Stock Picks Bob's Advice

Friday, 27 March 2009

Rollins (ROL) and Walgreen (WAG) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

In general I have a very defined program for buying and selling shares based on the underlying performance of the stock in question. But simply put, Rollins (ROL) represented an over-weighted position in my trading account and I didn't like the way it was trading. In many ways, this is exactly the type of transaction I try to avoid, this gestalt approach to investing, but I have always reserved the right to make small adjustments to my account, including replacing a position, when it simply didn't seem to be trading well. For instance, the stock has been trading down when the market has been otherwise strong, and the chart looks vulnerable to a correction from my amateur perspective.

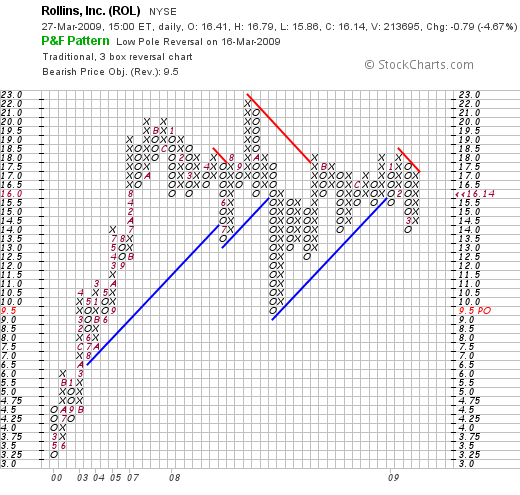

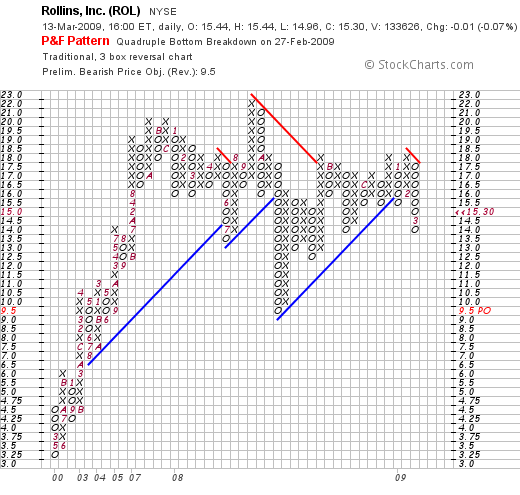

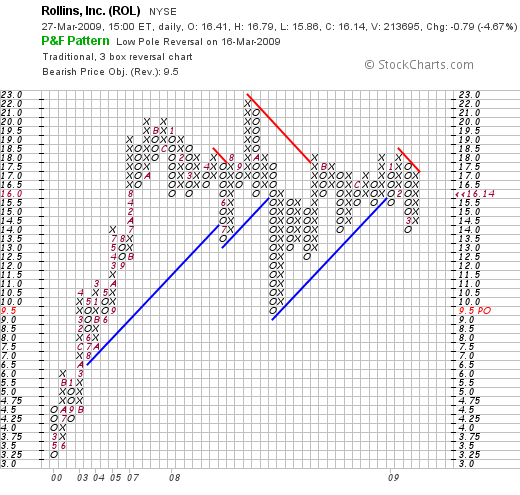

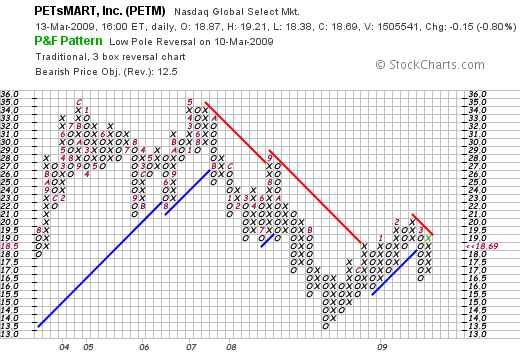

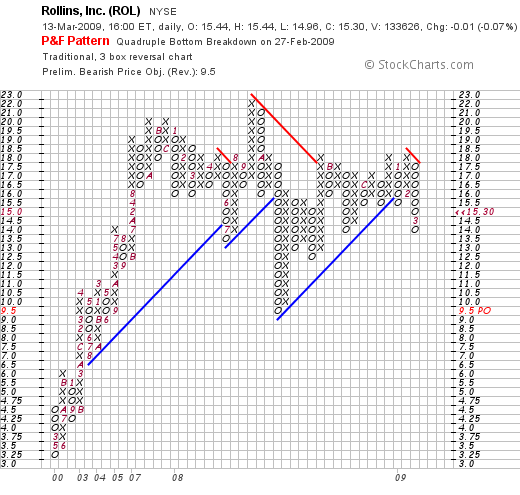

In fact, let's take a look at that 'point & figure' chart from StockCharts.com on Rollins (ROL):

This is more or less the third time the stock has broken through support levels and with the market now correcting from its recent bull move, it seemed like it might be a good time to step aside. Time will tell.

Certainly, the last quarterly report was good for Rollins (ROL)and the '5-Yr Restated' financials from Morningstar look solid except perhaps for a bit of a heavy load of current liabilities reported at $272.8 million, with $14 million in cash and $103 million in other current assets giving the current ratio a value of about .42 well under my own preferred current ratio of at least 1.0 or 1.5. Considering that the company is only generating $76 million in free cash flow for the past 12 months, from my own amateur perspective, this might mean that the company will need to be issuing shares or looking to borrow funds to cover these liabilities.

I didn't feel comfortable being overweighted in this company, and chose to switch into a new holding, Walgreen (WAG), which appeared to be outperforming the market today.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

I am a frequent visitor to my local Walgreen store, so it certainly is something I am familiar with. I am afraid that may sound a bit Peter Lynch, but this stock is also a stock that I first was introduced to as an investment via Gene Walden and his "The 100 Best Stocks to Own in America". Gene, wherever you are now, thank you for helping introduce me to some of the concepts that drive my own thinking today! For Walden, consistency of earnings, revenue growth, and even dividends was key. Walgreen (WAG) for years has been a steady performer and even in today's difficult retail and economic environment, still works to grow its presence across the United States and Canada.

Just four days ago, on March 23, 2009, Walgreen (WAG) reported 2nd quarter 2009 results. Revenue for the quarter came in at $16.48 billion up 7% over the prior year. More importantly they exceeded analysts' expectations of $16.42 billion. Earnings came in at $640 million or $.65/share. Excluding restructuring cost of $.06/share, that worked out to $.71/share and once again they managed to exceed analysts' expectations of $.66/share according to Thomson Reuters.

Interestingly, they reported a 4% increase in total prescriptions for the quarter as compared to an industry-wide decrease of 1%. Their prescription business is driving sales as same-store prescription revenue climbed 2.9% while "front-end sales" of merchandise actually fell 1.2% during this period. Really not too bad with the economic slowdown affecting retail sales.

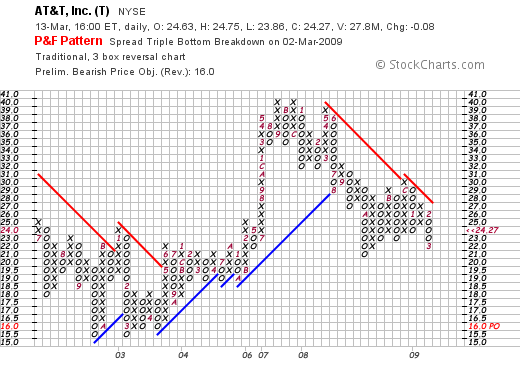

Furthermore, it looks as if most of the damage to Walgreen (WAG) shares is at least for the time being done. If we look at the 'point & figure' chart on Walgreen (WAG) from StockCharts.com, we can see that the stock has shown strong support at the $22 range down from a plateau in the $48 to $50 range between 2005 and 2008. It appears, from my amateur perspective, to have had a triple bottom at that level.

If we examine the Morningstar.com '5-Yr Restated' financials on Walgreen (WAG), we see that the company shows a superb record of increasing revenue from $37.5 billion in 2004 to $59.0 billion in 2008 and $60.0 billion in the trailing twelve months (TTM). Earnings per share have also steadily increased from $1.31/share in 2004 to $2.17/share in 2008 only to dip slightly to $2.12/share in the TTM.

Dividends have been increased each year (a really nice finding if you can identify companies with this record) from $.18/share in 2004 to $.40/share in 2008 and $.42/share in the TTM. In addition, the company has been reducing outstanding shares from 1.03 billion in 2004 to 996 million in 2008 and 994 million in the TTM.

Free cash flow has decreased recently but is decidedly positive with $1.1 billion reported in 2006 and $588 million reported in the TTM. Unlike the balance sheet on Rollins (ROL) above, Walgreen (WAG) is reported to have cash of $866 million and $11.273 billion in other current assets. This total of $12.1 billion, when compared to the $8.5 billion in current liabilities yields a current ratio nearly at 1.5. The company does have an additional $2.9 billion in long-term liabilities per Morningstar.

According to the Yahoo "Key Statistics" on Walgreen (WAG), the company is a large cap stock with a market capitalization of $26.07 billion. The trailing p/e is a very reasonable 12.69 with a forward p/e (fye 31-Aug-10) estimated at an even nicer 11.52. The PEG works out to a very acceptable 1.1 level.

Thinking a little bit more of valuation of the company, referring to the Fidelity.com eresearch page on Walgreen, we can see that the Price/Sales works out to a nice 0.4 compared to the industry average of 1.00. In terms of profitability, the company is reported to have a Return on Equity (TTM) of 16.68%, slightly below the industry average of 18.35% according to Fidelity.

As already noted, there are 998 million shares outstanding per Yahoo, with 980.12 million that float. As of March 10, 2009, Yahoo reports that there were 23.39 million shares out short, but due to the large daily volume of 10.8 million, works out to a short interest ratio of only 2.1.

The company pays a forward annual dividend of $.45/share yielding 1.7%. Walgreen (WAG) last split their shares February 16, 1999, when they declared a 2:1 stock split.

Anyhow, I made the switch from Rollins (ROL) to Walgreen (WAG). In the process, I reduced my exposure from this relatively over-sized position to a smaller position similar to the size of my other holdings. I am still not real comfortable with the market. I am not convinced that the Geithner plan will yield quick results and that the worldwide economic challenges will be easily surmounted.

However, I am confident that my neighborhood Walgreen store will remain busy with their growing number of 24 hour pharmacies and extensive front-end merchandise!

Thanks again for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them right here on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 15 March 2009

Trading Portfolio Update: Haemonetics (HAE), 3M (MMM), PetSmart (PETM), Rollins (ROL), and AT&T (T)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This blog has been about several things simultaneously. I have been trying to share with you ideas about stocks that might be suitable for investment, I have presented a way of managing your portfolio in response to market conditions and the stocks actions themselves, and I have shared with you my own trading account that I have for the most part been applying these same rules. In some sense, this account is my own investment experiment.

After a very strong week in the market, it seemed like a nice time to check on my own holdings, to see how the stocks are doing and how the actual companies are performing. These are actual holdings of mine in my own 'trading account'.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

Since I am at my 5 position minimum, I plan on selling all of my shares of HAE if the stock should incur a (12)% loss, which would work out to a sale price of $51.70 x .88 = $45.50. On the upside, my targeted appreciation point remains at a 30% gain which would work out to a price of $51.70 x 1.30 = $67.21. At that point, I would plan on selling 1/7th of my holdings or 7 shares. That sale on an appreciation target reached would also give me a 'buy signal' to be buying a new position.

Insofar as recent earnings, HAE reported 3rd quarter 2009 results on February 2, 2009. Revenue for the quarter ended December 27, 2008, increased 16% to $155.4 million from $134.6 million in the prior year, ahead of expectations of $144.9 million. Earnings came in at $.63/share (excluding one-time items), ahead of $.54/share the prior year. This beat expectations of $.61/share. The company also raised guidance for 2009 revenue and earnings.

Positive growth in earnings and revenue that beats expectations and finds a company raising guidance is about everything an investor could possibly seek in a quarterly report!

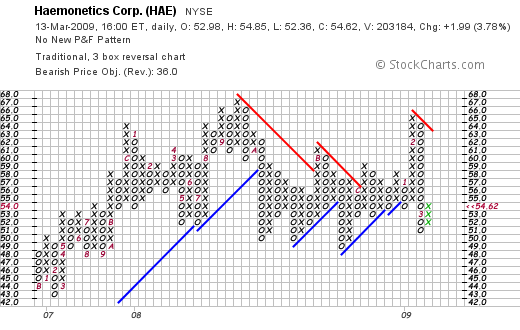

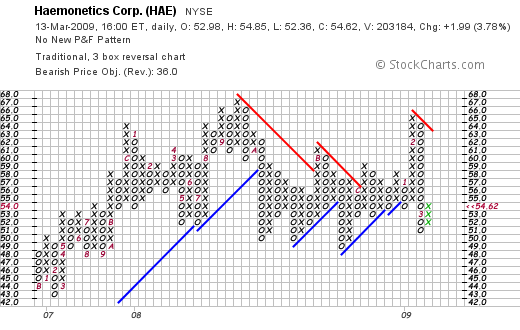

In terms of a recent chart, the point and figure chart on Haemonetics from StockCharts.com shows the pressure that the stock has been under even with these results. The stock recently bounced off the $49 level in November, 2008, broke through resistance at the $56 level, only to peat at $65 in February, 2009, pull back to a $51 level, and is only now appearing to try to once again move higher. In other words, since May, 2008, the stock has been trading in a range between $49 and $66.

3M (MMM) is a recent purchase of mine, having purchased 33 shares of MMM on 3/3/09 at a cost basis of $43.64. 3M closed at $48.00 on 3/13/09 for a gain of $4.36 or 10% since purchase. Again, insofar as a sale on the downside, a (12)% loss would mean a sale of all shares at $43.64 x .88 =$38.40. On the upside, a 1/7th sale at a 30% gain works out to a sale of 4 shares (!) at a price of 1.3 x $43.64 = $56.73.

On January 29, 2009, 3M (MMM) reported 4th quarter 2008 results. Sales for the company dipped (11.2)% to $5.51 billion, with earnings dropping (37)% to $536 million or $.77/share down from $851 million or $1.17/share the prior year. The company also reduced guidance to a (5) to (9)% dip in revenue and lowered expectations for 2009 earnings to a range of $4.30 to $4.70 from $4.50 to $4.95/share previously suggested. However, shortly thereafter, on February 11, 2009, the company announced that it would be raising its dividend 2% to $.51/share from $.50/share and they also extended their authorization to buy-back shares.

As you may realize, I have been adjusting my purchases recently towards more value investments with dividends and this 3M purchase has thus far worked out nicely.

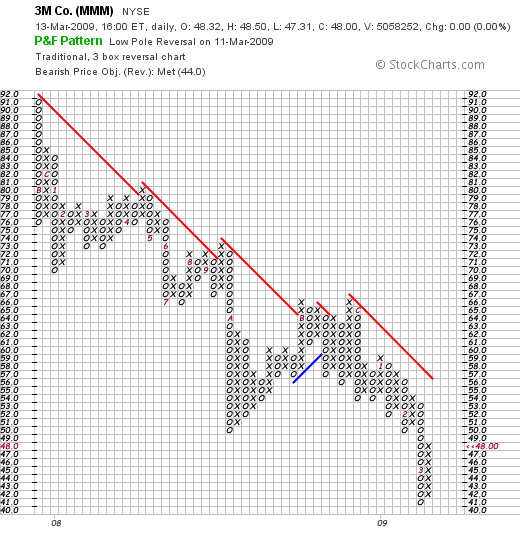

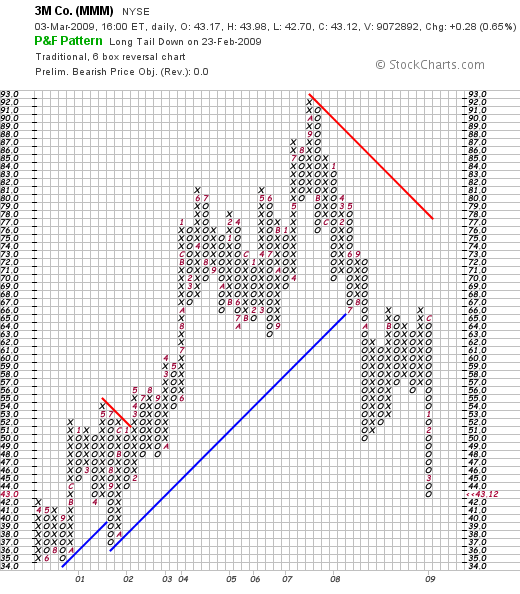

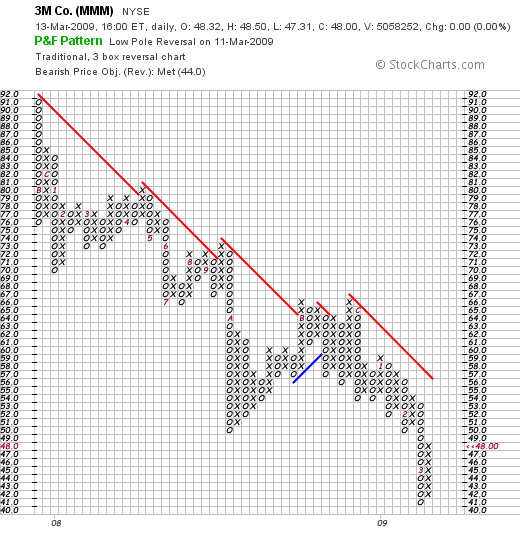

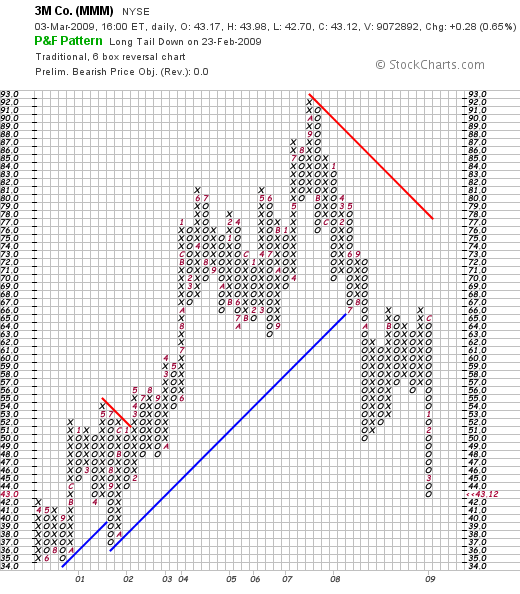

If we look at the point and figure chart on 3M from StockCharts.com, we can see little to admire. The stock recently bottomed at $41 after trading as high as $91/share in November, 2007. This stock has yet to find support in its price with a series of lower lows and lower highs and a 'resistance line' that has yet to be convincingly broken.

Currently I own 90 shares of PetSmart (PETM) that were acquired 11/20/08 at a cost basis of $15.50/share. I sold my first 1/7th of my holding (15 shares) on 2/6/09 when the stock reached a price of $19.90, representing a gain of $4.40 or 28.4%. This stock sale was initiated when the stock was trading at essentially a 30% gain, my first targeted sale point.

PETM closed at $18.69 on 3/13/09, for a current gain of $3.19 or 20.6% on my holding. Having sold 1/7th of my shares at a 30% gain, my next targeted sale would be 1/7th of my holdings or 12 shares if the stock should reach a 60% appreciation level or $15.50 x 1.60 = $24.80. On the downside, all shares would be sold if the stock should reach 'break-even' or $15.50. It is my policy to continue to move up my sale point after partial sales on appreciation and in this case, after a single sale at a 30% gain, the sale point is moved up to break-even.

On March 4, 3009, PetSmart (PETM) reported 4th quarter 2008 results. Revenue for the quarter increased 2.3% to $1.36 billion. (The company noted that this period was 13 weeks vs. the 14 week period the prior year.) Same store sales, a more important sales figure for a retail firm, increased 3% in the quarter. During this period, the company earned $78.4 million or $.62/share, up from $75.4 million or $.59/share the prior year period.

The company beat expectations of $.59/share and met revenue expectations of $1.36 billion. However, the company announced guidance for fiscal 2010 to a profit of $1.40 to $1.50/share (analysts had been expecting $1.48), and revenue guidance was mid-to-high single digits. Analysts expected $5.23 billion in revenue working out to a 3% increase.

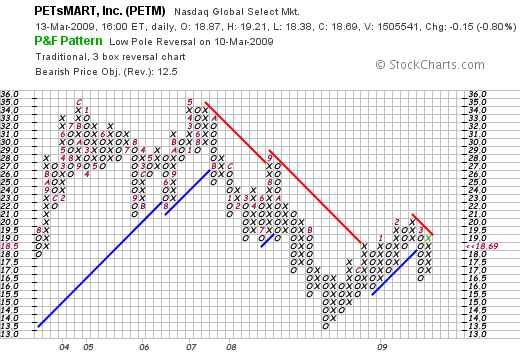

Reviewing the point and figure chart on PETM from StockCharts.com, we can see that the stock price actually 'rolled-over' after a 'double-top' in May, 2007, when the stock was as high as $35. Recently the stock bottomed at $13.50 in November, 2008, and has rallied back to a recent high of $20 in February, 2009. The stock has met some resistance recently and has come back from $16.50 to a recent price of $19.

Rollins (ROL) is my largest holding currently; I own 350 shares of ROL that were purchased 10/16/08 at a cost basis of $14.69. I have not sold any of these shares since my purchase. ROL closed 3/13/09 at $15.30 for a gain of $.61 or 4% since purchase.

Rollins (ROL) is my largest holding currently; I own 350 shares of ROL that were purchased 10/16/08 at a cost basis of $14.69. I have not sold any of these shares since my purchase. ROL closed 3/13/09 at $15.30 for a gain of $.61 or 4% since purchase.

On the upside, I plan on selling 1/7th or 50 shares of ROL should the stock appreciate to $14.69 x 1.30 = $19.10. On the downside, with 5 positions (at 6 or more holdings, my loss tolerance narrows to my usual 8%), my anticipated share of all shares of ROL would occur should the stock decline to .88 x $14.69 = $12.93.

On January 28, 2009, Rollins (ROL) reported 4th quarter 2008 results. For the quarter ended December 31, 2008, revenues came in at $248.1 million, up 14.9% over prior year's revenue of $216 million. Net income grew 5.2% to $12.6 milion or $.13/diluted share, up from $11.9 million or $.12/diluted share the prior year.

The point and figure chart on Rollins from StockCharts.com appears slightly more encouraging than some of the other charts of stocks in my portfolio. The stock had a meteoric rise from $3.25/share to a high of $22.00/share in September, 2008. Since that time, the price corrected to $9.50/share in October, 2008 and has been working its way higher except for some recent weakness when the stock broke through support at $15.50 in January, 2009, dipped as low as $14.00 and is now trying to move higher once again.

AT&T (T) is another of my recent purchases which represent what I would call my 'value' selections. I own 71 shares of T purchased 2/20/09 at a cost basis of $23.75/share.

AT&T closed at $24.27 on 3/13/09, representing a gain for me of $.52/share or 2.2% since purchase.

Insofar as sale points, on the upside, I would plan on selling 1/7th or 10 shares should T shares reach a 30% gain or 1.30 x $23.75 = $30.88. On the downside, a 12% loss works out to a price of 0.88 x $23.75 = $20.90. At that point all of my shares would be sold.

On January 28, 2009, AT&T (T) reported 4th quarter 2008 results. Net income fell 23.3% to $2.4 billion or $.41/share, down from $3.1 billion or $.51/share the prior year. Revenue climbed 2.4% to $31.4 billion.

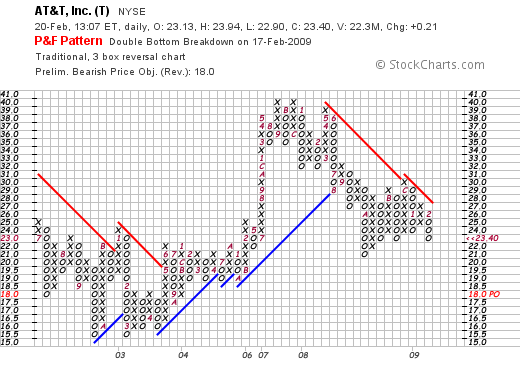

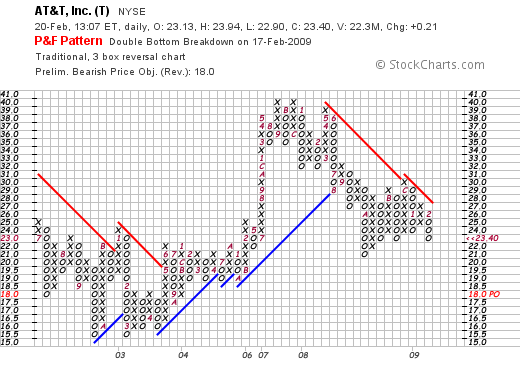

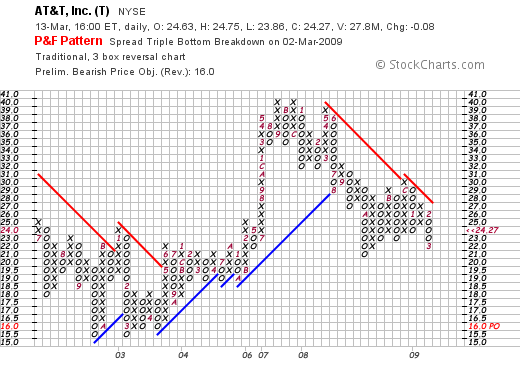

Checking the point and figure chart on AT&T (T) from StockCharts.com, we can see that the stock climbed from $16.00 in April, 2003, to a high of $40 in November, 2007, only to dip as low as $21 in October, 2008. The stock has recently been under pressure hitting $22 this month to close Friday at $24.27.

Overall, my trading account has a value of $34,860.14 as of 3/14/09. I continue to deposit $200 monthly into the account. The account consists of equities valued at $13,075.27 and cash of $21,748.87. Thus, I am 62.5% cash at this time.

I do not choose the amount of cash to be holding as compared to the amount in equities. It is the performance of my own stocks that dictates to me whether to be buying a new position or moving more into cash. The bear market that we are all experiencing has driven my portfolio to the minimum of 5 holdings. I shall move more into equities depending on the performance of my own stocks in response to the market and response to underlying news.

Year to date I have taken a total of $(443.49) of losses representing a total of $(443.49) in short-term losses and $0 in long-term gains or losses. As of 3/15/09, my stocks have an unrealized gain of $827.63.

Thanks so much for visiting and spending time on my blog. If you have any comments or questions, please feel to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 11 March 2009

On Starting an Investment Club During a Bear Market: Choosing a Philosophy

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The stock market eked out a gain today, closing at 6,930.40, up 3.91 or 0.06% on the day. It was a recently seemingly rare event to have the market close higher two days in a row---even with this relatively anemic follow-up to yesterday's big move.

The stock market eked out a gain today, closing at 6,930.40, up 3.91 or 0.06% on the day. It was a recently seemingly rare event to have the market close higher two days in a row---even with this relatively anemic follow-up to yesterday's big move.

In the face of this six brave individuals got together this evening at Michael Ablan's law office to put together the framework of a new investment club called Grounded Investment Club--named after the coffee shop with the same name where most of us get together early each morning to talk politics, stocks, or just complain and brainstorm about whatever is ailing society and is getting to us.

Most of the group, while respected in their own fields, are rather 'newbies' to the world of investing and stock selection. Each of us put in $500 with another four members promising contributions of the same but not present for the meeting. We completed our E*Trade application and sent in our first checks to open our account. As I joked, we look brilliant as we are now sitting 100% in cash.

We will be contributing $50/month as a minimum and setting up in a share-ownership format. It helps having a lawyer as a member along with an accountant to help us keep our books and file the appropriate tax forms in a timely fashion. Yours truly became 'Vice-President' of the club and I have been designated as the education coordinator.

It would seem to be a good time to beginning an investment club! I have been a member of Investnuts Investment Club here in La Crosse for several years and have written about that experience previously. As with any investment club that has been around for many years, we have found that there really is no place to hide and while we have raised significant cash, our performance has suffered along with many other individual investors worldwide.

Before ever getting to the question of what stock to purchase, it is wise to consider the varying philosophies towards investments.

Probably the broadest categories of investing strategies could be explained by the terms Value Investing, Growth Investing, and Momentum Investing. In general, my own particular strategy is a bit of an amalgam of all of the threee schools of thought with an emphasis on momentum and growth. Those particular strategies are not very useful from my perspective in today's market.

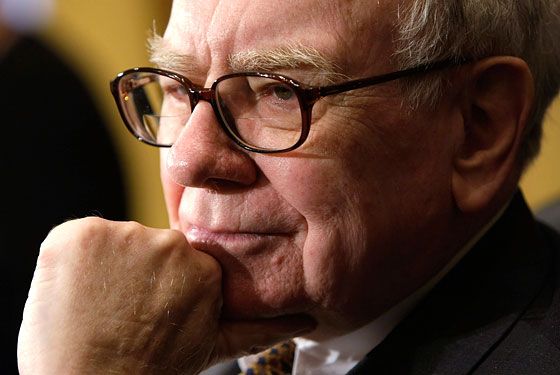

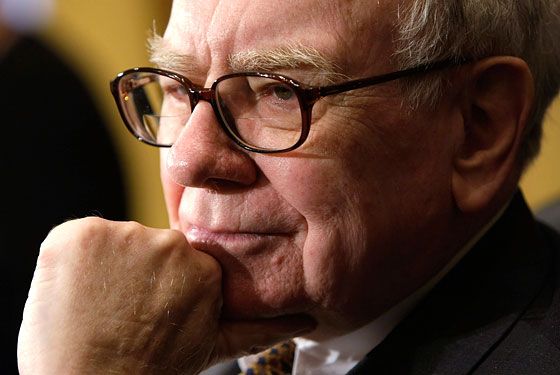

Value Investing has been popularized most recently by Warren Buffett who has become one of the richest individuals on the globe through his own application of the principles of Benjamin Graham, the author of Security Analysis, and an advocate in the disciplined evaluation of equities to identify those companies selling below book value or certainly closer to book value than other investments. It is the belief that the market is imperfect but eventually other investors will also recognize the proper valuation of a stock and that these types of investments represent safer buying opportunities than the types of stocks that might require an investor to pay a premium over book to purchase shares.

Value Investing has been popularized most recently by Warren Buffett who has become one of the richest individuals on the globe through his own application of the principles of Benjamin Graham, the author of Security Analysis, and an advocate in the disciplined evaluation of equities to identify those companies selling below book value or certainly closer to book value than other investments. It is the belief that the market is imperfect but eventually other investors will also recognize the proper valuation of a stock and that these types of investments represent safer buying opportunities than the types of stocks that might require an investor to pay a premium over book to purchase shares.

The other philosophy that an investor or investment club might consider adopting is the growth approach. This approach has been has been well utilized by the highly-regarded Peter Lynch a former manager of the phenomenally successful Fidelity Magellan Fund (FMAGX). (Recently, this growth-oriented fund has underperformed the market with a (51.75)% return for the past year earning it a single Morningstar star.)

The other philosophy that an investor or investment club might consider adopting is the growth approach. This approach has been has been well utilized by the highly-regarded Peter Lynch a former manager of the phenomenally successful Fidelity Magellan Fund (FMAGX). (Recently, this growth-oriented fund has underperformed the market with a (51.75)% return for the past year earning it a single Morningstar star.)

I share in the belief that earnings growth can drive share price appreciation. However, the simplistic view that Peter Lynch was a "buy what you know" kind of investor, isn't really a fair shake for this 'guru'.

In any case, with so many companies reporting earnings declines, it is difficult if not impossible in the midst of this bear market to identify growth stocks with any sense of certitude. I do not think a stock club would be well-advised to adopt a purely growth orientation without considering the difficult economic environment.

Finally, the third philosophy I believe it is important to consider is Momentum Investing. This has been best advocated by William O'Neil, the author of the now classic text "How to Make Money In Stocks" and the publisher of the Investor's Business Daily.

Finally, the third philosophy I believe it is important to consider is Momentum Investing. This has been best advocated by William O'Neil, the author of the now classic text "How to Make Money In Stocks" and the publisher of the Investor's Business Daily.

I have been a big advocate of O'Neil's CAN SLIM approach (with my own modifications). This philosophy depends on the persistence of earnings growth and price momentum combined to result in a winning strategy for the individual investor.

In good times I cannot think of a better approach to selecting stocks and managing a portfolio. But we are in times that are far from what could be described as "good".

Thus my recent purchases of AT&T (T) and 3M (MMM) and Sysco (SYY) are not truly momentum picks. They are value investments based on my own fears and observations about the ruthlessness of the correction we are facing. I, like other investors, have become more value-oriented, concerned about the P/E, PEG, and dividend yield as well as the financial soundness of the enterprise.

I continue to utilize Morningstar.com for the "5-Yr Restated Financials" on stocks. I do want to identify stocks with reasonable earnings reports and a record of revenue and earnings growth, stable outstanding shares, dividend growth if possible, solid free cash flow, and good balance sheets. It is more difficult to identify stocks with price momentum and upward price charts. They are simply rare if non-existent in the market today.

Thus for a club like our new Grounded club initiated today, I would have to identify value stocks that are now more widely available. Better yet, identification of growth stocks that are now demonstrating good value might be even more attractive.

Over time, this might even work for a bunch of amateurs meeting together once a month, chipping in their $50 each and playing the world of high finance together. If not, it is always good to spend time with friends!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 4 March 2009

Refining My Investment Strategy for Portfolio Management

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There is no doubt that this blog and my investment strategy is a work in progress! I wanted to refine two things about dealing with stock price declines when I am down to my minimum of 5 positions that I have tried to deal with in the past as well.

First of all, when down to five positions, I shall be moving my loss tolerance up to reduce churning my own account to a (12)% loss level. This is something I have tried to adopt in the past, but completely overlooked with my recent Sysco (SYY) sale, when I sold with the usual (8)% loss limit.

Second, thinking about sizing of replacement positions, it makes sense to reduce the size of the holding. But perhaps 1/2 of the average position is a bit severe. If indeed I plan to add positions at 5/4 of the average size as the stock portfolio grows above five positions, doesn't it make more intuitive sense to be replacing these minimum positions at 4/5 of the average? Perhaps that is too 'cute' by a half, but that makes more sense to me! Anyhow, this investment approach is about finesse and not banging anyone or anything over the head with investment strategies :).

Today we are having a bit of a bounce in the market. I suspect things are oversold in here but am not convinced that we are in the beginning of any kind of sustained rally. But then again, I cannot tell you what the market will be doing this afternoon let alone next week!

It is more important to be able to select stocks that either show significant value or demonstrate strong momentum in earnings and price appreciation and then manage those positions within your portfolio with some type of coherent strategy.

Thank you for your continued visits to this blog. I am an amateur investor, but I believe that my approach may well be innovative enough to warrant consideration. Meanwhile, I shall continue to share with you my thoughts, ramblings, fears, and hopes, and my own successes and failures in dealing with this once in a lifetime bear market that rivals the worst of markets in the 20th Century.

Yours in investing,

Bob

Tuesday, 3 March 2009

3M (MMM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With my sale of my small position in Sysco (SYY) at a loss, I generally would be 'sitting on my hands' with the proceeds as this was a sale on 'bad news'. However, since this sale was one of my five last holdings in my trading account, this dropped my portfolio to four positions, and paradoxically triggered a 'buy signal' however a modified signal at best.

With my sale of my small position in Sysco (SYY) at a loss, I generally would be 'sitting on my hands' with the proceeds as this was a sale on 'bad news'. However, since this sale was one of my five last holdings in my trading account, this dropped my portfolio to four positions, and paradoxically triggered a 'buy signal' however a modified signal at best.

I say 'modified' because when under my five position minimum, even while adding a position to bring it back to five I am cognizant of the signal telling me that the investing environment is awful and have thus set up my portfolio system to replace the holding with a new, albeit smaller position.

When buying a stock on 'bad news' triggered by getting under the minimum position number, my size is set at 50% of the average of the other holdings. On the other hand, when buying a stock with 'good news' triggered by the partial sale of a holding as it appreciates to a sale price level, the size of the new position is instead larger than the other positions---in fact it is set at 125% of the average holding.

Thus, while adding to my equity portion of my holdings in times of 'good news' I continue to shift towards cash even while purching a new stock forced by a market driving me to sell one or more of my minimum of five holdings.

Thus, after my sale of my Sysco (SYY) stock, my average of my four other positions worked out to approximately $2,800. Instead of buying a stock on momentum as I have been in the past doing when the market was quite a bit healthier, I turned to what I would call a 'value' approach and purchased 33 shares of 3M (MMM) at $43.40 today. MMM closed a little lower than that today at $43.12, up $.28 or 0.65% on the day.

Let's take a closer look at 3M and I hope to share with you my own thinking as to why I picked this particular stock today to add to my own portfolio.

First the latest earnings: on January 29, 2008, 3M (MMM) reported 4th quarter 2008 results. Sales for the quarter came in at $5.5 billion, down (11.2)% over the prior year. Adjusted earnings came in at $676 million or $.97/share, down from $863 million or $1.19/share in the prior year. The company in the same announcement cut guidance for 2009 to earnings of $4.30 to $4.70/shae, down from the prior range of $4.50 to $4.95. In addition, revenue was now estimated to decline 5-9% from prior guidance of a 3-7% decline.

Looking at the Morningstar.com "5-Yr Restated" financials, we can see the rise from $20 billion in revenue in 2004 to $25.3 billion in 2008, the increase in earnings from $3.56/share in 2004 to a peak of $5.60/share in 2007 before declining to $4.89 in 2008 (and apparently further down in 2009). The company has been buying back shares with outstanding shares declining steadily from 798 million in 2004 to 707 million in 2008. Free cash flow has been positive and growing from $2.7 billion in 2006 to $3.1 billion in 2008.

The balance sheet appear solid with $1.8 billion in cash and $7.7 billion in other current assets vs. a current liabilities of $5.8 billion and $9.8 billion in long-term liabilities.

Looking at Yahoo "Key Statistics", the company is a large cap stock with a market capitalization of $29.92 billion. The trailing p/e is a modes 8.81, with a forward p/e of 9.58 (fye 31-Dec-10). The PEG ratio is 1.07. Price/Sales is only 1.18. Meanwhile the company pays a foward dividend of $2.04 yielding 4.5%. The company's last stock split was 9/30/03 when the stock split 2:1.

If we look at a 'point & figure' chart on MMM from StockCharts.com, we can see that the stock peaked at $92 in October, 2007, only to decline sharply through support levels to its current level at $43 and change.

I do not know if 3M can hold this level. I do know that the stock which is profitable is now selling for a p/e under 9 and yields 4.5%. The stock is a fraction of its current peak and is selling at levels last seen back in early 2002.

Anyhow, I am now back to my minimum of 5 holdings. Tomorrow will reveal whether I shall be selling additional positions or whether this stock will also end up being a short-term holding.

Yours in investing,

Bob

Sysco (SYY) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There is no doubt that Sysco (SYY) is one of my long-time favorite companies in terms of the kind of what I would refer to as an infrastructure service industry---a company that behind the scenes provides food services and supplies to restaurants, hospitals and institutions throughout the United States and Canada. Thus, it was with great disappointment that yesterday I noticed that with the terrible bear market ravaging the best of stocks, Sysco (SYY) had not been spared the onslaught and when it hit and passed my (8)% loss limit, I sold my position.

There is no doubt that Sysco (SYY) is one of my long-time favorite companies in terms of the kind of what I would refer to as an infrastructure service industry---a company that behind the scenes provides food services and supplies to restaurants, hospitals and institutions throughout the United States and Canada. Thus, it was with great disappointment that yesterday I noticed that with the terrible bear market ravaging the best of stocks, Sysco (SYY) had not been spared the onslaught and when it hit and passed my (8)% loss limit, I sold my position.

On December 10, 2008, I purchased 154 shares of Sysco (SYY) for my trading account at a price of $22.668. Yesterday I sold these same 154 shares when the stock had declined to $20.8216. This represented a loss of $(1.85) or (8.15)% since purchase.

I am as clueless as the next investor as to how far the stock market is likely to fall, whether it is a good time to be buying or selling my holdings, and whether it actually would be wiser to be buying shares of Sysco (SYY) at these levels rather than executing a sale at this price level.

But this I do know--my own market investment strategy makes good sense to me. I believe it is necessary to limit losses to some acceptable amount, and that market forces dictate most of the price action of stocks rather than the individual stocks determining their own price course.

My investment strategy involves moving between a minimum of five holdings and a maximum of twenty, responding to market sales on losses by reducing my market exposure, and responding to stock appreciation by selling portions of those holdings at targeted levels. I also believe it is wise to use the actions of my own holdings to help me respond in some rational fashion to the irrational forces swirling around me.

Thus, with five holdings and with the sale of my Sysco stock now down to four holdings, I am 'required' to add a new position to my portfolio. But instead of replacing this holding with a position of equal size, I shall be adding a holding of smaller size thereby once again shifting towards cash even as I replace a new stock for an old holding. Currently, after selling a holding when at the minimum, I purchase a new position at 1/2 of the average size of the remaining four.

Today I found a stock that appeared attractive and once again moved up that minimum of five holdings while at the same time continuing to shift to cash in this difficult market. I shall be saving that entry for another blog.

Yours in investing,

Bob

Wednesday, 25 February 2009

Is Gold a Safe Haven?

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Jim Cramer believes in gold as something that belongs in everyone's portfolio.

Jim Cramer believes in gold as something that belongs in everyone's portfolio.

As reported February 23, 2009:

"Cramer said gold remains his favorite sector in the market, but he cautioned that even in a horrible market, investors can't have just gold in their portfolio."

Cramer is in good company. Alex Dumortier, CFA, on the Motley Fool site has reassured us all that gold may well be the "Ultimate Safe Haven Investment."

Cramer is in good company. Alex Dumortier, CFA, on the Motley Fool site has reassured us all that gold may well be the "Ultimate Safe Haven Investment."

He writes:

"For these reasons, and because of my deep misgivings about the way in which the government is taking on the current crisis, I think gold is an attractive choice as a portion of one's investable assets. I believe conditions look very favorable for gold to outperform the U.S. stock market in 2009 and over the next three to five years. Still, investing in gold isn't without its challenges."

Traditionally gold has been viewed as an inflation hedge. As Blanchard and Company, a retailer of gold coins and investments for the individual investor, has written in their "Why Own Gold?" commentary:

"Gold is renowned as a hedge against inflation. The most consistent factor determining the price of gold has been inflation - as inflation goes up, the price of gold goes up along with it. Since the end of World War II, the five years in which U.S. inflation was at its highest were 1946, 1974, 1975, 1979, and 1980. During those five years, the average real return on stocks, as measured by the Dow, was -12.33%; the average real return on gold was 130.4%.

Today, a number of factors are conspiring to create the perfect inflationary storm: extremely stimulative monetary policy, a major tax cut, a long term decline in the dollar, a spike in oil prices, a mammoth trade deficit, and America’s status as the world’s biggest debtor nation. Almost across the board, commodity prices are up despite the short-term absence of a weakening dollar which is often viewed as the principal reason for stronger commodity prices."

Jason Hamlin back in 2006 wrote on Seeking Alpha how "Gold Still Works as an Inflation Hedge."

Now, with deflationary pressures exerting their influence on the world economy, gold 'bugs' are suggesting that gold is also an excellent deflation hedge!

Jeffrey Nichols, a Managing Director of American Precious Metals Advisors writes on his blog, NICHOLSonGOLD.com that gold should be a safe haven in a deflationary environment:

"Here’s why gold is a deflation hedge:

During periods of deflation, when spending shrinks and savings (in anticipation of lower consumer prices) rise, households hoard cash and cash-equivalents such as short-term U.S. Treasury debt, bank deposits, and money-market instruments. Gold and silver are also a cash equivalents and some will choose to hold more of their savings in these metals, particularly during times of stress and economic uncertainty when gold just feels safer.

Moreover, deflations are also characterized by very low interest rates, both in nominal and real (inflation-adjusted) terms. Why? Because the demand for credit is very low (no one wants to borrow and, if they do want to borrow, the banks are loathe to lend), savings are high, and — importantly — the Fed and other central banks will push rates down to encourage economic recovery. So the opportunity cost of holding gold and silver (the interest forgone by holding these metals rather than an interest-bearing asset) is extremely low, further encouraging some investors to favor the metals (because of gold and silver’s other attractions and attributes) over alternatives."

It is an interesting hypothesis. And I suppose that we could use this argument to justify the high price in gold and Cramer's rant about buying gold stocks.

Perhaps a more revealing chart comes from the Gold Digest, in which it is noted that after the "Japanese Bubble" broke in 1988, the Yen gold price fell almost 50%.

As the article points out:

"The above empirical evidence is consistent with our thinking on the matter. When gold was officially linked to the national currencies (pre-1971), it was a hedge against deflation and would lose purchasing power during periods of inflation. When gold was 'set free' it became a hedge against inflation (or, more to the point, a hedge against the loss of confidence brought about by inflation)."

In other words, since the dollar is no longer linked to the price of gold, the deflation-protection role of gold is minimized.

American investors have gone through several bubbles, each one breaking and sending shock-waves through the economy. The "Dot-com bubble" burst on March 10, 2000, with the NASDAQ peaking at 5,132.52. We have seen the effect of the breaking of the United States Housing Bubble. We have benefited from the declining oil prices of the breaking oil bubble which peaked at $147.20/barrel in July, 2008, to its current price near $40.

Stephanie Mills has written:

"Everything that's old is new, and everything that's new is old."

Much like the Tulip mania that swept Holland and reached its peak in 1636-1637, we think that each time there is a reason for a peak in a commodity, whether it be a high-tech stock bubble justified by an enthusiastic George Gilder, oil prices justified by Peak Oil advocates, real estate prices justified by people like Gary and Margaret Hwang Smith, who, back in 2006, justified Southern California real estate prices based on rent calculations. As reported:

"In a paper the two presented at the Brookings Institution this week, "Bubble, Bubble, Where's the Housing Bubble?" they said that even though prices had risen rapidly and some buyers unrealistically expected the trend to continue, "the bubble is not, in fact, a bubble in most of these areas."

They argued that the value of a home is determined by the rent it could fetch. Calculate the future rents, subtract mortgage payments, taxes and other costs, factor in a good annual rate of return of 6 percent or more, and one should be looking at the proper price of a house or condo.

Their bottom line was: "Buying a house at current market prices still appears to be an attractive long-term investment."

Thus there will always be people who will justify a bubble phenomenon. Meanwhile Real Estate prices are crashing, milk prices have plunged, corn and soybean prices are down, aluminum prices are weak, and wages are stagnant. Meanwhile, the United States is in the midst of a "severe contraction", and the United States is threatened with a deflationary collapse and not inflationary problems at this time.

Will gold move higher in a deflationary environment? Perhaps, if you believe Cramer and other gold bugs who believe that gold can reach $2,000/ounce or higher.

As for me, with gold not linked to currency in the United States since President Nixon took the nation off the gold standard in 1971, I do not see a necessary increase in the price of anything, including gold, in a deflationary environment. While cash may be 'king' in a deflationary environment, will investors truly treat gold as a 'cash equivalent' or will it act perhaps more like a commodity?

Certainly I am not an economist, but can't you hear the echos of the same arguments that justified $146 oil when the bubble was breaking, or the real estate investor who justified the $1 million 'tear-down' in Southern California when the sky was the limit.

It appears to be part of the human condition to chase values of seemingly rare things to levels that are absurd. Is the gold price real? Time will tell. But I shall not be going along for the ride.

Yours in investing,

Bob

Tuesday, 24 February 2009

Writing a Column about Prostate Cancer

I wrote earlier in this blog about my own experience with Prostate Cancer. If you are a man over 50 and haven't had your PSA level checked, go out and get it done. It may save your life.

This is what I got published in the La Crosse Tribune yesterday:

Doctor learns about being on other side of the equation

.

Dr. Robert Freedland | La Crosse

“Two out of the ten biopsies came back positive.”

I can remember these words from this past summer as my urologist came into my own clinic where I was taking care of my patients with their eye problems to let me know that things weren’t quite perfect for me. I let my wife know the result of the biopsies. My son hurriedly rushed in from Madison that evening; his best friend’s dad had recently died from cancer and he was shaken. I called my other children and my sisters and brother in California to share with them the news. I was at times fearful of this event; but I knew enough to be guardedly optimistic.

After the age of 50, as is recommended, I started having PSA levels drawn with my physical exam to screen for prostate cancer. The science of Prostate Specific Antigen levels is somewhat imprecise. What is most important is called the “velocity” of the test levels. For me, a year ago, I had a level of around 3.0. On the upper-level of acceptable, I was encouraged to get this repeated this year and indeed this time it came in at 5.3—enough to warrant further investigation to rule out cancer; this included an ultrasound test and a series of 10 or 12 needle biopsies of the prostate.

My urologist reassured me that odds were in my favor—that the tests were unlikely to come back as cancer. Thus when he showed up in my office and told me we should talk further about the biopsies a few days later, I knew my luck hadn’t been that great, and that indeed I now faced further decisions. I made an appointment to visit with him with my wife and decide about the next steps.

It is estimated that about 180,000 men in America were diagnosed with prostate cancer in 2008. I was one of them. Fortunately, early detection of this disease now meant that a cure was within reach regardless of my choice of treatment. At 53, ‘watchful waiting’ which might be appropriate for a man in his 80’s for this slow-growing cancer wouldn’t be an acceptable choice for me. Thus, I could choose surgery—either the traditional radical prostatectomy or the newer robotic approach—-or I could decide to have either a seeding procedure with radioactive particles or external beam treatments. Either radiation or surgery has yielded similar outcomes with over 85% of men at 10 years being cancer-free.

I wasn’t really convinced that 85% was so great. After all, that meant that one man out of seven would experience a recurrence in that time period. And in fact, it is estimated that 28,000 men died from their prostate cancer in 2008. Nothing was for sure.

Being a surgeon myself, I leaned towards a surgical approach. I recall how the surgical residents would always joke that “a chance to cut is a chance to cure”. Personally, I liked the idea of removing any cancer from my body and dealing with the post-op surgical challenges rather than dealing with any small but real side-effects of radiation therapy. To understand my options better I visited with both a surgeon skilled in the new robotic approach to surgery on the prostate and a radiation oncologist who advised me about that regimen.

There wasn’t a “correct” answer to which was better. I chose robotic surgery and as suggested I took a month off to recover from surgery before getting back to my own medical practice. It was very different being a patient on a gurney waiting to be rolled into an O.R. as opposed to being the surgeon waiting for my own patients to arrive for their own operations. It was comforting to be cared for by talented medical personnel at every level of the process.

The results of surgery were encouraging. The tumor was limited to the prostate and all lymph nodes were negative. At this point, I just needed to be monitored and have PSA levels drawn on a regular basis. Other men have required hormonal therapy or radiation treatments. If my own tumor recurs, I shall also need additional therapy.

It has now been three months since my surgery. My first PSA test has returned at levels near zero so the outlook continues promising. Just like so many other cancer survivors, I too am anxious about my next medical exam to know if I am free of disease. But I have been fortunate to have a disease that is potentially curable; not every cancer patient is that lucky.

Dr. Robert Freedland is an ophthalmologist at Franciscan Skemp Healthcare.

Sunday, 22 February 2009

New PODCAST on Portfolio Management in the Face of a Bear Market!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Click HERE to listen to my latest podcast on Investment Management Strategy in the face of a bear market as well as listen to me read a few poems by Robert Frost.

Click HERE to listen to my latest podcast on Investment Management Strategy in the face of a bear market as well as listen to me read a few poems by Robert Frost.

Yours in investing,

Bob

Friday, 20 February 2009

AT&T (T) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I wrote earlier, I was disappointed in needing to sell my Morningstar (MORN) shares this morning as that stock fell under the pressure of a disappointing earnings report as well as the generalized weakness in the financial sector.

As I wrote earlier, I was disappointed in needing to sell my Morningstar (MORN) shares this morning as that stock fell under the pressure of a disappointing earnings report as well as the generalized weakness in the financial sector.

One stock that I have been watching as a possible 'safe haven' has been AT&T (T) which as I write is trading at $23.60, up $.41 or 1.77% on the day. AT&T at this price trades with a p/e of only 10.92 and a yield of 7.07%. A few moments ago I purchased 71 shares of T at a price of $23.64. This peculiar share amount was calculated as I have described previously by calculating the average size of my other four holdings and buying 1/2 of that average amount to replace my 5th position, Morningstar (MORN), which was also sold just this morning.

Scott Moritz over at Street.com commented about how Goldman Sachs analyst Jason Armstrong has upgraded both Verizon (VZ) and AT&T (T) and both stocks have responded positively.

The article explains:

"With AT&T and Verizon down about 18% so far this year, Armstrong says the "pendulum has swung too far" and that it's time to consider the long-range perspective. In a research note Friday, Armstrong recommends buying shares of the two telco titans now, while pessimism about the economy is weighing so heavily on the market.

Why now? Armstrong has three points: The bar has been lowered in terms of Wall Street expectations, both telcos have "an achievable path to growth in 2010," and both offer a big, safe dividend -- about 7% annual payout -- to help you bide your time."

Looking at the 4th quarter earnings report you will see that I have also accepted a less than stellar report with earnings coming in at $.41 this year down from $.51/share in the prior year. Revenues did manage to improve slightly to $31.1 billion, up 2.4% from last year's results.

Reviewing the Morningstar.com '5-Yr Restated' financials, we can see the impressive growth in revenue from $40.7 billion in 2004 to $118.9 billion in 2007 and $123.3 billion in the trailing twelve months (TTM). Earnings have grown, albeit a little inconsistently, from $1.77/share in 2004 to $1.94/share in 2007 and $2.26 in the TTM.

Dividends have also been raised yearly from $1.26 in 2004 to $1.47 in 2007 and $1.60 in the TTM. Shares have also grown from 3.3 billion in 2004 to 6.17 billion in 2007 and 6.01 billion in the TTM. Much of this share growth may be attributed to shares issued for acquisitions.

I remember well the original break-up of 'Ma Bell' in 1983 when the seven 'baby bells' were created. In 1998 SBC Communications acquired Pacific Telesis, the baby bell for the western states. In November, 2005, SBC Communications (the old baby bell Southwestern Bell) acquired AT&T and renamed itself AT&T. In 2006, AT&T spent $67 billion to acquire BellSouth.

Like Frankenstein, AT&T has been busy putting its pieces back together

again!

I confess to having a personal attraction to AT&T that transcends the stock and its particulars. Years ago, when my father was still alive, I really believe that AT&T was his favorite holding. He had owned it for many years and enjoyed the dividend stream and the many stock splits over the years. A while back I wrote about him and my own investing experience. But that shouldn't really enter into our own investing decisions, should it?

Let's take a brief look at the 'point and figure' chart on AT&T from StockCharts.com. Here we can see that the stock which corrected rather deeply in September, 2002, dipping to $15.50/share, revisited that low in Apri, 2003, and then climbed as high as $40/share in September, 2007, and again hit that high in December, 2007, only to dip as low as $21 in October, 2008. The stock has been struggling to move higher, with higher lows but meeting resistance on the upside. The stock is bouncing off the recent low of $23.00 from November, 2008, and now is showing some support at this price point.

Like most charts these days, the picture is less than encouraging. But if the dividend is secure, something we cannot depend on anymore, the stock may well be support in a bond-like fashion.

In any case, I am now a shareholder, albeit a small shareholder, in an 'old favorite' of if not mine, of my father who while no longer alive, was always my main mentor in this stock business.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

As is my policy, I try to share with you my own actions in my Trading Account as soon as possible as part of my own 'trading transparency'. Earlier today I sold my 350 shares in Rollins (ROL) at $16.054. These shares had been purchased 10/16/08 at a cost basisof $14.69/share; thus, I had a gain of $1.364/share or 9.3% since purchase.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

After selling my shares in Rollins (ROL) I replaced this holding with a new fifth holding, Walgreen (WAG) and purchased an amount equal to the average size of my other four holdings, about $2050. Precisely, I purchased 77 shares of Walgreen (WAG) at $26.63. WAG is trading at $26.40 as I write, so I am down a bit on this purchase already.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

The stock market eked out a gain today, closing at 6,930.40, up 3.91 or 0.06% on the day. It was a recently seemingly rare event to have the market close higher two days in a row---even with this relatively anemic follow-up to yesterday's big move.

The stock market eked out a gain today, closing at 6,930.40, up 3.91 or 0.06% on the day. It was a recently seemingly rare event to have the market close higher two days in a row---even with this relatively anemic follow-up to yesterday's big move.  Value Investing has been popularized most recently by

Value Investing has been popularized most recently by  The other philosophy that an investor or investment club might consider adopting is the growth approach. This approach has been has been well utilized by the highly-regarded

The other philosophy that an investor or investment club might consider adopting is the growth approach. This approach has been has been well utilized by the highly-regarded  Finally, the third philosophy I believe it is important to consider is

Finally, the third philosophy I believe it is important to consider is  With my sale of my small position in Sysco (SYY) at a loss, I generally would be 'sitting on my hands' with the proceeds as this was a sale on 'bad news'. However, since this sale was one of my five last holdings in my trading account, this dropped my portfolio to four positions, and paradoxically triggered a 'buy signal' however a modified signal at best.

With my sale of my small position in Sysco (SYY) at a loss, I generally would be 'sitting on my hands' with the proceeds as this was a sale on 'bad news'. However, since this sale was one of my five last holdings in my trading account, this dropped my portfolio to four positions, and paradoxically triggered a 'buy signal' however a modified signal at best.

Click

Click