Stock Picks Bob's Advice

Sunday, 2 December 2007

Harris Corp. (HRS) "Weekend Trading Portfolio Analysis

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of the roles of this blog, I have been sharing with you my thoughts on a multitude of 'investable' stocks. In addition, I am also trying to provide transparency on my actual investment activities. Recently, I have been participating in Covestor, where you can visit my Covestor page and review my actual holdings, purchases, sales, and performance overall relative to the S&P and other investors. I would encourage you to visit there.

But I plan on continuing to examine my holdings one by one on intervals. Currently I own 14 positions in my trading account. Trying to review a holding every 3 or 4 weeks, I shall be reviewing each holding about once/year. When I make a trade in any holding I shall certainly review that trade and the rationale behind it. When indicated, I shall also revisit each stock I hold, but my purpose of this blog is not to pump stocks but rather to share with you the reader my honest assessments of stocks from the perspective of an amateur investor. I share with you my accomplishments and my mistakes. From these discussions, I have tried to continue to enhance my own ability to build and manage a portfolio of stocks. I hope that this effort is helpful for you as well.

Last month I reviewed U.S. Global Invesors (GROW) a stock that I had at that time in my portfolio. I no longer own GROW, having sold those shares on November 7, 2007 with a small loss. Going alphabetically (by symbol) through my holdings brings me to Harris Corp. (HRS). Let's take another look at HRS and see if it still deserves a spot in my blog and in my portfolio!

HARRIS CORP. (HRS) IS RATED A BUY

What is my current holding and my trading history?

Currently I own 103 shares of Harris Corporation (HRS) that have a cost basis of $50.05 having been purchased 1/31/07. HRS closed at $62.77 on November 30, 2007, for an unrealized gain of $12.72 or 25.4% since purchase on these shares. I have sold one portion of my original 120 shares, having sold 17 shares of HRS on 11/7/07 at $65.16. This was at a gain of $15.11 or a gain of 30.02% since purchase. (Reviewing my sale strategy, it is my plan to sell 1/7th of my holdings should any of my stocks hit targets of 30, 60, 90, 120, 180, 240, 300, 360, 450%....etc.)

Currently I own 103 shares of Harris Corporation (HRS) that have a cost basis of $50.05 having been purchased 1/31/07. HRS closed at $62.77 on November 30, 2007, for an unrealized gain of $12.72 or 25.4% since purchase on these shares. I have sold one portion of my original 120 shares, having sold 17 shares of HRS on 11/7/07 at $65.16. This was at a gain of $15.11 or a gain of 30.02% since purchase. (Reviewing my sale strategy, it is my plan to sell 1/7th of my holdings should any of my stocks hit targets of 30, 60, 90, 120, 180, 240, 300, 360, 450%....etc.)

When would I sell next?

Having sold a portion of my holding at the 30% appreciation level, on the upside my next targeted appreciation level would be at a 60% appreciation point. This would work out to 1.6 x $50.05 = $80.08. On the downside, after a single sale at a 30% level, I move up my 'mental' stop to break-even (instead of an (8)% loss. Thus, if the stock should decline back to my purchase point--$50.05, then that decline would trigger a sale of the entire position.

What exactly does this company do?

According to the Yahoo "Profile" on Harris, the company

"...together with its subsidiaries, operates as a communications and information technology company that serves government and commercial markets worldwide."

How did the do in the latest quarter?

On November 1, 2008, Harris reported 1st quarter 2008 results. For the quarter ended September 28, 2007, revenue increased 30% to $1.2 billion  from $947 million in the same quarter last year. Net income was $100 million or $.73/diluted share, up from $83.9 million or $.60/diluted share in the same period a year ago.

from $947 million in the same quarter last year. Net income was $100 million or $.73/diluted share, up from $83.9 million or $.60/diluted share in the same period a year ago.

With this report the company also beat expectations. According to Thomson Financial analysts, Harris was expected to come in at $.74/share (excluding items the company came in at $.76) on revenue of $1.18 billion. The company also raised guidance for fiscal 2008 to a profit range of $3.35 to $3.45/share from prior guidance of $3.30 to $3.40/share. The company also announced that 2008 revenue should come in 21% ahead of the 2007 level.

From my perspective, a company that can report great results, beat expectations and raise guidance all at once, is about as strong an earnings report as an investor couple possibly hope for.

From my perspective, a company that can report great results, beat expectations and raise guidance all at once, is about as strong an earnings report as an investor couple possibly hope for.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials page, we can see the steady revenue growth fronm $2 billion in 2003 to $4.5 billion in the trailing twelve monts (TTM), the steady growth in earnings from $.45/share in 2003 to $3.43/share in 2007 and $3.56/share in the TTM, the increasing dividend from $.20/share in 2003 to $.50/share in the TTM, the expanding free cash flow from $204 million in 2004 to $359 million in the TTM, and the reasonable balance sheet with approximately $1.87 billion in current assets compared to $1.41 billion in current liabilities.

On the 'downside' there is the matter of the increased float from 14 million shares in 2003 to 23 million in 2007 and 140 million in the TTM. This, as I understand it, is due to issuance of shares for acquisitions. In any case, this increase in shares hasn't stopped the company from steadily increasing per share amounts.

What about some valuation numbers?

Checking Yahoo "Key Statistics" on Harris (HRS), we find that the market cap for this stock is $8.60 billion, making this stock a large cap stock. The trailing p/e is a reasonable 17.59, with a forward p/e (fye 29-Jun-09) of 16.01. With the strong growth expected (5 yr estimated) the PEG works out to a satisfactory 1.23.

Using the Fidelity.com eresearch page, HRS is shown to be reasonably valued with a Price/Sales (TTM) of 1.84, compared to the industry average of 5.14. In terms of profitability, as measurd by the Return on Equity (TTM), HRS comes in a bit under the industry average at 25.34% with the average being 26.87%.

Finishing up with Yahoo, we discover that there are 137.05 million shares outstanding with 135.89 million that float. Currently, as of 11/9/07, there were only 955,740 shares out short representing only 0.9 trading days of volume (the short interest). This doesn't appear significant to me.

The company currently pays a dividend of $.60/share yielding 1%. The last stock split was a 2:1 split paid out on March 31, 2005.

What does the chart look like?

Looking at the "point & figure" chart on Harris from StockCharts.com, we can see the steady appreciation in this stock from May, 2004, when the stock was trading as low as $21 to its peak in November, 2007, when the stock hit $66/share. The stock chart looks strong overall and hasn't broken down its strong and steady price appreciation.

Summary: What do I think?

Let's review some of the findings I discussed above. First of all the stock has been moving steadily higher trading a bit under its all-time high of $66. The stock reported quarterly results that were strong, beating expectations, and went ahead and raised guidance. The Morningstar.com report is also solid. My only concern is the apparent rapid growth in shares recently. But that does not appear to be significant as earnings and revenue growth have maintained a solid record. Valuation-wise, the p/e isn't bad, the PEG is under 1.5, and the Price/Sales is competitive. The Return on Equity is a tad under the average. And the chart looks solid.

The stock looks great. I have a small amount of concern with all of these defense contractors as we head into an election that might result in some changes for their prospects. But even this is only a small concern for me. I like this stock a lot. In fact I own the stock!

Thanks again for visiting! Be sure and visit my Covestor Page where you can find out more about my Trading Account and other investors who have chosen to participate on this website. (If you are interested in participating on Covestor, drop me a line at bobsadviceforstocks@lycos.com or just leave a message on the blog, and I shall send you a password for an account. I have four of those passes left and would like to share them with all of you readers!).

If you find the time, be sure and visit my Podcast Website where I discuss many of the same stocks I write about here on the blog. In addition, consider taking the time to visit my SocialPicks page where all of my picks from 2007 (even those I do not own) are evaluated and reviewed.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Wishing you all a healthy and profitable week in the market.

Bob

Posted by bobsadviceforstocks at 12:14 AM CST

|

Post Comment |

Permalink

Updated: Sunday, 2 December 2007 10:03 PM CST

Saturday, 1 December 2007

"Looking Back One Year" A review of stock picks from the week of May 29, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Usually in this location I would be posting about the various stock picks from the week a year and a half earlier. But I shall skip this review this week as there were no picks during that particular week. I can hear you saying that why don't I go ahead and review the next week then. Well it did cross my mind, but I have lots of things 'on my plate' this weekend and I shall take advantage of this fact to wait till next weekend to move ahead. Until then, be well and have a great week trading!

If you get a chance, be sure and visit my Covestor Page where all of my trades from my trading account are reviewed, my SocialPicks page where my picks from the past year are reviewed, and my Stock Picks Podcast page where you might listen to me reading a poem or possibly reviewing one of the many stocks reviewed on this website.

If you are adventurous, willing to take on a different kind of risk, and enjoy the possibility of greater returns on your money than possible in a money market account, you might wish to explore Prosper.com where you can participate in person-to-person loans in the form of a small portion of a larger group of lenders lending money with the Prosper.com website as an intermediary. But be forewarned, this kind of activity, while potentially with oversized returns, is fraught with risk involved in unsecured lending where only the risk of a credit-report 'ding' and being turned over to a collection agency stands between many of the lenders and defaults which can greatly reduce your returns.

(Full disclosure: If you sign up and fund a loan on Prosper before the end of the year we can both earn $25.)

I shall try to write up a report on my Prosper.com experience as this develops.

Regards!

Bob

Posted by bobsadviceforstocks at 10:11 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 1 December 2007 10:13 PM CST

Thursday, 29 November 2007

NVE Corporation (NVEC) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

NVE CORPORATION (NVEC) IS RATED A BUY

I wanted to see if I could briefly write up NVEC once again on this blog. NVE Corporation (NVEC) made the list of top % gainers on the NASDAQ today, currently trading at $27.70, up $3.10 or 12.60% on the day. I do not own any shares nor do I have any options on NVEC.

I wanted to see if I could briefly write up NVEC once again on this blog. NVE Corporation (NVEC) made the list of top % gainers on the NASDAQ today, currently trading at $27.70, up $3.10 or 12.60% on the day. I do not own any shares nor do I have any options on NVEC.

Why a 'revisit'?

I call this a "revisit" because I first posted NVEC on Stock Picks Bob's Advice on June 23, 2004, when the stock was trading at $36.61. Thus the stock is trading under that level!

I next revisited this stock on the blog on September 5, 2006, when the stock was trading at $34.01, also higher than the current stock price (!). And yet even with two prior picks at higher levels, I am back looking at this stock once more! It certainly hasn't gotten away without me yet.

Latest quarter?

Last month, on October 17, 2007, the company reported 2nd quarter 2008 results. Total revenue climbed 14% to $5 million from $4.4 million the prior year. Net income increased 28% to $1.64 million or $.34/diluted share, from $1.28 million or $.27/diluted share the prior year.

Longer-term?

The Morningstar.com "5-Yr Restated" financials page looks solid. The company has been steadily increasing its revenue since 2003 (except for a slight dip in 2005 to $11.6 million from $12.0 million), and has also (except for a dip in 2005) been increasing its earnings from $.15/share in 2003 to $1.00/share in 2007 and $1.22/share in the trailing twelve months (TTM). Outstanding shares have been fairly stable with 4 million in 2003, 5 million in 2004 and 5 million in the trailing twelve months.

Free cash flow has been positive and growing with $-0- reported in 2005, $3 million in 2006, $5 million in 2007 and $6 million in the TTM.

The balance sheet appear solid with $1 million in cash and $7 million in other current assets with $.9 million in current liabilities and $-0- in long-term liabilities.

Valuation?

Per Yahoo Key Statistics, this is a tiny company with a market capitalization of only $127.23 million. The trailing p/e is 22.44, the forward p/e is 17.94 (fye 31-Mar-09) and the PEG (5 yr estimated) is only 0.79.

According to the Fidelity.com eresearch website, the company is relatively richly priced with a Price/Sales (TTM) of 6.28 compared to the industry average of 3.98. Return on equity, however, is more profitable than the industry average coming in at 23.66% compared to the average of 14.38%.

Per Yahoo, there are 4.64 million shares outstanding with 4.62 million that float. As of 10/26/07, there were 1.32 million (!) of those shares out short representing 28.60% of the float or 14.2 trading days of volume (well above my own '3 day rule' for short interest).

No stock dividends and no splits are reported.

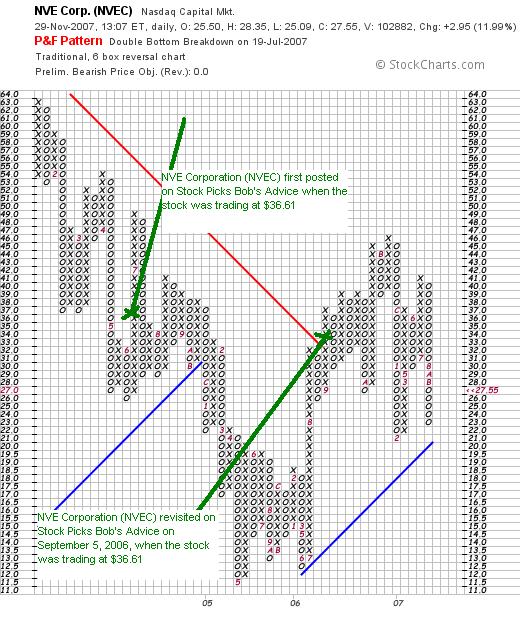

The chart?

Looking at the 'point & figure' chart from StockCharts.com, we can see that this stock has been highly volatile, bottoming in May, 2005, at $11.50 and has subsequently broken through resistance and appears to be moving higher. It is a very volatile stock.

Summary

I still like this stock. I have yet to have any of these picks move higher for me :(. Each time I have picked the stock it has moved lower until I once again revisit it here. I am optimistic that since the financial results bottomed in 2005, the stock is once again moving higher. Time will tell.

NVEC reported terrific earnings, has reasonable valuation, a PEG under 1.0, solid Morningstar.com results, a nice balance sheet, and a very volatile and less-convincing price chart.

Thanks so much for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 28 November 2007

Covestor.com "Home of Great Investors"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your investment advisers prior to making any investment decisions based on information on this website.

I finish many of my blog entries with an invitation for all of you to visit my Covestor Page, and I still extend to all of you that same invitation.

I finish many of my blog entries with an invitation for all of you to visit my Covestor Page, and I still extend to all of you that same invitation.

But in this article, I would like to invite you to visit some of the other great participants on Covestor, many with performances exceeding my own.

Sean Hannon, who blogs on Covestor as epicadv has a phenomenal record on Covestor with an annualized rate of 211.26%! (My own rate is around 21%, not bad but nothing like Sean's). Sean works as an investment advisor at EPIC Advisors, LLC. Kudos to Sean!

Sean Hannon, who blogs on Covestor as epicadv has a phenomenal record on Covestor with an annualized rate of 211.26%! (My own rate is around 21%, not bad but nothing like Sean's). Sean works as an investment advisor at EPIC Advisors, LLC. Kudos to Sean!

Flatwallet (that is the name he goes by) has done a terrific job in his account. He is up 30.81% since inception of his trading account association with Covestor, and has an annualized return of 103.47%. Flatwallet blogs over at "Get Rich or Blowout Tryin!".

Flatwallet (that is the name he goes by) has done a terrific job in his account. He is up 30.81% since inception of his trading account association with Covestor, and has an annualized return of 103.47%. Flatwallet blogs over at "Get Rich or Blowout Tryin!".

Another blogger and a terrific investor is mooney who blogs over at The Gnome of Zurich Investor. Mooney is up 25.10% since his participation with Covestor and has an annualized return of 60.39%.

My point is that you really ought to drop by and visit Covestor! It is not just about me, it is about lots of great people like the bloggers and investors I have discussed above. You can find about what they are buying, and what they are selling. And read their rationales. I sure enjoy my affiliation with Covestor.

p.s. If you are interested in setting up your own account for Covestor, be prepared to allow them to access your actual holdings and be prepared to be analyzed and followed by others. It is great when you are doing well; and can be a challenge when you might be underperforming the market! But I sure enjoy seeing all of the great and enthusiastic people who have signed up on this website strut their stuff!

Bob

Tuesday, 27 November 2007

Mea Culpa "Admitting an Error in Trading!"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I messed up today. I would like to apologize to my readers and to myself. (Can one really apologize to oneself?) In any case I would like to dissect this error a bit. Yesterday I was feeling particularly brilliant about moving into Graham (GHM) Friday and then exiting Monday with a nice gain. And success went right to my head. This is why I have all of these trading rules. I don't do well when I am doing it seat of the pants style.

Even so, I still reserve the right to 'take a chance' on any particular investment as long as the bulk of my entire portfolio is still with my relatively rigid trading rules. But I do not think I shall be doing too much of this when the rest of my portfolio is working just fine.

This is the picture of the 'Oracle at Delphi'. As opposed to the Oracle of Omaha, the Delphi Oracle is thought to be the originator of the phrase "Know Thyself." As related:

This is the picture of the 'Oracle at Delphi'. As opposed to the Oracle of Omaha, the Delphi Oracle is thought to be the originator of the phrase "Know Thyself." As related:

"The best known Delphic injunction was carved into the lintel at the Temple of Apollo: GNOTHI SEAUTON, Know Thyself. These words may have originated in Apollo's response to a question Chilon of Sparta asked: "What is best for man?" The reply, "Know thyself," is similar to the one believed to have been given to the Lydian king, Croesus, when he was told that he must know himself if he would live most happily. Croesus, a man of action and not philosophical, took this to mean that he should know his own strength, know what he wanted, and should rely on his own judgment. Others have found deeper meaning in these words, taking the "self" to mean the higher self, the true Self; to imply that as man is the microcosm of the macrocosm, he who knows himself knows all."

And I am still learning to 'know myself' even after 40 years of investing! I like to believe that I am a good trader, that I can pick a stock that may move higher that day, and then sell it a few moments ago. But frankly, that is a talent and knowledge-base entirely different from my stock-picking strategy. I think I am pretty good at 'picking investments' and really pretty lousy at 'picking trades'. There is a big difference between investing and managing a portfolio and trading stocks over the short-term.

Ironically, both of these two stocks: Graham (GHM) and Bolt (BTJ) share some similar criteria that allowed me to fool myself that since I had done well in one on Monday, I could do well with the other on Tuesday :). What I mean is that both of these companies are involved in the petroleum industry, Bolt in exploration, and Graham in refining. Both are AMEX stocks, both have small cap size with outstanding shares in the single digit millions of shares, and both are stocks that have great Morningstar.com reports and have been subjects of my reviews on this blog.

One big difference.

Momentum.

Isaac Newton expressed this best in his First Law of Motion in 1686 in the "Principia Mathematica Philosophiae Naturalis":

Isaac Newton expressed this best in his First Law of Motion in 1686 in the "Principia Mathematica Philosophiae Naturalis":

"A body continues in a state of rest or uniform motion in a straight line unless made to change that state by forces acting on it."

Graham (GHM) had positive price momentum when I bought it the other day. Bolt (BTJ) didn't. Graham was noted to be on the top % gainers list when I thought of investing in it, Bolt was something I thought about first rather than by evaluating the top gainers. What a world of difference!

So I apologize to all of you for this diversion. As I like to state, I am always learning about the market and yes, I am learning about myself. I tend to work best in a fairly rigid, rule-framed investing situation. I don't do as well just 'shooting from the hip'. There is so much more in picking up stocks for a trade that I really don't understand. For the time being, I shall leave these trades alone (until I break all of my rules once again!)

Anyhow, that's what happened. So today, when the market was moving higher, and virtually every single stock in my regular portfolio participated as they should, my over-sized investment in Bolt (BTJ) brought down my overall portfolio performance to just under break-even. I hope I learned my lesson.

Thanks so much for stopping by and visiting my blog! If you get a chance, you might be interested in listening to my Stock Picks Podcast. Furthermore, to see more about my actual trading portfolio, be sure and visit my Covestor Page. And if you would like to review some of my picks from the past year, be sure and stop by and visit my SocialPicks page.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on my blog or email me at bobsadviceforstocks@lycos.com. Wishing you all a wonderful Tuesday evening and a successful trading week.

Bob

Posted by bobsadviceforstocks at 8:05 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 27 November 2007 8:16 PM CST

Bolt (BTJ) "Trading Transparency"

O.K. I don't have the steel nerves to do these short-term trades! :). I shall try to stick more to my usual plodding style and not get my fingers burnt so quickly. With the market heading higher, Bolt (BTJ) is moving in the opposite direction. With a quick loss developing, I sold 1/2 of my 800 share position to reduce my exposure at $35.6725. Still sitting on the other 400 shares. I shall learn a lesson yet. Do what you know and don't go looking for the quick trade unless you understand the dynamics of the market and the stock! I should have known better on this one!

Bob

Bolt (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor. So please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am probably getting over-confident. So I tried another trade this morning. One of my favorite stocks, Bolt (BTJ) is under-valued from my perspective. So I went ahead and purchased 800 shares of Bolt (BTJ) at $37.3299. With the market rebounding this morning, I thought perchance that this stock might cooperate. It hasn't been technically very strong in the recent trading past.

Wish me luck.

Bob

Monday, 26 November 2007

Graham (GHM) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my 400 shares of Graham (GHM) at $66.1701. This position was not part of my long-term strategy, I have loads of margin, my own 'signals' are directing me to sit on my hands, and it was a nice short-term trade. I still like the stock.

GRAHAM (GHM) IS RATED A BUY

But I am no longer a stock-holder in this great company. I just purchased these shares on 11/23/07 at a cost basis of $62.47, so I had a gain of $3.70/share or 5.9% on my investment.

My sale is not due to my lack of interest in this company. I am concerned about staying within my trading rules, continuing to reduce my margin levels and buying and selling on signals.

Occasionally, I like to 'break all of the rules' and make a trade like this. But thus far, I have undone these trades after a short period of time and returned to my usual disciplined trader mentality. But it is nice to take a quick profit occasionally on a stock like this. I suspect that Graham (GHM) has lots further to go on the upside. But it will have to do it without me.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 25 November 2007

"Looking Back One Year" A review of stock picks from the week of May 22, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The weekend is almost over and I haven't written up my review. Let's take a look at the stocks I posted on this blog during the week of May 22, 2006. Each weekend I try to move ahead a week on this review which is now more like a year-and-a-half out, instead of a year. Last week I reviewed the picks from May 15, 2006.

These reviews assume a buy-and-hold approach to investing with equal dollar sized purchases of each of the stocks reviewed. In reality, I advocate and follow a fairly disciplined buying and selling strategy with my holdings including quick sales on stock declines and partial sales on stock appreciation. This difference in strategy would certainly affect portfolio performance but for the ease of this review, I assume a simple purchase of each stock discussed and an analysis is based on this assumption.

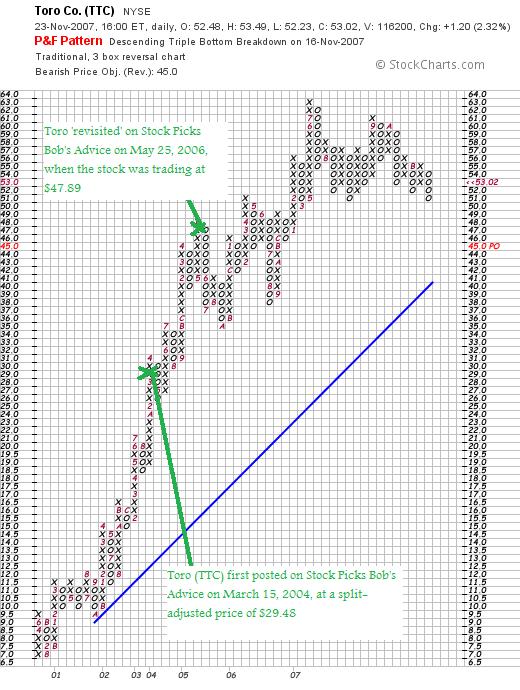

On May 25, 2006, I posted Toro (TTC) as a 'revisit' on Stock Picks Bob's Advice when the stock was trading at $47.89/share. Toro closed at $53.02 on November 23, 2007, for a gain of $5.13 or 10.7% since posting.

On May 25, 2006, I posted Toro (TTC) as a 'revisit' on Stock Picks Bob's Advice when the stock was trading at $47.89/share. Toro closed at $53.02 on November 23, 2007, for a gain of $5.13 or 10.7% since posting.

On August 23, 2007, Toro (TTC) reported 3rd quarter 2007 results. The company reported revenue of $478.7  million, up slightly from revenue of $477.9 million in the same quarter the prior year. Net earnings came in at $42.5 million or $1.02/diluted share, up from $40.3 million or $.91/diluted share the prior year.

million, up slightly from revenue of $477.9 million in the same quarter the prior year. Net earnings came in at $42.5 million or $1.02/diluted share, up from $40.3 million or $.91/diluted share the prior year.

The Morningstar.com "5-Yr Restated" financials page is intact, with steady revenue growth, earnings growth, dividend growth and free cash flow growth. The outstanding shares have been modestly declining and the balance sheet is solid.

TORO (TTC) IS RATED A BUY

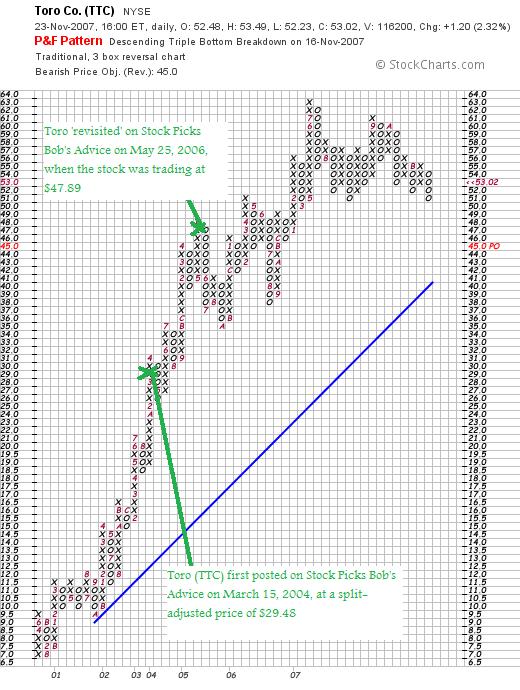

Let's take a look at the 'point & figure' chart from StockCharts.com:

We can see that while the stock price momentum has recently been under pressure, the upward move of this stock is still intact.

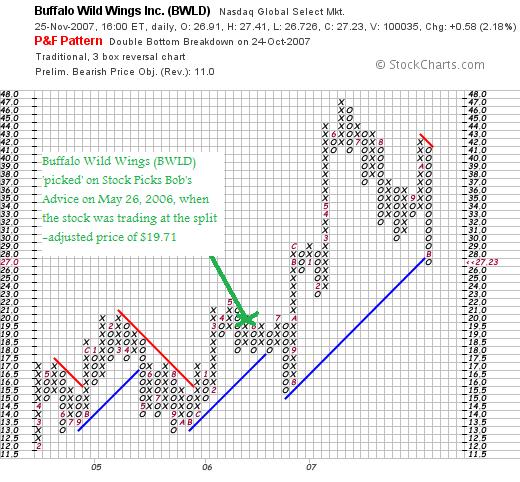

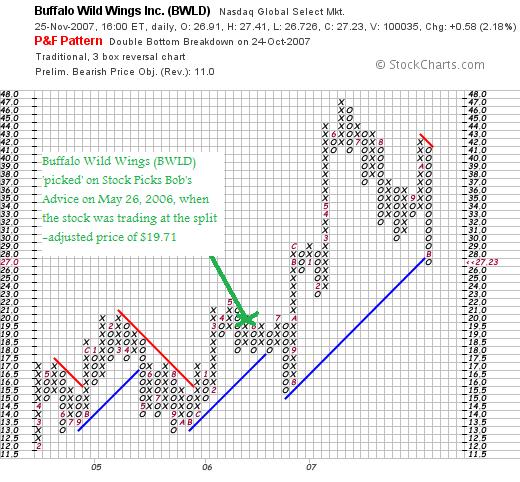

On May 26, 2006, I posted Buffalo Wild Wings (BWLD) on Stock Picks Bob's Advice when the stock was trading at $39.42. On June 18, 2007, BWLD had a 2:1 stock split, making my effective 'pick price' actually $19.71. BWLD closed at $27.23 on November 23, 2007, for a gain of $7.52 or 38.2% since posting.

On May 26, 2006, I posted Buffalo Wild Wings (BWLD) on Stock Picks Bob's Advice when the stock was trading at $39.42. On June 18, 2007, BWLD had a 2:1 stock split, making my effective 'pick price' actually $19.71. BWLD closed at $27.23 on November 23, 2007, for a gain of $7.52 or 38.2% since posting.

On October 30, 2007, Buffalo Wild Wings announced 3rd quarter 2007 results. Total revenue  climbed 20.5% to $82.4 million up from $68.3 million. Same store sales increased 8.3% at company owned restaurants and 5.9% at franchised restaurants. Earnings per share for the quarter came in at $.24/share, up from $.20/share the prior year.

climbed 20.5% to $82.4 million up from $68.3 million. Same store sales increased 8.3% at company owned restaurants and 5.9% at franchised restaurants. Earnings per share for the quarter came in at $.24/share, up from $.20/share the prior year.

Unfortunately, the company missed expectations on earnings which per Thomson Financial had been at $.26/share. However, revenue beat expectations of $81.4 million.

On a positive note, the Morningstar.com "5-Yr Restated" financials page appears intact. The company shows steady revenue growth, earnings growth, and relatively stable outstanding shares since 2004. (up sharply from 5 million to 16 million shares between 2002 and 2004.) Free cash flow is positive and growing and the balance sheet is solid.

BUFFALO WILD WINGS (BWLD) IS RATED A BUY

Let's take a closer look at the 'point & figure' chart on BWLD from StockCharts.com:

We can see in the above chart how the recent correction in the market has been bringing the price of BWLD down. I suspect the latest quarterly report when the company came in a couple of pennies light on estimates of earnings is making a difference in the price movement.

So how did I do with these two stocks? Really not bad. In fact, they both appreciated in price and the average of these two stocks was a gain of 24.5%.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website. Also check out my Covestor Page where Covestor has been analyzing my actual trading portfolio. And my SocialPicks page where all of my many picks from the first of the year have been evaluated.

Have a great week trading and stay well!

Bob

Saturday, 24 November 2007

Bidz.com (BIDZ)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was getting to do the weekend review and I realized I hadn't really picked any stocks this week for the blog :(. So since the market had climbed nicely, I figured there 'must be a pony in there somewhere' and set out to look.

I was getting to do the weekend review and I realized I hadn't really picked any stocks this week for the blog :(. So since the market had climbed nicely, I figured there 'must be a pony in there somewhere' and set out to look.

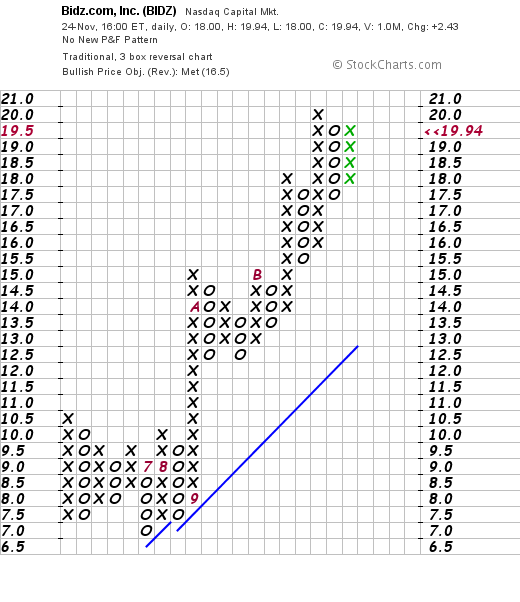

Looking through the list of top % gainers on the NASDAQ I came across BIDZ.com (BIDZ), a jewelry auction website that made the list and appears to deserve a place on this blog. BIDZ closed at $19.94, up $2.43 or 13.88% on the day!

BIDZ.COM (BIDZ) IS RATED A BUY

Let's take a look at this stock and I will explain why I chose this stock from all of the others moving higher yesterday. I do not own any shares nor do I have any options on this stock. And I still am leery of 'dot.com' stocks!

What exactly does this company do?

According to the Yahoo "Profile" on BIDZ, the company

According to the Yahoo "Profile" on BIDZ, the company

"...operates as an online retailer of jewelry primarily in the United States and internationally. The company operates a Web Site, BIDZ.com, for the purpose of selling merchandise, utilizing an online sales auction platform. Its product inventory includes gold, platinum, and silver jewelry set with diamonds, rubies, emeralds, sapphires, and other precious and semi-precious stones; and watches. Its products also include rings, necklaces, earrings, and bracelets."

How did they do in the latest quarter?

On November 12, 2007, BIDZ announced 3rd quarter 2007 results for the quarter ended September 30, 2007. Revenue came in at $40.1 million, up 48% over last year's $27.1 million. Net income for the period came in at $3.6 million or $.14/diluted share, up sharply from the $997,000 or $.04/diluted share reported the prior year.

The company easily beat expectations for the quarter which had been for $.11/share according to Reuters Estimates. In addition. the company raised guidance for the full year 2007 to revenue of $180 to $182 million. Analysts, per Reuters, had been expecting full year revenue of $170 to $180 million.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials on BIDZ, we find that revenue has steadily increased from $35 million in 2002 to $132 million in 2006 and $162 million in the trailing twelve months (TTM).

Earnings have also steadily improved from a loss of $(.40)/share in 2002 to break-even in 2004 to $.10/share in 2005 and $.40/share in the TTM.

Free cash flow has been a little less exciting with $-0- reported in 2004 improving to $1 million in 2006 and $0 million in the TTM. I, of course, would like to see a little positive free cash flow, but at least the company is not burning up its cash like some small companies and the old dot.com stocks.

Looking at the balance sheet, we see a satisfactory picture (imho), with $1 million in cash and $50 million in other current assets, balanced against current liabilities of $32.8 million. There are not long-term liabilities reported on Morningstar.com. This yields a satisfactory current ratio of 1.55.

What about some valuation numbers?

Looking at Yahoo "Key Statistics" on BIDZ, we can see that this is a small cap stock with a market cap of $475.45 million. The trailing p/e is a bit rich at 45.32, with a forward p/e a bit better at 39.88. However, the earnings are growing so quickly that the PEG (5 yr expected) works out to a downright cheap figure of 0.67. (I figure on a PEG of 1.0 to 1.5 being reasonable.)

Utilizing the Fidelity.com eresearch website, we find that the Price/Sales (TTM) ratio works out to 2.89, compared to the industry average of 11.80. In terms of profitability, the Return on Equity (TTM) also looks terrific at 85.81%, compared to an industry average of 16.72%.

Returning to Yahoo, we can see that there are 23.84 million shares outstanding but only 10.96 million that float. As of 10/26/07, there were 912,120 shares out short, resulting in a short ratio of 5.6 I generally use an arbitrary '3 day rule' for the short ratio in determining significance. With this significantly over 3, the stock looks vulnerable to a short squeeze. For me, without any negative news, this may well be a bullish sign.

No cash dividend is paid and no stock splits are reported on Yahoo.

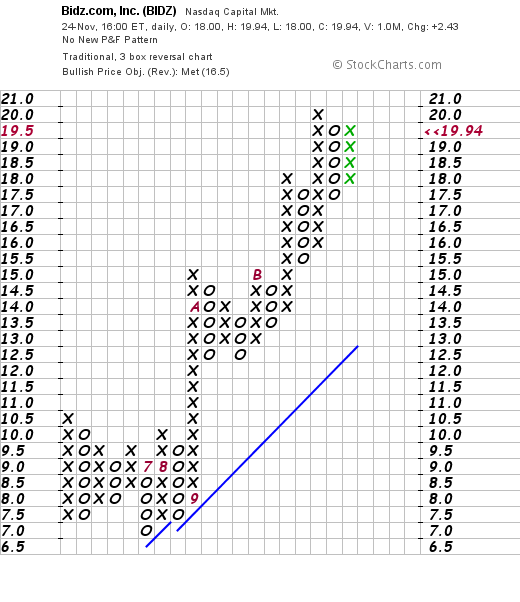

What does the chart look like?

Looking at the "point and figure" chart on BIDZ from StockCharts.com, we can see that while the stock was consolidating between $10.50 and $7.00 between June and July of this year, the stock broke out to the upside in September climbing to $15, pulling back and climbing again higher to $20. The stock is nearing this high and appears to be poised to move higher. The chart looks strong to me.

Summary: What do I think?

Needless to say, I like this stock! Let me review some of the things that piqued my interest (how do you like THAT word!) The stock moved nicely higher yesterday, the latest quarter was strong and the company beat expectations and raised guidance. The longer-term fundamentals look great with steadily improving revenue and earnings while the outstanding shares have remained very stable. Free cash flow could be better but isn't negative, and the balance sheet is solid.

Valuation-wise, the p/e is certainly a bit rich but the PEG is under 1.0, the Price/Sales is lower than the industrial group, and the Return on Equity is higher than its peers.

Finally, there are lots of shares out short, and the chart looks strong. As a final note, I feel some loyalty to the stock as I grew up near Culver City where this company is headquartered in California. I know that's a silly reason, but I like to share with you all of my thinking. And no, I don't know anyone in the management or who owns shares.

A picture of Culver City.

Thanks so much for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast website where you can hear me discuss a few of the stocks on the blog and perhaps listen to me read a poem :). Hey it's my podcast, and I get to do what I like :). I promise not to pull of any heads of syrofoam animals or throw any chairs like my favorite investor/entertainer Jim Cramer!

Also, be sure and visit my Stock Picks Covestor Page where my actual trading portfolio is monitored and evaluated. While you are at it stop by and visit my SocialPicks Page where all of my stock picks are discussed.

Finally, if you are interested in a different kind of investment, one that is not without significant rich, but potentially showing nice returns, consider visiting Prosper.com where you can participate in person-to-person loans in an eBay fashion bidding process where you anonymously enter small portions of a larger loan as a bid and become part of a loaning consortium. I now have about 19 loans outstanding. So far everyone is current and I am earning an average of approximately 15% on my loans. Now of course, there is tremendous risk in these unsecured loans, so do you homework before investing in Prosper. If you sign up before the end of the year and make a loan, you will be credited with $25 (and I will also receive credit for sending you over!)

Have a great weekend everyone! Please feel free to comment here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

Currently I own 103 shares of Harris Corporation (HRS) that have a cost basis of $50.05 having been purchased 1/31/07. HRS closed at $62.77 on November 30, 2007, for an unrealized gain of $12.72 or 25.4% since purchase on these shares. I have sold one portion of my original 120 shares, having sold 17 shares of HRS on 11/7/07 at $65.16. This was at a gain of $15.11 or a gain of 30.02% since purchase. (Reviewing my sale strategy, it is my plan to sell 1/7th of my holdings should any of my stocks hit targets of 30, 60, 90, 120, 180, 240, 300, 360, 450%....etc.)

from $947 million in the same quarter last year. Net income was $100 million or $.73/diluted share, up from $83.9 million or $.60/diluted share in the same period a year ago.

From my perspective, a company that can report great results, beat expectations and raise guidance all at once, is about as strong an earnings report as an investor couple possibly hope for.

I wanted to see if I could briefly write up NVEC once again on this blog. NVE Corporation (NVEC) made the

I wanted to see if I could briefly write up NVEC once again on this blog. NVE Corporation (NVEC) made the  I finish many of my blog entries with an invitation for all of you to visit my

I finish many of my blog entries with an invitation for all of you to visit my  Sean Hannon, who blogs on Covestor as

Sean Hannon, who blogs on Covestor as  Flatwallet

Flatwallet This is the picture of the '

This is the picture of the '

On May 25, 2006, I

On May 25, 2006, I

On May 26, 2006, I

On May 26, 2006, I

I was getting to do the weekend review and I realized I hadn't really picked any stocks this week for the blog :(. So since the market had climbed nicely, I figured there '

I was getting to do the weekend review and I realized I hadn't really picked any stocks this week for the blog :(. So since the market had climbed nicely, I figured there ' According to the

According to the