Stock Picks Bob's Advice

Saturday, 26 May 2007

Flotek Industries (FTK)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I would like to apologize once again for not making as many stock "picks" recently as I have in the past. My life and time demands keeps getting busier and busier and I suspect that I shall be making fewer posts than previously for the Summer and hopefully in the next few months shall be able to pick up the pace once again. But I intend to continue to post interesting stocks from time to time and continue with the trading "transparency" that shall keep you posted on my actual trading portfolio and the activity therein. I also intend to continue with the "weekend reviews" and the "trading portfolio reviews" so my anticipated 'backing-off' of blogging is likely not to materialize anyhow :).

This morning, I took a look at the stocks moving higher yesterday and came across a new name for me, Flotek (FTK), that I believe deserves a place on the blog. Flotek made the list of top % gainers on the AMEX, closing at $47.08, up $3.23 or 7.37% on the day.

This morning, I took a look at the stocks moving higher yesterday and came across a new name for me, Flotek (FTK), that I believe deserves a place on the blog. Flotek made the list of top % gainers on the AMEX, closing at $47.08, up $3.23 or 7.37% on the day.

I have reviewed so many different stocks that I thought I might have looked at this one previously, so I searched through my blog using Google, :), something that I suggest to all of you as well as my "pico search" function, but didn't find any reference to Flotek among my many past stock picks. I do not own any shares of this stock, nor do I have any options. However,

FLOTEK (FTK) IS RATED A BUY

Let's take a closer look at this company and I shall try to walk you through my thinking and why I like this stock. I recently had a note suggesting my recent Mesa Lab (MLAB) purchase might be like my Bolt (BTJ) success. I suspect this particular stock, also in the oil industry, and also on the AMEX might well act more like Bolt that MLAB, but then again I would be just speculating on the future. You know I don't like to do THAT! :). But as Ed Sullivan like to say, let's get on with the shooooo.

What exactly does this company do?

According to the Yahoo "Profile" on Flotek, the company

"...provides oilfield services and equipment to the energy and mining industries in the United States and internationally. It has three segments: Chemicals and Logistics, Drilling Products, and Artificial Lift."

"...provides oilfield services and equipment to the energy and mining industries in the United States and internationally. It has three segments: Chemicals and Logistics, Drilling Products, and Artificial Lift."

How did they do in the latest quarter?

On May 9, 2007, Flotek announced 1st quarter 2007 results. For the quarter ended March 31, 2007, revenues grew 118% to $35.1 million, up from $16.1 million in the year-ago same period. Net income came in at $3.7 million or $.39/diluted share, up 111% from the $1.8 million, and up 105% from the $.19/diluted share in the same period in 2006.

What about longer-term results?

If we examine the Morningstar.com "5-Yr Restated" financials on Flotek, we can see a very pretty picture of steady revenue growth from $11.3 million in 2002 to $52.9 million in 2005 and $100.6 million in 2006. Extrapolating the current quarter (which we cannot routinely do not knowing the seasonality of results) would get us to at least a $140 million rate for 2007. Earnings, which were losses in 2002 and 2003 at $(1.10 and $1.23 respectively), turned profitable in 2004 at $.31/share, increased to $.94/share in 2005 and $1.22/share in 2006.

No dividends have been paid, and the company has slightly increased its outstanding shares from 5 million in 2002 to 9 million in 2006. This 80% increase in shares is somewhat concerning. However, the company has increased its revenue over 800% during the same period. I can live with this dilution :).

Free cash flow, while small, has been positive recently with $2 million in 2004, $-0- in 2005, and $3 million in 2006.

The balance sheet looks fine with $500,000 in cash and $37.6 million in other current assets. This total of $38.1 million in current assets can easily cover the $20.7 million in current liabilities yielding a current ratio of 1.82.

What about some valuation numbers on this stock?

Looking at Yahoo "Key Statistics" on FTK, we can see that this is a small cap stock with a market capitalization of only $427.53 million. The trailing p/e is a bit rich at 33.04, but the forward p/e is far better at 14.49 (fye 31-Dec-08). We don't have a PEG ratio, but with the rapid growth in the latest quarter (at over 100%) I suspect the PEG has to be at 1.0 or under from my own 'guesstimating' (is that an allowable word here?).

Using the Fidelity.com eresearch website, we can see that the stock is also richly valued in terms of the Price/Sales ratio where FTK comes in at a ratio of 3.49 (TTM), compared to the industry average of 2.02. However, Fidelity also points out that in terms of profitability, as measured by the Return on Equity (ROE), the company has a ROE (TTM) of 25.92%, well ahead of the industry average of 14.43%.

Finishing up with Yahoo, we can see that there are only 9.08 million shares outstanding with 6.73 million that float. Currently, there are 302,580 shares out short (as of 4/10/07), representing 3.9% of the float. However, due to the relatively low level of average trading volume (74,375 shares), this represents a significant (imho) level of short interest with 9 trading days of short sales (the short ratio). This short interest may well pressure the stock higher (as it seems to be currently doing) as the short-sellers, betting against the stock rise, may be "squeezed" into buying shares.

There are no dividends reported on Yahoo, and no stock splits.

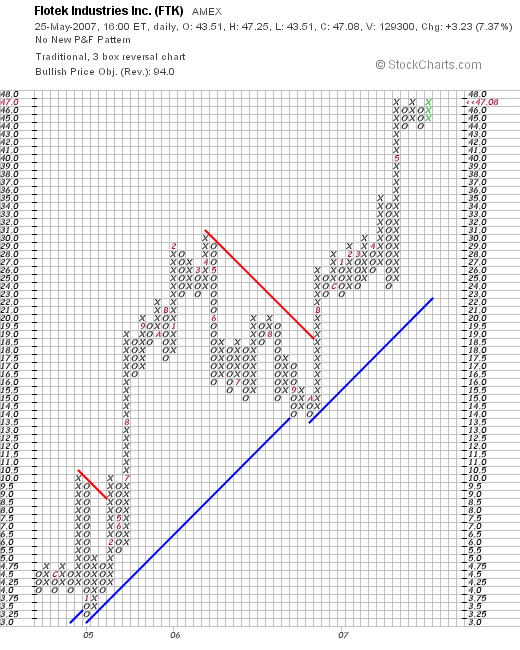

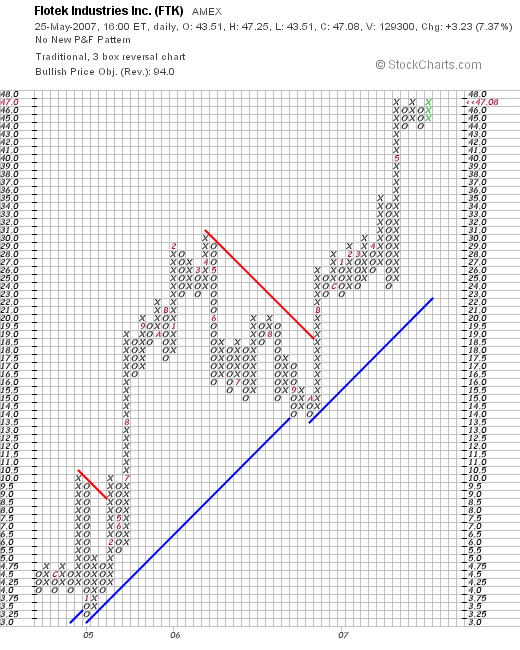

What about the chart?

If we look at a "Point & Figure" chart from StockCharts.com on Flotek, we can see what appears to be a very strong upward move for this stock from the $4.00 level in late 2004 to the current level around $47. The stock has been consolidating at the current level the last few weeks forming a flag formation. As I have pointed out previously, I am not a market technician, but the chart simply looks like the price has been moving strongly higher. I see nothing in the current news about the company that suggests anything should change.

Summary: What do I think about this stock?

Needless to say, I like this stock a lot. They reported a phenomenal quarterly report, the stock moved higher in the face of lots of naysayers and short-sellers who are likely now fueling the higher price move. The fundamentals are almost impeccable and the chart looks nice. The only thing it doesn't do is pay a dividend.

Anyhow, I wanted to get a great stock posted, and let you know I was still blogging :). If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Website.

Have a great Memorial Day Weekend everyone!

Bob

Thursday, 24 May 2007

A Reader Writes "This raises a question...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I had a great letter from Doug S. who wrote:

Earlier today I had a great letter from Doug S. who wrote:

"Bob: looked at this when you wrote it up in January and didn't buy

because of float and more importantly volume(market makers typically have had a 1/2 to 1 point spread). This raises a question. When you run across a situation like this, great fundamentals with these

problem what are your thoughts. EBIX and even LECO(true float of only about 2 mil it's so closely held) are similar situations."

Doug,

Thanks so much for writing! You have written some very good points about selecting an appropriate stock for investment. In general, I have avoided making too many investments in the smallest of capitalization stocks. However, the utilization of trading rules and the fact that each investment is only a small part of a larger portfolio, allows me the liberty of occasionally purchasing stock in a company like Mesa which according to the Yahoo "profile" on Mesa, has a market capitalization of only $75 million, making this a "microcap" stock. Also, according to Yahoo, the company has a float of only 2.52 million shares and an averae trading volume of only 2,320 shares each day. One can easily imagine why there would be such a wide spread on the bid/ask equation and why an owner in this stock might experience increased volatility.

A small float can work in a positive fashion as well, as witnessed by the trading in the stock yesterday on the back of a strong earnings announcement.

Since I am prepared to part company with any of my investment on an 8% losss, this strategy gives me the confidence to buy shares in companies that might otherwise be too small fo be safe for purchase.

EBIX is also another tiny company with solid numbers. I wouldn't hesitate to buy this stock assuming the rest of the analysis was o.k. LECO, another great company, has a float of over 40 million so it doesn't really fit into the picture in the same fashion.

Bottom line is that assuming everything else is intact, I am prepared to buy stocks of small market capitalization firms. I am less anxious to buy low-priced stocks much under $10. I have found the lower priced stocks to have far too much price volatility to allow me to hang on to them very long.

I am not completely sure that I have answered your question. In summary, I am prepared to buy any particular stock that fits my criteria, and am prepared to sell any of the stocks I own if they hit a sale point that I have predetermined at the time of purchase. I try not to have too many tiny market cap stocks and often spend time looking at the NYSE for top % gainers in order to prevent this from happening in my account.

Let me know if I have addressed your own concerns. I can only tell you what I do. There isn't any correct answer for a question like this. Only opinions.

If you have any other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 23 May 2007

Selling My 2nd Lot in Baldor for a New Position in Mesa Laboratories (MLAB) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

If any of you think that I am NOT an amateur investor, then after THIS story, I am sure I shall have you convinced! The other thing about this story is that it is so EMBARASSING. I mean, when you BLOG, you do it all publicly. All of your OOPS and SHUCKS and 'didn't mean to do THAT...' if you know what I mean :). I am entirely human. And I can really err :).

Yesterday, I got all excited about the Cytyc acquisition and decided to sell my remaining shares of Cytyc which being acquired, were sort of unlikely to appreciate much from their elevated point anyhow. So I went looking at the top % gainers list, as I am prone to do. And boy was I excited. I had written up Baldor (BEZ) a couple of times and really liked their numbers and it was on the top % gainers list! Cleverly thinking about my 1/7th sale figures (being rather quick with the '7's tables' in multiplication in school), I decided to buy 140 shares of Baldor. And I wrote it up on the blog and shared it with all of you with a big :). Sort of like that kid that stuck his thumb in the pie and pulled out a plum and said what a good boy am I....or however that nursery rhyme goes :).

O.K. so this morning I check my Fidelity account and see not 140 shares but 280 shares of Baldor. Boy did THEY mess up I figure and emailed them right away. HOW could they mess up like THAT??? To follow up on this, I got a representative on the line and shared with him my apparent observation of a Fidelity screw-up. What did they do? I wanted to know, Enter that purchase twice? Fortunately the cooler-headed representative walked me through my own account and low and behold, I ALREADY HAD PURCHASED BALDOR SHARES TWO WEEKS AGO when sold my portion of UEIC. YIKES.

O.K., to make a short story long, I sold 140 shares of Baldor, and checking the lists of top % gainers, came across another favorite, Mesa Laboratories (MLAB) which I had previously written up on Stock Picks Bob's Advice on January 12, 2007, making a nice move higher today. Mesa reported 4th quarter 2007 results this morning that were very strong. The stock moved very strongly higher and I picked up 210 shares of Mesa at $24.00/share. As I write this up, Mesa is trading at $24.00, up $5.50 or 29.73% on the day. I hope the stock can hold this sharp gain and not shake me out on the profit-taking :). Wish me luck.

MESA LABORATORIES (MLAB) IS RATED A BUY

While I am at it, let me update you on another sale. My Meridian Bioscience (VIVO) hit a 180% appreciation level and a little earlier today I sold 45 shares of my 315 share position (1/7th) at $20.84. Meridian (VIVO) was purchased 4/21/05, and has a cost basis of $7.42/share. Thus, this partial sale represented a gain of $13.03 or 175.6% after expenses (this was at a bit over 180% appreciation before commissions, etc.

Normally with a partial sale at a gain, I would be 'eligible' to add a new position. However, with LOTS of margin, I have capped my portfolio at 20 positions and this small sale will be used to help reduce the significant margin level. When I get a chance, I shall need to update you on my current Trading Account holdings and all of the margin, etc., held in the account.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please be sure and visit my Stock Picks Podcast Website, where I discuss many of the same stocks I write about here on this website.

Bob

Tuesday, 22 May 2007

Cytyc (CYTC), Baldor (BEZ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I discussed yesterday, Hologic (HOLX), one of my holdings, announced it was purchasing Cytyc (CYTC) another of my holdings in my Trading Account. With the sharp rise in Cytyc stock after the announcement, I was able to sell 1/7th of my holding after it hit a 180% appreciation target. I purchased Gildan (GIL) yesterday to fill out my trading account portfolio at 20 positions.

This morning, after reviewing the list of top % gainers on the NYSE, I saw that Baldor (BEZ), a stock that I have reviewed recently was on the list, and I went ahead and sold my 162 remaining shares of Cytyc at $43.49 (these shares were purchased 1/29/04 with a cost basis of $14.86/share) and purchased 140 shares of Baldor (BEZ) at $47.1095. Wish me luck!

I made this swap as it was my own assessment that Cytyc, unless another offer came in, would likely sit at the current price until the acquisition was completed. I was not interested in additional shares of Hologic which would be received and with the market fairly richly valued, it made sense to lock-in the gain on Cytyc that I had experienced. At least that has been my thinking. This sale on an acquisition is an event that I haven't really planned on in this portfolio. However, with an impending acquisition, I shall be reserving the right to unload my shares and replace the entire position at my own timing. We shall see how this works out.

It is useful to have what I call a large 'vocabulary' of investable stocks. When I saw Baldor moving higher today it was pretty simple to recheck some of the basic data including the latest quarter and Morningstar page to confirm that things were still intact. Having reviewed the stock previously, I was comfortable replacing my Cytyc with something completely different!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where you can download podcasts and listen to me discussing many of the same stocks I write about here on the blog!

Regards to all of my friends!

Bob

Monday, 21 May 2007

Gildan Activewear (GIL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice today. If you had read my previous note you would see that I had that "nickel" in my pocket once again with my partial sale of Cytyc (CYTC) on news it was being acquired by Hologic (HOLX), which happens to be another holding of mine.

Looking through the list of top % gainers today, being at under my 20 position maximum I thus had 'permission' to add a new holding to my Trading Account, I saw that an old favorite of mine, Gildan Activewear (GIL) was acting well, trading at $72.12, up $2.01 or 2.87% on the day as I write. I first wrote up Gildan on December 2, 2004, when the stock was trading at $32.65. Unfortunately, I didn't buy any shares at that time.

A few moments ago I purchased 105 shares of Gildan (GIL) at $72.16. I will try to update Gildan on the blog when I get a chance. They recently announced a stock split, and a great earnings report that exceeded expectations by a penny. Anyhow, it is a stock that has a great track record, and who knew that an apparel company like Gildan could be such a strong growth stock?

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Cytyc (CYTC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I don't usually have the strange combination of one of my holdings (Hologic (HOLX)) announcing an acquisition of another of my holdings (Cytyc (CYTC)). As is usually the case, this meant a sharp rise in my CYTC stock and a not quite as steep decline in HOLX. At this point, I shall go ahead and sell my 1/7th position in CYTC as it hit a sale point at a more than 180% gain from my purchase. I shall wait and see if the company is indeed going to be acquired, and if there aren't any better offers out there. If the acquisition becomes set, I shall be selling my CYTC stock and simply replacing it with another position. This would be one time where a sale was on 'good news' and yet I plan on eventually unloading the entire position.

A few moments ago I sold 26 shares of my CYTC position (1/7th of my 188 shares I owned) at $43.16. These shares were purchased 1/29/04 at a cost basis of $14.86, with a gain of $28.30 or 190.4% since purchase. This represents my fifth partial sale with prior sales at 30, 60, 90, and 120% levels.

Since I am under 20 positions (19), I again have a nickel in my pocket and shall be looking for a new position on the top % gainers list. I shall keep you posted. Meanwhile, I shall need to monitor my HOLX which unfortunately, could end up being sold on the 8% loss level if things deteriorate further.

Bob

Sunday, 20 May 2007

Meridian Bioscience (VIVO) "A Podcast"

Click HERE for the Podcast on Meridian Bioscience (VIVO) that I recently posted on my Podomatic Website.

Bob

"Happy Birthday! Guess Who's Four?"

Hello Friends! Thanks so much for stopping by my blog, Stock Picks Bob's Advice! Somehow I missed my own birthday a few days ago.

On May 12, 2003, I made my first entry on this blog, talking abou St. Jude Medical (STJ), I wrote:

"May 12, 2003 St Jude Medical

This is one I picked up today. STJ is the stock symbol. I do not as I write and publish this own any shares. Am thinking about suggesting this to my stock club. Company had a great day today with a nice move on the upside. Last Quarter was good and the past five years have been steady growth. Closed at $55.30 up $2.92. So the daily momentum helped it make the list."

The rest as they say is history :). A few facts about the blog. First of all, I now have 1,485 entries, and all of them are still available by date. I also have problems finding entries on my own website, and cannot always recall whether I have written up a stock or not. In that case, I Google the stock name along with the "Stock Picks Bob's Advice" phrase to identify it.

According to my Sitemeter counter, I have had a total of 126,324 visitors, who have looked at 223,879 pages of my blog. I average 176 visitors/day who view 285 pages/day.

Enough statistics! I would like to use this entry to thank all of you for visiting my website, encouraging this amateur to continue in what he has been doing, and providing me with the occasional question, comment, or word of encouragement that has made all of the difference.

I look forward to more entries here on Stock Picks as I strive to develop and refine my own approach to investing and managing a portfolio and invite you to all come along for the ride. I hope that we all are learning about stocks together.

Be sure and have a piece of cake and some ice cream before you leave.

Bob

Saturday, 19 May 2007

Meridian Bioscience (VIVO) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the additional tasks that I try to address each weekend is to examine my actual holdings in my Trading Account. I have been going alphabetically (by symbol), looking at one of my now nineteen positions every two or three weeks. I do this as part of the transparency of the blogging that I do on this website. So that you may better understand my philosophy, my actual decision-making, and even help decide if what I do actually works, it is useful at least for me to share with you the actual holdings and trades in my account. I hope that all of you also find it useful.

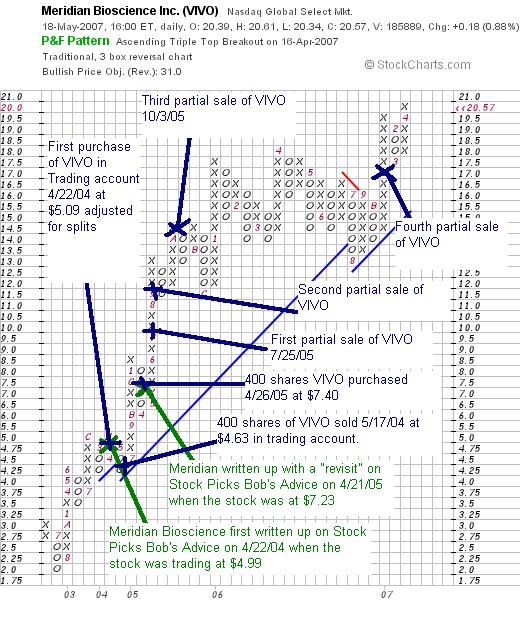

On April 21, 2007, I reviewed Universal Electronics (UEIC) on Stock Picks Bob's Advice. Going alphabetically (by symbol) I am now up to Meridian Bioscience (VIVO).

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold.

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold.

I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

My first write up of Meridian Bioscience was on April 22, 2004, the same day as my first purchase, when the stock was trading at $11.22. Adjusted for a 3:2 stock split in September, 2005, and another 3:2 stock split on May 14, 2007, this represents a pick price of $11.22 x 2/3 x 2/3 = $4.99. With the stock closing at $20.57, this represents an appreciation of $15.58 or 312.2% since the original "pick". However, due to the stock volatility, I was shaken out the next month and had to wait a year before finding the opportunity to add the stock back into the portfolio.

Even back in 2004 I was utilizing essentially the same 'stock-picking strategy' as I currently employ. In fact, when I first wrote up Meridian I had some words that ring true today:

"Meridian did ALL of the things I like a stock to do...announced great earnings, declared an INCREASED dividend, and INCREASED guidance for the rest of the year. And NATURALLY, the stock moved up nicely today after the announcement this morning."

On April 21, 2005, I "revisited" Meridian Bioscience (VIVO) when the stock was trading at $16.265. With the two stock splits first the 3:2 on 9/6/05, and the 3:2 on 5/14/07, this represented an effective pick price of $16.265 x 2/3 x 2/3 = $7.23. Again, with the stock closing at $20.57 on 5/18/07, this represents an appreciation of $13.34 or 184.5% since posting.

Let's take another look at Meridian and see if it still deserves a spot on this blog and why

MERIDIAN (VIVO) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on VIVO, the company

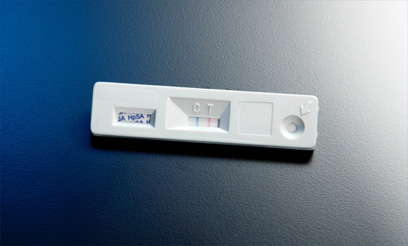

"...an integrated life science company, engages in the development, manufacture, sale, and distribution of diagnostic test kits primarily for respiratory, gastrointestinal, viral, and parasitic infectious diseases. The immunodiagnostic technologies used in its diagnostic test kits include enzyme immunoassay, immunofluorescence, particle agglutination/aggregation, immunodiffusion, complement fixation, and chemical stains."

How did they do in the latest quarter?

On April 19, 2007, Meridian Bioscience announced 2nd quarter 2007 results. Second quarter sales came in at $32.1 million a 14% increase over prior year same period results. Net earnings for the quarter came in at $5.88 million, an increase of 25% over the same period last year. Diluted earnings per share for the quarter were $.22/share, up 22% from last year's results. The company also raised its dividend to $.16/share, representing a 39% increase at $.64/share indicated, over last year's dividends.

The company also announced a 3:2 stock split in the same announcement. Strong earnings, raised dividends, and a stock split are in general a great recipe for continued strong stock price performance!

How about longer-term results?

Let's take another look at that Morningstar.com "5-Yr Restated" financials page! First of all we can see the steady picture of revenue growth from $59.1 million in 2002 to $108.4 million in 2006 and $112.2 million in the trailing twelve months (TTM).

Earnings have been a beautiful picture of consistent growth, with $.15/share reported in 2002, $.21 in 2003, $.27 in 2004, $.35 in 2005, $.45 in 2006 and $.49/share in the TTM.

Dividends have also been steadily been increasing with $.12/share in 2002, increasing to $.28/share in 2006, and $.31/share in the trailing twelve months (TTM). It is nice enough to have a dividend, something that I don't require, but find attractive, yet it is another level of performance to regularly increase that payment as well!

The company has slowly increased its float with 33 million shares in 2002 increasing to 39 million in 2006 and 39 million in the TTM. This represents a slightly less than 20% dilution by increasing shares during the time that revenue nearly doubled, earnings tripled and dividends more than doubled. This is an acceptable dilution from my perspective, representing a growth in shares, something that I prefer not to see, that is far less than the growth in revenue and the growth in earnings, and even the growth in the dividend payment!

Free cash flow has been positive and growing! The company reported $10 million in free cash flow in 2004, $16 million in 2005, $19 million in 2006, and $21 million in the TTM.

Finally, the balance sheet is pristine with $42.3 million in cash, enough to pay off both the $18.6 million in current liabilities and the $5.2 million in long-term liabilities almost 2x over! Combining the $42.3 million in cash and the $40.6 million in other current assets yields a total current assets of $82.9 million, which when divided by the $18.6 million in current liabilities yields a current ratio of 4.46, much higher than the minimum healthy level of 1.25.

This is really an incredible Morningstar.com page on this stock. And I am not just saying this because I own shares in this stock, which I do, but because of the numbers that show an incredible consistency in growth and financial strength!

What about some valuation numbers on this stock?

Reviewing the Yahoo "Key Statistics" on VIVO we can see that this stock is a small cap stock with a market capitalization of only $817.02 million. The trailing p/e is quite rich at 39.33, with a forward p/e of 29.39. The PEG (5 yr expected) is a bit better at 1.36 (acceptable imho is 1.0 to 1.5 on PEG).

Using the Fidelity.com eresearch website, we find that the company has a Price/Sales (TTM) of 6.96, much lower than the average of 28.09 in its industry. As measured by Return on Equity (TTM), the company is also more profitable than its peers with a ratio of 21.71%, compared to the industry average of 16.94% according to Fidelity.

Finishing up with Yahoo, we can see that there are 39.72 million shares outstanding with 32.71 million shares that float. Of these that float, there were 2.34 million shares out short as of 4/10/07, representing 6.2% of the float or 14.1 trading days of volume. This is a large number of shares sold short in anticipation of a decline in the stock price by these naysayers. With continued good news and the stock split, this represents a lot of potential buying pressure as the short-sellers get squeezed.

As noted above, the company has an annual dividend of $.43/share yielding a not-insignificant 2.10%, and last split its stock just days ago, with a 3:2 stock split on May 14, 2007.

What does the chart look like?

Let's take a look at a "Point & Figure" chart on VIVO from StockCharts.com. We can see how strong this chart is and how it almost appears to be reaccelerating from a consolidation period in July through August, 2006.

Summary: What do I think about this stock?

Well, needless to say, I own this stock, so please take that into consideration. However, the company is rather phenomenal for its consistency in delivering revenue growth, earnings growth, dividend growth, minimally increasing the stock float, increasing free cash flow and having a solid balance sheet. On the downside the stock is richly valued and shouldn't experience any mis-step or it is likely to be punished with a stock correction. However, if the company continues to generate good news, the abundance of short-sellers on this stock may well drive the stock higher as well. Finally the chart looks fine.

I like this stock a lot.

But you knew that already didn't you?

Have a great weekend! Thanks again for visiting my blog and be sure and leave a comment if you have any. You can drop me a line at bobsadviceforstocks@lycos.com if you get a chance or listen to my podcast at Stock Picks Bob's Advice Podcast Website if you are so motivated!

Regards to all of you!

Bob

"Looking Back One Year" A review of stock picks from the week of December 26, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There is nothing magical about my process of picking stocks. I do believe that among my picks may be found some of the top performing stocks of the future. That, at least, is my hope. However, in order to identify these stocks it is necessary to recognize mistakes in investing quickly, and thus I suggest that losses are kept to a minimum by selling stocks that perform poorly, and that gaining stocks are maintained and yet their gains are essentially hedged against changing fortunes by small sales at appreciation targets. Again, this is my strategy. Time will tell if it is successful.

As I have written previously, I have been trying each weekend to go back a little more than a year and review the entire week's stock picks to see how they would have turned out if indeed if they were purchased. This evaluation assumes a 'buy and hold' strategy, with equal dollars invested in each of the stocks discussed that particular week. In practice, I advocate and employ a very different strategy of disciplined portfolio management that requires me to sell stocks if they should incur small 8% losses, and also to sell portions of stocks as they appreciate. This different approach would certainly result in a very different performance experience in holding all of these stocks.

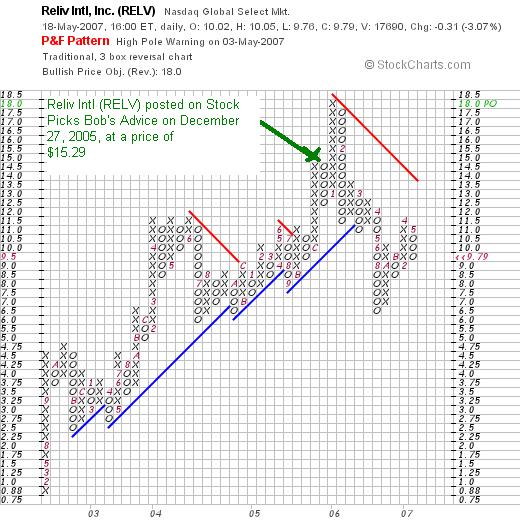

On December 27, 2005, I posted Reliv International (RELV) on Stock Picks Bob's Advice at a price of $15.29. Reliv closed at $9.79 on May 18, 2007, for a loss of $(5.50) or (36.0)% since posting. I do not own any shares nor do I have any options on this stock.

On December 27, 2005, I posted Reliv International (RELV) on Stock Picks Bob's Advice at a price of $15.29. Reliv closed at $9.79 on May 18, 2007, for a loss of $(5.50) or (36.0)% since posting. I do not own any shares nor do I have any options on this stock.

On May 2, 2007, Reliv Intl (RELV) announced 1st quarter 2007 results. Net sales increased 12.1% to $35.0 million from $31.2 million last year. Net income was $2.6 million, up 6.9% over last year's results. Diluted earnings per share increased from $.15/share a year ago to $.16/share this year.

On May 2, 2007, Reliv Intl (RELV) announced 1st quarter 2007 results. Net sales increased 12.1% to $35.0 million from $31.2 million last year. Net income was $2.6 million, up 6.9% over last year's results. Diluted earnings per share increased from $.15/share a year ago to $.16/share this year.

With the satisfactory earnings report, the intact Morningstar.com page, but the weak technical appearance of the price chart,

RELIV INTERNATIONAL (RELV) IS RATED A HOLD

So how did I do during that Christmas week in 2005? Well not exactly glowing. With only one stock picked that week, the average performance was the performance of that only selection which unfortunately recorded a (36.0)% loss. This once again demonstrates the need to manage one's holdings closely regardless of one's belief about the prospects of any particular stock!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, where you can listen to me discuss many of the same stocks I write about here on this website.

Have a great weekend everyone!

Bob

Newer | Latest | Older

This morning, I took a look at the stocks moving higher yesterday and came across a new name for me, Flotek (FTK), that I believe deserves a place on the blog. Flotek made the list of top % gainers on the AMEX, closing at $47.08, up $3.23 or 7.37% on the day.

This morning, I took a look at the stocks moving higher yesterday and came across a new name for me, Flotek (FTK), that I believe deserves a place on the blog. Flotek made the list of top % gainers on the AMEX, closing at $47.08, up $3.23 or 7.37% on the day."...provides oilfield services and equipment to the energy and mining industries in the United States and internationally. It has three segments: Chemicals and Logistics, Drilling Products, and Artificial Lift."

Earlier today I had a great letter from Doug S. who wrote:

Earlier today I had a great letter from Doug S. who wrote:

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold.

Currently, I own 315 shares of Meridian (VIVO) that were acquired on 4/21/05 at a cost basis of $7.42/share. Meridian shares closed at $20.57 on 5/18/07, representing an unrealized gain of $13.15 or 177.2% on these shares. I have already sold portions of Meridian four times as per my portfolio management strategy, selling shares at 30, 60, 90 and 120% appreciation levels. Meridian is actually approaching the next targeted appreciation level which after a 120% target, is at 180% appreciation. Calculating this figure, the next sale would be triggered if the stock should reach a 2.80 x $7.42 = $20.78. If that is reached then I plan on selling 1/7th or 315/7 = 45 shares. If the stock should fail to reach that level, then on the downside, a sale of all remaining shares would be triggered if the stock should decline to 1/2 of the highest previous sale point or 1/2 of a 120% gain= 60%, or 1.60 x $7.42 = $11.87. In that case, all remaining shares would be sold. I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

I have sometimes been questioned whether I would ever 'revisit' a stock after selling it at a loss. My current ownership of Meridian is not my first time as a stockholder. I actually first purchased VIVO 4/22/04, only to sell the stock less than a month later on 5/17/04, after incurring my 8% loss. It took me only to the following year on 4/21/05 to revisit this stock and once again add it as a holding to my portfolio.

On December 27, 2005, I

On December 27, 2005, I  On May 2, 2007, Reliv Intl (RELV) announced

On May 2, 2007, Reliv Intl (RELV) announced