from $1.0 billion in 2001 to a low of $.8 billion in 2003. However, revenue growth has been strong since then climbing to $1.7 billion in 2005 and $1.9 billion in the trailing twelve months (TTM).

Earnings have also been weaker several years ago, falling from $.80/share in 2001, to a loss of $(2.35) in 2002. Since that time, earnings are up sharply to $1.20/share in 2005 and $1.93 in the TTM. Free cash flow has also been improving, with $(121) million in 2003, improving to $(24) million in 2004, $96 million in 2005 and $81 million in the TTM.

The balance sheet looks strong with $230.9 million in cash and $646.7 million in other current assets. This is adequate to cover both the $371.9 million in current liabilities and the $336.3 million in long-term liabilities combined.

My next screen in this process is to look at some valuation numbers. I generally have found Yahoo to be useful for this process, and for JLG, I shall review the

"Key Statistics" page on JLG. Here we find that this stock is a Mid-Cap stock with a market capitalization of $2.56 billion. (I am using the

Ameritrade website definitions which specify a market cap between $500 million and $3 billion for a mid-cap stock.) The trailing p/e is moderate at 26.53, and the forward p/e (fye 31-Jul-07) is downright reasonable at 14.91. Thus the '5 Yr Expected' PEG is pretty cheap at 1.08.

Using the

Fidelity.com eResearch website, we can see that this company has been assigned the Industrial Group of "Farm/Construction Machinery". Within this group, the stock has a moderate Price/Sales ratio of only 1.4. Topping off this list is Joy Global with a Price/Sales ratio of 3.0, JLG at 1.4, Caterpillar at 1.3, Deere at 0.8, and AGCO at 0.3 and CNH Global also at 0.3. Thus, even though the Price/Sales ratio appears cheap out of context, within its industrial group, the stock is rather reasonably priced.

Returning to Yahoo for some additional numbers, we find that there are 51.67 million shares outstanding with 3.15 million shares out short as of 12/12/05. This represents 6.205 of the float or 3.8 trading days (the short ratio). The company pays a small dividend of $.02/share and last split 7/2/96, when the company had a 3:1 stock split.

What about a chart? If we take a look at the

"Point & Figure" chart on JLG from Stockcharts.com, we can see how the stock traded lower from March, 2001, at $14.00, down to a low of $4.00/share in March, 2003. Since that time, the stock has been extremely strong, breaking through resistance at $15.50 in November, 2003, to its current $50 level.

So what do I think? Well, I liked it enough to buy some shares! I am down a couple of $'s on the purchase, so I hope that the market holds up and I don't get "shaken out". The timing of these buys might need to be refined a bit :).

Thanks again for visiting! Remember that I am an amateur at all of this. And if you have any question or comments, please feel free to leav ethem on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 12 January 2006

"Trading Transparency" Affymetrix (AFFX)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I have trading rules that I have discussed elsewhere on this blog. Let me just refresh your memory on this one: if you sell a stock once at a gain (30% appreciation), do not let it go back to an 8% loss prior to selling. That is, sell it at break-even!

And that is exactly what I did a few moments ago. I owned 120 shares of Affymetrix (AFFX) with a cost basis of $40.98, purchased 1/27/05. I had sold 40 shares at a price of $53.18, which represents a gain of 29.8% (my first sale point). A few moments ago, I unloaded my remaining shares of AFFX when it hit $40.80, under my purchase price, per my rules of selling at break-even if I have sold once on a gain.

That will tie my hands and I shall be waiting for a sale on "good news" in order to add back a new position.

If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" CDIS, JLG

Hello Friends! I don't have time for a full update, but wanted to let you know that I sold 28 shares of CDIS (1/6th of my position) earlier today at a 120% gain and with this "permission" purchased 160 shares of JLG. Details to follow!

Bob

Wednesday, 11 January 2006

"Revisiting a Stock Pick" Manitowoc Co. (MTW)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisor prior to making any investment decisions based on information on this website.

Click

HERE for the PODCAST on MANITOWOC CO

As I have commented on elsewhere in this blog, I like to write about stocks that I actually own and also many stocks that I don't own but appear to have attractive characteristics that might be worth consideration. Since I am now approaching three years of blogging, I have many stocks that have been reviewed and occasionally choose to take a second look at these stocks. My policy, is to wait at least a year prior to a repeat posting of a stock on this blog.

I was looking through the list of top % gainers on the NYSE today, and I came across The Manitowoc Company (MTW), an old favorite of mine from this blog, which closed at $58.70, up $3.35 or 6.05% on the day. I do not own any shares of this stock nor do I have any options. I first posted MTW on Stock Picks Bob's Advice on November 22, 2004, a little over a year ago, when it was trading at $38.29. The stock is now up $20.41 or 53.3% since posting. I answered an inquiry from a reader about MTW on Stock Picks Bob's Advice just two months ago, on November 13, 2005, when MTW was trading at $46.96, so the stock has appreciated $11.74, or 25% just in the last six or seven weeks!

Let's take another look at this company starting with the Yahoo "Profile" on Manitowoc Co.. According to Yahoo, the company

Let's take another look at this company starting with the Yahoo "Profile" on Manitowoc Co.. According to Yahoo, the company

"...engages in the manufacture and sale of cranes, foodservice equipment, and marine equipment worldwide. The company operates in three segments Cranes and Related Products (Crane), Foodservice Equipment (Foodservice), and Marine."

And what was the news that pushed the stock higher today? First, the company

announced that fiscal '05 would exceed previous guidance followed by an

upgrade from Robert W. Baird.

How about the latest quarterly results? On November 2, 2005, Manitowoc (MTW)

announced 3rd quarter financial results. For the quarter ended September 30, 2005, net sales increased 23% to $564.9 million, from $460.8 million in the same quarter last year. Net earnings came in at $17.1 million up from $12.7 million the prior year. On a fully diluted eps basis, this came in at $.55/share this year vs $.47/share the prior year. In addition, the company increased full year eps guidance from $2.15-$2.30/share, up to $2.30 to $2.35/share in the year ahead. I have taken to calling earnings reports that show increasing revenue, earnings, and increased guidance a "trifecta", which would be just about as good a report as we can currently identify.

And how about longer-term? Taking a look at the

Morningstar.com "5-Yr Restated" financials, we can see the steady growth in revenue from $.7 billion in 2000 to $2.0 billion in 2004 and $2.2 billion in the trailing twelve months (TTM). Earnings have been far more erratic, dropping from $2.40/share in 2000 to $(.80)/share in 2002. However, since that point in time, earnings have grown steadily to $1.74 in the TTM.

Free cash flow has also been a bit erratic, but has stayed positive with $62 million reported in 2002, and $39 million in the TTM.

The balance sheet is reasonable with $122.6 million in cash and $749.8 million in other current assets. This should be enough to cover the $643.2 million in current liabilities and some of the $735.4 million in long-term debt.

Looking at

Yahoo "Key Statistics" on MTW, we find that this is a mid cap stock with a market capitalization of $1.78 billion. The trailing p/e is a bit rich 33.30, but with the rapid growth in earnings expected, we have a forward p/e (fye 31-Dec-06) is much nicer at 16.72.

According to the

Fidelity.com eResearch website on MTW, the company is in the "Farm/Construction Machinery" Industrial Group. The Price/Sales of MTW at 0.8 is in the middle of the group with Joy Global (JOYG) at the top with a Price/sales ratio of 2.9. This is followed by Caterpillar (CAT) at 1.2, Manitowic (MTW) at 0.8, Deere (DE) at 0.8, AGCO (AG) at 0.3, and CNH Global (CNH) at 0.3.

Looking at some additional statistics from Yahoo, we can find that there are 30.25 million shares outstanding with 4.90% of the shares out short as of 12/12/05, representing 5.7 trading days of volume. The company pays a small dividend of $.28/share yielding 0.5%. The last stock split was a 3:2 split in April, 1999.

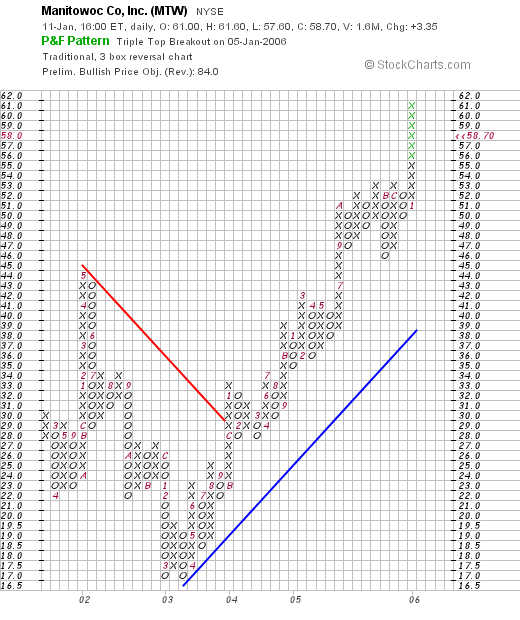

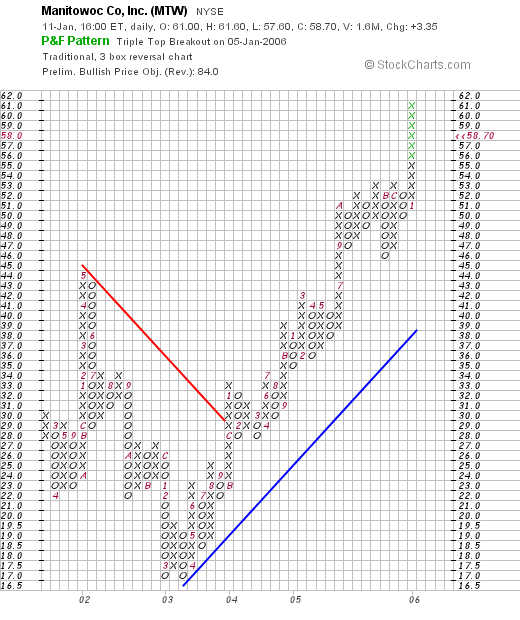

What about a chart? Looking at the

"Point & Figure" chart from Stockcharts.com:

We can see the sell off from the $45 peak in May, 2002, down to a low of $17 in February, 2003. Since that time, the stock has exploded to the upside, charging ahead to its current level around $58.70.

So what do I think? Well, the stock made a great move higher today. The latest quarterly report was superb with all of my "trifecta" findings of increased revenue, earnings, and raised guidance. The Morningstar.com report looks solid, except for a bit of an erratic performance during 2002. Since then, things look much for optimistic. Valuation appears reasonable and the chart looks nice.

It is just that I am not in the market to buy anything now. I am waiting for a "permission slip" with a sale of a portion of one of my holdings at an appreciation target.

If you have any questions or comments, you can reach me at bobsadviceforstocks@lycos.com or go ahead and leave your words on the blog itself.

Bob

Posted by bobsadviceforstocks at 4:03 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 12 January 2006 12:24 AM CST

Monday, 9 January 2006

"Revisiting a Stock Pick" Palomar Medical Technologies (PMTI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Click

HERE for the PODCAST on PALOMAR MEDICAL TECHNOLOGIES (PMTI)

I was scanning the

list of top % gainers on the NASDAQ today, and came across an 'old favorite' of mine, Palomar Medical Technologies (PMTI), which is trading as I write at $39.05, up $4.37 or 12.60% on the day. I do not own any shares nor do I have any options on this stock.

I first

reviewed PMTI on Stock Picks Bob's Advice on June 15, 2004, when the stock was trading at $14.83. Thus, the stock has appreciated an impressive $24.22 or 163.3% since my first post. Too bad I

didn't buy any shares!

Palomar is on the move today, in part from

Jim Cramer on "Mad Money" who plugged the stock on Friday. But the stock also has criteria that makes it a great investment without this endorsement. However, when we can find stocks that fit the things I screen for, and somebody influential like Cramer comes along and adds an endorsement, that is only a 'plus' for the future price appreciation imho.

Let's take a closer look at this stock and let me show you why I wrote up this company a year-and-a-half ago and why I still like this stock.

First of all, let's review their business. According to the

Yahoo "Profile" on PMTI, the company

"...engages in the research, development, manufacturing, and distribution of light based systems for hair removal and other cosmetic treatments. It offers products based on technologies that include hair removal, removal of benign pigmented lesions, such as age and sun spots; tattoo removal; acne treatment; wrinkle removal; pseudofolliculitis barbae or pfb treatment; treatment of red pigmentation in hypertrophic and keloid scars; treatment of verrucae, skin tags, seborrheic keratosis; deep tissue heating for relief of muscle and joint pain; noninvasive treatment of facial and leg veins and other benign vascular lesions, such as rosacea, spider veins, port wine stains and hemangiomas; and other skin treatments."

So basically, they treat skin disease problems with a laser.

What about their latest quarterly result? On October 27, 2005, Palomar

reported 3rd quarter 2005 results. Revenues for the quarter ended September 30, 2005, came in at $19.3 million, up 44% from the $13.9 million reported in the same quarter a year ago. Net income for the quarter came in at $4.6 million or $.24/diluted share, up about 100% from the $2.1 million or $.12/diluted share reported in the same quarter last year. This was a very strong report imho.

And what about longer-term results? Looking at the

Morningstar.com "5-Yr Restated" financials, we can see a pretty picture of revenue growth with $13.2 million in revenue reported in 2000, growing steadily to $54.4 million in 2004 and $71 million in the trailing twelve months (TTM).

Earnings have also improved steadily from a loss of $(.97) in 2000, to a profit of $.94 in the TTM. Free cash flow has been improving steadily as well, from $(1) million in 2002 to $11 million in 2004 and $17 million in the TTM.

Morningstar.com shows the balance sheet to be gorgeous with $39.7 million in cash, which by itself can cover the combined $13.6 million in current liabilities and the $-0- of long-term liabilities almost 3x over! In addition, the company has an additional $17.3 million in other current assets per Morningstar. This looks quite solid to me!

And what about valuation? Looking through

Yahoo "Key Statistics" on Palomar for some numbers on this, we find that this is a mid-cap stock with a market capitalization of $660.26 million. The trailing p/e is a bit rich at 42, and the forward p/e (fye 31-Dec-06) is a bit better at 33.24. The PEG ratio (5 yr expected) is 1.44.

According to the

Fidelity.com eResearch website, Palomar is in the "Medical Appliances/Equipment" group, and within this group is priced the most expensive in terms of the price/sales ratio. PMTI tops the list with a ratio of 9.3, followed by St. Jude (STJ) at 7.4, Medtronic (MDT) at 6.7, Zimmer Holdings (ZMH) at 5.3, Biomet (BMET) at 4.7, and Edwards Life Sciences (EW) at 2.6.

Going back to Yahoo for a few more numbers, we can see that there are 16.98 million shares outstanding and as of 12/12/05, there were 3.50 million of them out short representing 22% of the float! This is a short ratio of, get this, 21.8 days! (the short ratio). I use a ratio of 3 days for significance, and I really suspect that Cramer's plug of this stock with the huge short interest probably added to a squeeze of the shorts, and there are likely short-sellers who are trying desparately to cover their short-sales rather frantically as the stock climbs today! (Now all of that last part is just speculation on my part, but the large number of shares out short in the face of a sharp rise in the price can only give one pause!)

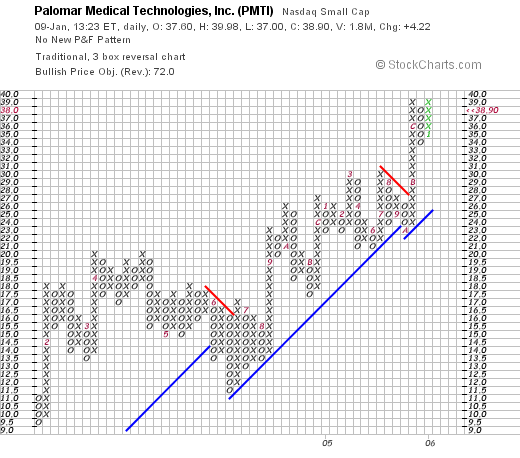

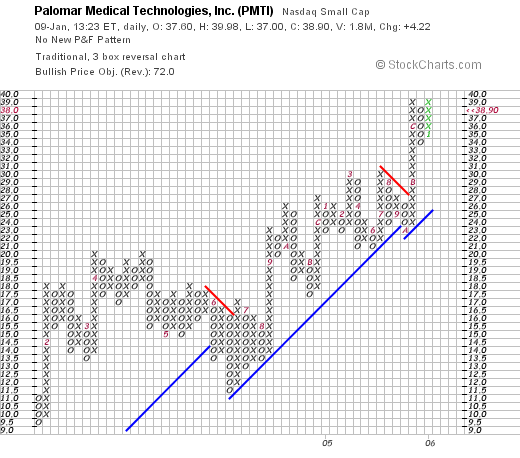

What about the chart? Looking at the

"Point & Figure" chart on Palomar from Stockcharts.com, we can see the sharp rise in price from $9.50/share in January, 2005, to the $38.90 level it is trading at today. The graph looks strong except for a mile sell-off in June, 2004, to the $10.50 level.

So what do I think? Well, I wish I had bought some shares back in 2004! However, the stock still looks strong with a nice move today with LOADS of short-sellers in the stock, the last quarter was strong with both earnings and revenue growth galore, steadily growing earnings and free cash flow and a very solid balance sheet. Valuation is a bit rich with the stock with a Price/Sales ratio in the top of its group, the P/E in the 40's and a PEG at 1.44. However, except for that, most everything else looks solid!

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 1:29 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 12 January 2006 12:49 AM CST

Newer | Latest | Older

I currently own 210 shares of Meridian Biosciences (VIVO) that were acquired on 4/21/05, a bit under a year ago, at a cost basis of $11.13. VIVO closed on 1/13/06 at $24.40, giving me a gain of $13.27 or 119.2%. I have sold portions of VIVO four times (as is my strategy) on 7/25/04, 9/1/05, 10/3/05, and 1/6/06. These sales were approximately at the 30%, 60%, 90%, and 120% gain points. Initially, I have been selling 1/4 positions, but lately, I have reduced these portions of remaining shares down to 1/6 of my positions to allow my positions to grow.

I currently own 210 shares of Meridian Biosciences (VIVO) that were acquired on 4/21/05, a bit under a year ago, at a cost basis of $11.13. VIVO closed on 1/13/06 at $24.40, giving me a gain of $13.27 or 119.2%. I have sold portions of VIVO four times (as is my strategy) on 7/25/04, 9/1/05, 10/3/05, and 1/6/06. These sales were approximately at the 30%, 60%, 90%, and 120% gain points. Initially, I have been selling 1/4 positions, but lately, I have reduced these portions of remaining shares down to 1/6 of my positions to allow my positions to grow. Let's first take a look at what this company does. According to the Yahoo "Profile" on VIVO, the company

Let's first take a look at what this company does. According to the Yahoo "Profile" on VIVO, the company And how about longer-term results? Does Meridian still show consistency in the Morningstar report? Reviewing the Morningstar.com "5-Yr Restated" financials, we can see the steady growth in revenue from $56.1 million in 2001 to $93 million in 2005. Earnings have also steadily improved from a loss of $(.47) in 2001 to $.52/share in 2005. Dividends have also been consistently increased from $.17/share in 2001 to $.31/share in 2005. Dividends by themselves are a bit unusual in as small a company as this!

And how about longer-term results? Does Meridian still show consistency in the Morningstar report? Reviewing the Morningstar.com "5-Yr Restated" financials, we can see the steady growth in revenue from $56.1 million in 2001 to $93 million in 2005. Earnings have also steadily improved from a loss of $(.47) in 2001 to $.52/share in 2005. Dividends have also been consistently increased from $.17/share in 2001 to $.31/share in 2005. Dividends by themselves are a bit unusual in as small a company as this! And what about "valuation"? Reviewing the Yahoo "Key Statistics" on Meridian, we can see that this is a mid-cap stock with a market capitalization of $635.86 million. For those that are new to all of this, recall that market capitalization is calculated by multiplying the total number of shares outstanding by the market price of each share.

And what about "valuation"? Reviewing the Yahoo "Key Statistics" on Meridian, we can see that this is a mid-cap stock with a market capitalization of $635.86 million. For those that are new to all of this, recall that market capitalization is calculated by multiplying the total number of shares outstanding by the market price of each share.

CalDive (CDIS) is a stock that besides writing it up as a 'pick', I also do own in my trading portfolio. I

CalDive (CDIS) is a stock that besides writing it up as a 'pick', I also do own in my trading portfolio. I  On November 1, 2005, CalDive

On November 1, 2005, CalDive  On November 5, 2004, I

On November 5, 2004, I  I had a nice letter from a Xanga reader "Y" who writes:

I had a nice letter from a Xanga reader "Y" who writes: Wow! That was a whole lot of a comment. Let me try to address what you have written and then take a short look at Nike (NKE).

Wow! That was a whole lot of a comment. Let me try to address what you have written and then take a short look at Nike (NKE).  But let's take a look at Nike and see what I think about how it fits into my particular perspective on stocks. Always remember, I am completely unable to say whether Nike is going to go up or down in price. But maybe I can tell you whether this stock fits into my perspective of investing decisions. I do not own any shares of Nike nor do I have any options on this stock.

But let's take a look at Nike and see what I think about how it fits into my particular perspective on stocks. Always remember, I am completely unable to say whether Nike is going to go up or down in price. But maybe I can tell you whether this stock fits into my perspective of investing decisions. I do not own any shares of Nike nor do I have any options on this stock. So while it was a nice report with growing revenue and earnings and the company did exceed expectations, the cautionary note is enough to give an investor at least a little bit of a pause. I am sure the market has absorbed that news and is already looking beyond that issue.

So while it was a nice report with growing revenue and earnings and the company did exceed expectations, the cautionary note is enough to give an investor at least a little bit of a pause. I am sure the market has absorbed that news and is already looking beyond that issue. Looking at

Looking at

Yesterday, as I

Yesterday, as I  Anyhow, let's take a closer look at this company. According to the

Anyhow, let's take a closer look at this company. According to the  My next step in screening for a selection on the blog is to look at Morningstar for a longer-term assessment. Looking at the

My next step in screening for a selection on the blog is to look at Morningstar for a longer-term assessment. Looking at the  Returning to Yahoo for some additional numbers, we find that there are 51.67 million shares outstanding with 3.15 million shares out short as of 12/12/05. This represents 6.205 of the float or 3.8 trading days (the short ratio). The company pays a small dividend of $.02/share and last split 7/2/96, when the company had a 3:1 stock split.

Returning to Yahoo for some additional numbers, we find that there are 51.67 million shares outstanding with 3.15 million shares out short as of 12/12/05. This represents 6.205 of the float or 3.8 trading days (the short ratio). The company pays a small dividend of $.02/share and last split 7/2/96, when the company had a 3:1 stock split.

As I have commented on elsewhere in this blog, I like to write about stocks that I actually own and also many stocks that I don't own but appear to have attractive characteristics that might be worth consideration. Since I am now approaching three years of blogging, I have many stocks that have been reviewed and occasionally choose to take a second look at these stocks. My policy, is to wait at least a year prior to a repeat posting of a stock on this blog.

As I have commented on elsewhere in this blog, I like to write about stocks that I actually own and also many stocks that I don't own but appear to have attractive characteristics that might be worth consideration. Since I am now approaching three years of blogging, I have many stocks that have been reviewed and occasionally choose to take a second look at these stocks. My policy, is to wait at least a year prior to a repeat posting of a stock on this blog.

Let's take another look at this company starting with the

Let's take another look at this company starting with the  And how about longer-term? Taking a look at the

And how about longer-term? Taking a look at the

I was scanning the

I was scanning the  I first

I first  First of all, let's review their business. According to the

First of all, let's review their business. According to the  And what about longer-term results? Looking at the

And what about longer-term results? Looking at the  And what about valuation? Looking through

And what about valuation? Looking through