Stock Picks Bob's Advice

Friday, 24 December 2004

"Looking Back One Year" A review of stock picks from the week of November 3, 2003

Hello Friends! I wish all of my friends a very Merry Christmas and wishes for a Happy and Healthy New Year! Since we are at the end of the trading week (and because I skipped last week!), I thought I would take a few moments to review the stock picks from my blog,

Stock Picks Bob's Advice from about a year ago.

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website.

As ALWAYS, please remember that I am an amateur investor so please consult with your professional investment advisor before making any decisions based on information on this website as selections may or may not be appropriate, timely, or even profitable for you! I cannot be responsible for any of your losses nor will I take credit for any of your gains! If you have any questions or comments, please feel free to drop me a line at bobsadviceforstocks@lycos.com .

On November 5, 2003, I

posted Beazer Homes (BZH) on Stock Picks at $106.34/share. BZH closed at $143.55 on 12/23/04 for a gain of $37.21/share or 35.0%.

On November 5, 2004, BZH

reported 4th quarter 2004 results. Revenue for the quarter ended September 30, 2004, came in at $1.21 billion, up 16.5%. Net income was $80.1 million, up 40.1% from the prior year. And on a diluted EPS basis, came in at $5.82, up 39.2% from the $4.18 the prior year. These were great results!

In fact, BZH recently

announced a 3:1 stock split subject to shareholder approval.

On November 5, 2003, I

picked Watson Pharmaceuticals (WPI) for Stock Picks at a price of $41.01. WPI closed at $32.30 on 12/23/04 for a loss of $(8.71) or (21.2)%.

On October 27, 2004, Watson (WPI)

announced 3rd quarter 2004 results. Total net revenue for the 3rd quarter ended September 30, 2004, increased 14% to $408.0 million from $358.8 million last year. Net income for the quarter was $14.6 million compared to net income of $51.5 million last year. Including charges, eps came in at $.13 vs $.47/share last year. (Without these one time charges, eps would still be only $.45/share, still down slightly from last year.) Certainly, imho, we could have seen better results!

On November 6, 2003, I

selected Rofin-Sinar Technologies (RSTI) for Stock Picks at a price of $28.87. RSTI closed at $41.09 on 12/23/04 for a gain of $12.22 or 42.3%.

On November 10, 2004, RSTI

reported 4th quarter 2004 results. For the quarter ended September 30, 2004, Net sales came in at $93.6 million, up 26% from the prior year's $74.1 million. Net income was $14.1 million, vs. $4.9 million the prior year, up 192%. Great numbers!

On November 6, 2003, I

posted Aceto Corporation (ACET) on Stock Picks at $17.42/share. ACET split 3:2 on 1/5/04 for an effective pick price of $11.62. ACET closed at $19.19 on 12/23/04 for a gain of $7.57 or 65.1%.

On November 9, 2004, ACET

announced 1st quarter 2005 results. Net sales increased 12% to $80.8 million. Net income grew 8% to $3.4 million or $.21/diluted share. Last year net income was $3.1 million or $.20/diluted share. On December 3, 2004, ACET

announced a 3:2 stock split and a 30% increase in the dividend. These are the kind of announcements showing confidence in a company that the street likes, and the stock price has responded accordingly!

Finally, on Friday, November 7, 2003, I

posted LeapFrog Enterprises (LF) on Stock Picks at $35.71/share. LeapFrog closed at $13.10 on 12/23/04 for a loss of $(22.61) or (63.3)%.

On October 27, 2004, LeapFrog (LF)

reported 3rd quarter 2004 results. Net sales increased 13% to $231.1 million from $203.9 million the prior year same quarter. Net income, however, came in at $20.2 million or $.33/share, down from $33.4 million, or $.55/diluted share the prior year. However, the company fortunately maintained 2004 guidance.

So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.

Thanks again for stopping by! I hope that all of your Holidays are always Merry! Above all have a healthy and safe 2005! If you have any questions, or just want to wish ME a Holiday Greeting (is that a hint or what?), feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 3:10 PM CST

|

Post Comment |

Permalink

Updated: Friday, 24 December 2004 8:09 PM CST

Thursday, 23 December 2004

December 23, 2004 Napco Security Systems (NSSC)

Hello Friends! Thanks so much for stopping by my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so PLEASE consult with your professional investment advisors to make sure that all investments discussed are appropriate, timely, and likely to be profitable for you. I cannot be responsible for any of your losses nor take credit for any of your gains! If you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Today, while scanning the

list of top % gainers on the NASDAQ, I came across Napco Security Systems (NSSC) which, as I write, is trading at $13.141, up $1.482 or 12.71% on the day. I do NOT own any shares nor have any options or other positions related to this stock. According to the

Yahoo "Profile", NSSC is "...engaged in the development, manufacture, distribution and sale of security alarm products and door security devices for commercial and residential installations."

On November 9, 2004, NAPCO

reported 1st quarter 2005 results. Net sales increased 37% to $13.4 million from $9.8 million last year. The net income for the quarter was $513,000 or $.06/share compared to a net loss of $(282,000) or $(.04)/share last year. These were nice results.

If we look longer term at a

"5-Yr Restated" Financials on Morningstar.com, we can see several nice points: steady revenue growth (recently accelerating) from $54 million in 2000 to $62 million in the trailing twelve months.

Earnings per share have been a bit more erratic, dropping from $.24/share in 2000 down to $.12/share in 2003 but increasing steadily from then.

Free cash flow, however, has been positive and steady, increasing slightly from $6 million in 2002 to $7 million in the trailing twelve months (TTM).

Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

How about valuation? Looking at

"Key Statistics" from Yahoo on NSSC we can see that this is a TINY company, really a microcap stock with a market cap of only $112.38 million. The trailing p/e is 27.40, no forward p/e is available (probably no analysts follow to give us these estimates), and thus no PEG. The price/sales isn't bad at 1.61, and that p/e sounds reasonable with the quick recent growth.

Yahoo reports 8.51 million shares outstanding and of these only 5.80 million float. Currently (11/8/04) there are 938,000 shares out short representing 12.676 trading days or 16.17% of the float. This imho might represent a possible "squeeze" of the shorts in the making....if the stock rises, they will need to scramble to buy shares to cover their short positions.

Yahoo shows no cash dividends. A 20% stock dividend was issued on 11/18/04.

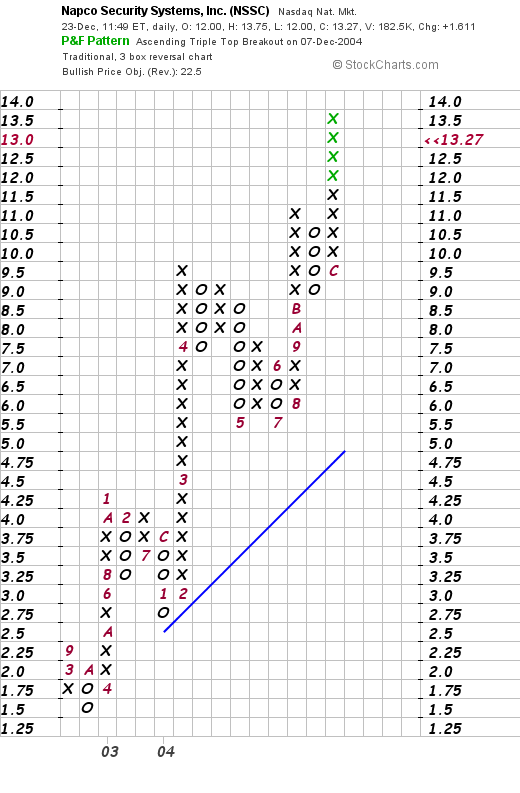

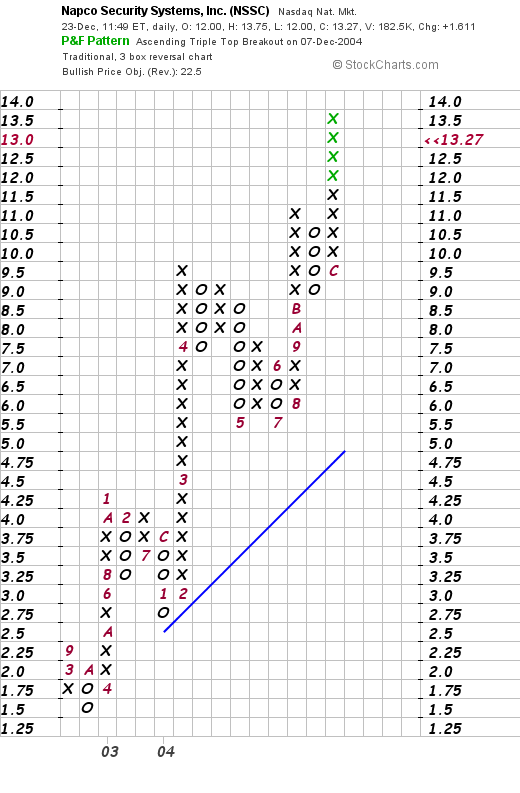

How about technicals? If we look at a Point & Figure chart from

Stockcharts.com:

We can see a very strong chart rising from $1.50 in late 2003 to the current level of around $14.00. the stock looks nice imho.

So what do I think? I really like this stock a lot. Only thing is it is quite small, has a price near $10.00, and might be quite volatile. Now, if I had any cash, or my portfolio gave me a buy signal, I might just be buying a few shares! Thanks again for stopping by! Have a wonderful Holiday Season and a very healthy, happy, and profitable 2005!

Bob

Tuesday, 21 December 2004

"Trading Transparency" AMMD and PARL

Hello Friends! I have been patiently (almost) waiting on my American Medical Systems stock (AMMD) which has been closing on my second sale point. A few moments ago I unloaded 35 shares of my 150 shares of AMMD at a price of $41.15. These shares were purchased on 1/9/04 at a cost of $25.82, so I had a gain of $15.33 or 59.4% (my goal was 60% so i did jump the gun a teency bit...is THAT a word?). My first sale of 50 shares out of the original 200 was executed on 6/24/04 at a price of $32.08, for a gain of $6.26 or 24.2%...so I jumped the gun a bit on that too! And after selling a portion today, well that gave me the "permission slip" to add a new position!

Scanning the lists of top % gainers today I came across Parlux Fragrances (PARL). I first

posted Parlux (PARL) on Stock Picks On October 7, 2004, when it was trading at $14.95. Today I purchased 300 shares of PARL at $22.20. PARL is trading strongly today, currently as I write at $22.181, up $1.551 or 7.52% on the day!

The rest as they say is history! Thanks so much for stopping by. Please remember that I am an amateur so please consult with your investment advisors before acting on any information on this website! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Monday, 20 December 2004

Revisiting DRS Technologies (DRS)

Hello Friends! As I noted earlier, I sold some of my Cantel at the 60% sell point, enabling me to add a position. I picked up 200 shares of DRS Technologies (DRS) and wanted to revisit this stock. I

first posted DRS Tech (DRS) on

Stock Picks Bob's Advice on August 6, 2003, when it was trading at $27.98/share. DRS closed today at $44.35, up $1.28 or 2.97% on the day.

According to the

Yahoo "Profile", DRS "...is a supplier of defense electronic products and systems."

On November 5, 2004, DRS

announced 2nd quarter results. Revenue for the quarter was $328 million, up 59% from $206.2 million a year ago. The latest acquisition of Integrated Defense Technologies helped boost results. Quarterly income rose to $14.4 million or $.52/share, beating estimates of $.45/share, and up from $9.4 million or $.41/share last year.

Looking longer-term, the

Morningstar.com "5-Yr Restated" financials show that revenue has increased from $.4 billion in 2000 to $1.3 billion in the trailing twelve months (TTM).

Earnings during this period have also steadily increased from $.76/share to $2.02/share in the TTM. There has been some dilution in shares with 13 million in 2002, increasing to 27 million in the TTM.

Free cash flow has been positive and increasing from $14 million in 2002 to $99 million in the TTM.

The balance sheet looks fine, although long-term debt is a bit heavy, with $71.9 million in cash and $413.6 million in other current assets balanced against $352.1 million in current liabilities and $588.8 million in long-term liabilities.

How about "valuation"? Looking at

"Key Statistics" on Yahoo, we can see that this is a mid-cap stock with a market cap of $1.21 billion. The trailing p/e is reasonable at 22.23 and the forward p/e is nice at 18.56. The PEG is a bit high (?) at 1.28. And price/sales is a reasonable 0.93.

Yahoo reports 27.21 million shares outstanding with 26.60 million of them that float. Currently there are 1.42 million shares out short (11/8/04) representing 5.36% of the float or 4.814 trading days of volume. No stock dividend or stock split is reported on Yahoo.

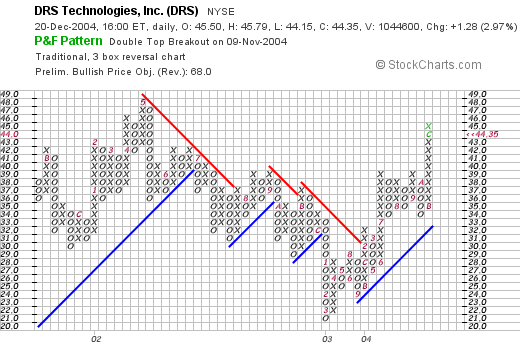

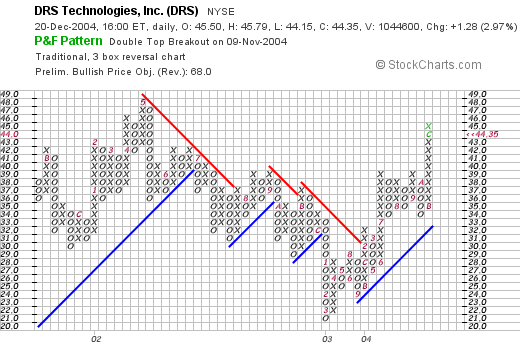

How about "technicals"? Taking a look at a

"Point & Figure" chart from Stockcharts.com, we can see that the stock which increased in price between August and December of 2001, peaked at around $48/share in May, 2002, then declined to a low of $21/share in March, 2003. The stock has been climbing since that time and appears to be on an upward trajectory without being over-extended. In other words the chart looks nice.

So what do I think about DRS? Well, I liked it enough to buy some shares today! Actually, it was a name that I was familiar with and seeing it on the list of top % gainers, well it was a no-brainer, imho, to buy some shares. The latest quarterly report is quite strong, the growth as reported on Morningstar is great. The free cash flow is positive and growing, the balance sheet looks fine, the valuations are reasonable. And if you haven't noticed it, the US is in an armed struggle and defense expenditures appear to be going nowhere but up!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Bob

"Trading Transparency" DRS Technologies (DRS)

Well that nickel didn't stay in my pocket very long! Looking through the lists of top % gainers, I came across DRS Technologies, a defense contractor that I have owned in the past.

I purchased 200 shares of DRS at $44.69 in my trading account. DRS is currently trading at $44.67/share as I write, up 3.71% on the day. I will try to update the DRS story later!

Regards!

Bob

"Trading Transparency" Cantel (CMN)

Hello Friends! This is a quick post to let you know that I hit a sale point on Cantel (CMN) on the upside. A few moments ago, I sold 55 shares, representing approximately 1/4 of my 225 shares of Cantel as it hit a 60% gain. The 55 shares were sold at $33.75. I have a cost basis of $20.04, and thus had a gain of $13.71 or 68.4%. These shares were acquired on 6/4/04, and thus I have owned them just over six months.

I sold my first shares (of my 300 shares originally purchased); 75 shares were sold 7/8/04 at a price of $25.20, for a gain of $5.16 or 25.7% (a little shy of the 30% gain!). Cantel recently announced a 3:2 stock split, but I am not sure what is driving the stock higher today as it is up $2.64 or 8.47% on the day enabling me to sell a portion of my holdings.

My favorite part of this is that I can now look around to purchase a new position! I don't have to sit on my hands at the moment...and I shall let you know if I find anything suitable to buy for my account!

Bob

P.S. Sorry about not getting that "Weekend Review" out...will address that soon hopefully!

Sunday, 19 December 2004

December 19, 2004 C R Bard (BCR)

Hello Friends! Thanks so much for stopping by my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, not a certified investment advisor, so please consult with your professional investment advisors prior to making any decisions based on information on this website. As alway, remember that I cannot be responsible for your losses nor do I want to take credit for any of your gains. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or leave them right here on the blog!

Earlier this week I intended to post C R Bard (BCR) here on Stock Picks, and quite frankly I never got around to it! It had a nice day with a big jump in price on Thursday, when it made the list of top % gainers and got my attention:

Now in retrospect, interestingly, the stock not only made a nice move higher, it has held onto that gain showing how strong that price move really was!

Now in retrospect, interestingly, the stock not only made a nice move higher, it has held onto that gain showing how strong that price move really was!

BCR closed on Friday, December 17, 2004, at $63.90, down $(.09) or (.14)% on the day. According to the Yahoo "Profile", C.R.Bard "...is engaged in the design, manufacture, packaging, distribution and sale of medical surgical, diagnostic and patient care devices." I do not own any shares nor do I have any options or leveraged positions in this stock.

What drove the stock higher Thursday was a report released on Wednesday 12/15/04, after the close, that the company saw 2005 earnings growth of at least 14%. In addition, the company predicted revenue growth of 10 to 11% adjusted for currency exchange rates. The company also suggested that the next quarter's results of $.61, in line with consensus, was reaffirmed except that if it missed the target it "will be because profits exceeded the estimate." This comment is a way of raising guidance, almost always bullish for a stock price!

How about the latest quarter's results? On October 19, 2004, BCR reported 3rd quarter 2004 results. Net sales came in at $421.9 million for the quarter ended September 30, 2004, up 17% over the prior year's net sales of $361.8 million. (Adjusting for currency exchange rates, this still came in for a 15% increase in net sales!). Net income was $102.4 million and diluted earnings came in at $.95, up 99% and 94% respectively over the prior year. Excluding one time items, net income and diluted eps still came in at a gain of 33% and 31% respectively compared to the same quarter in 2003. These were very strong results!

How about the latest quarter's results? On October 19, 2004, BCR reported 3rd quarter 2004 results. Net sales came in at $421.9 million for the quarter ended September 30, 2004, up 17% over the prior year's net sales of $361.8 million. (Adjusting for currency exchange rates, this still came in for a 15% increase in net sales!). Net income was $102.4 million and diluted earnings came in at $.95, up 99% and 94% respectively over the prior year. Excluding one time items, net income and diluted eps still came in at a gain of 33% and 31% respectively compared to the same quarter in 2003. These were very strong results!

How about 'longer-term'? Taking a look at the Morningstar.com "5-Yr Restated" financials, we can see the steady revenue growth from $1.04 billion in 1999 to $1.61 billion in the trailing twelve months (TTM).

Earnings during this period have been steadily, if not perfectly, growing from $1.14/share in 1999 to $2.37/share in the trailing twelve months. Dividends (!) have also been steadily increasing with small increases each and every year since 1999 when the dividend was $.39/share, to the TTM when it was reported on Morningstar at $.47/share.

Free cash flow, while not increasing, has been strong at $230 million in 2001, holding at $205 million in the TTM. The balance sheet is also quite solid with $485.2 million in cash and $485.4 million in other current assets, plenty to cover both the current liabilities of $375.8 million AND pay off all of the long-term liabilities of $258.5 million and still have current assets left over!

What about 'valuation' questions? Looking at "Key Statistics" on Yahoo, we can see that this is a large cap stock (over $3 billion market cap) with a market cap of $6.69 billion. The trailing p/e is moderate at 26.97 with a forward p/e (fye 31-Dec-05) of 22.82. The PEG also suggests a slight premium for this stock at 1.76. It doesn't look like we are the first to discover this company!

What about 'valuation' questions? Looking at "Key Statistics" on Yahoo, we can see that this is a large cap stock (over $3 billion market cap) with a market cap of $6.69 billion. The trailing p/e is moderate at 26.97 with a forward p/e (fye 31-Dec-05) of 22.82. The PEG also suggests a slight premium for this stock at 1.76. It doesn't look like we are the first to discover this company!

Yahoo reports 104.65 million shares outstanding with 101.7 million that float. Currently, as of 11/8/04, there are 1.41 million shares out short, which although sounding like a large number, actually only represents 1.38% of the float or 2.023 trading days to cover. So it isn't a big deal imho.

As I noted earlier, the company currently has a dividend of $.48/share yielding 0.75%. The company also recently (6/1/04) split their stock 2:1.

How about 'technicals'? If we take a look at a Point & Figure Chart on C.R.Bard, we can see the very strong price performance on this company. Trading sideways between March, 1999, and August, 2003, at around the $30.00 range, the stock has exploded to the upside to the $64 range. If anything, the stock may be a bit over-valued and the price ahead of itself...but I usually do not try to outsmart the graph. Thus, the stock chart, at least at this time, looks very strong!

So what do I think? Well the latest earnings report was very strong. They raised guidance, the past five years have been solid with steady free cash flow generated and the balance sheet is excellent. The valuation is a bit steep and the stock chart might be a bit over-extended. Otherwise I love this stock. Unfortunately, I don't have any available cash to buy any shares....and am waiting, in any case, for a buy signal with my own portfolio.

Until then, I shall sit on my hands and not buy anything! Thanks again for stopping by and visiting! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

A reader writes, "What about Rogers Corp.?"

Hello Friends! I always enjoy receiving comments and questions from readers. Yesterday I received a nice note from pdhanks, Thank You for the kind words pd. I also received a question from Chingow, who asked me about Rogers Corp (ROG). Let me try to tackle that question. Even though pd is kind, I am indeed an amateur investor so please consult with your professional investment advisors before acting on anything I write! By the way, I do not own any stock in Rogers (ROG)...but wish to share with you anything I can find that either makes this stock an investment consistent with my goals or perhaps a fine investment that just doesn't fit into my investment goals.

First of all, Rogers (ROG) closed at $45.28 on December 17, 2004, down $(.37) or (.81)% for the day. According to the

Yahoo "Profile" on Rogers, Rogers "...manufactures and sells specialty polymer composite materials and components that it develops for markets and applications around the world." O.K. sounds ok so far!

The first place I like to look when thinking about a stock is the latest quarter results. That way, I can try to get a feeling for how a company is doing right "now". On October 20, 2004, Rogers

announced 3rd quarter 2004 results. They reported that quarterly income rose to $6.5 million or $.38/share, up from $6.3 million, but down from $.39/share last year. So THAT was a mixed report; revenue jumped slightly, but earnings edged lower. However, net sales jumped 53% to $86.7 million from $56.5 million last year. THAT is the kind of result I do like. Apparently $10.4 million in additional revenue was do to an acquisition of "Durel".

HOWEVER, as part of that earnings report, Rogers LOWERED expectations, predicting profit of $.40 to $.45/share on sales of $82-$87 million. Analysts had been expecting $.54/share on revenue of $91.7 million. I always PREFER companies that RAISE expectations above analysts views instead of lowering them. Raising expectations is sort of like raising the thermostat on a cold winter day (boy can I ever relate to THAT here in Wisconsin!), first you raise the thermostat and later the whole house warms up! If you lower that "thermostat" by lowering expectations, I am afraid there is a good chance, at least short-term, to see a decline in the stock price.

How about longer-term? My next step is usually to navigate over to the Morningstar.com site. For Rogers, looking at the

Morningstar.com "5-Yr Restated" financials, I start with the easily understood bar graphs at the top of the page where the revenue results are displayed. I prefer to see continually increasing revenue bars. For Rogers, revenue actually declined from $247.8 million in 1999 down to $216.0 million in 2001. It has been improving recently, and Morningstar shows $363.5 million in the trailing twelve months (or TTM as Morningstar calls it!) With the last several years showing improvement, that isn't bad, but imho, I prefer steady growth all five years.

Earnings also have been a bit erratic dipping to $.98/share in 2001 from $1.19 in 1999, but since then they have been growing very strongly to $2.32 in the TTM. So this doesn't look too bad either.

Free cash flow? Well that is sort of the actual money either being generated or consumed by the operation in question. For ROG, according to Morningstar, Free Cash Flow has been positive, with $21 million in 2001, dropping to $5 million in the TTM. Again, this looks nice, but to look 'fabulous' I like to see positive and increasing free cash flow.

How about their 'balance sheet'? At least on Morningstar.com, this looks fine. They are showing $29 million in cash and $118 million in other current assets. That is plenty to cover both the $55.3 million in current liabilities and $30.6 million in long-term debt.

So what do I check next? My next step is to try to figure out 'valuation' questions, at least on a basic level. For this, I again turn to Yahoo, looking at the

"Key Statistics" on Rogers. Here we can see that ROG is a mid-cap stock (see market capitalization definition

here), with a market cap of $758.8 million. The trailing p/e is nice at 19.49 (anything under 20 with a reasonable growth rate is "nice" to me!), and the forward p/e (based on earnings estimates instead of actual recorded earnings) is 17.02 (fye 28-Dec-05). Also showing reasonable valuation is the PEG which is reported at 1.02. Anything near 1.0 is a good PEG imho.

Yahoo reports 16.76 million shares outstanding with 14.20 million of them that float. Currently there are 544,000 shares out short (as of 11/8/04) representing only 3.83% of the float or 6.044 trading days of volume. I arbitrarily use 3.0 trading days, and anything higher than that is a bullish indicator, imho, suggesting a more significant level of shares out short that eventually need to be 'covered' by being purchased.

ROG does not pay a dividend and the last stock split was in May, 200, when the company split 2:1.

How about 'technicals'? For this I turn to

the Point & Figure Chart on Stockcharts.com. I have started to fairly exclusively rely on these "Point & Figure" style of charts which show buying pressure and upward price movement with columns of 'x's' and columns of 'o's' for descending prices. This graph looks like this:

Here we can see what appears to be a very strong chart from October, 2002, when the stock was trading around $21 to a peak at about $71 in July, 2004. However, the stock really looks like it broke down after that and I am not convinced it has found an area of support where it appears to be moving higher. The chart looks discouraging to me.

So what do I think? Well, the latest quarter result leaves some things to be desired. Revenue DID jump strongly but earnings faltered and the company lowered expectations for the upcoming quarter. The Morningstar.com report looked nice, at least for the last several years, and valuation was reasonable. However, the chart leaves a bit to be desired imho.

This stock might turn out to be a fabulous investment. My thoughts are that it just doesn't fit into my criteria. That does not mean the stock might not rise from here and turn out to be a fabulous purchase. It just is that it doesn't fit into my target parameters. I hope you understand what I am saying! Also, I AM an amateur investor, so please consult with your professional investment advisors before making any decision one way or another. If you have any questions, you can post them on my blog, Stock Picks Bob's Advice, on my Xanga blog, or email me at bobsadviceforstocks@lycos.com .

Thanks so much for visiting, for participating in my blog, and for all of the kind words! Have a wonderful Sunday and a very happy Holiday Season!

Bob

Sunday, 12 December 2004

"Looking Back One Year" A review of stock picks from the week of October 27, 2003

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. It is Sunday evening, and I REALLY should have gotten this together earlier, but I am a BIG procrastinator. THAT will be one of my New Year's Resolutions once again...to be more proactive about getting things done! As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website to make sure such decisions are timely, appropriate, and likely to be profitable for you. If you have any questions about this or any other aspect of this blog, please feel free to email me at bobsadviceforstocks@lycos.com .

On October 28, 2003, I

posted Portfolio Recovery Associates (PRAA) on Stock Picks at a price of $26.93. PRAA closed on 12/10/04 at a price of $36.67, for a gain of $9.74 or 36.2%.

On 10/21/04, PRAA

announced 3rd quarter 2004 results. Total revenue was up 28% to $28.3 million from $22.2 million last year. Net income came in at $7.0 million or $.44/diluted share for the quarter ended September 30, 2004, a 26% increase from the $5.5 million or $.35/diluted share last year.

I

posted Altiris (ATRS) on Stock Picks On October 28, 2003, at a price of $31.93. ATRS closed at $30.07 on 12/10/04 for a loss of $(1.86) or (5.8)%.

On October 25, 2004, ATRS

announced 3rd quarter 2004 results. Total revenue came in at $40.7 million, up strongly from the $25.4 million reported in the third quarter of 2003. Net income was $3.4 million or $.12/diluted share. This compares unfavorably with net income last year of $3.8 million or $.15/diluted share.

I

posted Opnet (OPNT) on Stock Picks on 10/29/03 at a price of $14.10. OPNT closed on 12/10/04 at $8.05, down $(6.05) from the pick price of a loss of (42.9)%.

On October 28, 2004, OPNT

reported 2nd quarter 2005 results. Revenue for the second quarter ended September 30, 2004, was $14.2 million up from $13.4 million last year. Earnings per share, however, came in at $.02/diluted share, down sharply from $.07/diluted share in the same quarter last year. Once again we see stock prices following earnings results, both good & bad.

On October 29, 2003, I

posted SpectraLink (SLNK) on Stock Picks at a price of $18.54. SLNK closed at $14.62 on 12/10/04 for a loss of $(3.92) or (21.1)%.

On October 20, 2004, SpectraLink

announced 3rd quarter 2004 results. Net sales for the quarter ended September 30, 2004, increased to $23.0 million from $18.3 million last year. Diluted earnings came in at $.15/share, up from $.12/share last year. Overall a reasonably good quarter.

Kyphon (KYPH) was posted on Stock Picks

Kyphon (KYPH) was posted on Stock Picks on October 30, 2003, at a price of $29.15. KYPH closed at $23.30 on 12/10/04, for a loss of $(5.85) or (20)%.

On October 26, 2004, KYPH

reported 3rd quarter 2004 results. For the quarter ended September 30, 2004, net sales came in at $55.8 million, a 59% increase over the $35.1 million in the same period in 2003. Net income for the quarter came in at $6.1 million, or $.14/diluted share compared with $.11/diluted share the prior year.

On October 30, 2003, I

posted Netscreen (NSCN) on Stock Picks at a cost of $27.16. Early in 2004, Juniper (JNPR) purchased NSCN for 1.404 shares of Juniper. JNPR closed at $28.14 on 12/10/04, making the Netscreen shares worth $39.51 for a gain of $12.35 or 45.5%.

So, overall, how did we do that week? (Please note that the entire analysis involves a buy and hold strategy which I do not employ in my own trading account!). For the week, I had four losers ranging from (5.8)% to (42.9)%, and two gainers gaining 36.2% and 45.5%. Overall the average, for the six picks, I had an average loss of (1.33)%. Could have been better!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 7:27 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 12 December 2004 11:01 PM CST

Wednesday, 8 December 2004

December 8, 2004 Cogent Systems (COGT)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional, Certified Investment Advisors, to make sure that all of your investment decisions are appropriate, timely, and likely to be profitable for you!

Looking through the

list of top % gainers on the NASDAQ today, I came across Cogent Systems (COGT), which as I write is trading at $35.027, up $2.847 on the day or 8.85%. I do not own any shares of Cogent nor do I have any other leveraged related positions in this issue.

According to the

Yahoo "Profile" on COGT, Cogent "...is a provider of automated fingerprint identification systems (AFIS) and other fingerprint biometrics solutions to governments, law enforcement agencies and other organizations worldwide."

On November 1, 2004, COGT

reported 3rd quarter 2004 results. For the quarter ended September 30, 2004, revenues came in at $23.4 million, up 37% SEQUENTIALLY from the prior quarter which had $17.1 million in revenue. This was up over 1,500% from the $1.3 million in revenue reported in the same quarter in 2003. Net income on a GAAP basis, came in at $19.8 million or $.28/diluted share compared to net income of $7.2 million or $.10/diluted share the PRIOR quarter! The prior year same quarter showed a loss of $(973,000) or $(.02)/diluted share. This is a very new publicly traded company, having come public during this third quarter. It apparently is in the sweet spot of the security world and provides a product that is in high demand in our age of heightened security awareness and identification needs.

How about longer-term? If we look at a

"5-Yr Restated" financials on Morningstar.com, we can see that revenue was stagnant between 1999 at $16 million, dropping to $13 million in 2001, then increasing steadily since then to $55 million in the trailing twelve months (TTM).

Morningstar does not show any earnings, but the latest report as noted above shows rapid earnings growth.

Free cash flow has also turned decidedly positive with $3 million reported in 2001, dropping to $2 million in 2002, then climbing to $19 million in 2003 with $27 million reported in the trailing twelve months.

If we look at the Morningstar.com balance sheet as presented on the same page we can see that the company is plenty solvent with $22.5 million in cash and $24.7 million in other current assets. That is enough to easily cover both the $14.2 million in current liabilities and the $13.4 million in long-term liabilities combined.

How about valuation? This picture isn't quite as pretty. This company has a market cap of $2.82 billion, making it almost a large cap company. The trailing p/e is rich at 63.92, the forward p/e isn't much better per Yahoo at 67.12 (fye 31-Dec-05), and the PEG is at 2.78. In spite of all of this pricey valuation, this company is growing SO FAST, I mean earnings up 1,500% year over year....and revenue up 37% sequentially....that I probably wouldn't be frightened away from this one...but this isn't any kind of "Filene's Bargain Basement" kind of stock!

Yahoo reports 80.79 million shares outstanding with 19.00 million of them that float. Of these 327,000 shares are out short as of 11/8/04, representing 1.72% of the float or only .372 trading days of volume, so that isn't much! No cash dividend nor any stock dividends are reported on Yahoo.

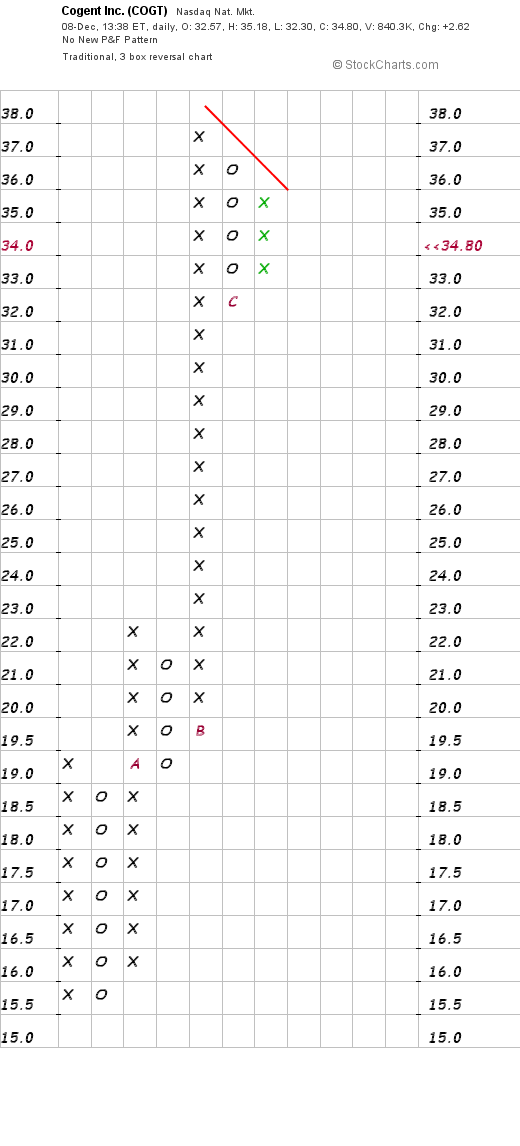

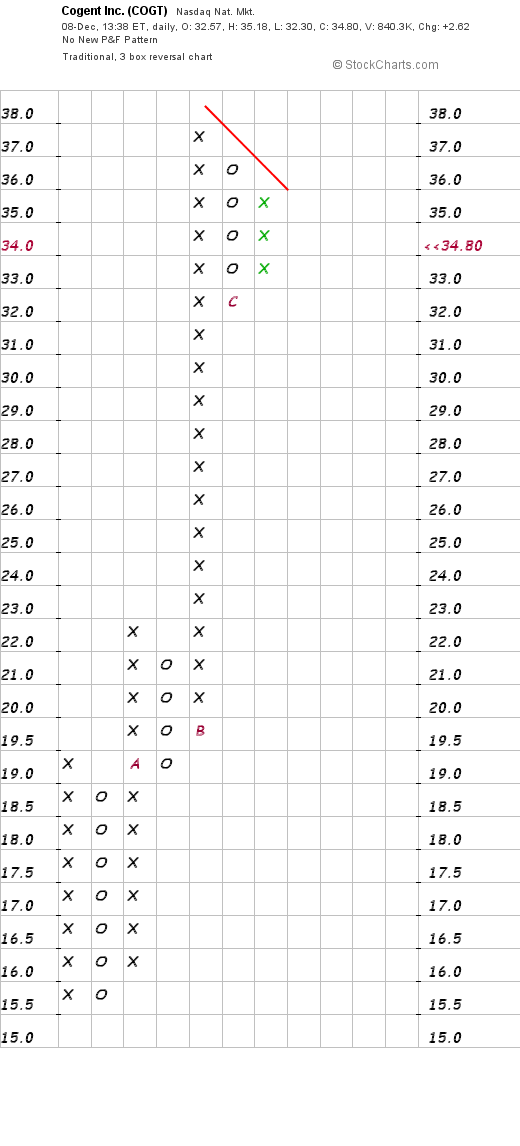

How about "technicals". Looking at a

Point and Figure Chart from Stockcharts.com:

we see a very limited chart in duration, but wow, look at this stock go!

So what do I think? Well this is a very interesting stock. It reminds me a little bit of Ceradyne (CRDN) which I have reviewed on this blog elsewhere. The business, fingerprint identification, is about as timely as any business I have looked out. This company has a product, is profitable, is generating free cash flow, and has a nice balance sheet. On top of this, they have unbelievable earnings and revenue growth the last couple of quarters. In addition, their chart shows amazing strength. I suspect that the security issues propelling this stock ahead will not just disappear and we may see a lot of growth in this business in the future! Of course, we don't know if other technology will prove better or if other companies will offer competing products...but for the moment, well if I had some money to invest, I probably would be buying some shares!

Thanks so much for stopping by. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadvicefostocks@lycos.com .

Bob

Newer | Latest | Older

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website.

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website. On November 5, 2003, I posted Beazer Homes (BZH) on Stock Picks at $106.34/share. BZH closed at $143.55 on 12/23/04 for a gain of $37.21/share or 35.0%.

On November 5, 2003, I posted Beazer Homes (BZH) on Stock Picks at $106.34/share. BZH closed at $143.55 on 12/23/04 for a gain of $37.21/share or 35.0%. On November 5, 2003, I picked Watson Pharmaceuticals (WPI) for Stock Picks at a price of $41.01. WPI closed at $32.30 on 12/23/04 for a loss of $(8.71) or (21.2)%.

On November 5, 2003, I picked Watson Pharmaceuticals (WPI) for Stock Picks at a price of $41.01. WPI closed at $32.30 on 12/23/04 for a loss of $(8.71) or (21.2)%. On November 6, 2003, I selected Rofin-Sinar Technologies (RSTI) for Stock Picks at a price of $28.87. RSTI closed at $41.09 on 12/23/04 for a gain of $12.22 or 42.3%.

On November 6, 2003, I selected Rofin-Sinar Technologies (RSTI) for Stock Picks at a price of $28.87. RSTI closed at $41.09 on 12/23/04 for a gain of $12.22 or 42.3%. On November 6, 2003, I posted Aceto Corporation (ACET) on Stock Picks at $17.42/share. ACET split 3:2 on 1/5/04 for an effective pick price of $11.62. ACET closed at $19.19 on 12/23/04 for a gain of $7.57 or 65.1%.

On November 6, 2003, I posted Aceto Corporation (ACET) on Stock Picks at $17.42/share. ACET split 3:2 on 1/5/04 for an effective pick price of $11.62. ACET closed at $19.19 on 12/23/04 for a gain of $7.57 or 65.1%. Finally, on Friday, November 7, 2003, I posted LeapFrog Enterprises (LF) on Stock Picks at $35.71/share. LeapFrog closed at $13.10 on 12/23/04 for a loss of $(22.61) or (63.3)%.

Finally, on Friday, November 7, 2003, I posted LeapFrog Enterprises (LF) on Stock Picks at $35.71/share. LeapFrog closed at $13.10 on 12/23/04 for a loss of $(22.61) or (63.3)%. So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.

So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.

Today, while scanning the

Today, while scanning the  On November 9, 2004, NAPCO

On November 9, 2004, NAPCO  Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

According to the

According to the  Looking longer-term, the

Looking longer-term, the  How about "valuation"? Looking at

How about "valuation"? Looking at

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Now in retrospect, interestingly, the stock not only made a nice move higher, it has held onto that gain showing how strong that price move really was!

Now in retrospect, interestingly, the stock not only made a nice move higher, it has held onto that gain showing how strong that price move really was! How about the latest quarter's results? On October 19, 2004, BCR

How about the latest quarter's results? On October 19, 2004, BCR  What about 'valuation' questions? Looking at

What about 'valuation' questions? Looking at

First of all, Rogers (ROG) closed at $45.28 on December 17, 2004, down $(.37) or (.81)% for the day. According to the

First of all, Rogers (ROG) closed at $45.28 on December 17, 2004, down $(.37) or (.81)% for the day. According to the  The first place I like to look when thinking about a stock is the latest quarter results. That way, I can try to get a feeling for how a company is doing right "now". On October 20, 2004, Rogers

The first place I like to look when thinking about a stock is the latest quarter results. That way, I can try to get a feeling for how a company is doing right "now". On October 20, 2004, Rogers  How about longer-term? My next step is usually to navigate over to the Morningstar.com site. For Rogers, looking at the

How about longer-term? My next step is usually to navigate over to the Morningstar.com site. For Rogers, looking at the  So what do I check next? My next step is to try to figure out 'valuation' questions, at least on a basic level. For this, I again turn to Yahoo, looking at the

So what do I check next? My next step is to try to figure out 'valuation' questions, at least on a basic level. For this, I again turn to Yahoo, looking at the

On October 28, 2003, I

On October 28, 2003, I  I

I  I

I  On October 29, 2003, I

On October 29, 2003, I

On October 30, 2003, I

On October 30, 2003, I  So, overall, how did we do that week? (Please note that the entire analysis involves a buy and hold strategy which I do not employ in my own trading account!). For the week, I had four losers ranging from (5.8)% to (42.9)%, and two gainers gaining 36.2% and 45.5%. Overall the average, for the six picks, I had an average loss of (1.33)%. Could have been better!

So, overall, how did we do that week? (Please note that the entire analysis involves a buy and hold strategy which I do not employ in my own trading account!). For the week, I had four losers ranging from (5.8)% to (42.9)%, and two gainers gaining 36.2% and 45.5%. Overall the average, for the six picks, I had an average loss of (1.33)%. Could have been better! Looking through the

Looking through the  According to the

According to the  If we look at the Morningstar.com balance sheet as presented on the same page we can see that the company is plenty solvent with $22.5 million in cash and $24.7 million in other current assets. That is enough to easily cover both the $14.2 million in current liabilities and the $13.4 million in long-term liabilities combined.

If we look at the Morningstar.com balance sheet as presented on the same page we can see that the company is plenty solvent with $22.5 million in cash and $24.7 million in other current assets. That is enough to easily cover both the $14.2 million in current liabilities and the $13.4 million in long-term liabilities combined.