Stock Picks Bob's Advice

Saturday, 9 July 2005

"Looking Back One Year" A review of stock picks from the week of May 17, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

In this image provided by commuter Alexander Chadwick, taken on his mobile phone camera, passengers are evacuated from an underground train in a tunnel near Kings Cross station in London, Thursday. (AP/Alexander Chadwick)

Before I go on to review anything, I would like to express my condolences to those who have lost loved ones or who have experienced injuries in the London bombings. We truly are one interconnected world around here. I hope that the rest of 2005 finds all of you safe and in good health.

These weekend reviews are my method of trying to determine how the stock picks selected here are performing in practice. These reviews assume a buy and hold technique which is

not what I employ in my own trading portfolio. I advocate selling losing stocks quickly (I use an 8% loss as my limit) and selling gaining stocks at targeted appreciation ranges, slowly.

On May 18, 2004, I

posted Staples (SPLS) on Stock Picks at $26.39. SPLS had a 3:2 stock split on 4/18/05, making my effective pick price actually $17.59. SPLS closed at $21.92 on 7/8/05 for a gain of $4.33 or 24.6% since posting.

On May 17, 2005, Staples

reported 1st quarter 2005 results. Total company sales for the quarter ended April 30, 2005, grew 13% to $3.90 billion from $3.45 billion for the same quarter in 2004. Net income came in at $159 million, this worked out to $.21/diluted share, up 24% from the first quarter of 2004.

On May 19, 2004, I

posted Advanced Neuromodulation Systems (ANSI) on Stock Picks at $33.03. ANSI closed at $41.21 on 7/8/05 for a gain of $8.18 or 24.8% since posting.

On April 28, 2005, ANSI

announced 1st quarter 2005 results. Revenue increased 21.4% for the three months ended March 31, 2005, to $32.3 million from $26.6 million in the same quarter in 2004. Excluding a gain on a sale of Cyberonics common stock, earnings for the first quarter came in at $.22/diluted share, up from $.19/diluted share last year.

On May 20, 2004, I

posted PetSmart (PETM) on Stock Picks at $28.40/share. PETM closed at $31.43/share on 7/8/05, for a gain of $3.03 or 10.7%.

On May 18, 2004, PetsMart (PETM)

reported 1st quarter 2005 results. Sales climbed 13.4% to $903.2 million during the quarter, from $796.3 million in the same quarter last year. Importantly, same store sales growth for the quarter came in at 5.7%. Net income grew to $44.7 million or $.30/share, up from $31.9 million or $.21/share last year.

Finally, on May 21, 2004, I

posted Marvell Technology Group (MRVL) on Stock Picks at a price of $42.99. MRVL had a 2:1 stock split on 6/29/04, making my effective "pick price" actually $21.50. MRVL closed at $39.91 on 7/8/05 for a gain of $18.41 or 85.6% since posting!

On May 19, 2005, MRVL

reported 1st quarter 2006 results. For the quarter ended April 30, 2005, revenue came in at $364.8 million, a 35% over net revenue of $269.6 million in the first quarter of fiscal 2005. Net income (GAAP) was reported at $63.5 million, or $.20/diluted share, up strongly from $14.5 million, or $.05/diluted share in the first quarter of 2005. These were strong results imho, and help explain the strong stock performance.

So how did we do that week? Well nothing short of spectacular. My only disappointment is that these four stocks are not in my own portfolio...I can't own everything :(. Anyhow, the average performance of these four stocks works out to a gain of 36.4%!

Certainly past performance is NO guarantee of future price movement, but this is certainly encouraging for what I am trying to do on this website. Also, this represents just four picks from one particular week, so take it all with a grain of salt!

Thanks so much for stopping by! If you have any comments, or questions, please feel free to email me at bobsadviceforstocks@lycos.com. (Or feel free to leave comments right here on the blog!)

Bob

Friday, 8 July 2005

A Reader Writes "Comment on LSCP?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through my email (you can drop me a line at bobsadviceforstocks@lycos.com and I shall try to answer you if possible, most likely right here on the blog!), I wanted to answer a question from P.C. who writes:

Bob,

I am enjoying your blog. I am wondering if you can

comment on LSCP.

Thanks in advance.

Regards,

P.C.

First of all, thanks for the kind words on the blog! I very much appreciate any and all feedback from readers so the comment is noted. Insofar as Laserscope (LSCP) is concerned, this is an old favorite of mine, I have actually owned it in my trading portfolio (until I hit my 8% loss), and I still have a few shares of it in one of my son's accounts, and I am pretty sure my stock club owns some shares of this as well. I do not personally have any LSCP stock or options as I write.

I first

posted Laserscope (LSCP) on Stock Picks on December 31, 2004, when it was trading at $35.99. Laserscope is currently trading at $38.70, down $3.43 or (8.14%) on the day, on the heels of an

"underperform" rating by Jefferies today. Even with this large drop, LSCP is trading up $2.71 from where I posted it, or 7.5% ahead. There was a recent and timely

article on Motley Fool, pointing out the high "beta" of this stock, which is a measurement of volatility. My own sale on an 8% loss, and today's precipitous move confirms this volatility!

Let's take another brief look at this company! According to the

Yahoo "Profile" on LSCP, the company "...engages in the design, manufacture, sale, and service of medical laser systems and related energy devices for the medical office, outpatient surgical center, and hospital markets worldwide. The company's product portfolio consists of lasers and other light-based systems for applications in the urology, dermatology, and aesthetic surgery markets."

The first place I go in checking a stock out is the "headlines" section of Yahoo looking for the latest quarterly report. What do I require of a stock? That the revenue

and the earnings are positive and growing!

On April 27, 2005, Laserscope

reported 1st quarter 2005 results. In summary, revenue grew 50% to $28.2 million from $18.8 million the prior year. Net income rose over 100% to $5 million or $.22/share, from $2.2 million or $.10/share the prior year same quarter. These results look "solid" to me!

My next step is to go over to the Morningstar website and check out some of the longer-term financials. In particular, looking at the

"5-Yr Restated" financials on Morningstar.com, we can note the following: a beautiful progression of revenue growth the past five years, except for a small dip from $35.4 million in 2000, to $35.1 million in 2001, climbing steadily since then to $103.2 million in the trailing twelve months (TTM).

Earnings, which also dipped from $.01/share in 2000 to a loss of $(.05)/share in 2001, have climbed steadily since then to $.77/share in the TTM.

Free cash flow has also been improving, growing from $1 million in 2002 to $8 million in the TTM.

The balance sheet, as presented on Morningstar.com is nothing short of gorgeous! The company is reported to have $22 million in cash and $46.6 million in other current assets, balanced against $24 million in current liabilities and NO long-term liabilities at all!

Generally, my next step in looking at a stock is to 'travel' back to Yahoo, in particular looking at the

"Key Statistics" on LSCP. Here we can see that this is a "mid cap" stock with a market capitalization of $851.34 million.

The trailing p/e is a bit rich at 50.50, with a forward p/e of 35.72. The PEG is also a bit steep at 1.94, and the Price/Sales ratio is 9.01.

Yahoo reports 22.07 million shares outstanding with 20.16 million that float. Currently there are 3.13 million shares out short (!) representing 15.10% of the float (as of 6/10/05) or 13.8 trading days of volume. I use a 'three day rule' on short interest for my own purposes of determining significance, and this looks like a lot of shares out short that will need to be covered.

Yahoo does not report any cash nor any stock dividend by Laserscope.

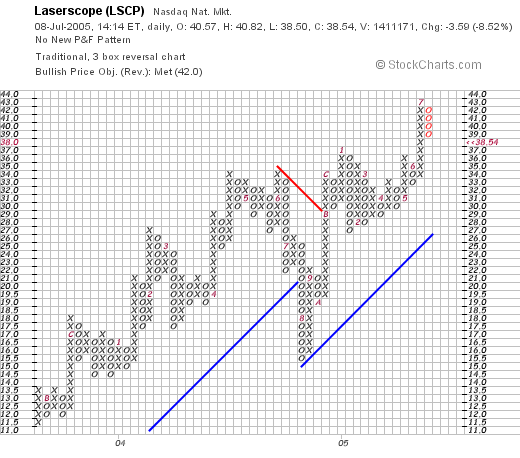

Finally, I like to take a look at the price chart. I am in no way at all a technician, and I simply try to roughly see if the stock looks like the latest trend is higher, sideways, or lower!

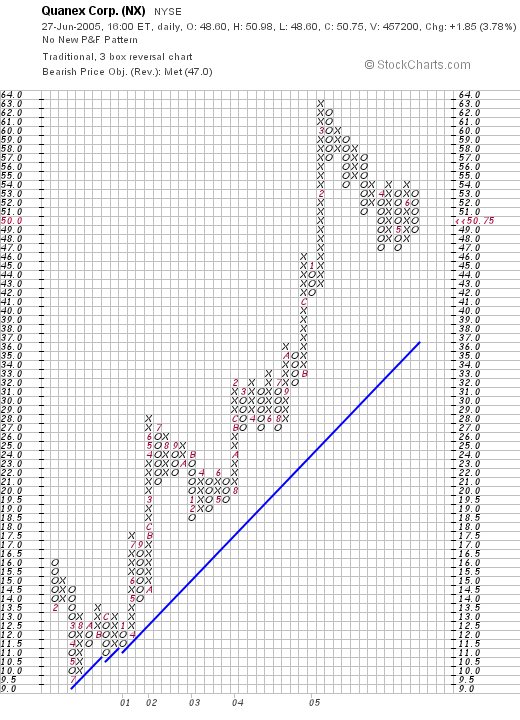

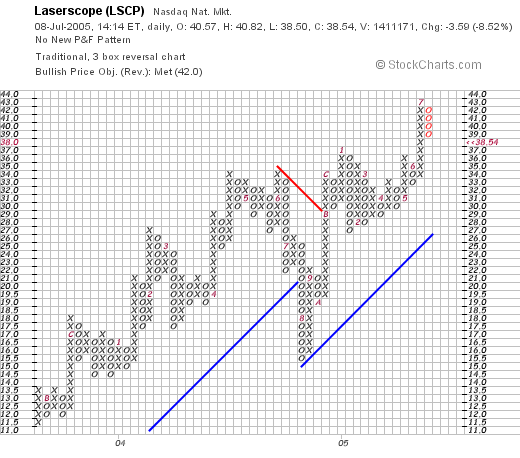

Looking at the

"Point & Figure" chart on LSCP from Stockcharts.com, we can see what looks like an uninterrupted move higher for LSCP, which is currently undergoing some price correction. The overall upward trend appears intact.

So what do I think?

Well in review, this is an old stock pick and a favorite of mine from this blog. I do not currently own any shares. However, the latest quarter was beautiful, the past five years have been solid, the company is growing its free cash flow, the balance sheet looks nice, but the valuation is a bit rich. Even with the correction today, the chart looks nice!

I generally buy stocks making strong moves higher on the day I purchase them, so I wouldn't personally be buying a stock moving down so strongly. However, the rest of the story is intact, and except for valuation including PEG, P/E, and Price/Sales, which are all a bit "rich" the stocks still looks nice to me!

I hope that was helpful for you! Thanks again for stopping by and if you or anyone else has any questions, please feel free to leave them right on the blog, or you can email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" KYPH

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

My Kyphon (KYPH) stock is having a nice day today (as are lots of other stocks) trading at $38.20 as I write, up $2.88 or 8.15% on the day. A few moments ago, I sold 50 shares of my 200 shares of Kyphon at $38.20. This is 1/4 of my position, a portion that I regularly sell as my stocks hit their price targets. I acquired these shares on 5/20/05 at a cost basis of $29.21, so this was a gain of $8.99/share or 30.8%. As you may recall, my target gains are 30, 60, 90, 120, then 180, 240, 300, 360, and then by 90% etc.

Since I am at my full complement of stock in my portfolio (25 positions), I shall be at long last, using these proceeds to start paying down my very high margin level. I will not be adding any new positions until either I fall back to less than 25 positions, and then go back to 25 on a buy signal, or I have paid off my margin entirely.

Thanks so much for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com. (Or leave a message right here on the blog.)

Bob

Tuesday, 5 July 2005

July 5, 2005 Bausch & Lomb (BOL)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the

list of top % gainers on the NYSE today and came across Bausch & Lomb (BOL) which closed at $87.50, up $5.72 or 6.99% on the day. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on BOL, the company "engages in the development, manufacture, and marketing of eye health products. The company offers its products in five product categories: contact lens, lens care, pharmaceuticals, cataract and vitreoretinal, and refractive."

What drove the stock higher today, in addition to the strong overall tone of the market, was the

news report that Bausch & Lomb was acquiring a "55-percent controlling interest in the Shangdong Chia Tai Freda Pharmaceutical Group (CTF), the leading ophthalmic pharmaceutical group in China..." This will cost BOL $200 million in cash and accelerate BOL's penetration into the Chinese market.

On April 19, 2005, Bausch & Lomb

reported 1st quarter 2005 results. First quarter sales came in at $554.3 million, a 9% increase over last year's $510.3 million (a 6% increase when currency adjustments are made), and earnings per share rose 47% to $.63 from $.43/share in the same quarter a year ago.

If we look at a bit of a longer-term financial picture, using the

"5-Yr Restated" financials from Morningstar.com, we can see a fairly steady picture of revenue growth except for a slight dip from $1.72 billion in sales in 2000 to $1.67 billion in 2001. However, since 2001, revenue has grown steadily with $2.28 billion reported in the trailing twelve months (TTM).

Earnings have also increased, except for a dip from $1.52 in 2000 to $.39/share in 2001, earnings have otherwise grown steadily from that $.39/share level in 2001 to $3.13 in the trailing twelve months (TTM).

Free cash flow, per Morningstar, has been solid with $145 million in 2002 growing to $160 million in the TTM.

The balance sheet is also pretty solid with $483 million in cash and $900.4 million in other current assets, easily covering the $794.2 million in current liabilities and "making a dent" in the $758.3 million in long-term liabilities as well.

Looking at

"Key Statistics" on BOL from Yahoo, we can see that this is a large cap stock with a market capitalization of $4.69 billion. The trailing p/e isn't too highat 28.04, and the forwar p/e (fye 25-Dec-06) is even lower at 21.77. The "5 yr expected) PEG is 1.57.

Within the "Medical Instruments/Supplies" Industrial group, Bausch & Lomb is very reasonably valued with a Price/Sales ratio of 1.9. Other companies in the same group include Alcon (ACL) with a ratio of 8.3, Guidant (GDT) at 5.6, Stryker (SYK) at 4.3, Boston Scientific (BSX) at 3.6, and Baxter (BAX) at 2.4. Bausch & Lomb (BOL) is the cheapest with a Price/Sales ratio of only 1.9.

Other "Key Statistics" from the same Yahoo page reveal that BOL has 53.45 million shares outstanding with 52.32 million of them that float. Of these, 1.82 million shares are out short, representing 3.40% of the float or 3.6 trading days of volume. This is just over my own level of 3 trading days for significance.

The company does pay a small dividend of $.52/share yielding 0.64%. The last stock split was a 2:1 split in July, 1991.

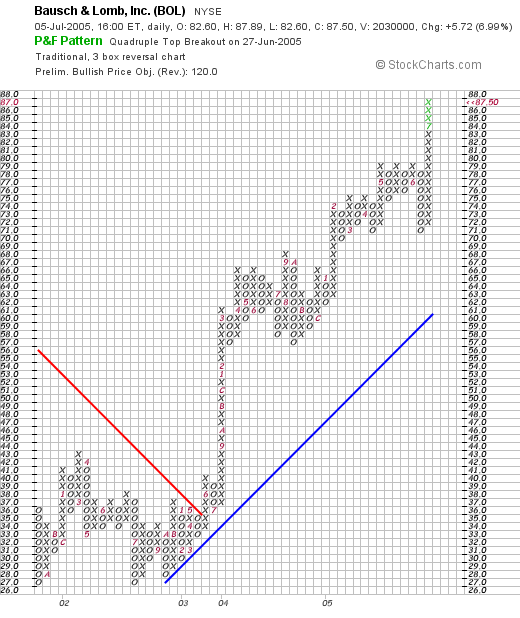

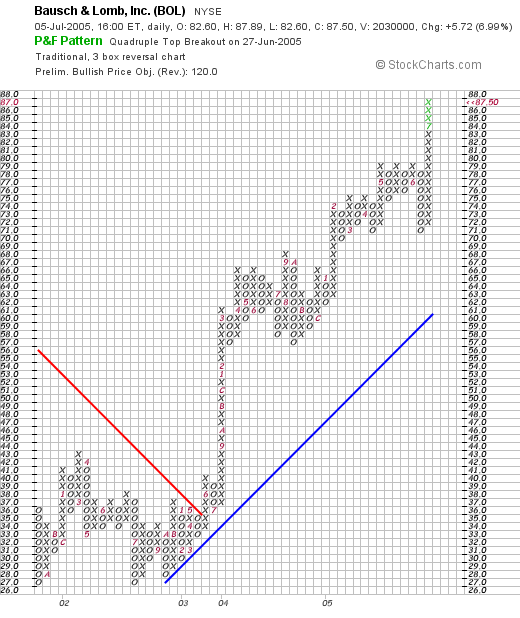

What about a chart? If we take a look at the

Stockcharts.com "Point & Figure" chart on B&L, we can see that the stock was trading "sideways" between late 2001 through May, 2003, with a range of $27 to $42. The stock broke through resistance and then trading strongly higher through the last half of 2003, until the present time, when it now is testing new highs in the $87 range.

So what do I think? I do find it intriguing that the company is entering the Chinese market with its acquisition. In summary, the last quarter was strong, the past five years have shown steady growth in both revenue and earnings, free cash flow is positive and slowly growing, and the balance sheet is solid. Valuation is a bit steep insofar as the PEG is concerned, but the Price/Sales puts BOL as the most reasonable of its industrial group in terms of valuation. And the chart looks strong!

So what do I think? I do find it intriguing that the company is entering the Chinese market with its acquisition. In summary, the last quarter was strong, the past five years have shown steady growth in both revenue and earnings, free cash flow is positive and slowly growing, and the balance sheet is solid. Valuation is a bit steep insofar as the PEG is concerned, but the Price/Sales puts BOL as the most reasonable of its industrial group in terms of valuation. And the chart looks strong!

This is the kind of stock I probably would enjoy owning long-term. (I already own Cooper (COO) which is at least partly a competitor to BOL). I do not have any cash to invest, and more important am fully invested, so no matter what the "signal", I shall not be buying any new stocks until I drop back to 24 positions.

Thanks again for stopping by! If you have any questions or comments, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 11:26 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 5 July 2005 11:32 PM CDT

"Looking Back One Year" A review of stock picks from the week of May 10, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. I hope that you all had a very happy and safe 4th of July. For those of you in other countries, I still wish you a happy 4th! But I suppose it just doesn't mean the same thing! :)

As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I am just sneaking in my weekend review. It is late, and in a few hours, the markets will open for trading once again here in the States. In order to determine whether what I am writing is working, I like to go back about a year and see how the stock picks actually would have done if I had purchased them. I

do purchase some of them, but far from a majority of issues that are discussed.

For the sake of review, I assume a buy and hold strategy for all stock picks on the blog. This is done even though I actually follow a strategy of selling any losing stocks quickly at an 8% loss level, and selling gaining stocks slowly at a series of price appreciation targets.

The first stock selected that week was

Hewitt Associates (HEW), which I picked for Stock Picks on May 10, 2004, when it was trading at $30.26. HEW closed at $26.76 on 7/1/05, for a loss of ($3.50) or (11.6%).

On May 4, 2005, HEW

reported 2nd quarter 2005 results. Total revenue for the quarter jumped to $712.6 million, from $559.5 million the prior year same quarter. Net income, however, dropped to $27.2 million from $30.4 million last year. On a diluted earnings per share basis, this worked out to $.23/share, down 25.1% from $.31/share last year.

On May 11, 2004, I

posted Rayovac (ROV) on Stock Picks at a price of $27.20. On April 27, 2005, Rayovac shareholders passed a resolution to

change the corporate name from Rayovac (ROV) to Spectrum Brands (SPC) as of 5/2/05. SPC closed at $33.70 on 7/1/05 for a gain of $6.50 or 23.9% since posting.

On May 4, 2005,

Spectrum announced 2nd quarter 2005 results Looking for both earnings and revenue growth to get a "thumbs-up" on this blog, SPC reported a large increase in net sales from $278.0 million to $534.5 million, in large part due to the acquisition of United Industries. The net loss for the quarter came in at ($1.9) million, compared to net income of $2.6 million last year, or on a per share diluted basis, this worked out to ($.04)/diluted share loss, vs. a gain of $.08/share the prior year.

On May 13, 2004, I

posted MapInfo (MAPS) on Stock Picks at a price of $10.50. MAPS closed at $10.515 on 7/1/05, virtually unchanged from the post price, with a gain of $.015/share or .14% since posting.

On April 21, 2005,

MapInfo reported 2nd quarter 2005 results. Revenue grew to $35.5 million, compared with $31.4 million the prior year. Net income more than doubled at $2.5 million or $.12/share, up from $1.07 million, or $.07/diluted share. (There were 1/3 more shares outstanding in 2005 than in 2004, explaining the discrepancy in growth.)

The last "pick" for that week was Panera Bread (PNRA) which was

posted on Stock Picks on May 14, 2004, at a price of $35.63. PNRA closed at $61.50 on 7/1/05 for a gain of $25.87 or 72.6%.

On May 17, 2005, PNRA

reported 1st quarter 2005 results. Revenue for the quarter ended April 19, 2005, jumped 37% to $178.1 million from $129.9 million last year. Net income jumped 47% to $13.9 million from $9.5 million last year. On a per share basis, diluted earnings grew 42% to $.44/share, up from $.31/share in the prior year same quarter. The company also

raised guidance both for revenue and earnings, a very positive event!

So how did I do with my four selections for the week of May 10, 2004? Three out of four of the stock picks showed gains, ranging from almost unchanged at .14%, to a solid gain of 72.6% by Panera. Only Hewitt showed a loss, dropping by (11.6%) since posting the stock a little over a year ago. Averaging all four performances gives us an average return of 21.26% for the four stocks selected!

Thanks again for stopping by! If you have any questions or comments, please feel free to leave them right here on the blog or you can email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 1:08 AM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 5 July 2005 1:18 AM CDT

Saturday, 2 July 2005

A Reader Writes "Can I get your opinion on the company EZPW?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through my mail, I found a question from S.Y.L., who was interested in learning about a company EXPW. SYL wrote:

Hi,

Can I get your opinion on the company: EZPW? I completely understand that you are not a professional, but I'm still interested in getting an opinion from a more seasoned investor than me. I found this one doing some basic screening and it looks quite good. Good earnings growth, low debt, and very very low valuation ratios. Am I missing anything or is this stock as good as it seems to me? Please be as open as possible. I'm interested in hearing about how you would go about researching this company further.

I'm looking forward to your reply.

Regards,

SYL

Thanks so much for writing again SYL! I will tell you how I go about looking at a stock, but this is certainly not the only way!

EZPW stands for Ezcorp, Inc. EZPW closed at $11.03, up $.28 or 2.60% on 7/1/05. According to the

Yahoo "profile" on EZPW, the company "...operates pawnshops and payday loan stores in the United States."

My first step is to check the latest quarterly report. On April 20, 2005, EZCORP (EZPW)

announced 2nd quarter 2005 results. Some of the basic things I look at are: revenue growth and earnings. For the quarter ended March 31, 2005, EZPW reported revenue growth of 8% to $63.1 million compared with $58.3 million the prior year. Net income jumped 32% to $4.0 million ($.29/share) compared with $3.0 million ($.23/share) the prior year same period. These appeared to me to be fairly solid results.

Generally, my next step in the process is to go over to Morningstar.com, in particular the "5-Yr Restated" financials, which for EZPW is located

here. By the way, I do not own any shares or options in EZPW, nor am I "picking" this stock for my blog. I just want to answer a question from a reader!

The financials show some good information and are also deficient for this particular stock. We can see on the Morningstar page that revenue, except for a small drop between 2000 and 2001, has been steadily increasing. $197.4 million was reported in revenue in 2000, dropping to $186.2 million in 2001, but has increased each year to the $235.9 million in the trailing twelve months (TTM).

Earnings have also steadily improved, increasing from a loss of ($2.71) in 2000 to a net positive income of $.90/share in the TTM.

Free cash flow appears to be positive if we can apply a mathematical subtraction of capital spending from operating cash flow, however, I don't extrapolate anything on these financial reports on my blog. In fact, the balance sheet is also absent from Morningstar. You might be able to get this information elsewhere, but relying on Morningstar, I generally avoid stocks completely with incomplete financial reports. There are plenty with complete numbers to choose from!

My next step is to review some basic parameters of this company. For this purpose, I like to use

Yahoo "Key Statistics" on EZPW. Here we can see that this company is virtually a "micro-cap" stock with a market capitalization of only $137.07 million.

As you noted in your question, the P/E is certainly cheap at 12.21, with a forward p/e of 8.48. Thus the company has a PEG ratio of only 0.52. Price/sales is also cheap at 0.56.

EZPW has only 12.43 million shares outstanding with 11.10 million that float. Currently there are only 183,010 shares out short, representing 1.70% of the float or only 1.1 trading days of volume. No cash dividends and no stock dividends are noted on Yahoo.

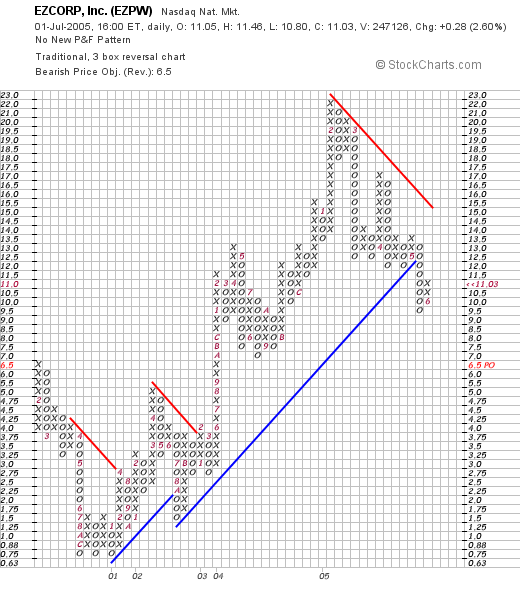

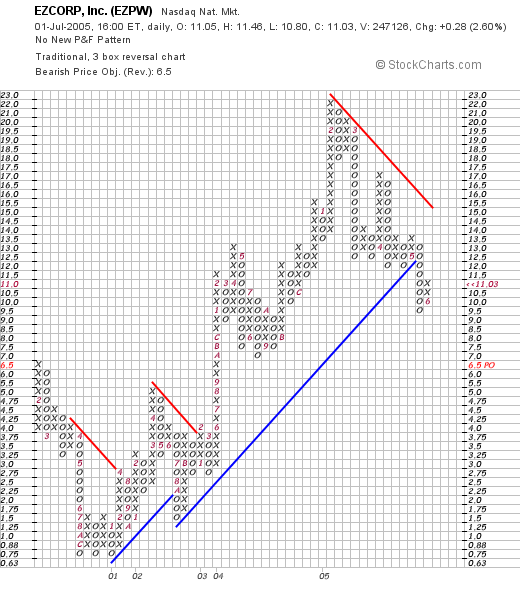

Finally, I like to take a look at a "Point & Figure" chart from Stockcharts.com. For EZPW, this is located

here.

Here we can see that the stock bottomed at around $.75/share in late 2000. The stock has been moving higher recently, with a peak at $22 recorded in February, 2005. The stock has actually been looking weaker recently, with a breakdown, decline below the "support" line at $11.50 in May, 2005. The stock appears to be still trading weakly.

So what do I think of this stock? I like the recent quarterly report, the five year growth in revenue in earnings, and the valuation. Things I am uncomfortable with regarding this stock is the tiny nature of the company, the fact that possibly because of the size, I do not have any reported free cash flow, nor is the balance sheet specified. With the graph looking weak, I would not be inclined to be buying any of these shares. In addition, I suspect that the stock might be looking weak due to concerns over tightening of credit market with the repeated increases in the interest rates by the "Fed". But I frankly don't know!

In conclusion, this stock is an interesting candidate but I just don't have enough information to recommend this stock. I am unable to get all of the information that would help me make an investment.

Thanks again for stopping by and taking the time to write me a question! If you or anyone else have questions regarding a stock or one of my posts, please feel free to email me at bobsadviceforstocks@gmail.com.

Bob

Wednesday, 29 June 2005

A Reader Writes "Why does the percent gain appeal to you?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was checking my mail this evening and I found an interesting question from S.Y.L. who writes:

Bob,

Greetings from Minnesota. I have become a regular reader of your blog

recently, after finding a link to it from the blog at Wealthcast.com. What

interests me most about your stock picking ways is that they closely

resemble my own, except for one thing which I wanted to ask you about. A

good starting point for me is Yahoo! Finance's volume leaders list. It

interested me to learn you take a different approach, and look at Yahoo!

Finance's percent gainers list. Why does the percent gain appeal to you?

I'm very interested in reading your reply.

Good night

Regards,

S.Y.L.

First of all, thanks so much for writing! I have been fortunate to receive a link from Jack Rothstein who is a well-regard professional investment advisor, so this might be a great question for him as well :). However, since this is

my strategy, I probably should try to tackle this question.

A few years back, before the dot.com "bust" I found that I could literally buy stocks on the top percentage gaining lists and sell them the same day a few hours later for a profit. What I realized was that many of these stocks have what we refer to as "price momentum" and after these large gains, would have a high probability to go higher yet.

More recently, I have used this "price momentum" screen, as we could call it, as a starting point. In other words, it is my belief that among these strong stocks, there may be things we can determine that will allow us to more safely predict that stocks like these will continue to advance. At least

that is my working hypothesis.

Thus, after looking at stocks on the top % gainers list, I go on to check some very important fundamental issues, like earnings and revenue growth, free cash flow, and the balance sheet. With these looking positive, I make my educated "guess" that the stock is likely to be moving higher and that today's price action is not a fluke.

Is high volume a good or better indicator? I really don't know. I don't know if what I am doing will be successful long-term. I don't know if there are many better ways to pick stocks. There is so much that I don't know!

However, thus far, I have been pleased with the results I have experienced with this approach and if you go through the many stocks I have examined, I am sure that you will find among them some of the strongest stocks in the market the past couple of years!

I hope this answers your question. I am sure that you can tell by my answer that I am truly an amateur investor! If you have another approach, and think it is maybe "better", please feel free to email me and let me know how you approach stock picking and how your results have been!

Bob

"Revisiting a Stock Pick" Millipore (MIL)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As the number of stock picks discussed on this blog grows, I find it helpful to revisit prior stock picks when they once again meet the criteria that I use to pick stocks on this website. In fact, one can think of this as a "reconfirmation" of a stock pick, that is, the stock once

again is identified in the screens that I use. In general, I prefer to allow a year to pass by before re-discussing any of the stock selections on the blog.

On January 27, 2004, I

posted Millipore (MIL) on Stock Picks at a price of $50.87. MIL is currently trading at $57.40, up $3.05 or 5.61% on the day. The stock has appreciated $6.53 or 12.8% since posting in 2004.

I identified Milliopore (MIL) on the

list of top % gainers on the NYSE today, and on review, the story is intact. I do not own any shares or options in Millipore.

As I like to do when examining a possible stock for inclusion on this blog, is to check the latest quarterly results. On April 21, 2005, MIL

reported 1st quarter 2005 results. First quarter sales came in at $250 million, up 12% from $222 million in the same quarter last year. Earnings came in at $32.3 million or $.64/diluted share, up 16% from the $27.2 million or $.55/diluted share reported in the same quarter in the 2004 fiscal year.

For a longer-term perspective, let's take a look at the

"5-Yr Restated" financials from Morningstar.com. Here we can see a very nice picture of steady revenue growth from $600 million in sales in 2000, steadily growing to the $911 million reported in the trailing twelve months (TTM).

Earnings have been a little less steady, dropping from $2.53/share in 2000 to $.65/share in 2001, but increasing each year thereafter to the current $2.19 in the TTM.

Free cash flow has also been steadily growing in the last several years from $28 million in 2002 to $116 million in the TTM.

Morningstar.com shows the balance sheet for MIL to be solid with $141.3 million in cash and $393.2 million in other current assets, plenty to cover both the $149.9 million in current liabilities and the $196.4 million in long-term liabilities.

Considering "valuation" issues on this stock,

"Key Statistics" from Yahoo shows that Millipore (MIL) is a large cap stock with a market capitalization of $2.85 billion. The trailing p/e is moderate at 25.93, and the forward p/e (fye 31-Dec-06) is nicer at 20.67. Thus, the "5 yr expected" PEG is 1.57. (with a PEG of 1.0 considered an ideal valuation for a stock with the Price/earnings ratio commensurate with the growth rate).

Yahoo reports the Price/Sales ratio as being 2.98. Referring to my Fidelity brokerage research, we can see that MIL is priced midway, insofar as the Price/Sales ratio is concerned, in the "Scientific/Tech Instruments" Industry. At the top is Garmin (GRMN) with P/S ratio of 5.7, Flir (FLIR) at 4.3, followed by MIL at 3.0, Applied Biosystems (ABI) is lower at 2.2, Beckman Coulter (BEC) at 1.6, and Agilent (A) at 1.6.

Other statistics from Yahoo on MIL reveal that this company has 49.94 million shares outstanding with 49.83 million of them that float. As of 5/10/05, there were 1.45 million shares out short representing 2.90% of the float or 2.1 trading days of volume (the "short ratio"). No cash dividend is paid, and the last stock split was a 2:1 in July, 1995.

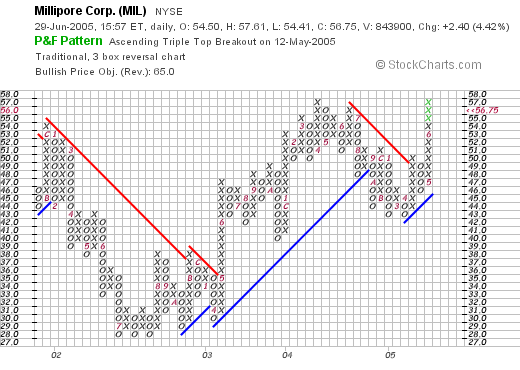

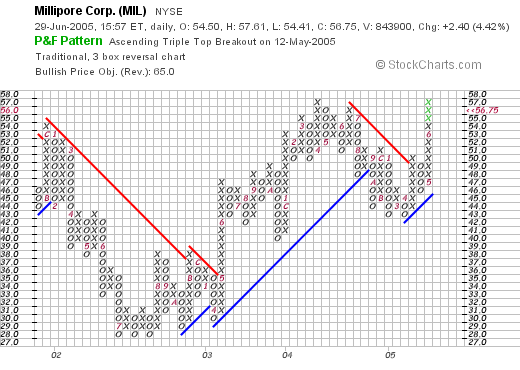

So what does the chart look like? Taking a look at a

"Point & Figure" chart from Stockcharts.com on MIL, we can see that this stock has had broad price swings the last few years, with a downward move from $54 to $28 between January, 2002 and July, 2002, followed by some consolidation and a move higher to $57 in June, 2004, and more recently, a breakdown in price to the $42 level in April, 2005. The stock has now broken through resistance at the $49 level, and has traded higher to the $57 range. The stock looks bullish to me, but does not appear overextended.

So what do I think? Well the stock looks attractive to me if not the strongest growth record I have reviewed here. Let's review: the stock made a nice move higher today, last quarter was a solid report with growth in the mid teens both in terms of revenue expansion and earnings growth. The last five years have been strong years with steady revenue growth, albeit with a bit of weakness in earnings several years ago. The company is spinning off increasing amounts of free cash to be added to an already solid balance sheet. Valuation appears reasonable if not cheap, and the chart looks positive but not over-extended.

Of course, I don't have any money to be buying any stock. But if I did....well enough hypotheticals! Thanks so much for stopping by. If you have any questions or comments, please feel free to leave them right here on the bloc, or feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 27 June 2005

June 27, 2005 Quanex (NX)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

This evening, browsing through the

list of top % gainers on the NYSE today, I came across Quanex (NX) which closed at $50.75, up $1.85 or 3.78% on the day. I do not own any shares of Quanex nor do I have any options.

According to the

Yahoo "Profile" on NX, the company "...manufactures engineered materials and components for the vehicular products and building products markets."

On May 26, 2005,

Quanex reported 2nd quarter 2005 results. For the three months ended April 30, 2005, revenue climbed 43% to $533.8 million from $372.9 million. Earnings came in at $51 million, or $1.93/share, up sharply from $11.5 million, or $.46/share in the prior year same quarter. The company beat expectations with this report and also raised guidance for the full year. Both were bullish events for this stock!

Longer term, looking at the

"5-Yr Restated" financials from Morningstar.com, we can see that revenue was slightly lower between 2000 when sales were $806 million, dropping to $777 million in 2001. Revenue has grown steadily since that time, reaching $1.8 billion in the trailing twelve months (TTM).

Earnings have been a bit erratic, climbing from a loss of ($.70)/share in 2000 to $3.52 in 2002, dropping to $1.75 in 2003 then climbing further in 2004 and 2005.

The company does pay a dividend, which has climbed from $.43/share in 2000 to $.51/share in the TTM.

NX has also been increasing its free cash flow steadily the past few years with $50 million reported in 2002, growing to $158 million in the TTM.

Checking

Yahoo "Key Statistics" for NX, we can see that NX is a mid-cap stock with a market capitalization of $1.26 billion. The trailing p/e is downright cheap at 11.17, with a forward p/e (fye 31-Oct 06) of 10.25. The (5 yr expected) PEG comes in at 0.56, one of the lowest PEGS I have seen since I started Stock Picks over two years ago.

While NX's Price/Sales ratio is very cheap at 0.7, looking at the "Steel & Iron" Industry group, we can see that

all of the stocks in this particular group sport very low Price/Sales ratio. Specifically, Precision Casparts (PCP) tops off the list at 1.8, Quanex (NX) and Allegheny Technologies (ATI) are next at 0.7 each, Nucor (NUE) follows at 0.6, Steel Dynamics (STLD) is next at 0.5 tied with Worthington Industries (WOR) also at 0.5. Thus, Quanex is on the low end of the range, but still in the middle of the "pack".

Other statistics from Yahoo include 25.32 million shares outstanding with 24.96 million of them that float. Currently, there are 674,860 shares out short as of 5/10/05, representing 2.7% of the float, or 1.7 trading days of volume.

As indicated above, the company

does pay a small dividend of $.53/share yielding 1.09%. The last stock split was a 3:2 split this year on 1/3/05.

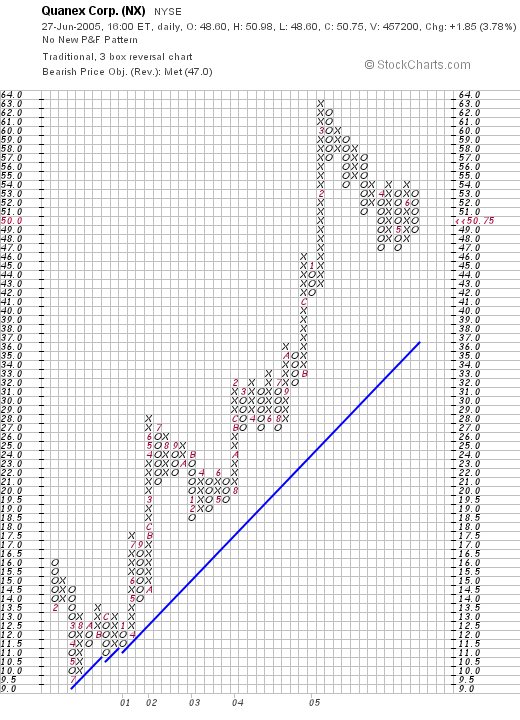

And how does the chart look? Taking a look at a

"Point & Figure Chart" for NX on Stockcharts.com:

We can see that this has been an exceptionally strong stock since it bottomed at $9.50 in July, 2000, and has climbed steadily since, currently trading at the $50.75 level. The graph looks nice to me!

So what do I think? Well the company did make a nice move higher today in an otherwise sloppy market. The latest quarter was impressive, with the company posting stronger earnings and revenue growth, exceeding expectations for the quarter, and raising guidance for the rest of the year.

The last five years, except for the erratic earnings, which recently have been climbing, were solid results. Free cash flow has been growing, and the balance sheet is solid.

The valuation figures are nice with a very low P/E, a PEG just over 0.5, and a Price/Sales under 1.0. This looks good as well. Finally, the chart is strong.

My biggest concern is that this might yet be a bit cyclical, tied to big-ticket items like trucks for the company to stay on its trajectory. Now, if I just had some cash to invest :).

Thanks so much for stopping by! Please feel free to email me at bobsadviceforstocks@lycos.com if you have any questions or comments. Of course, please feel right at home to post some notes right in the blog itself!

Bob

Saturday, 25 June 2005

"Looking Back One Year" A review of stock picks from the week of May 3, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

We had one heck of a week! Both the NASDAQ and the NYSE corrected as concerns about the health of the economy, the housing "bubble" and the price of oil came together in a rather bearish fashion! And just as my own trading portfolio was getting fully invested at 25 positions. Maybe that should be another negative indicator (?).

Anyhow, it is the weekend now, and we can take a look at some selections from about a year ago. Last weekend I reviewed selections from the week of April 26, 2004. Today, let's take a look at the selections from the following week, the week of May 3, 2004, here on Stock Picks.

Please remember that this discussion assumes a buy and hold approach to investing. In practice, I sell my losing stocks quickly and sell portions of my gaining stocks slowly. Thus performance using the different strategies will be materially different. Nevertheless, let's take a look at the four stocks mentioned here that week and see what happened to them!

On 5/3/04, I

posted Province Healthcare (PRV) on Stock Picks at a price of $16.80/share. On April 15, 2005, LifePoint Hospitals (LPNT) announced the completion of the acquisition of Province for $11.375/share and .2917 shares of LPNT. With LPNT closing at $47.13 on 6/24/05, that currently works out to $11.375 and (.2917)($47.13) which works out to $25.12, for a gain of $8.32 or 49.5%.

On May 5, 2005, I

posted Impax (IPXLE) on Stock Picks at $24.95. IPXLE closed at $15.49 on 6/24/05, for a loss of ($9.46) or (37.9%).

On May 23, 2005, IPXL

received a NASDAQ delisting notice due to failure to post the first quarter results in a timely fashion.

On May 6, 2004, I

posted Diebold (DBD) on Stock Picks at $46.95. DBD closed at $49.22 on 6/24/05, for a gain of $2.27 or 4.8%.

On April 20, 2005, Diebold

reported 1st quarter 2005 results. Revenue came in at $540.2 million, up 8.4% from the prior year, however, net income was $26.7 million, down from $29.2 million the prior year, or $.37, a decline of (7.5)% from $.40/share the prior year. This was due to a restructuring charge, but I still insist on both growth in earnings and revenue to get a "thumbs-up" on this sheet!

Finally, on May 7, 2004, I

posted Provide Commerce (PRVD) on Stock Picks at a price of $20.16. PRVD closed at $22.79 on 6/24/05 for a gain of $2.63 or 13%.

On April 28, 2005, PRVD

announced 3rd quarter 2005 results. For the quarter ended March 31, 2005, net sales increased 40% to $57.2 million from $40.2 million the prior year. GAAP net income for the third quarter came in at $3.5 million or $.25/diluted share, down from $15.9 million or $1.14/diluted share last year. However, the shift in results is due to an income tax expense this year which negatively impacted earnings, and an income tax credit last year, which assisted earnings. Taking out these expenses and credits, "Pro Forma" earnings actually increased 59% to $4.4 million or $.32/diluted share. The "Pro Forma" results are probably more indicative of the actual health of the company, but for my purposes on the blog, not knowing detailed accounting information, I will stay with the GAAP results.

So how did we do with the four stocks? Well, one got acquired, and three are getting "thumbs-down" from me. However, these four stocks actually generated three gains ranging from 4.8% to 49.5%, and one loss at (37.9)%. The average of these four stocks works out to a gain of 7.35%.

Thanks so much for stopping by! If you have any questions, or comments, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 2:12 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 25 June 2005 2:18 PM CDT

Newer | Latest | Older

On May 18, 2004, I posted Staples (SPLS) on Stock Picks at $26.39. SPLS had a 3:2 stock split on 4/18/05, making my effective pick price actually $17.59. SPLS closed at $21.92 on 7/8/05 for a gain of $4.33 or 24.6% since posting.

On May 18, 2004, I posted Staples (SPLS) on Stock Picks at $26.39. SPLS had a 3:2 stock split on 4/18/05, making my effective pick price actually $17.59. SPLS closed at $21.92 on 7/8/05 for a gain of $4.33 or 24.6% since posting. On May 17, 2005, Staples reported 1st quarter 2005 results. Total company sales for the quarter ended April 30, 2005, grew 13% to $3.90 billion from $3.45 billion for the same quarter in 2004. Net income came in at $159 million, this worked out to $.21/diluted share, up 24% from the first quarter of 2004.

On May 17, 2005, Staples reported 1st quarter 2005 results. Total company sales for the quarter ended April 30, 2005, grew 13% to $3.90 billion from $3.45 billion for the same quarter in 2004. Net income came in at $159 million, this worked out to $.21/diluted share, up 24% from the first quarter of 2004. On May 19, 2004, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks at $33.03. ANSI closed at $41.21 on 7/8/05 for a gain of $8.18 or 24.8% since posting.

On May 19, 2004, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks at $33.03. ANSI closed at $41.21 on 7/8/05 for a gain of $8.18 or 24.8% since posting. On April 28, 2005, ANSI announced 1st quarter 2005 results. Revenue increased 21.4% for the three months ended March 31, 2005, to $32.3 million from $26.6 million in the same quarter in 2004. Excluding a gain on a sale of Cyberonics common stock, earnings for the first quarter came in at $.22/diluted share, up from $.19/diluted share last year.

On April 28, 2005, ANSI announced 1st quarter 2005 results. Revenue increased 21.4% for the three months ended March 31, 2005, to $32.3 million from $26.6 million in the same quarter in 2004. Excluding a gain on a sale of Cyberonics common stock, earnings for the first quarter came in at $.22/diluted share, up from $.19/diluted share last year.  On May 20, 2004, I posted PetSmart (PETM) on Stock Picks at $28.40/share. PETM closed at $31.43/share on 7/8/05, for a gain of $3.03 or 10.7%.

On May 20, 2004, I posted PetSmart (PETM) on Stock Picks at $28.40/share. PETM closed at $31.43/share on 7/8/05, for a gain of $3.03 or 10.7%. On May 18, 2004, PetsMart (PETM) reported 1st quarter 2005 results. Sales climbed 13.4% to $903.2 million during the quarter, from $796.3 million in the same quarter last year. Importantly, same store sales growth for the quarter came in at 5.7%. Net income grew to $44.7 million or $.30/share, up from $31.9 million or $.21/share last year.

On May 18, 2004, PetsMart (PETM) reported 1st quarter 2005 results. Sales climbed 13.4% to $903.2 million during the quarter, from $796.3 million in the same quarter last year. Importantly, same store sales growth for the quarter came in at 5.7%. Net income grew to $44.7 million or $.30/share, up from $31.9 million or $.21/share last year. Finally, on May 21, 2004, I posted Marvell Technology Group (MRVL) on Stock Picks at a price of $42.99. MRVL had a 2:1 stock split on 6/29/04, making my effective "pick price" actually $21.50. MRVL closed at $39.91 on 7/8/05 for a gain of $18.41 or 85.6% since posting!

Finally, on May 21, 2004, I posted Marvell Technology Group (MRVL) on Stock Picks at a price of $42.99. MRVL had a 2:1 stock split on 6/29/04, making my effective "pick price" actually $21.50. MRVL closed at $39.91 on 7/8/05 for a gain of $18.41 or 85.6% since posting! On May 19, 2005, MRVL reported 1st quarter 2006 results. For the quarter ended April 30, 2005, revenue came in at $364.8 million, a 35% over net revenue of $269.6 million in the first quarter of fiscal 2005. Net income (GAAP) was reported at $63.5 million, or $.20/diluted share, up strongly from $14.5 million, or $.05/diluted share in the first quarter of 2005. These were strong results imho, and help explain the strong stock performance.

On May 19, 2005, MRVL reported 1st quarter 2006 results. For the quarter ended April 30, 2005, revenue came in at $364.8 million, a 35% over net revenue of $269.6 million in the first quarter of fiscal 2005. Net income (GAAP) was reported at $63.5 million, or $.20/diluted share, up strongly from $14.5 million, or $.05/diluted share in the first quarter of 2005. These were strong results imho, and help explain the strong stock performance.

Looking through my email (you can drop me a line at bobsadviceforstocks@lycos.com and I shall try to answer you if possible, most likely right here on the blog!), I wanted to answer a question from P.C. who writes:

Looking through my email (you can drop me a line at bobsadviceforstocks@lycos.com and I shall try to answer you if possible, most likely right here on the blog!), I wanted to answer a question from P.C. who writes: I first

I first  The first place I go in checking a stock out is the "headlines" section of Yahoo looking for the latest quarterly report. What do I require of a stock? That the revenue and the earnings are positive and growing!

The first place I go in checking a stock out is the "headlines" section of Yahoo looking for the latest quarterly report. What do I require of a stock? That the revenue and the earnings are positive and growing!  My next step is to go over to the Morningstar website and check out some of the longer-term financials. In particular, looking at the

My next step is to go over to the Morningstar website and check out some of the longer-term financials. In particular, looking at the  Generally, my next step in looking at a stock is to 'travel' back to Yahoo, in particular looking at the

Generally, my next step in looking at a stock is to 'travel' back to Yahoo, in particular looking at the

I was looking through the

I was looking through the  What drove the stock higher today, in addition to the strong overall tone of the market, was the

What drove the stock higher today, in addition to the strong overall tone of the market, was the  If we look at a bit of a longer-term financial picture, using the

If we look at a bit of a longer-term financial picture, using the  Other "Key Statistics" from the same Yahoo page reveal that BOL has 53.45 million shares outstanding with 52.32 million of them that float. Of these, 1.82 million shares are out short, representing 3.40% of the float or 3.6 trading days of volume. This is just over my own level of 3 trading days for significance.

Other "Key Statistics" from the same Yahoo page reveal that BOL has 53.45 million shares outstanding with 52.32 million of them that float. Of these, 1.82 million shares are out short, representing 3.40% of the float or 3.6 trading days of volume. This is just over my own level of 3 trading days for significance.

So what do I think? I do find it intriguing that the company is entering the Chinese market with its acquisition. In summary, the last quarter was strong, the past five years have shown steady growth in both revenue and earnings, free cash flow is positive and slowly growing, and the balance sheet is solid. Valuation is a bit steep insofar as the PEG is concerned, but the Price/Sales puts BOL as the most reasonable of its industrial group in terms of valuation. And the chart looks strong!

So what do I think? I do find it intriguing that the company is entering the Chinese market with its acquisition. In summary, the last quarter was strong, the past five years have shown steady growth in both revenue and earnings, free cash flow is positive and slowly growing, and the balance sheet is solid. Valuation is a bit steep insofar as the PEG is concerned, but the Price/Sales puts BOL as the most reasonable of its industrial group in terms of valuation. And the chart looks strong! Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  The first stock selected that week was

The first stock selected that week was  On May 4, 2005, HEW

On May 4, 2005, HEW  On May 11, 2004, I

On May 11, 2004, I  On May 13, 2004, I

On May 13, 2004, I  The last "pick" for that week was Panera Bread (PNRA) which was

The last "pick" for that week was Panera Bread (PNRA) which was  EZPW stands for Ezcorp, Inc. EZPW closed at $11.03, up $.28 or 2.60% on 7/1/05. According to the

EZPW stands for Ezcorp, Inc. EZPW closed at $11.03, up $.28 or 2.60% on 7/1/05. According to the

On January 27, 2004, I

On January 27, 2004, I  I identified Milliopore (MIL) on the

I identified Milliopore (MIL) on the  For a longer-term perspective, let's take a look at the

For a longer-term perspective, let's take a look at the  Considering "valuation" issues on this stock,

Considering "valuation" issues on this stock,  Other statistics from Yahoo on MIL reveal that this company has 49.94 million shares outstanding with 49.83 million of them that float. As of 5/10/05, there were 1.45 million shares out short representing 2.90% of the float or 2.1 trading days of volume (the "short ratio"). No cash dividend is paid, and the last stock split was a 2:1 in July, 1995.

Other statistics from Yahoo on MIL reveal that this company has 49.94 million shares outstanding with 49.83 million of them that float. As of 5/10/05, there were 1.45 million shares out short representing 2.90% of the float or 2.1 trading days of volume (the "short ratio"). No cash dividend is paid, and the last stock split was a 2:1 in July, 1995.

This evening, browsing through the

This evening, browsing through the  According to the

According to the  Earnings have been a bit erratic, climbing from a loss of ($.70)/share in 2000 to $3.52 in 2002, dropping to $1.75 in 2003 then climbing further in 2004 and 2005.

Earnings have been a bit erratic, climbing from a loss of ($.70)/share in 2000 to $3.52 in 2002, dropping to $1.75 in 2003 then climbing further in 2004 and 2005. Other statistics from Yahoo include 25.32 million shares outstanding with 24.96 million of them that float. Currently, there are 674,860 shares out short as of 5/10/05, representing 2.7% of the float, or 1.7 trading days of volume.

Other statistics from Yahoo include 25.32 million shares outstanding with 24.96 million of them that float. Currently, there are 674,860 shares out short as of 5/10/05, representing 2.7% of the float, or 1.7 trading days of volume.

On 5/3/04, I

On 5/3/04, I  On May 5, 2005, I

On May 5, 2005, I  On May 6, 2004, I

On May 6, 2004, I  Finally, on May 7, 2004, I

Finally, on May 7, 2004, I