Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received a comment on my post on Jos. A Bank Clothiers (JOSB) earlier this weekend. I wanted to share it with you and hopefully this will continue to answer questions about my own strategy and the rationale behind it.

Ydurp wrote:

Fantastic stock ya got there. Hey, I never thanked you for turning me onto MTW. I bought it after reading your review (my broker just shook his head) and it took a while bit it managed to take off. I don't understand why it's in a slump, unless it's because of the marine aspect of the biz. But that seems to be a relatively small part of their operation. Would you have sold all of it by now? When I read about their growing sales in China I'm inclined to hang in there. Another question I have is that don't you get taxed differently on stock you sell before a year is up?I posted Manitowoc Co. (MTW) on 11/22/04 when it was trading at $38.29. I haven't really been following it closely, so let me take a closer look at the stock. (Always remember that even if I start sounding "professional", I am an amateur investor in real life....). MTW is currently trading (11/11/05), one year later, at $46.96, so this is a nice appreciation of $8.67 or 22.6% since posting. I do not unfortunately own any shares of this company.

Your posts, and this one in particular, are sounding more and more professional. I like the lingo. Thanks for everything you do.

On November 2, 2005, just a few days ago really, the company announced 3rd quarter 2005 results. Revenue climbed 23% to $564.9 million from $460.8 million. Diluted eps came in at $.55/share, up from $.47. This was a nice quarterly report.

Checking the Morningstar.com "5-Yr Restated" financials (one of my favorite pages for getting a handle on a stock), we can see that at least as updated by Morningstar, the steady revenue growth is intact, the earnings growth is intact, the company did increase its dividend from 2004 to the past twelve months, but that the free cash flow turned negative with $(10) million reported in the TTM.

The balance sheet looks adequate, if not overwhelmingly positive. The company is a bit heavy on debt. Otherwise things look ok.

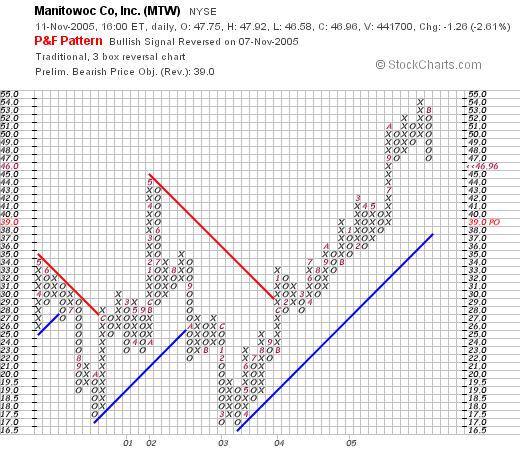

Looking at a "Point & Figure" chart on MTW from Stockcharts.com I think the technical performance of this particular stock is intact. It hasn't really broken down. Take a look at the chart that I have linked to. I don't see any news items that would explain anything about the company. Overall, I like what I see.

As far as selling, please remember that you can do what you choose to do. My own strategy involves selling all of my shares if a stock declines either to an 8% loss after a first purchase, to break-even after a single partial sale on a gain, or if it retraces 50% of my last targeted gain sale.

Recall that I sell shares on the upward appreciation of a stock if it hits 30%, 60%, 90%, 120%, 180%, 240%, 300%, 360%, 450%....etc. At each of these appreciation levels, I sell 1/4 of my holding. Sort of "hedging" my bet! Thus, if I have never sold a stock at any gain, then I sell if it declines to an 8% loss, if I sold 1/4 of my holdings at a 30% gain, then I would sell ALL of my shares at break-even. Same if I have sold twice, once at a 30% gain, and once at a 60% gain; if it declines back to the 30% level (1/2 of my highest gain), then I sell all of my shares. It is very mechanical. I don't do very much thinking.

I do reserve the right to sell all of my shares if there is something that comes out that is clearly fundamentally negative for the company. Even then I may react too quickly to sell when I should have just let the stock price dictate my action.

Finally, you ask about the holding period and taxation in the United States.

Quoting an article from MSNBC.com from 11/2/05:

If you're in the 10% or 15% tax bracket:

Assets held for a year or less are taxed at your ordinary income tax rate.

Assets held for more than a year are taxed at a 5% rate.

If your tax bracket is greater than 15%:

Assets held for a year or less are taxed at your ordinary income tax rate.

Assets held for more than a year are taxed at a 15% rate.

The difference can be enormous. If you hold a security for 12 1/2 months and then sell, you'll likely pay just a 15% tax on the gains. If you sell after holding for only 11 1/2 months, though, you'll be taxed at your ordinary income rate, which can be as high as 35%. So you might pay more than twice as much in taxes.

I think this explains the difference, but you might wish to check with your own accountant or do a Google search for more information.

My strategy is not sensitive to tax questions. I am just trying to maximize my portfolio performance. However, since short-term gains are taxed higher, it does work out that I accumulate a lot of small short-term losses when I sell stocks quickly at an 8% loss that cancel out the gains. Over time, most of my gains are long-term gains, and are thus taxed at a lower rate.

Thanks again for your kind words. I have been blogging now for almost three years and I think I am getting more of a system down. I am glad that you checked with your broker before making an investment decision. I think that my rationale for the stocks I discuss is something you could share with him/her before making a decision and I am sure they will appreciate your homework on the investment idea.

Regards! And thanks for visiting here.

Bob

Updated: Sunday, 13 November 2005 5:07 PM CST