Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I haven't been very busy posting this past week. There really hasn't been much to write about except the continuing challenge to the markets by the ongoing correction. My own Trading Portfolio is down to just 6 positions, from my maximum of 20 and just above my minimum of 5. These positions are: Copart (CPRT), Covance (CVD), IHS (IHS), Morningstar (MORN), ResMed (RMD) and Meridian (VIVO).

Especially with just 6 positions, it is easy to have one stock exert an inordinate amount of effect on the portfolio. This is exactly what happened Friday when Copart disappointed investors with their quarterly report. The stock plunged $(3.93) or (10)% to $35.50, erasing much of the 'paper profits' on this holding. However, with the stock trading above my cost of $33.72, and with the report not really being bad enough from my perspective to unload the shares, I hang on and take my 'licks' from this correction

As part of my weekend activity on this blog, I have been trying to look back at stocks I posted a year ago. Having missed several weeks along the way, it is really a retrospective analysis of stocks selected for this blog more like 1 1/2 years earlier! In any case, I work week by week through past stock selections to find out what worked, what didn't, and can we possibly learn from these selections.

This review assumes a buy and hold approach to investing. In reality, I use a disciplined portfolio management strategy designed to limit losses by quick sales of declining stocks and retaining gains by partial sales at appreciation targets. The difference between these two strategies would certainly affect eventual investment performance. But for the ease of analysis, I shall continue to do my reviews assuming a passive buy and hold strategy for these stock picks.

Last weekend I reviewed the pick(s) from the week of August 14, 2006. Let's move a week ahead and take a look at the activity on this blog for the week of August 21, 2006. Fortunately for this reviewer, I only 'picked' one stock on the blog during the week of August 21, 2006. Unfortunately for this reviewer it was a bust!

Last weekend I reviewed the pick(s) from the week of August 14, 2006. Let's move a week ahead and take a look at the activity on this blog for the week of August 21, 2006. Fortunately for this reviewer, I only 'picked' one stock on the blog during the week of August 21, 2006. Unfortunately for this reviewer it was a bust!

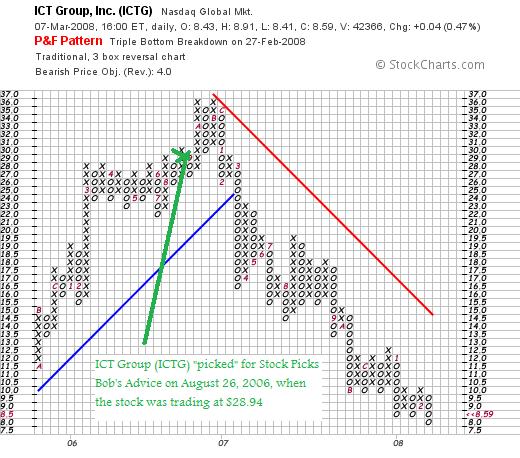

On August 26, 2006, I posted ICT Group (ICTG) on Stock Picks Bob's Advice when the stock was trading at $28.94. ICTG closed at $8.59 on March 7, 2008, for a loss of $(20.35) or (70.3)% since posting. (We can see from this price performance, that maintaining a loss limit of (8)% or whatever you choose, would be better than picking a stock and blindly hanging on!)

Let's take a closer look at this stock and I will explain why

ICT GROUP (ICTG) IS RATED A HOLD

First of all what does this company do?

According to the Yahoo "Profile" on ICT Group (ICTG), the company

"...and its subsidiaries provide outsourced customer management and business process outsourcing solutions. It offers customer care/retention, technical support and customer acquisition, and cross-selling/upselling services, as well as market research, database marketing, data capture/collection, email management, collections, and other back-office business processing services."

How did they do in the latest quarter?

On February 27, 2008, ICTG reported 4th quarter 2007 results. Revenue for the quarter ended December 31, 2007, came in at $112.5 million, down from $117.2 million the year earlier. The company reported a net loss of $(3.0) million or $(.19)/diluted share. Excluding one-time expenses, the company came in with net income of $922,000 or $.06/diluted share. In any case, compared to last year, this was way down from the $5.1 million in net income or $.32/diluted share reported. Even with the excluded items, the company failed to meet expectations on revenue for the quarter of $114.6 million but did beat on earnings which had been expected to come in at $.03/share

The company was not very optimistic about 1st quarter 2008 results:

"For the first quarter of 2008, the Company expects revenue to be slightly below fourth quarter 2007 levels. As indicated during the Company’s third quarter earnings call, first quarter expenses will be higher than normal due to seasonal factors, as well as for training and other start-up costs associated with a large contract won in the third quarter and the completion of the accelerated ramp-up of ICT GROUP’s offshore facilities. Consequently, first quarter 2008 diluted earnings per share are expected to result in a loss of $0.03 to $0.07 per diluted share."

This reduced guidance was well below street expectations.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ICTG, we can see that the revenue picture is intact with steady increases from $299 million in 2002 and $448 million in 2006 and $458 million in the trailing twelve months (TTM). Earnings, however, have dipped from the $1.11/share reported in 2006 to a loss of $(.24)/share in the TTM.

Free cash flow has also turned negative at $(4) million from 2006 when $9 million of free cash flow was generated. The balance sheet is still solid with $24 million in cash and $101 million of current assets, compared to current liabilities of $47.3 million and a nominal amount of long-term debt recorded at $6.5 million. This $125 million in current assets yields a current ratio of over 2.0 when compared to the current liabilities of $47.3 million.

What about valuation numbers?

Reviewing Yahoo "Key Statistics" on ICTG, we can see that this is a small cap stock with a market capitalization of only $135.64 million. There is no trailing p/e recorded, but the PEG is cheap at $.73 and the forward p/e is also cheap at 10.23 (fye 31-Dec-09).

Reviewing the Fidelity.com eresearch website, we find that the Price/Sales (TTM) is cheap at 0.30 compared to the industry average of 2.05. With the recent losses, the Return on Equity (ROE) (TTM) is reported at (7.23)% compared to the average of 27.89 in the industry per Fidelity.

Finishing up with Yahoo, we can see that there are only 15.79 million shares outstanding with 8.91 million that float. Of these 618,890 shares were out short as of 2/12/08, representing 7.1 trading days of volume or 6.4% of the float. This is significant and represents some bullish possibilities with the ratio well above my own '3 day rule' for short interest.

No dividends and no stock splits are reported on Yahoo.

What does the chart look like?

Reviewing the "point & figure" chart on ICT Group (ICTG) from StockCharts.com, we can see how the stock climbed from October, 2005, when it was trading at $11.50 to a peak of $36 in November, 2006. The stock has declined steadily since that time to the current low of $8.59 just pennies above the recent low of $8.

Summary: What do I think?

When I first started writing up this particular stock to review, I initially ranked this as a "sell". But it just seems too late to be advocating a "sell" on a stock that is as decimated as this one is. The forward p/e (if it can indeed once again turn profitable) is only 10 or so. The PEG is well under 1.0, the Price/Sales ratio is cheap. What this has turned into is a value play. Not my kind of stock at all. But it appears too late to be advocating a 'sell'. Thus, the 'hold'.

If the stock can indeed turn around in a couple of quarters, we may well see this stock moving higher once again beyone its very depressed levels.

THAT was the only stock I picked during that week back in August, 2006. And it was a humdinger. This stock emphasizes, and I cannot overemphasize this point, the imperative of limiting losses and not riding a stock down all the way from a peak. Thus, my performance for that week back in August, 2006, was a loss of (70.3)% on my pick--the only stock selected for the blog. Probably the worst week I have reviewed for awhile.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my trading portfolio is analyzed, my SocialPicks page where you can view my picks from the last year or so, and my Podcast Page where my podcasts are stored for you listening pleasure!

Hoping we all have a little more profitable week in the days ahead!

Yours in investing,

Bob

Updated: Sunday, 9 March 2008 5:18 PM CST