Stock Picks Bob's Advice

Wednesday, 10 November 2010

Baxter International (BAX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There are many places that I find ideas. Occasionally we have friends that sometimes seem to be wise and actually deserve more credit than we attribute to them in selecting stocks for investments and in general making wise observations about the world.

There are many places that I find ideas. Occasionally we have friends that sometimes seem to be wise and actually deserve more credit than we attribute to them in selecting stocks for investments and in general making wise observations about the world.

My good friend Dennis C. is a neonatal specialist that I know who I run into during the course of my own work. I have learned that when Dennis talks, I reall ought to listen. (with my apologies to E. F. Hutton!) I promised Dennis that I would certainly take a look at Baxter (BAX) and indeed I liked what I saw and wanted to get around to sharing it with all of you here on this blog. I do not currently own any shares of Baxter but family members of mine do own some shares at this time. Baxter (BAX) closed at $51.90 on 11/10/10, up $.23 or .45% on the day.

Years ago I owned shares of Baxter Travenol, the parent company of Baxter. I found a fascinating summary of the history of this company:

"In 1931, physicians Donald Baxter of Los Angeles and Ralph Falk of Boise, Idaho, started the Don Baxter Intravenous Products Corp., which made supplies for IV systems in hospitals. In 1933, Baxter started a manufacturing plant in Glenview. A pioneer in blood preservation methods as well as IV supplies, Baxter grew steadily. In 1947, it moved its headquarters to Morton Grove; the company soon employed over 500 people in the Chicago area. Annual sales grew from about $10 million in the mid-1950s to more than $100 million by 1967, when the company was making dialysis equipment, heart-lung machines, and many other equipment items for hospitals. In 1975, when it employed about 2,200 in the Chicago area, the company moved its headquarters to suburban Glenview; the following year, its name changed to Baxter Travenol Laboratories. The company grew rapidly thereafter. In 1985, when annual sales stood at about $2 billion, Baxter bought the American Hospital Supply Corp., an even larger Chicago-area medical supply company. The new company, which in 1988 became Baxter International Inc., was an enormous entity that soon approached $10 billion in annual sales; about 10,000 of its 50,000 employees worldwide were in the Chicago area. During the 1990s, however, Baxter sold off several divisions, including many of the old American Hospital Supply Corp. operations"

"In 1931, physicians Donald Baxter of Los Angeles and Ralph Falk of Boise, Idaho, started the Don Baxter Intravenous Products Corp., which made supplies for IV systems in hospitals. In 1933, Baxter started a manufacturing plant in Glenview. A pioneer in blood preservation methods as well as IV supplies, Baxter grew steadily. In 1947, it moved its headquarters to Morton Grove; the company soon employed over 500 people in the Chicago area. Annual sales grew from about $10 million in the mid-1950s to more than $100 million by 1967, when the company was making dialysis equipment, heart-lung machines, and many other equipment items for hospitals. In 1975, when it employed about 2,200 in the Chicago area, the company moved its headquarters to suburban Glenview; the following year, its name changed to Baxter Travenol Laboratories. The company grew rapidly thereafter. In 1985, when annual sales stood at about $2 billion, Baxter bought the American Hospital Supply Corp., an even larger Chicago-area medical supply company. The new company, which in 1988 became Baxter International Inc., was an enormous entity that soon approached $10 billion in annual sales; about 10,000 of its 50,000 employees worldwide were in the Chicago area. During the 1990s, however, Baxter sold off several divisions, including many of the old American Hospital Supply Corp. operations"

But what about Baxter International (BAX) today?

The company still makes intravenous equipment but now has become a major plasma product company as well as dialysis product supplier. According to the Yahoo "Profile" on BAX, the company

"...through its subsidiaries, develops, manufactures, and markets products for people with hemophilia, immune disorders, infectious diseases, kidney disease, trauma, and other chronic and acute medical conditions. It operates in three segments: BioScience, Medication Delivery, and Renal."

On October 21, 2010, Baxter (BAX) reported 3rd quarter results. In the third quarter the company had net earnings of $594 million or $1.01/share, up from $532 million or $.87/share in the same quarter the prior year. Analysts had been expecting $.97/share according to Thomson Reuters, thus the company exceeded expectations on earnings during the quarter.

Sales for the quarter rose 3% to $3.2 billion. The company also went ahead and raised guidance with sales growth in 2010 at 2-3% from prior guidance of 1-3%, and earnings of $3.96 to $3.98/share ahead of the prior quarter's guidance for 2010 of $3.93 to $3.98/share.

Shortly after this earnings report, The Motley Fool released a nice review of Baxter asking the quaestion, "Is Baxter International the Perfect Stock?". They didn't actually think that Baxter was perfect, but "it's a decent play for conservative investors" according to The Fool.

Just yesterday (November 9, 2010), Baxter announced that it would be raising its quarterly dividend from $.29/share to $.31/share.

Longer-term, looking at the Morningstar "5-Yr Financials", we can see that revenue has increased steadily from $9.8 billion in 2005 to $12.8 billion in the trailing twelve months (TTM). Earnings, however, while increasing from $1.52/share in 2005 peaked at $3.59/share in 2009, but dipped to $2.61/share in the TTM. Average shares increased from 629 million in 2005 to 656 million in 2006 but since then has decreased with share buy-backs from that level to 654 million in 2007 and to 601 million in the TTM.

The company according to Morningstar has total current assets of $8.27 billion and total current liabilities of $4.46 billion, yielding a current ratio of 1.85. I appreciate seeing this ratio above 1.5 in terms of expressing the company's ability to pay off liabilities in the immediate future.

Free cash flow as reported by Morningstar, has increased steadily from $1.1 billion in 2005 to $2.9 billion in 2009 and $3.05 billion in the TTM.

In terms of valuation, we can review the "Key Statistics" on BAX from Yahoo where we find that this is a large cap stock with a market capitalization of $30.33 Billion. The trailing p/e is reported at 19.02 with a forward p/e (fye Dec 31, 2011) of 12.24. The PEG Ratio (5 yr expected) works out to an acceptable 1.40.

Yahoo reports 584.37 million shares outstanding with 583.23 million of those shares that float. Currently, as of 10/15/10, there were 8.11 million shares out short representing a short interest ratio of 1.9 trading days, well under my own 3 day level of significance. The company pays a forward annual dividend rate of $1.24 with a forward yield of 2.39%. The company has a payout ratio of 44% suggesting adequate room to pay and increase its dividend in the future. The last stock split was a 2:1 stock split back in May, 2001.

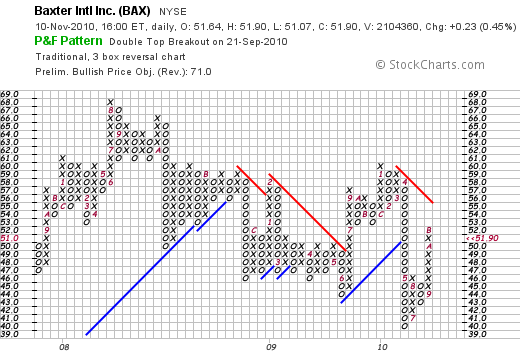

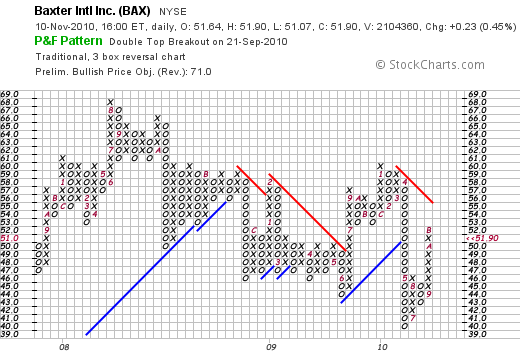

If we review the 'point & figure' chart on Baxter International (BAX) we see that the stock has actually been trading sideways for the past 3 years in the $40 to $67 range. The company recently broke through support and is moving up towards a resistance level of $55. Technically, from my amateur perspective, I would like to see this stock break through this resistance level and create a new support line to confirm its move to the upside. Certainly the stock chart does not appear over-extended.

To summarize, Baxter International (BAX) has reported strong earnings that beat expectations and the company recently raised guidance as well as announced an increased dividend payment. Valuation appears reasonable and the company has been buying back shares while producing increasing free cash flow and growing revenue. Earnings the past five years have not been as consistent but appear to be back on track.

With our aging population dealing with an ever-increasing number of diabetic patients we may well need to prepare for a growing kidney disease problem which can result in dialysis. Combined with increasing access to medical care with likely continuing healthcare reform worldwide may mean more business for Baxter with basic medical products like I.V. devices to more complex products such as plasma products and dialysis supplies.

The stock appears to be very reasonably valued and if anything we are early in the price appreciation of this company which has moved little since late 2007.

If you have any comments or questions, please feel free to leave your comments or questions right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 14 October 2010

International Business Machines (IBM)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I look through the many lists of stocks making the news, it occurred to me that I hadn't looked recently at "Big Blue", International Business Machines (IBM). As I write (10/14/10), IBM is trading at $141.30, up $.88 or .63% on the day. I do not own any shares of IBM.

International Business Machines (IBM) is a company that I have personally been familiar with for many years. Back in 1971 as a high school student I took my first programming classes working with Fortran IV. After high school, my first sumer job was with Petersen Publishing Company in L.A. working as a keypuncher on a keypunching machine typing out endless articles for magazines like Guns & Ammo and Wheels Afield. But that was a long time ago :).

Frankly, as soon as the Macintosh from Apple (AAPL) arrived, I was sold on the quirky alternative from Cupertino. Unfortunately I never bought any of those shares either! Even today, Apple (AAPL) is one of the most 'popular' of investments and its performance has been stellar. But IBM has been a quiet giant of a company and deserves more attention even today.

Let me stop reminiscing for a bit and spend a little time sharing with you my thoughts on IBM.

According to the Yahoo "Profile" on International Business Machines (IBM), the company

"..develops and manufactures information technology (IT) products and services worldwide."

IBM has reinvented itself many times moving further from the 'big box  computers' I remember and more into the integration of hardware and software and servicing of these products. This article describes some of the recent developments in this business transformation.

computers' I remember and more into the integration of hardware and software and servicing of these products. This article describes some of the recent developments in this business transformation.

But let's talk about basic stuff like earnings and revenue performance for this major company. IBM is scheduled to release 3rd quarter 2010 results on October 18, 2010. As this article relates, IBM has had a very strong month climbing to an all-time high:

"The shares' moves in recent weeks have had some outside help, in particular positive quarterly results from an IBM competitor, the Accenture PLC consulting firm, and strong commentary about the corporate server buying from Intel Corp., the world's biggest maker of microprocessors."

Current expectations are for net income of $2.75/share on revenue of $24.12 billion per Thomson Reuters analysts. This would " mark the 31st straight quarter in which IBM has posted higher earnings than the year before." Pretty amazing stuff but also driven by cost-cutting and stock repurchases as the article points out.

On July 19, 2010, IBM reported their 2nd quarter 2010 results. Net income for the 2nd quarter came in at $2.61/share ahead of expectations of $2.58/share. Revenue, however, came in a bit light at $23.7 billion behind analysts' view of $24.17 billion for the quarter. Net income for the quarter was $3.4 billion up 9% from the prior year. Even though the company missed revenue expectations that quarter they did raise guidance for 2010 to $11.25/share (but analysts had expected even higher guidance). With expectations doused the stock experienced a short-term price pull back on that news announcement making the current quarter expectations even more significant.

Reviewing the Morningstar.com "Financials" on International Business Machines (IBM), we can see that revenue came in at $91.1 billion in 2005, peaked at $103.6 billion in 2008, before retreating to $95.8 billion in 2009. Even with this dip in revenue, net income has steadily increased from $7.9 billion in 2005 to $13.4 billion in 2009. On a per share basis this was an increase from $4.87/share in 2005 to $10.01/share in 2009. Due to share buy-backs, outstanding shares dipped from 1.6 billion in 2005 to 1.34 billion in 2009.

Free cash flow as reported on Morningstar, dipped from $11.1 billion in 2005 to $9.8 billion in 2006 only to turn around and steadily increase to $17.3 billion in 2010

In terms of valuation, looking at the Yahoo "Key Statistics" on IBM, we see that this is a very large cap stock with a market capitalization of $177 billion. (Mega Cap Stocks have been defined as market capitalization in excess of $200 billion). Yahoo reports them with a trailing p/e of 13.32 and a forward (fye Dec 31 2011) p/e of 11.39. Valuation appears reasonable with a PEG (5 yr expected) of 1.06.

Yahoo reports 1.26 billion shares outstanding with a similar float. As of September 15, 2010, there were 15.84 million shares out short with a short ratio of 3.20 slightly ahead of my own arbitrary 3 day rule for significance. The company pays an annual 'forward' dividend of $2.60 with a forward yield of 1.90%. The payout ratio of 22% suggests that this is well-covered with room for increases. The last stock split was a 2:1 split back in May, 1999.

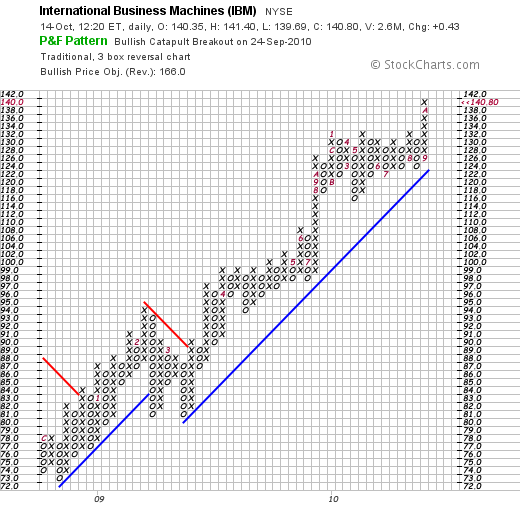

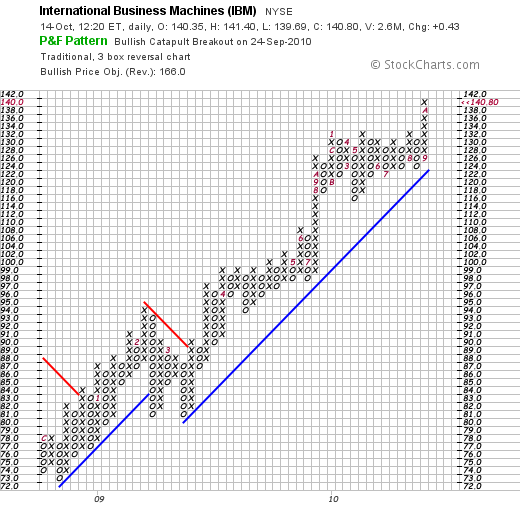

Quite frankly what drew me to looking at IBM in the first place was the incredible price chart that quietly was moving steadily higher. If we review the 'point & figure' chart on IBM from StockCharts.com, we can see the phenomenal price move from $73 in December, 2008, to its current price at $140 in October, 2010. Almost without even a blink, this stock has charged strongly and quietly higher.

Clearly much has changed at 'big blue' since Louis Gerstner arrived in 1993 from RJF Nabisco to take IBM from financial challenges and help transform this company into the high tech powerhouse that it is today. So while I have been an Apple (AAPL) fan for many years and do not begrudge Apple anything for its phenomenal success, IBM is worth another look. Let's see what the earnings report next week shall bring, but this company appears to be executing in a rather impressive fashion!

Thanks again for stopping by and visiting my blog. I apologize for my paucity of posts but shall continue to blog here as much as time and opportunity allows. If you have any comments or questions, please feel to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Saturday, 28 August 2010

Colgate-Palmolive (CL)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wrote in the previous entry how my shares of McDonald's (MCD) had appreciated 30% since my purchase triggering a partial sale and a 'trading signal' to add a new holding to my own portfolio. I did this and purchased shares of Colgate-Palmolive (CL). Just catching up with this purchase, I wanted to share with you a few thoughts about this company.

I wrote in the previous entry how my shares of McDonald's (MCD) had appreciated 30% since my purchase triggering a partial sale and a 'trading signal' to add a new holding to my own portfolio. I did this and purchased shares of Colgate-Palmolive (CL). Just catching up with this purchase, I wanted to share with you a few thoughts about this company.

Probably like you I am uncertain about the health of our economy over the intermediate term. I tend to agree with Paul Krugman that the economic stimulus advanced by the Obama administration wasn't big enough. I am also concerned about our level of debt and the size of government but my own basic Economics education has convinced me that Keynes was right 'enough' that austerity right now is absolutely the wrong time to be cutting back.

I think the bail-out of GM, the TARP funds, the financial re-regulation is all medicine indicated for the illness this patient is facing. It disappoints me that in this difficult time of high unemployment, increasing disparity of wealth, and global financial stress that our Republicans in office do not give the newly elected President a chance and instead obstruct at every turn.

OK enough politics. Many of you who are my friends probably know that I love politics almost as much as I enjoy investing!

Let's talk Colgate (CL).

According to the Yahoo "Profile" on Colgate-Palmolive (CL), this company

"....together with its subsidiaries, manufactures and markets consumer products worldwide. It offers oral care products including toothpaste, toothbrushes, and mouth rinses, as well as dental floss and pharmaceutical products for dentists and other oral health professionals; personal care products, such as liquid hand soap, shower gels, bar soaps, deodorants, antiperspirants, shampoos, and conditioners; and home care products comprising laundry detergents, dishwashing liquids and detergents, household cleaners, and oil soaps, as well as fabric conditioners."

"....together with its subsidiaries, manufactures and markets consumer products worldwide. It offers oral care products including toothpaste, toothbrushes, and mouth rinses, as well as dental floss and pharmaceutical products for dentists and other oral health professionals; personal care products, such as liquid hand soap, shower gels, bar soaps, deodorants, antiperspirants, shampoos, and conditioners; and home care products comprising laundry detergents, dishwashing liquids and detergents, household cleaners, and oil soaps, as well as fabric conditioners."

While I purchased shares of Colgate (CL) as a 'comfort stock' their quarterly report on July 29, 2010, was less than stellar. Colgate reported earning $603 million or $1.17/share in the quarter ended in June, 2010. Those results are up from $562 million in earnings or $1.07/share in the prior year same period. The company beat expectations on earnings as analysts had been expecting $1.16/share but revenue came in light as analysts had been expecting $3.94 billion in revenue. Some of the problems came in from Venezuela where currency devaluation affected results.

Morningstar.com allows us a longer-term perspective on Colgate-Palmolive. We can see that revenue has grown steadily from $11.4 billion in 2005 to $15.330 billion in 2008 with a slight dip to $15.327 billion in 2009. Net income has grown uninterruptedly from $1.35 billion in 2005 to $2.29 billion in 2009. Diluted earnings have also increased without interruption from $2.43/share in 2005 to $4.37/share in 2009.

Free cash flow for CL has increased from $1.39 billion in 2005 to $2.70 billion in 2009. Most recent balance sheet numbes show $3.8 billion in total current assets compared to $3.60 billion in total current liabilities. The company also has $4.42 billion in long-term liabilities reported.

Looking at Yahoo "Key Statistics" on Colgate-Palmolive (CL), we can see that this is a large cap stock with a market capitalization of $36.09 billion. The stock has a trailing p/e of 17.71 with a forward p/e (fye Dec 31, 2011) estimated at 14.22. The PEG ratio is a bit rich at 1.69.

Yahoo reports 486 million shares outstanding with 483.37 million that float. As of August 13, 2010, there were 5 million shares out short representing a short ratio of only 1.40. The forward annual dividend is $2.12 working out to a 2.8% yield. The dividend is well covered with a 44% payout ratio. The last stock split was July 1, 1999, when the stock was split 2:1.

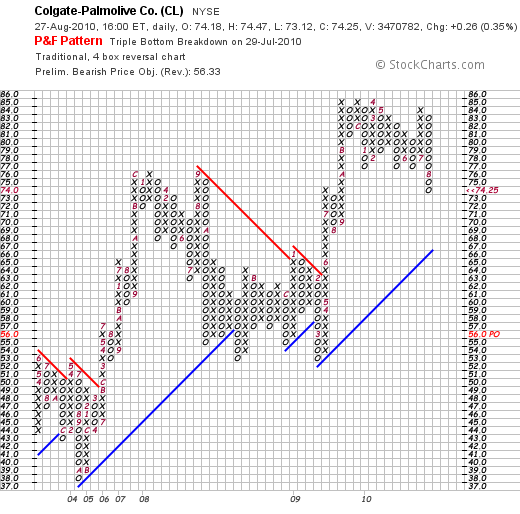

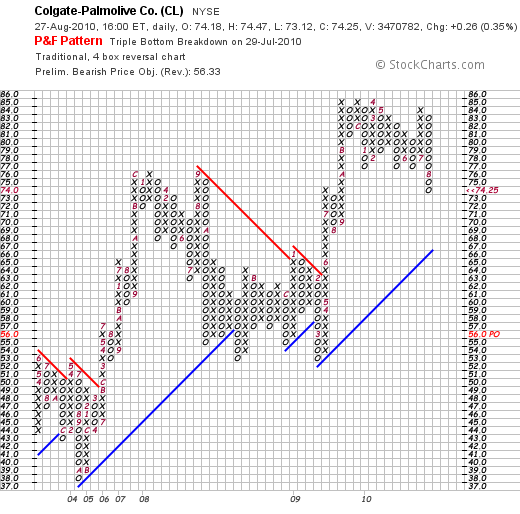

In terms of the technical performance of this stock, if we examine the 'point & figure' chart on Colgate-Palmolive (CL) from StockCharts.com, we can see that looking a little longer-term, CL has traded from a low of $37 back in October, 2004, to a high of $85 in August, 2009. Currently correcting from another pass at the $85 level in July, 2010, the stock has pulled back rather sharply to its current price of $74.25. While short-term a bit weak, longer-term, the trend appears higher.

In summary, I am aware of the difficult times we find ourselves living in, investing in, and even dealing with the politics of the 'cure'. Long-term, I am every bit as bullish on America as Kudlow. But right now, I need a comfort stock. A stock I have grown up with that I use to brush my teeth, clean my dishes, and even shampoo my hair. Colgate is a long-term winner as the rest of the world advances and starts increasingly demand consumer products that Colgate is prepared to deliver.

Long-term, Colgate "has paid uninterrupted dividends on its common stock since 1895 and increased payments to common shareholders every year for 47 years." A very blue blue-chip stock indeed!

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 19 August 2010

Colgate Palmolive (CL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website

As part of my strategy of managing my portfolio, I have chosen to sell a small portion of my own holdings as they appreciate to targeted price levels. After an initial purchase, I sell 1/7th of my holding, if it appreciates to a 30% gain from my purchase price. After a sale of a portion of a holding at a gain, I use this action as a 'signal' to indicate to me that the health of the market is reasonable for a new purchase of stock.

As part of my strategy of managing my portfolio, I have chosen to sell a small portion of my own holdings as they appreciate to targeted price levels. After an initial purchase, I sell 1/7th of my holding, if it appreciates to a 30% gain from my purchase price. After a sale of a portion of a holding at a gain, I use this action as a 'signal' to indicate to me that the health of the market is reasonable for a new purchase of stock.

On August 18, 2010, my McDonald's (MCD) shares reached $73.51 and I sold 1/7th of my holding, 7 shares, at $73.51. These shares had been acquired September 23, 2009, at a cost basis of $56.39/share. Thus I had a gain of $17.12 or 30.4% since purchase. I still own 45 shars of MCD in my own portfolio after this sale.

Being under my maximum of 20 holdings, and with this 'permission slip' in hand, I went ahead and44 shares of Colgate Palmolive (CL) at $76.97/share. The size of this purchase was dictated by my own  calculation of 125% of the average size of the remaining holdings.

calculation of 125% of the average size of the remaining holdings.

CL has long been a favorite of mine, and along with its dividend and the incredible stability of its product mix, I chose to add it into my portfolio. I shall write up a little more about Colgate Palmolive (CL) and why I chose to add it to my portfolio in the near future.

Yours in investing,

Bob

Sunday, 15 August 2010

Medtronic (MDT) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

In the difficult market that we find ourselves, I also find it difficult to highlight new stocks that I find appropriate to include in this blog and possibly in my own portfolio. Picking up an old copy of "100 Best Stocks to own in America" by Gene Walden (7th edition), (which you can pick up here on Amazon), I opened up the page on Medtronic (MDT) and thought it might be worthwhile to revisit this stock. (Even though Walden's classic is nearly 10 years old, I still find inspiration in his philosophy and discipline.)

I last wrote up Medtronic (MDT) on Stock Picks on November 29, 2009. At this time, I do not own any shares of this stock. Medtronic (MDT) closed at $35.57 on August 13, 2010, down $(.42) on the day.

According to the Yahoo "Profile" on Medtronic (MDT), the company

According to the Yahoo "Profile" on Medtronic (MDT), the company

"...manufactures, and sells device-based medical therapies worldwide. Its Cardiac Rhythm Disease Management segment offers cardiac pacemakers, implantable defibrillators, cardiac resynchronization therapy devices, atrial fibrillation products, leads, ablation products, electrophysiology catheters, information systems, diagnostics and monitoring products, and patient management tools. The company’s Spinal segment offers thoracolumbar, cervical, and interbody spinal devices; bone growth substitutes; and devices for vertebral compression fractures and spinal stenosis. Its CardioVascular segment offers coronary and peripheral stents and related delivery systems, endovascular stent graft systems, distal embolic protection systems, perfusion systems, positioning and stabilization systems, products for the repair and replacement of heart valves, and surgical ablation products, as well as balloon angioplasty catheters, guide catheters, guidewires, diagnostic catheters, and accessories. The company’s Neuromodulation segment offers neurostimulators, implantable drug delivery systems, deep brain stimulation systems, and urology and gastroenterology devices. Its Diabetes segment offers external insulin pumps, continuous glucose monitors, carelink therapy management software, and blood glucose meters. The company’s Surgical Technologies segment offers tissue-removal systems, surgical drill systems, fluid-control products, cranial fixation devices, nerve monitoring systems, image-guided surgery systems, intra-operative imaging systems, a Ménière’s disease therapy device, and a portfolio of products to treat benign snoring and obstructive sleep apnea."

To summarize, they are involved in medical devices that treat heart rhythm, treatment, spinal, CNS, diabetic, and surgical and sleep apnea problems.

Medtronic has announced that it will be reporting on 1st quarter 2011 results on August 24, 2010. They recently announced their completed acquisition of ATS Medical for $370 million expanding their cardiac surgical and diagnostic line of products. Since the 4th quarter report, Medtronic announced a dividend increase of 9% from $.205/share to $.225/share.

On May 25, 2010, Medtronic (MDT) reported 4th quarter 2010 results with revenue growth of 10% from $3.8 billion in the year earlier perior to $4.2 billion this quarter. Analysts had expected $4.19 billion in revenue. Net income rose to $954 million or $.86/share in quarter ended April 30, 2010, up from $103 million or $.09/share the prior year. Adjusted earnings came in at $.89/share, a penny ahead of estimates.

On May 25, 2010, Medtronic (MDT) reported 4th quarter 2010 results with revenue growth of 10% from $3.8 billion in the year earlier perior to $4.2 billion this quarter. Analysts had expected $4.19 billion in revenue. Net income rose to $954 million or $.86/share in quarter ended April 30, 2010, up from $103 million or $.09/share the prior year. Adjusted earnings came in at $.89/share, a penny ahead of estimates.

Longer-term, checking the Morningstar Financials on MDT, we can see that revenue has increased from $11.3 billion in 2006 to $15.8 billion in 2010. Net income has increased from $2.5 billion in 2006 to $3.1 billion in 2010 after a dip in both 2008 and 2009, results rebounded in 2010.

Earnings per share similarly climbed from $2.09/share in 2006 to $2.41/share in 2007, before dipping to $1.95 in 2008 and $1.93 in 2009. Earnings rebounded to $2.79/share in 2010. Outstanding shares have gradually dipped from 1.2 billion in 2006 to 1.1 billion in 2010.

Free cash flow has been strong with $963 million reported in 2006 increasing steadily to $3.56 billion in 2010.

Medtronic's balance sheet appears solid with latest Morningstar results showing $9.8 billion in current assets in 2010 with total current liabilities reported at $5.12 billion. Non-current liabilities are recorded at $8.3 billion.

Checking the Yahoo "Key Statistics" on Medtronic (MDT), we can see that this stock is a large cap stock with a market capitalization of $38.52 billion. The company has a very modest p/e of 12.74 with a forward p/e (fye Apr 30, 2012) of 9.34 with a resultant PEG (5 Yr Expected) of 1.05.

The company has 1.08 billion shares outstanding. As of July 30, 2010, there were 11.46 million shares out short representing a short ratio of only 1.90. The company currently pays a forward dividend of $.90/share with a forward yield of 2.5%. The payout ratio is only 29% suggesting ample room for dividend payment and growth.

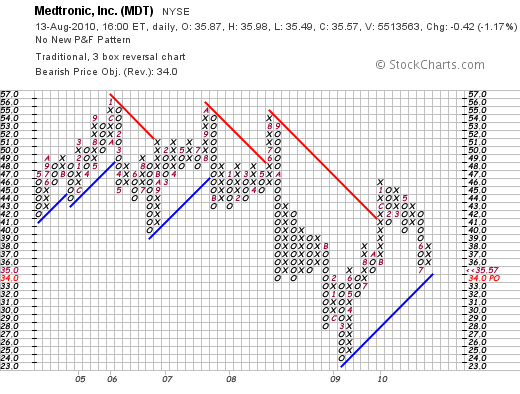

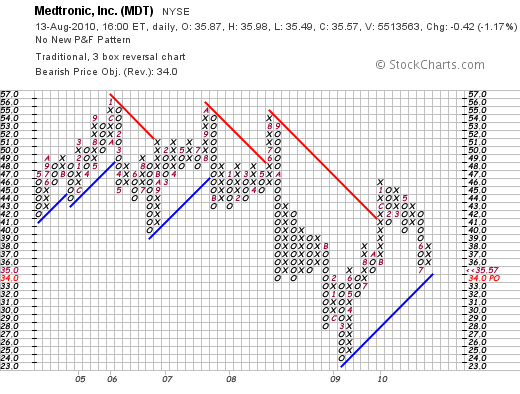

If we examine the "point & figure" chart on Medtronic from StockCharts.com, we can see that the share price broke down from a high of $54 in August, 2008, to a low of $24 in February, 2009, before moving higher through resistance at $41. After a recent peak at $47 in January, 2010, the stock has sold off testing its recent support levels at $35. Overall, the stock appears to be nominally in an uptrend and certainly not over-extended.

In conclusion, Medtronic (MDT) is an old favorite of mine that represents excellent value with a p/e just over 12, a PEG just over 1.0 and a dividend yield of 2.5%. The company reported 2010 results that reversed a two-year slide in earnings and revenue growth. However, they are set to report earnings once again in next ten days.

As we look for 'safe' places to park our investment money, Medtronic may well represent the value and long-term prospects that make this a timely investment.

Thank you again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 11 August 2010

Thanks to Fred Wilson!

Hello Friends! Instead of listing the usual disclaimer, I would like to publicly thank Fred Wilson for his kind comments on AVC "musings of a VC in NYC".

Fred is a Venture Capitalist who has invested in and organized investments in a multitude of new organizations including Twitter, Covestor, and foursquare, three of the internet enterprises that occupy a great deal of my own time! Through Union Square Ventures, he has been a powerful influence on social media and social investing websites. Thank you for all you do Fred!

Fred is a Venture Capitalist who has invested in and organized investments in a multitude of new organizations including Twitter, Covestor, and foursquare, three of the internet enterprises that occupy a great deal of my own time! Through Union Square Ventures, he has been a powerful influence on social media and social investing websites. Thank you for all you do Fred!

Fred was kind enough to discuss my own activity with Covestor. (Here is the link to my Covestor page.) Covestor has allowed me to monitor and evaluate my own trading activity and performance and to allow me to share this information with all of you my readers. In addition, if you are so inclined, Covestor allows individuals to shadow fellow investors with portfolios that seek to duplicate the activity of model managers. Visit Covestor to find out more.

We live in very difficult investing times and indeed difficult times even for Venture Capitalists. I shall continue to work to share with you my ideas and rationales for each of the decisions I make as I try to learn along with all of you how to deal with financial markets that can climb 2% one day only to dip 3% the next. Steadiness and consistency are key as well as continued evaluation of the information, assumption, and actual performance that results from any given strategy.

Thank you all for visiting and participating with me on this journey.

If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 8 August 2010

PerkinElmer, Inc. (PKI)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Before I get on with my entry about PerkinElmer (PKI), I would like to share with you a special new place on my travel list, Dickey Farms. I just came back from a trip to Atlanta, with a side-stop to visit cousins in Macon, Georgia, who were kind enough to take me to Musella, Georgia to try some famous Georgia Peaches with attention to the soft-serve peach ice cream!

OK I also enjoyed some samples of the peach bread, some fresh free-stone peaches, and drooled over the fried peach pies, peach fritters, peach preserves, and everything peach.

I took this picture this weekend of a couple of the people at Dickey's who help make it all possible. If you stop by, tell them Bob sent you!

I haven't been very active in the trading department as none of my stocks have hit sales on the downside or upside. Unfortunately, the street was very disappointed with Church & Dwight (CHD) which reported 2nd quarter results that while beating expectations, the company forecast profit margins under pressure. On the upside, McDonald's (MCD) continued to show strength even as the economy showed new weakness threatening a double-dip recovery.

Returning to my usual haunts in the top % gainers lists, I came across PerkinElmer, Inc. (PKI) which closed at $22.29 on August 6, 2010, up $2.24 or 11.17% on the day. I do not own any shares of this stock.

Returning to my usual haunts in the top % gainers lists, I came across PerkinElmer, Inc. (PKI) which closed at $22.29 on August 6, 2010, up $2.24 or 11.17% on the day. I do not own any shares of this stock.

PKI moved higher on the back of 2nd quarter earnings that came in at $42.6 million or $.46/share compared with $38.2 million or $.20/share the prior year same period. Sales climbed 14% to $497.8 million. Adjusted earnings came in at $.38/share, ahead of the $.33/share estimate.

PerkinElmer went ahead and raised guidance for the full-year to $1.49 to $1.54/share from prior guidance of $1.43 to $1.48/share ahead of analysts who have been expecting $1.46/share.

The outstanding results led Robert W. Baird analyst Quintin Lai to comment:

"PerkinElmer expects high single-digit organic revenue growth in second-half 2010 with contributions from both human health and environmental health segments," he wrote. Lai rates the stock at "Outperform" with a price target of $29 per share."

According to the Yahoo "Profile" on PerkinElmer (PKI), the company

"...provides technology, services, and solutions to the diagnostics, research, environmental, safety and security, industrial and laboratory services markets. PerkinElmer has the portfolios of functional cellular science research technologies, as well as GPCR and kinase products used in researching approximately 75% of drug pathways. The company operates through two segments, Human Health and Environmental Health."

"...provides technology, services, and solutions to the diagnostics, research, environmental, safety and security, industrial and laboratory services markets. PerkinElmer has the portfolios of functional cellular science research technologies, as well as GPCR and kinase products used in researching approximately 75% of drug pathways. The company operates through two segments, Human Health and Environmental Health."

Looking longer-term at the Morningstar.com "Financials" on PerkinElmer (PKI), we can see that revenue has grown from $1.47 billion in 2005 to $1.94 billion in 2008 before dipping to $1.81 billion in 2009.

PKI has struggled with net income which dipped from $268 million in 2005 to as low as $86 million in 2009. Similarly diluted earnings per share have dipped from $2.04 in 2005 to $.73/share in 2009.

Reviewing the Morningstar information regarding their balance sheet, we can see that the company has current assets of $884 million, easily covering the total current liabilities of $496 million. Total non-current liabilities totals $939 million. The company generated $117 million in free cash flow in 2009 down slightly from the $175 million in free cash flow the prior year.

In terms of valuation, the Yahoo "Key Statistics" on PKI reveal that the market capitalization of $2.63 billion makes this company a mid cap stock. The trailing p/e is a relatively rich 26.22. However, the forward p/e is a reasonable 13.19 (fye Jan 3, 2012), with a PEG (5 yr estimated) even more reasonable at 1.09.

The company has 117.81 million shares outstanding with a float of 116.44 million. As of July 15, 2010, there were 1.73 million shares out short with a modest short ratio of only 1.0.

The company pays a forward annual dividend rate of $.28/share yielding an anticipated 1.4% based on the current price. The last stock split was a 2:1 back on June 4, 2001.

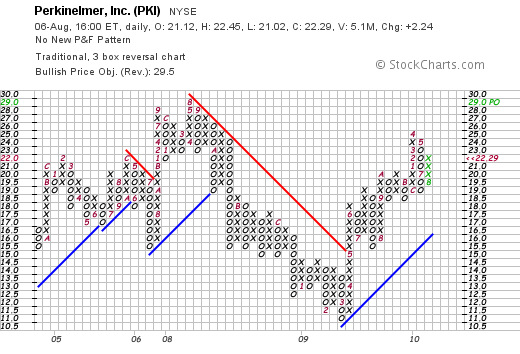

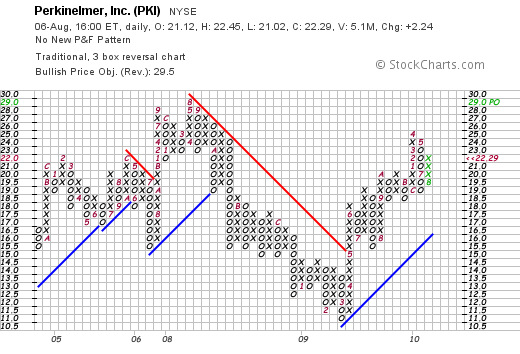

Technically, the 'point & figure' chart from StockCharts.com is encouraging. This stock peaked back in June, 2008, at the $29 level, dipped as low as $11.00 in March, 2009, before rallying back, breaking through resistance at $15 and moving to the current $22.29 level, below the recent high of $25 set in April, 2010.

In summary, PerkinElmers (PKI) appears to be firing on all cylinders after several years of relatively mediocre financial performance. They reported a strong quarter in both of their business segments that beat expectations. They also went ahead and raised guidance for the year. The stock appears to be reasonably priced, pays a small dividend, and has a nice chart to boot! This is the kind of stock that I might consider buying for my own portfolio if the right buy signal could be recorded. Meanwhile, I shall add it to my burgeoning list of appealing stocks on this blog!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 25 July 2010

Informatica Corporation (INFA)

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur so please remember to always consult with your professional investment advisers prior to making any investment decisions based on the information on this website.

With the difficult stock market environment that we have experienced recently, you may have observed and I have written about my move towards 'value' rather than 'growth' investing. I have selected stocks for my own portfolio as well as for this blog to discuss that are what I would call investment 'stalwarts' that are reasonably priced, pay good dividends, and can weather the vagaries of the economy. You have seen me discuss stocks such as Coca-Cola (KO), Sysco (SYY) and McDonald's (MCD). These are certainly terrific companies but I want to try with this post to tip-toe back towards the original intent of this blog, to discuss those companies with steady revenue and earnings growth.

With the difficult stock market environment that we have experienced recently, you may have observed and I have written about my move towards 'value' rather than 'growth' investing. I have selected stocks for my own portfolio as well as for this blog to discuss that are what I would call investment 'stalwarts' that are reasonably priced, pay good dividends, and can weather the vagaries of the economy. You have seen me discuss stocks such as Coca-Cola (KO), Sysco (SYY) and McDonald's (MCD). These are certainly terrific companies but I want to try with this post to tip-toe back towards the original intent of this blog, to discuss those companies with steady revenue and earnings growth.

Informatica (INFA) closed at $30.43, up $3.38 or 12.5% on the day, enough to make the list of top % gainers on the NASDAQ. I do not own any shares of this stock.

According to the Yahoo "Profile" on Informatica (INFA), the company

"...provides enterprise data integration and data quality software and services in the United States and internationally. Its software handles various enterprise-wide data integration initiatives, including data warehousing, data migration, data consolidation, data synchronization, and data quality, as well as the establishment of data hubs, data services, cross-enterprise data exchange, and integration competency centers."

This is not exactly what I would call a "Peter Lynch" style of investment! Not a stock that my daughter is talking about in the local mall. What is compelling about this stock is the financial results that they have and continue to generate.

On July 22, 2010, Informatic reported 2nd quarter results after the close of trading. Revenue for the quarter came in at $155.7 million, ahead of estimates of $143.7 million and earnings came in at $.25/share, also ahead of estimates of $.23/share.

Reviewing the Morningstar.com '5 Years' financials, we can see that revenue has grown from $267 million in 2005 to $325 million in 2006, $391 million in 2007, $456 million in 2008 and $501 million in 2009. It is not just the growth but the consistency of growth that makes this so impressive.

Net income similarly has grown consistently from $34 million in 2005 to $64 million in 2009. Diluted earnings per share have increased from $.37/share in 2005 to $.66/share in 2009 without missing a beat! Outstanding shares have grown modestly from 92 million shares in 2005 to 103 million shares in 2009.

Free cash flow has increased from $28 million in 2005 to $95 million in 2008 but did slip slightly to $74 million in 2009 according to Morningstar.com.

Looking at the Morningstar balance sheet numbers on Informatica (INFA), the company has, as of December, 2009, $614 million in current assets compared to $256 million in current liabilities, yielding a solid current ratio of 2.4. The company is reported to also have what appears to be a very manageable amount of non-current liabilities totaling $251 million.

Reviewing the Yahoo "Key Statistics" on INFA, we can see that this is a mid cap stock with a market capitalization of $2.79 billion. The trailing p/e is rich at 46.46 but with the rapid growth estimated the forward p/e (fye Dec 31, 2011) is estimated at a bit more reasonable 24.34. However, the PEG still comes in a bit rich as well at 1.63. The stock certainly isn't undiscovered :).

INFA has 91.8 million shares outstanding with 90.86 million that float. As of 6/30/10, there were 6.15 million shares out short representing a short ratio of 3.40, just ahead of my own 3 day rule for significance. The company does not pay a dividend and last split its shares with a 2:1 split back on December 14, 2000.

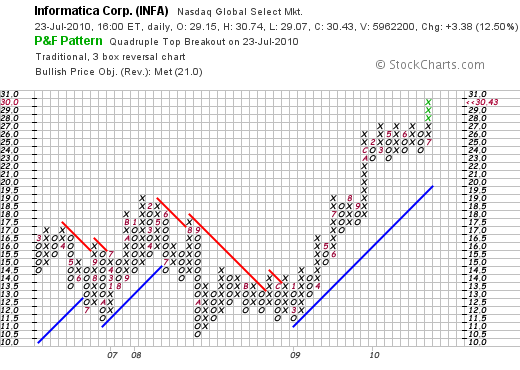

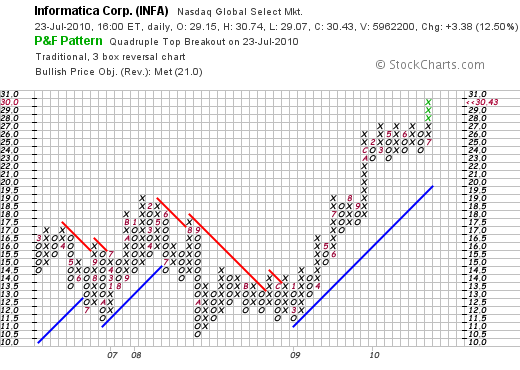

Reviewing the 'point & figure' chart on Informatica (INFA), we can see that the stock traded in a fairly tight range between March, 2006 and July, 2009, between approximately $10.50 and $19.00. In September, 2009, the stock broke out to the upside to a new range between $23 and $27 where it traded in a configuration known as a 'high tight flag' as I understand technical patterns. The stock with its recent move has broken out into a higher price range on good news.

To summarize, Informatica (INFA) had a strong day Friday moving out to new highs on an earnings report that beat expectations. The company has steadily grown its revenue and earnings for the past five years and has a strong balance sheet. However, valuation is a bit rich with a p/e and PEG a big higher than I would like if I were to suggest a 'value' investment. But this represents a terrific tech stock that clearly is capitalizing on the never-ending growth of the information business.

Simply put, it would be a great addition to my own portfolio if I had a signal to be buying a stock!

Thanks again for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 18 July 2010

Dr Pepper Snapple Group (DPS)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

We have been having a heat wave in Boston, Southern California, in fact much of the United States, including New York City, as well as overseas in London, and across Russia. Putting it plainly, it has been a hot summer for many across the globe.

We have been having a heat wave in Boston, Southern California, in fact much of the United States, including New York City, as well as overseas in London, and across Russia. Putting it plainly, it has been a hot summer for many across the globe.

It is this hot weather and a bit of a sunburn today after doing a bit of bike-riding that leads me to think about Snapple, and in particular the Dr Pepper Snapple Group (DPS). I do not have any shares of this company but believe it is the kind of stock I would like to be owning! DPS closed at $38.25 on July 16, 2010, down $(.73) or (1.87)% on the day as the market sold off rather severely with the Dow closing at 10,097.50 down 261.41 or (2.52)% on the day. Full disclosure: Diet Peach Tea by Snapple is one of my favorite drinks!

According to the Yahoo "Profile" on Dr Pepper Snapple Group (DPS), the company

According to the Yahoo "Profile" on Dr Pepper Snapple Group (DPS), the company

"...operates as a brand owner, manufacturer, and distributor of non-alcoholic beverages in the United States, Canada, Mexico, and the Caribbean. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, and mixers. The company offers its CSD products primarily under the Dr Pepper, Sunkist soda, 7UP, A&W, Canada Dry, Crush, Schweppes, Squirt, RC Cola, Diet Rite, Sundrop, Welch’s, Vernors, Country Time, IBC, Mistic, and Venom Energy brand names; and NCB products principally under the Snapple, Mott’s, Hawaiian Punch, Clamato, Yoo-Hoo, Country Time, Nantucket Nectars, ReaLemon, Mr and Mrs T, Rose’s, and Margaritaville brand names."

Snapple has a fascinating history beyond its recent association with Quaker Oats and with Dr Pepper:

"Snapple was founded in 1972 by Arnold Greenberg, Leonard Marsh, and Hyman Golden. Greenberg operated a health food store on the lower east side of Manhattan. His boyhood friend Marsh ran a window-washing service with his brother-in-law, Golden. In the early 1970s, the three founded Unadulterated Food Products, Inc., to sell pure fruit juices in unusual blends to health food stores. Products were bottled at a small plant in the New York metropolitan area. The partners ran the business in their spare time while all three kept their regular jobs, and the enterprise plodded along until the late 1970s.

In 1978, Unadulterated Foods began to market carbonated apple juice. The company called the product "Snapple," after purchasing the name for $500."

Dr Pepper Snapple Group (DPS) is a very young company:

"The company was established in 2008 following the spin-off of Cadbury Schweppes Americas Beverages (CSAB) from Cadbury Schweppes plc. On May 7, 2008, DPS became a publicly traded company listed on the New York Stock Exchange."

Snapple became part of Cadbury Schweppes in 2000 after it was purchased from Triarc Group which had acquired Snapple back in 1997.

In any case, in a Peter Lynch fashion, I like their tea and their financial results are attractive. On May 6, 2010, DPS announced 1st quarter results that were a bit less than stellar. Earnings came in at $89 million or $.35/share down from $132 million or $.52/share last year. Excluding one-time charges, the company earned $.40/share, which while behind last year's $.52 result, came in ahead of the $.32/share expected by analysts.

Revenue for the quarter dipped to $1.25 billion from $1.26 billion last year under the $1.28 billion expected by analysts. The company maintained sales guidance for the year with DPS expected to grow sales by 3-5% for the year. In addition, they raised earnings guidance to a new range of $2.29 to $2.37/share, up from prior guidance of $2.27 to $2.35. While reporting a mixed earnings report, the outlook was decidedly upbeat and the stock price has performed well since that report.

Watching my weight (without much success) I also enjoy an occasional Diet Dr. Pepper (for full disclosure!)

Watching my weight (without much success) I also enjoy an occasional Diet Dr. Pepper (for full disclosure!)

If we review the Morningstar Income Statement on Dr Pepper Snapple Group Inc. (DPS), we can see that revenue has grown steadily from 2005 to 2007 from $3.2 billion to $5.7 billion. In 2008 this dipped to $5.7 billion and the company has reported $5.5 billion in the trailing twelve months (TTM).

Earnings dipped from $2.01 in 2006 to a loss of $(1.23) in 2008 and has come in at $2.17/share in the TTM.

Outstanding shares have been stable with 254 million reported in 2006 and 255 million in the TTM.

According to the Morningstar Balance Sheet, the company has $1.28 billion in current assets including $280 million in cash and has total current liabilities of $854 million, yielding a current ratio of nearly 1.5.

Looking at the Morningstar Cash Flow page, we can see that free cash flowhas improved from $373 million in 2007 to $405 million in 2008 and $548 million in 2009.

Some recent news stories affecting the company include an announcement on July 13, 2010, that the board approved a $1 billion buyback of shares to be completed over the next three years. In another positive development for the company, the Coca-Cola Co. (KO) announced on June 7, 2010, that they would be paying $715 million to the Dr Pepper Snapple Groups for rights to distribute Dr Pepper and Canada Dry in United States. They also will be distributing Canada Dr., C Plus, and Schweppes in Canada. Another bullish announcement was made on May 19, 2010, when the company announced a 67% increase in the dividend to $.25/share or $1.00/share on an annual basis.

Examining the Yahoo "Key Statistics" on DPS, we can see that this is a larger 'mid cap stock' with a market capitalization of $9.4 billion. The trailing p/e is a moderate 19.08 with a forward p/e of 13.66 (fye Dec 31, 2011). Thus, the PEG is reasonably valued at 1.37.

Other valuation numbers include the Price/Sales ratio (TTM) which comes in at 1.75, below the industry average of 2.62 according to the Fidelity.com eresearch website. However, profit margins which include Return on Sales (TTM) come in at 9.28% under the industry average of 14.96%. Similarly return on investment comes in at 7.28% below the industry average of 17.06%.

Yahoo reports that as of June 30, 2010, there were 6.25 million shares out short representing only 1.7 trading days, well below my own arbitrary 3 day rule for short interest. As noted above, the company pays a forward dividend of $1.00/share yielding a not-insignificant 2.60%. The company has a payout ratio of only 15%.

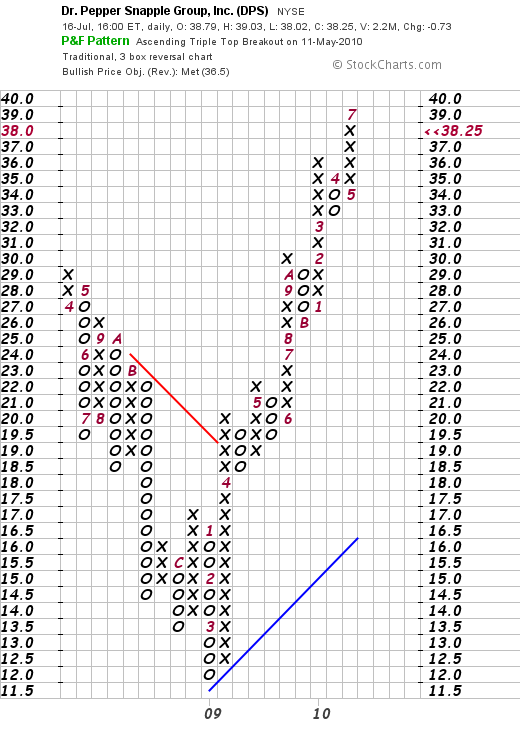

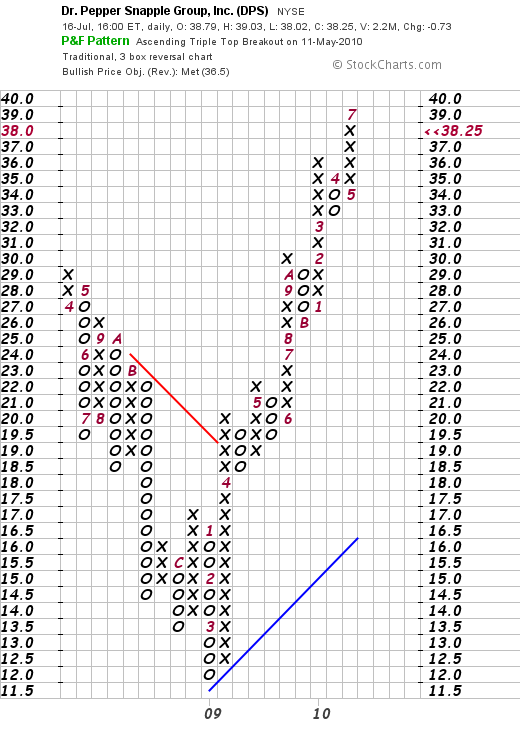

Reviewing the StockCharts.com 'point & figure' chart on Dr Pepper Snapple Group (DPS) we can see that after coming public in April, 2008, the stock peaked at $29 before slipping to a low of $12.00 in March, 2009. Since then the stock has been quite strong hitting a recent high this month at $39/share. Overall the chart looks quite strong if a bit extended.

To summarize, in the heat of this summer with the market acting quite cold, I would like to share with you a cold drink and a warm investment :). Dr Pepper Snapple Group (DPS) is a relatively new company with a stable of beverage products well established in the market. While their latest quarterly report was still showing the effects of the recession, the company guided earnings higher, maintained revenue growth expectations, and recently sharply increased the dividend and announced a three year $1 billion stock buy-back.

I do not own any shares and still limit my new position purchases from signals generated by my own portfolio as it reaches selling points on gains. These signals do not appear to be imminent but DPS is the kind of investment that deserves to be on your tray, or should I say an investment that deserves to be consumed over ice?

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Tuesday, 29 June 2010

Ecolab (ECL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers.

The stock market had a miserable day today. The Dow closed down 268 points or (2.65)%, the Nasdaq was worse with an 85 point or (3.85)% loss. Even the S&P was hit, closing at 1041, down 33 or (3.10)% on the day.

The stock market had a miserable day today. The Dow closed down 268 points or (2.65)%, the Nasdaq was worse with an 85 point or (3.85)% loss. Even the S&P was hit, closing at 1041, down 33 or (3.10)% on the day.

In the midst of this bloodbath, my Ecolab (ECL) stock, which I had recently purchased last month on 4/30/10 in my swith from Schlumberger (SLB), was made at a cost basis of $49.10. I sold all 65 of my shares today at $45.05/share, yielding me a loss of $(4.05) or (8.2)% since purchase.

I did not sell this stock because of any particular fundamental piece of information that disturbed me. I like this company and would prefer to be a shareholder of its shares.

However, my own trading system demands of me to sell shares in companies in which I have made an initial purchase when they have declined (8)% since that purchase. That is exactly what happened to my Ecolab (ECL) shares.

It is also not surprising that this holding was a recent purchase.

It makes sense that the positions that would be 'undone' first would be the recent purchases that are most vulnerable to a downdraft in the market.

One of my goals in pursuing this blog and putting my own real holdings, my successes and failures out publicly is to test whether one can reall do what I am striving to do. I am working to minimize my losses both individually by selling stocks quickly should they decline and also to utilize that sale as an indicator in itself that something is rotten with the market. Thus the proceeds of this sale are remaining in cash.

My cash position is approximately 40% now. I didn't do this on purpose. It wasn't a stroke of genius. It was my own strategy of selling holdings on declines and putting the proceeds in cash. I am avoiding reinvesting these sales on losses so I shall not make a bigger mistake and compound these losses with additional sales on losses.

I shall be waiting for a sale on a gain to be adding a new holding. This may be awhile. Meanwhile, I shall be patient. Monitor my own holdings and am prepared to unload additional stocks until I am at my minimum of 5 holdings. Even then, I shall not tolerate losses but rather shall sell these at 8% declines, replacing them as well with new positions (because I need 5 holdings) but am planning to do this with even smaller in size positions as I work to reduce my exposure to equities as indicated by my own sales.

Thank you again for stopping by and visiting. I hope that my explanation is comprehensible for you. If not, please let me explain more. You can leave your questions or comments right here on the blog or contact me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

![]() There are many places that I find ideas. Occasionally we have friends that sometimes seem to be wise and actually deserve more credit than we attribute to them in selecting stocks for investments and in general making wise observations about the world.

There are many places that I find ideas. Occasionally we have friends that sometimes seem to be wise and actually deserve more credit than we attribute to them in selecting stocks for investments and in general making wise observations about the world."In 1931, physicians Donald Baxter of Los Angeles and Ralph Falk of Boise, Idaho, started the Don Baxter Intravenous Products Corp., which made supplies for IV systems in hospitals. In 1933, Baxter started a manufacturing plant in Glenview. A pioneer in blood preservation methods as well as IV supplies, Baxter grew steadily. In 1947, it moved its headquarters to Morton Grove; the company soon employed over 500 people in the Chicago area. Annual sales grew from about $10 million in the mid-1950s to more than $100 million by 1967, when the company was making dialysis equipment, heart-lung machines, and many other equipment items for hospitals. In 1975, when it employed about 2,200 in the Chicago area, the company moved its headquarters to suburban Glenview; the following year, its name changed to Baxter Travenol Laboratories. The company grew rapidly thereafter. In 1985, when annual sales stood at about $2 billion, Baxter bought the American Hospital Supply Corp., an even larger Chicago-area medical supply company. The new company, which in 1988 became Baxter International Inc., was an enormous entity that soon approached $10 billion in annual sales; about 10,000 of its 50,000 employees worldwide were in the Chicago area. During the 1990s, however, Baxter sold off several divisions, including many of the old American Hospital Supply Corp. operations"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,

I wrote in the previous entry how my shares of McDonald's (MCD) had appreciated 30% since my purchase triggering a partial sale and a 'trading signal' to add a new holding to my own portfolio. I did this and purchased shares of Colgate-Palmolive (CL). Just catching up with this purchase, I wanted to share with you a few thoughts about this company.

I wrote in the previous entry how my shares of McDonald's (MCD) had appreciated 30% since my purchase triggering a partial sale and a 'trading signal' to add a new holding to my own portfolio. I did this and purchased shares of Colgate-Palmolive (CL). Just catching up with this purchase, I wanted to share with you a few thoughts about this company.

As part of my strategy of managing my portfolio, I have chosen to sell a small portion of my own holdings as they appreciate to targeted price levels. After an initial purchase, I sell 1/7th of my holding, if it appreciates to a 30% gain from my purchase price. After a sale of a portion of a holding at a gain, I use this action as a 'signal' to indicate to me that the health of the market is reasonable for a new purchase of stock.

As part of my strategy of managing my portfolio, I have chosen to sell a small portion of my own holdings as they appreciate to targeted price levels. After an initial purchase, I sell 1/7th of my holding, if it appreciates to a 30% gain from my purchase price. After a sale of a portion of a holding at a gain, I use this action as a 'signal' to indicate to me that the health of the market is reasonable for a new purchase of stock. According to the

According to the  On May 25, 2010, Medtronic (MDT) reported

On May 25, 2010, Medtronic (MDT) reported

Fred is a Venture Capitalist who has invested in and organized investments in a multitude of new organizations including

Fred is a Venture Capitalist who has invested in and organized investments in a multitude of new organizations including  Returning to my usual haunts in the

Returning to my usual haunts in the

With the

With the

We have been having a heat wave in

We have been having a heat wave in  According to the

According to the  Watching my weight (without much success) I also enjoy an occasional Diet Dr. Pepper (for full disclosure!)

Watching my weight (without much success) I also enjoy an occasional Diet Dr. Pepper (for full disclosure!)