Stock Picks Bob's Advice

Saturday, 15 January 2005

"Looking Back One Year" A review of stock picks from the week of November 24, 2003

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. This is the entry that I like to do to review in a methodical fashion all of the stock picks I have posted on this Weblog. Please remember, like always, that I am an amateur investor. So consult with your professional investment advisor before making any investment decisions based on information on this website! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

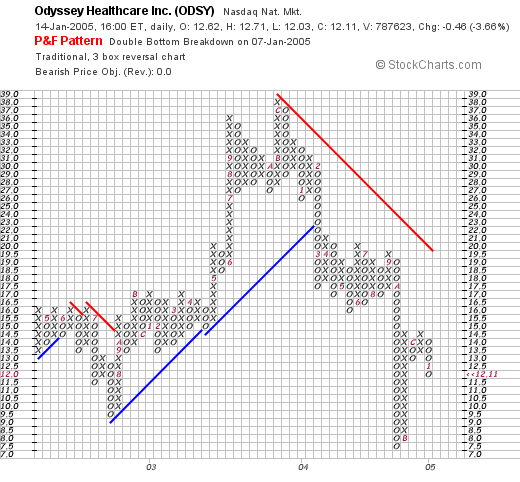

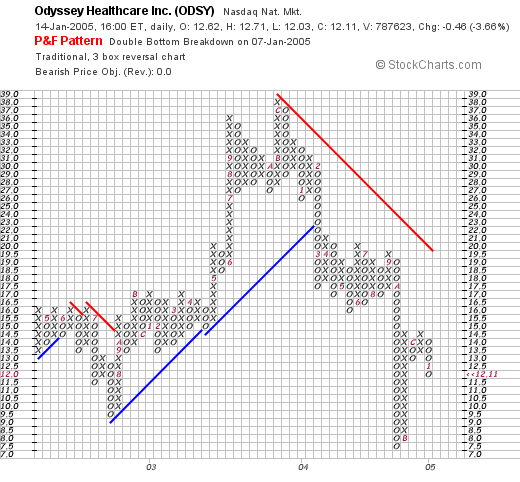

The first stock I posted on Stock Picks that particular week was Odyssey Healthcare (ODSY). I

posted Odyssey (ODSY) on November 24, 2003, at a price of $35.94. ODSY closed at $12.11 on 1/14/05, for a loss of $(23.83) or (66.3)%.

On November 1, 2004

ODSY reported 3rd quarter 2004 results. Net patient revenue for the third quarter of 2004 ended September 30, 2004, actually jumped 23.1% to $87.5 million, compared to $71.0 million the prior year. Net income for the quarter was $9.0 million, a 14.7% increase over the $7.8 million the prior year. On a per diluted share basis, this came in at $.24, a 14.3% increase over the $.21 in the same quarter in 2003. Overall, not too bad results.

However, if we look at the ODSY

Point & Figure chart from Stockcharts.com, the graph still looks awful.

The stock broke down in February, 2004, when it broke through a support level at around $23 and has traded lower since. It actually is significantly off its lows of $7.50 which it reached in October, 2004. I would like to see the stock above $19.50 to feel it might be reversing its downward trend.

On November 26, 2003, I made the second post of the week and posted H&R Block (HRB) on Stock Picks at a price of $53.41. HRB closed at $47.34 for a loss of $(6.07) or (11.4)%.

On November 26, 2003, I made the second post of the week and posted H&R Block (HRB) on Stock Picks at a price of $53.41. HRB closed at $47.34 for a loss of $(6.07) or (11.4)%.

On November 23, 2004, HRB reported 2nd quarter results. Revenues for the quarter ended October 31, 2004, came in at $539.3 million a 5.2% drop from the second quarter of 2003. In addition they reported they lost $(52.2) million or $(.32)/share compared to a loss of $(10.4) million or $(.06)/share last year. To top off this dismal report, HRB lowered its expectations for earnings for the year to $3.50 to $4.00/share from $4.00 to $4.25/share previously provided as guidance.

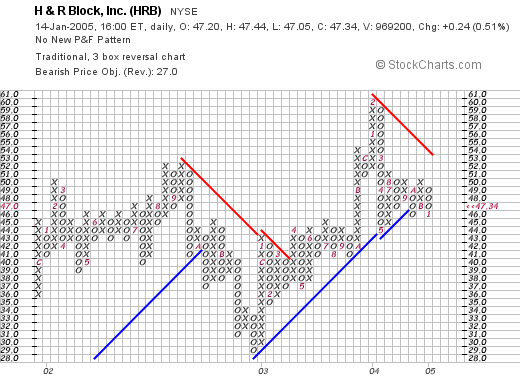

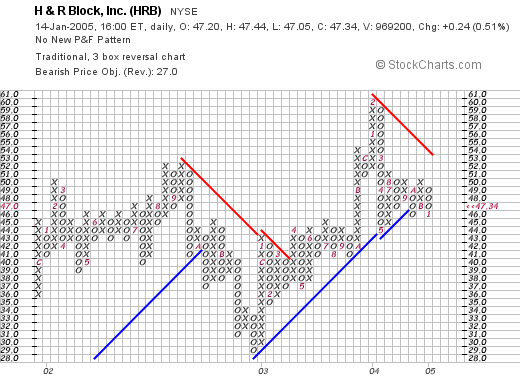

You can imagine how the stock responded! Looking at a Point & Figure on HRB from Stockcharts.com, we can see how the stock seemed to be moving higher from its lows in December, 2002, at around $29.00 to a high of $60 in February, 2004. However it broke through support in October 2004, and has been under the support line since.

Overall, a fair chart, but not very encouraging to me!

So how did we do? In a word, lousy. The week of November 24, 2003, I picked two stocks on this blog: ODSY which is now down (66.3)% and HRB which is down (11.4)% for an average loss of (38.85)%. So what does this prove? First of all, that this "system" of picking stocks is no less fallible than the next one and that is why you should consult with your advisors! Next, it shows the importance, imho, of NOT letting your losses run, and instead, cutting them short. I use an 8% stop in my trading and I would suggest that every investor have some sort of loss limit when they make a decision to buy a stock.

We have had many outstanding weeks on Stock Picks, but this one I would rather forget!

Thanks so much for stopping by! Please leave your comments right here on the blog or drop me a line at bobsadviceforstocks@lycos.com if you have any questions or comments.

Bob

Posted by bobsadviceforstocks at 10:20 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 15 January 2005 10:23 AM CST

Friday, 14 January 2005

"Revisiting a Stock Pick" Scientific Games (SGMS)

Hello Friends! It is the end of the week and we got a bit of a rally today. The market was getting terribly oversold after multiple down days this year, and it was time to see a few "bargain hunters" jumping in to bid up prices. I will wait and see if there is any follow-through next week; I just don't see the catalyst for a new bull run...but then again, I do not claim to be any kind of expert on predicting the market! In fact, I would like to thank you for visiting my blog,

Stock Picks Bob's Advice. As I like to point out multiple times around here, I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

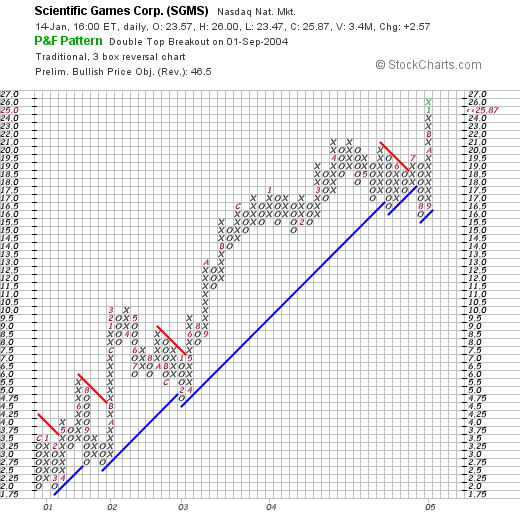

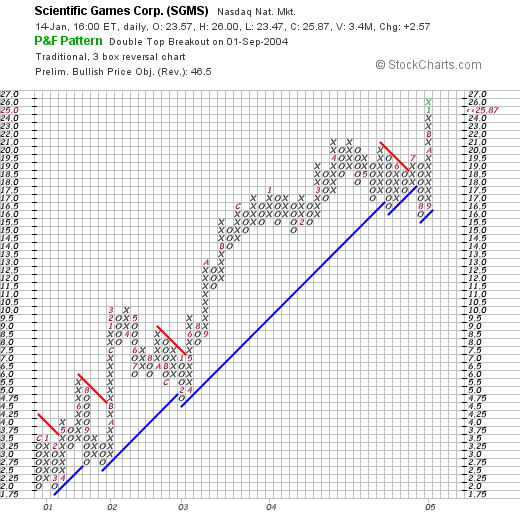

After blogging over a year-and-a-half, and making literally hundreds of stock picks, I think I owe it to myself and to my readers to revisit stocks if they are still worthy of being discussed. Recently I started the process of re-posting a stock, if it has been over a year since I originally discussed it, and if it again makes the list of top % gainers, and deserves to be noted! Scientific Games (SGMS) is such a stock!

I first

posted Scientific Games (SGMS) on Stock Picks on September 12, 2003, when it was trading at $11.55/share. To give you some perspective, SGMS closed today at $25.87, up $2.57/share or 11.03% on the day! And to think that even I did NOT ever buy any shares :(.

According to the

Yahoo "Profile" on SGMS, SGMS "...is a provider of services, systems and products to both the instant ticket lottery industry and the pari-mutuel wagering industry based on revenues." What drove the stock higher today was a

report that SGMS and International Game Technology (IGT) have formed a "worldwide, long-term strategic alliance to jointly provide products for the converging gaming market." Clearly, the "street" liked the idea of the alliance of these two gaming 'titans'.

If we look at the latest quarterly result for SGMS, on November 1, 2004, Scientific Games

reported 3rd quarter 2004 results. For the quarter ended September 30, 2004, revenues increased 36% to $179.3 million from $132.1 million reported in the same quarter of 2003. On a diluted basis, net income increased 60% to $.24/share from $.15/share in 2003. These were great results!

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar, we can see that revenue has grown nicely from $211.1 million in 1999 to $719.7 million in the trailing twelve months (TTM).

Earnings dipped from $.01/share in 1999 to a loss of $(.84)/share in 2000. Since that year, earnings have improved each year to the current $.84/share in the TTM.

Free cash flow, according to Morningstar, has also improved from $55 million in 2001 to $108 millin in the trailing twelve months.

The balance sheet appears adequate, if a bit heavy on long-term debt, with $96.6 million in cash and $164.1 million in other current assets. That is plenty to cover the current liabilities of $129.5 million and to make a bit of a dent in the long-term debt of $566.3 million.

What about "valuation"? To assess this, I like to review the

"Key Statistics" from Yahoo. Here we can see that SGMS is still defined (under $3 billion) as a mid cap stock with a market capitalization of $2.28 Billion. The trailing p/e is moderate at 30.87 with a forward p/e (fye 31-Dec-05) of 23.31. The "5-Yr" PEG is nice at 1.16, and the Price/Sales ratio isn't bad at 2.85 (but not exactly cheap.)

Yahoo reports 88.08 million shares outstanding with 61.80 million of them that float. Of these there are 3.31 million shares out short as of 12/8/04, representing 5.36% of the float, or 3.456 trading days of volume.

Yahoo does not report any cash dividends. The stock last split 2:1 in October, 1993.

What about "technicals"? If we take a look at a

Point & Figure chart from stockcharts.com, we can see an extremely strong stock that has not faltered in any significant fashion since late 2000. In August, 2004, the stock broke through a support level down to $16/share, but has been climbing steadily since. This chart looks nice to me!

So what do I think? Well, I wish I HAD bought some shares back in 2003. Quite frankly, the stock almost looks stronger than ASKJ which I DID buy some shares...hmmm. Anyhow, the move today is nice, the latest quarter was impressive, the alliance with IGT is convincing, the free cash flow is great, the balance sheet is solid, and the chart looks super. What else can I say. Now if I hadn't bought that ASKJ so quickly....lol. You all have a great weekend!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

"Trading Transparency" ASKJ

Well, about 15 seconds after I posted that last post on ASKJ, I decided I convinced myself and purchased 240 shares at $30.07 in my trading account. Hopefully, the bear market doesn't return and gobble up my principle, so I will be watching this one closely! Thanks again for stopping by.

Bob

January 14, 2005 Ask Jeeves (ASKJ)

Hello Friends! Thanks again for stopping by and visiting my blog,

Stock Picks Bob's Advice. As I always like to remind you, please remember that I am an amateur investor, so please consult with your professional investment advisors to make sure that all investments discussed are appropriate, timely, and likely to be profitable for you, prior to making any investment decisions based on information on this website. As always, please feel free to email me at bobsadviceforstocks@lycos.com if you have any comments, questions, or words of encouragement.

Looking through the

list of top % gainers on the NASDAQ, I came across Ask Jeeves (ASKJ), the internet company responsible for the search engine of the same name. ASKJ, as I write, is trading at $29.59, up $2.55 or 9.43%. Prior to the opening today, Piper Jaffray

upgraded the stock from "market perform" to "outperform". This apparently was enough to lift the stock price in an already strong market today.

According to the

Yahoo "Profile", ASKJ "...operates four websites dedicated to search: Ask.com, Ask.co.uk,. Teoma.com, and AJKids.com." Also "Ask Jeeves also delivers or syndicates its search technology and advertising products to approximately 41 third-party Websites as of December 31, 2003."

Looking for the latest quarterly report, I found that

ASKJ reported 3rd quarter 2004 results on October 27, 2004. For the quarter ended September 30, 2004, revenue came in at $75.7 million, a 178% increase over revenues of $27.2 million the prior year.

Using GAAP (Generally Accepted Accounting Practices) income from continuing operations came in at $10.7 million or $.15/share, up from $3.8 million or $.07/share the prior year.

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar.com, we can see that revenue HAS been a bit erratic, increasing from $22.0 million in 1999 to $95.7 million in 2000, dropping to $65.0 million in 2002, but then steadily increasing to $207.1 million in the trailing twelve months (TTM).

Earnings dropped from a loss of $(5.51)/share in 2000 to $(11.48)/share in 2001, however, they have improved steadily since then and ASKJ reported a profit of $.67/share in the trailing twelve months.

Free cash flow which WAS negative at $(33) million in 2001 and $(44) million in 2002, turned positive at $20 million in 2003 and $41 million in the TTM.

The balance sheet appears solid. ASKJ has $89.5 million in cash, enough to pay off the $48.3 million in current liabilities, and to pay off a big part of the $1115.9 million in long-term debt. In addition ASKJ has $44.7 million in other current assets.

What about "valuation"? Taking a look at

"Key Statistics" on ASKJ from Yahoo, we can see that this is a mid-cap stock with a market cap of $1.74 billion. The trailing p/e is 43.88, and the forward p/e (fye 31-Dec-05) is nicer at 21.65. The "5-Yr restated" PEG is only 0.86. Price/sales is a bit rich at 7.61.

Yahoo reports 58.25 million shares outstanding with 54.30 million of them that float. Currently there are 6.44 million shares out short as of 12/8/04. This represents 11.87% of the float, but only 1.505 days of trading volume. Yahoo reports no cash dividend and no stock splits!

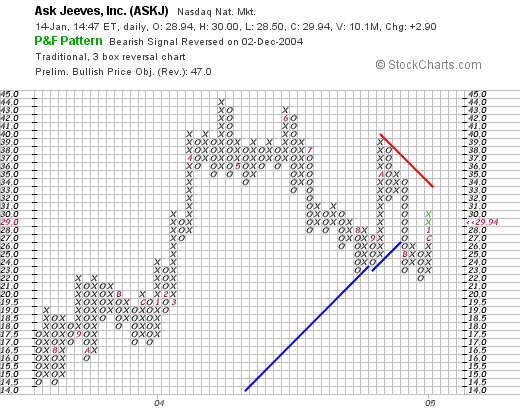

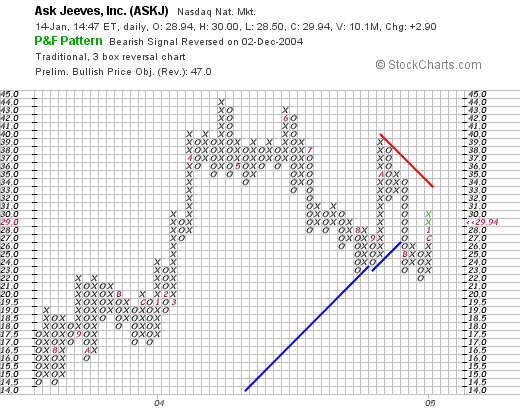

What about "technicals"? If we take a look at the

Point & Figure Chart for ASKJ on Stockcharts, we can see that the stock was moving ahead nicely through 2003 and much of 2004, until breaking through a support level at around $27 in late 2004. The stock does appear to be pushing higher, but it would be nice to see it break through around $32 before feeling like the bullish trend has been re-established.

So what do I think? Well the stock is moving higher on a brokerage house upgrade...the latest quarter was quite strong, the last several (if not the last 5) years have been strong, free cash flow is moving positive, the balance sheet is solid, and valuation isn't bad with a 5-Yr PEG under 1.0. It really doesn't look bad to me and I just might add it to the "Trading Portfolio". I haven't made up my mind, now with the EXPO sale, I can feel that nickel "burning a hole in my pants pocket."

So what do I think? Well the stock is moving higher on a brokerage house upgrade...the latest quarter was quite strong, the last several (if not the last 5) years have been strong, free cash flow is moving positive, the balance sheet is solid, and valuation isn't bad with a 5-Yr PEG under 1.0. It really doesn't look bad to me and I just might add it to the "Trading Portfolio". I haven't made up my mind, now with the EXPO sale, I can feel that nickel "burning a hole in my pants pocket."

Thanks again for stopping by! I hope that my discussions are helpful for you. I know they help me think clearly about stocks and determine why or why not I want to own them!

Bob

Posted by bobsadviceforstocks at 1:53 PM CST

|

Post Comment |

Permalink

Updated: Friday, 14 January 2005 2:00 PM CST

"Trading Transparency" EXPO

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, remember I am an amateur investor, so please consult with your professional investment advisors prior to making any decisions based on information on this website!

I was looking through my

"Trading Portfolio" earlier today and noted that my stock in Exponent (EXPO) had a sharp drop in an otherwise strong market. In fact, as I write, EXPO is trading at $25.90, down $3.19 or 10.97%. Now, since I had already sold a portion of my holdings at a 30% gain, and the EXPO stock was still selling at about a 30% gain, this was not a sell signal by price alone. However, I was determined to get to the bottom of the price drop!

Yesterday, after the close of trading, EXPO

announced preliminary 4th quarter results and 2005 guidance. They announced that the fourth quarter would come in under previous guidance due to some delays in anticipated contracts and that the 1st half of 2005 also would come in a little slower than expected. This is not the kind of news I like to hear!

I purchased these 150 shares on October 21, 2003, so it has been more than a year that I have held on to them. In fact, they were purchased with a cost basis of $19.77/share. Thus, at the current price of $25.90, I have a gain of $6.13/share or 31%.

Thus, I have a new "rule" for trading. If I sell a stock in my portfolio "pre-emptively", that is on the announcement of bad news affecting fundamentals, then as long as I have a gain of significance, then I can replace that stock with another purchase! (You know how those nickels burn a hole in my pocket.)

So I am out of Expo and am now looking for a new position to replace it. I will keep you posted. Meanwhile, if you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Thursday, 13 January 2005

"Revisiting a Stock Pick" Ventana Medical Systems (VMSI)

Hello Friends! Thank you for stopping by and visiting my blog,

Stock Picks Bob's Advice. It has definitely been a "bearish" January. Hopefully, it will turn out to be more of a "Yogi Bear" market than one of those mean growling kind of mauling bear markets. I will vote for Yogi, one of my favorite bears growing up. As always, please remember that I am an amateur investor. (Now what KIND of professional investment advisor would run a picture of Yogi Bear in the midst of a stock decline, anyhow?). So if you like what you read here, please go ahead and consult with your professional investment advisors prior to making any investment decisions to make sure that such decisions are appropriate, timely, and likely to be profitable for you! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

On December 23, 2003, I

posted Ventana (VMSI) on Stock Picks at $39.80. In fact, I like Ventana so much, that I ended up buying some shares for my

"Current Trading Portfolio" and I still do own 150 shares in that account.

Looking through the

list of top % gainers on the NASDAQ today, I saw that VMSI had made the list. As I write, VMSI is trading at $64.36, up $4.54 or 7.59% on the day. Since it has been over a year since I have examined this stock on the blog, I thought it was a good idea to review a stock that I have already "picked" and is doing well enough to make the top % gainers list today!

Taking a look at the

Yahoo "Profile" on VMSI, we find that Ventana "...develops, manufactures and markets instrument-reagent systems that automate slide staining in anatomical pathology and drug discover laboratories worldwide."

And what was it that drove the stock higher today? Earlier this morning, VMSI

announced that things were going to be doing "better" than what the street was expecting. In other words, they 'raised guidance.' They raised guidance for both the final quarter in 2004 as well as the 2005 outlook. In my mind, I can see about a million analysts out there doing the calculations of future earnings and revenue growth and recalculating what a proper value of the stock is today. And they did exactly that, driving the stock higher.

And what about the latest quarter that has already been reported? On October 23, 2004, VMSI

announced 3rd quarter 2004 results. For the quarter ended September 30, 2004, sales came in at $39.3 million, a 23% increase over the same quarter in the 2003 fiscal year. GAAP net income for the quarter was $4.1 million or $.23/diluted share, up from $3.3 million, or $.19/diluted share the prior year. These were solid results. The company at THAT time raised guidance for 2004, and confirmed guidance for 2005. The repeated raising of guidance is bullish (and not Yogi-bearish) indeed.

How about longer-term? If we take a look at the

"5-Yr Restated" financials on Morningstar, we can see that revenue growth has been superb, increasing from $69.4 million in 1999 to $155.8 million in the trailing twelve months (TTM).

Earnings, which dropped from $.88/share in 1999 to a loss of $(1.85)/share in 2000, have increased steadily since then to $.59/share in the trailing twelve months (TTM). Free cash flow, which was a negative $(29) million in 2001, has also been improving, and Morningstar records $15 million in the trailing twelve months (TTM).

The balance sheet is gorgeous, with $40.6 million in cash reported per Morningstar, with $32.8 million in current assets, and just $2.0 million in long-term liabilities. Amounts that are easily covered with just the available cash! In addition, Morningstar reports Ventana with $45.7 million of additional current assets.

How about "valuation"? Looking at

Yahoo "Key Statistics" on VMSI, we can see that this company is a mid-cap stock with a market capitalization of $1.12 billion. The trailing p/e is very rich at 109.61, with a forward p/e of 43.99. Thus, even with a great growth in earnings, we have a 5-yr PEG per Yahoo of 2.25. Price/sales is also rich at 6.67.

Yahoo reports 17.38 million shares outstanding with 15.30 million that float. Of these, as of 12/8/04, there were 1.63 million shares out short. This represents 10.67% of the float (!), and 17.01 trading days of average volume. Today's steep spike in the stock price may very well represent a short "squeeze" and traders hustle to cover their borrowed shares sold short. Just a possibility (?)

No stock dividend and no stock split reported on Yahoo.

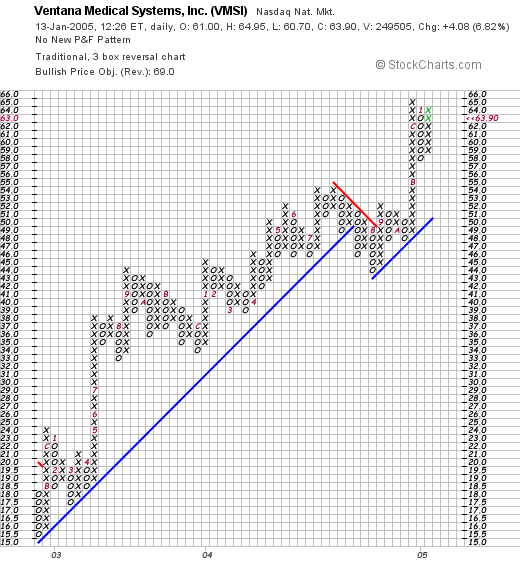

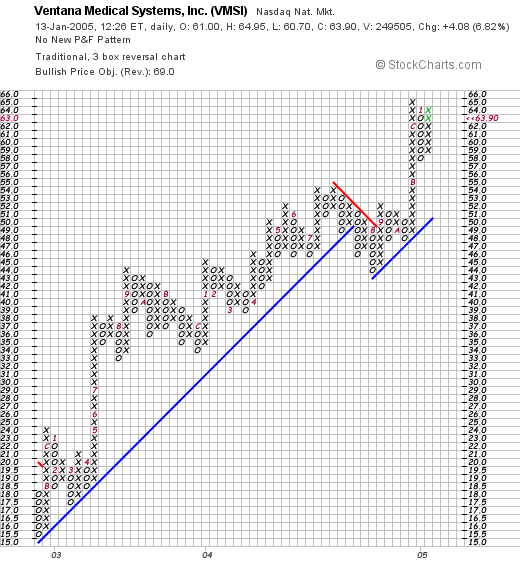

How about "technicals"? If we take a look at a

"Point & Figure" chart on VMSI from Stockcharts:

we can see a very strong price chart for Ventana from late 2002, when the stock was trading around $15/share, to the latest trades of around $64. Except for a short period of weakness in August, 2004, this stock has literally roared ahead!

So what do I think? Well I do own some shares of this stock, so please take that into consideration. I love the latest earnings guidance for 2005, the latest quarterly report was wonderful, the Morningstar analysis looks good, but the only thing holding me back a little is the "value hat" I try to wear as well, and the stock looks a bit pricey (I mean with a p/e over 100!). So let the buyer beware!

Thanks again for stopping by! If you have any questions or comments, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com .

Bob

Tuesday, 11 January 2005

January 11, 2005 Plantronics (PLT)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NYSE today, I came across Plantronics (PLT) which, as I write, is trading at $40.05, up $1.26 or 3.25% on the day. I do not own any shares nor any options on this stock!

It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you!

According to the

Yahoo "Profile", PLT "...is a worldwide designer, manufacturer and marketer of lightweight communications headsets for phones and cellphones, telephone headset systems, accessories and related services for business and personal use."

On October 19, 2004, PLT

reported 2nd quarter 2005 results. Revenues for the quarter increased 37% to $130.2 million up from $95.1 million in the same quarter for fiscal year 2004.

Diluted eps came in at $.49/share, up from $.27/share the prior year. The company also gave fairly bullish guidance for the 3rd quarter 2005 that is upcoming and due to be reported shortly.

How about longer-term? Taking a look at the

"5-Yr Restated" financials on Morningstar, we can see that revenue has grown, a little inconsistently, from $315 million in 2000 to $490.7 million in the trailing twelve months. Earnings were also a bit erratic, dropping from $1.22 in 2000 to $.74/share in 2002, but then steadily increasing to the $1.72/share in the trailing twelve months (TTM).

(This is a real Plantronics headset!)

Free cash flow, as reported on Morningstar, has also been fairly solid with $55 million in 2002, and $54 million in the trailing twelve months.

The balance sheet, per Morningstar is really quite impeccable. PLT has $214.3 million in cash, enough to cover BOTH the current liabilities of $74.0 million, AND the long-term liabilities of $8.1 million, almost three times over. In addition, Morningstar reports that they have an additional $158.6 million of other current assets.

How about "valuation" issues? Looking at

"Key Statistics" from Yahoo, we can see that this is a mid-cap stock with a market cap of $1.94 billion. The trailing p/e is moderate at 23.33, the forward p/e (fye 3-Apr-06) is better at 19.66. The PEG (5 yr expected) is nice at 1.31.

Yahoo reports 48.37 million shares outstanding, with 47.70 million of them that float. Currently there is a smallish 820,000 shares out short as of 12/8/04, representing 1.72% of the float or 1.934 trading days. This doesn't look like an issue to me.

In addition, the company DOES pay a small dividend of $.20/share yielding 0.52%. The last stock split was a 3:1 split, per Yahoo, in August, 2000.

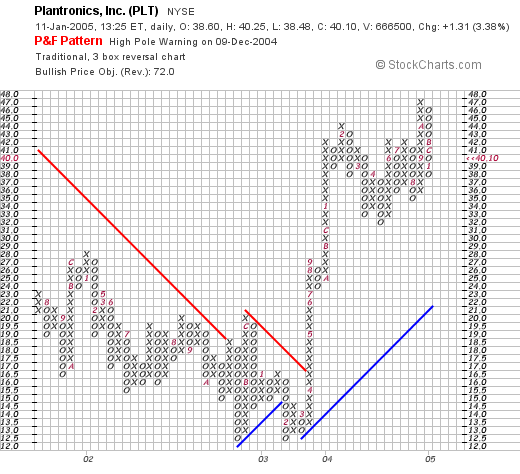

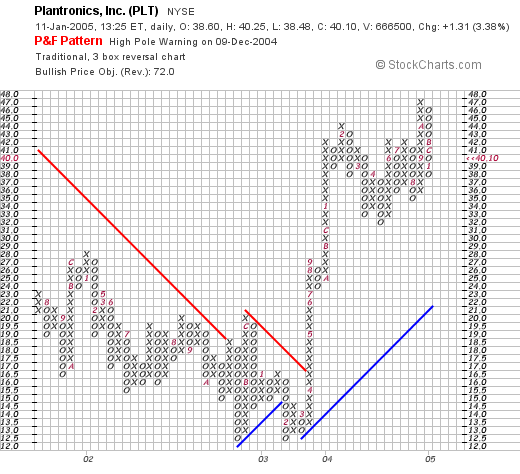

How about "technicals"? Taking a look at a

PLT Point & Figure chart from Stockcharts, we can see that this stock was actually trading lower, from late 2001 through March, 2003. The stock broke through resistance in mid-April 2003, and has been trading higher since. The stock looks strong technically to me!

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

So if I had some cash to spend, would I be buying? Well, this does fit my criteria, so it would probably be a buy!

Thanks again for stopping by. If you have any comments, questions, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com. Please excuse my extra photos, I have just been so disappointed with the market tone, that I needed just a little levity. (not levitation, I will leave that to Bewitched.)

Bob

Monday, 10 January 2005

January 10, 2005 Pilgrim's Pride (PPC)

Hello Friends! Thanks for stopping by and visiting my blog,

Stock Picks Bob's Advice. Maybe I am just getting "chicken" today after all of the sell-off's in the NASDAQ, but I have got a poultry producer to present!

(If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the

list of top NYSE % gainers. According to the

Yahoo "Profile", PPC "...is a producer of poultry in both the United States and Mexico. In the United States, the Company produces both prepared and fresh chicken and turkey, while in Mexico it produces fresh chicken."

What drove the stock higher, was the

report from PPC in which it raised earnings estimates for the 1st quarter 2005. Upward revisions of earnings are a very bullish indicator imho!

On November 8, 2004, Pilgrim's Pride

reported 4th quarter 2004 results. For the quarter ended October 2, 2004, net sales came in at $1.5 billion, up from $709 million the prior year. Net income per diluted share climbed to $1.09/share, up from $.61/diluted share in 2003. These results are NOT "chicken-feed"!

How about longer-term? Taking a look at the

"5-Yr Restated" financials from Morningstar, we can see the steady revenue growth from $1.5 billion in 2000 to $5.4 billion in the trailing twelve months (TTM).

Earnings, however, have been a bit erratic, dropping from $1.27 in 2000 to a low of $.35 in 2002. However, they have climbed steadily since, with $2.05 reported in the TTM.

Free cash flow has also been growing nicely with $18 million reported in 2002, increasing to $193 million in 2004.

The balance sheet is basically solid imho, with $38.2 milion in cash and $979.1 million in other current assets, balanced against $633.5 million in current liabilities and $689.5 million in long-term debt.

How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

Yahoo reports 66.56 million shares outstanding with 40.60 million that float. Of these, there are 3.31 million shares out short as of 12/8/04, representing 8.16% of the float. These are significant, with a short raio of 4.359. The number of shares out short dropped by a million between November and December...so many of the short sellers are covering their previously based bets on a decrease in the stock price!

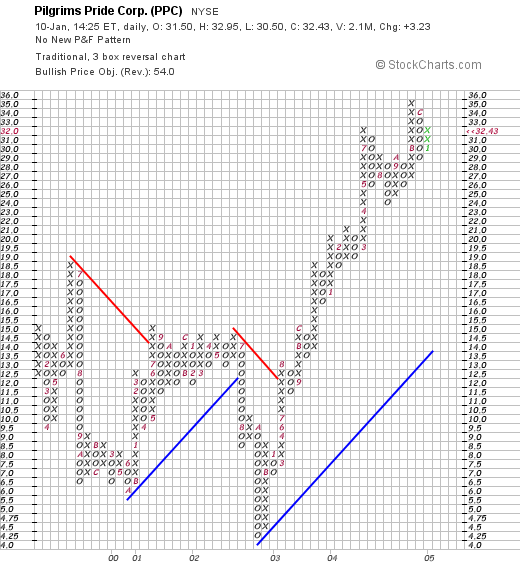

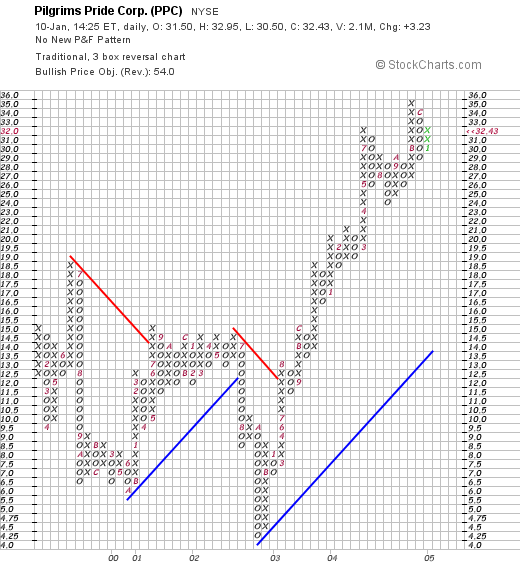

How about "technicals"? If we take a look at a

Point & Figure Chart from Stockcharts.com, we can see what appears to be a very stong chart since about March, 2003, when PPC was trading at around $7.00/share, until today, where it currently trades at $32.61.

The stock chart looks quite strong to me if not a little overextended.

So what do I think?  I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

Thanks again for stopping by! Please feel free to email me at bobsadviceforstocks@lycos.com or leave a message right here on the blog if you have a question or comment.

Bob

Saturday, 8 January 2005

"Looking Back One Year" A review of stock picks from the week of November 17, 2003

Hello Friends! It is the weekend and I for one could use a break from all of the bearish trading activity we have witnessed the past few days. I like to use the weekend to review some past stock picks. The week of November 17, 2003 was not a busy week on my blog,

Stock Picks Bob's Advice. In fact, I only discussed three stocks: Sybron Dental Specialties (SYD), Daktronics (DAKT), and Hot Topic (HOTT). Of these, I purchased shares of SYD for my

Current Trading Portfolio, and still own some shares. As always, remember that I am an amateur investor, so PLEASE consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

On November 18, 2003, I

posted Sybron (SYD) on Stock Picks at a price of $25.80. (I know that is the price, as that is the price that I purchased shares that day even though as I sometimes have done, left out the price on the post!). SYD closed at $33.23 on 1/7/05, for a gain of $7.43 or 28.8% since the post.

So are they still worthy of a spot on this blog? Well, taking a look at the latest quarterly report, SYD

reported 4th quarter 2004 results on November 15, 2004. For the quarter ended September 30, 2004, net sales came in at $145.7 million, a 5.8% increase over the $137.7 million in net sales the prior year. Net income for the quarter was $16.1 million or $.40/diluted share, compared with $17.3 million, or $.43/diluted share the prior year. This is nothing to "write home about" with a small growth in revenue and a small drop in earnings per share. While I wouldn't run out and sell this stock based on the news (and I haven't), I wouldn't run out and be buying any shares at this point either!

On November 19, 2003, I

picked Daktronics (DAKT) for Stock Picks at $17.74. DAKT closed at $23.34 on 1/7/05, for a gain of $5.60 or 31.6%.

And how does their latest quarter look? Well, on November 17, 2004, DAKT

reported 2nd quarter results. For the quarter ended October 30, 2004, net sales came in at $59.5 million, compared with net sales the prior year of $58.3 million. Net income worked out to $5.2 million or $.26/diluted share vs. $6.7 million, or $.34/diluted share last year. Just like with SYD, we have a company with a quarter with a slow growth in revenue associated with a decline in earnings. Again, I wouldn't sell on this but I wouldn't be buying either!

Finally, on November 20, 2003, I

posted Hot Topic (HOTT) on Stock Picks at $28.61. HOTT closed at $17.48, for a loss of $(11.13) or (38.9)%.

Insofar as their latest quarterly report, on November 17, 2004, HOTT

reported 3rd quarter 2004 results. Net sales for the quarter ended October 30, 2004, came in at $180.8 million, a 12% increase from $161.5 milllion the prior year. However, this was done on new store openings, as comparable store sales DECREASED 4.2% during the quarter. I hate lower same store sales reports! Net income for the quarter decreased to $12.6 million or $.27/diluted share, down from

$15.3 million, or $.31/diluted share the prior year. Thus, we have a miserable report, imho, with declining revenue AND declining earnings AND declining same store sales. That was strike 1, 2, and 3, in my book! They would be OUT if I had any!

So how did we do that week if we had purchased those shares and held on? Two of the three stocks (SYD and DAKT) both had significant gains of approximately 30%, and HOTT had a 40% loss. Thus, the average performance worked out to a 7.2% gain since the pick week. Not too bad, considering all three have just had fairly mediocre earnings reports and would not be my first choices for this blog at this time!

Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience

this is the link to CARE, one of my favorite charities in America.

Bob

January 8, 2004 Constellation Brands (STZ)

Hello Friends! I wanted to get this one out yesterday, but you know how that goes. One thing led to another, and I was calling it a day! I sure am glad you took the time to stop by and visit my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the

list of top % gainers on the NYSE where I found this stock.

According to the

Yahoo "Profile", "Constellation Brands, Inc. is an international producer and marketer of beverage alcohol brands with a portfolio across the wine, spirits, and imported beer categories." Some of the brands that

I recognized, included St Pauli Girl, Almaden, Inglenook, Black Velvet, Fleischmannis and Schenley. They have many other labels and vineyards as well!

On Thursday, January 6th, after the close of trading, STZ

announced 3rd quarter results. For the quarter ended November 30, 2004, net sales were up 10% from the prior year at $1.36 billion, up from $1.21 billion the prior year. Net income came in at $96.9 million, up from $82.8 million the prior year, a 17% jump. Earnings per share were up 14% to $.83/share. The street liked these results, and the stock jumped in price in response to the good news!

Taking a look at

"5-Yr Restated" financials on Morningstar, we can see that revenue has grown fairly steadily from $2.3 billion in 2000 to $3.8 billion in the trailing twelve months (TTM). Earnings have also grown from $.52/share to $2.45/share in the TTM.

Free cash flow has been solid and slowly improving from $142 million in 2002 to $196 million in the TTM.

The balance sheet looks solid if not perfect imho, with $9.8 million in cash and $2.28 billion in other current assets balanced against $1.2 billion in current liabilities and $2.07 billion in long-term debt.

What about "valuation"? Taking a look at the

"Key Statistics" on STZ from Yahoo, we can see that this is a large cap stock with a market cap of $5.30 billion. The trailing p/e is 'nice' at 19.51, with a forward p/e (fye 29-Feb-06) of 16.38. The '5-yr expected' PEG is 1.33, which isn't too high at all. Price/sales also reasonable imho at 1.28.

Yahoo reports 107.92 million shares outstanding with 92.80 million of them that float. Of these, 2.51 million shares are out short as of 12/8/04, representing 2.71% of the float or 5.786 trading days of volume. Using my arbitrary 3 day figure, this short interest is getting a bit significant and might explain the sharp pop in stock price yesterday.

No dividends are paid and the last stock split was a 2:1 split in May, 2002.

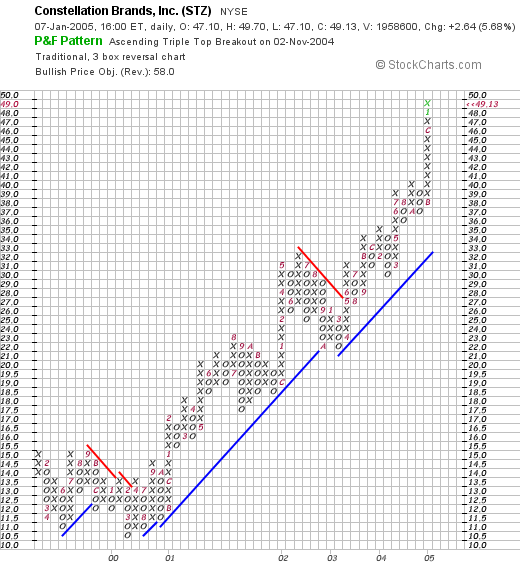

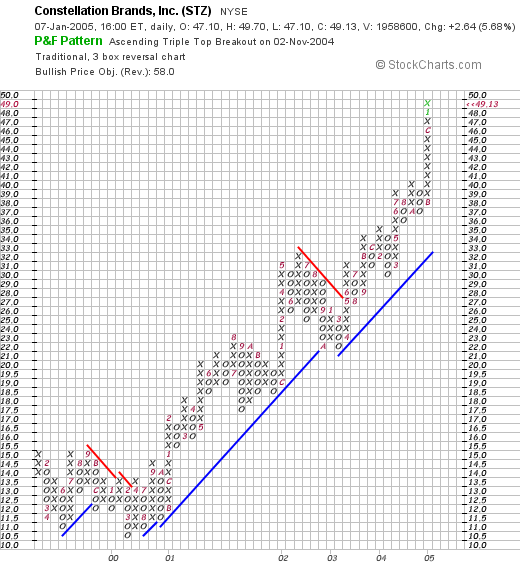

How about "technicals"? If we take a look at a

Point & Figure chart from Stockcharts.com, we can see that this stock has been roaring higher since September 2000. If anything, it is a little over-extended, but certainly, imho, this does not appear to be a weak chart.

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

Anyhow, I don't have any money to be buying stock now. The NASDAQ has been awful this past week, and I don't think I will be buying anything soon.

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com!

Bob

Posted by bobsadviceforstocks at 11:15 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 8 January 2005 2:38 PM CST

Newer | Latest | Older

The first stock I posted on Stock Picks that particular week was Odyssey Healthcare (ODSY). I posted Odyssey (ODSY) on November 24, 2003, at a price of $35.94. ODSY closed at $12.11 on 1/14/05, for a loss of $(23.83) or (66.3)%.

The first stock I posted on Stock Picks that particular week was Odyssey Healthcare (ODSY). I posted Odyssey (ODSY) on November 24, 2003, at a price of $35.94. ODSY closed at $12.11 on 1/14/05, for a loss of $(23.83) or (66.3)%.

On November 26, 2003, I made the second post of the week and posted H&R Block (HRB) on Stock Picks at a price of $53.41. HRB closed at $47.34 for a loss of $(6.07) or (11.4)%.

On November 26, 2003, I made the second post of the week and posted H&R Block (HRB) on Stock Picks at a price of $53.41. HRB closed at $47.34 for a loss of $(6.07) or (11.4)%.

After blogging over a year-and-a-half, and making literally hundreds of stock picks, I think I owe it to myself and to my readers to revisit stocks if they are still worthy of being discussed. Recently I started the process of re-posting a stock, if it has been over a year since I originally discussed it, and if it again makes the list of top % gainers, and deserves to be noted! Scientific Games (SGMS) is such a stock!

After blogging over a year-and-a-half, and making literally hundreds of stock picks, I think I owe it to myself and to my readers to revisit stocks if they are still worthy of being discussed. Recently I started the process of re-posting a stock, if it has been over a year since I originally discussed it, and if it again makes the list of top % gainers, and deserves to be noted! Scientific Games (SGMS) is such a stock! I first

I first  According to the

According to the  If we look at the latest quarterly result for SGMS, on November 1, 2004, Scientific Games

If we look at the latest quarterly result for SGMS, on November 1, 2004, Scientific Games  What about "valuation"? To assess this, I like to review the

What about "valuation"? To assess this, I like to review the

Looking through the

Looking through the  According to the

According to the  Looking for the latest quarterly report, I found that

Looking for the latest quarterly report, I found that  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the  What about "valuation"? Taking a look at

What about "valuation"? Taking a look at

So what do I think? Well the stock is moving higher on a brokerage house upgrade...the latest quarter was quite strong, the last several (if not the last 5) years have been strong, free cash flow is moving positive, the balance sheet is solid, and valuation isn't bad with a 5-Yr PEG under 1.0. It really doesn't look bad to me and I just might add it to the

So what do I think? Well the stock is moving higher on a brokerage house upgrade...the latest quarter was quite strong, the last several (if not the last 5) years have been strong, free cash flow is moving positive, the balance sheet is solid, and valuation isn't bad with a 5-Yr PEG under 1.0. It really doesn't look bad to me and I just might add it to the  Hello Friends! Thank you for stopping by and visiting my blog,

Hello Friends! Thank you for stopping by and visiting my blog,  On December 23, 2003, I

On December 23, 2003, I  Taking a look at the

Taking a look at the  And what was it that drove the stock higher today? Earlier this morning, VMSI

And what was it that drove the stock higher today? Earlier this morning, VMSI  How about longer-term? If we take a look at the

How about longer-term? If we take a look at the

Looking through the

Looking through the  It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you!

It is another DOWN day in the market, at least thus far, and I have enclosed the only "funny" headset picture I could find on the net! I hope it brings a smile to you! (This is a real Plantronics headset!)

(This is a real Plantronics headset!) How about "valuation" issues? Looking at

How about "valuation" issues? Looking at

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho.

(speaking of headsets, wasn't Ray Walston's "martian headgear" about as tops as you can get?)So seriously, what do I think? Well, this stock actually looks pretty nice to me. Let's review, it is strong today in an otherwise weak market, the last quarter results were quite good, and the last few years have been strong (although not consistently over the last 5). They pay a dividend! They are generating free cash flow and their balance sheet is superb. Valuation-wise it also doesn't look bad and the chart is very pretty imho. (If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

(If things are slow today for you, maybe you can "find the chicken"...a twist on the "find Waldo" series my kids grew up with.) As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com. Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the

Pilgrim's Price (PPC) is having a great day today in the market, trading at $32.52, up $3.32 or 11.37% as I write, and making it to the  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the  How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

How about valuation? This is a "large" mid-cap stock with a market cap of $2.18 billion. The trailing p/e is nice at 16.58, and the forward p/e is even prettier at 11.24 (fye 2-Oct-06). The PEG (5-Yr estimated) is 1.25, and the Price/Sales is even more reasonable at 0.36.

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes!

I think this stock is a very interesting proposition if you want to "play chicken". Ugh. Terrible pun. But seriously, the latest quarterly report was strong, the company is raising estimates, the earnings have been solid the last few years, the balance sheet is great, and valuation is reasonable. And while we are at it the chart looks quite strong. By the way, I do not own any shares of PPC nor do I have any options. Now, if I could just GET a signal from my portfolio to add a position....well you know how that goes! On November 18, 2003, I

On November 18, 2003, I  On November 19, 2003, I

On November 19, 2003, I  Finally, on November 20, 2003, I

Finally, on November 20, 2003, I  Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience

Thanks so much for stopping by! Once again, all of my thoughts and prayers go out to all of the Tsunami victims and all those who are suffering from disease, poverty, or the scourge of war and crime. If you haven't already done so, consider donating to your favorite charity right now. For your convenience  Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the

Constellation Brands (STZ) had a nice day yesterday, closing at $49.13, up $2.64 or 5.68% on the day. This was good enough to make the  According to the

According to the  Taking a look at

Taking a look at

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?

So what do I think? Well, I am posting this here because I like what I am reading. This is a larger capitalization stock than many that I have reviewed previously on Stock Picks. However, the latest quarter is strong, the last five years have been solid, the free cash flow is attractive, the balance sheet is reasonable, and valuation is also at a nice level. Furthermore, this is not a high-tech stock that will fluctuate with boom and bust. This is more of a consumer stock, and who doesn't like a glass of wine on occasion?