Stock Picks Bob's Advice

Sunday, 4 February 2007

AMN Healthcare Services (AHS) "Long-Term Review #4"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I try to do several things at the same time on this blog: review stocks of interest, share with a trading portfolio, and discuss portfolio management strategies that I actually employ. Additionally, to determine if the picks I discuss are any good, I have been trying to review these selections and find out how they would have turned out if I had indeed purchased shares. I do occasionally purchase shares in the stocks I discuss and I try to let you know when and if I own shares when I discuss equities. However, most stocks I discuss I do not have any shares in them, I just feel they are worth attention and become my "vocabulary" of investing. In the last few months, I have started going back to the beginning of this website, which had its birth back in May, 2003, almost four years ago! I am trying to write these stocks up in order, reviewing any "pick" that is still traded.

On January 28, 2007, I reviewed HealthExtras (HLEX) my 'pick #3' on this blog. Today, let's take a look at AMN Healthcare Services (AHS), my 'pick #4' which was posted on May 15, 2003, on Stock Picks Bob's Advice!

I wrote:

"Thursday, 15 May 2003

May 15, 2003 AMN Healthcare Services (AHS)

Scanning through the NYSE best advancers, AHS shows up. Stock is at $10.05 up $.53 for a 5.7% gain or thereabouts. Last quarter just reported is a little confusing--reported on April 29th, showing a 15% increase in revenue with a 21% increase in earnings per share. The company which apparently does 'locums' healthcare people has had a fairly meteoric growth in revenue from $68.8 million in 1997 to 87.7 million in 1998, 146.5 million in 1999, and 230.8 million in 2000, 517.8 million in 2001 and 663.8 million for the trailing 12 months....at least on Morningstar. With the last quarter at 199 million....extrapolating gets about 800 million for next 12 months. However, short term, same day they also reported they expect to miss Wall Street's estimates for the coming quarter. Cash flow wise they are still burning some cash...at least as of 2002 Morningstar website....may actually be cash flow positive at this time based on trends. Anyhow, that 's a provocative pick for this site....I don't own any. Actually hit an 8% stop today on my portfolio with ITIC....a title insurance company...that has low daily volume and thus liquidity. Something probably to avoid to escape the subsequent volatility that comes with very few shares traded daily. Good luck! Bob"

AHS closed at $26.34 on February 2, 2007, for a gain of $16.29 or 162.1% since posting!

Let's take a closer look at this company and see how it is doing today!

What exactly does this company do?

What exactly does this company do?

According to the Yahoo "Profile" on AMN Healthcare (AHS), the company

"...engages in the recruitment and placement of physicians, nurses, and allied health professionals on a temporary or permanent basis at acute-care hospitals and other healthcare facilities in the United States and internationally."

How did they do in the latest quarter?

On November 1, 2006, AHS reported 3rd quarter 2006 results. Revenue came in at $282.7 million, a 69% increase from the $166.9 million in revenue reported in the same quarter last year. Net income climbed 38.3% to $9.4 million from $6.8 million last year. This represented a 27.3% increase on a per diluted share basis from $.22/share last year to $.28/share this year. In the same report the company raised guidance for full year revenue and diluted eps from prior guidance given in August, 2006. New guidance was fully year 2006 revenue from $1.07 billion to $1.08 billion, and full year diluted eps to range from $.94 to $.96/share.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on AHS, we find that revenue has been erratic with $518 million in 2001 increasing to $776 million in 2002, before dropping to $629 million in 2004. Since 2004, revenue has again been on the rise increasing to $706 million in 2005 and $1.02 billion in the Trailing Twelve Months (TTM).

Earnings also dipped from $1.12 in 2002 to a low of $.55/share in 2004, before rebounding to $.69/share in 2005 and $.94/share in the TTM.

The company has reduced its shares outstanding overall with 43 million in 2002, dropping to 29 million in 2005 before rebounding slightly to 34 million shares in the TTM.

Free cash flow numbers are not reported on Morningstar.

The balance sheet looks solid with $3.5 million in cash and $217.7 million in other current assets reported on Morningstar.com. This total of $221.2 million can easily cover the $110.2 million in current liabilities yielding a current ratio of 2.01. In addition, the company has another $272 million in long-term liabilities.

How about some valuation numbers on this stock?

Looking at the Yahoo "Key Statistics" on AMH Healthcare (AHS), we can see that this is a small cap stock with a market capitalization of $896.2 million. (The definition of small cap, mid cap, and large cap varies by the source. In this glossary, the definition for a small cap stock is between $250 million to $1 billion.) The trailing p/e is a moderate 28.11 with a forward p/e (fye 31-Dec-07) estimated at 22.13. The PEG (5 yr expected) is a reasonable 1.43.

According to the Fidelity.com eresearch website, the Price/Sales is reasonable for AHS at 0.83, with an industry average of 1.07. The Return on Equity (ROE TTM) is a reasonable 15.34%, with an industry average of 15.61%. Thus the company, by this profitability measurement, is about as profitable as similar companies in the same industry as measured by the ROE.

Finishing up with Yahoo, we find that there are 34.03 million shares outstanding with 33.57 million that float. As of 1/9/07, it is reported that there are 1.85 million shares out short representing 5.5% of the float or 5.9 trading days of volume. This is almost twice my '3 day rule' for short interest and may well represent a potential 'short squeeze' if the company, which is expected to report earnings any day, comes in with a strong report.

No cash dividend is paid and no stock split is reported on Yahoo.

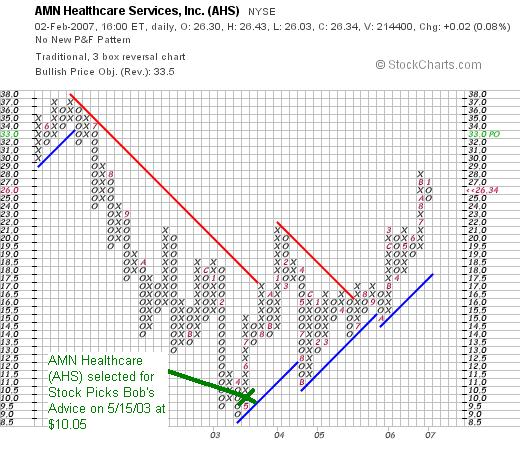

What does the chart look like?

If we examine a "Point & Figure" chart on AHS from StockCharts.com, we can see how the 'turn-around' in 2004, as noted by the Morningstar.com report, is seen in the chart as well. The stock price had been declining from a high of $37 in June, 2002, to a low of $9.00 in April, 2003, a month before being 'picked' on the blog. The stock subsequently has moved steadily higher, and is now just a few points under its recent high of $28. The stock has a way to go before reaching its prior high on this chart back at the $37 level.

Summary: What do I think about this stock?

This stock actually turned out to be a terrific stock that I "picked" on the blog, when technically, it was just turning itself out from a prolonged downward price correction. If I were using the charts, well, I probably would never have posted this one. Recent earnings have been very strong and the company has raised guidance. Valuation appears reasonable with a p/e in the 20's and a PEG under 1.5. The Morningstar.com page is missing the free cash flow, which is unfortunate, but otherwise the results look nice and the balance sheet looks solid. The chart even looks nice with the stock clearly moving higher breaking the trend from the last several years. If I were buying stock, and this one was on the top % list, I might well pick this stock once again!

Thanks again for visiting! I hope you all have a great week trading coming up. And be sure to leave a comment on the blog or email me at bobsadviceforstocks@lycos.com if you have any comments or questions. You are welcome to come and visit my Stock Picks Podcast website as well where I discuss some of the many stocks I write about here on the blog!

Bob

"Looking Back One Year" A review of stock picks from the week of September 26, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I try to do on weekends is to review past stock selections to see how they would have turned out if I had purchased stock in these companies. This review assumes a "buy and hold" strategy. In practice, I advocate and employ a disciplined portfolio strategy that sells stocks quickly and completely on price declines and slowly and partially as the stock appreciates. This difference in strategy would certainly affect investment performance.

Let's take a look at the three stocks I discussed during the week of September 26, 2005.

On September 26, 2005, I posted Rocky Mountain Chocolate Factory (RMCF) on Stock Picks Bob's Advice when the stock was trading at $15.34. RMCF closed at $13.90 on February 2, 2007, for a net loss of $(1.44) or (9.4)%.

On September 26, 2005, I posted Rocky Mountain Chocolate Factory (RMCF) on Stock Picks Bob's Advice when the stock was trading at $15.34. RMCF closed at $13.90 on February 2, 2007, for a net loss of $(1.44) or (9.4)%.

On January 4, 2007, RMCF reported 3rd quarter 2007 results. For the quarter ended November 30, 2006, revenues climbed 13.7% to $9.1 million compared to $8.0 million in the same quarter the prior year. Net earnings climbed 19.4% to $1.3 million, compared to the $1.1 million in the same period last year. Diluted eps climbed 23.5% to $.21/share from $.17/share in the prior year.

On January 4, 2007, RMCF reported 3rd quarter 2007 results. For the quarter ended November 30, 2006, revenues climbed 13.7% to $9.1 million compared to $8.0 million in the same quarter the prior year. Net earnings climbed 19.4% to $1.3 million, compared to the $1.1 million in the same period last year. Diluted eps climbed 23.5% to $.21/share from $.17/share in the prior year.

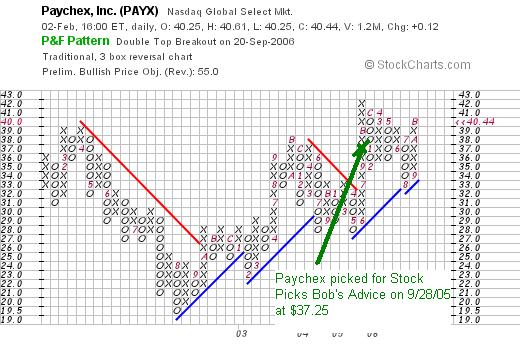

On September 28, 2005, I posted Paychex (PAYX) on Stock Picks Bob's Advice when it was trading at $37.25. Paychex closed at $40.44 on February 2, 2007, for a gain of $3.19 or 8.6% since posting.

On December 20, 2006, Paychex announced 2nd quarter 2007 results. For the quarter ended November 30, 2006, the total revenue came in at $454.9 million, a 14% increase over the $399.8 million reported in the same period last year. Net income came in at $132.7 million or $.35/diluted share, up 18% over the net income of $112.6 million or $.30/diluted share last year. The company beat expectations on earnings which had been estimated to come in at $.34/share, but missed slightly on revenue which had been estimated by analysts at $456 million.

On December 20, 2006, Paychex announced 2nd quarter 2007 results. For the quarter ended November 30, 2006, the total revenue came in at $454.9 million, a 14% increase over the $399.8 million reported in the same period last year. Net income came in at $132.7 million or $.35/diluted share, up 18% over the net income of $112.6 million or $.30/diluted share last year. The company beat expectations on earnings which had been estimated to come in at $.34/share, but missed slightly on revenue which had been estimated by analysts at $456 million.

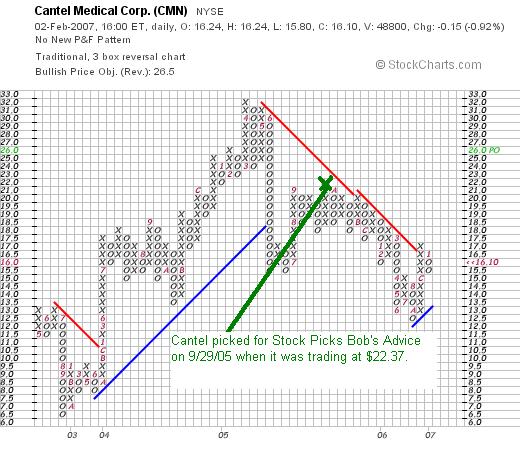

Finally, on September 29, 2005, I posted Cantel Medical (CMN) on Stock Picks Bob's Advice when it was trading at $22.37. Cantel closed at $16.10 on February 2, 2007, for a loss of $(6.27) or (28)% since posting.

Finally, on September 29, 2005, I posted Cantel Medical (CMN) on Stock Picks Bob's Advice when it was trading at $22.37. Cantel closed at $16.10 on February 2, 2007, for a loss of $(6.27) or (28)% since posting.

On December 7, 2006, Cantel reported earnings for the quarter ended October 31, 2006. Sales came in at $50.5 million, up 6% from the sales of $47.8 million reported in the same quarter in 2005. Net income was $1.7 million or $.11/diluted share, down from $2.2 million or $.13/diluted share the previous year. The company missed expectations of $.12/share on earnings, but beat sales consensus of $48.3 million.

On December 7, 2006, Cantel reported earnings for the quarter ended October 31, 2006. Sales came in at $50.5 million, up 6% from the sales of $47.8 million reported in the same quarter in 2005. Net income was $1.7 million or $.11/diluted share, down from $2.2 million or $.13/diluted share the previous year. The company missed expectations of $.12/share on earnings, but beat sales consensus of $48.3 million.

Reviewing the chart shows the already evident technical weakness. Certainly, I should avoid "picking stocks" that show this type of weakness regardless of their fundamentals in the future if at all possible.

So how did I do with these three stocks from that week in September, 2005? In a word, mediocre. The three stocks had an average loss of (9.6)%. Clearly, there is nothing magical about what I write. The stocks I cover have the potential of losses so this speaks well against blindly following these "picks" yet the potential of limiting losers and keeping winners is still the redeeming element.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Site. It is certainly time for a podcast, now if I can only find the time :).

Bob

Posted by bobsadviceforstocks at 6:20 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 4 February 2007 6:21 PM CST

Friday, 2 February 2007

Cerner Corp. (CERN)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember to consult with your professional investment advisors prior to making any investment decision based on information on this website.

Earlier today I replaced my holding of Concur Technologies (CNQR) with a purchase of 120 shares of Cerner (CERN). Cerner closed today at $50.61, up $4.81 or 10.5% on the day. (I actually purchased shares at $49.67, shortfly before the close of trading. I believe that this stock 'fits the bill' better than the Concur shares and promised you I would review this company and share with you my thinking.

Earlier today I replaced my holding of Concur Technologies (CNQR) with a purchase of 120 shares of Cerner (CERN). Cerner closed today at $50.61, up $4.81 or 10.5% on the day. (I actually purchased shares at $49.67, shortfly before the close of trading. I believe that this stock 'fits the bill' better than the Concur shares and promised you I would review this company and share with you my thinking.

What exactly does this company do?

According to the Yahoo "Profile" on Cerner, the company

"...supplies healthcare information technology solutions worldwide. It designs, develops, markets, installs, hosts, and supports software information technology and content solutions for healthcare organizations and consumers. The company implements and supports software solutions and hardware that provide healthcare providers with secure access to clinical, administrative, and financial data in real time."

How did they do in the latest quarter?

Yesterday, on February 1, 2007, after the close of trading, Cerner announced 2006 4th quarter results. It was this announcement that actually drove the stock higher today! Fourth quarter 2006 revenues climbed 17% to $380.8 million from $325.8 million in the year-ago same quarter. Net earnings, on a GAAP basis, were $39.1 million with diluted eps coming in at $.48/share. In the prior year, net earnings were $27.4 million, and diluted eps were $.34.

The company beat expectations: analysts were expecting earnings of $.41/share on revenue of $363.9 million. In addition, the company raised guidance for the 1st quarter 2007 to earnings of $.34 to $.35/share, on sales of $365 to $375 million. Analysts are looking earnings of $.35/share on sales of $359.3 million.

What about longer-term financial results?

Examining the Morningstar.com "5-Yr Restated" financials, we can see that revenue has been steadily increasing from $561 million in 2001 to $1.2 billion in 2005 and $1.3 billion in the trailing twelve months (TTM). Earnings have been a bit more erratic early on with a loss of $(.61)/share in 2001 to a gain of $.65, then a dip to $.59/share in 2003. Since then earnings have been on the rise with $.86/share reported in 2004, $1.10/share in 2005 and $1.22/share in the TTM. The company has grown its outstanding shares very slowly, with 69 million in 2001 increasing five years later to 78 million, a just under a 15% increase while revenues have increased more than 100% and earnings have crown similarly by almost 100% since 2002.

Free cash flow has been positive and basically growing with $51 million in 2003, $112 million in 2004, $128 million in 2005 and $126 million in the TTM.

The balance sheet also appears solid, with $276.7 in cash and $407.0 million in other current assets. This total of $683.7 million, when compared to the current liabilities of $264.1 million, yields a current ratio of 2.59. Generally current ratios of 1.25 or higher are considered healthy.

How about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Cerner, we can see that this is a mid cap stock with a market capitalization of $3.95 Billion. The trailing p/e is a bit rich at 41.69, but with earnings growing rapidly, the forward p/e (fye 31-Dec-07) is estimated at a more reasonable, but not cheap, 29.95. Thus the 5-yr expected PEG ratio is a nice 1.36.

According to the Fidelity.com eresearch website, the Price/Sales (TTM) ratio works out to a reasonable 2.59, with the 'Industry Average' being 5.13. Cerner is also more profitable than the average company in its industrial group with a Return on Equity (TTM) calculated at 12.88 with an industry average listed at (77.54)%. So in addition to being reasonably priced relative to the sales, the company apparently is more profitable than other companies in the same industrial group!

Finishing up with Yahoo, we find that there are 78.14 million shares outstanding with 64.58 million that float. As of 1/9/07, there were 10.57 million shares out short representing 16.30% of the float (!) and the short ratio is an impressive 27.1. That means, considering 5 trading days/week, that it would take over 5 weeks of average trading volume just for the short-sellers to cover their shorts. I suspect very strongly that we are witnessing a 'short squeeze' on this stock that may well continue into next week or longer (?).

No cash dividends are reported and the stock split 2:1 last year on January 10, 2006.

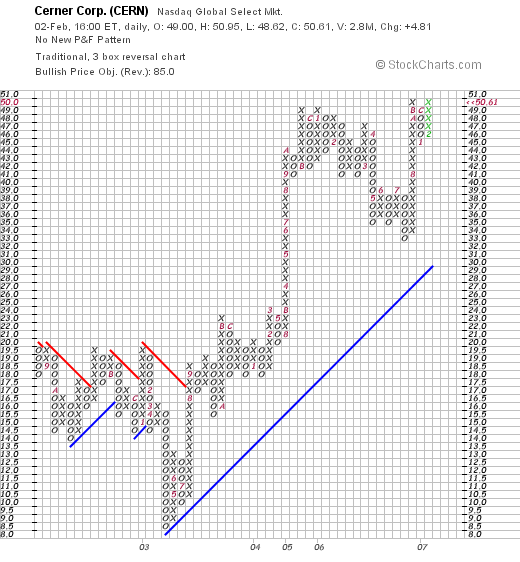

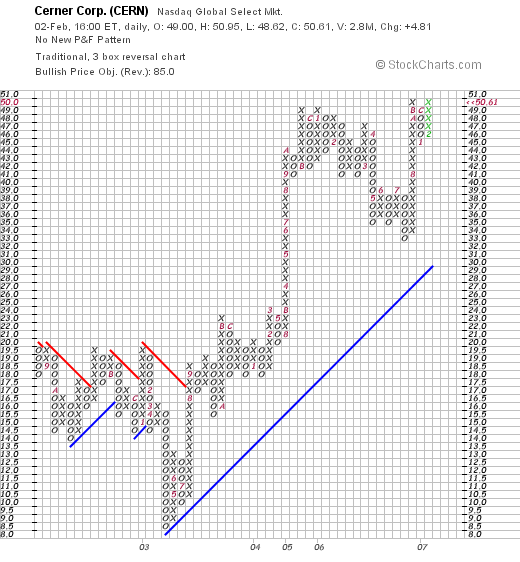

What does the chart look like?

If we review a "Point & Figure" chart on Cerner from StockCharts.com, we can see that as we reported earlier, the period between 2002 and 2003 was a bit erratic (as was the earnings), with the stock dropping from $19.50 in August, 2002, to a low of $8.50 in April, 2003. Since that time, the stock has fairly steadily moved ahead and actually appears only now to be once again breaking into new high territory. The chart looks encouraging to me!

Summary: What do I think about Cerner?

First of all, let me qualify this entire entry and remind everyone that I have purchased shares of Cerner and this stock is part of my trading portfolio now. That being said, the reason why I bought shares is first of all, the stock is showing good daily momentum today, making the top % gainers list. The latest quarter was solid, with strong revenue and earnings growth that both exceeded expectations. In addition, the company raised guidance for the upcoming quarter.

The Morningstar.com report is solid with steady revenue and earnings growth the past few years, steady shares outstanding, nice free cash flow which is basically increasing, and a solid balance sheet. Valuewise, the p/e is indeed a bit rich, but with earnings growing strongly, the PEG is under 1.5, the Price/Sales is cheap for its group, and the ROE is higher than the average company in its group as well. Finally, there is a TON of shares out short that need to be purchased. It will literally take weeks for the short-sellers to cover their bets against the company without a large increase in average daily volume. Finally, the chart looks strong. There is little not to like about this stock! And that's why I made the switch!

Thanks again for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by my Stock Picks Podcast Website, where you can download mp3's of me discussing manyt of the stocks I write about here on the blog.

Have a great weekend!

Bob

Cerner Corp. (CERN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today I 'undid' my purchase of Concur Technologies (CNQR). The stock was actually higher from where I had purchased it yesterday but it simply did not follow my own peculiar trading rules for a stock. I gave it some thought; considered just hanging in there with the purchase, but decided against it, and sold my shares. Since this was neither a sale on 'good news' or a sale on 'bad news', but rather a purchase and sale on a 'dumb mistake', I decided to go ahead and replace this stock with another stock, which hopefully would meet my investment rules.

This afternoon I purchased 120 shares of Cerner Corp. (CERN) at a price of $49.67. Cerner was on the top % list and had a great day, closing at $50.61, up $4.81, or 10.50% on the day. I had thought I had reviewed this stock already, but I cannot find it on the blog (lol) (I had to Google my own blog...do you ever have that problem?), and promise to attempt to get it reviewed if not shortly then sometime this weekend.

Thanks so much for stopping by and visiting! Have a great weekend everyone!

Bob

Concur Technologies (CNQR) "Trading Transparency"

Just a short note. A few moments ago I decided to pull the plug on my CNQR stock. I bought this yesterday quite frankly without conscientiously doing my homework and when yesterday evening I went through the numbers, it just didn't add up. I don't like how the company is to be making less money this year than last, how they missed expectations on the earnings side, and even though I bought it (and publicly at that!), and even though the stock is up fractionally today, it just isn't my investment style.

So out it went. I sold my 240 shares of CNQR at a price of $17.82, with a net of $4,277.19. I purchased these yesterday at a price of $17.40, and a cost of $4,185.89, so I did make almost $100, but that is not the point. It wasn't my strategy, I didn't think before I bought it....and out it went!

However, I shall be on the look-out this afternoon for a stock that does fit instead of CNQR. I just feel better this way rather than leaving it in my portfolio when I bought it for the wrong reasons.

Relieved,

Bob

Thursday, 1 February 2007

Concur Technologies (CNQR)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

This afternoon, after selling a 1/6th of my holding in Precision Castparts (PCP), I had the opportunity of buying another position. As I like to do, I went to the top % gainers list to see if there were any stocks there that met my criteria for investing. There I found Concur Technologies (CNQR) which closed at $17.42, up $2.37 or 15.75% on the day. I purchased 240 shares of CNQR at a price of $17.40, shortly before the close of trading.

This afternoon, after selling a 1/6th of my holding in Precision Castparts (PCP), I had the opportunity of buying another position. As I like to do, I went to the top % gainers list to see if there were any stocks there that met my criteria for investing. There I found Concur Technologies (CNQR) which closed at $17.42, up $2.37 or 15.75% on the day. I purchased 240 shares of CNQR at a price of $17.40, shortly before the close of trading.

As I promised earlier today, let's take a look at this company and I think I can show you why it belongs on this blog and why I chose to take a position in this stock!

What exactly does this company do?

According to the Yahoo "Profile" on Concur, the company

"...provides business services and software solutions that automate corporate travel and expense management processes in the United States. Its flagship services include Concur Expense, an expense reporting solution that provides the process and information for management to reduce manual processing, improve internal controls, increase business policy compliance, speed up reimbursement, and increase expense report accuracy; and Cliqbook Travel, which enables customers to provide online corporate travel booking capabilities to its employees and enables customers to search for travel data from multiple sources, as well as delivers online booking, reporting, and agency support."

How did they do in the latest quarter?

Yesterday, after the close of trading, Concur (CNQR) announced first quarter 2007 results for the quarter ended December 31, 2006. Total revenue for the quarter climbed 52% from last year's results to $29.2 million from $19.3 million last year. This was also a sequential increase of 6% from the previous quarter. Net income was $1.0 million, or $.02/share, compared to net income of $.6 million or $.02/diluted share in the year ago quarter. This year's quarter included a provision for income taxes of $1.4 million, compared to no provision for taxes in the prior year. However, in general I prefer to see increasing earnings regardless of the reason, and might not have purchased this stock if I was more critical at the time of my purchase!

The company beat expectations for revenue, with analysts expecting revenue of $27.5 million and missed estimates for earnings with the $.02 reported, when analysts were expecting $.05/share. In the same article the company is reported to guide analysts to $29.5 million in the upcoming quarter and $.02/share in earnings. Total 2007 results is expected to be revenue of $121 to $125 million and earnings of $.10/share. Again, looking closely, this stock is not a perfect match for my strategy of increasing revenue and earnings.

What about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials on CNQR, we can see that revenue has steadily increased from $45 million in 2002 to $97 million in 2006. Earnings, which were at a loss of $(.46)/share in 2002, turned profitable at $.03/share in 2003 and have steadily increased since them to $.87/share in 2006.

The company has also increased the number of shares outstanding from 27 million in 2002 to 36 million in the TTM, while revenue was up 100%, shares outstanding increased by only 33%.

Free cash flow has been erratic but positive recently at $1 million, up from a $(3) million in 2005.

The balance sheet is adequate with $16.3 million in cash and $32.7 million in other current assets. This easily covers the $39.4 million in current liabilities which works out to a current ratio of 1.24. In addition, the company has $24.6 million in long-term liabilities.

How about some valuation numbers on this stock?

Checking Yahoo "Key Statistics" on CNQR, we can see that this is a small cap stock with a market capitalization of $545.97 million. The trailing p/e is a reasonable 19.98, with a forward p/e of 42.49.

Using the Fidelity.com eresearch website for more information, we find that the Price/Sales (TTM) works out to a modest 5.47 compared to the industry average of 5.74. This company reported a Return on Equity (TTM) of 40.22% compared to an industry average of 21.27%.

Finishing up with Yahoo, we find that there are 36.21 million shares outstanding and 32.47 million that float. Currently there are 5.12 million shares out short as of 1/9/07. Currently there are 5.12 million shares out short which is 14.70% of the float or 10.4 trading days of volume. Today's sharp move higher on relatively unimpressive earnings, suggests the possibility that the 10.4 trading days of volume (the short interest), might well be at work with a 'squeeze' of the short sellers.

No dividend and no stock split is reported on Yahoo.

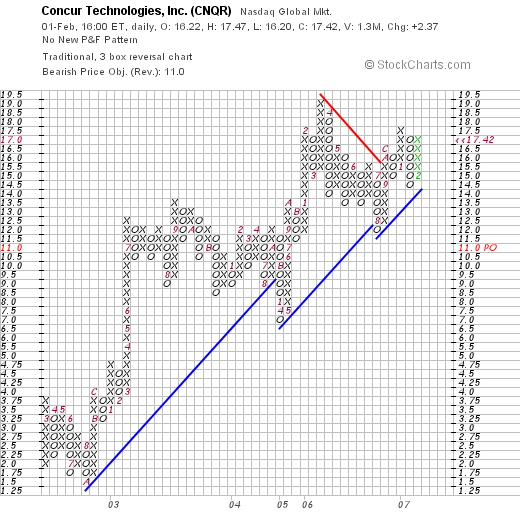

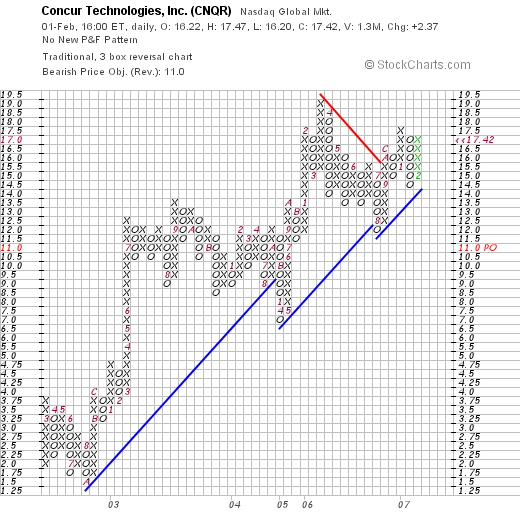

What does the chart look like?

Looking at the "Point & Figure" chart on Concur from StockCharts.com we can see a fairly strong price performance from a low of $1.50 in September, 2002, to a high of $19.00 in March, 2006. Since then the stock pulled back to $12 only to resume its upward march.

Summary: What do I think?

To tell you the truth (lol), I think if I had looked at this one closely, I might have passed on this purchase. I don't like flat earnings, I don't like that the next 12 months will have earnings under the prior year's results. Otherwise the numbers are supportive of the purchase. I shall have to watch this one relatively closely and sell it if the price performance is under question. Otherwise the chart appears strong.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave a comment on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Concur Technologies (CNQR) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, I spent my nickel :(. With the 'permission slip' to buy a new position with the Precision Castparts, I set out to find a stock that met my criteria on the top % gainers list. I came across a new name, Concur Technologies (CNQR) that fits the bill, and I purchased 240 shares at $17.40.

As I write, CNQR is trading at $17.40, up $2.35 or 15.61% on the day. When I get a chance, I shall write up an entry on this stock and 'make sure' that this stock fits my needs. But I have already purchased shares so.....anyhow, will get to it at a later time. Meanwhile, I shall need to settle down a bit. Haven't had this busy a couple of days for awhile!

Thanks again for stopping by! If you have any comments or questions, please feel free to write them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Precision Castparts (PCP) "Trading Transparency'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago my Precision Castparts (PCP) holding hit one of my appreciation targets. As you may recall, I use 30, 60, 90, 120, then 180, 240, 300, 360, 450, 540%...etc. targets to sell 1/6th of my holdings. I sold 20 shares of my 120 share position (leaving 100 shares in my Trading Account) at a price of $90.20. I had purchased these shares 10/24/06, about 3 months ago, at a cost basis of $69.05. It has been an excellent performer for me!

This sale represented a gain of $21.15/share or 30.6%. Since I am at 14 positions, under my maximum of 25, this also gives me a "permission slip" to add a new position to the account.

As I like to joke, that 'nickel' is already burning a hole in my pocket.

Thanks so much for stopping by!

Bob

Wednesday, 31 January 2007

A Reader Writes "What is your strategy....?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my favorite things about writing a blog is reading and responding to questions and comments from readers. And when I get a letter from 'overseas', then it is all the more special. And when a reader like Dror is kind enough to write more than once...well it is just special! O.K., enough of the sentimental stuff. Let me share with you what Dror wrote and what my thoughts are on the subject.

One of my favorite things about writing a blog is reading and responding to questions and comments from readers. And when I get a letter from 'overseas', then it is all the more special. And when a reader like Dror is kind enough to write more than once...well it is just special! O.K., enough of the sentimental stuff. Let me share with you what Dror wrote and what my thoughts are on the subject.

Dror's letter:

"Hi Bob,

I've been wondering what is your strategy on stocks that do not get out of your -8% and the +30% thresholds for a few months...

When will you take them out of your portfolio, will you wait a quarter, two, or wait indefinitely until some threshold is broken?

Bob, I really appreciate your perseverance on sharing your thoughts and strategies with everybody.

Thanks so much,

Dror (From Israel, yes ;-)"

Dror,

Thank you so much for writing! The question, as I see it, is what to do when a stock in a portfolio is a bit lethargic, sitting between the extremes of my first sale...either on the downside at an 8% loss, or on the upside at a 30% gain. Should you be impatient and unload the stock or hang in there?

Basically, when a stock sits for a long time....for instance my Wolverine World Wide (WWW) which I held for over a year before selling my first partial position today...I generally sit tight. Of course, I try to review the fundamental information I can glean from the internet....double-check each quarterly report, look at the news etc. If there is anything wrong with the company, I always reserve the right to unload any position without regard to any trading rules.

But if everything is intact and yet the stock price is not responding, perhaps it is a question of the market environment. If we are to believe that our portfolios are able to tell us when to commit more funds to the market...as I do...by hitting sales targets on the upside. And if we accept that sales within our portfolios may well indicate a "sick" market environment leading me to "sit on my hands" on proceeds from sales on the downside, then it goes as well that failure to move either way may well represent the result of a market itself that is in the doldrums, sort of listlessly trading in a range of prices.

Patience is indeed a virtue. I haven't been doing much trading at all the last six months and then today two of my holdings hit sale points at targeted gains. So one never knows.

I believe it was Antoine St. Exupery who in The Little Prince wrote "On ne sait jamais." I am not sure why that quote just hit me as significant, but then again, there must be a reason :).

Thanks again for writing, for participating, and for being a loyal reader. Things like that mean a lot to me!

Your friend and fellow investor,

Bob

Hologic (HOLX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any decisions based on information on this website.

Just before the close of trading my Wolverine World Wide (WWW) hit the first sale point at a 30% appreciation target. Being under my maximum holdings with only 13 positions out of my potential 25, this gave me a "permission slip" to add a new position. Checking the top % gainers list, I saw that Hologic (HOLX), another old favorite of mine had hit the list. I checked and saw that they came in with strong earnings and had raised guidance....both big positives for a stock.

Shortly before the close of trading (at 3:55 pm exactly :)), I went ahead and purchased 120 shares at $55.49.

Thanks again for stopping by and visiting. I try very hard to share with you all of my trades and my thinking behind it as I work to refine my own strategy!

Bob

Newer | Latest | Older

What exactly does this company do?

What exactly does this company do?

On September 26, 2005, I

On September 26, 2005, I  On January 4, 2007, RMCF reported 3rd quarter 2007 results. For the quarter ended November 30, 2006, revenues climbed 13.7% to $9.1 million compared to $8.0 million in the same quarter the prior year. Net earnings climbed 19.4% to $1.3 million, compared to the $1.1 million in the same period last year. Diluted eps climbed 23.5% to $.21/share from $.17/share in the prior year.

On January 4, 2007, RMCF reported 3rd quarter 2007 results. For the quarter ended November 30, 2006, revenues climbed 13.7% to $9.1 million compared to $8.0 million in the same quarter the prior year. Net earnings climbed 19.4% to $1.3 million, compared to the $1.1 million in the same period last year. Diluted eps climbed 23.5% to $.21/share from $.17/share in the prior year.

Finally, on September 29, 2005, I

Finally, on September 29, 2005, I  On December 7, 2006, Cantel reported

On December 7, 2006, Cantel reported  Earlier today I replaced my holding of Concur Technologies (CNQR) with a purchase of 120 shares of Cerner (CERN). Cerner closed today at $50.61, up $4.81 or 10.5% on the day. (I actually purchased shares at $49.67, shortfly before the close of trading. I believe that this stock 'fits the bill' better than the Concur shares and promised you I would review this company and share with you my thinking.

Earlier today I replaced my holding of Concur Technologies (CNQR) with a purchase of 120 shares of Cerner (CERN). Cerner closed today at $50.61, up $4.81 or 10.5% on the day. (I actually purchased shares at $49.67, shortfly before the close of trading. I believe that this stock 'fits the bill' better than the Concur shares and promised you I would review this company and share with you my thinking.

This afternoon, after selling a 1/6th of my holding in Precision Castparts (PCP), I had the opportunity of buying another position. As I like to do, I went to the

This afternoon, after selling a 1/6th of my holding in Precision Castparts (PCP), I had the opportunity of buying another position. As I like to do, I went to the

One of my favorite things about writing a blog is reading and responding to questions and comments from readers. And when I get a letter from 'overseas', then it is all the more special. And when a reader like Dror is kind enough to write more than once...well it is just special! O.K., enough of the sentimental stuff. Let me share with you what Dror wrote and what my thoughts are on the subject.

One of my favorite things about writing a blog is reading and responding to questions and comments from readers. And when I get a letter from 'overseas', then it is all the more special. And when a reader like Dror is kind enough to write more than once...well it is just special! O.K., enough of the sentimental stuff. Let me share with you what Dror wrote and what my thoughts are on the subject.