Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the list of top % gainers on the NASDAQ today, I came across Paychex (PAYX) which closed at $37.25, up $3.16 or 9.27% on the day. Even though my stock club has owned some shares of this stock, I do not personally own any shares or options on this company.

Looking through the list of top % gainers on the NASDAQ today, I came across Paychex (PAYX) which closed at $37.25, up $3.16 or 9.27% on the day. Even though my stock club has owned some shares of this stock, I do not personally own any shares or options on this company.According to the Yahoo "Profile" on PAYX, the company "...provides computerized payroll, as well as integrated human resource and employee benefits outsourcing solutions for small and medium sized businesses in the United States. It offers payroll processing; tax filing and payment; employee payment; time and attendance solutions; regulatory compliance, such as new hire reporting and garnishment processing; retirement services administration; employee benefits administration; workers' compensation insurance; and human resource administrative services."

On September 27, 2005, (after the close of trading yesterday), Paychex announced 1st quarter 2006 results. Total revenue for the quarter ended August 31, 2005, came in at $403.7 million, a 17% increase over the $345.0 million reported in the same period last year. Net income came in at $115.0 million for the quarter or $.30/diluted share, a 31% increase over net income of $87.7 million or $.23/diluted share last year. In addition, the company raised revenue growth guidance for 2006 to be in the range of 13% to 15%. Overall, a very satisfactory report!

What about a longer-term view of the company? Looking at a "5-Yr Restated" financials from Morningstar.com, we can see a steady picture of revenue growth from $.9 billion in 2001 to $1.4 billion in 2005. Earnings have also steadily grown from $.68/share in 2001 to $.97 in 2005. The company also pays a dividend has raised it each and every years since at least 2001 when it was $.33/share, increasing to $.51/share in 2005.

What about a longer-term view of the company? Looking at a "5-Yr Restated" financials from Morningstar.com, we can see a steady picture of revenue growth from $.9 billion in 2001 to $1.4 billion in 2005. Earnings have also steadily grown from $.68/share in 2001 to $.97 in 2005. The company also pays a dividend has raised it each and every years since at least 2001 when it was $.33/share, increasing to $.51/share in 2005.Free cash flow has been positive and growin from $313 million in 2003 to $397 million in 2005.

In addition, the balance sheet looks solid with $707.6 million in cash and $3.0 billion in other current assets, as balanced against a sizeable $2.9 billion in current liabilites and only $51.6 million in long-term liabilities. Overall, current assets favor liabilities, but it isn't an overwhelming ratio.

Taking a look at Yahoo "Key Statistics" on PAYX, we find that the market cap is a large cap $14.11 billion. The trailing p/e is rich at 38.36 with a forward p/e just a bit better at 28.01. Demonstrating the rich valuation, we find PAYX with a PEG of 1.71.

Looking at Fidelity.com "eresearch", we find that Paychex is in the "Staffin/Oustsourcing Svcs" Industrial Group. Also, by this parameter, Paychex is priced rather richly. The company leads this group in valuation with a price/sales ratio of 9.0, this is followed by Robert Half (RHI) at 2.0, Gevith HR (GVHR) at 1.1, Administaff (ASF) at 0.9, and Manpower (MAN) at 0.2.

Other key statistics on Yahoo document the 378.71 million shares outstanding. As of 8/10/05, there were 8.72 million shares out short representing 2.6% of the float or 5 trading days of volume. Using my arbitrary 3 day rule, this level of short interest does look significant and may be driving the stock higher (?).

As noted previously, the company does pay a small dividend currently at $.52/share yielding 1.5%. The last stock split reported on Yahoo was a 3:2 split on May 23, 2000.

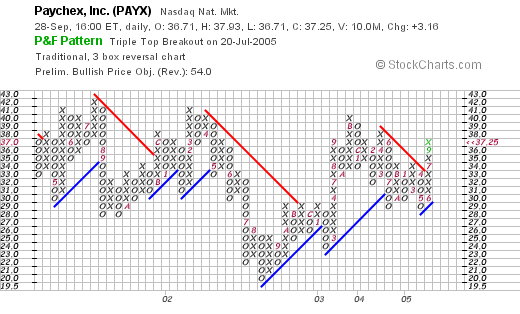

What about a chart? Looking at a Paychex "Point & Figure" chart:

The chart is rather unimpressive with basically a sideways move in the stock price from April, 2001, to the current level at $37.25. The stock certainly does not look overextended and the recent price action above the support line also looks promising as the stock broke through resistance at the $32 level.

What do I think? I actually like the stock. The earnings have been solid, the Morningstar information is impressive with steady reven, earnings, and free cash flow, and the balance sheet looks nice.

On the downside, the valuation is rich with a p/e in the 30's and the forward p/e only in the 20's with a PEG over 1.5. And a price/sales ratio that is way ahead of its peers in the same industrial group.

Anyhow, thanks so much for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or leave them right here on the blog!

Bob