Stock Picks Bob's Advice

Sunday, 9 July 2006

A Reader Writes: 'Instructions on how to send an mp3?'

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Keith from Melbourne, Florida, was kind enough earlier this week to let me know that my latest podcast was missing the final ten minutes. I corrected the problem, although I did overlap about 30 seconds...I shall work on my Audacity skills....I promise!

I encouraged Keith, as I did all of you, to consider sending me an mp3, or an audio clip that I would be happy to include in my

podcast website. He wrote:

"Bob

It is repaired. I was able to download it but it went right into Qucktime so I was not able to download it to my IPOD or even save it to my HD. I was hoping to be able to do it so I could save it and listen to again.

Also thank you for the shout out. I will check out the microphone to send you an MP3. Could you put the instructions or site on your Blog?

Thanks

Keith

Let me try to answer your question Keith. First of all, the easiest thing to do, imho, is to pick up an inexpensive headphone/microphone combination at Best Buy, Circuit City, or your local electronics/business store. (I don't have any stock in those two, it is just I have access to Best Buy).

If you go to my

main podomatic page..you should see a place to leave comments along the right side of the page. You can either directly record these comments on Podomatic or you can create an mp3 file with freeware like Audacity or Garage Band if you have a Mac...this is a little harder because as I understand it you need to export it into iTunes then export it back to your desktop as an mp3...I prefer Audacity.

You can find Audacity by going to http://audacity.soundforge.net and download it for free. If that link doesn't work just search under "Audacity recording software" on Google.

Let me know how this works and looking forward to including my first guest mp3 into the podcast. Let me know how your club is doing and what you all think of my process....Thanks again Keith!

Bob

Posted by bobsadviceforstocks at 8:22 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 9 July 2006 10:40 PM CDT

Monday, 3 July 2006

Sirenza Microdevices Inc. (SMDI) July 3, 2006

CLICK HERE FOR MY PODCAST ON SIRENZAHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I hope you all had a chance to read through my previous post on

"My Investment Strategy". As I go through this review, I think you will see how this all fits in.

Looking for a candidate to review this afternoon, I started with the

list of top % gainers on the NASDAQ. After examining several of the names on this list, I came across Sirenza Microdevices (SMDI) which closed at $13.52, up $1.38 or 11.37% on the day. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on Sirenza, the company

"...engages in the design and supply of radio frequency (RF) components for the commercial communications, consumer and aerospace, defense, and homeland security equipment markets. The company’s products receive and transmit voice and data signals in mobile wireless communications networks, as well as in other wireless and wireline applications in the United States and internationally."

On May 3, 2006, SMDI

announced 1st quarter 2006 results. The company reported revenue for the quarter ended March 31, 2006, of $20.9 million, a 72% increase over the $12.1 million reported in the same quarter last year. In addition, this was a 7% sequential increase in revenue over the immediately preceding quarter. Net income was $1.6 million or $.04/share compared to a net loss of $(1.8) million or $(.05)/diluted share in the prior year same quarter.

On a longer-term basis, if we review the

Morningstar.com "5-Yr Restated" financials on SMDI, we can see a steady increase in revenue from $19.8 million in 2001 to $64.2 million in 2005 and $72.9 million in the trailing twelve months (TTM0.

Earnings have turned around from a loss of $(.67)/share in 2001 to a profit of $.01/share in 2004, $.04/share in 2005 and $.13/share in the trailing twelve months.

The company

has been increasing its float (and I believe using the shares for acquisitions) increasing the number of shares outstanding from 29 million in 2001 to 35 million in 2005 and 45 million in the TTM. This 50% increase in shares outstanding was apparently effective as the company grew its revenues almost 400% and turned from a loss of $(.67)/share ot a profit of $.13 in this same period of time.

Free cash flow which also was a negative $(10) million in 2003, improved to $2 million in 2004, $6 million in 2005 and $10 million in the trailing twelve months.

The balance sheet looks solid with $24.9 million in cash reported, enough to pay off

both the $12.3 million in current liabilities and the $.3 million in long-term liabilities combined almost twice over. Calculating the current ratio, with total current assets adding up to $46.7 million, compared with the $12.3 million in current liabilities gives us a ratio of 3.8. Also appearing quite healthy.

Looking at the

"Key Statistics on SMDI from Yahoo", we see that this is a mid-cap stock with a market capitalization of $605.07 million. The trailing p/e is

rich at 108.16, but the company is just turning profitable and estimates allow a forward p/e (fye 31-Dec-07) of only 22.53. Thus, even though the p/e is currently over 100, the PEG is only 1.22.

Using the

Fidelity.com eresearch website, we find that the company is in the "Semiconductor-Integrated Circuit" industrial group. The Price/Sales ratio also appears rich relative to this group with Sirenza (SMDI) coming in at 6.5. This is only exceeded by Marvell (MRVL), and followed by Broadcom (BRCM) at 6.1, Semtech (SMTC) at 4.6, RF Micro Devices (RFMD) at 1.5 and Skyworks (SWKS) at 1.1.

Regarding profitability, this company is in the middle of its group with a return on equity (ROE) of 9.6%. Tops in the group is Broadcom (BRCM) at 15.6%, followed by Marvell (MRVL) at 11.7%, Semtech (SMTC) at 9.9% the SMDI, then RF Microdevices (RFMD) at 2.9% and Skyworks (SWKS) at 2%.

Finishing up with Yahoo, we can see that there are 44.75 million shares outstanding with 24.84 million that float. Currently there are 1.63 million shares out short (6/12/06) representing 5.70% of the float or 2.7 trading days of volume (under my 3 day cut-off for significance in this "short ratio").

No dividend is paid and no stock split is reported on Yahoo.

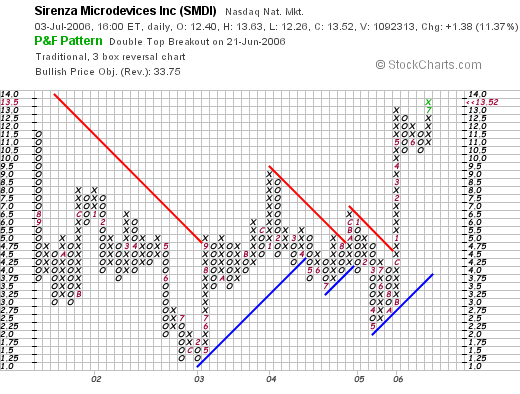

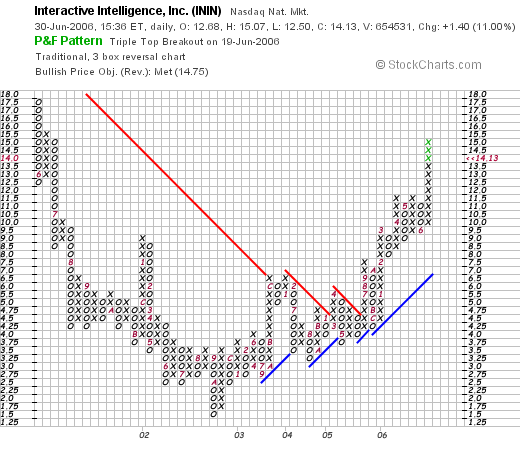

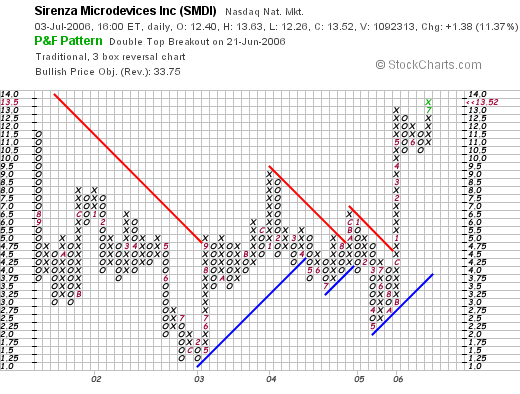

If we review the

"Point & Figure" chart on Sirenza from StockCharts.com:

We can see that this stock, which traded down from $11.50 in July, 2001, to a low of $1.25 in February, 2003, then moved higher in a step-wise and tentative fashion, finally decisively breaking out into higher price ranges in December, 2005, breaking through resistance at $4.50 and moving to the current range of $13. The stock appears to have broken higher once again and overall, the chart looks fine to me.

So to summarize, here is a stock in the semiconductor area that moved higher today. The latest quarter was quite strong and the Morningstar.com report looks very consistently strong the past five years. Valuation is rich both in terms of p/e and Price/Sales but the company is improving its earnings so quickly that the PEG is under 1.5. Finally the chart looks encouraging.

Anyhow, that's the pick for today! Thanks again for stopping by and visiting. Please drop me a line at bobsadviceforstocks@lycos.com if you have any comments or questions. Also, be sure and listen to my Stock Picks Bob's Advice Podcast Site.

Bob

Posted by bobsadviceforstocks at 1:36 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 3 July 2006 11:36 PM CDT

Saturday, 1 July 2006

My Investment Strategy

CLICK HERE FOR MY PODCAST ON INVESTMENT STRATEGYHappy 4th of July everyone!

I wanted to share with you this picture of the Star Spangled Banner from the Smithsonian. I had a chance to visit the Smithsonian a couple of years ago and that flag still stays in my memory and the effort that has gone into preserving it for future generations. Thank you Smithsonian.

Getting off of my patriotic platform, I wanted to spend a few moments this evening restating the purpose of this blog, my thoughts on investing, and my strategy for dealing with markets whether they be bear markets or bull markets.

Please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions regarding your own investments. However, I have been investing for 38 almost 39 years now. I have read much, and I have had my share of losses as well as gains, and I have been distilling my thoughts into this approach which is what this blog is really about.

There are four basic parts of my approach that I would like to share with you in no particular order. The first thing I would like to discuss is the overall approach to the portfolio, that is how do I manage my portfolio, especially in response to market forces and to individual stock performance.

I have found that I am basically unable to accurately guess the future direction of the market. I do not know from one day to the next whether the market will be rising or falling the upcoming day or week or even year. Maybe others have better luck, but I don't presume this ability.

Thus, I have chosen a more passive technique for managing my portfolio. I have labeled this approach my "zen" approach, meaning that I am trying hard to listen to my portfolio, the stocks that I do own, as they through their own actions "talk" to me. (Is this too touchy-feely or what?).

Simply put, my stocks can do one of two things that affect my trading activity: they can either rise in price and reach targeted sale points, an event that I refer to as "good news"; or they can drop in price and reach sale points, an event that I refer to as "bad news." Alternatively, stocks may experience "bad news" meaning actual news that I choose to interpret as being fundamentally bad. I try not to make this judgment too often but I do reserve the right to intervene to sell stocks on these real news events.

And how do these events affect my strategy? Long ago I accepted the wisdom of limiting losses when they were small, and started to sell stocks at 8% losses. This particular rule was adopted from William O'Neill and the CANSLIM approach of Investors Business Daily. I could understand that avoiding large losses was important. However, I found myself buying additional stocks after a sale at a loss, and then rather quickly being handed an additional loss after selling the second stock at another 8% loss. In other words, the market was compounding my losses for me. This simply didn't make sense.

Thus, I have decided that after selling a stock at a loss, that I would not immediately re-invest the proceeds. Instead I would "sit on my hands" until I had a different signal that it would be time to buy.

This is where the "good news" comes in. If we are to assume that sales within our portfolios are indicative of a poor investment climate, it is also reasonable to assume that our portfolio should also be generating "good news" or signals that it is time to add a position. Since I have used a sale on the downside as "bad news" it makes sense to use a sale on the upside as "good news".

It is this good news/bad news dichotomy that drives my portfolio into equities from cash and back into cash again. I like to credit Robert Lichello who wrote "How to Make $1,000,000 in the Stock Market-Automatically with some of this philosophy and strategy that he developed to move money into and out of mutual funds by his own strategy. I use nothing like what he did, but he inspired me to think about this approach.

Since I cannot endlessly add positions, and at the same time, I cannot go down to zero positions as I use my positions to give me information, I decided upon 25 positions as my maximum and 6 positions as my minimum number of holdings. I suggest to people that they start at 12 positions, which would be "neutral" with 50% of their cash invested. Then, they would either drop down to 6 or up to 24 (or 25) on good news.

The next thing I want to touch on is my selling strategy for individual holdings that I referred to in the above discussion. First the bad news selling. As I indicated above, after an initial purchase, I sell if a stock drops to an 8% loss. When I sell on events that I refer to as "bad news", I sell the entire position, all of the shares that I own.

After making a single partial sale on "good news", which for me the first targeted partial sale is at a 30% appreciation point, then, if the stock starts to decline, I like to sell the stock entirely at break-even, keeping to the well-established doctrine of avoiding letting a stock which you had a profit, develop a loss.

However, if I have made partial sales more than once, for instance, twice: once at 30% and once at 60% appreciation points, then I allow a stock to retrace only 50% of the highest appreciation sale point. That is if a stock had a partial sale at both 30 and 60% points, then I would sell all of my remaining shares if the stock retraced back to a 30% appreciation point from the original purchase.

As noted above, whenever I sell shares on "bad news", I sit on my hands. I do not go out and buy a different stock hoping this time it would do better. I use this sale as a signal to pull back from the market. I "listen" to my portfolio!

What about sales on "good news"? Here I try to stay with my basic philosophy of "selling declining stocks quickly and completely, and selling gaining stocks slowly and partially." What do I mean by this?

I have already shared with you my strategy for selling on the downside. On the upside, I have established targeted appreciation points to make small, partial sales of my positions. While originally selling 1/4 of my remaining shares at each sale point, I realized the size of the positions was dwindling and I needed to either stretch out the intervals or reduce my sale amount. Choosing the latter, I have recently been selling 1/6th of my positions at each targeted appreciation point...and this has been working well at maintaining the size of the positions.

Currently, my targeted sale points are in groups of four: 30, 60, 90, and 120% appreciation points, then 180, 240, 300, and 360% appreciation, then 450, 540, 630, and 720%....etc. These appreciation points are rather arbitrary, but at each of these points my system directs me to sell 1/6th of my holding and to use the proceeds along with additional funds to add a new position to the portfolio as long as I am under my 25 position maximum. At the maximum, the proceeds would be just placed in cash, awaiting a future purchase.

How do I determine which stocks to buy? This is what all of my stocks that I discuss is about. Stocks that are suitable for buying by my strategy, are stocks which on the day that I have "permission" to add a new position are they themselves on the top % gainers list. Other criteria include a latest quarterly result with both increased revenue and earnings (beating expectations and raising guidance is a plus!) In addition, I want to see consistent revenue and earnings growth on the Morningstar report and positive free cash flow, without too much of a growth in the number of shares outstanding. Also, the balance sheet should show an abundance of assets and a scarcity of liabilities :). If possible, some valuation numbers including a PEG between 1.0 and 1.5, and a Price/Sales ratio not too high in its group, and a Return on equity that is high for its group. I also like to see lots of short-sellers who might be in the midst of a squeeze. I review point and figure charts and simply put, just like to see a chart with the price moving steadily higher.

Anyhow, THAT's a mouthful for this evening. I haven't talked much about my strategy for awhile, and knowing how many new people just drop by here and depart, I wanted to have another chance to share this philosophy and investing strategy that I have been employing with all of you readers and listeners!

Have a healthy and safe 4th of July!

If you have any comments or questions, please feel to write me at bobsadviceforstocks@lycos.com and be sure to listen to my Stock Picks Bob's Advice Podcast Site

Bob

Posted by bobsadviceforstocks at 10:43 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 7 July 2006 10:48 PM CDT

An Update on my Trading Portfolio!

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago I updated my portfolio on

Jubak's Refugee Site on MSN where I am a member. After going through all of this work, I thought I would share with you readers my updated information on my portfolio. You can see that the size of my portfolio has been shrinking, both with sales of stocks and reduced # of positions as well as incurred losses. Overall, the portfolio is doing just fine thank you and I shall be sticking with my strategy which it may well be time to discuss on another entry.

Here is my post:

Hello Refugees! Another month has passed and I wanted to update my trading portfolio for those who may be interested. I have been using my trading strategy to cut losses at 8% and am sitting on my hands, as I like to say, until I get a buying signal, which for me is a partial sale at a gain on my remaining stocks.

This analysis is as of the close of trading June 30, 2006.

I am now down to 14 positions (from 18 a month ago) as the market corrected and I continued to unload positions. My maximum remains 25 positions, and I shall start replacing sales at 6 positions, my minimum # of positions planned.

The account net worth is $57,085.26. I now am up to a 72.71% equity position. The market value of my securities stands at $78,508.64. My margin debit balance is now down to $21,423.38.

Current positions (# shares, date of purchase, closing stock price, cost basis, % gain (loss))

Barnes (B) (360 shares, 2/16/06, $19.95, $19.58, 1.91%)

Coach (COH) (102 shares, 2/25/03, $29.90, $8.33, 258.89%)

Cytyc (CYTC) (225 Shares, 1/29/04, $25.36, $14.86, 70.71%)

Genesco (GCO) (200 shares, 5/26/05, $33.87, $34.40, (1.54)%)

Healthways (HWAY) (107 shares, 6/18/04, $52.64, $23.53, 123.75%)

Kyphon (KYPH) (150 shares, 5/20/05, $38.36, $29.21, 31.30%)

Morningstar (MORN) (167 shares, 11/22/05, $41.48, $32.57, 27.34%)

Quality Systems (QSII) (88 shares, 7/28/03, $36.82, $7.75, 375.17%)

ResMed (RMD) (150 shares, 2/4/05, $46.95, $29.87, 57.19%)

Starbucks (SBUX) (50 shares, 1/24/03, $37.76, $11.40, 231.09%)

Meridian Bioscience (VIVO) (210 shares, 4/21/05, $24.95, $11.13, 124.20%)

Toro (TTC) (120 shares, 5/25/06, $46.70, $48.36, (3.43)%)

Ventana Medical Systems (VMSI) (188 shares, 4/16/04, $47.18, $23.47, 101.02%)

Wolverine World Wide (WWW) (240 shares, 4/19/06, $23.33, $23.55, (.92)%)

History since last post: On 6/5/06 I paid out $575 for a car payment (I am buying my car out of this portfolio), on 6/7/06 I sold my 400 shares of Packeteer at $10.86, I sold my 187 shares of Jos a Bank (JOSB) at $27.00 on 6/8/06, on 6/12/06 I received 180 shares of Barnes Group (B) as part of a 2:1 stock split, on 6/15/06 I made a payment of $2445 out of the account for a misc. expense, and on 6/15/06 I received $200 (my monthly deposit), and paid $324.94 in margin on 6/20/06, on 6/21/06 I sold my 142 shares of Helix Energy Solutions (HELX) at $29.844, paid out a check of $255 on 6/21/06 for some blog work, and sold my 320 shares of SRA Intl (SRX) on 6/28/06 at $27.2605.

As of the close of trading on 6/30/06, the account has had $241.50 of taxable income and $2,269.79 of margin expenses in 2006. The total net short-term loss totalled $(1,643.69) and the total realized net long-term gain was $8,945.43, for a total realized gain of $7,301.74.

As of the close of trading on 6/30/06, the account had an unrealized gain totalling $24,113.52.

I hope this continued reporting is helpful. If you are interested in my stock picking strategy, you are more than welcome to visit my blog at https://bobsadviceforstocks.tripod.com/bobsadviceforstocks/ or listen to my podcast at http://bobsadviceforstocks.podomatic.com.

I am an amateur investor, so please take that into consideration before making any investment decisions based on my writing or podcast.

Please let me know if these updates are helpful.

Bob

I should note that on the original first post I left out my Toro stock accidentally and have corrected that problem on this post!

Regards. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Weekend Review" and a PREVIEW of new Stock Picks Bob's Advice Blog

Hello Friends! I am sure I am probably jumping the gun, but here is the

link to my latest entry "Weekend Review" and a preview of my new blog site for Stock Picks Bob's Advice.

I am sure I am premature to start letting a few of you on the site, so note that most entries are dummies and that refinements are still ongoing. Still, the comments section is open and I would LOVE to have you all comment on the look and feel of the site and any improvements you might suggest.

Thanks for helping out with this.

Bob

Friday, 30 June 2006

Interactive Intelligence (ININ) June 30, 2006

CLICK HERE FOR MY PODCAST ON INTERACTIVE INTELLIGENCEHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I want to talk about a stock this afternoon that may deserve our attention, Interactive Intelligence (ININ). I don't have any shares nor do I have any options on this stock. As a change from my prior recent posts, I want to try to make posting a bit simpler for me. Less photos, just the scoop :). Let me know what you think.

Looking through the

list of top % gainers on the NASDAQ today, I came across Interactive Intelligence (ININ), which as I write is trading at $14.27, up $1.54 or 12.10% on the day. I do not own any shares or options on this stock. But let me try to go through the numbers with you and explain why I like the company.

According to the

Yahoo "Profile" on ININ, the company

"...provides business communications software solutions for contact center automation, enterprise Internet protocol telephony, unified communications, and self-service automation."

I didn't see any news to explain today's move to the upside.

Going through some of the things I like to review on a company, ININ

reported 1st quarter results on April 25, 2006, for the quarter ended March 31, 2006. Revenue came in at $17.9 million, up 23% from $14.6 million in the same quarter last year. Net income worked out to $1.0 million or $.06/share, compared to net income of $25,000 and earnings of $0.00/share in the first quarter of 2005.

Longer-term? Reviewing the

Morningstar.com "5-Yr Restated" financials on Interactive, we can see that except for a slight dip in revenue from $47.9 million in 2001 to $47.8 million in 2002, revenue has grown steadily to $62.9 million in 2005 and $66.3 million in the trailing twelve months (TTM).

Earnings show steady improvement with a loss of $(.73)/share in 2001, improving to a profit in 2004 at $.06/share, increasing to $.13/share in 2005 and $.19/share in the TTM. Meanwhile, the number of shares outstanding has stayed relatively constant with 15 million shares in 2001, increasing to 16 million in 2005.

Free cash flow has also been on the upswing with $(3) million in 2003, improving to $3 million in 2005 and $5 million in the TTM.

Balance-sheet? The company has $18.9 million in cahs and $19.1 million in other current assets. This is balanced against a $32.4 million in current liabilities yielding a current ratio of 1.17. This is below what I have learned is "healthy" for a current ratio which should be at least 1.5. However, the company has $-0- long-term liabilities per Yahoo. So this doesn't look too bad at all.

Valuation? Reviewing

Yahoo "Key Statistics" on ININ, we find that this company has a market cap of $232.4 million. The trailing p/e is rich at 77.32, with a forward p/e of 36.28 (fye 31-Dec-07). The PEG ratio, which is reasonable between 1 and 1.5 imho, is also richly valued at 2.22.

Checking the

Fidelity.com eresearch website, we can see that ININ has a Price/Sales ratio of 3.3. This is relatively rich in the "Business Software and Services" industrial group. Other stocks in the group are led by BEA Systems (BEAS) with a ratio of 4.2, First Data (FDC) also at 3.3, Automatic Data Processing (ADP at 3, Business Objects (BOBJ) at 2.4, and Fiserv (FISV) at 2.

If we review profitability, we find that Interactive (ININ) is actually the most profitable in the group with a ROE of 41.7%. This followed by FISV at 19.7%, FDC at 19%, ADP at 18.9%, BEAS at 13.2% and BOBJ at 5.8%.

Finishing up with Yahoo, we find that there are only 16.41 million shares outstanding with 7.90 million that float. In addition, as of 6/12/06, there were only 14,630 shares out short representing 0.2% of the float and 0.2 trading days of volume. No dividend is paid and no stock split is reported on Yahoo.

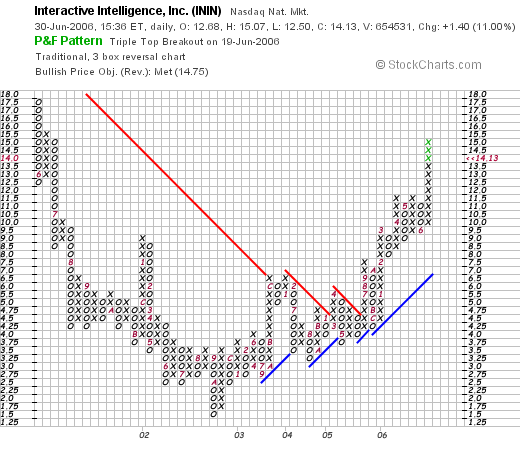

What about a chart?

Here we see an interesting chart with a decline from $17.50 starting in May, 2001, to a low of $1.50 in October, 2002. After breaking through resitance at $4.50 in June, 2005, the stock has once again started moving strongly higher to its current level of $14.13. The chart looks encouraging.

Summary. What do I think? Well it is an interesting, albeit small company. The latest quarter was quite strong, and the Morningstar.com report shows a gradually improving picture with revenue and earnings growing, free cash turning positive and a reasonably strong balance sheeet. Valuation-wise, the p/e is rich, the PEG is over 2.2 and the Price/sales is near the top of its group. Profitability, however, exceeds the other companies in the same group. And with the company as small as it is, certainly a premium in valuation is warranted imho.

Thanks again for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also be sure and visit my Stock Picks Bob's Advice Podcast Site.

Bob

Posted by bobsadviceforstocks at 2:58 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 30 June 2006 8:20 PM CDT

Wednesday, 28 June 2006

"Trading Transparency" SRA International (SRX)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please reemmber that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago another of my stocks in my actual trading portfolio hit a sale point on the downside. SRA International (SRX), which I had purchased 320 share of on 2/1/05, at a cost basis of $29.82, was sold at $27.26, for a loss of $(2.56) or (8.6)%. This was my only sale of this stock and as per my trading strategy, I unload the entire position if it hits or passes an 8% loss. Also per my strategy, I shall be "sitting on my hands" with the proceeds, waiting for a sale of a partial position at a gain (what I call a sale on "good news"). Thus, my portfolio, which had been up to 24 positions of my maximum 25, is now down to 14 positions (still ahead of my minimum of 6). Fortunately, it appears that this round of selling is done, and the rest of my stocks are moving slightly higher this afternoon for the most part!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure to visit my

Stock Picks Bob's Advice Podcast Site.

Bob

Sunday, 25 June 2006

Kyphon (KYPH) "Weekend Trading Portfolio Analysis"

CLICK HERE FOR MY PODCAST ON KYPHON

CLICK HERE FOR MY PODCAST ON KYPHONHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

This blog serves a lot of different purposes. For one thing, I am trying to enhance my ability in picking stocks for potential price appreciation. In addition, I am working on my own trading strategy that determines which stocks to buy, when to buy them and when to sell them. I guess that is something we are all trying to do!

As part of my effort on "transparency" I regularly list my trading portfolio within the posts of the blog, and on weekends, try to review each of my individual holdings to see how they are doing, and what their current fundamentals look like. This post is about Kyphon (KYPH), the next stock in my actual trading portfolio going alphabetically after Jos. A. Bank (JOSB), which I now no longer own, but which I

reviewed on Stock Picks Bob's Advice on May 21, 2006. So let's take a look at Kyphon, see how I have done with this investment and what the current evaluation looks like. (Is that another dangling participle?)

Before I get to the actual review of Kyphon, let me point out that this stock is an 'old favorite' of mine, having first

posted Kyphon on Stock Picks Bob's Advice on October 30, 2003 , and

revisited this Stock Pick on May 20, 2005. This is also the second time that I have owned this stock having purchased 300 shares of Kyphon on April 5, 2004, and sold all 300 shares with a loss of $(734.69) after only 8 days, selling the shares on April 13, 2004.

My current holdings of 150 shares of Kyphon were purchased May 20, 2005, with a cost basis of $29.21/share. I have already sold 50 shares of my original 200 that were purchased 7/8/05 at a price of $37.98, with a gain of $8.77 or 30%, my first targeted appreciation point. At that date I was selling 1/4 positions of my stock. Subsequently, I have adjusted this to 1/6th positions at targeted gains to avoid diminishing the size of my original investment.

KYPH closed at $34.69 on June 23, 2006, for an unrealized gain of $5.48 or 18.8% since my purchase. Since I have already sold one portion of my original holding at a gain, my next targeted sale on the downside would be at break-even or $29.21. On the upside, my next partial sale (1/6th of my remaining shares) is planned at a 60% appreciation point, which would work out to 1.60 x $29.21 = $46.74.

Anyhow, that's what I have been doing with Kyphon....let's take a closer look at the stock itself.

1. What does the company do?

1. What does the company do?According to the

Yahoo "Profile" on Kyphon, the company

"...engages in the design, manufacture, and marketing of medical devices to treat and restore spinal anatomy using minimally invasive technology. Its products include KyphX Bone Access Systems, which is used to create a working channel into fractured bone; KyphX Xpander, Elevate, Exact, and Express inflatable bone tamps, which are disposable sterile devices that combine the functionality of a metal bone tamp with the engineering principles of medical balloon technologies."

2. How did they do in the latest quarter?On April 27, 2006, Kyphon

reported 1st quarter 2006 results. Net sales for the quarter ended March 31, 2006, came in at $91.4 million, a 38% increase over the same quarter in the prior year result of $66.2 million. Earnings per diluted share grew 27% to $.19/share up from $.15/share the prior year. The company related in the report how due to new accounting requirements related to stock-based compensation, these results would have been even better without this additional reporting included.

3. How has Kyphon been doing longer-term?

Reviewing the

Morningstar.com "5-Yr Restated" financials, we find that revenue has steadily and rapidly grown from $36.1 million in 2001 to $306.1 million in 2005 and $331.3 million in the trailing twelve months (TTM).

Earnings, which dipped from $.65/share in 2003 to $.50/share in 2004, increased to $.66/share in 2005 and $.70/share in the TTM. It should be noted that the company has been modestly increasing its shares outstanding from 38 million in 2003 to 44 million in the TTM. However, this less than a 16% increase in shares outstanding has been accompanied by an almost 300% increase in revenue.

Free cash flow has grown from $9 million in 2003 to $65 million in the TTM.

Insofar as the balance sheet is concerned, Kyphon looks terrific with $217.2 million in cash reported enough to cover both the combined $64.7 million in current liabilities and the modest $8.9 million in long-term liabilities combined almost three times over! If we calculate the current ratio by adding the $217.2 million in cash with the $85.8 million in other current assets, we have $303 million in total current assets which when divided by the $64.7 million in current liabilities yields a current ratio of 4.68. Generally speaking, a current ratio of 1.5 or higher is considered 'healthy' so a ratio of 4.68 is very strong indeed!

4. How about some valuation numbers on this stock?

Reviewing

Yahoo "Key Statistics" on Kyphon, we find that the stock is a mid-cap stock with a market capitalization of $1.53 billion. The trailing p/e is rich at 49.77, and the forward p/e is a bit better (fye 31-Dec-07) at 27.75. In spite of this rich p/e, the (5 yr expected) PEG is only 1.11, still suggesting that the stock is reasonably priced (imho).

Using the

Fidelity.com eresearch website, we find that Kyphon is in the "Medical Instruments/Supplies" industrial group. Looking at the Price/Sales ratio, we can see that KYPH is second richest in valuation by this parameter with a Price/Sales ratio of 4.8. Topping this group is another of my "picks" Cytyc (CYTC) at a ratio of 5.9. Following KYPH is Stryker (SYK) at 3.7, Becton Dickinson (BDX) at 2.8, Baxter International (BAX) at 2.4 along with Boston Scientific (BSX) at 2.4.

Looking at profitability, specifically the "Return on Equity" (ROE), we find that Kyphon is lowest in this group with a ROE of 13.2%. Topping this group is Baxter (BAX) at 21.8%, Cytyc (CYTC) at 20.7%, Becton Dickinson (BDX) at 20.3%, Stryker (SYK) at 20.2% and Boston Scientific at 14.1%.

Thus by these particular ratios we find the disturbing combination that this particular company is the second 'richest' in valuation by the Price/Sales ratio in this group while being the last in terms of profitability. Clearly, this stock is being valued in terms of future results and not entirely by current performance.

Finishing up with Yahoo, we find that there are 44.22 million shares outstanding and 43.29 million that float. Of these shares, 6.08 million are out short representing 13.80% of the float or 10.8 trading days of volume (the short ratio) as of May 10, 2006. Using my own 3 day short ratio rule, this appears significant, and may lead to a short "squeeze" if the company should continue to report strong financial results. The second quarter which ends in a few day should be reported in a few weeks.

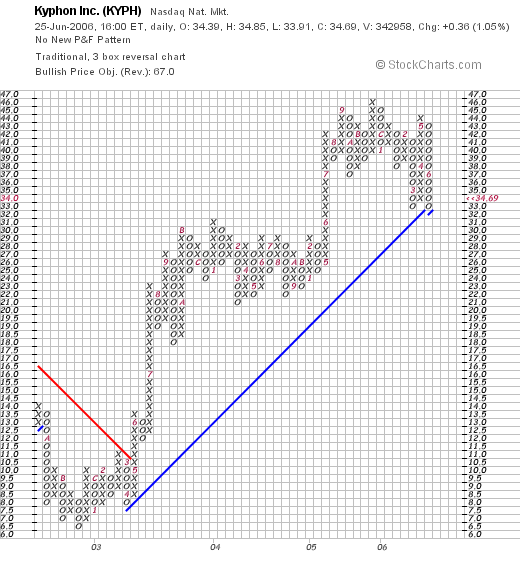

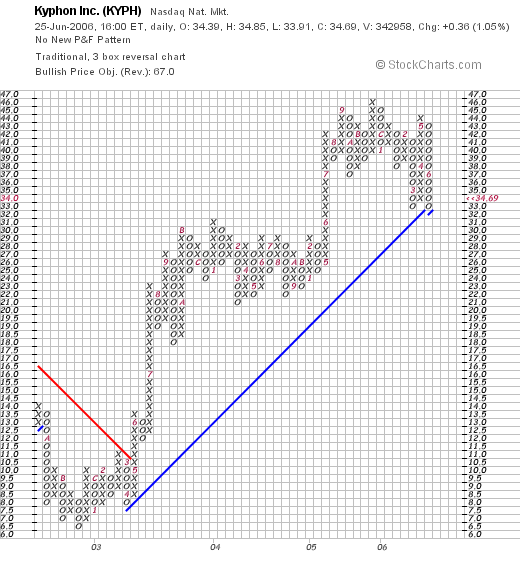

5. What does the chart look like?If we review the

"Point & Figure" chart on Kyphon from StockCharts.com, we can see that the company dipped from $14.00 in late 2002, to a low of $6.50 in November, 2002. Since then the stock has been moving higher to a high of $46 in November, 2005. The stock has been consolidating in this range and is now testing its "support line" at the $33.00 range. It clearly has been under pressure the past month while the market has corrected, however, it does not appear to have totally broken-down at this point.

6. Summary: What do I think about this stock?

First of all I like this stock enough to own it :). But seriously, looking through the information I have examined, we find that this company is a 'young' medical device manufacturer that is demonstrating its ability to grow sales strongly, is increasingly profitable, is generating increasing free cash flow and has a great balance sheet. Valuation-wise, we find that this company may be 'priced for perfection'. The p/e is rich at 49.77, but the PEG is nice at 1.1 suggesting the expected rapid earnings growth. The Price/Sales ratio is also second in its group indicating the rich valuation. And the ROE is at the bottom of its group, pointing out that profitablility, which is likely improving quickly, is still not robust relative to other stocks in its industrial group. On the plus side, there are lots of people betting against the stock with over 10 days of short interest outstanding. However, with a solid earnings report next month, this could turn against the shorts. In addition, the chart still looks strong although on the short-term, it has been under pressure alongside most of the stocks in the market.

Anyhow, that's my review of Kyphon, one of the stocks I still own in my trading portfolio! Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also remember to visit my Stock Picks Bob's Advice Podcast Site where you can listen to me talk about many of the same stocks I write about on this blog!

Enjoy the rest of your weekend!

Bob

Posted by bobsadviceforstocks at 9:59 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 25 June 2006 12:40 PM CDT

Saturday, 24 June 2006

"Looking Back One Year" A review of stock picks from the week of March 21, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog

Stock Picks Bob's Advice. As always, please remember that I am an amateur invesor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I apologize for missing a couple of weekend reviews. Long story. But anyway, I am back on track!

In order to assess the validity of what I write about here on this website, I have been trying to review past picks going a week at a time. I review all of the picks that week and calculate their performance based on a simple "buy and hold" strategy.

In practice, I actually manage my portfolio in a disciplined fashion, selling my poorly performing stocks quickly and completely, and selling my stronger appreciating investments slowly and partially at targeted appreciation points. This difference in strategy will of course affect performance.

On March 23, 2005, I

posted Forest Laboratories (FRX) on Stock Picks Bob's Advice when the stock was trading at $37.90. Forest closed at $37.56 on June 23, 2006, for a loss of $(.34) or (.9)% since posting.

On April 25, 2006, Forest Laboratories

announced 4th quarter 2006 results. For the quarter ended March 31, 2006, revenue for the quarter increased 16% to $756 million from $653 million the prior year same period. Diluted earnings per share grew 87% to $.28/share from $.15/share in the prior year same period.

On March 25, 2005, I

posted Aladdin Knowledge Systems (ALDN) on Stock Picks Bob's Advice when Aladdin was trading at $23.26. ALDN closed at $19.46 on June 23, 2006, for a loss of $(3.80) or (16.3)%.

On April 24, 2006, ALDN

reported 1st quarter results. Revenue for the quarter rose to $22.9 million from $20.3 million the same period last year exceeding analysts' expectations of $22.6 million. Net income climed to $3.8 million or $.25/share, up from $1.2 million or $.10/share in the prior year same period. Analysts had been expecting earnings of $.27/share. Thus, revenue exceeded expectations, but earnings which grew nicely

didn't quite meet expectations.

So how did we do with these two stock picks from that week a little over a year ago? In a word, mediocre :(. These stocks had an average loss of (8.6)%.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com or leave your comments right on the blog and be sure to visit my

Stock Picks Bob's Advice Podcast SiteBob

Thursday, 22 June 2006

A Reader Writes "HELX....Since then the stock has gone down. Any ideas?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today I had a nice letter from Marie B. who wrote:

"I bought Cal Dive, 200 shares at 36.00. It went up to around 45.

Then I decided to buy some more and when I started to, it had a name change to Helx.

I bought 1,000 shares at 39.80.

Then there was an announcement that Cal Dive, a wholly owned subsidiary of Helx was coming out with an IPO.

I said What??

How can an established company with issued stock, making good money, change the name and then come out with an IPO?

The logic of this has been figured every which way, by me, and I can't figure it out. It seems to me all the gravy is going to go to new stockholders, while I originally bought it for the earnings.

Now Cal Dive = Helx is call an energy solution company.

Since then the stock has gone down.

Any ideas?

Marie B."

First of all Marie, thank you so much for writing. I would hate to say that 'your guess is as good as mine' for an answer, but maybe I can shed some insight on your excellent question.

Before I do, I want to emphasize one thing about my investment approach. While I am concerned about things management does, the most important driving factor in my investment decision process is the price of the stock itself. If indeed you had reached a 30% gain (which you were close to if not there), I personally would begin selling shares and not averaging up. Then if the stock had dropped to break-even, I would have sold the whole thing kit-and-kaboodle! But that is my approach, and yours might be even better. I do like the idea of making a small investment and then if the stock appreciates a certain amount, making my "full" investment. However, that's not what I do around here :).

I found most of the information regarding your question (by the way if you read my last post you will see that I have now sold out of my remaining shares of Helix) on the Company Website. On February 27, 2006, Cal Dive (CDIS)

announced the name change from Cal Dive (CDIS) to Helix Energy Solutions Group (HELX). As they reported in the news release:

"The choice of an appropriate new name has perplexed us for many months; however, we believe that the acquisition of Helix RDS last year brought us a perfect answer. A helix is of course a spiral, but, more interestingly, a double helix is the natural shape that defines the structure of DNA, a basic building block of all of us. The two strands of the double helix are anti - parallel, which means that they run in opposite directions.

"The clear analogy for us is that we regard it as entirely natural for our strategy to have the two strands of energy service and production. These strands have also proven to be counter cyclical, as service activity lags changes in the commodity prices which drive production returns.

"Therefore, our new name will be HELIX ENERGY SOLUTIONS and we pledge to continue to focus on both high quality service provision and value adding oil and gas production, as a partner and operator.

"While we take the name of one subsidiary, we will on pass 'Cal Dive' to our Shelf services business unit. We may then sell a minority stake in it via an initial public offering later this year. This press release does not constitute on offer of any securities for sale. The proceeds from such a sale would be used to help finance a planned investment program in service assets that are more core to our strategy, e.g., production facilities or even a second Q4000-type vessel.

"We look forward to the support of all our stakeholders as this 'twist' of fate unfolds. In return we will strive daily to be as successful as 'Cal Dive' has always been."

The very next day the company

announced an outstanding 4th quarter 2005 result with revenue climbing to $264 million from $163 million the prior year. Diluted earnings more than doubled from $.32/share in the fourth quarter of 2004 to $.69/share in the same quarter in 2005. What more could an investor want?

On May 2, 2006, the company now named Helix (HELX)

announced 1st quarter 2006 results. These were also outstanding with revenue growing from $159.6 million to $291.6 million in 2006. Earnings came in at $.67/share, up sharply for the first quarter 2006, from $.32/share in the same quarter in 2005. In addition the company raised the lower end of earnings guidance for the full year 2006 to $2.70 to $3.30/diluted share. What else could an investor want?

As you noted, the company essentially spun off some of its ownership of the now Cal Dive subsidiary through an IPO of stock. This was not an IPO for the entire company but rather for an interest in one of its now sibsidiaries: Cal Dive. As noted in the

report,

"Helix Energy Solutions Announces Filing for Initial Public Offering of a Minority Stake in Its Subsidiary, Cal Dive International, Inc.

HOUSTON, May 31 /PRNewswire-FirstCall/ -- Helix Energy Solutions Group, Inc. (Nasdaq: HELX) announced today that Cal Dive International, Inc. (a wholly-owned subsidiary) filed with the Securities and Exchange Commission a Form S-1 for its planned initial public offering (IPO) of a minority interest in Cal Dive's common stock.

The offering will be made only by means of a prospectus. Once available, preliminary prospectuses may be obtained from Cal Dive International, Inc., 400 North Sam Houston Parkway E, Houston, Texas 77060 or by calling (281) 618-0400."

The news story explained:

" About Cal Dive International, Inc.

Cal Dive International, Inc., a wholly-owned subsidiary of Helix Energy Solutions, is a marine contractor that provides diving, pipelay and pipe burial services to the offshore oil and natural gas industry.

About Helix Energy Solutions

Helix Energy Solutions is an energy services company that provides innovative solutions to the oil and gas industry worldwide for marginal field development, alternative development plans, field life extension and abandonment, with service lines including diving services, shelf and deepwater construction, robotics, well operations, well engineering and subsurface consulting services, platform ownership and oil and gas production."

So indeed this is all very confusing. And I don't think the "street" much liked it either. Anyhow, I don't think much about all of this accounting stuff. If the stock price indicates I should sell shares, I do so whether on good or bad news. However, sometimes, if you see something which seems

peculiar or

confusing, you might just want to back out of an investment. This particular maneuver doesn't sound too bad to me. It appears that the company wants to spin-off the CalDive subsidiary to the public and use the funds to enhance the Helix Energy portion of the company. I suppose they view the development of oil and natural gas assets, if I am understanding this properly, of more potential than the CalDive underwater work. Just my guess.

Let's take a quick look at the chart and see

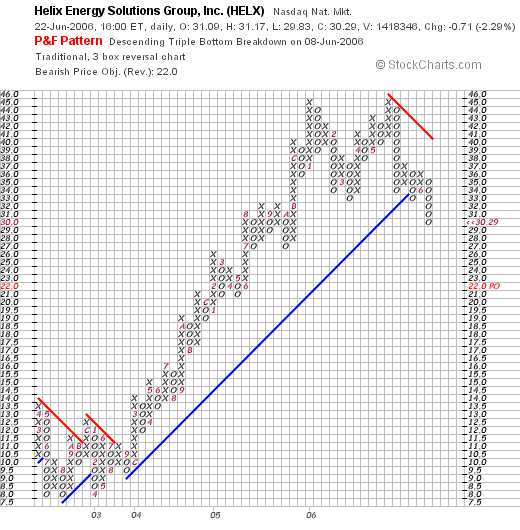

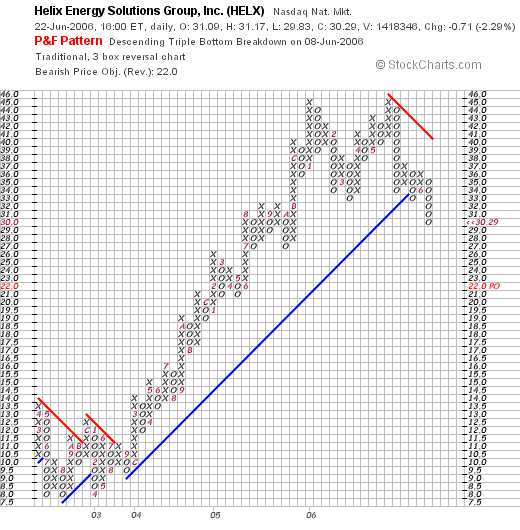

when the company started showing technical weakness in the price. Looking at the

Helix Energy Solutions "Point & Figure" chart from StockCharts.com, we can see that the stock price actually started showing weakness way back in January, 2006, and then in May, 2006, even before the IPO announcement, the company stock price was struggling.

But is this really due to the stock or is it just the lousy market banging up this stock?

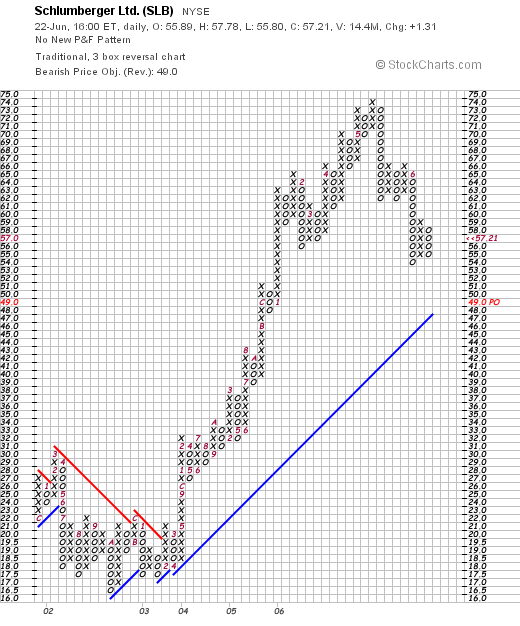

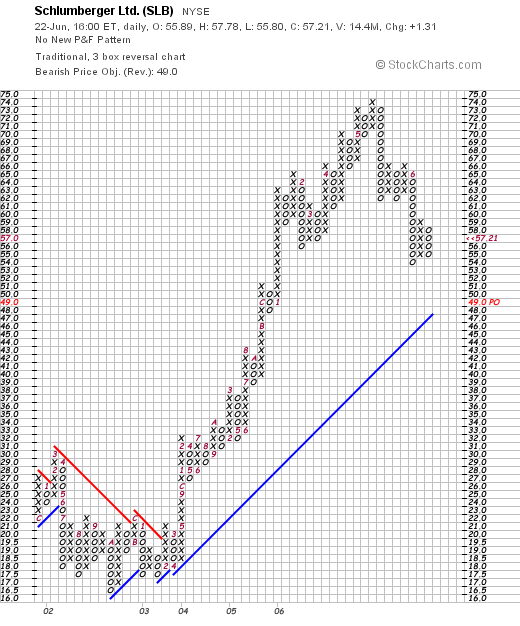

Let's take a look at another oil service stock: Schlumberger (SLB) and I think you will see some similarity in the "Point & Figure" chart from StockCharts.com on SLB:

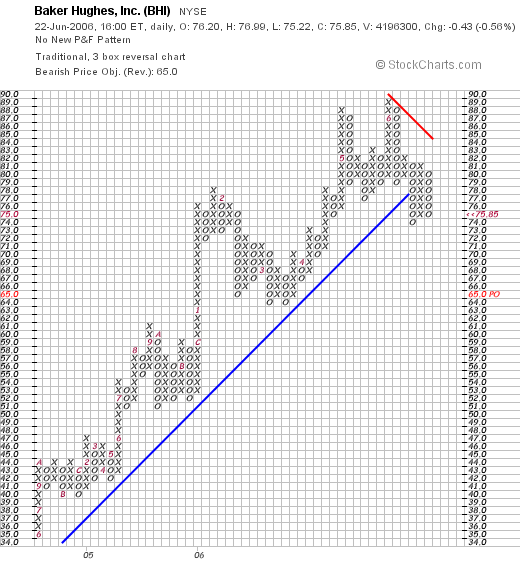

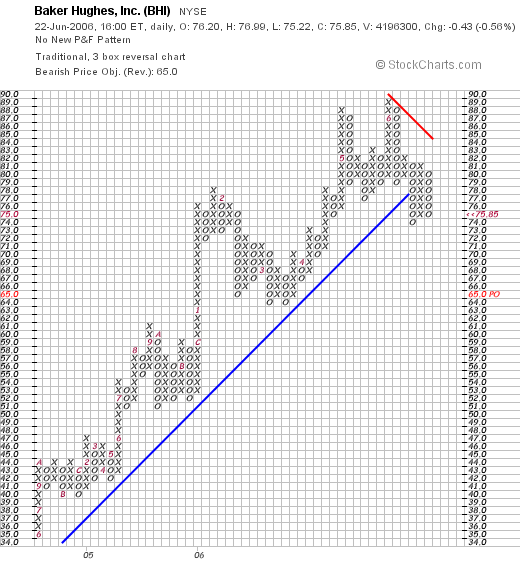

Or to finish up with this point, let's take a look at another oil service firm, Baker Hughes (BHI), which has a "Pont & Figure" chart on BHI:

I think you see my point.

All of the stocks in this industrial group, and indeed in the entire market started breaking down in May. So while we can be annoyed and confused and perplexed about all of the dealings of the Management of this company, there are larger forces afoot called the stock market that were bearing down on this stock like so many others.

Getting back to my original point about responding to the price of stocks and not what the meaning of all of the news really is. I just am not good enough to tell if the accounting strategy and spin-offs are good for the investors or not.

I do know when I am losing or making money however :).

Thanks so much for stopping by, visiting and writing a letter!!! Your input and participation is greatly appreciated.

Please be sure to send your comments and questions to bobsadviceforstocks@lycos.com. Let me know your name (first name and location is adequate) and how you use my blog, etc. Also, be sure to stop by and visit my Stock Picks Bob's Advice Podcast Site.

Bob

Newer | Latest | Older

I hope you all had a chance to read through my previous post on

I hope you all had a chance to read through my previous post on

I want to talk about a stock this afternoon that may deserve our attention, Interactive Intelligence (ININ). I don't have any shares nor do I have any options on this stock. As a change from my prior recent posts, I want to try to make posting a bit simpler for me. Less photos, just the scoop :). Let me know what you think.

I want to talk about a stock this afternoon that may deserve our attention, Interactive Intelligence (ININ). I don't have any shares nor do I have any options on this stock. As a change from my prior recent posts, I want to try to make posting a bit simpler for me. Less photos, just the scoop :). Let me know what you think.

As part of my effort on "transparency" I regularly list my trading portfolio within the posts of the blog, and on weekends, try to review each of my individual holdings to see how they are doing, and what their current fundamentals look like. This post is about Kyphon (KYPH), the next stock in my actual trading portfolio going alphabetically after Jos. A. Bank (JOSB), which I now no longer own, but which I

As part of my effort on "transparency" I regularly list my trading portfolio within the posts of the blog, and on weekends, try to review each of my individual holdings to see how they are doing, and what their current fundamentals look like. This post is about Kyphon (KYPH), the next stock in my actual trading portfolio going alphabetically after Jos. A. Bank (JOSB), which I now no longer own, but which I  1. What does the company do?

1. What does the company do? Reviewing the

Reviewing the

Finishing up with Yahoo, we find that there are 44.22 million shares outstanding and 43.29 million that float. Of these shares, 6.08 million are out short representing 13.80% of the float or 10.8 trading days of volume (the short ratio) as of May 10, 2006. Using my own 3 day short ratio rule, this appears significant, and may lead to a short "squeeze" if the company should continue to report strong financial results. The second quarter which ends in a few day should be reported in a few weeks.

Finishing up with Yahoo, we find that there are 44.22 million shares outstanding and 43.29 million that float. Of these shares, 6.08 million are out short representing 13.80% of the float or 10.8 trading days of volume (the short ratio) as of May 10, 2006. Using my own 3 day short ratio rule, this appears significant, and may lead to a short "squeeze" if the company should continue to report strong financial results. The second quarter which ends in a few day should be reported in a few weeks.

On March 23, 2005, I

On March 23, 2005, I  On April 25, 2006, Forest Laboratories

On April 25, 2006, Forest Laboratories  On March 25, 2005, I

On March 25, 2005, I  Earlier today I had a nice letter from Marie B. who wrote:

Earlier today I had a nice letter from Marie B. who wrote: