Hello Friends! I am going to TRY to add some images to these posts...let's see how this works! As always, PLEASE remember to do your own investigation of all of these investments discussed on this website as I am an AMATEUR investor! So remember to consult with your own investment advisors prior to making any decisions, to make sure investments discussed are timely and appropriate for you!

Hello Friends! I am going to TRY to add some images to these posts...let's see how this works! As always, PLEASE remember to do your own investigation of all of these investments discussed on this website as I am an AMATEUR investor! So remember to consult with your own investment advisors prior to making any decisions, to make sure investments discussed are timely and appropriate for you!I came across Impax Labs (IPXL) this morning. Quite frankly, it is not a perfect fit for this blog, but I suspect if I get TOO picky, we will all miss out on some great companies...let's see how it goes. IPXL is trading currently at $24.95, up $3.95 or 18.81% on the day. According to the Yahoo profile, IPXL "...is a technology-based specialty pharmaceutical company focused on the development and commercialization of generic and brand name pharmaceuticals, utilizing its controlled-release and other in-house development and formulation expertise."

And guess what? What drove this stock higher was an outstanding earnings report that was released this morning (5/5/04) before the opening of trading. Check out these numbers: revenue for the first quarter ended March 31, 2004, came in at $38.5 million, up more than 240% from last year's $11.4 million in the same quarter. Now even more impressive, was the point that revenue grew more than 131% from the PRIOR quarter's revenue of $16.8 million! Net income came in at $9.05 million or $.14/diluted share compared to a LOSS of $(3.2) million or $(.07)/share the prior year. These numbers BY THEMSELVES are so interesting I may JUST go buy some shares...if I can find something to sell...hmmmm.

If we check the "5-Yr Restated" financials on Morningstar, we can see that revenue has grown a bit inconsistently from $1.2 million in 1999 to what Morningstar was reporting at $50.4 million in the trailing twelve months. However, this obviously does not include the current quarter.

Morningstar.com also shows a decreasing loss from $(.73)/share in 1998, to $(.25)/share in the trailing twelve months. This company is JUST turning profitable.

Free cash flow, unfortunately, is also negative but improving with $(34) million in 2001, $(30) million in 2002 and $(22) million in the trailing twelve months.

The balance sheet looks quite adequate, imho, with $22.5 million in cash, $28.7 million in other current liabilities, and $31 million in current liabilities with $27.5 million in long-term liabilities.

Looking at "Key Statistics" on Yahoo.com, we can see that the Market Cap is at $1.45 billion, the trailing p/e is not meaningful (due to earlier losses) but the forward p/e isn't bad at 21.40, with a PEG (5-yr predicted) downright reasonable at 1.14.

Price/sales is downright expensive however at 20.68.

IPXL has 57.93 million shares outstanding with 36.40 million of them that float. Currently, as of 4/7/04, there were 3.66 million shares out short, which is quite a big number, representing 10.04% of the float or 3.296 trading days. I suspect that today's sharp spike in the price represents a 'squeeze' of the shorts who are scrambling to cover their borrowed shares as the price climbs.

No cash dividend is reported and Yahoo does not report any stock splits either.

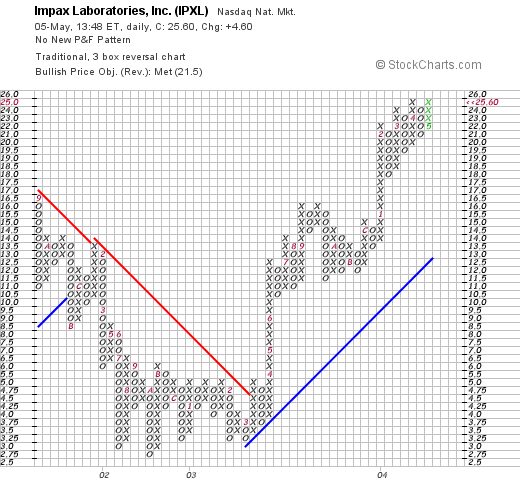

How about Technicals? Looking at a

IPXL Point and figure chart, we can see that this stock broke out strongly in mid-March 2003 and has headed higher from the $4.75/share level to its current level.

What do I think? This is an INTRIGUING stock. I do not currently hold any shares or leveraged positions, but would be happy to buy some. I may even check my trading portfolio to see if there is any way to add a few shares! Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob