Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This blog has been about several things simultaneously. I have been trying to share with you ideas about stocks that might be suitable for investment, I have presented a way of managing your portfolio in response to market conditions and the stocks actions themselves, and I have shared with you my own trading account that I have for the most part been applying these same rules. In some sense, this account is my own investment experiment.

After a very strong week in the market, it seemed like a nice time to check on my own holdings, to see how the stocks are doing and how the actual companies are performing. These are actual holdings of mine in my own 'trading account'.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

I currently own 50 shares of Haemonetics (HAE) that were purchased 10/27/08 at a cost basis of $51.70. HAE closed at $54.62 on March 13, 2009, for a gain of $2.92 or 5.6% since purchase. I have not sold any of these shares since purchase.

Since I am at my 5 position minimum, I plan on selling all of my shares of HAE if the stock should incur a (12)% loss, which would work out to a sale price of $51.70 x .88 = $45.50. On the upside, my targeted appreciation point remains at a 30% gain which would work out to a price of $51.70 x 1.30 = $67.21. At that point, I would plan on selling 1/7th of my holdings or 7 shares. That sale on an appreciation target reached would also give me a 'buy signal' to be buying a new position.

Insofar as recent earnings, HAE reported 3rd quarter 2009 results on February 2, 2009. Revenue for the quarter ended December 27, 2008, increased 16% to $155.4 million from $134.6 million in the prior year, ahead of expectations of $144.9 million. Earnings came in at $.63/share (excluding one-time items), ahead of $.54/share the prior year. This beat expectations of $.61/share. The company also raised guidance for 2009 revenue and earnings.

Positive growth in earnings and revenue that beats expectations and finds a company raising guidance is about everything an investor could possibly seek in a quarterly report!

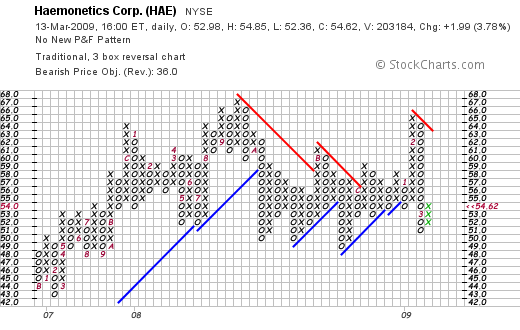

In terms of a recent chart, the point and figure chart on Haemonetics from StockCharts.com shows the pressure that the stock has been under even with these results. The stock recently bounced off the $49 level in November, 2008, broke through resistance at the $56 level, only to peat at $65 in February, 2009, pull back to a $51 level, and is only now appearing to try to once again move higher. In other words, since May, 2008, the stock has been trading in a range between $49 and $66.

3M (MMM) is a recent purchase of mine, having purchased 33 shares of MMM on 3/3/09 at a cost basis of $43.64. 3M closed at $48.00 on 3/13/09 for a gain of $4.36 or 10% since purchase. Again, insofar as a sale on the downside, a (12)% loss would mean a sale of all shares at $43.64 x .88 =$38.40. On the upside, a 1/7th sale at a 30% gain works out to a sale of 4 shares (!) at a price of 1.3 x $43.64 = $56.73.

On January 29, 2009, 3M (MMM) reported 4th quarter 2008 results. Sales for the company dipped (11.2)% to $5.51 billion, with earnings dropping (37)% to $536 million or $.77/share down from $851 million or $1.17/share the prior year. The company also reduced guidance to a (5) to (9)% dip in revenue and lowered expectations for 2009 earnings to a range of $4.30 to $4.70 from $4.50 to $4.95/share previously suggested. However, shortly thereafter, on February 11, 2009, the company announced that it would be raising its dividend 2% to $.51/share from $.50/share and they also extended their authorization to buy-back shares.

As you may realize, I have been adjusting my purchases recently towards more value investments with dividends and this 3M purchase has thus far worked out nicely.

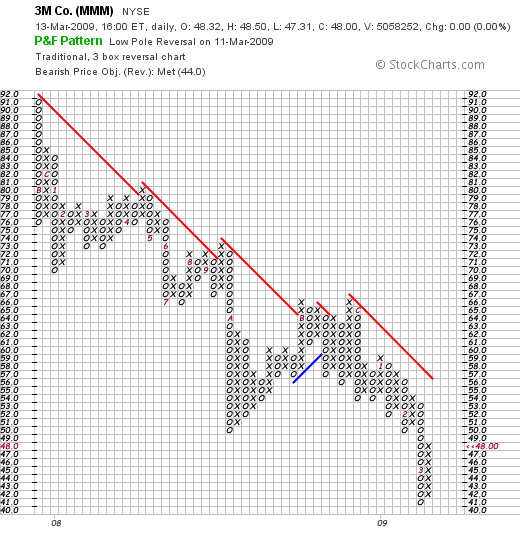

If we look at the point and figure chart on 3M from StockCharts.com, we can see little to admire. The stock recently bottomed at $41 after trading as high as $91/share in November, 2007. This stock has yet to find support in its price with a series of lower lows and lower highs and a 'resistance line' that has yet to be convincingly broken.

Currently I own 90 shares of PetSmart (PETM) that were acquired 11/20/08 at a cost basis of $15.50/share. I sold my first 1/7th of my holding (15 shares) on 2/6/09 when the stock reached a price of $19.90, representing a gain of $4.40 or 28.4%. This stock sale was initiated when the stock was trading at essentially a 30% gain, my first targeted sale point.

PETM closed at $18.69 on 3/13/09, for a current gain of $3.19 or 20.6% on my holding. Having sold 1/7th of my shares at a 30% gain, my next targeted sale would be 1/7th of my holdings or 12 shares if the stock should reach a 60% appreciation level or $15.50 x 1.60 = $24.80. On the downside, all shares would be sold if the stock should reach 'break-even' or $15.50. It is my policy to continue to move up my sale point after partial sales on appreciation and in this case, after a single sale at a 30% gain, the sale point is moved up to break-even.

On March 4, 3009, PetSmart (PETM) reported 4th quarter 2008 results. Revenue for the quarter increased 2.3% to $1.36 billion. (The company noted that this period was 13 weeks vs. the 14 week period the prior year.) Same store sales, a more important sales figure for a retail firm, increased 3% in the quarter. During this period, the company earned $78.4 million or $.62/share, up from $75.4 million or $.59/share the prior year period.

The company beat expectations of $.59/share and met revenue expectations of $1.36 billion. However, the company announced guidance for fiscal 2010 to a profit of $1.40 to $1.50/share (analysts had been expecting $1.48), and revenue guidance was mid-to-high single digits. Analysts expected $5.23 billion in revenue working out to a 3% increase.

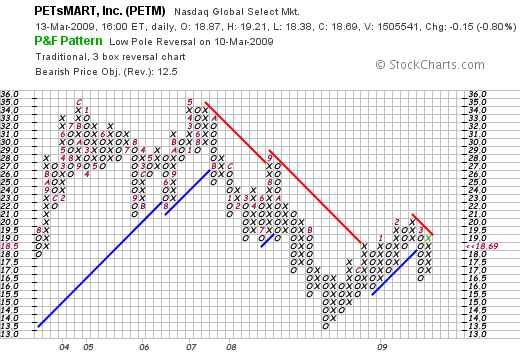

Reviewing the point and figure chart on PETM from StockCharts.com, we can see that the stock price actually 'rolled-over' after a 'double-top' in May, 2007, when the stock was as high as $35. Recently the stock bottomed at $13.50 in November, 2008, and has rallied back to a recent high of $20 in February, 2009. The stock has met some resistance recently and has come back from $16.50 to a recent price of $19.

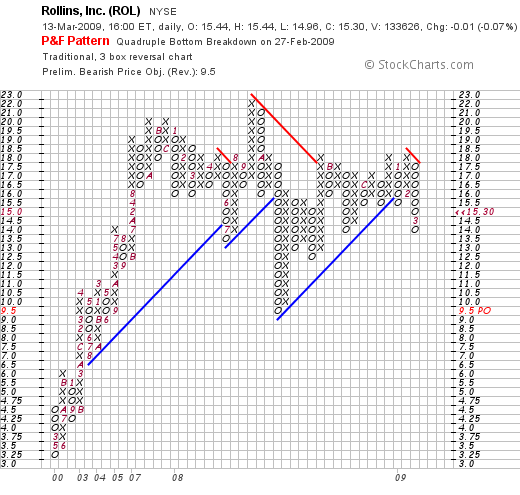

Rollins (ROL) is my largest holding currently; I own 350 shares of ROL that were purchased 10/16/08 at a cost basis of $14.69. I have not sold any of these shares since my purchase. ROL closed 3/13/09 at $15.30 for a gain of $.61 or 4% since purchase.

Rollins (ROL) is my largest holding currently; I own 350 shares of ROL that were purchased 10/16/08 at a cost basis of $14.69. I have not sold any of these shares since my purchase. ROL closed 3/13/09 at $15.30 for a gain of $.61 or 4% since purchase.

On the upside, I plan on selling 1/7th or 50 shares of ROL should the stock appreciate to $14.69 x 1.30 = $19.10. On the downside, with 5 positions (at 6 or more holdings, my loss tolerance narrows to my usual 8%), my anticipated share of all shares of ROL would occur should the stock decline to .88 x $14.69 = $12.93.

On January 28, 2009, Rollins (ROL) reported 4th quarter 2008 results. For the quarter ended December 31, 2008, revenues came in at $248.1 million, up 14.9% over prior year's revenue of $216 million. Net income grew 5.2% to $12.6 milion or $.13/diluted share, up from $11.9 million or $.12/diluted share the prior year.

The point and figure chart on Rollins from StockCharts.com appears slightly more encouraging than some of the other charts of stocks in my portfolio. The stock had a meteoric rise from $3.25/share to a high of $22.00/share in September, 2008. Since that time, the price corrected to $9.50/share in October, 2008 and has been working its way higher except for some recent weakness when the stock broke through support at $15.50 in January, 2009, dipped as low as $14.00 and is now trying to move higher once again.

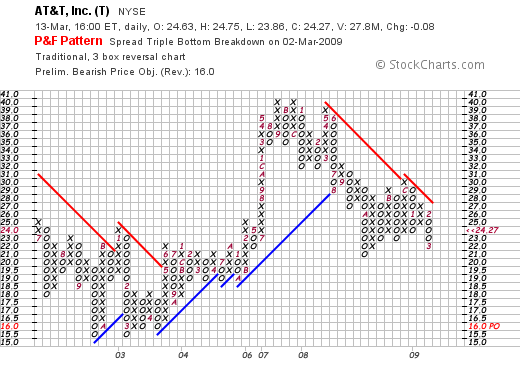

AT&T (T) is another of my recent purchases which represent what I would call my 'value' selections. I own 71 shares of T purchased 2/20/09 at a cost basis of $23.75/share.

AT&T closed at $24.27 on 3/13/09, representing a gain for me of $.52/share or 2.2% since purchase.

Insofar as sale points, on the upside, I would plan on selling 1/7th or 10 shares should T shares reach a 30% gain or 1.30 x $23.75 = $30.88. On the downside, a 12% loss works out to a price of 0.88 x $23.75 = $20.90. At that point all of my shares would be sold.

On January 28, 2009, AT&T (T) reported 4th quarter 2008 results. Net income fell 23.3% to $2.4 billion or $.41/share, down from $3.1 billion or $.51/share the prior year. Revenue climbed 2.4% to $31.4 billion.

Checking the point and figure chart on AT&T (T) from StockCharts.com, we can see that the stock climbed from $16.00 in April, 2003, to a high of $40 in November, 2007, only to dip as low as $21 in October, 2008. The stock has recently been under pressure hitting $22 this month to close Friday at $24.27.

Overall, my trading account has a value of $34,860.14 as of 3/14/09. I continue to deposit $200 monthly into the account. The account consists of equities valued at $13,075.27 and cash of $21,748.87. Thus, I am 62.5% cash at this time.

I do not choose the amount of cash to be holding as compared to the amount in equities. It is the performance of my own stocks that dictates to me whether to be buying a new position or moving more into cash. The bear market that we are all experiencing has driven my portfolio to the minimum of 5 holdings. I shall move more into equities depending on the performance of my own stocks in response to the market and response to underlying news.

Year to date I have taken a total of $(443.49) of losses representing a total of $(443.49) in short-term losses and $0 in long-term gains or losses. As of 3/15/09, my stocks have an unrealized gain of $827.63.

Thanks so much for visiting and spending time on my blog. If you have any comments or questions, please feel to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob