Stock Picks Bob's Advice

Saturday, 11 February 2006

A Reader Writes, "How do you narrow down the list for your (almost) daily selection?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any invesment decisions based on information on this website.

I was checking my mailbox this morning, and I saw that I had a nice letter from a regular reader of mine who raises some interesting questions. She wrote:

Hi Bob,

I'm still following your website and am amazed at how many good stocks you've selected over the years.

As I look at the top % gainers each day, I am surprised how many there are and the various reasons they are on the list that day. (stock splits, earnings, takeovers, news, rumors, announcements when earnings will be announced...)

How do you narrow down the list for your (almost) daily selection?

Thanks and as always -- keep the great blog going.

Lisa G

First of all I would like to thank you for your kind words! I often think that I have been blessed or just lucky to have fallen on to so many great stocks! I don't really think it is luck but rather a bit of homework that lands me some of these selections.

As you know, I am a big fan of the top % gainers list. I concentrate most on the NASDAQ but also look at the NYSE and the AMEX as well. Surprisingly with the long list of top % gainers there are often only one or two stocks that meet my own particular criteria. I also eliminate stocks that are much under $10, I am not a big fan of ADR's (foreign stocks trading in the US), and financial stocks.

I certainly do not write up all of the stocks I identify. Just don't have the time or energy :). In addition, I do also use a little seat of the pants approach to the stock. If I have a couple of different ones that I can "pick", then I will often gravitate to the medical stocks with the good numbers or the retail issues that show evidence of being able to expand and grow their business long-term. But I try to write up as many different kinds of stocks as possible.

For instance, I was taking a look at Tractor Supply (TSCO) the other day and didn't get around to writing it up. This company had a great quarterly report, solid Morningstar results, nice same-store sales (up 10% the prior month), and a nice chart. That is about all I need to write up a stock.

There are certain factors that are "must-haves" for me when selecting a stock, and those include the latest quarterly result, the presence of positive free cash flow, and a decent balance sheet. The chart is often the last thing I examine.

Does this answer you question? Probably not. But seriously, I will often go through virtually every single stock (over $10) on the top % gainers lists before finding a stock that meets even my basic criteria.

Is this the only way to buy stock or select stock ideas? Absolutely not. I don't even know if it is the best way, or even if it will be profitable long-term. Just something I have been doing and writing about :).

Much of my thoughts have been drawn from William O'Neill's CANSLIM theories but there are many differences as well. In any case, thanks so much for visiting. If you find a stock that you think belongs on my blog, and I haven't done anything about it, well please let me know!

Bob

"Looking Back One Year" A review of stock picks from the week of November 22, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my weekend tasks on this blog is to take a look at previous posts and see how things are working out. This review assumes a "buy and hold" approach to investing. In practice, I do

not just buy and hold stocks. I sell my holdings quickly if they develop an 8% loss, and I sell my gaining stocks slowly and partially as they hit appreciation targets. In any case, this continuing review may be helpful in determining what works and what doesn't!

On November 22, 2004, I

posted Manitowoc Co. (MTW) on Stock Picks Bob's Advice on November 22, 2004, when it was trading at $38.29/share. Manitowoc Co. closed at $69.11 on 2/10/06, for a gain of $30.82 or 80.5% since posting!

On February 1, 2006, MTW

announced 4th quarter 2005 results. For the fourth quarter ended December 31, 2005, revenue climbed 16% to $589 million. Diluted eps came in at $.47/share (excluding special items), up 34% from the same quarter last year. This was a strong report for MTW!

On November 26, 2004, I

posted RPC (RES) on Stock Picks Bob's Advice when it was trading at $27.07. RES closed at $28.21, so at first glance it appears that the stock hasn't moved much since posting. However, a closer examination reveals that the stock had a 3:2 split 3/11/05, and then another 3/2 split on 12/13/05, giving my pick price an adjusted price of $27.07 x 2/3 x 2/3 = $12.03 (!). Thus, the pick had a gain of $16.18 or 134.5% since posting. Unfortunately, I didn't buy any shares of either of these two companies :(.

On October 26, 2005, RES

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenues increased 30.5% to $115.8 million, compared with $88.7 milion in the same quarter the prior year. Net income for the quarter was $23.1 million or $.53/diluted share compared with $10.2 million or $.24/diluted share the prior year. This was a terrific quarter and the stock continued to climb higher!

So how did we do? Do you have to ask? I was pretty lucky that week in November, 2004, with two stock picks; MTW gaining 80.5% and RES gaining 134.5%, for an average performance of 107.5% for these two stocks on the blog since their selection.

Please remember that past performance is NO guarantee of future price performance. And that I truly am an amateur investor. Anyhow, that's the review for the week. Next week I shall try to get to the week of November 29, 2004.

Thanks again for visiting. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your comments right on the blog!

Bob

Angiodynamics (ANGO) Weekend Trading Portfolio Analysis

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I enjoy posting lots of stock market ideas on this blog. From these ideas I have built my own trading portfolio. About six months ago I started reviewing my positions which now number twenty-one. Two weeks ago I finished the list with

Ventana Medical Systems (VMSI). Having gotten to the end of the list, this week I am starting back at the top of the alphabet with AngioDynamics (ANGO).

I first

reviewed AngioDynamics on Stock Picks Bob's Advice just last month on January 6, 2006 shortly after purchasing 240 shares at $26.22. ANGO closed 2/10/06 at $25.60, for a loss of $(.62) or (2.4)% since purchase. If the stock drops to an 8% loss or down to $24.12 or lower, I shall be selling my shares. On the other hand, if the stock appreciates 30% to my first 'sale target', or to $34.09, then I shall be selling a portion of my holdings at a gain.

Let's take another look at AngioDynamics and see if all of the reasons why I made the purchase are still intact.

First of all, the

Yahoo "Profile" explains the business. The company

"...engages in the design, development, manufacture, and marketing of medical devices for the minimally invasive diagnosis and treatment of peripheral vascular disease. Its products include angiographic catheters, hemodialysis catheters, plasma thromboplastin antecedent dilation catheters, thrombolytic products, image-guided vascular access products, endovascular laser venous system products, and drainage products."

One of my key criteria for selecting stocks on this blog remains the latest quarterly report. I like to see growing earnings and revenue, and if the company can exceed expectations and/or raise guidance, that is all the better! On Decmber 19, 2005, ANGO

reported 2nd quarter 2006 results. Net sales grew 30% to $18.7 million. Net income climbed 60% to $1.7 million or $.13/share. These were solid results that I reviewed previously on the original blog post.

Before "picking" a stock or even before purchasing a stock for my own portfolio, I like to see some consistency of financial results over the past several years. Looking at the

Morningstar.com "5-Yr Restated" financials on ANGO, we can see the steady revenue growth from $23.4 million in 2001 to $60.3 million in 2005 and $63.6 million in the trailing twelve months (TTM).

Earnings are first reported in 2005 as $.37/share increasing to $.41/share in the TTM.

Free cash flow has been steadily improving from $(3) million in 2003 to $3 million in 2005 and $4 million in the TTM.

The balance sheet is gorgeous with $28.8 million in cash, enough to cover both the $6.4 million in current liabilities and the $2.9 million in long-term liabilities almost 3x over! In addition, the company has $22.2 million in other current assets.

And what about some "valuation" numbers? Looking at the

Yahoo "Key Statistics" on ANGO, we can see that this is a Small-Cap stock with a market capitalization of $316.24 million. The trailing p/e is rich at 57.27, the forward p/e (fye 28-May-07) is estimated at 35.56, and the anticipated earnings growth is coming anticipated to be fast enough that the PEG is only 1.23. Generally under 1.5 on the PEG may be considered a good value.

According to the

Fidelity.com eResearch website, AngioDynamics is moderately priced relative to its Price/Sales ratio in the group "Medical Instuments/Supplies". Topping this group is Alcon (ACL) with a Price/Sales ratio of 8.3, Guidant (GDT) at 6.8, then AngioDynamics (ANGO) at 4.9, Stryker (SYK) at 4.1, Boston Scientific (BSX) at 2.8 and Baxter (BAX) at the bottom of the list at 2.4.

Going back to Yahoo for some more numbers, AngioDynamics has 12.35 million shares outstanding with 10.11 million that float. Of these 207,380 shares are out short representing just 1 day of trading. No cash dividend and no stock dividend are reported.

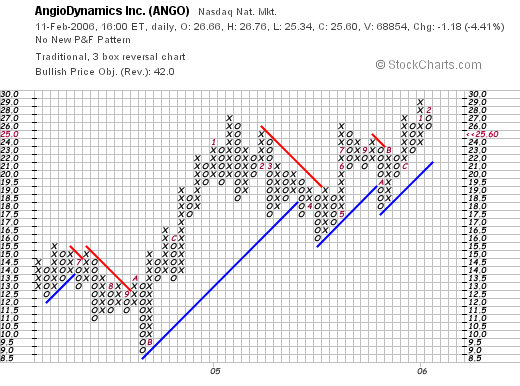

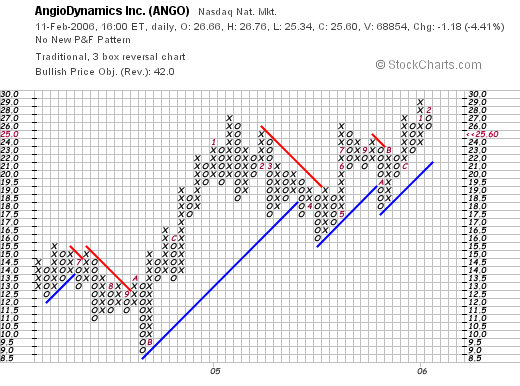

What about the chart? Looking at the

"Point & Figure" chart on ANGO:

We can see that although I am personally down a little over 2% on my purchase, the chart on this stock appears intact with just a small retracement from its relatively steady upward move.

So what do I think? Well things still look strong to me. The latest quarterly report was solid, the Morningstar.com report looks very good, and valuation, although a bit rich, isn't bad with a PEG under 1.5. In addition the chart is solid. But rules are rules and if hits the 8% loss, out it goes!

Thanks again for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 9 February 2006

February 9, 2006 Akamai Technologies (AKAM)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the

list of top % gainers on the NASDAQ this evening and came across Akamai Technologies Inc. (AKAM) which closed at $26.01, up $4.01 or 18.23% on the day. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on Akamai, the company

"...provides services for the delivery of content and business processes over the Internet for businesses, government agencies, and other enterprises. It offers services and solutions for content and application delivery, application performance services, on demand managed services, and business performance management services based on its technological platform, EdgePlatform."

Once again we can see that it was the latest

earnings report that drove the stock higher today. After the close of the market yesterday, the company announced 4th quarter 2005 results. Revenue for the quarter ended December 31, 2005, came in at $82.7 million, a 9% sequential increase in revenue, and a 44% increase over the fourth quarter 2004 revenue of $57.6 million. Net Income (GAAP) was $25.8 million or $.16/share. This was a large increase from the prior year's figure of $13.4 million or $.10/diluted share. In addition, as reported this morning, the company is optimistic about 2006. It was

reported that"The company's revenue in 2005 totaled $283 million, up 35 percent from 2004. Akamai expects at least $360 million in revenue this year."

Things appear to be looking up for Akamai!

How about longer-term? Reviewing the

Morningstar.com "5-Yr Restated" financials on Akamai, we can see that revenue, except for a dip between 2001 and 2002, has otherwise been steadily increasing from $89.8 million in 2000 to $210 million in 2004 and $258 million in the trailing twelve months (TTM).

Earnings have only recently turned positive with losses of $(10.07)/share in 2000, dropping to a low of $(23.59)/share in 2001, then gradually decreasing, until turning positive in 2004 at $.25/share, and $2.09/share in the TTM.

Free cash flow which also was negative at $(73) million in 2002, improved to $(19) million in 2003, then turned positive at $39 million in 2004 and $45 million in the TTM.

AKAM, according to Morningstar.com, has $67 million in cash and $53.1 million in other current assets. Balanced agains the $57.9 million in current liabilities this gives us a "current ratio" of greater than 2:1. In addition, there are enough current assets, to start paying down the $211.5 million in long-term liabilities.

Reviewing

Yahoo "Key Statistics" on Akamai, we find that this is actually a large-cap stock with a market capitalization of $3.95 billion. The trailing p/e is cheap at 13.04, but the forward p/e is 37.70. The company is anticipated to be growing its earnings fast enough that the PEG is a moderate 1.64.

According to the

Fidelity.com eResearch website, AKAM is also the 'priciest' of the stocks in the "Internet Software & Services" Indsustrial Group. The company has a Price/Sales ratio of 13.7, only exceeded by Salesforce.com with a ratio of 16.7. These two are followed by eBay at 12.7, Symantec at 6.3 and Internet Security Systems at 3.2.

Going back to Yahoo, we can see that there are 151.98 million shares outstanding at 136.47 milllion of them float. Of these shares, 8.09 million are out short as of 1/10/06, representing 3.8 normal trading days of volume. This number is even less if we take the average of 3.9 million share daily the past 10 days. Thus the large spike in volume with the stock price surge may well be an indication of short-sellers scrambling to cover their shares. No cash dividend and no stock dividend are reported on Yahoo.

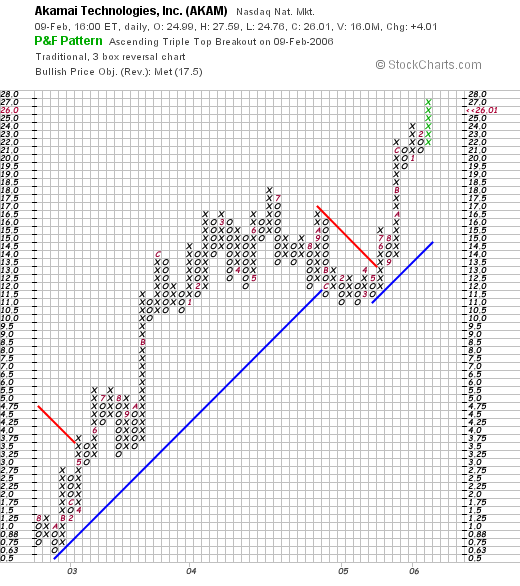

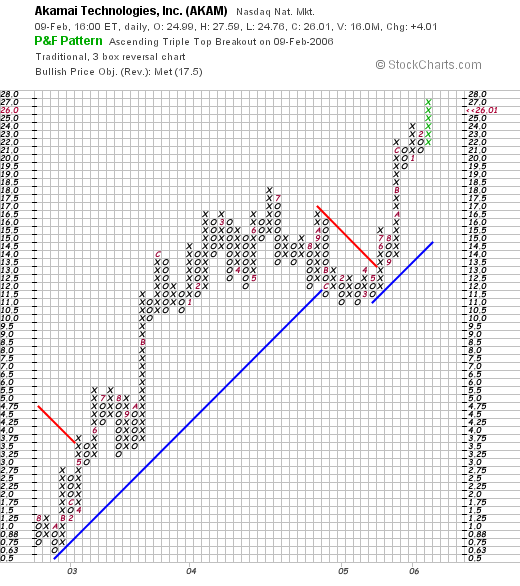

What about a chart? Looking at a

"Point & Figure" chart on Stockcharts.com:

We can see that the stock has traded sharply higher from August, 2002, when the stock was traidng at $.65/share, to the current level of $26.01. The company did break down below support in May, 2005, but quickly bounced back, breaking through resistance in May, 2005, and moving solidly higher.

So what do I think? Let's summarize. Today the stock moved strongly higher (and is moving a few cents higher in after-hours trading as well.) The company reported a solid earnings report and raised guidance for 2006. Morningstar looks nice, although the company did only recently turn positive, losses are one thing I would like to avoid. Earnings, revenue, and free cash flow are showing nice improvements the past few years. However, valuation is a bit rich with a big Price/Sales ratio. The P/E isn't cheap but the PEG is better at 1.64.

Anyhow, these are the things I like to look at before "picking" a stock. The company fits in well on this blog and if I were in the market to be buying a positions, this is the kind of stock I might be able to buy.

Please feel free to drop me a line at bobsadviceforstocks@lycos.com if you have any questions or comments. Also, please feel free to comment right on the blog if that is your preference.

Bob

A Reader Writes "I woke up yesterday and saw everything in the red..."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today, I had a comment from a frustrated reader who left a comment on my Xanga "shadow" blog where I also post comments. She was trying hard to learn how to invest and was coming up empty. She wrote:

I sat here for a good while, trying to think of how to say this. I lost my confidence today. That's what it is. When I woke up and saw how everything was back up, including the two stocks I should have held onto, I realized I had no business betting like this. Because that's all it is. An hour after I sold Bristol Meyers they came out with this new drug that Cramer was raving about. Only he was promoting a small biotech, as I recall. At his Harvard thing he told some kid to get rid of Bristol Meyers. The next day I looked at the five-year chart and it was right where it had been five years ago. The reason I sold Nokia was because I went through hell with that stock. My broker bought it for both my accounts. Because I didn't establish a new starting price, I didn't notice when it had gone down 8%. It's back up today and the news was that it had some great new contract in the UK.

I'm working as hard and as fast as I can to learn this stuff but these were all about bad timing. Mine. I went to look at my portfolio, to see what I had started out with. I'm embarrassed to say I have managed to lose 10,000 in five years, just in my IRA. And what really pisses me off is that my broker is mainly responsible for that. I could forgive myself but he should know better.

When I thought about how frugally I am trying to live now and how I just picked up the phone today and bought 6,000 worth of Packeteer, I think I must be crazy. I really thought I had a feel for what was going on in the market. When I woke up yesterday and saw everything in the red, I thought this was it. All those people pulling their money out fooled me. I thought I knew what was going on but I don't. And it's paralyzing.

Let me first say that I am glad that you wrote all of this today. I am unhappy that you are experiencing much of the angst of investing. The pain and depression when stocks decline and the euphoria when they climb higher. I also experience many of those things as well as the self-doubt that comes with wrong decisons.

Investing is not about confidence. Investing is about the ability to analyze and divorce oneself from one's emotions and make decisions.

It is almost impossible not to look back at stocks that you have sold and then kick yourself when they climb higher without you. It is better not to look back too often :).

It is difficult to learn new methods of investing. To change from a portfolio of good old fashioned blue chips to little companies one has never heard of.

But it doesn't have to be about gambling.

Gambling is about putting money down and having random events occur, hoping that one random event will lead to a big payout or "jackpot". Investing is about buying a piece of a company. But it is only gambling when one is arbitrarily picking stocks without any foundation to expect performance.

And when a stock climbs, I do not particularly require it to go up forever. I sell portions of stock rather quickly to hedge that investment, to reduce my risk exposure. And when a stock declines below my purchase price, I sell it quickly to avoid a small loss becoming a large loss. And within my own portfolio, I listen to the market, and as stocks are sold on bad news, I move funds into cash. And when stocks appreciate on good news, I move cash into equities. This isn't gambling. This is thinking, observing and acting.

As for your purchase of Packeteer. I also own the stock. I suspect you purchased shares to follow my investment decision. That's ok with me. But you need to think about your plans for each of your investments before you even make the purchase. You need to be prepared for terrible bear markets which will ravage your investment values, and for the more common bull markets where values will skyrocket. I have learned long ago that there is nothing shameful about taking small profits, or admitting small mistakes with sales. I am not interested in gambling. You know I don't go for the homeruns. I go for the base hits. Sometimes I am surprised how well some of my selections have done. But I am far from perfect myself.

Paralyzing? That's the worse thing in the world when dealing with investments. It is far better to realize that with a trading strategy, one is never paralyzed. The actions of the market dictate ones trades.

Please find a broker you are comfortable with. If you don't like your current broker, shop around. Do not gamble with your investments. If my ideas are too radical, well slow down and just buy one or two of what I do, and get used to it.

My strategy is unproven. It might even be unprofitable over the long-term. You know I don't think so but I don't really know! I am not a financial advisor, so take everything I write with a grain of salt. Meanwhile, hang in there. Don't panic. Don't be paralyzed. But think about your breathing. Think about the universe. Slow down and develop a plan for each of your investments. And when the time comes to act on them, do not hesitate. With every decision you make, comes added confidence in your ability to decide!

Bob

Wednesday, 8 February 2006

February 8, 2006 Stamps.com Inc. (STMP)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Sometimes even a "dot.com" stock makes it to the list here on Stock Picks! I was looking through the

list of top % gainers on the NASDAQ today and came across Stamps.Com Inc. (STMP) which had a nice day today, closing at $30.99, up $5.82 or 23.12% on the day. I do not own any shares nor do I have any options on this company.

According to the

Yahoo "Profile" on STMP, the company

"...provides Internet-based postage solutions. It operates in three segments: Internet Postage Service, PhotoStamps, and Online Store. The Internet Postage Service segment offers service, which enables users to print information-based indicia, or electronic stamps, directly onto envelopes or labels using ordinary laser or inkjet printers. The PhotoStamps segment allows consumers to turn digital photos, designs, or images into valid US postage. The Online Store segment sells NetStamps consumables, including labels, shipping labels, Internet postage labels, dedicated postage printers, label inkjet and laser toner cartridges, scales, and other mailing and shipping-focused office supplies.

What drove the stock higher today was the

announcement of 4th quarter 2005 results. For the fourth quarter ended December 31, 2005, revenue was $20.6 million, a 76% increase over the prior year same quarter result. GAAP net income was $4.1 million or $.17/diluted share, up 176% vs. last year's result of $1.46 million or $.06/diluted share. This result beat expectations and Stamps.com

raised guidance, as reported:

"Looking ahead, Stamps.com sees 2006 earnings of 53 cents to 63 cents a share, or 65 cents to 75 cents a share excluding stock-based compensation costs. Analysts project earnings of 63 cents a share."

And how about longer-term results? Looking at the

Morningstar.com "5-Yr Restated" financials on STMP, we find that revenue grew slowly between 2000 and 2002 when it increased from $15.2 million to $16.3 million. Since 2002, revenue growth has accelerated to $38.1 million in 2004 and $53 million in the trailing twelve months (TTM).

The company has been gradually reducing its losses, decreasing from $(9.08)/share in 2000 the $(.21)/share in 2004. The company turned profitable in the TTM reporting $.34/share in earnings.

Free cash flow, while dropping from $1 million in 2002 to a negative $(6) million in 2003, turned positive at $1 million in 2004 and increased to $9 million in the TTM.

The balance sheet as reported by Morningstar.com is solid with $38.6 million in cash and $4 million in other current assets giving STMP a current ratio of 6 considering the $6.8 million in current liabilities. Morningstar does not report any long-term liabilities for this company.

And how about some valuation numbers for this company? Looking at

Yahoo "Key Statistics" on STMP, we can see that Stamps.com is a mid-cap stock with a market capitalization of $721.94 million. The trailing p/e is a very rich 93.06, but with the rapid growth, and the forward p/e of 52.53 (fye 31-Dec-06), the PEG works out to a more reasonable 1.58.

According to the

Fidelity.com eResearch website on STMP, the company is in the "Catalog/Mail Order Houses" industrial group. Within this group, at least according to the Price/Sales figure, the company is also richly valued, leading the entire group with a price/sales figure of 11.3. The next stock in the group is much lower, Coldwater Creek (CWTR) at 2.7, followed by J Jill (JILL) at 1.1, ValueVision (VVTV) at 0.7, Insight Enterprises (NSIT) at 0.3, and PC Connection (PCCC) at 0.1.

Going back to Yahoo "Key Statistics" for some additional numbers on this company, we find that there are only 23.30 million shares outstanding with 12.46 million of them that 'float'. The short interest, as of 1/10/06, stood at 2.28 million shares or 7.7 trading days of volume. This looks significant to me and may well be the cause of the sharp price rise today on good earnings news.

The company does not pay a cash dividend and the last stock split was a reverse 1:2 paid on 5/12/04.

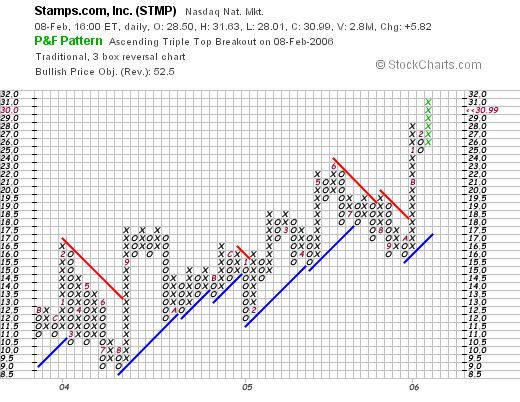

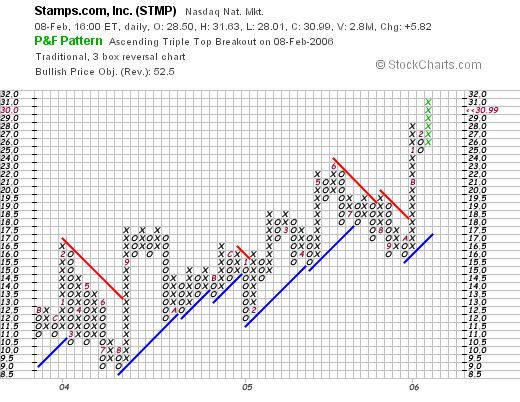

And what does the graph look like? Looking at a

"Point & Figure" chart on STMP from StockCharts.com:

We can see the stock has an interesting chart, with an increasing 'saw-tooth' like pattern of gradual increases in price from the $8.50 level in August, 2004, to the current level of $30.99. The stock chart looks strong and not over-extended to me!

In summary, this is a very small company with what appears to be a niche product. The latest quarterly report was strong with outstanding growth in revenue and earnings and the company beat expectations. In addition, the company raised guidance on the upcoming year's earnings. A nice report overall.

The Morningstar.com report shows that revenue has recently been growing and the company has just turned positive. The balance sheet is strong as well. Valuation, however, is a bit rich, with a sky-high Price/Sales number, and a P/E in the 90's. The PEG, however, is just a shade over 1.5.

I am not in the market to be buying any stocks, but if I were, this is the kind of stock I might very well be purchasing. Thanks for visiting and please drop me a line if you have any comments or questions.

Bob

Tuesday, 7 February 2006

February 7, 2006 Gardner Denver Machinery (GDI)

Click ***HERE*** for my PODCAST on GARDNER DENVERHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the

list of top % gainers on the NYSE today and came across Gardner Denver Machinery (GDI) which as I write is trading at $58.68, up $2.98 today or 5.35%. I do not own any shares of this company nor do I have any options.

According to the

Yahoo "Profile" on Gardner Denver, the company

"...engages in the design, manufacture, and marketing of compressor and vacuum products, as well as fluid transfer products. Its Compressor and Vacuum Products segment offers rotary screw, reciprocating, sliding vane, and centrifugal air compressors; positive displacement, centrifugal, and side channel blowers; and liquid ring pumps and engineered systems for industrial and commercial applications."

What drove the stock higher was the

announcement of 4th quarter earnings. As reported:

"Revenues for the three months ended December 31, 2005 were $369.3 million, a 53% increase compared to the fourth quarter of the previous year, primarily as a result of acquisitions completed in 2005 and strong organic growth. Net income for the three months ended December 31, 2005 was $25.3 million, an 86% increase compared to the same period last year, as a result of the benefit of acquisitions and flow-through profitability on organic revenue growth. Diluted earnings per share for the three months of 2005 was $0.96, 43% higher than the previous year. Cash generated by operations increased 55% to $119 million in 2005, compared to $77 million in the previous year.

This report was very strong as the company exceeded

estimates of $.77/share and also raised guidance for 2006. This is indeed what I like to call a "trifecta" in an earnings report!

And what about longer-term results? Looking at the

Morningstar.com "5-Yr Restated" financials on GDI, we can see that revenue has grown steadily from $379 million in 2000 to $420 million in 2001, then dipping slightly to $418 million in 2002. However, since 2002, the revenue growth has accelerated to $740 million in 2004 and $1.09 billion in the trailing twelve months (TTM).

Earnings have also been erratic with $1.21 reported in 2000, and $1.27 reported in 2003. However, since 2003, earnings have grown strongly with $1.92 reported in 2004 and $2.44 reported in the TTM.

Free cash flow has been positive and growing with $39 million in 2002, $57 million in 2004 and $77 million in the TTM.

The balance sheet shows cash at $114.6 million and other current assets at $4.8 million. With current liabilities of $316.5 million, this gives us a current ratio of close to 2.0 which is solid. The long-term liabilities stand at $779.3 million.

What about some key numbers on this stock?

Looking at

Yahoo "Key Statistics" on Gardner Denver Machinery, we find that this is a mid-cap stock with a market capitalization of $1.52 billion. The trailing p/e is moderate at 24.36, and the forward p/e (fye 31-Dec-06) is even nicer at 19.31. With the strong growth in earnings, the PEG (5 yr expected) comes in at a bargain-level 0.60.

Reviewing the

Fidelity.com eResearch website, we can see that even by the Price/Sales ratio, GDI is reasonably priced. According to Fidelity.com, the company belongs in the "Diversified Machinery" industrial group. Within this group, the most expensive stock (by Price/Sales ratio) is Roper Industries (ROP) with a Price/Sales ratio of 2.5. Next is Pall (PLL) and Illinois Tool Works (ITW) at 1.9, followed by Ingersoll-Rand (IR) at 1.3. Gardner Denver (GDI) is next at 1.1 and Eaton (ETN) is the most reasonably priced in the group with a Price/Sales ratio of only 0.9.

Looking back at Yahoo for some more numbers on this stock, we find that there are 25.97 million shares outstanding, and 25.52 million of them float. Of these shares, 1.15 million shares are out short representing 4.50% of the float or 8.1 trading days of volume (the short ratio). From my perspective, this is significant being over 3 days of volume, and with the strong earnings report, there is likely a bit of a squeeze of the shorts going on as they scramble to buy shares driving the stock higher yet.

No cash dividend is reported and the last stock split was a 3:2 split paid in December, 1997.

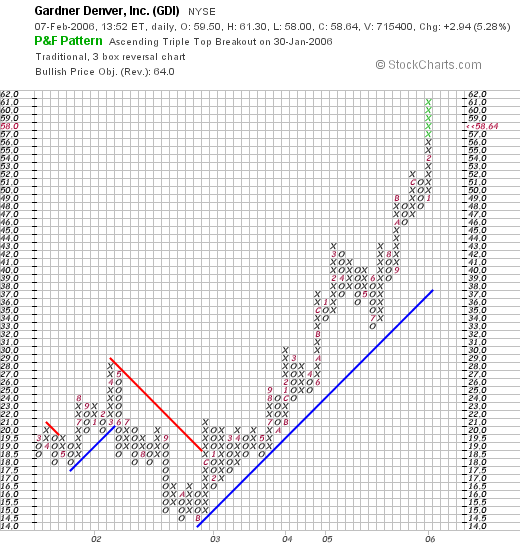

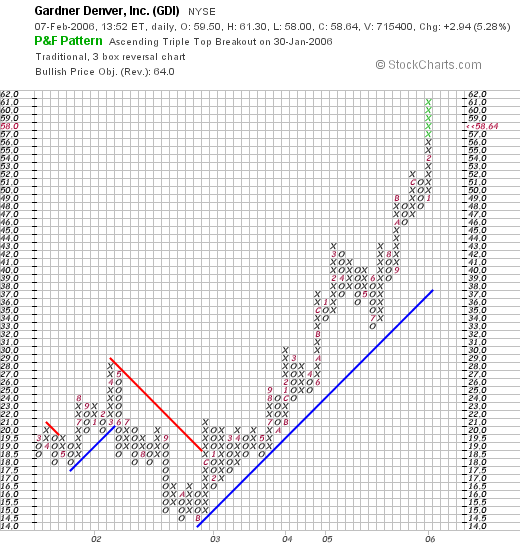

What about a chart? Looking at a

"Point & Figure" chart on GDI from StockCharts.com:

We can see that the stock trading weakly between April, 2002, when the stock hit a price of $27, down to a low of $14.50 in November, 2002. Since then, the stock has traded strongly higher for the past three straight years, reaching the $58.70 level today. The stock looks strong to me!

So what do I think? In summary, the stock is moving higher today in the face of a weak market on the back of a solid earnings report. Both earnings and revenue climbed strongly and the company beat expectations. In addition, the company has raised guidance for 2006. A solid report.

Morningstar.com, at least for the past three years looks solid. Prior to this, the numbers were flat. However, things appear to have turned around in 2003 and 2004, and thus the chart looks good during this period as well. Free cash flow is positive and growing and the balance sheet looks nice with a current ratio of almost 2:1.

Valuation-wise, we have a stock with a p/e in the 20's and a PEG at about 0.64. The Price/Sales ratio is also one of the cheapest in its industrial group coming in at 1.1. This also looks nice.

Finally, the chart looks strong.

In fact, there isn't much I don't like about this stock. The stock price may be a bit ahead of itself, I like it when the price hugs that support line, but that is in itself a weak criticism, especially with the reasonable valuation.

Since I just sold a stock at a loss, I am in no position to be buying anything at all anyway. But if I were.....:). Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 1:50 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 7 February 2006 9:34 PM CST

"Trading Transparency" FMC Technologies (FTI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisor prior to making any investment decisions based on information on this website.

Earlier this morning, my FMC Technologies (FTI) hit my 8% loss limit and I sold my 160 shares at $48.12. I had just purchased these shares 1/30/06 at a cost basis of $52.37, so this represented a loss of $(4.25), or (8.1)%.

This doesn't really change my personal opinion of the company, but my timing worked out poorly, buying an oil-services-related company just as the oil market was correcting. Rules are rules, and the stock is gone. As with my own strategy, I shall be 'sitting on my hands' waiting until one of my remaining 21 positions hits a sale at a gain target, prior to adding a new position.

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 6 February 2006

"Trading Portfolio" Update as of 2/4/06

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor and that you should always consult with your professional investment advisors prior to making any investment decisions based on informatin on this website.

Instead of reviewing a stock pick from my trading portfolio, I wanted to give you an update tonight on my holdings, my margin, and my activity in my account. Here is what I have written, as copied from

Jubak Refugee Website:

"Hello Jubak Refugee Friends,

This is another update of my trading portfolio based on my blog Stock Picks Bob's Advice. My last update was on 12/30/05. These values are as of this morning 2/6/06.

I am currently at 22 positions, 3 under my maximum of 25 positions. I am waiting for another sale of a portion of my holdings at a gain to go to 23 or more positions. After I reach my 25 position level, the sales of portions of holdings at gain targets will be used to pay down the substantial margin I am still holding. I continue to pull $550/month (for a car payment) and pay margin interest from the account, while automatically adding $200/month from my checking.

As of 2/4/06, the account net worth stood at $79,120.89. Securities were at $139,172.38, with $60,051.49 of margin debt outstanding. Margin equity stood at 56.85%.

Current positions (# shares) in my trading portfolio: ANGO (240), BOOM (200), CDIS (142), COH (102), CYTC (225), FTI (160), GCO (200), HIBB (84), HWAY (128), JLG (160), JOSB (150), KYPH (150), MORN (200), PKTR (400), QSII (44), RMD (180), SBUX (59), SRX (320), STJ (180), SYD (113), VIVO (210), and VMSI (225).

Since 12/30/05, the following transactions have occurred: on 1/3/06, I sold my 160 shares of BCSI at $41.95, on 1/6/06, I sold 43 shares of VIVO at $24.52, on 1/6/06 I purchased 240 shares of ANGO, on 1/12/06 I purchased 160 shares of JLG, on 1/12/06 I sold 28 shares of CDIS, on 1/12/06 I sold 120 shares of AFFX, on 1/27/06 I bought 400 shares of PKTR, on 1/27/06 I sold 40 shares of BOOM, on 1/30/06 I sold 30 shares of JOSB, on 1/30/06 I bought 160 shares of FTI at $52.30, and on 2/1/06, AMHC changed to HWAY.

As of 2/4/06, the account has net short-term gains of $816.04, and net long-term gains of $636.12, for a total realized gain for 2006 of $1,452.16. For the year, I have paid $284.97 in margin interest. As of 2/6/06, the account has $41,488.52 in unrealized gains.

I hope that this update is helpful and that you all come and visit my blog where I discuss new stock picks and past picks.

Bob"

Some of you have commented about me keeping you better posted with my trading portfolio holdings and trades. I hope this post will answer many of your quesitons.

If you have any comments or questions, please feel free to reach me at bobsadviceforstocks@lycos.com.

Bob

Aldila (ALDA) A Reader Writes "...your thoughts on Aldila (ALDA)"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. Please remember that I am an amateur investor, so please remember to consult with your professional investment adviosrs prior to making any investment decisions based on information on this website.

Looking through my mail this afternoon, I came across a nice letter from Ariel, who writes from Argentina. His letter states:

"Hi Bob!

I have discovered your blog almost a year ago, and it has become one of my favourites. I check it out daily and I must say that I have learned a lot. Thanks a lot for all your tips!

I have been looking at your system for buying and selling stocks and it almost makes perfect sense to me. I was just wondering if you had considered not selling part of your stocks at the 30%, 60%, etc. thresholds, and instead sticking to your shares until you unload all of them because of either (i) the stock initially went down by 8%, or (ii) after passing the 30% threshold, the stock reached one of your previous thresholds. I was planning to use the same thresholds as you use, but just as check points, without selling any of the shares if the stock is going up. In this way, if the stock keeps on going up, you stay invested in the stock. I would like to know your thoughts.

I would also like to take the opportunity to know your thoughts on Aldila (ALDA). I am quite bullish on this stock.

Thanks once more!

Ariel"

First of all, thank you for your kind words and encouragement. I always enjoy hearing from readers who have suggestions, comments, and questions! On the question of not selling parts of my stocks at % gain points, and just waiting. That might indeed be a good idea. I guess I am even a bit more conservative than you on this matter. Selling a small portion of a gaining stock is for me a way of 'hedging my bet'. A lot of the stocks that I review tend to be quite volatile. They climb quickly, and occasionally can correct just as quickly. If you need to be convinced, take a look at Intuitive Surgical (ISURG) the past few days.

It may turn out that your approach could indeed be more profitable than what I am doing. Let me know how it works. On the other hand, I find that my overall philosophy of selling poorly performing stocks quickly and completely, and then selling nicely performing stocks slowly and partially makes absolute sense. It is this bias that builds the portfolio. By the way, I also stay invested in the stock as it climbs (albeit with smaller positions). And with my recent change to selling 1/6th positions at the targeted appreciation points, my absolute holding should also increase in size.

I hope this answers your question. It is important for you to develop your own strategy of buying and selling stocks. There are many variations on what I am doing that are likely to be successful, and I am sure there are some approaches that will be even more successful than my strategy, so don't feel tied down to what I am doing! The important thing is to have a strategy and to stick with it. And if you come across something that works even better, well don't hesitate to change your methods and adapt to new information.

Now insofar as your question on Aldila (ALDA), let me take a quick look and see what we find. First of all, I must assume that you are an owner of Aldila shares. I don't own any shares of ALDA, nor do I have any options.

What does Aldila do? According to the

Yahoo "Profile" on ALDA, the company

"...through its subsidiaries, engages in the design and manufacture of graphite (carbon fiber-based composite) golf shafts in the United States. It sells its shafts to golf club manufacturers, distributors, and golf pro and repair shops."

By the way Aldila (ALDA) closed today (2/6/06) at $29.89, up $.52 or 1.77% on the day.

As you probably know, if you are a regular reader of this blog, I like to go to the latest quarterly report for the first 'screen' when picking stocks (after finding a stock on the top % gainers lists).

On October 26, 2005, ALDA

reported 3rd quarter 2005 results. Net sales for the quarter ended September 30, 2005, came in at $19.3 million, a 79% increase over sales of $10.8 million in the same period the prior year. Net income was $3.8 million or $.68/diluted share, representing an approximately 10-15% increase over the net income of $3.3 million or $.62/diluted share the prior year. Clearly, this was a good report, but it is interesting that the revenue grew far faster than income.

How about longer-term? Looking at the

Morningstar.com "5-Yr Restated" financials on ALDA, we find that revenue actually decreased from $55.9 million in 2000 to a low of $37.5 million in 2002 before turning higher to $52.8 million in 2004 and $71.4 million in the TTM.

The company also just turned profitable in 2004, with losses dropping to $(10.10)/share in 2001, improving steadily thereafter. The company has reported $2.25/share in income in the TTM. In addiiton, the company paid $.20/share in dividends in 2004 and $1.35/share in the TTM.

Free cash flow is positive and growing with $2 million reported in 2002, $8 million in 2004 and $8 million in the TTM.

The balance sheet is perfect with $19.4 million in cash and $20.4 million in other current assets, giving the company a current ratio of almost 5. They have $8.8 million in current liabilities per Morningstar and no long-term liabilities at all.

Looking at

Yahoo "Key Statistics" on ALDA, we find that this is a very small company with a market cap of only $160.42 million. The trailing p/e is cheap at 13.22. Price/sales is 2.21, there are only 5.37 million shares outstanding with 4.17 million that float. There are 70,830 shares short representing 1.40% of the float or 2.5 trading days of volume. The company has an indicated dividend of $.60/share yielding 2%. The last stock split was a reverse 1:3 split June, 2002.

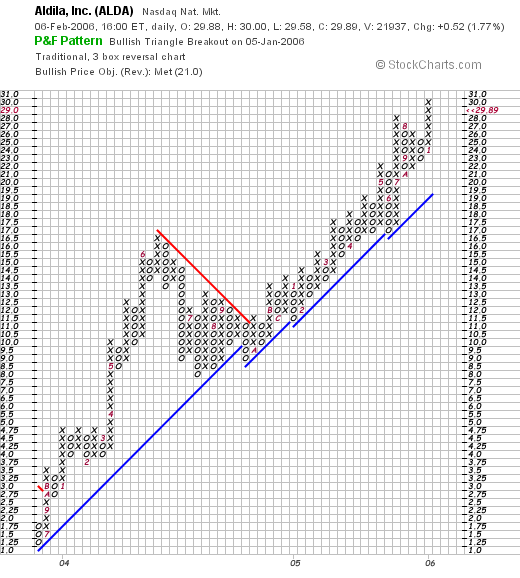

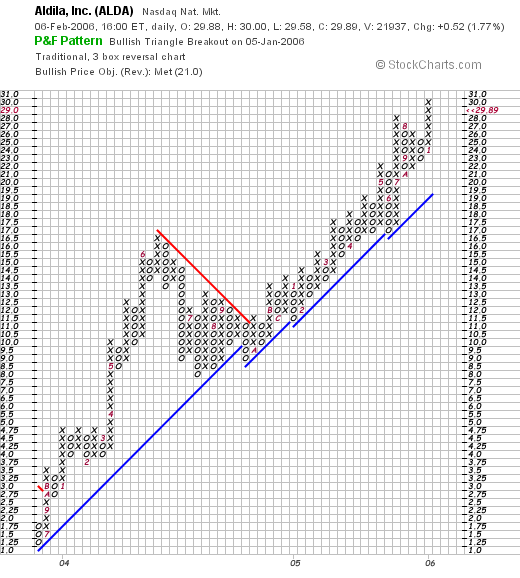

What about a chart? Reviewing the

"Point & Figure" chart from Stockcharts.com on ALDA:

We can see a beautiful chart with the stock moving almost perfectly steadily higher from $1.25 in June, 2003 to the current $30 level today. There was a small correction in the stock price as initially the price seemed to get ahead of itself in June, 2004, when the stock corrected from $17/share to $11.50/share. After that the stock price increased rather steadily.

So what do I think? Aldila fits in to my strategy fairly well. I prefer an even longer period of steady revenue and earnings growth, but the company has been doing this the past few years. Morningstar looks fairly nice with steadily improving free cahs flow and a solid balance sheet. Valuation is nice with a low p/e and the chart is gorgeous. Like any small cap stock, one can expect additional volatility, and I don't know enough about golf clubs to give you a feeling for how this stock does down the road.

I hope my commentary was helpful to you. Please feel free to write again! If you or anyone else have questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

I was checking my mailbox this morning, and I saw that I had a nice letter from a regular reader of mine who raises some interesting questions. She wrote:

I was checking my mailbox this morning, and I saw that I had a nice letter from a regular reader of mine who raises some interesting questions. She wrote:

On November 22, 2004, I

On November 22, 2004, I  On February 1, 2006, MTW

On February 1, 2006, MTW  On November 26, 2004, I

On November 26, 2004, I

I enjoy posting lots of stock market ideas on this blog. From these ideas I have built my own trading portfolio. About six months ago I started reviewing my positions which now number twenty-one. Two weeks ago I finished the list with

I enjoy posting lots of stock market ideas on this blog. From these ideas I have built my own trading portfolio. About six months ago I started reviewing my positions which now number twenty-one. Two weeks ago I finished the list with

I was looking through the

I was looking through the

Sometimes even a "dot.com" stock makes it to the list here on Stock Picks! I was looking through the

Sometimes even a "dot.com" stock makes it to the list here on Stock Picks! I was looking through the

I was looking through the

I was looking through the  According to the

According to the  And what about longer-term results? Looking at the

And what about longer-term results? Looking at the  Looking at

Looking at  Looking back at Yahoo for some more numbers on this stock, we find that there are 25.97 million shares outstanding, and 25.52 million of them float. Of these shares, 1.15 million shares are out short representing 4.50% of the float or 8.1 trading days of volume (the short ratio). From my perspective, this is significant being over 3 days of volume, and with the strong earnings report, there is likely a bit of a squeeze of the shorts going on as they scramble to buy shares driving the stock higher yet.

Looking back at Yahoo for some more numbers on this stock, we find that there are 25.97 million shares outstanding, and 25.52 million of them float. Of these shares, 1.15 million shares are out short representing 4.50% of the float or 8.1 trading days of volume (the short ratio). From my perspective, this is significant being over 3 days of volume, and with the strong earnings report, there is likely a bit of a squeeze of the shorts going on as they scramble to buy shares driving the stock higher yet.

What does Aldila do? According to the

What does Aldila do? According to the