Stock Picks Bob's Advice

Saturday, 22 March 2008

"Looking Back One Year" A review of stock picks from the week of September 4, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It was a shortened trading week with Good Friday giving us all a well-needed break from the volatility of trading recently. But one of the things I like to do on this blog is to review past stock picks. Going a week at a time, I started this process out reviewing stocks from the prior year. Well one thing led to another, and now I am about a year-and-a-half out from these reviews.

Last week I reviewed the picks from August 28, 2006 (there weren't any), and going a week ahead, let's look at the pick from the week of September 4, 2006. As I have pointed out previously, these reviews assume a buy and hold approach to investing. In practice, I advocate as well as personally employ a disciplined portfolio management strategy (except when I make one of my 'trades'), involving limiting losses on the downside by selling entire positions that are performing poorly, and locking in gains by selling small portions of holdings as they reach appreciation targets.

For the ease of analysis, I have always assumed a buy and hold approach to these stock picks. However, the difference in these strategies would certainly affect performance.

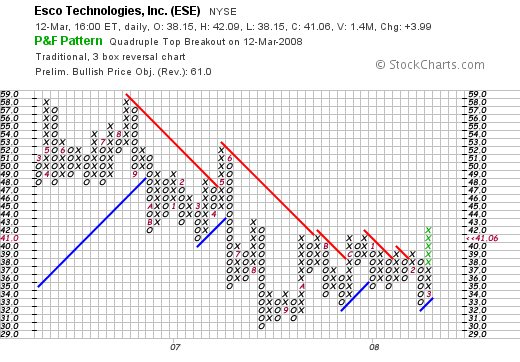

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it.

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it.

The post in 2006 was actually a 'revisit' of this stock as it has been a 'favorite' of mine (a previous selection on this blog), having 'picked' it on June 23, 2004, when the stock was trading at $36.61, an even higher price, and yet even though I have posted the stock twice previously, and the stock has declined each time subsequently (!), I would like to explain why

NVE CORPORATION (NVEC) IS RATED A BUY.

What exactly does this company do?

According to the Yahoo "Profile" on NVEC, the company

"...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

"...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

How did they do in the latest quarter?

On January 23, 2008, NVE Corporation (NVEC) reported 3rd quarter 2008 results. for the quarter ended December 31, 2007, the company announced total revenue of $4.77 million, a 23% increase from the $3.86 million in the prior-year same period. Net income climbed 62% to $1.7 million or $.36/diluted share compared to $1.05 million or $.22/share the prior year.

As is so important with an earnings announcement, it was their performance relative to expectations that was most impressive. In fact, the $.36/share exceeded expectations according to analysts polled by Thomson Financial which had been looking for $.30/share. this was enough to have both Broadpoint Capital and Northland Securities upgrade their ratings on this stock to "Buy" and "Outperform" from neutral ratings.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials, we find that revenue has steadily increased from $9 million in 2003 to $16 million in 2007 and $19 million in the trailing twelve months (TTM), (except for a dip from $12.0 million in 2004 to $11.6 million in 2005). Earnings have also been improving recently with a bit of an erratic record between 2004 and 2006, from $.15/share in 2003 to $1.00 in 2007 and $1.37/share in the TTM. (Earnings dipped from $.45/share in 2004 to $.37/share in 2005 before rebounding and steadily increasing from $.39/share in 2006 to the current levels).

Outstanding shares have been stable with 4 million reported in 2003 increasing to 5 million in the TTM. Free cash flow has been positive and improving recently with -0- in 2005, $3 million in 2006, $5 million in 2007 and $6 million in the TTM.

The balance sheet is solid with $1 million in cash and $8 million in other current assets, which when compared to the $1.2 milliion in current liabilities yields a current ratio of over 7. NO long-term debt is reported on Morningstar.com.

What about some valuation numbers?

Checking the Yahoo "Key Statistics" on NVEC, we can see that this is really a tiny company, what we call a Micro Cap Stock, with a market capitalization of only $121.05 million.

The trailing p/e is reasonable (imho) at 19.12, with a forward p/e (fye 31-Mar-09) estimated at 15.17. This steady growth in earnings anticipated, results in a PEG of only 0.70, which for me is quite cheap.

Using the Fidelity.com eresearch website, we find that the Price/Sales (TTM) ratio is a bit steep at 6.35 compared to the industry average of 3.54. In terms of profitability, Fidelity reports that the Return on Equity (TTM) is a bit better than average at 24.52%, compared to the industry average of 22.22%.

Returning to Yahoo, we can see that this company has only 4.64 million shares outstanding with 4.62 million that float. As of 2/26/08, there were 444,640 shares out short representing 9.65 of the float or 5.9 trading days of volume. This is well down from the 1.08 million shares that were out short the prior month. This suggests that over 500,000 shares that were out short have been re-purchased as the negativity surrounding this stock appears to be reduced with the strong earnings report....at least that would be my take. I just don't see what is so negative about this company to be selling short!

Finally, as noted above, not dividends are paid and the last stock split was actually a reverse split of 1:5 on November 22, 2002.

What does the chart look like?

Reviewing the 'point & figure' chart on NVEC from StockCharts.com, we can see the very unimpressive technical appearance of this stock chart which has declined from a peak of $54 in April, 2004, to a low of $11.50 in may, 2005, only to start climbing in an erratic fashion to a peak of $46 in November, 2006, recently dipping past support at $19.50, and trying to find some support for a move higher. The stock is certainly not over-extended technically (lol), but appears longer-term to be breaking through the downward move from 2004 (?).

Summary: What do I think about NVE Corporation?

Well, needless to say, despite the mediocre chart, I really like this stock. Am I a glutton for punishment or what? But seriously, they reported a terrific quarter, beat expectations, and have a record recently of terrific revenue and earnings growth, positive free cash flow, and a solid balance sheet.

Valuation-wise, except for the rich Price/Sales ratio, they have a reasonable p/e, a great PEG, and a Return on Equity exceeding their peers. Now, if we could only see a bit more technical support in the stock chart :).

Thanks again for visiting! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can follow my actual trading account, my SocialPicks page where you can review my past stock picks from the last year or so, and my Podcast Page where you can download some mp3's of me discussing a few of the stocks I write up here on the website.

Have a great weekend everyone! And a Happy Easter to all of my friends!

Yours in investing,

Bob

Thursday, 20 March 2008

Do Large Banks Need More Financial Help than Homeowners?

Last week the White House made it clear that they would use the veto power of the President to stop the effort by Congressional Democrats to assist homeowners who may be facing foreclosure.

As reported:

"Opening what is likely to be an intense political battle in the deepening mortgage crisis, the White House said it strongly opposed the bill, which would let bankruptcy court judges modify the terms of a mortgage as part of the restructuring of a debt in a bankruptcy filing."

The article continued:

"But mortgage lenders, and the Wall Street firms that purchased the loans, have mounted a campaign against the bill, saying it would send a chilling message to investors and lead to higher borrowing costs in the future.

“We’re pulling out all the stops on this,” said Stephen O’Connor, chief lobbyist for the Mortgage Bankers Association. “How will lenders and investors react to the added risk? They will likely charge a higher interest rate, likely charge more points on the mortgage and likely demand higher down payments.”"

Not wanting to send any 'chilling messages' to investors, these same Wall Street firms are now borrowing billions of dollars to help their own financial future.

I read with interest today:

"The new lending program gives the 20 primary dealers of Treasury securities special access to the Fed's discount window. The overnight loans are overcollateralized and pay the prevailing discount rate, currently 2.50%."

But I guess it wouldn't be fair for a bankruptcy court to reduce a mortgage interest rate to say....something like 2.5% would it?

Who were these borrowers willing to take money from the Fed?

As noted in the same article:

"In the week ending Wednesday, the investment banks borrowed a daily average of $13.4 billion from the Fed, implying an average borrowing of about $19 billion for Monday and Tuesday.

Three investment banks -- Morgan Stanley, Goldman Sachs and Lehman Bros. -- have publicly announced they borrowed from the Fed. Others may also have done so, but the names of the borrowers are not announced by the Fed."

Also:

"As part of the takeover bid, the Fed also gave J.P. Morgan up to $30 billion in support for potential losses from the riskiest assets owned by Bear. That credit line had apparently not been tapped as of Wednesday."

And the cost of aid to the public instead of to Morgan Stanley and the like?

As the Wall Street Journal

reported, the Representative Barney Frank proposal would assist distressed homeowners and cost the FHA $10 billion.

Meanwhile, President Bush is also threatening to veto the reckless $4 billion in aid to states and localities to redevelop abandoned and foreclosed houses.

Contrast THAT to the aid given the last two days to the banks.

Is it really too much to ask for a government to offer

'fair and balanced' assistance to lenders and borrowers alike?

Bob

Posted by bobsadviceforstocks at 6:06 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 20 March 2008 6:14 PM CDT

Tuesday, 18 March 2008

FactSet Research Systems Inc. (FDS) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am still getting over my terribly bad case of timing yesterday, when I bought and sold Lehman (LEH) for a quick loss. Very quick. Yesterday I bought a bunch of Lehman for $34+ and then sold about 20 minutes later at about $31+...for about a $(2,500) quick loss and swore I would be done (for quite a while) with these 'trades' after burning my fingers once more. Ironically (!), Lehman closed TODAY at $46.49, up $14.74. So I had the right idea but horrible timing. :(. I am an investor, not a trader. Let me write THAT one on the blackboard about 1,000 times....hmmmm.

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!

As the French author, Francois de la Rochefoucauld has written:

"The only thing constant in life is change"

...so it is with the market these days.

Licking my wounds, and returning to the list of top % gainers today, I was pleased to see FactSet Research Systems Inc. (FDS) on the list closing at $52.43, up $7.90 or 17.74% on the day. I do not own any shares nor do I have any options on this stock.

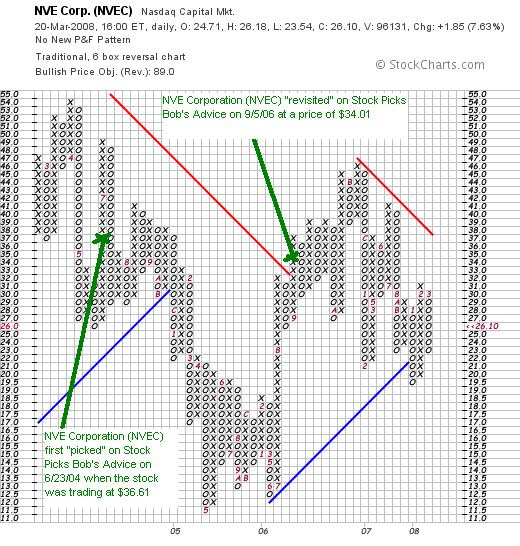

I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first reviewed FactSet (FDS) on Stock Picks Bob's Advice on June 17, 2003, when the stock was trading at $40.39, which adjusted for a 3:2 stock split on February 7, 2005, this works out to a price of $26.93. FactSet was next revisited on Stock Picks Bob's Advice on May 18, 2005, when the stock was trading at $31.53. With today's close at $52.43, this represents an appreciation of $25.50 or 94.7% since my 2003 post, and an appreciation of $20.90 or 66.3% since my 2005 post.

I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first reviewed FactSet (FDS) on Stock Picks Bob's Advice on June 17, 2003, when the stock was trading at $40.39, which adjusted for a 3:2 stock split on February 7, 2005, this works out to a price of $26.93. FactSet was next revisited on Stock Picks Bob's Advice on May 18, 2005, when the stock was trading at $31.53. With today's close at $52.43, this represents an appreciation of $25.50 or 94.7% since my 2003 post, and an appreciation of $20.90 or 66.3% since my 2005 post.

Let's take a closer look at this stock and I will show you why

FACTSET RESEARCH (FDS) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on FactSet (FDS), the company

"...provides financial and economic information, including fundamental financial data on various companies to the investment community worldwide. Its primary product includes Marquee, a quotes and news application for company's investment management and banking clients."

And how did they do in the latest quarter?

It was the announcement of 2nd quarter 2008 earnings today, combined with the rally in equities that led to the big spike in price in FDS stock today. Earnings for the quarter ended February 29, 2008, increased 21% to $140.2 million compared to the year earlier same period. Net income increased to $29.5 million from $26.5 million last year and diluted earnings per share grew to $.59 from $.52 last year.

As pointed out in this report, "Excluding one-time costs and gains, the company earned $31.1 million or 62 cents per share compared with $26.5 million or 52 cents per share last year." This was ahead of analysts expectations according to analysts polled by Thomson Financial who expected profit of $.60/share. The company also beat expectations on revenue which had been expected to come in at $139.6 million.

Factset also raised guidance today for the upcoming quarter, guiding sales to between $145 and $149 million compared to the $121.1 million reported in the 3rd quarter of 2007. Currently, analysts polled by Thomson Financial are expecting sales of $143.5 million.

This is what I have in the past referred to as a 'trifecta-plus' in an earnings report: strong growth in both revenue and earnings, beating expectations on both, associated with the raising of guidance for future results! There isn't much more an investor could want from a report than this!

What about longer-term results?

Since I am generally not interested in 'one-quarter wonders' on this blog, and instead am looking for stocks demonstrating persistence of quality results, I like to review the Morningstar results on each company.

Reviewing the "5-Yr Restated" financials from Morningstar.com on this company, we can see the steady revenue growth noted by the gradual pattern of increasing purple bars...with $222 million in revenue in 2003 increasing to $476 million in 2007 and $501 million in the trailing twelve months (TTM).

Earnings show an equally consistent and impressive pattern of growth, growing from $.99/share in 2003 to $2.14/share in 2007 and $2.25/share in the TTM. The company also pays a dividend and has been steadily increasing it from $.15/share in 2003 to $.36/share in 2007 and $.42/share in the TTM. Outstanding shares have been extremely stable with 52 million shares reported in 2003 actually decreasing to 51 million in the TTM.

Free cash flow has been positive and has grown, except for a slight dip in the TTM, from $72 million in 2005 to $117 million in 2007 and $110 million in the TTM.

The balance sheet appears quite healthy to me with $155 million in cash, which by itself could easily pay off both the $64.9 million in current liabilities and the $28.7 million in long-term liabilities combined with plenty left over as well! Calculating the current ratio, the $242 million in total current asset, when divided by the $64.9 million in current liabilities, yields a very healthy ratio of 3.73.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on FactSet (FDS), we find that the company is a mid cap stock with a market capitalization of $2.53 billion. The trailing p/e is a very acceptable (for me) 23.29, with a forward p/e (fye 31-Aug-09) of 18.53). With rapid growth estimated to continue, the PEG ratio works out to an acceptable 1.15 (generally I prefer PEG's between 1.0 and 1.5).

Looking at the Price/Sales ratio, we can see that the stock is reasonably priced with a Price/Sales (TTM) figure of 4.32 compared to the industry average of 4.78 per the Fidelity.com eresearch website. Profitability may be a little light compared to comparables, at least as measured by the Return on Equity (TTM) which comes in at 27.88% vs. the $31.41% ROE (TTM) of similary companies per Fidelity.

Finishing up with the Yahoo numbers, there are 48.23 million shares outstanding with 42.87 million that float. Currently (as of 2/26/08) there are 4.89 million shares out short, representing 9.7 trading days of volume (the short ratio)--far in excess of my own '3 day rule' for significance. This is 11.3% of the float---and may have well resulted in a 'short squeeze' today on the back of the great earnings report and the surge in overall stock prices.

As I noted, the company pays a dividend which on a 'forward basis' is $.48/share or yielding 1.00%. The last stock split, also noted above, was a 3:2 split on February 7, 2005.

What does the chart look like?

Looking at the 'point & figure' chart on FactSet Research (FDS) from StockCharts.com, we can see the tremendous appreciation in stock price from a low of $12 in September, 2001, to a high of $73 in October, 2007. The stock has been under some pressure recently along with all of the financial-related companies, but rebounded strongly today. The chart still looks acceptable to me without being over-extended but I would appreciate seeing the stock back at the $68 level before this amateur could feel that the technicals looked quite encouraging!

Summary: What do I think?

Needless to say I really like this stock. The only thing giving me concern has been the recent weakness in all of the Financial Stocks and this stock rides along with those companies. They reported great earnings, beat expectations and raised guidance. Longer-term, they have steadily raised revenue results, earnings results, and also pay a dividend which they have been steadily raising!

Outstanding shares are absolutely stable, free cash flow is positive and basically growing, and the balance sheet appears solid.

Valuation-wise, the p/e is moderate, the Price/Sales is low compared to its peers, the Return on Equity is a tad weak, but the PEG is at a very acceptable level. On top of this, there are a lot of short-sellers who are feeling the Cramer 'house of pain' in this stock. Finally, with the current move higher, the stock chart is moderately hopeful for a continued appreciation in this stock price. If I were buying a stock (at least when I am following my own rules :(), this is the kind of stock I would be buying.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is reviewed and analyzed, my SocialPicks page where you can find out more about my stock picks from the past year, and my Podcast Page where you can download some mp3's of me discussing some of the many stocks I review here on the blog.

I hope this entry finds you in good health and at least slightly better spirits today as fed pulls out almost all of the plugs to get the economy and this market moving once more.

Yours in investing,

Bob

Monday, 17 March 2008

Lehman Bros (LEH) "Trading Transparency"

Quick post. Dumb move on Lehman (LEH). WHAT was I thinking?

Anyhow, I undid that trade, settled down, and am back to my usual trading rules. The market handed me a loss as quickly as I ever have seen. That was a head-fake with a rally, and now the bear came roaring back loud as ever.

Trade: Sold 1,000 shares of LEH at $31.411.

I shall keep you posted.

Just about every time I try something like this, I learn a lesson. OUCH.

Shows you why I still blog. Why I am accountable to all of you. And I am sorry if I disappointed anyone with that trade. I am human after all. It just looked too good to be true. And it was.

More later.

Yours in investing.

Bob

Lehman Bros (LEH) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I took a shot at a bounce on Lehman (LEH) on a bounce. I know I shouldn't be making trades, but then again, if it breaks down, I am out quickly.

Here are the details:

1,000 shares of LEH purchased at $34.274. I suspect the bounce won't hold, and I shoulda known better. Anyhow,

I'll keep you posted. LEH is dropping further as I write. $32.73. So....I think I am out if it breaks $32.00. Could be in five minutes :(.

Bob

O.K. I promise to stick to my rules next time. double-promise.

Sunday, 16 March 2008

Bear Stearns (BSC) To Be Sold at $2/share?

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It has been reported that JPMorgan Chase & Co. will be purchasing Bear Stearns (BSC) in an all-stock transaction that works out to $2/share.

It has been reported that JPMorgan Chase & Co. will be purchasing Bear Stearns (BSC) in an all-stock transaction that works out to $2/share.

"NEW YORK (Reuters) - JPMorgan Chase & Co said on Sunday it would buy stricken rival Bear Stearns for just $2 a share in an all-stock deal valuing the fifth largest investment bank at about $236 million.

Under the deal, the Federal Reserve will provide special financing and has agreed to fund up to $30 billion of Bear Stearns' less liquid assets.

In a statement, JPMorgan said it would exchange 0.05473 shares of its stock for one share of Bear Stearns' stock. It is guaranteeing the trading obligations of Bear Stearns and its subsidiaries."

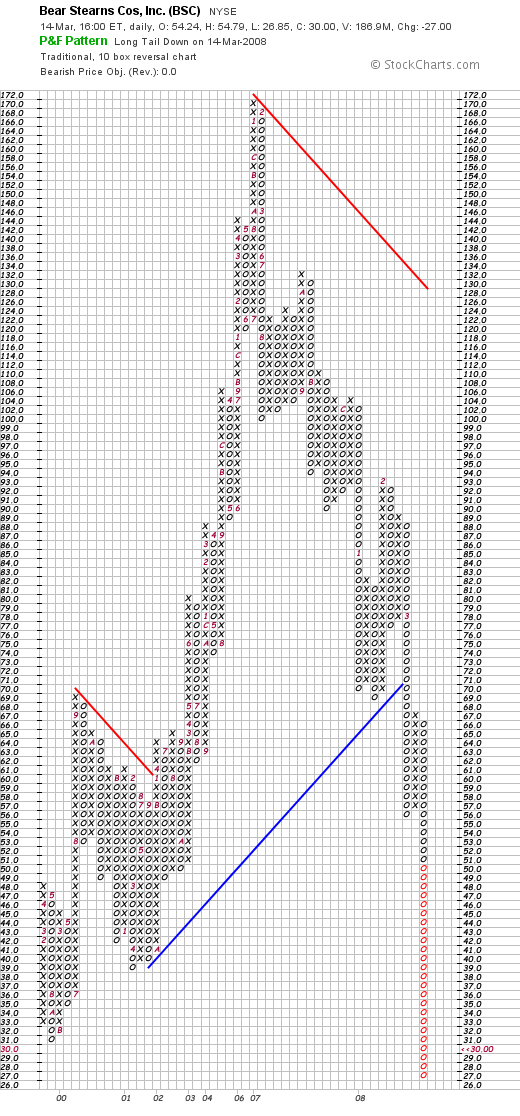

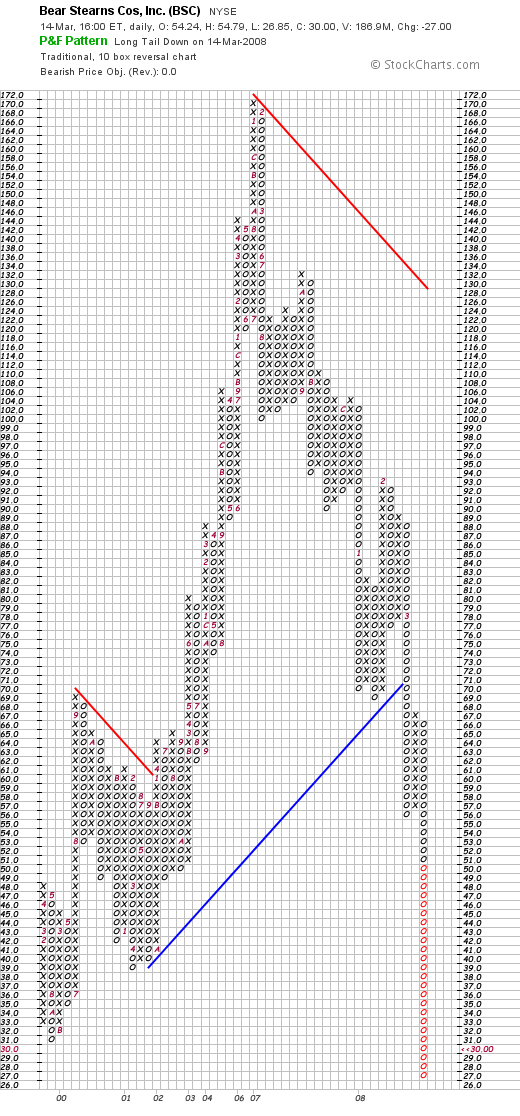

Take a look at the chart for Bear Stearns from StockCharts.com:

It is enough to make you sick.

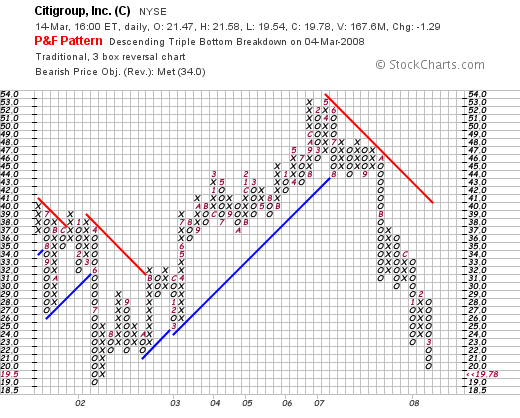

Let's just take a look at a few other financials:

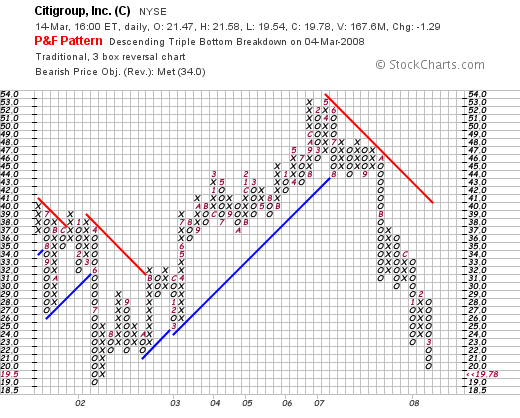

The chart for Citigroup (C) from StockCharts.com:

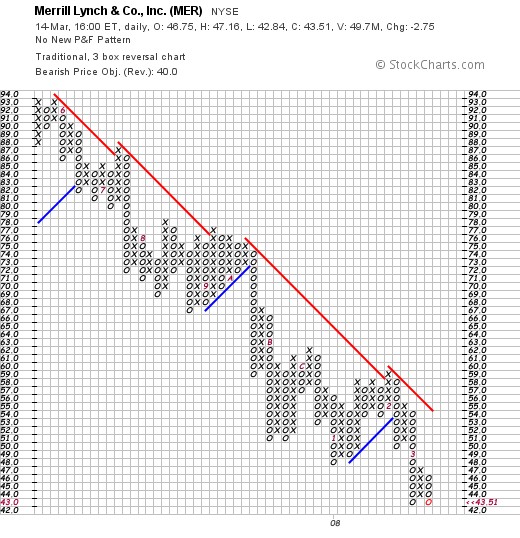

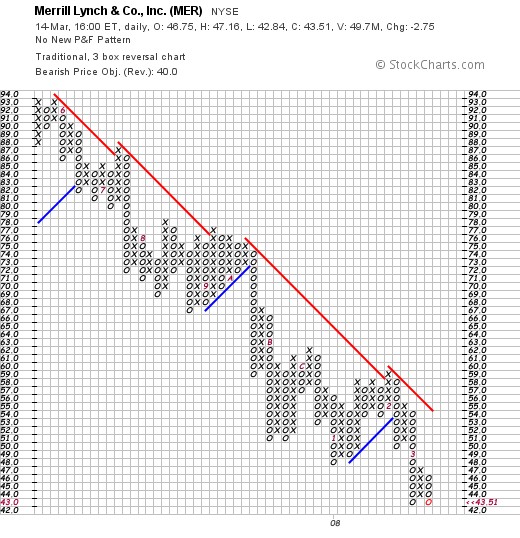

Or the chart for Merrill Lynch:

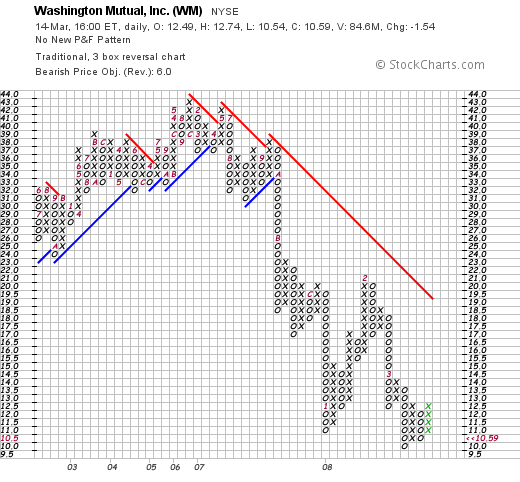

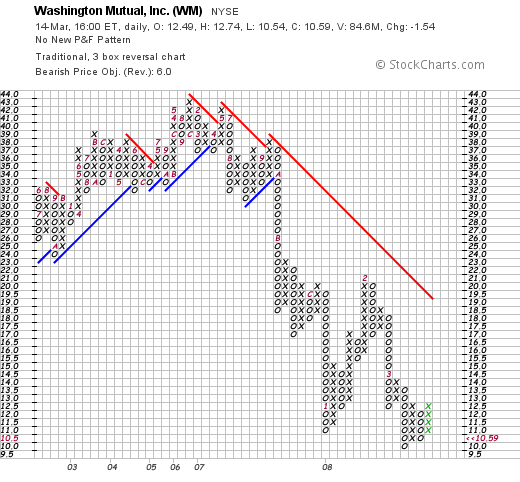

Or Washington Mutual (WM):

How low can these go?

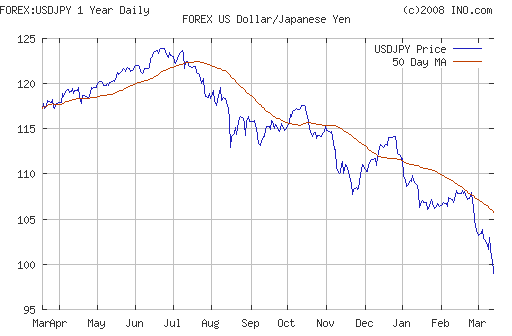

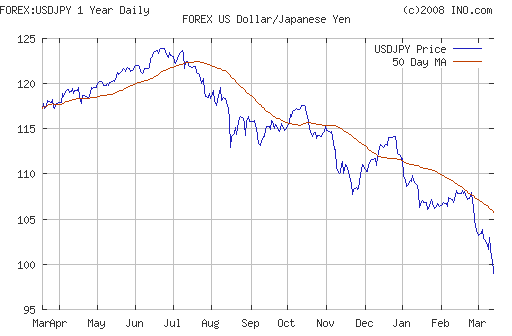

And if that's not enough, here is the dollar-yen chart:

Just something to think about as we await the markets

An interesting footnote is the important role that JP Morgan has played in prior stock market melt-downs. An excellent review is found in The Big Picture, as they reflected on the 1929 crash:

"Thursday Oct. 24, 1929: For so many months so many people had saved money and borrowed money and borrowed on their borrowings to possess themselves of the little pieces of paper by virtue of which they became partners in U. S. Industry. Now they were trying to get rid of them even more frantically than they had tried to get them. Stocks bought without reference to their earnings were being sold without reference to their dividends. At around noon there came the no-bid menace. Even in a panic-market, someone must buy the "dumped" shares, but stocks were dropping from 2 to 10 points between sales—losing from 2 to 10 points before a buyer could be found for them. Sound stocks at shrunk prices—and nobody to buy them. It looked as if U. S. Industries' little partners were in a fair way to bankrupt the firm.

Then at 1:30 p. m., a popular broker and huntsman named Richard F. Whitney strode through the mob of desperate traders, made swiftly for Post No. 2 where, under the supervision of specialists like that doughty warrior, General Oliver C. Bridgeman, the stock of the United States Steel Corp., most pivotal of all U. S. stocks, is traded in. Steel too, had been sinking fast. Having broken down through 200, it was now at 190. If it should sink further, Panic with its most awful leer, might surely take command. Loudly, confidently at Post No. 2, Broker Whitney made known that he offered $205 per share for 25,000 shares of Steel—an order for $5,000,000 worth of stock at 15 points above the market. Soon tickers were flashing the news: "Steel, 205 bid.'' More and more steel was bought, until 200,000 shares had been purchased against constantly rising quotations. Other buyers bought other pivotal stocks. In an hour General Electric was up 21 points, Montgomery Ward up 23, Radio up 16, A. T. & T. up 22. How far the market would have gone downward on its unchecked momentum is difficult to say. But brokers and traders alike agreed that the man who bid 205 for 25,000 shares of Steel had made himself a hero of a financially historic moment.

That hero, Richard Whitney, head of Richard Whitney & Co., was brother of George Whitney, Morgan Partner. Back of his action lay a noontime meeting held at No. 23 Wall St., Home of the House of Morgan. Although an excited Hearst reporter would have it that the Head of the House was present, actually, John Pierpont Morgan was in Europe. It was Partner Thomas W. Lament with whom conferred Charles E. Mitchell, National City Bank; William C. Potter, Guaranty Trust; Albert H. Wiggin, Chase National Bank; Seward Prosser, Bankers Trust. These men controlled resources of more than $6,000,000,000. They met briefly; they issued no formal statement. But to newsmen, Mr. Lamont remarked that brokerage houses were in excellent condition, that the liquidation appeared technical rather than fundamental. He also conveyed, without specifically committing himself, the impression that the banks were ready to support the market. And the meeting was hardly over before Hero Whitney had become Heroic.

Traders, talking over the Morgan meeting, failed to remember any previous occasion on which a stock market conference had been called while a trading session was still in progress. They did recall, however, that in 1907, with call money at 125%. Secretary of the Treasury Cortelyou conferred with J. P. Morgan, put $25,000,000 of Government funds into Manhattan banks, halted the Panic. They remembered too the Northern Pacific crash of 1901. when, after Northern Pacific stock had gone overnight from $150 to $1,000 a share, the House of Morgan, representing the late great James J. Hill and the House of Kuhn, Loeb, representing the late great Edward H. Harriman, compromised at $150 a share, saved from ruin many a short. Then there was the U. S.-England war scare of 1895 when, with money at 80%, J. P. Morgan offered money at 6%, averted a threatened crash.

Thus bankers have for a long time recognized their responsibilities as panic-preventers, and when the glass house of speculation has cracked and splintered, it has most often been the strong House of Morgan that has assumed the responsibility of fame and brought order out of confusion." (emphasis added)"

Anyhow, it may not be 1929, but then again, it is indeed JPMorgan Chase that is possibly (?) averting another crisis.

Yours in investing,

Bob

Krispy Kreme Doughnuts (KKD) "Long-Term Review #17"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website. Seeing as I didn't have any stocks to review in my "Weekend Review", it seemed reasonable to take another 'long-term view' on this blog.

These reviews and analyses have been done assuming a 'buy and hold' approach to investing. In reality, I practice and advocate a disciplined investment strategy (a link to my podcast on this topic) that involves carefully screening stocks for inclusion into a trading portfolio and then managing those investments by limiting losses by quick sales on declines and preserving gains by selling portions of appreciating stocks at targeted appreciation levels.

Some months ago I decided that it would be helpful to start looking at the very earliest entries on this blog to find out how they all turned out. Hopefully with these analyses we can identify reasons to be selecting stocks and identifying what were the best prognosticators for success. And not all of these picks have been successful!

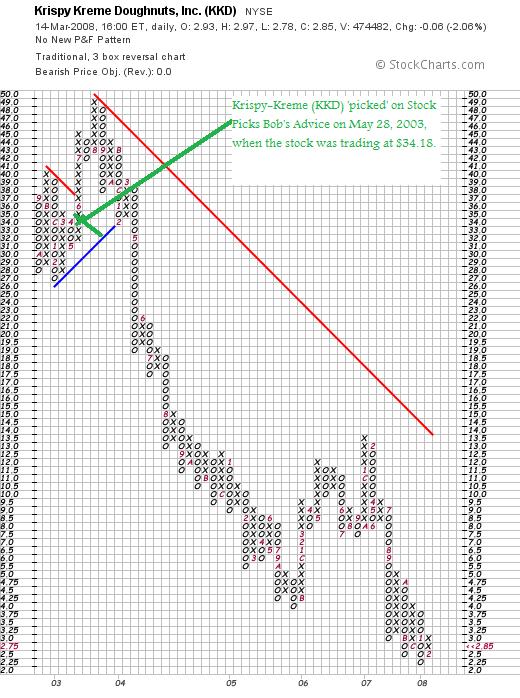

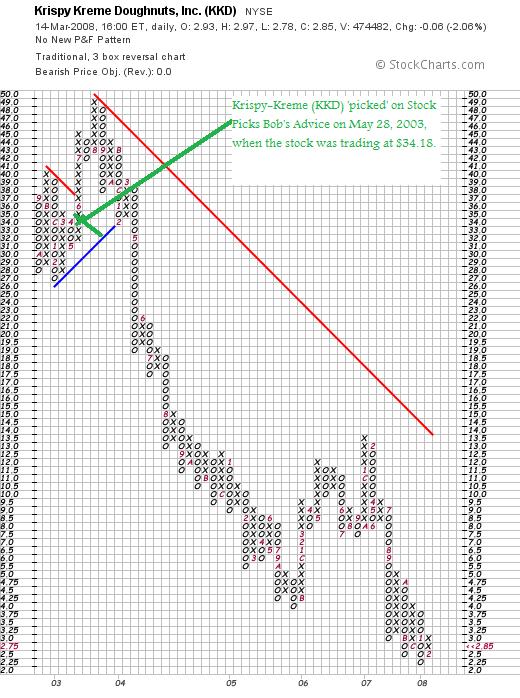

Last weekend I reviewed Westcorp (WES) which was initially posted on May 27, 2003. The very next day I wrote up Krispy Kreme Doughnuts (KKD) on Stock Picks Bob's Advice. Let's review that entry and see how KKD is doing today.

"May 28, 2003

Krispy Kreme Doughnuts (KKD)

The market paused this morning as if it wanted to correct as the bears came out growling....but the bulls resumed their push and the momentum on the upside continues. As I write (10:43 am CST) market up 45 points.

An old favorite of mine, Krispy Kreme Doughnuts, hit the list today. They had a GREAT earnings report today as they continue their explosive revenue and earnings growth....all on the back of a glazed doughnut! (so much for low carb dieting)....earnings reported today with earnings up a strong 47%, their sales rose 34% to $148.7 million from $111.1 million last year.

As reported by the CEO on CNBC this morning same store sales growth continued in the double digit area up about 11% year over year. (These are the stores that have been open at least a year).

On Morningstar we see sales growing from $80.9 million in 1999, $220.2 million in 2000, $300.7 million in 2001, $394.4 million in 2002, and now with a $148 million for the quarter we have about an extrapolated $600 mnillion level for the year 2003 if everything continues at the same rate.

Looking at cash flow we do see a NEGATIVE 34 million number but with all the rest of the figures so good, I guess we can look over this for a good doughnut or two. Maybe with a cup of their new coffee!

I do not at this time own any shares but have in the past and am not planning at this time to purchase new shares. Nobody in my family owns shares either.

Have a great day investing! Did anybody besides me snag some SYNO? Bob"

Krispy Kreme Doughnuts (KKD) closed at $2.85 on March 14, 2008. Using Yahoo to get the historical price on Krispy Kreme we can see that KKD closed at $34.18 on May 28, 2003. Thus, I had a loss on this pick of $(31.33) or (91.7)% on this unfortunate stock pick! I do not currently own any shares nor do I have any options on this stock.

Krispy Kreme Doughnuts (KKD) closed at $2.85 on March 14, 2008. Using Yahoo to get the historical price on Krispy Kreme we can see that KKD closed at $34.18 on May 28, 2003. Thus, I had a loss on this pick of $(31.33) or (91.7)% on this unfortunate stock pick! I do not currently own any shares nor do I have any options on this stock.

Let's take a closer look at this company and see how we should rate this stock!

What exactly does this company do?

According to the Yahoo "Profile" on KKD, the company

"...operates as a branded retailer and wholesaler of doughnuts. It engages in the ownership and franchising of Krispy Kreme doughnut stores, which make and sell approximately 20 varieties of doughnuts. These stores also offer an array of coffees and other beverages. As of January 28, 2007, there were 395 Krispy Kreme stores operated system wide in 40 states in the United States, Australia, Canada, Hong Kong, Indonesia, Japan, Kuwait, Mexico, the Philippines, South Korea, and the United Kingdom, of which 113 were owned by the company and 282 were owned by franchisees. The company was founded in 1937 and is headquartered in Winston-Salem, North Carolina."

"...operates as a branded retailer and wholesaler of doughnuts. It engages in the ownership and franchising of Krispy Kreme doughnut stores, which make and sell approximately 20 varieties of doughnuts. These stores also offer an array of coffees and other beverages. As of January 28, 2007, there were 395 Krispy Kreme stores operated system wide in 40 states in the United States, Australia, Canada, Hong Kong, Indonesia, Japan, Kuwait, Mexico, the Philippines, South Korea, and the United Kingdom, of which 113 were owned by the company and 282 were owned by franchisees. The company was founded in 1937 and is headquartered in Winston-Salem, North Carolina."

How did they do in the latest quarter?

On December 6, 2007, KKD announced 3rd quarter 2008 results. For the quarter ended October 28, 2007, sales declined (11.7)% to $103.4 million from $117.1 million in the third quarter of the prior year. The net loss for the quarter was $(798,000) or $(.01) per diluted share, improved from a loss of $(7.2) million or $(.12)/diluted share the prior year.

There has been a lot of turmoil at this doughnut maker. On January 7, 2008, the CEO was replaced by Chairman James Morgan. On the other hand, the underlying value in the company and the brand has not been ignored either; Kuwaiti contractor Mohamed Abdulmohsin Al Kharafi & Sons on February 5, 2008, increased its stake in the company up to a sizeable 13.8%.

What about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials, we can see that revenue actually increased along with earnings from 2003 to 2004 when revenue climbed to $649 million from $491 million and earnings jumped from $.52/share to $.78/share. However, in 2005 these results diverged with revenue continuing to grow to $708 million but the company turning in a large loss of $(3.22)/share. Since 2005 revenue has slipped sequentially down to $461 million in 2007 and $431 million in the trailing twelve months (TTM). Earnings have shown consistent although decreasing losses with $(2.20)/share reported in 2006, $(.70)/share in 2007 and $(.90)/share in the TTM.

Free cash flow has fortunately been positive recently with $18 million in 2007 and $8 million in the TTM. The balance sheet is also adequate with $23 million in cash and $54 million in other current assets reported. This total of $77 million in total current assets yields a current ratio of 1.69, an 'acceptable' current ratio imho. The company is reported to have an additional $114.7 million in long-term liabilities.

What about some valuation numbers?

Reviewing the data on Yahoo "Key Statistics" we find that Krispy Kreme (KKD) is now a 'micro cap' stock with a market capitalization of only $186.77 million. Since the company is losing money there is no trailing p/e. However, there are estimates of a return to profitability allowing us to estimate a forward p/e (fye 28-Jan-09) of 40.71. Again, no PEG ratio is possible.

Using the Fidelity.com eresearch website, we can see that valuation-wise, with a Price/Sales (TTM) ratio of only 0.43, compared to the industry average of 3.06, this represents an outstanding value. Also, with all of the recent losses, the return on equity (TTM) amounts to a (65.03)% compared to the industry average of 19.03%.

Finishing up with Yahoo, we can see that there are 65.53 million shares outstanding with 55.83 milion that float. Currently, there are 8.14 million shares out short representing 17.5 days of trading volume, a significant short-ratio imho using my own '3 day rule' of significance on short interest.

No dividends are paid and the last stock split was a 2:1 split back on June 15, 2001.

What does the chart look like?

Looking at the StockCharts.com 'point & figure' chart on KKD, we can see that the stock actually moved higher from October, 2002, when it was at $28 until my 'pick' and then peaked at $49 in August, 2003. The stock has had a dismal track record dipping first to $4.00 in October, 2005, rebounding up to $13.50 in January, 2007, only to dip down to a low of $2.25 in January, 2008. The stock is struggling at its current price, but it appears that most (?) of the damage may already have been done.

Summary: What do I think about this stock now?

First of all, in a Peter Lynch sort of fashion, I really like Krispy Kreme Doughnuts....ok they are fattening and all, and I am on a diet, but they are a nice treat.

The fundamentals on this stock are dismal. The only good thing I can say is that they are losing less money, are free cash flow positive, and have an adequate balance sheet. Revenue has been declining and the chart looks horrendous. It is just that so much of the damage has been done and the value of the stock is starting to look compelling with the Price/Sales ratio under 0.5.

Now if they could just turn profitable and start growing their revenue once again.

In general, I would like to say this is rated a "SELL" but with so much of the damage done, and the Kuwaiti investor starting to accumulate shares, I am forced to rate this differently:

KRISPY KREME DOUGHNUTS (KKD) IS RATED A HOLD

O.K. I hoped I didn't wimp out on this one. Just cause I love thouse doughnuts and am still in mourning after our own local Krispy Kreme outlet closed up. It has been easier to diet since then :). It just seemed that it would be 'too late' to start advising a sale on a stock that is this beaten up already!

Thanks again for visiting! If you get a chance, be sure and visit my Covestor.com website where my actual trading portfolio is reviewed, my SocialPicks Page where my stock picks from the past year or so are examined, and my Podcast Page where you can download mp3's of me discussing some of the many stocks I write about here on the blog. Good-luck next week investing. Be sure and maintain trading rules whatever you do! Limit your losses and exercise caution; it is getting ugly outside.

Yours in investing,

Bob

"Looking Back One Year" A review of stock picks from the week of August 28, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I try to review past stock picks on weekends going a week at a time. Last weekend I examined the selections on this blog from the week of August 21, 2006. Going a week ahead to August 28, 2006, I took a break on the blog, not posting any selections that week. Thus, I am entitled to a break here with this review. I shall move to the next week in the future. Meanwhile, have a wonderful weekend and maybe a better week trading next week?

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:50 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 16 March 2008 10:51 AM CDT

Saturday, 15 March 2008

My Prosper.com Account: Update #2

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Last month, on February 10, 2008, I discussed my Prosper.com account. (If you do choose to sign up via these links, please know that there is a $25 incentive when you make your first loan and also a $25 fee that I receive for making that referral!)

It is difficult to read the financial news without reading about the ongoing credit crunch. I have great concerns about person-to-person lending arrangements in the midst of this credit problem and economic slow-down.

And yet Prosper.com CEO Chris Larsen sees opportunity in this 'credit crunch'. As he recently related in an interview with the San Francisco Business Times:

"Prosper CEO Chris Larsen said Monday that the San Francisco company is benefiting from the credit crunch that's sending more lenders and borrowers to the person-to-person lending marketplace.

More people with good credit are coming to Prosper as home equity loans and credit cards become harder to obtain, Larsen told 350 people attending the company's Prosper Days in San Francisco.

"Banks are retrenching so aggressively," he said. Prosper lenders have also pulled back on loans made to subprime borrowers.

Larsen also anticipates more people might be willing to lend on Prosper as rates fall on other investments following the Fed's dramatic rate cuts."

However, I still am cautious about the safety of lending unsecured amounts to individuals in this set-up and would encourage all of you to exercise reasonable caution and care. Certainly emphasizing higher quality borrowers and spreading out your loans to multiple borrowers is a reasonable approach to reduce some of the risk. Meanwhile, I am committed to continuing to share with you my own experience on Prosper.com.

A recent article on these type lending arrangements recently was published in the Wall Street Journal. Pay special attention to the comments sections, especially to ira01 who details some of his perceptions of the risks involved in lending on Prosper. Especially useful is his link to LendingStats.com which summarizes the Prosper.com lending experience.

In fact, you can view my statistics on Prosper.com here.

Reviewing my own Prosper.com information, I currently have 53 active loans vallued at $2,816.62. I continue with my automatic $50 deposit into Prosper.com twice/month. I have $15.37 in payments pending, $122.59 in current bids that are 'winning', yet still not concluded for an average interest rate of 18.62%. I have had total loans of $2,960.69, with $248.63 in payments received. My average interest rate on my loans is at 15.69% with a daily interest accrual of $1.20.

Right now 50 of my 53 loans are current. I have one loan which is less than 15 days late on a payment (it is marked as having a pyament being processed); however, I have two loans which are more problematic. One is between 15 days and 30 days late with a principal balance of $(47.87), and one which is greater than 30 days overdue and has been entered into collection. That one has a balance of $(46.76).

My first loan was written September 20, 2007, and my latest loan was approved March 10, 2008.

If you are interested in learning more about Prosper.com, you can click here to enroll. Like I have noted, I do receive a $25 referral fee if you do decide to make a loan. I have tried to emphasize the tremendous risks involved, risks that have grown as the credit crunch develops and the pressure on homeowners and others who may seek unsecured loans may increase.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is monitored and evaluated as well as my SocialPicks Page where my stock picks are followed and monitored. If you are interested, consider dropping by my Podcast Page where you can download mp3's of me discussing some of the many stocks and issues I address in the blog!

Hoping next week brings all of us good health and financial success.

Yours in investing!

Bob

Posted by bobsadviceforstocks at 1:36 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 15 March 2008 1:37 PM CDT

Wednesday, 12 March 2008

Esco Technologies (ESE)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment adivisers prior to making any investment decisions based on information on this website. I was rather excited about my new Seeking Alpha affiliation....o.k. it is just another website, but I really am an amateur, and this is big stuff :). (This is really new, so they haven't even posted an article yet....I shall have to wait and see how this works out!)

And it is late (9:30 pm Wisconsin time) and I have to be up at 5:00 to get out and do my walk at the University. I am a confirmed couch potato, but have been working at increasing my activity of late....besides the markets aren't open that hour anyhow. I generally get into rather heated political discussions with my fellow walkers....but that is another story as well.

What I am trying to get at is I want to make this a brief entry and instead I am writing word after word trying to explain to you why I want this to be short. Now does that make sense?

There wasn't any follow-through from yesterday's big rally as the market closed today (3/12/08) at 12,1110.24, down (46.57) and the Nasdaq closed down (11.89) at 2,243.87. Oil charged ahead over the $100 level closing at $109.92, and gold continued to push the $1,000/ounce level closing at $4.70. It really wasn't the kind of trading day to make an investor smile.

But back to my review. (If those Seeking Alpha folks had read this before they certified me I might never had gotten that medal!)

Esco Technologies (ESE) made the list of top % gainers today, closing at $41.06, up $3.99 or 10.76% on the day. I do not own any shares or options of this stock.

Esco Technologies (ESE) made the list of top % gainers today, closing at $41.06, up $3.99 or 10.76% on the day. I do not own any shares or options of this stock.

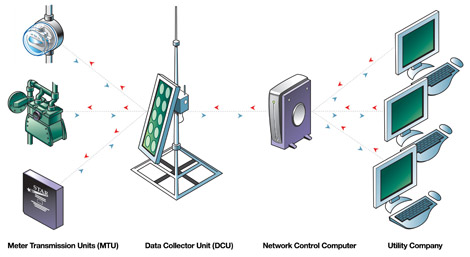

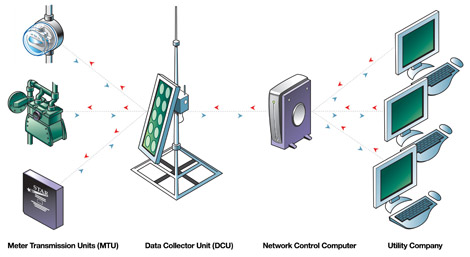

In a nutshell, this company that produces devices for the electric utility business, reported an order for 88,000 electronic devices from PG&E and has a

potential for up to 4.1 million 'gas units' over the life of this contract. With the price of natural gas going through the roof, the 'street' liked this report and I guess figured Esco was in the right business at the right time :).

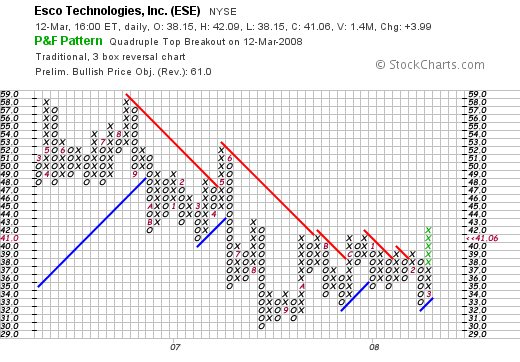

O.K. keeping it simple, the last quarter reported on February 7, 2008, was solid. The Morningstar.com "5-Yr Restated" financials look great, and the point and figure chart from StockCharts.com, appears to show that the company is breaking through recent resistance on the upside and is far from over-extended!

With all of this in mind,

ESCO TECHNOLOGIES (ESE) IS RATED A BUY

O.K. that was briefer than usual. But did it make my point?

Thanks so much for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing!

Bob

Newer | Latest | Older

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it.

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it."...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!  I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first

I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first  It has been

It has been

Krispy Kreme Doughnuts (KKD) closed at $2.85 on March 14, 2008. Using Yahoo to get the

Krispy Kreme Doughnuts (KKD) closed at $2.85 on March 14, 2008. Using Yahoo to get the

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Esco Technologies (ESE) made the

Esco Technologies (ESE) made the